Btc futures with up to 20x leverage

Margin trading, NO USD requirement, high returns, clean management tools and more

trade european style vanilla options

with up to 10x leverage

on the most advanced BTC Options Trading Platform on the Market.

hft high-speed matching engine

with less than 1ms latency

Mobile friendly advanced trading platform or trade via high performance REST, Websocket and FIX API

your bitcoins are safe

90% of bitcoins in cold storage

Bitcoin Options Are Headed to The U.S.

- More on Blockchain and Bitcoin

What's the Vice Industry Token—A Crypto for Porn?

Governance: Why Crypto Investors Should Care

Blockchain-as-a-Service (BaaS)

Blockchain-as-a-Service (BaaS)Which FAANG Will Win the Blockchain Wars?

In the space of a few years, Bitcoin has gone from something couch potatoes trade for a slice of pizza via a Reddit thread, to one of the hottest commodities on the market.

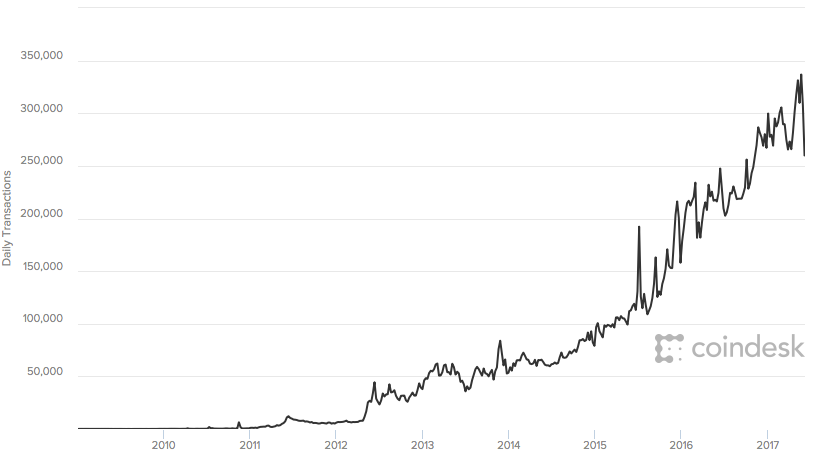

In the last five years, total daily transactions in the Bitcoin market has risen 900% from 33800 to over 335,000 according to CoinDesk. As the cryptocurrency has become more popular, so have the instruments to trade it. More exchanges are opening up, and Bitcoin ETFs may be on their way. But one tool that is already up and running is Bitcoin options. For years, Bitcoin option trading was not regulated in the U.S. but this looks set to change with a recent decision by the Commodity Futures Trading Commission (CFTC). (See also: Bitcoin Pizza Day: Celebrating the $20 Million Pizza Order)

However, trading Bitcoin options is not for the faint-hearted. They are extremely volatile and very expensive. (See also: Why Aren't Hedge Funds Interested in Bitcoin?)

Bitcoin daily transactions

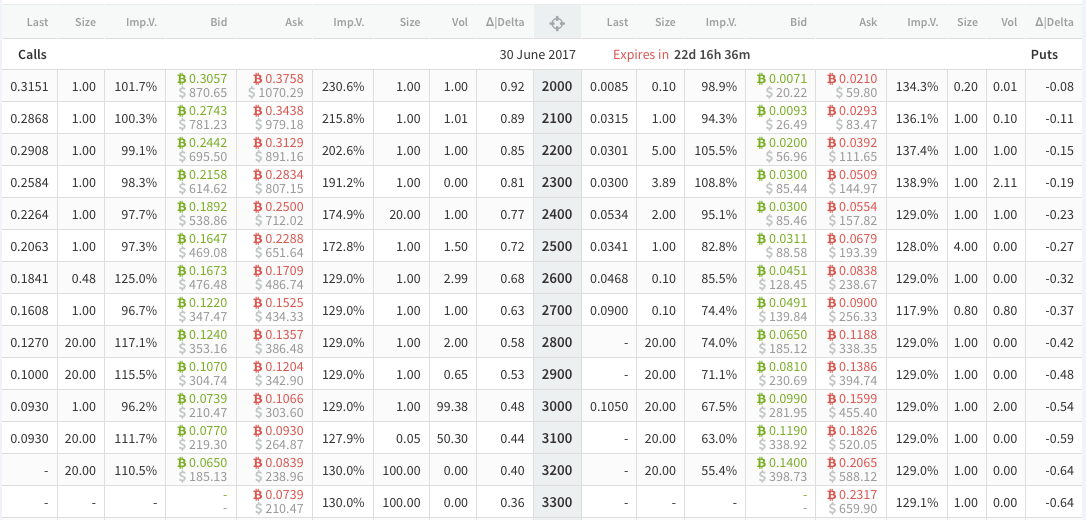

How bitcoin options trade

Bitcoin options trade the same as any other basic call or put option where an investor pays a premium for the right - but not obligation - to buy or sell an agreed amount of Bitcoins on an agreed date. Additionally, various offshore exchanges offer binary options, where traders bet on a yes/no scenario. For example, whether or not Bitcoin will rise or fall, or whether or not it will be above or below a specific price on a specific day.

Why are they so expensive?

One major difference in trading Bitcoin options at the moment is the price. Bitcoin is one of - if not the most - volatile asset trading at this time, meaning to buy an option is very expensive. Take a look at the below pricing screen for June 7, 2017.

An important tool in pricing an option is implied volatility. As IV rises, so does the price of an option. The above pricing screen for options with a 30 June (22-day) expiry show implied volatility ranging from 90% to above 200% for strike prices from 2000 to 3200. So how expensive is this? VERY! On October 2, 2017, for example, the 30-day IV for the S&P 500 was nearing record lows at 6.7%, according to data from the Options Industry Council, and even in the height of the Great Recession, IV did not reach the types of levels we are now seeing in Bitcoin trading. On November 14, 2008, two months after the collapse of Lehman Brothers short-term IV reached record highs of 65%.

Bitcoin options trading in the U.S.

After months of lobbying, Bitcoin options are soon to be legal in the U.S. On October 2, 2017, the Commodity Futures Trading Commission (CFTC) announced the approval of LedgerX for clearing derivatives. LedgerX, a digital-currency platform, announced in May it had raised $11.4 million via its parent company Ledger Holdings in the hope the CFTC decision would rule in its favor, which it did. "A U.S. federally-regulated venue for derivative contracts settling in digital currencies opens the market to a much larger customer base," Paul Chou, LedgerX CEO said in a press release.

CEO Chou said he expects the company to begin Bitcoin option trading in the fall and hopes to extend to Ethereum later in the year.

Growing Acceptance

The push for options was given further validity when in October the Chicago Mercantile Exchange (CME) announced it plans to launch Bitcoin futures in the fourth-quarter of 2017. "Given increasing client interest in the evolving cryptocurrency markets, we have decided to introduce a bitcoin futures contract," Terry Duffy, Chief Executive Officer of the CME said in a statement.

As popularity in the cryptocurrency grows the products to trade the underlying asset will widen. Despite being relatively new, Bitcoin option trading is available in a handful of countries, which will soon include the U.S.

However, for those looking to dabble in options be warned, they are expensive and volatile so buckle up!

What are Bitcoin Futures, Options and CFD’s?

First of all what are options and what are futures – to do a long explanation can get quite complicated so be prepared.

First of all what are options and what are futures – to do a long explanation can get quite complicated so be prepared.

The idea was to provide farmers and producers to lock in their profits and not be subject to volatility in prices when they were ready to sell what they had made – a way of transferring risk or taking on risk.

The futures contract is a way of agreeing to sell or buy a specific quantity of a specific product at a specific price on a future date.

The buyer of the futures contract buys the right to sell at the price and the seller agrees to accept the goods at that future date for that price – the buyer is said to go short and the seller is said to go long as if the price for the product goes up he has the right to buy at a lower price – vice versa for the seller as he can sell the product for a better price if the price goes down. Futures can be traded during their contract life and have value depending on the perceived price when the contract will end – and as the price moves generally the losing party has to post money in escrow as collateral to reduce counterparty risk.

With Bitcoin futures you are fixing the price that you want to sell or buy a certain amount of bitcoins at a certain point in the future. As you don’t have to make the purchase immediately then you are also leveraging your position by having exposure to an asset whilst only posting collateral – or a small percentage of its cost – so with 10 to 1 leverage you are exposed to ten Bitcoins instead of one – but also exposed to their potential losses – leverage is a dangerous game but also a potentially rewarding one.

With options there is a more complex set of instruments and terms – there are calls and puts with calls and puts both having a long and short position. If you buy a call you are said to go long and if you sell a call you are said to go short – and for put options you are said to go long if you buy a put option and short if you sell one.

A Bitcoin call option gives exposure to rising prices in the underlying above a certain price – known as the strike price – the long call will gain money if the price of bitcoin rises to be paid by the short position in the Bitcoin call. If the Bitcoin price is at $300 and the strike price is set to above, at, or below that, then the long Bitcoin call option is said to be in the money, at the money, or out of the money. The seller (short) position in the Bitcoin call position will receive a fee from the long position at the start of the contract. Contracts can be exercised in various ways – for example some options can be settled during the contracts existence (European options) or only at its end (American Options).

For Bitcoin Puts the pricing idea is very much the same except the bet is only if the price goes down below a certain strike price. For example long put option would gain money if the Bitcoin price fell below the strike price of the option – so if the strike price was $350 per Bitcoin and the Bitcoin price was at $300 then the option would be in the money and priced at $50 or more depending on how much time value the Bitcoin option contract had left. The short put Bitcoin position would be losing money as they would have sold the option on the bet that the price would rise and so owe money as it has fallen.

CFD’s are slightly easier for the smaller investors to gain leverage at through the range of platforms such as Plus500, Avatrade and Etoro. However most forms of contracts can be structured i.e. futures and options – if a stop loss is put into a CFD contract it essentially converts it from a future like instrument to option contract. CFD’s allow for smaller amounts and more custom sizes than larger exchanges and hedge fund sized positions. CFD providers provide a variety of potential instruments and methods to gain exposure and leverage to the Bitcoin price as well as the Litecoin price - and some innovative crypto or bitcoin exchanges are structuring options and futures contracts for Bitcoin and Litecoin and other crypto currencies.

These contracts are extremely useful for various hedging techniques and can be used by various exchanges who hold a lot of Bitcoin or cash – so they can pay a premium to rid themselves of the volatility risk – i.e a Bitcoin exchange or ATM provider could buy a long Bitcoin Put that matches the value of its holdings.

This Bitcoin Put would gain money if the price of Bitcoin went down but would cost them money to have that protection. They are paying money to reduce the volatility risk of Bitcoin. If the price goes up, they have spent the money on the option but, their holding are exposed to the rising Bitcoin price by the Bitcoin they hold – of course, whether this is worth it depends on the cost of hedging their position to downside risk!

Bitcoin options

81% Highest Payout

BITCOIN OPTIONS TRADING

Choose the Best Bitcoin Options Trading Portal.

81% Highest Payout

LITECOIN OPTIONS TRADING

Choose the Best Litecoin Options Trading Portal.

81% Highest Payout

ETHCOIN OPTIONS TRADING

Choose the Best Ethereum Options Trading Portal.

WHAT IS BINARY OPTION

Binary options are a simple way to trade price fluctuations in multiple global markets, but a trader needs to understand the risks and rewards of these often-misunderstood instruments. Binary options are different from traditional options. If traded, one will find these options have different payouts, fees and risks, not to mention an entirely different liquidity structure and investment process

Binary options are classed as exotic options, yet binaries are extremely simple to use and understand functionally. The most common binary option is a "high-low" option. Providing access to stocks, indices, commodities and foreign exchange, a high-low binary option is also called a fixed-return option. This is because the option has an expiry date/time and also what is called a strike price. If a trader wagers correctly on the market's direction and the price at the time of expiry is on the correct side of the strike price, the trader is paid a fixed return regardless of how much the instrument moved. A trader who wagers incorrectly on the market's direction loses her/his investment.

Bitcoin Options Will Be Available This Fall

Why Cryptocurrencies Are Selling Off

Start your day with what's moving markets in Asia. Sign up here to receive our newsletter.

Digital currency investors and miners will be able to hedge the volatile assets under U.S. regulatory oversight for the first time in just a couple of months.

The U.S. Commodity Futures Trading Commission granted LedgerX LLC, a cryptocurrency trading platform operator, registration as a clearing house for derivatives contracts settling in digital currencies, according to a statement by the regulators Monday. With the approval, LedgerX is set to become the first federally regulated digital currency options exchange and clearinghouse in the U.S. as interest and volatility in the method of exchange surges.

“It’s an important milestone for the digital currency market broadly,” said Paul Chou, a former Goldman Sachs Group Inc. trader, who is LedgerX’s chief executive. “This will pave the way for others globally to look at the space and the appropriate way to regulate a new market like this.”

The New York-based company plans to offer one to six month bitcoin-to-dollars options contracts in late September to early October, Chou said in a telephone interview. Contracts for other digital currencies including for Ethereum’s ether are expected to follow, as well as longer-term protection.

The CFTC had granted LedgerX authorization to trade digital currencies earlier this month. The company, which is backed by Alphabet Inc.’s venture-capital arm, aims to provide institutional investors the ability to hedge against price swings in digital currencies in the same way they protect against volatility in other assets.

Other platforms that offer options trading are Bitcoin Mercantile Exchange, owned by Seychelles-incorporated HDR Global Trading Ltd., and Deribit of Amsterdam. In 2015, the CFTC ordered bitcoin options trading platform Derivabit, which was based in California, to cease operations as it hadn’t followed regulatory procedures.

This is another step in the crypto-currency community’s efforts for the sector to mature and draw in a broader user and investor base. Bitcoin had been under pressure as feuding factions disagreed on how to help the digital asset scale, until prices rebounded last week on signs an agreement is near.

Chou said the ability to hedge digital assets will attract institutional investors who had been on the sidelines.

“We’re getting people that want to hedge and people that want exposure to a new asset class that they can add to their portfolio and help diversify, and get potential upside of potential digital currency,” Chou said. “We want to keep it to a certain size in the beginning before we scale up over the next couple of months.”

— With assistance by Benjamin Bain

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin options

Like put and call options for a stock, but for the future price of Bitcoin?

It is possible, there various sites that provide option (or option like) trading. Each have their pros and cons. Of the ones I know of theses seemed the best. However YMMV and caveat emptor.

At time of writing here are some simple ones:

It's possible in theory, but right now there are no good markets to actually do it. The only one I know is MPEX which has multiple problems and should be avoided.

OP, here you go: Haven't used the service myself.

MPEx is fine, it offers options.

Accounts there are expensive (30 BTC IIRC) but there are third-party brokers that will let you avoid these fees by offering a different fee structure.

If you want to deal with MPEx directly you should have some knowledge about PGP as its security architecture is based on it and requires to be able to clearsign orders.

It doesn't have any specific issues that I know of (except for the opinionated PR perhaps).

I have never traded options, so you should make sure that you look into any details before trading. Just keep yourself safe!

But here are some sites I found:

There are now quite a few ways to hedge the price of BTC. One way is with IG Markets binary options. There are also CFDs (contracts for difference) at several providers.

As for "dark pools" this concept is impossible on BTC since every 10 minutes all transactions are broadcast.

Trading Bitcoin Binary Options Without Getting Scammed – 88% ROI??

If you’re looking into Bitcoin trading you’ve probably encountered companies like Trade Rush which provide Bitcoin Binary Options trading.

If you’re looking into Bitcoin trading you’ve probably encountered companies like Trade Rush which provide Bitcoin Binary Options trading.

What Are Bitcoin Binary Options ?

Bitcoin Binary Options is a form of trading in which you predict if the price of Bitcoin will rise or fall in a certain amount of time. If you’re correct you earn the option’s payoff, if you’re incorrect you lose your investment. Each Bitcoin binary option has a specific expiration date at which the option is checked to see if it’s “In the money” (you were correct) or “Out of the money” (you were incorrect). Each Bitcoin binary option also has a specific payoff that you can win. They are called “Binary Options” because the outcome is either win or lose, there’s nothing in between.

An example for Bitcoin Binary Option Trading

For example, let’s say it’s 10am and the BTC price is $575.505. You believe that by 5:10pm on March 17th the price will be higher than $575.505 so you buy a “Call” option. If at 4pm the BTC price is higher than $575.505, you earn the payout of 73% of your investment, if it’s lower, you lose. Another example is if you think the BTC price will go down. You then buy a “Put” option. If the price at the expiration time is lower than the original price, you earn the option’s payout.

The Upside of Bitcoin Binary Options

- You don’t have to know the exact value of Bitcoin when the option expires, only if it increased or decreased.

- You don’t have to have extensive knowledge in trading to participate in Bitcoin binary options.

- Payout can reach up to 88% return on investment.

The Downside of Bitcoin Binary Options

As you may have noticed, Bitcoin binary options have a great similarity to plain gambling. If you study binary options in detail you will see that the trading platform will always have an edge over the investor (you need to win over 50% of the time just to break even). Because of the unpredictable nature of Bitcoin binary options many countries have strict regulations regarding who is allowed to operate such a business, it is advisable to check if the exchange were you wish to trade Bitcoin binary options is regulated. Also Bitcoin options can become highly addictive (just like gambling), and no matter how knowledgable you are, it’s impossible to consistently predict what Bitcoin prices will do within a short time frame.

Bitcoin Binary Options Exchanges

Today, two companies have taken the advantage of Bitcoin’s increasing volatility and are allowing customers to trade in Bitcoin binary options: TradeRush – Accepts customers Worldwide. Top Option – Does not accept US customers.

Be careful! You’re Capital is At Risk

If I wasn’t clear enough until now, then keep in mind that trading in Binary Options is highly speculative and involves a significant risk of loss. Such trading is not suitable for all investors so you must ensure that you fully understand the risks before trading.

Trade Bitcoin

Bitcoin Spreads: A Better Way

Nadex Bitcoin Spreads let you trade the price of Bitcoin (based on the trusted TeraBit Index SM ) without having to own bitcoins. There's no need for wallets or conversion, since the contracts are settled in US dollars.

Best of all, it's as easy to trade price drops as it is to trade rallies. Short-selling Bitcoin is as easy as buying when you use Bitcoin Spreads.

As the price of Bitcoin varies up and down, the spread's value moves as well, but with limits. Above the ceiling or below the floor, the value of the spread stops moving and remains at its upper or lower limit (depending on whether you are a buyer or seller).

In this way, your risk-reward remains within a defined range. One limit is your profit target. The other is your guaranteed protection against unlimited losses.

Trade all the markets you love

Bitcoin opportunity without the hassle

Since its "hacker" beginnings, Bitcoin and cryptocurrency have gone mainstream and soared in value. More traders than ever want to add cryptocurrencies to their portfolios.

However, the volatility makes the Bitcoin market good for short-term trades, not just "buy and hold."

Nadex Bitcoin Spreads allow you to take short-term positions on the price of Bitcoin, with risk-reward protections built in. Selling is as easy as buying, meaning you have profit opportunities no matter which direction the Bitcoin market is trending.

Trade the price of Bitcoin without buying and selling the bitcoins themselves. No "mining," no risk exposure outside your comfort level—you can just trade with all the benefits of the Nadex exchange: limited risk, transparent price, and CFTC regulation.

Bitcoin Spread Trading Example

A Bitcoin spread lets you trade in such a way that your risk and reward are contained within a floor-to-ceiling price range. For example a spread contract might be named:

Bitcoin 12000 - 12500 (4:00PM)

This means that the price range you are trading lies between a floor (low) of $12,000 per bitcoin up to a ceiling (high) of $12,500 per bitcoin.

If the real-time current price of Bitcoin is

The price of the binary option is always between zero and 100. Let’s say the option is currently priced at 47.50 bid/57.50 offer. You buy at the offer price, sell at the bid, or place a limit order for a better price.

The binary option will settle at either 100 (if yes) or zero (if no). Your profit/loss is the difference between the settlement price (zero or 100) and the price you bought or sold at.

All Nadex Bitcoin binary options are settled by the last tick before expiration of the TeraBit® Bitcoin Price Index. Nadex offers daily and weekly Bitcoin binary option contracts expiring at 3:00PM EST.

Кредитное плечо до 100x. Торговля контрактами без срока действия. Лучшие в отрасли меры безопасности.

Добро пожаловать на самую современную платформу торговли биткоинами!

Регистрация занимает менее 30 секунд и не требует предоставления персональных данных.

Начните торговать через считанные минуты; для внесения депозита нужно только 1 подтверждение.

Хотите попробовать демо-торговлю?

Рынок BitMEX по XBT/USD — самый ликвидный в мире: ликвидность выше, чем на любой другой бирже.

Кол-во проверок за секунду. Платформа BitMEX непрерывно проверяет баланс и историю всех счетов.

Биткойны были потеряны в результате вторжения или взлома. BitMEX хранит все средства в надежном хранилище.

Уникальные продукты

BitMEX предлагает кредитное плечо до 100х на биткоин, а также высокое кредитное плечо по контрактам на альткойны.

Расширенный API

Наш торговый механизм был создан с использованием технологий, применяемых в инвестиционных банках и хедж-фондах.

Передовые меры безопасности

BitMEX использует новейшую многофакторную систему безопасности, как внутри, так и снаружи. Безопасность — наш главный приоритет.

Тип контракта

BitMEX предлагает различные типы контрактов. Покупка и все выплаты по контрактам осуществляются в биткойнах.

Только BitMEX предлагает «бессрочный контракт» с высоким кредитным плечом, который никогда не истекает!

Спекулятивный бессрочный продукт на биткоин с кредитным плечом до 100х, без срока экспирации и с низкой комиссией!

Откройте длинную или короткую позицию по контракту Monero с кредитным плечом 25х!

Контракты Ethereum и Ethereum Classic торгуются с кредитным плечом до 50х!

Начните торговать сейчас!

BitMEX — платформа для пиринговой (Р2Р) торговли криптопродуктами.

BitMEX и мобильные приложения, выпущенные под товарной маркой BMEX, полностью принадлежат и работают под управлением компании HDR Global Trading Limited, зарегистрированной в Республике Сейшельские Острова, или ее соответствующих уполномоченных дочерних компаний.

Комментариев нет:

Отправить комментарий