Bitcoin splits in 2

Bitcoin-themed balloons at the "Inside Bitcoins: The Future of Virtual Currency Conference" in New York. Reuters/Lucas Jackson

Bitcoin-themed balloons at the "Inside Bitcoins: The Future of Virtual Currency Conference" in New York. Reuters/Lucas Jackson

Bitcoin power brokers were unable to come behind a single solution that would have preserved a unified cryptocurrency by Tuesday morning's deadline.

As such, the digital currency has officially forked and split in two: bitcoin cash and bitcoin.

Miners were able to seek out bitcoin cash beginning Tuesday morning, and the cryptocurrency-focused news website CoinDesk said the first bitcoin cash was mined at about 2:20 p.m. ET.

"There seems to be some technical issues that might be slowing it down, but yes, the fork has happened," Peter Borovykh of Blockchain Driven, a blockchain technology company, told Business Insider earlier on Tuesday.

Miners are the folks who solve complex computer problems using software to unleash digital coins into the market. It took a couple of hours after the official fork for miners to unlock the first bitcoin cash coins.

"It seems as if people overestimated the mining power, or the support from miners — hence, it is taking far longer than most expected," Iqbal Gandham, the UK managing director at the social investment network eToro, said in a statement sent to Business Insider just before the split.

Bitcoin was the first digital currency built on blockchain technology, in which transactions are independently verified by the network without the need of a middleman like a bank. Bitcoin cash is built on the same blockchain network as bitcoin, but the new software increases the size of the "blocks" that make up the network to allow it to process more information.

Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly 10-year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds.

Bitcoin power brokers have been squabbling over the rules that should guide the cryptocurrency's blockchain network.

On one side are the so-called core developers. They are in favor of smaller bitcoin blocks, which they say are less vulnerable to hacking. On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable.

Until last week, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support.

Servers for data storage seen at Advania's Thor Data Center in Hafnarfjordur, Iceland. Thomson Reuters

Then bitcoin cash came along. The solution is a fork of the bitcoin system. The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes.

Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets.

"A group of miners who didn't like SegWit2x are opting for this new software that will increase the size of blocks from the current 1 megabyte to 8," Morris told Business Insider.

To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency.

Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. But that doesn't mean the value of investors' holdings will double.

Because bitcoin cash will initially draw its value from bitcoin's market cap, it will most likely cause bitcoin's value to drop by an amount proportional to its adoption. Bitcoin was already trading down by 5.78% at $2,715 on Tuesday following word that bitcoin cash had gone live. Morris told Business Insider that bitcoin cash was trading in the futures market for about $200 to $400 last week, suggesting that's the range it would fall in during regular trading.

Kraken, a bitcoin exchange, tweeted Tuesday morning that it was experiencing delays getting bitcoin cash to show on user's accounts.

"Please note," the exchange said, that bitcoin cash "balances have not been credit yet." It added that it was "working to credit as soon as possible."

Numerous exchanges have said they won't back bitcoin cash.

"In the event of two separate blockchains after August 1, 2017 we will only support one version," David Farmer, the director of Biz Ops at Coinbase, a cryptocurrency exchange, wrote in a blog post. "We have no plans to support the bitcoin cash fork."

Coinbase has served nearly 9 million customers across 32 countries, according to the firm's website. The firm has enabled the exchange of over $20 billion worth of digital currency.

But just because some big players won't get behind it doesn't necessarily mean bitcoin cash will be a dud or that it couldn't eventually usurp the original bitcoin. Miners may rally behind bitcoin cash if it turns out to be the better digital currency.

"Bitcoin cash has a chance to become the dominant cryptocurrency contingent upon its ability to gain trust and support from both current and new players as well as security of its network," Borovykh of Blockchain Driven said. "Due to, at least temporary, solution of the scalability issues, bitcoin cash could attract more new capital to the entire crypto space, thus helping increase overall market cap."

Arthur Hayes, the CEO of BitMEX, a bitcoin derivative exchange, told Business Insider he thought a fork would benefit the cryptocurrency in the long run after some short-term volatility and confusion.

"There are people with billions of dollars of skin in the game," Hayes said. "And they will ultimately go with the superior bitcoin network, and the market will follow."

Bitcoin is expected to 'fork' today, and its price could take a dramatic hit — here's what that means

Bitcoin is about to fork in two. Flickr/tetsuya yamamoto Bitcoin users have found themselves in the middle of a civil war as developers and miners have disagreed over the future of the cryptocurrency. And it could cause bitcoin to fork.

On one hand, the core developers want to keep the blocks that make up bitcoin's network limited in their size to protect it from hacks. On the other hand, some miners want to make the blocks bigger to improve the network's speed.

That disagreement means a bitcoin "fork" could occur on Tuesday as the deadline for a decision is set for 8:20 a.m. ET.

According to a blog post from bitcoin exchange Coinbase, a fork is "change to the software of the digital currency that creates two separate versions of the blockchain with a shared history." Coinbase warns that forks can be both temporary or permanent and occur because users may disagree on the best path forward for the cryptocurrency, which could ultimately lead to it splitting in two.

Forks have occurred in cryptocurrencies before. Bitcoin's rival, Ethereum, experienced its own fork in 2016, eventually leading to the creation of the form of the cryptocurrency we know today.

As for how bitcoin will respond to Tuesday's decision, no one knows. But the majority of bets placed on the event are predicting the price will fall from here. Of the 470 people who bet on the event on Bodog, "310 people think the price will dip below $2,000 per coin," according to a company spokesperson.

"No matter what happens on August 1, this date will be considered an important event preceded and followed by increasing levels of volatility in prices of Bitcoin and potentially its peers (Litecoin and Ethereum)," Stefan Qin and Justin Ledbetter of Virgil Capital told Business Insider. "Scalability is an issue, and short-term risks of resolving it are much smaller than the long-term risks of not doing anything about it."

Bitcoin is up 189% in 2017, trading at $2,808 a coin.

Markets Insider

Markets Insider

Bitcoin Prepares For an Ugly Breakup

On Friday, a group of major cryptocurrency exchanges announced their planned response to the split of bitcoin into two separate pools of currency and processing power. That event, known as a “hard fork,” is viewed as increasingly likely among bitcoin leaders, as a years-long debate about the network’s technical limitations and broader vision comes to a head.

The marketplaces, including marquee portals BitStamp and Kraken, said on Friday that if a hard fork occurs, they will let users trade both conventional bitcoin, and any alternate version that emerges. The most likely bitcoin spinoff is known as Bitcoin Unlimited, which the world’s largest bitcoin server group, or “mining pool,” recently announced it would back.

Bitcoin has been pushed to the verge of this split by a years-long debate about what’s known as block size. Under bitcoin’s existing code, there’s a tight limit on the amount of data that can be included in a batch of transactions, and as the network has grown in popularity, that limit has slowed the processing of payments. Moves that once took seconds to clear can now take hours, and all players seem to agree that some sort of change is necessary.

But there are competing visions about any fix’s goals and methods. One bitcoin entrepreneur has summarized the divide as between a Bitcoin Unlimited contingent updating bitcoin to support many small transactions, and a Bitcoin Core cadre who believe in smaller changes, fewer transactions, and more stability.

The decentralized, even anarchistic nature of bitcoin administration makes the process of change unwieldy. Bitcoin hosts (“miners”) essentially ‘vote’ on any system changes by choosing what software to run. But if large groups choose to run mutually incompatible code, they generate separate transaction records, and in essence, entirely separate pools of currency.

Currently, according to Silicon Angle, nearly 40% of bitcoin miners support Bitcoin Unlimited—not enough to force a system-wide changeover to the new protocol, but enough to establish a splinter group.

The exchanges’ announcement may help smooth the potential chaos of a hard fork. The crypto world got a preview last year when Ethereum, a major bitcoin alternative, underwent a planned fork to reverse the results of a multimillion dollar hack. That unexpectedly led to two competing systems, which reportedly interfered with one another’s operations.

If bitcoin’s big players want to go their separate ways, then, some advance planning seems very healthy.

Bitcoin Just Avoided a Massive Breakup, But It's Getting a Little One Instead

The Bitcoin community has finally done what for years seemed impossible, pulling together to approve a software upgrade, known as Segwit2x, intended to increase network capacity. That has forestalled the looming threat of a potentially damaging “fork” that could have split the network.

But, unsurprisingly, not all of Bitcoin’s players are happy with the solution. A relatively small faction, spearheaded by former Facebook engineer Amaury Sechet, still believes that Segwit2x doesn’t go far enough in scaling Bitcoin’s capacity. Sechet’s faction says that on August 1st, they’ll launch a fork known as Bitcoin Cash, and take some of Bitcoin’s processing power with them.

Bitcoin Cash is planned to have a bigger “block size” than Bitcoin after Segwit2x, ostensibly giving it more capacity to handle transactions with low fees. But it won’t implement the SegWit upgrade that allows more transactions to be handled by secondary systems.

Bitcoin proper will be basically unaffected by the creation of the new cryptocurrency, and all holders of Bitcoin will get equivalent funds in Bitcoin Cash on the day of the fork. A futures market for Bitcoin Cash has already emerged, and currently values it at around 13% of Bitcoin’s price. That means that when the split happens, something like $6 billion in new market value will be created from thin air.

Whether that value lasts, though, will hinge on whether cryptocurrency leaders and investors believe in Bitcoin Cash’s technical vision—and so far, the signals are decidedly mixed. Many prominent cryptocurrency exchanges, including Coinbase and Bitstamp, have said they won’t support Bitcoin Cash. Investors who want a piece of the action are being advised to move their Bitcoins either to a wallet they control directly, or to an exchange that has pledged to pass Bitcoin Cash along to them, currently including Kraken and Bitfinex.

Upcoming Bitcoin Forks in 2018 – Here’s What to Watch For

Last updated on May 8th, 2018 at 03:58 pm

Back in August 2017, the first coin created from a Bitcoin fork came into existence: Bitcoin Cash. However, since then, two other coins have also been “forked” from Bitcoin: Bitcoin Gold (October 2017) and Bitcoin Diamond (November 2017). Most people are still wondering what these forks are, how they happen, and how one can profit from them. Here’s my take on all of this.

What you will learn in this video

- What is a Bitcoin fork?

- Why should you be interested in forks?

- What are the dangers surrounding forks?

- How to safely claims coins from hard forks?

- What are the upcoming Bitcoin forks?

What the hell is a Bitcoin fork?

We discussed Bitcoin forks back when Bitcoin Cash was just coming out. If you want the full explanation, you can read the original post. If you want the quick and dirty explanation, keep on reading this post.

A fork is basically an alteration of the current Bitcoin code (or protocol). It means someone is changing the rules.

Imagine you’re playing a game with thousands of people from all around the world and then someone says, “Let’s change the rules.” Normally, for the game to work properly, everyone needs to agree on the rules being changed. If that happens, then the change is implemented and everything continues as normal.

If there isn’t a large consensus about the change, two versions of the game will be created (one with the old rules and one with the new rules)—in other words, there will be a fork in the game.

The same can happen with Bitcoin’s code. Generally speaking, when a fork happens, you’ll have an “original Bitcoin” and a “new Bitcoin.” For example, Bitcoin Cash changed the block size from 1 MB to 8 MB so more transactions could be processed with each block. There were those who supported this change and switched to a new coin called Bitcoin Cash (or Bcash), and there were those who decided to stay with the original rules and keep using the original Bitcoin.

Of course, this is a very simplified explanation of forks—not all forks are created equal. There are soft forks, which allow the new rules to play well with the old rules, and there are hard forks, which don’t allow this and create a totally different coin. All of the Bitcoin forks you’re hearing about lately are actually hard forks.

Why should I even care about a fork?

Great question! There are several reasons you should care about a fork:

- You may want to switch over to the new rules and the new coin because you think it’s better than using the original Bitcoin.

- The fork could have an impact on the Bitcoin community, Bitcoin’s adoption, and even Bitcoin’s price (we’ll get to that later on).

- You may want to profit from the fork by selling the new coins that are delivered to every Bitcoin holder.

Wait, what? I get free coins?

Yes. Let’s go back to our game analogy.

Imagine your game has been running for a very long time, and you’ve managed to accumulate a considerable amount of points in it. Now someone wants to change the rules but doesn’t want everybody to lose their points, so the new game will start at a certain point in time, and everyone will have the same amount of points they accumulated up until that point.

If, for example, you had 150 points in the original game, you could switch to the new game and still have 150 points. You could also play both games in parallel and have 150 points in each. Now let’s see how this works with Bitcoin.

When a fork occurs, the people who decide on forking Bitcoin say, “Look, we don’t like the original rules—we want to create new rules. So starting from block number 453,342 (for example), we’ll change to the new rules.” Anyone who had Bitcoins at the time of the fork will now have two Bitcoins: the original one and the new one. You can decide which one to use, or you can even use both.

If for example, you have 1 Bitcoin in your possession when the fork occurs, you’ll still have that 1 Bitcoin, but you’ll also be able to claim 1 “new Bitcoin” on the network that’s running the “new Bitcoin rules” (since that coin didn’t start out from scratch and is continuing the original Bitcoin’s history).

It can get a bit confusing, but the main point to remember is this:

When a Bitcoin fork occurs, anyone holding any amount of Bitcoins will get the same amount of the new currency as well. This doesn’t happen automatically; you do need to claim these coins, but each new coin has a different claiming mechanism, and we won’t be able to cover them all.

Once you claim your new coins, you can then hold on to them or sell them if they’re being traded on an exchange. This means that you can basically generate money for nothing; all you did was claim coins from thin air and sell them on an exchange.

Easy money! Or is it?

The dangers of Bitcoin forks

When the forking trend started out with Bitcoin Cash, it seemed that the fork was a legitimate way of expressing discontent with the road Bitcoin was taking (hence a fork in the road).

However, it seems like the more recent forks are pretty similar to each other, and the main reason for creating them has more to do with marketing than actual ideology. If someone thinks they can create a better coin than Bitcoin, they can create a brand new altcoin—there’s no need to create a Bitcoin clone.

Devs decide to fork Bitcoin for three main reasons (in my opinion, at least):

- Marketing buzz: Bitcoin forks are the new ICOs. Everyone is looking to get free coins, so people are actively looking for information (you’re reading this article, aren’t you?). What better way to get eyes on your project without a lot of work? Just say you’re forking Bitcoin and you’re done.

- Quick money for devs: Some of these forks aren’t really copies of Bitcoin’s history. The rules are changed in such a way that devs receive a large initial amount of the new coin, which they can then dump onto the market once the coin starts trading.

- Scams: Some forks are flat-out scams. There’s already been one reported scam: Bitcoin Platinum. Scams can come in the form of forks that are created to short Bitcoin’s price (e.g., Bitcoin Platinum) or something more elaborate such as forks that are created to steal users’ real Bitcoins in the process of claiming the new coin (e.g., Bitcoin Gold fake wallet).

As you can see, claiming coins from a fork entails a considerable amount of risk from the user’s side.

How to safely claim coins from a fork

First, I’d suggest reading a bit about the project. Find out who the developers are, what their track record is, how far along they are in their road map, what have other publications written about them, and the like. If all that makes sense to you, then perhaps the fork is indeed legit.

However, even if a fork is legit, it doesn’t mean it’s worth going through the hassle of claiming its coins. The claiming process is usually complicated, and you risk losing your coins if you don’t know exactly what you’re doing. Say you’re holding 0.5 Bitcoins, and you’re eligible for 0.5 Bitcoin Gold. I’m not sure the immediate profit is worth the risk. This is, of course, a personal decision you should make.

For example, one of the most important things that a forked coin has to implement is something called replay protection. It basically means that the network will be able to separate the new coin from the original one and not accidentally send the original one to the new coin address when claiming the forked coin.

If, in the end, you decide you want to claim your coins, I suggest that you follow guides only from well-known wallets (i.e., TREZOR, Ledger, etc.) or credited publications. Keep in mind that in the end, it’s your money, and no publication will be able to take responsibility if you do something wrong along the way—even if they accidentally published misinformation (as we unfortunately once did in the past).

What I’m trying to say is that it’s a risky business. Make sure to understand the process and make your own choices.

If you do decide to claim forked coins you need to make sure your Bitcoins are in a wallet that allows you access to the private keys. This means you need to get your Bitcoins off exchanges and other web wallets before the fork occurs. If you don’t have access to your private keys you won’t be able to extract the forked coin.

Once the fork occurs you’ll need to do two things:

- Send your Bitcoins to a new wallet with a different private key

- Upload your old private key to a wallet that supports the forked coin

Since each fork is different it’s hard to say which wallet will support each fork. Usually the official fork site will display the wallets and exchanges that support it. If you leave your coins on an exchange that supports the fork there’s a good chance you can avoid extracting the coins yourself and that the exchange will do it for you, however you are basically at their mercy.

Remember, the one rule you should always follow before trying to claim any coins is to move your Bitcoins to a new wallet with a new seed phrase. This move will reduce the chances of you losing your Bitcoin to almost zero.

Upcoming Bitcoin forks for 2017-2018

Now that we’ve got that out of the way, let’s review the upcoming Bitcoin forks.

IMPORTANT: None of these forks have been verified by our team. You are forking your coins at your own risk. Please make sure to do proper research before taking action on any fork.

Super Bitcoin (SBTC)

Fork Date: 12/12/2017 — Block 498,888

Changes from original protocol: smart contracts, Lightning Network, zero-knowledge proofs, 8 MB block size

Distribution method: 1 BTC = 1 SBTC

Super Bitcoin aims to “make Bitcoin great again,” although the developers accept the idea as an experiment. It incorporates the best proposals from the Bitcoin community to see how all the forefront technologies combine.

BitcoinX (BCX)

Fork Date: 12/12/2017 — Block 498,888

Changes from original protocol: combining zero-knowledge proof, smart contract, DPOS consensus, crosschain technology data, SegWit, Lightning Network

Distribution method: 1BTC = 10,000 BCX

BitcoinX is designed to release the full potential of Bitcoin in a scalable way for the future. By combining speed, smart contracts, and privacy, the development team is looking to build a cryptocurrency to suit modern society.

Lightning Bitcoin (LBTC)

Fork Date: 18/12/2017 — Block 499,999

Changes from original protocol: DPoS Consensus, three-second block time, 2 MB block size, no difficulty adjustment, smart contracts

Distribution method: 1BTC = 1 LBTC

Lightning Bitcoin pushes the boundaries of blockchain speed with bigger block sizes that are created in seconds rather than minutes. The addition of smart contracts and DPoS consensus should allow for a truly high-speed autonomous network.

Bitcoin God (GOD)

Fork Date: 25/12/2017 — Block 501,225

Changes from original protocol: no pre-mine, proof of stake, smart contracts, Lightning Network, large block size

Distribution method: 1 BTC = 1 GOD

Some details are still to be confirmed for Bitcoin God, but the branding is rather catchy. Proof of stake, smart contracts, and Lightning Network will make for an interesting change to the usual Bitcoin protocols.

Bitcoin Cash Plus (BCP)

Fork Date: 2/1/2018 — Block 501,407

Changes from original protocol: No pre-mine, SigHash, emergency difficulty adjustment (EDA), 8 MB block size

Distribution method: 1BTC = 1 BCP

Bitcoin Cash Plus throws more confusion into the Bitcoin industry. Is it that much different from the hotly tipped Bitcoin Cash? Zero pre-mining is a healthy way to start, but little information is available on its website.

Bitcoin Uranium (BUM)

Fork Date: Around 31/12/2017 — Block not yet announced

Changes from original protocol: No pre-mine, one-minute block time, SegWit, unique address format

Distribution method: 1BTC = 1 BUM

Bitcoin Uranium wants to send rippling shockwaves through Bitcoin and reinitiate a truly decentralized currency. Quick block times combined with Equihash will allow GPU/CPU mining aims to open up mining to everybody.

Bitcoin Atom (BCA)

Fork Date: January 2018 — Block 505888

Changes from original protocol: Hybrid consensus (PoS and PoW), Lightning Network, Hash time-locked contracts

Distribution method: 1 BTC = 1 BCA

Bitcoin Atom focuses its efforts on consensus modeling and off-chain transactions. A new form of combined Proof of Stake and Proof of Work may allow for increased security, while the Lightning Network creates “atomic swaps.”

Bitcoin Silver (BTCS)

Fork Date: December 2017 — Block not yet announced

Changes from original protocol: 30-second block time, SegWit, every block difficulty adjustment

Distribution method: 1BTC = 1 BTS

Bitcoin Silver remains mysterious, especially given that there’s no working website or cohesive Github. Speedy block times mixed with SegWit is an interesting scaling idea, but we’ve yet to see any details that are set in stone.

UnitedBitcoin (UB)

Fork Date: 12.12.17 – Block 498777

Changes from original protocol: No-premine, 8mb block size, Segwit, Replay protection, Smart contracts, Lightning network

Distribution method: 1BTC = 1UB

UnitedBitcoin is literally trying to make everyone happy. It takes a mesh of BTC, BCH and Ethereum ideas and combines them on its blockchain. It’s a lot to take in for one cryptocurrency but why not have it all?

Bitcoin Diamond (BCD)

Fork Date: 24.11.17 – Block 495866

Changes from original protocol: No-premine, 8mb block size, Replay protection, Encrypted amounts, 210 million supply

Distribution method: 1BTC = 10BCD

Bitcoin Diamond’s design is another build on Bitcoin Cash with the 8mb block size. Diamond builds privacy and extra supply into this model. It wants to make Bitcoin more affordable whilst keeping transaction amounts encrypted.

Bitcoin Oil (OBTC)

Fork Date: 12.12.17 – Block 498888

Changes from original protocol: No-premine, Proof of Stake, CPU mining, 1.5 minute block interval, Every block difficulty adjustment, 2mb block size

Distribution method: 1BTC = 1OBTC

Bitcoin Oil has no actual relation to the real world commodity, it is simply a metaphor for the project. There are millions of unclaimed fork coins and token laying dormant, using OBTC’s blockchain protocol unclaimed coins are redistributed as block rewards.

Bitcoin World (BTW)

Fork Date: 17.12.17 – Block 499777

Changes from original protocol: 210 billion supply, 8mb block size, Equihash PoW, Replay protection

Distribution method: 1BTC = 10000BTW

Bitcoin World is another effort to bring Bitcoin back to the ordinary person. Added supply level coupled with Equihash mining should lower prices while making mining more accessible.

Bitcoin Stake (BTCS)

Fork Date: 19.12.17 – Block 499999

Changes from original protocol: Proof of Stake consensus

Distribution method: 1BTC = 100BTCS

Bitcoin Stake focuses on its consensus method for a more sustainable cryptocurrency. The Proof of Stake mining protocol breaks the control of large PoW miners and offers a more eco friendly option.

Bitcoin Faith (BTF)

Fork Date: 19.12.17 – Block 500000

Changes from original protocol: Zero knowledge privacy, Smart contracts, 8mb block size, Lightning network

Distribution method: 1BTC = 1BTF

You’ve got to have a little faith in Bitcoin right? But which one? Bitcoin Faith. A mixture of leading features including 8mb block size and lightning network aims to set up a brighter future for cryptocurrency.

Bitcoin Top (BTT)

Fork Date: 26.12.17 – Block 501118

Changes from original protocol: 8mb block size, Segwit, Replay protection,

Distribution method: 1BTC = 1BTT

Bitcoin Top aims to be ‘better than better’, ‘the top Bitcoin’ but it has a long way to go after a late 2017 fork. 8mb block size coupled with Segwit makes up its way of scaling cryptocurrency.

Bitcoin File (BIFI)

Fork Date: 27.12.17 – Block 501225

Changes from original protocol: Increased block size, Smart contracts, Content network

Distribution method: 1BTC = 1000BIFI

Bitcoin File aims to be more than just a currency, it wants to provide a global content network. Using a fork of the Bitcoin blockchain, BIFI is trying to create an effective, secure and environmentally friendly storage network.

Bitcoin Segwit2X X11 (B2X)

Fork Date: 28.12.17 – Block 501451

Changes from original protocol: Segwit2x X11 encryption algorithm, Upto 4mb block size, 2.5 minute block time, Every block difficulty adjustment, Reply protection

Distribution method: 1BTC = 1B2X

Not to be confused with the previous cancelled fork SegWit2X. This is a different operation but in many ways very similar. Segwit with increased block size resembles the original fork proposal and B2X now adds a 2.5 minute block generation time.

Bitcoin Pizza (BPA)

Fork Date: 01.01.18 – Block 501888

Changes from original protocol: Directed Acyclic Graph technology (DAG)

Distribution method: 1BTC = 1BPA

Bitcoin Pizza is forking the legacy blockchain data and moving forward with a completely different angle. DAG technology, as we have seen with the IOTA altcoin, is thought of as a faster network style, although trust and consensus are issues with Pizza.

Bitcoin Smart (BCS)

Fork Date: 21.01.18 – Block 505050

Changes from original protocol: 2.1 billion supply, Equihash mining, 8mb block size, Segwit, Replay protection, No premine, Smart Contract

Distribution method: 1BTC = 100BCS

Bitcoin Smart integrates a staggering selection of features grabbing protocols from everywhere. The highlights of Segwit, 8mb blocks and equihash are accompanied by smart contracts for a really nifty selection.

Bitcoin Interest (BCI)

Fork Date: 22.01.18 – Block 505083

Changes from original protocol: Equihash mining, Savings feature, Every block difficulty adjustment, Segwit, Replay protection, Earn interest

Distribution method: 1BTC = 1BCI

Bitcoin Interest has the added bonus of a savings feature where investors can actually earn interest on their funds. Segwit and regular difficulty adjustment should also make it a swift cheap payment network.

Quantum Bitcoin (QBTC)

Fork Date: 28.01.18 – Block TBA

Changes from original protocol: Lightning Network, 8mb block size, Privacy protection, Replay protection, Pow + PoS consensus, Smart Contracts

Distribution method: 1BTC = 1QBTC

Quantum Bitcoin aims to take some of the biggest and best Bitcoin ideas and amalgamate them into a single package. Big blocks, Lightning Network and privacy makes for another speculative project.

Bitcoin LITE (BTCL)

Fork Date: 30.01.18 – Block TBA

Changes from original protocol: Proof of Stake consensus, Privacy options

Distribution method: 1BTC = 1BTCL

Bitcoin LITE is nothing special, in fact it is aiming to be to Bitcoin what silver is to gold. Sound familiar? This is more of a Litecoin competitor that is to include a premine. Nothing of note here really.

Bitcoin Ore (BCO)

Fork Date: 31.12.17 – Block 501949

Changes from original protocol: Proof of Capacity consensus, 8mb block size, 5 minute block time, Replay protection

Distribution method: 1BTC = 1BCO

Bitcoin Ore uses a new consensus style called Proof of Capacity. It touts the more energy efficient cheaper mining solution as the future of Bitcoin. Steady roll out over 2018 will be interesting to watch.

Bitcoin Private (BTCP)

Fork Date: January 2018 – Block TBA

Changes from original protocol: Private transactions

Distribution method: 1BTC = 1BTCP + 1ZCL = 1BTCP

Bitcoin Private forks both Bitcoin Legacy and Zclassic to create a privacy coin. With more information still to be released we will have to wait and see how this one shapes up.

Your ultimate guide to the upcoming fork that’s splitting the Bitcoin community

There’s a lot of fuss in the bitcoin community about what will happen on August 1. Will the cryptocurrency split into two new ones? Will it not? What is BIP 91? What is BIP 148? What is SegWit?

The incredibly significant date is just around the corner but there are still so many unanswered questions!

I have put together this guide to walk you through the whole situation to keep you informed about the developments. As of this writing, it seems like, bitcoin will avoid the chain split — for now. However, even though it seems like the opposing parties have reached a joint conclusion, there’s still a lot that needs to happen to avert the split.

To understand what’s actually happening and why the bitcoin community has split into two, it’s best to take a look at one of the fundamental issues of cryptocurrency — or to be more exact — how people disagree about how to fix that issue.

On one side, there are the people who manage the open sourced software for bitcoin. They are like the organisation/community that keeps the development on the bitcoin protocol running. On the other side are the miners, who deploy computers to run the bitcoin network (blockchain). Both sides are crucial to keep the bitcoin running — one side can’t do it without the other. And to fully understand the issue, you need to understand the mechanics of bitcoin, and that’s why I’ve tried to explain the complete deal with bitcoin chain split in this guide.

What is the problem with bitcoin?

Most people think of bitcoin as a digital currency that you can use to buy and sell things online. That’s technically correct, but that’s not bitcoin’s real value.

Bitcoins aren’t really feasible for everyday transactions, and we’re nowhere near being able to walk into a Starbucks and pay for our coffee in bitcoins. But why is that? Wouldn’t make sense for the makers of bitcoin to implement it as an real alternative to other currency, and thereby increase the value of bitcoin?

Well, the reason that hasn’t happened is that the bitcoin blockchain is slow and expensive. It’s nowhere close to meeting the standards for payment technology as the bitcoin network can process up to six transactions per second, while the VISA network can process over 1600 transactions per second.

The only way the general public will adopt to the decentralized network is if it will be as fast and convenient as existing payment networks. Unless that happens, bitcoin will be used mostly as an instrument to store value.

Why is the network so slow?

Bitcoin’s network is built on top of a blockchain. If you haven’t yet read the ultimate guide to understanding blockchain , think of blockchain as a register containing several pages (blocks) where each page contains several transactions. As soon as a page has been filled with transactions, it needs to be added to the register before starting to record transactions on the next page.

Before a page (block) can be added to the register (chain), there’s some processing that needs to be done to ensure that everyone agrees with the contents it contains. The process approximately takes 10 minutes for each block.

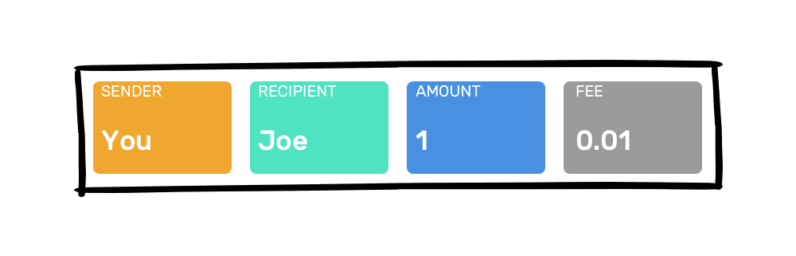

Imagine, you are sending 1 BTC to your friend, Joe. The transaction will look something like this.

Credit: Mohit Mamoria Among other things, a transaction contains information about the sender, the recipient, the amount and the transaction fee.

Credit: Mohit Mamoria Among other things, a transaction contains information about the sender, the recipient, the amount and the transaction fee.

Wait a minute, transaction fee? Yes, there’s an additional fee that you can pay to incentivize miners to include your transaction in a block as soon as possible. There’s no set price and it’s entirely up to you how much you are willing to pay to speed up the process.

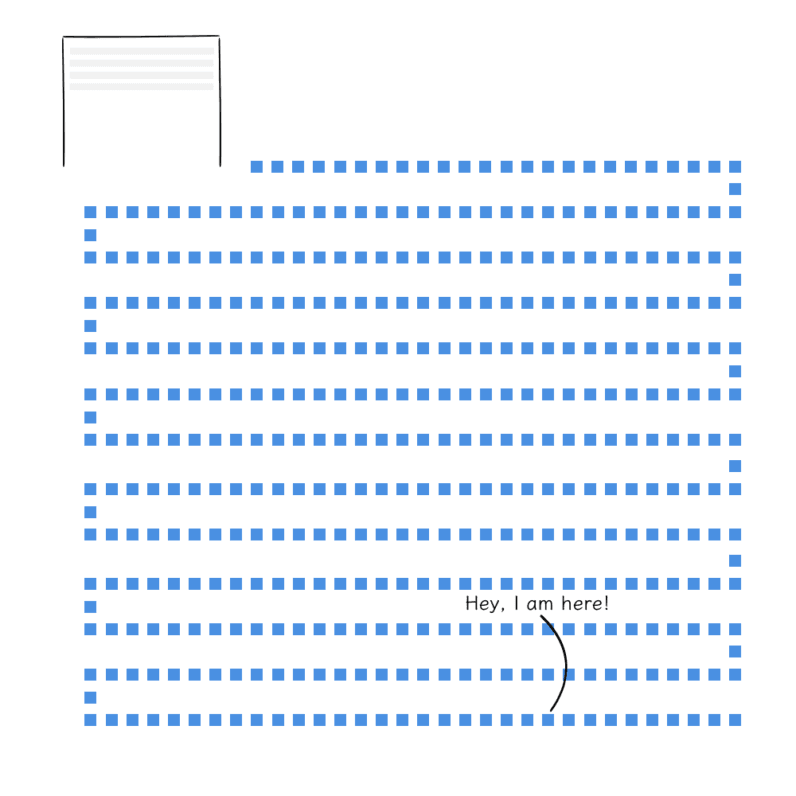

At any given moment, there are several transactions available to be recorded on the current page. If you look for number of unconfirmed (pending) transactions any time through the day, the number will always be close to ten thousand . That’s when the 99 percent of the world is yet to come to cryptocurrencies. The number then can easily be north of several millions.

Credit: Mohit Mamoria The miners (computers working in the blockchain network) have to decide which of the available transactions to include in the current block. To help them decide, they look at which transactions yield the most rewards — meaning that the transactions with the highest transaction fee will be included first.

Credit: Mohit Mamoria The miners (computers working in the blockchain network) have to decide which of the available transactions to include in the current block. To help them decide, they look at which transactions yield the most rewards — meaning that the transactions with the highest transaction fee will be included first.

Credit: Mohit Mamoria If there are enough transactions with higher transaction fee than yours to fill up the block, your transaction will have to wait in queue. The wait can last from a few minutes to a few hours. And sometimes, even days. The more you pay in transaction fee, the quicker your transaction is processed.

Credit: Mohit Mamoria If there are enough transactions with higher transaction fee than yours to fill up the block, your transaction will have to wait in queue. The wait can last from a few minutes to a few hours. And sometimes, even days. The more you pay in transaction fee, the quicker your transaction is processed.

Credit: Mohit Mamoria For the users, using Bitcoin has become slow and expensive. Not exactly what the ‘money of the internet’ should be like.

Credit: Mohit Mamoria For the users, using Bitcoin has become slow and expensive. Not exactly what the ‘money of the internet’ should be like.

However, this has prompted smart people to ask an important question: “How can we scale the capacity of the bitcoin blockchain?”

The funny thing is that there were too many smart people asking that question. The people who are running Bitcoin (the people who are maintaining the open sourced code that runs on people’s computers) believe in one solution, while the miners (the people who run the code on their own computers) believe in another.

The solution proposed by the people running Bitcoin favors the users, while the solution proposed by the miners favors themselves (what a surprise!). It’s this disagreement that’s led to the confusion around August 1 and the potential split of the Bitcoin blockchain. We’ll come back on this topic later in the post; let’s understand the solutions first.

The solution that favors the users

What the people running Bitcoin came up with originated in how we store a transaction in a block. The solution was originally to remove the malleability of blocks, but it had a positive side effect: it increased the capacity of the blockchain too. To understand it better, we’ll need to understand how blocks look like.

The solution is known by several names on the internet, such as SegWit, BIP 148 and UASF (User Activated Soft Fork).

What does a block look like?

In the most simple view, a block in the chain has two kinds of data in it — header and transactions.

Header contains meta data of the block, but that’s not relevant to the August 1 fork. The header is tiny and only takes up about a percent of the block’s data. The other 99 percent of the block’s data is made up of transactions that are included in the block.

Credit: Mohit Mamoria If we dig deeper to see what makes up a single transaction, we’ll find that besides the obvious things — like sender, recipients, amount and transaction fee — it also contains something called a ‘Signature’ or ‘Witness’. The Signature verifies that the sender has enough balance to send the said amount of bitcoins in the transactions. This particular data is only used once at the beginning, but it makes up almost 65 percent of the data in a transaction.

Credit: Mohit Mamoria If we dig deeper to see what makes up a single transaction, we’ll find that besides the obvious things — like sender, recipients, amount and transaction fee — it also contains something called a ‘Signature’ or ‘Witness’. The Signature verifies that the sender has enough balance to send the said amount of bitcoins in the transactions. This particular data is only used once at the beginning, but it makes up almost 65 percent of the data in a transaction.

Credit: Mohit Mamoria The total allowed size of a block is 1MB, and most of it is filled with data that isn’t critical to the block. The idea is to move the Signature/Witness data towards the end of the block in a separate structure.

Credit: Mohit Mamoria The total allowed size of a block is 1MB, and most of it is filled with data that isn’t critical to the block. The idea is to move the Signature/Witness data towards the end of the block in a separate structure.

Credit: Mohit Mamoria This separate structure isn’t required to be included in the blockchain. If a node (individual participating computer in the network) can, it’s great. If it cannot, no big deal. Because of this property, it is called a Soft Fork.

Credit: Mohit Mamoria This separate structure isn’t required to be included in the blockchain. If a node (individual participating computer in the network) can, it’s great. If it cannot, no big deal. Because of this property, it is called a Soft Fork.

Some nodes will update their software and begin working on the new block structure, while the nodes that decide to stay on the legacy software will simply ignore the Witness portion. This optimization in the structure allows more transactions to be included in a block.

This solution is technically called SegWit because of Segregating (separating) Witness from the block structure. And it favors the users.

How does SegWit favor the users?

The new structure can hold a lot more transactions than the current structure can. It causes the competition among unconfirmed transactions to be included in the block goes down. And with it, the transaction fee goes down. Transaction fees are a part of the reward that the miners get. With lower fee, the reward for mining the block will go down too. Not just that, this new structure also something that is called Lightning Network that allows micro payments (you paying for coffee at Starbucks) to be processed instantaneously without any fee.

The leading argument against this solution is that it’s a temporary fix and that a ‘Hard Fork’ will eventually be implemented down the road. And the Hard Fork is the miners’ proposition.

The solution that favors the miners

The miners propose a solution that will scale the network for a longer term. Their proposition is to implement SegWit (Soft Fork) like the users propose, and in addition to that, they also want to increase the size of the block from current 1MB to 2MB. Thus, the name — SegWit 2x.

Besides being known as SegWit 2x, the miners’ solution is also called MASF (Miner Activated Soft Fork) and BIP 91.

At first glance, this solution looks way better.

I can almost hear you shouting, “The network will be even faster. Yay!”

However, the devil lies in the details. If this solution is implemented, every miner in the network will have to upgrade their hardware and software. There is no concept of backward compatibility included in this solution. Those who won’t upgrade will be orphaned by the network. That’s why it is called a Hard Fork. Let’s take a closer look.

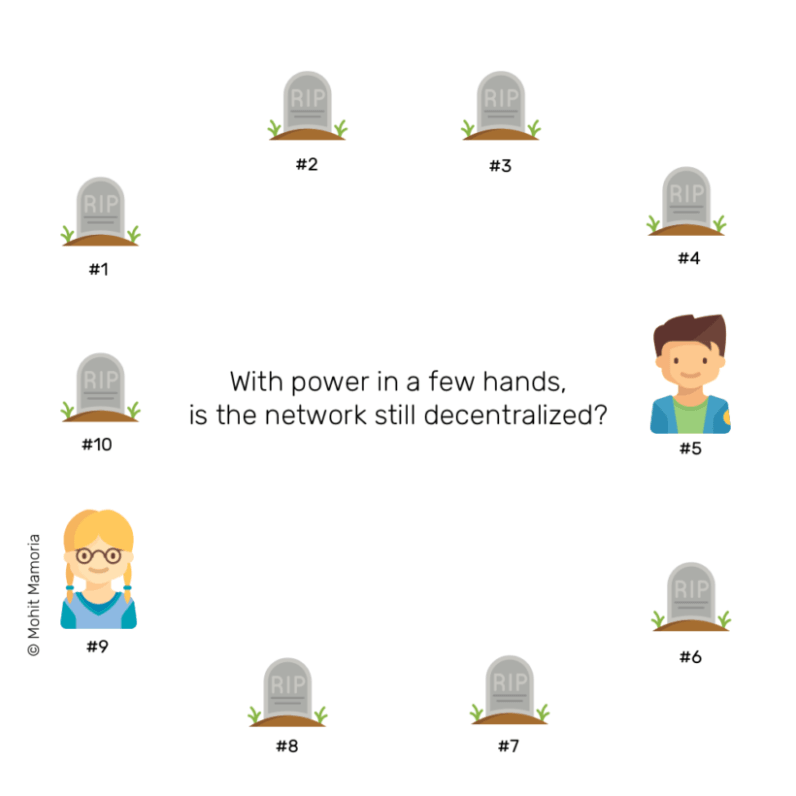

Imagine there are ten miners in the network, and that six of them decide to upgrade to larger sized blocks. These six will continue working on making the longest chain even longer, but their mined blocks will be discarded by the rest four who still consider old block size to be true.

Credit: Mohit Mamoria How does SegWit 2x favor miners?

Credit: Mohit Mamoria How does SegWit 2x favor miners?

What do miners like? Higher rewards. What do miners like even more? Less competition.

Due to the fact that not everyone will have enough money to upgrade their computation power to mine larger blocks profitably, smaller miners will vanish away from the network. This will leave larger and fewer miners in the network — which dramatically reduces the competition.

When Satoshi Nakamoto [presented](https://bitcoin.org/bitcoin.pdf) the glorious idea of building a decentralized future, he didn’t mean it just in theory, but he meant it in practice. Putting power in the hands of few large miners goes against the foundational idea of bitcoin’s existence.

Credit: Mohit Mamoria If you’d ask miners they’d probably say something like “We are running the network. We must have a say how we want to run it. If we shut our computers and go away, there’ll be no bitcoin.”

Credit: Mohit Mamoria If you’d ask miners they’d probably say something like “We are running the network. We must have a say how we want to run it. If we shut our computers and go away, there’ll be no bitcoin.”

And if they did, they’d be right. But they’re also wrong.

They are right when they say there’ll be no bitcoin if they go away, yet they’re wrong because when they say only they are running the network, they’re saying it with the same intentions as that of people running regular banks and governments.

Blockchain is not just a software protocol that allows financial transactions. It is the protocol that changes the fundamental beliefs of our species.

With this protocol, there is no place for the sense of ownership. Everybody owns the network and nobody owns the network. The sooner we accept it, the sooner we’ll be able to make real progress.

What exactly is the split that everybody is talking about?

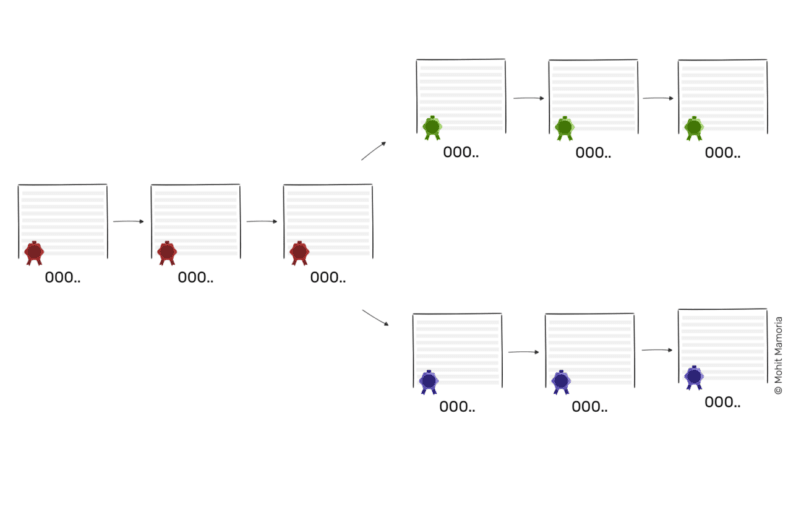

Remember when the blocks mined by six of our miners were discarded by the rest four? Let’s see what the blockchain looks like for them. The four miners who are working on the smaller block size, will continue mining their own set of blocks and will be making their own version of the longest chain.

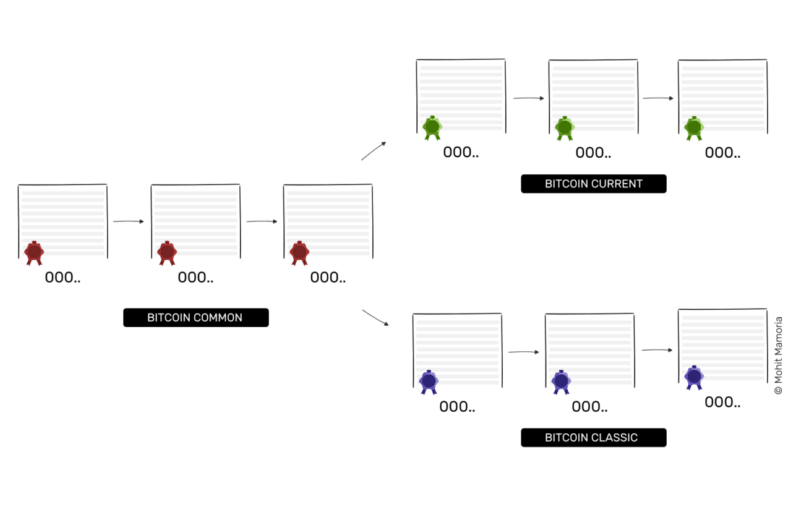

Credit: Mohit Mamoria When that happens, the blockchain will split in two blockchains. Some nodes will be working on one version and some on the other. Let’s label the resulting blockchain like so:

Credit: Mohit Mamoria When that happens, the blockchain will split in two blockchains. Some nodes will be working on one version and some on the other. Let’s label the resulting blockchain like so:

Credit: Mohit Mamoria The ‘Bitcoin Common’ part of the chain is the part before the split. Miners with the upgraded computers will work on the ‘Bitcoin Current’ branch of the chain while the miners who are still on the old block size will form the ‘Bitcoin Classic’ branch of the chain.

Credit: Mohit Mamoria The ‘Bitcoin Common’ part of the chain is the part before the split. Miners with the upgraded computers will work on the ‘Bitcoin Current’ branch of the chain while the miners who are still on the old block size will form the ‘Bitcoin Classic’ branch of the chain.

Bitcoin, the currency, will therefore effectively be split into two. Coins that were collected by users during the Bitcoin Common can be spent on both Bitcoin Classic and Bitcoin Current. However, the coins that will be traded on Bitcoin Classic will be different from those traded on Bitcoin Current. They will be different in quantity, different in value and different in adoption. They will be as different as any two pre-existing cryptocurrencies can be.

What will happen to the bitcoins you own?

It depends where you’ve kept your bitcoins. If they are on your own computer, you can spend them twice — once on each blockchain. But if they are stored in an online wallet, the fate of your coins is in their hands.

Every online wallet will have their own take how they want to proceed with this blockchain split. They might either migrate your coins to one version of the blockchain or allow you to spend on both. It depends.

What I’d advise you to do is not make any transactions a few days before and after August 1, 2017. Because of the fork, you might lose your bitcoins into the thin air. After all, bitcoins are nothing but records of transactions. If you transaction doesn’t get recorded by either of the chains, they will be gone forever. Poof.

There’s a lot of turmoil around what might happen on August 1. Over last couple of weeks, markets have been more volatile than ever. As of this writing on July 24, 2017, almost all the miners are signaling BIP 91 (the miner’s proposition). With this, it seems like bitcoin will avoid the split on August 1, but it is not a guarantee still. Miners saying that they will implement BIP 91 doesn’t mean necessarily mean that they will. This is just a statement of intent from the miners.

To really implement BIP 91, majority of the miners will have to upgrade the software on all of their computer before August 1. Miners running the updated software is still under 50 percent.

If the miners stick to their intent over next week too, the SegWit part of SegWit 2x will be activated, and the 2x part (increasing the block size from 1MB to 2MB) will be on its way later this year, which will be a hard fork. What might happen during the hard fork? We’ll bring another guide then to keep you informed on the matter.

Still have questions? You can ask me via Twitter @mohitmamoria. And if there’s another topic that you’d like an ultimate guide on, please let me know in the comments below!

Bitcoin Miners Back Proposed Timeline for 2017 Hard Fork

A group of bitcoin miners constituting close to 80% of the network hashrate, as well representatives from exchanges, service providers and contributors to the Bitcoin Core development project, have proposed a development timeline for scaling the bitcoin network.

The statement's release comes after a more than 18 hour-long meeting in Hong Kong that drew participants from China's bitcoin mining community and members of the Bitcoin Core team.

Some of the letter's signatories were party to a previous statement that voiced opposition to any "contentious hard fork" to the bitcoin network.

According the proposed timeline, Bitcoin Core contributors Matt Corallo, Luke Dashjr, Cory Fields, Johnson Lau and Peter Todd will produce and recommend code for a hard fork to the bitcoin network that would feature a block size increase. The code for this proposal is expected to be made available by July.

This proposal would be presented three months after the release of Segregated Witness, a proposed change to bitcoin's code that alters the way in which bitcoin transaction signature data is stored.

Representatives for miners AntPool, A-XBT, BitFury, Bitmain, BTCC, BW, F2Pool, GHash.io and Genesis Mining have agreed to support Segregated Witness, expected to be released in April. According to data from Blockchain.info, the larger miners on the list of signatories have produced roughly 80% of all blocks in recent days.

The group went on to say that, following approval by the volunteer Bitcoin Core team and a show of "strong community support", it would support the deployment of that hard fork – a change to the network that would require users to download new software in order to stay compatible – with activation taking place sometime "around July 2017".

The statement reads:

"This hard-fork is expected to include features which are currently being discussed within technical communities, including an increase in the non-witness data to be around 2 MB, with the total size no more than 4 MB, and will only be adopted with broad support across the entire Bitcoin community."

Further, the statement indicated that the signatories would, for now, only use production versions of the Core software.

"We will only run Bitcoin Core-compatible consensus systems, eventually containing both SegWit and the hard-fork, in production, for the foreseeable future," it said.

This reflects a change from a previous version of the statement published online that featured stronger language in the commitment to use Core over other alternatives. Later removed, it said that the group would "not run Bitcoin Classic", a reference to the alternative implementation released earlier this month that includes code for a transaction block size increase to 2 megabyte (MB) versus the current 1 MB per block.

A full list of signatories can be found here.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Consensus 2017: BitPay CEO Calls Bitcoin Fork 'Only Option' For Businesses

BitPay's chief executive made the case for a fork at the bitcoin scaling discussion panel at CoinDesk's Consensus 2017 conference today.

Centered on a two-year debate focusing on the size of transaction blocks on the bitcoin network, global discussion on the issue has so far passed through a few phases with varying proposals to increase the throughput of the system being put forward along the way.

Most recently, investment firm Digital Currency Group advanced a proposal that would see the Segregated Witness upgrade activate and start a countdown to a 2MB block size increase – though, a similar idea has been proposed and rejected by developers before.

As this debate has been raging for a couple of years now, members of the scaling panel were quick to note their frustration.

Payment processor BitPay, for one, has been toying with different options in search of a solution, a path that has included the exploration of alternative implementations. Stephen Pair, the company's CEO, went as far as to call for a fork that would end in two bitcoins.

"It's not working for us. The first option is to use a fork of bitcoin, second option is to use a fork of bitcoin, third option is to use a fork of bitcoin. We don't have any other option right now."

"Long-term we need one chain that's liquid and secure. But for a while we might run two versions of bitcoin to see which one works out," he added later, arguing that the market should decide which version ultimately prevails.

Not everyone agreed that this is the best way forward.

"Nobody that I've talked to wants chain to split. I don't think there will be," said Peter Rizun, chief scientist of Bitcoin Unlimited, another bitcoin client that has been the center of the bitcoin debate for the past year or so.

The DCG proposal was also raised during the panel, with Bitcoin Core contributor Eric Lombrozo calling the proposal a "logistics nightmare" – but chatter on that subject was quickly derailed.

Other options?

In a way, the panel showcased the many dimensions of the debate. Much of the discussion that took place centered on what role users on the bitcoin network play.

One of the more recent developments in the scaling debate is a proposed effort known as a "user-activated soft fork" (UASF), a mechanism that has been used in the past to push through a particular type of critical change to bitcoin (known as the "consensus level"). Yet it didn't see much of the limelight until an unknown developer posted the idea as an alternative to the current mechanism, which requires near-universal support among miners.

Advocates have been advancing the concept as a way to push SegWit across the finish line. It's not a change mechanism that everyone agree is safe, but some on the panel seemed open to the idea.

In fact, Lombrozo put on a UASF hat several minutes into the panel.

"We don't have to stay on the same chain. That's the freedom and the right that everyone has. Including the user-activated soft fork. I would never say that you can't do that," Pair said, agreeing that users have options.

Still, the panel itself demonstrated how the debate has grown even more complex over time, with alternative implementations like Unlimited and Bcoin seeking a path forward. Bcoin is an alternative client that tries to solve the debate with an experimental technology that would effectively allow users to choose their own block size.

Purse CEO Andrew Lee posited that Bcoin is a way to help diversify the community of developers in the bitcoin sphere, which he believes has been monopolized by one implementation, Bitcoin Core.

Despite all the new developments and proposals, though, moderator Jameson Lopp argued that users should expect this kind of debate for the long haul, concluding:

"This is a debate that in my opinion will probably never end."

Disclosures: CoinDesk is a subsidiary of Digital Currency Group. Digital Currency Group has an ownership stake in BitPay.

Image by Alyssa Hertig for CoinDesk

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422bd65d31cc8ea3 • Your IP : 185.87.51.142 • Performance & security by Cloudflare

Комментариев нет:

Отправить комментарий