BRINGING BITCOIN TO EVERYDAY LIFE

Interested in getting started with Bitcoin? Make a smooth transition from fiat to digital money! Xapo provides the tools you need to purchase bitcoins, then manage them through our easy-to-use online wallet, or store them in Xapo's free, ultra-secure Vault.

Welcome to Digital Money

The Xapo Wallet provides a way to manage your funds when you want and where you want.

Secured. Trusted.

Xapo has been described by The Wall Street Journal as the Fort Knox of bitcoin storage. So if you’re looking to secure your bitcoins, then look no further than the Xapo Vault. We’ve developed a new standard of bitcoin security so you can rest assured that your money is safe as it can be.

What others are saying

Lawrence H. Summers was the Secretary of the Treasury under President Bill Clinton, and continues to be one of the leading economic and policy thinkers of our time. “Until now whenever we’ve needed to transfer money we’ve had to rely on a third party, whether it be a bank, a clearing house or a payment network. Bitcoin offers, for the first time, a method for transferring value and making payments from anywhere to anywhere, in real-time, without any intermediary. This could mean we soon see many billions of people sending bitcoin everyday as easily as they currently send a text message.”

Dee Hock is the founder of Visa, and is responsible for effectively creating payment systems as we know them today. “Bitcoin represents not only the future of payments but also the future of governance,” Mr. Hock said. “We live in the 21st century but are still using command and control organizational structures from the 16th century. Bitcoin is one of the best examples of how a decentralized, peer-to-peer organization can solve problems that these dated organizations cannot. Like the Internet, Bitcoin is not owned or controlled by any one entity, so it presents incredible opportunities for new levels of efficiency and transparency in financial transactions.”

John Reed was formerly the Chairman & CEO of Citibank, and was responsible for growing Citibank into the world’s first truly global financial franchise. Under Mr. Reed’s leadership Citibank developed the modern ATM and helped redefine the modern retail banking experience. “Financial services have remained largely untouched by the digital revolution,” says Mr. Reed. “Bitcoin represents a real opportunity for changing that. Money at its core is simply a ledger for keeping track of debts and Bitcoin is truly the best iteration of a universal ledger we’ve ever seen. The mere fact that there will never be more than 21 million bitcoins and that each bitcoin can be divided into 100 million units makes it a significant improvement on any historical form of currency.”

Lawrence H. Summers

Lawrence H. Summers was the Secretary of the Treasury under President Bill Clinton, and continues to be one of the leading economic and policy thinkers of our time. “Until now whenever we’ve needed to transfer money we’ve had to rely on a third party, whether it be a bank, a clearing house or a payment network. Bitcoin offers, for the first time, a method for transferring value and making payments from anywhere to anywhere, in real-time, without any intermediary. This could mean we soon see many billions of people sending bitcoin everyday as easily as they currently send a text message.”

Dee Hock is the founder of Visa, and is responsible for effectively creating payment systems as we know them today. “Bitcoin represents not only the future of payments but also the future of governance,” Mr. Hock said. “We live in the 21st century but are still using command and control organizational structures from the 16th century. Bitcoin is one of the best examples of how a decentralized, peer-to-peer organization can solve problems that these dated organizations cannot. Like the Internet, Bitcoin is not owned or controlled by any one entity, so it presents incredible opportunities for new levels of efficiency and transparency in financial transactions.”

John Reed was formerly the Chairman & CEO of Citibank, and was responsible for growing Citibank into the world’s first truly global financial franchise. Under Mr. Reed’s leadership Citibank developed the modern ATM and helped redefine the modern retail banking experience. “Financial services have remained largely untouched by the digital revolution,” says Mr. Reed. “Bitcoin represents a real opportunity for changing that. Money at its core is simply a ledger for keeping track of debts and Bitcoin is truly the best iteration of a universal ledger we’ve ever seen. The mere fact that there will never be more than 21 million bitcoins and that each bitcoin can be divided into 100 million units makes it a significant improvement on any historical form of currency.”

How To Get A Bitcoin Debit Card

Bitcoin debit cards help bridge the Bitcoin world with traditional finance and you can either buy Bitcoins with your debit card or load a debit card with bitcoins to then spend bitcoins at almost any credit card accepting merchant.

- Overview - Table of Contents

- Cryptopay VISA Debit Card

- SpectroCoin Debit Card

- Uquid Debit Card

- Bitpay VISA Debit Card

- Xapo Debit Card

- Coinbase Shift Card

- Bitwala VISA Debit Card

- Services To Avoid

Buying bitcoins with a debit card is incredibly easy and we recommend SpectroCoin.

While Bitcoin debit cards do not allow users to spend bitcoins directly they at least allow people to store balances in bitcoin.

Since most debit card top ups only take a few seconds to confirm then bitcoin balances can be held up until the need to spend.

Cryptopay Debit Card

The oldest and most established Bitcoin debit card, the Cryptopay bitcoin debit VISA card with over 23,000 issued. Cryptopay bitcoin cards have made it simple for customers to spend bitcoins at millions of businesses around the world.

For purchases both online and offline, Cryptopay makes the process convenient for users and easier than ever for merchants.

There are both plastic and virtual Cryptopay Bitcoin cards issued. Cryptopay customers are not required to complete ID verification provided if they are happy to stay within the lower debit card limits. It is possible to stay anonymous where desired.

Costs range between €15.00, £15.00, $15.00 and €2.50, £2.50, $2.50 depending on currency, location and card limits.

SpectroCoin VISA Debit Card

SpectroCoin offers Bitcoin prepaid cards, which can be used at any ATM around the globe or shops as an ordinary payment card.

The card is funded instantly, so you do not have to worry about exchanging your bitcoins in advance.

The card can be denominated in dollars (USD), euros (EUR) or pounds (GBP).

Pay with bitcoins wherever you want. SpectroCoin bitcoin debit card is accepted everywhere where MasterCard or VISA is accepted. That includes automated teller machines (ATMs) for cash withdrawal, online sites, and physical shops. This Bitcoin debit card can also be linked to PayPal or any other online wallet.

Virtual and physical bitcoin debit cards are available. Virtual bitcoin cards are issued instantly and can be used to spend bitcoins anywhere online. Physical bitcoin cards are delivered within 1-4 weeks and can be used to spend bitcoins anywhere physically and online.

Instant loading. Bitcoin debit cards can be loaded immediately from SpectroCoin wallet.

No verification required. To simplify the process, you are not obliged to complete verification immediately. However, to benefit from higher debit card limits, you will have to verify your account.

Cards in several currencies are available. USD (dollar), EUR (euro) and GBP (pound) cards are issued.

Multiple digital currencies this debit card can be funded with various digital currencies including Bitcoin, DASH and more.

Low fees are guaranteed for SpectroCoin bitcoin debit card holders. The dollar, euro or pound denominated debit card costs 9 USD/8 EUR/6 GBP respectively. There is also no loading fee.

Unlimited lifetime withdrawals and deposits to the bitcoin debit card for verified cardholders. Other limits also being high.

Uquid VISA Debit Card

Uquid guaranteed for free access to Bitcoin, Ethereum, Litecoint, PIVX, Ripple, Monero, DASH and other 75 cryptocurrencies network.

Uquid enables users to utilise all the benefits of transfer coins into the debit card with real market price.

With guaranteed provides an easy and hassle-free. Unbanked and travellers can obtain a Visa debit card with no identification or credit check required and free delivery to 178+ countries.

Uquid users can spend over 75 different cryptocurrencies on mobile top ups, bill payments, pharmacy and food vouchers, transportation tickets, wi-fi recharges, and PIN-less calls.

BitPay VISA Debit Card

Although the newest Bitcoin debit card, BitPay's VISA card is perhaps the most exciting of the bunch. It is the first Bitcoin debit card that is available to US residents from all 50 states.

BitPay's debit card costs $9.95 to order, and arrives 7-10 days after purchase. It can be used online, in-person, and also works with any ATM that works with VISA cards.

Unlike Shift's debit card (featured below), deposits lock in value in dollars. Shift's debit card spends directly from your Coinbase balance, which creates an accounting nightmare for capital gains taxes when it comes time to file.

Xapo Debit Card

Xapo's debit card was the first to market. It is available in most European countries, but not the United States.

The Xapo debit card costs $20 and also has an annual fee of $12. Once ordered, the card takes 10-25 days to be delivered. It debits funds directly from your Xapo web wallet.

Coinbase / Shift Card

Shift was the first Bitcoin debit card available to U.S. residents. It is currently available to residents in 41 U.S. states.

The Shift card connects to your Coinbase account. For each debit card purchase, it automatically withdrawals the necessary amount of bitcoins based on the dollar value of the transaction.

For now, the Shift card is completely free to use but costs $10 to purchase. Shift and Coinbase have both stated that in the future there will be transaction fees for each purchase.

Bitwala Visa Debit Card

Bitwala’s VISA debit card is the most affordable bitcoin debit card on the market, both in terms of card price and the lowest, transparent fees that follow card usage.

The Bitwala debit cards are issued in both physical and virtual forms and costs €2.00. Customers can also enjoy a super low 0.5% (€1 min.) fee for card top ups using Bitcoin or Altcoins.

Denominated in Euros, the Bitwala debit card can be used to pay online and offline where VISA is accepted. Cardholders can also cash out at any ATM worldwide with the best rates and transparent fees.

Bitwala offers 2 shipping plans: Free of charge (Arrives 7-10 days after purchase, no tracking information) and express shipping that costs €69.00 (Arrives 3-5 days after purchase incl. tracking information).

Services To Avoid

BitPlastic - was among the first Bitcoin debit cards. However, they do not appear to be innovating much.

Supposedly they are TOR compatible but I get strange error messages whenever I try to use their services. Perhaps I have too much cybersecurity on my computer for them!!

Additionally, many websites may fail to process a card with no-name. And if you lose your card then you have lost your funds so be extra careful!

E-Coin/Wirexapp - The signup process was extremely poor and required a phone verification. Then the account did not even function properly. So I am not sure they even offer a legitimate Bitcoin debit card at all. So just steer clear of these guys.

Prepaid Card

Prepaid Card features

Discover endless possibilities with Cryptopay

Shop anywhere with our card

It’s easy to exchange and load your prepaid card with funds from your Cryptopay Bitcoin Wallet. Use your card anywhere major cards are accepted.

Online or offline

Cryptopay prepaid card works online, offline and internationally, making it simple for customers to use at millions of businesses around the world.

Standard or Express delivery

We always have cards in stock, so yours can be shipped the day after you place your order. The fastest option to receive the card is through DHL Express service. (3-10 Business Days)

Transparent pricing and limits

Decide which Cryptopay cards fit your needs

Plastic prepaid card

Ideal for ATM withdrawals and offline shopping

Virtual prepaid card

Ideal for online shopping and account verifications

Still have questions?

Want to know more about Cryptopay Debit Card?

Why do I need a Cryptopay card?

Using Cryptopay card is by far the easiest and fastest way to cash-out your bitcoins. Convert your bitcoins whenever you need them, easily through Cryptopay mobile or web app.

How do I activate my card?

When you receive your prepaid card you will receive instructions on how to activate your card. Please read them carefully. If you have any questions, please don’t hesitate to contact our support.

How do I pay for a prepaid card?

You can pay for a prepaid card using any of the currencies accepted by Cryptopay — Pounds, Dollars, Euros & Bitcoins. Once you have sufficient funds, you’ll be able to order your card.

Where can I get my card statement?

All your prepaid card transactions are displayed in your Cryptopay account. You can track your payments, deposits, withdrawals, and transactions online, available 24/7.

Bitcoin kaufen mit Kreditkarte

Anmerkung: Wenn Sie Bitcoins mit Paypal oder einer Kreditkarte ausschließlich zum Handeln kaufen möchen, sollten Sie sich AvaTrade oder Plus500 Bitcoin CFD trading ansehen. Für weitere Informationen sollten Sie zunächst diesen Artikel lesen.

Ich weiß, dass viele Leute danach gefragt haben also habe ich mir überlegt, einen Beitrag über dieses Thema zu schreiben. Bitcoins mit einer Kreditkarte zu kaufen ist sehr ähnlich zum Kaufen von Bitcoins mit PayPal , da beides über die PayPal Webseite abgewickelt wird.

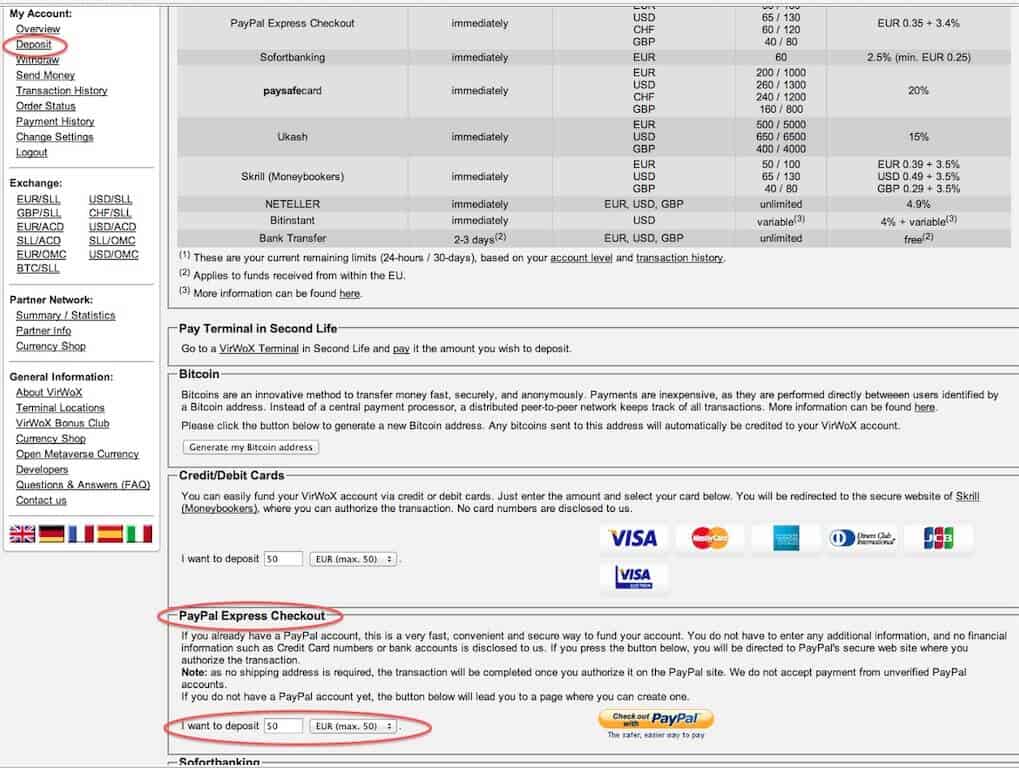

Das erste was Sie machen sollten ist es, zu VirWox zu gehen. VirWox ist ein Virtueller Weltweiter Austausch, der ursprünglich darauf ausgelegt war, Second Life Lindens zu handeln – eine virtuelle Währung, auch als SLL bekannt. Wir werden VirWox als Mittelmann verwenden, um Bitcoins mit einer Kreditkarte zu kaufen, da die meisten Orte dies aufgrund vieler Probleme nicht erlauben.

Nachdem Sie also bei VirWox gelandet sind, müssen Sie sich anmelden. Oben links befindet sich ein Link auf dem steht: „Not registered yet ?“. Diesen können Sie hier sehen:

Alles was Sie dann machen müssen ist das Ausfüllen Ihrer Daten. Das Feld „Avatar Name“ können Sie enfach bei „No Avatar“ belassen. Der Avatar wird aus dem Spiel Second Life entnommen und wir müssen hier nichts verknüpfen.

Wenn Sie alle Informationen eingegeben haben, können Sie einfach auf „Register“ klicken. Sie werden als nächstes eine E-Mail von VirWox erhalten mit Ihrem vorläufigen Passwort. Ich empfehle dringlich, das Passwort schnell zu ändern, da Sie über diese Seite mit echtem Geld handeln werden.

Wenn Sie die E-Mail erhalten haben, können Sie sich einfach bei VirWox mit Ihrem Nutzernamen und Passwort einloggen. Zunächst müssen Sie nun ein wenig Geld auf Ihr Konto einzahlen. Klicken Sie einfach auf den „Deposit“ Link auf der linken Seite und gehen Sie zum PayPal Express Checkout Bereich. Hier können Sie auswählen wie viel Geld Sie einzahlen möchten.

Bedenken Sie dass es einen Höchstbetrag für Einzahlungen gibt, dieser erhöht sich jedoch mit der Zeit (die genauen Beträge stehen auf der VirWox Homepage). Nachdem Sie also den Betrag eingegeben haben den Sie einzahlen wollen, klicken Sie einfach auf den „PayPal“ Knopf.

Sie werden nun auf die PayPal Bezahlseite umgeleitet. Wenn Sie ein PayPal Konto besitzen, können Sie sich einfach einloggen und die Bezahlung tätigen. Wenn Sie allerdings bisher kein Kondo bei PayPal angelegt haben und mit einer Kreditkarte bezahlen möchten, können Sie einfach auf den Link „Don’t have a PayPal Account?“ („Ich habe kein PayPal Konto“) klicken.

Wenn Sie auf den Link geklickt haben können Sie einfach Ihre Kreditkarteninformationen eingeben und die Einzahlung an VirWox mit Ihrer Kreditkarte bezahlen.

Nachdem Sie das Geld eingezahlt haben, wird es in VirWox oben links in USD angezeigt. Jetzt ist es an der Zeit, ein paar Bitcoins zu kaufen. Der erste Schritt ist es, mit Ihren USD ein paar SLL zu kaufen. Klicken Sie dazu einfach auf SLL/USD und wählen Sie aus wie viele SLL Sie kaufen möchten anhand des derzeitigen Wechselkurses.

Im Bild oben habe ich nicht genügend USD, um SLL zu kaufen, wenn Sie jedoch den Schritten bis jetzt richtig gefolgt sind, werden Sie den Betrag an SLL sehen können, den Sie mit Ihren USD kaufen können.

Nachdem Sie SLL gekauft haben, werden diese auch oben links angezeigt (Sie können meine oben links im Bild vorher sehen). Und jetzt ist es an der Zeit, diese SLL in BTC umzuwandeln. Gehen Sie also zum SLL/BTC Wechsel und tauschen sie einfach so viele SLLs um wie Sie möchten.

Nach diesem Schritt ist manchmal eine manuelle Überprüfung von VirWox nötig. Das kann bis zu 48 Stunden dauern, ist jedoch meist innerhalb von 6 Stunden erledigt.

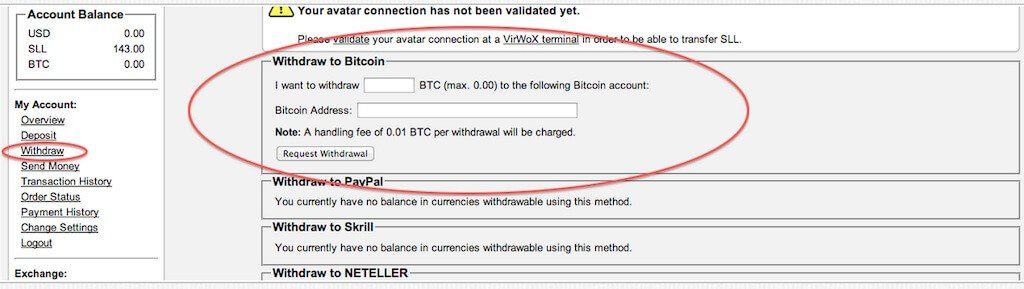

Nachdem Sie den Wechsel erledigt haben, werden auch die Bitcoins in Ihrem Konto oben links angezeigt. Der letzte Schritt ist es nun, die Bitcoins in Ihr „Wallet“ zu bekommen. Klicken Sie also auf „Withdraw“ („abheben“)auf der linken Seite. Dort können Sie eine Bitcoin Adresse angeben, an die Sie Ihre neu erworbenen Bitcoins senden können.

Nachdem die Transaktion bestätigt wurde (das kann bis zu 48 Stunden dauern, meist ist es jedoch innerhalb von 2 Stunden abgeschlossen), werden die Bitcoins in Ihrem Geldbeutel auftauchen. So können Sie also Bitcoins mit einer Kreditkarte kaufen.

Best Bitcoin Card – a Crypto Currency Debit Card Comparison

Bitcoin is the internet of money – and with a Bitcoin Debit Card, you can pay anywhere on this planet where Credit- or Debit Cards are accepted with the Crypto Currency of your choice. Together with your Bitcoin Wallet, you can replace about 95% of all services a normal Bank can provide to you. If you want to invest and trade, you can choose a crypto currency broker from a big variety of websites as well.

With the big difference that you have total control over your money, nobody else. This is the future of finance. Enjoy the freedom. If you have questions about buying a Bitcoin Debit Card, make sure to read our “How to choose” guide.

How To Get A Bitcoin Debit Card

Bitcoin debit cards help bridge the Bitcoin world with traditional finance and you can either buy Bitcoins with your debit card or load a debit card with bitcoins to then spend bitcoins at almost any credit card accepting merchant.

- Overview - Table of Contents

- Cryptopay VISA Debit Card

- SpectroCoin Debit Card

- Uquid Debit Card

- Bitpay VISA Debit Card

- Xapo Debit Card

- Coinbase Shift Card

- Bitwala VISA Debit Card

- Services To Avoid

Buying bitcoins with a debit card is incredibly easy and we recommend SpectroCoin.

While Bitcoin debit cards do not allow users to spend bitcoins directly they at least allow people to store balances in bitcoin.

Since most debit card top ups only take a few seconds to confirm then bitcoin balances can be held up until the need to spend.

Cryptopay Debit Card

The oldest and most established Bitcoin debit card, the Cryptopay bitcoin debit VISA card with over 23,000 issued. Cryptopay bitcoin cards have made it simple for customers to spend bitcoins at millions of businesses around the world.

For purchases both online and offline, Cryptopay makes the process convenient for users and easier than ever for merchants.

There are both plastic and virtual Cryptopay Bitcoin cards issued. Cryptopay customers are not required to complete ID verification provided if they are happy to stay within the lower debit card limits. It is possible to stay anonymous where desired.

Costs range between €15.00, £15.00, $15.00 and €2.50, £2.50, $2.50 depending on currency, location and card limits.

SpectroCoin VISA Debit Card

SpectroCoin offers Bitcoin prepaid cards, which can be used at any ATM around the globe or shops as an ordinary payment card.

The card is funded instantly, so you do not have to worry about exchanging your bitcoins in advance.

The card can be denominated in dollars (USD), euros (EUR) or pounds (GBP).

Pay with bitcoins wherever you want. SpectroCoin bitcoin debit card is accepted everywhere where MasterCard or VISA is accepted. That includes automated teller machines (ATMs) for cash withdrawal, online sites, and physical shops. This Bitcoin debit card can also be linked to PayPal or any other online wallet.

Virtual and physical bitcoin debit cards are available. Virtual bitcoin cards are issued instantly and can be used to spend bitcoins anywhere online. Physical bitcoin cards are delivered within 1-4 weeks and can be used to spend bitcoins anywhere physically and online.

Instant loading. Bitcoin debit cards can be loaded immediately from SpectroCoin wallet.

No verification required. To simplify the process, you are not obliged to complete verification immediately. However, to benefit from higher debit card limits, you will have to verify your account.

Cards in several currencies are available. USD (dollar), EUR (euro) and GBP (pound) cards are issued.

Multiple digital currencies this debit card can be funded with various digital currencies including Bitcoin, DASH and more.

Low fees are guaranteed for SpectroCoin bitcoin debit card holders. The dollar, euro or pound denominated debit card costs 9 USD/8 EUR/6 GBP respectively. There is also no loading fee.

Unlimited lifetime withdrawals and deposits to the bitcoin debit card for verified cardholders. Other limits also being high.

Uquid VISA Debit Card

Uquid guaranteed for free access to Bitcoin, Ethereum, Litecoint, PIVX, Ripple, Monero, DASH and other 75 cryptocurrencies network.

Uquid enables users to utilise all the benefits of transfer coins into the debit card with real market price.

With guaranteed provides an easy and hassle-free. Unbanked and travellers can obtain a Visa debit card with no identification or credit check required and free delivery to 178+ countries.

Uquid users can spend over 75 different cryptocurrencies on mobile top ups, bill payments, pharmacy and food vouchers, transportation tickets, wi-fi recharges, and PIN-less calls.

BitPay VISA Debit Card

Although the newest Bitcoin debit card, BitPay's VISA card is perhaps the most exciting of the bunch. It is the first Bitcoin debit card that is available to US residents from all 50 states.

BitPay's debit card costs $9.95 to order, and arrives 7-10 days after purchase. It can be used online, in-person, and also works with any ATM that works with VISA cards.

Unlike Shift's debit card (featured below), deposits lock in value in dollars. Shift's debit card spends directly from your Coinbase balance, which creates an accounting nightmare for capital gains taxes when it comes time to file.

Xapo Debit Card

Xapo's debit card was the first to market. It is available in most European countries, but not the United States.

The Xapo debit card costs $20 and also has an annual fee of $12. Once ordered, the card takes 10-25 days to be delivered. It debits funds directly from your Xapo web wallet.

Coinbase / Shift Card

Shift was the first Bitcoin debit card available to U.S. residents. It is currently available to residents in 41 U.S. states.

The Shift card connects to your Coinbase account. For each debit card purchase, it automatically withdrawals the necessary amount of bitcoins based on the dollar value of the transaction.

For now, the Shift card is completely free to use but costs $10 to purchase. Shift and Coinbase have both stated that in the future there will be transaction fees for each purchase.

Bitwala Visa Debit Card

Bitwala’s VISA debit card is the most affordable bitcoin debit card on the market, both in terms of card price and the lowest, transparent fees that follow card usage.

The Bitwala debit cards are issued in both physical and virtual forms and costs €2.00. Customers can also enjoy a super low 0.5% (€1 min.) fee for card top ups using Bitcoin or Altcoins.

Denominated in Euros, the Bitwala debit card can be used to pay online and offline where VISA is accepted. Cardholders can also cash out at any ATM worldwide with the best rates and transparent fees.

Bitwala offers 2 shipping plans: Free of charge (Arrives 7-10 days after purchase, no tracking information) and express shipping that costs €69.00 (Arrives 3-5 days after purchase incl. tracking information).

Services To Avoid

BitPlastic - was among the first Bitcoin debit cards. However, they do not appear to be innovating much.

Supposedly they are TOR compatible but I get strange error messages whenever I try to use their services. Perhaps I have too much cybersecurity on my computer for them!!

Additionally, many websites may fail to process a card with no-name. And if you lose your card then you have lost your funds so be extra careful!

E-Coin/Wirexapp - The signup process was extremely poor and required a phone verification. Then the account did not even function properly. So I am not sure they even offer a legitimate Bitcoin debit card at all. So just steer clear of these guys.

BITCOIN MIT KREDITKARTE KAUFEN

Vor ein paar Jahren war es noch gar nicht möglich mit einer Krdeit- oder Debitkarte Bitcoin zu kaufen. Heute kann man das bei einigen Unternehmen machen. Das ist eine gute Option, vorallem wenn Sie kleine Mengen brauchen oder es schnell gehen muss. Aber das Zahlen mit der Kreditkarte hat auch einige Nachteile, und zwar sind die Gebϋhren hoch und es besteht auch Betrugsgefahr. Wir haben fϋr Sie eine Liste der Unternehmen, die Kreditkarte als Zahlungsweise akkzeptieren, zusammengestellt.

Bei diesm Unternehmen kann man Bitcoins einfach, schnell und bequem mit einer 3D Sicheren Kredit- oder Debitkarte in ganz Europa kaufen.

Ist im Ermöglichen des Kaufs von Bitcoins mit einer Kreditkarte der Spezialist.

Sie ermöglichen Ihnen Bitcoins mit einer Kreditkarte, Debitkarte, per Sofortϋberweisung, SEPA Giropay und Online zu kaufen.

Bei diesem Unternehmen ist es möglich Bitcoins mit der Kreditkarte , mit Bargeld, AstroPay, SEPA zu zahlen.

Das Unernehmen bietet Ihnen die Möglichkeit die Bitcoins mit der 3Dsicheren Kreditkarte in Europa zu kaufen. Sie haben hier hohe Limits, die Ihnen zur Verfϋgung stehen.

Der Nutzer muss zuerst einen Account anlegen, um einen sicheren Handel von Bitcoins beginnen zu können. Das geht einfach, indem Sie Ihre E-Mail Adresse, die Kontakt und auch Identifikationsdaten eingeben. Nach der Aktivierung muss der Nutzer nur noch die E-Mail Adresse und die Handynummer bestätigen und es kann los gehen.

Verifizieren und Kreditkarte hinterlegen

Man muss sich als Nutzer verifizieren lassen, um Bitcoins mit Kreditkarte kaufen zu können. Das machen Sie mit einem Klick auf Kauf/Verkauf . Dank der Netverify geht das recht schnell:

- Personalausweis oder Fϋhrerschein bereit halten

- Dieses in der Webcam vorzeigen

- Fertig

Und nur noch ein kleiner Schritt, noch die Kreditkarte hinterlegen und ein Guthaben auf das Konto einzahlen und das ist alles. Nach einer erfolgreichen Transaktion wird die Kreditkarte im System hintergelegt und kann von nun an automatisch genutzt werden.

Bitcoin kreditkarte

Best Bitcoin Exchange

Find the best place to buy and sell Bitcoins from 20+ exchanges we reviewed

Buy Bitcoin Instantly

Use our geo-based search engine to find the fastest exchange in your area

Best Bitcoin Wallet

Choose the most secure wallet for storing your coins (we review all of them)

One of the great advantages of Bitcoin is its international nature. Wherever you are in the world, so long as…

To get started mining your L3+ Litecoin, or other Scrypt coins, watch this video! You can also use it to…

Kyber Network is a decentralized exchange for cryptocurrencies. Founded by Loi Luu, Victor Tran, and Yaron Velner in 2017, Kyber…

Not long ago, I reviewed one of the most popular cloud mining platforms around: Genesis Mining. I tried to establish whether…

Zcash is a privacy coin that’s been on the market for a few years now. It uses a mining algorithm…

While many people follow Bitcoin’s price, not everyone knows exactly how this price is determined. Bitcoin is unlike traditional assets…

Everything You Need to Know About ICO Marketing in 2018 If 2017 is to be remembered for something, then it…

What you will learn in this video What are some of the best ways to earn Bitcoin today? On the…

Note: USB Bitcoin miners (aka Stickminers) are not profitable ways to mine Bitcoin. Bitcoin Mining To quickly get up-to-speed on…

BitShares (BTS) is an open source financial platform and decentralized exchange on the blockchain. Launched in July 2014, it seeks…

The Wirex Payment Card

Manage money smarter with the most versatile payment card in the world.

Order your card.

Fund with £, $, €, Bitcoin or Litecoin.

Your choice of…

For Everyday Spending

- Shop in store, online or withdraw at the ATM

- Advanced card security (chip and PIN, card freeze, and more)

- Track your spending and use worldwide, with instant currency exchange between £, $, €, Bitcoin and Litecoin

And It’s Crypto-Friendly

- Spend crypto via instant exchange into £, $, €

- Over 50+ altcoin deposits supported

- Easily connect to your Wirex crypto wallets

- Perfect if you’re new to crypto or an advanced user

Card order price

* Your first card order. Ordering Wirex cards and opening the currency accounts is free, however you will be charged a monthly fee for the account maintenance by the issuer.

* Administration / Payment operations support e.g., trace payment or recall payment – any external bank costs associated with the transaction will be charged additionally. In Foreign Exchange ePOS transactions, currencies are converted at a wholesale rate.

Card Limits

* Currencies are converted at wholesale rate

** Load amount is unlimited but must not exceed maximum balance at any one time. For example, should you wish to purchase an amount of bitcoin that requires more than your maximum balance, you must perform multiple transactions.

Full price specification can be found in terms and conditions

Order your Wirex Payment Card today

Register for your free Wirex account — giving you access to a fully-featured hybrid finance mobile app with cryptocurrency wallets, currency accounts and payment cards*, ideal for buying, storing, spending, exchanging and sending your money anytime, anywhere. *Cryptocurrency balances must be converted to GBP, EUR, or USD before being available for card payments.

Frequently Asked Questions

Who is eligible for the Wirex card?

The Wirex Payment Card is available in GBP, USD, and EUR in the UK with availability in Europe coming very soon. Customers must be over 18 and legally resident in the UK.

How do I fund my card?

Add funds to your Wirex account via bank transfer, debit or credit card, payment services or by converting cryptocurrency such as bitcoin or litecoin into GBP, USD, and EUR.

Where can I use the card?

Use your Wirex card for in-store purchases, online shopping, and ATM withdrawals.

What kind of card is it?

The GBP card is a Visa Debit Card and the EUR or USD cards are prepaid. Card balances are linked to your Wirex currency account. The Wirex app gives you the same convenience as your regular banking services, with the added benefits of instant currency conversions, money transfers and access to cryptocurrencies - all with significantly lower fees than your bank would charge.

Trade bitcoin securely, fast and easy

Coinify Your Money, Payments or Assets

We enable businesses and individuals to adopt financial innovation. Our currency conversion services are tailored for businesses and customers of different sizes and needs.

Connecting traditional and new worlds to bring you ease of use

Compliant platform that helps to protect your value

Professional team with virtual currency experience since 2010

Official partners

Blockchain Currency Services for Everyone

With Coinify, the options are truly manifold: you can trade cryptocurrencies, use them as payment methods, or integrate them in your existing services. Whether you are an individual consumer looking for investment options, a business owner looking for alternative payment methods, or a large organisation looking for a white label solution, we have something for you.

Coinify Trade - Buy or Sell Bitcoin

Buy bitcoin instantly with card or via bank order. Sell bitcoin and receive money in your account.

Coinify Merchant - Accept Blockchain Payments

Add alternative payment options and give your customers the possibility to pay you in 15 different blockchain currencies from most countries in the world. Receive payouts in your national currency.

Coinify Enterprise Solution - Integrate Coinify API

Whether you are a payment service provider, fintech disruptor, traditional financial institution or government organisation, you can take your business to the next level using the Coinify API to offer virtual currency payments or trading services.

Комментариев нет:

Отправить комментарий