Bitcoin vs Ethereum – Which one is Better?

With all of the commotion going on in the world of cryptocurrency, some interesting questions arise. A lot of people still feel they need to choose between Bitcoin or Ethereum, because one of them “has” to be better than the other. That is not the case by any means, as both ecosystems are trying to do things entirely. However, there are some aspects of both currencies which can be referred to as “being better than” its counterpart.

3. The Technology Battle

On paper, one could argue Bitcoin is better than any other cryptocurrency, token, or digital asset because those other offerings would not be around, were it not for Bitcoin. In this regard, the popular cryptocurrency has a leg up over any other currency in existence. Bitcoin will always be the first “major” cryptocurrency, and it has been around for 9 years now. Ethereum, on the other hand, only came to market a few years ago.

That being said, Ethereum offers some interesting pieces of technology. Smart contracts have been quite a revolutionary technology, although the same concept will be part of the Bitcoin protocol soon. Bitcoin has a disturbing lack of decentralized application possibilities, which makes Ethereum seem “better” in this regard. Then again, there is no “major” decentralized application in existence to be embraced by mainstream society either. Ethereum has a technological edge over Bitcoin, but until it is used by the masses, it is a matter of semantics.

2. Number of Coins

When we look at the available supply of currency, Bitcoin is clearly more scarce than Ethereum. In fact, Bitcoin has a hard coin supply cap of 21 million BTC. Ethereum has over 92 million coins in circulation, with more being mined every day. Even when Ethereum switches to proof of stake, it will remain an inflationary currency to some degree. A lot of people tend to overlook this fact, although it is certainly worth taking into consideration.

Not knowing how many ETH will be in circulation at its peak is somewhat disconcerting. A lot of Ethereum enthusiasts will shrug this off and claim it doesn’t matter. Rest assured such “details” should matter to everyone who gets involved in any cryptocurrency. Ethereum is not the only currency without a fixed maximum supply cap right now, but given its current market cap, it could become an issue over time. Bitcoin is better in this regard, as there is no confusion regarding the available supply.

1. Speculation

From a speculative point of view, both Bitcoin and Ethereum have seen significant value gains over the past year. In the case of Bitcoin, these gains have been smaller percentage-wise. Then again, Bitcoin was created well before Ethereum and has seen its value increase steadily over the years. Ethereum’s value suddenly picked up over the past year and a half. Whether or not that trend can be sustained over the long term, remains to be seen.

At the same time, the Ethereum price is still linked to the Bitcoin price. When Bitcoin goes up, Ethereum will often go down a bit until it stabilizes. As Bitcoin declines in value, Ethereum either goes down along with it, or sees a small gain. These values often correct themselves within mere hours, though. Right now, Bitcoin is clearly the bullish currency of the two, whereas Ethereum is trying to stabilize. All cryptocurrencies depend on what Bitcoin is doing, and Ethereum is no exception.

If you liked this article, follow us on Twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Nice article, thank you.

This article is not accurate. There is 30% of bitcoin coins that are ‘Lost’, and actually when Bit drops so does Eth, when Bit raises, so does Eth. They are tied very closely to each other. Not in the manner the writer noted. Research before you talk.

You are correct!

Ethereum is garbage.

2008 showed everyone the predatory nature of banks.

The solution Satoshi Nakamoto came up with was to disintermediate the banks entirely. People are corruptible, math is not.

If people want to spurn Nakamoto’s gift and trust bankers with Ripple, Ethereum, etc that’s their business.

I have no doubt that anyone using banker crypto, having forgotten the past, will be doomed to repeat it.

“Ethereum is garbage” – upset that there’s something out there that actually has some utility, that people – and businesses, including banks – are actually using to drive value and efficiency, rather than just hoard like Bitcoin?

Dude is obviously a Bitcoin fanboy. Just look at his comment history. He feels the pressure building because Ethereum is in such high demand. He fears “The Flippening”. In case you haven’t heard, that is when Ethereum will overtake Bitcoin as the new dominant currency. Many Bitcoin fanboys are terrified of what Ethereum is doing right now.

I’ve caught these Ethereum trolls shilling on almost every Bitcoin forum!

Same tactics almost verbatim, no facts and personal attacks, fake names and empty profiles on Facebook.

How much do they pay you to troll Bitcoin forums?

Let’s hope they pay you in something other than Ethereum because in spite of your attacks, Ethereum is a fundamentally bad cryptocurrency.

“Ethereum is garbage” congratulations on being one of the only people on the planet who has this opinion.

No cap on total unit, and a rewritable blockchain…No thanks.

Yeah, because that’s why Bitcoin was originally created. May I remind you that the primary users base of Bitcoin used to be criminals, and to some extent still is. Bitcoin is only the dominant cryptocurrency right now because it is the oldest. The world hasn’t seen anything like Ethereum since Bitcoin, and I think you know it. Ethereum is what Bitcoin should have been all along. If you think Ethereum is garbage, then I’m guessing you have a lot invested in Bitcoin and are scared to death because you know Ethereum is a superior product and will very probably overthrow Bitcoin as the dominant cryptocurrency. If you based your opinion on reality and not just loyalty because of your investment, you would know that Ethereum is a much better solution.

The “primary users base” of Bitcoin has never been criminals. That would be like saying the primary user base of cash was bank robbers, lol.

A few, much publicized cases were used to make headlines and cast aspersions on Bitcoin.

By dollar value the banks themselves were far more guilty of laundering money for drug cartels and financial fraud as in the case of toxic securities. The list goes on, but how about the latest case of fraud by Wells Fargo, does that justify saying “a majority of banks are engaged in criminal fraud”?

As far as Ethereum is concerned there are some very real flaws.

There is no cap on total units and that is ultimately inflationary.

Ethereum is controlled by a small group that can and does edit the Blockchain when it deems necessary, as evidenced by the “DAO Debacle” that led to the Ethereum split. These two factors alone indicate that Ethereum is not a “good store of value”.

If one needs the programmability aspect Of Ethereum I would suggest Ethereum classic, same programmability and much more honest.

As far as cryptocurrencies go there are other altcoin with good fundamentals but as you say Bitcoin is the largest and well established.

If one is interested in altcoins, I would recommend both both Litecoin and Auroracoin for their sound fundamentals.

The majority of the public isn’t ready to give up traditional banking for crypto currencies, and they won’t just jump straight from one to the other. At the same time, the banking industry isn’t going to just fold up shop and go home. They still represent more market share and power than the crypto currency markets. It makes sense that as banks adopt Ethereum, Ripple, and the like, this will be the most likely path for the majority of users to “get on” the blockchain. If you like a return on investment, it makes sense to like all of these coins right now as the public will always prefer the simplest route to adoption.

Exactly. It’s the best way to get rapid development and adoption of crypto of the masses to get a feel of its potential. Any developments and ideas may likely spill over into other crypto markets. And when the mainstream gets comfortable, it may give them the know how to use and trade/invest for better more sound crypto competition in the future as they seek to optimise any flaws out.

It definitely looks like Ethereum supporters are trolls here…. fake names and no Avatars….

Spreading misinformation and FUD.

Good point Russell, I’ve caught these Ethereum trolls shilling on almost every Bitcoin forum!

The writing styles are so similar that I think it’s the same character(s).

Same tactics almost verbatim, no facts and personal attacks, fake names and empty profiles on Facebook.

This author is just trying to down talk Ethereum. What this author is oblivious of or does not want to think of is how POS changes the whole equation.. With POS the power is in the hands of the people who own the Ethers and not just left to the mercy of the miners. So any dilution or inflation just adds to the net worth of those who are the stakeholders only. So contradictory to the propositions made regarding unlimited supply, whoever wants to get a stake or part of the new age economy is well served by taking a stake now itself rather than waiting more time and pay more. POS will actually create more demand with everyone wanting to own a part and especially the enterprises and governments as well. This is something only those in the know now know about. Others creating FUD are those who have a self interest or are paid just to write the article. Worth thinking about.

“any dilution or inflation just adds to the net worth”…Are you crazy?

That goes against any of economic model ever devised by anyone, other than your employer…

Wouldn’t it be wise to have a stake in both BTC and ETH? Would a scenario arise where Bitcoin becomes more of store of value, ‘digital gold’ type hedge against central bank fiat printing where ETH becomes a daily transactional currency with little or no overhead to the buyer and seller with lots of apps for consumers to choose from to load on their smartphones. So the use case is people doing day to day transactions on ETH or Litecoin. Now there are hundreds more with all of them having their own mission statement and purpose.

The diversity you’re talking about is probably Litecoin.

Faster transaction times because of Segwit integration but still good fundamentals of decentralization and an 84 million cap on units.

It’s not that prefer Bitcoin, in fact my all time favorite is Auroracoin.

I just don’t trust a banker crypto especially one with no cap on units and controlled by the same group that brought us the world financial crisis of 2008.

BITCOIN VS ALTCOINS & ETHEREUM

Contrary to the dominant narritive, Bitcoin has no problem…it’s immunities to change is what gives it a credible decentralized quality. It is precisely because Chinese miners, Bitcoin core developers, or these large exchanges cannot make changes or force updates on Bitcoin’s network, that we can see proof that Bitcoin is the most decentralized.

NOTE: Bitcoin already functions perfect as a store of value…It doesn’t need to function as a currency yet.

My biggest concern for Ethereum and all other altcoins is their governance models: if Ethereum moves to proof of stake, and the big Banks are the largest stake holders, the promised innovation and decentralization will be captured and put under their control again.

Ethereum seems capable of changes easily, thus it is too centralized to serve as a store of value… it may eventually connect to Bitcoin for value, or it will be replaced by an innovative sidechain or update to Bitcoin soon.

The only thing that matters for a viable blockchain is it’s use as a store of value….all other functionality comes later as the free market demands.

Ethereum is a bad speculative Investment, because it is soo easy to change… Bitcoin is the new standard that has far surpassed Golds’ 5000 year reign…but let’s face it horses have been awround longer, but few people are willing to take a horse, over a car, on a cross country ride. Technology progresses, and when it finally works, it changes even our longest traditions.

The Ethereum shills seem to be repeating the same message in every forum:

“Get on board before you’re left out” and “If you have questions about Ethereum as store of value, you must be a Bitcoin fanboy”.

As I’ve said, I’ve found what appears to be these same people on almost every Bitcoin forum spouting the same nonsense under assumed names and empty profiles.

I’m tempted to start “trolling” the Ethereum forums and injecting common sense but I don’t get paid to do it the way they are.

I think the narrative is starting to break through mainstream conversations…

Bitcoin does not have to be a currency it only has to be a store of value.

But I think once it is a store of value then soon after they will innovate on top of it and develop a currency feature.

In my opinion there’s many reasons why Ethereum is a ridiculous speculative investment… I don’t think it’s going to be much longer before people realize this and start moving coins into Bitcoin.

Bitcoin will fail to be a store of value if it can’t be a currency. The masses wont like 10 minute wait times at best when better real replacement currencies exist. There is simply a larger market to be a currency and a sound currency is always a good store of value.

Bitcoin is only surviving on first mover advantage and will be obsolete if it can’t fix this and service the 99% of the mainstream demand it is leaving on the table.

You people are mental. How in the heck is bitcoin a store of value when it can gain or lose 20% in a week? That is the opposite of a store of value

I don’t know anyone invested in Ethereum who is not either also invested in Bitcoin, or would like to be also invested in Bitcoin. Compare the two communities /r/Bitcoin and /r/Ethereum on reddit. Ethereum’s community is not badmouthing Bitcoin. It exists because of Bitcoin, so that would be a rather ridiculous stance to take. Bitcoin being the first blockchain currency, and now acting as the “gateway” cryptocurrency contains a larger percentage of uneducated (I don’t mean that in a bad way) investors. They want in on the craze but either don’t care to know, or don’t yet know what blockchain is, how it works, and why its existence will impact virtually every existing industry. This is an advantage that the Ethereum community has in that if you’re sold on Ethereum, most likely you understand the benefit and potential of a blockchain that has the capability of attaching contracts to transactions.

No one likes a troll.

You people are mental. How in the heck is bitcoin a store of value when it can gain or lose 20% in a week? That is the opposite of a store of value.

use binary options to increase your bitcoin investments you can start

trading today with only 1.5btc and earn up to 5.5btc in less than a

week,for this reason many bitcoin owners are now opting to use binary

options to improve their bitcoin investments as much as possible,many

people have suffered from the stress involved in investing,many

investments takes long revenue to mature or earn viable revenue,binary

options comes with short term payout unlike the traditional

formats….this is an opportunity for those that have lost too much and

those that are tired of earning less,inbox me via email for more details [email protected]

As I am sure most of you have heard this before I am new to Crypto. Bought into Ethereum a few months back bc I liked what I read about it and where it was heading a few months back and the price predictions for end of year and 2018. I am not invested in Bitcoin and don’t really care to at this point but I do feel more inclined lately to sell off Ethereum and use profits and additional funds to buy into Ripple. I like the idea of being in on something that hasn’t reached over .50 with predictions forecasting a possible of .75-.95 by EOY and 2.00 end of 2018! What do you think of Ripples price predictions for end of year and 2018. Are they too bold like most other Top Ten Cryptos or more legitimate than others.

Bitcoin Vs Ethereum: Driven by Different Purposes

Ethereum has received a lot of attention since its announcement at the North American Bitcoin Conference in early 2014 by Vitalik Buterin. The natural consequence of its rising popularity has been its constant comparison to Bitcoin, the first virtual currency. It is important for investors to understand the similarities and differences between Bitcoin and Ethereum.

Bitcoin, the first virtual currency, was born nine years back in 2008. It introduced a novel idea set out in a white paper by the mysterious Satoshi Nakamoto: Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government issued currencies. There are no physical Bitcoins, only balances associated with public and private keys.

Over these years, the acceptance of the concept of a virtual currency has increased among regulators and government bodies. Although it isn’t a formally recognized medium of payment or store of value, it has managed a niche for itself and continues to coexist in the financial system despite being regularly scrutinized and debated.

Blockchain

The attempts to understand Bitcoin more closely resulted in the discovery of blockchain, the technology that powers it. The blockchain is not just the hottest topic in the FinTech world but also a sought after technology in many industries.

A blockchain is a public ledger of all transactions in a given system that have ever been executed. It is constantly growing as completed blocks are added to it. The blocks are added to the blockchain in linear, chronological order through cryptography, ensuring they remain beyond the power of manipulators. The blockchain thus stands as a tamper-proof record of all transactions on the network, accessible to all participants. The blockchain offers a chance to work at lower costs with greater regulatory compliance, reduced risk, and enhanced efficiency.

Enter Ethereum!

Blockchain technology is being used to create applications which are beyond just supporting a digital currency. Such applications are often referred to as Crypto 2.0, Blockchain 2.0 or even Bitcoin 2.0.

Launched in 2015, Ethereum is the largest and most well-established, open-ended decentralized software platform that enables SmartContracts and Distributed Applications (ĐApps) to be built and run without any downtime, fraud, control or interference from a third party. Ethereum is not just a platform but also a programming language (Turing complete) running on a blockchain, helping developers to build and publish distributed applications. (See also: What is Ethereum?)

The potential applications of Ethereum are wide ranging and run on its platform-specific cryptographic token, Ether. In 2014, Ethereum had launched a pre-sale for ether which received an overwhelming response. Ether is like a vehicle for moving around on the Ethereum platform and is sought by developers looking to develop and run applications inside Ethereum.

Ether is used broadly for two purposes: it is traded as a digital currency exchange like other cryptocurrencies and is used inside Ethereum to run applications and even to monetize work. According to Ethereum, it can be used to “codify, decentralize, secure and trade just about anything.” One of the big projects around Ethereum is Microsoft’s partnership with ConsenSys which offers “Ethereum Blockchain as a Service (EBaaS) on Microsoft Azure so Enterprise clients and developers can have a single click cloud-based blockchain developer environment.”

Bitcoin Vs Ethereum

While both Bitcoin and Ethereum are powered by the principle of distributed ledgers and cryptography, the two differ in many technical ways. For example, the programming language used by Ethereum is Turning complete whereas Bitcoin is in a stack based language. Other differences include block time (Ethereum transaction is confirmed in seconds compared to minutes for Bitcoin) and their basic builds (Ethereum uses ethash while Bitcoin uses secure hash algorithm, SHA-256). (See also: Risks and Rewards of Investing in Bitcoin.)

However, from a general point of view, Bitcoin and Ethereum differ in purpose. While Bitcoin is created as an alternative to regular money and is thus a medium of payment transaction and store of value, Ethereum is developed as a platform which facilitates peer-to-peer contracts and applications via its own currency vehicle. While Bitcoin and Ether are both digital currencies, the primary purpose of Ether is not to establish itself as a payment alternative (unlike Bitcoin) but to facilitate and monetize the working of Ethereum to enable developers to build and run distributed applications (ĐApps).

The Bottom Line

In sum, Ethereum is an advancement based on the principle of blockchain that supports bitcoin but with a purpose that does not compete with Bitcoin. However, the popularity and rising market capitalization of Ether brings it in competition with all cryptocurrencies, especially from the trading perspective. Currently, the market cap of Ether (ETH) is more than Ripple and Litecoin, although it’s far behind Bitcoin (BTC). On the whole, Bitcoin and Ethereum are different versions using the blockchain technology, and are set to establish themselves, driven by different intentions.

[ Bitcoin. Ethereum. Ripple. There are new, impactful cryptocurrencies and tokens arriving every day. Learn the basics of cryptocurrency, how we got here, and what the future of crypto holds for us in Investopedia Academy's Cryptocurrency for Beginners course. Taught by fintech Entrepreneur Lex Sokolin, Cryptocurrency for Beginners gives you the foundation you need to successfully enter the world of cryptocurrencies. ]

Ethereum vs bitcoin

Bitcoin’s sole purpose is to be the virtual currency of the internet, and uses blockchain to do this.

Ethereum focusses on the bigger problem.

Here’s a little bit about Ethereum:

Ethereum was created in 2015 by a man called Vitalik Buterin.

Vitalik had the vision of not only having a decentralised cryptocurrency (like Bitcoin) but also allowing decentralised applications to be created on the Ethereum blockchain that use Smart Contracts.

The whole idea of blockchain is to remove the power from the third parties and allow the user to control their own data.

What is a decentralised application?

“Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference.

These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property.

This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middle man or counterparty risk.”

To understand this better, I’m going to give an example of how decentralised apps and smart contracts will change the world we live in:

I’ll use pizza as my example, because everyone can relate to pizza!

Say you wanted to order pizza to your house, you have to create an account, enter your banking details and give the app your address to receive your pizza. Many people overlook the risks that are associated with trusting a third party to handle such sensitive data. If this company’s serves are hacked into, the hacker will have your bank details and your address… Scary stuff.

So, you ordered a chicken BBQ pizza, which is everyone’s favorite, and they turn up with a ham and pineapple pizza (wtf), or worse yet they don’t turn up at all! As you have already paid for this pizza, what do you do? The process of refunding this money, is entirely reliant on a third party (often PayPal or your bank) and can take weeks if the refund even happens. Placing your trust in this pizza company is again a risk that is overlooked.

Now let’s use the same example using Ethereum’s blockchain.

You want to buy pizza, you go onto the decentralised app and place your order – your data is stored on the blockchain and you give permission via a smart contract for the pizza company to view your address.

Your order is created in a smart contract and once the order is delivered and verified by you that it is correct, the funds are released to the pizza company.

This may seem minor for a pizza company, but think about more expensive goods and services that users will benefit from this blockchain.

A smart contract can be created to pay a worker for every hour they work, they log their hours on the blockchain and then after verification the funds are instantly transferred to them

Buying goods internationally can be tracked and verified – reducing fraud.

Property buying can be facilitated through the contract

Every industry that has a contract in place will be able to use the blockchain of Ethereum

I hope that it is now clear that the technology behind Ethereum will have a real world use and change how business operates entirely.

It is worth noting that Ethereum is also vastly quicker than BTC, average block time being 15 seconds for Ethereum opposed to 10 minutes for BTC.

Bitcoin VS Ethereum: Cryptocurrency Comparison

Last updated on February 22nd, 2018 at 12:31 pm

Since its release in early 2009, Bitcoin has been the trailblazing leader of the cryptocurrency revolution. Countless imitators have come and gone but Bitcoin remains dominant, despite nearing the current limits of its transactional capacity.

Ethereum, created mid-2015, is Bitcoin’s strongest rival… But can Ethereum deliver on the hype surrounding its complicated technology, as well as recover from the recent spectacular failure of the DAO, to usurp Bitcoin’s primacy?

- Created

- Market cap

- Popular support

- Blockchain

- Scalable

- Mining

- Supply

- Development

- Hash rate

- Initial distribution

Complimentary or Competing Cryptocurrencies?

How valid is the frequent claim that Bitcoin and Ethereum aren’t direct competitors but rather complimentary aspects of the new, blockchain-based economy? The peaceful coexistence theory holds that the web is vast and deep enough for Bitcoin and Ethereum to carve out their respective niches:

Bitcoin specialising in its role as digital gold; offering a dependable monetary system free from unbounded inflation and political intervention.

Bitcoin specialising in its role as digital gold; offering a dependable monetary system free from unbounded inflation and political intervention.

Ethereum evolving into the world computer; a blockchain-based programming language enabling code-based contracts and decentralised applications.

Ethereum evolving into the world computer; a blockchain-based programming language enabling code-based contracts and decentralised applications.

In practice, matters are more complex. Given the extensibility of cryptocurrency, neither coin has a clearly defined sphere of operation. There is considerable overlap between their functions and markets, with nothing to prevent user migration.

For example, additional layers built upon Bitcoin, such as the Rootstock.io smart contact platform, threaten to trespass on Ethereum’s playground. Rootstock promises to do everything Ethereum can, with the added security of a two-way peg to the more secure Bitcoin network.

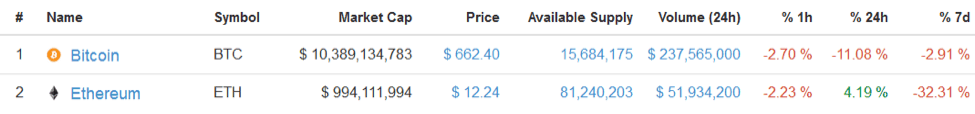

Likewise, Ethereum has become a popular trading and investment instrument, infringing upon Bitcoin’s domain as “magic internet money.” Ethereum’s daily trading volume, insofar as such figures can be trusted for either currency, is currently about 1/5 th that of Bitcoin:

Stats as of the 21 st of June 2016, courtesy of CoinMarketCap

Stats as of the 21 st of June 2016, courtesy of CoinMarketCap

Bitcoin VS Ethereum – Competitive Factors

The following user scenarios serve to illustrate the frequent necessity of choosing between Bitcoin and Ethereum:

- Traders and Investors allocating capital according to expected returns and perceived safety,

- CEOs and Founders must choose the best platform to serve their business,

- Developers have only so much time to contribute to open source projects,

- Miners invest in different types of hardware depending on which coin they mine,

- Media disseminates only the most compelling stories to their audience, etc.

Peaceful coexistence is a myth; Bitcoin and Ethereum clearly compete for users. The good news is that such competition should ultimately produce better cryptocurrencies.

Bitcoin VS Ethereum – Popular Support

Bitcoin users tend to be politically and economically conscious. Many users support certain principles, such as individual sovereignty and free markets. There exists a definite aversion to central planning and control, so Bitcoin is often revered as the counter to central banks and big governments.

Bitcoin users tend to be politically and economically conscious. Many users support certain principles, such as individual sovereignty and free markets. There exists a definite aversion to central planning and control, so Bitcoin is often revered as the counter to central banks and big governments.

Ethereum users tend to be less ideologically-motivated. They are generally content to vest ultimate authority in Vitalik Buterin, inventor of Ethereum. The community’s focus tends to be on the technology’s future business and financial applications.

Ethereum users tend to be less ideologically-motivated. They are generally content to vest ultimate authority in Vitalik Buterin, inventor of Ethereum. The community’s focus tends to be on the technology’s future business and financial applications.

The network effect, expressed mathematically by Metcalfe’s law, states that a network’s value is proportional to its number of users. Whether we’re talking fax machines, social media or cryptocurrency; people are more likely to join popular networks. As the first cryptocurrency, Bitcoin has a clear first-mover advantage here.

Bitcoin VS Ethereum – Scripting Language

Bitcoin transaction data doesn’t just confer ownership of coins; it also conveys certain instructions relating to transaction. For example, a recently-implemented change allows sent coins to be locked for a custom time period. The set of possible instructions is known as Bitcoin’s scripting language and it’s intentionally limited to transactional processing.

Bitcoin transaction data doesn’t just confer ownership of coins; it also conveys certain instructions relating to transaction. For example, a recently-implemented change allows sent coins to be locked for a custom time period. The set of possible instructions is known as Bitcoin’s scripting language and it’s intentionally limited to transactional processing.

Ethereum’s primary innovation was to expand this set of instructions into a fully-featured programming language such as JavaScript, which Ethereum’s language closely resembles. This is what is meant by Ethereum being “Turing-complete.”

Ethereum’s primary innovation was to expand this set of instructions into a fully-featured programming language such as JavaScript, which Ethereum’s language closely resembles. This is what is meant by Ethereum being “Turing-complete.”

Risk vs. Reward: The undeniable fact is that, by adding complexity at the protocol level, Ethereum presents a larger attack surface to adversaries. This heightened risk of attack makes Ethereum an inferior store of value. Further, there is no decisive advantage gained from Ethereum’s scripting language which could not be duplicated via protocol-separate code. Bitcoin may be in trouble if Ethereum ever develops such a killer app but until then…

Bitcoin VS Ethereum – Blockchain

Bitcoin has a Proof of Work blockchain which is currently composed of 1 megabyte blocks. These blocks are mined on average every 10 minutes by SHA-256 hashing. Bitcoin mining is primarily performed by ASIC devices. Bitcoin’s blockchain can process around 3 transactions per second.

Bitcoin has a Proof of Work blockchain which is currently composed of 1 megabyte blocks. These blocks are mined on average every 10 minutes by SHA-256 hashing. Bitcoin mining is primarily performed by ASIC devices. Bitcoin’s blockchain can process around 3 transactions per second.

Ethereum currently has a Proof of Work blockchain, although a proposed fork will switch it to Proof of Stake (PoS). The Ethereum blockchain is composed of blocks of variable size. Blocks are mined on average every 15 seconds by hashing a modified Dagger-Hashimoto algorithm. This algorithm is designed to resist processing by ASIC devices; as a result Ethereum mining is primarily performed by graphics cards. Ethereum’s blockchain can process around 25 transactions per second.

Ethereum currently has a Proof of Work blockchain, although a proposed fork will switch it to Proof of Stake (PoS). The Ethereum blockchain is composed of blocks of variable size. Blocks are mined on average every 15 seconds by hashing a modified Dagger-Hashimoto algorithm. This algorithm is designed to resist processing by ASIC devices; as a result Ethereum mining is primarily performed by graphics cards. Ethereum’s blockchain can process around 25 transactions per second.

Scalability: Ethereum appears to have a clear advantage in terms of blockchain scalability. Bitcoin is in the process of upgrading its transactional capacity.

Security: In terms of blockchain security, massive infrastructure investment by Bitcoin miners has resulted in a peak Bitcoin hashrate of 1,803,059,256 GH/s (1.8 ExaHash). This greatly exceeds Ethereum’s hashrate, which peaked at a comparatively paltry 3,010 GH/s (3 TeraHash). The monetary cost to perform a 51% attack on Bitcoin is proportionately greater.

Decentralisation: Hashrate distribution among mining pools is fairly equal between Bitcoin and Ethereum on a percentage basis.

The majority of Bitcoin mining occurs in China due to favourable economic factors. This raises a red flag in terms of the potential pressure the Chinese state could exert on the Bitcoin mining network. While Bitcoin could alter its mining algorithm to thwart any takeover attempt, this “mining hardware reset” would doubtless prove tremendously destructive.

Although Ethereum mining in its current state resembles the glory days of individual-level Bitcoin mining, its planned switch to PoS will likely increase centralisation. Gavin Andresen, former Bitcoin lead developer, succinctly critiqued PoS thus: “I think proof-of-stake is hard coded, ‘the rich get richer’ and is deeply unfair.”

Mining: Ethereum is profitable to mine on high-end GPUs, especially given low power costs. Advanced graphic cards are available for under $200 and can also run games and other apps. However, before investing in a mining rig, aspiring Ethereum miners should consider that the upcoming change to PoS will invalidate their investment.

Bitcoin is only profitable when mined with specialised ASIC hardware running on very low cost electricity. High-end ASIC hardware costs over $2000 per unit and has no purpose besides mining Bitcoin. The pace of ASIC hardware advancement is slowing as it approaches the limits of semiconductor miniaturisation technology; it can be hoped that this process, perhaps in combination with the increasing power generation efficiencies, will eventually lead to a more widely-dispersed Bitcoin mining network.

Bitcoin VS Ethereum – Supply

Bitcoin’s total supply will be strictly limited to 21 million coins. Bitcoin’s issuance is halved roughly every 4 years. As of the next halving in July 2016, Bitcoin’s inflation rate will drop to an annual rate of

Bitcoin’s total supply will be strictly limited to 21 million coins. Bitcoin’s issuance is halved roughly every 4 years. As of the next halving in July 2016, Bitcoin’s inflation rate will drop to an annual rate of

5%. Future halving events, combined with coins lost through user error, will ultimately result in a deflationary currency.

Ethereum’s issuance by miners is capped at an annual rate of 18 million ETH. This represents an inflation rate of

Ethereum’s issuance by miners is capped at an annual rate of 18 million ETH. This represents an inflation rate of

20% at the current supply. As ETH is not consumed by running programs but instead sent to the miner of the associated transaction, Ethereum’s value is likely to decline in the long term.

Implications: All else remaining equal, the purchasing power of a deflationary currency will rise over time whereas the relative value of an inflationary currency will fall. Bitcoin therefore encourages saving and benefits early adopters who bought in cheaply. Ethereum encourages spending and lowers the cost of entry for newcomers.

Bitcoin VS Ethereum – Initial Distribution

Bitcoin is thought to have been mined exclusively by Satoshi Nakomoto in its early phase. At that time, there was no barrier to the entry of other miners, other than Bitcoin’s obscurity. It’s estimated that Satoshi owns roughly 5% of total supply. As Satoshi’s coins have yet to move, some speculate they may be inaccessible.

Bitcoin is thought to have been mined exclusively by Satoshi Nakomoto in its early phase. At that time, there was no barrier to the entry of other miners, other than Bitcoin’s obscurity. It’s estimated that Satoshi owns roughly 5% of total supply. As Satoshi’s coins have yet to move, some speculate they may be inaccessible.

Ethereum’s distribution took the form of an ICO (Initial Coin Offering), whereby 31,529 BTC was traded for 60,102,216 ETH in advance of the Ethereum blockchain’s launch. Approximately $14m USD was raised in this fashion by the Ethereum Foundation, which awarded itself 12m ETH; roughly 14% of the current total supply.

Ethereum’s distribution took the form of an ICO (Initial Coin Offering), whereby 31,529 BTC was traded for 60,102,216 ETH in advance of the Ethereum blockchain’s launch. Approximately $14m USD was raised in this fashion by the Ethereum Foundation, which awarded itself 12m ETH; roughly 14% of the current total supply.

Fairness: Bitcoin had a demonstrably fairer launch. The Ethereum Foundation’s majority stake is somewhat concerning given the intended switch to Proof of Stake mining. Under PoS, the likelihood of minting new tokens is proportional to holdings. This raises the possibility of the further concentration of self-awarded wealth.

Bitcoin VS Ethereum – Development

Bitcoin’s codebase benefits from over 100 Core contributors and several alternative implementations. With over $10b in assets on the line, they take a conservative approach to development. All proposed improvements must undergo peer review and rigorous testing prior to being merged.

Bitcoin’s codebase benefits from over 100 Core contributors and several alternative implementations. With over $10b in assets on the line, they take a conservative approach to development. All proposed improvements must undergo peer review and rigorous testing prior to being merged.

The perceived slow pace of this process, at least in terms of scaling, led to contention (the so-called Blocksize Debate) and the eventual estrangement of numerous users, several companies and even a few developers. Core developers are now under considerable pressure in terms of delivering scaling solutions without compromising security.

Ethereum is the brainchild of Vitalik Buterin, who handled its initial development along with 3 other skilled developers. They were able to pick and choose ideas from the development of Bitcoin and altcoins and introduce new ideas of their own. However, literally anyone can code a smart contract which runs on top of Ethereum. Herein lays both opportunity and danger.

Ethereum is the brainchild of Vitalik Buterin, who handled its initial development along with 3 other skilled developers. They were able to pick and choose ideas from the development of Bitcoin and altcoins and introduce new ideas of their own. However, literally anyone can code a smart contract which runs on top of Ethereum. Herein lays both opportunity and danger.

Certain estimates put the number of bugs per line of contract code at 1 in 10. As seen with the draining of The DAO and numerous minor incidents, investing in such contracts without proper code review can lead to serious loss. More work is required to secure smart contracts before they can reliably underwrite new ways of doing business.

A Developing Story: both coins face considerable challenges if order to realise their full potential. However, this industry tends to attract some of the world’s best and brightest minds, who invariably relish intellectual challenge.

Final Word

Bitcoin has more lives than a cat, by an order of magnitude. Betting against Bitcoin is just not advisable, as many have learnt to their detriment. If SegWit, the Lightning Network, Rootstock, Elements and other exciting developments play out as expected, Bitcoin will retain its crown with ease.

Bitcoin has more lives than a cat, by an order of magnitude. Betting against Bitcoin is just not advisable, as many have learnt to their detriment. If SegWit, the Lightning Network, Rootstock, Elements and other exciting developments play out as expected, Bitcoin will retain its crown with ease.

Ethereum is no safe bet, which is not to say it couldn’t pay off handsomely. The uncertainty surrounding its prospects increases its volatility, making it a great instrument for traders.

Ethereum is no safe bet, which is not to say it couldn’t pay off handsomely. The uncertainty surrounding its prospects increases its volatility, making it a great instrument for traders.

In the short term, much will depend on how the DAO crisis is resolved. Medium term, there’s considerable uncertainty around the PoS fork and how it’ll impact network security and incentives. Long-term, doubts remain regarding Ethereum’s high rate of inflation and its significant pre-mine. If it’s to survive, it must also evolve past dependence on a single trusted authority, in the person of Vitalik.

Ethereum Vs Bitcoin: What's The Main Difference?

While Bitcoin has long been dominant in the cryptocurrency scene, it is certainly not alone. Ethereum is another cryptocurrency related project that has attracted a lot of hype because of its additional features and applications.

Ethereum: More Than Just Money

The first thing about Ethereum is that it is not just a digital currency. It is a blockchain-based platform with many aspects. It features smart contracts, the Ethereum Virtual Machine (EVM) and it uses its currency called ether for peer-to-peer contracts.

Ethereum's smart contracts use blockchain stored applications for contract negotiation and facilitation. The benefit of these contracts is that the blockchain provides a decentralized way to verify and enforce them. The decentralized aspect makes it incredibly difficult for fraud or censorship. Ethereum's smart contracts aim to provide greater security than traditional contracts and bring down the associated costs.

The smart contract applications are powered by ether, Ethereum's blockchain based cryptocurrency. Ether, as well as other crypto-assets, are held in the Ethereum Wallet, which allows you to create and use smart contracts. The system has been described by the New York Times as..

"a single shared computer that is run by the network of users and on which resources are parceled out and paid for by ether."

Implement Smart Contracts With Your Own Cryptocurrency

Ethereum allows you to create digital tokens that can be used to represent virtual shares, assets, proof of membership and more. These smart contracts are compatible with any wallet, as well as exchanges that use a standard coin API. You can copy the code from Ethereum's website and then use your tokens for many purposes, including the representation of shares, forms of voting and also fundraising. You can either have a fixed amount of tokens in circulation or have a fluctuating amount based on predetermined rules.

You Don't Need Kickstarter When You Have Ethereum

One great feature of Ethereum is that it gives developers a means to raise funds for various applications. For your new project, you can set up a contract and seek pledges from the community. The money that is raised will be held until the goal is reached or until an agreed upon date. The funds will be released back to the contributors if the goal is not met, or go on to the project if it is successful. Kicking out Kickstarter means that the third party is taken out, along with their rules, and also the fees they charge (when you include processing fees, Kickstarter can take up to 10% of a project's budget).

Skip the Traditional Management Structure With Democratic Autonomous Organizations

Not only can Ethereum help you source funding, but it can also help to provide the organizational structure to get your idea off the ground. You can collect proposals from the people who backed your project and then hold votes on how you should proceed. This means that you can skip the expense of a traditional structure, such as hiring managers and doing paperwork. Ethereum also protects your project from outside influences, while its decentralized network means that you won't face downtime.

The Finer Details: Differences Between Ethereum and Bitcoin

There are also many smaller aspects that differ between the two blockchain-based projects. Bitcoin's average block time is about 10 minutes, while Ethereum's aims to be 12 seconds. This quick time is enabled by Ethereum's GHOST protocol. A faster block time means that confirmations are quicker. However, there are also more orphaned blocks.

Another key difference between them is their monetary supply. More than two-thirds of all available bitcoin have already been mined, with the majority going to early miners. Ethereum raised its launch capital with a presale and only about half of its coins will have been mined by its fifth year of existence.

The reward for mining Bitcoin halves about every four years and it is currently valued at 12.5 bitcoins. Ethereum rewards miners based on its proof-of-work algorithm called Ethash, with 5 ether given for each block. Ethash is a memory hard hashing algorithm, which encourages decentralized mining by individuals, rather than the use of more centralized ASICs as with Bitcoin.

Bitcoin and Ethereum also cost their transactions in different ways. In Ethereum, it is called Gas, and the costing of transactions depends on their storage needs, complexity and bandwidth usage. In Bitcoin, the transactions are limited by the block size and they compete equally with each other.

Ethereum features its own Turing complete internal code, which means that anything can be calculated with enough computing power and enough time. Bitcoin does not have this capability. While there are certainly advantages to the Turing-complete, its complexity also brings security complications, which contributed to the DAO attack in June.

Ethereum and Bitcoin: Two Very Different Beasts

While many will compare the cryptocurrency aspect of both Ethereum and Bitcoin, the reality is that they are vastly different projects and have different intentions. Bitcoin has emerged as a relatively stable digital currency, while Ethereum aims to encompass more, with ether just a component of its smart contract applications.

Ethereum vs bitcoin

What is the main difference?

Well, the fact that Ethereum was created from Bitcoin open-source says a lot about the basic differences between the two of them; the first one is actually the very first cryptocurrency in the world so is the most known, installed and houses any kind of users and investors. On the other side, Ethereum is one of the newest cryptocurrencies but despite that, it quickly positioned right after BTC thanks to its diverse platform that might not be very friendly for the newest users but it is slowly getting more approachable for them as it is quite useful for the most expert traders.

Is in that Ethereum platform where the primordial difference between Ether and Bitcoin is. As BTC is the first cryptoasset, the chainblock was newly developed and though only in relation to the cryptocoin trade, period, that is its final object in order to maintain a relatively stable e-currency. Ethereum, on the contrary, is an integrated platform where users can develop other projects and transactions besides trading cryptocurrencies.

Ether is not only one of the concepts this platform seeks to develop and, as the system grows, it is possible that other cryptocurrencies depend on Ethereum as they do now on Bitcoin. But the smart contracts are what gives Ethereum so much popularity in this short time.

Other differences

In smaller aspects, as Ethereum is newer and therefore has a more modern technology, it surpasses BTC system in some tiny factors:

• Time for transaction confirmation: Bitcoin’s time for confirmation is one of the slowest ones with an average of 10 minutes per transaction while Ethereum works in around 12 seconds thanks to its GHOST protocol.

• Monetary supply: Bitcoin has a quite limited stash that is actually getting to its limits while Ethereum supply is quite greater than BTC’s and is not nearly to its limits, actually it is said that Ether has no total limit and can be created as much of it as necessary, only an annual limit of 18USD million is set.

• The mining reward is quite different too; Bitcoin is quite simpler to mine and has a reward around 12BTC per transaction but it is constantly diminishing with time. On the other hand, Ethereum rewards are lower, only 5ETH per transaction but it seems to be much more stable.

• The cost of transaction: in Bitcoin, every transaction competes equally with each other while in Ethereum, the costing is directly related to the storage needs.

• Turing internal code: unlike Bitcoin, Ethereum counts with its own Turing internal and integral code which gives the possibility to perform any calculation if we have the time and right equipment. Bitcoin is a little bit more uncertain in this aspect.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin vs. Ethereum

What’s the difference between Bitcoin and Ethereum?

First, it’s important to understand that there are two categories of digital coins: Cryptocurrencies (e.g. Bitcoin, Litecoin, ZCash, Monero, etc) and Tokens (e.g. Ethereum, Filecoin, Storj, Blockstack, etc.)

Bitcoin is a “cryptocurrency.” Bitcoin and other cryptocurrencies are competing against existing money (and gold) to replace them with a truly global currency.

The promise of Bitcoin is that it is:

- A global currency which allows individuals to own their own money (without having to rely on national banks).

- Lower fees for transferring money across geographic borders.

- Financial stability for people who live in countries with unstable currencies. (e.g. In 2016, the Venezuela’s currency hit an inflation rate of 800%). In addition, two-thirds of the current global population has no access to banking, or limited access — Bitcoin is changing that.

Ethereum is a “token.” What Bitcoin does for money, Ethereum does for contracts. Ethereum’s innovation is that is allows you to write Smart Contracts: basically any digital agreement where you can say “if this” happens, “then something else happens.” For example:

- If I vote for the President, then my vote is official and no one else can vote as me.

- If I sign my name on this document, then I own the car, and you no longer own the car.

- Up until now we’ve carried out these agreements with a signature at the bottom of a paper document. Ethereum dramatically improves this model because it is digital, and proof of the transaction can never be deleted.

Bitcoin vs Ethereum vs Ripple: Comparing The Cryptos

The cryptocurrency niche is becoming somewhat crowded, and increasingly defined by a Bitcoin vs Ethereum vs Ripple war! These three cryptos can be considered the market leaders, with Bitcoin the most established, Ethereum the major challenge to its supremacy, and Ripple having made a big splash in a short period of time.

Image source: YouTube Video Screenshot

Image source: YouTube Video Screenshot

Although each of these products has generated a significant amount of noise in their short lifespans, many people still only have a sketchy understanding of the differences between the major crypto players. So here ValueWalk gives a rundown on the differences between the three, and assesses how the Bitcoin vs Ethereum vs Ripple battle is shaping up.

Scalability

When making the Bitcoin vs Ethereum vs Ripple comparison, there are four key areas to look at. The first of these is scalability; namely, how many transactions can be conducted by the cryptocurrencies every second. It is in this area that we can instantly see a massive difference between the three, and begin to understand how Ripple has indeed made such a Ripple!

While both Ethereum and Bitcoin are scalable, the latter achieves a maximum number of transactions of 7 per second, while Ethereum can deliver nearly double this with around 15 per second. These figures may sound as if they hand Ethereum a major advantage, but Ripple absolutely blows both of the major players out of the water in this department.

Ripple is capable of delivering a staggering 1,500 transactions every second, providing it with a huge advantage over Bitcoin and Ethereum. It is this above all else which has led to the early prominence of Ripple, and which could play a major part in the development of the cryptocurrency sector.

Transaction speed

Another major front in the Bitcoin vs Ethereum vs Ripple battle is the transaction of speed delivered by the three platforms. It is not hugely surprising to learn that Ripple has a message advantage here too, as both Bitcoin and Ethereum have acquired huge backlogs and ecosystems by now.

Thus, the 40-minute transaction speed of Bitcoin is much slower than Ethereum, and massively slow in comparison to Ripple. Ethereum delivers a transaction speed of two minutes, with Ripple able to offer its transactions in merely seconds. Indeed, Ripple can deliver a transaction every four seconds, providing it with an absolutely massive advantage over Ethereum and Bitcoin at this time.

Mainstream

However, another major consideration in the Bitcoin vs Ethereum vs Ripple comparison is whether the currencies have entered the mainstream of public consciousness. This has both advantages and disadvantages, with Ripple not particularly well-known at the time of writing, but also offering very attractive price structure in comparison to Ethereum and Bitcoin.

The reality is that only Ethereum and Bitcoin can be considered part of the mainstream at present, but Ripple has been making headlines recently, and could rapidly enter the central territory of the niche in the coming months.

In the Bitcoin vs Ethereum vs Ripple war, there is obviously only one winner in the price department. Bitcoin has escalated so rapidly in value that those who invested in the cryptocurrency in the early days are almost without exception significantly wealthy by now. The price of Bitcoin has touched $20,000, but is currently stable at around $15,000; an increase of 1,500% over the last 12 months.

Ethereum is competitively priced at around $750, but its value has also escalated rapidly over the last couple of years. Meanwhile, Ripple can be considered an embryonic entry to the crypto niche, and is thus only valued at $1 per coin. Considering the advantages and potential of Ripple, this number is set to inflate significantly over the next few years.

Technical differences

Ethereum can be considered slightly different to the other two currencies, being geared towards complicated interactions between several parties rather than consumer payments. CNBC has noted that it provides numerous potential uses, such as reconciliation, enabling smart contracts to be distributed on the Ethereum network.

While Ripple is only the fourth largest cryptocurrency in terms of market capitalization, being worth $36 billion currently, it has advantages over both Bitcoin and Ethereum which could provide an explosion in is value in the foreseeable future.

Ripple is pre-mined, with one hundred billion units in existence, twenty billion of which are retained by the creators of the currency. This differs from Bitcoin in particular, which is entirely based on the mining of its network to a fixed rate of 21 million potential Bitcoin units.

The distributed platform provided by Ripple is particularly highly regarded, as it is tailored towards the financial service sector. “The ability to transfer from one currency to another instantly becomes possible with the XRP as the intermediary currency. Clearly, there’s a lot of excitement surrounding Ripple,” The Motley Fool noted.

And New York Law School professor Houman Shadab believes that Ripple will be attractive to the traditional financial hierarchy, owing to the “control they afford over the system”. Shadab also asserted that Ripple isn’t “subject to the vagaries of price volatility of the underlying currencies. And also they have a more secure, distributed authentication process that doesn’t rely on the incentives of miners who authenticate transactions based on the value of the currency.”

Bitcoin is arguably the purest cryptocurrency of the three, being completely decentralized, and based on a libertarian ethos. Bitcoin can be viewed as a reaction against central bank control of money, and one that has achieved a level of success that was scarcely possibly to imagine.

Yet the antipathy of the established financial elite to Bitcoin could ultimately be its undoing, despite its absolutely unprecedented success. While Bitcoin is the investment story of the century so far, it is a story that has yet to unfold fully, with many investors bullish on its potential.

Ether vs. Ethereum: What Is the Difference?

Ethereum is a blockchain platform and Ether is the token that powers the network built on that platform.

The novelist L.M. Montgomery once wrote, “It’s dreadful what little things lead people to misunderstand each other.” In the altcoin world, these misunderstandings tend to occur when trying to make sense of the multitude of similar terms that exist.

One common headache is the casual interchangeability of terms like “Ethereum,” Ethers,” and ethers” – even though they all mean something different.

In the simplest terms, “Ethereum” refers to the decentralized platform where developers can write smart contracts, specialized programs that can perform specific acts on the Ethereum Virtual Machine, in order to perform and verify transactions to the Ethereum blockchain. Ether refers to programmable tokens that are used as currency on the Ethereum platform.

This, of course, becomes confusing when you realize that ether (ETH) can also be a denomination of ether, referring to one tradeable unit, or 1,000,000,000,000,000,000 individual ether or “weis.”

This article clarifies the differences in Ethereum terminology.

What is “Ethereum,” Anyway?

To understand what Ethereum is, consider a comparison to the American economy. The Ethereum platform can be compared to the American economy in general, and the American banking system specifically. It is the rules-keeper and the referee; it is both the forum where the various transactions that make up the economy happen and the final arbitrator to those transactions’ validity.

As there is no specific singular thing as the “economy,” there is no singular instance of “Ethereum.” Ethereum refers to the Ethereum Virtual Machine, the users’ computers that form the nodes of the Ethereum network, and the Ethereum blockchain that is used to record and verify the transactions on the platform.

Using the same analogy, ether would be the dollar. It is both the currency with which transactions are conducted and the motivation for conducting those transactions. Just as a bank is willing to extend a loan in order for a business to conduct customer transactions in exchange for interest, miners are rewarded with ether in the form of a transaction fee for transactions conducted using their mined blocks. Ethereum users can use these ether as the currency for programmable smart contracts, which can do specific and specialized transactions in accordance with their developers’ design.

In Ethereum terminology, ether is the “gas” that drives the EVM’s transactions.

Most end users, however, will never deal with ether in that sense. The ether that is used for investment purposes is a denomination of ether equal to one quintillion (10 18 ) ether. This is commonly referred to as Ether (ETH).

Комментариев нет:

Отправить комментарий