JPMorgan explains why a bitcoin ETF is a 'holy grail' that could change the game

A small toy figure is seen on representations of the Bitcoin virtual currency in this illustration picture Thomson Reuters

A small toy figure is seen on representations of the Bitcoin virtual currency in this illustration picture Thomson Reuters

- 10 bitcoin-link ETFs are waiting in regulatory limbo, according to JPMorgan.

- The bank described such a fund as the "holy grail" for the cryptocurrency.

It's not clear if or when a bitcoin-link exchange-traded fund will go live, but it is clear that such a fund would be a game-changer for the digital currency.

A bitcoin ETF has been viewed as a natural next step in bitcoin's maturation as an asset and could precipitate the entrance of more retail investors into the crypto market.

JPMorgan outlined the benefits of such a fund in a note out to clients on Friday, referring to it as the "holy grail for owners and investors." Here's the bank:

- Easier access: "Investors need wallets to trade the physical Bitcoins today, making it hard to access. ETFs are frequently traded and highly accessible via investors' brokerage accounts."

- Liquid market: "ETFs are actively traded and highly transparent."

- High integrity: "ETFs are traded through brokerage accounts that carry with them insurance via SIPC. Bitcoin exchanges have no such insurance and expose holders to potential fraud and theft."

However, the idea of a bitcoin ETF has received push-back from regulators who want to evaluate the potential risk they could present to investors. In response to that pushback, at least five companies have withdrawn their applications for a bitcoin ETF. As many as 10 bitcoin-link ETFs are sitting in regulatory limbo, waiting for approval.

Such a product could have a transformational impact on the cryptocurrency. JPMorgan said that impact could resemble the impact of the first gold-link ETF.

"Launched in 2004, SPDR Gold Shares ETF was the first gold ETF approved in the US by the SEC," the bank said.

"Since its launch, retail access to gold has skyrocketed as new investors more easily turn to the gold market as a portfolio diversifier and as a foundational asset."

After the launch of the SPDR fund, the price of gold skyrocketed from $440 to a peak of $1,900 in 2011, the bank said.

"Today, the SPDR Gold Shares ETF is one of the biggest ETFs in the market with over $35 billion under management," JPMorgan said.

That's probably why we've seen a race by firms to launch their own bitcoin ETF, as the first mover advantage could ultimately translate into a fund's long term success.

Why Buy This Expensive Bitcoin Trust Instead of Actual Bitcoin?

If you're interested in getting invested in the digital currency world, now seems to be as good a time as ever. Bitcoin has seen repeated record-setting price levels, and a host of other digital currencies are becoming increasingly popular around the globe. And yet, there are some reasons why even seasoned investors may be reluctant to get involved in direct investments relating to cryptocurrencies. Fortunately for those people, there is an over-the-counter trust focusing on Bitcoin in particular that can simplify the process. It is called the Bitcoin Investment Trust (GBTC) and it is provided by Grayscale Investments. Here are some of the basic details about the new trust and its relationship to the digital currency itself.

Significant Returns Already

The Bitcoin Investment Trust has won a spectacular set of gains over the past year. According to MicroCap Daily, the trust was trading for less than $100 just one year ago, while in the intervening time it has risen to more than $1000. It has finally settled back to about $800 as of this writing. The trust's success mirrors that of Bitcoin, and that makes sense: the trust is exclusively tied to that cryptocurrency, and its value is derived solely from that of Bitcoin.

Why the Huge Premium for GBTC?

Potential investors are likely wondering why GBTC shares can be found at such a high premium over Bitcoin. The issue seems to lie in supply and demand. While Bitcoin demand has skyrocketed, GBTC has kept its shares outstanding close to 1.7 million in the two years that it has existed. In fact, the ETF seems unlikely to change the number of total outstanding shares in the future, according to the company's head of research, Ihor Dusaniwsky. He explains that "it is unlikely that GBTC's outstanding share amount will climb above 1.7 million anytime soon."

This is not to say that there aren't significant concerns about GBTC as well. Andrew Left of Citron Research has publicly criticized the trust, and Seeking Alpha speculates that his statements may be linked to GBTC's cratering premium relative to Bitcoin, possibly due to investors having sold off their shares in a rush of skepticism. According to Citron, GBTC marks the "most dangerous way to own Bitcoin."

It is useful to note that GBTC didn't always seem this expensive in comparison with Bitcoin. Before Bitcoin's price spiked in the past several weeks, the trust traded on an average premium of just 10% above the crypto currency in 2017. The issue seems to have come about when Bitcoin's demand blew up and GBTC's supply did not change. As Bitcoin continues to spread further into the financial world, it will be interesting to see where GBTC's share prices go as well.

SEC Expected to Decide Bitcoin ETF's Fate By Friday

The US Securities and Exchange Commission's decision on the much-anticipated bitcoin exchange-traded fund (ETF) is expected by Friday, according to a source with knowledge of the agency's deliberations.

The SEC has an 11th March deadline to make a decision regarding the proposed rule change that would clear the way for the ETF, which would be the first of its kind. Yet because the 11th falls on a Saturday, that decision will come before that date – potentially before Friday, the source said.

The decision, regardless of the outcome, will cap a more than three-year period since investors Cameron and Tyler Winklevoss first filed with the SEC in mid-2013.

Should the fund receive approval, some analysts have speculated that bitcoin markets could rise as a result. That expected approval appears to be baked into some quarters of the market already, driving the price to new all-time highs in recent days.

The digital currency's price continually neared $1,300 in recent sessions, reaching $1,293.47 on 3rd March, CoinDesk Bitcoin Price Index (BPI) figures show. However, bitcoin prices kept falling back during their climb toward $1,300, eventually experiencing a sharp drop on 7th March, during which markets plunged below $1,200 for a brief period.

On the other hand, analysts have argued that, should the SEC reject the rule change that would allow the Bats Global Exchange to list the ETF, bitcoin's price could be negatively affected.

Phil Bak, who was previously a New York Stock Exchange managing director and currently serves as CEO for ETF issuer ACSI Funds, told CoinDesk that, generally, the SEC seeks to avoid the appearance of "publicly rejecting an ETF". He went on to argue that, if the agency didn't plan on approving one of these funds, it would likely ask for the filing to be pulled ahead of any final decision.

Yet according to Bak, the lack of such a pullback so close to the deadline could be driven by other factors specific to the bitcoin ETF.

"In this case, the government agency may want to show the world it is unsure about bitcoin. Alternatively, it could also be that the advocates want to support it to the end and let this proposed fund get its day in court, rejection or not."

'A coin toss'

In the absence of a definitive statement from the SEC, it's perhaps easy to see why a common refrain of uncertainty has emerged the week of the decision.

As Arthur Hayes, co-founder and CEO of exchange platform BitMEX, explained:

"I have heard good arguments for and against the ETF being approved. At this point it is a coin toss."

Hayes' exchange is home to an ETF-tied prediction market, where traders can essentially bet on the outcome of the decision, and that has seen significant fluctuations over the past month. At times, traders have given the fund estimated chances of between 2% and 70%, depending on the day. At press time, the prediction market shows a roughly 50% estimated chance of approval.

Charles Hayter, co-founder and CEO of CryptoCompare, offered similar sentiment, stating that the fund's odds of receiving approval are "more than likely plucked out of the air on this one".

Those close to the industry aren't the only ones comparing the SEC decision to a coin flip.

For example, Bloomberg Intelligence senior analyst Eric Balchunas recently argued that the ETF has about a 50-50 chance of receiving approval.

The waiting game

For now, at least, those standing by for the SEC's decision can only watch and wait as the 11th March deadline grows nearer.

Yet, as argued by one analyst, those hoping for a conclusion to the years-long process might not get an answer until after that date.

Jeff Bishop, ETF expert and co-founder of investor message board platform RagingBull.com, speculated that, in the end, the SEC could punt its decision further past the 11th – particularly in light of recent price gains.

"I have the feeling they will find a way to delay this even more though. With bitcoin at all-time highs and the SEC having a terrible record for allowing new ETFs to come to market at absolute tops, they will likely push back on this until things cool a bit," he said.

That said, Bishop said he believes the ETF should be approved.

"It should be up to investors to decide the true price of bitcoin. The more liquidity and options [there are] to trade it, the more transparent and accurate the pricing will be," Bishop told CoinDesk, concluding:

"It should not be up to a government agency to withhold something like this from the public."

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Bitcoin Flying As ETF Gets Second Shot

Would-be bitcoin ETF investors are in wait-and-see mode as the Securities and Exchange Commission reconsiders whether to allow the first bitcoin exchange-traded fund to come to fruition. To the dismay of many, the SEC rejected the Winklevoss Bitcoin ETF (COIN) in a March 10 decision, citing a lack of regulation and surveillance-sharing agreements between exchanges.

Bats Global Markets, operator of the exchange on which the ETF would trade and which is owned by the same parent company—CBOE—as ETF.com, responded to the SEC's verdict by filing a "petition for review" of the disapproval on March 24.

Bats argued that the commission's initial conclusion "is clearly erroneous," "inconsistent with prior ETP [exchange-traded products] approval orders" and that "the manipulation concerns . are overstated and largely theoretical."

Bats urged the SEC to approve its proposed rule change, which would open the door to the listing of the ETF and "provide investors access to bitcoin through a regulated and transparent investment vehicle."

On April 24, the SEC agreed to consider Bats’ petition for review, and asked for public comments on the original disapproval order. The last of those comments was submitted on May 15, setting the stage for a new round of deliberations by the commission.

High Bar For Approval

Though hopes are high that the bitcoin ETF will eventually be approved―public comments on the fund have been largely positive―analysts aren't confident the SEC will turn around so soon after its previous negative ruling and suddenly give it the green light.

Spencer Bogart, managing director and head of research for Blockchain Capital, is skeptical that the SEC will change its tune on the bitcoin ETF.

"Their reason for disapproval was the underlying markets for bitcoin, which haven't changed in the weeks since they made their decision,” he said. “One of the issues was that Bats hadn't set up surveillance-sharing agreements with the major exchanges on which bitcoin is traded, with the purpose of identifying and stomping out market manipulation. Even if they did, a lot of those exchanges reside in jurisdictions that don't have much of a regulatory body that can go and take action against people that are doing something bad to the market."

However, Bogart did leave open the possibility that the SEC's thinking could change on the ETF if a new set of people look into the matter.

“It is possible that, in the short time period from when the SEC disapproved to when the petition was granted, there was a significant regime change at the SEC," explained Bogart. "You could have a different group of people who want to review the matter because they aren't sure the decision to disapprove was a good choice. I’ve heard whisperings that there are many people within this administration who are friendly or at least amicable to digital currencies like bitcoin."

Bitcoin Surging Even Without ETF

Regardless of what the future holds for bitcoin ETFs, the digital currency itself isn't fazed. Since March 10—the day the SEC originally rejected the Winklevoss Bitcoin ETF—the price of bitcoin is up an incredible 91%, last hitting an all-time high of more than $2,200 on Monday. Year-to-date, bitcoin is up 130%.

If anything, the price only accelerated on the upside after the SEC's disapproval, though most analysts attribute the surge to other factors.

"The big driver of the rally seems to be what’s going on in Japan and Korea," noted Bogart. "In Japan, recently there's been a change to acknowledge bitcoin as a legal payment method. That in and of itself wasn't significant as, generally, people don't like to spend bitcoin; they like to hold it."

"But Japan's move provides some regulatory clarity, and now there are major tech companies that want to open up bitcoin exchanges in Japan,” Bogart said. “So what you saw was volume in existing bitcoin exchanges in Japan went through the roof and pushed the prices up. Koreans look closely at Japan and tend to imitate a lot of activity there, so there's been a lot of demand from that area of the world also."

"That's been the story of bitcoin,” added Bogart. “A lot of times it's just sitting there doing nothing and then either something falls apart in a particular corner of the world, or in some corner of the world, some regulatory agency decides to be favorable to bitcoin and then you see these random rallies. Then as you begin to rally, speculators pile in, and it becomes a self-perpetuating cycle."

Bitcoin ETF

Featured Story

When Is the Winklevoss Bitcoin ETF IPO?

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - March 1, 2017

The Winklevoss Bitcoin ETF IPO launch date has not yet been set.

When it occurs depends on whether the SEC approves a rule change that will allow the Winklevoss Bitcoin Trust (the ETF's official name) to begin trading.

What happens with the Winklevoss ETF will determine the fate of two others also awaiting SEC approval.

Article Index

When Is the Winklevoss Bitcoin ETF IPO?

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - March 1, 2017

Start the conversation

The Winklevoss Bitcoin ETF IPO launch date has not yet been set.

When it occurs depends on whether the SEC approves a rule change that will allow the Winklevoss Bitcoin Trust (the ETF's official name) to begin trading.

What happens with the Winklevoss ETF will determine the fate of two others also awaiting SEC approval.

What Is the Winklevoss Bitcoin ETF?

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - February 28, 2017

Start the conversation

The Winklevoss Bitcoin ETF is an exchange-traded fund that will make it much easier to invest in the Bitcoin digital currency.

The Winklevoss Bitcoin Trust still requires SEC approval of a rule change. A decision is expected by March 11.

But if the SEC does approve this Bitcoin ETF, the price of Bitcoin could double in a very short time.

The First Bitcoin ETF Could Win Approval in March Despite Long Odds

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - February 2, 2017

Start the conversation

The SEC has plenty of reasons not to approve the first Bitcoin ETF by next month's deadline. But there's a good chance the agency will surprise everyone and make the first Bitcoin ETF a reality.

Most analysts believe the SEC will turn down the three active bids to become the first Bitcoin ETF, which includes the Winklevoss Bitcoin Trust.

Winklevoss Bitcoin ETF Update This Week Could Help SEC Approval

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - October 21, 2016

Start the conversation

As the Winklevoss Bitcoin ETF enters the home stretch in its bid for SEC approval, its latest filing shows it's doing all it can to convince the agency that its ETF will be a safe investing vehicle.

The latest amendment to the Winklevoss Bitcoin Trust's S-1 filing reveals that it has enlisted two respected partners, financial services company State Street Corp. and accounting firm Burr Pilger Mayer.

Why the First Bitcoin ETF Could Double the Price of Bitcoin

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - September 9, 2016

Start the conversation

When the first Bitcoin ETF lands - an event that could happen any day now - it will have a dramatic impact on the price of Bitcoin.

The arrival of the first Bitcoin ETF will be a powerful Bitcoin price catalyst because it will mimic other commodity-based ETFs, particularly those based on gold and silver.

Those ETFs were primary factors in the steep rise in gold and silver prices a decade ago.

Bitcoin ETFs Can Work – but This Ethereum ETF Won't

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - July 20, 2016

Start the conversation

Seeing two Bitcoin ETFs seeking regulatory approval, an upstart group has now filed for something even more radical - an Ethereum ETF.

The evidence suggests the group, the EtherIndex Ether Trust, threw together its S-1 filing with the SEC willy-nilly in an effort to be first in line to file for an Ethereum ETF.

But the problems with this ETF proposal run much deeper than that.

Why the SolidX Bitcoin ETF Is a Step Behind the Winklevoss Bitcoin ETF

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - July 13, 2016

Start the conversation

One Bitcoin ETF is good, but two are better. And now that the SolidX Bitcoin ETF has filed an S-1 with the Securities and Exchange Commission, we could have two Bitcoin ETFs trading on major U.S. exchanges by next year.

The only question now is which one will gain the bragging rights of making it first to the finish line.

How One Simple Hedge Could Actually Give the Biggest Profits of the 21st Century

By Michael A. Robinson , Defense + Tech Specialist , Money Morning • @Robinson_STI - February 9, 2016

Start the conversation

Millions of investors dedicate a portion of their portfolio to gold or some other precious metal as a hedge - as "insurance" - against trouble in other markets.

At its base, this is a sound strategy, because precious metals generally aren't affected by the ups and downs of the stock market.

This isn't a "gold service," however. Our interest is in tech investing. So let's spend today investigating what I think of as "the gold of tech."

Not only can you use this investment as a hedge, but financial players are beginning to eye the technology behind it as way to disrupt the $500 billion payments industry.

Bitcoin News: Now That the CFTC Says It's a Commodity, What's Next?

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - September 18, 2015

Start the conversation

In a major piece of Bitcoin news, the Commodity Futures Trading Commission (CFTC) ruled that the digital currency is a commodity.

It's a significant step along the road toward Bitcoin regulation. While some early adopters of Bitcoin would prefer no government involvement with Bitcoin, Bitcoin regulation is necessary for the digital currency to play any meaningful role in the financial system.

Looking for a Bitcoin Stock Symbol? We've Got Them All

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - June 12, 2015

Start the conversation

Looking for the Bitcoin stock symbol is not as straightforward as you might think.

Technically speaking, there's no such thing as a "Bitcoin stock symbol," although there are several tickers associated with Bitcoin.

Price of Bitcoin Creeps Up on Wave of Major Developments

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - May 4, 2015

Start the conversation

A rapid-fire string of good news over the past week has help nudge up the price of Bitcoin.

A week ago the Bitcoin price was hovering around $225, somewhat disappointing since just six weeks earlier it was threating to break through the $300 level.

But then we started to get some major positive Bitcoin news. Over the past few days, the Bitcoin price is up about 7%, trading in the neighborhood of $240

The First Bitcoin ETF Offers Easy Way to Profit from Virtual Currency (GBTC)

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - March 3, 2015

Start the conversation

The first Bitcoin ETF ordinary investors can buy will be the Bitcoin Investment Trust.

With approval last week from the Financial Industry Regulatory Authority (FINRA) to sell its shares on the OTC Markets, shares should start trading within the next couple of weeks.

The fund gives investors a way to invest in Bitcoin without going to the trouble of buying Bitcoin and worrying about having a secure place to store it.

This Bitcoin Price Chart Shows What's Blocking Faster Adoption

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - February 3, 2015

Start the conversation

The Bitcoin price chart for January shows volatility is just as much of an issue for the digital currency as ever.

But for Bitcoin to gain mainstream adoption, this problem must be solved. A currency that can Bitcoin's tendency to lose 20% to 40% of its value in a matter of days, or even hours, discourages its use for daily transactions.

Winklevoss Bitcoin ETF Files to Sell 1 Million Shares (Nasdaq: COIN)

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - January 2, 2015

Start the conversation

Taking one step closer to going live, the Winklevoss Bitcoin ETF filed an amendment Dec. 30 to its Securities and Exchange Commission (SEC) prospectus to list 1 million shares at an offer price of $20.09 per share.

If approved, the aggregate value of the shares will be $20.09 million.

Officially known as the Winklevoss Bitcoin Trust, this exchange-traded fund is intended to be an easy way to invest in Bitcoin.

Bitcoin Forecast 2015: Four Powerful Trends Will Deliver a Pivotal Year

By David Zeiler , Associate Editor , Money Morning • @DavidGZeiler - December 18, 2014

Start the conversation

The Bitcoin forecast for 2015 is for major strides toward the promise we've been hearing about for more than a year.

The power of the idea - a decentralized, digital currency that includes ownership data and can move money around the world in an instant - just keeps gaining traction.

But the Bitcoin forecast 2015 isn't just for more of the same. For sure, mass adoption will continue. But next year we'll see a lot more activity on Wall Street as well as a lot more innovation from Bitcoin startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin ETF Approved In March 2017: A Black Swan With Asymmetric Risk/Reward

Our thesis is that the probability of a Bitcoin ETF approved in the near term has been misevaluated as a "very low chance" event by major investment and research firms.

As such, there is an attractive return/risk ratio for investors taking positions in the OTC market before March 2017.

We provide a target price of $3,678 for Bitcoin in case an ETF is approved in 2017 and a target price of $551 in case it is rejected this year.

We assign a probability of 35% for approval against 65% probability for rejection, making our final weighted average expected price $1645.45 or a +67.8% expected return above the current price.

In this analysis, we will focus on the facts surrounding an upcoming notable event: the final decision on the Winklevoss Bitcoin ETF (COIN) approval by the Securities Exchange Commission on March 11th, 2017 and the attractiveness of opening long positions before this date.

In its 8 years of existence, Bitcoin has polarized analysts, investors, and scholars. Consensus on Bitcoin's merit has not been reached, and observers usually engage in two opposed extremes of opinions that either deplore it or aggrandize it. Although its utility as a means of exchange is controversial, from a purely quantitative point of view the evidence suggests continued growth in transaction volume through the Bitcoin network, continued growth in interest from new markets, and continued growth in entrepreneurial attention. We describe the current state of the Bitcoin economy, the upcoming ETF approval chances, and the potential implications for investors.

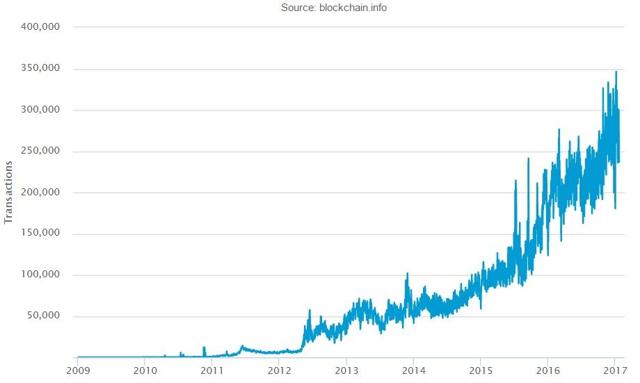

Steady growth in transactions processed by the Bitcoin network

Transactions processed by the payment network have been growing at a stable pace for the past 5 years. This was the original use case of Bitcoin and the data indicates that it is fulfilling its goal at a current rate of

250,000 transactions per day.

Daily confirmed transactions on Bitcoin's blockchain - Source: Blockchain.info

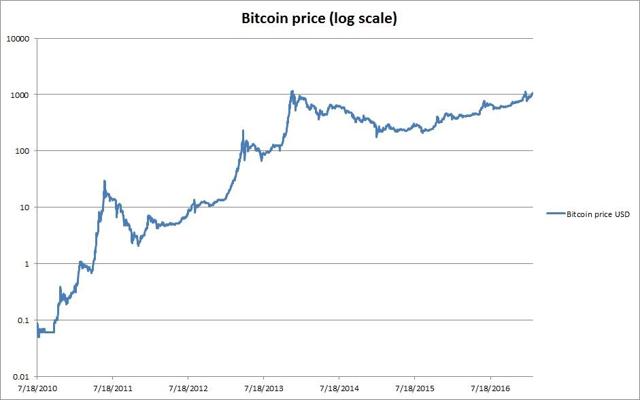

Bitcoin price near all-time high

Although the original intention of Bitcoin was to become a digital currency payment network, probably the most successful use of Bitcoin today is as a speculative vehicle. At $981 per unit and a total market capitalization of $16 billion, the cryptocurrency is heavily traded back and forth for CNY, USD, EUR, among other 26 national currencies. Just in the 30 day period of 12/24/16 to 1/22/17 the aggregate of Bitcoin exchanges have reported a combined trading volume of 154,713,805.60 BTC, or approximately $141.6 billion at today's price, an average of $4,719 million per day of trading (source: Bitcoinity.org). Since end of January Bitcoin trading volume has declined substantially in China due to new exchange fees after pressure from the Chinese central bank; however the price of Bitcoin shows robustness and keeps approaching the all time high of 2013.

Bitcoin price chart in log scale, expressed in USD - Source: Coindesk.com

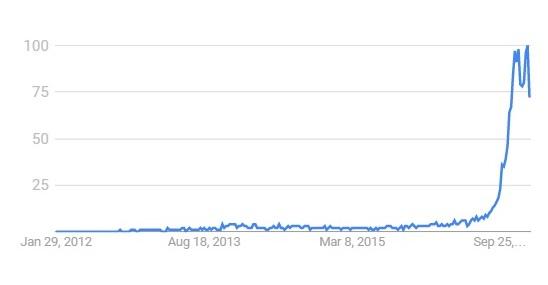

Exponential growth of internet searches related to Bitcoin in high inflation countries: the case of Nigeria, Ghana & Venezuela

The appeal of Bitcoin as a kind of "digital gold" that has no borders and can be concealed easily seems to be an attractive angle for developing economies that suffer highly inflationary regimes. Based on data provided by Google, internet search volume for the keyword "bitcoin" has been growing geometrically in Venezuela, Nigeria, and Ghana during the last year, being on the list of the top 5 countries in the world with most interest on the subject. In Nigeria, the buying pressure to acquire the cryptocurrency made the price soar in the local markets to the equivalent of USD 1,730 on Jan 4th, the highest price ever recorded in Bitcoin's history (source: Luno.com).

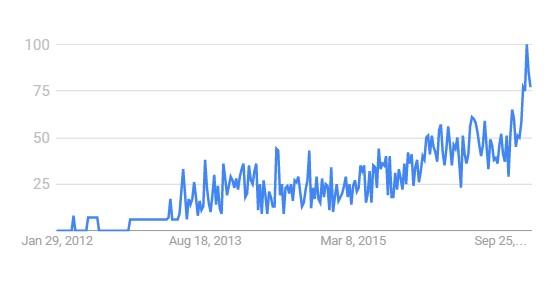

Nigeria: 15.38% CPI inflation rate (2016)

Google search volume in Nigeria 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

Ghana: 17.02% CPI inflation rate (2016)

Google search volume in Ghana 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

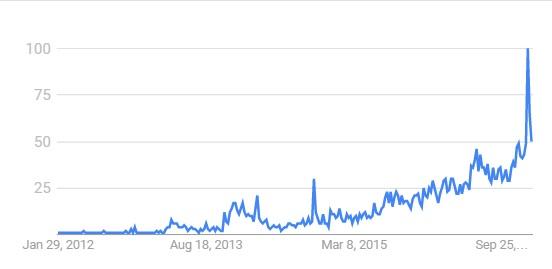

Venezuela: 475.61% CPI inflation rate (2016)

Google search volume in Venezuela 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

WHY THE BITCOIN ETF IS CLOSER TO REALITY THAN WHAT THE MARKET CONSENSUS IMPLIES

Our main argument in favor of taking positions in Bitcoin is sustained on five pieces of evidence that cover regulation, insider knowledge, market forces, competitive actions, and political considerations. We believe this evidence has not been described in the past by mainstream investment and research firms while analyzing it now provides an edge to take profitable positions.

Exhausted terms by SEC in the approval process of the first Bitcoin ETF - Inaction by SEC in March '17 will approve de-facto the ETF

The rule-change application of COIN was submitted on July 2nd 2016, after almost three years of preparation with previous SEC filings. The SEC has consecutively requested three extensions to make a decision: the first one was in September '16, another in November '16, and the last one in January '17. Based on the timelines described in the SEC response, the last date for approval or disapproval of the rule-change is March 11th 2017, date after which the ETF would be approved by default if the SEC does not communicate a decision.

Applicant of the first Bitcoin ETF taking steps that indicate positive SEC consideration

The Winklevoss brothers are behind the COIN ETF application. We identify several steps they have publicly taken that might indicate progress in conversations with SEC or at least their aligned involvement as promoters:

- On Feb 19th, 2014 the Winklevoss brothers created Winkdex, an index to track Bitcoin prices that is now divulged by major financial information vendors as Bloomberg and Reuters. This could be a pre-requisite for information transparency.

- Since Jan 23rd, 2015 they are now operating a Bitcoin spot exchange (Gemini.com) based in New York that is fully operates under US law. It is plausible that their intention is to source liquidity for their Bitcoin ETF through their own spot exchange. This could be a pre-requisite for orderly trading, liquidity access, and capital formation.

- Through Gemini.com, on Sep 21st, 2016 they created a daily auction process to settle the Bitcoin price once a day. This could be a pre-requisite for fair market price fixation.

- On Dec 8th, 2016, the Winklevoss brothers inaugurated a website specifically for investor relationship management and promotion of the COIN ETF. Taking action to launch the ETF website after 3 years of conversations with the SEC might be indicative of a change of perception of the twins, pointing to their optimism.

- On Feb 8th, 2017, the Winklevoss brothers communicated to the SEC that they had secured the services of three of the largest high frequency trading firms to provide liquidity and efficiency to the COIN ETF: Convergex, KCG, and Virtu Financial.

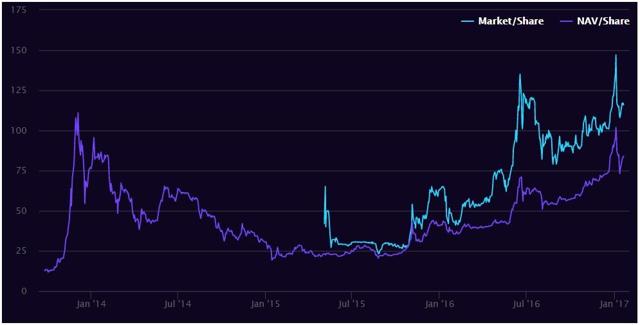

Premiums on closed-end fund GBTC suggest the SEC might step up to benefit market function with an open-end ETF

The Bitcoin closed-end fund GBTC floats on the OTCQX exchange with notorious premiums. In the past few years, there have been sessions where the GBTC market prices have reached up to 2x-3x net asset value (NAV). The fund has closed every week since inception significantly above NAV. GBTC has been wildly successful as an investment vehicle delivering returns in the triple digits to investors, but the closed-end nature of the fund is presenting friction to market participants and an ETF would be a more efficient tracker of the underlying asset.

GBTC market price per share vs NAV per share - Source: Grayscale Investments

More than one chance: three Bitcoin ETFs are under consideration by the SEC

The Winklevoss Bitcoin Trust started the application process with the SEC almost four years ago but only last year it entered into the realm of possibilities with its application for a rule-change for the BATS exchange. However it is not the only candidate to materialize a publicly traded ETF:

- SolidX Bitcoin ETF (XBTC) applied to become publicly traded on NYSEArca on June 22nd, 2016, being the approval SEC deadline on March 30th, 2017. The main peculiarity of this vehicle is its proposed 100% insurance on holdings.

- Grayscale Bitcoin Investment Trust ETF (OTCQX:GBTC) applied to modify its current status from a closed-end fund (traded on OTCQX) to an open-end ETF (on NYSEArca) on January 20th, 2017, and by end-October 2017 the SEC should communicate its final decision.

Heavy pro-Bitcoin presence in President Trump's Administration leans the balance towards a higher chance of a Bitcoin ETF approval

The Trump Administration is well known for its anti-regulation stance, as it was seen with the Dodd-Frank Act repeal. There are multiple pro-Bitcoin enthusiasts involved in some way or another with the current US administration, including Mick Mulvaney (director of the U.S. Office of Budget nominee), Peter Thiel (Paypal co-founder), Balaji Srinivasan (21.co CEO and potential FDA director nominee), Travis Kalanick (UBER CEO), and others. Trump's entourage leans the balance towards a more accepting perspective for Bitcoin.

WHY THE BITCOIN ETF WILL DELIVER IMMEDIATE RETURNS FOR BITCOIN HOLDERS

We propose the case for a massive increase in the accessibility of Bitcoin as an investment asset class if an open-end style fund like the Bitcoin ETF starts trading on a major equity exchange and how this new disponibility will grow the returns of Bitcoin investors.

Buying pressure on the Bitcoin ETF will shift the demand curve of Bitcoin's digital tokens

As per the SEC filing, every 10,000 units of the ETF can be redeemed or exchanged for the underlying. The COIN ETF shares will impact demand of spot bitcoins through their interchangeability.

If Bitcoin is currently a $16 Billion technology startup, the ETF will be equivalent to its IPO

Currently, Bitcoin trading is dominated by OTC exchanges that operate under no explicit guidelines. A move into public exchanges will deliver:

- Guarantee of regulatory oversight for investors

- Qualitative increase in visibility as an asset class

- More credibility in the financial scene

- Further consideration and analysis of its technical capabilities

As Bitcoin has achieved its current multi-billion market value without access to organized financial markets, we foresee great interest in case it becomes publicly traded in the form of an ETF.

Useful or not as an actual currency, Bitcoin will be used as a diversification asset

Independently of its merits as a technology or financial innovation, Bitcoin excels as a lowly correlated asset against major asset classes (see Ark Investments 2017). As such, it has a place in modern portfolio management. For as long as the Bitcoin network continues to find use in the developing world, underground markets or even collectible memorabilia, this emerging asset class will continue attracting investors looking to reduce portfolio beta.

Bitcoin exhibits a 0.037 correlation with S&P 500 on 30 day returns

Because hedge funds ($2.7 trillion assets under management) and endowment funds ($1.4 trillion AUM) are sophisticated players inclined to zero beta multi-asset portfolios, they will be the least hesitant to take positions to achieve lower return correlation with equities. After them, other sophisticated investors will follow.

The Bitcoin ETF will invite the entrance of significant amounts of capital, while the event is not accompanied by more units in circulation

The supply curve is fixed in the Bitcoin protocol to a maximum total emission of 21 million bitcoins, a circulation to be reached in 2130. The current volume of bitcoins in circulation stands at 16,119,688 BTC units (source: Blockchain.info) and the rest up to the maximum 21 million would be issued following a logarithmic schedule that enforces limited supply for Bitcoin.

To manipulate or sabotage the supply of Bitcoin and place more units in circulation, a malicious actor would need to out-invest the Bitcoin network computational power, which currently stands at 3,398,970 Tera hashes per second (source: Blockchain.info). With last generation supercomputing hardware (NVIDIA Tesla S2070 GPU parallel processors), the total investment needed to reach the required computational power to change the supply stands at $150 billion. With custom-made specialized hardware (i.e. made-to-order by a semiconductor fab like TSMC or Samsung), the cost could be reduced to a few billion dollars as per industry experts. Based on these data points, we consider unlikely any change in the Bitcoin issuance schedule.

TARGET PRICE & RECOMMENDATION

Our recommendation is to allocate anywhere between 0.2% and 5.0% of portfolio to Bitcoin using an OTC spot exchange. Avoid using the closed-end fund GBTC as it trades at substantial premium vs NAV.

In case of approval of a BTC ETF, our estimated target price for Bitcoin is $3,678. The estimate is based on the calculations of Needham & Company of $300 million influx in the first week of trading of the fund together with our assessment of Bitcoin's top 8 spot exchanges' order book depth as per BitcoinCharts.com 3-month historical order depth data.

In case of rejection by the SEC, our estimated target price for Bitcoin is $551, calculated on the basis of a mean reversion scenario for which we used the weighted average of the last 5 years of prices of Bitcoin as per BitcoinAverage.com data.

It seems unlikely, among all the other reasons, that the commission is going to want to move forward with a product where the major trading is done on exchanges [in China] that may not be following our AML guidelines.

-- David Brill, former General Counsel of Gemini.com in Coindesk.com interview 1/20/2017

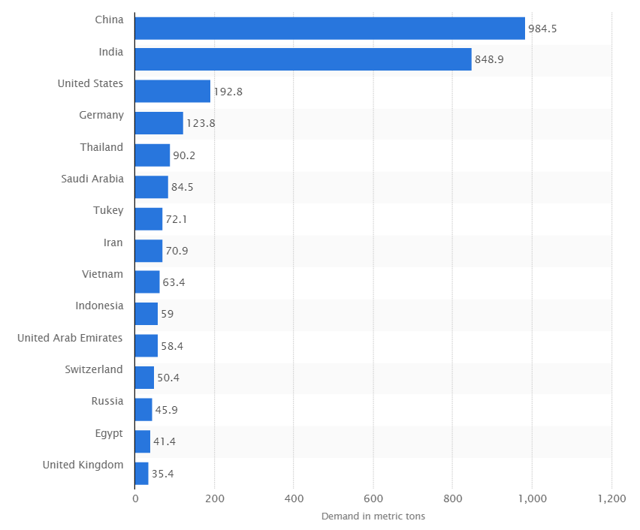

Our counter-argument to this view is that the vast majority of OTC gold purchase transactions are happening also in China and India, with combined purchase volume 9.5x larger than the US. Consumer gold has no AML guidelines and can be acquired without identification requirements in retail shops. These conditions did not present an obstacle to the SEC for the approval of the first gold ETF (NYSEARCA:GLD) on 2005, and thus we believe the SEC will follow the same guidance with Bitcoin.

In parallel, there is strong indication that the Chinese central bank and regulatory organisms requested as recently as Feb 8th 2017 an immediate enforcement of anti-money laundering procedures on all major Chinese Bitcoin exchanges.

CONSUMER GOLD PURCHASES IN 2015

Consumer purchases of gold by country in 2015 - Source: Statista.com

The probability of approval for a Bitcoin ETF is higher than what the current market consensus implies. We consider this event a potential Black Swan that will have a profound impact in the investment world. Critical dates for the near term are March 11th (COIN ETF Security Exchange Commission's decision deadline), March 30th (XBTC ETF decision) and October (GBTC ETF decision). In case of ETF approval we predict a large upside, while in case of rejection the losses could be limited to 50% of the capital. Our recommendation is speculative buy of Bitcoin spot on OTC exchanges before March 11th, 2017 and hold at least until October 2017.

Disclosure: I am/we are long BITCOIN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

JPMorgan explains why a bitcoin ETF is a 'holy grail' that could change the game

A small toy figure is seen on representations of the Bitcoin virtual currency in this illustration picture Thomson Reuters

A small toy figure is seen on representations of the Bitcoin virtual currency in this illustration picture Thomson Reuters

- 10 bitcoin-link ETFs are waiting in regulatory limbo, according to JPMorgan.

- The bank described such a fund as the "holy grail" for the cryptocurrency.

It's not clear if or when a bitcoin-link exchange-traded fund will go live, but it is clear that such a fund would be a game-changer for the digital currency.

A bitcoin ETF has been viewed as a natural next step in bitcoin's maturation as an asset and could precipitate the entrance of more retail investors into the crypto market.

JPMorgan outlined the benefits of such a fund in a note out to clients on Friday, referring to it as the "holy grail for owners and investors." Here's the bank:

- Easier access: "Investors need wallets to trade the physical Bitcoins today, making it hard to access. ETFs are frequently traded and highly accessible via investors' brokerage accounts."

- Liquid market: "ETFs are actively traded and highly transparent."

- High integrity: "ETFs are traded through brokerage accounts that carry with them insurance via SIPC. Bitcoin exchanges have no such insurance and expose holders to potential fraud and theft."

However, the idea of a bitcoin ETF has received push-back from regulators who want to evaluate the potential risk they could present to investors. In response to that pushback, at least five companies have withdrawn their applications for a bitcoin ETF. As many as 10 bitcoin-link ETFs are sitting in regulatory limbo, waiting for approval.

Such a product could have a transformational impact on the cryptocurrency. JPMorgan said that impact could resemble the impact of the first gold-link ETF.

"Launched in 2004, SPDR Gold Shares ETF was the first gold ETF approved in the US by the SEC," the bank said.

"Since its launch, retail access to gold has skyrocketed as new investors more easily turn to the gold market as a portfolio diversifier and as a foundational asset."

After the launch of the SPDR fund, the price of gold skyrocketed from $440 to a peak of $1,900 in 2011, the bank said.

"Today, the SPDR Gold Shares ETF is one of the biggest ETFs in the market with over $35 billion under management," JPMorgan said.

That's probably why we've seen a race by firms to launch their own bitcoin ETF, as the first mover advantage could ultimately translate into a fund's long term success.

SEC Quietly Puts Bitcoin ETF Proposals Back on the Table

The US Securities and Exchange Commission (SEC) has quietly begun considering two Bitcoin ETF proposals, public documents show.

According to SEC documents dated March 23, the agency has instituted formal proceedings to determine whether to approve a rule change that would allow NYSE Arca to list two exchange-traded funds (ETFs) proposed by fund provider ProShares.

ProShares Bitcoin ETF and ProShares Short Bitcoin ETF would each hold Bitcoin futures contracts, providing retail investors with the ability to indirectly invest in the flagship cryptocurrency — or bet against it — through a familiar investment product.

“The Commission is instituting proceedings pursuant to Section 19(b)(2)(B) of the Act to determine whether the proposed rule change should be approved or disapproved. Institution of such proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change,” the order says.

ProShares had first proposed these two funds in September — before CBOE and CME had launched their Bitcoin futures products — and NYSE Arca began seeking SEC approval to list these funds in December.

However, as CCN reported, the SEC requested that fund providers withdraw their Bitcoin ETF applications and issued a statement expressing reluctance to approve these products until more investor protections are put in place.

Last month, Chris Concannon, president of CBOE, penned a letter to the SEC asking them to consider Bitcoin ETF proposals on a case-by-case basis rather than as a product class. He noted that CBOE has successfully cleared several rounds of Bitcoin futures expirations without incident and said that the Bitcoin markets are rapidly maturing and could soon warrant a regulated ETF.

Per SEC guidelines, the proposed rule change will be published in the Federal Register, after which the public will have 21 days to comment and an additional 14 days to submit rebuttals to other comments.

Comments can be submitted through email or the SEC website, and commenters should reference file number SR-NYSEArca-2017-139 on the subject line.

How to Invest in a Bitcoin ETF

While buying bitcoin has become as easy as the click of a button, some investors still prefer to stick to traditional investment vehicles to gain investment exposure to the digital currency. Currently, the only publicly traded ETFs (exchange-traded funds) that you can buy to invest in bitcoin are ARK Invest’s ARK Web x.0 ETF and the ARK Innovation ETF. In this guide, we’ll cover the basics of each.

ARK Web x.0 ETF

The ARK Web x.0 ETF (NYSEARCA: ARKW) was launched by ARK Investment Management LLC in 2015 as one of its actively managed Innovation ETFs. The ETF is listed on the New York Stock Exchange and was the first publicly traded ETF to invest in the digital currency bitcoin.

To gain exposure to bitcoin, ARK Invest purchased shares in Grayscale’s Bitcoin Investment Trust (OTCQX: GBTC), which is an over-the-counter traded fund that invests exclusively in bitcoin. (Read our guide to the Bitcoin Investment Trust here.)

Bitcoin is the largest holding in the ARK Web x.0 ETF and currently makes up eight percent of the fund. Aside from the digital currency, the ETF also provides investors with exposure to disruptive Internet-based businesses that are projected to experience significant growth in the future, such as cloud computing, machine learning, e-commerce, and others. Major holdings in the fund include Amazon, Tesla, Facebook, Alphabet, and Netflix.

Since its inception, the ARK Web x.0 ETF has generated 47.4 percent return. Year-to-date the net asset value (NAV) of the fund has increased by over 15 percent as the fund benefited from bitcoin’s steep rally since the beginning of the year.

The ETF has an expense ratio of 0.75 percent and is managed by Catherine D. Wood.

Комментариев нет:

Отправить комментарий