Bitcoin Vaults: How to Put an End to Bitcoin Theft

Recall that we introduced the Bitcoin Vault abstraction last week. This new abstraction allows you to move the coins that you do not need immediately into a special kind of account called a vault. If they are stolen from the vault, you get to use a recovery key to get them back from the hacker. If the recovery key is also stolen, then you can convert the funds into mining fees, ensuring that the hacker does not benefit from the theft. Vaults do not affect fungibility or irreversibility of regular Bitcoin transactions; they solely improve your personal protection. (The paper has the details).

We recently answered some questions from the press regarding vaults. The questions were quite interesting and insightful -- so much so that they can be used as an FAQ list. Our response did not go out in time to make it into the article, so here it is, a vault FAQ.

- What's the impact of vault transactions on fungibility and irreversibility of Bitcoin transactions?

Vaults do not affect fungibility at all, nor do they affect the irreversibility of regular transactions.

Vaults are a personal defense mechanism: you take the coins that you want to protect, the coins that you want to keep in a cold wallet, and put them in a vault address that you create (call it V). In doing so, you give up the ability to spend them quickly in return for theft prevention. When you want to spend the coins, you unvault them from V into your hot wallet (W). This operation takes time to complete -- it takes exactly as long as the unvaulting period you specified when you created your vault. Once the coins have arrived at W, you pay a merchant M from W. Only coins in your possession can be vaulted; coins cannot be vaulted retroactively; and they can only be unvaulted back to your possession. You can't trick someone into accepting a vault payment and then take your coins back! Merchants will readily detect that they are being paid with a vault payment, and will not accept such payments. So a vault user can only take the coins out of the vault into her own hot wallet, and then, after that unvaulting is complete, issue payments from the hot wallet to merchants. Consequently, the irreversibility of regular transactions remains untouched. Overall, the entire design revolves around adding a new feature for improving one's own security, without disturbing any of the rest of Bitcoin's properties.

- Are you, or your students, working on the code to implement it and offer it to bitcoin through perhaps a pull request? Does the code require fundamental changes or can it easily be implemented?

Yes, we have the full vault functionality implemented. We plan to submit a pull request and a corresponding BIP. The changes required are incredibly modest: just a single new opcode that is easy to implement.

- What's the difference between using a hardware wallet like a Trezor or a vault?

Vaults are complementary to hardware security mechanisms such as Trezor hardware wallets. Note that it is not good practice to store a key solely in a Trezor, as it may be physically lost or damaged. Vaults are orthogonal to protections against key loss and should always be accompanied by backups/multisig strategies that protect against that. The keys should be replicated, and the replicas need to be protected -- the more replicas there are, the greater the attack surface. If the funds do not need to be spent immediately, such protection is best achieved with a vault.

- I notice you introduced the matter to the mailing list. What do you think of bitcoin's development process? Is it open/close, welcoming, you think ideas are judged on merit, etc?

We think very highly of the Bitcoin core developers and the Bitcoin development process, which follows open source principles. At the moment, the maximum block size debate seems to have tied up many cycles over a very important, but ultimately short term, battle. We hope the maximum block size debate can get settled quickly so we can all focus on more interesting developments that will go beyond the scalability question, such as how to expand Bitcoin's functionality and fulfill its promise of delivering a new kind of digital money with new capabilities.

- Any general comments in regards to the specific bitcoin vault proposal and more generally in regards to bitcoin development?

For years now, we have been watching people lose their coins to hackers. And it's just not their fault: our operating systems are nowhere near secure enough for highly valuable assets. Regular people cannot be expected to know and follow the incredibly complicated opsec procedures to maintain a bulletproof device. Worse, there is no help on the horizon. The Microsofts, Apples and Googles of the world are not going to be able to improve the state of client-side operating system security -- they have been trying for years, and what we have today is the best they've got: the computer security problem is just too hard.

Vaults allow Bitcoin users to step around this problem. It's Bitcoin users' way of saying "ok, I realize that a determined hacker can get into my machines, that I might lose my key or I might have a temporary lapse, but I will be able to keep my coins despite occasional failures of this kind."

We believe that this can be game changer for cryptocurrencies and their mainstream adoption.

Coin Ultimate Trading

The fairest and most transparent cryptocurrency exchange.

Fiat trading

Buy Bitcoin, Ethereum, Litecoin or other cryptocurrencies using SGD or USD with minimum 0.095% fees.

All cryptocurrencies are stored offline. Withdrawals are checked and processed semi-manually.

Our blazingly fast match engine can handle millions of orders per second.

No market manipulation. First in first out order execution. All see the same order books.

Trade cryptocurrencies and their derivatives within a simple and easy to use interface.

COINUT was designed to make it easier, faster and more secure for people all over the world to trade cryptocurrencies and their derivatives. With deep experience in cryptocurrency, and a fascination for its tremendous potential, the COINUT team is comprised of leading experts in Computer Science and Finance. COINUT exchange is owned by the COINUT Group and headquartered in Asia’s financial hub, Singapore, with subsidiaries in north America and Europe. The company is backed by Boost VC in Sillicon Valley and NUS Enterprise in Singapore.

Beginner’s Guide to Mining Bitcoins

Last updated on May 18th, 2018 at 03:08 pm

One of the biggest problems I ran into when I was looking to start mining Bitcoin for investment and profit was most of the sites were written for the advanced user. I am not a professional coder, I have no experience with Ubuntu, Linux and minimal experience with Mac. So, this is for the individual or group that wants to get started the easy way.

1. Get a Bitcoin mining rig

Bitcoin mining is a very competitive niche to get into. As more and more miners come on board with the latest mining hardware the difficulty to mine increases each day. Before even starting out with Bitcoin mining you need to do your due diligence. This means you need to find out if Bitcoin mining is even profitable for you.

The best way to do this is through the use of a Bitcoin mining calculator. Just enter the data of the Bitcoin miner you are planning on buying and see how long it will take you to break even or make a profit. However, I can tell you from the get go that if you don’t have a few hundred dollars to spare you probably won’t be able to mine any Bitcoins.

Once you’ve finished with your calculations it’s time to get your miner. Make sure to go over our different Bitcoin mining hardware reviews to understand which miner is best for you. Today, the Antminer S9 is the newest and most powerful miner.

Select miner

AntMiner S9

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

As a side note it’s important to state that in the past it was possible to mine Bitcoins with your computer or with a graphics card (also known as GPU mining). Today however, the mining niche has become so competitive that you’ll need to use ASIC miners – special computers built strictly for mining Bitcoins.

2. Get a Bitcoin wallet

First thing you need to do is get a “Bitcoin Wallet“. Because Bitcoin is an internet based currency, you need a place to keep your Bitcoins. Once you have a wallet make sure to get your wallet address. It will be a long sequence of letters and numbers. Each wallet has a different way to get the public Bitcoin address but most wallets are pretty straight forward about it. Notice that you’ll need your PUBLIC bitcoin address and not your PRIVATE KEY (which is like a password for your wallet).

If you’re using a self hosted wallet (i.e. you downloaded a program to your computer and are not using an internet based service) there’s one additional very important step. Make sure you have a copy of the wallet.dat file on a thumb drive and print a copy out and keep it in a safe location. You can view a tutorial on how to create a secure wallet here. The reason is that if you computer crashes and you do not have a copy of your wallet.dat file, you will lose all of your Bitcoins. They won’t go to someone else, they will disappear forever. It is like burning cash.

3. Find a mining pool

Now that you have a wallet you are probably roaring to go, but if you actually want to make Bitcoin (money), you probably need to join a mining pool. A mining pool is a group of Bitcoin miners that combines their computing power to make more Bitcoins. The reason you shouldn’t go it alone is that Bitcoins are awarded in blocks, usually 12.5 at a time, and unless you get extremely lucky, you will not be getting any of those coins.

In a pool, you are given smaller and easier algorithms to solve and all of your combined work will make you more likely to solve the bigger algorithm and earn Bitcoins that are spread out throughout the pool based on your contribution. Basically, you will make a more consistent amount of Bitcoins and will be more likely to receive a good return on your investment.

When choosing which mining pool to join you will need to ask several questions:

- What is the reward method? – Proportional/Pay Per Share/Score Based/PPLNS

- What fee they charge for mining and withdrawal of funds?

- How frequently they find a block (means how frequently I get rewarded)?

- How easy it is to withdraw funds?

- What kind of stats they provide?

- How stable is the pool?

To answer most of these questions you can use our best Bitcoin mining pools review or this excellent post from BitcoinTalk. You can also find a complete comparison of mining pools inside the Bitcoin wiki. For the purpose of demonstration I will use Slush’s Pool when mining for Bitcoins. Once you are signed up with a pool you will get a username and password for that specific pool which we will use later on.

Follow the link to go to their site and click the “Sign up here” link at the top of their site and follow their step by step instructions. After you have your account set up, you will need to add a “Worker”. Basically, for every miner that you have running, you will need to have a worker ID so the pool can keep track of your contributions.

4. Get a mining program for your computer

Now that you’ve got the basics covered we’re almost ready to mine. You will need a mining client to run on your computer to that you will be able to control and monitor your mining rig. Depending on what mining rig you got you will need to find the right software. Many mining pools have their own software but some don’t. You can find a list of Bitcoin mining software here.

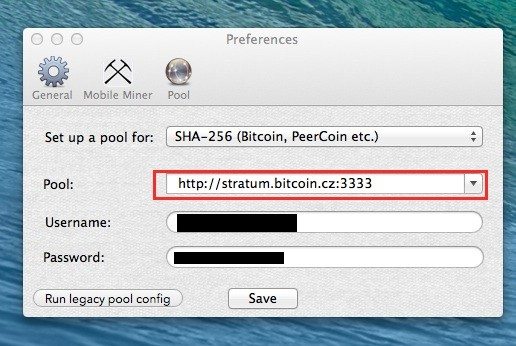

I’m using a mac so I will use a program called MacMiner. The most popular program I’ve found for a PC are BFGMiner and 50Miner . If you want to compare different mining software you can do this here.

5. Start mining

OK, so hopefully now everything is ready to go. Connect you miner to a power outlet and fire it up. Make sure to connect it also to your computer (usually via USB) and open up your mining software. The first thing you’ll need to do is to enter your mining pool, username and password.

Once this is configured you’ll basically start mining for Bitcoins. You will actually start collections shares which represent your part of the work in finding the next block. According to the pool you’ve chosen you will be paid for your share of coins – just make sure that you enter your address in the required fields when signing up to the pool. Here’s a full video of me mining in action:

Conclusion – perhaps it’s better just to buy the coins?

To conclude this article here’s something to consider. Perhaps it would be more profitable for you to just buy Bitcoins with the money you plan to spend on Bitcoin mining. Many times just buying the coins will yield a higher ROI (return on investment) than mining. If you want to dig into this a bit deeper here’s a post about exactly that.

Getting started with Bitcoin

Using Bitcoin to pay and get paid is easy and accessible to everyone.

1. Inform yourself

Bitcoin is different than what you know and use every day. Before you start using Bitcoin, there are a few things that you need to know in order to use it securely and avoid common pitfalls.

2. Choose your wallet

You can bring a Bitcoin wallet in your everyday life with your mobile or you can have a wallet only for online payments on your computer. In any case, choosing your wallet can be done in a minute.

3. Get Bitcoin

You can get Bitcoin by accepting it as a payment for goods and services. There are also several ways you can buy Bitcoin.

4. Spend Bitcoin

There is a growing number of services and merchants accepting Bitcoin all over the world. You can use Bitcoin to pay them and rate your experience to help honest businesses to gain more visibility.

1. Inform yourself

Bitcoin does not require merchants to change their habits. However, Bitcoin is different than what you know and use every day. Before you start using Bitcoin, there are a few things that you need to know in order to use it securely and avoid common pitfalls.

2. Processing payments

You can process payments and invoices by yourself or you can use merchant services and deposit money in your local currency or bitcoins. Most point of sales businesses use a tablet or a mobile phone to let customers pay with their mobile phones.

3. Accounting and taxes

Merchants often deposit and display prices in their local currency. In other cases, Bitcoin works similarly to a foreign currency. To get appropriate guidance regarding tax compliance for your own jurisdiction, you should contact a qualified accountant.

4. Gaining visibility

There is a growing number of users searching for ways to spend their bitcoins. You can submit your business in online directories to help them easily find you. You can also display the Bitcoin logo on your website or your brick and mortar business.

Bitcoin IRA Reviews - How To Put Bitcoins In Your Retirement Account

Technology has changed how we manage our individual retirement accounts (IRAs). We no longer need to visit the offices of an investment firm to manage our accounts. We can do it comfortably from our homes.

What has largely remained unchanged since IRAs were introduced in 1974, are the types of investments we use to fund them. Until now, traditional forms of funding have included stocks, bonds, certificates of deposits and physical assets with value.

However, the world of investing is changing. Our world is becoming increasingly digital with each passing day, with a large portion of our lives now taking place online. It stands to reason that a digital currency and investment option would be ready to change the landscape.

What Is Bitcoin?

Bitcoin is a digital currency that exists on a blockchain, a public ledger, on the internet. As the public ledger uses cryptography to secure transactions, it is also a cryptocurrency.

No central authority, like a bank or government, updates the blockchain ledger. In place of a central authority, computers run the bitcoin core software in a peer-to-peer network and manage it through consensus.

The process of finding consensus on the status of the shared public ledger is known as “mining”. Every ten minutes, computers in the network compete to find a solution to a mathematical problem the bitcoin protocol provides.

The winning computer updates the ledger for ten minutes. It also keeps the new bitcoins released within that time—12.5 bitcoins.

A software developer by the name (or pseudonym) of Satoshi Nakamoto released the first version of bitcoin core software in January 2009. The first release came three months after Nakamoto published a white paper in a cypherpunk mailing list describing how the technology would work.

No individual, company or institution owns the bitcoin protocol as it is an open-source project. Software developers all across the world contribute to its improvement.

A complex ecosystem of mining operations, wallet services, exchanges and investment platforms has grown around bitcoin. Close to $2 billion has been invested into companies and startups offering related services. The cryptocurrency has grown to about $38 billion in market capitalization.

Bitcoin was the first cryptocurrency ever created. Since its creation, more than a thousand others have come into existence. All cryptocurrencies work with the same concept and technology, but have a wide range of differing features and use cases.

The most popular alternative coins (altcoins) include Ethereum, Litecoin, Ripple and NEM and Ethereum Classic.

Over 150,000 merchants worldwide accept bitcoin as payment for goods and services, mostly through payment processors like BitPay. Users can even use the cryptocurrency to shop on Amazon through the payment exchange Purse.io.

Bitcoin has the potential to be a unit of account. Individuals and organizations can use it to measure and track the worth of assets, price, expenditure and income. At the moment, the majority of users find it convenient to denominate items in fiat currency when using bitcoin.

The most popular use of bitcoin however is as a store of value. It is convenient for remittances, as it moves fast across borders. It is also a popular long-term investment asset.

Its price has grown from zero to above $3000 in a span of eight years. Someone who bought $400 worth of bitcoin in 2011 is worth over $1 million in 2017.

Advantages of Bitcoin as an Investment

Bitcoin’s supply is capped. There will never be more than 21 million in circulation. The number coming into circulation diminish when the new supply halves every four years. The network will mine the last coin in the year 2140. The deflationary nature of bitcoin has earned it the tag ‘digital gold.’

Meanwhile, the adoption of bitcoin is growing around the world as shown by each transaction the network confirms. The daily average was about 50,000 transactions in 2013. That number has risen to about 320,000 in 2017.

The diminishing number of new bitcoins coming into circulation, combined with expanding worldwide adoption, creates an environment for its value to continue to grow.

Another advantage of bitcoin as an investment is that you can hold it independent of a custodian. This gives you full control over your holdings and protects you from third-party mismanagement or fraud.

You can have full control over your bitcoins even when you use custodial services through multisignature wallets. The infrastructure allows for a wallet to have two or three separate private keys. All keys are needed in order for an authorized transaction to take place. A secure wallet provider like Bitgo keeps each key in a separate “cold storage” (or offline away from the internet) locations to ensure maximum security.

Bitcoin exists independently from assets such as stocks, savings and bonds. During an economic crisis, bitcoins do not fall in value with the rest of assets, but rather, they have historically increased in value in an inverse relationship.

Is Bitcoin Allowable by the IRS as a Retirement Asset?

Bitcoin is less than ten years old and most regulators around the world have not conclusively taken a position on the cryptocurrency. The USA is one of countries that have issued guidelines on its use.

In March 2014, the Internal Revenue Service (IRS) declared it would treat bitcoin as a commodity for taxation purposes, the way it treats stocks and bonds. The IRS has declared that Bitcoin will be regarded as a “property” and will thus require a custodian in order to comply with regulations.

Self-Directed IRAs

Typical IRA custodians accept only mainstream assets such as stocks, bonds, mutual funds and certificates of deposits (CDs), as the IRS directs. The best option you have to include bitcoins in your retirement plans is to use a self-directed IRA, which allows you to invest in a cryptocurrency like Bitcoin.

When using a self-directed IRA, you can either buy and hold bitcoins, or buy shares of dedicated funds that hold them. The first option allows you to buy and sell depending on the price movement and earnings from the volatility. This requires you to acquire the skills of an asset or forex trader.

By investing in dedicated funds that hold bitcoins, you delegate decision making about when to buy and sell to expert investors.

Bitcoins can be bought from exchanges. These are companies that match buyers and sellers of cryptocurrencies. Genesis, Coinbase and Kraken are some of the exchanges registered in the US.

Where Is Bitcoin Stored?

A bitcoin wallet is an application that holds the private keys (digital signature) you use to authorise movement of coins assigned to you on the blockchain. If someone accesses your wallet, they can steal your bitcoins.

Different types of wallets exist. Some like Bitcoin Core, Armory and Electrum are decentralized. No individual or organization owns them. They run as open projects. Meanwhile, others like Blockchain.info, Coinbase and Xapo are centralized and run by profit-making businesses.

Decentralized wallets offer full control of your private keys and thus your bitcoins. Converseley, centralized wallets require you to trust administrators with your private keys.

Bitcoin wallets also fall into two broad categories: hot and cold wallets. Hot wallets are those that connect to the internet. Wallets in this category include apps downloaded to a to smartphone, signing into a web browser, and software downloaded to a laptop or desktop computer.

Cold wallets never come into contact with the internet, such (non-internet connected) desktops or USB sticks. This category also includes hardware wallets, which are separate devices designed to store bitcoins.

You can also generate a wallet and print it on a piece of paper through Bitaddress.org. Paper wallets are the most secure cold wallet, especially if you generate it offline and clean the computer and printer caches before reconnecting to the internet.

You can share the public address of your paper wallet with those who pay you. You need to secure the copy with the private keys in a safety deposit box, however, especially if it holds huge amounts of bitcoins.

Cold wallets are the most appropriate for long-term storage of huge amounts of bitcoin because they are not susceptible to remote hacking.

Should you invest in a Bitcoin IRA?

The best investment you can make is a mixture of all the available options. The more asset classes you invest in, the more you spread your risks. A Bitcoin IRA is a high-growth potential investment available to you to develop a diverse portfolio.

A Bitcoin IRA is a special investment because it is not linked to the other investment options such as finance, bonds and stock. In times of global economic crisis, bitcoin isn’t infected with the toxicity of the markets. The factors that influence its price are different, which adds to its value as an option to spreads your risks.

Like any investment, bitcoin comes with risks. Bitcoin is projected to continue growing in value, but, of course, there are no guarantees. There is also a possibility of its underlying technology failing. It could break while developers tweak the core software to improve user experience or to scale the size of network to meet demand.

How Do I Get Started?

There are two options available to you

- Do it yourself (such as setting up an LLC for IRS-compliance)

- Use experts to help (such as BitcoinIRA.com)

To set up a bitcoin IRA yourself you’ll need to take steps to ensure it is IRS-compliant, this includes setting up an LLC for your Bitcoins, however there are many risks to holding bitcoin in a self-directed IRA LLC, including a lengthy list of “prohibited transactions” that can disqualify the tax protection of assets within the IRA.

Legally, an IRA and its owner are separate entities and must act separately. The list of “prohibited transactions” is intended to prevent account owners from drawing double benefits from the IRA’s tax protection.

For example, account owners cannot put up the assets of their IRA LLC as security for a loan, since that would give them the double benefit of tax-protected assets and collateral.

Under these same rules, account owners cannot sell bitcoin to their own IRA LLC and must buy and store bitcoin in the name of the LLC, not their own names.

For investors who own bitcoin and want to transfer it into an IRA LLC, there’s only one option: sell the bitcoin, then contribute the proceeds — in U.S. dollars — to the IRA LLC, and then buy bitcoin in the name of the LLC with its own cash assets.

As with real estate and other unconventional investments, it’s also the responsibility of investors to report the fair market value of their assets to their custodian each year, whether those assets are held in an LLC or not.

For assets such as stocks and bonds, these values are assessed automatically. For real estate and unconventional investments like bitcoin, a third-party assessment is usually required.

If an account owner fails to report the value of their assets accurately to their custodian or engages in a “prohibited transaction,” their IRA can be disqualified and all assets distributed and taxed. Last but not least, account owners must also file annual reports and pay fees to the Secretary of State where the IRA LLC is incorporated.

Even if account owners cross all the t’s and dot all the i’s, bad custodians can still get them in trouble.

The best option to use a turn-key service that handles all the steps while ensuring security and IRS-compliance.

Recommended Service - BitcoinIRA.com

The majority of IRA custodians and trustees still either lack the technical capacity to add bitcoin to the options they offer, they are wary of its volatility, or they are waiting for clearer regulatory guidelines. Meanwhile, cryptocurrencies are growing and the advantage of being an early investor is slipping away.

BitcoinIRA.com was the first to offer this and remains the largest company in this space with a lot of strong customer reviews on Google and Facebook. They offer a full-service solution that assists investors in rolling over their existing retirement funds from one custodian to another, coordinating trades with a reputable exchange and securing their Bitcoins in a Cold Storage Wallet exclusively with Bitgo, a secure wallet service provider. They take a commission that varies based on your overall investment amount, however it’s reasonable given the risks and compliance issues involved.

Newer, lesser known services include PENSCO Trust Company, Millennium Trust Company and The Entrust Group. Some of these services provide help with do-it-yourself options, but the consumer bears greater risks with compliance and theft.

How Can I Buy Bitcoin?

Last updated: 26th January 2018

So you've learned the basics about bitcoin, you're excited about the potential and now you want to buy some*. But how?

(*Please, never invest more than you can afford to lose – cryptocurrencies are volatile and the price could go down as well as up.)

Bitcoin can be bought on exchanges, or directly from other people via marketplaces.

You can pay for them in a variety of ways, ranging from hard cash to credit and debit cards to wire transfers, or even with other cryptocurrencies, depending on who you are buying them from and where you live.

1 – set up a wallet

The first step is to set up a wallet to store your bitcoin – you will need one, whatever your preferred method of purchase. This could be an online wallet (either part of an exchange platform, or via an independent provider), a desktop wallet, a mobile wallet or an offline one (such as a hardware device or a paper wallet).

Even within these categories of wallets there is a wide variety of services to choose from, so do some research before deciding on which version best suits your needs.

You can find more information on some of the wallets out there, as well as tips on how to use them, here and here.

The most important part of any wallet is keeping your keys (a string of characters) and/or passwords safe. If you lose them, you lose access to the bitcoin stored there.

BUYING ONLINE

2 – open an account at an exchange

Cryptocurrency exchanges will buy and sell bitcoin on your behalf. There are hundreds currently operating, with varying degrees of liquidity and security, and new ones continue to emerge while others end up closing down. As with wallets, it is advisable to do some research before choosing – you may be lucky enough to have several reputable exchanges to choose from, or your access may be limited to one or two, depending on your geographical area.

The largest bitcoin exchange in the world at the moment in terms of US$ volume is Bitfinex, although it is mainly aimed at spot traders. Other high-volume exchanges are Coinbase, Bitstamp and Poloniex, but for small amounts, most reputable exchanges should work well. (Note: at time of writing, the surge of interest in bitcoin trading is placing strain on most retail buy and sell operations, so a degree of patience and caution is recommended.)

With the clampdown on know-your-client (KYC) and anti-money-laundering (AML) regulation, many exchanges now require verified identification for account setup. This will usually include a photo of your official ID, and sometimes also a proof of address.

Most exchanges accept payment via bank transfer or credit card, and some are willing to work with Paypal transfers. And most exchanges charge fees (which generally include the fees for using the bitcoin network).

Each exchange has a different procedure for both setup and transaction, and should give you sufficient detail to be able to execute the purchase. If not, consider changing the service provider.

Once the exchange has received payment, it will purchase the corresponding amount of bitcoin on your behalf, and deposit them in an automatically generated wallet on the exchange. This can take minutes, or sometimes hours due to network bottlenecks. If you wish (recommended), you can then move the funds to your off-exchange wallet.

BUYING WITH CASH

2 – choose a purchase method

Platforms such as LocalBitcoins will help you to find individuals near you who are willing to exchange bitcoin for cash. Also, LibertyX lists retail outlets across the United States at which you can exchange cash for bitcoin. And WallofCoins, Paxful and BitQuick will direct you to a bank branch near you that will allow you to make a cash deposit and receive bitcoin a few hours later.

ATMs are machines that will send bitcoin to your wallet in exchange for cash. They operate in a similar way to bank ATMs – you feed in the bills, hold your wallet's QR code up to a screen, and the corresponding amount of bitcoin are beamed to your account. Coinatmradar can help you to find a bitcoin ATM near you.

(Note: specific businesses mentioned here are not the only options available, and should not be taken as a recommendation.)

Authored by Noelle Acheson. Bitcoin image via Shutterstock.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin put

I want to Buy something using bitcoins but I am not sure how to put bitcoins in my "Wallet".

Could somebody please help me?

When new Bitcoins are issued (7,200 per day, on average) they go to those who are mining for bitcoins. At one point in time, mining to acquire bitcoins was something that was relatively easy to do. That is no longer the case. So now to acquire bitcoins one would normally buy bitcoins at an exchange.

What options are available to you will differ based on where you are, what payment methods you have available, how quickly you need the bitcoins and how many you intend to buy.

Trade War Fears Put Bitcoin in Focus as a Possible Hedge

President Trump’s call for tariffs on steel and aluminum imports set off a frenzy of comments about such a move triggering a trade war, but one winner from any such implementation could be Bitcoin.

Doomsday scenarios were outlined ad nauseam, equity investors and traders panicked and caused markets around the world to sell off, but Bitcoin experienced a rally of sorts. As the debate raged over the president’s proposal, some observers discussed how cryptos could benefit.

Tariffs on the way?

The president on Thursday called for a 25% tariff and 10% tariff to be put on imports of steel and aluminum, respectively. That immediately sparked fears from a barrage of pundits who said that such tariffs could trigger a trade war.

Supporters of such tariffs say it’s about time, and agreed with the president’s comments that the tariffs could build up the country’s steel and aluminum industries.

Bitcoin as a hedge

We’ve told you about hedge fund manager Brian Kelly who’s developed the reputation for being a Bitcoin bull. On Friday, he discussed on CNBC’s Fast Money how Bitcoin could be used as a hedge against any trade war that may result from the president’s tariff proposal if it is implemented.

"In this environment, I want to own those things that are deflationary and fixed supply in an inflationary environment. And look at what Bitcoin has done the last couple of days."

During trade wars, currencies tend to weaken. This was the case with the dollar, which depreciated in value last week, Kelly noted. In past trade wars, investors would hedge with gold, however, now Bitcoin could be an option.

"But you know what, now we have Bitcoin. [It] has a fixed supply. It acts exactly like a hard asset, exactly like a commodity. Generally speaking, you want to own hard assets.”

Bitcoin/stock market correlation still being debated

Over the past few months, many have tried to correlate Bitcoin’s price movements with the ups and downs of the stock market. However, this week, Bitcoin showed how it refuses to go along with traditional finance thinking.

While the Dow sold off almost 1,000 points by Friday before recovering, Bitcoin’s price moved higher with few dips. It’s up by 6.4% for the week, noted CNBC.

In fact, the volatile asset continues to regain some of its February losses. It peaked around $19,500 in mid-December, only to fall below $6,000 last month. Prices hovered just over $11,000 Friday. - CNBC

YahooFinance

Starbucks dips, Hormel up slightly, Apple sinks

Buy Bitcoin Bearish Bitcoin Put Up or Shut Up

Amazon (AMZN) Backs Acko to Strengthen Presence in India

Hey everybody Dave Bartosiak with Trending Stocks at Zacks.com. Shhh. You hear that? No. You can’t. Because I can’t hear anything other than people talking bitcoin. Market at all-time highs? Have you seen bitcoin? Tax cuts pass? Yeah but my brother has an Ethereum farm in Indiana. Canadian weed stocks like Aurora Cannibis ACBFF on the run? Sure, but don’t you think bitcoin cash will surpass bitcoin due to smaller block sizes and lower fees.

Look man, I know bitcoin is fun to talk about. And you disenfranchised millennials have a thing for taking down the existing social hierarchy that has locked you out of your dream job as an astronaut rock star race car driver that moonlights as a fireman. Yes, Reddit obviously makes you smarter than everyone else. Cryptocurrencies are the millennial 401k so take your fiat currency and shove it.

Don’t you old guys start giggling yet because I’ve got a fistful of salt for you too so pucker up. Staring up at the clouds, shaking your fists and yelling at bitcoin. Bitterly calling it a Ponzi scheme and the biggest bubble since Tulip Mania. Ain’t that the pot calling the kettle black. You had the dot com bubble, the real estate boom, and now a QE fueled rally off the bottom, yet, you have the nerve to talk garbage about crypto. It’s not backed by anything? No, it’s just backed by the millions of nodes in the blockchain. Talking about, “You can have blockchain without crypto.” Sure, if you ignore the definition of blockchain and replace it with the word database. Ignore the independent confirmation of transactions by third parties compensated for accuracy.

There is a certain mania developing here, but perhaps it’s not in the underlying cryptocurrencies. It’s in this new phenomenon where you just add “blockchain” to your name and your stock rockets up 1,000%. RIOT, used to be a company called Bioptix, now Riot Blockchain. Long Island Tea LTEA company decided Strong Island Iced Tea wasn’t a good idea, decided instead to be called Long Island Blockchain. Longfin LFIN announced they bought Ziddu.com, a company that uses the blockchain for micro-lending. These companies have added more than 1,ooo% in some cases. Heck, I’m gonna get in on this action. Did you know that Bartosiak doesn’t mean incredibly handsome in Polish? Nope. Bartosiak is actually Polish for Blockchain. My name is really Dave Blockchain. Hello, payroll department? That’s right, What about Dave? You are now clear to quadruple my salary because my last name is Blockchain.

I know this is all fun and games until someone gets hurt so here’s real advice. If you believe in crypto, buy some crypto, add crypto stock exposure, and become a HODLER. Not a holder, a HODLER. If you think it’s a scam, take a few bucks and short it if you dare. But sitting on the sidelines and yelling back and forth at each other is like not voting then taking politics all day. Also, remember at this stage it’s speculative. So don’t go pouring in your avocado toast money or putting it on credit cards. The bulls think bitcoin goes to a million, the bears think it’s worthless. I suspect the truth is somewhere in-between.

Every time you share this video, one of the four billion people on Earth with a cellphone and no bank account gets connected to the world economy. Subscribe to the YouTube channel, twitter @bartosiastics and come back for all the Trending Stocks with Zacks.com, I’m Dave Bartosiak.

Now See All Our Private Trades

While today's Zacks Rank #1 new additions are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for all Zacks trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Комментариев нет:

Отправить комментарий