Bitcoin statistik

Bitcoin XT is a full node implementation of a Bitcoin Cash (BCH) and Bitcoin (BTC). Bitcoin XT embraces Bitcoin's original vision of simple, reliable, low-cost transactions for everyone in the world. Bitcoin XT originated as a series of patches on top of Bitcoin Core and is now a independently maintained software fork. We do deterministic builds so anyone can check the downloads correspond to the source code.

What we stand for

The XT mission statement defines what the project believes is important: commitment to these principles are what differentiates us from Bitcoin Core. We try to follow Satoshi's original vision, as it is that vision which brought the Bitcoin community together.

- Scaling the network up to handle user demand is important, even if that means the network changes along the way. It's what Satoshi wanted and the idea of a global system used by ordinary people is what motivated many of us to join him.

- XT provides people with information they need, even if using it requires them to make risk based decisions. For example:

- We believe unconfirmed transactions are important. Many merchants want or need to accept payments within seconds rather than minutes or hours. XT accepts this fact and does what it can to minimize the risk, then help sellers judge what remains. It is committed to the first seen rule. We will not adopt changes that make unconfirmed transactions riskier.

- Lightweight wallets are important. Most users cannot or will not run a fully verifying node. Most of the world population does not even own a computer: they will experience the internet exclusively via smartphones. These users must sacrifice some security in order to participate, so XT supports whatever technical tradeoffs wallet developers wish to explore.

- Decision making is quick and clear. Decisions are made according to a leadership hierarchy. The XT software encodes decisions that follow the above principles: people who disagree are welcome to use different software, or patch ours. We do not consider writing principled software to be centralizing and do not refuse to select reasonable defaults.

- The Bitcoin XT community is friendly, pragmatic, cares about app developers and considers the user experience in everything we do. We value professionalism in technical approach and communication.

Block size hard fork

Many years ago, a capacity limit was introduced into Bitcoin by Satoshi. He intended it to be removed once lightweight wallets were developed, however, this was never done. As predicted Bitcoin has run out of capacity and users are experiencing reliability problems as a result. The Bitcoin Core developers are unwilling to increase the block chain's capacity, finally this caused the network split into Bitcoin Cash (BCH) and Bitcoin (BTC). Miners and users who disagree with them have switched to Bitcoin XT or switched to other clients following the Bitcoin Cash consensus.

There has been much community debate on this topic. You can read analysis and explanations for why we think raising the block size limit is important here:

By mining with Bitcoin XT you are empowered to vote on a new maximum block size limit. This indicates to the rest of the network that you support updating the limit. When 75% of the block votes are in agreement, a new limit will automatically activate.

Soft limit: Bitcoin XT supports configuring the maximum size of blocks to mine. When set your node will not create blocks larger than the limit, although it will still accept them.

Mining is only supported on the Bitcoin Cash network only, as Bitcoin XT does not implement segwit.

Users and merchants

By running Bitcoin XT you take no risks: if insufficient mining hash power runs XT to reach supermajority then nothing will happen. If enough does, you will follow the new chain and things will continue as normal.

Additionally, XT has a useful feature: double spend monitoring and relaying. By running XT you help propagate information about double spends across the network, making it harder for payment fraudsters to steal from sellers by broadcasting two conflicting transactions simultaneously.

Get in touch via our chatroom on Gitter. Appropriate topics include:

- Discussion of new patches

- Questions around usage or how best to configure XT for mining

- Development ideas (please at least try to implement your idea before asking others to do so!)

Be polite and debate ideas rather than people.

Bitcoin Price Ticker Widget

CoinDesk has a Bitcoin Price Ticker widget that can be embedded for free into your own website or blog.

The widget displays the current Bitcoin Price Index, today's high and low, and a sparkline showing price movements over the last sixty minutes.

Use the following code to embed the 210 x 130px widget into your site:

The widget is also available in a larger size (300 x 250px) by using the following code:

You can either left-, right- or center-align the widget on your page by using the "data-align" attribute, for example:

Please download our README file for further information on how to use the Bitcoin Price Ticker widget.

Buy and sell digital currency

Coinbase is the easiest and most trusted place to buy, sell, and manage your digital currency.

Create your digital currency portfolio today

Coinbase has a variety of features that make it the best place to start trading

Manage your portfolio

Buy and sell popular digital currencies, keep track of them in the one place.

Recurring buys

Invest in digital currency slowly over time by scheduling buys daily, weekly, or monthly.

Vault protection

For added security, store your funds in a vault with time delayed withdrawals.

Mobile apps

Stay on top of the markets with the Coinbase app for Android or iOS.

The most trusted digital currency platform

Here are a few reasons why you should choose Coinbase

Secure storage

We store the vast majority of the digital assets held on Coinbase in secure offline storage.

Protected by insurance

Digital currency stored on our servers is covered by our insurance policy.

Industry best practices

We take security seriously, and have built a reputation of being the most trusted in the space.

Bitcoin statistik

TESTIMONI 28 MAY 2018

Saya mengenali bitzara.com sbulan yg lepas melalui rakan sya.mula2 sya pikir projek ni lebih kurang sama dgn program2 HYIP lain yg byk dipromote diluar sana. Jaga hati kawan.letakla modal minima.

Kemudian sya vuba kenalkan pd kwn2 lain. Alhamdulillah penerimaan posigif.dlm 2 hari sya telah dapat modal balik. Saya terus tambah modal dari masa kesemasa disamping terus kongsi peluang pd kwn2

Kepada yg creative.platform bitzara.com bkn shj memberi peluang mengandakan modal.malah memneri jalan utk mencipta pendapatan kedua setiap hari.. Sebenarnya profit anda tak perlu withdraw jika anda faham bagaimana mencipta pendapatan bersama platform bitzara.com

Diharapkan prog ini terus maju

Bizz2u- Rakan Niaga Anda

011-12647052

Johor Bahru

TESTIMONI 21 MAY 2018

Bismillah.

Harini saya terpanggil untuk berkongsi pengalaman saya selama 3 bulan dengan bitzara. Pada asal saya cuma sekadar mencuba dan tak pernah berharap akan pergi sejauh ini dengan bitzara, tapi selepas sebulan…saya tengok income saya dengan bitzara ni tak pernah sama…

makin hari makin bertambah pulak, tentang withdrawal memang saya tak boleh nak nafikan apa-apa..memang sharp dan tak pernah lewat, sekarang sy aktif menaja sebab bukan sekadar nak cari income lebih semata-mata, tapi bila saya dapat berkongsi keuntungan ini dengan orang-orang yg join under saya, saya rasa sangat puas…lebih-lebih lagi di bulan puasa ni, masing-masing bersyukur dengan rezki yg datang melimpah dari bitzara. Saya doakan kawan-kawan yg lain mudah-mudahan akan terus maju dengan Bitzara.

Mt Juadi – 49

Ipoh – Perak

LIVE STATISTIK

WITHDRAWAL DAN DEPOSIT TERKINI

*update setiap 30 min

JADI SALAH SEORANG ‘FUNDER’ KAMI DAN TERIMA PROFIT KEUNTUNGAN SETIAP HARI

APA ITU BITZARA

Asalamualaikum dan salam sejahtera. Sekiranya anda sedang mencari sebuah program penjanaan pendapatan secara pasif setiap hari, kini anda sudah berada didalam laman web yang betul. Sebelum itu, izinkan kami memperkenalkan latar belakang kami, dan sedikit pengenalan berkenaan program ini.

Kami merupakan beberapa orang usahawan yang bertapak di Malaysia. Sejak beberapa tahun di kebelakangan ini, kita mendapat berita bahawa harga Bitcoin telah melonjak naik begitu tinggi sekali. Rasanya tidak perlu lagi kami perjelas apa itu Bitcoin kerana kami percaya rakyat di negara ini sudah celik IT dan tahu akan kewujudan matawang jenis baru ini. Sekiranya anda masih baru dan inginkan informasi berkenaan Bitcoin, anda kami sarankan untuk mendapatkan maklumat tersebut melalui laman carian Google.

Oleh yang demikian, kami juga tidak mahu melepaskan peluang keemasan ini. Melalui perkongsian modal yang kami ada , kami telah berjaya membina sebuah pusat mining dan trading Bitcoin. Pada awalnya kami hanya menjalankan operasi mining dan trading Bitcoin secara kecil-kecilan sahaja.

Dalam beberapa bulan operasi mining dan trading ini dijalankan, kami hanya mampu memperoleh keuntungan yang terlalu sedikit dan tidak berbaloi jika dibandingkan dengan masa serta kos yang kami tanggung.

Oleh kerana kekangan dari segi modal, kami tidak mampu untuk menjana keuntungan yang lebih tinggi didalam trading Bitcoin apatah lagi untuk menambah mesin mining yang mana kos untuk sebuah mesin mining ini adalah sekitar RM10,000-RM20,000 seunit, dan jika ingin menjana keuntungan yang tinggi, kami memerlukan sekurang-kurangnya 100 unit mesin mining.

Di sinilah tercetusnya idea kami untuk membuka program BITZARA ini.

Bermula pada bulan Oktober 2017, pihak kami telah melancarkan laman web program ini untuk menjemput sesiapa sahaja yang memiliki modal untuk menjadi salah seorang “funder” program mining dan trading Bitcoin kami.

Dengan adanya program seperti ini, kita sebenarnya mewujudkan satu situasi “win-win”. Pihak kami dapat menjana keuntungan melalui mining dan trading BITCOIN dan anda pula sebagai “funder” akan dibayar profit daripada jumlah modal yang anda keluarkan untuk program kami.

Pihak kami percaya tawaran yang dibuat ini amat berbaloi untuk kedua-dua belah pihak.

The New York Stock Exchange

Data & Tech Resources

5 Challenges The Tech Industry Is Taking On

DXC: Top Tech Trends in 2018

Global Leaders Meet Here

Note: Quote Data is Delayed At Least 15 Minutes

Market Data is delayed by 15 minutes and is for informational and/or educational purposes only. In certain circumstances, securities with respect to which the relevant exchange has commenced delisting proceedings may continue to be traded pending appeal of that determination. To view a list of securities that are subject to delisting, including those that continue to be traded pending appeal, please click here .

CUSIP identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor?s Financial Services, LLC, The CUSIP Database, © 2018 American Bankers Association. "CUSIP" is a registered trademark of the American Bankers Association.

Yield data is for informational purposes only.

10 Fakta Mengejutkan Tentang Bitcoin

Halo sobat pintar! tahukah kalian tentang Bitcoin? Bitcoin adalah mata uang virtual yang dikembangkan sejak tahun 2009 oleh seseorang yang mempunyai nama samaran Satoshi Nakamoto. Seiring perkembangannya, Bitcoin menjadi fenomena baru yang banyak diperbincakan netizen.

Nah, kali ini TipsPintar.com akan membahas fakta-fakta mengejutkan tentang Bitcoin yang belum banyak diketahui. daripada berlama-lama, langsung saja kita simak!

Inilah Fakta-Fakta Mengejutkan tentang Bitcoin

1. Penemu Bitcoin Masih Misterius

Satoshi Nakamoto Masih Misterius

Penemu Bitcoin, Satoshi Nakamoto diklaim merupakan pria kelahiran Jepang pada tahun 1995. Namun hingga saat ini, belum ada yang mengetahui eksistensi Satoshi Nakamoto. Bisa dibilang, belum ada yang mengetahui identitas sebenarnya dari nama Satoshi Nakamoto.

2. Bitcoin Terbatas

Bitcoin Sengaja Diciptakan Terbatas

Untuk menjaga kestabilannya, Bitcoin dibuat terbatas. Di dunia ini, hanya ada 21 juta Bitcoin yang tersedia. Dengan begitu, Bitcoin akan mirip seperti emas yang jumlahnya terbatas. Semakin terbatas suatu hal maka semakin berharga tersebut, mungkin itu yang menjadi prinsip Bitcoin.

3. Sangat Sulit Melacak Pengirim dan Penerima

Sangat Sulit Melacak Penerima dan Pengirim Bitcoin

Sangat sulit atau bisa dibilang tidak mungkin untuk mengetahui detail pengirim dan penerima Bitcoin. Hal itu disebabkan karena alamat IP dari Bitcoin menggunakan 34 alphanumeric karakter.

4. Benda Pertama yang Dibeli dengan Bitcoin

Pizza Menjadi Transaksi Pertama Dengan Bitcoin

Jika menurut kalian benda pertama yang dibeli dengan Bitcoin adalah benda yang mahal ataupun gadget yang keren, kalian salah besar. Hal pertama yang beli dengan Bitcoin adalah Pizza seharga $25. Transaksi tersebut dilakukan antara Satoshi dan Han Finley pada tahun 2009.

5. Jaringan Bitcoin Sangat Superior

Jaringan Bitcoin Sangat Superior

Menurut para ahli, jaringan Bitcoin mempunyai kekuatan 2.046.364 Pflop/s. Jika kita mengumpulkan 500 superkomputer paling kuat, kita hanya akan mendapatkan kekuatan 274 Pflop/s, jelas sangat jauh dibawah jaringan Bitcoin. Hal ini menunjukan bahwa jaringan Bitcoin sangat superior.

6. Bitcoin Sudah Mencapai Luar Angkasa

Model 3D Bitcoin di Luar Angkasa

Pada 2016, sebuah penyedia Bitcoin wallet, Genesis Mining, mengirim Bitcoin ke luar angkasa. Genesis Mining membuat model 3D dari Bitcoin dan paper wallet Bitcoin yang diikatkan pada sebuah balon udara dan melakukan transaksi pada ketinggian 20 KM. Transaksi terakhir tercatat pada ketinggian 34 KM.

7. Transaksi Bitcoin Tidak Ditarik Ulang

Gambaran Transaksi dengan Bitcoin

Tidak seperti platform populer lainnya, transaksi Bitcoin tidak bisa ditarik ulang. Artinya, anda tidak akan mendapat kesempatan kedua saat melakukan transaksi dengan Bitcoin.

8. FBI Mempunyai Bitcoin Wallet Terbesar

Silk Road, The Anonymous Market Place

Ketika FBI menutup operasi dari Silk Road dan menyita segala asset dari pemiliknya, saat itu, FBI menjadi pemilik Bitcoin wallet terbesar di dunia. Seperti dilansir TipsPintar.com dari Wired Magazine, FBI mengendalikan lebih dari $120 juta.

9. Jangan Sampai Kehilangan Bitcoin Wallet

Jangan Sampai Kehilangan Bitcoin Wallet

Seperti kita menyimpan uang di bank account online, Bitcoin yang kita punya juga sangat amat di Bitcoin wallet. Tapi jangan sampai kehilangan Bitcoin wallet yang kita punya, karena saat kita kehilangan Bitcoin wallet, kita juga akan kehilangan Bitcoin yang kita punya untuk selamanya.

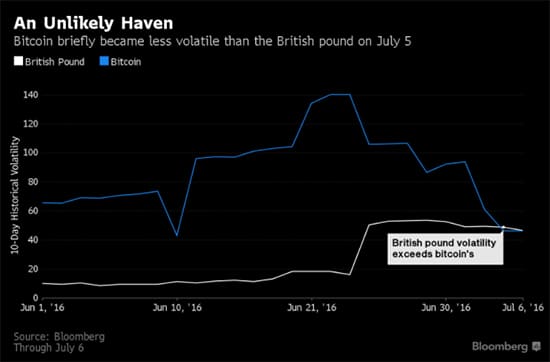

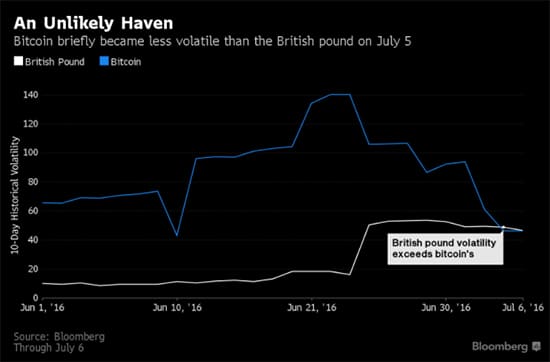

10. Bitcoin Sangat Tidak Stabil

Statistik Perkembangan Bitcoin Yang Tidak Stabil

Semenjak diluncurkan, satu dekade terakhir ini, Bitcoin menjadi salah satu fenomena yang sangat penting di dunia digital. Harganya sudah menyentuh ribuan dollar Amerika. Walaupun demikian, Bitcoin adalah salah satu mata uang yang sangat tidak stabil, tidak dapat prediksi walaupun kita sudah menganalisa jejaknya.

Litecoin (LTC)

Market Cap Rank: 6. of 1000+

Litecoin (LTC)

Price calculator

Litecoin (LTC) Price graph / chart

Litecoin (LTC) price on exchanges

Binance | LTC/BTC | 0.0160640 | 120.25

Huobi | LTC/BTC | 0.0160850 | 120.41

OKEx | LTC/BTC | 0.0161087 | 120.58

Bitfinex | LTC/BTC | 0.0000000 | 0.00

Bittrex | LTC/BTC | 0.0160745 | 120.33

HitBTC | LTC/BTC | 0.0160600 | 120.22

Poloniex | LTC/BTC | 0.0160767 | 120.35

Kucoin | LTC/BTC | 0.0160420 | 120.09

Cryptopia | LTC/BTC | 0.0161202 | 120.67

Litecoin (LTC) price in fiat

About Litecoin (LTC)

Litecoin is a peer-to-peer Internet currency that enables instant, near-zero cost payments to anyone in the world. Litecoin is an open source, global payment network that is fully decentralized without any central authorities. Mathematics secures the network and empowers individuals to control their own finances. Litecoin features faster transaction confirmation times and improved storage efficiency than the leading math-based currency. With substantial industry support, liquidity and trade volume, Litecoin is a proven medium of commerce complementary to Bitcoin.

Litecoin was actually one of the first forks of Bitcoin. Its creator, Charlie Lee, was a former Google employee and created Litecoin when he got into cryptocurrency.

The Litecoin blockchain is capable of handling higher transaction volume than Bitcoin. Due to more frequent block generation, the network supports more transactions without a need to modify the software in the future. As a result, merchants get faster confirmation times, while still having ability to wait for more confirmations when selling bigger ticket items if they chose to.

Litecoin is an open source software project released under the MIT/X11 license which gives you the ability to run, modify, and copy the software and to distribute it at your option. The software is released in a transparent process that allows for independent verification of binaries and their corresponding source code.

Litecoin Wallet encryption allows you to secure your wallet just like Bitcoin, so that you can view transactions and your account balance, but are required to enter your password before spending litecoins.

This provides protection from wallet-stealing viruses and trojans as well as a sanity check before sending payments.

Litecoin is created at 4 times the rate of Bitcoin and there will be an ultimate total of 84 Million coins.

We believe Litecoin is one of the most used cryptocurrencies and is here to stay and will continue to play an important role in further cryptocurrency and digital asset development.

Bitcoin statistik

You can now easily add and edit venues directly from coinmap. Get your business listed in seconds!

Unified Search

Our single line search allows you to quickly search for the venue if you know its name or address.

Feedback is very important. That's why you can quickly give rating to venues.

Two Dynamic Views

You can experience two different perspectives depending on the selected zoom level.

Look closer to discover places nearby. Look from the distance to get an overview of bitcoin adoption worldwide.

World view

Subscribe to Our Newsletter

Do you want to be the first to know about the new coinmap features?

By subscribing, you agree with the terms of Mailchimp Privacy Policy.

Copyright © SatoshiLabs. All Rights Reserved.

Portions of data © OpenStreetMap contributors.

10 Fakta Mengejutkan Tentang Bitcoin

Halo sobat pintar! tahukah kalian tentang Bitcoin? Bitcoin adalah mata uang virtual yang dikembangkan sejak tahun 2009 oleh seseorang yang mempunyai nama samaran Satoshi Nakamoto. Seiring perkembangannya, Bitcoin menjadi fenomena baru yang banyak diperbincakan netizen.

Nah, kali ini TipsPintar.com akan membahas fakta-fakta mengejutkan tentang Bitcoin yang belum banyak diketahui. daripada berlama-lama, langsung saja kita simak!

Inilah Fakta-Fakta Mengejutkan tentang Bitcoin

1. Penemu Bitcoin Masih Misterius

Satoshi Nakamoto Masih Misterius

Penemu Bitcoin, Satoshi Nakamoto diklaim merupakan pria kelahiran Jepang pada tahun 1995. Namun hingga saat ini, belum ada yang mengetahui eksistensi Satoshi Nakamoto. Bisa dibilang, belum ada yang mengetahui identitas sebenarnya dari nama Satoshi Nakamoto.

2. Bitcoin Terbatas

Bitcoin Sengaja Diciptakan Terbatas

Untuk menjaga kestabilannya, Bitcoin dibuat terbatas. Di dunia ini, hanya ada 21 juta Bitcoin yang tersedia. Dengan begitu, Bitcoin akan mirip seperti emas yang jumlahnya terbatas. Semakin terbatas suatu hal maka semakin berharga tersebut, mungkin itu yang menjadi prinsip Bitcoin.

3. Sangat Sulit Melacak Pengirim dan Penerima

Sangat Sulit Melacak Penerima dan Pengirim Bitcoin

Sangat sulit atau bisa dibilang tidak mungkin untuk mengetahui detail pengirim dan penerima Bitcoin. Hal itu disebabkan karena alamat IP dari Bitcoin menggunakan 34 alphanumeric karakter.

4. Benda Pertama yang Dibeli dengan Bitcoin

Pizza Menjadi Transaksi Pertama Dengan Bitcoin

Jika menurut kalian benda pertama yang dibeli dengan Bitcoin adalah benda yang mahal ataupun gadget yang keren, kalian salah besar. Hal pertama yang beli dengan Bitcoin adalah Pizza seharga $25. Transaksi tersebut dilakukan antara Satoshi dan Han Finley pada tahun 2009.

5. Jaringan Bitcoin Sangat Superior

Jaringan Bitcoin Sangat Superior

Menurut para ahli, jaringan Bitcoin mempunyai kekuatan 2.046.364 Pflop/s. Jika kita mengumpulkan 500 superkomputer paling kuat, kita hanya akan mendapatkan kekuatan 274 Pflop/s, jelas sangat jauh dibawah jaringan Bitcoin. Hal ini menunjukan bahwa jaringan Bitcoin sangat superior.

6. Bitcoin Sudah Mencapai Luar Angkasa

Model 3D Bitcoin di Luar Angkasa

Pada 2016, sebuah penyedia Bitcoin wallet, Genesis Mining, mengirim Bitcoin ke luar angkasa. Genesis Mining membuat model 3D dari Bitcoin dan paper wallet Bitcoin yang diikatkan pada sebuah balon udara dan melakukan transaksi pada ketinggian 20 KM. Transaksi terakhir tercatat pada ketinggian 34 KM.

7. Transaksi Bitcoin Tidak Ditarik Ulang

Gambaran Transaksi dengan Bitcoin

Tidak seperti platform populer lainnya, transaksi Bitcoin tidak bisa ditarik ulang. Artinya, anda tidak akan mendapat kesempatan kedua saat melakukan transaksi dengan Bitcoin.

8. FBI Mempunyai Bitcoin Wallet Terbesar

Silk Road, The Anonymous Market Place

Ketika FBI menutup operasi dari Silk Road dan menyita segala asset dari pemiliknya, saat itu, FBI menjadi pemilik Bitcoin wallet terbesar di dunia. Seperti dilansir TipsPintar.com dari Wired Magazine, FBI mengendalikan lebih dari $120 juta.

9. Jangan Sampai Kehilangan Bitcoin Wallet

Jangan Sampai Kehilangan Bitcoin Wallet

Seperti kita menyimpan uang di bank account online, Bitcoin yang kita punya juga sangat amat di Bitcoin wallet. Tapi jangan sampai kehilangan Bitcoin wallet yang kita punya, karena saat kita kehilangan Bitcoin wallet, kita juga akan kehilangan Bitcoin yang kita punya untuk selamanya.

10. Bitcoin Sangat Tidak Stabil

Statistik Perkembangan Bitcoin Yang Tidak Stabil

Semenjak diluncurkan, satu dekade terakhir ini, Bitcoin menjadi salah satu fenomena yang sangat penting di dunia digital. Harganya sudah menyentuh ribuan dollar Amerika. Walaupun demikian, Bitcoin adalah salah satu mata uang yang sangat tidak stabil, tidak dapat prediksi walaupun kita sudah menganalisa jejaknya.

Bitcoin Energy Consumption Index

Key Network Statistics

*The assumptions underlying this energy consumption estimate can be found here. Criticism and potential validation of the estimate is discussed here.

Did you know?

Ever since its inception Bitcoin’s trust-minimizing consensus has been enabled by its proof-of-work algorithm. The machines performing the “work” are consuming huge amounts of energy while doing so. The Bitcoin Energy Consumption Index was created to provide insight into this amount, and raise awareness on the unsustainability of the proof-of-work algorithm.

Note that the Index contains the aggregate of Bitcoin and Bitcoin Cash (other forks of the Bitcoin network are not included). A separate index was created for Ethereum, which can be found here.

What kind of work are miners performing?

New sets of transactions (blocks) are added to Bitcoin’s blockchain roughly every 10 minutes by so-called miners. While working on the blockchain these miners aren’t required to trust each other. The only thing miners have to trust is the code that runs Bitcoin. The code includes several rules to validate new transactions. For example, a transaction can only be valid if the sender actually owns the sent amount. Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners.

The trick is to get all miners to agree on the same history of transactions. Every miner in the network is constantly tasked with preparing the next batch of transactions for the blockchain. Only one of these blocks will be randomly selected to become the latest block on the chain. Random selection in a distributed network isn’t easy, so this is where proof-of-work comes in. In proof-of-work, the next block comes from the first miner that produces a valid one. This is easier said than done, as the Bitcoin protocol makes it very difficult for miners to do so. In fact, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid bock every 10 minutes on average. Once one of the miners finally manages to produce a valid block, it will inform the rest of the network. Other miners will accept this block once they confirm it adheres to all rules, and then discard whatever block they had been working on themselves. The lucky miner gets rewarded with a fixed amount of coins, along with the transaction fees belonging to the processed transactions in the new block. The cycle then starts again.

The process of producing a valid block is largely based on trial and error, where miners are making numerous attempts every second trying to find the right value for a block component called the “nonce“, and hoping the resulting completed block will match the requirements (as there is no way to predict the outcome). For this reason, mining is sometimes compared to a lottery where you can pick your own numbers. The number of attempts (hashes) per second is given by your mining equipment’s hashrate. This will typically be expressed in Gigahash per second (1 billion hashes per second).

Sustainability

The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs. The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency. If Bitcoin was a country, it would rank as shown below.

Apart from the previous comparison, it also possible to compare Bitcoin’s energy consumption to some of the world’s biggest energy consuming nations. The result is shown hereafter.

Carbon footprint

Bitcoin’s biggest problem is not even its massive energy consumption, but that the network is mostly fueled by coal-fired power plants in China. Coal-based electricity is available at very low rates in this country. Even with a conservative emission factor, this results in an extreme carbon footprint for each unique Bitcoin transaction.

Comparing Bitcoin’s energy consumption to other payment systems

To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. According to VISA, the company consumed a total amount of 674,922 Gigajoules of energy (from various sources) globally for all its operations. This means that VISA has an energy need equal to that of around 17,000 U.S. households. We also know VISA processed 111.2 billion transactions in 2017. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy intensive per transaction than VISA (note that the chart below compares a single Bitcoin transaction to 100,000 VISA transactions).

Of course, these numbers are far from perfect (e.g. energy consumption of VISA offices isn’t included), but the differences are so extreme that they will remain shocking regardless. A comparison with the average non-cash transaction in the regular financial system still reveals that an average Bitcoin transaction requires several thousands of times more energy. One could argue that this is simply the price of a transaction that doesn’t require a trusted third party, but this price doesn’t have to be so high as will be discussed hereafter.

Alternatives

Proof-of-work was the first consensus algorithm that managed to prove itself, but it isn’t the only consensus algorithm. More energy efficient algorithms, like proof-of-stake, have been in development over recent years. In proof-of-stake coin owners create blocks rather than miners, thus not requiring power hungry machines that produce as many hashes per second as possible. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. Bitcoin could potentially switch to such an consensus algorithm, which would significantly improve sustainability. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Nevertheless the work on these algorithms offers good hope for the future.

Energy consumption model and key assumptions

Even though the total network hashrate can easily be calculated, it is impossible to tell what this means in terms of energy consumption as there is no central register with all active machines (and their exact power consumption). In the past, energy consumption estimates typically included an assumption on what machines were still active and how they were distributed, in order to arrive at a certain number of Watts consumed per Gigahash/sec (GH/s). A detailed examination of a real-world Bitcoin mine shows why such an approach will certainly lead to underestimating the network’s energy consumption, because it disregards relevant factors like machine-reliability, climate and cooling costs. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective.

The index is built on the premise that miner income and costs are related. Since electricity costs are a major component of the ongoing costs, it follows that the total electricity consumption of the Bitcoin network must be related to miner income as well. To put it simply, the higher mining revenues, the more energy-hungry machines can be supported. How the Bitcoin Energy Consumption Index uses miner income to arrive at an energy consumption estimate is explained in detail here (also in peer-reviewed academic literature here), and summarized in the following infographic:

Note that one may reach different conclusions on applying different assumptions (a calculator that allows for testing different assumptions has been made available here). The chosen assumptions have been chosen in such a way that they can be considered to be both intuitive and conservative, based on information of actual mining operations. In the end, the goal of the Index is not to produce a perfect estimate, but to produce an economically credible day-to-day estimate that is more accurate and robust than an estimate based on the efficiency of a selection of mining machines.

Criticism and Validation

Update: the methodology underlying the Bitcoin Energy Consumption Index has been anchored in peer-reviewed academic literature since May 2018. The full paper can be found here.

Over time, the Bitcoin Energy Consumption Index has been subject to a fair amount of criticism. Entrepreneur Marc Bevand, who argues that there are serious faults in the way the Bitcoin Energy Consumption Index is calculated, is often quoted in this regard. In his own market-based and technical analysis of Bitcoin’s electricity consumption Bevand argues that Bitcoin’s real energy consumption is much lower (

18 terawatt hours/year per January 11, 2018) than the number provided by the Bitcoin Energy Consumption Index. But this alternative approach, based on analysis of Bitcoin’s hashrate (computational power), is not without controversy either. Morgan Stanley accurately captured the main problems in this approach in their report “Bitcoin ASIC production substantiates electricity use” (January 3, 2018), explaining that “the hash-rate methodology uses a fairly optimistic set of efficiency assumptions and may not allow enough for electricity consumption by cooling and networking gear”. The impact of this can be significant, as becomes apparent from BitFury CEO Valery Vavilov’s earlier comment that “many data centers around the world have 30 to 40 percent of electricity costs going to cooling” (40 to 65 percent relative to non-cooling electricity costs). It’s thus not surprising that a hash-rate based approach produces a lower energy consumption estimate.

In the same report Morgan Stanley does argue that Bitcoin’s energy consumption must be at least 23 terawatt-hour per year (per January 3, 2018). Morgan Stanley finds this number based on “Quartz’s report of its tour of the Bitmain mining data center, equipped with the most recent 1387-based mining rigs, this past fall”. At the time, this data center was drawing 40 megawatts per hour and represented 4% of the global Bitcoin network capacity (6M TH/s). Morgan Stanley continues by stating that “the Bitcoin network’s recent active hash rate has been

15.2M TH/s, which implies total hourly Bitcoin electricity consumption is well more than 2700 megawatts/hour (23 terawatt hours/year)”. The company also notes that a realistic number is likely to be higher because “the most efficient mining rigs used by Bitmain in its facilities are not yet widely available” (the Bitcoin Energy Consumption Index was showing

37 terawatt hours/year on the same day). For this reason, Morgan Stanley concludes that “current use estimates are probably in the right general range”.

Of course, the Bitcoin Energy Consumption Index is also very much a prediction model for future Bitcoin energy consumption (unlike hashrate-based estimates that have no predictive properties). The model predicts that miners will ultimately spend 60% of their revenues on electricity. At the moment (January 2018), miners are spending a lot less on electricity. On January 25, 2018, the Bitcoin Energy Index was estimating just 22% of miner revenues ($2.2B versus $10.4B) were actually spent on electricity costs. Based on this, the Energy Consumption Index would thus predict a possible energy consumption of around 130 terawatt hours/year (assuming stable revenues). This increase appears to be in line with expected miner production.

With regard to future energy consumption, Morgan Stanley estimates that Taiwan Semiconductor Manufacturing Company “has Bitcoin ASIC orders for 15-20K wafer-starts per month for 1Q18”. With each wafer capable of supplying chips for “

27-30 Bitcoin mining rigs”, the total Bitcoin mining pool “could see up to 5-7.5M new rigs added in the next 12 months” if “1Q18 production rates are maintained through 2018”. By the end of 2018, this means that “the Bitcoin network could potentially draw more than 13,500 megawatts/hour (120 terawatt-hours/year)”, or even 16,000 megawatts/hour (140 terawatt-hours/year) based on “90% utilization and 60% direct electricity usage”.

Altogether, it can be concluded that the relatively simple Bitcoin Energy Consumption Index model is supported by both emprical evidence from real-world mining facilities, as well as Bitcoin ASIC miner production forecasts.

Recommended Reading

The Bitcoin Energy Consumption Index is the first real-time estimate of the energy consumed by the Bitcoin network, but certainly not the first. A list of articles that have focussed on this subject in the past are featured below. These articles have served as an inspiration for the Energy Index, and may also serve as a validation of the estimated numbers.

Комментариев нет:

Отправить комментарий