Bitcoin Generator - Generate Free BTC To Your Wallet

Enter Your Bitcoin Wallet Address:

Generate Bitcoin Amount:

Processing, please wait.

Our server generated the Bitcoins successfuly

15qonr8oWntoDkFJEjpLxHx9mCd7MkRPEa

or simply by using this QR Code:

Latest Generated BitCoins Using Our Bitcoin Generator

How to Use Bitcoin Generator - Instructions

About the Bitcoin Generator

BitcoinGenerator.me, also known as the "Bitcoin Hack", is the ultimate personal Bitcoin Generator. It's an online encrypted software that generates free Bitcoins to your platform's wallet account. It uses a peer-to-peer cryptography system that generates the cryptocurrency (Bitcoin) into your account (wallet). Generated through a process called "mining", it represents a transaction verifier by creating a transaction block. Each block links to the previous block, making a chain. That's where the name "Blockchain" comes from.

Bitcoin increases its value daily. In fact, it's the fastest growing market stock in the world. Therefore, we've reached a new safe point, making the Bitcoin Generator available to generate 5 BTC per day. We're looking forward to increase the value in near future. The tools has been in development for many months. It's now released in public, completely free to use. It's updated and worked on daily, to make sure everything runs smoothly.

How to Generate Free Bitcoins

The "Bitcoin Generator" stores the generated Bitcoins in a store called "wallet". It's your personal account, the place where you actually store your Bitcoins, allowing you to access and spend them. Once your generation process has been verified, Bitcoins will be added to your wallet.

The Generation process has been simplified nowadays. Although, it hasn't been always like that. Through time, the process came to be extremely hard. So, it became a necessity to make it easier.

BitcoinGenerator.me made that possible, generating a small quantity to your personal account only. It's still impossible to add Bitcoins to other people's accounts, since you have to verify the transaction.

Here's a simple video with instructions how to generate free bitcoins to your account. Your wallet address is extremely important, so make sure you copy it directly from your Wallet Account. Bitcoin generation process lasts several minutes, so make sure you follow the steps correctly:

In case you find the video tutorial confusing, here's a transcript of it:

1. Login into your wallet. Find your "Wallet Address", commonly present once you press on the "Request" button.

2. Copy your Wallet Address. Make sure you've made the right selection and you copied the correct address.

3. Paste your Wallet Address in generator's text area. Make sure it's the correct one, otherwise you will receive an error message.

4. Slide the desired amount of Bitcoins you want to generate and click on the "Start!" button.

5. If the info is correct, confirmation message will popup. Confirm it by clicking on the "Confirm" button below.

6. Wait for the procedure to finish. Once it's finished, you will have to verify the transaction.

7. There are two ways to verify the transaction:

a. The first step is by paying the miners fee (small amount) and wait for the "3/3 confirmation" process.

b. Second step is to verify that you are a human (and not a bot), by completing the "Human verification" process. It is usually completed with a survey or mobile number.

8. When all the steps are finished click on the "Confirm" button and you are DONE!

After that you will receive your Bitcoins. The process is pretty simple, however you will need to verify it. This is the main reason why you can't add Bitcoins to another person's account instead of your own.

Once the 3/3 confirmation process is done, simply login on your Blockchain account. Your BTC will be there. Best of luck!

Bitcoin Generator

The Generator

This generator allows you to add free Bitcoins to your wallet. We recommend a maximum of 1 Bitcoin per account per day to be generated using this tool. This is mainly to stay under the radar and avoid getting noticed. The generator is free to use and is being updated as much as possible to keep it from getting detected and fixed.

What are Bitcoins?

Bitcoin is a currency. Just like the dollar or the euro. The biggest difference is that the Bitcoin is fully digital, and makes use of peer-to-peer technology. A commonly used acronym for bitcoin is “BTC” (like Dollars “USD” and Euro “EUR”).

How do you get bitcoins?

You can buy bitcoins online, which requires you to have a a bitcoin wallet. You can download this Bitcoin wallet on your own computer, or through an online service. The latter option has the advantage that you can access your bitcoins from any device with internet.

Adding bitcoins with this generator is completely free.

Download below!

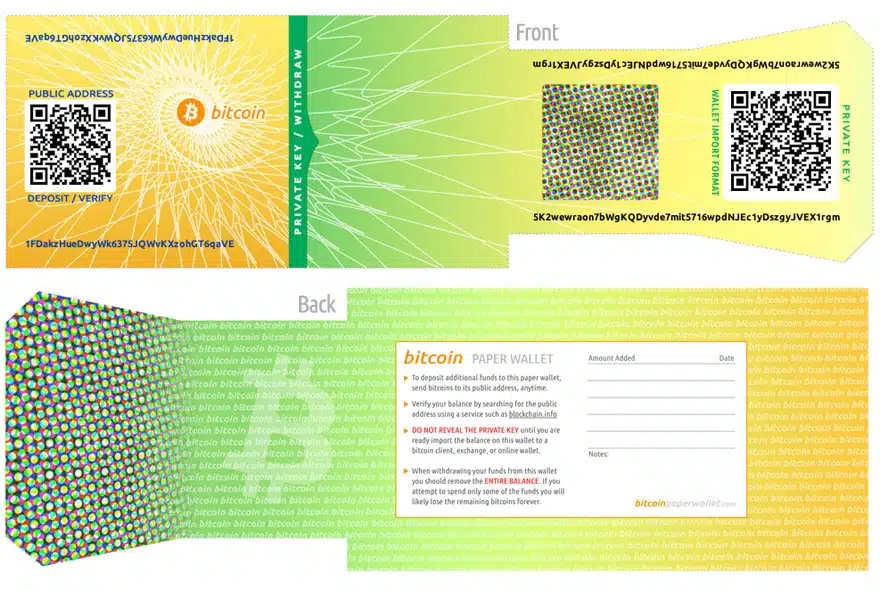

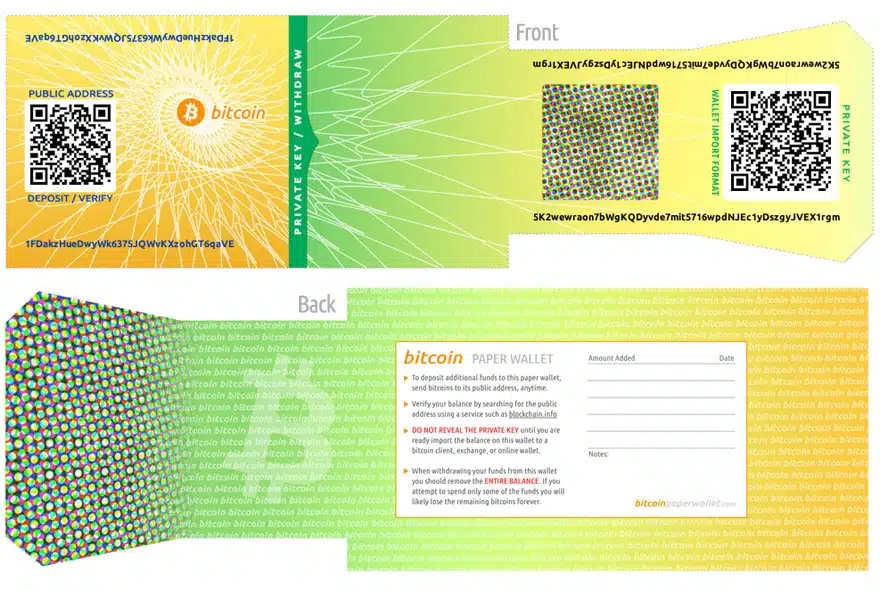

bitcoinpaperwallet.com

Store bitcoins on your own tamper-resistant paper wallet

Tamper-evident stickers and the bootable CD are now 10% off. Plus, every order includes FREE SHIPPING to anywhere in the world, and a free limited edition sticker.

Order here »

Make Paper Wallets to Keep Your Bitcoin Addresses Safe.

For long-term storage of bitcoins (or giving as gifts) it's not safe to store your bitcoins in an exchange or online wallet. These types of sites are regularly hacked. Even keeping a live wallet on your own computer can be risky.

Be your own bank.

By printing out your own tamper-resistant bitcoin wallets and generating your own addresses, you can minimize your exposure to hackers as well as untrustworthy people in your home or office. Just transfer your bitcoins into your new wallets, and use common sense to keep your wallets safe the way you would jewels and ordinary cash. Or give them away!

"Bitcoin Cash" Paper Wallets

In August 2017, the Bitcoin blockchain "forked" creating a new digital currency called Bitcoin Cash (BCH). Paper wallets generated on this site are fully compatible with Bitcoin Cash. A special design is available to make it easy to identify Bitcoin Cash paper wallets.

Click here to try out the Bitcoin Cash paper wallet generator.

What's special about this design?

But first read everything on this page since you should take some precautions to make sure your new wallets are secure.

NEW: Litecoin & Dogecoin paper wallets, too!

Video: How to make a paper bitcoin wallet

Why trust this site?

This generator is based on BitAddress.org, the well established and most trustworthy open-source engine for generating addresses using your own browser's JavaScript engine. No crypto-code is run on this web server, and no addresses are transmitted over the Internet. BIP-38 encryption is fully supported as well. If you don't trust this service (or pseudorandom number generators in general) this wallet service lets you roll dice, shuffle cards, or supply your own "vanity keys". To be more secure, you should download this wallet generator from GitHub and run it offline, or even boot from this Ubuntu CD.

Canton Becker—who started this service in 2013—is easily reached for questions, Bitcoin business consultation, or custom designs at:

Canton Becker—who started this service in 2013—is easily reached for questions, Bitcoin business consultation, or custom designs at:

Wallets come in 12 different languages, as well as special Christmas and "red envelope" / Chinese New Year designs. Here's a PDF template for making an envelope for giving away Bitcoin for the holidays.

Wallets come in 12 different languages, as well as special Christmas and "red envelope" / Chinese New Year designs. Here's a PDF template for making an envelope for giving away Bitcoin for the holidays.

1. Tri-Fold Template

This bitcoin key generator guides you to print both a front side and a back side for your paper wallet. All sensitive details on the front side (the private key and QR code) are folded up and securely taped shut so as to stay hidden. For additional security, you can seal your wallets with the tamper-evident serialized hologram stickers available for purchase on this site—though any sufficiently opaque (light-blocking) tape will work fine.

2. Tamper Resistant

One risk with a paper wallet is that someone with physical access to your wallet may "sneak a peek" at the private key and withdraw your funds without your knowledge. This wallet's folding design and obfuscating security patterns resist "candling" -- the process of shining a bright light through the paper to reveal what's printed inside. Serialized tamper-evident hologram stickers destory themselves when removed, preventing stickers from being replaced with new ones.

3. Perfect for Giving

Want to give bitcoins to someone who isn't tech-savvy? Need to send bitcoins by mail? Use a pre-loaded paper wallet. The sealed-shut folded design helps to ensure that the recipient won't accidentally reveal the private key. For recipients unfamiliar with bitcoin, the reverse side of the wallet has printed instructions for checking the wallet balance and withdrawing funds.

Order Paper Wallet Supplies

Use this form to purchase tamper-evident holographic stickers with serial numbers, zip-sealing bags made specifically for this folding wallet design, or a bootable CD for making paper wallets offline.

Once shipped, USA orders take about 4 business days to arrive. Orders to the EU & Australia usually take 10 business days. Mailing to certain countries (e.g. Russia, Estonia, Brazil) can take significantly longer.

All orders include a free large vinyl 'bitcoin' sticker for your car, laptop, or crypto-evangelism activities.

Please complete all *Required fields above.

What can I get?

1) Tamper-evident serialized hologram stickers, silver and gold.

2) Ubuntu LiveCD with the wallet generator pre-installed. It will boot on almost any computer with an optical drive, whether you're using a Mac or PC.

3) A limited edition high-quality vinyl Bitcoin sticker for your laptop or car -- free with every order.

4) Zip-sealing bags, perfectly sized for this design.

Hologram stickers come in silver and gold tints, and feature unique serial numbers printed in pairs. You can also order a customized Ubuntu "LiveCD" with the generator pre-installed -- by far the easiest and safest way to print out secure wallets. All orders include free first-class shipping, plus one free zip-sealing bag and a high quality 3.5 inch vinyl 'bitcoin' sticker for your car or laptop.

Serial numbers (e.g. 002505) are laser-eteched in pairs directly onto the stickers.

Oooooh, rainbows!

The shiny hologram tape used to seal up the paper wallets you see on this site isn't just for good looks. It's "tamper-evident" tape that provides a deterrent to a significant group of would-be thieves: someone in your trusted environment (home, work) who might be motivated to steal your coins if you were unlikely to notice the withdrawal until checking your balance online.

- The holographic design on this tape is irreversibly damaged as soon as the tape is lifted from the paper, no matter how carefully it is replaced.

- Unique serial numbers (printed in pairs) guard against merely replacing old stickers with brand new stickers

- The reflective quality of the tape protects against "candling" -- using a super-bright light source (like a laser) to see the private key through the folds.

Secure Wallet Generation & Safekeeping

Helpful tips organized in ascending degrees of paranoia

Keeping it Safe

The biggest threat to your wallet isn't an evil WiFi packet-sniffing robot. Your worst enemy is water. If you have access to a laser printer, use it—because laser printers melt waterproof plastic (toner) onto paper instead of using ink. When using an inkjet printer, consider storing your wallet in a zip-sealing plastic bag (like those sold on this site) or printing on waterproof paper, or treating the paper with a clear coat spray like Krylon "Preserve It".

The biggest threat to your wallet isn't an evil WiFi packet-sniffing robot. Your worst enemy is water. If you have access to a laser printer, use it—because laser printers melt waterproof plastic (toner) onto paper instead of using ink. When using an inkjet printer, consider storing your wallet in a zip-sealing plastic bag (like those sold on this site) or printing on waterproof paper, or treating the paper with a clear coat spray like Krylon "Preserve It".

tldr: Treat a paper wallet like cash. If you lose it or if it becomes illegible, the coins are gone forever.

Even the condensation from the outside of a glass set on top of an inkjet print can destroy it.

Here's what a tiny bit of water will do to an inkjet-printed wallet:

Withdrawing Funds

The private key on this wallet is recorded in typical "Wallet Import Format" (WIF). Many online services (e.g. blockchain.info, coinbase.com) will let you import or "sweep" your paper wallet using this key. Plan on importing your entire balance. Afterwards, discontinue using the paper wallet—as if you were breaking open a piggy bank. If you try to spend or withdraw only a portion of your funds, you risk losing the remaining balance forever.

The private key on this wallet is recorded in typical "Wallet Import Format" (WIF). Many online services (e.g. blockchain.info, coinbase.com) will let you import or "sweep" your paper wallet using this key. Plan on importing your entire balance. Afterwards, discontinue using the paper wallet—as if you were breaking open a piggy bank. If you try to spend or withdraw only a portion of your funds, you risk losing the remaining balance forever.

How to import paper wallets »

tldr: Add funds to your wallet as often as you like, but withdraw them all at once—otherwise your balance may disappear forever.

Going Offline

Your wallet may be vulnerable to prying eyes when you are generating the keys and printing them out. Although the wallet generator on this website is SSL-encrypted, it's still possible for someone to be snooping on you. (For example, your computer might have malware that broadcasts your screen to a remote location.) The most important safety measure is to go offline and run the javascript wallet generator on your own computer instead of this website.

Your wallet may be vulnerable to prying eyes when you are generating the keys and printing them out. Although the wallet generator on this website is SSL-encrypted, it's still possible for someone to be snooping on you. (For example, your computer might have malware that broadcasts your screen to a remote location.) The most important safety measure is to go offline and run the javascript wallet generator on your own computer instead of this website.

Here's how »

tldr: Download the ZIP file or get the Ubuntu LiveCD and run the wallet generator with your Internet connection turned off.

How to run this wallet generator offline

You can order the Ubuntu LiveCD from this site (which comes with the wallet generator securely pre-installed)

- Download the wallet generator from GitHub as a ZIP file to your computer.

- Turn off your Internet connection. (Power off the modem!)

- Extract the ZIP file and drag the HTML file inside of it onto Safari, Firefox, or Chrome (not Intenet Explorer.)

- Print out your wallet(s).

- Reboot your computer and power cycle your printer before going back online.

https://github.com/cantonbecker/bitcoinpaperwallet

https://github.com/cantonbecker/bitcoinpaperwallet

Destroying Cache Files

The problem with printing out secure documents—even if your computer is 100% virus/trojan free—is that your printer driver and/or operating system may be keeping copies of the documents you print in some sort of "spool" or print queue. If a hacker or virus gets into your computer and knows to look for these cache files, then they can get your private keys and "sweep" your wallets. Here are some tips on how to securely delete your printer "spool" files.

The problem with printing out secure documents—even if your computer is 100% virus/trojan free—is that your printer driver and/or operating system may be keeping copies of the documents you print in some sort of "spool" or print queue. If a hacker or virus gets into your computer and knows to look for these cache files, then they can get your private keys and "sweep" your wallets. Here are some tips on how to securely delete your printer "spool" files.

tldr: Learn how to delete your printer cache files after printing secure documents.

How to delete pesky printer cache files

- Enable 'FileVault' to encrypt your filesystem so that cache files cannot be 'undeleted'.

- Set up a symbolic link from /private/var/spool/cups/cache/ to a removable media volume (e.g. a SD card) and disconnect it when not in use.

- Use an encrypted filesystem so that your cache files cannot be 'undeleted'.

- Read this FAQ on how to change the destination of your cache (spool) files to removable media.

- Use a live-boot CD instead of a regular hard drive OS install. This way when you reboot your computer, all cache files are deleted from memory and no jobs are ever written to disk.

Hey, do you know much about printer spools on your operating system? I need your help for this section! canton@gmail.com

Using a Clean OS

If you've got loads of applications on your computer, or if you use your computer for "risky behavior" (like installing freeware or visiting java / flash websites) consider dedicating a computer (or at least a bootable partition / thumbdrive / "live CD") for paper wallet printing. Never take that install online. Transfer the wallet generator ZIP file from GitHub to your clean OS using a thumbdrive or other non-networked method.

If you've got loads of applications on your computer, or if you use your computer for "risky behavior" (like installing freeware or visiting java / flash websites) consider dedicating a computer (or at least a bootable partition / thumbdrive / "live CD") for paper wallet printing. Never take that install online. Transfer the wallet generator ZIP file from GitHub to your clean OS using a thumbdrive or other non-networked method.

tldr: Run the wallet generator on a dedicated offline computer / OS.

Using a Dumb Printer

Some advanced printers have internal storage (even hard drives) that preserve copies of printouts. This is a risk if someone gets access to your printer, or if you dispose of your printer. There is also the possibility that a smart enough printer can be hacked. This isn't quite tinfoil-hat level paranoia, as we've seen examples in the wild of viruses that rewrite the firmware of non-computer devices indirectly connected to the Internet. If this concerns you, don't use a fancy printer, and never let your printer have access to the Internet or to an Internet-connected computer.

Some advanced printers have internal storage (even hard drives) that preserve copies of printouts. This is a risk if someone gets access to your printer, or if you dispose of your printer. There is also the possibility that a smart enough printer can be hacked. This isn't quite tinfoil-hat level paranoia, as we've seen examples in the wild of viruses that rewrite the firmware of non-computer devices indirectly connected to the Internet. If this concerns you, don't use a fancy printer, and never let your printer have access to the Internet or to an Internet-connected computer.

tldr: Smart printers save copies of what they print and may be vulnerable to super-smart viruses. Use a dumb offline printer whose firmware can't be reprogrammed.

Overwhelmed? Scared silly?

There's no need to follow all of these precautions. If you're just generating some give-away wallets for fun or to store small amounts of bitcoin, relax. Just use the online wallet generator on a trusted computer over a secure Internet connection. For storing larger amounts, follow as many of these security precautions as you can.

Frequently Asked Questions

Why Did You Make This?

I love Bitcoin. I love how it's elegant, functional, philosophical, and radical.

Unfortunately, for folks not steeped in cypherpunk ideology and network security, bitcoins are hard to understand, hard to purchase, and hard to keep safe. The primary purpose of this site is to make it easier to keep your coins safe once you've gone through the hard work of acquiring some.

The secondary purpose of this site is to encourage you to expand the understanding and acceptance of Bitcoin by loading up and giving away these beautiful and fairly idiot-proof paper wallets.

Hey, here's a couple bitcoins. Keep this paper somewhere safe for now, because some day it might be worth a whole lot and you can buy yourself something nice. Enjoy!

About the Author

Canton Becker has been making web sites and programming database-driven web applications since 1993. Before that, he worked on "Gopherspace" — the predecessor to the World Wide Web.

In 1995, he co-founded Rocket Network, an online music collaboration application whose development brought in US$40M of investment from Paul Allen, Cisco and other generous tech pioneers.

Since exiting the company in 2000, Canton works one-on-one with small businesses and non-profits to build beautiful and intuitive websites. And he obsesses constantly about Bitcoin.

This site benefits from "standing on the shoulders of giants"—in this case the superb work of bitaddress.org, whose code does the key generation and QR code rendering at the heart of this wallet generator.

Also, thanks to Artiom Chilaru of flexlabs.org for the excellent BIP38 implementation, and to Martin Ankerl for the algorithmic 'guilloche' background pattern generator.

Donations to encourage this project are warmly welcomed. Thank you!

Donate bitcoin, because you have some.

1Pjg628vjMLBvADrPHsthtzKiryM2y46DG

You can also add a donation when you order hologram stickers.

Donate using PayPal / USD / Euro, because you're oldschool.

© Copyright 2014 by Canton Becker. The text on this page is released and licensed under Creative Commons Attribution 3.0, which means that you are free to distribute, use and modify it for any personal or commercial purpose provided that you include an obvious link back to bitcoinpaperwallet.com. The Bitcoin Paper Wallet software (HTML and Javascript) may be modified and redistributed according to the MIT and GPL licenses described in the source code. The bitcoinpaperwallet.com logo, hologram sticker design, and folding wallet design are copyrighted and may not be replicated or used without permission except for personal use.

© Copyright 2014 by Canton Becker. The text on this page is released and licensed under Creative Commons Attribution 3.0, which means that you are free to distribute, use and modify it for any personal or commercial purpose provided that you include an obvious link back to bitcoinpaperwallet.com. The Bitcoin Paper Wallet software (HTML and Javascript) may be modified and redistributed according to the MIT and GPL licenses described in the source code. The bitcoinpaperwallet.com logo, hologram sticker design, and folding wallet design are copyrighted and may not be replicated or used without permission except for personal use.

BitcoinMaker.com : Bitcoin news and Domain names for sale

Please go to Buy This Domain to purchase these domain names:

What is Bitcoin?

Bitcoin is a digital crypto-currency with no single point of failure due to its decentralized peer-to-peer architecture. The source code is publicly available and changes to the reference Bitcoin client are made via concensus within the community. Advantages of Bitcoin include irreversible transactions (i.e. no possibility of chargebacks as with credit cards), pseudo-anonymous, limited and fixed inflation, near instant transactions, multi-platform, no double-spend and little to no barriers to entry and more. It was created by an anonymous person known as Satoshi Nakamoto. Find out more at WeUseCoins.com.

Bitcoin Latest News

This RSS feed URL is deprecated

This RSS feed URL is deprecated, please update. New URLs can be found in the footers at https://news.google.com/news

Posted on 29 May 2018 | 11:16 am

Bitcoin Price Faces Last Major Support Level Before $5K - Yahoo Finance

Posted on 29 May 2018 | 10:22 am

Austrian Regulator Freezes Crypto Mining Firm Amid Investigation

The Austrian Financial Market Authority has suspended the operations of cryptocurrency mining firm INVIA GmbH for offering illegal investments.

Posted on 29 May 2018 | 10:15 am

Bitcoin is definitely a bubble, says Wikipedia founder - MarketWatch

Posted on 29 May 2018 | 9:21 am

Bitcoin Spinoff Hacked in Rare '51% Attack' - Fortune

Posted on 29 May 2018 | 8:48 am

Crypto is making a comeback as Italy's political crisis mounts - Business Insider

Posted on 29 May 2018 | 8:34 am

Meet Kakao: How Korea's Largest Mobile Giant Is Embracing Blockchain

Jason Han, CEO of Kakao's blockchain subsidiary Ground X, tells CoinDesk his thoughts on how crypto could impact big business.

Posted on 29 May 2018 | 8:30 am

A Bitcoin Halvening Is Two Years Away -- Here's What'll Happen To The Bitcoin Price - Forbes

Posted on 29 May 2018 | 8:18 am

Bitcoin holds $7000; volatility trends lower - MarketWatch

Posted on 29 May 2018 | 7:46 am

Crypto Payroll Processor Bitwage Launches ICO Advisory Firm

Bitcoin payroll firm Bitwage has launched an advisory company aimed to make it easier for companies to launch token sales.

Posted on 29 May 2018 | 7:00 am

Korean National Assembly Makes Official Proposal to Lift ICO Ban

South Korea's legislative arm of government is pushing for the removal of the country's ban on domestic initial coin offerings.

Posted on 29 May 2018 | 6:10 am

An 'Emergency Sale' of Bitcoins Just Earned $14 Million for German Law Enforcement - Fortune

Posted on 29 May 2018 | 5:31 am

Peter Thiel Believes Bitcoin May Be on the Outs - Investopedia (blog)

Posted on 29 May 2018 | 4:01 am

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Posted on 29 May 2018 | 4:00 am

Baidu's 'Wikipedia' Now Logs Revisions on a Blockchain

Chinese search giant Baidu has turned to blockchain technology in order to make its online encyclopedia more traceable and transparent.

Posted on 29 May 2018 | 2:00 am

Japan's Ban Is a Wake-Up Call to Defend Privacy Coins

To advocate for regulatory leniency, we must consider the advantages, not the disadvantages, that privacy coins will provide to the greater community.

Posted on 29 May 2018 | 1:00 am

A New Twist On Lightning Tech Could Be Coming Soon to Bitcoin - Coindesk

Posted on 28 May 2018 | 10:06 pm

I Would Be Shocked If Bitcoin Prices Weren't Manipulated - Forbes

Posted on 28 May 2018 | 12:36 pm

Op Ed: How Atomic Swaps Could Work for Stock Market Trading

Traditional stock market trades can leverage the concept of atomic swaps to facilitate direct stock-to-stock trades without requiring cash positions.

Atomic Stocks Overview

In traditional stock exchanges, retail investors in public markets are unable to switch from one position to another without first going into cash. For example, an investor looking to trade his or her Amazon shares for PayPal shares must first exchange these Amazon shares for U.S. dollars, before buying PayPal shares with these dollars.

This style of exchange creates unnecessary friction and expense because of a) transaction costs incurred on the sale of the asset, as well as on the purchase of the new asset; b) U.S. dollar purchasing power exchange-rate risk; and c) transaction fees paid to the broker that the purchaser is using, as well as the bid-ask spread that exists for each publicly traded stock (which occurs on both the sale of the previously held asset, as well as on the newly purchased asset).

Atomic Swaps

In the context of cryptocurrency, atomic swaps are a proposed feature that could allow direct conversion between two cryptocurrencies without having to use a third-party intermediary or exchange. By employing hash time-locked smart contracts, atomic swaps guarantee that parties will deliver the currency needed for the trade, or else the transaction is automatically canceled. These “all or nothing” trades preserve atomicity because they either take place or are canceled immediately. For example, customer A could directly trade his or her bitcoin for customer B’s ether with full confidence that the trade will either take place or terminate if either party doesn’t deliver their side of the bargain.

Atomic Stocks

Harnessing the principle of atomic swaps, direct stock-to-stock exchanges (Atomic Stock Exchanges) enable retail investors to avoid the forced conversion into cash that occurs when selling a stock to USD just to buy back another stock.

It is a commonplace occurrence to switch between stock positions for retail investors and financial firms, and the prevention of touching cash allows for the avoidance of transaction fees that would normally be incurred when making these trades, and the cost-saving consolidation of the bid-ask spreads on both of these stocks into one bid-ask spread. While the larger cost saving would occur on direct stock-stock swaps, there are incremental cost savings on the bid-ask spread as well.

Atomic Stock Exchanges could feasibly work with large-cap stocks that have deep pools of liquidity, such as stocks on the S&P 500, and the liquidity needed for making the trades would be provided by high-frequency traders (HFT) who could make up the gap that exists.

This would squeeze HFT margins, but as a commodity business that provides a middleman service, we imagine they would facilitate this as a way to make incremental revenues (if they have no other options).

By focusing on the needs of the average retail consumer, we realize that in many cases, the sale into cash is forced and doesn’t correspond to what the investor actually wants, which is to simply switch from one highly liquid position to another.

Atomic Stock Exchange: Practical Example

Let’s imagine for simplicity that only the S&P 500 is available and that we want to rotate out of Google stock into Facebook stock because we think that Facebook stock has been shifted off of its fundamental value due to the Cambridge Analytica scandal. Therefore, we want to exchange our Google shares for Facebook shares; because they are both denominated in USD, there is a ratio of what one share is worth relative to the other share. On the market close of May 4, 2018, one share of Google is worth 5.95 shares of Facebook stock. In this hypothetical exchange, shares are fractional, and you are able to exchange one Google share for 5.95 Facebook shares and vice versa.

The “spread” in this case would be the amount of Google stock you receive when making this exchange. You would only receive 5.93 shares of Facebook when you are doing this exchange, and the market maker is getting 0.02 Facebook shares in exchange for facilitating this transaction. These shares add up over time in favor of the market maker and serve as their profit once they liquidate them.

This spread dynamic could potentially cause an issue since market makers are now being paid by stock instead of in cash, unlike with normal bid-ask spreads. However, this could allow market makers to profit via the appreciation of these shares during the trading day as well. However, nothing would prevent HFT from liquidating the shares they receive as cash immediately as well, provided someone takes this trade.

Exchange Dynamics

To start, Atomic Stock Exchanges would charge no exchange fees. Revenue can be made by selling order flow and the right to trade on this exchange to HFT. The way the buy and sell process would work from stock to stock could be: when a sell order is placed, it is specified which position the firm would like to exchange into, and provided that this trade is available, it is filled by simply swapping shares. This is where HFT could be invaluable as a market maker and be able to profit off the spread. This would serve as a way to make a profit, and many exchanges try to obfuscate the fact that they make money off retail investors doing so.

Questions Worth Considering

What is the main issue that would have to be overcome to create an Atomic Stock Exchange?

It’s critical to figure out how to enable the purchasing of decimalized amounts of shares and how to pair users that are actually looking to swap shares with each other. In private markets, counterparties have broad control over their trade arrangements, but in public markets this utility hasn’t yet been harnessed. In other words, for atomic stocks to work, an Atomic Stock Exchange would have to create decimalized shares. When we consider that for a retail user of E-Trade or Charles Schwab, the cost of going from Amazon to Facebook is selling one and buying the other, each of which carries a transaction fee, and we see that this could be a huge cost savings for the average retail investor, even if a service had to be paid on the back end to enable a decimalized share service to exist. However, for an Atomic Stock Exchange to be profitable, it would have to support massive volume.

Is decimalization of shares in public markets the equivalent of decimalization for stock prices?

Before 2001, all stock prices in the U.S. were quoted as 1/16 of a dollar, creating opportunities for arbitrage, but also creating massive inefficiencies within markets as well. Decimalization has led to tighter spreads because of the corresponding smaller price increments and movements. With decimalization, the minimum price movement is now one cent, allowing for tighter spreads between the bid and the ask levels. For example, shares could be decimalized out to five decimal places, allowing for the equivalent trading of shares.

Would the theoretical lack of (or less) cash be an issue for this exchange?

Many exchanges make money by putting cash that hasn’t been invested into money market accounts. An Atomic Stock Exchange could allow for these kinds of cash holdings as well.

What about liquidity?

Atomic Stock Exchanges can be built on top of existing exchanges, meaning that retail investors can still switch to cash positions if they wish to do so.

Do any kind of similar trades already happen?

Institutional investors can already execute paired trades that never expose them directly to fiat currency. But retail investors miss out on this opportunity.

This paper is part of a research project being developed by Erik Kuebler and Oscar Avatare at the University of Washington. If you have any feedback, suggestions or questions, please email ekuebler@uw.edu or oavatare@uw.edu.

This article originally appeared on Bitcoin Magazine.

Posted on 28 May 2018 | 9:31 am

Universities to Build Blockchain DAO for Affordable Education

A group of top-tier Chinese universities plans to build a distributed organization to make educational resources more accessible and affordable.

Posted on 28 May 2018 | 9:10 am

Blockchain Could 'Revolutionize' Retail and CPG Industries: Deloitte

A Deloitte report suggests the retail and consumer packaged goods sectors could see benefits from blockchain integration across a number of use cases.

Posted on 28 May 2018 | 8:30 am

China Poised to Form Blockchain Standards Committee This Year

China expects to form its national blockchain standards committee by the end of 2018, according to an IT ministry official.

Posted on 28 May 2018 | 5:05 am

No Miners? Intel Seeks to Automate DLT Block Verification

A newly released Intel patent application sets out a system for automatically creating and validating blocks on a distributed ledger.

Posted on 28 May 2018 | 3:33 am

Chinese Blockchain Event Draws Backlash Over Chairman Mao Stunt

Chinese crypto media firms are boycotting a blockchain event after the organizer used a Chairman Mao impersonator to fire up the audience.

Posted on 28 May 2018 | 2:00 am

Bitcoin Magazine’s Week in Review: Expanding Exchanges and Investors

Cryptocurrencies and exchanges were the focus this week. Coinbase is getting into the decentralized exchange business with its acquisition of Paradex, potentially opening up thousands of ERC-20 tokens to traders, depending on what the SEC ends up doing with regulations. The parent company of the New York Stock Exchange, Intercontinental Exchange, continues work to implement a system to allow large investors to trade bitcoin directly. And Germany’s Deutsche Boerse is looking at getting into the cryptocurrency game. Finally, the city of Memphis had its first blockchain conference, which included keynotes from FedEx and a hackathon for various market segments that included some great prizes.

Featured stories by Amy Castor, David Hollerith and Nick Marinoff

Stay on top of the best stories in the bitcoin, blockchain and cryptocurrency industry. Subscribe to our newsletter here.

Coinbase Takes Another Step Toward Trading ICO Tokens by Acquiring

Cryptocurrency exchange Coinbase just made an enormous play by acquiring decentralized relayer Paradex this week. Paradex bills itself as a decentralized exchange (DEX), meaning no third party is involved in holding the funds. Instead, users can use the platform to trade ERC20 tokens directly wallet to wallet. Paradex is built on top of the 0x (pronounced “zero x”) protocol.

Right now, Coinbase trades four coins: bitcoin (BTC), bitcoin cash (BCH), ether (ETH) and litecoin (LTC). Adding ERC20 tokens could significantly boost the number of digital assets it carries. Due to the ICO boom that has taken place over the last few years, thousands of different ICO tokens are now available.

German Stock Exchange Eyes Bitcoin and Cryptocurrencies

Frankfurt Stock Exchange parent company, Deutsche Boerse AG, appears to have begun work on technology that will allow them to offer their clients bitcoin and cryptocurrency-related products.

Speaking at an industry event in London on May 23, 2018, Jeffrey Tessler, head of clients, products and core markets for Deutsche Boerse, said they are considering offering cryptocurrency products: "We are deep at work with it."

The Old New Thing: ICE and the Future of Bitcoin Trading and Regulation

As reported earlier by The New York Times (NYT) and Bitcoin Magazine, Intercontinental Exchange (ICE), parent company of the New York Stock Exchange (NYSE), is developing an online trading platform that would allow large investors to trade bitcoin directly. As news about the ICE platform continues to develop, Bitcoin Magazine spoke with lawyers Ben Sauter and Dave McGill of Kobre & Kim, a New York City law firm which specializes in disputes and investigations, to examine the regulatory issues surrounding the launch of such a platform, including swap contracts and the implications the ICE platform might have on cryptocurrency trading in the future.

What Happened At Graceland’s Ethereum Conference

In its first year, EthMemphis distinguished its place on the blockchain conference circuit for displaying an under-the-hood glimpse at what actually moves this young industry forward, specifically on the Ethereum network. The focus was on blockchain topics and projects applied to supply chain, healthcare, tourism/hospitality, education and law.

Verge Cryptocurrency Suffers Its Second Hack in Less Than Two Months

While Verge executives are claiming a DDoS attack is responsible for the recent serious delays on their blockchain, it appears that the problem may be more serious than the company is implying. The attack lasted more than a few hours and has resulted in over 35 million XVGs (worth approximately $1.7 million) being stolen. The theft occurred when hackers exploited a specific glitch in Verge’s technology by mining multiple blocks virtually one second apart using the same algorithm. This was the same tactic used in a hack just last month that saw over 250,000 XVGs disappear into thin air, forcing Verge to prepare a subsequent hard fork.

This article originally appeared on Bitcoin Magazine.

Posted on 27 May 2018 | 10:58 am

Podcast Platform Castbox Launches Blockchain Project to Reward Creators

Award-winning global podcast platform Castbox has announced the release of ContentBox, a blockchain-based infrastructure for decentralized digital content. The project is backed by Bo Shen — the founder of Fenbushi Capital and an early adopter of Ethereum — who will serve as both a cornerstone investor and strategic advisor to the team.

Shen said, “The nature of blockchain technology is to take a slice of the pie from vested interest groups, where you are bound to encounter resistance. To get your project off the ground, you must have vast industry and product resources. I invested in ContentBox because it has a strong technical team and a wealth of industry experience, and I believe it will become the first killer app for the digital content industry.”

Founded two years ago by former Google manager Renee Wang, Castbox allows listeners to find, access and create spoken audio content in multiple languages through virtually any device. The company’s proprietary technology includes in-audio deep search so listeners can customize their audio experiences, and curated podcast recommendations powered by natural language processing (NLP) and machine learning. With over 16 million users in 175 countries, the company has raised roughly $30 million in funding from top venture capital firms like ZhenFund, SIG China and IDG.

Since the days of Napster’s inception, audio content publishers and creators have fought over who should have control in how content is monetized and distributed. Speaking with Bitcoin Magazine, Wang said that the creation of ContentBox was inspired by the ongoing fight against copyright infringement and piracy in the digital content arena.

“Independent creators and publishers are under attack from all sides,” she said. “Take YouTube as an example. There was once a time when the platform democratized the creation and distribution of user-generated videos. Creators that produced great content were rewarded accordingly, and YouTube quickly became a major player in the entertainment industry.”

More than a decade later, smaller, independent creators are struggling to make a living, she noted.

“They pour their hearts and souls into their work, but these big platforms have taken full control over the way content is handled, leaving the average creator with little to no income, and virtually no ownership over their content. This issue is rampant across all major content platforms. Publishers face the same challenge, as more and more of their content is shared and consumed on third-party channels like Facebook.”

Wang says that the digital media industry was originally built on principles of inclusivity, but that it has also become too top heavy to support independent publishers and creators. In addition, most advertising revenue winds up in the hands of major studios instead of the creators, where it belongs.

She says the blockchain can solve this problem by removing middlemen and high transaction fees, while also introducing new streams of revenue like activity-based income (i.e. creators are paid when someone listens to their content) and subscriptions.

“The digital content industry has remained relatively opaque over the years regarding paid media, and advertisers typically rely on vanity metrics like impressions to determine returns on investments (ROIs),” said Wang.

She suggested that the blockchain can allow advertisers to tap into shared statistics and pay via advertisement viewership automated by smart contracts.

“By decentralizing the podcast industry with a shared content pool, a shared user pool and a unified payout system, this new project creates an open source community that can’t be controlled by a few industry giants.”

This is where ContentBox comes in. The system provides listeners with an array of blockchain-based solutions that power a unified payout system for the digital content arena. Users can access content by paying with digital tokens through what’s known as BOX Payout, a secure and borderless payment transaction network.

“The base asset of ContentBox are BOX tokens which are Ethereum-based and are standard ERC20,” said Wang. “There won't be an ICO but there will be an airdrop. BOX tokens are the only way to transact within the app but they will be listed on a couple crypto exchanges by early July, so users will be able to cash out to Ether if desired.”

Users garner these tokens by sharing content with others, inviting friends and joining the company’s Telegram channel. They are also granted access to digital wallets that manage their rewards.

“Consumers engage in a wide variety of value-creating activities vital to the growth of the podcast community, like helping to share and create content, but are never financially rewarded,” said Wang. “Blockchain allows listeners to become stakeholders that get rewarded for their contributions. In turn, they can directly reward their favorite podcasters with the tokens they earn, or unlock premium content.”

This article originally appeared on Bitcoin Magazine.

Posted on 25 May 2018 | 3:02 pm

Op Ed: The Benefits of Incentivizing Node Operators in Public Blockchains

The cryptocurrency industry has seen tremendous growth this year, with a 3,363 percent increase in market capitalization and a 216 percent increase in cryptocurrency and asset exchanges. While this is certainly promising, it foreshadows a unique scalability problem. At present, most crypto companies are almost entirely dependent on the charity of “nodes” to establish and enforce the rules of their platform — all with little or no incentive to do so.

For years, this has been the industry standard, and, so long as the system isn’t overwhelmed, it holds up. However, with the recent surge of activity surrounding cryptocurrency, the time and energy required to validate each transaction is becoming more and more time-consuming. With expanding size and scale, the question becomes, is it worthwhile to operate a node in today’s digital climate?

Traditional node operators harness the power of everyday computers to run an overlaying security protocol that polices the blockchain. If a transaction violates the consensus algorithm, it’s immediately flagged and removed. As more nodes enter the system, the more secure the governance layer becomes, increasing efficiencies and fortifying trust. However, as demand increases, so too does the pool of transactions that need to be verified, which ultimately raises the resource burden for node operators — discouraging participation.

Now, if these nodes were incentivized for their participation, crypto companies would be able to entice larger quantities of node operators. Such incentives can take a variety of forms. First and foremost, companies can implement a donation pool in the blockchain, where members are required to pay a small participation fee that will be distributed through a smart contract to node operators. Imagine this as a “price of entry” for blockchain exchanges, where participants in the community pay for the efficiencies and securities that would have been provided for free.

Another possibility is to incentivize nodes with a portion of the mining reward. Here, each node operator receives a predetermined cut of the overall mining return assuming that they meet specific criteria per pay period. This process carries a number of advantages. Unlike donation pools, which are largely contingent upon the number of paying participants in the space, mining incentives are more dependable, maintaining blockchain functionality regardless of how many actors are engaged with the system.

Cryptocurrencies like Dash and ZenCash that have put into place systems that incentivize node operators have seen their networks grow exponentially as a result. By providing a percentage of the mining reward to node operators, in the span of mere months, these cryptocurrencies have seen the number of operators grow in size by hundreds and even thousands. These operators, in turn, have worked to ensure consistency and improved usability in the end-user experience, opening the possibility for creating dApps, smart contracts and other services on top of the network.

In the pursuit of true decentralization, industry experts must start thinking critically about the role that node operators should — and will — play in the future of the industry. To transform short-term gains into long-term successes, it will be increasingly important for crypto companies to bring their platforms to scale, and step one will be to incentivize, instead of expect, node operators to keep the community afloat. Simply stated, with cryptocurrency, we are on the precipice of a new era of innovation, and as the industry grows, we must be prepared to grow with it.

This is a guest post by by Rob Viglione, co-founder of ZenCash. Views expressed are his own and do not necessarily reflect those of Bitcoin Magazine or BTC Media.

This article originally appeared on Bitcoin Magazine.

Posted on 25 May 2018 | 1:52 pm

U.S. Justice Department Probes Price Manipulation on Bitcoin Markets

The U.S. Justice Department is looking into whether the price of bitcoin and other virtual currencies are being manipulated, according to a report in Bloomberg that referenced four unnamed sources for the information.

Still in its early phases, the criminal probe will bring in other agencies, like the Commodity Futures Trading Commission (CFTC), a regulator that oversees bitcoin derivatives, sources said.

On spot markets, like GDAX, Poloniex and Bitfinex, where cryptocurrencies change hands immediately, the price of bitcoin can vacillate wildly in a matter of hours. Starting in early 2017, the price of bitcoin ballooned from $1,000 to a record high of around $20,000 in mid-December. Currently, the price now sits in around $7,500.

Unlike in Japan, where virtual currency exchanges are subject the same rules and oversight as any other financial institutions and are required to register with the government, in the U.S. and other countries, cryptocurrency exchanges are still largely unregulated, opening up the doors to fraud and manipulation.

As for the U.S. Justice Department, its probe will focus on practices like spoofing, where a trader puts in a large buy or sell order only to withdraw the order as soon as the price starts to go up or down; and wash trading, where an investor simultaneously buys and sells assets to increase the volume of trading. Painting the tape, where traders trade amongst themselves to make it look like there is a flurry of activity going on, is yet another method of market manipulation.

All of these illegal trading practices are particularly effective in manipulating asset prices in relatively small markets. Cryptocurrency spot markets are said to handle only a small fraction of overall bitcoin trading, while bigger deals take place in over-the-counter (OTC) markets, like Gemini Global Trading, Circle and Cumberland Mining, where big investors, miners and hedge funds move hundreds of millions of dollars in cryptocurrencies daily.

Earlier this year, Jordan Belfort, the original “Wolf of Wall Street,” who served jail time in connection with stock-market manipulation, warned bitcoin traders of “corruption” and “improper trading practices” in the markets and looming government crackdowns. “If you think the governments of the world don’t have the power to shut this down, you are very wrong. They do,” Belfort said in a video.

This article originally appeared on Bitcoin Magazine.

Posted on 24 May 2018 | 11:04 am

Coinbase Takes Another Step Toward Trading ICO Tokens by Acquiring Paradex

Cryptocurrency exchange Coinbase has taken another step toward trading ERC20 tokens by acquiring decentralized relayer Paradex. ERC20 is the Ethereum technical standard that the majority of initial coin offering (ICO) tokens are based on.

Paradex announced the news on its website today, May 23, 2018, adding that its site will be down temporarily while it works to make the integrations with Coinbase.

Paradex bills itself as a decentralized exchange (DEX), meaning no third party is involved in holding the funds. Instead, users can use the platform to trade ERC20 tokens directly wallet to wallet. Paradex is built on top of the 0x (pronounced “zero x”) protocol.

Right now, Coinbase trades four coins: bitcoin (BTC), bitcoin cash (BCH), ether (ETH) and litecoin (LTC). Adding ERC20 tokens could significantly boost the number of digital assets it carries. Due to the ICO boom that has taken place over the last few years, thousands of different ICO tokens are now available.

But because U.S. regulators are in the midst of clarifying their stance on virtual currencies, many exchanges are holding back from listing ICO tokens. In March 2018, the U.S. Securities and Exchange Commission (SEC) issued a clear warning to virtual currency exchanges that some ICO tokens may qualify as noncompliant securities, and any exchange that lists security tokens needs to either register as a national securities exchange or operate under an exemption and set itself up as an alternative trading system (ATS).

To that end, in April 2018, Coinbase reportedly entered into talks with the SEC to take steps to become an ATS. In a possible lead-up to those plans, in late March 2018, Coinbase announced it was adding support for ERC20 into all its trading platforms.

In a blog post, Coinbase CEO Brian Armstrong stated that Coinbase is initially planning to offer Paradex to customers outside of the U.S. and eventually to its U.S. customers.

Coinbase offers two types of trading platforms: Coinbase for novice traders and GDAX for the more experienced traders. According to Reuters, Coinbase is revamping GDAX and rolling it over to a new service dubbed “Coinbase Pro” next month.

This article originally appeared on Bitcoin Magazine.

Posted on 23 May 2018 | 5:51 pm

Bitcoin Miner Maker Canaan Files for Hong Kong IPO

Canaan Creative, one of the biggest manufacturers of bitcoin mining chips and devices, has filed for an initial public offering (IPO) with the Stock Exchange of Hong Kong (HKEX).

Filed on May 15, the firm's application is still in draft form and pending approval from the HKEX, so it remains unknown at this stage how much the China-based company is valued at and what figure it intends to raise.

However, a report from Bloomberg suggests that the firm aims to raise $1 billion, which, if true and ultimately successful, would make it the largest ever IPO in the cryptocurrency industry.

Meanwhile, the document also offers a glimpse into the firm's financial health. According to a financial statement included as part of the IPO filing, Canaan raised 1.3 billion yuan ($204 million) in revenue in 2017 alone, marking 3,000 percent year-on-year growth compared with 2016.

Similarly, the firm also brought in a net profit of $56 million in 2017 – a six-fold increase over the previous year.

This isn't the first time that the bitcoin miner maker has closed on becoming a publicly traded entity. As previously reported by CoinDesk, an attempted acquisition deal in 2016 would have seen Canaan go public on China's Shenzhen Stock Exchange, but the stock exchange eventually blocked the move over "uncertainties."

In May 2017, the company raised 300 million yuan ($43 million at the time) in a Series A round that saw the participation of Jin Jiang International Group, Baopu Asset Management and Tunlan Investment.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

BitcoinMaker.com : Bitcoin news and Domain names for sale

Please go to Buy This Domain to purchase these domain names:

What is Bitcoin?

Bitcoin is a digital crypto-currency with no single point of failure due to its decentralized peer-to-peer architecture. The source code is publicly available and changes to the reference Bitcoin client are made via concensus within the community. Advantages of Bitcoin include irreversible transactions (i.e. no possibility of chargebacks as with credit cards), pseudo-anonymous, limited and fixed inflation, near instant transactions, multi-platform, no double-spend and little to no barriers to entry and more. It was created by an anonymous person known as Satoshi Nakamoto. Find out more at WeUseCoins.com.

Bitcoin Latest News

This RSS feed URL is deprecated

This RSS feed URL is deprecated, please update. New URLs can be found in the footers at https://news.google.com/news

Posted on 29 May 2018 | 11:16 am

Bitcoin Price Faces Last Major Support Level Before $5K - Yahoo Finance

Posted on 29 May 2018 | 10:22 am

Austrian Regulator Freezes Crypto Mining Firm Amid Investigation

The Austrian Financial Market Authority has suspended the operations of cryptocurrency mining firm INVIA GmbH for offering illegal investments.

Posted on 29 May 2018 | 10:15 am

Bitcoin is definitely a bubble, says Wikipedia founder - MarketWatch

Posted on 29 May 2018 | 9:21 am

Bitcoin Spinoff Hacked in Rare '51% Attack' - Fortune

Posted on 29 May 2018 | 8:48 am

Crypto is making a comeback as Italy's political crisis mounts - Business Insider

Posted on 29 May 2018 | 8:34 am

Meet Kakao: How Korea's Largest Mobile Giant Is Embracing Blockchain

Jason Han, CEO of Kakao's blockchain subsidiary Ground X, tells CoinDesk his thoughts on how crypto could impact big business.

Posted on 29 May 2018 | 8:30 am

A Bitcoin Halvening Is Two Years Away -- Here's What'll Happen To The Bitcoin Price - Forbes

Posted on 29 May 2018 | 8:18 am

Bitcoin holds $7000; volatility trends lower - MarketWatch

Posted on 29 May 2018 | 7:46 am

Crypto Payroll Processor Bitwage Launches ICO Advisory Firm

Bitcoin payroll firm Bitwage has launched an advisory company aimed to make it easier for companies to launch token sales.

Posted on 29 May 2018 | 7:00 am

An 'Emergency Sale' of Bitcoins Just Earned $14 Million for German Law Enforcement - Fortune

Posted on 29 May 2018 | 5:31 am

Peter Thiel Believes Bitcoin May Be on the Outs - Investopedia (blog)

Posted on 29 May 2018 | 4:01 am

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Posted on 29 May 2018 | 4:00 am

Bitcoin Price Faces Last Major Support Level Before $5K

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Posted on 29 May 2018 | 3:00 am

Baidu's 'Wikipedia' Now Logs Revisions on a Blockchain

Chinese search giant Baidu has turned to blockchain technology in order to make its online encyclopedia more traceable and transparent.

Posted on 29 May 2018 | 2:00 am

A New Twist On Lightning Tech Could Be Coming Soon to Bitcoin - Coindesk

Posted on 28 May 2018 | 10:06 pm

A New Twist On Lightning Tech Could Be Coming Soon to Bitcoin

The lightning network is still new, but a group of its devs are already thinking about an alternative technology to better protect users' funds.

Posted on 28 May 2018 | 10:00 pm

I Would Be Shocked If Bitcoin Prices Weren't Manipulated - Forbes

Posted on 28 May 2018 | 12:36 pm

Op Ed: How Atomic Swaps Could Work for Stock Market Trading

Traditional stock market trades can leverage the concept of atomic swaps to facilitate direct stock-to-stock trades without requiring cash positions.

Atomic Stocks Overview

In traditional stock exchanges, retail investors in public markets are unable to switch from one position to another without first going into cash. For example, an investor looking to trade his or her Amazon shares for PayPal shares must first exchange these Amazon shares for U.S. dollars, before buying PayPal shares with these dollars.

This style of exchange creates unnecessary friction and expense because of a) transaction costs incurred on the sale of the asset, as well as on the purchase of the new asset; b) U.S. dollar purchasing power exchange-rate risk; and c) transaction fees paid to the broker that the purchaser is using, as well as the bid-ask spread that exists for each publicly traded stock (which occurs on both the sale of the previously held asset, as well as on the newly purchased asset).

Atomic Swaps

In the context of cryptocurrency, atomic swaps are a proposed feature that could allow direct conversion between two cryptocurrencies without having to use a third-party intermediary or exchange. By employing hash time-locked smart contracts, atomic swaps guarantee that parties will deliver the currency needed for the trade, or else the transaction is automatically canceled. These “all or nothing” trades preserve atomicity because they either take place or are canceled immediately. For example, customer A could directly trade his or her bitcoin for customer B’s ether with full confidence that the trade will either take place or terminate if either party doesn’t deliver their side of the bargain.

Atomic Stocks

Harnessing the principle of atomic swaps, direct stock-to-stock exchanges (Atomic Stock Exchanges) enable retail investors to avoid the forced conversion into cash that occurs when selling a stock to USD just to buy back another stock.

It is a commonplace occurrence to switch between stock positions for retail investors and financial firms, and the prevention of touching cash allows for the avoidance of transaction fees that would normally be incurred when making these trades, and the cost-saving consolidation of the bid-ask spreads on both of these stocks into one bid-ask spread. While the larger cost saving would occur on direct stock-stock swaps, there are incremental cost savings on the bid-ask spread as well.

Atomic Stock Exchanges could feasibly work with large-cap stocks that have deep pools of liquidity, such as stocks on the S&P 500, and the liquidity needed for making the trades would be provided by high-frequency traders (HFT) who could make up the gap that exists.

This would squeeze HFT margins, but as a commodity business that provides a middleman service, we imagine they would facilitate this as a way to make incremental revenues (if they have no other options).

By focusing on the needs of the average retail consumer, we realize that in many cases, the sale into cash is forced and doesn’t correspond to what the investor actually wants, which is to simply switch from one highly liquid position to another.

Atomic Stock Exchange: Practical Example

Let’s imagine for simplicity that only the S&P 500 is available and that we want to rotate out of Google stock into Facebook stock because we think that Facebook stock has been shifted off of its fundamental value due to the Cambridge Analytica scandal. Therefore, we want to exchange our Google shares for Facebook shares; because they are both denominated in USD, there is a ratio of what one share is worth relative to the other share. On the market close of May 4, 2018, one share of Google is worth 5.95 shares of Facebook stock. In this hypothetical exchange, shares are fractional, and you are able to exchange one Google share for 5.95 Facebook shares and vice versa.

The “spread” in this case would be the amount of Google stock you receive when making this exchange. You would only receive 5.93 shares of Facebook when you are doing this exchange, and the market maker is getting 0.02 Facebook shares in exchange for facilitating this transaction. These shares add up over time in favor of the market maker and serve as their profit once they liquidate them.

This spread dynamic could potentially cause an issue since market makers are now being paid by stock instead of in cash, unlike with normal bid-ask spreads. However, this could allow market makers to profit via the appreciation of these shares during the trading day as well. However, nothing would prevent HFT from liquidating the shares they receive as cash immediately as well, provided someone takes this trade.

Exchange Dynamics

To start, Atomic Stock Exchanges would charge no exchange fees. Revenue can be made by selling order flow and the right to trade on this exchange to HFT. The way the buy and sell process would work from stock to stock could be: when a sell order is placed, it is specified which position the firm would like to exchange into, and provided that this trade is available, it is filled by simply swapping shares. This is where HFT could be invaluable as a market maker and be able to profit off the spread. This would serve as a way to make a profit, and many exchanges try to obfuscate the fact that they make money off retail investors doing so.

Questions Worth Considering

What is the main issue that would have to be overcome to create an Atomic Stock Exchange?

It’s critical to figure out how to enable the purchasing of decimalized amounts of shares and how to pair users that are actually looking to swap shares with each other. In private markets, counterparties have broad control over their trade arrangements, but in public markets this utility hasn’t yet been harnessed. In other words, for atomic stocks to work, an Atomic Stock Exchange would have to create decimalized shares. When we consider that for a retail user of E-Trade or Charles Schwab, the cost of going from Amazon to Facebook is selling one and buying the other, each of which carries a transaction fee, and we see that this could be a huge cost savings for the average retail investor, even if a service had to be paid on the back end to enable a decimalized share service to exist. However, for an Atomic Stock Exchange to be profitable, it would have to support massive volume.

Is decimalization of shares in public markets the equivalent of decimalization for stock prices?

Before 2001, all stock prices in the U.S. were quoted as 1/16 of a dollar, creating opportunities for arbitrage, but also creating massive inefficiencies within markets as well. Decimalization has led to tighter spreads because of the corresponding smaller price increments and movements. With decimalization, the minimum price movement is now one cent, allowing for tighter spreads between the bid and the ask levels. For example, shares could be decimalized out to five decimal places, allowing for the equivalent trading of shares.

Would the theoretical lack of (or less) cash be an issue for this exchange?

Many exchanges make money by putting cash that hasn’t been invested into money market accounts. An Atomic Stock Exchange could allow for these kinds of cash holdings as well.

What about liquidity?

Atomic Stock Exchanges can be built on top of existing exchanges, meaning that retail investors can still switch to cash positions if they wish to do so.

Do any kind of similar trades already happen?

Institutional investors can already execute paired trades that never expose them directly to fiat currency. But retail investors miss out on this opportunity.

This paper is part of a research project being developed by Erik Kuebler and Oscar Avatare at the University of Washington. If you have any feedback, suggestions or questions, please email ekuebler@uw.edu or oavatare@uw.edu.

This article originally appeared on Bitcoin Magazine.

Posted on 28 May 2018 | 9:31 am

Universities to Build Blockchain DAO for Affordable Education

A group of top-tier Chinese universities plans to build a distributed organization to make educational resources more accessible and affordable.

Posted on 28 May 2018 | 9:10 am

Blockchain Could 'Revolutionize' Retail and CPG Industries: Deloitte

A Deloitte report suggests the retail and consumer packaged goods sectors could see benefits from blockchain integration across a number of use cases.

Posted on 28 May 2018 | 8:30 am

Bank of Russia Official: Still Too Early to Gauge Blockchain's Potential

A senior official at Russia's central bank has said blockchain technology is immature but may have industrial-scale applications.

Posted on 28 May 2018 | 7:00 am

Amid Chaos, Our Decentralized Future Is Being Built

Blockchain can upend – not just the business models of recent decades – but a millennia-old societal practice of deep significance to civilization.

Posted on 28 May 2018 | 6:00 am

Bitcoin Bears In Charge But Indecision Could Spur Rally

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

Posted on 28 May 2018 | 4:25 am

No Miners? Intel Seeks to Automate DLT Block Verification

A newly released Intel patent application sets out a system for automatically creating and validating blocks on a distributed ledger.

Posted on 28 May 2018 | 3:33 am

Chinese Blockchain Event Draws Backlash Over Chairman Mao Stunt

Chinese crypto media firms are boycotting a blockchain event after the organizer used a Chairman Mao impersonator to fire up the audience.

Posted on 28 May 2018 | 2:00 am

What to Expect When Ethereum Classic Diffuses Its 'Difficulty Bomb'

The upcoming ethereum classic fork will disable a 'difficulty bomb,' committing the network to a proof-of-work consensus algorithm.

Posted on 28 May 2018 | 12:30 am

Bitcoin Magazine’s Week in Review: Expanding Exchanges and Investors

Cryptocurrencies and exchanges were the focus this week. Coinbase is getting into the decentralized exchange business with its acquisition of Paradex, potentially opening up thousands of ERC-20 tokens to traders, depending on what the SEC ends up doing with regulations. The parent company of the New York Stock Exchange, Intercontinental Exchange, continues work to implement a system to allow large investors to trade bitcoin directly. And Germany’s Deutsche Boerse is looking at getting into the cryptocurrency game. Finally, the city of Memphis had its first blockchain conference, which included keynotes from FedEx and a hackathon for various market segments that included some great prizes.

Featured stories by Amy Castor, David Hollerith and Nick Marinoff

Stay on top of the best stories in the bitcoin, blockchain and cryptocurrency industry. Subscribe to our newsletter here.

Coinbase Takes Another Step Toward Trading ICO Tokens by Acquiring

Cryptocurrency exchange Coinbase just made an enormous play by acquiring decentralized relayer Paradex this week. Paradex bills itself as a decentralized exchange (DEX), meaning no third party is involved in holding the funds. Instead, users can use the platform to trade ERC20 tokens directly wallet to wallet. Paradex is built on top of the 0x (pronounced “zero x”) protocol.

Right now, Coinbase trades four coins: bitcoin (BTC), bitcoin cash (BCH), ether (ETH) and litecoin (LTC). Adding ERC20 tokens could significantly boost the number of digital assets it carries. Due to the ICO boom that has taken place over the last few years, thousands of different ICO tokens are now available.

German Stock Exchange Eyes Bitcoin and Cryptocurrencies

Frankfurt Stock Exchange parent company, Deutsche Boerse AG, appears to have begun work on technology that will allow them to offer their clients bitcoin and cryptocurrency-related products.