Private key

This page contains sample addresses and/or private keys. Do not send bitcoins to or import any sample keys; you will lose your money.

A private key in the context of Bitcoin is a secret number that allows bitcoins to be spent. Every Bitcoin wallet contains one or more private keys, which are saved in the wallet file. The private keys are mathematically related to all Bitcoin addresses generated for the wallet.

Because the private key is the "ticket" that allows someone to spend bitcoins, it is important that these are kept secure. Private keys can be kept on computer files, but in some cases are also short enough that they can be printed on paper.

Some wallets allow private keys to be imported without generating any transactions while other wallets or services require that the private key be swept. When a private key is swept, a transaction is broadcast that sends the balance controlled by the private key to a new address in the wallet. Just as with any other transaction, there is risk of swept transactions to be double-spending.

In contrast, bitcoind provides a facility to import a private key without creating a sweep transaction. This is considered very dangerous, and not intended to be used even by power users or experts except in very specific cases. Bitcoins can be easily stolen at any time, from a wallet which has imported an untrusted or otherwise insecure private key - this can include private keys generated offline and never seen by someone else [1] [2] .

An example private key

In Bitcoin, a private key is a 256-bit number, which can be represented one of several ways. Here is a private key in hexadecimal - 256 bits in hexadecimal is 32 bytes, or 64 characters in the range 0-9 or A-F.

Range of valid ECDSA private keys

Nearly every 256-bit number is a valid ECDSA private key. Specifically, any 256-bit number from 0x1 to 0xFFFF FFFF FFFF FFFF FFFF FFFF FFFF FFFE BAAE DCE6 AF48 A03B BFD2 5E8C D036 4140 is a valid private key.

The range of valid private keys is governed by the secp256k1 ECDSA standard used by Bitcoin.

Hierarchical Deterministic (HD) Wallet Keys

Wallet software may use a BIP 32 seed to generate many private keys and corresponding public keys from a single secret value. This is called a hierarchical deterministic wallet, or HD wallet for short. The seed value, or master extended key, consists of a 256-bit private key and a 256-bit chain code, for 512 bits in total. The seed value should not be confused with the private keys used directly to sign Bitcoin transactions.

Users are strongly advised to use HD wallets, for safety reasons: An HD wallet only needs to be backed up once typically using a mnemonic phrase; thereafter in the future, that single backup can always deterministically regenerate the same private keys. Therefore, it can safely recover all addresses, and all funds sent to those addresses. Non-HD wallets generate a new randomly-selected private key for each new address; therefore, if the wallet file is lost or damaged, the user will irretrievably lose all funds received to addresses generated after the most recent backup.

Base58 Wallet Import format

When importing or sweeping ECDSA private keys, a shorter format known as wallet import format is often used, which offers a few advantages. The wallet import format is shorter, and includes built-in error checking codes so that typos can be automatically detected and/or corrected (which is impossible in hex format) and type bits indicating how it is intended to be used. Wallet import format is the most common way to represent private keys in Bitcoin. For private keys associated with uncompressed public keys, they are 51 characters and always start with the number 5 on mainnet (9 on testnet). Private keys associated with compressed public keys are 52 characters and start with a capital L or K on mainnet (c on testnet). This is the same private key in (mainnet) wallet import format:

When a WIF private key is imported, it always corresponds to exactly one Bitcoin address. Any utility which performs the conversion can display the matching Bitcoin address. The mathematical conversion is somewhat complex and best left to a computer, but it's notable that the WIF guarantees it will always correspond to the same address no matter which program is used to convert it.

The Bitcoin address implemented using the sample above is: 1CC3X2gu58d6wXUW _SAMPLE_ADDRESS_DO_NOT_SEND_ MffpuzN9JAfTUWu4Kj

Mini private key format

Some applications use the mini private key format. Not every private key or Bitcoin address has a corresponding mini private key - they have to be generated a certain way in order to ensure a mini private key exists for an address. The mini private key is used for applications where space is critical, such as in QR codes and in physical bitcoins. The above example has a mini key, which is:

Any Bitcoins sent to the address 1CC3X2gu58d6wXUW _SAMPLE_ADDRESS_DO_NOT_SEND_ MffpuzN9JAfTUWu4Kj can be spent by anybody who knows the private key implementing it in any of the three formats, regardless of when the bitcoins were sent, unless the wallet receiving them has since made use of the coins generated. The private key is only needed to spend the bitcoins, not necessarily to see the value of them.

If a private key controlling unspent bitcoins is compromised or stolen, the value can only be protected if it is immediately spent to a different output which is secure. Because bitcoins can only be spent once, when they are spent using a private key, the private key becomes worthless. It is often possible, but inadvisable and insecure, to use the address implemented by the private key again, in which case the same private key would be reused.

What is a Bitcoin Private Key, How to Use It, Keep it Safe!

Last updated on January 22nd, 2018 at 09:47 am

What is Bitcoin? Bitcoin is a digital currency and a payment system that was introduced as an open source software by Satoshi Nakamoto who developed it. It utilizes peer to peer technology since money can be transferred from one individual to another directly without the involvement of a central bank. All payments are usually recorded on a public ledger. Individuals using software such as wallet software can get to send and receive bitcoins electronically through a PC, smartphone or web app.

What is a Bitcoin Private Key?

What is a bitcoin private key? Bitcoin private key is a secret number generated to allow individuals to spend their bitcoins. When users are issued with a bitcoin address, they are also issued with a bitcoin private key. It is usually a 256 bit number and since it is the golden ticket that allows an individual to spend his or her bitcoins, it needs to be kept safe and securely.

A private key can be used to accept, sell and donate bitcoin. Many charities are now accepting bitcoins.

How to Keep Bitcoin Private Key Safe?

One of the ways one can keep a bitcoin private key safely is by storing it on their computers in a disk that is encrypted. You can also print it on a piece of paper. This can be accomplished by using pywallet. Pywallet is a utility developed using python that allows users to extract private keys from their wallet files. The extracted files can then be printed on to a small piece of paper using a printer.

What a Bitcoin Private Key is Used for?

In order to make a transaction, the user should have availability to a tool or program that allows importing of the private key. Some wallets may make a transaction without the need of importing the private key. Others will require the private key to be swept. When private keys pass through the procedure of sweeping, a transaction will be broadcast to another address and which will include the balance.

How to Import a Bitcoin Private Key?

How does one import a bitcoin private key? One of the methods includes the use of blockchain.info. This online tool assists users to import private keys easily. This is achieved through their wallet service which is referred to as a hybrid ewallet. Since it is an online tool, it doesn’t store your wallet information. This is kept on your browser as an encrypted file. You are required to issue your password or alias so as to access your account.

BIPS also allows the importation of private keys easily by simply allowing the user to either type the key manually from the paper wallet or scan it using a QR reader app through a smartphone’s camera. Other bitcoin private key import providers include Mycelium which provides an android app that can be downloaded from Google play. The app allows one to either scan the code from the paper wallet or by use of cold storage.

Bitcoin Public and Private Keys

Bitcoin For Dummies

There is more to a bitcoin wallet than just the address itself. It also contains the public and private key for each of your bitcoin addresses. Your bitcoin private key is a randomly generated string (numbers and letters), allowing bitcoins to be spent. A private key is always mathematically related to the bitcoin wallet address, but is impossible to reverse engineer thanks to a strong encryption code base.

If you don’t back up your private key and you lose it, you can no longer access your bitcoin wallet to spend funds.

As mentioned, there is also a public key. This causes some confusion, as some people assume that a bitcoin wallet address and the public key are the same. That is not the case, but they are mathematically related. A bitcoin wallet address is a hashed version of your public key.

Every public key is 256 bits long — sorry, this is mathematical stuff — and the final hash (your wallet address) is 160 bits long. The public key is used to ensure you are the owner of an address that can receive funds. The public key is also mathematically derived from your private key, but using reverse mathematics to derive the private key would take the world’s most powerful supercomputer many trillion years to crack.

Besides these key pairs and a bitcoin wallet address, your bitcoin wallet also stores a separate log of all of your incoming and outgoing transactions. Every transaction linked to your address will be stored by the bitcoin wallet to give users an overview of their spending and receiving habits.

Last but not least, a bitcoin wallet also stores your user preferences. However, these preferences depend on which wallet type you’re using and on which platform. The Bitcoin Core client, for example, has very few preferences to tinker around with, making it less confusing for novice users to get the hang of it.

How to import private keys

Before reading this page, users should note that messing with ECDSA private keys is very dangerous and can result in losing bitcoins, even long after the import. It is recommended that outside of self-generated vanity addresses, users should never import (or export) private keys. [1] [2]

Using Blockchain.info

As of August 2012, possibly the easiest way to import a private key is using Blockchain.info's My Wallet service. When successully imported through the "Import/Export" screen, the bitcoins assigned to a private key can be immediately sent to any Bitcoin address. It is extremely risky and not recommended to use Blockchain.info or any online third-party service to import private keys, because they can steal your BitCoins if they have the keys. It's best to import them using bitcoind as described below.

Using BIPS

As of August 2013,  BIPS allows for easy import of private key using Paper Wallet - Import. User can choose to type in the private key manually or scan a QR code containing the private key using the camera. The user must wait 6 confirmations for access to the funds, and system is based on batch importation. It is extremely risky and not recommended to use BIPS or any online third-party service to import private keys, because they can steal your BitCoins if they have the keys. It's best to import them using bitcoind as described below.

BIPS allows for easy import of private key using Paper Wallet - Import. User can choose to type in the private key manually or scan a QR code containing the private key using the camera. The user must wait 6 confirmations for access to the funds, and system is based on batch importation. It is extremely risky and not recommended to use BIPS or any online third-party service to import private keys, because they can steal your BitCoins if they have the keys. It's best to import them using bitcoind as described below.

Using Mycelium

Steps described are with the following settings:

- Export mode enabled

- Aggregated view disabled

Partial spend from cold storage

Use this function if you would like to keep some funds on the paper wallet.

- Download Mycelium from the Android Play Store or through iTunes.

- Press the menu button and select "Cold Storage"

- Scan in private key

- Select your destination address

- Select the amount

- Press the blue currency tag at the top to toggle currency.

- Send!

After spending, the private key in memory is destroyed so the paper private key remains somewhat secure. Despite this, best practice is to immediately send the remaining balance to a paper wallet that was generated offline.

Import key from a paper wallet

Use this function if you would like to import a private key so all funds are immediately available for spending.

- Download Mycelium from the Android Play Store or through iTunes.

- Key Management

- Press the blue '+' symbol

- Scan in private key

After importing this paper private key, you might consider destroying the original so it cannot be found and your funds stolen. Alternatively, you can keep it safe to be used as an offline backup.

Using bitcoind

If you have Version 7 or later it is now trival. See: How to import private keys v7+

If you are using Cold storage, a Paper wallet or generating vanity addresses you may have a need to import a Private key. Since Bitcoin-QT/bitcoind v0.6.0, you can import private keys using built-in RPC command importprivkey. Before v0.6.0, you needed to rely on third-party wallet.dat manipulation tool such as Pywallet.

This article describes how to import a private key through the RPC API of bitcoind, which is a topic for advanced users.

Note that importing a key to bitcoind and/or Bitcoin-Qt may be dangerous and is not recommended unless you understand the full details of how it works

Start Bitcoin client

Unlike third-party wallet.dat manipulation tools such as Pywallet, you do not have to close the Bitcoin client before proceeding. Instead, you need to start the bitcoind server.

- Close bitcoin-qt and start bitcoind -daemon in Terminal Emulator. The version of bitcoind MUST be the same as bitcoin-qt!

Bitcoin-QT does not enable its RPC interface by default. To enable it:

- Close Bitcoin-QT and restart it with bitcoin-qt -server.

Unlock your wallet

If you have an encrypted wallet (recommended), you need to unlock it temporarily before importing private keys. The RPC command for unlocking an encrypted wallet is walletpassphrase

. Typing this directly in a bash terminal will leave your wallet passphrase directly in the bash history but there are a couple of techniques you can use to avoid this. Simply add a space before the command:

Another alternative is to use a bash variable:

Import Private key(s)

The last command unlocked your wallet temporarily for 120 seconds, during which time you must import your private keys. Since private keys can be as important as your passphrase, you may want to use the same techniques as above to prevent their being recorded in bash history (bash variable or space before the command):

The importing process is now started. Bitcoind will rescan the entire block data to ensure this key has not been used before. This process will take from one to two minutes, depending on your CPU performance. DO NOT abort it before finishing!

To avoid rescanning run the following.

If no errors occurs, the import is a success and Bitcoin-QT users will be able to see the new address in the GUI immediately. If you need to import more keys, just repeat the instructions above. There is currently no command to import a batch of private keys so you will need to wait a minute or two for each key to be imported.

Cleaning up

This will lock your wallet again (so you don't have to wait for timeout)

These commands will clear the passphrase and private key from memory if you used the read technique. If you started bitcoind, you will need to stop it before Bitcoin-QT will start again:

By Rich Apodaca | Updated May 25th, 2017

Private keys have been part of Bitcoin from the beginning. Wallet software often tries to shield users from the need to directly handle and understand private keys. Even so, most users eventually come face to face with private keys, too often with unpleasant results.

A basic understanding of private keys can protect you from losing money and other mishaps, but it can also offer useful insights into how Bitcoin works. This guide outlines Bitcoin’s the most important private key concepts.

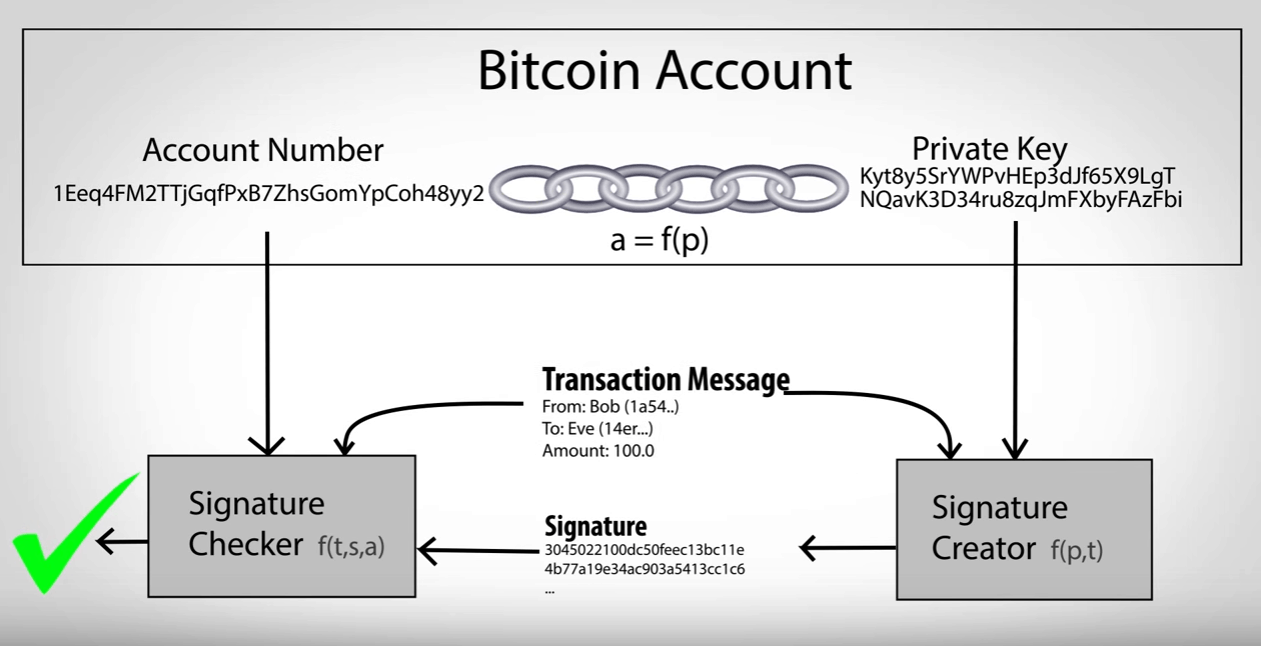

Bitcoin: A Secure Messaging System

Bitcoin may be best known as an electronic cash system, but underneath it all runs a secure messaging system built on the Internet. Instead of relaying emails, texts, or web pages, the Bitcoin network processes value-transfer messages called transactions. Private keys help authenticate these messages and identify each other.

An example helps illustrate the problems that private keys solve. Imagine that Alice wants to pay Bob using an electronic coin with a face value of ฿1. To do so, she must create a transaction identifying Bob as the payee. Then Alice needs to publish the transaction to the Bitcoin network.

To use this system, Alice must solve two fundamental problems:

- Alice needs a way to identify both herself and Bob in the transaction. She can’t employ a trusted authority such as a government registry or email provider because that would create a central point of failure — the very thing Bitcoin was created to eliminate.

- Alice needs a way to prevent others from changing her transaction and forging transactions in her name.

Bitcoin solves both problems through a system called public key cryptography. This system uses two pieces of information to authenticate messages. A public key identifies a sender or recipient, and can be distributed to others. A private key creates an unforgeable message signature. Unlike the public keys, the private key must be kept secret. Public and private keys are mathematically linked through a signature algorithm, a mathematical procedure for creating identities, signing messages, and validating signatures.

With this overview in mind, here are six things about private keys to keep in mind as you use Bitcoin.

1. A Private Key is Just a Number

A Bitcoin private key is simply an integer between one and about 10 77 . This may not seem like much of a selection, but for practical purposes it’s essentially infinite.

If you could process one trillion private keys per second, it would take more than one million times the age of the universe to count them all. Even worse, just enumerating these keys would consume more than the total energy output of the sun for 32 years. Bitcoin’s entire security model rests on the infeasibility of mapping this vast keyspace.

Because private keys contain many digits, an alternative called Wallet Import Format (WIF) has been devised. This format begins with the number “5” and contains a sequence of letters and numbers. For example, here’s a private key represented in WIF format:

Given the importance of keeping private keys secret, they are sometimes encrypted. A popular method produces strings of text that look like WIF encoding, but starting with the number “6.” Decrypting a private key encoded in this way requires the password that was set when the private key was encrypted.

2. Transactions are Messages Signed with a Private Key

To prevent forgery, Bitcoin requires that each transaction bear a digital signature. This signature, like a private key, is just a number selected from a very large range. Wallet software generates a signature by mathematically processing a transaction together with the correct private key.

Anyone with a signature and public key can easily authenticate a message. However, the only way to produce a valid message signature is to use the private key matching the published public key. In other words, digital signatures are practically impossible to forge.

Unlike a physical signature you might write on a check, a transaction signature changes if the transaction changes even slightly. The way the signature will change is unpredictable, ensuring that only a person in possession of a private key can provide the correct signature.

Notice that the internal format of a transaction is less important than the idea that transactions are digitally signed messages whose authenticity can be quickly and cheaply checked. For details on transactions and how they’re used in Bitcoin, see A Visual Language for Bitcoin Transactions.

3. Anyone Who Knows Your Private Key Can Steal Your Funds

Any valid transaction bearing a valid signature will be accepted by the Bitcoin network. At the same time, any person in possession of a private key can sign a transaction. These two facts taken together mean that someone knowing only your private key can steal from you.

Many avenues are open to thieves who steal private keys. Two of the most popular are storage media and communications channels. For this reason, extreme caution must be taken whenever storing or transmitting private keys.

Software wallets usually store private keys in a “wallet file” on the main hard drive. Wallets often place this file in a standard, well-known directory, making it an ideal target bitcoin-specific malware.

To counter this threat, software wallets offer an option to encrypt the wallet file. Any attacker gaining access to your wallet file would then need to decrypt it. The difficulty of decryption depends on the quality of the encryption and strength of the password being used. Wallet files can be encrypted on many software wallets by adding a password.

Password Protection. Encrypting Electrum’s wallet file by adding a password.

Password Protection. Encrypting Electrum’s wallet file by adding a password.

Although wallet backups are a good idea, they can potentially leak private keys. For example, it may be tempting to save a backup of your software wallet to a cloud storage service such as Dropbox. However, anyone capable of viewing this backup online (a potentially long list of people) would be in a position to steal some or all of your funds. A similar problem could arise through emailing backups to yourself or leaving a private key around the house. Encryption can reduce, but not eliminate the risk.

Preventing the accidental release of private keys is the main purpose of “cold storage.” For more information, see A Gentle Introduction to Bitcoin Cold Storage.

4. A Private Key Generates a Public Key Which Generates an Address

A public key is obtained by subjecting a private key to a set of mathematical operations defined in a set of standards known as Elliptic Curve Cryptography (ECC). Whereas a private key is an integer, a public key is a 2D coordinate composed of two integers. To make a public key easier to process, it can be transformed into a single value. One approach appends the y-coordinate to the x-coordinate. This technique produces an “uncompressed” public key. A “compressed” public key uses only the x-coordinate with a symmetry flag.

Private Key to Address. A private key, which is just a number such as 42, can be transformed mathematically into a public key. A public key is then transformed into an address. Each step is irreversible.

Each of these steps is irreversible. An address can’t generate a public key, nor can a public key generate a private key. This relationship is known as a mathematical trapdoor — a function that’s easy to perform in one direction, but practically impossible to perform in the opposite direction. This unidirectionality underpins Bitcoin’s security model.

Just as private keys can be shortened to make them more usable with displays and keyboards, so too can public keys. An address results from applying a multi-step transformation to a public key. This results in a string of text and digits, usually starting with the number “1”.

Notice that no network is needed at any point in the generation of a private key or the corresponding address. Every computer on the Bitcoin network knows about the mathematical relationship between public and private keys. This enables each participant to select private keys and sign transactions independently of the Bitcoin network. The vast private keyspace ensures that any properly-selected key will be unique.

5. Security Depends on Choosing a Good Private Key

Knowledge of a private key is the only verification needed to spend an electronic coin. Private keys should therefore be kept secret. However, careless selection of a private key can lead to theft just as easily as its accidental release.

For example, imagine that we want to use a private key that’s easy to remember. The number 1 is both easy to remember and a valid Bitcoin private key. But how secure would it be?

The private key 1 generates this address:

If you follow the link, you’ll notice that the address has already been involved in over 1,000 transactions for a total of over 7 BTC within the last few years. If you wanted, you could easily spend any available funds at this address because the private key is known to you.

Now imagine you’re a thief determined to steal bitcoin. One strategy might be to compile a list of easy-to-remember private keys. Next, generate the addresses for these keys and monitor the Bitcoin network for incoming payments to one of them. When one arrives, immediately sign a transaction moving the funds to another address you control.

Contrast the ease of this scheme with a situation in which a private key was chosen by a perfect random number generator. With no clue what the key might be, brute force iteration would be the only option. As we’ve already seen, carrying out this plan is physically impossible.

What would happen if the random number generator were not quite random? For example, what if all output private keys were clustered about a constant value within a narrow range?

Any attacker aware of such a defect could drastically reduce the necessary search space. Under the right conditions, it would become practical to monitor all of the addresses based on the faulty random number generator and steal funds from any one of them at will.

The need to select a good private key becomes especially important with brain wallets. One method to create a brain wallet starts with a passphrase such as “to be or not to be”, then applies a mathematical function to convert this text to a private key. Applying the most popular conversion algorithm (SHA-256) to this passphrase generates the address:

As you can see, this address was used as late as 2016 to store funds, which were immediately withdrawn.

Unfortunately, it’s not always easy to tell what qualifies as an insecure brain wallet passphrase and what doesn’t. Attackers can exploit this uncertainty and the inexperience of new users to steal funds. For example, a thief might compile an enormous database of common phrases and passwords. Such a database might number in the trillions of entries or more, but would still be searchable in its entirety with little computational effort.

Compare this situation to the one with website passwords. If you register for a web service using a password someone else happens to have chosen, you don’t take over their account because your username must be unique. Bitcoin private keys are different in that they serve the dual role of user identification (via address generation) and authentication (via digital signatures).

Secure private keys are generated with a high degree of unpredictability so they can’t be guessed before or after the fact.

6. Private Keys are (Somewhat) Portable

For the most part, wallet software hides the process of generating, using, and storing private keys. However, private keys can become visible from time to time. When this happens, understanding private keys and how they interact with your specific software becomes important.

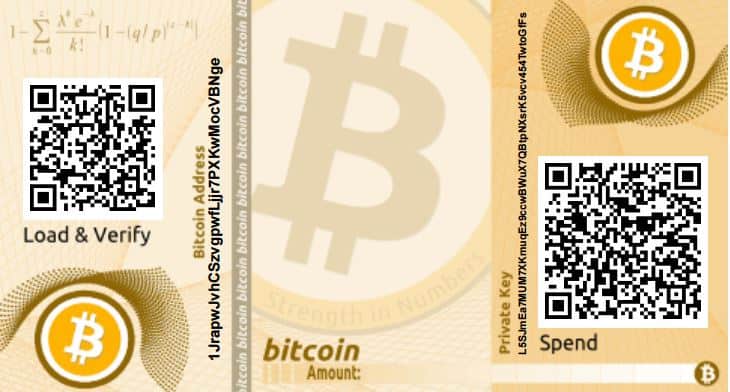

Paper wallets present the most common route by which private keys show up outside of software wallets. Although they come in a multitude of formats, the essential feature of any paper wallet is a printed private key.

Paper Wallet. Example paper wallet. To the right is the private key, represented both as a QR code and a string of text beginning with the number “5” and written vertically.

Paper Wallet. Example paper wallet. To the right is the private key, represented both as a QR code and a string of text beginning with the number “5” and written vertically.

Many software wallets support sweeping. A sweep creates a new transaction paying one of the software wallet’s existing addresses. This procedure may or may not empty the address associated with the private key. For more information on the dangers of manipulating bare private keys, see Five Ways to Lose Money with Bitcoin Change Addresses.

Should your wallet application begin to malfunction, its private keys can often be imported into another application. This rescue procedure provides the second main route through which private keys become visible to end users. A closely-related procedure consists of restoring the state of a software wallet through a backup file.

Conclusions

Bitcoin can be thought of as an open messaging system secured by public key cryptography. In contrast to other systems protected by username and password logins, Bitcoin is secured through digital message signatures created with a unique private key. This single point of access places a very high value on the secure generation, use, and storage of private keys.

What is a Bitcoin Private Key?

A private key is just a number picked at random.

A private key is just a number picked at random.

The private key is used to generate the public key through an irreversible process.

In the case of Bitcoin the Private key is turned into the Public key through Elliptic Curve Cryptography or ECC for short.

If you lose your private key you can't access your Bitcoins, and if someone else finds it out they can steal them.

A Private key is just a long number and in the case of a Bitcoin it is a number between 1 & 1.158x 10^77. In practice this number is generated using a secure random number generator that is then fed into the SHA-256 hashing algorithm. The SHA-256 hashing algorithm takes a string of numbers and outputs a 256 bit number which then has to be checked to see if it is less than 1.158x 10^77.

When creating your private key most software will do this under the hood, but if you choose certain methods on your own such as 1x10^77 or other certain obvious numbers and then hash via the SHA-256 – hackers can create rainbow tables and match to your private key, public key and address. If you do this and choose a particular phrase you are reducing the entropy or chaos of your choice! Always opt for randomness just to be safe even if the chances are very small.

The point of using Elliptic curve cryptography is to find a method whereby you can create a Bitcoin Public Key easily Bitcoin Private Key but not the reverse – i.e. find the Bitcoin Private Key from its Public Key.

This is due to the discrete logarithm problem for elliptic curves, where the best mathematical solutions to break elliptic curve cryptography have to take step proportional to 2n/2 , where n is the length of the number which the Bitcoin key has to below (1.158x 10^77) (also known as the field size the curve is based on for modular arithmetic).

In practice this means that a hacker would need 21^28 calculations to break elliptic curve cryptography based on Bitcoins specifications. Using a million CPU’s this would take about 260 billion times the age of the universe – a heck of a long time.

The public bitcoin key that is produced by elliptic curve cryptography is actually a point with x and y coordinates. To see why have a look at our in depth guide to Elliptic curve cryptography.

Bitcoin Private Keys: Everything You Need To Know

What if you lost all of your bitcoins tomorrow? What would you do?

Let me stress this point:

“If you don’t own your private key, you don’t own your bitcoins.”

Yes, you read that right.

Even the most knowledgeable man on Bitcoin says:

“The private key must remain secret at all times because revealing it to third parties is equivalent to giving them control over the bitcoins secured by that key. The private key must also be backed up and protected from accidental loss, because if it’s lost it cannot be recovered and the funds secured by it are forever lost, too.”

― Andreas M. Antonopoulos, Mastering Bitcoin: Unlocking Digital Cryptocurrencies

In my earlier guide on Bitcoin wallets, I have used two terms extensively- Private Address (or key) and Public Address (or key). These keys are what make Bitcoin the safest and most widely used cryptocurrency.

To understand private keys and public keys, let us look at an example.

Consider a mailbox where you receive your physical mail.

It has a unique and specific number (an address). If someone has to deliver you a letter, he/she must know your house/flat number to deliver it.

And as the receiver, you have a private address (or key) to unlock the mailbox and collect your belongings.

In real life, do you give your keys to someone unknown?

You always keep track of your key and don’t jeopardize the contents inside of your mailbox.

Similarly, just like your house/flat number, anyone in the Bitcoin world can know your public address (Bitcoin address) to send you bitcoins. And to unlock (spend/send) those bitcoins, you would require your private address (or key) for which you need to take full responsibility, just like the keys of the mailbox.

I feel that understanding the underlying technical aspect of keys is important so that your remain better informed and educated enough to take care of them.

In the next section, I will tell some basic technical aspects of these keys.

What is a Private Address (or key)?

A private key is a secret, alphanumeric password/number used to spend/send your bitcoins to another Bitcoin address. It is a 256-bit long number which is picked randomly as soon as you make a wallet.

The degree of randomness and uniqueness is well defined by cryptographic functions for security purposes.

This is how the Bitcoin private key looks (it always starts with 5):

5Kb8kLf9zgWQnogidDA76MzPL6TsZZY36hWXMssSzNydYXYB9KF

What is a Public Address (or key)?

This is another alphanumeric address/number which is derived from private keys only by using cryptographic math functions.

It is impossible to reverse engineer and reach the private key from which it was generated.

This is the address used to publicly receive bitcoins.

This how the Bitcoin public address looks (it always starts with 1):

1EHNa6Q4Jz2uvNExL497mE43ikXhwF6kZm

This address is always seen and broadcasted for receiving bitcoins. Users can make as many public addresses as they want to receive bitcoins.

What are Bitcoin private keys used for?

Private keys are used for making irreversible transactions. Yes, irreversible!

They are the key to spending and sending your bitcoins to anyone and anywhere. This irreversibility is guaranteed by mathematical signatures which are linked to each transaction whenever we use the private keys to send bitcoins.

And for each transaction, these signatures are unique, even though they are generated from the same private keys. This feature makes them impossible to copy. The user can confidently use the same private key again and again.

Moreover, the signatures are mathematically related to Bitcoin addresses. This math relation helps in confirming that the signatures are only of that particular account holder who wants to transfer bitcoins.

How do we keep private keys safe?

It is OK if you didn’t understand the above technical stuff.

You can still use Bitcoin as long as you keep your private keys safe.

These digital keys are crucial in the ownership of bitcoins. These keys are not stored on the Bitcoin network but are created and stored by the file/software (a.k.a. wallet).

A wallet stores these keys. There are a lot of types of wallets out there and some allow the private keys to be stored and guarded by the user.

Some keep the key safe on behalf of the user.

I have explored each type of safety measure for you so that you can choose the most effective wallet according to your needs.

Web and Mobile Wallets

Most of the web and mobile wallet software services in the Bitcoin market store your private key on your behalf on their servers.

They get stored in an encrypted form which only you can decrypt.

In this kind of wallet, your keys are held by someone else, and if that gets hacked or stolen, your bitcoins are gone. That is why you need to take extra safety measures when dealing with these services.

However, there are really great wallets like MyCelium, which I personally use because of its additional security features and compatibility with hardware wallets.

Desktop Wallets

Desktop wallets are relatively safe. In such wallets, once you install them on your desktop, you will get your Bitcoin address and private key in a downloadable and importable file.

These importable keys can be made password protected and stored on a memory stick or hard drive.

But once you lose the file of the private key, you will lose the bitcoins.

I am going to discuss each one of these in detail in upcoming articles.

Here are a few desktop Bitcoin wallets:

Bitcoin Desktop Wallets

Hardware Wallets

Hardware wallets are basically an electronic invention made to store your private keys offline away from the vulnerable online environment so that they can’t be hacked.

Some hardware wallets come with security grid cards similar to some debit cards in order to verify the transaction. Some even have a little digital screen to verify your transactions.

They are temper proof and come with a limited user interface. In case your device is destroyed, as long as you have a backup code, you can retrieve your keys and bitcoins.

Some of the popular hardware wallets are:

Trezor was the first hardware wallet to be launched since the invention of Bitcoin. It is a small device which can be connected via a USB cable to your personal computer. Its fundamental purpose is to store the private keys offline and sign transactions.

Ledger Nano S can be used even on a computer that is infected with malware. It has two buttons which are needed to be pressed together to sign and confirm a transaction, making impossible for a hacker to use.

Ledger Nano S also requires the user to create a PIN code on setup. The PIN code helps prevent the loss of bitcoins in case your Nano S gets lost.

It supports Bitcoin, Ethereum, and other popular altcoins, and connects with other software wallets like MyCelium. Here are few videos to learn more about Ledger Nano S:

Paper Wallets (Cold Storage)

Paper wallets are simply Bitcoin private keys printed on a piece of paper. It can have the Bitcoin public address also printed on it, but not necessarily. Paper wallets are an effective way of storing Bitcoin private keys offline.

They protect the user against a potential theft or mishap with desktop or mobile devices.

These kinds of wallets are also called “cold storage” because the keys are generated offline and never stored online or on a computer.

You can make your paper wallet from bitaddress.org, which is an HTML page specifically for this purpose only.

You can save the HTML page offline and remain disconnected from the internet to generate the keys. They can be printed on paper or stored as a soft copy on a USB or hard drive. Read my previous guide on how to make a Bitcoin paper wallet.

Bitcoin Paper Wallet

Conclusion

In a Bitcoin wallet, the most important thing is your private key because it will prove that the bitcoins you claim as your own are actually yours.

In upcoming posts, I will cover how to set up a wallet for each type (Mobile/Desktop/Hardware/Paper) and how to save/import your private keys.

How are you keeping your private keys safe? Let us know what you do in the comments below!! Have a question about Bitcoin Private keys? Feel free to ask in the comment section below.

Happy reading, learning, and sharing with the CoinSutra Community!

Here are a few more Bitcoin wallet related guides that you must read next:

Become a Part of CoinSutra Bitcoin community

Deals & Discounts

CoinSutra Users, Rejoice! Exclusive 10% off On Gate.io Trading Fees Just For You

BitMEX Deal: 10% Fee Discount For 6 months

Wirex Deal: Free Bitcoin Debit Card & Claim 0.5% Cash Back On Purchases

COMMENTs ( 168 )

I’m trying to understand who owns a bitcoin’s private key when the bitcoin is owned by multiple “investors.” Like if I buy a tenth of a coin, do I get the private key? If not, what good is it? If so, what’s stopping me from spending the whole coin?

Sudhir Khatwani says

You can buy Bitcoins in fractions up to 8 decimal places and you own keys of whatever you buy, you are not at the risk of other fractions…it is not a whole number key or key of traditional look you are assuming to be.

where would I then find this key?

Sudhir Khatwani says

In the wallet, while you set it up for the first time.

I’ve read there’s theoretically no limit to how small a bitcoin can be divided. But, okay, suppose I buy a hundred/billionth of a bitcoin (smallest current unit), and you own the rest of it. Are you saying I get my own private part of a public/private ECDH key pair that is different from yours? I’m still confused.

Sudhir Khatwani says

It will be different keys for everyone hold different parts/fractions of BTC.

And it not divisible to any limit, smallest unit is Satoshi- Pls read this- https://coinsutra.com/what-is-satoshi-btc-usd-converters/

Thank you, Sudhir. So even just to buy 1/100,000,000th of a bitcoin you get your own set of ECDH keys. Must be a nightmare for the network. Is this where “dust” (denial of service) attacks originate? If I buy 1,000,000 Satoshi all from different sellers, do I then need to keep track of a million keys, or can I combine them into 1/100th of a bitcoin under a single key pair?

hello brother its really nice to meet you

i wander if mayby its possible i ask you help for you make a video on how to recover my BTC from bitcoin QT wallet bicouse i only have my passphrase and my bitcoin address and i really dont see any video available anywere 🙁

can you please help me out brother ? i dont mind to pay you if i manage to recover my BTC

if you can make a video on youtube please send me the link on my email and also send your BTC address bicouse i really want to pay you for your services

thanks brother take care

Sudhir Khatwani says

Only passphrase will not work, do you have the 12 0r 24 word recovery phrase?

i have a address. how can i found the private key of that address ?

Sudhir Khatwani says

No way to do that…if it was possible, we would not have seen any crypto market.

Actually, it is possible. Like all asymmetric encryption, the ECDH problem can be solved. Given current hardware, it’s still hard. But there are weaker curves. And there are mathematical approaches. One could also get (very) lucky. Also, quantum computing is expected to render elliptic curve encryption obsolete. I also wonder how long until the big bitcoin miners switch from trying to solve the double SHA256 hash to attacking known public keys.

Sudhir Khatwani says

Yeah, I know that but so far not, so enjoy and live the day.

Why don’t people make multiple backups of their wallet.dat file?

Sudhir Khatwani says

They might be scared of getting hacked or losing their file

Not if they do what I do. I have removed the file from my computer and have numerous copies on SD cards and burnt to DVD’s. About 10 copies in total.

Chris Miller says

If I were to ever “invest” in bitcoin, I’d encrypt my wallet.dat file (probably under rijndael) and store it in multiple locations, including a public cloud like gmail’s.

You can encrypt in the wallet and a public store can be hacked.

Chris Miller says

No way to decrypt an encrypted wallet.dat file. Not with the strength of modern symmetric methods: e.g. blowfish, rijndael, serpent, etc. Unless you know the key. Look at the lockee virus. I’d probably put all my wallets in one big encrypted file/archive. It’d be perfectly safe in anyone’s hands. You could store it anywhere.

If i buy bitcoin on Coinbase or Zebpay, do I not have a private key until i transfer it to my hardware wallet. In other words i bought and set up a Nano S, did the Nano create my private key for me and before that I did not have one? Or does the Nano just protecy my private key. How was I able to send BTC before setting up my nano?

Sudhir Khatwani says

Coinbase & Zebpay means you don’t have your keys simple.

And when you use Ledger nano s like wallets you will get 12-24 word seed words/keys that are actually your private keys and you need to keep them secure, Ledger doesn’t hold your keys. Also watch these video tutorials-

thanks this is a very good article, can i request coinbase to share my private key?

Sudhir Khatwani says

They don’t share private keys.

Hello Sudhir, thx for the article. Under the heading “Desktop Wallets” what do you mean when you say: “But once you lose the file of the private key, you will lose the bitcoins.”? I mean how is it possible to lose a file? Thx Roger

Sudhir Khatwani says

Sometimes such files contain your private keys in raw form and if you tamper with them or if somehow you don’t have the back-up of the file and it gets deleted in such case you are risking your holdings which can be lost

Hi Sudhir, i just had a question. So if im using a hardware wallet like neon for example to store neo. and i lose my laptop. but the software is password protected etc. Or i spill water and ruin my hardrive. How do i have access to my crypto commodities again? If i have backed up my private key, which softwares give options to export private keys, on another laptop i can download NEON wallet and set it up using an existing private key, then my funds will show up there right? so a wallet is just a place to enter your pvt key and see your funds. your real source of funds is still your private key right? Please just clear this confusion

Sudhir Khatwani says

Yes, private keys are the only thing that matters.

Sometimes you also get seed words or keys that are also used to generate private keys only.

As, long as you have the keys, no matter what happens to your device, you can always recover your cryptos via a compatible software by re-installing everything.

if i have the private key but forget the corresponding public key , i can just regenerate the public key and access to the coin right?

Sudhir Khatwani says

Yes, you can do that.

Hope your doing well.

My question is, if we import the private keys can i then transfer that particular bitcoin’s to other person or sell it.

2. The bitcoins which i transferred to Bittrex or Poloniex can i get/extract the private keys of that too.

Sudhir Khatwani says

I’m confused…i have approx$3000 total invested in roughly 65-70 different alt coins, across the exchanges Binance, Kucoin, hitbtc, Ctyptopia, Poloniex & yobits. I have been doing this for approx 5 mos now& it is quite a learning process… I’m shocked to read that If i don’t have the private Keys to my coins, that i don’t own them at all!! I have been leaving My money on the exchanges and watching my amounts go up-and-down as the market does and have known that a will it was something I needed to think about but the more I looked into it the more confusing it seemed to be and the fact that I might seem to have multiple wallets with 65 to 70 different Coins potentially it just seemed like an overwhelming thing to do that wasn’t necessarily critical this point my confusion is in this at what point do use take your money or stock at AV off the exchange and put it into a wallet if it’s in a wallet doesn’t that mean it can’t grow it such leaps off the exchange is that correct I understand would be protected them against loss but so one would only usually probly do that if you couldn’t afford to lose money or if you add a substantial amount of a specific coin that you wanted to protect is that correct in my situation the most I have of any 1 coin is about a $100 of those 65 to 70 so seeing that On average they are each only valued between 20- $50 max, In a case would it be necessary or recommended for me to put them into wallets or wouldn’t you lead them on the exchange so that they can hopefully grow because it’s such a small amount? And also with these private keys for is that what’s prefer do S API keys you can have the option of creating on the exchanges are those the same things? And also with regards to these keys is it per coin on each exchange or is it Per wallet across the Board or is it per exchange I’m not understanding where these are generated specific xactly or if there if it’s possible to generate them on the exchange or only in A wallet itself. And I’ve given my situation with the fact that the most is a $100 of value if you would agree that it is OK to leave them on the exchange until they grow and further in value or I invest more money in one or more Of them Which while it then would you recommend given my situation because I don’t want to have a bunch of wallets like a bunch of keys to the house on a huge key chain that’s too much to remember and be too difficult and the store what would you in my situation recommend as far as wallets goes which one and I M an agreement upon the fact that whatever which ever when I do it should be offline I want one that’s offline not when it’s available online that hackers can get to an in any respect it on any chance of that any possibility so given that which while it would you recommend for me? I’m not opposed to paying for something that is worthwhile but if possible are there any you would recommend that are free service wise? or is it necessary to pay for something because It is well worth it, Because in that case I don’t have a problem I understand If it’s a necessity and an expert recommends it. I have a question also I have a few different currencies that have been in maintenance status For several months and I’m not permitted to withdraw or access them or do anything with them and this is a few different exchanges it Bit coin diamond on by Binance for example, Rep on Cryptopia, etc.. Have tried city messages to customer service with there seems to be a relax of quality service agents and responses or anything of value as far as help on the exchanges which is disappointing but I can understand that I’ve due to the vector in many are in different countries however I cannot seem to find an answer as to how to to deal with this problem or to see any end in sight I can’t foresee any end in sight I feel like I just my money’s been stolen Practically, Because I can’t access Funds, sell, transfer, or do anything With it. Can you recommend anything to do to brunt resolve to those situations? Re: certain Exchanges: Are there any exchanges you’d advise against doing business with? Because I’m just beginning to see trends with ones, that seem to be manipulated. I’ve watched, and have come to recent conclusion that it’s probs by wise to stay away from cryptopia, specifically, as it seems to be fixed to some extent I’ve noticed, as well as many of the coins on yobits, too. Can you recommended an exchange that’s reputable, but offers a wide range of alt coins, similar to the large number offered on Cryptopia, that has high volume of trading and no suspicious manipulating of coins that’s noticeable even to a beginner like me!? Im looking for one to replace cryptopia, but have struggled to find one with the wide selection, which has been frustrating. One final question if you don’t mind: with regards to transferring from one exchange to another, when u generate a wallet address to transfer the coins, why are some 100%different from each other, and then others, will generate the very same address that came up when i did the last transfer a few minutes prior? Literally, if im transferring 6 alt coins from one exchange to one other one, the first 3 will be the same address generated, then the 4th will be something totally different and new, then the 5th i have had return to issuing the same address as the first 3 generated, then the 6th come up with entirely different one again. Why Does it seem as if there’s no rhyme or reason to any of this I thought each and every coin whispers to have a separate wallet address that was not like any other. Even on the same exchange can somebody clarify that and also once it is used for that coin isn’t it always supposed to stay the same that same address every time? And just for clarification this address would be public or considered private that I’m generate when I want to deposit money in do certain wallets or transfer across weeks 1 from 1 exchange to another is that the same as a public or private address I’m just trying to discern the differences between all of them still.. If I didn’t make clear already how do I go about generating these private addresses and specifically when and where and at what point should I or J recommended Are necessary that I do so ?? I know is not a questions but I so preciate any help or clarification time been trying to do this on my own And for all that I learned I feel like there’s just as much if not more they don’t understand and I deftly just need some clarification on these points especially because I may not own any mine coins at this point by your definition can I don’t have the keys to any kinds of wallets so help help help so I can make a change now and protect myself!! thank you!!

Sudhir Khatwani says

Thanks, looks like you are now enlightened. If you don’t trade frequently keep your coins in your wallet and have 70 altcoins is not a good idea at all.

And in wallets also you will keep gaining/losing just like on exchanges but in wallets, you are further protected against exchange hacks. For further questions pls visit and ask here one by one- https://ask.coinsutra.com/

i see that in the above you mentioned : The user can confidently use the same private key again and again.

i thought every private key has exactly one corresponding public key, and every public key has one address. How can you use that again and again?

say if i bought btc in coinbase and i transfer the bitcoin into another wallet ( 1 transaction), in this transaction

( from coinbase to my wallet), there will be a pair of public and private key generated , i will get the private key form the wallet to unlock the bitcoin?

say after that i plan to transfer another quantity of bitcoin to another user, i know the user’s public address (key) , with the public key i generate another private key for the another user to unlock the bitcoin?

i also see that you use public address and public key interchangeably, however they are different as a bitcoin wallet address is a hashed version of your public key, is it correct?

thanks for the great articles – i have 4 questions, hope you can answer me

1) only the receiver of btc creates public address, then it will generate a pair of keys ( public and private ) , the sender of btc will use the private key to access the btc given in previous transaction and send to the address of the receivers , is it correct?

2) if i buy bitcoin in piece in multiple times ( for example each time i buy 0.2 btc for 5 times, i end up having 1 bitcoin), do i have 5 private keys? if i were to send out 1 bitcoin to another address , do i have to send 5 times?

3) if a donation account ( a static account) has only one public address asking for multiple senders to send to that address, and people donate to that, the person can access all the BTC sent to that static public address with one private keys?

Sudhir Khatwani says

1) Not able to understand what you are asking? BTC address can be generated by receiver and sender both. And they hold their respective keys related to their addresses. BTC just moves from one public address to another.

2) If you send 0.2 again and again to the same address then you have one single key and if you send it to 5 different address you will have multiple keys.

3) Yes, you are right.

I heard that obtaining the private key means taking ownership of the bitcoins. How to do this practically? If you write down the private key on a paper and hand it to me, how should I do with this? and if more than 1 person get this paper at the same time who would be the owner?

Thankyou!

Sudhir Khatwani says

Put these keys in a wallet to claim your btc. Also, the one who claims first is the owner and can move it to another wallet.

Thank you for quick answering. Seems I couldn’t find a way to “put these keys in a wallet”. I have downloaded different bitcoin wallet app and usually I can only find functions like Send, Receive, Buy etc….and for “Receive” it is only about sending the public key to someone else.

Did I miss anything?

Chris Miller says

your explanation of the asymmetric encryption method that allows users to verify ownership actually isn’t at all technical, but purely metaphorical. One would have to study and understand elliptic curve theory and math to appreciate the difficulty of the problem someone wanting to steal your bitcoin would need to solve. Other cryptocurrencies use elliptic curve, too, which has been around about 30 years now.(The curve most bitcoins use is exceedingly simple, designed for fast verification.) Also, cryptocurrencies have zero intrinsic value as an investment, and so rely strictly and totally on what’s called a “greater fool” strategy.

I have a paper wallet, which I photocopied as a backup, the lost the original. The photocopy QR code for private key was wrinkled and didn’t scan, so utilized the alpha numeric key. Had trouble getting the alpha numeric key to take in blockhain.org wallet, then got it to be accepted in another wallet, which it has been pending for 4 days now. How would I know if the alpha numeric code was accurate? Would it reject the code immediately if it wasn’t accurate?

Sudhir Khatwani says

If it wasn’t accurate it will reject automatically. Moreover, there are several formats of the private keys so which one are you using I don’t know. Some more inputs like formats will help in analyzing.

Please help me..my email got hacked and i don’t know how to recover my private key..I have all other details but how do i get back my private key

Private key

Private key of Bitcoin or cryptocurrency is a secret number that allows bitcoins or the respective cryptocurrency to be spent. Every Bitcoin address has a matching private key, which is saved in the wallet file of the person who owns the balance. The private key is mathematically related to the address, and is designed so that the Bitcoin address can be calculated from the private key, but importantly, the same cannot be done in reverse.

Because the private key is the "ticket" that allows someone to spend bitcoins, it is important that these are kept secure. Private keys can be kept on computer files, but they are also short enough that they can be printed on paper. An example of a utility that allows extraction of private keys from your wallet file for printing purposes is pywallet.

In order to create a transaction with a private key, it must be available to a program or service that allows entry or importing of private keys. Some wallets allow the private key to be imported without generating any transactions while other wallets or services require that the private key be swept. When a private key is swept, a transaction is broadcast that sends the entire balance held by the private key to another address in the wallet or securely controlled by the service in question. Private key can be generated with the special programs generators.

An example of private key sweeping is the method used on MtGox's Add Funds screen and BIPS Import screen. Just as with any other deposit, there is risk of double-spending so funds are deposited to the MtGox account after a six-confirmation wait (typically one hour). In contrast Blockchain.info's My Wallet service and Bitcoin-QT each provide a facility to import an encryption private key without creating a sweep transaction[1].

Private key example Edit

In Bitcoin, private key is a 256-bit number, which can be represented one of several ways. Here is a private key in hexadecimal - 256 bits in hexadecimal is 32 bytes, or 64 characters in the range 0-9 or A-F. Bitcoin private key length:

Range of valid Edit

Nearly every 256-bit number is a valid private key. Specifically, any 256-bit number between 0x1 and 0xFFFF FFFF FFFF FFFF FFFF FFFF FFFF FFFE BAAE DCE6 AF48 A03B BFD2 5E8C D036 4141 is a valid private key.

The range of valid private keys is governed by the secp256k1 ECDSA standard used by Bitcoin.

Base 58 WIf Edit

When we represent private keys in Bitcoin, however, we use a shorter format known as wallet import format, which offers a few advantages. The wallet import format is shorter, and includes built-in error checking codes so that typos can be automatically detected and/or corrected (which is impossible in hex format). Wallet import format is the most common way to represent private keys in blockchain. For private keys associated with uncompressed public keys, they are 51 characters and always start with the number 5. Private keys associated with compressed public keys are 52 characters and start with a capital L or K. This is the same private key in wallet import format.

When a private key is imported, it always corresponds to exactly one Bitcoin address. Any utility which performs the conversion can display the matching address. The mathematical conversion is somewhat complex and best left to a computer, but it's notable that each private key will always correspond to the same address no matter which program is used to convert it.

The Bitcoin address corresponding to the sample above is: 1CC3X2gu58d6wXUWMffpuzN9JAfTUWu4Kj

Mini format Edit

Some applications use the mini private key format. Not every public key or Bitcoin address has a corresponding mini private key - they have to be generated a certain way in order to ensure a mini private key exists for an address. The mini private key is used for applications where space is critical, such as in QR codes and in physical bitcoins. The above example has a mini key, which is:

Any transaction that has the correct signature will be accepted by the Bitcoin network. At the same time, any person who owns your private key can create the correct transaction. These two facts connected together mean that someone who knows your private key can steal from you.

Many paths are open to thieves who want private keys. The two most popular paths are memory carriers (flash cards) and communication channels. Therefore, should adhere to strict measures during transportation and storage of the private keys.

Software wallets usually store private keys in the” wallet file " on the main hard drive. Wallets usually store this file in a standard, well-known directory, making it an ideal target for viruses directed against the owners of currency exchange.

To counter the threat, software wallets offer the ability to encrypt the wallet file. Any intruder who gains access to your wallet file will then need to decode it. The complexity of this task depends on the encryption quality and the strength of the password used. Wallet files can be encrypted with a variety of wallet programs, you just need to set a password.

Although wallet backups are a good idea, they can potentially serve as a leak of private keys. For example, you might find it tempting to save a wallet file in a cloud storage service like Dropbox. However, anyone who can view the backup online (the list of such people may be unexpectedly long), will be able to steal some or all of your money. A similar problem can arise when sending backups to yourself by e-mail or if you leave the backup sheet in an unreliable place at home. Private key encryption can reduce the risk, but not eliminate it completely[2].

Preventing accidental leakage of private keys-the main task of the “cold storage”.

A public key (address) is a set of symbols that the blockchain uses to identify a specific wallet. You get translations for it, you can show it to other users.

Another thing – a private key. Under no circumstances can it be shown to outsiders, including developers Exodus wallet.

In no case, it can not be imported into other people's wallets or into new wallets (for example, to obtain Bitcoin Cash and Bitcoin Gold) as long as the main wallet (from which the key) has bitcoins. First, transfer them to another secure wallet, and then import the private key into new wallets.

- There are many online scammers who use social engineering to steal your keys.

- They can offer you free tokens (Airdrop) for every bitcoin you store in your wallet.

- Or help to get a new coin (Bitcoin Gold) faster than others through an innovative online wallet.

- Gimmicks can be mass. Their main task is to get you to upload a private key to the network or an application they have written.

If you do it – and you can say goodbye to the cryptocurrency portfolio.

Operations with cryptocurrency wallets (especially for the export and import of private keys) should be performed only on a secure computer, without connecting to the Internet.

The correct option is to install Linux (easy to manage – Mint) on a virtual machine, open the Exodus wallet on its base and carry out all operations in this environment.

There may be too many hidden threats (dangerous loopholes list) on your desktop to export private keys with a serious cryptocurrency balance[3].

If a private key with a Bitcoin balance is compromised or stolen, the bitcoin balance can only be protected if it is immediately sent to a different address whose private key is not compromised. Because bitcoins can only be spent once, once they are spent using a private key, the private key is worthless unless new amount are sent to the address. Furthermore, private key can be observed in the cryptography context. It is also known like a SSH key, secret key or encryption key.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Private Electrum Wallet - How to sweep/import Private Key

Главная > Wallets > Tutorials > Bitcoin Private Electrum Wallet - How to sweep/import Private Key

Step 1. Install the Bitcoin Private Electrum Wallet

Install the wallet following these instructions, and create a new wallet.

Step 2. Go to Wallet - Private Keys - Sweep

Step 3. Enter your Private Keys

In this field, paste your private keys. Both Bitcoin Private Keys and Zclassic Private Keys work.

After entering all private keys you would like to import, press 'Sweep'.

The address mentioned there is the BTCP address they will be sent to. By default it is set to the address of your current wallet.

Please ensure you do not change this to another address in case you do not hold the private keys to that wallet.

Другие статьи

Who runs Bitcoin Private?

Bitcoin Private is a community-driven BTC/ZCL fork consisting of over 50 talented contributors currently. We are fully transparent to the community and often allow them to make decisions regarding the fork and the future of Bitcoin Private.

Комментариев нет:

Отправить комментарий