Bitcoin Mining in China

China is the undisputed world leader in Bitcoin mining.

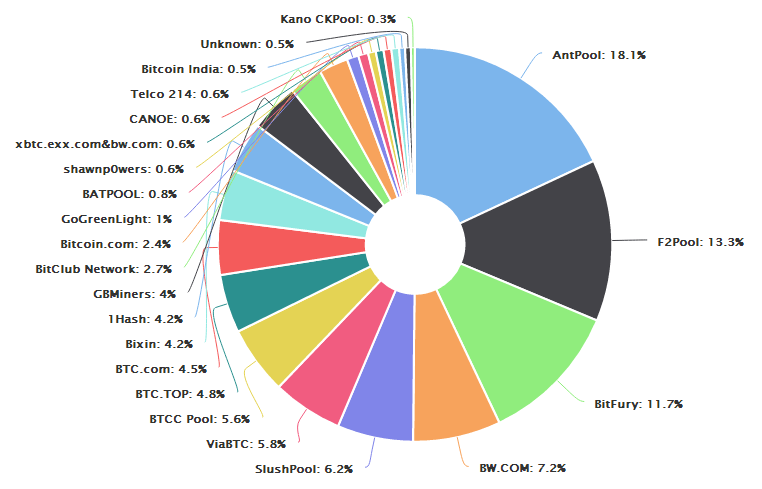

Chinese mining pools control more than 70% of the Bitcoin network’s collective hashrate.

Here is our estimated* mining hash power breakdown by country:

15% of the hash rate is missing from above chart, but it’s likely that China crontrols an even greater amount.

Not only does China manufacture most of the world’s mining equipment, but massive mining farms are located there to take advantage of extremely cheap electricity prices.

China also accounts for hefty Bitcoin trading volumes. Chinese exchanges used to lead the world in terms of volume.

Chinese volume has fallen substantially since the PBOC decreed that exchanges could no longer offer 0% trading fees. This ruling flushed a lot of wash trading from the Chinese exchanges.

So, just why is China the world’s leader in Bitcoin mining?

Reason #1: Cheap Electricity

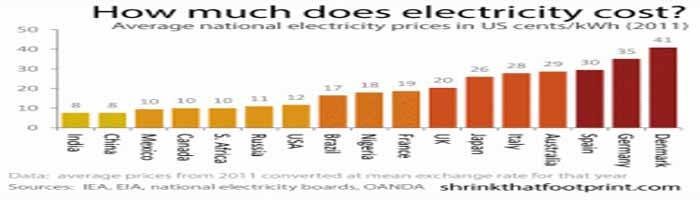

Electricity cost is the most important factor for a profitable mining operation. As mining difficulty increases, the least efficient miners are forced to shut down first.

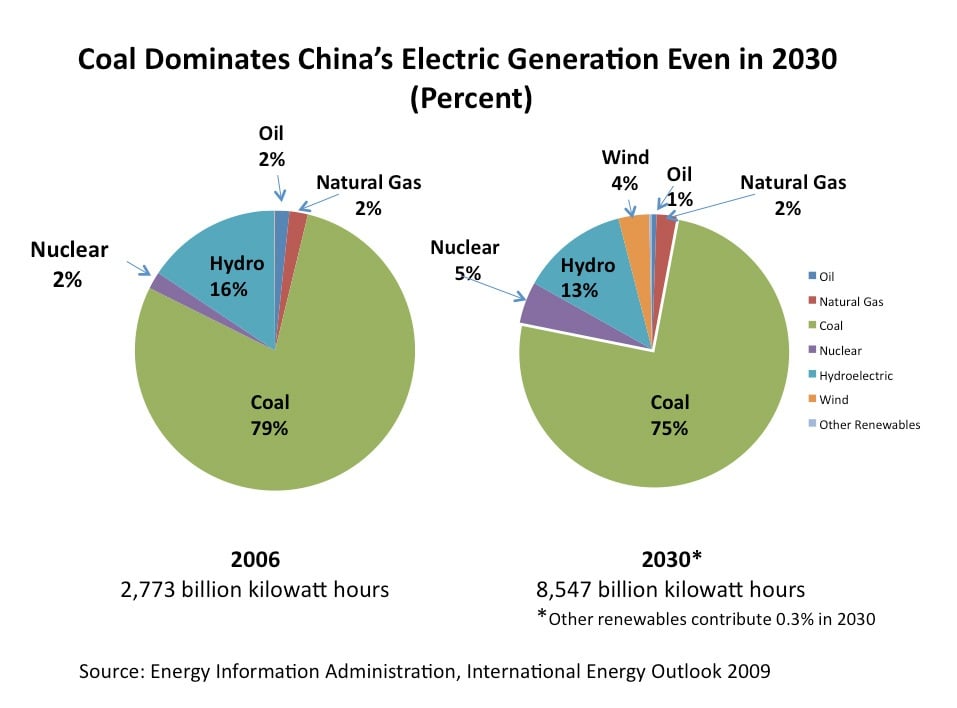

Electricity in China is extremely cheap compared to most other countries. Chinese electricity in industrial regions is either supplied by hydro-electric facilities or subsidized by the state.

China’s cheap electricity keeps Chinese miners at peak efficiency and allows them to outlast their foreign competitors.

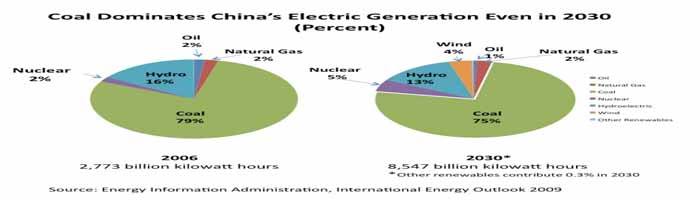

Reason #2: Excess Coal

Coal is the cheapest power source but also the dirtiest. It’s well-known that China has comparatively lax environmental policies. Major cities like Beijing are notorious for their high levels of smog, produced mostly by burning coal.

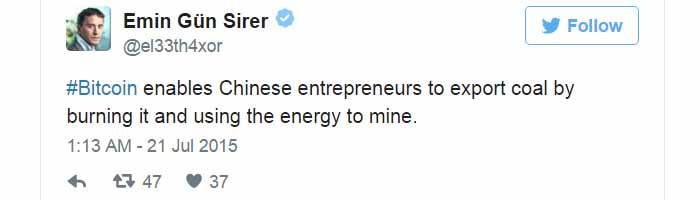

Energy producers can freely burn coal and use the energy for Bitcoin mining. Instead of physically transporting the coal, it’s easier and more cost-effective to establish a Bitcoin mining operation near a source of coal and convert carbon directly to crypto.

#Bitcoin enables Chinese entrepreneurs to export coal by burning it and using the energy to mine.

— Emin Gün Sirer (@el33th4xor) July 20, 2015

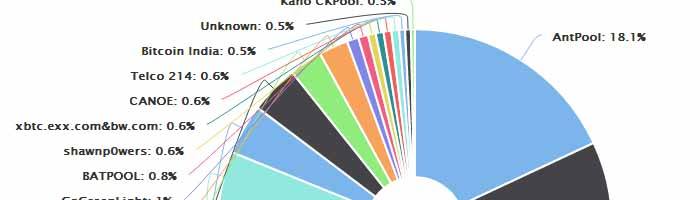

Reason #3: Leading Bitcoin Mining Pools

Mining pools, as the name implies, are collaborations between individual miners and, frequently, major mining companies. Their hashrate is combined so that the pool has a better chance of finding a block. The block reward is then shared among all contributing members, according to their proportional hashrate.

The result is that many miners outside of China are attracted to Chinese mining pools due to their size. The bigger a pool, the more steady and predictable a member’s earnings. Many miners are lured by the prospect of small, steady earnings as part of a major pool, as opposed to the high- reward-but-low-odds lottery which is solo or small-pool mining.

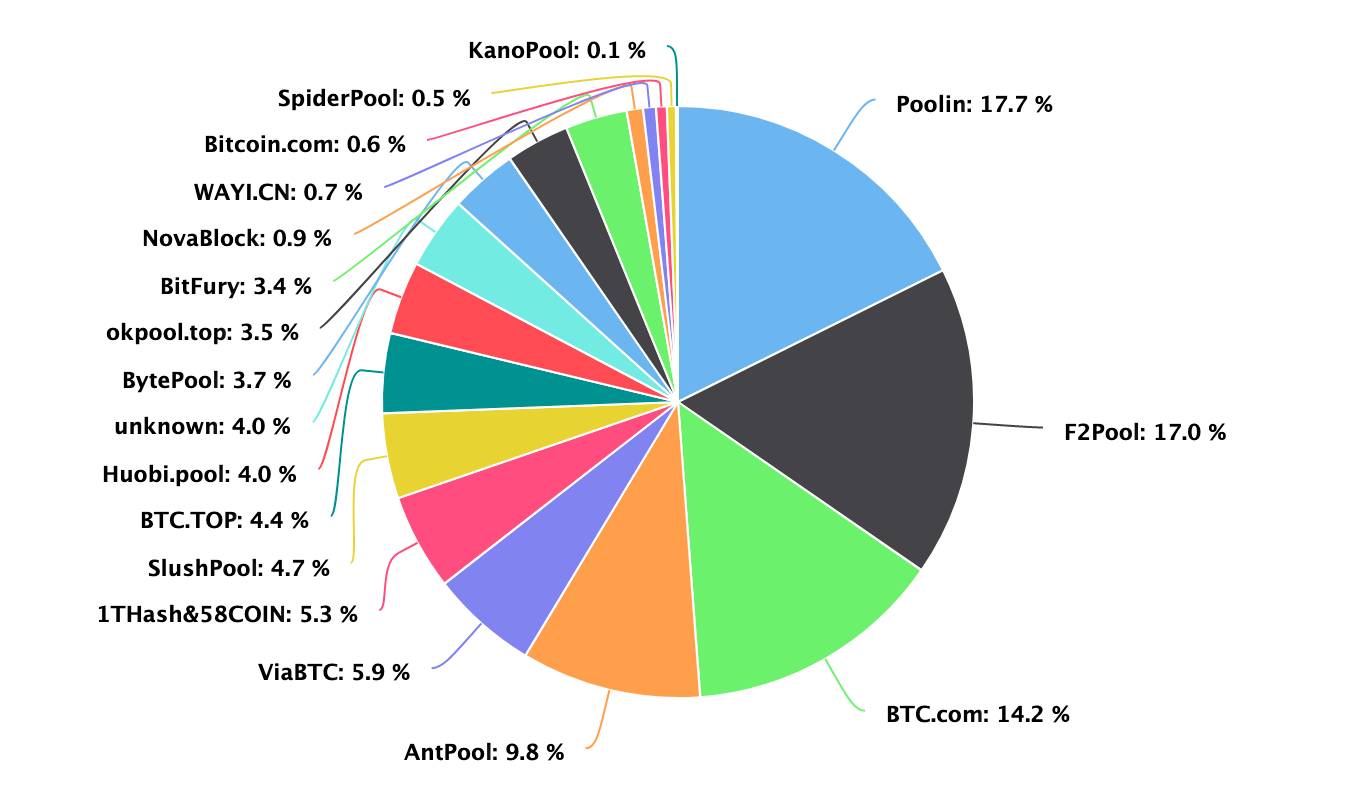

China is home to four of the five largest Bitcoin mining pools over the past year. As of the 29 th of March, 2017, the distribution of hashrate was as follows:

1. AntPool

Antpool is another Chinese based mining pool, maintained by the ASIC manufacturer, BitMain. Antpool has mined nearly 20% of all blocks over the past year. Antpool currently has a hashrate of about 675 Petahash per second (PH/s).

There is some speculation that AntPool disguises its true hashrate by running subsidiary pools. These are said to include ViaBTC, BTC.com, GBMiners, CANOE and possibly others.

2. F2Pool / DiscusFish

F2Pool, also known as DiscusFish, is based in China. F2Pool has mined about 18.5% of all blocks over the past twelve months. At the time of writing, it controlled about 380 PH/s.

3. BTCC

BTCC is China’s third largest Bitcoin exchange and also operates a large mining pool. The BTCC pool has mined about 11% of all blocks over the past year. It controls about 240 PH/s.

4. BW Pool

BW, established in 2014, is another mining company based in China. BW’s pool has mined about 10% of all blocks over the last year. It controls in the region of 225 PH/s.

So, what does this situation mean for Bitcoin? Sadly, nothing good:

Mining Centralization

There’s a definite downside to China’s mining dominance:

Centralization!

Having so much mining power centralized in any single country exposes the Bitcoin network to a worrying degree of political risk.

Should the Chinese government decide to crack down on Bitcoin, perhaps seeing it as a threat to their economy or a competitor to their own planned digital currency, they could wreak untold havoc in the Bitcoin ecosystem.

Inside a Chinese Bitcoin Mining Operation

The video below offers an inside look at how Bitcoin mining farms in China operate:

*This section will provide insight on how we calculated our mining estimation chart.

We looked at the network hash rate chart at blockchain.info.

At the time of writing, here are the Chinese pools and their respective hash rates:

- Antpool - 21.9%

- BTC.top - 13.8%

- F2pool - 8.6%

- BTCC Pool - 7.9%

- Bixin - 6.7%

- ViaBTC - 6.5%

- BW.com - 4.8%

- 1Hash - 1.2%

- Batpool - 0.6%

The total from these pools is 72%.

For India, GBMiners controls

3.4% of the hash rate while Bitcoin India has

0.3%. This gives 3.7% for India.

BitFury has most of its hardware running in Georgia, and Bitfury is at 2.3%.

BitClub has most of its farms in Iceland and at time of writing is at about 2% of hash rate.

There are no pools that definitely point towards the USA and Venezueland having lots of hash power, but it is known that there is decent mining activity in these countries.

China wants an “orderly exit” from bitcoin mining

Written by

Written by

Bitcoin mining could be on its last legs in China.

The country’s top internet-finance regulator, the Leading Group of Internet Financial Risks Remediation, issued a notice asking local governments to “guide” bitcoin-mining operations to make an “orderly exit” from the business, according to a leaked document online . Citing government sources, Bloomberg and Reuters earlier reported that China is planning to limit electricity supply to bitcoin miners.

“Currently, there are some so-called ‘mining’ enterprises that produce ‘virtual currencies.’ They have consumed huge amounts of resources and stoked speculation of ‘virtual currencies,’” according to the document dated Jan. 2.

The document, issued to local offices of the internet-finance regulator, asks local authorities to use measures linked to electricity price, land use, tax, and environmental protection, among other things, to guide bitcoin miners to quit the business. It also asks the local offices to report information about mining facilities in their regions, as well as the progress of the exits from mining by Jan. 10, and then on the tenth day of every month.

Calls to the contact number on the document went unanswered.

Also leaked online was a separate document from the internet-finance regulator’s Xinjiang office, dated Jan. 4. The document asks the local authority in the western region to report miners’ exit progress by the fifth day of each month. It also cited concerns over energy usage and speculation as in the national-level document.

When reached by Quartz in a phone call, Zhang Qiubin from the Xinjiang office confirmed the authenticity of the local document, but refused to comment on the national-level one. But both documents note that the regulatory decisions on bitcoin mining were made during a November meeting between the internet-finance regulator and its local branches.

The Leading Group of Internet Financial Risks Remediation was set up by China’s cabinet in 2016, with Pan Gongsheng, a deputy governor of the Chinese central bank, as its head. Pan said in December that the central bank has made the right decisions in banning initial coin offerings (ICOs) and shutting down local cryptocurrency exchanges . He also predicted the death of bitcoin .

China accounts for more than two-thirds of the world’s processing power devoted to bitcoin mining. It’s also home to some of the world’s leading creators of mining hardware, which usually also operate large mining pools—groups of miners who agree to add up their resources to improve their odds of finding bitcoin.

The latest crackdown on bitcoin mining comes amid China’s efforts to better distribute electricity to places where power is undersupplied. Bitcoin miners have taken advantage of cheap power in coal-abundant areas like Xinjiang and Inner Mongolia in recent years to expand their operations.

It’s also worth noting that Beijing worries about social chaos triggered by small investors who lose money investing in risky financial products, and has cracked down on investment vehicles like peer-to-peer lending and online insurance . Shutting down crypto exchanges would be on its own insufficient to curtail the hype around bitcoin and other cryptocurrencies, as the documents indicate.

Already, some of the biggest bitcoin miners in China are moving operations overseas , with the US and Canada among popular options. But still, industrial players have doubts over how effective the state crackdown could be: For one thing, local governments have strong incentives to keep big mining firms running in their localities, given the huge tax and electricity bills they pay. An employee with Beijing-based Bitmain, which runs some of the world’s largest mining facilities, told Quartz that the company hasn’t heard anything from the Xinjiang government regarding its mining operations there.

As to mining farms owned by smaller players, especially those in the mountainous areas of Sichuan and Yunnan provinces, simply locating the miners is a near impossible task. A growing number of private owners of hydropower plants in the two regions have begun to operate mining machines themselves as the price of bitcoin has surged, Du Jun, founder of Node Capital, a Beijing-based venture-capital firm focusing on the blockchain industry, told Quartz prior to news of the latest crackdown. “How can you find them?” he asks.

Chinas Dominance In Bitcoin Mining

China can't be beaten in terms of leading the world of Bitcoin mining. Mining pools of Chinese dominates above sixty percent of the entire hashrate collectively in Bitcoin network.

They don't just produce the mining equipment of the world but also huge and gigantic farms were located in their vicinity to make opportunities such as cheaper electricity prices.

Trading volumes also of Chinese Bitcoiners are huge accounts. It largely lead the world of Bitcoin exchanges when talking about volume.

On the other hand :

On the event where PBOC ruled out about no 0% trading fees offer anymore, Chinese volumes constantly fallen. The decree actually made a large amount of wash trading for Chinese trading.

So what's behind China's becoming the world leader on mining Bicoins?

1. Cheap Electricity

Power cost is the most imperative component for a gainful mining operation. As mining trouble builds, the minimum effective miners are compelled to close down first.

Power in China is amazingly modest contrasted with most different nations. Chinese power in modern locales is either provided by hydro-electric offices or financed by the state.

China's modest power keeps Chinese excavators at pinnacle productivity and permits them to outlive their outside rivals.

2. Excess Coal

Coal is the least expensive power source additionally the dirtiest. It's notable that China has similarly remiss natural approaches. Significant urban areas like Beijing are infamous for their elevated amounts of exhaust cloud, delivered for the most part by consuming coal.

Vitality makers can unreservedly consume coal and utilize the vitality for Bitcoin mining. Rather than physically transporting the coal, it's less demanding and more savvy to set up a Bitcoin mining operation close to a wellspring of coal and change over carbon straightforwardly to crypto.

3. Leader of Mining Pools

Mining pools, as the name suggests, are coordinated efforts between individual mineworkers and, as often as possible, real mining organizations. Their hashrate is joined so that the pool has a superior possibility of finding a piece. The piece reward is then shared among every single contributing part, as indicated by their relative hashrate.

The outcome is that numerous mineworkers outside of China are pulled in to Chinese mining pools because of their size. The greater a pool, the all the more unfaltering and unsurprising a part's income.

Numerous mineworkers are attracted by the possibility of little, relentless profit as a feature of a noteworthy pool, rather than the high-compensate yet low-chances lottery which is solo or little pool mining.

China is home to four of the five biggest Bitcoin mining pools over the previous year. As of the 29th of March, 2017, the appropriation of hashrate was as per the following:

a. AntPool

Antpool is another Chinese based mining pool, maintained by the ASIC manufacturer, BitMain. Antpool has mined nearly 20% of all blocks over the past year. Antpool currently has a hashrate of about 675 Petahash per second (PH/s).

There is some speculation that AntPool disguises its true hashrate by running subsidiary pools. These are said to include ViaBTC, BTC.com, GBMiners, CANOE and possibly others.

b. DiscusFish / F2Pool

F2Pool, otherwise called DiscusFish, is situated in China. F2Pool has mined around 18.5% of all squares in the course of recent months. At the season of keeping in touch with, it controlled around 380 PH/s.

c. BTCC

BTCC is China's third biggest Bitcoin trade and furthermore works an expansive mining pool. The BTCC pool has mined around 11% of all squares over the previous year. It controls around 240 PH/s.

d. BW Pool

BW, built up in 2014, is another mining organization situated in China. BW's pool has mined around 10% of all squares throughout the most recent year. It controls in the district of 225 PH/s.

Things being what they are, what does this circumstance mean for Bitcoin? Unfortunately, no good thing:

Mining Centralization

There is also a disadvantage on China's dominance.

Having so much mining power incorporated in any single nation uncovered the Bitcoin system to a stressing level of political hazard.

Ought to the Chinese government choose to get serious about Bitcoin, maybe considering it to be a danger to their economy or a contender to their own arranged computerized cash, they could wreak untold destruction in the Bitcoin environment.

China Intensifies Crackdown On Bitcoin Mining

- More on Bitcoin

Why Nobel Economist Robert Shiller Is Still A Bitcoin Skeptic

Ex-JPM Blockchain Lead Announces New Venture

Dorsey: Internet Deserves Its Own Cryptocurrency

US Drifting Toward Non-Uniform Currency: Fed Exec

China intensified its efforts to crack down on bitcoin miners this week by putting out a notice that calls for government task forces to “actively guide” in the closure of bitcoin mining operations. (See also: China Curbs Electricity For Bitcoin Miners).

A report in the Wall Street Journal states that the notice calls for an “orderly exit” and does not mention a deadline. It further states that bitcoin mining “consumes a large amount of electricity and also encourages a spirit of speculation in “virtual currencies.” It also characterizes bitcoin mining among activities that “deviate from the needs of the real economy.”

Government officials in China have been asked to wield a policy axe on the cryptocurrency. This means that they will cite or promulgate regulation to limit various aspects of bitcoin mining, including electricity consumption, land use, tax collection, and environmental regulation.

The Importance Of China In The Bitcoin Mining Ecosystem

China plays an important role in the bitcoin mining ecosystem. In the last month, it accounted for 80% of all mined bitcoins. The country offers several advantages to bitcoin miners from cheap electricity to centralized mining operations. Both factors have helped sustain bitcoin’s price. For example, energy bills represent 90% of overall costs for bitcoin mining.

China’s supply of plentiful hydropower and cheap coal have helped power companies optimize their operations during downtime. (See also: Hydropower: The Key To Future Bitcoin Mining?)

Some claim that the centralization of bitcoin mining in the country has led to the development of an efficient hash rate for bitcoin. In turn, this has helped maintain a constant supply of bitcoin and ensured profitability for miners despite rising costs and fees. (See also: 5 Best States For Bitcoin Mining And The Worst.)

Will It Affect Bitcoin Mining Operations?

To be sure, China’s crackdown is not a bolt from the blue. Several prominent bitcoin mining operations have already moved out of the country. For example, Bitmain, the world’s largest bitcoin mining pool, has set up operations in Inner Mongolia. Others are moving to cooler climes, such as Iceland.

According to recent reports, Canada is expected to be a major beneficiary of the shift in Chinese policy. Since the Chinese government has not specified a deadline, it is likely that bitcoin’s price will not experience radically volatile moves due to the development.

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin. It is unclear whether he owns other bitcoin forks.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Why China is Leading the Global Rise of Bitcoin

The bitcoin story in China sounds like a mini-metaphor for the Chinese economy itself: while the rest of the world was looking elsewhere, its citizens worked to acquire vast amounts of new wealth before bursting into the headlines only recently as a superpower.

As of this November, China is home to the world's largest-volume bitcoin exchange (BTC China), some of the largest mining operations, and could well be leading the global rise of bitcoin.

It was in May that China surpassed all other countries with 84,000 bitcoin wallet downloads, a world record few noticed.

Then came a half hour CCTV2 (Chinese state-owned television) documentary on digital currencies which sparked local interest, and even provoked a mining boom.

There was a gold rush as the Chinese tech community constructed mining rigs on a grand scale, paying $12,000-$15,000 for hardware and recouping their setup costs within a few weeks. Although increased difficulty means it's now more a matter of months before breaking even, mining remains a popular pursuit.

China now also has the world's second-highest number of bitcoin nodes according to Bitnodes, with 14,100 online in September 2013 (that's 11.3% of the global total).

BTC China, world #1

China's main exchange, BTC China, beat Mt. Gox and Bitstamp to become the world's highest volume bitcoin exchange at the end of October. Also this week, BTC China secured $5m in funding from Lightspeed Venture Partners' local arm Lightspeed China to expand its operations further.

Some 109,841 bitcoins changed hands in the week preceding 4th November, compared with Bitstamp's 93,372 and Mt Gox's 76,673. Unlike the world's other large-volume exchanges, BTC China does not charge any transaction fees.

CEO Bobby Lee, a long-term resident of the US, returned to China a few years ago and joined BTC China in April 2013 to help bitcoin fulfill its promise in the world's second largest economy.

He notes it was actually China that set the record for bitcoin value that month:

"The all-time high price record was set in mid-April, at CNY 1,944. Very few people know about this — our all-time high price equated to $308, whereas most media sources quote $265 as the all-time price (on MtGox/Bitstamp), back in mid-April.

So for a good 12+ hours back in April this year, people in China were trading bitcoin well above the $265 levels."

BTC China then went on to surpass its own record with a CNY 1,978 value on 8th November 2013. At the time of writing, the value was CNY 2,726.01, or around $447.43.

At present, BTC China trades only Chinese currency* for bitcoins. Though the site has an English interface, limited access to that currency globally limits its user base to China residents.

A local view

One such resident is Zennon Kapron, a Shanghai-based Canadian bitcoin enthusiast who performs research and consulting to the financial technology world through his company Kapronasia.

He also writes regularly on Chinese business issues and delivered a presentation titled Bitcoin in China: Chomping at the Bit? at the recent Bitcoin Singapore 2013 conference.

To what does he attribute bitcoin's popularity in China, and how could others benefit from it?

"There's BTC China's no-fee trading for starters. You can leave your money on the platform, your coins on the platform, and trade in and out for free," he said.

The entry and exit points aren't free, with a 0.5% Tenpay (China's PayPal equivalent) cash in/out fee, and a 1% bank transfer fee.

Capital controls in China are strict. It's easy to bring money into the country, but getting it out (to invest or spend) is more difficult. That means there are are plenty of wealthy Chinese citizens and residents looking to move their money around the world with greater freedom. Kapron explained:

"Some people have the equivalent of tens of millions in dollar-equivalent value in China and they want to get it out.

They want to send their children to school in Canada, the US, Australia. Wealthy families, new and old money — it's not a lack of trust in the local system, it's just a need to diversify their investments."

China's huge population is cash-heavy yet increasingly wired, he said. Domestic investment options are limited to stocks, property, and more property.

Kapronasia itself has separate entities registered in mainland China and Hong Kong, but even moving funds between the two is problematic. To do so in the fiat economy, one actually has to invoice the other and perform a currency conversion.

To test bitcoin's efficiency Kapron bought 10 BTC in the US through Coinbase, sent it directly to BTC China and withdrew the money in CNY, which "takes 20 minutes or less once you know what you're doing".

"I was shocked by how easy it was. The value was CNY 20,000 when I cashed in and CNY 30,000 when I cashed out because of bitcoin's increase in value, so I made even more," he added.

Despite the increased trading activity and media hype, the story 'on the ground' in China is smaller-scale.

The only physical stores accepting bitcoin are a couple of enthusiast cafes in Beijing and, while about 134 individual sellers on Taobao (China's answer to eBay) accept bitcoin, it is far from a popular payment option.

"This is all being driven by a very very small part of the population. When I speak to other people they're very interested and want to get involved, but they know nothing about it yet."

You may or may not have heard, but China has been down the digital currency road before. Quite a way down, as it happens.

Q coin, a centralized digital currency controlled by instant messaging service QQ, became wildly popular in the mid 2000s with a trading volume equal to $60,000+ per day by 2007.

Government regulators stepped in, stamped down and severely limited its use, fearing it was being used for 'black market transactions' and money laundering.

Bitcoin may be bringing back memories of Q coin's glory days: with a more user-friendly interface, and with government control restricted to fiat entry/exit points, it could give the Chinese a transaction method for which they've already shown a preference.

Publicity stunts

Kapron recently covered a story about local company Shanda, whose real estate arm promoted a recent upmarket condo development by announcing it would accept bitcoin as payment for property.

Whether the Shanda real estate deal was an authentic financial experiment or just a promotional gimmick is unknown; nor do we know how many people actually paid or part-paid for new apartments in bitcoin. But Shanda is primarily an IT company and its customers mainly young and tech-savvy professionals, so their choice of PR tool was an effective one.

Search giant Baidu's 'announcement' it would start accepting bitcoin was a little underwhelming in reality: it was an unofficial statement by the company's security software arm, perhaps also trying to create hype.

Chinese are still really into mining

"It's also hard to tell exactly how much mining activity is coming out of China these days," Kapron said. Shenzhen-based company Bitfountain is also a popular manufacturer of USB mining hardware worldwide.

"The numbers were pretty incredible when we looked into operations," he said, adding:

"Some were providing 'hosted mining' — renting out the space and equipment, or providing rental equipment for miners to host themselves.

Around April-May 2013, the fast payback (just a few weeks) from doing that was amazing."

China's challenges are your challenges

Bitcoin's reputation in China faces the same hurdles as it does in other countries. There is software and security usability, public awareness and the threat of government attempts to intervene.

There are also the problems of inexperienced and rogue business elements jumping in to take advantage of the hype. Just last week, a (supposedly) Hong Kong-based exchange called GBL went missing in action, taking with it $4.1m in its customers' wealth.

At the time of writing, BTC China's rate was 1 BTC for CNY 2,972 ($487.84).

*CNY: the currency of China, also known as renminbi (RMB) or Chinese Yuan.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

How China Took Center Stage in Bitcoin’s Civil War

Slide Show | 10 Photos

Mining for Bitcoin in China

Mining for Bitcoin in China

Credit Gilles Sabrie for The New York Times

A delegation of American executives flew to Beijing in April for a secret meeting just blocks from Tiananmen Square. They had come to court the new kingmakers in one of the strangest experiments in money the world has seen: the virtual currency known as Bitcoin.

Against long odds, and despite an abstruse structure, in which supercomputers “mine” the currency via mathematical formulas, Bitcoin has become a multibillion-dollar industry. It has attracted major investments from Silicon Valley and a significant following on Wall Street.

Yet Bitcoin, which is both a new kind of digital money and an unusual financial network, is having something of an identity crisis. Like so many technologies before it, the virtual currency is coming up against the inevitable push and pull between commercial growth and the purity of its original ambitions.

In its early conception, Bitcoin was to exist beyond the control of any single government or country. It would be based everywhere and nowhere.

Yet despite the talk of a borderless currency, a handful of Chinese companies have effectively assumed majority control of the Bitcoin network. They have done so through canny investments and vast farms of computer servers dispersed around the country. The American delegation flew to Beijing because that was where much of the Bitcoin power was concentrated.

Listen: ‘Bitcoin Divided,’ From Planet Money

The writer, Nathaniel Popper, joined NPR’s Planet Money to explore how a behind-the-scenes fight over Bitcoin spilled out into the real world. You can also hear this episode on iTunes.

At the time of the meeting, held at the Grand Hyatt hotel, over 70 percent of the transactions on the Bitcoin network were going through just four Chinese companies, known as Bitcoin mining pools — and most flowed through just two of those companies. That gives them what amounts to veto power over any changes to the Bitcoin software and technology.

China has become a market for Bitcoin unlike anything in the West, fueling huge investments in server farms as well as enormous speculative trading on Chinese Bitcoin exchanges. Chinese exchanges have accounted for 42 percent of all Bitcoin transactions this year, according to an analysis performed for The New York Times by Chainalysis. Just last week, the Chinese internet giant Baidu joined with three Chinese banks to invest in the American Bitcoin company Circle.

But China’s clout is raising worries about Bitcoin’s independence and decentralization, which was supposed to give the technology freedom from the sort of government crackdowns and interventions that are commonplace in the Chinese financial world.

“The concentration in a single jurisdiction does not bode well,” said Emin Gun Sirer, a professor at Cornell and a Bitcoin researcher. “We need to pay attention to these things if we want decentralization to be a meaningful thing.”

The power of Chinese companies has already come to play a major role in a civil war that has divided Bitcoin followers over the last year and led to the departure of one of the top developers of the virtual currency. The dispute has hinged on technical matters as well as on bigger questions of what Bitcoin should look like in 10 or 20 years.

New data on Bitcoin’s use reveals that most of the transactions come from exchanges — most of all, exchanges in China — where people speculate on the value of the currency. People using Bitcoin to buy or sell products or services are a small proportion of all transactions. Chainalysis assembled the data for New York Times.

The movement of Bitcoins in 2016

Exchanges where Bitcoin can be bought and sold for Chinese currency

Exchanges where Bitcoin can be bought in dollars

The movement of Bitcoins in 2016

Exchanges where Bitcoin can be bought and sold for Chinese currency

Exchanges where Bitcoin can be bought in dollars

The movement of Bitcoins in 2016

Exchanges where Bitcoin can be bought and sold for Chinese currency

By The New York Times

Network Bottleneck

The American companies whose executives journeyed to the Grand Hyatt — including venture-capital-funded start-ups like Coinbase and Circle — are fighting to make Bitcoin bigger. They hope to expand the capacity of the Bitcoin network so that it can process more transactions and compete with the PayPals and Visas of the world.

The current size of the network goes back to the early days, when Bitcoin’s founder, Satoshi Nakamoto, limited the amount of data that could travel through the network, essentially capping it at about seven transactions a second. As Bitcoin has grown more popular, those limits have caused severe congestion and led to lengthy transaction delays.

The American delegation in China had a software proposal, known as Bitcoin Classic, that would change all that.

The Chinese companies, though, had the ultimate decision-making power over any changes in the software, and they did not agree with the American delegation. The Chinese had thrown in their lot with another group of longtime programmers who wanted to keep Bitcoin smaller, in part to keep it more secure. The Americans hoped to persuade the Chinese to switch sides.

In a hotel conference room, the American team of about a half-dozen people cycled through its PowerPoint slides, in English and Chinese, arguing for expansion of the network, most notably pointing to the long delays that have been plaguing the system as a result of the congestion. The Chinese representatives listened and conferred among themselves. The group took a break for a lunch of lamb and dumplings at a nearby mall.

“We kept coming back and saying, ‘For better or worse, you have this leadership in the industry, and everyone is looking to you to show some leadership,’” said Brian Armstrong, chief executive of Coinbase.

Ultimately, Mr. Armstrong said, “We were unable to convince them.”

Some Bitcoin advocates have complained that the Chinese companies have been motivated only by short-term profit, rather than the long-term success and ideals of the project. Bobby Lee, chief executive of the Bitcoin company BTCC, which is based in Shanghai, bristled at that — and at the notion that the Chinese companies represent any sort of united front. He attended the April meeting and pointed out that the Chinese companies had disagreed among themselves on how urgent it was to make changes to the Bitcoin software.

He said the American companies failed to understand the power dynamics in the room that day. “It was almost like imperialistic Westerners coming to China and telling us what to do,” Mr. Lee said in an interview last week. “There has been a history on this. The Chinese people have long memories.”

A Mining Powerhouse

The mysterious creator of Bitcoin, Satoshi Nakamoto, released the software in early 2009. It was designed to provide both a digital coin and a new way to move and hold money, much as email had made it possible to send messages without using a postal service.

From the beginning, the system was designed to be decentralized — operated by all the people who joined their computers to the Bitcoin network and helped process the transactions, much as Wikipedia entries are written and maintained by volunteers around the world.

The appeal of a group-run network was that there would be no single point of failure and no company that could shut things down if the police intervened. This was censorship-free money, Bitcoin followers liked to say. Decision-making power for the network resided with the people who joined it, in proportion to the computing power they provided.

The allure of new riches provided the incentive to join: Every 10 minutes, new Bitcoins would be released and given to one of the computers helping maintain the system. In the lingo of Bitcoin, these computers were said to be mining for currency. They also served as accountants for the network.

For the first few years, aside from its use as a payment method on the Silk Road, an online drug market that has since been shut down, Bitcoin failed to gain much traction. It burst into the world’s consciousness in 2013 when the price of the digital money began to spike, in no small part because Chinese investors began trading Bitcoins in large numbers.

Mr. Lee said the Chinese took quickly to Bitcoin for several reasons. For one thing, the Chinese government had strictly limited other potential investment avenues, giving citizens a hunger for new assets. Also, Mr. Lee said, the Chinese loved the volatile price of Bitcoin, which gave the fledgling currency network the feeling of online gambling, a very popular activity in China.

There has been widespread speculation that Chinese people have used Bitcoin to get money out of the country and evade capital controls, but Mr. Lee and other experts said the evidence suggests this is not a significant phenomenon.

China’s Bitcoin Dominance

Chinese companies mined about 70 percent of all new Bitcoins produced in the last month. Miners receive Bitcoins and have decision-making power over changes to the Bitcoin software, roughly in proportion to the amount of computing power they devote to the network.

Share of Bitcoin mining blocks

May 24 to June 24, 2016

By The New York Times

“No Chinese person is pushing for Bitcoin because it’s libertarian or because it’s going to cause the downfall of governments,” said Mr. Lee, who moved to China after growing up in Africa and the United States and studying at Stanford. “This was an investment.”

The extent of the speculative activity in China in late 2013 pushed the price of a single Bitcoin above $1,000. That surge — and the accompanying media spotlight — led China’s government to intervene in December 2013 and cut off the flow of money between Chinese banks and Bitcoin exchanges, popping what appeared to be a Bitcoin bubble.

The frenzy, though, awakened interest in another aspect of the currency: Bitcoin mining.

Peter Ng, a former investment manager, is one of the many people in China who moved from trading Bitcoins to amassing computing power to mine them. First, he mined for himself. More recently he has created data centers across China where other people can pay to set up their own mining computers. He now has 28 such centers, all of them filled with endless racks of servers, tangled cords and fans cooling the machines.

Mr. Ng, 36, said he had become an expert in finding cheap energy, often in places where a coal plant or hydroelectric dam was built to support some industrial project that never happened. The Bitcoin mining machines in his facilities use about 38 megawatts of electricity, he said, enough to power a small city.

The people who put their machines in Mr. Ng’s data centers generally join mining pools, which smooth the financial returns of smaller players. A popular one, BTCC Pool, is run by Mr. Lee’s company. This month it attracted about 13 percent of the total computational power on the Bitcoin network. The most powerful pool in China — or anywhere in the world — is known as F2Pool, and it had 27 percent of the network’s computational power last month.

The Politics of Pools

Big pool operators have become the kingmakers of the Bitcoin world: Running the pools confers the right to vote on changes to Bitcoin’s software, and the bigger the pool, the more voting power. If members of a pool disagree, they can switch to another pool. But most miners choose a pool based on its payout structure, not its Bitcoin politics.

It was his role overseeing BTCC Pool that got Mr. Lee invited to the meeting with the American delegation in Beijing. The head of operations at F2Pool, Wang Chun, was also there.

Perhaps the most important player in the Chinese Bitcoin world is Jihan Wu, 30, a former investment analyst who founded what is often described in China as the world’s most valuable Bitcoin company. That company, Bitmain, began to build computers in 2013 using chips specially designed to do mining computations.

Bitmain, which has 250 employees, manufactures and sells Bitcoin mining computers. It also operates a pool that other miners can join, called Antpool, and keeps a significant number of mining machines for itself, which it maintains in Iceland and the United States, as well as in China. The machines that Bitmain retains for itself account for 10 percent of the computing power on the global Bitcoin network and are enough to produce new coins worth about $230,000 each day, at the exchange rate last week.

Mr. Wu and the other mining pool operators in China have often seemed somewhat surprised, and even unhappy, that their investments have given them decision-making power within the Bitcoin network. “Miners are the hardware guys. Why are you asking us about software?” is the line that Mr. Ng said he often hears from miners.

This attitude initially led most Chinese miners to align themselves with old-line Bitcoin coders, known as the core programmers, who have resisted changing the software. The miners wanted to take no risks with the money they were minting.

But lately, Mr. Wu has grown increasingly vocal in his belief that the network is going to have to expand, and soon, if it wants to keep its followers. He said in an email last week that if the core programmers did not increase the number of transactions going through the network by July, he would begin looking for alternatives to expand the network.

However the software debate goes, there are fears that China’s government could decide, at some point, to pressure miners in the country to use their influence to alter the rules of the Bitcoin network. The government’s intervention in 2013 suggests that Bitcoin is not too small to escape notice.

Mr. Wu dismissed that concern. He also said that as more Americans buy his Bitmain machines and take advantage of cheap power in places like Washington State, mining will naturally become more decentralized. Already, he said, 30 to 40 percent of new Bitmain machines are being shipped out of China.

For now, though, China remains dominant.

“The Chinese government normally expects its businesses to obtain a leading role in emerging industries,” he said. “China’s Bitcoin businesses have achieved that.”

David Kestenbaum and Paul Mozur contributed reporting.

A version of this article appears in print on July 3, 2016, on Page BU1 of the New York edition with the headline: The New Bitcoin Superpower. Order Reprints | Today's Paper | Subscribe

We’re interested in your feedback on this page. Tell us what you think.

Bitcoin Mining Pools

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

What is a Mining Pool?

Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power.

While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Miners can, however, choose to redirect their hashing power to a different mining pool at anytime.

Pool Concentration in China

Before we get into the best mining pools to join, it’s important to note that most mining pools are in China. Many only have Chinese websites and support. Mining centralization in China is one of Bitcoin’s biggest issues at the moment.

There are about 20 major mining pools. Broken down by the percent of hash power controlled by a pool, and the location of that pool’s company, we estimate that Chinese pools control

81% of the network hash rate:

The Biggest Mining Pools

The list below details the biggest Bitcoin mining pools. This is based on info from Blockchain’s pool share chart:

We strongly recommend new miners to join Slush Pool despite it not being one of the biggest pools. It was the first Bitcoin mining pool and remains one of the most reliable and trusted pools, especially for beginners.

BTC.com is a public mining pool that can be joined. However, we strongly recommend joining Slush Pool instead.

Antpool is a mining pool based in China and owned by BitMain. Antpool mines about 25% of all blocks.

ViaBTC is a somewhat new mining pool that has been around for about one year. It’s targeted towards Chinese miners.

Slush was the first mining pool and currently mines about 3% of all blocks.

Slush is probably one of the best and most popular mining pools despite not being one of the largest.

DiscusFish, also known as F2Pool, is based in China. F2Pool has mined about 5-6% of all blocks over the past six months.

BTC.top is a private pool and cannot be joined.

7. Bitclub.Network

Bitclub Network is a large mining pool but appears to be somewhat shady. We recommend staying away from this pool.

BTCC is a pool and also China’s third largest Bitcoin exchange. Its mining pool currently mines about 7% of all blocks.

Bitfury is a private pool that cannot be joined. Bitfury currently mines about 2% of all blocks.

10. BW Pool

BW, established in 2014, is another mining company based in China. It currently mines about 2% of all blocks.

Bitcoin Mining Pool Comparison

The comparison chart above is just a quick reference. The location of a pool does not matter all that much. Most of the pools have servers in every country so even if the mining pool is based in China, you could connect to a server in the US, for example.

Get a Bitcoin Wallet and Mining Software

Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet.

Mining Pools vs Cloud Mining

Many people read about mining pools and think it is just a group that pays out free bitcoins. This is not true! Mining pools are for people who have mining hardware to split profits.

Many people get mining pools confused with cloud mining. Cloud mining is where you pay a service provider to miner for you and you get the rewards.

Just Want Bitcoins?

If you just want bitcoins, mining is NOT the best way to obtain coins.

Buying bitcoins is the EASIEST and FASTEST way to purchase bitcoins.

Get $10 worth of free bitcoins when you buy $100 or more at Coinbase.

Which Countries Mine the most Bitcoins?

Bitcoin mining tends to gravitate towards countries with cheap electricity.

As Bitcoin mining is somewhat centralized, 10-15 mining companies have claimed the vast majority of network hash power.

With many of these companies in the same country, only a number of countries mine and export a significant amount of bitcoins.

China mines the most bitcoins and therefore ends up “exporting” the most bitcoins.

Electricity in China is very cheap and has allowed Chinese Bitcoin miners to gain a very large percentage of Bitcoin’s hash power.

It’s rumored that some Chinese power companies point their excess energy towards Bitcoin mining facilities so that no energy goes to waste.

China is home to many of the top Bitcoin mining companies:

It’s estimated that these mining pools own somewhere around 60% of Bitcoins hash power, meaning they mine about 60% of all new bitcoins.

Georgia is home to BitFury, one of the largest producers of Bitcoin mining hardware and chips. BitFury currently mines about 15% of all bitcoins.

Sweden is home to KnCMiner, a Bitcoin mining company based in Stockholm. KnCMiner currently mines about 7.5% of all bitcoins.

The US is home to 21 Inc., a Bitcoin mining company based in California.

21 runs a large amount of miners, but also sells low powered bitcoin miners as part of their 21 Bitcoin computer.

Most of the hash power from the 21 Bitcoin computers is pointed towards 21’s mining pool. 21 Inc. mines about 3% of all bitcoins.

Other Countries

The countries above mine about 80% of all bitcoins.

The rest of the hash power is spread across the rest of the world, often pointed at smaller mining pools like Slush (Czech Republic) and Eligius (US).

A Note on Pools

While we can see which mining pools are the largest, it’s important to understand that the hash power pointed towards a mining pool isn’t necessarily owned by the mining pool itself.

There are a few cases, like with BitFury and KnCMiner, where the company itself runs the mining operation but doesn’t run a mining pool.

Bitcoin miners can switch mining pools easily by routing their hash power to a different pool, so the market share of pools is constantly changing.

To make the list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail.

The size of mining pools is constantly changing. We will do our best to keep this posted up-to-date.

If you cloud mine then you don’t need to select a pool; the cloud mining company does this automatically.

Why are Miners Important?

Bitcoin miners are crucial to Bitcoin and its security. Without miners, Bitcoin would be vulnerable and easy to attack.

Most Bitcoin users don’t mine.

However, miners are responsible for the creation of all new bitcoins and a fascinating part of the Bitcoin ecosystem.

Mining, once done on the average home computer, is now mostly done in large, specialized warehouses with massive amounts of mining hardware.

These warehouses usually direct their hashing power towards mining pools.

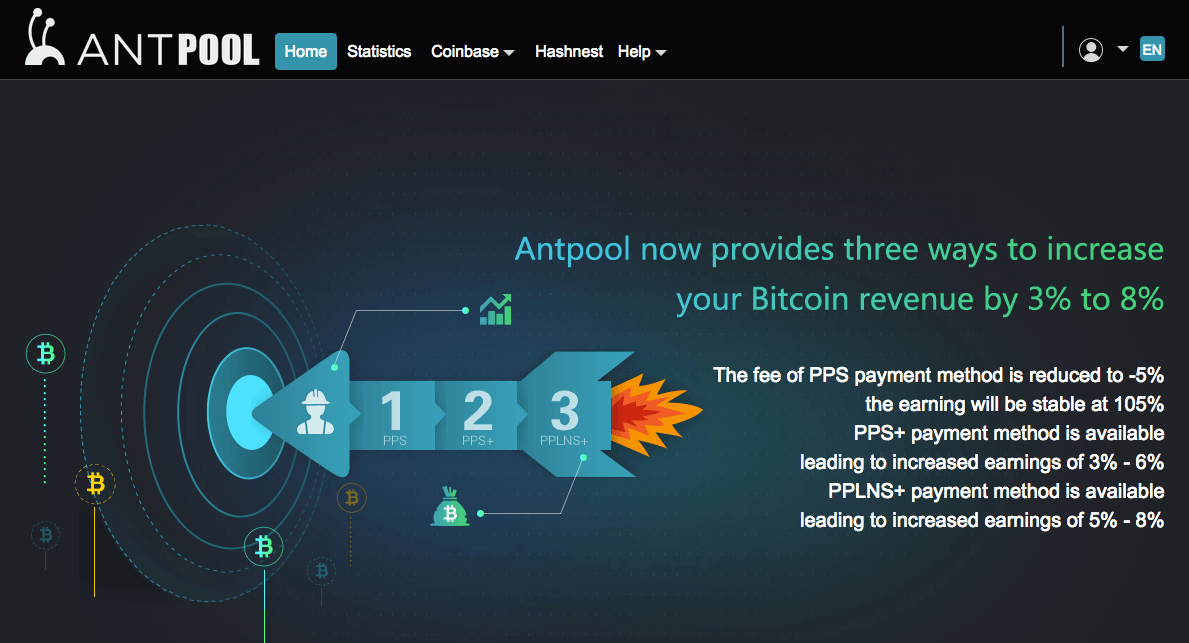

Antpool Review

Despite recent controversy, Antpool remains the largest Bitcoin mining pool in terms of its Bitcoin network hash rate. Antpool holds roughly 15% of the total hash rate of all Bitcoin mining pools.

About Antpool

Antpool mined its first block in March 2014, meaning that it emerged roughly four years after the first mining pool; Slushpool.

Antpool is run by Bitmain Technologies Ltd., the world’s largest Bitcoin mining hardware manufacturer, and a large portion of their pool is run on Bitmain’s own mining rigs.

Antpool supports p2pool and stratum mining modes with nodes that are spread all over the world to ensure stability (US, Germany, China etc.).

Also, Antpool’s user interface is surprisingly slick considering that the underlying company thrives mostly off of hardware sales.

How to Join Antpool

The pool is free to join and the process is simple.

First, you need to acquire Bitcoin mining hardware. Then you need to download mining software. If you need help deciding, I suggest you take a look at our hardware and software guides.

Hardware is important because it determines the size of your contribution to the pool’s hash rate. Software is important because it enables you to direct your hardware’s hash power towards the pool you prefer. So make sure to make the right choice in order to optimize your rewards.

Finally, sign up at antpool.com to get started.

What are Antpool’s Fees?

Antpool claims that it does not charge any fees for using its pool. Although there is some truth to this claim, it is not 100% correct.

While Antpool does not directly charge fees, it also does not disclose the Bitcoin transaction fees that are collected. Basically, clients are left in the dark. Currently, every Bitcoin block has a 12.5 BTC reward which Antpool does share with you when it finds a block.

Lately, however, Bitcoin transaction fees have been rising and an additional 1-2 bitcoins are collected per block by pools. At this time, Antpool keeps 1-2 bitcoins form transaction fees for itself, which are not shared with miners who have hash power pointed toward the pool.

It can be argued that these rates prevent the service from being usable for small-time and big-volume users. Consequently, some users on bitcointalk.org heed that the undisclosed fees make the service unwise to use for the time being.

What is the Payout Threshold?

The pool does not appear to have a payout threshold and pays out every day around 10 AM UTC.

The minimum withdrawal amount is 0.0005 BTC (other sources say 0.001 BTC).

Can you do Solo Mining on Antpool?

Solo mining means you mine for bitcoins without joining a pool. So if you use Antpool you are not solo mining by default.

Generally, you will receive more frequent payouts by joining a pool.

What is the Controversy around Antpool?

Antpool has refused to enable arguably beneficial upgrades to Bitcoin for reasons based on claims that have been largely disproved. Notably, this has taken place with somewhat of a vindictive attitude.

More specifically, the controversy revolves around Segwit – a feature that requires miner activation to be enabled. Despite the fact that most Bitcoin users want this feature activated, Antpool, among other pools, appears to be blocking this feature.

Antpool began signaling for Bitcoin Unlimited in early March 2017 for reasons that have not been elucidated by Bitmain CEO (and cofounder Jihan Wu).

Antpool claims that it will only signal for Segwit if there is a hardfork, which is a proposition that most users oppose. Furthermore, allegations that the owner refuses to sell hardware to Segwit supporters have also begun to circulate.

By using Antpool, you allow the pool to decide your hardware’s approach to these matters, meaning that the pool that you used dictates the type of Bitcoin protocol that your hardware employs. If you wish to decide which implementation your hardware should signal for, you can use a pool that leaves the choice to its users, like the Slush mining pool.

Bitfury Information

According to BlockTrail, Bitfury is the third largest Bitcoin mining pool and mines about 11% of all blocks.

The main difference between the Bitfury pool and other mining pools is that Bitfury is a private pool.

Bitfury, the company, makes its own mining hardware and runs its own pool. So, unlike Slush or Antpool, Bitfury cannot be joined if you run mining hardware at home.

Bitfury 16nm ASIC Chip

Unrelated to its pool, Bitfury sells a 16nm ASIC mining chip.

Although Bitfury controls a large portion of the Bitcoin network hash rate, its committed to making Bitcoin decentralized :

BitFury is fundamentally committed to being a responsible player in the Bitcoin community and we want to work with all integrated partners and resellers to make our unique technology widely available ensuring that the network remains decentralized and we move into the exahash era together.

Valery Vavilov, CEO of BitFury

BTCC Mining Pool Review

BTCC Mining Pool is run by BTCC, a Bitcoin company based in China. The company also runs a Bitcoin exchange, wallet, prints physical bitcoins and more!

Worldwide Servers

BTCC runs servers all over the world so your mining hardware can connect easily to the BTCC pool.

So even though BTCC is based in China, don’t be worried that you can’t use or join the pool:

Our mining pool currently has customers from the United States, South America, Europe, China, and Africa.

Bobby Lee, BTCC CEO

Shared Transaction Fees

One great thing about BTCC pool is that it shares Bitcoin transaction fees with its miners.

In every Bitcoin block, around 1-2 BTC worth of transaction fees are also rewarded to the pool.

Some pools keep these fees for themselves and DO NOT share with their miners! BTCC evenly splits the transaction fees among its miners, just like it splits the 12.5 BTC reward.

Slush Pool Review

Slush Pool is run by Satoshi Labs and was the world’s first ever Bitcoin mining pool. It’s advanced yet also a great pool for beginners.

How to Join and Use Slush Pool

Slush Pool is easy to join.

- First, register an account.

- Configure your mining software to point your hardware’s hash power to Slush Pool.

- Enter your Bitcoin wallet address that will receive the payouts.

Here is a helpful video that shows you how to get started:

Slush Mining Pool URLs

According to Slush’s website, there are the current URLs for the mining pool. You will want to point your software towards the URL location closest to you. This will maximize your mining profits.

USA, east coast:

Europe

China, mainland

Asia-Pacific/Singapore:

What are Slush Pool’s Fees?

Slush Pool charges 2% of all payouts.

This may seem like a lot but unlike other pools it shares the transaction fees with its miners. At current levels, these amount to 1-2 BTC more per block.

Satoshi Labs

Satoshi Labs runs Slush Pool. They also make the Bitcoin TREZOR hardware wallet and Coinmap.org.

Ethereum Mining Pool

Many people want to use the pools above for Ethereum too. But, most of the pools listed above are only for Bitcoin mining. Please see our post on Ethereum mining pools for more info on ETH specific pools.

Litecoin Mining Pool

Like Ethereum, none of the pools above support litecoin. For LTC mining you will need separate hardware and a separate pool.

Bitcoin Mining Pool Taxes

You’ll have to consult an accountant or lawyer in your area. But most likely you will have to pay income tax on income from mining pools just like you would for any other type of income.

China Introduces New Rules for Bitcoin Mining Operations

Most people are well aware of how the majority of Bitcoin mining takes place in China. Not only is this a centralization problem, it also means China is still dictating the Bitcoin landscape to a certain extent. Last week, news broke that the Chinese government was cracking down on Bitcoin mining. It seems a portion of that information was vastly overstated, even though mining business operators were asked to exit the industry in an orderly fashion.

The Future of Bitcoin Mining in China

It was only a matter of time before the Chinese government turned its attention to other parts of the cryptocurrency industry which could prove problematic in the long run. After the PBoC shut down CNY-based trading a while ago, it was time for it to look at the Bitcoin mining industry. Given the vast electricity use associated with this type of operation and the speculative side of cryptocurrency, a new decree has been issued. It is not something most Chinese Bitcoin miners will like, though.

It seems the Chinese government is greatly concerned over the consumption of electricity associated with the mining of cryptocurrencies. Since the government wants to focus primarily on curbing deviations from the real economy, Bitcoin and consorts have proven to be rather problematic. Moreover, these issues have been discussed among the country’s municipalities and provincial governments. As a result, a new “arrangement” has been put in place to make cryptocurrency mining far less attractive.

The goal is to guide firms in exiting the cryptocurrency mining business as soon as possible. The decree will affect the amount of electricity businesses can use moving forward, which will effectively put an end to cryptocurrency mining over time. It is expected this “exodus” will commence on January 10, although it remains unclear how long companies will have to exit the industry.

It is evident this sector is a problem for the Chinese government, although most cryptocurrency enthusiasts were well aware that such measures would be introduced sooner or later. Companies which continue to mine – but in a scaled-down manner – will have to adhere to some new conditions. D etails will need to be provided to the government including the business name, registered capital, the number of mining machines, operating income, and so forth. None of these guidelines are overly invasive, although a reduction in the amount of electricity to be consumed will force companies to either scale down or look for new places to set up shop.

Speaking of which, it seems a few companies are already planning to leave China altogether. It seems Canada is an attractive destination right now, although locations with access to renewable energy sources will become even more attractive over time. It is a good thing to see mining firms leaving China – either partially or fully – as it has become evident this Asian country wants nothing to do with cryptocurrencies whatsoever.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Photos: Inside one of the world’s largest bitcoin mines

Written by

Written by

One of the world’s largest bitcoin mines is located in the SanShangLiang industrial park on the outskirts of the city of Ordos, in Inner Mongolia, an autonomous region that’s part of China. It’s 400 miles from China’s capital, Beijing, and 35 miles from the the city of Baotou. The mine is just off the highway, near the intersection of Latitutde 3rd Road and Longitude 3rd Road. It sits amidst abandoned, half-built factories—victims of an earlier coal mining boom that fizzled out, leaving Ordos and its outlying areas littered with the shells of unfinished buildings.

The mine belongs to Bitmain, a Beijing-based company that also makes mining machines that perform billions of calculations per second to try and crack the cryptographic puzzle that yields new bitcoins. Fifty Bitmain staff, many of them local to Ordos, watch over eight buildings crammed with 25,000 machines that are cranking through calculations 24 hours a day. One of the buildings is devoted to mining litecoin, an ascendant cryptocurrency. The staff live on-site in a building with a dormitory, offices, a canteen, and a repair center. For recreation, they play basketball on an unfinished cement court.

Bitcoin mining consumes enormous amounts of electricity, which is why miners seek out locations that offer cheap energy. The Ordos mine was set up in 2014, making it China’s oldest large-scale bitcoin mining facility. Bitmain acquired it in 2015. It’s powered by electricity mostly from coal-fired power plants. Its daily electricity bill amounts to $39,000. Bitmain also operates other mines in China’s remote areas, like the mountainous Yunnan province in the south and the autonomous region of Xinjiang in the west.

Despite the costs, bitcoin mining remains a lucrative industry. At the current bitcoin price of about $4,000 per bitcoin, miners compete for over $7 million in new bitcoins a day. The more processing power a mining operation controls, the higher its chances of winning a chunk of those millions. The Ordos mine accounts for over 4% of the processing power on the bitcoin network—a huge amount for a single facility.

Quartz visited the mine in Ordos on Aug. 11.

The Bitmain mine in Ordos, Inner Mongolia, has eight buildings containing mining machines. One of them is dedicated to litecoin and seven mine bitcoins. An additional building is inactive. (Aurelien Foucault for Quartz)

Racks of litecoin-mining machines in the Bitmain unit dedicated to litecoin. (Aurelien Foucault for Quartz)

Power cords and their fuse box inside a bitcoin mining unit. (Aurelien Foucault for Quartz)

Racks of bitcoin-mining machines inside a mining facility. (Aurelien Foucault for Quartz)

Leftover tubing and cables lying on the ground between two mining units. (Aurelien Foucault for Quartz)

A bitcoin mining machine with its battery on a shelf. (Aurelien Foucault for Quartz)

A worker monitors operating status of bitcoin-mining machines. (Aurelien Foucault for Quartz)

Workers clean the shelves of bitcoin-mining machines. (Aurelien Foucault for Quartz)

Industrial suction blower fans can be found all along the side of the mining units. They’re used to increase the airflow inside the building and lower the temperature. (Aurelien Foucault for Quartz)

The administrative office of the main building. (Aurelien Foucault for Quartz)

Packing materials from mining devices fill up a warehouse on site. (Aurelien Foucault for Quartz)

A worker fixes a component on a mining machine. (Aurelien Foucault for Quartz)

Workers prepare to bring fixed machines back to the mines. (Aurelien Foucault for Quartz)

The exterior of one of the mining units. (Aurelien Foucault for Quartz)

A worker monitors operating status of a machine. (Aurelien Foucault for Quartz)

The massive switch to one of the many power transformers on the mine. These are hosted in buildings separate from the mining machines. (Aurelien Foucault for Quartz)

A set of keys used to get access to the transformers on site. (Aurelien Foucault for Quartz)

A local citizen of nearby Ordos, recent college graduate Hou Jie, 24, is a maintenance worker at the mine. He shares this dorm room with seven other employees. (Aurelien Foucault for Quartz)

A cook prepares dinner in the kitchen of the main building. (Aurelien Foucault for Quartz)

Workers enjoy their dinner in the dining hall. (Aurelien Foucault for Quartz)

View of one of the buildings in the compound. (Aurelien Foucault for Quartz)

Correction (Aug. 21): Xinjiang is in the west of China. A previous version of this story incorrectly said it was in the east.

Комментариев нет:

Отправить комментарий