Bitcoin bis 2030 über 500.000 Dollar wert?

Gemäß einer Prognose von Jeremy Liew und Peter Smith soll ein Bitcoin bis 2030 über 500.000 Dollar wert sein.

Bitcoin benötigt keine Vorstellung, handelt es sich doch um die Kryptowährung mit dem höchsten Marktkapital, einer riesigen Community und Minern, die inzwischen mit einer Hashrate von 3 EH/s arbeiten. Seit einigen Monaten zeigt Bitcoin weiterhin einen starken positiven Preistrend, der den Bitcoin-Kurs auf über 1.000 Dollar hob.

Nun wurden Prognosen präsentiert, nach denen die Kryptowährung innerhalb der nächsten dreizehn Jahre auf einen Kurs von 500.000 Dollar steigen soll.

Eine dieser Prognosen kam von Jeremy Liew und Peter Smith und wurde im Business Insider veröffentlicht. Hier handelt es sich keineswegs um Unbekannte: Jeremy war der erste Investor von Snapchat und Peter Smith ist Gründer und CEO des Krypto-Unternehmens Blockchain.

Hintergründe zu der Einschätzung Bitcoins

Ihre Prognose begründen die beiden über die ansteigende Bitcoin-Adoption: Der Markt für Überweisungen ist in den letzten fünfzehn Jahren um 100% Prozent gewachsen – für Bitcoin-basierte, weltweite Transaktionen existiert also ein großer Markt.

Doch es gibt noch einen weiteren Grund: Die politisch brisanten Zeiten unter anderem in den Vereinigten Staaten und in Großbritannien soll gemäß der Prognose auch verstärkt dazu führen, dass Leute ihr Eigentum in Bitcoin absichern. Wie man an den Beispielen in China, Venezuela oder Indien sieht hat eine derartige Absicherung schon heute begonnen: Das System, was den Menschen ohne Bankkonto eine finanzielle Absicherung ermöglicht, ist Bitcoin.

Die immer stärkere Nutzung von Mobilgeräten hilft den Menschen dort, entsprechende Services zu nutzen. In den kommenden Jahren soll Bitcoin in 50% der Smartphone-basierten Transaktionen ausmachen.

Gemäß der Prognose von Liew und Smith soll das Bitcoin-Netzwerk bis 2030 um 6100% wachsen. Mit über 20 Millionen verfügbaren Bitcoin und einem dramatischen Anstieg an Nutzern soll gemäß dieses Szenarios der Wert von Bitcoin ein All-time-high im Jahr 2030 erreicht haben.

Natürlich muss für eine derartig hohe Akzeptanz von Bitcoin als Zahlungsmittel das oft diskutierte Skalierungsproblem gelöst werden. Sollte es hier zu keiner Lösung kommen wird man sich nach anderen Kryptowährungen umschauen. Doch bis 2030 ist noch viel Zeit – und mit Bestrebungen wie SegWit kümmern sich einige um das Skalierungsproblem.

Ob die dargestellte Einschätzung wirklich realistisch ist, wird natürlich die Zeit zeigen. So oder so ist es jedoch interessant, wenn namhafte Leute in Magazinen, die nicht zu den üblichen Bitcoin/Blockchain-Magazinen gehören, eine derart gewagte These vertreten.

Englische Originalversion von Gautham via Newsbtc

Über Dr. Philipp Giese

Dr. Philipp Giese arbeitet als Chief Analyst für BTC-ECHO und ist auf die Bereiche Chartanalyse und Technologie spezialisiert. Der promovierte Physiker kann dabei auf jahrelange Berufserfahrung als technologischer Berater zurückgreifen. Zudem ist er zentraler Ansprechpartner im Discord-Channel von BTC-ECHO und pflegt als Speaker und Interviewer den Austausch mit Startups, Entwicklern und Visionären.

Dr. Philipp Giese arbeitet als Chief Analyst für BTC-ECHO und ist auf die Bereiche Chartanalyse und Technologie spezialisiert. Der promovierte Physiker kann dabei auf jahrelange Berufserfahrung als technologischer Berater zurückgreifen. Zudem ist er zentraler Ansprechpartner im Discord-Channel von BTC-ECHO und pflegt als Speaker und Interviewer den Austausch mit Startups, Entwicklern und Visionären.

7 Cryptocurrency Predictions From the Experts

Fortune convened some top cryptocurrency entrepreneurs, venture capitalists, bankers, and others to chat about the future of digital money at Fortune’s Brainstorm Tech conference in Aspen, Colo. last week. A select group met at the Aspen Institute for a breakfast roundtable discussion on Wednesday morning.

Headliners on the panel included Balaji Srinivasan, CEO and cofounder of 21.co, a cryptocurrency startup that has raised more in traditional VC funding than almost other one. Another was Peter Smith, CEO and cofounder of Blockchain, a U.K.-based cryptocurrency wallet company that recently raised $40 million from GV, the venture capital arm of Alphabet, parent company of Google (goog). And Kathleen Breitman, CEO and cofounder of Tezos, a blockchain startup that this year raised more than $200 million in an initial coin offering, or ICO, and which counts celeb investor Tim Draper among its backers.

The crew of experts weighed in on everything from the longevity of Bitcoin, the original cryptocurrency and blockchain, or cryptographically secured public ledger, to the latest trend of hosting so-called token sales to fund projects, especially on Ethereum, a rival blockchain to Bitcoin’s, to the future of a decentralized web. Here are some of the predictions we heard.

1. Bitcoin and Ethereum are here to stay.

Most people who are enthusiastic about cryptocurrency appear to agree that Bitcoin and its newer rival Ethereum have staying power, though they may be more bullish on one versus the other. “In terms of 5 to 10 years, Bitcoin and Ether will be around I bet,” Balaji Srinivasan told the room of more than 70 people.

Peter Smith said his company, Blockchain, which was early to Bitcoin, has only just started to warm up to newcomer Ethereum. In contrast, Mike Cagney, CEO and cofounder of SoFi, a personal finance company, said during a separate session on the main stage that he was hotter on the latter technology.

Bitcoin “has some purpose but its application for commercial transaction is limited right now,” Cagney said. “The blockchain and Ethereum, on the other hand, have absolutely fascinating infrastructure applications,” he continued, mentioning the possibility to overhaul title insurance, which involves policies related to real estate, as one example.

2. As yet unknown coins will hit the big time.

Bitcoin and Ethereum may have stolen the show at this point, but the innovation won’t end there. Expect more winners on the horizon.

Kathleen Breitman is hopeful that Tezos, her own blockchain bet, will fill a niche that solves problems with extant blockchains. In particular, she and her project’s developers are designing Tezos to automatically push software updates out to the network, thus, in theory, avoiding the divisive feuding over upgrades that has wracked systems like Bitcoin over the past few years.

No one can say how many tokens and coins and blockchain protocols will eventually win out, but the experts seem to think there’s room for a multitude. “It’s likely that another one or two dominant ones we haven’t seen yet in the market,” Smith projected. “Another really dominant coin could come out this year or next year.”

3. Sure, people will get burned.

For the time being, token sales might seem like a fantastic way to raise a lot of money quickly and with few questions asked. Will this lead to riches for some? Undoubtedly—indeed, it already has. And rip-offs for others? Almost certainly.

Smith said he presumes that market manipulation and insider dealing is rampant among purveyors of initial coin offerings. “We’re cautious about it in the short term,” Smith said of his company. “But you have to temper that with the idea that every new technology is going to be like that in the beginning.”

Brad Garlinghouse, CEO of Ripple and a former executive at Yahoo, voiced his less forgiving concerns about the sector on a separate panel. “Heavily regulated markets are typically heavily regulated for a reason,” he said. “Frauds are happening, people are going to jail.”

4. ICOs will (eventually) give Silicon Valley and Wall Street a run for their money.

The days of making a pilgrimage to the homes of the holders of purse strings are coming to an end. In a world where anyone can participate as an investor online, physical location matters much less.

“It used to be you had to come to Silicon Valley, walk up Sand Hill Road, network with individuals,” Srinivasan said about entrepreneurs seeking funding, often strolling up a strip to the west of Palo Alto that long has been associated with venture capital firms. ICOs change all that.

Projects are already getting funded this Kickstarter-like new way. Breitman said she that when she set up Tezos’ token sale, she aimed to “get as many people who wanted to participate in the ecosystem to contribute.” The company raised more than $200 million to date and, according to her, more than 30,000 Tezos wallets have been opened.

5. Regulations will stick.

Elena Kvochko, chief information officer of the security division at Barclays, said that her bank has had talks with regulators about Bitcoin, blockchains, and their ilk. The rule-sticklers appear to be open to the idea as long as “know your customer” laws are obeyed, although its still early days.

Meanwhile, as governments settle on sets of rules of the road, countries like Switzerland, Singapore, and Estonia are jostling to develop frameworks that easily accommodate the new technology, Srinivasan said. They’re seeking to displace geographic incumbents and become hubs for a new wave of business financing. “If you’re a U.S. person or business, you have a good deal to be concerned about,” Smith said.

Breitman added that until the rules are agreed upon, it’s “best to be transparent” about what one is doing.

6. Speculation will subside as “killer apps” take hold.

As cryptocurrency prices fluctuate wildly, speculators have been having a field day. However, there’s reason to believe the markets will become more stable, as Bitcoin gradually has over the past couple of years (despite its still big price swings), Smith said.

In order for these computer coins to catch on big-time, they need a use-case that beats traditional money. Ideally, this ought to be better than merely “buying drugs,” as Jeff John Roberts, Fortune reporter and the session’s moderator, noted.

Srinivasan proposed one possible scenario. Imagine that “all your waking hours are spent in the Matrix,” he said, referring to a virtual reality in which everyone is enmeshed in the future. As people from all over the world meet and interact, they will need a medium of exchange. “To transact, you can’t just hand over a dollar bill,” Srinivasan said. “You need an international currency for that.”

“It might take a while but there’s going to be more of a need to transact across borders than there is today,” he said.

7. Cryptocurrencies will pressure incumbents to improve.

Whenever a consumer swipes or dips a credit card, payment processors charge a fee.

Nicko van Someren, chief technology officer of the Linux Foundation, pointed out that the fee companies like Visa or Mastercard charge exceeds the cost to clear or settle transactions. These businesses can potentially process transactions quicker and cheaper, he contended.

One potential outcome of the adoption of alternate systems, like Bitcoin, is to provide companies with the impetus to improve their services. “Bitcoin is good because it will make banks move toward the real cost of handling these transactions,” van Someren said. (By extension, in Ethereum’s case, one could imagine upstart companies built on it forcing giants like Amazon, Facebook, or Dropbox to reconsider or improve their respective offerings.)

Smith, meanwhile, was less optimistic about incumbents’ ability to adapt to such change. “I don’t think be lot of room for banks to simply adjust their price models,” he said.

Bitcoin just soared to a new $1,600 high — but the first investor in Snapchat thinks it could hit $500,000 by 2030

Jeremy Liew. Getty Bitcoin has been the top-performing currency in the world in six of the past seven years, climbing from zero to a new high value of about $1,600.

Jeremy Liew. Getty Bitcoin has been the top-performing currency in the world in six of the past seven years, climbing from zero to a new high value of about $1,600.

But the cryptocurrency isn't anywhere close to its potential, according to Jeremy Liew, the first investor in Snapchat, and Peter Smith, the CEO and cofounder of Blockchain.

In a presentation sent to Business Insider, the duo laid out their case for bitcoin exploding to $500,000 by 2030.

Their argument is based on increased interest in bitcoin, thanks to:

Bitcoin-based remittances

Remittance transfers, or electronic money transfers to foreign countries, have almost doubled over the past 15 years to 0.76% of gross world product, data from the World Bank shows.

"Expats sending money home have found in bitcoin an inexpensive alternative, and we assume that the percentage of bitcoin-based remittances will sharply increase with greater bitcoin awareness," the two said.

Uncertainty

Liew and Smith said increased political uncertainty in the UK, US, and developing nations would help elevate the level of interest in bitcoin.

"We believe bitcoin awareness, high liquidity, ease of transport, and continued market outperformance as geopolitical risks mount will make bitcoin a strong contender for investment at a consumer and investor level," the two said.

Mobile penetration

Liew and Smith said the percentage of noncash transactions would climb from 15% to 30% in the next 10 years as the world becomes more connected through smartphones.

The global smartphone penetration rate is 63%, and the total number of smartphone users is expected to increase by 1 billion by 2020. The GSMA, a trade body that represents the interests of mobile operators worldwide, says 90% of these users will come from developing countries.

This would make it possible for nearly everyone to have a bank in their pocket, and that should provide a boost for bitcoin as well. Liew and Smith say bitcoin could account for 50% of all noncash transactions.

Here are the basic model drivers Liew and Smith used:

- A bitcoin price of $1,000 in 2017.

- Network users will grow by a factor of 61 from now until 2030. "Put another way, we need a population of bitcoin users around a quarter of the Chinese population (or 5% of the global population) in 2030 to see bitcoin at $500k," Liew and Smith told Business Insider. Bitcoin's user network grew from 120,000 users in 2013 to 6.5 million users in 2017, or by a factor of about 54, and this could be just the beginning. Growth of that magnitude would mean 400 million users in 2030.

- The average value of bitcoin held per user will hit $25,000. "As institutional investor cash in bitcoin, sophisticated investors trading bitcoin, and bitcoin-based ETFs proliferate, we think the average bitcoin value held will increase to around $25k per Bitcoin holder," Liew and Smith said. Currently, with bitcoin's market cap of $16.4 billion, each of its 6.5 million users holds $2,515 worth of bitcoin on average.

- Bitcoin's 2030 market cap is decided by the number of bitcoin holders multiplied by the average bitcoin value held.

- Bitcoin's 2030 supply will be about 20 million.

- Bitcoin's 2030 price and user count will total $500,000 and 400 million, respectively. The price was found by taking the $10 trillion market cap and dividing it by the fixed supply of 20 million bitcoin.

But a lot could go wrong, too. News surrounding bitcoin has been rather negative as of late.

China, which is responsible for nearly 100% of trading in bitcoin, has been cracking down on trading. The three biggest exchanges recently announced a 0.2% fee on all transactions and blocked withdrawals from trading accounts.

The US Securities and Exchange Commission also rejected two bitcoin exchange-traded funds and will rule on another one in the future. It's not expected to be approved.

However, Smith says bitcoin is still in its early stages.

"The SEC's ruling wasn't a surprise to us," he told Business Insider. He said that "getting that sort of approval" could take a long time.

"In the meantime, bitcoin is already simple to buy and hold, and as the asset continues to mature, we'll continue to see an increase in the development and deployment of surrounding products," he said.

And while bitcoin hasn't been granted regulatory approval in the US, it is catching on elsewhere. On April 1, the cryptocurrency became a legal payment method in Japan.

Another threat to its future is developers who are threatening to set up a "hard fork," or alternative marketplace for bitcoin. This would result in the split of into bitcoin and bitcoin unlimited. However, Smith isn't worried.

"Bitcoin has strong economic incentives to prevent this," he said. "If the last two years of healthy contention and debate lead to a conclusion, it's that bitcoin is incredibly resilient and stable. In fact, the bitcoin blockchain has operated for seven-plus years with no downtime, a feat no other back-end system operating at this scale can claim."

But the cryptocurrency sees violent price swings uncommon among the more traditional currencies. Bitcoin rallied 20% in the first week of 2017 before crashing 35% on word that China was cracking down on trading.

The cryptocurrency has regained those losses and is trading up about 67% so far this year.

Bitcoin prognose 2030

Still have a question? Ask your own!

With consideration to the following projected conditions [weightage in square brackets]:

- the current projection by Tim Draper is US$250,000 per BTC in 2022 [low],

- and also projected by Tim Draper is that fiat currencies will no longer be as relevant as they are today in 5 years from now, i.e. by 2023 [medium]

- at which, we could likely attain critical mass by 2025 with mass adoption and bitcoin going mainstream [high]

- considering that past halving prices were US$13 (1st halving in November 2012) and US$648 (2nd halving in July 2016) [high]

- and by 2030, bitcoin would have gone through the 3rd halving in 2020 (6.25 btc/block), 4th halving in 2024 (3.125 btc/block) and 5th halving in 2028 (1.5625 btc/block) [high]

- with current price in 2018 rounded off at US$10,000 [high]

- extrapolated to US$25,000 by end of 2018 [medium]

- with approx. 20 million BTC in circulation by 2030 and total amount of money required to run the global economy [USD trillion/BTC quantity]

- multiplied by a diversity factor of 0.5 for half in bitcoin and half in all other financial assets [medium]

…throwing all the above data into the mix yields a projected bitcoin price of US$625,000 by the year 2030.

There are a lot of these questions on Quora and it is indeed fun to speculate on what the price of a bitcoin may be in 2030.

Hundreds of thousands of dollars or even more than a million dollars a very, very, possible and some may even say likely. One warning I’ll toss out though is some of the more optimistic predictions tend to overlook something.

In a scenario where the world has moved steadily into crypto and away from fiat, leading to skyrocketing bitcoin prices, the value of dollars will also have fallen, i.e. significant inflation will have occurred. So in that world, a bitcoin worth 1,000,000 USD won’t actually be able to buy as much as 1,000,000 USD buys today.

In fact, some predict a period of hyperbitcoinization - a time when people begin dumping fiat en masse and switching to bitcoin and other cryptos. If this were to happen, the value of national currencies would crash and 1 bitcoin could be worth millions of dollars. But that will in large part be due to the fact that those dollars will rapidly become worthless.

In that scenario, you wouldn’t want to be the last person moving out of fiat into crypto. Even if you don’t have a ton of faith in Bitcoin, it’s probably prudent to purchase a small amount as an insurance policy.

How many dollars will 1 bitcoin be in 2030? A more radical question might be this - how long until we stop mentally pricing things in dollars and start mentally pricing them in satoshis (1/100,000,000th of a bitcoin)?

I’m going to go with approximately $20,800 based on the argument of current price, not adjusted for inflation though, and that it’s generally doubled at some point within a few months of a halving, which we just had in July 2016, it’s currently at just below $1,300, and there are three more halving events before 2030.

However, don’t take that for hoyle, because It’s hard to say, because Bitcoin is highly volatile. People thought E-Gold would last forever but it was gone before Bitcoin even began. Now, we know that short of the end of the world, or a complete overhaul of all technology we currently know, Bitcoin will theoretically last until at least 2140. Every time it has halved, the value has eventually doubled. Not always right away, because people get scared and sell their Bitcoins right after the halving events, driving the price down initially, but then it goes back up when it’s now harder to mine than last year at the 2016 halving. There are at least three more halvings between now and 2030 - which will occur in 2020, 2024, and 2028.

Merely assuming that each halving will result in an eventual double price, and 2030 is far enough past the 2028 halving, assuming people are still interested in Bitcoin also, and not factoring inflation, as of right now (March 2017) it’s just under $1300. If that holds until 2020, at least that high, and doubles at some point after each halving, then it’s not unreasonable to hypothesize that the price would be approximately $20,800 in 2030.

What’s The Predicted Worth Of Bitcoin, Litecoin And Ethereum Coins By 2020, 2025, 2030?

How much are Bitcoin Litecoin Ethereum coins predicted to be worth by 2020, 2025, 2030?

No one can predict the future, so perhaps the best way to answer this question is with another impossible question, like this one from Jyri Mäkinen, who identifies on Quora as being “part of Blockchain Evolution.” He said: How much money is in the world?

This question, “How much are Bitcoin, Litecoin and Ethereum coins predicted to be worth by 2020, 2025, 2030?” originally appeared on Quora, the knowledge sharing network where compelling questions are answered by people with unique insights.

Answers by Bill C. Riemers, Brian Schuster,Jyri Mäkinen, Charles Guinn, Geno Jones, George Tung, Puneet Gupta, Akli Le Coq, Vincent Bressler, Lance Jepsen, Wolfgang Beer and Shakthi Kumar.

Bill C. Riemers, works at Red Hat (2006-present)

Answered June 22

At one point I computed (that) if the entire world’s economy was replaced with bitcoins, then each bitcoin would be worth about $2 million dollars in current dollars.

However, the fallacy of this argument is even if you believe the e-currency will replace all normal currency, there is absolutely no reason to believe it will be bitcoins that rule the day.

There are huge technical flaws with bitcoins. Same with Ethereum. Really the same can be said of most of the e-currencies I’ve tried. Sure maybe the blockchain is reasonably secure. But every time there is a fork in the code, there is a potential new ecurrency. How would you ever know if you were holding the best one? And who wants to take a day to resync their blockchain wallets each time Windows does an unexpected update?

The trades are corrupt, as are many of the users. Really what we have in e-currencies is evil and corrupt. Just as bad as the Federal Reserve.

Well actually worse. For all the horrors of the Federal Reserve, at least I can find the names of the board members.

It seems like every day a new e-currency comes online. Once a week there is a major price adjustment because let’s face it, the value is based strictly on “faith” just like USD, only with e-currency, there is no one big that will fail if the e-currency fails. So it is 100 percent speculation.

Some happen to provide some side benefit that is worthwhile. And many are working to improve the design flaws. For example the POS change for Ethereum will be a major game changer. Whether that will win out in the market is anyone’s guess.

Ethereum is an inflationary currency, and will remain so. But for reasons of trying to get mass adoption, you can expect inflation will be limited until ETH matches bitcoins in market cap.

If bitcoins win the day, you can expect the value to be up to $2 million eventually. If ETH wins the day, it would be pure speculation to even guess… If it remains the Wild West. Eventually these two will both disappear to be replaced by something better.

Brian Schuster, Industry Analyst at Hivergent, a blockchain company

Answered Aug. 16

This is a difficult question to answer. We could be in the middle of a financial crash at any point. However, I’ll give you the next best thing, which is what I think the “correct” market cap would be for the blockchain space in due time.

Just using Ethereum as an example, we can already see some trends about the actual output of these blockchain organizations and how the market rates their native assets. ETH on the Ethereum blockchain, on its 2-year anniversary this year, was worth roughly $30 billion. Even by Silicon Valley standards, that’s a high valuation. Facebook was only worth $1 billion after two years, which is still considered one of the fastest growing organizations in SV history.

Because of this, we can assume that cryptocurrency market caps lead the market cap of the underlying organizations/assets. In the case of Bitcoin, it was valued in the many billions of dollars well before the underlying utility actually proved to be worth that much. The same thing can be said about Ethereum and even Ripple.

So, we may start to speculate that the market cap of the cryptocurrency is some multiple of the underlying utility/value provided by the organization or the asset. For the sake of comparison, let’s say the value is 10X what the underlying organization would normally be worth. While this has been far from proven true (and even a bit silly considering we’re comparing for-profit with not-for profit orgs), we can start to see if this stands up to muster.

Currently, the market capitalization of the blockchain is $141 billion, most of that value coming from the top 2–3 cryptocurrencies (Bitcoin, Ethereum and Ripple). Out of hundreds of other blockchains that have attempted to create value, these three or the current gold/silver/bronze medalists. Is we used our 10X multiplier above, that would mean that the value of these “organizations” would worth:

If you heard about a company coming out of Silicon Valley and their organizations were valued at these amounts, would that seem reasonable to you? To me, it does. We have lots of examples of unicorn organizations being worth tens of billions after 10 years, and even organizations only a few years old being worth over $1 billion.

10X may not be the right multiplier (we are in a bubble, after all), but this seems like a reasonable place to start until we learn more about how this market works. So, to answer the question, I think it’s reasonable to see a $10 trillion cryptocurrency market by 2030.

After 2008, we saw many internet companies like Google and Facebook be worth hundreds of billions of dollars. Given a decade of maturity, I can see the underlying organizations in the blockchain space being valued at a trillion collectively. Using our 10X multiplier, we might then say that the cryptocurrency market collectively would be worth $10 trillion.

I’m sure this method can be improved upon (and hope it does), but for the time being, this is the intuition that makes sense to me in this space.

Related Content From Our Editor

Jyri Mäkinen, Part of Blockchain Evolution (2017-present)

Answered June 5

If we think blockchain-based economy is better than current one, then most likely we will see most of the money flowing to blockchains in future.

There can always be flaws in any system. Blockchains carry great promises but time will show.

Problem is that we don’t really know how much money is in the world. When we buy cryptocurrencies and log this money to blockchains, we might just find out.

My estimated price:

Current total market cap of all cryptocurrencies is

Here is an estimate that there is $1.2 quadrillion in the world which is $1,200,000 billion. You can find it here: all the money in the world, in one chart

So if all economy would flip to blockchains they would grow about 12,000 times from this point. Let say only 10 percent of the world economy will flip to blockchains inside the next 10 years, this means income of 1,200 times your startup capital. So that would mean if you invest $1000 now it could be $1.2 million in 10 years.

Charles Guinn, Studier of Blockchain and cryptocurrency enthusiast.(2011)

Updated Aug. 1

The founder of bitcoin once said that bitcoin will either gain massive volume or none at all. At the current rate it is gaining massive volume and everything appears to be on a steady rise. Although as Alain Pilon has commented, “it is important to note that all the current coin can also crash and be replaced with another…”

Bitcoin is a really cool idea but ideas come a dime a dozen. There are old books about AI developing a currency similar to a cryptocurrency to fund itself to take over the world so the idea of a decentralized currency is not new.

The technology behind bitcoin is known as the blockchain and it is revolutionary. The blockchain can be used for many things involving data, not just digital assets, businesses can theoretically operate entirely on a blockchain database.

Cryptocurrencies will take the world by a storm and the future sounds bright. You can expect big things in the coming years.

Source: The Conversation (Blockchain is useful for a lot more than just Bitcoin)

Geno Jones, Electronics/IT (2004-present)

Answered June 7

As far as value goes, I don’t know about a 50K bitcoin. To be honest while it is actually very possible, at the same time I think that projection is a bit bullish. However, I remember Max Kieser telling everyone about 3 years ago that I would not be shocked to see a 10K bitcoin. I had the same sentiments actually. The more people that pickup on blockchain technology and accept it as payment the better off we all are really. Right now if you look BTC has 40+ percent of the total market cap for digital currency.

Particl seems like a fairly interesting investment right now. It is an anonymous coin and is going to have a built-in marketplace with a smart escrow system built into the blockchain. What this means is that if you don’t get your product to your satisfaction and the seller does not work with you to release your funds you can choose not to release funds for the product.

But keep in mind if you burn the escrow you lose coins but the seller must also put up coins that get burned as well. So unless either party wants to waste coins it is in both parties’ best interest to transact in a fair manner.

This does a couple of things. It prevents scams by using built-in leverage, and it puts leverage on the demand for more coins than just what you need for a single purchase, thus making holders out of people who wish to use smart escrow. This solves one of the largest cryptocurrency problems still not really solved today. They are also working on a built-in marketplace — an eBay of sorts with no third party.

I happen to love dogecoin. It has been a fairly profitable coin since its inception really. It was always marketed as the non-investment coin but I’ll let you in on a little secret. It was likely one of the most profitable coins to make trades. I cannot tell you the number of times it has risen and fallen from glory. These fluctuations resulted in 100-percent gains — I believe likely more than any other coin. It has and has always had a strong user base and many are die-hard.

The amount of things that the coin did during its launch really was a movement at the time. Things like helping the Jamaican bobsled team afford to go to the Olympics. Funding water systems and schools in Africa. Helping Nascar Racer Josh Wiese with sponsorship to race for NHRA. There are many other things I am missing I’m sure. While I hold very little of the coin at current I enjoy the community of people that came out of this movement. It really showed that even a coin with a small store of value at the time is capable of moving mountains if enough people get behind it. This was more important to me then a lot of metrics it provided to foundation for faith in digital currency and really was a mind-opening experience for me. While I am no longer a large holder of dogecoin or any of the coins mentioned I would accept it as a form of payment any day.

Blockchain technology is still in stages of infancy. What we must realize is that we are experiencing the tipping point. Everyone is aware of this effect but not a lot of people are aware of what the tipping point is. Actually the tipping point is misunderstood because it has very little to do with tipping. As most people would suspect, once something is tipped over 50 percent of it is going to fall. However, this is not the case. Think of the tipping point as a very top-heavy tall structure with a very light foundation. The tipping point is when 10 percent of a noncentric group gets on board with a specific idea or ideal. This is the point when things start to gain favor and in this case it would be the world’s population. You see — and I hate to use the term as it is used so much — “people are waking up to crypto currency and its potential.”

George Tung, Bitcoin and Cryptocurrency Enthusiast.

Answered June 5

Anyone answering is just throwing out random numbers because quite honestly no one knows. Remember when Bitcoin climbed to $1200 a few years ago? Everyone thought it would keep rising until it crashed back to the $200 levels before climbing to where it is now.

So right now everyone is super excited and throwing out big numbers on where BTC, LTC and ETH will be, but be cautious. There might be huge ups and downs. But overall if you play the long game and buy and hold, you’ll be setting yourself up for a really good profit and potential life changer.

- BTC 2020 – $10,000

- BTC 2025 – $50,000

- BTC 2030 – $500,000

- ETH 2020 – $1,000

- ETH 2025 – $5,000

- ETH 2030 – $50,000

I’m not guessing on LTC because I don’t believe there is any value on holding onto them.

Puneet Gupta, Blockchain Explorer, Digital Marketer, Startup Mentor

Answered Aug. 17

By 2050, it is predicted that Bitcoin, Litecoin and Ethereum will be the currencies you will use to buy and sell products and services. Most of the fiat currencies will disappear.

These cryptocurrencies are still at a very nascent stage. Either they will be massive or they will vanish. We still cannot predict the future path these coins will take.

Currently it is the next big thing after the Internet. It is Web 3.0 with payments. People who believe in these coins are not worried about their value in 2030 or beyond but they are waiting for the day when Bitcoin will be the only currency they can transact in.

Either way, do your own research. If you believe in Bitcoins or other coins, you will not have to worry about the price. Or you can make some profits and get out before the market crashes.

Akli Le Coq, Inspector at Direction Générale Des Finances Publiques (2016-present)

Answered Aug. 16

Do your own research and only trust yourself on investment.

Almost everyone fails with prediction. I have no crystal ball either.

OK, let’s try anyway, using a well-known method : minimal target market cap, anticipating a very reasonable 10 percent market share for each cryptocurrency :

Usage : store of value

Market : global wealth around the world

Market cap : $255 trillion (source : Credit Suisse Global Wealth report, 2016)

Minimal target market cap for BTC : $25.5 trillion

Minimal target price for BTC : $1,300,000

Usage : retail and daily payments

Market : retail transactions -> $21 trillion in 2020 (source : CapGemini Global Payments report, 2016). Room for competitors if they can reach Litecoin’s volume and network effect.

Minimal target market cap : $2.1 trillion

Minimal target price : $23,000

Usage : decentralized applications (dapps)

Market : decentralized applications -> I’m not able to put any number here… but dapps can potentially replace stock markets, crowdfunding, working organizations…It’s huge but there is also room for NEO as a competitor for China or other blockchains.

Minimal target market cap : impossible to say but potentially more than bitcoin

Minimal target price : impossible to say but potentially more than bitcoin

Vincent Bressler

Answered June 3

If Bitcoin successfully transitions to supporting high volume off chain transactions, then Bitcoin will probably be worth 50K or more by 2020.

We will probably find out if Bitcoin can overcome entrenched interests and make the transition within the next few months.

If Bitcoin fails to make this transition, then every blockchain will be damaged, but Litecoin will probably come out of that as the new leader since it already has the required code to support high volume off chain transactions.

Ethereum may self-destruct or may find a real application, but I don’t like its long-term prospects. If Bitcoin makes the transition, then everything that Ethereum promises can be done with side chains or other techniques.

Within a few years, assuming that cryptocurrencies really take off, fungibility will become a major obstacle. Fungibility is the property of money whereby each unit is indistinguishable from every other unit. In the absence of fungibility, it is possible to censor cryptocurrency transactions.

Really big wealth will not transition into a blockchain lacking fungibility and privacy. As far as I know, only one blockchain right now has fungibility, privacy, has an active community, uses well-understood cryptography, does not have a pre-mine, and does not have rent seeking structure to reward insiders. That crypto currency is Monero.

Lance Jepsen, Owner (2009-present)

Answered June 7

Bitcoin is projected by some to be $20,000 by 2020, $100,000 by 2025, and $500,000 by 2030. The catalyst for this growth is more countries legalizing bitcoin over time and thus more financial products based on bitcoins.

There are over 700 cryptocurrencies and so I predict most are going to collapse and investors will lose everything.

Wolfgang Beer, Author

Updated June 10

Bitcoin definitely is a serious and mature technology in terms of its blockchain. While it is still depending on temp hype cycles, Bitcoin already shows an extremely high and stable market capitalization, as CryptoCurrency Market Capitalizations shows:

It’s clear for me that Bitcoin will stay and gain on importance. My expectation is for 2020 that Bitcoin will be stable around $1000 per BTC, 2025 around $1500 BTC and 2030 around $3000USD per BTC.

Shakthi Kumar, AP Software Manager at Amazon

Answered Jun 1

Here is my timeline for crypto currency. The coins will be the future but there will be consolidation based on tech progress.

2020: There will be a 5–8x increase from the current price across all cryptocurrencies.

2025: Quantum computers are accessible to end users. All existing cryptocurrencies using non-quantum resistant algorithms will crash to zero.

So bitcoin crashes to zero.

2030: New variants of bitcoin and ether run become mainstream. So watch out for quantum resistant alt coins.

The question, “How much are Bitcoin, Litecoin and Ethereum coins predicted to be worth by 2020, 2025, 2030?” originally appeared on Quora, the knowledge sharing network where compelling questions are answered by people with unique insights.

Sign up for the Moguldom newsletter — the most compelling business news you need to know about reversing inequality in tech, delivered straight to your inbox.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Copyright © 2018 Slim Beleggen

Heeft u geen account?

Dit rapport is enkel voor abonnees.

Niet Bitcoin of Ethereum is de beste cryptomunt, maar Dash met een stijging van 2.500% in 2017

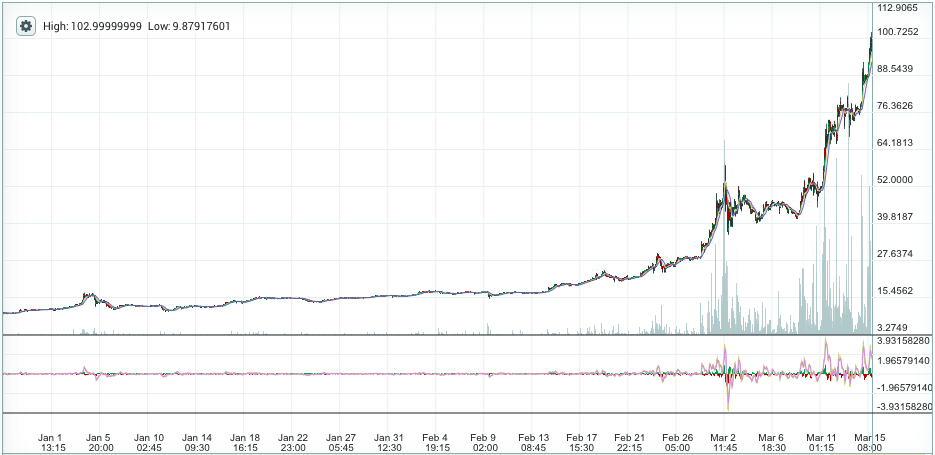

Wie onze blogs volgt, kent zeker en vast Bitcoin. De laatste tijd kwam Ethereum ook vaak in beeld. Toch is het ‘Dash’ dat de show steelt onder de digitale munten. Dash, dat staat voor Digital Cash, steeg dit jaar al van minder dan $4 naar meer dan $100 of een stijging van maar liefst 2.500%!

Dash is ontstaan uit Darkcoin in maart 2015. Het is eerder een cryptomunt zoals Bitcoin, maar het heeft enkele extra voordelen die Bitcoin niet heeft. Bij Bitcoin duurt het minstens 10 minuten om een transactie te bevestigen, soms zelfs uren. Dash heeft een InstaSend betaalsysteem waarbij transacties worden goedgekeurd in seconden.

Dash wordt steeds meer aanzien als Bitcoin 2.0 en dat zie je ook aan de grafiek.

Dash heeft ook een veel grotere privacy dan Bitcoin. PrivateSend verzekert dat de transactiegeschiedenis en jouw balans privaat blijft. Maar het meest innovatieve onderdeel aan Dash zijn de ‘masternodes’. ‘Masternodes’ zorgen ervoor dat niet alleen de mijners worden beloond om cryptomunten te mijnen, maar ook dat de validatie, opslag en diensten aan de technologie worden beloond.

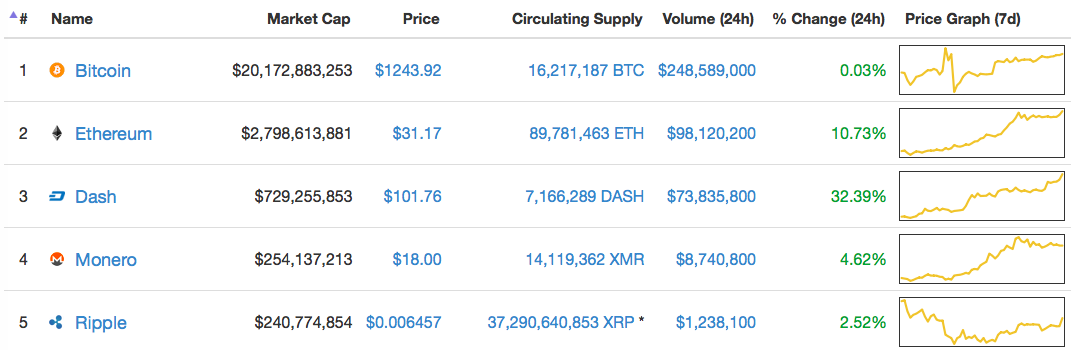

Met een marktkapitalisatie van meer dan $700 miljoen is Dash nog steeds kleiner dan Ethereum (bijna $3 miljard) en Bitcoin (meer dan $20 miljard). Maar het is ondertussen wel een veelvoud van andere digitale munten zoals Monero ($250 miljoen) of Ripple ($240 miljoen).

Nog een voordeel aan Dash is de mogelijkheid om projecten te financieren. Zo financiert Dash in feite zichzelf. Je kan een voorstel indienen om het netwerk beter te maken en iedereen met een masternode kan stemmen.

Dash is als het ware Bitcoin 2.0 met enkele grote voordelen ten opzichte van de eerste echte digitale munt. Iemand die begin 2017 €40.000 had geïnvesteerd in Dash, zou nu miljonair zijn nadat de koers x 25 is gegaan.

Bitcoin, Ethereum en nu Dash komen steeds meer onder de aandacht. De opmars van de cryptomunten lijkt nog maar net begonnen. Wie deze trend wil volgen, kan daarvoor terecht in het Technologie Rapport.

Wie deze strategie volgde heeft vandaag 56% méér cryptomunten

Bij Slim Beleggen hebben we een speciale strategie ontwikkeld waarbij elke daling op de cryptomarkt niets meer is dan een super hefboom om enorm veel winst te boeken wanneer de prijzen terug stijgen.

Reacties

Deel

Als geregistreerd lid ontvangt u de gratis nieuwsbrief en kunt u al het laatste nieuws op de website lezen.

Bitcoin: 1 Million US- Dollar in 10 Jahren?

von Timo Emden

Testen Sie anhand eines kostenlosen Demokontos von IG den Handel des Bitcoin.

(DailyFX.de) – Der Kurs des Bitcoin kennt vor allem seit Anfang des zweiten Quartals kein Halten mehr. Mittlerweile hat sich der Kurs seit diesem Zeitpunkt verdoppelt und steuert nun auf 3.000 US- Dollar zu. Zudem hat der Kurs das glänzende Edelmetall Gold längst hinter sich gelassen . Aktuell ist ein Bitcoin mehr als doppelt so viel Wert wie eine Feinunze Gold.

Verständlicherweise bringen solche massive Gewinne auch Mondpreisprognosen mit sich: Wence Casares, CEO von Xapo verkündete jüngst auf der Consensus Konferenz in New York eine Prognose von einer Million US- Dollar pro Bitcoin in zehn Jahren. Im April war es noch Blockchain CEO Peter Smith, welcher sich der Prognose von 500.000 US- Dollar bis Ende 2030 des Snapchat Investors Jeremy Liew anschloss.

Beide glauben, dass das Bitcoin- Bewusstsein eine hohe Liquidität, leichte Transaktionswege und ein Helfer in Zeiten geopolitischer Risiken sein wird.

Eine Prognose von einer Milliarde US- Dollar in zehn Jahren ist m.E. mehr als gewagt und sollte mit größter Vorsicht bedacht werden. Casares ist nicht der Erste, welcher solch eine Mondpreisprognose herausgibt. Die jüngste Prognose von bis zu 3.500 US- Dollar eckte zwar bereits auch an diversen Ecken an, dennoch ist diese m.E. mehr als wahrscheinlich. Mittlerweile könnte der Kurs bei einem sich fortsetzenden Anstieg jenes Niveau sogar noch zur Hälfte des Jahres erreichen.

Vorsicht vor Rücksetzern

Der Bitcoinkurs ist und bleibt anfällig. Die digitale Münze übertrifft sich fast täglich selbst und sucht nach neuen Höchstständen. Doch die Gefahr einer Überhitzung ist da. Widerstand sollte m.E. nun bei der nächsten wichtigen psychologischen Hürde von 3.000 US- Dollar warten. Folgerichtige Unterstützung wartet für die Bullen nun bei 2.500 US- Dollar pro Bitcoin.

Was zeichnet einen erfolgreichen Trader aus und wie kann ich klassische Fehler vermeiden? Lernen Sie noch heute unsere Trading- Leitfäden kennen!

Analyse geschrieben von Timo Emden, Marktanalyst von DailyFX.de

DailyFX stellt Neuigkeiten zu Forex und technische Analysen, die sich auf Trends beziehen, die die globalen Währungsmärkte beeinflussen, zur Verfügung.

3 381 пользователь находится здесь

МОДЕРАТОРЫ

- carlslarson Developer

- heliumcraft Satoshi Nakamoto

- _CapR_ Collector

- nbr1bonehead Lucky

- etherboard 2 years account age. > 2 years account age.

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 2 года назад , изменено * автор ryoumh

Want to add to the discussion?

[–]x_ETHeREAL_x 5 очков 6 очков 7 очков 2 года назад (1 дочерний комментарий)

[–]ItsAConspiracy Ethereum fan 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]nbr1bonehead Lucky 2 очка 3 очка 4 очка 2 года назад (7 дочерних комментарев)

[–]nbr1bonehead Lucky 1 очко 2 очка 3 очка 2 года назад (5 дочерних комментарев)

[–]nbr1bonehead Lucky 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]ItsAConspiracy Ethereum fan 0 очков 1 очко 2 очка 2 года назад (3 дочерних комментария)

[–]ItsAConspiracy Ethereum fan 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]mcmike313 3 - 4 years account age. 400 - 1000 comment karma. 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]sreaka 1 очко 2 очка 3 очка 2 года назад (1 дочерний комментарий)

[–]sn0wr4in 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 83226 on app-760 at 2018-05-29 18:35:22.908907+00:00 running 7e980a7 country code: RU.

Bitcoin bis 2030 über 500.000 Dollar wert?

Gemäß einer Prognose von Jeremy Liew und Peter Smith soll ein Bitcoin bis 2030 über 500.000 Dollar wert sein.

Bitcoin benötigt keine Vorstellung, handelt es sich doch um die Kryptowährung mit dem höchsten Marktkapital, einer riesigen Community und Minern, die inzwischen mit einer Hashrate von 3 EH/s arbeiten. Seit einigen Monaten zeigt Bitcoin weiterhin einen starken positiven Preistrend, der den Bitcoin-Kurs auf über 1.000 Dollar hob.

Nun wurden Prognosen präsentiert, nach denen die Kryptowährung innerhalb der nächsten dreizehn Jahre auf einen Kurs von 500.000 Dollar steigen soll.

Eine dieser Prognosen kam von Jeremy Liew und Peter Smith und wurde im Business Insider veröffentlicht. Hier handelt es sich keineswegs um Unbekannte: Jeremy war der erste Investor von Snapchat und Peter Smith ist Gründer und CEO des Krypto-Unternehmens Blockchain.

Hintergründe zu der Einschätzung Bitcoins

Ihre Prognose begründen die beiden über die ansteigende Bitcoin-Adoption: Der Markt für Überweisungen ist in den letzten fünfzehn Jahren um 100% Prozent gewachsen – für Bitcoin-basierte, weltweite Transaktionen existiert also ein großer Markt.

Doch es gibt noch einen weiteren Grund: Die politisch brisanten Zeiten unter anderem in den Vereinigten Staaten und in Großbritannien soll gemäß der Prognose auch verstärkt dazu führen, dass Leute ihr Eigentum in Bitcoin absichern. Wie man an den Beispielen in China, Venezuela oder Indien sieht hat eine derartige Absicherung schon heute begonnen: Das System, was den Menschen ohne Bankkonto eine finanzielle Absicherung ermöglicht, ist Bitcoin.

Die immer stärkere Nutzung von Mobilgeräten hilft den Menschen dort, entsprechende Services zu nutzen. In den kommenden Jahren soll Bitcoin in 50% der Smartphone-basierten Transaktionen ausmachen.

Gemäß der Prognose von Liew und Smith soll das Bitcoin-Netzwerk bis 2030 um 6100% wachsen. Mit über 20 Millionen verfügbaren Bitcoin und einem dramatischen Anstieg an Nutzern soll gemäß dieses Szenarios der Wert von Bitcoin ein All-time-high im Jahr 2030 erreicht haben.

Natürlich muss für eine derartig hohe Akzeptanz von Bitcoin als Zahlungsmittel das oft diskutierte Skalierungsproblem gelöst werden. Sollte es hier zu keiner Lösung kommen wird man sich nach anderen Kryptowährungen umschauen. Doch bis 2030 ist noch viel Zeit – und mit Bestrebungen wie SegWit kümmern sich einige um das Skalierungsproblem.

Ob die dargestellte Einschätzung wirklich realistisch ist, wird natürlich die Zeit zeigen. So oder so ist es jedoch interessant, wenn namhafte Leute in Magazinen, die nicht zu den üblichen Bitcoin/Blockchain-Magazinen gehören, eine derart gewagte These vertreten.

Englische Originalversion von Gautham via Newsbtc

Über Dr. Philipp Giese

Dr. Philipp Giese arbeitet als Chief Analyst für BTC-ECHO und ist auf die Bereiche Chartanalyse und Technologie spezialisiert. Der promovierte Physiker kann dabei auf jahrelange Berufserfahrung als technologischer Berater zurückgreifen. Zudem ist er zentraler Ansprechpartner im Discord-Channel von BTC-ECHO und pflegt als Speaker und Interviewer den Austausch mit Startups, Entwicklern und Visionären.

Dr. Philipp Giese arbeitet als Chief Analyst für BTC-ECHO und ist auf die Bereiche Chartanalyse und Technologie spezialisiert. Der promovierte Physiker kann dabei auf jahrelange Berufserfahrung als technologischer Berater zurückgreifen. Zudem ist er zentraler Ansprechpartner im Discord-Channel von BTC-ECHO und pflegt als Speaker und Interviewer den Austausch mit Startups, Entwicklern und Visionären.

Комментариев нет:

Отправить комментарий