Buy Bitcoin in Germany

All links are external & open in a new tab, except for "Read Review" buttons. Before jumping into this page, an important disclosure.

You'll need a Bitcoin wallet before you buy since some exchanges require one.

Don't have a wallet? Read our guide on the best Bitcoin wallets.

Coinmama

Coinmama

Coinmama allows customers in almost every country to buy bitcoin with a credit or debit card. They charge an

6% fee on each purchase.

- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

- Some of the highest fees among credit/debit card bitcoin brokers

BitPanda

BitPanda

BitPanda is a Bitcoin broker based in Austria.

They have high payment limits and low fees across their wide range of payment methods.

BitPanda offers customers the option to buy bitcoins with credit card, debit card, SOFORT, Skrill, NETELLER, giropay, eps, SEPA, and Online Bank Transfer.

- Some of the lowest fees for buying bitcoins with credit/debit card

- Reliable and trusted broker

- Fees aren't shown openly on the site but instead included in the buying price

CEX.io Buy Bitcoin Read Review

CEX.io Buy Bitcoin Read Review

CEX.io lets you buy bitcoin with a credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Purchases made with a credit card give you access to your bitcoin immediately. CEX.io works in the United States, Europe, and certain countries in South America.

- Support for many countries and regions

- Low 0.2% trading fee

- Established and trusted exchange

- Verification process is extensive, requiring much personal information (including a photo) and incurring a long delay

- GBP market lacks liquidity

Luno Buy Bitcoin

Luno Buy Bitcoin

Luno is a Bitcoin exchange based in Singapore. It originally launched to support countries like South Africa and Indonesia, but recently expanded to Europe and supports the purchase of bitcoin through SEPA transfers.

- Trusted exchange that has been around for a long time

- Free deposits and low withdrawal fees

- Users should not store bitcoins in Luno's wallet service

- Limited deposit options, only SEPA for European users

Bitcoin.de

Bitcoin.de

Bitcoin.de is a major European peer-to-peer Bitcoin exchange. Users can buy bitcoin online from other Bitcoin.de users through SEPA bank transfers.

- One of the oldest and largest exchanges in Europe

- Claims to have high security and regular audits

- Limited to SEPA as a payment method

Cointed Buy Bitcoin

Cointed Buy Bitcoin

Cointed allows customers to buy and sell bitcoins across Europe, using SEPA, Skrill, cash, and many other payment options. They also operate 9 Bitcoin ATMs across Austria.

- Many payment methods available

- ID verification required, so not a private way to buy

Paymium Buy Bitcoin

Paymium Buy Bitcoin

Paymium was the first European Bitcoin exchange, founded in 2011. It provides a EUR/BTC exchange service, and complies with all relevent European Regulations. Customers can purchase bitcoins via SEPA, wire transfer, or credit card.

- Established and trusted exchange

- Mobile app available

- ID verification required for amounts over €2,500, so not private

Bity Buy Bitcoin

Bity Buy Bitcoin

Bity is a Bitcoin exchange and ATM operator, based in Switzerland. Their 5 ATMs allow for a quick first purchase and only require phone verification for an initial buy limit of 1,000 EUR or CHF. Their online service accepts wire transfers, SOFORT and online bank transfers.

- Easy to start buying bitcoins after mobile phone verification

- Payment limit of up to €100,000 annually after intensive verification

- ID verification is required for most purchases, so not a private way to buy

- Low annual limit of only €4,000 without intensive verification

LakeBTC Buy Bitcoin

LakeBTC Buy Bitcoin

LakeBTC is the fourth largest Bitcoin exchange in China. They operate internationally, in around 40 different countries. LakeBTC is one of the top 15 global exchanges based average daily trading volume. Customers can deposit via cash, bank wire, Western Union, MoneyGram, OKPay, Perfect Money, PayPal, Payza, Skrill, Neteller, Leupay, CHATS or LakePay, although not all methods are available in all countries.

Bitcoin Startups Munich Launches in Germany

After Berlin, Munich is going to be the next hub for Bitcoin startups within the arguably pro-Bitcoin Germany. Bitcoin Startups Munich, a business networking group that connects Bitcoin entrepreneurs and is building an ecosystem of Bitcoin startups, met for the first time on the evening of Thursday, August 28th. The event took place in the premises of Opentabs, a payment processing and e-commerce startup in East Munich.

After Berlin, Munich is going to be the next hub for Bitcoin startups within the arguably pro-Bitcoin Germany. Bitcoin Startups Munich, a business networking group that connects Bitcoin entrepreneurs and is building an ecosystem of Bitcoin startups, met for the first time on the evening of Thursday, August 28th. The event took place in the premises of Opentabs, a payment processing and e-commerce startup in East Munich.

Attendance and Interest Soar at First Meeting

More than 50 persons attended the event in a crowded conference room. A diverse crowd was on hand –software developers, journalists, investors, students, and entrepreneurs, including a startup founder from Vietnam who provided an overview of the state of the Bitcoin ecosystem in South-East Asia.

The event began with a brief introduction and welcome speech by Dr. Bastian Brand and Cris Genc, the two main organizers of the event.

Dr Bastian Brand and Cris Genc

Dr Bastian Brand and Cris Genc

Dirk Röder provided a summary of Bitcoin’s fundamentals to those in attendance who were new to the topic of crypto-currencies. After this, Marco Streng gave a presentation on his experiences at Genesis Mining, a German mining operator, and stressed the rapid pace of innovation in the sector.

Marco Streng from Genesis Mining

Marco Streng from Genesis Mining

After a short networking break, Bastian Spielmann, blogger at Consensus Analytics, gave a presentation entitled “Bitcoin 2.0 – Myths and Reality” where he evaluated projects such as Ethereum, Mastercoin and Bitshares and dispelled some of the myths surrounding advanced block chain-based technologies. The lively discussion and the guest appearance of Dominik Weil, manager of Bitcoin Vietnam, the leading Bitcoin exchange in Vietnam, aided the presentation immensely.

In light of the overwhelming interest and support, the decision has been made to host a monthly meeting going forward. In anticipation of the large number of attendees expected at the next session, which will focus on Bitcoin’s attributes for consumers, Bitcoin Startups Munich has decided to move to a larger location.

Dr. Bastian Brand and Dominik Weil said the following about the Meetup.

Dr. Bastian Brand (Founder of Bitcoin Startups Munich):

“Having visited a number of Bitcoin conferences and met with many Munich Bitcoin enthusiasts, I had a sense there was a real need to create a new networking platform that features presentations by experts and that provides access to consumers, investors or journalists. This was the catalyst for Bitcoin Startups Munich. Now, after we have concluded our first meeting I am overwhelmed by the audience’s positive reception and extremely grateful to all those who have helped to organize this event.”

Dominik Weil (Manager of Bitcoin Vietnam, former community leader of Bitcoin Frankfurt):

“I just can congratulate the organizers of putting that together and hope they can keep the pace and the spirit show so far. The case this is going to happen, I believe that Munich can soon establish itself as another Bitcoin Hotspot in Germany besides Berlin. Especially in times were unthoughtful regulatory approaches by the authorities are strangulating the German Bitcoin Startup scene, it is great to see that people are still pushing forward to avoid the complete ossification of the German Bitcoin scene – despite unreasonable regulations by the powers that be and the – as a logical result – caused brain drain of young German entrepreneurs to locations abroad, were they actually can execute their ideas. Therefore, we should all be thankful for people like Bastian and his co-organizers, who have not given up on Germany as a place of innovation – and I hope they will be able to reap the rewards of their efforts in time.”

About Bitcoin Startups Munich

Bitcoin Startups Munich was founded by corporate finance consultant, and author of the industry report “The Intelligent Crypto-Investor,” Dr. Bastian Brand in response to a perceived need to create a business-oriented networking group that brings together Bitcoin enthusiasts with investors, entrepreneurs and developers from the Munich region. Bitcoin Startups Munich aims to operate on two levels.

Firstly, it organizes a range of events and workshops where presentations are given that help people understand how Bitcoin works both from a technical as well as from a business / economic / investment perspective. Secondly, it features a website. The website of Bitcoin Startups Munich contains profiles of Bitcoin-related startups as well as live recordings of the presentations given at the aforementioned events. By providing this information, the website helps investors to find suitable companies, sector experts and entrepreneurs to reach out to a global audience and Bitcoin enthusiasts around the globe to access quality content on the latest developments in the Bitcoin space. The website and media presence of Bitcoin Startups Munich is managed by Cris Genc who has recently written an academic thesis on the success criteria of Bitcoin adoption in Germany e-commerce.

Germany recognizes Bitcoin as ‘private money’

Berlin has acknowledged the virtual tender as a "currency unit" and "private money," according to German newspaper Die Welt.

The classification means that some commercial profits on Bitcoin related endeavors may be taxable, but personal use of the currency will remain tax-free, the paper reported.

The recognition was laid out in a Finance Ministry response to a query from Frank Schaeffler, a member of parliament’s Finance Committee.

"For the first time, the federal government recognizes Bitcoins as private money," said Schaeffler.

In July, the first trading platform for Bitcoins in Europe with direct cooperation with a bank regulated by the Financial Supervisory Authority was set in Germany. Bitcoin Deutschland GmbH agreed to convey Bitcoins on its platform as an intermediary through the German web 2.0 bank Fidor.

Bitcoin has been a popular form of payment around the globe since it was first introduced in 2009, as people became dissatisfied with the conventional banking system. Meanwhile, the currency’s viability has been questioned because Bitcoins are backed by neither a government nor a central bank.

At the beginning of August, a US federal judge in Texas ruled that Bitcoin is a legitimate currency. The decision came after Trendon Shavers, a 30-year-old businessman, was charged with running a Ponzi scheme, scamming customers out of roughly US$4.5 million worth of the crypto-currency through his online hedge fund. He argued that Bitcoin is not real money and therefore is not subject to regulation by the US government. However, the court dismissed his claim.

The ruling brought Bitcoin one step closer to being recognized as a real currency. However, the decision opened up the possibility for the virtual money to be regulated by governments, which oppose the original concept of Bitcoin – a peer-to-peer, relatively anonymous payment.

Supporters of the virtual currency argue that it helps protect the identities of users from theft and credit card fraud. Critics argue that the lack of regulatory oversight and alleged greater privacy makes the currency more attractive to scammers. In addition, skeptics question the currency’s volatile exchange rate, inflexible supply, high risk of loss, and minimal use in trade.

An overseer group called the Bitcoin Foundation standardizes, protects and promotes Bitcoin. The economic rules are enforced collectively by the Bitcoin network, which limits the total number of currency units to 21 million, according to the official Bitcoin website. Currently, the price of a unit is around $ 110 (82 euros), according to online currency conversion sites.

Where and How to Buy Bitcoins

Best Ways to Buy

This guide will teach you how to buy bitcoins.

It's easy to find where to buy bitcoins online because there are so many options.

If you want to learn the best way to buy bitcoins, keep reading!

Welcome to Buy Bitcoin Worldwide! I'm Jordan Tuwiner, the founder of this site.

We understand that buying bitcoins can be extremely confusing and frustrating. Luckily for you, this site has ample information to help make buying bitcoins easier for you.

Introduction to Buying

Want to learn how to purchase bitcoin or get bitcoins?

You’re in the right place!

The short answer is:

Find a Bitcoin exchange

Trade your local currency, like U.S. dollar or Euro, for bitcoins

For the long answer, read this Bitcoin buying guide and by the end you’ll understand these key points:

How and where to buy bitcoin

How to choose the right exchange

How to secure your coins after you buy

How to avoid scams

Below, we listed exchanges you can use to purchase BTC. We suggest our listed exchanges and doing your own research before making your final decision.

Certain exchanges are simply there to steal your personal information or rob you of your bitcoins.

We conduct intensive research on every exchange we list to filter out any and all dishonest exchanges.

Choosing an Exchange: Which is the Best Bitcoin Exchange?

To select the perfect exchange for your needs, consider these 7 factors.

1. Privacy: Keep Your Information Safe!

Want to buy BTC privately?

You can already cross off a number of payment methods:

- Bank transfer

- Credit card

- Debit card

- PayPal

- Any other method that requires personally or identifying information

Buying bitcoins with cash or cash deposit is the most private way to purchase bitcoins.

We also have a detailed guide which reveals your options for buying without verification or ID.

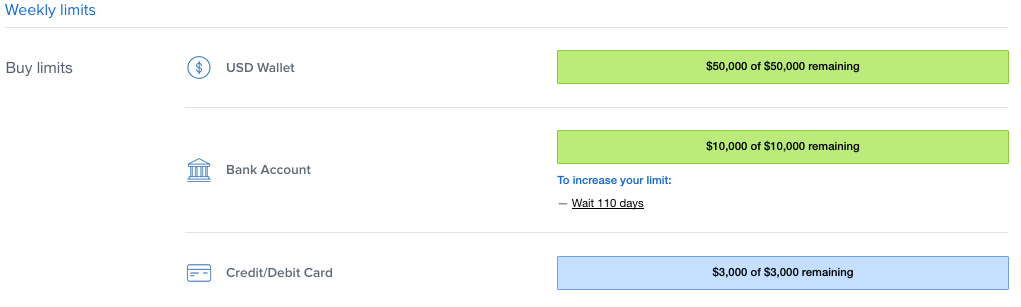

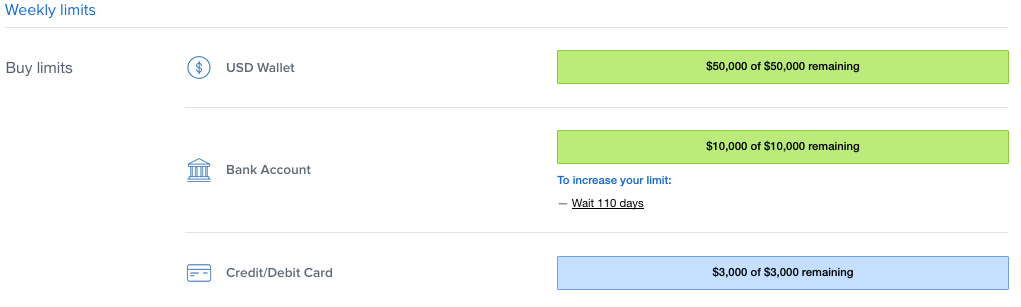

2. Limits: Are You Buying a Lot of Coins?

If you need to buy a large amount of bitcoins--say 25 or more--then big brokers or major exchanges are the way to go.

Coinbase has high limits for buying with a bank account.

CoinMama has the highest limits for buying with a credit card.

Most cash exchanges have no buying limits. Limits, however, will vary between individual sellers and are usually lower than online exchanges.

3. Speed: When Do You Need Access to your Bitcoins?

How quickly do you need to convert regular money into bitcoins? Different payment methods deliver your coins at different speeds.

Your first Bitcoin purchase may be time consuming. Once you get everything setup all subsequent purchases will be much faster!

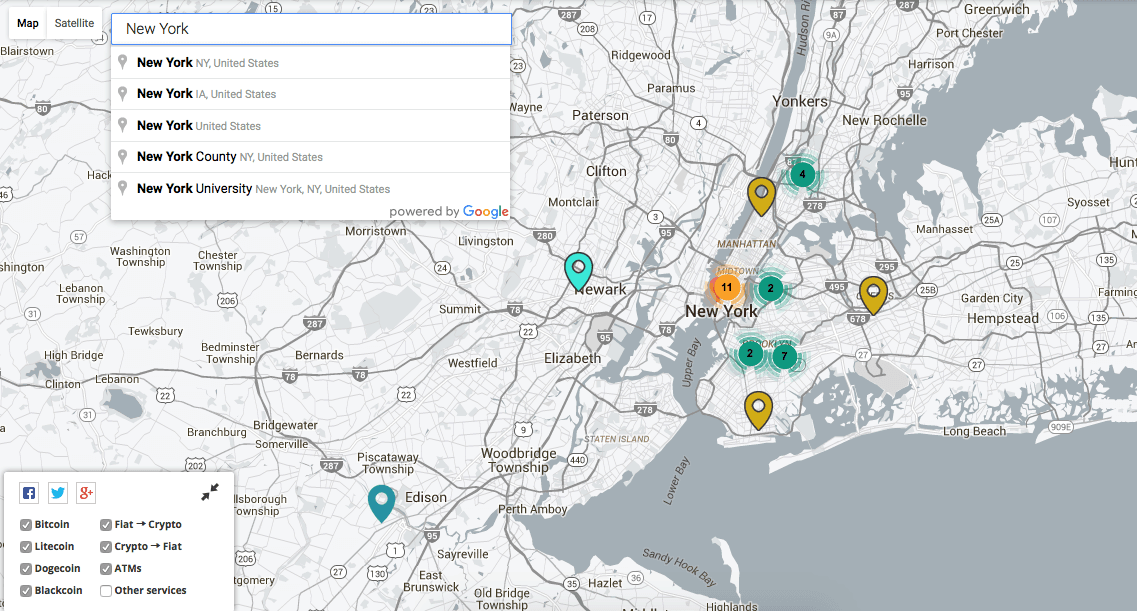

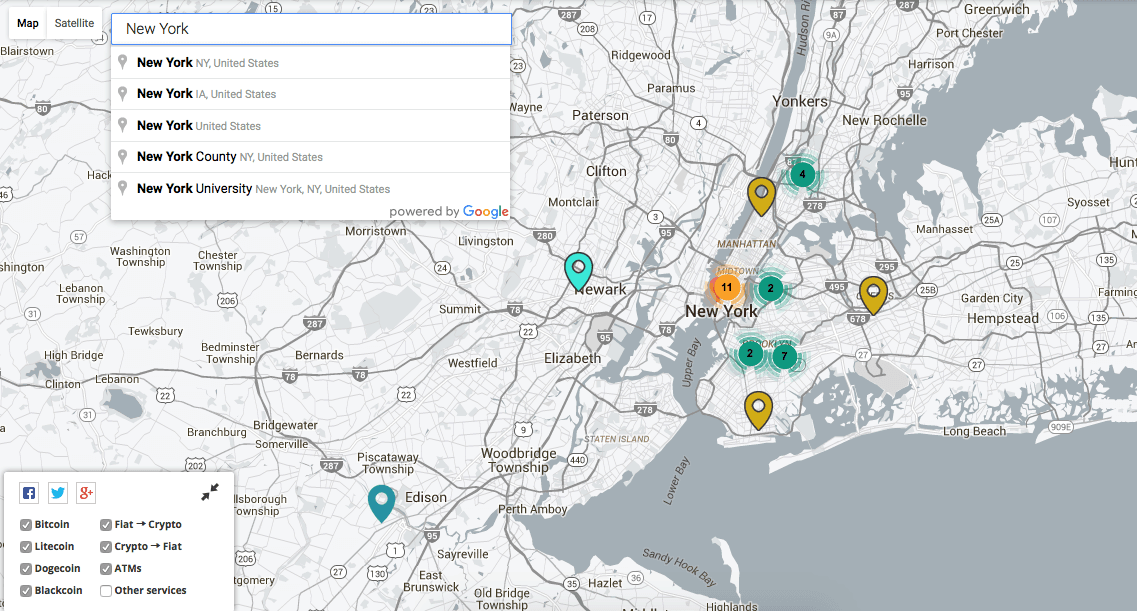

Bitcoin ATMs can be the fastest way to purchase bitcoin if you’re lucky enough to have one in your area. Here's a map to help you out.

Some brokers offer instant buys with bank transfer, credit card, or debit card.

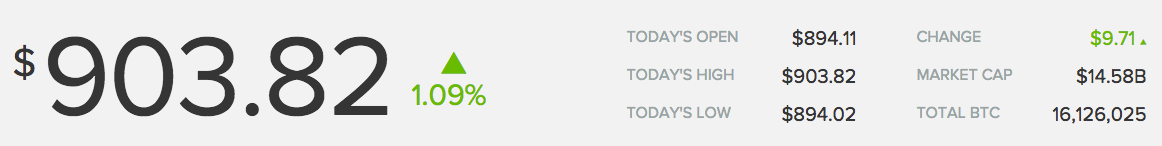

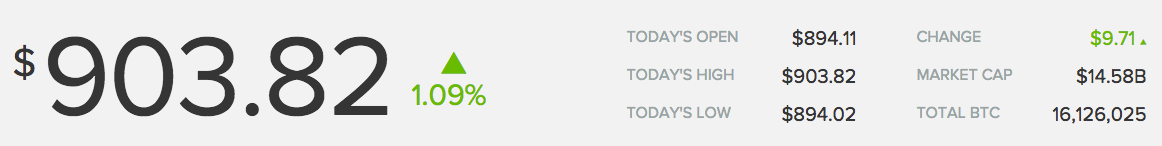

4. Exchange Rate

There is no official Bitcoin price. Use BitcoinAverage or CoinDesk to see the average price of Bitcoin across all major international Bitcoin exchanges and compare that to the price on your chosen exchange.

5. Reputation: Don't Get Scammed!

How long has the exchange been in service? Is the exchange trustworthy? Our Bitcoin exchange reviews can help you to find a trusted exchange.

6. Fees: Are You Getting a Good Deal?

How much does the exchange charge for its services? The fee will vary greatly based on the payment method you choose to use.

Remember to include deposit and withdrawal fees as well as trading fees. Some exchanges will lower their fees if you trade a lot of bitcoins.

7. Payment Method

How can you pay for the bitcoins? Payment method may be the most important factor.

We're sure you already have a payment method in mind that you'd prefer to use. More on that below.

Get a Wallet!

Some exchanges require a Bitcoin wallet before you can buy.

If you don't have a wallet yet, learn how to get a Bitcoin wallet and then come back.

We'll wait for you here ;)

Know your Payment Method?

Payment Methods

We can both agree that this Bitcoin stuff is confusing. Stick with us!

We're about to have you on your way to choosing a payment method and buying bitcoins.

Where to Buy Bitcoin?

- Purchase bitcoins online with a credit card, debit card, or bank transfer.

- Acquire bitcoins from a Bitcoin ATM near you.

- Buy bitcoins with cash locally or via cash deposit.

- Convert PayPal to Bitcoin online.

The above was just a brief overview of where you can buy bitcoin. Now, let's get into the details.

In order to buy bitcoins, you’ll need to exchange your local currency, like Dollars or Euros, for bitcoin. Here’s an overview of the 4 most common payment methods:

1. Credit or Debit Card

Credit/debit cards are the most common way to pay online. So, it's really no surprise that many people want to buy bitcoins this way.

Why buy bitcoin with a credit/debit card?

- Credit cards are a payment method most people are familiar with; probably the easiest way to buy bitcoins online

- Delivery of bitcoins is instant once initial verification is complete

Why NOT buy bitcoin with a credit/debit card?

- High fees; if you're patient and not in a rush to buy then use a bank transfer for lower fees

- Not a private way to buy; your ID will be required to buy with a credit card

A few places to buy bitcoins online with a credit card are:

Bank Account or Bank Transfer

Bank transfer is one of best ways to buy bitcoins in most countries.

Why buy bitcoins with bank account/transfer?

- Good way to buy large amounts of bitcoins

- Using a bank transfer will usually result in the lowest fees, so you can get a great price on your purchase

Why not to buy bitcoins with bank account/transfer?

- Usually requires ID verification, so not a good choice for privacy

- Slow; in the USA, bank transfers can take up to 5 days to complete

Some of the best ways to buy bitcoins with your bank account:

Cash deposit is often the fastest and most private ways to buy bitcoin. You can usually receive your bitcoins within a couple hours.

What are cash exchanges good for?

- Can be more private since in some cases no personal information is required

- Can be nearly instant; no need to wait 5 days for a bank transfer to process

What are cash exchanges bad for?

- Privacy comes at a cost; cash exchanges often have price 5-15% above market rate

- Easier to get scammed or robbed; need to be on alert and follow the exchange's rules

Some of the best places to buy bitcoin instantly with cash:

Note: There is no easy way to buy bitcoin at Walmart. We get asked this A LOT!

There are Bitcoin ATMs all around the world that let you purchase bitcoin with cash.

You simply insert cash into the machine, and get bitcoins sent to your wallet.

Use Coin ATM Radar to find a Bitcoin ATM near you.

What are Bitcoin ATMs good for?

- Can be more private since in most cases no personal information is required

- If you have an ATM in your area it can be a convenient and fast way to buy coins

What are Bitcoin ATMs bad for?

- Privacy comes at a cost; Bitcoin ATMs often have a 5-15% premium above market rate

There is no way to directly buy bitcoins with PayPal. Under PayPal’s terms and conditions merchants are not allowed to sell bitcoins for PayPal.

I really recommend not buying bitcoins with PayPal. The fees are really high. Chances are that your PayPal is connected to your credit card or bank account, which can be used to buy at much lower fees.

However, there are a few hacks to get around this. You can buy other digital items with PayPal and sell those items for bitcoin. It's all explained in our guide on how to buy bitcoins with PayPal.

Why buy bitcoins with PayPal?

- If you already have a balance, it can be an easy and fast way to convert PayPal to bitcoins

Cons of buying bitcoins with PayPal

- Fees are over 12%; much better to just buy with a credit card or bank account

Frequently Asked Questions

If you're still a bit confused, that's okay. Buying bitcoins is hard, but that's why I built this site, to make it easier!

If you still need help, I hope this FAQ will help to answer any remaining questions.

When is the Right Time to Buy?

As with any market, nothing is for sure. Bitcoin is traded 24/7 and its price changes every second.

Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts from other Bitcoin trading sites. These charts will help you understand Bitcoin’s price history across the many global Bitcoin exchanges.

Why Does Buying Bitcoin Take So Long?

Long wait times are usually a problem with existing payment systems, not with Bitcoin itself.

Bitcoin transactions only take about 10 minutes to confirm. Bank transfers in the U.S., for example, can take up to five days to complete.

Bitcoin transactions can be confirmed as quickly as 10 minutes; it’s rare to experience a delay longer than one hour.

This means that a merchant can’t release bitcoins to a customer until five days have passed unless they're willing to take on risk.

Can You Sell Bitcoins?

Yes, of course! Most exchanges that let you buy bitcoins also let you sell (for a fee of course).

Why Do I Need to Upload my ID for Some Exchanges?

This is due to Know Your Customer (KYC) laws which require exchanges to record the real world identity of their clients.

Can Anyone Buy Bitcoin?

Bitcoin requires no permission to use or buy.

You will have to check the legality of Bitcoin in your country. In most countries Bitcoin is legal!

Should I Buy Physical Bitcoins?

Physical bitcoins are physical, metal coins with a Bitcoin private key embedded inside.

We recommend that you stay away from physical bitcoins unless you’re a numismatist.

While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. The creator could create two copies of the private key.

Unless you immediately open and withdraw the digital bitcoins from your physical bitcoin, the creator could at any time steal the funds it contains.

Can I Buy Partial Bitcoins?

Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into 100,000,000 pieces. Each unit of bitcoin, or 0.00000001 bitcoin, is called a satoshi.

Most exchanges let you buy as little as $5 worth of bitcoins at a time.

Why Should I Buy Bitcoin Instead of Mining?

A long time ago anyone could mine bitcoins on their computer at home. Today, only specialized computer hardware is powerful enough to do this.

Think about it like this:

Should you buy gold or mine gold? Well, to mine gold you need big powerful machines, a lot of time, and money to buy the machinery. This is why most people just purchase gold online or from a broker.

So Bitcoin is no different.

You should just buy some if you want coins without trying to mine.

Do I need a Bitcoin Account Before Buying?

With Bitcoin, there are not really accounts.

Instead, you should have a Bitcoin wallet. If you want to store bitcoins, then a wallet is where you keep them.

In Bitcoin these wallets are not called an account but a wallet functions almost the same way. The only difference is you are responsible for the security if your wallet rather than placing the security in the hands of a bank or trust.

How do I check if I received a Bitcoin payment?

Why Would Someone Even Want to Buy Bitcoins?

There are many reasons people want to own bitcoins.

Many people like to purchase some and put them to the side in the hopes that they will be worth more in the future.

Many people are using bitcoins to remit money to their families from out of the country. Right now, Bitcoin is one of the cheapest ways to do this.

People also use Bitcoin to buy stuff online. Big companies like Microsoft, Dell, Newegg and Overstock all accept bitcoins.

Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. Most stock markets only open on weekdays from 9 AM to 5 PM. So many traders buy and sell bitcoins because it is a fun and fast market to trade.

Can I Buy Bitcoin Stock?

Bitcoin itself is not a stock despite it functioning somewhat like one. You can’t buy bitcoins through a traditional stock fund and instead have to buy bitcoins yourself. This may change in the future if a Bitcoin ETF ever gets approved.

What Happens When you Purchase Bitcoins?

Bitcoins are actually just secret digital codes. When you buy bitcoins, the seller is using a wallet to transfer the ownership of the coins to you. Once your purchase is complete, the codes are now owned by you and not the seller.

Why Are the Chinese Buying So Much BTC?

It seems the Chinese really like Bitcoin’s properties such as its sound monetary policy and that it can be used anywhere in the world. Bitcoin's volatility also makes it interesting for speculative traders.

Is Bitcoin Legal?

Bitcoin is legal in nearly every country. Only a few countries have actually banned the use of bitcoins. Before you buy, make sure you double-check the legal status of Bitcoin in your country.

Why do I need to buy bitcoins before buying most altcoins?

Bitcoin functions as the "reserve" currency of cryptocurrency. So it is very hard to buy other coins without first buying bitcoins. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. This is mostly because Bitcoin has very good liquidity and is traded on every cryptocurrency exchange. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies.

Am I Anonymous when I Buy?

Bitcoin is not anonymous but rather pseudonymous. All Bitcoin transactions are public but it is not always known the real identity behind any give Bitcoin address.

Can I use Multiple Exchanges?

If the limits on one exchange are to low you can simply open an account with another exchange to give yourself the ability to buy more.

You can signup, join, and use as many Bitcoin exchanges as you want that are available in your country.

Do I need to Pay Taxes on Bitcoin?

In most countries you will need to pay some kind of tax if you buy bitcoins, sell them, and make a gain. In the US you must do this on every transaction.

Be sure to check with your country’s tax authorities to make sure you are paying all the required taxes on your bitcoin use.

What Other Ways can I Get Bitcoins Besides Buying?

Just like any other form of money, you can get bitcoins by requesting from your employer to be paid in bitcoins.

Avoiding Bitcoin Scams: Don't Lose Money!

I've been using Bitcoin for 3+ years. I've never fallen victim to a single scam. Follow the tips explained here and you'll greatly reduce your chances of losing money.

There are many scams related to Bitcoin. Scammers target new Bitcoiners and less tech-savvy users. Follow these basic rules in order to avoid Bitcoin scams:

Study your intended exchange and make sure it’s trustworthy. Search forums like Reddit for the experiences of other users.

You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. If you don’t find your intended exchange listed on this site, extra caution and research is advised as it may be a scam!

Check Ratings

If you’re using a peer-to-peer exchange like LocalBitcoins or Wall of Coins, check the seller’s feedback. If most of their feedback is positive, your trade is more likely to go through without issues. If a seller has lots of negative feedback, it’s best to simply stay away and find a more reliable seller.

Use Escrow

Many scammers will try an approach like this:

“Send me bitcoins, and once I get the bitcoins I’ll pay you on PayPal!”

Don’t ever agree to a trade like this. Bitcoin payments are irreversible, so if you send first the scammer can simply not pay you and keep their bitcoins.

PayPal can't force the scammer to pay either, due to the pseudonymous nature of Bitcoin which doesn’t record the identity of a payment’s sender or recipient. This would leave you with no way to get your bitcoins back.

Stay Away from Bitcoin investments

Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. If it sounds too good to be true, stay away.

Be Careful with Altcoins

What are altcoins? Altcoins are cryptocurrencies other than Bitcoin.

Altcoins are traded globally on hundreds of exchanges. Avoid throwing money into coins which are experiencing a sudden and dramatic spike in price and volume. Such moves, especially in insignificant coins with otherwise thin volume and flat price action, are likely to crash fast.

Secure your Coins

Don't store coins on Bitcoin exchanges! Bitcoin users have lost over $1 billion worth of bitcoins in exchange hacks and scams.

Here are two examples where users got screwed by leaving bitcoins with a third party:

So, do yourself a favor:

Get yourself a Bitcoin wallet and control your own coins. For large amounts of bitcoins, we recommend cryptocurrency hardware wallets. Hardware wallets are small, offline devices that store your bitcoins offline and out of reach from hackers and malware.

Why? It's pretty simple:

- Hardware wallets are the easiest way to securely store bitcoins and easy to backup

- Less margin for error; setup is easy even for less technical users

Check out the Bitcoin hardware wallet comparison chart below:

In Germany, Bitcoin Is Now Legal Tender

What's the Latest Development?

On Monday, Germany's finance ministry brought Bitcoin one step closer to legitimacy by declaring it a "unit of account," thus allowing it to be used as legal currency for tax and trading purposes. Supporter and parliament member Frank Schaeffler says that classifying the virtual currency under the country's banking rules represents "a first step" towards denationalizing the production of money, and hopes that the government doesn't interfere with its success: "A free country should. not intervene in citizens' private choice of money."

Blockchain & Bitcoin Conference Germany, Berlin

Conference dedicated to cryptocurrencies, blockchain technology and ICO.

All you need to know about blockchain integration into business and investing in token sales.

Learn more about the implementation of blockchain projects and generating income with cryptocurrency and ICO! Register in advance and get a discount.

Present your company to the most interested target audience! Your brand will be in the foreground of future investors and customers.

Catch a lot of newsworthy events and make your media source even more popular in a blockchain community. Become our media partner!

Are you a blockchain entrepreneur, a lawyer or an expert in the field of cryptocurrency and ICO? Do you have anything to share with the audience? Become our speaker!

About the conference

The first large-scale conference in Berlin organized by Smile-Expo, dedicated to cryptocurrencies, blockchain and ICO.

Key topics:

- how to implement blockchain into business processes;

- cryptocurrencies: analytics and forecasts;

- legislation: experience and prospects;

- ICO for startups and investors.

Participants: developers, entrepreneurs, investors, financial experts, blockchain enthusiasts, lawyers, startups founders.

The official language at the Conference – English.

Conference working hours: 10 a.m. – 6 p.m.

Get a full program before the conference

04 April 09:00 04 April 09:00

Registration of participants. Welcoming coffee

04 April 09:50 04 April 09:50

Review of the conference program

Technical Vice President of Innovation and New Technologies, IBM Cloud

04 April 10:00 04 April 10:00

The Advancement of Blockchain Technology: From Concept to Implementation

Are you curious about the future of Blockchain? Viewed as both an opportunity and a threat, Blockchain technology is allowing your business to reimagine business networks and the fundamental ways they exchange value and information. Blockchain has shifted from hype to reality across many industries including Financial Services, Supply Chain, Retail, Healthcare and Government. Supported by the Linux Foundation's open source, open-standards based Hyperledger Project, Blockchain has the potential to improve regulatory compliance, reduce cost as well as advance trade. Come to this session to understand what the future holds for Blockchain by taking a closer look at a specific Blockchain case study.

Rechtsanwältin / Partner bei DWF speaker of the finance working group of the German Blockchain asscociation

04 April 10:25 04 April 10:25

Token Regulation – current status of discussion

Regulators around the globe start to voice their opinion of the regulation of token sales. This presentation will give an update about the legal classification of tokens and the regulations applying to sales, related services and listing as currently discussed in Germany.

Managing Growth, Ocean Protocol

04 April 10:50 04 April 10:50

A new data economy with power to the people

How do we build a decentralized data services ecosystem, why do we need it, and how do we incentivize users to curate and serve up relevant data. First I would describe why AI needs more data, and what are the current issues. How do we solve them (by pooling resources and creating tokens to incentivize curation), using token curated registries and curation markers. And finally what are the potential applications.

04 April 11:20 04 April 11:20

How blockchain can impact supply chain due diligence

The immutability and distributed nature of blockchain make it a promising technology for supply chain assurance, but how practically can it be used. In this session we will look at a number of conceptual models and their different trade offs.

04 April 11:45 04 April 11:45

Big Data Project Leader at CERN, Blockchain Expert and orvium.io founder

04 April 12:00 04 April 12:00

Blockchain and Open Science Evolution

In 1989, Tim Berners-Lee, created the World Wide Web (WWW) at CERN. The WWW was made available via an open license and that was key to make achievements far beyond its expectations.

However, this open philosophy is not applied to the rest of scientific knowledge. The industry behind science dissemination keeps information behind paywalls and introduces biases, delays and barriers,

which limit the impact of science in society. Blockchain allows transparent, open, trustworthy, decentralized and traceable environments. This represents an unprecedented opportunity to disrupt the current

industry, return the control of science to scientists and enhance science impacts on society. Learn in this session how blockchain can make science more transparent, universal and open than ever.

Blockchain Architect, MaibornWolff

04 April 12:30 04 April 12:30

Evaluate ICOs From a Technical Point of View

ICOs are a new form of raising money from a worldwide audience, but at this stage some white papers lack detailed information on either financials or technical details. Therefore some sort of technical guidance provides necessary evaluation to found a rating on. We would share some of our methods of our advisory for VCs as well as start-ups with the audience.

04 April 13:00 04 April 13:00

Associates at Baker & McKenzie Zurich

04 April 14:00 04 April 14:00

The EU General Data Protection Regulation is coming. Are You Ready?

The GDPR goes into effect this May and works to modernize the existing data protection laws of the EU. The distributed and often public nature of blockchain protocols pose interesting questions for how the privacy rules and obligations will apply to blockchain-based companies. This presentation will discuss what companies need to consider before offering their tokens to the public.

Founder & CEO, SatoshiPay

04 April 14:30 04 April 14:30

Nanopayments on the Blockchain - pocket change for the web

Have you ever thought of transferring 1 cent across the internet? SatoshiPay is a login-free, one-click payment widget for the web. SatoshiPay's blockchain-based technology makes it possible to transfer super-small amounts between content publishers and consumers. This means new revenue streams can be explored: publishers can sell content for as little as 1 cent without any friction, bundling, or signup.

04 April 15:20 04 April 15:20

TAITOSS PROJECT and AI Technology

04 April 15:35 04 April 15:35

04 April 15:45 04 April 15:45

CEO, Precious Metals & Cryptocurrency Expert, Midas Touch Consulting

04 April 16:00 04 April 16:00

CEO at RefToken, Founder at ICO Launch Malta

04 April 16:00 04 April 16:00

Blockchain & A.I. Architect for Automotive & Industry, Porsche Digital Lab - the Porsche tech laboratory

04 April 16:00 04 April 16:00

Lawyer and Manager at PwC Legal

04 April 16:00 04 April 16:00

Senior Manager at EY

04 April 16:00 04 April 16:00

From strategy to execution of ICOs: prospects, regulation and current state

04 April 16:50 04 April 16:50

Co-founder and Board Member at Adel

04 April 17:05 04 April 17:05

Who will be a Borderless Citizen™ in the 21st Century?

Adel's co-founder explores the creation of virtual communities fueling by blockchain innovation. The presentation explores the evolution of the Virtual State™ and the Borderless Citizen™.

Thanks to the Internet, and blockchain technology, the world is waking up to a political, economic, social and technological renaissance. The next two decades will be a fundamental shift in human interaction, sharing, and freedom. All aspects of vertical and horizontal markets will be affected, including Finance & Banking, Healthcare, eGovernment, Communications, Information Technology (IT) and the Internet of things (IoT). Adel’s General Manager will analyze this paradigm shift in behavior and present a vision for the future.

04 April 17:30 04 April 17:30

Closing of the conference

Become a speaker

IBM Cloud , Technical Vice President of Innovation and New Technologies

Dr. Nina-Luisa Siedler

Rechtsanwältin / Partner bei DWF speaker of the finance working group of the German Blockchain asscociation

Ocean Protocol , Managing Growth

Manuel Martin Marquez

Big Data Project Leader at CERN, Blockchain Expert and orvium.io founder

MaibornWolff , Blockchain Architect

Peter Mitchell and Christopher Murrer

Associates at Baker & McKenzie Zurich

SatoshiPay , Founder & CEO

Midas Touch Consulting , CEO, Precious Metals & Cryptocurrency Expert

CEO at RefToken, Founder at ICO Launch Malta

Porsche Digital Lab - the Porsche tech laboratory , Blockchain & A.I. Architect for Automotive & Industry

Lawyer and Manager at PwC Legal

Senior Manager at EY

Co-founder and Board Member at Adel

Subscribe and be the first one to learn about top speakers

Theme: «Registration of participants. Welcoming coffee»

04 April, 09:00 04 April, 09:00

Theme: «Review of the conference program»

Moderator's welcome speech

04 April, 09:50 04 April, 09:50

Theme: «The Advancement of Blockchain Technology: From Concept to Implementation»

Technical Vice President of Innovation and New Technologies, IBM Cloud

04 April, 10:00 04 April, 10:00

René Bostic is the Technical Vice President of Innovation and New Technologies for IBM Cloud. Enjoying her career with IBM during the modern millennial technological era, she is an expert in cloud computing, DevOps and emerging cloud technologies such as Blockchain. René has presented at IT Roadmap Conferences sponsored by IDG Enterprises, the Gartner Enterprise Architecture Summit sponsored by Gartner, Cloud Expo sponsored by SYS-CON Media and the Agile2017 Conference to name a few. Cloud Expo named René a faculty member for both their 2017 Cloud Expo East and Cloud Expo West Conferences. René is a member of the Society of Women Engineers (SWE) and a member of the Society of Information Management (SIM). René received a Business and Economics degree with a minor in Computer Science from St. Andrews Presbyterian University (Laurinburg, North Carolina, USA). She resides in Atlanta, Georgia, USA.

Theme: «Token Regulation – current status of discussion»

Dr. Nina-Luisa Siedler

Rechtsanwältin / Partner bei DWF speaker of the finance working group of the German Blockchain asscociation

04 April, 10:25 04 April, 10:25

Nina-Luisa Siedler is partner at DWF, a technology-oriented global law firm, and head of the international Blockchain Competence Group. She focusses on the legal implication of blockchain/distributed ledger technology projects and assists her clients with the structuring of business cases in the infrastructure, IoT, data, logistic, energy and retail sector as well as the financing via token sales. Nina-Luisa Siedler is founding member of Blockchain Bundesverband (the German blockchain association) and speaker of the finance as well as the token/ICO working groups. She is also an advisor of BlockchainHub

Germany Won't Tax You for Buying Coffee With Bitcoin

Germany won't tax bitcoin users for using the cryptocurrency as a means of payment, the Ministry of Finance has said.

The guidance, published Tuesday, sets Germany apart from the U.S., where the Internal Revenue Service treats bitcoin as property for tax purposes – which means that if an American buys a cup of coffee with bitcoin, it's technically considered a sale of property and potentially subject to capital gains tax.

Instead, Germany will regard bitcoin as the equivalent to legal tender for tax purposes when used as a means of payment, according to a new document.

The Bundesministerium der Finanzen based its guidance on a 2015 European Union Court of Justice ruling on value added taxes (VAT).

The court ruling creates a precedent for European Union nations to tax bitcoin while providing exemptions for certain types of transactions.

Notably, the new German document justified its tax decisions by regarding cryptocurrencies a legal method for payment, stating:

"Virtual currencies (cryptocurrencies, e.g., Bitcoin) become the equivalent to legal means of payment, insofar as these so-called virtual currencies of those involved in the transaction as an alternative contractual and immediate means of payment have been accepted."

For tax purposes, this means that converting bitcoin into a fiat currency or vice versa is "a taxable miscellaneous benefit." When a buyer of goods pays with bitcoin, an article of the EU's VAT Directive will be applied to the price of bitcoin at the time of the transaction, as documented by the seller, according to the document.

However, as per the EU ruling, the actual act of converting a cryptocurrency to fiat or vice versa is classified as a "supply of services," and therefore a party acting as an intermediary for the exchange will not be taxed.

Payment fees sent to digital wallet providers or other services can likewise also be taxed, according to the document.

Other aspects of the cryptocurrency ecosystem will not be taxed. Miners who receive block rewards will not be taxed, as their services are considered to be voluntary, according to the document.

Similarly, exchange operators that buy or sell bitcoin in their own name as an intermediary will receive a tax exemption, though an exchange operating as a technical marketplace will not receive any such exemption.

Editor's note: Statements in this article were translated from German.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Germany Gets Its First Crypto Exchange for Whales

Germany’s VPE Wertpapierhandelsbank AG (VPE) has announced its institutional investor cryptocurrency trading services and claims them to be the first of their kind for the country. Armed with a Bundesanstalt für Finanzdienstleistungsaufsicht (Bafin) license, in expanding its brokerage offerings VPE purports to offer “best-in-class technology” to customers, “secure and regulated.”

VPE Launches Germany’s First Institutional Investor Cryptocurrency Trading Services

VPE Wertpapierhandelsbank AG spokesperson Katharina Strenski stressed, “Until now, institutional investors have faced high entry barriers to crypto trading. Our cryptocurrency trading services offer a much more convenient alternative.”

The world over, institutional investors, or whales, usually control vast sums of capital. They’ve been looking for ways to leverage cryptocurrency markets, but often run up against their own lobbying efforts in wielding government regulatory power to insulate themselves from competition. The consequences thus far include uneven access to a red hot and emerging asset class, arguably the future of finance in one form or another, cryptocurrency.

“Cryptocurrencies such as Bitcoin, Litecoin, Ethereum and others have become a promising asset class in recent years,” Ms. Strenski detailed. “To date, trading digital tokens has been restricted to crypto exchanges and online marketplaces. We are pleased to be the first German bank to offer our customers cryptocurrency trading services.”

VPE is a German centric exchange-based OTC trader. Financial corporations, private investors, and institutional investors (whales) get brokerage services, investment advice, and portfolio management. Under that umbrella, the bank offers clearing services, settlement of transactions in securities, contracts for difference, options, and futures.

Germany Is an Economic Powerhouse

Germany is an economic powerhouse, and so any entry its companies make into the crypto space will undoubtedly move the needle. It ranks as Europe’s economic engine and its largest economy, is a constant innovator, and is a giant exporter of goods. Routinely the country can boast Europe’s lowest employment rate, and its citizens average over $50K per capita.

All this could point to a boost for the digital asset sector as German institutional investors are among the most profitable companies in the world. For its part, as a “securities trading bank,” the bank’s press release continues , “VPE has an impressive trading track record and has access to the appropriate networks and technical requirements for processing individual transactions. VPE also meets all necessary KYC (Know your Customer) and AML (Anti-Money-Laundering) requirements.”

VPE also offers automated crypto trades, “developed in partnership with Solarisbank, the first banking platform with a full banking license, and with support from leading banking and legal crypto experts. VPE’s virtual currency trading account is held in escrow by Solarisbank. Customers will also receive access to an individual virtual currency wallet hosted by VPE. This will make trading fast and simple while ensuring the highest security standards,” the company insists.

Do you think German institutional investors will be a boost for crypto markets? Let us know in the comments section below.

Images courtesy of Shutterstock, VPE.

Need to calculate your bitcoin holdings? Check our tools section.

Where and How to Buy Bitcoins

Best Ways to Buy

This guide will teach you how to buy bitcoins.

It's easy to find where to buy bitcoins online because there are so many options.

If you want to learn the best way to buy bitcoins, keep reading!

Welcome to Buy Bitcoin Worldwide! I'm Jordan Tuwiner, the founder of this site.

We understand that buying bitcoins can be extremely confusing and frustrating. Luckily for you, this site has ample information to help make buying bitcoins easier for you.

Introduction to Buying

Want to learn how to purchase bitcoin or get bitcoins?

You’re in the right place!

The short answer is:

Find a Bitcoin exchange

Trade your local currency, like U.S. dollar or Euro, for bitcoins

For the long answer, read this Bitcoin buying guide and by the end you’ll understand these key points:

How and where to buy bitcoin

How to choose the right exchange

How to secure your coins after you buy

How to avoid scams

Below, we listed exchanges you can use to purchase BTC. We suggest our listed exchanges and doing your own research before making your final decision.

Certain exchanges are simply there to steal your personal information or rob you of your bitcoins.

We conduct intensive research on every exchange we list to filter out any and all dishonest exchanges.

Choosing an Exchange: Which is the Best Bitcoin Exchange?

To select the perfect exchange for your needs, consider these 7 factors.

1. Privacy: Keep Your Information Safe!

Want to buy BTC privately?

You can already cross off a number of payment methods:

- Bank transfer

- Credit card

- Debit card

- PayPal

- Any other method that requires personally or identifying information

Buying bitcoins with cash or cash deposit is the most private way to purchase bitcoins.

We also have a detailed guide which reveals your options for buying without verification or ID.

2. Limits: Are You Buying a Lot of Coins?

If you need to buy a large amount of bitcoins--say 25 or more--then big brokers or major exchanges are the way to go.

Coinbase has high limits for buying with a bank account.

CoinMama has the highest limits for buying with a credit card.

Most cash exchanges have no buying limits. Limits, however, will vary between individual sellers and are usually lower than online exchanges.

3. Speed: When Do You Need Access to your Bitcoins?

How quickly do you need to convert regular money into bitcoins? Different payment methods deliver your coins at different speeds.

Your first Bitcoin purchase may be time consuming. Once you get everything setup all subsequent purchases will be much faster!

Bitcoin ATMs can be the fastest way to purchase bitcoin if you’re lucky enough to have one in your area. Here's a map to help you out.

Some brokers offer instant buys with bank transfer, credit card, or debit card.

4. Exchange Rate

There is no official Bitcoin price. Use BitcoinAverage or CoinDesk to see the average price of Bitcoin across all major international Bitcoin exchanges and compare that to the price on your chosen exchange.

5. Reputation: Don't Get Scammed!

How long has the exchange been in service? Is the exchange trustworthy? Our Bitcoin exchange reviews can help you to find a trusted exchange.

6. Fees: Are You Getting a Good Deal?

How much does the exchange charge for its services? The fee will vary greatly based on the payment method you choose to use.

Remember to include deposit and withdrawal fees as well as trading fees. Some exchanges will lower their fees if you trade a lot of bitcoins.

7. Payment Method

How can you pay for the bitcoins? Payment method may be the most important factor.

We're sure you already have a payment method in mind that you'd prefer to use. More on that below.

Get a Wallet!

Some exchanges require a Bitcoin wallet before you can buy.

If you don't have a wallet yet, learn how to get a Bitcoin wallet and then come back.

We'll wait for you here ;)

Know your Payment Method?

Payment Methods

We can both agree that this Bitcoin stuff is confusing. Stick with us!

We're about to have you on your way to choosing a payment method and buying bitcoins.

Where to Buy Bitcoin?

- Purchase bitcoins online with a credit card, debit card, or bank transfer.

- Acquire bitcoins from a Bitcoin ATM near you.

- Buy bitcoins with cash locally or via cash deposit.

- Convert PayPal to Bitcoin online.

The above was just a brief overview of where you can buy bitcoin. Now, let's get into the details.

In order to buy bitcoins, you’ll need to exchange your local currency, like Dollars or Euros, for bitcoin. Here’s an overview of the 4 most common payment methods:

1. Credit or Debit Card

Credit/debit cards are the most common way to pay online. So, it's really no surprise that many people want to buy bitcoins this way.

Why buy bitcoin with a credit/debit card?

- Credit cards are a payment method most people are familiar with; probably the easiest way to buy bitcoins online

- Delivery of bitcoins is instant once initial verification is complete

Why NOT buy bitcoin with a credit/debit card?

- High fees; if you're patient and not in a rush to buy then use a bank transfer for lower fees

- Not a private way to buy; your ID will be required to buy with a credit card

A few places to buy bitcoins online with a credit card are:

Bank Account or Bank Transfer

Bank transfer is one of best ways to buy bitcoins in most countries.

Why buy bitcoins with bank account/transfer?

- Good way to buy large amounts of bitcoins

- Using a bank transfer will usually result in the lowest fees, so you can get a great price on your purchase

Why not to buy bitcoins with bank account/transfer?

- Usually requires ID verification, so not a good choice for privacy

- Slow; in the USA, bank transfers can take up to 5 days to complete

Some of the best ways to buy bitcoins with your bank account:

Cash deposit is often the fastest and most private ways to buy bitcoin. You can usually receive your bitcoins within a couple hours.

What are cash exchanges good for?

- Can be more private since in some cases no personal information is required

- Can be nearly instant; no need to wait 5 days for a bank transfer to process

What are cash exchanges bad for?

- Privacy comes at a cost; cash exchanges often have price 5-15% above market rate

- Easier to get scammed or robbed; need to be on alert and follow the exchange's rules

Some of the best places to buy bitcoin instantly with cash:

Note: There is no easy way to buy bitcoin at Walmart. We get asked this A LOT!

There are Bitcoin ATMs all around the world that let you purchase bitcoin with cash.

You simply insert cash into the machine, and get bitcoins sent to your wallet.

Use Coin ATM Radar to find a Bitcoin ATM near you.

What are Bitcoin ATMs good for?

- Can be more private since in most cases no personal information is required

- If you have an ATM in your area it can be a convenient and fast way to buy coins

What are Bitcoin ATMs bad for?

- Privacy comes at a cost; Bitcoin ATMs often have a 5-15% premium above market rate

There is no way to directly buy bitcoins with PayPal. Under PayPal’s terms and conditions merchants are not allowed to sell bitcoins for PayPal.

I really recommend not buying bitcoins with PayPal. The fees are really high. Chances are that your PayPal is connected to your credit card or bank account, which can be used to buy at much lower fees.

However, there are a few hacks to get around this. You can buy other digital items with PayPal and sell those items for bitcoin. It's all explained in our guide on how to buy bitcoins with PayPal.

Why buy bitcoins with PayPal?

- If you already have a balance, it can be an easy and fast way to convert PayPal to bitcoins

Cons of buying bitcoins with PayPal

- Fees are over 12%; much better to just buy with a credit card or bank account

Frequently Asked Questions

If you're still a bit confused, that's okay. Buying bitcoins is hard, but that's why I built this site, to make it easier!

If you still need help, I hope this FAQ will help to answer any remaining questions.

When is the Right Time to Buy?

As with any market, nothing is for sure. Bitcoin is traded 24/7 and its price changes every second.

Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts from other Bitcoin trading sites. These charts will help you understand Bitcoin’s price history across the many global Bitcoin exchanges.

Why Does Buying Bitcoin Take So Long?

Long wait times are usually a problem with existing payment systems, not with Bitcoin itself.

Bitcoin transactions only take about 10 minutes to confirm. Bank transfers in the U.S., for example, can take up to five days to complete.

Bitcoin transactions can be confirmed as quickly as 10 minutes; it’s rare to experience a delay longer than one hour.

This means that a merchant can’t release bitcoins to a customer until five days have passed unless they're willing to take on risk.

Can You Sell Bitcoins?

Yes, of course! Most exchanges that let you buy bitcoins also let you sell (for a fee of course).

Why Do I Need to Upload my ID for Some Exchanges?

This is due to Know Your Customer (KYC) laws which require exchanges to record the real world identity of their clients.

Can Anyone Buy Bitcoin?

Bitcoin requires no permission to use or buy.

You will have to check the legality of Bitcoin in your country. In most countries Bitcoin is legal!

Should I Buy Physical Bitcoins?

Physical bitcoins are physical, metal coins with a Bitcoin private key embedded inside.

We recommend that you stay away from physical bitcoins unless you’re a numismatist.

While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. The creator could create two copies of the private key.

Unless you immediately open and withdraw the digital bitcoins from your physical bitcoin, the creator could at any time steal the funds it contains.

Can I Buy Partial Bitcoins?

Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into 100,000,000 pieces. Each unit of bitcoin, or 0.00000001 bitcoin, is called a satoshi.

Most exchanges let you buy as little as $5 worth of bitcoins at a time.

Why Should I Buy Bitcoin Instead of Mining?

A long time ago anyone could mine bitcoins on their computer at home. Today, only specialized computer hardware is powerful enough to do this.

Think about it like this:

Should you buy gold or mine gold? Well, to mine gold you need big powerful machines, a lot of time, and money to buy the machinery. This is why most people just purchase gold online or from a broker.

So Bitcoin is no different.

You should just buy some if you want coins without trying to mine.

Do I need a Bitcoin Account Before Buying?

With Bitcoin, there are not really accounts.

Instead, you should have a Bitcoin wallet. If you want to store bitcoins, then a wallet is where you keep them.

In Bitcoin these wallets are not called an account but a wallet functions almost the same way. The only difference is you are responsible for the security if your wallet rather than placing the security in the hands of a bank or trust.

How do I check if I received a Bitcoin payment?

Why Would Someone Even Want to Buy Bitcoins?

There are many reasons people want to own bitcoins.

Many people like to purchase some and put them to the side in the hopes that they will be worth more in the future.

Many people are using bitcoins to remit money to their families from out of the country. Right now, Bitcoin is one of the cheapest ways to do this.

People also use Bitcoin to buy stuff online. Big companies like Microsoft, Dell, Newegg and Overstock all accept bitcoins.

Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. Most stock markets only open on weekdays from 9 AM to 5 PM. So many traders buy and sell bitcoins because it is a fun and fast market to trade.

Can I Buy Bitcoin Stock?

Bitcoin itself is not a stock despite it functioning somewhat like one. You can’t buy bitcoins through a traditional stock fund and instead have to buy bitcoins yourself. This may change in the future if a Bitcoin ETF ever gets approved.

What Happens When you Purchase Bitcoins?

Bitcoins are actually just secret digital codes. When you buy bitcoins, the seller is using a wallet to transfer the ownership of the coins to you. Once your purchase is complete, the codes are now owned by you and not the seller.

Why Are the Chinese Buying So Much BTC?

It seems the Chinese really like Bitcoin’s properties such as its sound monetary policy and that it can be used anywhere in the world. Bitcoin's volatility also makes it interesting for speculative traders.

Is Bitcoin Legal?

Bitcoin is legal in nearly every country. Only a few countries have actually banned the use of bitcoins. Before you buy, make sure you double-check the legal status of Bitcoin in your country.

Why do I need to buy bitcoins before buying most altcoins?

Bitcoin functions as the "reserve" currency of cryptocurrency. So it is very hard to buy other coins without first buying bitcoins. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. This is mostly because Bitcoin has very good liquidity and is traded on every cryptocurrency exchange. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies.

Am I Anonymous when I Buy?

Bitcoin is not anonymous but rather pseudonymous. All Bitcoin transactions are public but it is not always known the real identity behind any give Bitcoin address.

Can I use Multiple Exchanges?

If the limits on one exchange are to low you can simply open an account with another exchange to give yourself the ability to buy more.

You can signup, join, and use as many Bitcoin exchanges as you want that are available in your country.

Do I need to Pay Taxes on Bitcoin?

In most countries you will need to pay some kind of tax if you buy bitcoins, sell them, and make a gain. In the US you must do this on every transaction.

Be sure to check with your country’s tax authorities to make sure you are paying all the required taxes on your bitcoin use.

What Other Ways can I Get Bitcoins Besides Buying?

Just like any other form of money, you can get bitcoins by requesting from your employer to be paid in bitcoins.

Avoiding Bitcoin Scams: Don't Lose Money!

I've been using Bitcoin for 3+ years. I've never fallen victim to a single scam. Follow the tips explained here and you'll greatly reduce your chances of losing money.

There are many scams related to Bitcoin. Scammers target new Bitcoiners and less tech-savvy users. Follow these basic rules in order to avoid Bitcoin scams:

Study your intended exchange and make sure it’s trustworthy. Search forums like Reddit for the experiences of other users.

You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. If you don’t find your intended exchange listed on this site, extra caution and research is advised as it may be a scam!

Check Ratings

If you’re using a peer-to-peer exchange like LocalBitcoins or Wall of Coins, check the seller’s feedback. If most of their feedback is positive, your trade is more likely to go through without issues. If a seller has lots of negative feedback, it’s best to simply stay away and find a more reliable seller.

Use Escrow

Many scammers will try an approach like this:

“Send me bitcoins, and once I get the bitcoins I’ll pay you on PayPal!”

Don’t ever agree to a trade like this. Bitcoin payments are irreversible, so if you send first the scammer can simply not pay you and keep their bitcoins.

PayPal can't force the scammer to pay either, due to the pseudonymous nature of Bitcoin which doesn’t record the identity of a payment’s sender or recipient. This would leave you with no way to get your bitcoins back.

Stay Away from Bitcoin investments

Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. If it sounds too good to be true, stay away.

Be Careful with Altcoins

What are altcoins? Altcoins are cryptocurrencies other than Bitcoin.

Altcoins are traded globally on hundreds of exchanges. Avoid throwing money into coins which are experiencing a sudden and dramatic spike in price and volume. Such moves, especially in insignificant coins with otherwise thin volume and flat price action, are likely to crash fast.

Secure your Coins

Don't store coins on Bitcoin exchanges! Bitcoin users have lost over $1 billion worth of bitcoins in exchange hacks and scams.

Here are two examples where users got screwed by leaving bitcoins with a third party:

So, do yourself a favor:

Get yourself a Bitcoin wallet and control your own coins. For large amounts of bitcoins, we recommend cryptocurrency hardware wallets. Hardware wallets are small, offline devices that store your bitcoins offline and out of reach from hackers and malware.

Why? It's pretty simple:

- Hardware wallets are the easiest way to securely store bitcoins and easy to backup

- Less margin for error; setup is easy even for less technical users

Check out the Bitcoin hardware wallet comparison chart below:

Комментариев нет:

Отправить комментарий