Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

Bitcoin kurs

V il du gerne vide mere om bitcoin kurs, så er du kommet til det helt rigtige sted.

Kursen på bitcoin har udviklet sig drastisk siden sin begyndelse i 2008. Prisen for 1 bitcoin var i juni 2009 0,0001 USD. Kursen for 1 bitcoin den 1. juni 2017 var 2400 USD.

Mange forventer, at kursen på bitcoin stadig vil stige kraftigt i fremtiden i takt med en stigende kendskabsgrad og øget popularitet.

Bitcoin kurs live

Bitcoin kurs live giver dig et øjeblikkeligt billede af prisen på bitcoin lige nu. Bitcoin kursen er forholdsvis volatil, den kan derfor have kraftige udsving på ganske kort tid.

Nu kender du kursen på bitcoin, men hvor meget ved du egentlig om bitcoin? Tryk på knappen og test din viden:

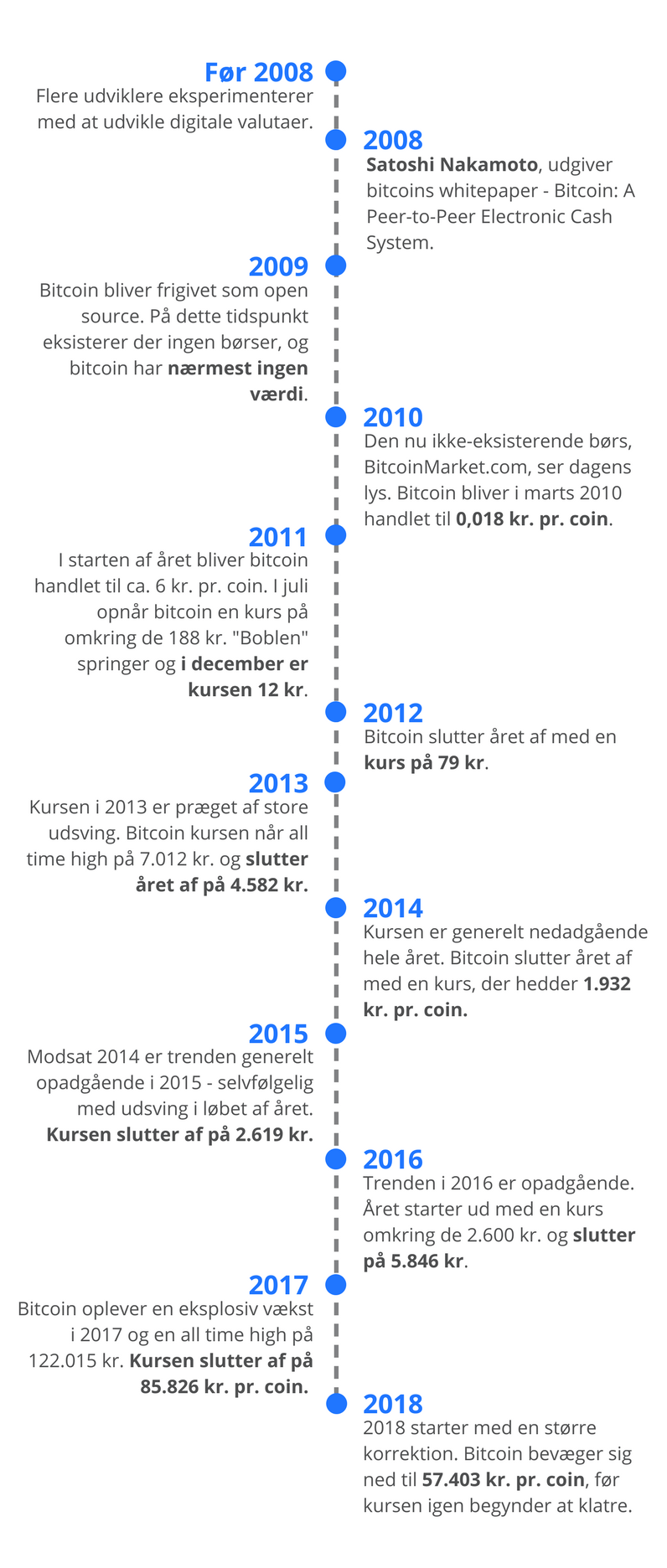

Historisk bitcoin kurs

Ovenstående interaktive infografik giver dig mulighed for at se bitcoin kursen i et historisk perspektiv. Du vælger selv, om du vil have et indblik i bitcoins kurs de sidste 24, 12, 6 eller 2 måneder. Du kan også vælge at se, hvordan kursen har bevæget sig den sidste måned.

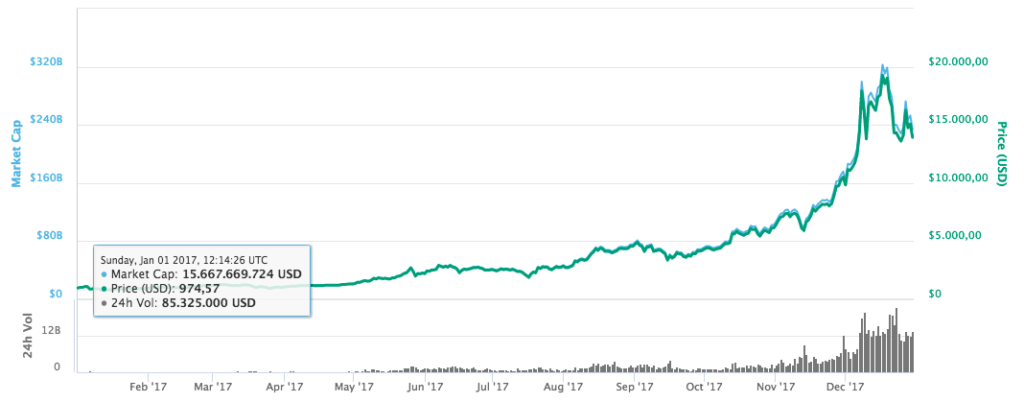

Kursudviklingen har specielt været opadgående i 2017. Dog har kursudviklingen for bitcoin været nedadgående i september 2017 og igen i december 2017.

Kursen på bitcoin har også haft nogle store udsving gennem årene. Det er et af kendetegnende ved bitcoin kursen, at den er utrolig volatil. Dette kendetegn har bitcoin til fælles med mange af de andre cryptocurrencies.

Hvis du vælger at købe bitcoin , eller en anden cryptocurrency skal du derfor være indforstået med, at kursudviklingen er præget af store udsving.

Hurtigt historisk indblik – De sidste fem år

Der er sket meget med bitcoins prisniveau de sidste 5 år. Specielt 2017 har været et år med en eksplosiv kursudvikling. Tag et kig på nedenstående opstilling og dan dig et hurtigt overblik over, hvordan kursudviklingen på bitcoin har været de sidste fem år. Ønsker du et mere detaljeret indblik, kan du tage et kig på vores infografik længere nede på siden. Den giver dig en forståelse for, hvordan kursen har bevæget sig fra starten til i dag.

- 31. december 2013 – 4.582 DKK pr. bitcoin.

- 31. december 2014 – 1.932 DKK pr. bitcoin.

- 31. december 2015 – 2.619 DKK pr. bitcoin.

- 31 december 2016 – 5.846 DKK pr. bitcoin.

- 31 december 2017 – 85.826 DKK pr. bitcoin.

Graf over bitcoin kursens udvikling i 2017

Nedenfor ser du en graf over hvordan kursen på bitcoin har udviklet sig i 2017.

Bitcoin kurs 2018

Bitcoins kurs sluttede 2017 flot af med en pris på omkring de 86.650 DKK pr. coin. Det betyder at værdien af bitcoin ca. 15-dobblede i 2017. Bitcoin kursen opnåede sit højeste niveau nogensinde i 2017 – helt præcist den 17. december, hvor prisen pr. bitcoin lød på omkring de 122.015 DKK.

2018 startede godt og kursen bevægede sig i løbet af 6 dage op på omkring de 107.000 DKK. Fra den bitcoin kurs skete der en større forventet korrektion, hvor prisen pr. bitcoin bevægede sig helt ned til omkring de 57.000 DKK den 17. januar 2018. Grunden til at denne korrektion var forventet, skyldes at bitcoin hvert år siden 2015 har lavet en større korrektion i januar.

Der er delte meninger om, hvordan bitcoin kursen vil udvikle sig i 2018. Kay Van-Petersen, en analytiker fra Saxo Bank , mener at bitcoin kan ramme de magiske 100.000 USD pr. coin i 2018 – en pris i danske kroner på omkring de 607.000.

Bitcoin pris

Bitcoin prisen er altså en størrelse, som kan variere en del. Du kan derfor ikke forvente at den nuværende pris på bitcoin også er den samme om 5 minutter. Prisen bevæger sig hele tiden op og ned.

Venter du på en bestemt bitcoin kurs, så kan du risikere at vente længe. Der er ikke nogen garanti for, at bitcoin prisen vil falde til det niveau, hvor du ønsker at købe. Derfor må du muligvis affinde dig med den nuværende bitcoin pris, hvis du ønsker at købe. Dog kan du i et historisk perspektiv se, at der løbende kommer kurskorrektioner. Bitcoins løbende kurskorrektioner giver dig mulighed for at købe, når prisen er billigere end tidligere.

Bitcoin værdi

Hvad er det, som giver bitcoin værdi? Bitcoin har ligesom almindelig valuta kun værdi, fordi vi er enige om det. Værdien af bitcoin er altså kun noget værd, så længe vi er enige om det, og det samme er gældende for den danske krone.

Hvor meget værdi en bitcoin repræsenterer er bestemt af udbud og efterspørgsel. Udbuddet af bitcoins vil ikke stige yderligere, når vi når et udbud på 21 millioner. Herefter vil der ikke kunne skabes flere bitcoins. Fortsætter efterspørgslen på bitcoin med at stige, så vil værdien af bitcoin ligeledes stige. Ender bitcoin med at blive et accepteret og alment betalingsmiddel i mange lande, så vil bitcoin værdien blive høj.

Der er delte meninger om, hvilket niveau bitcoin vil nå værdimæssigt. Så der er ikke andet for end at følge bitcoin kursen her på siden, og se om værdien fortsætter med at stige på lang sigt.

Bitcoin kurs gennem årene – Infografik

Nedenfor kan du tage et kig på vores tidslinje infografik, der viser hvordan kursen på bitcoin har udviklet sig gennem årene.

Bitcoin kursen i fremtiden

Bitcoin kurs er en af de fraser indenfor kryptovaluta, som aller flest mennesker søger på. Det vidner om, at interessen for hvordan kursen på bitcoin bevæger sig, er noget som mange mennesker, synes er spændende.

Her på siden bliver du både præsenteret for kursen på bitcoin i realtid, og du har samtidig mulighed for at få et dybdegående historisk indblik i kursen – både via vores statistiske og interaktive infografik…

Men hvordan vil kursen bevæge sig i fremtiden:

Det er virkelig noget som kan skille vandene. Der er mennesker som national bankdirektøren, Lars Rohde, der mener, at bitcoin er det rene tulipmania ( tulipanboblen ), og at det kun er et spørgsmål om tid før boblen springer.

I den anden ende af skalaen har vi Kay Van-Petersen, som er analytiker for Saxo Bank, der mener, at prisen på bitcoin vil ramme 100.000 USD i 2018.

Bitcoin Smart Banknotes Launched in Singapore

A digital asset smart banknote manufacturer has launched bitcoin banknotes at a store in Singapore. Designed to make owning and circulating cryptocurrencies as easy as using paper money, they are currently available in denominations of 0.01 and 0.05 BTC.

Bitcoin Banknotes Debut in Singapore

Digital asset banknote manufacturer Tangem announced the launch of smart bitcoin banknotes at the Megafash Suntec City store in Singapore on Thursday.

Megafash store in Singapore.

Megafash store in Singapore.

The announcement states:

Available immediately in denominations of 0.01 and 0.05 BTC, Tangem Notes radically improve the simplicity and security of acquiring, owning, and circulating cryptocurrencies for both sophisticated and incoming users.

With headquarters in Switzerland’s cryptovalley Zug and Hong Kong, Tangem also has offices in Singapore, Moscow, and China, according to its website.

The company says it “is delivering the first shipment of 10,000 production notes to prospective partners and distributors around the world for commercial pilots.”

How Tangem’s Smart Banknotes Work

Tangem explains that their bitcoin smart banknotes are “Comparable to a well-protected paper banknote” and “Cheap enough to hand over.” Citing their ease of use, the company says there is “No special infrastructure, no complicated applications – just touch the banknote with an NFC-capable smartphone to be 100% sure it has valid assets.”

Illustration of how the banknotes work.

Illustration of how the banknotes work.

Transferring ownership of the notes is anonymous and instant, Tangem claims. “Physically hand over the whole wallet together with the blockchain private key. No transaction fees, no need to await confirmation blockchain.” Moreover, the company says that its banknotes are equipped with “high-grade EAL6+ protection for all cryptocurrencies. Irretrievable private keys prohibit replication of wallet and its assets.”

Competitor Opendime has long offered a physical product with a similar purpose but shaped more like a USB thumb drive and without any amount printed on them.

Security Questions

Tangem’s hardware is based on Samsung Semiconductor’s S3D350A chip. The company claims to offer “the first hardware storage solution on the market with its entire electronics and cryptography certified to the Common Criteria EAL6+ and EMVCo security standards.”

Tangem’s hardware is based on Samsung Semiconductor’s S3D350A chip. The company claims to offer “the first hardware storage solution on the market with its entire electronics and cryptography certified to the Common Criteria EAL6+ and EMVCo security standards.”

As with any embedded firmware-based product in the cryptocurrency space, security audits and open-source code are paramount to earning users’ trust to ensure that the company does not have access to the funds stored on their product. At the time of this writing, Tangem’s only publicly available code is for its iOS and Android apps on Github.

However, the company claims that it has shared the full source code of its proprietary chip firmware with a Swiss security firm, Kudelski Group, adding that this firm has completed an in-depth review and comprehensive security audit of its product’s architecture.

What do you think of these bitcoin smart banknotes? Let us know in the comments section below.

Images courtesy of Shutterstock, Samsung, and Tangem.

Need to calculate your bitcoin holdings? Check our tools section.

Major Belarusian Bank Starts Offering Bitcoin CFD as Belarus Gets Less Crypto Friendly

A well-known bank in Belarus will begin offering a bitcoin contract for difference (CFD) product through its platform, a joint project with a Swiss bank. Meanwhile, Belarus is growing less crypto friendly, reportedly amending its decree to impose strict KYC rules.

New Bitcoin CFD Product

Mtbankfx is an accredited FX dealer and the first banking forex platform in Belarus. Launched in July 2016, it is a joint project between Minsk Transit Bank (Mtbank), one of the most well-known banks in Belarus, and Swiss Dukascopy Bank SA.

Mtbankfx is an accredited FX dealer and the first banking forex platform in Belarus. Launched in July 2016, it is a joint project between Minsk Transit Bank (Mtbank), one of the most well-known banks in Belarus, and Swiss Dukascopy Bank SA.

The platform will start offering a bitcoin CFD product next week, according to local media. It has already added information and updated its terms of service to reflect this new offering.

The platform will start offering a bitcoin CFD product next week, according to local media. It has already added information and updated its terms of service to reflect this new offering.

Mtbankfx explains in its terms of service that its tools, including the BTC/USD tool with 1:3 leverage, are “available for transactions around the clock – from the opening of the market on Sundays at 21:00 GMT in the summer (22:00 GMT in the winter) until the market closes on Fridays at 20:00 GMT in summer/winter time.” For the bitcoin CFD specifically, the company wrote:

All open positions as of 20:00 GMT Fridays will be forcibly closed.

While the platform offers CFDs for many underlying assets, the bitcoin CFD is the only one that will be forcibly closed.

On March 29, Switzerland’s Dukascopy Bank SA launched its own BTC/USD CFD product for European clients. “Bitcoin to US Dollar (BTC/USD) with leverage 1:3 has been added for live trading,” the company stated.

Belarus Becoming Less Crypto Friendly

Belarusian president Alexander Lukashenko signed the decree “On the development of the digital economy” in January that legalized cryptocurrencies, initial coin offerings, and smart contracts. The decree went into effect in March.

However, local media reported this week that amendments to that decree are already being prepared to obligate cryptocurrency exchanges operating within the High-Tech Park (HTP) to disclose their data and identify customers.

Ria Novosti’s source explained that “beneficiaries must meet the requirements for reputation” such as having no criminal record and no bankruptcy proceedings against them, in whole or part. “They should [also] show the availability of funds in accounts of at least $5 million and confirm the sources of their origin.” Additionally, Forklog elaborated:

Operators are required to identify the clients of the exchanges, as well as record and store all types of communications with them. In certain cases, exchange-residents of the HTP will be required to conduct customer verification procedures.

The news outlet added, “information about customers and their transactions should be stored at crypto exchanges for at least five years.”

Do you think Belarus will become even less crypto friendly? Let us know in the comments section below.

Images courtesy of Shutterstock and Mtbankfx.

Need to calculate your bitcoin holdings? Check our tools section.

Bitcoin Price Target For 2017

Bitcoin needs a different type of analysis than traditional asset classes.

Bitcoin's fundamentals look great, with growing acceptance as a form of money.

The price of bitcoin could go as high as $2,000 in 2017.

Bitcoin (OTCQX:GBTC) is a totally different investment asset type than traditional asset classes. Traditional analysis methods do not applying when forecasting the price of bitcoin . That's why we apply a more fundamental approach in this article in order to come up with a bitcoin price forecast for 2017.

How NOT to forecast a bitcoin price

Most readers would turn to the cryptocurrency blogosphere where they will read ultra-bullish bitcoin price forecasts for 2017 similar to this one from Coindesk. The issue with this approach is that those sites only feature bitcoin enthusiasts and entrepreneurs, so they offer a very biased view.

Traditional financial media, on the other hand, have their classic story telling format. That is not a useful approach either for investors. For instance, CNBC looked at the ongoing stream of articles that compare bitcoin with gold (NYSEARCA:GLD), and concluded that "the comparison is perhaps a positive signal that bitcoin is being commoditized. But bitcoin is not a commodity, while gold has been a commodity for thousands of years." That obviously does not tell anything about the future price of bitcoin.

Fortune.com explained how demand for safe haven assets have fallen since the elections "on a stronger dollar, signs of future interest rate hikes, and potentially business-friendly policies that may arise from the Trump administration. Those potential regulatory changes would raise the chances of higher-yielding stocks." That also is not useful as input for a bitcoin price forecast.

The most interesting headline comes from CNBC: "Bitcoin predicted to rise 165% to $2,000 in 2017 driven by Trump's spending binge and dollar rally."

There is obviously no correlation between the bitcoin price and the dollar or any other regular asset. Large investors simply don't pull money out of currencies, stocks (NYSEARCA:SPY) or gold in order to buy bitcoins.

A legitimate bitcoin forecast for 2017

We believe that a combination of price analysis and fundamental analysis is the most appropriate way to come up with a legitimate bitcoin forecast.

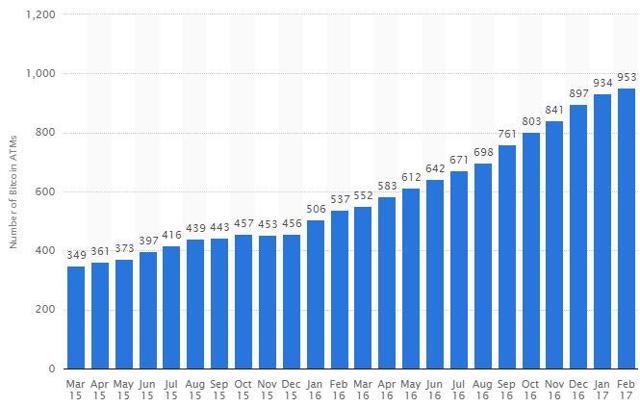

Fundamentally, the bitcoin usage data look great: Usage of bitcoins keeps on increasing, and that is exactly what it fundamentally is all about. Because of the fact that bitcoin is a form of money, the widening acceptance of bitcoin is the most fundamental data point to consider.

According to Statista, bitcoin usage keeps on growing as seen by the number of Bitcoin ATMs, which increased from 538 in January 2016 to 838 by November. Most Bitcoin ATMs, as of July 2016, were located in the United States (345) and Canada (108). The Bitcoin ATMs located in Europe as of June 2016 constituted 24.02 percent of the global ATM market share.

Moreover, several bitcoin charts confirm a growing usage and acceptance:

- Bitcoins in circulation rose 10% in the last 12 months.

- Trading volume on major bitcoin exchanges is structurally higher in the last 12 months.

- The average number of transactions per block is structurally higher in the last 12 months.

Last but not least, this research paper on bitcoin's big picture trends identifies 3 marked regimes that have evolved as the bitcoin economy has grown and matured: From an early prototype stage, to a second growth stage populated in large part with "sin" enterprise (i.e., gambling, black markets), to a third stage marked by a sharp progression away from "sin" and toward legitimate enterprises.

In other words, fundamentally, the picture for bitcoin looks very good. This is not only a market for speculators anymore, but one of real users.

We are confident, based on the objective data set outlined above that bitcoin's price rise is not only legitimate, but will continue. That results in a bullish bitcoin price forecast for 2017 and beyond.

From a bitcoin price analysis point of view, the long-term chart (courtesy: Finviz) looks very constructive. Readers should compare the steep rally in 2013 with the steady and solid rise in the last 2 years. As the price of bitcoin took out all-time highs, it suggests it has much more upside potential.

The only 'negative' is that the price rise has accelerated in recent weeks. Investors want to see a steady rise, not a parabolic rise. So we hope there will be a healthy correction sooner rather than later to cool off emotions. Ideally, bitcoin's price corrects to the $1,000 to $1,100 area in the coming weeks.

We could easily see bitcoin's price move to $2,000 in 2017.

This bitcoin price forecast for 2017 originally appeared on InvestingHaven.com

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Bitcoin Price Prediction for 2017

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the opinion of its author and does not constitute as investment advice. Bitcoin is a very volatile currency and you’re putting your capital at risk when investing in it (just like any other investment).

2017 will be upon us soon enough, so it should come as no surprise that many bitcoin experts are looking ahead to the upcoming year. Given that bitcoin has built in features to encourage its price to rise over time, and given the growing acceptance of both non-government currencies and digital currencies, there are plenty of reasons to be optimistic.

Understanding the anti-inflationary features of bitcoin is essential to understanding its price. Bitcoin’s price back in May weighed in at “only” about $450. In the run up to the new supply for mined blocks being cut in half bitcoin’s price began to rise, breaking the $750 mark in mid June. Bitcoin’s price has declined a bit since, but is still about $600, far higher than it was earlier this year.

The Bitcoin reward for mining won’t be halved until early July in 2020. Regardless, the bitcoin’s price will likely continue to trend up through 2017. This doesn’t mean that bitcoin won’t suffer setbacks, but the overall trend line will likely point up through 2017.

Bitcoin Use Likely To Increase Dramatically in 2017

Juniper Research, a respected research firm, predicts that bitcoin transactions will triple in 2017, reaching $92 billion dollars. Juniper notes several factors that should encourage the increased adoption of bitcoin in 2016 and through 2017, including the fragility of the Chinese economy, the Brexit vote and on-going issues in Europe, including high unemployment and bad public finances, and numerous other issues.

As national governments continue to struggle and the global economy is exposed to high risks, it’s likely that an increasing number of people will look to bitcoin and other alternative currencies/investments. Bitcoin has taken on the mantle of a “safe haven” investment, due to the fact that it is free from government interference, and that supply is limited. Governments can increase money supply at pretty much any whim, thereby decreasing the individual value currency units. Bitcoin’s supply, on the other hand, is already set and cannot be changed.

If the global market grows more turbulent in the months ahead (which is quite likely), people may start ditching their traditional currencies in favor of bitcoin. This will lead to increased use of bitcoin, and as more people use the currency, demand for it will rise, and prices along with it.

Bitcoin Price Predictions for 2017

Daniel Masters, a co-founder at the multi-million dollar bitcoin hedge fund, predicts that bitcoin will hit $4,400 by the end of 2017. Masters believes that bitcoin adoption will continue to increase, and more companies will accept it as payment. This increased adoption will be propelled investments in blockchain technology.

Alan Donohoe, the founder of the Bitcoin Association of Ireland, made a more down to earth prediction earlier this year, suggesting that bitcoin will rise to about the 800 pound mark. This would put bitcoin up above the $1,000 USD mark, a price point that bitcoin last approached (and in some cases broke) back in 2013.

SpectroCoin CEO Vytautas Karalevicius argues that bitcoin transactions will increase 10 times. If this proves to be accurate, Karalevicius believes that bitcoin will rise to about $1800 to $1900. This is based on the correlation between bitcoin turnover and price that we’ve generally seen so far.

Banker Predicts $600 for 2016, Doubling in 2017

At the beginning of the year an analyst with Wedbush Securities, Gil Luria, predicted a price of about $600 in 2016. As of right now, Luria’s prediction is pretty much spot on as bitcoin has been trending at about $600 dollars over the past several weeks. Luria believes that bitcoin will continue to grow as a transaction medium, another prediction that largely appears to be correct.

For 2017 Luria predicts that bitcoin’s price will once again double. In fact, Luria believes that bitcoin’s price will essentially double all the way up until 2025, which would mark an increase of 4,500%! If this prediction turns out to be correct, investors could generate massive returns.

Three Factors That Could Spur Bitcoin Growth

Vinny Lingham, the CEO of Civic, predicts that bitcoin could hit $3,000 in 2017. Lingham’s predictions are especially notable because he’s made a name for himself by being willing to state contrarian views, and has accurately predicted drops in bitcoin’s price. Now, however, Lingham believes that the remainder of 2016 and 2017 will be very good years for bitcoin.

Lingham’s prediction comes down to three factors. First, venture capital investments in bitcoin and blockchain technology have now topped a billion dollars, and as more companies invest, use and acceptance of bitcoin will likely increase. Second, a “short squeeze” may be forming as people who have shorted bitcoin may be forced to buy bitcoins to repay their short bets. Third, bitcoin will continue to enjoy natural inflation due to its limited supply.

Lingham also suggests that an arms race could breakout as governments decide to start to buy up bitcoin. So far, most governments have shied away from bitcoin, but as adoption increases, they may get into the game. Go

An Important Caveat: Experts May Make Self Serving Predictions

Many of the predictions made above are coming from people who have self-serving interests, and would benefit greatly if bitcoin suddenly increased dramatically. While many of the experts may be making honest predictions, we can’t rule out that some may simply be trying to blow hot air into the market to heat things up.

In some more extreme cases, “experts” have predicted that bitcoin could hit $35,000 or more in the near future. This, however, seems unlikely. By making such huge predictions, however, people can stir up the pot and maybe bolster markets, all while ensuring that their name gets passed around.

Breaking the $1,000 Dollar Mark Is Very Possible

Most experts are predicting that bitcoin will break $1,000 in 2017. This would mean that bitcoin’s price may actually double from where it is trading at right now. Such returns would present an extraordinary amount of growth. Such returns are also very plausible.

There are several key factors at play. First, the global economy is on tenuous grounds, and bitcoin is a safe haven currency/asset. If the global economy does hit a rough patch, which is very plausible, then bitcoin and other safe haven assets and currencies will enjoy a boost.

Second, many governments, including Japan and the Eurozone, have been engaging in quantitative easing. This means that they are increasing their money supply by creating money and buying up new assets. This increases inflation and encourages people to invest in things like bitcoin.

Third, an increasing number of companies, and especially retailers, are taking interest in bitcoin. Others are also interesting in blockchain technology. As interest grows, adoption will spread, and as more people use bitcoin, prices should increase.

So while $5,000 and other numbers are perhaps a bit overly optimistic, $1,000 seems very reasonable. And if a major event does unfold, such as a global recession, or a major company like Amazon announcing that it will accept bitcoin, who knows those $5,000 dollar predictions might not look so overzealous after all.

If you have any thoughts about Bitcoin’s price for 2017 I would love to hear them in the comment section below.

Bitcoin Predictions for 2017

Bitcoin (BTC), the world's largest and most widely used cryptocurrency, has only been around for a handful of years - since 2009. 2016 proved to be a good year for the digital currency, more than doubling over the course of the year from around $400 to just under $1,000. Some analysts predict that 2017 will be another banner year, while others are more skeptical and calling this recent rise a bubble that is waiting to burst. (See also: Bitcoin's Price History)

Looking back at 2016

In 2015, Bitcoin had risen modestly, from $313 to $431, a 37% rise, kicking off a year of steady growth throughout 2016. In last year's Investopedia article looking at how 2016 would shape up, many predictions proved to be correct: increased demand did come from China as capital controls did tighten and regulators continued to devalue the Yuan systematically. However, predictions that venture capital (VC) investment would rise fell a bit flat: bitcoin-related companies raised nearly $500 million in total in 2015, but only around $350 million in 2016. (Look back at: The Outlook for Bitcoin in 2016)

2016 also saw relative price stability in Bitcoin, as its price rose steadily and with lower volatility than had been experienced in the past, and it also gained wider acceptance and legitimacy as a means of payment. Plagued by negative image problems surrounding its use for illegal or illicit transactions such as for drugs and money laundering, a 2016 research paper showed that the transactions occurring on the Bitcoin network became more and more legitimized with far less suspect activity as the Bitcoin economy has grown and matured.

2016 also saw the second so-called halving of the Bitcoin block reward, the number of bitcoins found in each block. Set to automatically reduce by 50% approximately every four years, in 2009 there were 50 BTC per block and by summer 2016 just 12.5 BTC. This has reduced the rate of new supply and given an increasing demand, naturally put upward pressure on the price.

Looking Forward to 2017

Already, 2017 has started strong out of the gates for Bitcoin's price, exceeding $1,000 and approaching $1,100 in just the first few days of the year, levels not seen since late-2013 when it's price briefly exceeded $1,200. This top, of course, was followed by a crash in the price of Bitcoin, sending it down to below $250 soon after. This has led some skeptics to claim that this price rise, too, is a bubble. However, many things are different this time around. The size and computing power of the Bitcoin mining network, which confirms and validates transactions, has risen exponentially since then, and the number of users, merchants, and exchange volume has grown similarly. Moreover, the rapid rise back in 2013 is now attributed to fraudulent trading and price manipulation that exploited illiquid and immature markets, and which eventually led to the famous collapse of the primary, and corrupt, Bitcoin exchange, Mt. Gox. This past year's rise in price has enjoyed liquid, developed markets with many exchanges in competition with one another, and without any evidence of price manipulation.

Demand for Bitcoin as a currency is also likely to continue to grow in 2017, again as China has promised to restrict capital outflows and to devalue its currency in order to protect exporters. Another large economy that has seen increased demand for Bitcoin is India, whose government surprised many by scrapping large-denomination banknotes and causing a panic for cash in the country of more than a billion residents. A rising U.S. dollar has also caused some in emerging markets to seek alternatives to fiat currencies as debt denominated in dollars becomes more expensive to service. (For more, see: Bitcoin Prices in India Soar Amid Demonetization Drive)

2017 may also see increased focus on Bitcoin as the dominant digital currency amid many hundreds of alternatives (sometimes called 'altcoins') including notably Litecoin, Ethereum and Zerocash. Some proponents of altcoins had hoped that improvements or enhanced features that made them objectively "better" than Bitcoin would help dislodge it as the dominant player. Those efforts have seemed to fail, as Bitcoin continues to climb, its market cap now approaching $18 billion, while its next closer competitor, Ethereum is struggling to break through $1 billion. So-called Bitcoin supremacy or dominance is also likely to damper efforts of private blockchain implementations that have been attempted largely in the financial sector, notably with the consortium R3CEV or IBM's Hyperledger project. (See also: Bitcoin Vs. Litecoin Vs. Dogecoin: Comparing Virtual Currencies)

The Bottom Line

So what then will happen to Bitcoin in 2017? Some analysts have speculated the price could double from here to reach $2,100 by year's end while others claim it will fall to zero. Only time will tell. Personally, I see increased demand given a limited supply and geopolitical events pushing up the price, but how high I cannot guess. (For more, see: Could Bitcoin's Price Surpass $2,000 in 2017?)

Bitcoin kurs 2017

British FX Firm Currencies Direct Pilots Ripple Tech

May 29, 2018 at 17:15 | Nikhilesh De

Foreign exchange brokerage Currencies Direct successfully completed several international transfers using Ripple's xRapid product.

Austrian Regulator Freezes Crypto Mining Firm Amid Investigation

May 29, 2018 at 16:15 | Nikhilesh De

The Austrian Financial Market Authority has suspended the operations of cryptocurrency mining firm INVIA GmbH for offering illegal investments.

Crypto Payroll Processor Bitwage Launches ICO Advisory Firm

May 29, 2018 at 13:00 | Nikhilesh De

Bitcoin payroll firm Bitwage has launched an advisory company aimed to make it easier for companies to launch token sales.

Korean National Assembly Makes Official Proposal to Lift ICO Ban

May 29, 2018 at 12:10 | Daniel Palmer

South Korea's legislative arm of government is pushing for the removal of the country's ban on domestic initial coin offerings.

EOS Forced to Patch 'Epic' Security Loopholes Ahead of Launch

May 29, 2018 at 11:01 | Wolfie Zhao

Blockchain platform EOS says serious vulnerabilities reported by an internet security firm just days before its mainnet launch have been fixed.

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Baidu's 'Wikipedia' Now Logs Revisions on a Blockchain

May 29, 2018 at 08:00 | Wolfie Zhao

Chinese search giant Baidu has turned to blockchain technology in order to make its online encyclopedia more traceable and transparent.

Universities to Build Blockchain DAO for Affordable Education

May 28, 2018 at 15:10 | Wolfie Zhao

A group of top-tier Chinese universities plans to build a distributed organization to make educational resources more accessible and affordable.

Blockchain Could 'Revolutionize' Retail and CPG Industries: Deloitte

A Deloitte report suggests the retail and consumer packaged goods sectors could see benefits from blockchain integration across a number of use cases.

Ridesharing App Founder Wants to Build a Blockchain 'Uber'

May 28, 2018 at 13:30 | Chuan Tian

Chen Weixing, founder of Chinese ride-hailing app Kuaidi Dache, is planning to build a blockchain-based application for ride-sharing.

Bank of Russia Official: Still Too Early to Gauge Blockchain's Potential

A senior official at Russia's central bank has said blockchain technology is immature but may have industrial-scale applications.

Amid Chaos, Our Decentralized Future Is Being Built

May 28, 2018 at 12:00 | Michael J Casey

Blockchain can upend – not just the business models of recent decades – but a millennia-old societal practice of deep significance to…

China Poised to Form Blockchain Standards Committee This Year

May 28, 2018 at 11:05 | Chuan Tian

China expects to form its national blockchain standards committee by the end of 2018, according to an IT ministry official.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

The Bitcoin.com Wallet

Available for mobile and desktop

Now live, Satoshi Pulse. A comprehensive, realtime listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

Latest News

What Happened to Bitcoin?

The Bitcoin Core (BTC) network is in trouble due to high fees and slow transaction times. Bitcoin Cash (BCH) is the upgrade that solves these problems.

Learn more about Bitcoin Cash with our guide

DOWNLOAD A WALLET

Get Started With Bitcoin

Learn About Bitcoin

Bitcoin is changing the way people think about money. Educate yourself about this ground-breaking payment system.

Download a Wallet

Bitcoin is received, stored, and sent using software known as a вЂ˜Bitcoin Wallet’. Download the official Bitcoin.com Wallet for free.

Use Bitcoin

Bitcoin makes it easy to send real money quickly to anywhere in the world! Bitcoin can also be used to make purchases from a variety of online retailers.

Read the Latest

Bitcoin.com offers the latest news, cutting-edge reporting. Also, don’t miss our Bitcoin guides.

Visit the Forum

Read about community issues. Voice your opinion. Check out the latest Bitcoin trends.

Play Bitcoin Games

Play casino games with free tokens or actual Bitcoin. Bitcoin Games is a provably fair gaming platform.

Start Cloud Mining

Join the most profitable mining pool in the world.

Vote on Bitcoin Issues

Bitcoinocracy is a free and decentralized way to voice your opinion. Signed votes cannot be forged, and are fully auditable by all users.

Комментариев нет:

Отправить комментарий