Bitcoin limit

As per the current rules there will only ever be 21 million coins at most (explained in other answers here). However, I'd like to add that this is by general agreement, which means that it can be changed.

Looking at the history of money, I am skeptical that there will only ever be 21 million coins. I don't know of too many instances in history when money could be created out of thin air and wasn't. It would be foolish to ignore history. Whether or not there will be more than 21 million coins depends on whether or not "the people" demand it, and once again history is our guide.

What Happens to Bitcoin After All 21 Million are Mined?

Bitcoin is like gold in many ways. Like gold, Bitcoin cannot simply be created arbitrarily. Gold must be mined out of the ground, and Bitcoin must be mined via digital means. Linked with this process is the stipulation set forth by the founders of Bitcoin that, like gold, it have a limited and finite supply. In fact, there are only 21 million Bitcoins that can be mined in total. Once miners have unlocked this many Bitcoins, the planet's supply will essentially be tapped out, unless Bitcoin's protocol is changed to allow for a larger supply. Supporters of Bitcoin say that, like gold, the fixed supply of the currency means that banks are kept in check and not allowed to arbitrarily issue fiduciary media. But what will happen when the global supply of Bitcoin reaches its limit?

[ Interested in learning the history of Bitcoin, from 0 coins to the eventual 21,000,000? Investopedia Academy's Cryptocurrency for Beginners course gives you an extensive introduction to not only Bitcoin, but the whole cryptocurrency realm. And for $99 it will only cost you a fraction of a Bitcoin. Check it out today! ]

Effects on Bitcoin Miners

It may seem that the group of individuals most directly effected by the limit of the Bitcoin supply will be the Bitcoin miners themselves. On one hand, there are detractors of the Bitcoin limitation who that say that miners will be forced away from the block rewards they receive for their work once the Bitcoin supply has reached 21 million in circulation. In this case, these miners may need to rely on transaction fees in order to maintain operations. Bitcoin.com points to an argument that miners will then find the process unaffordable, leading to a reduction in the number of miners, a centralization process of the Bitcoin network, and numerous negative effects on the Bitcoin system.

This argument assumes that transaction fees alone will be insufficient to keep Bitcoin miners financially solvent once the mining process has been completed. On the other hand, there are reasons to believe that transaction fees and mining costs will even out in the future. Looking ahead by several decades, it is not difficult to imagine that mining chips will become small and highly efficient. This would reduce the burden placed on miners and would allow mining to become an activity with a lower threshold of initial cost. Further, transaction fees may increase, and this could help to keep miners afloat as well.

Price of Bitcoin

Bitcoin has already seen massive hikes in price in just the past few months. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase. There are also stockpiles of inactive coins that are held around the world, the largest supply of which belongs to the person or group who founded Bitcoin, Satoshi Nakamoto. Perhaps this supply, consisting of roughly one million Bitcoins, is intentionally being saved for a time when the global supply is facing increased levels of demand.

10 682 пользователя находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 1 год назад автор rastafariann

Want to add to the discussion?

[–]burstup 0 очков 1 очко 2 очка 1 год назад (2 дочерних комментария)

[–]burstup 0 очков 1 очко 2 очка 1 год назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 64525 on app-127 at 2018-05-29 20:52:01.255586+00:00 running 06400a4 country code: RU.

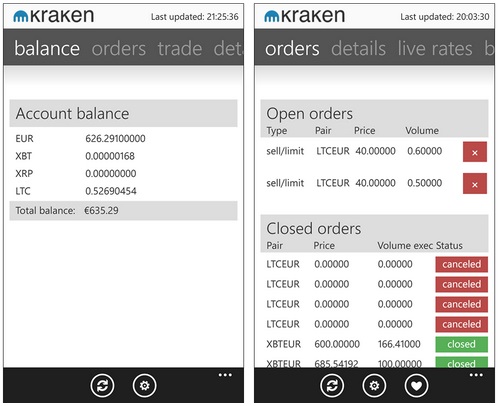

Coinbase has new Bitcoin limits while Microsoft allows Kraken app to include a trading feature

Last updated on January 2nd, 2018 at 12:00 am

The Bitcoin platform Coinbase is going to change its daily buy and sell limits, as well as the setting limits from BTC to US dollars. But the company is not the only one with news for the cryptocurrency community.

According to Coinbase’s blog, a level 2 user, for instance, will now have a purchase limit of $50,000 per day, instead of 50 BTC. “Right now that’s equivalent to about 60 BTC, but as the price of Bitcoin changes, the BTC equivalent will vary”, the company explains.

When we originally created the transfer limits on Coinbase, the price of Bitcoin was much lower. A limit of 50 BTC per day in August was only equivalent to $5,000. Today, it’s equivalent to over $40,000.

Coinbase is also reducing some limits, especially the ones associated with a Level 1 user. The buy and sell limits are both being reduced to $3,000 per day in this case, which is equivalent to the limit of 10 BTC per day that was created when Bitcoin reached $300 in November.

Coinbase is also reducing some limits, especially the ones associated with a Level 1 user. The buy and sell limits are both being reduced to $3,000 per day in this case, which is equivalent to the limit of 10 BTC per day that was created when Bitcoin reached $300 in November.

However, the platform recalls that if any user needs to exceed these limits, it is possible to turn into a Level 2 user with a limit of $50,000 per day.

“We hope these changes will make buying and selling on Coinbase an easier process for those more familiar with US dollar denominations, and also be a more stable solution to purchase limits as Bitcoin continues to grow into the future”, the message added.

Kraken app with Bitcoin trading options

On a related note, Microsoft has recently approved an update to the Kraken app for Windows Phone 8. The company now allows the users of the trading platform application to experience its Bitcoin trading capabilities.

This turns Kraken’s app into the first one to include such a feature on Microsoft’s online store, Techie News quotes. At the time of launching, the application only allowed the users to check live rates of different digital coins and to create a live chart that showed the latest rate for any digital cryptocurrencies duo.

This is the second update Kraken introduces in the app, according to the developer, Leon Cullens. Users can now open new trades directly from the app, a change that was authorized by Microsoft.

Images from Leon Cullens’ blog

Images from Leon Cullens’ blog

“That’s a huge endorsement in my opinion”, Cullens wrote in his blog, adding that so far “nobody really knew what Microsoft’s stance on Bitcoin trading apps was before today, but by approving my app they have shown that they’re not boycotting Bitcoin“.

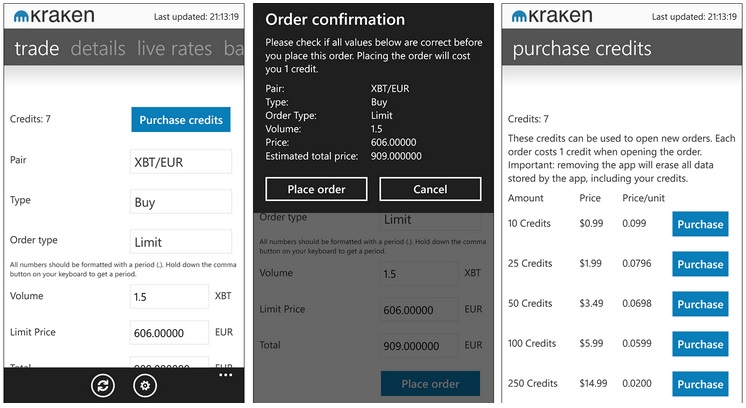

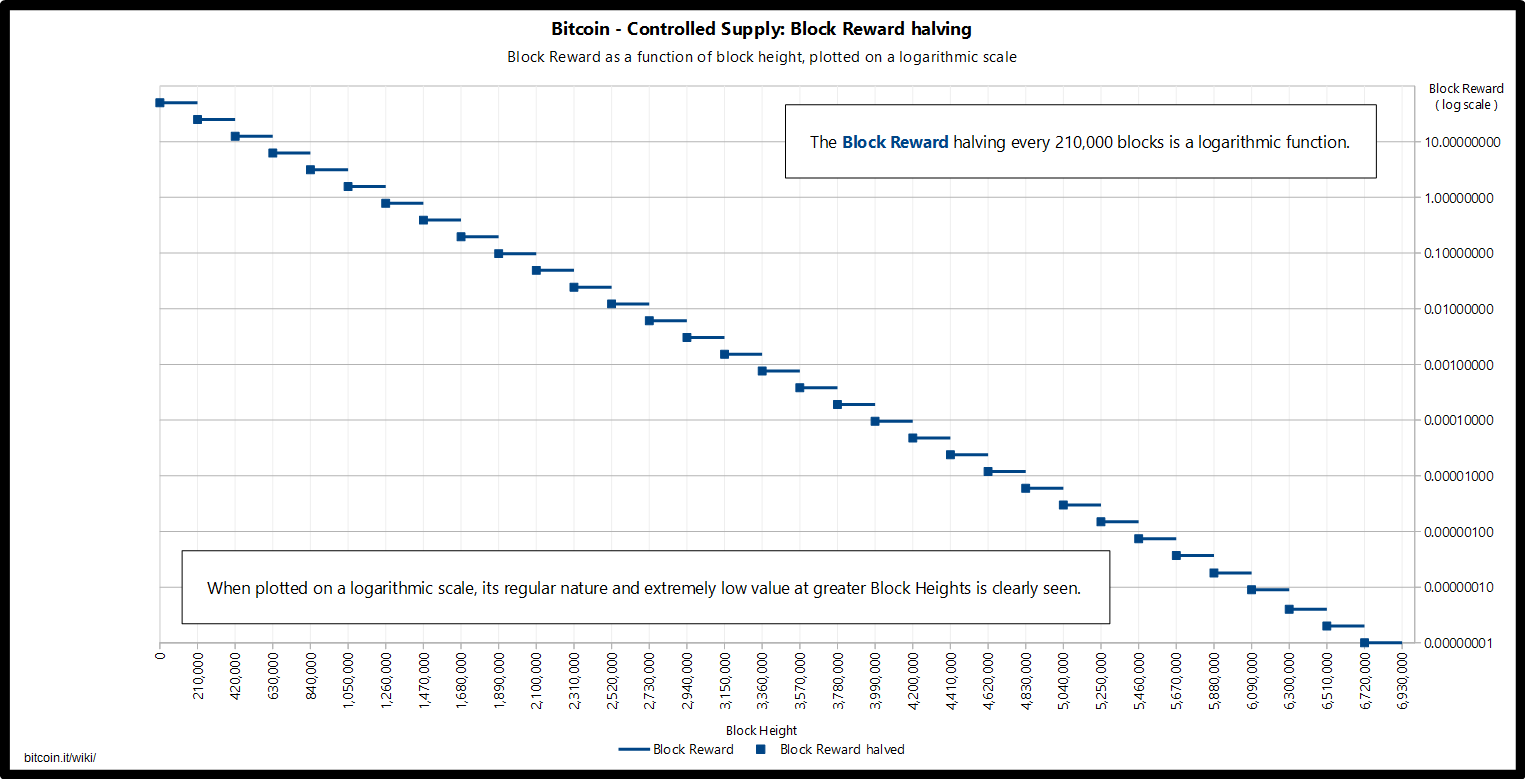

Controlled supply

In a centralized economy, currency is issued by a central bank at a rate that is supposed to match the growth of the amount of goods that are exchanged so that these goods can be traded with stable prices. The monetary base is controlled by a central bank. In the United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve or by a process called Quantitative Easing.

In a fully decentralized monetary system, there is no central authority that regulates the monetary base. Instead, currency is created by the nodes of a peer-to-peer network. The Bitcoin generation algorithm defines, in advance, how currency will be created and at what rate. Any currency that is generated by a malicious user that does not follow the rules will be rejected by the network and thus is worthless.

Currency with Finite Supply

Bitcoins are created each time a user discovers a new block. The rate of block creation is adjusted every 2016 blocks to aim for a constant two week adjustment period (equivalent to 6 per hour.) The number of bitcoins generated per block is set to decrease geometrically, with a 50% reduction every 210,000 blocks, or approximately four years. The result is that the number of bitcoins in existence will not exceed slightly less than 21 million. [2] Speculated justifications for the unintuitive value "21 million" are that it matches a 4-year reward halving schedule; or the ultimate total number of Satoshis that will be mined is close to the maximum capacity of a 64-bit floating point number. Satoshi has never really justified or explained many of these constants.

This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are mined. Users who use their computers to perform calculations to try and discover a block are thus called Miners.

Projected Bitcoins Short Term

This chart shows the number of bitcoins that will exist in the near future. The Year is a forecast and may be slightly off.

* In Block 124724, user midnightmagic mined a solo block to himself which underpaid the reward by a single Satoshi and simultaneously destroyed the block's fees. This is one of two only known reductions in the total mined supply of Bitcoin. Therefore, from block 124724 onwards, all total supply estimates must technically be reduced by 1 Satoshi.

Projected Bitcoins Long Term

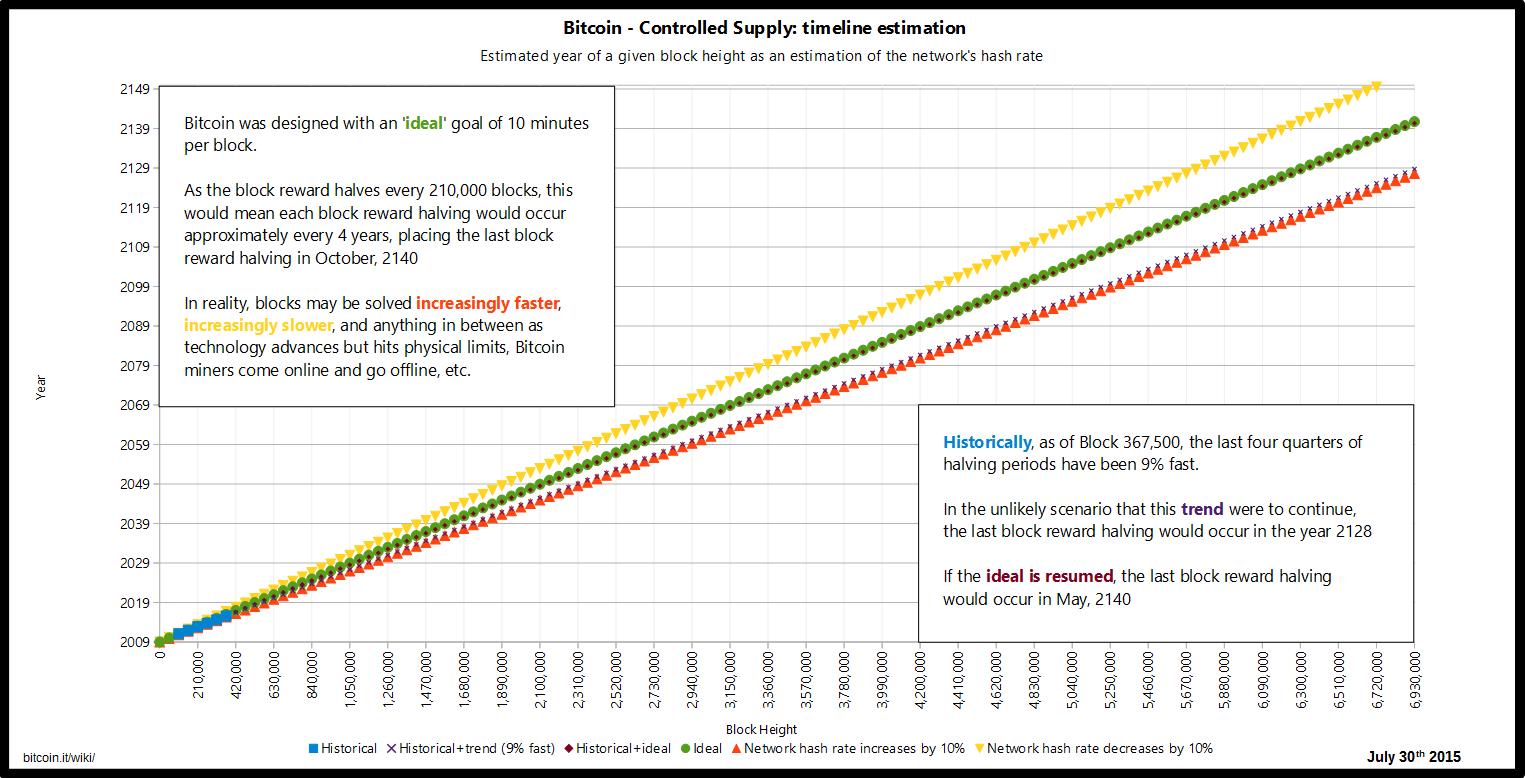

Because the number of bitcoins created each time a user discovers a new block - the block reward - is halved based on a fixed interval of blocks, and the time it takes on average to discover a block can vary based on mining power and the network difficulty, the exact time when the block reward is halved can vary as well. Consequently, the time the last Bitcoin will be created will also vary, and is subject to speculation based on assumptions.

If the mining power had remained constant since the first Bitcoin was mined, the last Bitcoin would have been mined somewhere near October 8th, 2140. Due to the mining power having increased overall over time, as of block 367,500 - assuming mining power remained constant from that block forward - the last Bitcoin will be mined on May 7th, 2140.

As it is very difficult to predict how mining power will evolve into the future - i.e. whether technological progress will continue to make hardware faster or whether mining will hit a a technological wall; or whether or not faster methods of SHA2 calculation will be discovered - putting an exact date or even year on this event is difficult.

The total number of bitcoins, as mentioned earlier, has an asymptote at 21 million, due to a side-effect of the data structure of the blockchain - specifically the integer storage type of the transaction output, this exact value would have been 20,999,999.9769 bitcoin. Should this technical limitation be adjusted by increasing the size of the field, the total number will still only approach a maximum of 21 million.

Note: The number of bitcoins are presented in a floating point format. However, these values are based on the number of satoshi per block originally in integer format to prevent compounding error.

* In block 124724, user midnightmagic solo mined a block which caused one less Satoshi to be created than would otherwise have come into existence. Therefore, all calculations from this block onwards must now, to be accurate, include this underpay in total Bitcoins in existence. Then, in an act of sheer stupidity, a more recent miner who failed to implement RSK properly destroyed an entire block reward of 12.5 XBT in block 501726.

What happens when all the bitcoins are mined?

The bitcoin inflation rate steadily trends downwards. At the time of writing, more than 3 out of every 4 bitcoins that will ever exist have already been mined, and the annual inflation rate is just 4%. The block reward given to miners is made up of newly-created bitcoins plus transaction fees. As inflation goes to zero miners will obtain an income only from transaction fees which will provide an incentive to keep mining to make transactions irreversible.

Due to deep technical reasons, block space is a scarce commodity, getting a transaction mined can be seen as purchasing a portion of it. By analogy, on average every 10 minutes a fixed amount of land is created and no more, people wanting to make transactions bid for parcels of this land. The sale of this land is what supports the miners even in a zero-inflation regime. The price of this land is set by demand for transactions (because the supply is fixed and known) and the mining difficulty readjusts around this to keep the average interval at 10 minutes.

Spendable Supply

The theoretical total number of bitcoins, slightly less than 21 million, should not be confused with the total spendable supply. The total spendable supply is always lower than the theoretical total supply, and is subject to accidental loss, willful destruction, and technical peculiarities.

One way to see a part of the destruction of coin is by collecting a sum of all unspent transaction outputs, using a Bitcoin RPC command gettxoutsetinfo . The total_amount value returned is the sum of all outputs that the client deems technically spendable but not currently spent. Note however that this does not take into account outputs that are exceedingly unlikely to be spent as is the case in loss and destruction via constructed addresses, for example.

Miner Underpay

The algorithm which decides whether a block is valid only checks to verify whether the total amount of the reward exceeds the reward plus available fees. Therefore it is possible for a miner to deliberately choose to underpay himself by any value: not only can this destroy the fees involved, but also the reward itself, which can prevent the total possible bitcoins that can come into existence from reaching its theoretical maximum. This is a form of underpay which the reference implementation recognises as impossible to spend. Some of the other types below are not recognised as officially destroying Bitcoins; it is possible for example to spend the 1BitcoinEaterAddressDontSendf59kuE if a corresponding private key is used (although this would imply that Bitcoin has been broken.)

Loss of bitcoin

Bitcoins may be lost if the conditions required to spend them are no longer known. For example, if you made a transaction to an address that requires a private key in order to spend those bitcoins further, had written that private key down on a piece of paper, but that piece of paper was lost. In this case, that bitcoin may also be considered lost, as the odds of randomly finding a matching private key are such that it is generally considered impossible.

Willful destruction of bitcoin

Bitcoins may also be willfully 'destroyed' - for example by attaching conditions that make it impossible to spend them.

A common method is to send bitcoin to an address that was constructed and only made to pass validity checks, but for which no private key is actually known. An example of such an address is "1BitcoinEaterAddressDontSendf59kuE", where the last "f59kuE" is text to make the preceding constructed text pass validation. Finding a matching private key is, again, generally considered impossible. For an example of how difficult this would be, see Vanitygen.

Another common method is to send bitcoin in a transaction where the conditions for spending are not just unfathomably unlikely, but literally impossible to meet. For example, a transaction that is made provably unspendable using OP_RETURN, or uses script operations that requires the user to prove that 1+1 equals 3.

A lesser known method is to send bitcoin to an address based on private key that is outside the range of valid ECDSA private keys. For example, the address 16QaFeudRUt8NYy2yzjm3BMvG4xBbAsBFM has a known matching private key of value 0 (zero), which is outside the valid range.

Technical peculiarities preventing spending of bitcoin

There are also technical peculiarities that prevent the spending of some bitcoin.

The first BTC 50, included in the genesis block, cannot be spent as its transaction is not in the global database.

In older versions of the bitcoin reference code, a miner could make their coinbase transaction (block reward) have the exact same ID as used in a previous block [3] . This effectively caused the previous block reward to become unspendable. Two known such cases [4] [5] are left as special cases in the code [6] as part of BIP 0030 changes that fixed this issue. These transactions were BTC 50 each.

Money Supply

While the number of bitcoins in existence will never exceed slightly less than 21 million, the money supply of bitcoins can exceed 21 million due to Fractional-reserve banking.

Because the monetary base of bitcoins cannot be expanded, the currency would be subject to severe deflation if it becomes widely used. Keynesian economists argue that deflation is bad for an economy because it incentivises individuals and businesses to save money rather than invest in businesses and create jobs. The Austrian school of thought counters this criticism, claiming that as deflation occurs in all stages of production, entrepreneurs who invest benefit from it. As a result, profit ratios tend to stay the same and only their magnitudes change. In other words, in a deflationary environment, goods and services decrease in price, but at the same time the cost for the production of these goods and services tend to decrease proportionally, effectively not affecting profits. Price deflation encourages an increase in hoarding — hence savings — which in turn tends to lower interest rates and increase the incentive for entrepreneurs to invest in projects of longer term.

Block size limit controversy

Originally, Bitcoin's block size was limited by the number of database locks required to process it (at most 10000). This limit was effectively around 500-750k in serialized bytes, and was forgotten until 2013 March. In 2010, an explicit block size limit of 1 MB was introduced into Bitcoin by Satoshi Nakamoto. He added it hidden in two commits [1] [2] [3] in secret. This limit was effectively a no-op due to the aforementioned forgotten limit.

In 2013 March, the original lock limit was discovered by accident (Bitcoin Core v0.8.0 failed to enforce it, leading to upgraded nodes splitting off the network). After resolving the crisis, it was determined that since nobody knew of the limit, it was safe to assume there was consensus to remove it, and a hardfork removing the limit was scheduled and cleanly activated in 2013 May. From this point forward, the 1 MB limit became the effective limiting factor of the block size for the first time.

The limit was not changed again before 2017 and was believed to require a very invasive hard fork to change. As transaction volume increased with widespread Bitcoin adoption, increasing the limit became subject to heavy debate in 2015. To prevent Bitcoin from temporarily or permanently splitting into separate payment networks ("altcoins"), hard forks require adoption by nearly all economically active full nodes.

Arguments in favor of increasing the blocksize

- More transactions per second

- Off-chain solutions are not yet ready to take off the load from the main blockchain.

Contentions

- Increased blocksize will leave space for extensions like Mastercoin, Counterparty, etc.

- Neutral: Bitcoin competitors will have lower fees

- Negative: Bitcoin full nodes are forced to use more resources that don't support Bitcoin

- Small blocks eventually will require higher fees for fast confirmations.

- Positive: It will no longer be cheap to spam transactions such as Satoshi Dice bets

- Positive: Fees will not be zero. This is eventually a necessity in order to incentivize miners and secure the mining ecosystem

- Negative: Bitcoin may look unattractive to new users with high fees

- Negative: High fees may stop or reverse global adoption, investment, development, support and centralization [clarification needed]

- Negative: Bitcoin users pay higher fees

- A low blocksize limit encourages higher transactions fees to incentivize miners ("let a fee market develop").

- A fee market naturally develops due to miner latency regardless [4]

- The relay network can be optimized so that miners don't have a stale rate increasing with latency. This should cause the fee market to once again require a block size limit to exist.

- A fee market naturally develops due to miner latency regardless [4]

Arguments in opposition to increasing the blocksize

- A hard fork requires waiting for sufficient consensus.

- Risk of catastrophic consensus failure [5][clarification needed]

- An emergency hard fork that can achieve consensus can be deployed on a short time period if needed. [6]

- Orphan rate amplification, more reorgs and double-spends due to slower propagation speeds.

- European/American pools at more of a disadvantage compared to the Chinese pools [why?]

- "Congestion" concerns can be solved with mempool improvements including transaction eviction.

- No amount of max block size would support all the world's future transactions on the main blockchain (various types of off-chain transactions are the only long-term solution)

- Fast block propagation is either not clearly viable, or (eg, IBLT) creates centralised controls.

Damage to decentralization

- Larger blocks make full nodes more expensive to operate.

- Therefore, larger blocks lead to less hashers running full nodes, which leads to centralized entities having more power, which makes Bitcoin require more trust, which weakens Bitcoins value proposition.

- Bitcoin is only useful if it is decentralized because centralization requires trust. Bitcoins value proposition is trustlessness.

- The larger the hash-rate a single miner controls, the more centralized Bitcoin becomes and the more trust using Bitcoin requires.

- Running your own full node while mining rather than giving another entity the right to your hash-power decreases the hash-rate of large miners. Those who have hash-power are able to control their own hash power if and only if they run a full node.

- Less individuals who control hash-power will run full nodes if running one becomes more expensive [7] .

On October 3, 2010, Jeff Garzik published a patch that immediately increases the block size to 7MB. [8] The patch had no users, but it was the earliest attempt at increasing the block size through a hardfork. Satoshi and theymos immediately said not to implement it, as it would make the user's node incompatible with the network. [9] This is the oft-cited post which many people claim proves Satoshi intended for the blocksize to increase. English, however, does not work that way. Satoshi spoke conditionally, not intentionally. [9]

Change block size limit based on miner votes, but don't leave the range (1MB, 32MB) without a softfork or hardfork respectively.

Bitcoin XT

Bitcoin XT was an alternative client that became notorious when it adopted BIP 101, which would direct an increase to 8 MB after both January 11, 2016 has passed and 75% of miners are in support, followed by doubling of the limit every two years with the size increasing linearly within those two year intervals.

XT failed to gain enough support to activate the hardfork, leading to Mike Hearn's resignation.

Increase to 2 MB on November 11, 2015.

Increase by 17.7% annually until 2063.

Bitcoin Classic

Adopt BIP 109 and hardfork to 2 MB in 2016. Dynamic max_block_size in 2017.

Segregated Witness

The final solution deployed was Segwit, increasing the block size limit to 2-4 MB without a hardfork.

Entities positions

Positions below are based on a suggested fixed block size increase to 20MiB. Positions against these larger blocks do not necessarily imply that they are against an increase in general, and may instead support a smaller and/or gradual increase.

Nvidia Tries to Limit GPU Sales to Cryptocurrency Miners

After years of enjoying the increased demand from cryptocurrency mining, GPU manufacturers have begun to signal they might not be too thrilled about miners overcrowding the market. Nvidia has requested retailers to take some measures to try and ensure its produces get into the hands of gamers, not miners.

Nvidia Tries to Protect Gamers

Nvidia Corporation (NASDAQ: NVDA), the graphics processing unit (GPU) manufacturer, is asking retailers to limit the amount of graphics cards they sell to cryptocurrency miners. This is done in an effort to tackle extreme price gouging and sever supply shortages caused by the rising profitability of cryptocurrency mining.

Nvidia Corporation (NASDAQ: NVDA), the graphics processing unit (GPU) manufacturer, is asking retailers to limit the amount of graphics cards they sell to cryptocurrency miners. This is done in an effort to tackle extreme price gouging and sever supply shortages caused by the rising profitability of cryptocurrency mining.

A review of graphics cards distributes in Germany has found that four out of six retailers has put in place stricter limits on Nvidia’s Geforce brand over the past month. By limiting the number of cards per order to two or three, the manufacturer hopes to discourage cryptocurrency miners who buy in bulk, and have as many as possible reach gamers.

A Three Pronged Attack

Cryptocurrency miners are now squeezing gamers out of the GPU market in three major ways. First, ASIC manufacturers such as Bitmain buy an ever greater amount of chips from foundries such as TSMC, leaving less production capability for Nvidia. Second, the big mining farms reportedly get large quantities of GPUs directly from factories in China before they can even enter the market. Third, smaller professional miners buy cards in the hundreds from retailers or online, pushing the price up and preventing them from reaching gamers.

Nvidia spokesman Boris Böhles told the German tech magazine computerbase that: “For NVIDIA, gamers come first. All activities related to our Geforce product line are targeted at our main audience. To ensure that Geforce gamers continue to have good Geforce graphics card availability in the current situation, we recommend that our trading partners make the appropriate arrangements to meet gamers’ needs as usual.” Still, Nvidia stresses that retailers do not have to follow this “recommendation,” as the manufacturer does not want to intervene in the freedom and independence of traders.

Should GPU manufacturers try to limit the use of their products to gamers only? Tell us what you think in the comments section below.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Could Bitcoin Futures Help Limit Volatility?

- More on Blockchain and Bitcoin

What's the Vice Industry Token—A Crypto for Porn?

Governance: Why Crypto Investors Should Care

Blockchain-as-a-Service (BaaS)

Blockchain-as-a-Service (BaaS)Which FAANG Will Win the Blockchain Wars?

Although news of CME's plans to launch bitcoin futures by the end of the year has faded somewhat since the backers of the SegWit2x hard fork protocol announced the cancelation of the impending fork, the bitcoin futures plans may have a dramatic and long-lasting impact on the way that bitcoin operates. CME, the world's largest exchange operator, prompted a huge rise in bitcoin prices when it announced earlier in the month that it would begin to facilitate trades of bitcoin futures at some point before the end of 2017. Along with that new product, Crypto Coins News reports that CME may impose limits on the price fluctuations of bitcoin in order to avoid extreme volatility. Price fluctuations have been a hallmark of all virtual currencies, and bitcoin in particular, from essentially their earliest days.

Trading Halts and a "Hard Cap"

CME will reportedly impose trading halts for a number of tiers of bitcoin price movements, as well as a "hard cap" which will restrict price swings at a certain level for any day. There will be multiple "soft limit" thresholds, taking effect at 7% and 13% wither above or below the previous day's settlement price. When a price swing of this level occurs, there will be a "two-minute pause in trading" for bitcoin futures. If the price climbs or falls by 20% or more in a single day, there will be a system-wide hard cap which will prevent all trading of bitcoin futures products for that day.

How does this compare with recent bitcoin price fluctuations? So far, bitcoin has swung by at least 20% on two days so far this year. It has achieved swings of 13% or more on 11 days, and fluctuations of at least 7% on 69 days for the year. This suggests that the soft and hard limits on bitcoin futures trading may take effect relatively often.

Limits Are Not New

CME has utilized similar limits in the past and for markets ranging from stock futures to gold and oil. Still, the widespread and extreme volatility that investors have come to expect from a cryptocurrency like bitcoin may test these limits more than those other areas. CME's chairman emeritus Leo Melamed, who founded financial futures, explained that his group would "tame" bitcoin. He stated that "[CME] will regulate, make bitcoin not wild, nor wilder. We'll tame it into a regular type instrument of trade with rules."

Of course, CME cannot place limits on the fluctuation of bitcoin prices. These will adjust due to normal market factors and may continue to be just as volatile as before futures were introduced. However, depending on how impactful the introduction of bitcoin futures is to the overall price of the cryptocurrency, CME's regulation of the futures space may have a backlash effect on the currency itself.

Nvidia Tries to Limit GPU Sales to Cryptocurrency Miners

After years of enjoying the increased demand from cryptocurrency mining, GPU manufacturers have begun to signal they might not be too thrilled about miners overcrowding the market. Nvidia has requested retailers to take some measures to try and ensure its produces get into the hands of gamers, not miners.

Nvidia Tries to Protect Gamers

Nvidia Corporation (NASDAQ: NVDA), the graphics processing unit (GPU) manufacturer, is asking retailers to limit the amount of graphics cards they sell to cryptocurrency miners. This is done in an effort to tackle extreme price gouging and sever supply shortages caused by the rising profitability of cryptocurrency mining.

Nvidia Corporation (NASDAQ: NVDA), the graphics processing unit (GPU) manufacturer, is asking retailers to limit the amount of graphics cards they sell to cryptocurrency miners. This is done in an effort to tackle extreme price gouging and sever supply shortages caused by the rising profitability of cryptocurrency mining.

A review of graphics cards distributes in Germany has found that four out of six retailers has put in place stricter limits on Nvidia’s Geforce brand over the past month. By limiting the number of cards per order to two or three, the manufacturer hopes to discourage cryptocurrency miners who buy in bulk, and have as many as possible reach gamers.

A Three Pronged Attack

Cryptocurrency miners are now squeezing gamers out of the GPU market in three major ways. First, ASIC manufacturers such as Bitmain buy an ever greater amount of chips from foundries such as TSMC, leaving less production capability for Nvidia. Second, the big mining farms reportedly get large quantities of GPUs directly from factories in China before they can even enter the market. Third, smaller professional miners buy cards in the hundreds from retailers or online, pushing the price up and preventing them from reaching gamers.

Nvidia spokesman Boris Böhles told the German tech magazine computerbase that: “For NVIDIA, gamers come first. All activities related to our Geforce product line are targeted at our main audience. To ensure that Geforce gamers continue to have good Geforce graphics card availability in the current situation, we recommend that our trading partners make the appropriate arrangements to meet gamers’ needs as usual.” Still, Nvidia stresses that retailers do not have to follow this “recommendation,” as the manufacturer does not want to intervene in the freedom and independence of traders.

Should GPU manufacturers try to limit the use of their products to gamers only? Tell us what you think in the comments section below.

Комментариев нет:

Отправить комментарий