Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

Bitcoin to Euro

Exchange rate calculated using USD Bitcoin price.

This site allows you to:

- See the Bitcoin exchange rate i.e. the current value of one bitcoin.

- Convert any amount to or from your preferred currency.

Bitcoin is a digital currency. You can use Bitcoin to send money to anyone via the Internet with no middleman. Learn more here.

Keep an eye on the Bitcoin price, even while browsing in other tabs. Simply keep this site open and see the live Bitcoin price in the browser tab. (Note: Some mobile browsers don’t yet support this feature.)

See how many bitcoins you can buy. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left.

See the value of your Bitcoin holdings. Enter the number of bitcoins you have, and watch their value fluctuate over time.

Compare Bitcoin to gold and other precious metals by checking out the converters for Bitcoin to gold, Bitcoin to silver, Bitcoin to platinum, and Bitcoin to palladium.

Try it on your phone or tablet—this site is designed with mobile devices in mind.

Convert in terms of smaller units e.g. microbitcoins (µ), millibitcoins (m). Toggle using keyboard shortcuts: 'u', 'm', and 'k'.

Bookmark your preferred currency e.g. Bitcoin to Euro, or Bitcoin to British Pound. This site currently supports 64 currencies.

Price data is continually gathered from multiple markets. A weighted average price of these markets is shown by default (based on 24-hour trade volume). Alternatively, you can choose a specific source from the settings menu.

Development

- Linkable (i.e. bookmarkable, shareable) amounts.

- A widget to be embedded on other sites.

- Options added for millibitcoins, and 3 new cryptocurrencies. 2014-03-16

- Volume-weighted pricing implemented as the default option. 2013-11-29

- Multiple data source options included. Currency chooser improved. 08-16

- Major Android-related bugs fixed. (Thanks to those who donated!) 07-07

You’re welcome to contact the creator of this site at Reddit or BitcoinTalk. Bug reports are greatly appreciated.

Disclaimer

The exchange rates on this site are for information purposes only. They are not guaranteed to be accurate, and are subject to change without notice.

Bitcoin price euro

The Bitcoin.com Composite Price Index

Unlike stocks, bitcoin markets never close. Bitcoin is traded 24 hours a day, 7 days a week, and 365 days a year in dozens of currency pairs at exchanges all over the world. Across the globe, people create buy and sell orders based on their individual valuations of bitcoin, leading to global, real-time price discovery.

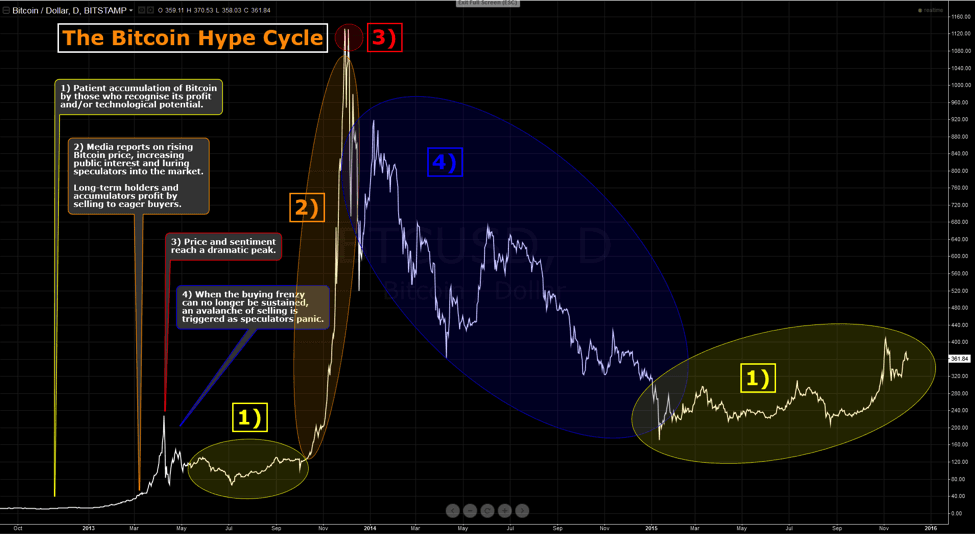

While Bitcoin's price history is not without major bubbles, volatilty overall has been trending downward.

All the Bitcoin news that you need ×

All the Bitcoin news and information you need.

Bitcoin Daily is delivered to your inbox each morning, we find the top 3 stories and offer our expert analysis. Not convinced? Check out our latest newsletter.

Bitcoin to Euro Exchange Rate & Historical Charts

Europe has always been an odd region when it comes to financial innovation. Every country has its own set of payment options, yet there is no universal solution – other than SEPA transfers (that are only used for online purchases).

Bitcoin has the potential to unify the European Union in this regard, although there is still a lot of work to be done. The digital currency space needs to evolve at an accelerated pace, especially in the Scandinavian region.

Even though Scandinavian countries have turned into cashless societies, it is unclear why the Bitcoin penetration in these countries is virtually invisible. It is also a part where we don’t hear much about Bitcoin-related news – this has been the case for several years.

France was among the first few countries to embrace Bitcoin, but things have changed over the past couple of years. Had the presidential candidate Le Penn won the election, she would have wanted to ban Bitcoin altogether. Not sure how she’d have gone about it considering the nature of Bitcoin allows the currency to stay decentralized.

Whether it be the adoption rate or Bitcoin regulations, overall it appears that Europe continues to lag behind so far as Bitcoin is concerned. Narrowing down to a possible reason why this is the case is not easy. It is likely the culmination of various reasons why Bitcoin is not doing so well in Europe.

Bitcoin in Europe

The financial situation of Europe has been tumbling off late. Considering the slowdown in the economy, instead of working towards the regulations that favor Bitcoin, European Union is looking to tighten the digital currency rules by the end of this year.

A report entitled ‘The Juncker Commission’s ten priorities: State of play at the start of 2017’ includes digital currencies for the first time as part of the Commission’s anti-money laundering efforts, which is a priority the Commission hopes to deliver by the end of 2017.

The amendments in the report seek to reduce anonymity surrounding digital currencies including bitcoin. At the same time, in order to prevent money laundering and terrorist financing, EU is also working towards identifying the Bitcoin users.

The directive, to be transposed by June 26, 2017, establishes a framework to require member states to identify and mitigate risks related to money laundering and terrorist financing.

As per the proposal, technology has created alternatives for financing that are beyond the scope of EU legislation that should no longer be justified. To keep pace with evolving trends, new measures to improve the existing preventive framework are needed.

The European Parliament has already approved a proposal for a task force to investigate the role of cryptocurrencies like bitcoin and blockchain technology.

The vote to establish this task force came soon after the European Parliament’s Committee on Economic and Monetary Affairs (ECON) recommended that the EU Commission consider revising EU payment laws, on the basis of its assessment of cryptocurrencies and blockchain technology.

The proposal defines “virtual currencies” as a digital representation of value that can be digitally transferred, stored or traded and accepted by natural or legal persons as a medium of exchange, but does not have legal tender status.

It defines “custodian wallet provider” as an entity providing services to safeguard cryptographic keys on behalf of customers, to holding, storing and transferring virtual currencies.

As for tightening the regulations, the ECB (European Central Bank) supported EU lawmakers’ directive require digital currency exchanges to license or register, including wallet providers. However, the proposed directive does not address when digital currencies are used without exchange into fiat currencies.

People could use digital currency to buy goods and services, which “could provide a means of financing illegal activities,” the ECB wrote. The bank also claimed some criminal groups can currently conceal their money transfers using digital currencies, benefiting from a degree of anonymity.

“To combat the risks related to the anonymity, National Financial Intelligence Units (NFIU) should be able to associate virtual currency addresses to the identity of the owner of virtual currencies.” the bank said. The possibility of allowing users to self-declare to authorities on a voluntary basis should also be considered.

The ECB went ahead to urge EU lawmakers to not promote digital currencies. Regulating digital currencies to prevent money laundering and terrorist financing is appropriate, the Bank explains. However, lawmakers “should not seek in this particular context to promote a wider use of virtual currencies.”

ECB also feels that the existing definition of digital currencies in the proposed directive are not clear enough. “The ECB recommends defining virtual currencies more specifically, in a manner that explicitly clarifies that virtual currencies are not legal currencies or money,” they wrote.

At the end of the report, European Parliament President Martin Schulz, Council President Robert Fico, and European Commission President Jean-Claude Juncker jointly declared that while they will continue to work on all legislative proposals, some initiatives will be given priority treatment.

Among the six areas of top priorities is “better protecting the security of our citizens,” the trio declared. One of the ways they suggested is through “improved instruments to criminalise terrorism and fight against money laundering and terrorist financing,” which digital currencies fall under.

Europe’s roadmap to restrict payments in Bitcoin

Cash and cryptocurrencies have been the target of the European Commission’s anti-money laundering efforts. Now the Commission published a roadmap of its proposal for the ‘restrictions on payments in cash’ initiative, extending them to cryptocurrencies including Bitcoin.

The aim of the roadmap aka ‘Inception Impact Assessment’ is to inform stakeholders such as law enforcement, tax authorities, central banks and everyone who would be impacted by the initiative and give them the opportunity to provide feedback.

Citing cash transactions’ feature of anonymity, the roadmap states that “such anonymity can also be misused for money laundering and terrorist financing purposes”, adding that cash payment restrictions would potentially be a means to fight criminal activities using large cash transactions.

The commission proposed a competent authority to be made responsible for ensuring transparency. Alternatively, the declaration can also be made independently by all parties to the payments.

Surprisingly, the commission extended these restrictions to cryptocurrencies as well. The problem with cryptocurrency is different from that of cash. Cryptocurrencies are not regulated at the EU level. They are considered anonymous because their transactions are recorded but “there is no reporting mechanism equivalent to that found in the mainstream banking system to identify suspicious activity”, the Commission explained.

The roadmap suggests: “An option could be to extend the restrictions to cash payments to all payments ensuring anonymity (cryptocurrencies, payment in kinds, etc.). On the other hand, restrictions on cash payments could promote the development of alternative payments technologies compatible with the non-anonymity objective pursued.”

According to the Commision, if the cash restrictions were to be extended to cryptocurrencies, they will supplement the existing proposed measures to reduce cryptocurrency anonymity as outlined in the Anti-Money Laundering Directive (AMLD).

The Commission has also been actively working on ways to reduce cryptocurrency anonymity since it published the ‘Action Plan for fighting against terrorist financing’ last February. It states that “there is a risk that virtual currency transfers may be used by terrorist organisations to conceal transfers”, prompting the Commission to extend “the scope of the AMLD to include virtual currency exchange platforms.”

As mentioned earlier, the Juncker administration confirmed that the fight against money laundering and terrorist financing, which includes cryptocurrencies, is its priority.

Malta’s PM, Dr. Joseph Muscat, on the other hand is asking Europe to embrace Bitcoin

He spoke at the CEPS Ideas Lab event where he proposed that “Europe should become the Bitcoin continent”. It is quite an intriguing statement by the Prime Minister of Malta, to say the least.

The event saw over 1000 participants of 43 different nationalities consisting of national governments’ representatives, businesses, NGOs and European institutions.

As a keynote speaker, Muscat proposed many ideas in favor of cryptocurrencies. “The rise of cryptocurrencies can be slowed but cannot be stopped,” the PM conveyed.

“Some financial institutions are painstakingly accepting the fact that the system at the back of such transactions is much more efficient and transparent than the classical ones,” he added.

The Maltese PM elaborated:

“My point is that rather than resist, European regulators should innovate and create mechanisms in which to regulate cryptocurrencies, in order to harness their potential and better protect consumers, while making Europe the natural home of innovators.”

Not just that, the rest of the government, including Labor Minister of Parliament Silvio Schembri, revealed the government’s vision to transform Malta into the Silicon Valley of Europe.

The government has made it clear that it will focus on the development of innovative technologies such as Bitcoin and Blockchain technology to stay at the forefront of European technological innovation.

EC considering limits on Bitcoin transactions

According to the recently released Inception Impact Assessment, EC is considering transaction limits on virtual currency transactions as it steps up efforts in its fight against the financing of terrorism.

The Commission published a Communication to the Council and the Parliament on an Action Plan to tackle terrorism financing. The Action Plan builds on existing EU rules to adapt to new threats and intends at updating EU policies that are in line with international standards.

The idea is to put a limit on the cash entering or leaving the country. According to the Action Plan, it states that ‘payments in cash are widely used in the financing of terrorist activities. In this context, the relevance of potential upper limits to cash payments could also be explored.

In February of last year, the Economic and Financial Affairs Council called on the Commission to explore the need for restrictions on cash payments exceeding certain thresholds. This can be seen in conjunction with the European Central Bank’s (ECB) decision as of 4 May, 2016 to discontinue the production of the 500 Euro banknote.

The EC is also considering an option to extend restrictions to cash payments to all payments ensuring anonymity, which includes virtual currencies and payments in kind.

The amendments to the Anti-Money Laundering Directive (AML) shares the Action Plan’s objective. Therefore, any measure that limits cash payments would be complementary to the actions addressed by the review of the AML Directive targeting risks posed through virtual currencies and prepaid instruments.

That said, actually implementing the strategy may not be so easy – it might even prove to be counterproductive, the assessment goes on to state.

“On the other hand, restrictions on cash payments could promote the development of alternative payments technologies compatible with the non-anonymity objective pursued,” the report adds.

The finance blog Wolf Street notes, the proposal may run into resistance from EU citizens as well, citing a backlash early last year against a bid to cap cash transactions in Germany, the bloc’s largest economy.

While no specific limits are cited in the assessment, it does highlight that different EU countries have adopted different approaches and that any final amount would need to take those strategies into consideration.

Paris and Brussels terrorist attacks called for this change

This sudden push for amendments came amid an increased regulatory debate about cryptocurrencies following the 2015 terrorist attacks in Paris. Much of the debate focused on the anonymity provided by cryptocurrency exchanges and prepaid cards.

The proposal for the amendment came within a week of Europe’s central law enforcement authority, Europol, published a report explicitly stating that there is no evidence of ISIS using bitcoin as a means to finance its activities.

Notably, exchange services between cryptocurrencies and fiat currencies and custodian wallet providers are not presently required to identify suspicious activity, the new proposal stated.

The question remains, can terrorists conceal transactions?

According to EC, terrorists can benefit from the anonymity provided by cryptocurrency platforms and can transfer money into the EU’s financial system. Hence, it is essential to extend the scope of EU Directive 2015/849 to require exchange services between cryptocurrencies and fiat currencies as well as custodian wallet providers.

For anti-money laundering and countering the financing of terrorism, authorities should be able to monitor the use of cryptocurrencies. It would safeguard technical advances and the high degree of transparency attained in alternative finance and social entrepreneurship.

Requiring exchange services between cryptocurrencies and fiat currencies and custodian wallet providers will not fully address the issue of anonymity of cryptocurrency transactions since the virtual currency environment will largely remain anonymous since users can also transact without these providers.

Cryptocurrencies like bitcoin are characterized by their anonymity, with neither payers nor payees required to identify themselves and the system open for anybody to use. Regulators believe this makes them attractive to criminals.

This perception comes from the so-called Islamic State – which claimed responsibility for the attacks on March in Brussels and November in Paris – was receiving funding via the so-called Dark Web. This part of the internet is highly encrypted and hard to reach where Bitcoin and other digital currencies are the preferred payment methods.

“There is a shadow banking system that now exists around the world that is capable of moving unlimited amounts of money… They (terrorists or criminals) know the banking system is well-monitored,” said Scott Dueweke, the founder of Zebryx, a digital identity consultancy.

A report from the U.K. Treasury and Home Office concluded digital-only currencies were already the preferred method of online payment for illicit goods like firearms and drugs.

It also added that the money-laundering risk associated with digital-only currencies was low, but could rise if their use became more prevalent.

There will negligible impact on Bitcoin exchanges if/when these regulations come in place, as they already comply with best practice on anti-money laundering and “know your customer” rules.

Those exchanges already in compliance include San Francisco-based Kraken, which claims to be the largest euro-bitcoin exchange, and Circle, a peer-to-peer digital currency player that has secured Barclays as a U.K. banking partner.

Other players might have to consider relocating their operations away from the European Union or not serving EU customers.

Some jurisdictions such as the U.S. and the U.K. have already launched similar crackdowns to that planned by the EU, which hopes to persuade others to do the same.

Europe’s Bitcoin user Demographics

The following statistics come from bitcoinx.io (now acquired by Bitcoin.com). It is interesting to see what sort of demographic uses Bitcoin in Europe.

- 39.9% of users are European

- 86.9% are male

- 38.2% are age 25-34

Bitcoin has been criticized in the past for not having a female presence. As a Mother Jones writer discussed last year, it’s clear that bitcoin “is dominated by men geeking out about the blockchain.”

That general sentiment holds value, but the overall theory was quickly debunked, as Forbes wrote an article that rumors of the lack of women in the bitcoin industry have been greatly exaggerated.

EBC wants to Support Blockchain

The European Central Bank has reaffirmed the need to make sure it takes initiatives to ensure regulations that do not undermine the development of blockchain or distributed ledger technologies (DLTs) in its Capital Markets Union mid-term review.

The bank said that Eurosystem (a collective comprising the ECB and the central banks of all member states who wield the Euro as the state currency), has a statutory task to support efficient payment and settlement systems.

One aspect of this is to make sure technology enables faster, safer and less costly domestic and cross-border transactions while ensuring that innovation based on disparate standards in different national markets does not obstruct integration.

Blockchain technology has attracted interest from both the financial industry and public authorities in their roles as supervisors and regulators. The adoption of DLT by market participants would require bringing technological innovation into the current legal framework.

There is also the need to examine the legal characteristics of virtual currencies and digital financial assets; the need to define interoperability standards among market participants; and the need to comprehend technological innovation for existing institutions as well as for financial oversight.

The ECB wants the existing initiatives develop harmonious and principle-based regulation be reinforced. The purpose is to make sure market participants creating new technologies will not be constrained by different national laws or by the risks of unanticipated regulations.

The review said the regulation should be developed that is long lasting. The bank should constantly interact with developers to prevent situations where regulations directed at specific innovations are overlooked until the innovations are ready for adoption by market participants.

That said, ECB believes it is still too early for blockchain to be implemented in Eurozone. The latest annual report from the European Central Bank, reiterated a position expressed in the past by ECB officials – namely, that the central bank isn’t likely to tap distributed ledgers in the near future.

“The ECB is open to considering new ways to enhance its market infrastructure. However, any technology-based innovation would have to meet high requirements in terms of safety and efficiency … At this stage of its development, [distributed ledger technology (DLT)] is not mature enough and therefore cannot be used in the Eurosystem’s market infrastructure. As DLT-based solutions are constantly evolving, the ECB will continue to monitor developments in this field and explore practical uses for DLT.”

Still, the ECB is pursuing a research effort alongside the Bank of Japan, which sees the two institutions weighing potential applications. The bank has kept the door open to possible use in the future, though it offered nothing in the way of a possible timeline or indications as to what would drive it to utilize the tech.

“As DLT-based solutions are constantly evolving, the ECB will continue to monitor developments in this field and explore practical uses for DLT,” the central bank said.

ECB and Bank of Japan join hands for DLT research

ECB executive board member Yves Mersch offered new details on the partnership with Bank of Japan. Mersch said that the two institutions plan to explore the tech, with an eye to publishing the results of its research sometime next year.

The ECB has also formed an internal task force focused on distributed ledgers, building on past research efforts. He said:

“Together with the Bank of Japan, we agreed to launch a joint research project which studies the possible use of [distributed ledger technology] for market infrastructure. The project is expected to release its main findings next year. This work can help define how new technologies can change the global financial ecosystem of today and ensure that central banks are adequately prepared.”

However, Mersch remarked that the tech “is not ready for mass adoption”, adding that at present that the ECB’s technical and security requirements would prohibit integration today. Furthermore, any system that might be developed either solely by the ECB or in partnership with other central banks would be subject to intense scrutiny prior to launch, Mersch said.

“It cannot be stressed enough that any technology-based market infrastructure service needs to be mature enough to meet high requirements in terms of safety and efficiency,” he added.

The statements perhaps represent the ECB’s most forceful on the subject to date. Banks around the world have invested time and resources into understanding distributed ledger technology. Most banks including the Bank of England, concluded that DLT could significantly reduce the costs of the banking system.

“We are on a journey which could radically alter the financial ecosystem as we know it. The ECB is committed to be part of this journey,” Mersch concluded.

EC proposes a pilot project and envisions DLT for future

European Commission, an institution of the European Union responsible for proposing legislation and implementing decisions, proposed a pilot project on blockchain technology with the goal of improving its regulation.

A draft of the proposal addressed to the ECB and other groups said a pilot project would be aimed at reinforcing the capacity and technical expertise of national regulators regarding blockchain technology.

The idea is to work towards creating an environment in which financial innovation for the benefit of consumers can thrive.

EC has also backed a Blockchain pilot with €500k Budget. With this EC seeks to gather opinions and to voice concerns around Blockchain and DLT. The Commission revealed that it would seek to improve its institutional knowledge through the pilot, operating in tandem with a task force created by the European Parliament last year.

The announcement includes some new details about the pilot, including its two-year duration and its €500k budget. While the scope of the project centers primarily on education, there do appear to be some practical elements, including a plan to build and animate a platform for the European blockchain community. This pilot, if successful, could lead to new policies in the EU centered around blockchain.

As the commission explained that the purpose will be to inform and assist the European Commission in understanding what role – if any – European public authorities should play to encourage the development and uptake of these technologies and to formulate related policy recommendations.

Whether any of the tests translate into actual applications of the tech by the Commission remains to be seen. However, according to the announcement, the body said it wants “explore possible use cases with a value added at EU level” – indicating that such approaches are possible.

France and Germany to Strengthen Control on Bitcoin

French Federal Finance Minister Wolfgang Schaeuble and former minister of social affairs Michel Sapin have proposed a set of financial measures to the European Commission, to urge the control of bank accounts and digital currencies.

European nations including Germany and France have begun to express their concerns towards the “anonymity” of digital currencies such as Bitcoin and Ripple, and their involvement in “financing of terrorism.”

Due to the increase in the use of bitcoin in purchasing illicit goods on the dark web and hacking attacks, Germany and France have been pressuring the EU Commission to implement improvised policies to control electronic and anonymous payment systems.

“Although much of the evidence is still anecdotal, concerns have been expressed by LE and financial experts in the wider international environment that commercial CSE online, among other criminal activities, is moving to a new unregulated, unbanked digital economy. Payment mechanisms providing a certain degree of anonymity are always open to abuse by those with criminal intentions, as developments in the use of Bitcoin show,”

The federal government of Germany has already taken the necessary procedures to file an official proposal regarding the reform of the Customs Administration Act, to allow the customs to monitor cross-border cash movements and electronic money such as bitcoin transactions.

However, government officials of Germany haven’t disclosed the methods that will be implemented in revealing digital transactions and settlement of electronic money. As it turns out, the German government is attempting to regulate bitcoin transactions by classifying them as a form of cash movement and possibly demand tax payments per each transaction.

Regardless of Germany’s strategy to regulate bitcoin transactions, president of the committee on finance of the French Senate Philippe Marini and the rest of the committee on finance of the French Senate classify bitcoin as an anonymous payment system, which provides big opportunity for money laundering.

“Most importantly, the fact that bitcoin transactions are anonymous makes the system a big opportunity for cybercrime and money laundering. On the 15th January public hearing, we were told that the Customs had arrested a drug trafficker who asked for payments in bitcoins. Of course, the website The Silk Road, the biggest online shopping center for drug dealers and weapon seekers, was shut down by the FBI at the end of 2013. But closing the website does not eliminate the risk: on 28th January 2014, the vice-president of the Bitcoin Foundation was arrested in New York and charged on money laundering.” said Marini.

It is still difficult to speculate whether the improvised draft of the Customs Administration Act and France’s proposal to implement heavier regulations on digital currencies will be processed.

If the European Commission confirms the requests of these two nations, bitcoin startups and investors will be negatively affected, and may possibly be required to provide sensitive financial and user data to government agencies for inspection.

France’s Central Bank to Launch a Blockchain Innovation Lab

The Banque de France revealed that it is opening a blockchain innovation lab as it seeks to work more with blockchain startups.

In a speech, presented by Banque de France governor Villeroy de Galhau at the Paris FinTech Forum, explained that more work needs to be done with the blockchain.

According to Galhau, ‘the digital revolution is creating challenges but also incredible opportunities that are just waiting to be seized, whether by FinTechs themselves, by the entire financial system or by the French and European economy as a whole.’

In a bid to boost the FinTech sector within the country, the governor said that officials are opening a new blockchain innovation lab.

According to the French central bank, it has already welcomed over 100 key innovators since the creation of its FinTech Innovation Unit. It has also set up a FinTech Forum with the Autorité des Marchés Financiers (AMF) to increase the bank’s interaction with innovators.

By doing so, it plans on working alongside startups giving them the freedom to think outside the box.

Galhau understands that the digital revolution is disrupting traditional banks with its customers’ needs. So much so, that according to the French bank, in 2007 62 percent of French people visited their branch several times a month.

In 2016, that number had fallen to as low as 20 percent with 13 percent belonging to the 18-34 age group.

“Beyond customer relationships, financial companies need to take a more comprehensive approach if they are to succeed in the digital transition – placing innovation at the heart of their strategic management, as well as rethinking their business models.”

The French bank has also conducted a discrete blockchain experiment.

The bank announced that it had tested the distributed ledger to understand the consequences of decentralizing ledger managing functions of SEPA credit identifier, a simplified version of cross-border Euro transfers within the Single Euro Payments Area (SEPA).

The experiment was conducted in partnership with Parisian FinTech startup Labo Blockchain and the Caisse des Dépôts et Consignations, which is a French public sector financial institution under parliament’s control and seen as the investment arm of the French government.

Estonian Bank Applies Blockchain to Create a Wallet App

The country is considered to be among the most Bitcoin and Blockchain friendly countries in the world.

Its tech-friendly government seems willing to implement innovations like blockchain technology for healthcare, banking services and even governance by allowing its citizens to become “e-Residents”. This service also gives Estonian citizens and businesses digital authentication.

It was also one of the first to use a blockchain-based e-voting service that enables people to become shareholders of Nasdaq’s Tallinn Stock Exchange.

Estonia-based LHV Bank has given its nod to create an app that will utilize the Bitcoin blockchain technology to facilitate transactions.

The money-transfer app has been named as “The Cuber Wallet,” and will be available on both Android and Apple devices. The financial services platform i.e. the app will enable users to send and receive euros at zero costs and in quick time.

According to Finextra, LHV said:

“Cuber (Cryptographic Universal Blockchain Entered Receivables) is technically a new kind of certificate of deposit that can be used as a building block for innovative financial products. The experiment will see it issue EUR 100,000 worth of “cryptographically protected” receivables claims against the bank.”

The test project is said to be based on colored coins, making LHV the first bank in the world to experiment with real programmable money. Colored Coins is a colored Bitcoin minting and exchange protocol that works on top of the Bitcoin blockchain infrastructure.

Bitcoin’s public ledger i.e. the open-source blockchain will be used as a database which will also allow developers to create new functions.

With this development, the bank is aiming to promote financial innovation which would immensely benefit the smaller software developers, start-ups and cryptocurrency exchanges, rather than the big banks.

For this purpose, the bank has also set up a fintech subsidiary, Cuber Technology. Rain Lõhmus, CEO of Cuber Technology, said: “We hope Cuber can do something similar to the financial industry – liberate innovation from organisational borders, truly decentralise it. And true innovation in the financial sector will flourish.”

As a financial services platform and as a financial instrument, Cuber can be used to store or generate value, transferring value, managing liquidity, and automate transactions between machines.

Estonia is known for the birthplace of Skype. It now hosts a number of Bitcoin ATMs and startups such as Paxful, a global peer-to-peer buying and selling service for bitcoins. With one of the highest internet penetration rates in the world, Estonia is well positioned to be a place where cryptocurrency users can certainly feel welcome.

Dutch investigators use “Bitcoin mixers” to stop money laundering

According to Financieele Dagblad, a Dutch newspaper, the Dutch government is trying to make it easier to launch a criminal investigation against persons who use bitcoin to launder money from illegal activities.

Dutch investigators have discovered criminals are shielding activities using “bitcoin mixers.” A bitcoin mixer is a grab bag with bitcoins of several owners. The bitcoins paid out from the bitcoin mixer cannot be traced back to the original owner.

The FIOD, the investigative arm of the Dutch tax authority, wishes to have the bitcoin mixers recognized as money laundering. By recognizing this activity as money laundering, investigators can take action against a suspect without having to demonstrate a reasonable suspicion of a crime.

Rolf Van Wegberg, of the knowledge institute TNO, which is investigating money laundering through Bitcoin, said he researched a handful of bitcoin mixers, with names like Onion Wallet and BitcoinBoost. He said the mixers are reviewed on the darknet by users.

Van Wegberg found that at low-rated mixers, his money was lost. On highly-rated mixers, he received his bitcoins back and was able to convert them into euros and send them to online payment services like PayPal and Western Union.

Interestingly, laundering costs often exceed 40%, but with the bitcoin mixer, it was only about 15%.

The use of the mixer alone will be sufficient to launch a case against a trader. A criminal can be prosecuted for money laundering more easily than for conducting a criminal transaction in which bitcoins are earned.

Van Wegberg said there can be legitimate reasons for using a mixer. If you are a foreign journalist in Myanmar getting your salary from a foreign medium, the mixer will hide the fact that the money is coming from a foreign media company.

The FIOD has been able to identify darknet criminal traffickers and parties that exchange Bitcoin for euros. In one case, a 24-year-old from Amsterdam and a 27-year-old from Utrecht were arrested on suspicion of drug trafficking and money laundering and participating in a criminal enterprise.

Another case of money laundering was concerned with a gang that used Bitcoin. In January 2015, Dutch prosecutors announced the arrest of 10 men suspected of using bitcoin to launder up to 20 million euros. It was reported that the suspects were seen as facilitators to drug dealers operating on the Dark Web laundering bitcoins.

Traders from this gang used “cashers,” parties that exchange bitcoins for euros. As per the report, there are approximately 50 so-called cryptomarkets and vendor shops and the Netherlands occupies a crucial position in the European illicit drugs markets.

Netherlands, a strong Fintech Contender

The country might be small, but it is demonstrating that good things come in small packages and illustrating its potential as one of the top FinTech countries in the world.

Even though The Netherlands has a population of around 17 million people, it isn’t afraid to keep up with the big players when it come to fintech. According to Startup Juncture, Netherland-based startups raised around €430 million in 2015, across 153 deals, up from 76 from the previous year.

Forbes also reported that the Netherlands was ranked as number one for introducing policies aimed at improving the growth of startups in the country.

So far as Bitcoin is concerned, the country is ahead of its neighbours like Germany, France and the UK. In its bid to become the next major FinTech hub of the world, the Netherlands invested in a blockchain development campus.

Its aim is to attract banks, financial, and FinTech companies under one roof to work towards the development of blockchain solutions.

The Netherlands has been working hard at embracing Bitcoin to be known as a Bitcoin-friendly country.

In 2014, Arnhem, one of the largest cities in the Netherlands, became the first place to have a supermarket that accepts Bitcoin.

Not only that but the Dutch have their very own digital currency, the Guldencoin, which was launched in 2014. Named after the guilder Dutch currency that the euro replaced, it has gained a significant level of acceptance among Dutch businesses.

It’s clear to see that while the Netherlands may be significantly smaller than other countries that certainly hasn’t stopped it from embracing bitcoin and the blockchain technology.

Bitcoin, Greece and other Struggling Economies

Two years ago, in 2015, when “Grexit” fears were looming in Europe, people were eyeing Bitcoin during the potential crisis.

In theory, when the conventional financial system is experiencing turbulence, alternative currencies such as Bitcoin should have their time to shine.

The decentralized nature of the currency means that it’s impossible for any central bank to impose controls on it, while the pseudonymity at its core could make it the perfect vehicle to get money into and out of the country while avoiding legal reprisals.

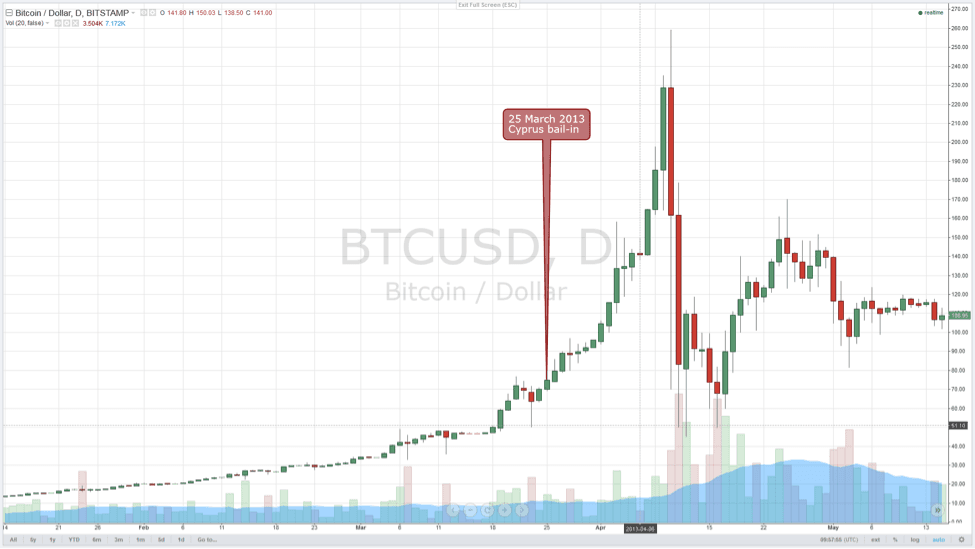

Part of the reason why the crisis is so tempting for proponents of the cryptocurrency is the echoes of a previous crisis in the Eurozone: the banking collapse in Cyprus in 2013, which saw that nation also impose capital controls to prevent massive outflows of currency from the panicking country.

That collapse came at the same time as the first major boom in the price of bitcoin, which began the year at less than $20 and peaked at ten times that by early April – before it all came crashing down.

At the time, many credited the price rise to an interest in the currency sparked by the banking crisis, but Nathaniel Popper, the author of the book Digital Gold: the Untold Story of Bitcoin, says that they are laboring under a misapprehension.

But what could Bitcoin really mean for other struggling Debt-Based Economies? Venezuela, for instance.

The US is known to the vast majority of the world as the global financial and economic powerhouse. Yet, the US holds the largest amount of external debt at $19.9 trillion. The UK, France, and Germany fall behind the US respectively as the second, third and fourth largest debt holders in the world.

Since mid-2016, investors and traders in the largest bitcoin exchange markets including US, China, and Japan began to perceive bitcoin as a safe haven asset and wealth management product (WMP).

Since then, unsurprisingly, Bitcoin has been the go-to asset for avoiding economic uncertainty and financial instability.

The ability to keep printing massive amounts of could inevitably lead to perhaps the largest bubble in modern history; the bubble of the central banks and the global financial system.

Realistically, financial systems of countries are overseen, manipulated and controlled by their respective governments.

Thus, similar to the attempts of Greece in 2015, central banks and regulators could impose harsh regulations or policies such as a haircut to seize funds from private investors, individuals and businesses through private banks.

To put it simply, funds or money stored in bank accounts and even fiat money or cash carry no actual value that is wholly dependent on the market. Their value is completely based on the governing party and its central bank.

As seen in the decline of the British pound, the value of a currency could plunge in short period of time due to political conflicts and financial disagreements.

At this rate, fiat money is approaching its decline and the emergence of a decentralized and market-based currency such as Bitcoin or any other cryptocurrencies that hold the philosophy of Bitcoin could threaten the global financial system.

The US is able to hold on to massive amounts of debt due to their leverage over the global economy and financial system. If it loses its leverage due to a complete restructuring of the financial system as a result of the popularization of bitcoin or other decentralized stores of value, the country could be placed under serious economic trouble.

For instance, the gross debt of the Australian government in 2007 was valued to be $53.25 billion. Today, the debt of Australia is $484.6 billion. Within a decade, the national debt of Australia increased by over 9x, as seen in the chart below.

Bitcoin is a practical and viable hedge against debt-based economies because its value solely depends on its market. Since bitcoin is decentralized by nature and has a fixed monetary supply, the value of bitcoin is decided by a simple concept of supply and demand.

But, since the supply of bitcoin is fixed, as long the demand for Bitcoin continues to increase, the value of Bitcoin will proportionally surge (to the moon).

Europe Could be Inching towards Becoming a Bitcoin Haven

Countries like France, Germany, and the UK have already established regulatory frameworks for Bitcoin companies, users and traders.

Other European countries have offered their unique regulatory frameworks with clarity, to ensure there exists no conflict between local businesses and regulators due to ambiguous regulations and policies like India.

Smaller countries such as Malta, have already begun to consider Bitcoin as a legitimate currency and revolutionary technology. This is also partly due to their thriving gambling industry.

As mentioned earlier, Joseph Muscat, prime minister of Malta, is quite a Bitcoin fan. He announced the approval of a national strategy to promote Bitcoin and Blockchain technology.

He said at a conference organized by the financial affairs parliamentary committee:

“This is not just about Bitcoin and I also look forward to seeing Blockchain technology implemented in the Lands Registry and the national health registries. Malta can be a global trail-blazer in this regard. I understand that regulators are wary of this technology but the fact is that it’s coming. We must be on the frontline in embracing this crucial innovation and we cannot just wait for others to take action and copy them. We must be the ones that others copy.”

Although Muscat raised several positive use cases of Bitcoin and Blockchain technology, Muscat specifically addressed the Bitcoin Blockchain’s ability to handle, store and process sensitive data such as lands registry in a secure, immutable and decentralized ecosystem.

Ubiquity, a US-based Blockchain startup, partnered with one of the land records bureaus of Brazil to utilize the Bitcoin Blockchain technology to integrate land records to the public Blockchain of Bitcoin.

Such method enables land bureaus and other government organizations to store data within an unalterable ledger.

“We are incredibly excited to announce our partnership with the land records bureau, a Cartório de Registro de Imóveis [Real Estate Registry Office] in Brazil. This partnership will help to demonstrate to government municipalities the power and benefits of using Blockchain-powered recordkeeping,” said Ubiquity founder and president Nathan Wosnack.

Future of Bitcoin in Germany is Looking Bright

According to a study by BearingPoint, 72% of all respondents in Germany indicate they have heard of virtual payment methods before. Moreover, 80% of survey participants know what Bitcoin is, or have used it in the past.

It is evident for everyone to see cryptocurrency is still far from a mainstream payment trend. Mobile payments are well ahead with 13% adoption rate, right behind PayPal with 77%. Though, card payments and cash remain dominant in Germany for the time being. As for Bitcoin, it only has 5% of the market share, which is quite decent for a currency that is just 8 years old.

Despite this lower adoption rate, BearingPoint sees a bright future for Bitcoin and other cryptocurrencies in Germany.

While these currencies are still somewhat in their infancy, it is worth nothing they are gaining traction already, especially Bitcoin. It has evolved well beyond the experimentation phase, and it is becoming a vital part of the financial market.

A Govt-Backed ‘Crypto Valley Association’ in Switzerland

Switzerland saw the launch of a new non-profit blockchain advocacy and development group with the launch of the Crypto Valley Association, backed by the government.

Headquartered in Zug, Switzerland’s ‘Crypto-Valley’ that is home to a number of bitcoin and blockchain startups, the new association will set out to support “the development of blockchain and cryptographic related technologies and business”.

Switzerland is proving to be an attractive country for companies in the Bitcoin and Blockchain industry. It is mainly due to the favorable regulatory environment put in place by the country’s financial regulator.

Reducing the barriers and requirements for Fintech firms, has seen the likes of Xapo, a bitcoin startup, gain “conditional approval” by the authority to operate in the country. As a result, Xapo has now relocated its global headquarters from San Francisco to the town of Zug.

The Swiss authorities’ Fintech-friendly agenda has resulted in wider exposure and adoption of Fintech innovations and, in particular, Bitcoin. Notable examples include the operator of Switzerland’s national railway service initiate a two-year pilot project that sell Bitcoin from over a thousand ticketing kiosks last year.

The launch of the Crypto Valley Association was all but an inevitability as Switzerland looks to gain a lead in the global Fintech race of rampant blockchain research and development.

Buy Bitcoin in Europe

It has never been easier to buy Bitcoin anywhere in Europe.

BitPanda is a Bitcoin broker based in Austria.

They have high payment limits and low fees across their wide range of payment methods.

It offers customers the option to buy bitcoins with credit card, debit card, SOFORT, Skrill, NETELLER, giropay, eps, SEPA, and Online Bank Transfer.

Coinbase is world’s largest Bitcoin exchange. Customers can buy bitcoin with a connected bank account, SEPA transfer, Interac Online, and many more payment methods.

It is available in 29 European countries. Users paying with SEPA transfer receive Bitcoin within 1-3 days.

CEX.io lets you buy bitcoin with a credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Purchases made with a credit card give you access to your Bitcoin immediately.

Coinhouse lets you buy bitcoins in Europe with a 3-D Secure-activated Visa or Mastercard credit/debit cards, certain prepaid cards and Neosurf tickets. While their fees are somewhat high, Coinhouse does offer relatively high buying limits.

Bitcoin.de is a major European peer-to-peer Bitcoin exchange. Users can buy bitcoin online from other Bitcoin.de users through SEPA bank transfers.

Coinfloor is based in the United Kingdom. They operate as both a Bitcoin exchange (Coinfloor Exchange) and broker referral service (Coinfloor Market). Coinfloor’s Exchange service accepts deposits in GBP, EUR, PLN and USD.

Customers can deposit to the Market via UK bank transfers and to the exchange via bank transfer, SEPA, or SWIFT.

Cointed allows customers to buy and sell bitcoins across Europe, using SEPA, Skrill, cash, and many other payment options. They also operate 9 Bitcoin ATMs across Austria.

Paymium was the first European Bitcoin exchange, founded in 2011. It provides a EUR/BTC exchange service, and complies with all relevant European Regulations. Customers can purchase bitcoins via SEPA, wire transfer, or credit card.

Bitstamp is one of the longer running Bitcoin exchanges. It has been around since 2011 and is a licensed exchange with the Luxembourg’s Ministry of Finance

It is a good option for traders and those buying large amounts of bitcoins. You will notice it has a confusing fee structure as it is geared towards traders. Unless you trade high volumes, you will likely pay 0.25% per buy.

If you buy bitcoins on Bitstamp with your credit card then the fees will be 8% for purchases up to $500 or €500. There are other exchanges that offer lower fees for buying bitcoins with a credit card or debit card.

LocalBitcoins.com is a marketplace that matches people who want to buy bitcoins with sellers who live nearby. This allows you to buy bitcoin in person with Euros in cash. They have a fantastic review system similar to Ebay or Amazon that lets you choose the right seller to buy bitcoin from.

There are many Bitcoin ATMs in Europe. If you happen to be near one of them, you could buy Bitcoin using cash.

Bitcoin ATMs can be a quick and easy way to buy bitcoins and they’re also private. That convenience and privacy, however, comes with a price; most ATMs have fees of 5-10%.

Spend Bitcoin in Europe

There are plenty of merchants accepting Bitcoin in Europe. Here is the list of a few:

Book your flights, hotels and cars with CheapAir and pay with Bitcoin.

Enjoy takeaway from over 2400 restaurants.

Takeaway service for Austrian customers.

Online casinos are in demand with the gamblers. Bitcosino lets you pay with Bitcoin and have plenty of games you could bet on.

Choose from a wide range of cannabis seeds at Linda Semilla.

TREZOR is more than just a bulletproof bitcoin wallet. It is also a security device for passwords, accounts and emails.

An online shop for all car related things, for almost any brand.

Grab duty free items online and pay with Bitcoin.

Digital Ocean is arguably the best cloud hosting provider out there and guess what? They accept Bitcoin.

Conclusion

There are only a few countries in Europe that have kept an open mind towards Bitcoin and other digital currencies. Other than that, Bitcoin usage is virtually non-existent as compared to other countries.

To understand this better, one needs to look at a few things about Euro. When it was first introduced, a lot of people felt a unified coin for all of Europe would be quite powerful. Despite the Euro surviving multiple crises, the currency has not brought European countries closer together by any means.

In fact, the monetary system has taken a significant hit, leaving consumers with far less purchasing power than they had before. That being said, the “Euro” has not failed entirely, but it didn’t really improve the situation either.

Nothing is going to stop the rise of Bitcoin and other digital currencies. European regulators would do well to innovate and create a landscape for Bitcoin rather than oppose it. Unfortunately, it doesn’t seem to be the case.

It would be interesting to see how European regulators decide to go ahead with Bitcoin considering japan recently legalized it as a payment method. Although, it is doubtful Europe will follow in Japan’s footsteps and stop opposing Bitcoin. Especially the UK is a guilty party in this regard.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Price Today in US Dollars

The Kitco Bitcoin price Index provides the latest Bitcoin price in US Dollars using an average from the world's leading exchanges.

Bitcoin in Various Currencies

Other Cryptocurrencies vs Bitcoin

Bitcoin Basics

WHAT IS BITCOIN?

Bitcoin is a digital currency, which allows transactions to be made without the interference of a central authority. The cryptocurrency system is a peer-to-peer open-source software, meaning computers are part of a mining process for coins.

WHO CREATED BITCOIN?

Bitcoin was designed and created by an anonymous programmer, or possibly group of programmers, by the name of Satoshi Nakamoto.

HOW CAN I BUY BITCOINS?

There are various places to buy bitcoin in exchanges for another currency, with international exchangess available as well as local. Popular international Bitcoin exchangess include Bitsquare, Coinbase, and Kraken.

HOW DO I STORE BITCOINS?

Bitcoins can be transferred from a bitcoin exchanges to one of many bitcoin wallets, ranging from online options to вЂ˜cold storage’.

WHAT CAN YOU BUY BITCOIN WITH?

Bitcoin can be purchased through a digital marketplace, through which you can fund your account with your currency of choice, and place an order on the open market. Bank transfers are the most popular mode of payment.

IS BITCOIN LEGAL?

The use and trade of Bitcoin is legal in the majority of countries in the world, however, because it is a deregulated marketplace, governments are concerned about its potential threat as a tool for money laundering. Although mining and exchanging are questionable in terms of legality, it is known to be legal for users who exchanges bitcoins for goods and services.

WHAT IS BLOCKCHAIN?

A blockchain is a digital ledger recording cryptocurrency transactions, maintaining records referred to as вЂ˜blocks’ in a linear, chronological order.

WHY USE A BLOCKCHAIN?

Using a blockchain ensures security and manages digital relationships as part of a system of record.

WHAT IS DISTRIBUTED LEDGER?

A distributed ledger is a database, digitally recording transaction information using cryptography, making it secure and unforgeable.

WHAT IS THE DIFFERENCE BETWEEN A BLOCKCHAIN AND A DATABASE?

There are several differences between a blockchain and a database, including the level of control. Blockchains are under a decentralized control, whereas a centralized database creates a dependent relationship between users and administrators. Users tend to prefer confidentiality, which is better achieved through a centralized database. Performance also differs, as a centralized database is able to compute information faster than blockchains.

WHAT ARE ALTCOINS?

The term вЂ˜altcoins’ is short for alternative coins. Given that Bitcoin was the first cryptocurrency to surface in the market, the other digital currencies that emerged are referred to as altcoins.

Bitcoin Price (BTC - USD)

GO IN-DEPTH ON BITCOIN PRICE

Crypto is making a comeback as Italy's political crisis mounts

Crypto markets are making a big comeback as political uncertainty grips Italy and Europe. .

NEWS FOR BITCOIN PRICEMore

INFO ON Bitcoin

BITCOIN HISTORICAL PRICES

BITCOIN CURRENCY CONVERTER More

About Bitcoin Price

What is Bitcoin? By Markets Insider

Bitcoin keeps coming back in the headlines. With any Bitcoin price change making news and keeping investors guessing.

In countries that accept it, you can buy groceries and clothes just as you would with the local currency. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket.

Bitcoin is divorced from governments and central banks. It's organized through a network known as a blockchain, which is basically an online ledger that keeps a secure record of each transaction and bitcoin price all in one place. Every time anyone buys or sells bitcoin, the swap gets logged. Several hundred of these back-and-forths make up a block.

No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins.

Why bother using it?

True to its origins as an open, decentralized currency, bitcoin is meant to be a quicker, cheaper, and more reliable form of payment than money tied to individual countries. In addition, it's the only form of money users can theoretically "mine" themselves, if they (and their computers) have the ability.

But even for those who don't discover using their own high-powered computers, anyone can buy and sell bitcoins at the bitcoin price they want, typically through online exchanges like Coinbase or LocalBitcoins.

A 2015 survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested.

Each bitcoin has a complicated ID, known as a hexadecimal code, that is many times more difficult to steal than someone's credit-card information. And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing.

But while fraudulent credit-card purchases are reversible, bitcoin transactions are not.

Bitcoin is unique in that there are a finite number of them: 21 million. Satoshi Nakamoto, bitcoin's enigmatic founder, arrived at that number by assuming people would discover, or "mine," a set number of blocks of transactions daily.

Every four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. (The reward right now is 12.5 bitcoins.) As a result, the number of bitcoins in circulation will approach 21 million, but never hit it.

This means bitcoin never experiences inflation. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won't be more bitcoin available in the future. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement. Which could render bitcoin price irrelevant.

The future of bitcoin

Historically, the currency has been extremely volatile. But go by its recent boom — and a forecast by Snapchat's first investor, Jeremy Liew, that it will hit a bitcoin price of $500,000 by 2030 — and nabbing even a fraction of a bitcoin starts to look a lot more enticing.

Bitcoin users predict 94% of all bitcoins will have been released by 2024. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. With bitcoin’s price dropping significantly. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference.

One of the biggest moments for Bitcoin came in August 2017. When the digital currency officially forked and split in two: bitcoin cash and bitcoin.

Miners were able to seek out bitcoin cash beginning Tuesday August 1st 2017, and the cryptocurrency-focused news website CoinDesk said the first bitcoin cash was mined at about 2:20 p.m. ET.

Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly 10-year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds.

Bitcoin power brokers have been squabbling over the rules that should guide the cryptocurrency's blockchain network.

On one side are the so-called core developers. They are in favor of smaller bitcoin blocks, which they say are less vulnerable to hacking. On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable.

Until just before the decision, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support.

Then bitcoin cash came along. The solution is a fork of the bitcoin system. The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes.

Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets.

"A group of miners who didn't like SegWit2x are opting for this new software that will increase the size of blocks from the current 1 megabyte to 8," Morris told Business Insider.

To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency.

Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. But that doesn't mean the value of investors' holdings will double.

Because bitcoin cash initially drew its value from bitcoin's market cap, it caused bitcoin's value to drop by an amount proportional to its adoption on launch.

The future of bitcoin and bitcoin’s price remains uncertain. It could go to a $1,000,000 or it could go to $0. No one truly knows.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin / Euro BTCEUR

BTCEUR Crypto Chart

Technical Analysis Summary

Related Symbols

BTCEUR may have a bit more retracement to go before moving up

Hope the bulls hold at the 0.618 fibbonachi (6435 euro)

BTC got overheated last year and exited the channel. In April it bounced off the support of that original channel and now it seems to struggle to pass the channel's resistance. Will BTC simply continue in the original channel? (until it gets overheated again?)

need to pay attention on btceur d1 chart by wolfe waves patern and fibonacci extentions 261.8 level.

Hello everyone! This could be the exit BTC is looking for. Good luck! *** My telegram channel is online now, PM me if you're interested to join our premium signals group. *** Good luck

BTCEUR the same retracement as BTCUSD expected