21 Inc Launches Bitcoin Fee Calculator

21 Inc, the developer of the first Bitcoin programmable device, has launched a free online service that estimates the fees and delay associated with a bitcoin transactions. When sending a bitcoin payment, the bigger the fee, the less time a user has to wait for the transaction to confirm.

The service, which is available at http://bitcoinfees.21.co, displays the fee in satoshis/byte. A satoshi is the smallest unit of measure in bitcoin.

“The fastest and cheapest transaction fee is currently 30 satoshis/byte, shown in green at the top.”

The calculator also shows the approximate delay in blocks and in minutes, “If transactions are predicted to have a delay between 1-3 blocks, there is a 90% chance that they will be confirmed within that range (around 10 to 30 minutes).”

The figures displayed are just estimates, a type of prediction that is formulated based on data gathered in the past three hours of blockchain activity. Statistics are also sourced from unconfirmed transactions. Monte Carlo simulations are used to derive the estimates for the wait times.

“From the simulations, it can be seen how fast transactions with different fees are likely to be included in the upcoming blocks. The predicted delay shown here is chosen to represent a 90% confidence interval.”

Developers who wish to make use of the data provided by the service can utilize the API provided by 21 Inc.

If you liked this article follow us on Twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin and altcoin price analysis and the latest cryptocurrency news.

Bitcoin fee calculator

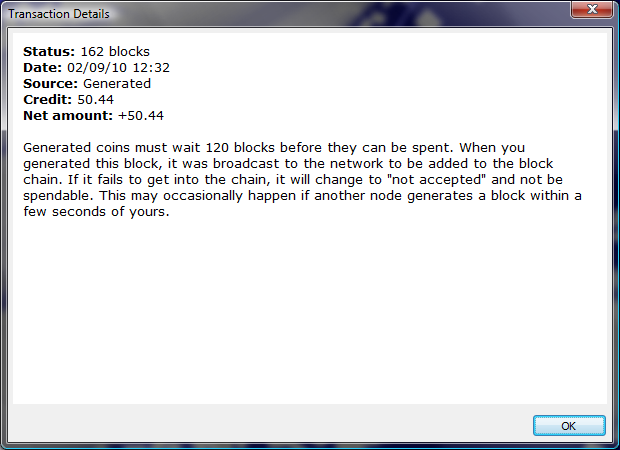

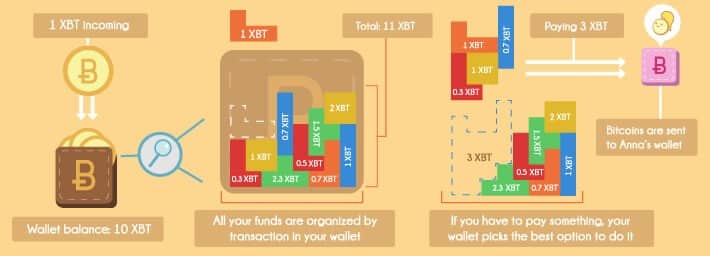

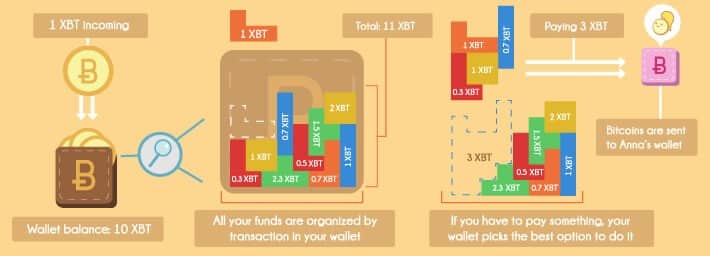

First of all, this refers to

I want to estimate the TX-Fee I would have to pay in a simple scenario where my wallet contains only 1 address Z that has received X payments.

I then want to pay all the wallets balance to Y different addresses at once.

Because I want to spent all of its balance, it would be great to know the transaction-fee, so that I can reduce Y, or pay the fee to Z in advance.

Since I prefer a worst-case-calculation, is it legit to count every incoming payment to my address as Input?

Is the following calculation correct?

A fee may not be required at all, if the priority of the transaction is high enough. Generally 1 BTC, one day old, is enough age and balance that you can send without a fee.

If any of the individual payments are below 0.01 BTC, a minimum fee will always be required.

The minimum fee, when required, is 0.0005 BTC per 1000 bytes of total transaction.

The contribution of each input and each output to the total size is somewhat consistent, it only varies largely if there are compressed keys (standard for newly generated addresses on a recent client version), some examples:

A) 1 input/1 output (sending exact balance of one input) = 191 bytes B) 1 input/2 output (sending money from single input with some change) = 258 bytes C) 2 input/1 output (consolidating two address balances to one output) = 404 bytes D) 12 input/2 output (sending from many inputs with change) = 1851 bytes

The easiest way to empty a wallet is to attempt to spend the entire balance with the transaction you desire, attempt to send it, and look at the "exceeds your balance after a 0.0xxx fee is included" message. Subtract the fee from the amount you are sending, and you should now be sending the entire wallet balance including the fee.

Transaction fees

Transaction fees are a fee that spenders may include in any Bitcoin transaction. The fee may be collected by the miner who includes the transaction in a block.

Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. The difference between the amount being spent and the amount being received is the transaction fee (which must be zero or more).

Bitcoin's design makes it easy and efficient for the spender to specify how much fee to pay, whereas it would be harder and less efficient for the recipient to specify the fee, so by custom the spender is almost always solely responsible for paying all necessary Bitcoin transaction fees.

When a miner creates a block proposal, the miner is entitled to specify where all the fees paid by the transactions in that block proposal should be sent. If the proposal results in a valid block that becomes a part of the best block chain, the fee income will be sent to the specified recipient. If a valid block does not collect all available fees, the amount not collected are permanently destroyed; this has happened on more than 1,000 occasions from 2011 to 2017, [1] [2] with decreasing frequency over time.

The market for block space

The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and demand in Bitcoin's free market for block space. [3] On the supply size, Bitcoin has a maximum block size (currently one million vbytes) that limits the maximum amount of transaction data that can be added to a block.

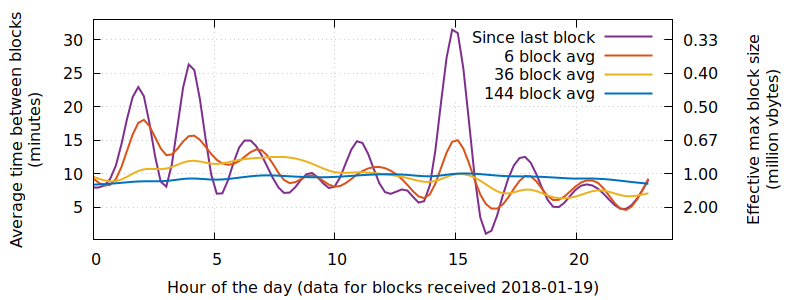

However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. As the number of blocks received in a period of time varies, so does the effective maximum block size. For example, in the illustration below we see the average time between blocks based on the time they were received by a node during a one day period (left axis) and the corresponding effective maximum block size implied by that block production rate (right axis, in million vbytes):

During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed.

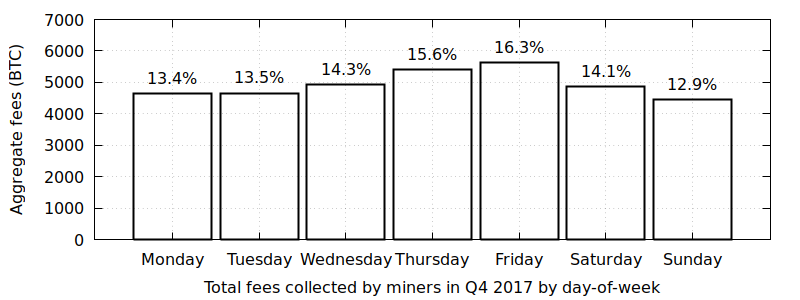

On the demand side of Bitcoin's free market for block space, each spender is under unique constraints when it comes to spending their bitcoins. Some are willing to pay high fees; some are not. Some desire fast confirmation; some are content with waiting a while. Some use wallets with excellent dynamic fee estimation; some do not. In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:

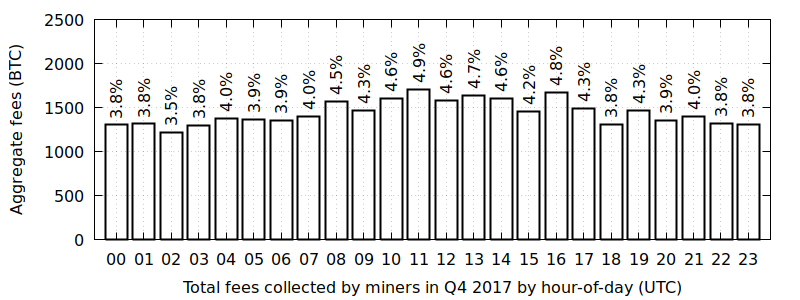

Another less recognizable cycle is the intra-day cycle where fees wax and wane during the day:

These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. Users with high time requirements may pay a higher than average transaction fee to be confirmed quickly, while users under less time pressure can save money by being prepared to wait longer for either a natural (but unpredictable) increase in supply or a (somewhat predictable) decrease in demand.

It is envisioned that over time the cumulative effect of collecting transaction fees will allow those creating new blocks to "earn" more bitcoins than will be mined from new bitcoins created by the new block itself. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. [4]

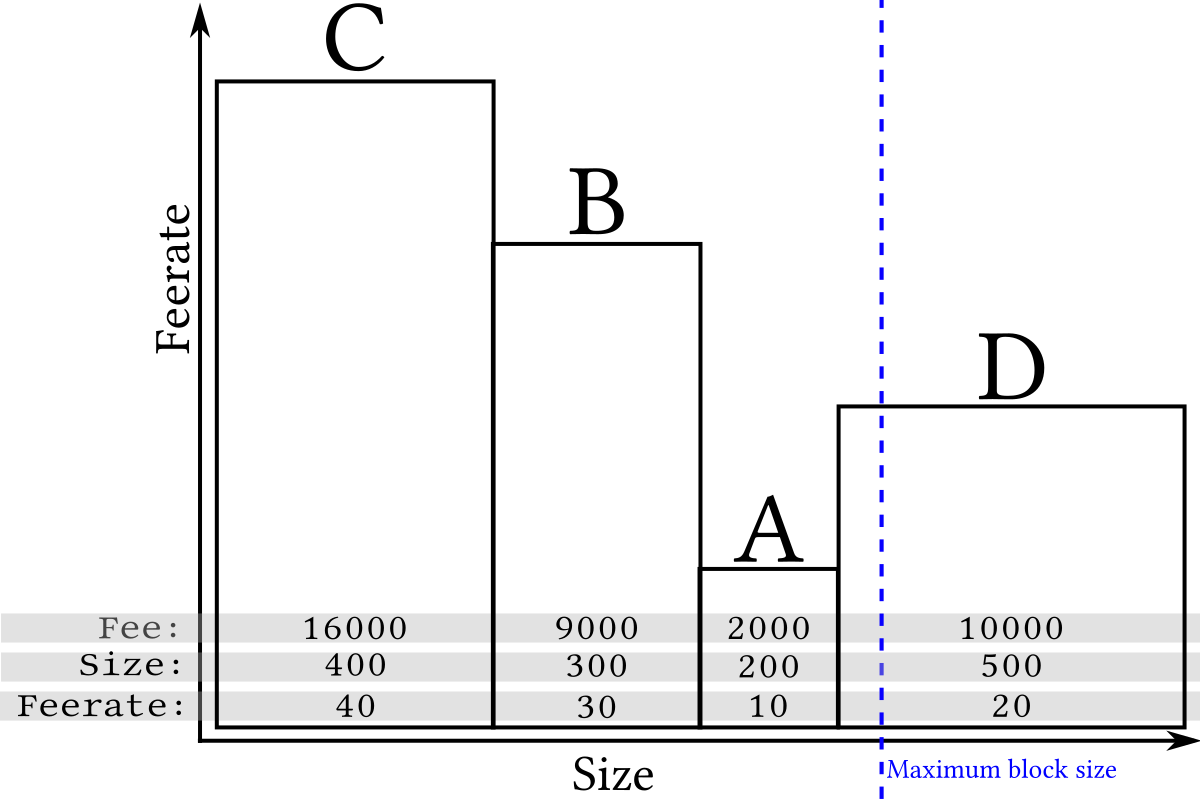

Perhaps the most important factor affecting how fast a transaction gets confirmed is its fee rate (often spelled feerate). This section describes why feerates are important and how to calculate a transaction's feerate.

Bitcoin transaction vary in size for a variety of reasons. We can easily visualize that by drawing four transactions side-by-side based on their size (length) with each of our examples larger than the previous one:

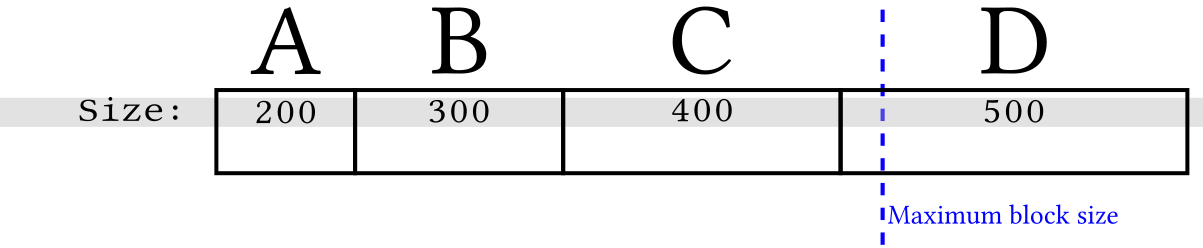

This method of illustrating length maxes it easy to also visualize an example maximum block size limit that constrains how much transaction data a miner can add to an individual block:

Since Bitcoin only allows whole transactions to be added to a particular block, at least one of the transactions in the example above can't be added to the next block. So how does a miner select which transactions to include? There's no required selection method (called policy) and no known way to make any particular policy required, but one strategy popular among miners is for each individual miner to attempt to maximize the amount of fee income they can collect from the transactions they include in their blocks.

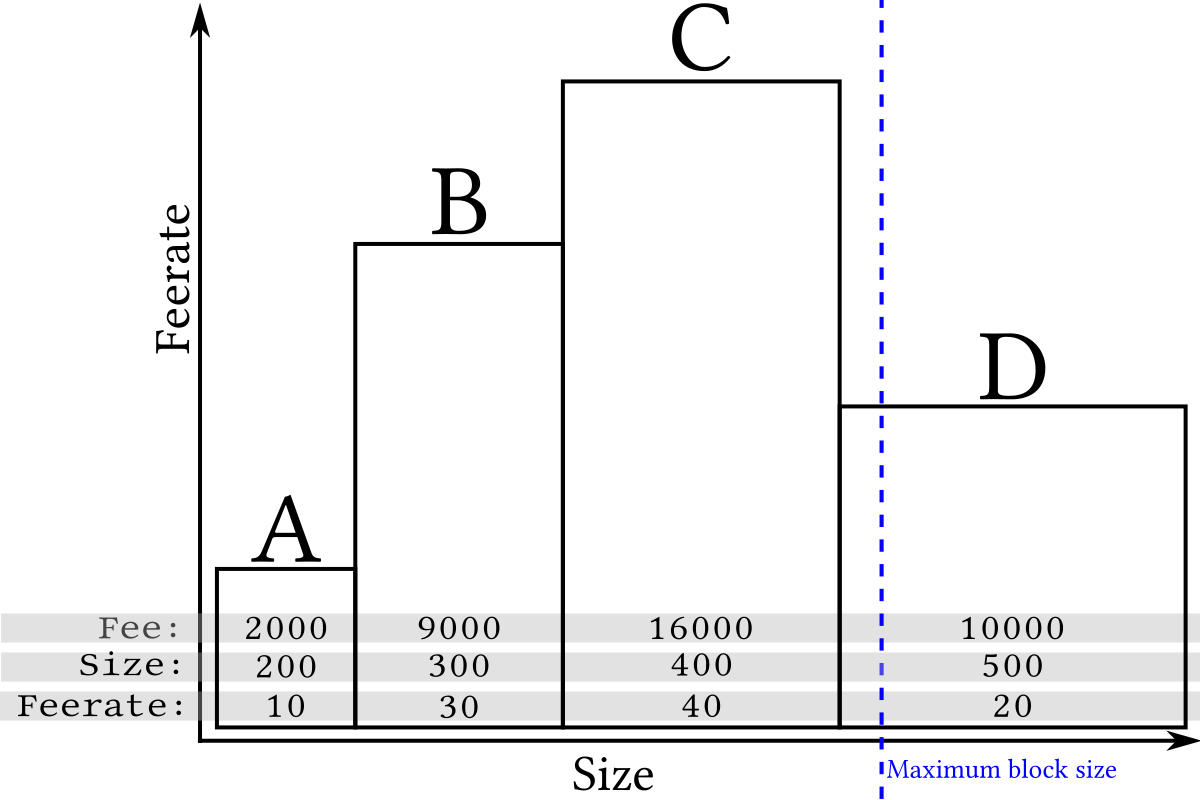

We can add a visualization of available fees to our previous illustration by keeping the length of each transaction the same but making the area of the transaction equal to its fee. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate:

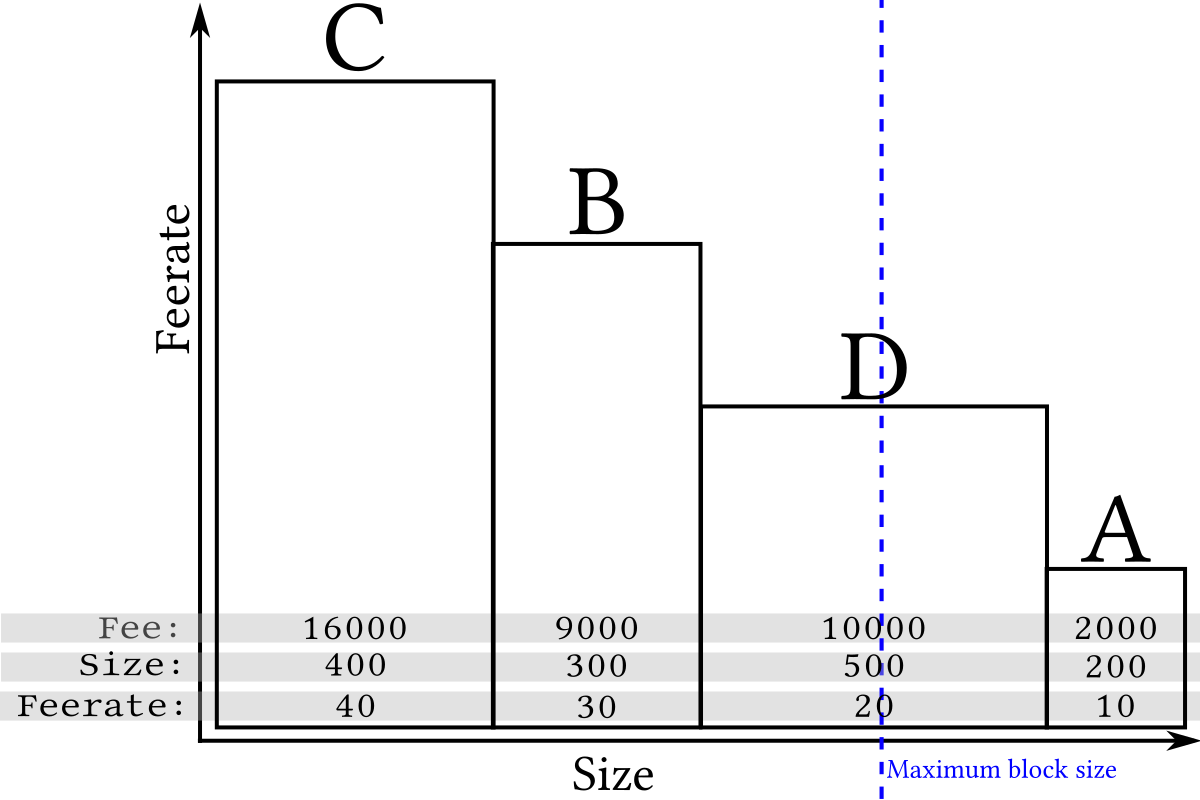

Although long (wide) transactions may contain more total fee, the high-feerate (tall) transactions are the most profitable to mine because their area is greatest compared to the amount of space (length) they take up in a block. For example, compare transaction B to transaction D in the illustration above. This means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:

Because only complete transactions can be added to a block, sometimes (as in the example above) the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit (still in highest-feerate order):

Excluding some rare and rarely-significant edge cases, the feerate sorting described above maximizes miner revenue for any given block size as long as none of the transactions depend on any of the other transactions being included in the same block (see the next section, feerates for dependent transactions, for more information about that).

To calculate the feerate for your transaction, take the fee the transaction pays and divide that by the size of the transaction (currently based on weight units or vbytes but no longer based on bytes). For example, if a transaction pays a fee of 2,250 nanobitcoins and is 225 vbytes in size, its feerate is 2,250 divided by 225, which is 10 nanobitcoins per vbyte (this happens to be the minimum fee Bitcoin Core Wallet will pay by default).

When comparing to the feerate between several transactions, ensure that the units used for all of the measurements are the same. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations.

Feerates for dependent transactions (child-pays-for-parent)

Bitcoin transactions can depend on the inclusion of other transactions in the same block, which complicates the feerate-based transaction selection described above. This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase the feerate of unconfirmed transactions.

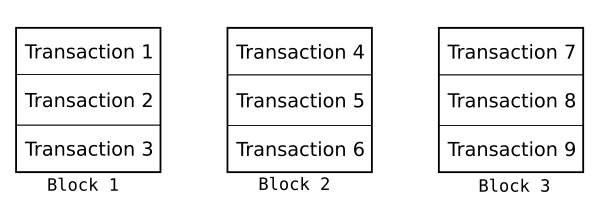

Each transaction in a block has a sequential order, one transaction after another. Each block in the block chain also has a sequential order, one block after another. This means that there's a single sequential order to every transaction in the best block chain.

One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B. Often this is easy to accomplish because transaction A appears in an earlier block than transaction B:

But if transaction A and B both appear in the same block, the rule still applies: transaction A must appear earlier in the block than transaction B.

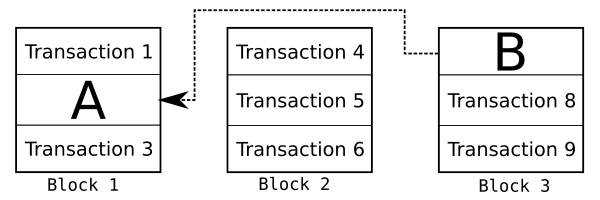

This complicates the task of maximizing fee revenue for miners. Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section above. But if both transaction A and B are unconfirmed, the miner cannot include B earlier in the block than A even if B pays a higher feerate. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Happily, it's only slightly more complex.

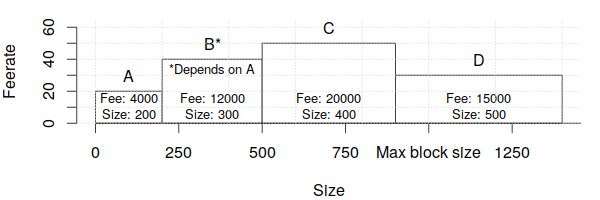

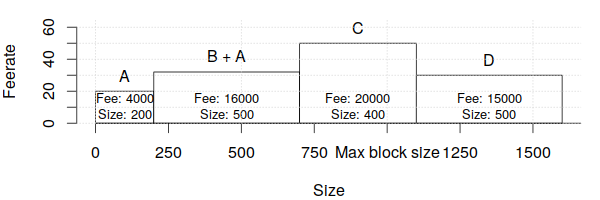

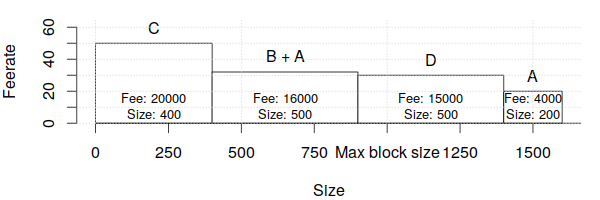

For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:

To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. To do that, every transaction available for inclusion in the next block has its feerate calculated for it and all of its unconfirmed ancestors. In the example, this means that transaction B is now considered as a combination of transaction B plus transaction A:

Note that this means that unconfirmed ancestor transactions will be considered twice or more, as in the case of transaction A in our example which is considered once as part of the transaction B+A group and once on its own. We'll deal with this complication in a moment.

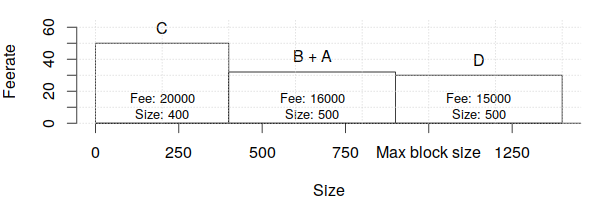

These transaction groups are then sorted in feerate order as described in the previous feerate section:

Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. In the example case, we remove the standalone version of transaction A since it's already part of the transaction B+A group:

Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. In this case, we can't, so no changes are made.

Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies.

Note: to ensure the algorithm runs quickly, implementations such as Bitcoin Core limit the maximum number of related transactions that will be collected together for consideration as one group. As of Bitcoin Core 0.15.0 (released late 2017), this is a maximum of 25 transactions, although there have been proposals to increase this amount somewhat.

For spenders, miner use of transaction grouping means that if you're waiting for an unconfirmed transaction that pays too low a feerate (e.g. transaction A), you can create a child transaction spending an output of that transaction and which pays a much higher feerate (e.g. transaction B) to encourage miners to confirm both transactions in the same block. Wallets that explicitly support this feature often call it child pays for parent (CPFP) because the child transaction B helps pay for the parent transaction A.

To calculate the feerate for a transaction group, sum the fees paid by all the the group's unconfirmed transactions and divide that by the sum of the sizes for all those same transactions (in weight units or vbytes). For example, if transaction A has a fee of 1,000 nanobitcoins and a size of 250 vbytes and transaction B has a fee of 3,000 nanobitcoins and a size of 150 vbytes, the combined feerate is (1,000 + 3,000)/(250 + 150), which is 10 nanobitcoins per vbyte.

The idea behind ancestor feerate grouping goes back to at least 2013 and saw several different proposals to add it to Bitcoin Core, with it finally becoming available for production with the August 2016 release of Bitcoin Core 0.13.0. [5]

Reference Implementation

The following sections describe the behavior of the reference implementation as of version 0.12.0. Earlier versions treated fees differently, as do other popular implementations (including possible later versions).

Users can decide to pay a predefined fee rate by setting `-paytxfee= ` (or `settxfee ` rpc during runtime). A value of `n=0` signals Bitcoin Core to use floating fees. By default, Bitcoin Core will use floating fees.

Based on past transaction data, floating fees approximate the fees required to get into the `m`th block from now. This is configurable with `-txconfirmtarget= ` (default: `2`).

Sometimes, it is not possible to give good estimates, or an estimate at all. Therefore, a fallback value can be set with `-fallbackfee= ` (default: `0.0002` BTC/kB).

At all times, Bitcoin Core will cap fees at `-maxtxfee= ` (default: 0.10) BTC. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. Finally, a user can set the minimum fee rate for all transactions with `-mintxfee=`, which defaults to 1000 satoshis per kB.

Note that a typical transaction is 500 bytes.

Including in Blocks

This section describes how the reference implementation selects which transactions to put into new blocks, with default settings. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more or fewer free transactions.

Then transactions that pay a fee of at least 0.00001 BTC/kb are added to the block, highest-fee-per-kilobyte transactions first, until the block is not more than 750,000 bytes big.

The remaining transactions remain in the miner's "memory pool", and may be included in later blocks if their priority or fee is large enough.

For Bitcoin Core 0.12.0 zero bytes [6] in the block are set aside for the highest-priority transactions. Transactions are added highest-priority-first to this section of the block.

The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0.00001 BTC is used to determine whether or not a transaction is considered "Free". However, the rule that all outputs must be 0.01 BTC or larger does not apply. To prevent "penny-flooding" denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to (by default) 15 thousand bytes per minute.

Welcome to 99Bitcoins’ simple Bitcoin Mining Calculator

This simple Bitcoin mining calculator will allow you to determine how much you can profit from a certain Bitcoin miner. It takes into account all relevant costs such as hardware, electricity and fees. See below for detailed instructions on how to use it.

Instructions on how to use the Bitcoin Mining Calculator:

- Enter the hash rate of the Bitcoin miner you’re planning to use

- Click on “Calculate mining revenue”

- That’s it! (we said it was simple….)

Note: If some values in the Bitcoin mining calculator don’t seem right (exchange rate, block reward, etc.) you can adjust them manually. However normally they are all up to date.

Keep in mind that:

- Revenue is shown in USD based on the current exchange rate, the exchange rate can (and probably will) change from time to time.

- Revenue is based on current difficulty to mine Bitcoins. Difficulty can (and probably will) change. From past experience it usually goes up as time goes by.

- Revenue IS NOT profit. You still have to take into account the cost of your mining hardware and the electricity to run it (and cool it down if needed).

If you want to know more about Bitcoin mining profitability check out this page.

How to Calculate Bitcoin Mining Profitability

Bitcoin mining secures the Bitcoin network. Without miners, Bitcoin could easily be attacked and even shut down. Since Bitcoin miners provide such an important service to the network, they are paid for their services! Each block mined by miners contains a block reward, which is paid out to the miner that successfully mined the block.

While mining today is very competitive, it is possible to run a successful and profitable mining farm. This post will outline the many factors that will determine whether or not your mining operation will be profitable.

Mining Hardware Costs

The upfront costs to pay for mining hardware is usually the largest expense for any new mining farm. Just like good computers cost more money, good mining hardware is expensive. The Antminer S7 is one currently the most efficient miner and costs $629. It only mines about $200 worth of bitcoins per month, meaning just based on hardware costs alone it will take more than three months to get back your money. This does not include electricity costs or equipment costs (more on this below).

When purchasing mining hardware, you will want to look at these metrics: Th/s and W/GH. Th/s, or sometimes Gh/s, measures a miner’s terahashes (Th/s) or gigahashes (Gh/s) per second and is called hash rate. A higher hash rate means a more powerful miner. You can use this simple calculator from Bitcoin Wisdom to determine how much money an amount of hash power will earn per month.

Hardware Efficiency

Hash power is not the end all for determining good miners, though. Miners use massive amounts of electricity. You want a miner that has both a high hash rate and uses the electricity provided efficiently.

W/GH is the metric used to display a miner’s efficiency. The Antminer S7 is also the most efficient miner available on the market, with 0.25 W/GH. Consider that the previous version of the S7, the S5, had an efficiency of just 0.51 W/GH. That means the S5 uses twice as much electricity per hash as the S7.

Buying a miner that has a low W/GH and also has good hash power is the key for any profitable mining operation.

Equipment Costs

Miners generate heat, and also need to be supplied with electricity. Unless you already have the needed parts, you will likely need to purchase cooling fans and power supplies.

Electricity Costs

Electricity costs can make or break any mining operation. A monthly electric bill means monthly costs on top of the upfront cost of the hardware.

China’s cheap electricity is one reason that nearly 60% of the Bitcoin network’s hashing power is located there. In the USA, for example, most mining hardware is run in Washington State, where there is cheap hydroelectricity. Venezuela’s crisis and cheap electricity has also made Bitcoin mining extremely profitable there.

Don’t discount electricity as a cost. It can make or break your mining operation.

Extra Heat and Weather

Creative miners in cold areas can use the heat generated by miners to heat their houses in the winter. If the heat generated by miners will partly replace your normal heating costs, it is one way to save money and improve your chances of profitability.

Miners in cold areas also have an advantage because they may not need to use extra fans to cool the hardware.

Bitcoin Mining Difficulty and Network Hash Power

The Bitcoin mining difficulty makes sure that Bitcoin blocks are mined, on average, every 10 minutes. A higher difficulty is indicative of more hash power joining the network.

As you would expect, more hash power on the network means that existing miners then control a lower percentage of the Bitcoin network hash power.

The image above shows the network hash power over the last 2 years. From September 2015 to February 2016, the network hash rate tripled. That means any miner who added no additional hardware to his farm would earn about 33% less bitcoins.

Hash rate and network difficulty are external factors that should be accounted for. It’s impossible to know difficulty months in advance. However, pay attention to advances in mining technology and efficiency to get a better idea of how the hash rate and difficulty may look down the line.

Bitcoin Price and Block Reward

Bitcoin’s price is volatile and can’t be predicted. You may calculate your profitability with a Bitcoin price of $500, but it won’t be accurate if the price drops to $300 the next day. Be prepared for price movements and understand that the Bitcoin price is a factor that you cannot control.

The Bitcoin block reward is at least one factor that is predictable. Every 4 years, the amount of bitcoins rewarded in each block is cut in half. The reward started at 50 bitcoins per block, and is now 25 bitcoins per block. In July 2016, this reward will fall to just 12.5 bitcoins per block.

Each block reward halving cuts miners’ shares of bitcoins in half. Miners can, however, see similar incomes after a reward halving if the fiat price of Bitcoin doubles.

Bitcoin Mining Calculators

To conclude, use a Bitcoin mining calculator to input your hardware information and electricity costs. This will give you a much better idea on your overall potential to run a profitable mining farm. Remember, however, that some factors like the Bitcoin price and mining difficulty change everyday and can have dramatic effects on profitability.

Bitcoin Fees Explained – Are Bitcoin Transaction Actually Free ?

Last updated on January 2nd, 2018 at 12:00 am

This video contains advanced concepts that were explained in previous videos. If you are new to Bitcoin it’s best to watch the previous tutorials before watching this one.

One of the major advantages of Bitcoin is that you can supposedly send money between any two points on earth for free. But if you’ve sent Bitcoins once or twice before you probably noticed that there are in fact transaction fees – so what’s going on here exactly ?

Before I explain how fees are calculated I want to explain what Bitcoin fees are. When miners order transactions into blocks inside the Blockchain they get paid twice – The first payment is by what you would call “the system” – which grants them a bounty for succeeding in entering their block of transactions. The second payment is the fees the users attached to the transactions that got included in that block.

But you don’t always have to pay these fees, there are certain rules that dictate if and when you need to pay them. Of course you can choose to disregard the rules and not attach a fee to your payment but it is then possible that your transaction will take a long time to be processed.

Rule #1 – Smaller amounts pay a fee

If the numbers of Bitcoins you are sending is smaller than 0.01 Bitcoins you will be required to pay a miners’ fee. This fee is required in order to prevent users from spamming the network with micro transactions.

Even if the whole transaction is more than 0.01 Bitcoins but the change you get back from your inputs is more than 0.01Bitcoins you will need to pay a fee.

Here’s a short example:

Let’s say you want to buy a watch for 1.999 Bitcoins. You use an input of 2 Bitcoins and receive back an input of 0.001 Bitcoins as change. Since the change is such a small amount you will require to pay an additional miner’s fee for it as well.

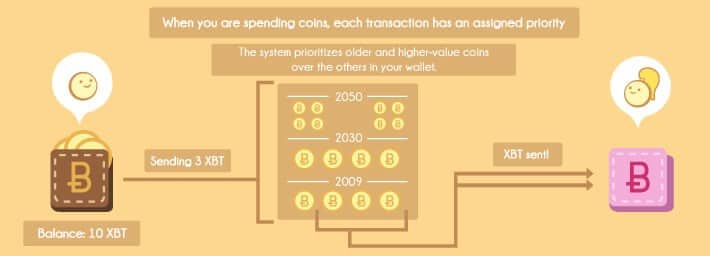

Rule #2 – Older coins have less fees

If the inputs you are sending in your transaction are older then there is a greater chance they won’t require a fee. Old coins means coins that haven’t been moved for a long time.

Rule #3 – Smaller transactions require less fees

Each transaction is made out of inputs. The less inputs used to compile a transaction, the less fees will be required. So if you are send 1 Bitcoin and use 4 inputs of 0.25 Bitcoins it is more likely that this will require a fee then if you were to send just 1 input of 1 Bitcoin.

Keep in mind that most times you won’t have that much control over whether your transaction requires fees or not. Your Bitcoin wallet will usually make the optimization of inputs for you so you will avoid fees when possible. Today’s miner fee is 0.0001 Bitcoin which is around $0.06 and is probably worth paying to get your transaction processed quickly.

The information in this post was built using the knowledge of AlefBit (Hebrew website) and BitcoinFees – Both amazing sources for Bitcoin information.

New Service Finds Optimum Bitcoin Transaction Fee

A new service is offering bitcoin users an answer to the common question: what is the optimum transaction fee?

Using network data from the past three hours, CoinTape lets users compare the current waiting times associated with various fee tiers, calculated in satoshis per byte.

It claims to predict delays with 90% confidence.

The default fee used by many bitcoin wallets is 10 satoshis (0.0000001) per byte. However, according to CoinTape, paying 20 satoshis (0.0000002 BTC) per byte will get you the fastest and cheapest transaction on the network.

For the average-sized bitcoin transaction, 645 bytes, this equates to a fee of 129 bits (0.000129 BTC ) (note that this is calculated on a transaction's size, not its dollar value).

The most popular fee ratio CoinTape lists, 41–50 satoshis per byte, used in more than 30,000 transactions today alone, is double this.

Network competition

As the number of bitcoin transactions rise, competition for space in each block is heating up. Miners prioritise transactions with the highest fees, working down the list until the block reaches its limit, commonly 750,000 bytes.

Transactions that don't make the cut remain in the miner's 'memory pool', a kind of bitcoin limbo. They may be included in future blocks depending on their priority or fee.

Currently, you can opt out of the fee altogether. However, there has been debate as to whether this should be raised, with a recent pull request to make a 10,000 satoshi minimum to reduce spam on the network.

CoinTape indicates that avoiding a fee is more likely to result in delays to your payment. It could take up to six blocks, or around one hour (blocks are created roughly every 10 minutes).

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Mining Calculator

Bitcoin Calculator Usage

All you need in order to make the Bitcoin Calculator display a result is to supply the speed of your mining hardware. In this simplest form the calculator will use the current Bitcoin difficulty, block value and USD/BTC rate for the calculations. However, the accuracy of the Bitcoin mining calculator improves the more honest information you supply.

Interpreting the Bitcoin Calculator Values

The mining results are based on multiple changing factors and are just valid for the given values, thus it's best practice to rely on the Bitcoin mining calculator for a short time frame only. While the Bitcoin difficulty has almost always risen after the expected validity of 14 days and thus might be somewhat forseeable, the Bitcoin exchange rate has proven to highly fluctuate, which might lead to a dramatically different outcome. Because of this dynamics we are only displaying results for at most one month.

Bitcoin. It's your money!

Be your own bank, take control of your own money and start using Bitcoin today!

Open Source

Coinbin is an open source web based wallet written in javascript and released under the MIT license which means it's free to use and edit.

We offer a fully transparent multisig solution which works seamlessly offline and with other bitcoin clients.

Raw Transactions

Create, verify, sign and broadcast custom raw transactions online with advanced features and minimal effort!

Quick access to an online wallet where only you have access to your own private keys & can calculate your own fee!

We support regular addresses, multisig, segwit / bech32 and stealth all with access to your own private keys!

Development

Use what we've built to write your own projects! See our documention (coming soon), or contribute at github.

Open Wallet browser based bitcoin wallet

Logout Welcome to your wallet, enjoy your stay!

New Address create a new address

Any keys used you will need to manually store safely as they will be needed later to redeem the bitcoins.

Address Options

You can use the advanced options below to generate different kind of keys and addresses.

New SegWit Address Smaller & Faster Transactions

Any keys used you will need to manually store safely as they will be needed later to redeem the bitcoins.

SegWit Address (Share)

Address Options

You can use the advanced options below to generate different kind of keys and addresses.

New Multisig Address Secure multisig address

Enter the public keys of all the participants, to create a multi signature address. Maximum of 15 allowed. Compressed and uncompressed public keys are accepted.

Enter the amount of signatures required to release the coins

Payment should be made to this address:

This script should be saved and should be shared with all the participants before a payment is made, so they may validate the authenticity of the address, it will also be used later to release the bitcoins.

New Time Locked Address Coins can be released only after a certain date

Use OP_CHECKLOCKTIMEVERIFY (OP_HODL) to create a time locked address where the funds are unspendable until a set date and time has passed.

Enter the public key that will be able to unlock the funds after the a certain date.

Enter the date and time or blockheight required to release the coins:

Payment should be made to this address:

This script should be saved and should be shared with all the participants before a payment is made, so they may validate the authenticity of the address, it will also be used later to release the bitcoins.

New HD Address making bip32 even easier

Use the form below to generate a master hierarchical deterministic address.

Address Options

You can use the advanced options below to generate different kinds of master addresses.

Transaction Create a new transaction

Use this page to create a raw transaction

Address, WIF key or Redeem Script:

Clear existing inputs when new inputs are loaded.

Null Data (80 byte limit, 40 bytes recommended)

Allow data to be sent within the transaction and stored in the blockchain by using OP_RETURN.

The locktime indicates the earliest time a transaction can be added to the block chain.

Replace By Fee (RBF)

The settings page can be used to select alternative networks of which you can retrieve your unspent outputs and broadcast a signed transaction into.

Enter the address and amount you wish to make a payment to.

Enter the details of inputs you wish to spend.

The transaction below has been generated and encoded. It can be broadcasted once it has been signed.

Bitcoin Fee Calculator

This page will give you a guide on the lowest fee to use to get your transaction included within the next few blocks. It works by predicting the size of a transaction and comparing it to another transaction in a recent block to determine an appropriate fee.

Recommended Fee: 0.00000000 BTC

for a transaction of 0 bytes

Regular Compressed 1 148 bytes *estimate

SegWit 0 0 bytes *estimate

MultiSig 0 0 bytes *estimate

Hodl Time Locked 0 0 bytes *estimate

Unknown 0 0 bytes *estimate

Regular p2pkh (1. ) 2 68 bytes *estimate

Regular p2sh (3. ) 0 0 bytes *estimate

Blockchain Data

This is based on us comparing your transaction against a very recent transaction found in a very recent block

Transaction Size: 0 bytes

Transaction Fee: 0.00000000

Satoshi per Byte: 0

Based on your data and this recently mined transaction we recommend a fee of 0.00000000 BTC to get it into the next few blocks

Enter your unsigned or signed hex encoded transaction below:

Estimate Input Size in bytes

Estimate Output Size in bytes

Verify transactions and other scripts

Enter the raw transaction, redeem script, pubkey, hd address or wif key to convert it into a readable format that can be verified manually.

Redeem Script

The above redeem script has been decoded

Signatures Required from

Transaction Script

The above script has been decoded

The above wif key has been decoded

Public key

The above public key has been encoded to its address

P2SH Segwit Address:

P2SH Segwit Redeem Script:

Bech32 Redeem Script:

HD Address

The key has been decoded

Key Derivation

The path of key derivation

Keys derived from the hd address provided

Sign Transaction once a transaction has been verified

Once you have verified a transaction you can sign and then broadcast it into the network.

The above transaction has been signed:

Broadcast Transaction into the bitcoin network

Enter your hex encoded bitcoin transaction

Development Javascript framework, API and more

About open source bitcoin wallet

Compatible with bitcoin core

What is Bitcoin?

Bitcoin is a type of digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank. See weusecoins.com for more information.

If you are looking to buy some Bitcoin try LocalBitcoins.com.

Information

Coinb.in is a free and open source project released under the MIT license, originally by OutCast3k in 2013. Discussion of the project can be found at bitcointalk.org during its early testing stages when its primary focus was to develop a proof of concept multisig solution in javascript.

Coinb.in is run and funded by the generosity of others in terms of development and hosting.

Coinb.in believes strongly in privacy, not only do we support the use of TOR, the site does not collect and store IP or transaction data via our servers nor do we store your bitcoins private key. We do route traffic via cloudflare using an SSL certificate.

We recommend that you first check our service status page and then blog page which has multiple guides. However if the problem persists you can contact us by emailing support

Please donate to 3K1oFZMks41C7qDYBsr72SYjapLqDuSYuN if you found this project useful or want to see more features!

Settings making coinb.in even better!

These simple settings below make coinb.in one of the most decentralized wallets in the world.

Select which network you'd like to use for key pair generation.

Bitcoin Fees Explained – Are Bitcoin Transaction Actually Free ?

Last updated on January 2nd, 2018 at 12:00 am

This video contains advanced concepts that were explained in previous videos. If you are new to Bitcoin it’s best to watch the previous tutorials before watching this one.

One of the major advantages of Bitcoin is that you can supposedly send money between any two points on earth for free. But if you’ve sent Bitcoins once or twice before you probably noticed that there are in fact transaction fees – so what’s going on here exactly ?

Before I explain how fees are calculated I want to explain what Bitcoin fees are. When miners order transactions into blocks inside the Blockchain they get paid twice – The first payment is by what you would call “the system” – which grants them a bounty for succeeding in entering their block of transactions. The second payment is the fees the users attached to the transactions that got included in that block.

But you don’t always have to pay these fees, there are certain rules that dictate if and when you need to pay them. Of course you can choose to disregard the rules and not attach a fee to your payment but it is then possible that your transaction will take a long time to be processed.

Rule #1 – Smaller amounts pay a fee

If the numbers of Bitcoins you are sending is smaller than 0.01 Bitcoins you will be required to pay a miners’ fee. This fee is required in order to prevent users from spamming the network with micro transactions.

Even if the whole transaction is more than 0.01 Bitcoins but the change you get back from your inputs is more than 0.01Bitcoins you will need to pay a fee.

Here’s a short example:

Let’s say you want to buy a watch for 1.999 Bitcoins. You use an input of 2 Bitcoins and receive back an input of 0.001 Bitcoins as change. Since the change is such a small amount you will require to pay an additional miner’s fee for it as well.

Rule #2 – Older coins have less fees

If the inputs you are sending in your transaction are older then there is a greater chance they won’t require a fee. Old coins means coins that haven’t been moved for a long time.

Rule #3 – Smaller transactions require less fees

Each transaction is made out of inputs. The less inputs used to compile a transaction, the less fees will be required. So if you are send 1 Bitcoin and use 4 inputs of 0.25 Bitcoins it is more likely that this will require a fee then if you were to send just 1 input of 1 Bitcoin.

Keep in mind that most times you won’t have that much control over whether your transaction requires fees or not. Your Bitcoin wallet will usually make the optimization of inputs for you so you will avoid fees when possible. Today’s miner fee is 0.0001 Bitcoin which is around $0.06 and is probably worth paying to get your transaction processed quickly.

The information in this post was built using the knowledge of AlefBit (Hebrew website) and BitcoinFees – Both amazing sources for Bitcoin information.

Комментариев нет:

Отправить комментарий