Faces of the Bitcoin Boom

Photos by Patrick Cavan Brown

March 9, 2018

Three hours east of Seattle, the sprawling Mid-Columbia Basin boasts some of the most productive orchards and farms in the world—and scenery right out of a Hollywood Western. But it’s also home to the nation’s cheapest power, thanks to five huge hydroelectric dams straddling the Columbia River. Today, bitcoin miners, who need huge amounts of power to run the calculations that generate the virtual currency, are flocking to the basin for those cheap megawatts, transforming the once-quiet quiet rural community into a cryptocurrency capital of the world.

Scroll down to see more photos | Read the full story

David Carlson, The Bitcoin Pioneer

Carlson, a former software engineer, is often credited with starting the basin’s bitcoin boom when he built one of the world’s first large-scale bitcoin mines in an old furniture store in Wenatchee. “We’re where the blockchain goes from that virtual concept to something that’s real in the world, something that somebody had to build and is actually running,” he says.

Today, Carlson’s company, Giga Watt, is working on a new venture—a megaproject made up of 24 prefabricated mining “pods” packed floor-to-ceiling with servers and fans. Each pod can be up and running in just over a month, and will be able to generate nearly three Bitcoin every 24 hours. Carlson himself won’t be the miner; Giga Watt will run the pods as hosting sites for other miners.

Benny, The Rogue Miner

In the Mid-Columbia Basin, smaller operators have been able to make real money running a few machines in home-based, under-the-radar mines. “Benny,” a self-taught, 20-something computer whiz who didn’t want to be identified with his real name, set up three mining servers in his Wenatchee home last summer. Since then, he has made enough profit not only to recover his initial investment but also to pay his monthly mortgage. As a bonus, the heat from the computers keeps his home heated all winter. “It’s just basically free money,” says Benny. “All I have to do is wake up in the morning and make sure nothing crashed during the night.”

Malachi Salcido, The Local Talent

Salcido, a Wenatchee native and building contractor, studied other miners before launching his own bitcoin operation in 2014. He’s now one of the biggest miners in the basin, and has worked hard to convince the community that bitcoin and the blockchain could transform the region into a technology hub. “What you can actually do with the technology, we’re only beginning to discover,” says the father of four. The basin is “building a platform that the entire world is going to use.” By the end of the year, Salcido will have 43 megawatts of total mining capacity. By 2020, he expects to have 150 megawatts.

Lauren Miehe, The Prospector

With a knack for turning old buildings into bitcoin mines, Miehe has helped numerous other outsiders set up mining operations in the basin. Today, he still runs his original mine, but he primarily manages sites for other miners. He’s been stunned by the interest in the region since bitcoin prices took off last year. “Right now, everyone is in full-greed mode,” he says.

Bitcoin’s boom is a boon for extremist groups

After Charlottesville's bloody Unite the Right rally in August, technology companies tightened rules against hate speech and banned many extremists from using Web hosting services, social media platforms and online payment systems.

But some on the furthest edges of the political spectrum soon found an effective tool for thwarting this industry crackdown: bitcoin.

Even before Charlottesville, Richard Spencer, a prominent member of the alt-right, a movement that espouses racist, anti-Semitic and sexist views and seeks a whites-only state, had gone as far as declaring bitcoin "the currency of the alt right." But far-right political leaders and experts on extremist movements alike say the adoption of bitcoin gained new urgency after Charlottesville as extremists looked for ways to operate beyond the reach of government control and the shifting policies of U.S. tech companies.

Those who began acquiring bitcoin in August already have reaped substantial returns, despite the recent volatility in its price. In the months since demonstrators carried flaming torches and chanted "Jews will not replace us," bitcoin has quadrupled in value. The digital currency began trading on several mainstream financial markets this month, pushing the price of a single bitcoin at times above $19,000. It was worth $16,000 at one point Tuesday.

Extremist figures who invested in bitcoin as a bulwark against efforts to block their political activity now find themselves holding what amount to winning lottery tickets. The proceeds could be used to communicate political messages, organize events and keep websites online even as most mainstream hosting services shun them, experts say.

"Bitcoin is allowing people in the movement to go beyond cash in an envelope or a check," said Heidi Beirich, head of the Intelligence Project at the Southern Poverty Law Center, a nonprofit group that tracks extremists. "It's really a godsend to them."

First created in 2009 by an anonymous computer programmer, bitcoin is a digital currency that is not issued by any government and has no physical manifestation, such as actual coins or bills. Someone who wants to buy bitcoin can sign up for one of many online exchanges — each account gets a unique identifier of numbers and letters — and pay dollars (or other traditional currency) for the digital currency. People can also send bitcoin to others or conduct transactions at any of a growing list of businesses, nonprofit groups and financial institutions that accept it.

A secure, continuously updated ledger called the blockchain records all transactions in a publicly visible way, assigning each an alphanumeric record. Unlike the closely government-regulated banking systems that record traditional financial transactions, the blockchain is completely decentralized, relying on complex mathematical calculations across countless computers worldwide.

Such a system makes it difficult for regulators and law enforcement agencies to monitor assets or know the identities of particular account holders. It also allows fringe groups not only to collect money, but to spend it more easily — for example, on foreign online services if U.S. companies restrict their access.

Google, GoDaddy, PayPal and others banned some far-right activists from their services after the Charlottesville rally, saying they violated rules against hate speech.

Spencer and others who have lost access to these services — a process they call being "de-platformed" — say they are effectively being denied free-speech rights.

"We have faced enormous problems from being de-platformed," Spencer said. "Bitcoin at least, from what I can tell, is not something from which we can be de-platformed."

Extremists are hardly alone in benefiting from surging bitcoin values. Early buyers include cryptography enthusiasts, libertarians and professional investors — as well as drug traffickers, money launderers and others who regularly conduct transactions on the "dark Web," a part of the Internet accessible only by using specialized software that helps shield online activity.

Also unaffiliated with the far right yet profiting handsomely is WikiLeaks founder Julian Assange, who tweeted in October that U.S. political pressure on traditional payment processors such as credit card companies to stop handling transactions for the site "caused us to invest in bitcoin — with > 50000% return." In a dig at policymakers who pressured the companies, Assange expressed his "deepest thanks."

It's impossible to know how many on the far right are reaping bitcoin windfalls, but researchers who monitor extreme political activity say they have detected a surge in transactions as people on the far right move assets into the digital currency and increasingly use it for ordinary business purposes. The SPLC is tracking roughly 200 bitcoin wallets — the way users store the currency online — that it says are held by extremists.

Public blockchain records make such monitoring possible. Researchers can study the times, dates and amounts of any transaction, along with what accounts, or wallets, are involved. That does not include the actual names of account holders, but such records can illuminate identities. The SPLC, for example, looks on the donation pages of extremist websites for bitcoin accounts that are seeking contributions.

According to SPLC research, among the most striking recent donations was 14.88 bitcoin paid to Andrew Anglin, editor of the Daily Stormer, a neo-Nazi online publication that lists a bitcoin account number online. The SPLC has labeled the Daily Stormer the nation's "top hate site."

The payment to Anglin came on Aug. 20, as the Daily Stormer — named after the Nazi propaganda tabloid "Der Stürmer" — was scrambling to recover after several Web hosting services kicked it off their platforms. Followers looking for the site at its familiar dailystormer.com address got error messages.

The amount of the donation carried particular significance; 1488 is a reference to a Nazi slogan — 14 words long — about the importance of protecting "a future for white children," and 88 refers to "Heil Hitler," both words of which start with the eighth letter of the alphabet. At the time of the donation, it was worth about $60,000. Had Anglin kept the entire amount, it would now be worth about $235,000.

Instead, it appears that Anglin gradually spent down the donation as he worked to get the Daily Stormer back onto the Web, according to John Bambenek, a cybersecurity researcher and threat-systems manager at Fidelis Cybersecurity who tracks bitcoin transactions.

But Bambenek said the account that made the 14.88 donation — whose owner is unknown — has gradually drained its value over a series of transactions. Bambenek said his research suggests that this account got its money from another, far larger one, now worth more than $45 million.

"The alt-right likes bitcoin the same way criminals and people on the dark Web like bitcoin," Bambenek said. "It's a great way to move around assets, especially when you're under the threat of investigation."

Bambenek has built a Twitter bot, called the Neonazi BTC Tracker, that automatically tweets a record of every transaction affecting 13 accounts he says are affiliated with known extremists and their websites.

Bambenek said there is also evidence that Anglin and others are moving their assets into other digital currencies that are harder to track but have not been growing as quickly in value as bitcoin.

Anglin, in a phone interview with The Washington Post, declined to confirm or comment on the 14.88 bitcoin transaction, but he expressed frustration at Bambenek's Twitter bot, saying that some of the information it tweets is inaccurate. Anglin also said he has used bitcoin almost exclusively since payment services blocked the Daily Stormer beginning in 2014.

"Bitcoin has helped out a lot," Anglin said.

Anglin was sued this year by the SPLC for allegedly inflicting emotional distress on a Jewish woman in Montana by unleashing a "troll storm" on her. In a Dec. 7 article on the Daily Stormer, Anglin noted the surge in bitcoin value and said, "Thank you so, so, so much" to the law center for its long-running efforts to get him banned from mainstream payment services, prompting his investment in bitcoin. (The Daily Stormer has said in court filings that its actions were protected speech and posed no real threat to the woman, according to news reports.)

The popularity of bitcoin on the political right is not confined to the most extreme elements. Conservative commentator Mike Cernovich — who co-sponsored the "Deploraball" to celebrate President Trump's inauguration but did not attend the Charlottesville rally and has distanced himself from anti-Semitic and white-nationalist figures — began touting the currency to his Twitter followers in September 2016, when it was worth about $600 per bitcoin.

The goal, Cernovich said, was to protect himself from efforts by tech companies or payment processors to block his political activity.

"That was the only reason I got into it," he said. "I just got really, really lucky."

Conservative publisher Charles C. Johnson — whose WeSearchr "bounty site" has raised more than $150,000 for the Daily Stormer's battle against the SPLC as part of what Johnson calls his support of free speech — said he has advocated the purchase of bitcoin since 2015. That's the year Twitter banned Johnson for soliciting donations for "taking out" a Black Lives Matter activist. (Johnson said afterward that he was seeking not to incite violence but to spur an investigation he believed would undermine the activist.)

Johnson said he has made substantial earnings on bitcoin investments and increasingly uses it to make donations to political leaders and groups.

"It's a form of digital gold," Johnson said. "It's not surprising that a lot of people on the political fringes would move toward an un-censorable currency."

Spencer, however, said he did not begin buying bitcoin when he touted it in the March tweet. In recent months, though, he has set up several accounts to raise money for various sites and causes.

"I really wish I had bought more bitcoin," Spencer said. "I guess we all do."

Follow The Post's tech blog, The Switch, where technology and policy connect.

Real time prices

"vires in numeris."

Receive all Bitcoinist news in Telegram!

Bitcoin Boom: Japan Trades $97 Billion in One Month

Japan has always been a hotspot for Bitcoin, but now there’s data to prove it.

World Leader

Japan’s Financial Services Agency (FSA) has officially released data which proves that the country is one of the foremost leaders in the world of Bitcoin trading.

According to the country’s financial watchdog, a minimum of 3.5 million people was trading digital currencies on Japan’s 17 domestic exchanges at the end of March. The data also shows that a resounding 84 percent of those individuals fall between the ages of 20 and 40.

The commonality in age does not come as a surprise. Earlier this month, Bitcoinist reported on New R25’s questioning of 4,734 male employees in Japan, aged 25-30, between January and March of 2018. The respondents’ answers revealed that approximately 14 percent owned some form of virtual currency, while 90 percent of those claimed they bought it as an investment.

The FSA also revealed that Bitcoin trading volume in March 2017 was $97 billion. As a point of comparison, the world’s largest cryptocurrency by market capitalization was trading at $22 million three years prior.

Likewise, the trading of margins, credit, and Bitcoin futures was up to $543 billion last year, compared to just $2 million in 2014.

Winning the Race

The FSA’s report comes at a time when Japan is making every effort to lead the world in effective cryptocurrency regulation. Most recently, the country unveiled guidelines for effectively regulating Initial Coin Offerings (ICOs) while still ensuring positive growth.

The country has also notably been both talking the talk and walking the walk.

Late last month, the FSA ordered both Tokyo GateWay and Fukuoka-based Mr. Exchange to make significant improvements to their data security on March 8th. Both exchanges were also ordered to improve various other safeguards which were found to be insufficient. Neither exchange was able to comply, leading to the closure of both and the return of users’ cash and digital assets.

The aforementioned exchanges joined the ranks of three other Japanese exchanges — Raimu, bitExpress, and Bit Station — forced to cease operations following the relatively new law which forces Japanese cryptocurrency exchanges to register with the FSA. Currently, 16 exchanges are registered with the financial watchdog.

What do you think about Japan’s approach to cryptocurrency and the regulation of its trading? Do you think other countries should model Japan’s efforts? Let us know in the comment below!

Images courtesy of Bitcoinist archives.

What’s behind the bitcoin boom?

What’s behind the bitcoin boom?

Unreal money: India’s policy on Bitcoin regulation is still evolving and no legal framework exists. | Photo Credit: AFP

While it has delivered stellar returns over the years, the volatile nature of the trade is not for the feeble-hearted

As the price of the bitcoin leapt past $10,000 this week, marking a tenfold gain in 2017, many investors seemed to nurse a ‘missed-out’ feeling. The financial press ran ‘how-to-invest-in-bitcoin’ tutorials right alongside unflattering comparisons of the bitcoin boom to the Tulip mania. If you are among the Indian investors who are rueing their decision to skip bitcoins in favour of the stock market, here are some bitcoin facts that may make you feel better.

Scarcity premium

In the financial markets, asset bubbles are spotted by comparing the traded price of an asset to its fair value. For stocks, the valuation metric may be the price-to-earnings or book value multiple. For oil or gold, there’s the cost of producing each barrel or ounce. The rupee is assessed on real effective exchange rate. But it’s hard to say if there’s a bubble brewing in bitcoins because it has no such valuation measure. Its price is therefore decided mainly by demand-supply dynamics.

No one knows yet, if Bitcoin’s pseudonymous inventor Satoshi Nakamoto was a computer engineer, academic or Silicon Valley geek. But one subject that Nakamoto certainly understood was economics. He knew that when unlimited demand chases finite supply, the result is sky-rocketing prices.

So, while creating the original algorithm to ‘mine’ blocks of bitcoins (new bitcoins are created when you use computers to solve complex mathematical problems set by the system), he set a finite limit on the bitcoins that could be mined for all time to come. He also ensured that the algorithm got more complex over time and that the bitcoin yield shrank in geometric proportion with each new block.

This has effectively set a hard limit of 21 million on total bitcoin supply, of which an estimated 16.7 million (80 per cent) has already been mined. Mining new blocks now entails gigawatts of electricity and computing power.

To make things interesting, there’s uncertainty about the existing bitcoin supply as well. About a million bitcoins are said to have been spirited away by Nakamoto himself, a few million have gone missing due to lost hard disks and forgotten passwords, and a good number are out of circulation because they’re stockpiled by investors.

This scarcity factor and the lack of a fair value measure makes the bitcoin a great playground for speculators, but a very uncomfortable one for long-term investors.

High on volatility

Looking back today, bitcoin returns for the last five years are drool-worthy. The rupee-equivalent price of a bitcoin has zoomed from under ₹600 in November 2012 to more than ₹6.8 lakh by November 2017, a cool 300% annualised return. In the same period, the BSE Sensex has produced a staid 11.5% despite a bull market.

If this is making you regret choosing stocks over bitcoins, do note that you would have needed nerves of steel to stay invested in bitcoins. While delivering stellar returns, the bitcoin has subjected its investors to an extremely rocky ride.

Over the last five years, the maximum loss made by the BSE Sensex on any given day was 5.93%. Its biggest single-day gain was 3.8%. The rupee, with which the bitcoin competes as a virtual currency, saw a biggest single-day depreciation (against the dollar) of 3.6% and gained 3.4% on its best day.

But the bitcoin, on its bad days, has proved five times as volatile as the Sensex. On its worst day in the last five years, its price tanked by 28% in dollar terms. At its most euphoric, it shot up by 41% in a single session. Also, 10% single-day losses were not unusual for the bitcoin, with 36 such occasions in the last five years.

The short history of the bitcoin has been punctuated by quite a few stomach-roiling events too. In 2014, thousands of bitcoins were stolen from the leading exchange Mt Gox which had to be shuttered. The event saw a two-year lull in the bitcoin bull market. In August, a breakaway faction Bitcoin Cash, ‘forked’ off from the main bitcoin blockchain. This week, global bitcoin exchanges reported outages and flash crashes unable to handle the sharp surge in traffic.Due to such volatility, though it has proved a blockbuster investment, the bitcoin hasn’t really made headway as a global alternative to conventional money.

Regulatory approval

When originally introduced, virtual currencies, backed by the ultra-democratic blockchain technology, were expected to offer a border-less alternative to fiat currencies, which were being systematically debased by governments in the developed world. There was clamour for a globally-accepted medium of exchange that was free of political hegemony.

But trading volumes in cryptocurrencies have tended to become quite concentrated in a few regions lately. They’ve also proved quite sensitive to governmental actions. After galloping fivefold between January and September 2017, bitcoins suffered a 30% blip this September after the Chinese government, wary of capital flight, ordered the shut-down of leading bitcoin exchanges. In April, markets cheered Japan’s decision to officially recognise bitcoins as legal tender and license 11 exchanges.

Trading volumes have also flown from one region to another depending on how favourably disposed regulators have been towards bitcoins. Chinese exchanges dominated bitcoin trading a couple of years ago with a more than 80% volume share. But after the clampdown, Japanese and U.S. exchanges now control over two-thirds of volumes.

In India, the RBI is still undecided on the issue of how and if at all it will regulate virtual currencies. Meanwhile, it has issued disclaimers that it hasn’t authorised bitcoins as a medium of exchange, warning investors of potential ‘financial, operational, legal, customer protection and security-related risks’ if they dabble in them.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

The Bitcoin Boom: In Code We Trust

- Dec. 18, 2017

You don’t need brilliant financial analysis skills to notice that Bitcoin is in a bubble. It has grown in value from about 39 cents to over $18,000 in just eight years and recently attracted broad media attention by doubling in just a few days. The conventional wisdom had been that illegal and illicit transactions — buying drugs or transferring money out of Argentina — accounted for much of Bitcoin’s value. Today the mainstream view sees mere greed and speculation.

Yet as Bitcoin continues to grow, there’s reason to think something deeper and more important is going on. Bitcoin’s rise may reflect, for better or worse, a monumental transfer of social trust: away from human institutions backed by government and to systems reliant on well-tested computer code. It is a trend that transcends finance: In our fear of human error, we are putting an increasingly deep faith in technology.

Bitcoin may be in a bubble, but not all bubbles are created equal. Some are shimmering nothings, reflecting little more than an underlying pyramid scheme. But others are like ocean swells that could become enormous waves. Consider the tech stocks of the late 1990s — a bubble, to be sure, but in retrospect, was Amazon really overvalued?

What gives the Bitcoin bubble significance is that, like ’90s tech, it is part of something much larger than itself. More and more we are losing faith in humans and depending instead on machines. The transformation is more obvious outside of finance. We trust in computers to fly airplanes, help surgeons cut into our bodies and simplify daily tasks, like finding our way home. In this respect, finance is actually behind: Where we no longer feel we can trust people, we let computer code take over.

Bitcoin is part of this trend. It was, after all, a carnival of human errors and misfeasance that inspired the invention of Bitcoin in 2009, namely, the financial crisis. Banks backed by economically powerful nations had been the symbol of financial trustworthiness, the gold standard in the post-gold era. But they revealed themselves as reckless, drunk on other people’s money, holding extraordinarily complex assets premised on a web of promises that were often mutually incompatible. To a computer programmer, the financial system still looks a lot like untested code with weak debugging that puts way too much faith in the idea that humans will behave properly. As with any bad software, it can be expected to crash when conditions change.

We might add that major governments — the issuers of currency, the guarantors of banks and enforcers of contracts — do not always inspire confidence. Governments can be tempted to print money recklessly or seize wealth brazenly from their citizens — Venezuelan hyperinflation and Indian demonetization are recent examples. But even the most trusted governments can be dubious. Europe, riddled by internal struggles among states, is still in shock about the planned departure of Britain from the European Union. China is a secretive authoritarian state that can lash out against its citizens and rivals when it feels insecure. The United States, perhaps the main guarantor of world solvency, is some $20 trillion in debt, constantly on the verge of default and headed by a serial bankruptee who prizes unpredictability. It is little wonder that the world’s citizens might be looking for alternatives.

Bitcoin’s fans don’t entirely distrust human institutions. It is rather that they’d prefer not to need to trust humans to keep their promises, when we know that we humans are deeply fallible. That might seem cynical, but perhaps it is appropriately humble. As Satoshi Nakamoto, the pseudonym for the person or persons who invented Bitcoin, puts it, “the root problem with conventional currency is all the trust that’s required to make it work.”

This all helps explain the popularity of Bitcoin as an asset independent of government, mainstream banks and their various shenanigans. But still, is it really worth anything at all? It is based on a “blockchain,” a technology that creates a decentralized public ledger and rigorously tracks transfers. It is maintained by its users, and no government can mint more coins. Bitcoin isn’t backed by any sovereign, and unlike a stock or a bond, it gives you a claim to nothing other than Bitcoin itself. Yet that illusory quality is true of most forms of money, a shared hallucination that we tolerate as long as it works. If enough others value something, that can be enough to make it serve as a store of value. Sure, Bitcoin will crash again, but over its lifetime, it has already withstood multiple crashes, runs and splits. It actually feels tested.

This isn’t to idealize Bitcoin. Despite its virtual nature, it is still a human institution, facing its own misdeeds and governance problems. Odds are that Bitcoin may never function well as a general medium of exchange (something you can buy things with) because of its wild fluctuations, but might work fine as a store of value that you can sell. It may, like Netscape circa 1995, be portending changes to come. But Bitcoin has captured something. As much as we may love other humans, it is now in code we trust.

Tim Wu is a law professor at Columbia, the author of “The Attention Merchants: The Epic Struggle to Get Inside Our Heads” and a contributing opinion writer.

Follow The New York Times Opinion section on Facebook and Twitter (@NYTopinion), and sign up for the Opinion Today newsletter.

The Bitcoin Boom: Asset, Currency, Commodity Or Collectible?

As I have noted with my earlier posts on crypto currencies, in general, and bitcoin, in particular, I find myself disagreeing with both its most virulent critics and its strongest proponents. Unlike Jamie Dimon, I don't believe that bitcoin is a fraud and that people who are "stupid enough to buy it" will pay a price for that stupidity. Unlike its biggest cheerleaders, I don't believe that crypto currencies are now or ever will be an asset class or that these currencies can change fundamental truths about risk, investing and management. The reason for the divide, though, is that the two sides seem to disagree fundamentally on what bitcoin is, and at the risk of raising hackles all the way around, I will argue that bitcoin is not an asset, but a currency, and as such, you cannot value it or invest in it. You can only price it and trade it.

Assets, Commodities, Currencies and Collectibles

Not everything can be valued, but almost everything can be priced. To understand the distinction between value and price, let me start by positing that every investment that I will look at has to fall into one of the following four groupings:

- Cash Generating Asset: An asset generates or is expected to generate cash flows in the future. A business that you own is definitely an asset, as is a claim on the cash flows on that business. Those claims can be either contractually set (bonds or debt), residual (equity or stock) or even contingent (options). What assets share in common is that these cash flows can be valued, and assets with high cash flows and less risk should be valued more than assets with lower cash flows and more risk. At the same time, assets can also be priced, relative to each other, by scaling the price that you pay to a common metric. With stocks, this takes the form of comparing pricing multiples (PE ratio, EV/EBITDA, Price to Book or Value/Sales) across similar companies to form pricing judgments of which stocks are cheap and which ones are expensive.

- Commodity: A commodity derives its value from its use as raw material to meet a fundamental need, whether it be energy, food or shelter. While that value can be estimated by looking at the demand for and supply of the commodity, there are long lag and lead times in both that make that valuation process much more difficult than for an asset. Consequently, commodities tend to be priced, often relative to their own history, with normalized oil, coal wheat or iron ore prices being computed by averaging prices across long cycles.

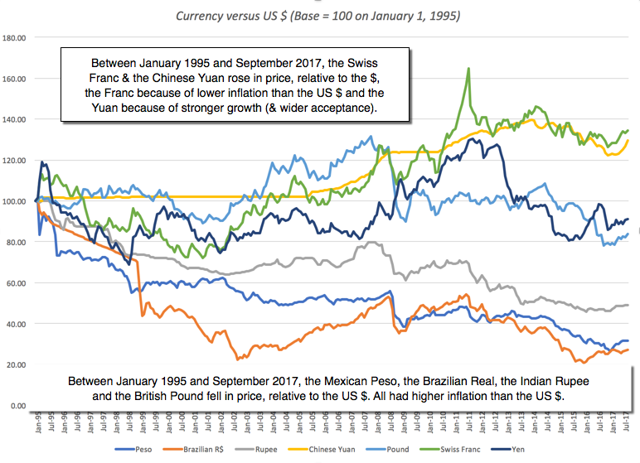

- Currency: A currency is a medium of exchange that you use to denominate cash flows and is a store of purchasing power, if you choose to not invest. Standing alone, currencies have no cash flows and cannot be valued, but they can be priced against other currencies. In the long term, currencies that are accepted more widely as a medium of exchange and that hold their purchasing power better over time should see their prices rise, relative to currencies that don't have those characteristics. In the short term, though, other forces including governments trying to manipulate exchange rates can dominate. Using a more conventional currency example, you can see this in a graph of the US $ against seven fiat currencies, where over the long term (1995-2017), you can see the Swiss Franc and the Chinese Yuan increasing in price, relative to the $, and the Mexican Peso, Brazilian Real, Indian Rupee and British Pound, dropping in price, again relative to the $.

- Collectible: A collectible has no cash flows and is not a medium of exchange but it can sometimes have aesthetic value (as is the case with a master painting or a sculpture) or an emotional attachment (a baseball card or team jersey). A collectible cannot be valued since it too generates no cash flows but it can be priced, based upon how other people perceive its desirability and the scarcity of the collectible.

Viewed through this prism, Gold is clearly not a cash flow generating asset, but is it a commodity? Since gold's value has little to do with its utilitarian functions and more to do with its longstanding function as a store of value, especially during crises or when you lose faith in paper currencies, it is more currency than commodity. Real estate is an asset, even if it takes the form of a personal home, because you would have had to pay rental expenses (a cash flow), in its absence. Private equity and hedge funds are forms of investing in assets, currencies, commodities or collectibles, and are not separate asset classes.

Investing versus Trading

The key is that cash generating assets can be both valued and priced, commodities can be priced much more easily than valued, and currencies and collectibles can only be priced. So what? I have written before about the divide between investing and trading and it is worth revisiting that contrast. To invest in something, you need to assess its value, compare to the price, and then act on that comparison, buying if the price is less than value and selling if it is greater. Trading is a much simpler exercise, where you price something, make a judgment on whether that price will go up or down in the next time period and then make a pricing bet. While you can be successful at either, the skill sets and tool kits that you use are different for investing and trading, and what makes for a good investor is different from the ingredients needed for good trading. The table below captures the difference between trading (the pricing game) and investing (the value game).

As I see it, you can play either the value or pricing game well, but being delusional about the game you are playing, and using the wrong tools or bringing the wrong skill set to that game, is a recipe for disaster.

What is Bitcoin?

The first step towards a serious debate on bitcoin then has to be deciding whether it is an asset, a currency, a commodity or collectible. Bitcoin is not an asset, since it does not generate cash flows standing alone for those who hold it (until you sell it). It is not a commodity, because it is not raw material that can be used in the production of something useful. The only exception that I can think off is that if it becomes a necessary component of smart contracts, it could take on the role of a commodity; that may be ethereum's saving grace, since it has been marketed less as a currency and more as a smart contracting lubricant. The choice then becomes whether it is a currency or a collectible, with its supporters tilting towards the former and its detractors the latter. I argued in my last post that Bitcoin is a currency, but it is not a good one yet, insofar as it has only limited acceptance as a medium of exchange and it is too volatile to be a store of value. Looking forward, there are three possible paths that I see for Bitcoin as a currency, from best case to worst case.

- The Global Digital Currency: In the best case scenario, Bitcoin gains wide acceptance in transactions across the world, becoming a widely used global digital currency. For this to happen, it has to become more stable (relative to other currencies), central banks and governments around the world have to accept its use (or at least not actively try to impede it) and the aura of mystery around it has to fade. If that happens, it could compete with fiat currencies and given the algorithm set limits on its creation, its high price could be justified.

- Gold for Millennials: In this scenario, Bitcoin becomes a haven for those who do not trust central banks, governments and fiat currencies. In short, it takes on the role that gold has, historically, for those who have lost trust in or fear centralized authority. It is interesting that the language of Bitcoin is filled with mining terminology, since it suggests that intentionally or otherwise, the creators of Bitcoin shared this vision. In fact, the hard cap on Bitcoin of 21 million is more compatible with this scenario than the first one. If this scenario unfolds, and Bitcoin shows the same staying power as gold, it will behave like gold does, rising during crises and dropping in more sanguine time periods.

- The 21st Century Tulip Bulb: In this, the worst case scenario, Bitcoin is like a shooting star, attracting more money as it soars, from those who see it as a source of easy profits, but just as quickly flares out as these traders move on to something new and different (which could be a different and better designed digital currency), leaving Bitcoin holders with memories of what might have been. If this happens, Bitcoin could very well become the equivalent of Tulip Bulbs, a speculative asset that saw its prices soar in the sixteen hundreds in Holland, before collapsing in the aftermath.

I would be lying if I said that I knew which of these scenarios will unfold, but they are all still plausible scenarios. If you are trading in Bitcoin, you may very well not care, since your time horizon may be in minutes and hours, not weeks, months or years. If you have a longer term interest in Bitcoin, though, your focus should be less on the noise of day-to-day price movements and more on advancements on its use as a currency. Note also that you could be a pessimist on Bitcoin and other crypto currencies but be an optimist about the underlying technology, especially block chain, and its potential for disruption.

Reality Checks

Combining the section where I classified investments into assets, commodities, currencies and collectibles with the one where I argued that Bitcoin is a "young" currency allows me to draw the following conclusions:

- Bitcoin is not an asset class: To those who are carving out a portion of their portfolios for Bitcoin, be clear about why you are doing it. It is not because you want to a diversified portfolio and hold all asset classes, it is because you want to use your trading skills on Bitcoin to supercharge your portfolio returns. Lest you view this as a swipe at cryptocurrencies, I would hasten to add that fiat currencies (like the US dollar, Euro or Yen) are not asset classes either.

- You cannot value Bitcoin, you can only price it: This follows from the acceptance that Bitcoin is a currency, not an asset or a commodity. Any one who claims to value Bitcoin either has a very different definition of value than I do or is just making up stuff as he or she goes along.

- It will be judged as a currency: In the long term, the price that you attach to Bitcoin will depend on how well it will performs as a currency. If it is accepted widely as a medium of exchange and is stable enough to be a store of value, it should command a high price. If it becomes gold-like, a fringe currency that investors flee to during crises, its price will be lower. Worse, if it is a transient currency that loses all purchasing power, as it is replaced by something new and different, it will crash and burn.

- You don't invest in Bitcoin, you trade it: Since you cannot value Bitcoin, you don't have a critical ingredient that you need to be an investor. You can trade Bitcoin and become wealthy doing so, but it is because you are a good trader.

- Good trader ingredients: To be a successful trader in Bitcoin, you need to recognize that moves in its price will have little do with fundamentals, everything to do with mood and momentum and big price shifts can happen on incremental information.

Would I buy Bitcoin at $6,100? No, but not for the reasons that you think. It is not because I believe that it is over valued, since I cannot make that judgment without valuing it and as I noted before, it cannot be valued. It is because I am not and never have been a good trader and, as a consequence, my pricing judgments are suspect. If you have good trading instincts, you should play the pricing game, as long as you recognize that it is a game, where you can win millions or lose millions, based upon your calls on momentum. If you win millions, I wish you the best! If you lose millions, please don't let paranoia lead you to blame the establishment, banks and governments for why you lost. Come easy, go easy!

What’s behind the bitcoin boom?

What’s behind the bitcoin boom?

Unreal money: India’s policy on Bitcoin regulation is still evolving and no legal framework exists. | Photo Credit: AFP

While it has delivered stellar returns over the years, the volatile nature of the trade is not for the feeble-hearted

As the price of the bitcoin leapt past $10,000 this week, marking a tenfold gain in 2017, many investors seemed to nurse a ‘missed-out’ feeling. The financial press ran ‘how-to-invest-in-bitcoin’ tutorials right alongside unflattering comparisons of the bitcoin boom to the Tulip mania. If you are among the Indian investors who are rueing their decision to skip bitcoins in favour of the stock market, here are some bitcoin facts that may make you feel better.

Scarcity premium

In the financial markets, asset bubbles are spotted by comparing the traded price of an asset to its fair value. For stocks, the valuation metric may be the price-to-earnings or book value multiple. For oil or gold, there’s the cost of producing each barrel or ounce. The rupee is assessed on real effective exchange rate. But it’s hard to say if there’s a bubble brewing in bitcoins because it has no such valuation measure. Its price is therefore decided mainly by demand-supply dynamics.

No one knows yet, if Bitcoin’s pseudonymous inventor Satoshi Nakamoto was a computer engineer, academic or Silicon Valley geek. But one subject that Nakamoto certainly understood was economics. He knew that when unlimited demand chases finite supply, the result is sky-rocketing prices.

So, while creating the original algorithm to ‘mine’ blocks of bitcoins (new bitcoins are created when you use computers to solve complex mathematical problems set by the system), he set a finite limit on the bitcoins that could be mined for all time to come. He also ensured that the algorithm got more complex over time and that the bitcoin yield shrank in geometric proportion with each new block.

This has effectively set a hard limit of 21 million on total bitcoin supply, of which an estimated 16.7 million (80 per cent) has already been mined. Mining new blocks now entails gigawatts of electricity and computing power.

To make things interesting, there’s uncertainty about the existing bitcoin supply as well. About a million bitcoins are said to have been spirited away by Nakamoto himself, a few million have gone missing due to lost hard disks and forgotten passwords, and a good number are out of circulation because they’re stockpiled by investors.

This scarcity factor and the lack of a fair value measure makes the bitcoin a great playground for speculators, but a very uncomfortable one for long-term investors.

High on volatility

Looking back today, bitcoin returns for the last five years are drool-worthy. The rupee-equivalent price of a bitcoin has zoomed from under ₹600 in November 2012 to more than ₹6.8 lakh by November 2017, a cool 300% annualised return. In the same period, the BSE Sensex has produced a staid 11.5% despite a bull market.

If this is making you regret choosing stocks over bitcoins, do note that you would have needed nerves of steel to stay invested in bitcoins. While delivering stellar returns, the bitcoin has subjected its investors to an extremely rocky ride.

Over the last five years, the maximum loss made by the BSE Sensex on any given day was 5.93%. Its biggest single-day gain was 3.8%. The rupee, with which the bitcoin competes as a virtual currency, saw a biggest single-day depreciation (against the dollar) of 3.6% and gained 3.4% on its best day.

But the bitcoin, on its bad days, has proved five times as volatile as the Sensex. On its worst day in the last five years, its price tanked by 28% in dollar terms. At its most euphoric, it shot up by 41% in a single session. Also, 10% single-day losses were not unusual for the bitcoin, with 36 such occasions in the last five years.

The short history of the bitcoin has been punctuated by quite a few stomach-roiling events too. In 2014, thousands of bitcoins were stolen from the leading exchange Mt Gox which had to be shuttered. The event saw a two-year lull in the bitcoin bull market. In August, a breakaway faction Bitcoin Cash, ‘forked’ off from the main bitcoin blockchain. This week, global bitcoin exchanges reported outages and flash crashes unable to handle the sharp surge in traffic.Due to such volatility, though it has proved a blockbuster investment, the bitcoin hasn’t really made headway as a global alternative to conventional money.

Regulatory approval

When originally introduced, virtual currencies, backed by the ultra-democratic blockchain technology, were expected to offer a border-less alternative to fiat currencies, which were being systematically debased by governments in the developed world. There was clamour for a globally-accepted medium of exchange that was free of political hegemony.

But trading volumes in cryptocurrencies have tended to become quite concentrated in a few regions lately. They’ve also proved quite sensitive to governmental actions. After galloping fivefold between January and September 2017, bitcoins suffered a 30% blip this September after the Chinese government, wary of capital flight, ordered the shut-down of leading bitcoin exchanges. In April, markets cheered Japan’s decision to officially recognise bitcoins as legal tender and license 11 exchanges.

Trading volumes have also flown from one region to another depending on how favourably disposed regulators have been towards bitcoins. Chinese exchanges dominated bitcoin trading a couple of years ago with a more than 80% volume share. But after the clampdown, Japanese and U.S. exchanges now control over two-thirds of volumes.

In India, the RBI is still undecided on the issue of how and if at all it will regulate virtual currencies. Meanwhile, it has issued disclaimers that it hasn’t authorised bitcoins as a medium of exchange, warning investors of potential ‘financial, operational, legal, customer protection and security-related risks’ if they dabble in them.

Bitcoin May Go Boom: A Guide to This Week's Big SEC Decision (Update)

[Update: The SEC rejected the ETF proposal on Friday afternoon, causing the price of bitcoin to slump.]

Bitcoin is at a critical juncture. Any time now, the Securities and Exchange Commission will issue a decision that could throw open the door to a flood of new capital, and change how many investors regard the digital currency.

The SEC’s bitcoin decision, which is over three years in the making, is due by Friday. Here’s a plain English guide to what might happen, including why the decision is so important and how it could affect the price of bitcoin.

What’s the SEC decision?

The agency must decide if the BATS stock exchange can change its rules to offer a bitcoin ETF (exchange traded fund), which would let people buy bitcoin like a common stock. The ETF—called the Winklevoss Bitcoin Trust ETF—is the creation of the Winklevoss brothers, who once fought Mark Zuckerberg for control of Facebook, and now own a large stock of bitcoins.

Why is this ETF such a big deal?

It’s all about liquidity. While there are plenty of places to buy bitcoin, many investment funds can only hold assets that meet certain regulatory standards—such as approval from the SEC. If the agency approves the ETF application, money managers who want to include bitcoin in their portfolio are likely to jump in. Meanwhile, millions of ordinary people will have an easy new way to buy the digital currency. I can’t really phrase it any better than this quote from BitMex, a bitcoin analysis site:

If the SEC approves the Bats rule change, all manner of American muppet retail investors can yolo into Bitcoin via a regulated ETF. The pool of eligible money that can easily obtain exposure to Bitcoin will dramatically rise. There are various predictions about the amount of money that could flow into Bitcoin. In short, it will be Yuge.

Where and when will we see the decision?

The SEC is obliged to make the decision by March 11, which is this Saturday. That means the ruling is almost certain to come out on Thursday or Friday.

According to Blake Estes, an alternative asset expert at the law firm Alston & Bird, the decision will appear on this SEC web page, and everyone will find out at the same time.

What are the odds the SEC says yes?

People are calling this a coin toss. Those who think the SEC will approve the ETF point to the skillful work carried out by the Winklevoss lawyers, and to the fact that bitcoin is far more mainstream than it was even two years ago. Today, many more people—including regulators—are familiar with digital currency and how it works. There is also a sense that a bitcoin ETF is sooner or later inevitable.

Pessimists, on the other hand, can point to two sets of concerns that could lead the SEC to give the thumbs down. The first of these relates to how the Winklevoss intend to run the operation. Some people are uneasy that the proposed ETF would use Winklevoss-controlled businesses to source and store the bitcoins that would back the shares. The other set of concerns lie with bitcoin itself. The digital currency has been subject to wild price fluctuations, driven in part by heists and insider antics. According to Estes, the SEC may worry the agency’s approval of an ETF could lead to a bubble inflated by bitcoin novices—a bubble that could then pop.

“Some fear it could be a good opportunity for legacy players to find the next sucker to take it off their hands,” said Estes.

How will this effect the price?

Bitcoin has been on another tear of late, nudging a record of $1,300 per unit—more than an ounce of gold. Some of this likely reflects investor optimism the SEC will approve the ETF, meaning a future price rise is partly baked-in. Nonetheless, there are broad expectations the short term price of bitcoin will go crazy if the SEC says yes.

If the SEC says no, it will have a negative effect, though probably not a very dramatic one. The reason is there are two other ETF application before the agency. One is called the Bitcoin Investment Trust, and was developed by Barry Silbert, a well known figure in the digital currency world. The other, called SolidX, is distinct in that proposes to insure its bitcoin assets.

As noted above, there is a general feeling that approval for a bitcoin ETF of one type or another is inevitable, and so a rebuff by the SEC to the Winkelvoss proposal would only be a temporary setback.

Should I buy bitcoin?

That’s something only you can decide—preferably after a lot of research. Today, many people see bitcoin as another alternative asset class to add to a diversified portfolio. But bitcoin has an extremely volatile history, and has been prone to spectacular crashes, so if you’re averse to risk, it’s probably not for you.

Behind bitcoin boom, Japanese retail investors pile in

TOKYO (Reuters) - Japan’s army of retail investors, no strangers to high risk bets in the past, have emerged as a major force in bitcoin’s spectacular rally, now accounting for an estimated 30-50 percent of trading in the cryptocurrency as it spikes to record highs.

Once skeptics, Japanese retail investors have been attracted by the digital currency’s volatility and inefficiencies in pricing that create opportunities to make money on arbitrage between exchanges.

“When I first heard about the bitcoin a few years ago, I thought it was a fraud,” said Yoshinori Kobayashi, 39, a former stock trader who took up bitcoin trading two-and-a-half years ago.

“But I tried it out after I had come to know some people making money on it. I bought it at 60,000 yen, which quickly become 80,000 yen and I started to regret I hadn’t started earlier,” said Kobayashi, who believes bitcoin is on a long uptrend but took some profits last week.

The spectacular surge in bitcoin, up more than 16-fold this year to above $17,000, has drawn comparisons to the 1970s gold spike or Japanese shares’ rally in the 1980s’ go-go era. Both of those delivered massive gains to Japanese retail investors before plunging sharply.

Statistics on bitcoin and crypto-currencies are patchy because their trading is unregulated in most countries.

According to data compiled by Jpbitcoin.com, a Japanese bitcoin website, yen-based bitcoin trades reached a record 4.51 million bitcoins in November, almost a half of the total of the world’s major exchanges of 9.29 million bitcoin.

Industry officials say not all yen-based bitcoin trading is done by Japanese retail players as some hedge funds now trade bitcoin in the yen to take advantage of price differentials between the yen and dollar prices.

Still, many industry officials estimate Japanese account for somewhere between a third and half of global bitcoin trade.

Japan’s global share of the bitcoin market jumped after a clampdown this year by Beijing saw bitcoin trading in yuan almost entirely disappear.

South Korea, another key centre for bitcoin trade, said it would hold an emergency meeting on Friday to discuss the trading of cryptocurrencies amid calls for tighter regulation.

VALIDITY AND VOLATILITY

Japan’s approach to bitcoin has encouraged retail investor interest.

The Japanese government in April granted cryptocurrencies legal status as a means of settlement and in September officially recognized 11 digital currencies exchanges.

Also in September, the tax agency issued clarification that revenues from bitcoin will be treated as income, from which trading losses can be deducted.

That eased concerns that profits from bitcoin might be taxed like gambling, where gains will be taxed but losses will not be regarded as costs.

Some investors including Kobayashi also feel affinity to bitcoin partly because its inventor, Satoshi Nakamoto, is said to be Japanese, though the true identity of the father of the blockchain technology is shrouded in mystery.

Trading at Japanese major bitcoin exchanges grew to 4.51 million bitcoin in November from 1.19 million in April. In dollar terms, it has surged to $35.4 billion in November from $1.45 billion in April.

A lack of major institutional investors is providing retail investors a rare chance to become dominant players, with primitive pricing leaving opportunities for savvy traders, market participants say.

Even within dollar based exchanges, it is not uncommon to see a price in one exchange 10 percent higher than another exchange, for example. Then there are often gaps of more than 10 percent between yen-based bitcoin price and dollar-based price.

“Most Japanese traders don’t even bother to check the dollar price,” said a veteran financial trader, who started bitcoin in September.

TEXTBOOK CASE

The trader also said bitcoin’s moves after it rose above 100,000 yen ($880) are very similar to what happened in a big rally in gold and silver in the past.

“They both rallied very quickly after having broken out many years of range-bound trading,” he said.

Indeed, many traders say technical analysis works remarkably well when it comes to bitcoin. Hiroyuki Kato has traded cryptocurrencies for two years, spending two to three hours a day studying the patterns and ratios popular in technical analysis on his smartphone or computer terminal.

“I use Bollinger Band, MACD, the stuff everyone knows. It’s easier to win in bitcoin than in FX and stocks,” said Kato, who quit his sales job at a trading firm about two years ago to focus on trading cryptocurrencies and other assets.

Among some financial professionals, there is growing talk that the meteoric rise in bitcoin resembles the “tulip mania” bubble in the Netherlands in the 17th century that burst spectacularly. However, many Japanese traders expect bitcoin’s stellar run to continue for some time yet.

“The world’s total financial assets is around 10 quadrillion yen, and bitcoin is only just about 0.1 percent of that, which seems way too small if we assume the use of bitcoin spreads,” Kobayashi said.

Bitcoin’s net worth could reach about 10 percent of the world’s assets, about 100 times its size today, Kobayashi reckons.

Kato believes the digital currency is already in a bubble but still expects the start of futures trading on the Chicago Merchantile Exchange next week to attract more funds from institutional investors and push up bitcoin prices further.

A major burst could happen in 2019, Kato says, but not until factors including low interest rates and the deep doubts harbored by many change.

“At the moment, many people are still skeptical about bitcoins and when many are skeptical, there won’t be a burst of the bubble.”

(For a graphic on Bitcoin's blistering ascent, click tmsnrt.rs/2AHKJPd)

Reporting by Hideyuki Sano, Yoshiyuki Osada and Daiki Iga; Editing by Lincoln Feast

Комментариев нет:

Отправить комментарий