Bitcoin Gold Hacked for $18 Million

It appears Bitcoin Gold (BTG) has been double spend attacked over and over again, totalling something in the neighborhood of $18 million at current prices. BTG forums seem to have been tracking the hack, going as far back as last week, monitoring the controversial coin’s hashrate, ultimately determining a 51% attack was under way.

Bitcoin Gold Gets $18 Million Haircut

“An unknown party with access to very large amounts of hashpower is trying to use ‘51% attacks,’” Bitcoin Gold forum poster Mental Nomad announced a week ago, “to perform ‘double spend’ attacks to steal money from Exchanges. We have been advising all exchanges to increase confirmations and carefully review large deposits.”

A founding economic principle of bitcoin was its alleviation of the double spend problem. It was a main stumbling block in the historical race to create a viable cryptographic monetary form – foiling a great many coders along the way. Satoshi Nakamoto solved it through a decentralized, distributed ledger confirmation process (blockchain). Going as far back as its genesis block from early 2009, users can be confident transactions aren’t rebroadcast. Like clockwork, 6 times an hour, blocks are added – copied to nodes within the universal network.

The offending wallet, according to the BTG team.

The offending wallet, according to the BTG team.

One way to achieve double spending is known as a 51% attack. It’s accomplished by bogarting the network’s computing power. With a majority, bad actors can get between the Nakamoto solution and transaction confirmations. By stymieing block completion in the usual manner, all sorts of mischief can arise: blockchain mining rewards redirected, users’ transactions reversed, etc. Not too long after, a double spending attack can commence, acting as the fiat equivalent to counterfeiting. Needless to type, any crypto suffering from such a problem is certain to immediately lose user confidence.

GTNjvCGssb2rbLnDV1xxsHmunQdvXnY2Ft

Over period of days, batches of BTG were deposited into exchanges supporting the forked coin, only to be sent back to the depositor’s wallet. The lag between such a transaction and some exchanges’ discovery is sufficient enough to nab tokens, doubling the filthy lucre. Exchanges trading bitcoin gold have responded by upping transaction confirmation filters, but evidently to no avail as the attacker gains ever-more BTG network control.

Bitcoin Gold team members seem to have communicated with some exchanges. “Requiring more confirmations greatly increases safety,” the forum details. “Until now, some Exchanges were operating with less than five confirmations required. We have been urging higher limits to prevent such an attack, and urging manual review of large deposits of BTG before clearing the funds for trading.” Indeed, according to BTG, “One of the targeted Exchanges reported that they strongly believe this attacker attempted to hit them with a double-spend of BTC in the past. In their words, ‘we are 100% sure that it is the same person, we found many associations between the accounts.’”

The traditional way BTC has been able to thwart double spend attacks.

The traditional way BTC has been able to thwart double spend attacks.

Evidence put forward by the BTG team points to address GTNjvCGssb2rbLnDV1xxsHmunQdvXnY2Ft as the attacker’s wallet; mined coins, according to the forum post reside at GXXjRkdquAkyHeJ6ReW3v4FY3QbgPfugTx. More than 388,201.92404001 BTG were funneled through the wallet, totalling more than $18 million according to Bitcoin Gold Explorer . That a top thirty crypto by market cap can be so easily troubled is a giant of enough problem, but it could also take exchanges down in the process – something the ecosystem is very sensitive to since Mt. Gox. And though, for now, BTG is confident enough to suggest users are not at risk, history shows that can quickly be the case as an exchange freezes withdrawals in an effort to stop hemorrhaging.

Bitcoin Gold has been beset by controversies since its birth fork late last year, including a recent dust-up between BCH advocate Craig Wright and BTG founder Jack Liao. To be fair, however, it is not the only blockchain to suffer a 51% attack. Mere days ago, recently Chinese government highly rated coin verge (XVG) was made to heel, again. These pages reported XVG, “On the morning of May 22, Suprvona, one of the largest altcoin mining pools, informed its 19,000 Twitter followers that verge was suffering yet another 51% attack, causing all blocks to be rejected.”

Do you think the BTG hack spells doom for the coin? Let us know what you think of this subject in the comments below.

Images via Pixabay, BTG Block Explorer.

Bitcoin Gold

For all future releases Just for the upcoming release Send me a reminder 1 trading day before

Position added successfully to:

Lul.to, a German audio and e-book pirate platform, trafficked in close to a quarter million titles, serving 30,000 users. Summer of last year, the country’s Cyber Crime Competence.

According to a Brazil-based crypto researcher, it would take as little as $70 million for hackers to bankrupt Ethereum Classic's network.

All altcoins may be vulnerable to a 51% attack, experts believe. As crypto coins become mainstream, there are plenty of low-hashrate coins with a high public profile. Verge (XVG).

There is a lot of speculation regarding the Bitcoin Gold issues. Some sources claim a mining pool attacked the network. Others claim it was Bitmain deploying additional ASICs to.

Some PoW currencies are using the same mining algorithms as their larger counterparts, making it much easier to hack the smaller networks with a 51% attack. Network Security.

Murphy’s Law states that “whatever can go wrong, will go wrong.” For Bitcoin Gold (BTG), this epigram appears to be spot on as the network recently fell victim to the dreaded 51.

First it happened to verge. $1.8m of cryptocurrency swiped in a matter of hours. Then to bitcoin gold, plundered in an $18m double spend attack. Then to verge again, this time to.

The Bitcoin Private (BTCP) digital asset may just see its fortunes reversed - John McAfee has tweeted his support and lent his team for promotion and marketing. This immediately.

It appears Bitcoin Gold (BTG) has been double spend attacked over and over again, totalling something in the neighborhood of $18 million at current prices. BTG forums seem to have.

Craig Wright had to be escorted out of an event after a standoff with the founder of Bitcoin Gold Jack Liao. During a conference in Taiwan, Wright once again tried to dodge.

Cryptocurrency exchange BitMEX published an analysis on Monday that listed the entire labyrinth of Bitcoin’s forks. The results reveal that the cryptocurrency has experienced.

Bitcoin Gold is definitely priced to better take advantage of the upcoming breakout, whichever direction it may be.

Just recently the Bitcoin Gold (BTG) developers announced the project’s consensus algorithm Equihash was “threatened” in a blog post called “A Response to the ASIC.

The Robinhood app, offering zero-fee crypto trading services, has now officially opened up for the state of Michigan, after offering commission-free Bitcoin and Ethereum trading to.

The MoneroV project lay inactive for a while, but managed to launch a mainnet and wallets, a not so difficult feat given that any fork can copy the code from the original asset.

Bitcoin Gold

For all future releases Just for the upcoming release Send me a reminder 1 trading day before

Position added successfully to:

Bitcoin Gold News

Some PoW currencies are using the same mining algorithms as their larger counterparts, making it much easier to hack the smaller.

Bitcoin Gold Analysis & Opinion

Yet another attack struck the cryptocurrency market recently.

Today, I’d like to take a look at Populous, a London-based.

On April 6, the dark web’s cryptocurrency of choice, Monero.

Some time ago I published the first part of my Bitcoin analysis.

Is Bitcoin the Answer?

What is money?

- what money really is

- where it comes from

- the fundamentals of how it moves between businesses, banks and countries

The Definition of Money

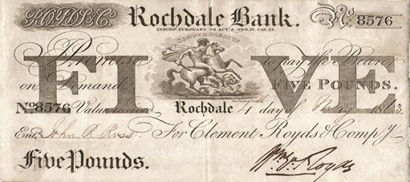

- "Money is coins and notes exchanged in trade." This is a poor attempt at a definition, but a popular one. Yes, some money is in the form of coins and notes, but vastly more is in the form of records, in bank accounts for example.

- "Money is a medium of exchange". Yes it is. This is a feature of money but this definition is inadequate because lots of things which are not money are also media of exchange. People often trade goods directly, so goods can be a medium of exchange, but they are not money. And besides, money is also a store of value. We don't define something by listing its attributes one by one. All that does is show us we can't put our finger on the essence of what we're talking about.

- "Money is a store of value". Yes it is. But so are houses, land, oil and cheese (if you happen to be a cheese merchant). None of these are money.

- "Money is wealth". No, it isn't. Lots of wealthy people have property but no money.

- Yes, it works for cash, a scorekeeping system which uses portable tokens, as well as for bank accounts, a scorekeeping system which uses records.

- Yes, you can see why you get money for working for someone, or perhaps for selling them something.

- Yes, it excludes bartered goods, and property, but does not exclude both property and money forming part of wealth.

- Yes, it allows for both storage and exchange, but can exist without either.

- Yes, it might be based on any of the exotic things we know have been used as money. It allows for anything which can be used to keep score, some of which are good for the purpose, and some not so good. We know people have used cowrie shells, broken sticks, coins made of all sorts of metals, banknotes, credit cards, bank accounts, promissory notes, bills of exchange, computer records, Bitcoins and lots of other things. They're perfectly entitled to. They are all systems for keeping score of unreturned favours, and they have all been the basis of valid, if mostly temporary, monetary systems.

Moving money around

What stimulates the creation of new types of money?

- Over recent years government's main economic lever has been monetary policy, by which it seeks (not very efficiently) to direct the way our economies behave, primarily through the manipulation of interest rates.

- Government operates a transparently simple policy when generating its own revenue. It looks for circumstances where our money changes hands, and it makes one side pay tax, and the other costlessly responsible for reporting and collecting it. That's why your income tax is paid by you and collected by your employer, why your VAT is paid by you and collected by your merchant, your Insurance Premium tax is paid by you and collected by your insurance company, and your travel tax paid by you and collected by your airline. The cost of money passing through private individuals' hands, as they earn it and spend it, is now frequently in excess of 60%.

- Government now puts the monetary system at the heart of its law and order policy. Until 2004 there were no particular qualifying criteria for using Pounds, Dollars, or Euros. Since then, having introduced a range of new Anti-Money-Laundering laws, government has made normal financial services businesses responsible for detecting and reporting the unrelated criminal behaviour of their clients. The penalties for doing something entirely normal, but in the service of a criminal, are now very severe, which is why people now looking for a bank account will already rate the process as up there with a visit to the dentist. Meanwhile the sadder aspect of this legislation is that it forced businesses to act as jury and judge on their customers, without there being a trial. Thousands of innocents – for example, people with Arabic sounding names – are now obstructed in their use of bank accounts by formal institutional prejudice triggered by this law, and the citizens of 12 countries deemed pervasively corrupt are automatically tagged as 'Politically Exposed Persons', which gets them routinely barred. The cost to business of its new policing function has been high, and the benefits have been undetectable; it doesn't seem to have reduced crime at all. After all, there are plenty of other scorekeeping systems for criminals to use.

Where does money come from?

How is money created?

'Naturally scarce' money

The two main money systems

- Falling collateral values can bust banks, losing depositors their money too. Multiple bank busts can spiral out of control into events like the Great Depression.

- Governments (and sometimes businesses too) mess with the bookkeeping by finding somewhere to park a bad debt where it never gets written off. Writing off a debt inconveniently eliminates the credit associated with it, establishing a painful loss for someone somewhere. So it suits fraudsters to pretend that non-performing or non-existent assets are neither. Parking a bad debt transforms the credit side into true 'fiat' money –money with neither inherent scarcity nor a collateral base – and is very similar to just printing banknotes. A big extension of this type of behaviour has been how the western world has coped with the 2007-9 financial crisis, which is another reason people are looking for an alternative.

- Forgery, which is essentially the same as the creation of fiat money, except that it's done by wicked criminals instead of governments.

A 'Bitcoin standard'

Conclusion

Paul Tustain is the founder and chairman of BullionVault.

See the full archive of Paul Tustain articles.

Please Note: All articles published here are to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. Please review our Terms & Conditions for accessing Gold News, RSS links are shown there.

Mobile apps

- live trading 24/7

- buy & sell instantly

Daily news email

Go to 'communications settings'

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin gold news

A MarketBeat account allows you to set up a watchlist and receive notifications for stocks you are interested in. Follow up to five stocks for free.

MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Whether you’re looking for analyst ratings, corporate buybacks, dividends, earnings, economic reports, financials, insider trades, IPOs, SEC filings or stock splits, MarketBeat has the objective information you need to analyze any stock.

Get analysts' upgrades, downgrades and new coverage delivered to your email inbox with our free daily newsletter:

Tag: bitcoin gold BTG

Nearly $14 Million in Crypto Sold by German Police

Bitcoin Gold Hacked for $18 Million

in case you missed it

Remembering Satoshi’s Vision — As it Was Written. Satoshi Nakamoto left the community in 2010, and no one has heard from the anonymous creator of bitcoin ever since. At the moment the bitcoin community has split into two factions due to the scaling debate, that coincidently started the same year Satoshi left… read more.

Press releases

PR: DIWtoken.com – Alpha Launch on Testnet Before the End of.

PR: Former Head of Strategy & Operations Consulting at KPMG Joins.

PR: Cryptocurrency Payment Service Platform Sopay Launches Crowdfunding on the LEEKICO.

Latest Comments

Sounds like too good to be true. Where is it's weakness?

It can be stressful seeing as bitcoin is crypto currency but it is possible. In recent times, the.

Hahahaha. I wll be following. You are my crypto dad.

No thank you dear stranger. There is no freakin 'chargeback' in cryptos. Go away now. with your 1.

yeah.. How will exchanges listing those coins will face this problem? By delisting them?

Roger That!

The latest episode of the Bitcoin (BCH) Weekly Roundup. Roger Ver speaks with one of our lead developers Corbin to talk you through all the latest Bitcoin news and happenings within the Bitcoin Cash Community. Subscribe to our Youtube channel here.

we are hiring

News.Bitcoin.com is Hiring Editorial Staff – In Tokyo, Stockholm and Your Town. Are you an experienced news editor or a news reporter with a nose for crypto? We are on a roll – increasing our readership every day – serving millions of readers each month… read more.

Did You Miss The Tokyo Conference?

Watch the talks from the Satoshi’s Vision Conference, that took place in Tokyo, March 23-25.

Listen to The Bitcoin.com Podcast Network

The Bitcoin.com Wallet: Available on all platforms

Check out all the latest features and create your wallet today! https://t.co/CNaJZzHtaZ pic.twitter.com/huq84amUJG

Download the Bitcoin.com Wallet right to your device for easy and secure access to your bitcoins. Perfect for beginners, the Bitcoin.com Wallet makes using and holding bitcoins easy. No logins required.

Get the latest price charts, statistics and our news feed on your site. Check out our widget services.

Most Commented This Week

We also deliver bite-sized news to your favourite messaging app; join our Telegram channel.

Bitcoin Gold suffers double spend attacks, $17.5 million lost

An unknown threat actor has so far managed to steal over 388,000 BTG from cryptocurrency exchanges.

By Charlie Osborne for Zero Day | May 25, 2018 -- 08:11 GMT (01:11 PDT) | Topic: Security

Bitcoin Gold (BTG) appears to be the target of a 51 percent attack, leading to the theft of approximately $17.5 million from cryptocurrency exchanges.

More security news

Traders of the coin, established in 2017 through a hard fork of the main Bitcoin (BTC) network, have been tracing the attack since last week.

Scrutiny of unusual activity on the network has revealed the scheme, in which "double spending" attacks have been launched against cryptocurrency exchanges trading the virtual currency.

According to the Bitcoin Gold team, exchanges rather than individual users have been targeted.

The first attack was recorded on 16 May and have now appeared to have ceased.

"An unknown party with access to very large amounts of hashpower is trying to use "51 percent attacks" to perform "double spend" attacks to steal money from exchanges," the team says. "We have been advising all exchanges to increase confirmations and carefully review large deposits. There is no risk to typical users or to existing funds being held."

51 percent attacks force reorganization in the blockchain. While not the result of a security flaw or vulnerabilities, the attack can -- theoretically -- be launched against any blockchain.

If a threat actor manages to wrestle control of over 50 percent of a network's computing power, they are able to both modify and exclude transactions of their own coins from blocks.

Attackers are then able to double spend, in which transactions are reversed after being confirmed, as well as prevent all other miners on a network from mining valid blocks.

Launching these types of attacks can be expensive and due to the vast computing power required, the only way they are made profitable is to attempt large double spend transactions -- and this, in turn, pivots attacks towards cryptocurrency exchanges.

The wallet address connected to the 51 percent scheme has received 388,201 BTG, which is worth approximately $17.5 million at the time of writing.

The majority of the funds have been moved to other addresses and only roughly 12,000 BTG remains in the account.

"One of the targeted exchanges reported that they strongly believe this attacker attempted to hit them with a double-spend of BTC in the past," the Bitcoin Gold team says. "In their words, "we are 100 percent sure that it is the same person, we found many associations between the accounts."

In response to the threat actor's attacks, a number of cryptocurrency exchanges have ramped up the number of confirmations they require to accept large transactions.

The Bitcoin Gold team says that a major upgrade planned for the end of June -- now being pushed to take place as soon as possible -- will eradicate the use of ASIC hardware to mine BTG.

ASIC systems are expected to ship at approximately the same time and have the potential to cause an imbalance to existing miners, and therefore, the team is tampering with the BTG algorithm to prevent this from occurring.

The organization says that the change in algorithm and a new fork will also reduce the risk of 51 percent attacks in the future.

"We've been working at an incredible pace the past days to put the plan and pieces together, and we expect to upgrade our mainnet approximately seven days after the necessary software is up and running on our testnet," the team says. "[. ] While it would be better to give all our partners more than seven days to test and deploy to avoid disruption, these attacks have already forced disruption on us all, so we feel it's best to get the upgrade completed as soon as we possibly can."

According to the Anti-Phishing Working Group, recent estimates suggest that since 2017, cyberattackers have managed to steal $1.2 billion in cryptocurrencies from exchanges, Initial Coin Offerings (ICOs), wallets, and more.

A similar attack method has recently been employed against Verge, a cryptocurrency offering which claims to bring back the anonymity once associated with cryptocurrency as a whole.

Earlier this week, reports surfaced which claimed that a threat actor has been able to successfully launch a 51 percent attack on the Verge blockchain, leading to the theft of approximately 35 million Verge coins (XVG), worth over $1.7 million.

Bitcoin Gold Hit by Double Spend Attack, Exchanges Lose Millions

A malicious miner successfully executed a double spend attack on the Bitcoin Gold network last week, making BTG at least the third altcoin to succumb to a network attack during that timespan.

Bitcoin Gold director of communications Edward Iskra first warned users about the attack on May 18, explaining that a malicious miner was using the exploit to steal funds from cryptocurrency exchanges.

To execute the attack, the miner acquired at least 51 percent of the network’s total hashpower, which provided them with temporary control of the blockchain. Obtaining this much hashpower is incredibly expensive — even on a smaller network like bitcoin gold — but it can be monetized by using it in tandem with a double spend attack.

After gaining control of the network, the attacker began depositing BTG at cryptocurrency exchanges while also attempting to send those same coins to a wallet under their control. Ordinarily, the blockchain would resolve this by including only the first transaction in the block, but the attacker was able to reverse transactions since they had majority control of the network.

Consequently, they were able to deposit funds on exchanges and quickly withdraw them again, after which they reversed the initial transaction so that they could send the coins they had originally deposited to another wallet.

Source: BTG Explorer

Source: BTG Explorer

A bitcoin gold address implicated in the attack has received more than 388,200 BTG since May 16 (mostly from transactions it sent to itself). Assuming all of those transactions were associated with the double spend exploit, the attacker could have stolen as much as $18.6 million worth of funds from exchanges.

The last transaction was sent on May 18, but the attacker could theoretically attempt to resume it if they still have access to enough hashpower to gain control of the blockchain.

Bitcoin gold’s developers advised exchanges to address the attack by increasing the number of confirmations required before they credit deposits to customer accounts. Blockchain data indicates that the attacker successfully reversed transactions as far back as 22 blocks, leading developers to advise raising confirmation requirements to 50 blocks.

At present, bitcoin gold ranks as the 26th-largest cryptocurrency, with a circulating market cap of $827 million.

Bitcoin gold is at least the third cryptocurrency network hit with a major attack in the past week alone.

As CCN reported, a miner manipulated two of privacy coin verge’s five hashing algorithms to maliciously mine more than 35 million XVG — worth

$1.75 million — in just a few hours. Previously, Japanese cryptocurrency monacoin was hit by an apparent block withholding attack after a miner gained as much as 57 percent of the network’s hashrate.

Bitcoin Gold: What to Know About the Blockchain's Next Split

Anyone who owns bitcoin will soon be able to receive a new cryptocurrency.

As of block 491,407 on the bitcoin blockchain, another alternative version of the protocol will be launched, resulting in a variant that's being branded bitcoin gold (BTG).

The project, which seeks to improve bitcoin's technology by changing how its competition for rewards is conducted, is the second to launch since August via an increasingly common process called a "hard fork."

Readers may remember the term from the launch of bitcoin cash, the alternative version of the bitcoin protocol that spurred global headlines for unexpectedly creating billions of dollars in value, seemingly out of thin air.

Looking ahead, many industry observers are expecting the same results this time around, though there may be reasons for enthusiasm to be tempered.

What is bitcoin gold?

In short, bitcoin gold aims to achieve two goals:

- First, bitcoin gold wants to change how mining works by making it so the most powerful mining machines (called ASICs) can no longer be used.

- Second, by attracting more people to this system over time, it hopes to free the bitcoin network from the large companies that offer these products, and it argues, command undue influence on the network.

Instead of scaling bitcoin to support more users, bitcoin gold tweaks bitcoin in an effort to "make bitcoin decentralized again." This, proponents argue, will make the network, designed to offer an egalitarian way to send payments digitally around the globe, more accessible to users.

And while created via the same mechanism, bitcoin gold differs from bitcoin cash in a few ways, most notably in its distribution.

- The bitcoin gold cryptocurrency is set to be created in advance (prior to the code being open-sourced to the public).

- About 1 percent of the total cryptocurrency tokens mined before the blockchain goes public will be used to pay the bitcoin gold development team.

- Once this distribution is over, the team claims it will launch the cryptocurrency so that users can redeem their coins.

Of course, while it aims to become the de-facto version of bitcoin, others might consider bitcoin gold an "altcoin" – the term has long been used to denote any cryptocurrency launched using bitcoin's existing code, but that has an alternative market or use case.

Do I have bitcoin gold?

All bitcoin owners will receive the cryptocurrency at a rate of 1 BTC to 1 BTG, setting the stage for possible market activity.

But, that's not to say it's totally intuitive to retrieve.

One quirk is that it'll be easier to redeem the funds from wallets or exchanges that recognize the cryptocurrency. The easiest way, then, to retrieve the bitcoin gold is to move bitcoin to a wallet or exchange that supports bitcoin gold, or to hold bitcoin in a wallet where you own your private keys (rather than holding them with an exchange).

To date, 20 exchanges and wallets promise to support bitcoin gold once it launches, according to the project's website.

Although one of the most popular U.S.-based exchanges, Coinbase stated on October 20 that it does not support bitcoin gold due to skepticism about how developers have made project information available to others.

"At this time, Coinbase cannot support bitcoin gold because its developers have not made the code available to the public for review. This is a major security risk," the post reads.

This is perhaps something to keep an eye on as the project progresses. Although the project will officially fork on Monday night, it's not yet open to anyone and everyone, and there's still plenty left on the developers' to-do list.

Who is behind bitcoin gold?

The team behind the hard fork appears to be a relatively small group.

Hong Kong-based LightningAsic CEO Jack Liao, who's an outspoken critic of the state of bitcoin mining, first broached the idea of bitcoin gold back in July.

His company LightningAsic sells mining equipment, including GPUs, the type of computing hardware bitcoin gold is supposed to rely on.

Since first introduced earlier this summer, the team has expanded to include pseudonymous lead developer h4x3rotab, as well as a team of five other volunteers who are now working on developing and promoting the cryptocurrency in their spare time.

The project can be tracked on Github and on the community Slack group.

How do people feel about bitcoin gold?

All that said, for those interested in exploring or using bitcoin gold, it's worth noting that it has generated its share of controversy.

Satoshi Labs CEO Marek Palatinus, who launched bitcoin's first ever mining pool, is skeptical the project will actually work to decentralize mining as planned.

And he's not the only one to throw shade at the new project.

Bitcoin developer Rhett Creighton is working on alternative bitcoin gold "protest fork" software that seeks to pursue the same idea but without setting aside some of the new cryptocurrency for development.

If more than 51% of miners choose to use his software, the so-called pre-distribution to developers will be erased, he told CoinDesk. "It's up to the miners to decide what they want," he added.

All in all, it's unclear if business and mining groups will ultimately support the project, and if they do, how much value the alternative blockchain could create.

For example, while a list of roughly 50 businesses and miners support the so-called Segwit2x fork, similar support hasn't been seen for bitcoin gold. Likewise, though bitcoin cash began with support from vocal miners and exchanges, bitcoin gold has arguably yet to benefit from such early activity.

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which helped organize the Segwit2x agreement.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Комментариев нет:

Отправить комментарий