Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

The Bitcoin.com Wallet

Available for mobile and desktop

Now live, Satoshi Pulse. A comprehensive, realtime listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

Latest News

What Happened to Bitcoin?

The Bitcoin Core (BTC) network is in trouble due to high fees and slow transaction times. Bitcoin Cash (BCH) is the upgrade that solves these problems.

Learn more about Bitcoin Cash with our guide

DOWNLOAD A WALLET

Get Started With Bitcoin

Learn About Bitcoin

Bitcoin is changing the way people think about money. Educate yourself about this ground-breaking payment system.

Download a Wallet

Bitcoin is received, stored, and sent using software known as a вЂ˜Bitcoin Wallet’. Download the official Bitcoin.com Wallet for free.

Use Bitcoin

Bitcoin makes it easy to send real money quickly to anywhere in the world! Bitcoin can also be used to make purchases from a variety of online retailers.

Read the Latest

Bitcoin.com offers the latest news, cutting-edge reporting. Also, don’t miss our Bitcoin guides.

Visit the Forum

Read about community issues. Voice your opinion. Check out the latest Bitcoin trends.

Play Bitcoin Games

Play casino games with free tokens or actual Bitcoin. Bitcoin Games is a provably fair gaming platform.

Start Cloud Mining

Join the most profitable mining pool in the world.

Vote on Bitcoin Issues

Bitcoinocracy is a free and decentralized way to voice your opinion. Signed votes cannot be forged, and are fully auditable by all users.

free bitcoin

WIN FREE BITCOINS EVERY HOUR!

WIN UP TO $200 IN FREE BITCOINS

MULTIPLY YOUR BITCOINS PLAYING HI-LO

WIN HI-LO JACKPOTS UP TO 1 BITCOIN

FREE WEEKLY LOTTERY WITH BIG PRIZES

BITCOIN SAVINGS ACCOUNT WITH DAILY INTEREST

50% REFERRAL COMMISSIONS FOR LIFE

WIN UP TO $200 IN FREE BITCOINS EVERY HOUR!

LOGIN TO YOUR ACCOUNT

68,854,620,948

142,024.54304167

Bitcoins Won By Users

FREE BITCOINS EVERY HOUR

Try your luck every hour playing our simple game and you could win up to $200 in free bitcoins!

PROVABLY FAIR HI-LO GAME

Multiply your bitcoins playing a simple HI-LO game that is designed to be provably fair by using a combination of math and cryptography. Win big HI-LO jackpot prizes up to 1 bitcoin every time you play.

FREE WEEKLY LOTTERY

Win big prizes with our weekly lottery for which you get free tickets every time you or someone referred by you plays the free bitcoin game.

GENEROUS REFERRAL PROGRAM

Refer your friends after signing up, and get 50% of whatever they win in addition to getting free lottery tickets every time they play.

WHAT IS BITCOIN?

Bitcoin is an innovative payment network and a new kind of money. Bitcoin uses peer-to-peer technology to operate with no central authority or banks managing transactions and the issuing of bitcoins is carried out collectively by the network. Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

© 2013 - 2016 , FreeBitco.in - All rights reserved.

FORGOT YOUR PASSWORD?

If you had entered an email address during signup, please type it in below and a password reset link will be sent to you.

PLEASE ENTER CAPTCHA

Please enter the letters that you see in the box below

If you are not receiving password reset emails from us, please add [email protected] to your address book and then try again.

RESET YOUR 2 FACTOR AUTHENTICATION

Please answer the questions below to pick the correct method for resetting your 2 factor authentication.

do you have the secret key?

Please fill in the form below to reset your 2FA.

TERMS OF SERVICE

Please abide by the following simple rules when using this website:

- Please do not use bots.

- Please be civil when contacting us and refrain from using strong language.

- Please do not try to abuse the free giveaway by creating multiple accounts and collecting the free prize more than once every hour using proxies or similar IP address changing applications/services.

If you are found to be breaking any of the above rules or trying to gain an unfair advantage to abuse the service, your account will be deleted and your account balance forfeited.

PRIVACY POLICY

We may occasionally use your email address to send you website announcements regarding changes to our website, including improvements, and service or product changes that may affect our website.

Cookies are sometimes used to improve the website experience of a visitor to a website. We may sometimes use cookies on this website to record aggregate statistical information about the visitors to our site and the use that our visitors make of the website. When collected this information is used by us to improve our website and further enhance the visitor experience and, may be shared with advertisers. Pease note that no personally identifiable information is recorded. We may also use the cookies to gather information about your general internet use to further assist us in developing or website. Where used, these cookies are downloaded to your computer automatically. This cookie file is stored on the hard drive of your computer. Cookies contain information that is transferred to your computer's hard drive and then stored there and transferred to us where appropriate to help us to improve our website and the service that we provide to you. All computers have the ability to decline cookies. You can easily decline or remove cookies from your computer using the settings within the Internet Options section in your computer control panel. Our advertisers may also use cookies on their website. We have no control over this and you should review the privacy policy of any advertiser that you visit as a result of an advert or link on this website.

We may occasionally share your non-confidential data with third parties to provide you with relevant offers that we feel may be of interest to you. When we do, we shall ensure that the third party complies with all laws and regulations relating to the safe and fair storage and usage of the data that we provide to them.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

What is Bitcoin?

Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! Bitcoin can be used to book hotels on Expedia, shop for furniture on Overstock and buy Xbox games. But much of the hype is about getting rich by trading it. The price of bitcoin skyrocketed into the thousands in 2017.

Why Bitcoins?

Bitcoins can be used to buy merchandise anonymously. In addition, international payments are easy and cheap because bitcoins are not tied to any country or subject to regulation. Small businesses may like them because there are no credit card fees. Some people just buy bitcoins as an investment, hoping that they’ll go up in value.

Acquiring Bitcoins

Buy on an Exchange

Many marketplaces called “bitcoin exchanges” allow people to buy or sell bitcoins using different currencies. Coinbase is a leading exchange, along with Bitstamp and Bitfinex. But security can be a concern: bitcoins worth tens of millions of dollars were stolen from Bitfinex when it was hacked in 2016.

Transfers

People can send bitcoins to each other using mobile apps or their computers. It’s similar to sending cash digitally.

Mining

People compete to “mine” bitcoins using computers to solve complex math puzzles. This is how bitcoins are created. Currently, a winner is rewarded with 12.5 bitcoins roughly every 10 minutes.

Owning Bitcoins

Bitcoins are stored in a “digital wallet,” which exists either in the cloud or on a user’s computer. The wallet is a kind of virtual bank account that allows users to send or receive bitcoins, pay for goods or save their money. Unlike bank accounts, bitcoin wallets are not insured by the FDIC.

Wallet in cloud: Servers have been hacked. Companies have fled with clients’ Bitcoins.

Wallet on computer: You can accidentally delete them. Viruses could destroy them.

Though each bitcoin transaction is recorded in a public log, names of buyers and sellers are never revealed – only their wallet IDs. While that keeps bitcoin users’ transactions private, it also lets them buy or sell anything without easily tracing it back to them. That’s why it has become the currency of choice for people online buying drugs or other illicit activities.

Future in question

No one knows what will become of bitcoin. It is mostly unregulated, but some countries like Japan, China and Australia have begun weighing regulations. Governments are concerned about taxation and their lack of control over the currency.

Bitcoin worth $9M buried in garbage dump

Hoarders everywhere may be feeling smug after a British man threw a hard drive containing more than $9 million in bitcoin into the trash.

Bitcoin worth almost as much as gold

Bitcoin prices have surged to a high of $1,242. That makes the virtual currency only slightly less expensive than an ounce of gold.

Senate takes a close look at Bitcoin

Bitcoins are hotter than ever. Now a U.S. Senate panel is taking a close look at the digital currency.

Most stock quote data provided by BATS. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. All times are ET. Disclaimer. Morningstar: © 2016 Morningstar, Inc. All Rights Reserved. Factset: FactSet Research Systems Inc. 2016. All rights reserved. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2016 and/or its affiliates.

© 2016 Cable News Network. A Time Warner Company. All Rights Reserved. Terms under which this service is provided to you. Privacy Policy. AdChoices.

The Bitcoin.com Wallet

Available for mobile and desktop

Now live, Satoshi Pulse. A comprehensive, realtime listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

Latest News

What Happened to Bitcoin?

The Bitcoin Core (BTC) network is in trouble due to high fees and slow transaction times. Bitcoin Cash (BCH) is the upgrade that solves these problems.

Learn more about Bitcoin Cash with our guide

DOWNLOAD A WALLET

Get Started With Bitcoin

Learn About Bitcoin

Bitcoin is changing the way people think about money. Educate yourself about this ground-breaking payment system.

Download a Wallet

Bitcoin is received, stored, and sent using software known as a вЂ˜Bitcoin Wallet’. Download the official Bitcoin.com Wallet for free.

Use Bitcoin

Bitcoin makes it easy to send real money quickly to anywhere in the world! Bitcoin can also be used to make purchases from a variety of online retailers.

Read the Latest

Bitcoin.com offers the latest news, cutting-edge reporting. Also, don’t miss our Bitcoin guides.

Visit the Forum

Read about community issues. Voice your opinion. Check out the latest Bitcoin trends.

Play Bitcoin Games

Play casino games with free tokens or actual Bitcoin. Bitcoin Games is a provably fair gaming platform.

Start Cloud Mining

Join the most profitable mining pool in the world.

Vote on Bitcoin Issues

Bitcoinocracy is a free and decentralized way to voice your opinion. Signed votes cannot be forged, and are fully auditable by all users.

Where and How to Buy Bitcoins

Best Ways to Buy

This guide will teach you how to buy bitcoins.

It's easy to find where to buy bitcoins online because there are so many options.

If you want to learn the best way to buy bitcoins, keep reading!

Welcome to Buy Bitcoin Worldwide! I'm Jordan Tuwiner, the founder of this site.

We understand that buying bitcoins can be extremely confusing and frustrating. Luckily for you, this site has ample information to help make buying bitcoins easier for you.

Introduction to Buying

Want to learn how to purchase bitcoin or get bitcoins?

You’re in the right place!

The short answer is:

Find a Bitcoin exchange

Trade your local currency, like U.S. dollar or Euro, for bitcoins

For the long answer, read this Bitcoin buying guide and by the end you’ll understand these key points:

How and where to buy bitcoin

How to choose the right exchange

How to secure your coins after you buy

How to avoid scams

Below, we listed exchanges you can use to purchase BTC. We suggest our listed exchanges and doing your own research before making your final decision.

Certain exchanges are simply there to steal your personal information or rob you of your bitcoins.

We conduct intensive research on every exchange we list to filter out any and all dishonest exchanges.

Choosing an Exchange: Which is the Best Bitcoin Exchange?

To select the perfect exchange for your needs, consider these 7 factors.

1. Privacy: Keep Your Information Safe!

Want to buy BTC privately?

You can already cross off a number of payment methods:

- Bank transfer

- Credit card

- Debit card

- PayPal

- Any other method that requires personally or identifying information

Buying bitcoins with cash or cash deposit is the most private way to purchase bitcoins.

We also have a detailed guide which reveals your options for buying without verification or ID.

2. Limits: Are You Buying a Lot of Coins?

If you need to buy a large amount of bitcoins--say 25 or more--then big brokers or major exchanges are the way to go.

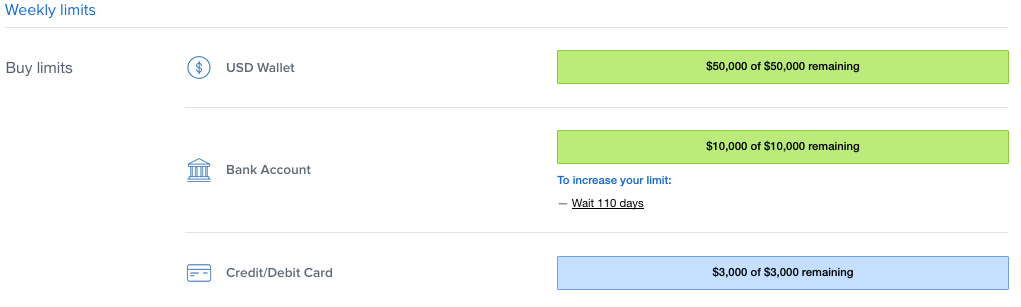

Coinbase has high limits for buying with a bank account.

CoinMama has the highest limits for buying with a credit card.

Most cash exchanges have no buying limits. Limits, however, will vary between individual sellers and are usually lower than online exchanges.

3. Speed: When Do You Need Access to your Bitcoins?

How quickly do you need to convert regular money into bitcoins? Different payment methods deliver your coins at different speeds.

Your first Bitcoin purchase may be time consuming. Once you get everything setup all subsequent purchases will be much faster!

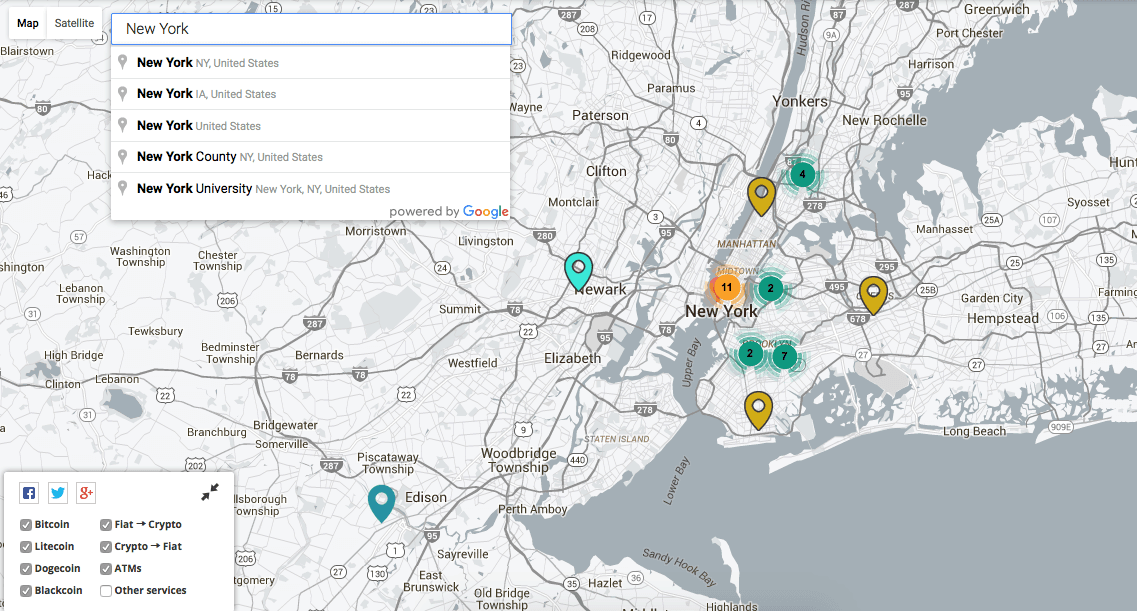

Bitcoin ATMs can be the fastest way to purchase bitcoin if you’re lucky enough to have one in your area. Here's a map to help you out.

Some brokers offer instant buys with bank transfer, credit card, or debit card.

4. Exchange Rate

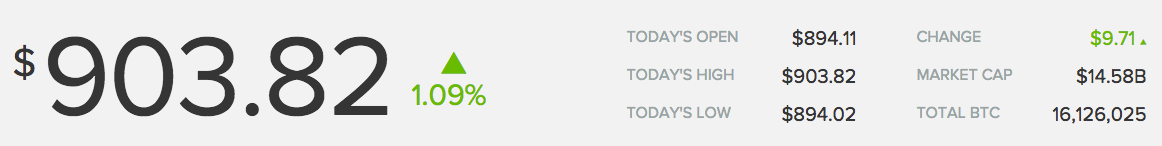

There is no official Bitcoin price. Use BitcoinAverage or CoinDesk to see the average price of Bitcoin across all major international Bitcoin exchanges and compare that to the price on your chosen exchange.

5. Reputation: Don't Get Scammed!

How long has the exchange been in service? Is the exchange trustworthy? Our Bitcoin exchange reviews can help you to find a trusted exchange.

6. Fees: Are You Getting a Good Deal?

How much does the exchange charge for its services? The fee will vary greatly based on the payment method you choose to use.

Remember to include deposit and withdrawal fees as well as trading fees. Some exchanges will lower their fees if you trade a lot of bitcoins.

7. Payment Method

How can you pay for the bitcoins? Payment method may be the most important factor.

We're sure you already have a payment method in mind that you'd prefer to use. More on that below.

Get a Wallet!

Some exchanges require a Bitcoin wallet before you can buy.

If you don't have a wallet yet, learn how to get a Bitcoin wallet and then come back.

We'll wait for you here ;)

Know your Payment Method?

Payment Methods

We can both agree that this Bitcoin stuff is confusing. Stick with us!

We're about to have you on your way to choosing a payment method and buying bitcoins.

Where to Buy Bitcoin?

- Purchase bitcoins online with a credit card, debit card, or bank transfer.

- Acquire bitcoins from a Bitcoin ATM near you.

- Buy bitcoins with cash locally or via cash deposit.

- Convert PayPal to Bitcoin online.

The above was just a brief overview of where you can buy bitcoin. Now, let's get into the details.

In order to buy bitcoins, you’ll need to exchange your local currency, like Dollars or Euros, for bitcoin. Here’s an overview of the 4 most common payment methods:

1. Credit or Debit Card

Credit/debit cards are the most common way to pay online. So, it's really no surprise that many people want to buy bitcoins this way.

Why buy bitcoin with a credit/debit card?

- Credit cards are a payment method most people are familiar with; probably the easiest way to buy bitcoins online

- Delivery of bitcoins is instant once initial verification is complete

Why NOT buy bitcoin with a credit/debit card?

- High fees; if you're patient and not in a rush to buy then use a bank transfer for lower fees

- Not a private way to buy; your ID will be required to buy with a credit card

A few places to buy bitcoins online with a credit card are:

Bank Account or Bank Transfer

Bank transfer is one of best ways to buy bitcoins in most countries.

Why buy bitcoins with bank account/transfer?

- Good way to buy large amounts of bitcoins

- Using a bank transfer will usually result in the lowest fees, so you can get a great price on your purchase

Why not to buy bitcoins with bank account/transfer?

- Usually requires ID verification, so not a good choice for privacy

- Slow; in the USA, bank transfers can take up to 5 days to complete

Some of the best ways to buy bitcoins with your bank account:

Cash deposit is often the fastest and most private ways to buy bitcoin. You can usually receive your bitcoins within a couple hours.

What are cash exchanges good for?

- Can be more private since in some cases no personal information is required

- Can be nearly instant; no need to wait 5 days for a bank transfer to process

What are cash exchanges bad for?

- Privacy comes at a cost; cash exchanges often have price 5-15% above market rate

- Easier to get scammed or robbed; need to be on alert and follow the exchange's rules

Some of the best places to buy bitcoin instantly with cash:

Note: There is no easy way to buy bitcoin at Walmart. We get asked this A LOT!

There are Bitcoin ATMs all around the world that let you purchase bitcoin with cash.

You simply insert cash into the machine, and get bitcoins sent to your wallet.

Use Coin ATM Radar to find a Bitcoin ATM near you.

What are Bitcoin ATMs good for?

- Can be more private since in most cases no personal information is required

- If you have an ATM in your area it can be a convenient and fast way to buy coins

What are Bitcoin ATMs bad for?

- Privacy comes at a cost; Bitcoin ATMs often have a 5-15% premium above market rate

There is no way to directly buy bitcoins with PayPal. Under PayPal’s terms and conditions merchants are not allowed to sell bitcoins for PayPal.

I really recommend not buying bitcoins with PayPal. The fees are really high. Chances are that your PayPal is connected to your credit card or bank account, which can be used to buy at much lower fees.

However, there are a few hacks to get around this. You can buy other digital items with PayPal and sell those items for bitcoin. It's all explained in our guide on how to buy bitcoins with PayPal.

Why buy bitcoins with PayPal?

- If you already have a balance, it can be an easy and fast way to convert PayPal to bitcoins

Cons of buying bitcoins with PayPal

- Fees are over 12%; much better to just buy with a credit card or bank account

Frequently Asked Questions

If you're still a bit confused, that's okay. Buying bitcoins is hard, but that's why I built this site, to make it easier!

If you still need help, I hope this FAQ will help to answer any remaining questions.

When is the Right Time to Buy?

As with any market, nothing is for sure. Bitcoin is traded 24/7 and its price changes every second.

Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts from other Bitcoin trading sites. These charts will help you understand Bitcoin’s price history across the many global Bitcoin exchanges.

Why Does Buying Bitcoin Take So Long?

Long wait times are usually a problem with existing payment systems, not with Bitcoin itself.

Bitcoin transactions only take about 10 minutes to confirm. Bank transfers in the U.S., for example, can take up to five days to complete.

Bitcoin transactions can be confirmed as quickly as 10 minutes; it’s rare to experience a delay longer than one hour.

This means that a merchant can’t release bitcoins to a customer until five days have passed unless they're willing to take on risk.

Can You Sell Bitcoins?

Yes, of course! Most exchanges that let you buy bitcoins also let you sell (for a fee of course).

Why Do I Need to Upload my ID for Some Exchanges?

This is due to Know Your Customer (KYC) laws which require exchanges to record the real world identity of their clients.

Can Anyone Buy Bitcoin?

Bitcoin requires no permission to use or buy.

You will have to check the legality of Bitcoin in your country. In most countries Bitcoin is legal!

Should I Buy Physical Bitcoins?

Physical bitcoins are physical, metal coins with a Bitcoin private key embedded inside.

We recommend that you stay away from physical bitcoins unless you’re a numismatist.

While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. The creator could create two copies of the private key.

Unless you immediately open and withdraw the digital bitcoins from your physical bitcoin, the creator could at any time steal the funds it contains.

Can I Buy Partial Bitcoins?

Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into 100,000,000 pieces. Each unit of bitcoin, or 0.00000001 bitcoin, is called a satoshi.

Most exchanges let you buy as little as $5 worth of bitcoins at a time.

Why Should I Buy Bitcoin Instead of Mining?

A long time ago anyone could mine bitcoins on their computer at home. Today, only specialized computer hardware is powerful enough to do this.

Think about it like this:

Should you buy gold or mine gold? Well, to mine gold you need big powerful machines, a lot of time, and money to buy the machinery. This is why most people just purchase gold online or from a broker.

So Bitcoin is no different.

You should just buy some if you want coins without trying to mine.

Do I need a Bitcoin Account Before Buying?

With Bitcoin, there are not really accounts.

Instead, you should have a Bitcoin wallet. If you want to store bitcoins, then a wallet is where you keep them.

In Bitcoin these wallets are not called an account but a wallet functions almost the same way. The only difference is you are responsible for the security if your wallet rather than placing the security in the hands of a bank or trust.

How do I check if I received a Bitcoin payment?

Why Would Someone Even Want to Buy Bitcoins?

There are many reasons people want to own bitcoins.

Many people like to purchase some and put them to the side in the hopes that they will be worth more in the future.

Many people are using bitcoins to remit money to their families from out of the country. Right now, Bitcoin is one of the cheapest ways to do this.

People also use Bitcoin to buy stuff online. Big companies like Microsoft, Dell, Newegg and Overstock all accept bitcoins.

Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. Most stock markets only open on weekdays from 9 AM to 5 PM. So many traders buy and sell bitcoins because it is a fun and fast market to trade.

Can I Buy Bitcoin Stock?

Bitcoin itself is not a stock despite it functioning somewhat like one. You can’t buy bitcoins through a traditional stock fund and instead have to buy bitcoins yourself. This may change in the future if a Bitcoin ETF ever gets approved.

What Happens When you Purchase Bitcoins?

Bitcoins are actually just secret digital codes. When you buy bitcoins, the seller is using a wallet to transfer the ownership of the coins to you. Once your purchase is complete, the codes are now owned by you and not the seller.

Why Are the Chinese Buying So Much BTC?

It seems the Chinese really like Bitcoin’s properties such as its sound monetary policy and that it can be used anywhere in the world. Bitcoin's volatility also makes it interesting for speculative traders.

Is Bitcoin Legal?

Bitcoin is legal in nearly every country. Only a few countries have actually banned the use of bitcoins. Before you buy, make sure you double-check the legal status of Bitcoin in your country.

Why do I need to buy bitcoins before buying most altcoins?

Bitcoin functions as the "reserve" currency of cryptocurrency. So it is very hard to buy other coins without first buying bitcoins. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. This is mostly because Bitcoin has very good liquidity and is traded on every cryptocurrency exchange. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies.

Am I Anonymous when I Buy?

Bitcoin is not anonymous but rather pseudonymous. All Bitcoin transactions are public but it is not always known the real identity behind any give Bitcoin address.

Can I use Multiple Exchanges?

If the limits on one exchange are to low you can simply open an account with another exchange to give yourself the ability to buy more.

You can signup, join, and use as many Bitcoin exchanges as you want that are available in your country.

Do I need to Pay Taxes on Bitcoin?

In most countries you will need to pay some kind of tax if you buy bitcoins, sell them, and make a gain. In the US you must do this on every transaction.

Be sure to check with your country’s tax authorities to make sure you are paying all the required taxes on your bitcoin use.

What Other Ways can I Get Bitcoins Besides Buying?

Just like any other form of money, you can get bitcoins by requesting from your employer to be paid in bitcoins.

Avoiding Bitcoin Scams: Don't Lose Money!

I've been using Bitcoin for 3+ years. I've never fallen victim to a single scam. Follow the tips explained here and you'll greatly reduce your chances of losing money.

There are many scams related to Bitcoin. Scammers target new Bitcoiners and less tech-savvy users. Follow these basic rules in order to avoid Bitcoin scams:

Study your intended exchange and make sure it’s trustworthy. Search forums like Reddit for the experiences of other users.

You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. If you don’t find your intended exchange listed on this site, extra caution and research is advised as it may be a scam!

Check Ratings

If you’re using a peer-to-peer exchange like LocalBitcoins or Wall of Coins, check the seller’s feedback. If most of their feedback is positive, your trade is more likely to go through without issues. If a seller has lots of negative feedback, it’s best to simply stay away and find a more reliable seller.

Use Escrow

Many scammers will try an approach like this:

“Send me bitcoins, and once I get the bitcoins I’ll pay you on PayPal!”

Don’t ever agree to a trade like this. Bitcoin payments are irreversible, so if you send first the scammer can simply not pay you and keep their bitcoins.

PayPal can't force the scammer to pay either, due to the pseudonymous nature of Bitcoin which doesn’t record the identity of a payment’s sender or recipient. This would leave you with no way to get your bitcoins back.

Stay Away from Bitcoin investments

Any service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. If it sounds too good to be true, stay away.

Be Careful with Altcoins

What are altcoins? Altcoins are cryptocurrencies other than Bitcoin.

Altcoins are traded globally on hundreds of exchanges. Avoid throwing money into coins which are experiencing a sudden and dramatic spike in price and volume. Such moves, especially in insignificant coins with otherwise thin volume and flat price action, are likely to crash fast.

Secure your Coins

Don't store coins on Bitcoin exchanges! Bitcoin users have lost over $1 billion worth of bitcoins in exchange hacks and scams.

Here are two examples where users got screwed by leaving bitcoins with a third party:

So, do yourself a favor:

Get yourself a Bitcoin wallet and control your own coins. For large amounts of bitcoins, we recommend cryptocurrency hardware wallets. Hardware wallets are small, offline devices that store your bitcoins offline and out of reach from hackers and malware.

Why? It's pretty simple:

- Hardware wallets are the easiest way to securely store bitcoins and easy to backup

- Less margin for error; setup is easy even for less technical users

Check out the Bitcoin hardware wallet comparison chart below:

Bitcoin Smart Banknotes Launched in Singapore

A digital asset smart banknote manufacturer has launched bitcoin banknotes at a store in Singapore. Designed to make owning and circulating cryptocurrencies as easy as using paper money, they are currently available in denominations of 0.01 and 0.05 BTC.

Bitcoin Banknotes Debut in Singapore

Digital asset banknote manufacturer Tangem announced the launch of smart bitcoin banknotes at the Megafash Suntec City store in Singapore on Thursday.

Megafash store in Singapore.

Megafash store in Singapore.

The announcement states:

Available immediately in denominations of 0.01 and 0.05 BTC, Tangem Notes radically improve the simplicity and security of acquiring, owning, and circulating cryptocurrencies for both sophisticated and incoming users.

With headquarters in Switzerland’s cryptovalley Zug and Hong Kong, Tangem also has offices in Singapore, Moscow, and China, according to its website.

The company says it “is delivering the first shipment of 10,000 production notes to prospective partners and distributors around the world for commercial pilots.”

How Tangem’s Smart Banknotes Work

Tangem explains that their bitcoin smart banknotes are “Comparable to a well-protected paper banknote” and “Cheap enough to hand over.” Citing their ease of use, the company says there is “No special infrastructure, no complicated applications – just touch the banknote with an NFC-capable smartphone to be 100% sure it has valid assets.”

Illustration of how the banknotes work.

Illustration of how the banknotes work.

Transferring ownership of the notes is anonymous and instant, Tangem claims. “Physically hand over the whole wallet together with the blockchain private key. No transaction fees, no need to await confirmation blockchain.” Moreover, the company says that its banknotes are equipped with “high-grade EAL6+ protection for all cryptocurrencies. Irretrievable private keys prohibit replication of wallet and its assets.”

Competitor Opendime has long offered a physical product with a similar purpose but shaped more like a USB thumb drive and without any amount printed on them.

Security Questions

Tangem’s hardware is based on Samsung Semiconductor’s S3D350A chip. The company claims to offer “the first hardware storage solution on the market with its entire electronics and cryptography certified to the Common Criteria EAL6+ and EMVCo security standards.”

Tangem’s hardware is based on Samsung Semiconductor’s S3D350A chip. The company claims to offer “the first hardware storage solution on the market with its entire electronics and cryptography certified to the Common Criteria EAL6+ and EMVCo security standards.”

As with any embedded firmware-based product in the cryptocurrency space, security audits and open-source code are paramount to earning users’ trust to ensure that the company does not have access to the funds stored on their product. At the time of this writing, Tangem’s only publicly available code is for its iOS and Android apps on Github.

However, the company claims that it has shared the full source code of its proprietary chip firmware with a Swiss security firm, Kudelski Group, adding that this firm has completed an in-depth review and comprehensive security audit of its product’s architecture.

What do you think of these bitcoin smart banknotes? Let us know in the comments section below.

Images courtesy of Shutterstock, Samsung, and Tangem.

Need to calculate your bitcoin holdings? Check our tools section.

Upcoming Bitcoin Forks in 2018 – Here’s What to Watch For

Last updated on May 8th, 2018 at 03:58 pm

Back in August 2017, the first coin created from a Bitcoin fork came into existence: Bitcoin Cash. However, since then, two other coins have also been “forked” from Bitcoin: Bitcoin Gold (October 2017) and Bitcoin Diamond (November 2017). Most people are still wondering what these forks are, how they happen, and how one can profit from them. Here’s my take on all of this.

What you will learn in this video

- What is a Bitcoin fork?

- Why should you be interested in forks?

- What are the dangers surrounding forks?

- How to safely claims coins from hard forks?

- What are the upcoming Bitcoin forks?

What the hell is a Bitcoin fork?

We discussed Bitcoin forks back when Bitcoin Cash was just coming out. If you want the full explanation, you can read the original post. If you want the quick and dirty explanation, keep on reading this post.

A fork is basically an alteration of the current Bitcoin code (or protocol). It means someone is changing the rules.

Imagine you’re playing a game with thousands of people from all around the world and then someone says, “Let’s change the rules.” Normally, for the game to work properly, everyone needs to agree on the rules being changed. If that happens, then the change is implemented and everything continues as normal.

If there isn’t a large consensus about the change, two versions of the game will be created (one with the old rules and one with the new rules)—in other words, there will be a fork in the game.

The same can happen with Bitcoin’s code. Generally speaking, when a fork happens, you’ll have an “original Bitcoin” and a “new Bitcoin.” For example, Bitcoin Cash changed the block size from 1 MB to 8 MB so more transactions could be processed with each block. There were those who supported this change and switched to a new coin called Bitcoin Cash (or Bcash), and there were those who decided to stay with the original rules and keep using the original Bitcoin.

Of course, this is a very simplified explanation of forks—not all forks are created equal. There are soft forks, which allow the new rules to play well with the old rules, and there are hard forks, which don’t allow this and create a totally different coin. All of the Bitcoin forks you’re hearing about lately are actually hard forks.

Why should I even care about a fork?

Great question! There are several reasons you should care about a fork:

- You may want to switch over to the new rules and the new coin because you think it’s better than using the original Bitcoin.

- The fork could have an impact on the Bitcoin community, Bitcoin’s adoption, and even Bitcoin’s price (we’ll get to that later on).

- You may want to profit from the fork by selling the new coins that are delivered to every Bitcoin holder.

Wait, what? I get free coins?

Yes. Let’s go back to our game analogy.

Imagine your game has been running for a very long time, and you’ve managed to accumulate a considerable amount of points in it. Now someone wants to change the rules but doesn’t want everybody to lose their points, so the new game will start at a certain point in time, and everyone will have the same amount of points they accumulated up until that point.

If, for example, you had 150 points in the original game, you could switch to the new game and still have 150 points. You could also play both games in parallel and have 150 points in each. Now let’s see how this works with Bitcoin.

When a fork occurs, the people who decide on forking Bitcoin say, “Look, we don’t like the original rules—we want to create new rules. So starting from block number 453,342 (for example), we’ll change to the new rules.” Anyone who had Bitcoins at the time of the fork will now have two Bitcoins: the original one and the new one. You can decide which one to use, or you can even use both.

If for example, you have 1 Bitcoin in your possession when the fork occurs, you’ll still have that 1 Bitcoin, but you’ll also be able to claim 1 “new Bitcoin” on the network that’s running the “new Bitcoin rules” (since that coin didn’t start out from scratch and is continuing the original Bitcoin’s history).

It can get a bit confusing, but the main point to remember is this:

When a Bitcoin fork occurs, anyone holding any amount of Bitcoins will get the same amount of the new currency as well. This doesn’t happen automatically; you do need to claim these coins, but each new coin has a different claiming mechanism, and we won’t be able to cover them all.

Once you claim your new coins, you can then hold on to them or sell them if they’re being traded on an exchange. This means that you can basically generate money for nothing; all you did was claim coins from thin air and sell them on an exchange.

Easy money! Or is it?

The dangers of Bitcoin forks

When the forking trend started out with Bitcoin Cash, it seemed that the fork was a legitimate way of expressing discontent with the road Bitcoin was taking (hence a fork in the road).

However, it seems like the more recent forks are pretty similar to each other, and the main reason for creating them has more to do with marketing than actual ideology. If someone thinks they can create a better coin than Bitcoin, they can create a brand new altcoin—there’s no need to create a Bitcoin clone.

Devs decide to fork Bitcoin for three main reasons (in my opinion, at least):

- Marketing buzz: Bitcoin forks are the new ICOs. Everyone is looking to get free coins, so people are actively looking for information (you’re reading this article, aren’t you?). What better way to get eyes on your project without a lot of work? Just say you’re forking Bitcoin and you’re done.

- Quick money for devs: Some of these forks aren’t really copies of Bitcoin’s history. The rules are changed in such a way that devs receive a large initial amount of the new coin, which they can then dump onto the market once the coin starts trading.

- Scams: Some forks are flat-out scams. There’s already been one reported scam: Bitcoin Platinum. Scams can come in the form of forks that are created to short Bitcoin’s price (e.g., Bitcoin Platinum) or something more elaborate such as forks that are created to steal users’ real Bitcoins in the process of claiming the new coin (e.g., Bitcoin Gold fake wallet).

As you can see, claiming coins from a fork entails a considerable amount of risk from the user’s side.

How to safely claim coins from a fork

First, I’d suggest reading a bit about the project. Find out who the developers are, what their track record is, how far along they are in their road map, what have other publications written about them, and the like. If all that makes sense to you, then perhaps the fork is indeed legit.

However, even if a fork is legit, it doesn’t mean it’s worth going through the hassle of claiming its coins. The claiming process is usually complicated, and you risk losing your coins if you don’t know exactly what you’re doing. Say you’re holding 0.5 Bitcoins, and you’re eligible for 0.5 Bitcoin Gold. I’m not sure the immediate profit is worth the risk. This is, of course, a personal decision you should make.

For example, one of the most important things that a forked coin has to implement is something called replay protection. It basically means that the network will be able to separate the new coin from the original one and not accidentally send the original one to the new coin address when claiming the forked coin.

If, in the end, you decide you want to claim your coins, I suggest that you follow guides only from well-known wallets (i.e., TREZOR, Ledger, etc.) or credited publications. Keep in mind that in the end, it’s your money, and no publication will be able to take responsibility if you do something wrong along the way—even if they accidentally published misinformation (as we unfortunately once did in the past).

What I’m trying to say is that it’s a risky business. Make sure to understand the process and make your own choices.

If you do decide to claim forked coins you need to make sure your Bitcoins are in a wallet that allows you access to the private keys. This means you need to get your Bitcoins off exchanges and other web wallets before the fork occurs. If you don’t have access to your private keys you won’t be able to extract the forked coin.

Once the fork occurs you’ll need to do two things:

- Send your Bitcoins to a new wallet with a different private key

- Upload your old private key to a wallet that supports the forked coin

Since each fork is different it’s hard to say which wallet will support each fork. Usually the official fork site will display the wallets and exchanges that support it. If you leave your coins on an exchange that supports the fork there’s a good chance you can avoid extracting the coins yourself and that the exchange will do it for you, however you are basically at their mercy.

Remember, the one rule you should always follow before trying to claim any coins is to move your Bitcoins to a new wallet with a new seed phrase. This move will reduce the chances of you losing your Bitcoin to almost zero.

Upcoming Bitcoin forks for 2017-2018

Now that we’ve got that out of the way, let’s review the upcoming Bitcoin forks.

IMPORTANT: None of these forks have been verified by our team. You are forking your coins at your own risk. Please make sure to do proper research before taking action on any fork.

Super Bitcoin (SBTC)

Fork Date: 12/12/2017 — Block 498,888

Changes from original protocol: smart contracts, Lightning Network, zero-knowledge proofs, 8 MB block size

Distribution method: 1 BTC = 1 SBTC

Super Bitcoin aims to “make Bitcoin great again,” although the developers accept the idea as an experiment. It incorporates the best proposals from the Bitcoin community to see how all the forefront technologies combine.

BitcoinX (BCX)

Fork Date: 12/12/2017 — Block 498,888

Changes from original protocol: combining zero-knowledge proof, smart contract, DPOS consensus, crosschain technology data, SegWit, Lightning Network

Distribution method: 1BTC = 10,000 BCX

BitcoinX is designed to release the full potential of Bitcoin in a scalable way for the future. By combining speed, smart contracts, and privacy, the development team is looking to build a cryptocurrency to suit modern society.

Lightning Bitcoin (LBTC)

Fork Date: 18/12/2017 — Block 499,999

Changes from original protocol: DPoS Consensus, three-second block time, 2 MB block size, no difficulty adjustment, smart contracts

Distribution method: 1BTC = 1 LBTC

Lightning Bitcoin pushes the boundaries of blockchain speed with bigger block sizes that are created in seconds rather than minutes. The addition of smart contracts and DPoS consensus should allow for a truly high-speed autonomous network.

Bitcoin God (GOD)

Fork Date: 25/12/2017 — Block 501,225

Changes from original protocol: no pre-mine, proof of stake, smart contracts, Lightning Network, large block size

Distribution method: 1 BTC = 1 GOD

Some details are still to be confirmed for Bitcoin God, but the branding is rather catchy. Proof of stake, smart contracts, and Lightning Network will make for an interesting change to the usual Bitcoin protocols.

Bitcoin Cash Plus (BCP)

Fork Date: 2/1/2018 — Block 501,407

Changes from original protocol: No pre-mine, SigHash, emergency difficulty adjustment (EDA), 8 MB block size

Distribution method: 1BTC = 1 BCP

Bitcoin Cash Plus throws more confusion into the Bitcoin industry. Is it that much different from the hotly tipped Bitcoin Cash? Zero pre-mining is a healthy way to start, but little information is available on its website.

Bitcoin Uranium (BUM)

Fork Date: Around 31/12/2017 — Block not yet announced

Changes from original protocol: No pre-mine, one-minute block time, SegWit, unique address format

Distribution method: 1BTC = 1 BUM

Bitcoin Uranium wants to send rippling shockwaves through Bitcoin and reinitiate a truly decentralized currency. Quick block times combined with Equihash will allow GPU/CPU mining aims to open up mining to everybody.

Bitcoin Atom (BCA)

Fork Date: January 2018 — Block 505888

Changes from original protocol: Hybrid consensus (PoS and PoW), Lightning Network, Hash time-locked contracts

Distribution method: 1 BTC = 1 BCA

Bitcoin Atom focuses its efforts on consensus modeling and off-chain transactions. A new form of combined Proof of Stake and Proof of Work may allow for increased security, while the Lightning Network creates “atomic swaps.”

Bitcoin Silver (BTCS)

Fork Date: December 2017 — Block not yet announced

Changes from original protocol: 30-second block time, SegWit, every block difficulty adjustment

Distribution method: 1BTC = 1 BTS

Bitcoin Silver remains mysterious, especially given that there’s no working website or cohesive Github. Speedy block times mixed with SegWit is an interesting scaling idea, but we’ve yet to see any details that are set in stone.

UnitedBitcoin (UB)

Fork Date: 12.12.17 – Block 498777

Changes from original protocol: No-premine, 8mb block size, Segwit, Replay protection, Smart contracts, Lightning network

Distribution method: 1BTC = 1UB

UnitedBitcoin is literally trying to make everyone happy. It takes a mesh of BTC, BCH and Ethereum ideas and combines them on its blockchain. It’s a lot to take in for one cryptocurrency but why not have it all?

Bitcoin Diamond (BCD)

Fork Date: 24.11.17 – Block 495866

Changes from original protocol: No-premine, 8mb block size, Replay protection, Encrypted amounts, 210 million supply

Distribution method: 1BTC = 10BCD

Bitcoin Diamond’s design is another build on Bitcoin Cash with the 8mb block size. Diamond builds privacy and extra supply into this model. It wants to make Bitcoin more affordable whilst keeping transaction amounts encrypted.

Bitcoin Oil (OBTC)

Fork Date: 12.12.17 – Block 498888

Changes from original protocol: No-premine, Proof of Stake, CPU mining, 1.5 minute block interval, Every block difficulty adjustment, 2mb block size

Distribution method: 1BTC = 1OBTC

Bitcoin Oil has no actual relation to the real world commodity, it is simply a metaphor for the project. There are millions of unclaimed fork coins and token laying dormant, using OBTC’s blockchain protocol unclaimed coins are redistributed as block rewards.

Bitcoin World (BTW)

Fork Date: 17.12.17 – Block 499777

Changes from original protocol: 210 billion supply, 8mb block size, Equihash PoW, Replay protection

Distribution method: 1BTC = 10000BTW

Bitcoin World is another effort to bring Bitcoin back to the ordinary person. Added supply level coupled with Equihash mining should lower prices while making mining more accessible.

Bitcoin Stake (BTCS)

Fork Date: 19.12.17 – Block 499999

Changes from original protocol: Proof of Stake consensus

Distribution method: 1BTC = 100BTCS

Bitcoin Stake focuses on its consensus method for a more sustainable cryptocurrency. The Proof of Stake mining protocol breaks the control of large PoW miners and offers a more eco friendly option.

Bitcoin Faith (BTF)

Fork Date: 19.12.17 – Block 500000

Changes from original protocol: Zero knowledge privacy, Smart contracts, 8mb block size, Lightning network

Distribution method: 1BTC = 1BTF

You’ve got to have a little faith in Bitcoin right? But which one? Bitcoin Faith. A mixture of leading features including 8mb block size and lightning network aims to set up a brighter future for cryptocurrency.

Bitcoin Top (BTT)

Fork Date: 26.12.17 – Block 501118

Changes from original protocol: 8mb block size, Segwit, Replay protection,

Distribution method: 1BTC = 1BTT

Bitcoin Top aims to be ‘better than better’, ‘the top Bitcoin’ but it has a long way to go after a late 2017 fork. 8mb block size coupled with Segwit makes up its way of scaling cryptocurrency.

Bitcoin File (BIFI)

Fork Date: 27.12.17 – Block 501225

Changes from original protocol: Increased block size, Smart contracts, Content network

Distribution method: 1BTC = 1000BIFI

Bitcoin File aims to be more than just a currency, it wants to provide a global content network. Using a fork of the Bitcoin blockchain, BIFI is trying to create an effective, secure and environmentally friendly storage network.

Bitcoin Segwit2X X11 (B2X)

Fork Date: 28.12.17 – Block 501451

Changes from original protocol: Segwit2x X11 encryption algorithm, Upto 4mb block size, 2.5 minute block time, Every block difficulty adjustment, Reply protection

Distribution method: 1BTC = 1B2X

Not to be confused with the previous cancelled fork SegWit2X. This is a different operation but in many ways very similar. Segwit with increased block size resembles the original fork proposal and B2X now adds a 2.5 minute block generation time.

Bitcoin Pizza (BPA)

Fork Date: 01.01.18 – Block 501888

Changes from original protocol: Directed Acyclic Graph technology (DAG)

Distribution method: 1BTC = 1BPA

Bitcoin Pizza is forking the legacy blockchain data and moving forward with a completely different angle. DAG technology, as we have seen with the IOTA altcoin, is thought of as a faster network style, although trust and consensus are issues with Pizza.

Bitcoin Smart (BCS)

Fork Date: 21.01.18 – Block 505050

Changes from original protocol: 2.1 billion supply, Equihash mining, 8mb block size, Segwit, Replay protection, No premine, Smart Contract

Distribution method: 1BTC = 100BCS

Bitcoin Smart integrates a staggering selection of features grabbing protocols from everywhere. The highlights of Segwit, 8mb blocks and equihash are accompanied by smart contracts for a really nifty selection.

Bitcoin Interest (BCI)

Fork Date: 22.01.18 – Block 505083

Changes from original protocol: Equihash mining, Savings feature, Every block difficulty adjustment, Segwit, Replay protection, Earn interest

Distribution method: 1BTC = 1BCI

Bitcoin Interest has the added bonus of a savings feature where investors can actually earn interest on their funds. Segwit and regular difficulty adjustment should also make it a swift cheap payment network.

Quantum Bitcoin (QBTC)

Fork Date: 28.01.18 – Block TBA

Changes from original protocol: Lightning Network, 8mb block size, Privacy protection, Replay protection, Pow + PoS consensus, Smart Contracts

Distribution method: 1BTC = 1QBTC

Quantum Bitcoin aims to take some of the biggest and best Bitcoin ideas and amalgamate them into a single package. Big blocks, Lightning Network and privacy makes for another speculative project.

Bitcoin LITE (BTCL)

Fork Date: 30.01.18 – Block TBA

Changes from original protocol: Proof of Stake consensus, Privacy options

Distribution method: 1BTC = 1BTCL

Bitcoin LITE is nothing special, in fact it is aiming to be to Bitcoin what silver is to gold. Sound familiar? This is more of a Litecoin competitor that is to include a premine. Nothing of note here really.

Bitcoin Ore (BCO)

Fork Date: 31.12.17 – Block 501949

Changes from original protocol: Proof of Capacity consensus, 8mb block size, 5 minute block time, Replay protection

Distribution method: 1BTC = 1BCO

Bitcoin Ore uses a new consensus style called Proof of Capacity. It touts the more energy efficient cheaper mining solution as the future of Bitcoin. Steady roll out over 2018 will be interesting to watch.

Bitcoin Private (BTCP)

Fork Date: January 2018 – Block TBA

Changes from original protocol: Private transactions

Distribution method: 1BTC = 1BTCP + 1ZCL = 1BTCP

Bitcoin Private forks both Bitcoin Legacy and Zclassic to create a privacy coin. With more information still to be released we will have to wait and see how this one shapes up.

How High Can Bitcoin's Price Go in 2018?

Had Jerry Brito’s daughter waited longer to emerge, she might have been someone else entirely. In November, as Brito paced the hospital for 23 hours while his wife was in the delivery room, he floated an alternative name for the baby: “Ten Thousand.”

The founding executive director of the nonprofit Coin Center, Brito had spent years advocating for Bitcoin, arguing that the cryptocurrency, and the technology underpinning it, would dramatically change our economy, reshaping the world into which we’re all born. Now Brito was on the cusp of realizing two long-held dreams. Even as his wife went into labor a few days after Thanksgiving, Bitcoin was taking off as well. Worth $950 at the start of the year, its price breached $9,000 while Brito waited in the maternity ward. This explained why his daughter was taking her time, he began saying: “This baby does not want to be born in a world where Bitcoin is not $10,000.”

Alas, the price was only $9,600 when Brito’s daughter arrived early Nov. 27; the parents went with a different name. But Bitcoin broke $10,000 the following night. And in the newborn’s first 10 days on earth, it more than doubled again, grazing $20,000. In all, Bitcoin has seen a roughly 20-fold rise since the beginning of 2017, outshining virtually every conventional investment.

For true believers, the soaring rise rewarded a deep-seated faith. “It’s always been kind of obvious to me that this technology is as profoundly revolutionary as the Internet was and is,” Brito says. But Bitcoin’s spike also represented the revolution’s next phase. Less prescient investors, fearing they’d miss the opportunity of a lifetime, had jumped into the currency, spurring a frenzy. “If Bitcoin is successful, the opportunity I have, my son will not have, and definitively, my son’s son will not have,” says Martin Garcia, managing director at Genesis Trading, the only licensed U.S. broker-dealer for Bitcoin. “Once it’s successful, it’s a boring investment—it’s a way to move money around the world.” And “boring” doesn’t earn you 1,800% in a year.

Going Mainstream

Bitcoin has provoked hysteria before. Over one stretch of 2013, its price surged 85-fold; it crashed the following year after a hack of the exchange Mt. Gox shook the confidence of many early devotees. It wasn’t until 2017, though, that Bitcoin hit a tipping point of mainstream popularity. By November, one of the biggest U.S. Bitcoin exchanges, Coinbase, had signed up some 12 million customers, surpassing the number of accounts at 46-year-old brokerage Charles Schwab (schw). Within weeks, Coinbase’s app became the iPhone’s most downloaded. At press time, Bitcoin, once largely an insurgent’s fantasy, was worth some $300 billion in real money.

“We are going through the biggest wealth generation opportunity of the century, and people want to participate,” says Meltem Demirors, director of development at Digital Currency Group. DCG oversees a cryptocurrency portfolio including 1% of the total Bitcoin supply. It also invests in startups working on blockchains, accounting tools that use networks of computers to collectively sustain mutually trusted, shared ledgers of transactions, without relying on any outside institutions as middlemen.

The appeal of this tech is stoked by geopolitical unease. Since its inception in 2009, Bitcoin has fed off the festering distrust in institutions sown by the financial crisis. And as populist sentiment has spread in the West, so has the allure of a decentralized currency outside the grasp of governments and banks. Bitcoin’s price jumped after the U.K.’s Brexit vote in 2016—and again when Donald Trump won the White House. Combine such surges with ransomware attacks demanding payment in Bitcoin and buyers from countries like Venezuela seeking refuge from hyperinflation, and Bitcoin’s significance has penetrated the public consciousness like never before.

“You do have people turning to it as that disaster hedge, much as they turn to gold,” says Chris Burniske, cofounder of VC firm Placeholder and coauthor of Cryptoassets, a new investor’s guide. “There’s so much ammunition” feeding this movement, agrees Mike Novogratz, a billionaire former hedge fund manager who now has 30% of his net worth invested in Bitcoin and other cryptocurrencies. Every establishment failure reinforces the thesis; after debacles like the Wells Fargo fake-account scandal, he asks, “I’m supposed to trust those f–king banks?”

Trust them or not, banks and asset managers are poised to flock to Bitcoin too. “Wall Street has just started to dip their toes in,” says Tyler Winklevoss, CEO and cofounder of Gemini, whose cryptocurrency exchange partnered with a more traditional one, CBOE, on Bitcoin futures contracts in December, offering institutional giants a way to participate. “It’s the bottom of the first inning.”

Skeptics see a familiar mix of new-paradigm euphoria and get-rich-quick mania, with an unhappy ending looming. “It seems like the dotcom bubble all over again, or the housing bubble all over again,” cautions Robert Shiller, the Nobel Prize–winning economist who literally wrote the book on the subject. (Shiller, who foresaw those crashes, tells Fortune he’s contemplating a fourth edition of his Irrational Exuberance, updated to include the cryptocurrency craze.)

Still, for now the stampede of optimists continues, economists and possible calamity be damned. As investors pile in from Main Street to Wall Street, the question becomes, Is Bitcoin’s rise more than an ephemeral rush?

Why Bitcoin Soared

In August 2010, nearly two years after conceiving of Bitcoin in a landmark white paper, Satoshi Nakamoto, the project’s pseudonymous, as yet unidentified creator (or creators), proposed a thought experiment. “Imagine there was a base metal as scarce as gold,” the inventor wrote in a thread on an online Bitcoin forum. The imaginary metal would not be “useful for any practical or ornamental purpose,” Nakamoto wrote, but would have “one special, magical property: [It] can be transported over a communications channel.”

Nakamoto was describing a physical analog to Bitcoin, and his point was to address a fundamental paradox of money: How does money get valued as a medium of exchange when its value lies solely in being a medium of exchange? The simple answer: It’s mostly subjective. Perhaps limited supply and instantaneous portability would be enough to justify a market value for Nakamoto’s magic substance. Maybe speculators, “foreseeing its potential usefulness for exchange,” would bet on the stuff. “I would definitely want some,” the philosopher teased.

Investors, it turns out, wanted some too—even though Bitcoin’s usefulness remains largely theoretical. While some advocates dream of Bitcoin becoming the first universal currency, supplanting central banks and replacing Visa and Mastercard, so far its computerized bits are, at best, equivalent to “digital gold.” They’re good as a place to park money—what economists call a “store of value”—but impractical for payments, says Matt Huang, a partner at VC firm Sequoia. “The popular narrative around using Bitcoin to buy coffee or pizza is a pipe dream at this point.”

Fred Ehrsam, ex-president of Coinbase, notes how unusual this “magical Internet money” is in practice. “The thing that gives it value is other people giving it value, which is a strange thing to wrap one’s mind around.” Strange, but hardly unprecedented: Like the green paper our economy is built on—and the gold and silver that predate it—Bitcoin is valuable because we collectively decide it is. “And if enough people agree,” adds Huang, “then the bubble can just persist.”

To justify Bitcoin’s tremendous rise, bulls like the Winklevoss twins point to Metcalfe’s Law, which states that a network’s value increases exponentially with each additional participant. Tyler, along with his brother Cameron, entered the national spotlight after suing Facebook CEO Mark Zuckerberg, their Harvard schoolmate, for allegedly stealing their business plan. In Bitcoin they’ve found a lucrative second act. Having invested a portion of their $65 million Facebook settlement in the cryptocurrency some years ago, the twins are said to have recently become billionaires. “Money is in many ways the ultimate social network,” Tyler says. “It’s a medium of value that connects us all.”

Bitcoin also enjoys the brand recognition shared by innovators that arrive early and dominate fast, like Google in search, Facebook in social networking, and Amazon in e-commerce. “Bitcoin is more contagious than all the other cryptocurrencies because it’s the first mover,” Yale economist Shiller says. “Just like Harvard is considered the most prestigious university because it was the first one” in the U.S.

Bitcoin’s uniquely set payout rate—which rewards “miners” for supporting the network with their computers—also helps make it more valuable. Prices of commodities like corn, oil, or gold often plunge when producers pump out supply to meet demand, creating inadvertent gluts. Bitcoin’s supply, in contrast, is forever fixed, by computer code, at a total of 21 million coins (of which about 80% have been produced). And nothing drives prices up like scarcity.

In the eyes of some supporters, these advantages add up to virtually unconstrained upside. Cybersecurity pioneer John McAfee recently set a $1 million price target for Bitcoin by 2020 (revised upward from $500,000). Others say the market value could match gold’s, which clocks in at $9.7 trillion—roughly $460,000 per coin.

Still, even Bitcoin’s greatest backers acknowledge the possibility that the cryptocurrency’s value could plummet—if, say, regulators in China or the U.S. decided to effectively outlaw it, or if a better and more functional blockchain superseded it. It would hardly be the first craze that fizzled fast. “I think of these as high-tech Beanie Babies or 21st-century tulips,” says Robert Hockett, a law professor at Cornell who gained notoriety after the financial crisis for proposing that cities use “eminent domain” to buy out underwater mortgages. Hockett sees echoes of that disaster in Bitcoin-mania. After a securities regulator warned that people were taking out mortgage loans to speculate on Bitcoin, he noted the irony: “It’s almost as though the cosmic joker out there is pulling our legs as maximally as possible.”

Hockett believes blockchain tech will prove a game-changer. But he can’t understand the fascination with Bitcoin, given its copious flaws. As the original cryptocurrency, Bitcoin suffers from drawbacks typical of first-generation technology. Transactions lack privacy, and fees commonly run as high as $20, even for transfers of small sums. Hackers run rampant. And the entire network can currently handle, at most, only seven transactions per second, compared to the thousands that Visa and Mastercard process in the same span. “It’s a bit like betting only on Betamax when new video technology was coming online in the 1980s,” Hockett says.

Jim Rickards, chief strategist at Meraglim, a financial analytics firm, views Bitcoin with equal fatalism. “I’m extremely bullish on the future” of blockchains, he says, “but I view Bitcoin as a Neanderthal, an evolutionary dead end.”

An Endangered Species?

When British scientists first encountered the platypus in the late 18th century, they suspected a hoax. The animal didn’t fit in their conventional taxonomic categories. It looked like a mole, but it had a duck’s bill, a beaver’s tail, and an otter’s feet. Plus, it was venomous and laid eggs. Still, “after really careful examination, they said, ‘This is real!’ ” says Spencer Bogart, head of research at Blockchain Capital, a venture capital firm devoted to cryptocurrencies and related tech.

Bogart is deploying a favorite analogy: “Just like the platypus is not good at being a reptile, a beaver, a duck, or an otter, but it’s great at being a platypus; Bitcoin is not good at being a currency, a commodity, or a fintech company, but it’s great at being Bitcoin. It’s creating its own category and asset class.”

When skeptics dismiss Bitcoin, bulls like Bogart push back. Unlike gold, Bitcoin is not static. The software code is under constant development. Its features can be tweaked, improved, and “forked” into new iterations, with the potential to unlock value in as yet unimagined ways. Many Bitcoin fans, for example, have high hopes for the “Lightning Network,” an improvement designed to facilitate quicker payments. If Bitcoin, in its evolution, acquires more compelling utility—making cross-border payments cheap and fast, for example, or enabling “smart” contracts that encode business relationships and automatically disburse payments—those who own stakes in the finite currency could find other would-be users, possibly even deep-pocketed corporations, clamoring to buy from them.

For many, this is reason enough to play the long game. Most of the earliest investors seem to be doing just that. People who have held Bitcoin for at least three years—so-called HODLers, a name that stems from a typo for “hold” in an online forum—are largely still HODLing. Their Bitcoins accounted for only 4% of the Bitcoins moved in 2017 to cryptocurrency exchanges, according to research provided to Fortune by Chainalysis, a digital forensics firm. Since moving to an exchange is a rough proxy for an intention to sell, this suggests the vast majority are keeping their windfall in reserve.

There are many reasons, of course, to take the wait-and-see approach with Bitcoin—from the fact that it could be worth double tomorrow, to the reality that there are currently few nonspeculative ways to actually spend or use it. The wealth management giant Fidelity, for one, allows employees to buy lunch with Bitcoin in the company cafeteria, but so far the program has been a dud. After all, paying $5 in Bitcoin for a sandwich today could be like paying $100 next Christmas. No one knows.

Therein lies a problem: If a cryptocurrency is too volatile to spend, it can’t be a useful currency. On the other hand, if it did someday stabilize and become widely used, its soaring prices would flatten out; it’ll be the “boring investment” that broker Martin Garcia fears. Either outcome—proof that Bitcoin can’t work as a currency, or proof that it can—could suck speculative money out of Bitcoin and precipitate a painful crash. Meanwhile, if the HODLers are sitting on Bitcoins until the currency achieves widespread functionality, just how long will they be willing to wait? “If three years becomes 10 years, the market will collapse,” says investor Novogratz. And in any of these scenarios, Bitcoin’s decentralized nature means there are few if any levers regulators (or anyone else) can pull to put a floor under a Bitcoin implosion.

Still, big players have decided these are risks well worth taking. Bubbles usually pop after the “dumb money” chases the smart money, but until now, it has mostly been individuals and small investors who have driven the Bitcoin phenomenon. While people can buy fractions of Bitcoin in increments of as little as $1 on cryptocurrency exchanges, institutional investors have largely been barred from those venues owing to fiduciary and compliance requirements around custody of assets.

Now that’s starting to change. Companies like Coinbase and BitGo are rolling out products catering to heavyweight investors, as even the most staid hedge funds and sovereign wealth managers come knocking. Goldman Sachs (gs) is said to be considering launching a Bitcoin trading operation. (The bank’s sole cryptocurrency-related investment to date, a startup called Circle, already operates a trading desk.) According to the bulls, the influx of smart money could eclipse all the wealth currently invested in Bitcoin—theoretically more than doubling the market value in one fell swoop.