Welcome to COINBLOCKERS

Bitcoin Gold (BTG) Mining Pool since Nov 14, 2017

Facts & Features

Currently we charge 1% fee.

Payout starts from 0.01 BTG. Payment Mode: PPLNT

Anonymous mining and privacy is guaranteed

Statistics

Detailed statistics for all your rigs, worker and BTG address.

Frequently maintained Stratum/Pool code. SSL mining for improved security.

Mining Rig Rentals

Mining Rig Rentals Port (7777) to support high demands.

Stable and DDOS protected Server with

Cached Frontend.

Will 2017 be Profitable for Bitcoin Mining?

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntMiner S7

AntMiner S9

Bitcoin mining during its early days were generally called as a gold rush. Bitcoin, an invention of Satoshi Nakomoto's, "a peer-to-peer electronic cash system,” opened up an entirely new perimeter, not just of freedom but of profit. People with a strong interest in such things were first to stake their claim, namely cypherpunks, cryptographers, technically-minded libertarians and assorted hackers.

But is there still gold in them thar hills?

From a few of early enthusiasts, it is with certainty that Bitcoin mining has advanced into a cottage industry to a specialized industrial-level venture. The easy money was taken out long ago and the rest are hidden under the cryptographic equivalent of miles of hard rock.

To be able to profitably excavate bitcoins nowadays, you need to have specialized, high-powered machinery. While it is technically possible for anyone to mine, those with underpowered setups will spend more money on electricity than have money generated through mining.

Common Mining Terms

To further understand Bitcoin mining, it helps to know a few basic technical terms:

Block: a group of Bitcoin transactions, as collected from current pending transactions and entered into an ever-growing record of blocks (aka “the blockchain”) by a miner. A new block is created on average every ten minutes.

Proof of Work Hashing: this is the function miners perform in order to define a new block. PoW hashing ensures the proper function of the Bitcoin blockchain. Miners compete to solve a cryptographic “puzzle,” known as a hash. There are no shortcuts in this process, which can only be solved with raw computational power. By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins.

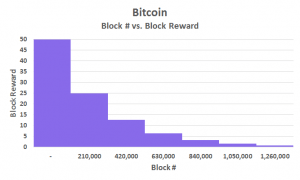

Block Reward: the number of newly-created bitcoins. This number was initially set to 50, halved to 25 in late-2012 and will halve again to 12.5 in mid-2016. This halving process continues, approximately every four years (or every 210,000 blocks), until all 21 million bitcoins are created. This is the only way in which new bitcoins can be created; by miners according to the code’s rate and limit.

Hashrate: a measure of a miner’s computational power. The higher their relative power, the more solutions (and hence, block rewards) they’re likely to find. Initially measured in hash per second (H/s), due to the increasing speed of mining hardware. H/s was soon commonly pre-fixed with SI units as follows:

Kilohash = KH/s (thousands of H/s), then

Megahash = MH/s (millions of H/s), then

Gigahash = GH/s (billions of H/s), then

Terahash = TH/s (trillions of H/s), and even

Petahash = PH/s (quadrillions of H/s).

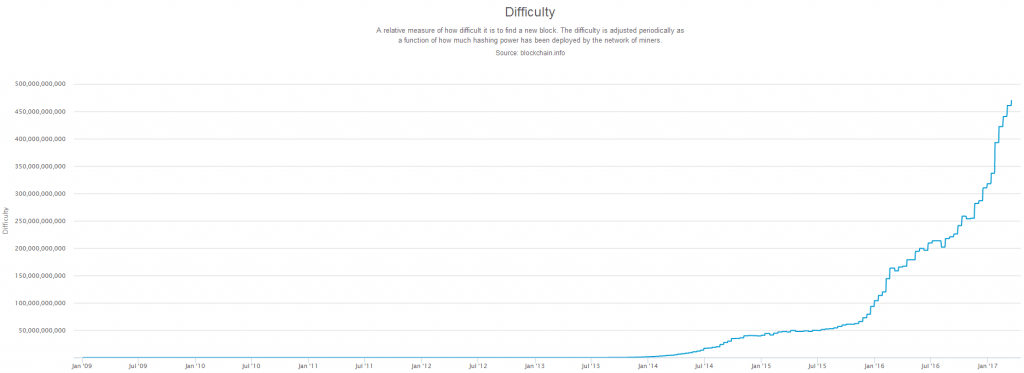

Difficulty: with hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly. Bitcoin’s Difficulty measure is what prevents this from happening, ensuring blocks are found roughly every 10 minutes. When total hashrate rises, the Difficulty of POW hashing adjusts upwards - and the inverse also applies. Difficulty auto-adjusts every two weeks (or 2016 blocks).

BTC / XBT exchange rate: the current fiat price of Bitcoin; critical for calculating profitability.

W/xHash/s: Watts per hashrate per second. Electricity is the major on-going cost of Bitcoin mining. The price paid per Watt will greatly influence profitability.

Mining Pool: unless you command a tremendous hashrate, your odds of solving a block by yourself (i.e. “solo-mining”) are extremely low. By banding together with other miners in a so-called pool, your combined odds of solving a block rise proportional to the pool’s total hashrate. Whenever they solve blocks, pools reward individual miners according to their contributed hashrate (minus commissions and the like).

Calculating Mining Profitability

Having these terms in mind, it’s viable to calculate the current profitability of Bitcoin mining for your circumstances. Bear in mind that the future profitability of mining cannot be reliably predicted. This is because of the ever-changing nature of the Difficulty modifier and the BTC price, in particular.

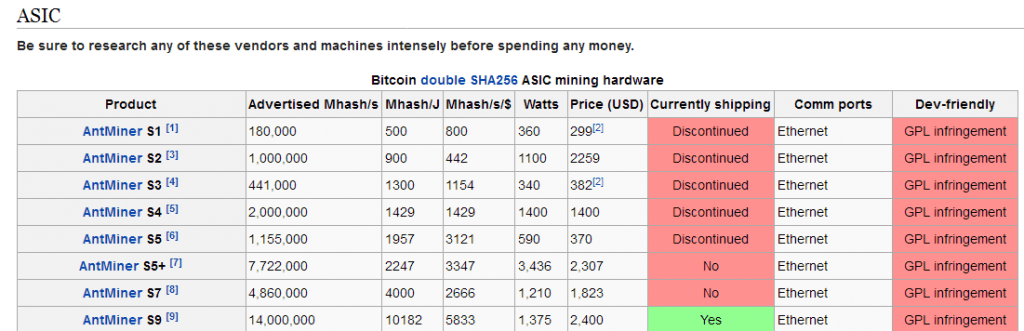

To start, we must select a suitable ASIC mining rig. To help in selection, the Bitcoin Wiki provides a handy mining hardware comparison: We'll select for our example the AntMiner S7 which is pretty much the cutting edge of mining tech and is a modern mining rig that offers a good hashrate for its power consumption. The S7 in Amazon is available for $609 and only $450 from BitMain, exclusive of shipping. $150 or so is added for the power supply units.

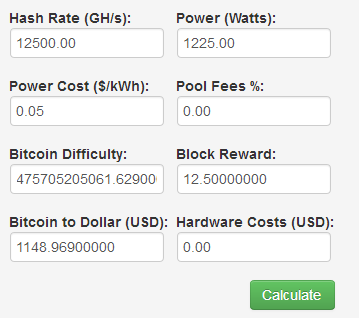

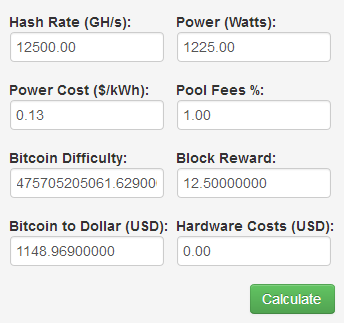

Next, we need to enter the S7’s specs and cost, as well as other info such as power cost and pool fees, into a suitable number-cruncher. CoinWarz.com offers a good mining profitability calculator, which automatically fills in the current BTC price, Difficulty and block reward info.

As a standard in China, the default power cost we will use is 10c (USD), but possibly to be much higher elsewhere. Check worldwide electricity prices or your utility bills for the exact price to know your own power cost. The 2.5% Pool Fee is for AntPool. There is generally lower or no fees for smaller pools but remember that they will seldom find blocks. Various pools’ fees and reward structures are compared in this list.

After all the needed info is registered, click Calculate for the profitability result:

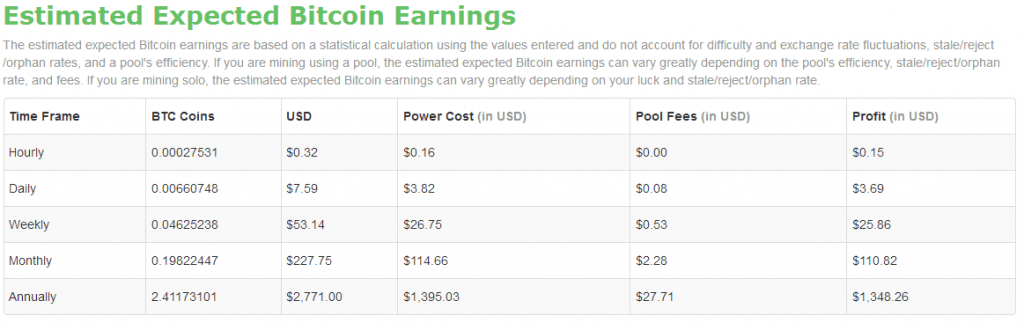

Not a bad result! $800 per year and you can use the miner’s excess heat to warm your home.

The American Scenarios

Exciting as it seems, let’s first recompute the average power cost per kWh in the USA (

12.5c) and the 12.5 BTC block reward which becomes the new standard in 45 days or so (see Bitcoin Clock for an up-to-date estimate):

Given the difficulty and price hold steady and by the looks of it, it turns out that in every year, an average American miner can only make $500. But, this could be an unsafe assumption! Bitcoin’s average hashrate surprisingly climbed by a whopping 30 percent by the time this article is being written.

The compensatory Difficulty spike, expected on the day following reports of this spike, completely alters the previous equation:

If we bump up the Difficulty in the mining calculator by the corresponding 30%, all profit evaporates! $500 is lost over one year’s worth of mining.

Unexpected Profit Loss: Difficulty Spikes, Price Crashes, Equipment Failures, Power Cuts, Shipping Delays & More

The aforementioned scene works as a perfect picture of the risks present in the Bitcoin mining. There is a possibility that even some big, corporate miners will be injured from such a steep Difficulty spike. Unless home miner has access to free or very low-cost electricity, it really has zero chance to compete in such challenging environment.

Remember also that the rate of degeneration in Bitcoin hardware is tremendously fast! One should be knowledgeable that during (pre-) ordering equipment, potential manufacturing, shipping, customs or other delays could be very costly in the end as difficulty rises or price falls during the interim.

There are many of other inaccurate things, and such downside risks must always be considered into any concept business plan.

The Chinese Scenarios

For interest’s sake, let’s check the scenario of Chinese miners, who represent the majority of Bitcoin mining power for good reason. The results may help us better predict the post-halving Bitcoin environment, as this article attempts to do.

Hobby Miners

Some Chinese regions are over-supplied with electricity, which are subsidized in many instances. Because of this, low power cost is made and we’ll assume to be 7c for a miner in the right province. To add, a number of mining hardware is invented in China resulting to likely be bought cheaper (and received sooner) by locals of the Middle Kingdom. We’ll assume a ¾ hardware price.

Before the Difficulty spike, a small-time Chinese miner with a single S7 connected to AntPool could have made over $1000 annually. That’s twice the profit of their American counterpart!

After the halving and Difficulty spike, the same miner would lose about $40 per year. For a Bitcoin lover, this is an easily-acceptable loss.

Industrial Miners

Cheap power sources are present in remote provinces so large-scale mining operations will situate closely there. One popular option is hydroelectric power from dams. From such enterprises we can assume a very low power cost, let’s say 5c. These operations also buy hardware in volumes so assuming they get S7s at $325, which is only half the price. One thousand S7 units seems a reasonable number, which permits us to simply add three zeros to hash rate, hardware and power costs. Lastly, these setups often run their own pools and so we’ll suppose zero pool fees.

The operation would net $1.4m annually, before the halving and Difficulty spike.

The operation would profit by about $200k annually, after the halving and Difficulty spike.

Given the initial hardware investment of $325k, a profit of $200k doesn’t look great. It can be seen that marginal mining operations will be forced out of business post-halving given the other costs involved in mining, such as property, salaries, maintenance, etc. Only those with the latest and greatest hardware and the cheapest electricity are likely to pull through. Bitcoin price is the only wild card. It’ll allow less efficient miners to keep the lights on for longer, if it rises sufficiently.

Conclusion

For an average home miner it will be a struggle to regain the cost of mining hardware and electricity. In this current given circumstance, profitability is highly unlikely. Once ASIC mining hardware innovation reaches the point of diminishing returns, the situation may improve in future. That, together with cheap, hopefully sustainable power solutions may once again make Bitcoin mining profitable to small individual miners around the world. The decentralization of the Bitcoin network, will also greatly improve hardening it against legislative risk.

Is Bitcoin Mining Profitable in 2018?

Last updated on February 26th, 2018 at 03:20 pm

Before we start, if you’re new to Bitcoin mining and don’t know what it is watch this short and simple explanation:

“Is Bitcoin Mining Profitable in 2018?“

The short answer would be “It depends on how much you’re willing to spend”. Each person asking himself this will get a slightly different answer since Bitcoin Mining profitability depends on many different factors. In order to find out Bitcoin mining profitability for different factors “mining profitability calculators” were invented.

These calculators take into account the different parameters such as electricity cost, the cost of your hardware and other variables and give you an estimate of your projected profit. Before I give you a short example of how this is calculated let’s make sure you are familiar with the different variables:

Bitcoin Mining terms you should get to know

Hash Rate – A Hash is the mathematical problem the miner’s computer needs to solve. The Hash Rate is the rate at which these problems are being solved. The more miners that join the Bitcoin network, the higher the network Hash Rate is.

The Hash Rate can also refer to your miner’s performance. Today Bitcoin miners (those super powerful computers talked about in the video) come with different Hash Rates. Miners’ performance is measured in MH/s (Mega hash per second), GH/s (Giga hash per second), TH/s (Terra hash per second) and even PH/s (Peta hash per second).

Bitcoins per Block – Each time a mathematical problem is solved, a constant amount of Bitcoins are created. The number of Bitcoins generated per block starts at 50 and is halved every 210,000 blocks (about four years). The current number of Bitcoins awarded per block is 12.5. The last block halving occurred on July 2016 and the next one will be in 2020.

Bitcoin Difficulty – Since the Bitcoin network is designed to produce a constant amount of Bitcoins every 10 minutes, the difficulty of solving the mathematical problems has to increase in order to adjust to the network’s Hash Rate increase. Basically this means that the more miners that join, the harder it gets to actually mine Bitcoins.

Electricity Rate – Operating a Bitcoin miner consumes a lot of electricity. You’ll need to find out your electricity rate in order to calculate profitability. This can usually be found on your monthly electricity bill.

Power consumption – Each miner consumes a different amount of energy. Make sure to find out the exact power consumption of your miner before calculating profitability. This can be found easily with a quick search on the Internet or through this list. Power consumption is measured in Watts.

Pool fees – In order to mine you’ll need to join a mining pool. A mining pool is a group of miners that join together in order to mine more effectively. The platform that brings them together is called a mining pool and it deducts some sort of a fee in order to maintain its operations. Once the pool manages to mine Bitcoins the profits are divided between the pool members depending on how much work each miner has done (i.e. their miner’s hash rate).

Time Frame – When calculating if Bitcoin mining is profitable you’ll have to define a time frame to relate to. Since the more time you mine, the more Bitcoins you’ll earn.

Profitability decline per year – This is probably the most important and elusive variable of them all. The idea is that since no one can actually predict the rate of miners joining the network no one can also predict how difficult it will be to mine in 6 weeks, 6 months or 6 years from now. This is one of the two reasons no one will ever be able to answer you once and for all “is Bitcoin mining profitable ?”. The second reason is the conversion rate. In the case below, you can insert an annual profitability decline factor that will help you estimate the growing difficulty.

Conversion rate – Since no one knows what the BTC/USD exchange rate will be in the future it’s hard to predict if Bitcoin mining will be profitable. If you’re into mining in order to accumulate Bitcoins only then this doesn’t need to bother you. But if you are planning to convert these Bitcoins in the future to any other currency this factor will have a major impact of course.

Get a mining calculator

In order to calculate all of these parameters and get an answer to our question we will use a mining profitability calculator. here’s a simple mining calculator from 99Bitcoins:

Bitcoin Mining Hardware Guide

The best Bitcoin mining hardware has evolved dramatically since 2009

At first, miners used their central processing unit (CPU) to mine, but soon this wasn't fast enough and it bogged down the system resources of the host computer. Miners quickly moved on to using the graphical processing unit (GPU) in computer graphics cards because they were able to hash data 50 to 100 times faster and consumed much less power per unit of work.

During the winter of 2011, a new industry sprang up with custom equipment that pushed the performance standards even higher. The first wave of these specialty bitcoin mining devices were easy to use Bitcoin miners were based on field-programmable gate array (FPGA) processors and attached to computers using a convenient USB connection.

FPGA miners used much less power than CPU's or GPU's and made concentrated mining farms possible for the first time.

Today's modern and best bitcoin mining hardware

Application-specific integrated circuit (ASIC) miners have taken over completely. These ASIC machines mine at unprecedented speeds while consuming much less power than FPGA or GPU mining rigs. Several reputable companies have established themselves with excellent products.

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntMiner S7

AntMiner S9

Best Bitcoin Mining Hardware

Two major factors go into determining the best bitcoin mining hardware: (1) cost and (2) electricity efficiency.

Bitcoin mining is difficult to do profitably but if you try then this Bitcoin miner is probably a good shot.

ASIC Bitcoin Mining Hardware

Application-specific integrated circuit chips (ASICs) are bitcoin mining hardware created solely to solve Bitcoin blocks. They have only minimal requirements for other normal computer applications. Consequently, ASIC Bitcoin mining systems can solve Bitcoin blocks much quicker and use less less electricity or power than older bitcoin mining hardware like CPUs, GPUs or FPGAs.

As Bitcoin mining increases in popularity and the Bitcoin price rises so does the value of ASIC Bitcoin mining hardware. As more Bitcoin mining hardware is deployed to secure the Bitcoin network the Bitcoin difficulty rises. This makes it impossible to profitably compete without a Bitcoin ASIC system. Furthermore, Bitcoin ASIC technology keeps getting faster, more efficient and more productive so it keeps pushing the limits of what makes the best Bitcoin mining hardware.

Some models of Bitcoin miners include Antminer S5, Antminer U3, ASICMiner BE Tube, ASICMiner BE Prisma, Avalon 2, Avalon 3, BTC Garden AM-V1 616 GH/s, VMC PLATINUM 6 MODULE, and USB miners.

AntMiner U2

BPMC Red Fury USB

GekkoScience

Best Bitcoin Cloud Mining Services

For those not interested in operating the actual hardware then they can purchase Bitcoin cloud mining contracts. Being listed in this section is NOT an endorsement of these services. There have been a tremendous amount of Bitcoin cloud mining scams.

Hashflare Review: Hashflare offers SHA-256 mining contracts and more profitable SHA-256 coins can be mined while automatic payouts are still in BTC. Customers must purchase at least 10 GH/s.

Genesis Mining Review: Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Genesis Mining offers three Bitcoin cloud mining plans that are reasonably priced. Zcash mining contracts are also available.

Hashing 24 Review: Hashing24 has been involved with Bitcoin mining since 2012. They have facilities in Iceland and Georgia. They use modern ASIC chips from BitFury deliver the maximum performance and efficiency possible.

Minex Review: Minex is an innovative aggregator of blockchain projects presented in an economic simulation game format. Users purchase Cloudpacks which can then be used to build an index from pre-picked sets of cloud mining farms, lotteries, casinos, real-world markets and much more.

Minergate Review: Offers both pool and merged mining and cloud mining services for Bitcoin.

Hashnest Review: Hashnest is operated by Bitmain, the producer of the Antminer line of Bitcoin miners. HashNest currently has over 600 Antminer S7s for rent. You can view the most up-to-date pricing and availability on Hashnest's website. At the time of writing one Antminer S7's hash rate can be rented for $1,200.

Bitcoin Cloud Mining Review: Currently all Bitcoin Cloud Mining contracts are sold out.

NiceHash Review: NiceHash is unique in that it uses an orderbook to match mining contract buyers and sellers. Check its website for up-to-date prices.

Eobot Review: Start cloud mining Bitcoin with as little as $10. Eobot claims customers can break even in 14 months.

MineOnCloud Review: MineOnCloud currently has about 35 TH/s of mining equipment for rent in the cloud. Some miners available for rent include AntMiner S4s and S5s.

Is Bitcoin Mining Profitable or Worth it in 2017 & 2018?

The early days of Bitcoin mining are often described as a gold rush.

The early days of Bitcoin mining are often described as a gold rush.

Satoshi Nakomoto’s invention of Bitcoin, “a peer-to-peer electronic cash system,” opened up an entirely new frontier, not just of freedom but of occasionally outrageous profits.

Those with a strong interest in such things, namely cypherpunks, cryptographers, technically-minded libertarians and assorted hackers, were first to stake their claim.

But is there still gold in them thar hills?

Bitcoin mining has grown from a handful of early enthusiasts into a cottage industry, into a specialized industrial-level venture. The easy money was scooped out a long time ago and what remains is buried under the cryptographic equivalent of tons of hard rock.

The sad truth is:

Only those with specialised, high-powered machinery are able to profitably extract bitcoins nowadays. While mining is still technically possible for anyone, those with underpowered setups will find more money is spent on electricity than is generated through mining.

In other words, mining won’t be profitable at a small scale unless you have access to free or really cheap electriciy.

We’ll explain this situation in depth but first, you need to know a few basic technical terms from the world of Bitcoin mining:

A group of Bitcoin transactions, chosen from the mempool (the list of all currently pending transactions) and recorded by a miner into the ever-growing record of blocks known as “the blockchain.”

A new block is created on average every ten minutes.

Proof of Work Hashing:

This is the cryptographic work which miners perform in order to find the solution which allows them to define a new block.

PoW hashing ensures the proper function of the Bitcoin blockchain. Miners compete to solve a cryptographic “puzzle,” known as a hash.

There are no shortcuts in this process, which can only be solved with raw computational power.

By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins.

Block Reward:

The number of newly-created bitcoins, awarded to whichever miner creates a block.

This number was initially set to 50, halved to 25 in late-2012, and halved again to 12.5 in mid-2016. The next halving event expected is around mid-2020.

This halving process will continue in this fashion, halving the block reward approximately every four years / 210,000 blocks, until all 21 million bitcoins are created.

Achieving the block reward is the only valid way in which new bitcoins can be created; by miners according to the code’s rate and limit.

Hashrate is the measure of a miner’s computational power.

The higher their relative power, the more solutions (and hence, block rewards) a miner is likely to find.

Initially measured in hash per second (H/s), due to the increasing speed of mining hardware. H/s was soon commonly pre-fixed with SI units as follows:

- Kilohash = KH/s(thousands of H/s), then

- Megahash =MH/s(millions of H/s), then

- Gigahash = GH/s(billions of H/s), then

- Terahash =TH/s(trillions of H/s), and even

- Petahash =PH/s(quadrillions of H/s).

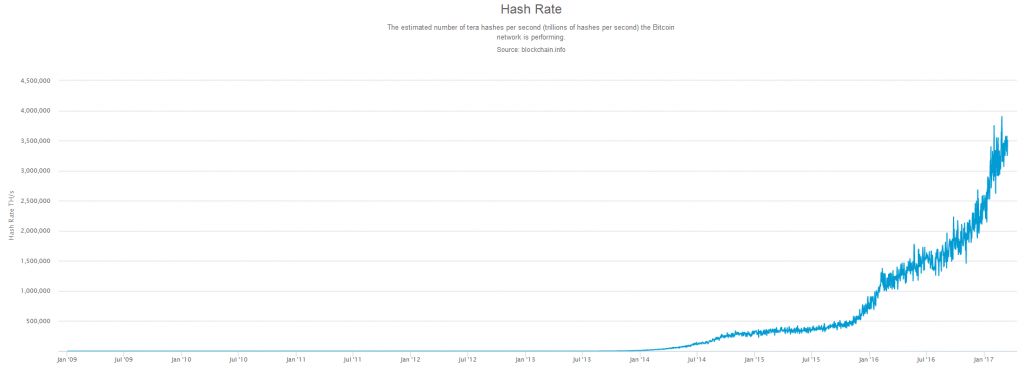

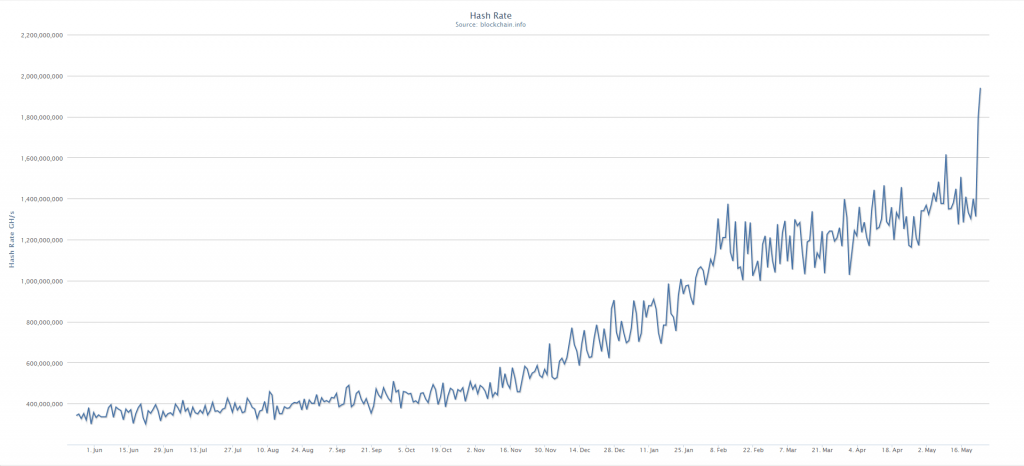

In early 2017, Bitcoin’s collective hashrate reached nearly 4 Exahash. This represents a tremendous investment into mining hardware, the R&D of such hardware, and electrical expenditure.

Difficulty:

With hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly.

Bitcoin’s Difficulty measure is what prevents this from happening. It adjusts to hashrate to ensure that blocks are found roughly every 10 minutes.

Note how closely Difficulty matches Hashrate in the 2 charts above.

When total hashrate rises, the Difficulty of POW hashing adjusts upwards – and the inverse also applies.

Difficulty auto-adjusts every two weeks (or 2016 blocks).

BTC / XBT exchange rate:

Watts per hashrate per second. Electricity is the major on-going cost of Bitcoin mining. The price paid per Watt will greatly influence profitability.

Mining Pool:

Unless you command a tremendous hashrate, your odds of solving a block by yourself (i.e. “solo-mining”) are extremely low.

By banding together with other miners in a so-called pool, your combined odds of solving a block rise proportional to the pool’s total hashrate.

Whenever they solve blocks, pools reward individual miners according to their contributed hashrate (minus commissions and the like).

Calculating Mining Profitability

With these terms in mind, it’s possible to calculate the current profitability (circa March 2017) of Bitcoin mining for your circumstances.

The future profitability of mining cannot be reliably predicted.

This is due to the ever-changing nature of the Difficulty modifier and the BTC price, in particular.

To begin, we must select a suitable ASIC mining rig. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison :

Although Bitcoin Wiki doesn’t list many models as currently shipping on from their manufacturers, all these mining rigs (and more) are available for resale as new or used.

The AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption.

It’s pretty much the cutting edge of mining tech so we’ll select it for our example.

The S9 is available for roughly $1800 up to $2400 from Amazon, or about $1365 from BitMain, shipping excluded. Power supply units will add another $120 or so to the price.

Next, we need to enter the S9’s specs and cost, as well as other info such as power cost and pool fees, into a suitable number-cruncher.

CoinWarz.com offers a good mining profitability calculator, which automatically fills in the current BTC price, Difficulty and block reward info. Note that the Hardware Costs field does not seem to influence the final calculation.

Scenario 1: Big Chinese Miners

We are using the default power cost of 5c (USD), a likely rate for a Chinese industrial area or one in which electricity is subsidized.

To determine your own power cost, check worldwide electricity prices or your utility bill for the exact price.

The 0% Pool Fee assumes a mining farm large enough to run its own pool. Smaller pools will generally offer lower or even no fees, but keep in mind they will seldom find blocks.

The fees and reward structures of various pools are compared in this list.

Once all the necessary info is entered, hit Calculate for the profitability result:

An excellent result! At this rate, the S9 unit would pay for itself within a year as well as make about $600 in profit! As a large miner would be able to negotiate a lower unit price on each S9, we can assume they’ll research profit even sooner.

Scenario 2: An American Hobby Miner

Before getting too excited about your potential mining profits, let’s recalculate them using the average residential Power cost per kWh in the USA (

12.5c) and a typical pool fee of 1%.

It’s not looking so great now.

At a Bitcoin price around $1150, it appears that the average American home miner makes only $1348 a year, assuming difficulty and price hold steady. In other words, the unit will pay for itself within a year.

This is a dangerous assumption! Bitcoin’s total hashrate – and thus its difficulty, has been consistently rising since the early years, sometimes jumping by double digit percentages within a month!

Therefore, any calculations should be regarded skeptically, as likely best-case scenarios.

Sources of Unexpected Profit Loss:

Difficulty Spikes, Price Crashes, Equipment Failures, Power Cuts, Shipping Delays & More!

Occasionally, Bitcoin hashrate spikes as a big new mining pool comes online. This happened in early 2016:

It’s quite possible that even some big, corporate miners found their profit margins under threat from the resulting steep spike in competition. Indeed, in mid-2016, Swedish Bitcoin mining firm KnCMiner declared bankruptcy.

The home miner really has no chance to compete in such a challenging environment, unless they have access to free or extremely low-cost electricity…

Also bear in mind that the rate of obsolescence in Bitcoin mining hardware is quite fast! New, more efficient mining hardware may be released at any time, although we are reaching the technological limits of improved efficiencies.

If (pre-)ordering any such equipment, be aware that potential manufacturing, shipping, customs or other delays could end up being very costly as difficulty rises or price falls during the interim.

There are plenty of other things which can wrong, for example:

- hardware failures,

- power outages,

- network disconnections &

- price crashes.

Such downside risks must always be factored into any sound business plan.

Conclusion

The average home miner will struggle to be profitable or recoup the cost of mining hardware and electricity.

Profitability is highly unlikely given the current circumstances.

The situation may improve in future once ASIC mining hardware innovation reaches the point of diminishing returns.

That, coupled with cheap, hopefully sustainable power solutions may once again make Bitcoin mining profitable to small individual miners around the world.

This would also greatly improve the decentralization of the Bitcoin network, hardening it against legislative risk.

Bitcoin Mining Pools

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

What is a Mining Pool?

Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power.

While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Miners can, however, choose to redirect their hashing power to a different mining pool at anytime.

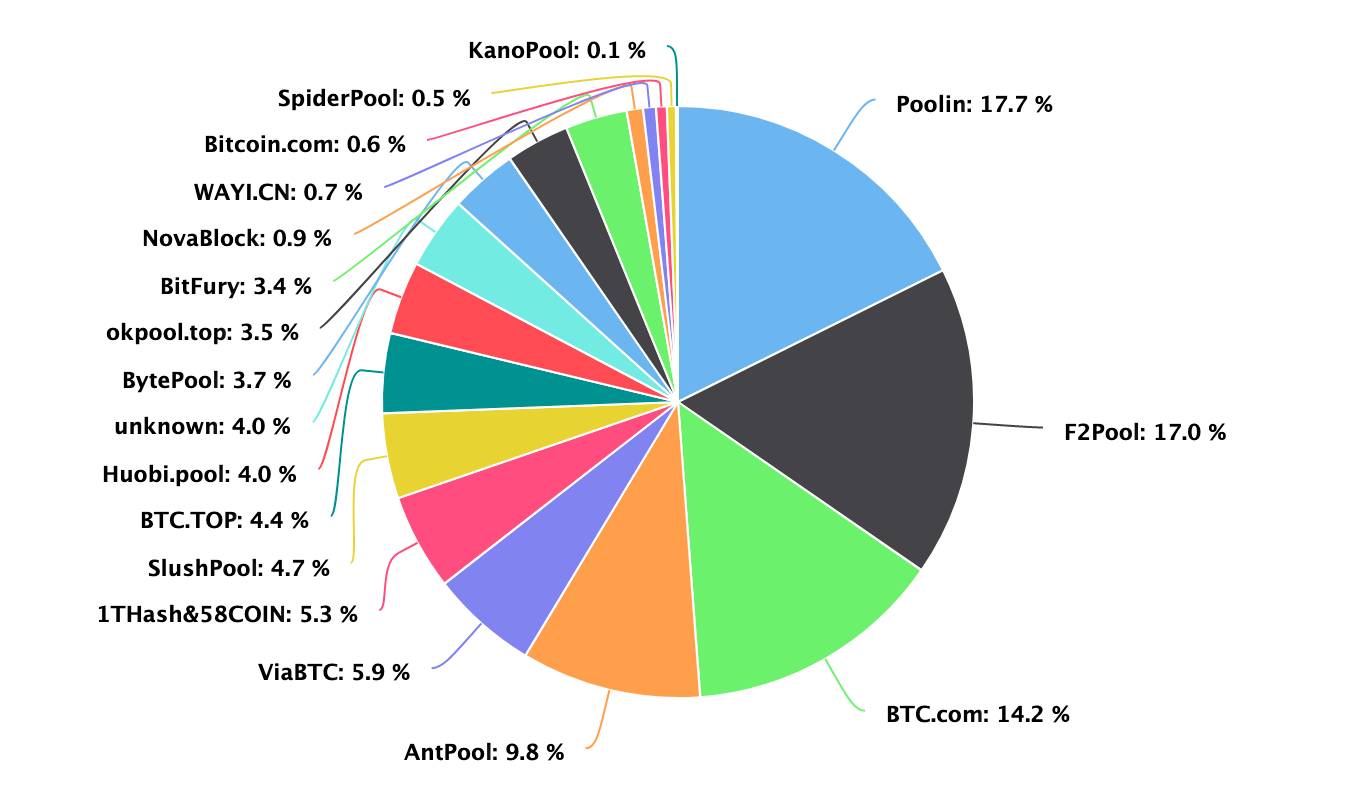

Pool Concentration in China

Before we get into the best mining pools to join, it’s important to note that most mining pools are in China. Many only have Chinese websites and support. Mining centralization in China is one of Bitcoin’s biggest issues at the moment.

There are about 20 major mining pools. Broken down by the percent of hash power controlled by a pool, and the location of that pool’s company, we estimate that Chinese pools control

81% of the network hash rate:

The Biggest Mining Pools

The list below details the biggest Bitcoin mining pools. This is based on info from Blockchain’s pool share chart:

We strongly recommend new miners to join Slush Pool despite it not being one of the biggest pools. It was the first Bitcoin mining pool and remains one of the most reliable and trusted pools, especially for beginners.

BTC.com is a public mining pool that can be joined. However, we strongly recommend joining Slush Pool instead.

Antpool is a mining pool based in China and owned by BitMain. Antpool mines about 25% of all blocks.

ViaBTC is a somewhat new mining pool that has been around for about one year. It’s targeted towards Chinese miners.

Slush was the first mining pool and currently mines about 3% of all blocks.

Slush is probably one of the best and most popular mining pools despite not being one of the largest.

DiscusFish, also known as F2Pool, is based in China. F2Pool has mined about 5-6% of all blocks over the past six months.

BTC.top is a private pool and cannot be joined.

7. Bitclub.Network

Bitclub Network is a large mining pool but appears to be somewhat shady. We recommend staying away from this pool.

BTCC is a pool and also China’s third largest Bitcoin exchange. Its mining pool currently mines about 7% of all blocks.

Bitfury is a private pool that cannot be joined. Bitfury currently mines about 2% of all blocks.

10. BW Pool

BW, established in 2014, is another mining company based in China. It currently mines about 2% of all blocks.

Bitcoin Mining Pool Comparison

The comparison chart above is just a quick reference. The location of a pool does not matter all that much. Most of the pools have servers in every country so even if the mining pool is based in China, you could connect to a server in the US, for example.

Get a Bitcoin Wallet and Mining Software

Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet.

Mining Pools vs Cloud Mining

Many people read about mining pools and think it is just a group that pays out free bitcoins. This is not true! Mining pools are for people who have mining hardware to split profits.

Many people get mining pools confused with cloud mining. Cloud mining is where you pay a service provider to miner for you and you get the rewards.

Just Want Bitcoins?

If you just want bitcoins, mining is NOT the best way to obtain coins.

Buying bitcoins is the EASIEST and FASTEST way to purchase bitcoins.

Get $10 worth of free bitcoins when you buy $100 or more at Coinbase.

Which Countries Mine the most Bitcoins?

Bitcoin mining tends to gravitate towards countries with cheap electricity.

As Bitcoin mining is somewhat centralized, 10-15 mining companies have claimed the vast majority of network hash power.

With many of these companies in the same country, only a number of countries mine and export a significant amount of bitcoins.

China mines the most bitcoins and therefore ends up “exporting” the most bitcoins.

Electricity in China is very cheap and has allowed Chinese Bitcoin miners to gain a very large percentage of Bitcoin’s hash power.

It’s rumored that some Chinese power companies point their excess energy towards Bitcoin mining facilities so that no energy goes to waste.

China is home to many of the top Bitcoin mining companies:

It’s estimated that these mining pools own somewhere around 60% of Bitcoins hash power, meaning they mine about 60% of all new bitcoins.

Georgia is home to BitFury, one of the largest producers of Bitcoin mining hardware and chips. BitFury currently mines about 15% of all bitcoins.

Sweden is home to KnCMiner, a Bitcoin mining company based in Stockholm. KnCMiner currently mines about 7.5% of all bitcoins.

The US is home to 21 Inc., a Bitcoin mining company based in California.

21 runs a large amount of miners, but also sells low powered bitcoin miners as part of their 21 Bitcoin computer.

Most of the hash power from the 21 Bitcoin computers is pointed towards 21’s mining pool. 21 Inc. mines about 3% of all bitcoins.

Other Countries

The countries above mine about 80% of all bitcoins.

The rest of the hash power is spread across the rest of the world, often pointed at smaller mining pools like Slush (Czech Republic) and Eligius (US).

A Note on Pools

While we can see which mining pools are the largest, it’s important to understand that the hash power pointed towards a mining pool isn’t necessarily owned by the mining pool itself.

There are a few cases, like with BitFury and KnCMiner, where the company itself runs the mining operation but doesn’t run a mining pool.

Bitcoin miners can switch mining pools easily by routing their hash power to a different pool, so the market share of pools is constantly changing.

To make the list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail.

The size of mining pools is constantly changing. We will do our best to keep this posted up-to-date.

If you cloud mine then you don’t need to select a pool; the cloud mining company does this automatically.

Why are Miners Important?

Bitcoin miners are crucial to Bitcoin and its security. Without miners, Bitcoin would be vulnerable and easy to attack.

Most Bitcoin users don’t mine.

However, miners are responsible for the creation of all new bitcoins and a fascinating part of the Bitcoin ecosystem.

Mining, once done on the average home computer, is now mostly done in large, specialized warehouses with massive amounts of mining hardware.

These warehouses usually direct their hashing power towards mining pools.

Antpool Review

Despite recent controversy, Antpool remains the largest Bitcoin mining pool in terms of its Bitcoin network hash rate. Antpool holds roughly 15% of the total hash rate of all Bitcoin mining pools.

About Antpool

Antpool mined its first block in March 2014, meaning that it emerged roughly four years after the first mining pool; Slushpool.

Antpool is run by Bitmain Technologies Ltd., the world’s largest Bitcoin mining hardware manufacturer, and a large portion of their pool is run on Bitmain’s own mining rigs.

Antpool supports p2pool and stratum mining modes with nodes that are spread all over the world to ensure stability (US, Germany, China etc.).

Also, Antpool’s user interface is surprisingly slick considering that the underlying company thrives mostly off of hardware sales.

How to Join Antpool

The pool is free to join and the process is simple.

First, you need to acquire Bitcoin mining hardware. Then you need to download mining software. If you need help deciding, I suggest you take a look at our hardware and software guides.

Hardware is important because it determines the size of your contribution to the pool’s hash rate. Software is important because it enables you to direct your hardware’s hash power towards the pool you prefer. So make sure to make the right choice in order to optimize your rewards.

Finally, sign up at antpool.com to get started.

What are Antpool’s Fees?

Antpool claims that it does not charge any fees for using its pool. Although there is some truth to this claim, it is not 100% correct.

While Antpool does not directly charge fees, it also does not disclose the Bitcoin transaction fees that are collected. Basically, clients are left in the dark. Currently, every Bitcoin block has a 12.5 BTC reward which Antpool does share with you when it finds a block.

Lately, however, Bitcoin transaction fees have been rising and an additional 1-2 bitcoins are collected per block by pools. At this time, Antpool keeps 1-2 bitcoins form transaction fees for itself, which are not shared with miners who have hash power pointed toward the pool.

It can be argued that these rates prevent the service from being usable for small-time and big-volume users. Consequently, some users on bitcointalk.org heed that the undisclosed fees make the service unwise to use for the time being.

What is the Payout Threshold?

The pool does not appear to have a payout threshold and pays out every day around 10 AM UTC.

The minimum withdrawal amount is 0.0005 BTC (other sources say 0.001 BTC).

Can you do Solo Mining on Antpool?

Solo mining means you mine for bitcoins without joining a pool. So if you use Antpool you are not solo mining by default.

Generally, you will receive more frequent payouts by joining a pool.

What is the Controversy around Antpool?

Antpool has refused to enable arguably beneficial upgrades to Bitcoin for reasons based on claims that have been largely disproved. Notably, this has taken place with somewhat of a vindictive attitude.

More specifically, the controversy revolves around Segwit – a feature that requires miner activation to be enabled. Despite the fact that most Bitcoin users want this feature activated, Antpool, among other pools, appears to be blocking this feature.

Antpool began signaling for Bitcoin Unlimited in early March 2017 for reasons that have not been elucidated by Bitmain CEO (and cofounder Jihan Wu).

Antpool claims that it will only signal for Segwit if there is a hardfork, which is a proposition that most users oppose. Furthermore, allegations that the owner refuses to sell hardware to Segwit supporters have also begun to circulate.

By using Antpool, you allow the pool to decide your hardware’s approach to these matters, meaning that the pool that you used dictates the type of Bitcoin protocol that your hardware employs. If you wish to decide which implementation your hardware should signal for, you can use a pool that leaves the choice to its users, like the Slush mining pool.

Bitfury Information

According to BlockTrail, Bitfury is the third largest Bitcoin mining pool and mines about 11% of all blocks.

The main difference between the Bitfury pool and other mining pools is that Bitfury is a private pool.

Bitfury, the company, makes its own mining hardware and runs its own pool. So, unlike Slush or Antpool, Bitfury cannot be joined if you run mining hardware at home.

Bitfury 16nm ASIC Chip

Unrelated to its pool, Bitfury sells a 16nm ASIC mining chip.

Although Bitfury controls a large portion of the Bitcoin network hash rate, its committed to making Bitcoin decentralized :

BitFury is fundamentally committed to being a responsible player in the Bitcoin community and we want to work with all integrated partners and resellers to make our unique technology widely available ensuring that the network remains decentralized and we move into the exahash era together.

Valery Vavilov, CEO of BitFury

BTCC Mining Pool Review

BTCC Mining Pool is run by BTCC, a Bitcoin company based in China. The company also runs a Bitcoin exchange, wallet, prints physical bitcoins and more!

Worldwide Servers

BTCC runs servers all over the world so your mining hardware can connect easily to the BTCC pool.

So even though BTCC is based in China, don’t be worried that you can’t use or join the pool:

Our mining pool currently has customers from the United States, South America, Europe, China, and Africa.

Bobby Lee, BTCC CEO

Shared Transaction Fees

One great thing about BTCC pool is that it shares Bitcoin transaction fees with its miners.

In every Bitcoin block, around 1-2 BTC worth of transaction fees are also rewarded to the pool.

Some pools keep these fees for themselves and DO NOT share with their miners! BTCC evenly splits the transaction fees among its miners, just like it splits the 12.5 BTC reward.

Slush Pool Review

Slush Pool is run by Satoshi Labs and was the world’s first ever Bitcoin mining pool. It’s advanced yet also a great pool for beginners.

How to Join and Use Slush Pool

Slush Pool is easy to join.

- First, register an account.

- Configure your mining software to point your hardware’s hash power to Slush Pool.

- Enter your Bitcoin wallet address that will receive the payouts.

Here is a helpful video that shows you how to get started:

Slush Mining Pool URLs

According to Slush’s website, there are the current URLs for the mining pool. You will want to point your software towards the URL location closest to you. This will maximize your mining profits.

USA, east coast:

Europe

China, mainland

Asia-Pacific/Singapore:

What are Slush Pool’s Fees?

Slush Pool charges 2% of all payouts.

This may seem like a lot but unlike other pools it shares the transaction fees with its miners. At current levels, these amount to 1-2 BTC more per block.

Satoshi Labs

Satoshi Labs runs Slush Pool. They also make the Bitcoin TREZOR hardware wallet and Coinmap.org.

Ethereum Mining Pool

Many people want to use the pools above for Ethereum too. But, most of the pools listed above are only for Bitcoin mining. Please see our post on Ethereum mining pools for more info on ETH specific pools.

Litecoin Mining Pool

Like Ethereum, none of the pools above support litecoin. For LTC mining you will need separate hardware and a separate pool.

Bitcoin Mining Pool Taxes

You’ll have to consult an accountant or lawyer in your area. But most likely you will have to pay income tax on income from mining pools just like you would for any other type of income.

Best Bitcoin Mining Hardware for 2018 – Bitcoin Miner Reviews

The following page reviews the best hardware available today in order to make some sort of a profit with Bitcoin mining.

If you’re completely new to Bitcoin mining please read our “Is Bitcoin mining still profitable?” post before moving on. It will give you a good idea about the profitability of mining and will make you think twice before entering this very competitive niche.

If however, you are aware of the competitive nature of Bitcoin mining and still want to get in the game, here you will be able to find the best Bitcoin mining hardware available. The good news is that there are not many mining hardware companies left that make ASIC miners so choosing will probably be easy. That’s also the bad news. Even though many websites state long lists of Bitcoin mining hardware, only a handful of mining rigs can deal with the rising Bitcoin mining difficulty that’s out there these day.

How to compare Bitcoin miners

Below is a side by side comparison of all relevant miners. Underneath the table you’ll be able to see a summarized review of each of the miners. Keep in mind that in order to see how profitable you can be with any Bitcoin miner you’ll need to use a Bitcoin mining calculator based on your electricity cost, the Bitcoin exchange rate and the increase in difficulty throughout time. Since not all of these variables are known you will have to guess some as best as you can.

Select miner

AntMiner S9

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

Use our basic Bitcoin mining calculator to help you compare miners

Antminer S5 Bitcoin Miner Summarized Review

The Antminer S5 is the entry level Bitcoin miner for someone who isn’t ready to part away with more than a few hundred bucks. Users who have purchased it seem mostly pleased with the device. However this is an outdated device and with today’s mining difficulty and decreasing block reward you won’t make more than 0.05 BTC each money in revenue. This means you’ll need to run it for about one year and 8 months to get a full Bitcoin. Some customers also complained about the device being too noisy, but that’s just how a miner works – it’s loud and hot.

Click here to view Antminer S5 deals on eBay

Avalon 6 BitcoinMiner Summarized Review

The Avalon 6 is a great contender for both S5 and S7 AntMiners. From the small number of reviews that can be found online people are saying that it’s not nearly as loud as your usual miner and the hash rate is pretty reasonable. However at the current price tag I see little reason to choose it over the competition, it’s $100 more than the S7 that brings to the table superior results.

Click here to view Avalon 6 deals on eBay

Antminer S7 Bitcoin Miner Summarized Review

The Antminer S7 was the raining champion up until a few months ago. Even at today’s difficulty levels and with the block reward halving you can still make 0.15BTC a month. It’s not a lot at the moment but if the Bitcoin price continues to rise it may be a profitable investment.

However I wouldn’t suggest buying this rig due to the fact that it’s neither here nor there. It’s too expensive for an entry-level device and it’s too weak to generate any substantial amount of Bitcoins. Users who bought the device seem generally happy with it however it was first introduced on August 2015, so it’s not that new.

Antminer S9 Bitcoin Miner Summarized Review

The most advanced and most efficient Bitcoin miner today is the Antminer S9. If you’re serious about Bitcoin mining this is your rig. At the current difficulty this miner can mine around 0.02 Bitcoins every month which makes it seem like it would break even within a year. However we did not take into account the electricity costs, pool fees and hardware cost. Not to mention the fact the difficulty can rise and the Bitcoin price can drop.

It seems that even though this is the toughest miner out there, there’s only a small amount of time until it too will become outdated. Until that happens though, it looks like a pretty reliable piece of equipment.

Antminer R4 Bitcoin Miner Summarized Review

The Antminer R4 is intended for hobby mining – basically people who want to mine Bitcoins at home. Even though it can’t compete with the S9 it will probably be a good contender for the S7. The main advantage it has over other miners is the fact that it is has a specialized cooling unit that is much quieter than any other Bitcoin miner out there – since it’s made for a home environment.

According to our mining calculator this miner should break even in about 12 months. However if Bitcoin’s price continues to rise this miner may yet yield a good return on investment.

Avalon 7 Bitcoin Miner Summarized Review

The Aavalon 721 (or Avalon 7 as it is known commonly) is the latest Bitcoin miner supplied by Avalon in late 2016. It has a lower price tag than most of the advanced miners but is also less powerful. It seems to be a good choice for people who are looking for a cheaper entry level miner and don’t want to go for an Antminer S7.

According to our calculations, this miner should break even in about 24 months, making it a pretty risky investment. You can also connect up to 5 Avalon 721s in a row creating a powerful 30 TH/s mining rig.

Antminer T9 Bitcoin Miner Summarized Review

The Antminer T9 is a more reliable, cheaper version of the successful S9 model. However, the T9 uses almost 30% more power than the S9 making it much less attractive in terms of return on investment. If you want to get up and mining as soon as possible and reliability is more important to you than efficiency, then we’d say the T9 is a reasonable choice. If you don’t pay for power and just want a good, fast miner you can “fire up and forget,” the Antminer T9 will fit the bill nicely.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Welcome to COINBLOCKERS

Bitcoin Gold (BTG) Mining Pool since Nov 14, 2017

Facts & Features

Currently we charge 1% fee.

Payout starts from 0.01 BTG. Payment Mode: PPLNT

Anonymous mining and privacy is guaranteed

Statistics

Detailed statistics for all your rigs, worker and BTG address.

Frequently maintained Stratum/Pool code. SSL mining for improved security.

Mining Rig Rentals

Mining Rig Rentals Port (7777) to support high demands.

Stable and DDOS protected Server with

Cached Frontend.

Bitcoin Mining

What is Bitcoin Mining?

Bitcoin Mining is a peer-to-peer computer process used to secure and verify bitcoin transactions—payments from one user to another on a decentralized network. Mining involves adding bitcoin transaction data to Bitcoin's global public ledger of past transactions. Each group of transactions is called a block. Blocks are secured by Bitcoin miners and build on top of each other forming a chain. This ledger of past transactions is called the blockchain. The blockchain serves to confirm transactions to the rest of the network as having taken place. Bitcoin nodes use the blockchain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

What is Proof-of-Work?

Bitcoin Mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady over time, producing a controlled finite monetary supply. Individual blocks must contain a proof-of-work to be considered valid. This proof-of-work (PoW) is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses a PoW function to protect against double-spending, which also makes Bitcoin's ledger immutable.

How Does Mining Create New Bitcoins?

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce bitcoins into the system. Miners are paid transaction fees as well as a subsidy of newly created coins, called block rewards. This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system through mining.

What Are Bitcoin Mining Pools?

During the last several years an incredible amount of Bitcoin mining power (hashrate) has come online making it harder for individuals to have enough hashrate to single-handedly solve a block and earn the payout reward. To compensate for this pool mining was introduced. Pooled mining is a mining approach where groups of individual miners contribute to the generation of a block, and then split the block reward according the contributed processing power.

Комментариев нет:

Отправить комментарий