What is Bitcoin Mining Difficulty

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. This is based on the hashcash function.

The Bitcoin Network Difficulty Metric

The Bitcoin network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

What is Bitcoin Mining?

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntRouter R1

Antminer S9

BPMC Red Fury USB

- Overview - Table of Contents

- What is Bitcoin Mining?

- Technical Background

- Bitcoin Mining Hardware

- Bitcoin Mining Software

- Bitcoin Cloud Mining

- Mining Infographic

- What is Proof of Work?

- What is Bitcoin Mining Difficulty?

- Other Languages

Before we begin.

Before you read further, please understand that most bitcoin users don't mine! But if you do then this Bitcoin miner is probably the best deal. Bitcoin mining for profit is very competitive and volatility in the Bitcoin price makes it difficult to realize monetary gains without also speculating on the price. Mining makes sense if you plan to do it for fun, to learn or to support the security of Bitcoin and do not care if you make a profit. If you have access to large amounts of cheap electricity and the ability to manage a large installation and business, you can mine for a profit.

If you want to get bitcoins based on a fixed amount of mining power, but you don't want to run the actual hardware yourself, you can purchase a mining contract.

Another tool many people like to buy is a Bitcoin debit card which enables people to load a debit card with funds via bitcoins.

What is Bitcoin mining?

Bitcoin mining is a lot like a giant lottery where you compete with your mining hardware with everyone on the network to earn bitcoins. Faster Bitcoin mining hardware is able to attempt more tries per second to win this lottery while the Bitcoin network itself adjusts roughly every two weeks to keep the rate of finding a winning block hash to every ten minutes. In the big picture, Bitcoin mining secures transactions that are recorded in Bitcon's public ledger, the block chain. By conducting a random lottery where electricity and specialized equipment are the price of admission, the cost to disrupt the Bitcoin network scales with the amount of hashing power that is being spent by all mining participants.

Technical Background

During mining, your Bitcoin mining hardware runs a cryptographic hashing function (two rounds of SHA256) on what is called a block header. For each new hash that is tried, the mining software will use a different number as the random element of the block header, this number is called the nonce. Depending on the nonce and what else is in the block the hashing function will yield a hash which looks something like this:

You can look at this hash as a really long number. (It's a hexadecimal number, meaning the letters A-F are the digits 10-15.) To ensure that blocks are found roughly every ten minutes, there is what's called a difficulty target. To create a valid block your miner has to find a hash that is below the difficulty target. So if for example the difficulty target is

any number that starts with a zero would be below the target, e.g.:

If we lower the target to

we now need two zeros in the beginning to be under it:

Because the target is such an unwieldy number with tons of digits, people generally use a simpler number to express the current target. This number is called the mining difficulty. The mining difficulty expresses how much harder the current block is to generate compared to the first block. So a difficulty of 70000 means to generate the current block you have to do 70000 times more work than Satoshi Nakamoto had to do generating the first block. To be fair, back then mining hardware and algorithms were a lot slower and less optimized.

To keep blocks coming roughly every 10 minutes, the difficulty is adjusted using a shared formula every 2016 blocks. The network tries to change it such that 2016 blocks at the current global network processing power take about 14 days. That's why, when the network power rises, the difficulty rises as well.

Bitcoin Mining Hardware

In the beginning, mining with a CPU was the only way to mine bitcoins and was done using the original Satoshi client. In the quest to further secure the network and earn more bitcoins, miners innovated on many fronts and for years now, CPU mining has been relatively futile. You might mine for decades using your laptop without earning a single coin.

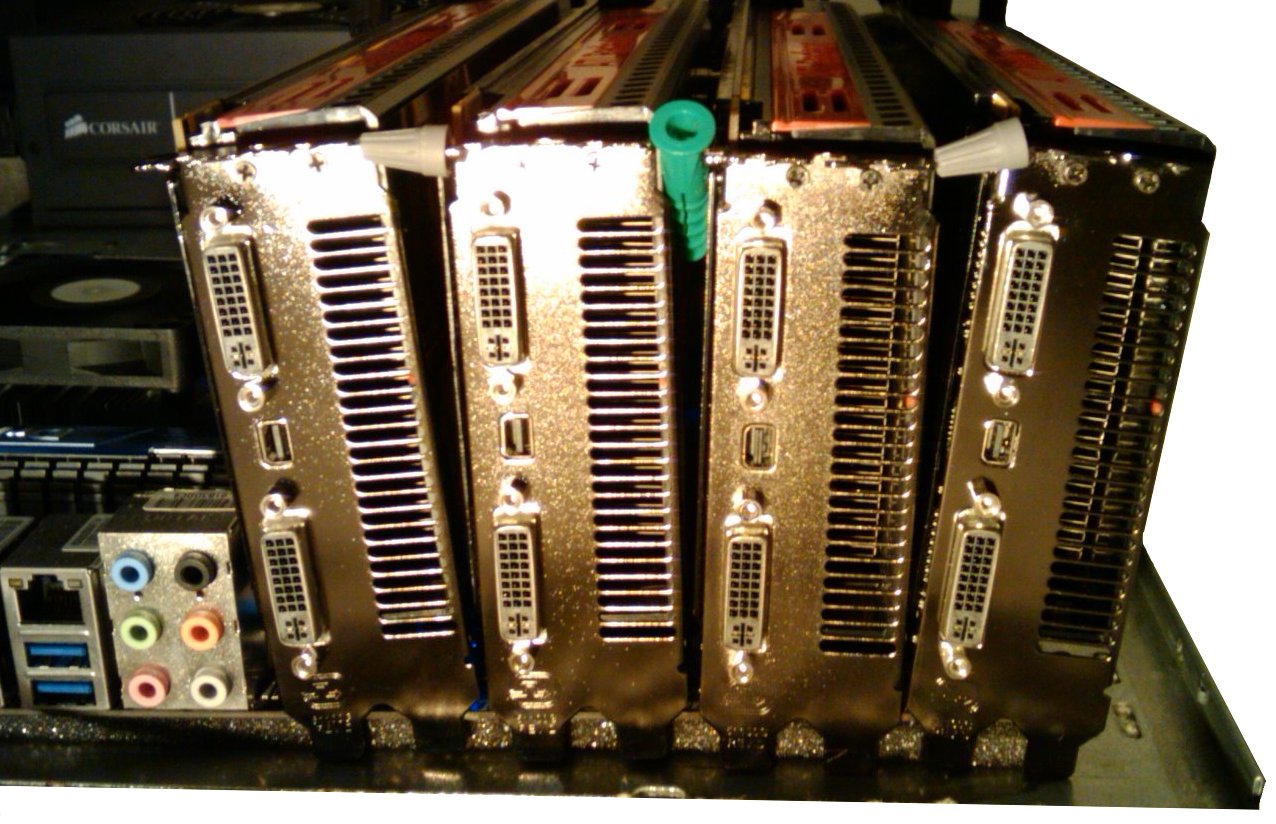

About a year and a half after the network started, it was discovered that high end graphics cards were much more efficient at bitcoin mining and the landscape changed. CPU bitcoin mining gave way to the GPU (Graphical Processing Unit). The massively parallel nature of some GPUs allowed for a 50x to 100x increase in bitcoin mining power while using far less power per unit of work.

While any modern GPU can be used to mine, the AMD line of GPU architecture turned out to be far superior to the nVidia architecture for mining bitcoins and the ATI Radeon HD 5870 turned out to be the most cost effective choice at the time.

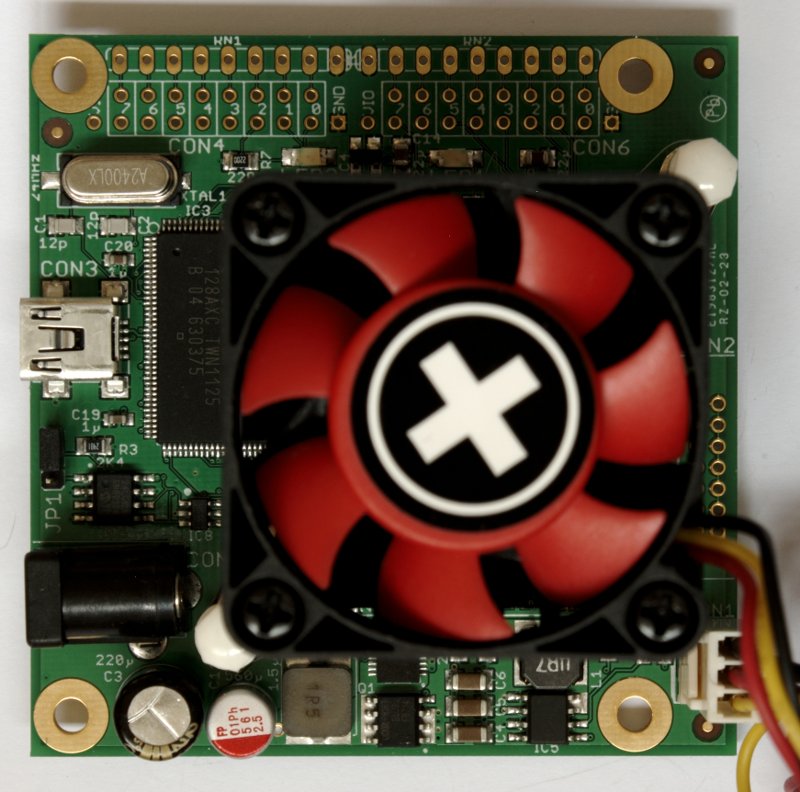

As with the CPU to GPU transition, the bitcoin mining world progressed up the technology food chain to the Field Programmable Gate Array. With the successful launch of the Butterfly Labs FPGA 'Single', the bitcoin mining hardware landscape gave way to specially manufactured hardware dedicated to mining bitcoins.

While the FPGAs didn't enjoy a 50x - 100x increase in mining speed as was seen with the transition from CPUs to GPUs, they provided a benefit through power efficiency and ease of use. A typical 600 MH/s graphics card consumed upwards of 400w of power, whereas a typical FPGA mining device would provide a hashrate of 826 MH/s at 80w of power.

That 5x improvement allowed the first large bitcoin mining farms to be constructed at an operational profit. The bitcoin mining industry was born.

The bitcoin mining world is now solidly in the Application Specific Integrated Circuit (ASIC) era. An ASIC is a chip designed specifically to do one thing and one thing only. Unlike FPGAs, an ASIC cannot be repurposed to perform other tasks.

An ASIC designed to mine bitcoins can only mine bitcoins and will only ever mine bitcoins. The inflexibility of an ASIC is offset by the fact that it offers a 100x increase in hashing power while reducing power consumption compared to all the previous technologies.

Unlike all the previous generations of hardware preceding ASIC, ASIC may be the "end of the line" when it comes to disruptive mining technology. CPUs were replaced by GPUs which were in turn replaced by FPGAs which were replaced by ASICs. There is nothing to replace ASICs now or even in the immediate future.

There will be stepwise refinement of the ASIC products and increases in efficiency, but nothing will offer the 50x to 100x increase in hashing power or 7x reduction in power usage that moves from previous technologies offered. This makes power consumption on an ASIC device the single most important factor of any ASIC product, as the expected useful lifetime of an ASIC mining device is longer than the entire history of bitcoin mining.

It is conceivable that an ASIC device purchased today would still be mining in two years if the device is power efficient enough and the cost of electricity does not exceed it's output. Mining profitability is also dictated by the exchange rate, but under all circumstances the more power efficient the mining device, the more profitable it is. If you want to try your luck at bitcoin mining then this Bitcoin miner is probably the best deal.

Bitcoin Mining Software

There are two basic ways to mine: On your own or as part of a Bitcoin mining pool or with Bitcoin cloud mining contracts and be sure to avoid Bitcoin cloud mining scams. Almost all miners choose to mine in a pool because it smooths out the luck inherent in the Bitcoin mining process. Before you join a pool, make sure you have a bitcoin wallet so you have a place to store your bitcoins. Next you will need to join a mining pool and set your miner(s) to connect to that pool. With pool mining, the profit from each block any pool member generates is divided up among the members of the pool according to the amount of hashes they contributed.

How much bandwidth does Bitcoin mining take? If you are using a bitcoin miner for mining with a pool then the amount should be negligible with about 10MB/day. However, what you do need is exceptional connectivity so that you get any updates on the work as fast as possible.

This gives the pool members a more frequent, steady payout (this is called reducing your variance), but your payout(s) can be decreased by whatever fee the pool might charge. Solo mining will give you large, infrequent payouts and pooled mining will give you small, frequent payouts, but both add up to the same amount if you're using a zero fee pool in the long-term.

Bitcoin Cloud Mining

By purchasing Bitcoin cloud mining contracts, investors can earn Bitcoins without dealing with the hassles of mining hardware, software, electricity, bandwidth or other offline issues.

Being listed in this section is NOT an endorsement of these services and is to serve merely as a Bitcoin cloud mining comparison. There have been a tremendous amount of Bitcoin cloud mining scams.

Hashflare Review: Hashflare offers SHA-256 mining contracts and more profitable SHA-256 coins can be mined while automatic payouts are still in BTC. Customers must purchase at least 10 GH/s.

Genesis Mining Review: Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Genesis Mining offers three Bitcoin cloud mining plans that are reasonably priced. Zcash mining contracts are also available.

Hashing 24 Review: Hashing24 has been involved with Bitcoin mining since 2012. They have facilities in Iceland and Georgia. They use modern ASIC chips from BitFury deliver the maximum performance and efficiency possible.

What is Bitcoin Mining?

Bitcoin mining is the process of adding transaction records to Bitcoin's public ledger of past transactions. This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place.

Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Bitcoin mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a "subsidy" of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

What is Proof of Work?

A proof of work is a piece of data which was difficult (costly, time-consuming) to produce so as to satisfy certain requirements. It must be trivial to check whether data satisfies said requirements.

Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated. Bitcoin uses the Hashcash proof of work.

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Bitcoin Network Difficulty Metric

The Bitcoin mining network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply or use a bitcoin mining calculator.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

Blitzboom and the guys from #bitcoin-dev for their help with writing the guide!

Difficulty

What is "difficulty"?

Difficulty is a measure of how difficult it is to find a hash below a given target.

The Bitcoin network has a global block difficulty. Valid blocks must have a hash below this target. Mining pools also have a pool-specific share difficulty setting a lower limit for shares.

How often does the network difficulty change?

What is the formula for difficulty?

difficulty = difficulty_1_target / current_target

(target is a 256 bit number)

difficulty_1_target can be different for various ways to measure difficulty. Traditionally, it represents a hash where the leading 32 bits are zero and the rest are one (this is known as "pool difficulty" or "pdiff"). The Bitcoin protocol represents targets as a custom floating point type with limited precision; as a result, Bitcoin clients often approximate difficulty based on this (this is known as "bdiff").

How is difficulty stored in blocks?

Each block stores a packed representation (called "Bits") for its actual hexadecimal target. The target can be derived from it via a predefined formula. For example, if the packed target in the block is 0x1b0404cb, the hexadecimal target is

Note that the 0x0404cb value is a signed value in this format. The largest legal value for this field is 0x7fffff. To make a larger value you must shift it down one full byte. Also 0x008000 is the smallest positive valid value.

How is difficulty calculated? What is the difference between bdiff and pdiff?

The highest possible target (difficulty 1) is defined as 0x1d00ffff, which gives us a hex target of

It should be noted that pooled mining often uses non-truncated targets, which puts "pool difficulty 1" at

So the difficulty at 0x1b0404cb is therefore:

Here's a fast way to calculate bitcoin difficulty. It uses a modified Taylor series for the logarithm (you can see tutorials on flipcode and wikipedia) and relies on logs to transform the difficulty calculation:

To see the math to go from the normal difficulty calculations (which require large big ints bigger than the space in any normal integer) to the calculation above, here's some python:

What is the current difficulty?

Current difficulty, as output by Bitcoin's getDifficulty.

What is the maximum difficulty?

There is no minimum target. The maximum difficulty is roughly: maximum_target / 1 (since 0 would result in infinity), which is a ridiculously huge number (about 2^224).

The actual maximum difficulty is when current_target=0, but we would not be able to calculate the difficulty if that happened. (fortunately it never will, so we're ok.)

Can the network difficulty go down?

Yes it can. See discussion in target.

What is the minimum difficulty?

The minimum difficulty, when the target is at the maximum allowed value, is 1.

What network hash rate results in a given difficulty?

The difficulty is adjusted every 2016 blocks based on the time it took to find the previous 2016 blocks. At the desired rate of one block each 10 minutes, 2016 blocks would take exactly two weeks to find. If the previous 2016 blocks took more than two weeks to find, the difficulty is reduced. If they took less than two weeks, the difficulty is increased. The change in difficulty is in proportion to the amount of time over or under two weeks the previous 2016 blocks took to find.

To find a block, the hash must be less than the target. The hash is effectively a random number between 0 and 2**256-1. The offset for difficulty 1 is

and for difficulty D is

The expected number of hashes we need to calculate to find a block with difficulty D is therefore

The difficulty is set such that the previous 2016 blocks would have been found at the rate of one every 10 minutes, so we were calculating (D * 2**48 / 0xffff) hashes in 600 seconds. That means the hash rate of the network was

over the previous 2016 blocks. Can be further simplified to

without much loss of accuracy.

At difficulty 1, that is around 7 Mhashes per second.

At the time of writing, the difficulty is 22012.4941572, which means that over the previous set of 2016 blocks found the average network hash rate was

How soon might I expect to generate a block?

The average time to find a block can be approximated by calculating:

where difficulty is the current difficulty, hashrate is the number of hashes your miner calculates per second, and time is the average in seconds between the blocks you find.

For example, using Python we calculate the average time to generate a block using a 1Ghash/s mining rig when the difficulty is 20000:

and find that it takes just under 24 hours on average.

Welcome to 99Bitcoins’ simple Bitcoin Mining Calculator

This simple Bitcoin mining calculator will allow you to determine how much you can profit from a certain Bitcoin miner. It takes into account all relevant costs such as hardware, electricity and fees. See below for detailed instructions on how to use it.

Instructions on how to use the Bitcoin Mining Calculator:

- Enter the hash rate of the Bitcoin miner you’re planning to use

- Click on “Calculate mining revenue”

- That’s it! (we said it was simple….)

Note: If some values in the Bitcoin mining calculator don’t seem right (exchange rate, block reward, etc.) you can adjust them manually. However normally they are all up to date.

Keep in mind that:

- Revenue is shown in USD based on the current exchange rate, the exchange rate can (and probably will) change from time to time.

- Revenue is based on current difficulty to mine Bitcoins. Difficulty can (and probably will) change. From past experience it usually goes up as time goes by.

- Revenue IS NOT profit. You still have to take into account the cost of your mining hardware and the electricity to run it (and cool it down if needed).

If you want to know more about Bitcoin mining profitability check out this page.

How to Calculate Bitcoin Mining Profitability

Bitcoin mining secures the Bitcoin network. Without miners, Bitcoin could easily be attacked and even shut down. Since Bitcoin miners provide such an important service to the network, they are paid for their services! Each block mined by miners contains a block reward, which is paid out to the miner that successfully mined the block.

While mining today is very competitive, it is possible to run a successful and profitable mining farm. This post will outline the many factors that will determine whether or not your mining operation will be profitable.

Mining Hardware Costs

The upfront costs to pay for mining hardware is usually the largest expense for any new mining farm. Just like good computers cost more money, good mining hardware is expensive. The Antminer S7 is one currently the most efficient miner and costs $629. It only mines about $200 worth of bitcoins per month, meaning just based on hardware costs alone it will take more than three months to get back your money. This does not include electricity costs or equipment costs (more on this below).

When purchasing mining hardware, you will want to look at these metrics: Th/s and W/GH. Th/s, or sometimes Gh/s, measures a miner’s terahashes (Th/s) or gigahashes (Gh/s) per second and is called hash rate. A higher hash rate means a more powerful miner. You can use this simple calculator from Bitcoin Wisdom to determine how much money an amount of hash power will earn per month.

Hardware Efficiency

Hash power is not the end all for determining good miners, though. Miners use massive amounts of electricity. You want a miner that has both a high hash rate and uses the electricity provided efficiently.

W/GH is the metric used to display a miner’s efficiency. The Antminer S7 is also the most efficient miner available on the market, with 0.25 W/GH. Consider that the previous version of the S7, the S5, had an efficiency of just 0.51 W/GH. That means the S5 uses twice as much electricity per hash as the S7.

Buying a miner that has a low W/GH and also has good hash power is the key for any profitable mining operation.

Equipment Costs

Miners generate heat, and also need to be supplied with electricity. Unless you already have the needed parts, you will likely need to purchase cooling fans and power supplies.

Electricity Costs

Electricity costs can make or break any mining operation. A monthly electric bill means monthly costs on top of the upfront cost of the hardware.

China’s cheap electricity is one reason that nearly 60% of the Bitcoin network’s hashing power is located there. In the USA, for example, most mining hardware is run in Washington State, where there is cheap hydroelectricity. Venezuela’s crisis and cheap electricity has also made Bitcoin mining extremely profitable there.

Don’t discount electricity as a cost. It can make or break your mining operation.

Extra Heat and Weather

Creative miners in cold areas can use the heat generated by miners to heat their houses in the winter. If the heat generated by miners will partly replace your normal heating costs, it is one way to save money and improve your chances of profitability.

Miners in cold areas also have an advantage because they may not need to use extra fans to cool the hardware.

Bitcoin Mining Difficulty and Network Hash Power

The Bitcoin mining difficulty makes sure that Bitcoin blocks are mined, on average, every 10 minutes. A higher difficulty is indicative of more hash power joining the network.

As you would expect, more hash power on the network means that existing miners then control a lower percentage of the Bitcoin network hash power.

The image above shows the network hash power over the last 2 years. From September 2015 to February 2016, the network hash rate tripled. That means any miner who added no additional hardware to his farm would earn about 33% less bitcoins.

Hash rate and network difficulty are external factors that should be accounted for. It’s impossible to know difficulty months in advance. However, pay attention to advances in mining technology and efficiency to get a better idea of how the hash rate and difficulty may look down the line.

Bitcoin Price and Block Reward

Bitcoin’s price is volatile and can’t be predicted. You may calculate your profitability with a Bitcoin price of $500, but it won’t be accurate if the price drops to $300 the next day. Be prepared for price movements and understand that the Bitcoin price is a factor that you cannot control.

The Bitcoin block reward is at least one factor that is predictable. Every 4 years, the amount of bitcoins rewarded in each block is cut in half. The reward started at 50 bitcoins per block, and is now 25 bitcoins per block. In July 2016, this reward will fall to just 12.5 bitcoins per block.

Each block reward halving cuts miners’ shares of bitcoins in half. Miners can, however, see similar incomes after a reward halving if the fiat price of Bitcoin doubles.

Bitcoin Mining Calculators

To conclude, use a Bitcoin mining calculator to input your hardware information and electricity costs. This will give you a much better idea on your overall potential to run a profitable mining farm. Remember, however, that some factors like the Bitcoin price and mining difficulty change everyday and can have dramatic effects on profitability.

Introduction

Mining is the process of adding transaction records to Bitcoin's public ledger of past transactions (and a "mining rig" is a colloquial metaphor for a single computer system that performs the necessary computations for "mining". This ledger of past transactions is called the block chain as it is a chain of blocks. The blockchain serves to confirm transactions to the rest of the network as having taken place. Bitcoin nodes use the blockchain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to set the history of transactions in a way that is computationally impractical to modify by any one entity. By downloading and verifying the blockchain, bitcoin nodes are able to reach consensus about the ordering of events in bitcoin.

Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a "subsidy" of newly created coins. This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new units available to anybody who wishes to take part. An important difference is that the supply does not depend on the amount of mining. In general changing total miner hashpower does not change how many bitcoins are created over the long term.

Difficulty

The Computationally-Difficult Problem

Mining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network. This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Difficulty Metric

The difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. The rate is recalculated every 2,016 blocks to a value such that the previous 2,016 blocks would have been generated in exactly one fortnight (two weeks) had everyone been mining at this difficulty. This is expected yield, on average, one block every ten minutes.

As more miners join, the rate of block creation increases. As the rate of block generation increases, the difficulty rises to compensate, which has a balancing of effect due to reducing the rate of block-creation. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by the other participants in the network.

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 12.5 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

The mining ecosystem

Users have used various types of hardware over time to mine blocks. Hardware specifications and performance statistics are detailed on the Mining Hardware Comparison page.

CPU Mining

Early Bitcoin client versions allowed users to use their CPUs to mine. The advent of GPU mining made CPU mining financially unwise as the hashrate of the network grew to such a degree that the amount of bitcoins produced by CPU mining became lower than the cost of power to operate a CPU. The option was therefore removed from the core Bitcoin client's user interface.

GPU Mining

GPU Mining is drastically faster and more efficient than CPU mining. See the main article: Why a GPU mines faster than a CPU. A variety of popular mining rigs have been documented.

FPGA Mining

FPGA mining is a very efficient and fast way to mine, comparable to GPU mining and drastically outperforming CPU mining. FPGAs typically consume very small amounts of power with relatively high hash ratings, making them more viable and efficient than GPU mining. See Mining Hardware Comparison for FPGA hardware specifications and statistics.

ASIC Mining

An application-specific integrated circuit, or ASIC, is a microchip designed and manufactured for a very specific purpose. ASICs designed for Bitcoin mining were first released in 2013. For the amount of power they consume, they are vastly faster than all previous technologies and already have made GPU mining financially.

Mining services (Cloud mining)

Mining contractors provide mining services with performance specified by contract, often referred to as a "Mining Contract." They may, for example, rent out a specific level of mining capacity for a set price at a specific duration.

As more and more miners competed for the limited supply of blocks, individuals found that they were working for months without finding a block and receiving any reward for their mining efforts. This made mining something of a gamble. To address the variance in their income miners started organizing themselves into pools so that they could share rewards more evenly. See Pooled mining and Comparison of mining pools.

Bitcoin's public ledger (the "block chain") was started on January 3rd, 2009 at 18:15 UTC presumably by Satoshi Nakamoto. The first block is known as the genesis block. The first transaction recorded in the first block was a single transaction paying the reward of 50 new bitcoins to its creator.

Bitcoin Mining Difficulty Chart = Historical Data

Last updated on January 2nd, 2018 at 12:00 am

The chart below is the ‘Bitcoin mining difficulty chart‘, also knowing as difficulty historical data chart. This chart tracks the difficulty of the algorithms that are used to create blocks. When bit coins are generated, they are created through solving complex problems. When a problem is solved, the block forms and the coins are released into the market. The difficulty changes market regulation however; the historical chart can help provide a great deal of useful information.

Bitcoin Mining Difficulty Chart

NOTE: This is a live chart!

The data/chart for the bitcoin mining difficulty chart is for informational purposes and indicative reading only. We are not responsible for its accuracy.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Cash’s Mining Difficulty Algorithm Remains Highly Controversial

A lot has been said and written in regards to Bitcoin Cash and its unusual mining difficulty algorithm. In a lot of cases, the mining difficulty adjusts in such a way that the altcoin becomes increasingly easy to mine when things go awry. A recent screenshot by Charlie Lee showed how the network sometimes generates dozens of blocks an hour before increasing the mining difficulty again, which in turn may cause network delays. It is certainly true that this may not necessarily represent Satoshi’s vision.

Bitcoin Cash’s EDA Still makes Little Sense

Whether you love it or hate it, you can’t deny that the Bitcoin Cash mining difficulty adjustment algorithm is a very intriguing creature. More specifically, this EDA can change the mining difficulty rather quickly. In most cases, the difficulty will lower as a way to speed up the network and ensure there is no backlog whatsoever. Once the mining power picks up again, the difficulty will readjust to increase the network time between blocks. It makes a lot of sense, but can sometimes lead to some odd side effects.

According to a screenshot shared by Litecoin founder Charlie Lee, the EDA may be working too well sometimes. In fact, the image he posted detailed 43 Bitcoin Cash blocks generated over the course of one hour. While that is not necessarily a bad thing, it could be viewed as a problem considering it means over 600 BCH were added to the circulating supply during that time. That rate is pretty alarming, as the erratic changes in time between blocks and rewards could cause some big consequences.

43 BCH blocks an hour. This will last for another day. Then, I expect another round of

3hr long blocks. Yup, Satoshi's vision! /s ? pic.twitter.com/lVVMJOtSWW

— Charlie Lee [NO2X] (@SatoshiLite) October 1, 2017

At the same time, such a “speeding up” of network blocks will eventually lead to a higher mining difficulty. When that happens, the time in between blocks may go up to several hours, which is less than ideal. This is certainly not the way Satoshi Nakamoto envisioned the evolution of the Bitcoin network whatsoever. Thankfully, the EDA is something that can be addressed by BCH developers, assuming they will ever be inclined to do so.

One thing that is worth taking into account is how this also influences the profitability of mining Bitcoin and Bitcoin Cash. A lower difficulty makes it more profitable to mine BCH over BTC, which means the Bitcoin network may struggle with its mempool every now and then. During times of high BCH difficulty, miners will often switch back to the main Bitcoin blockchain, leaving BCH hanging out to dry. It is far from an ideal situation for both networks; that much is rather evident.

Issues with the Bitcoin Cash mining difficulty algorithm have been discussed many times before. So far, the BCH developers don’t see a need to make any major changes, even though changes in block time are a bit erratic at times. At the time of writing, it is 60.5% more profitable to mine Bitcoin Cash than BTC itself. Then again, this has not affected Bitcoin network confirmation times just yet. One of our transactions got three confirmations within 20 minutes, which is pretty quick for a BTC transfer these days.

Moreover, during the writing of this article, we saw a total of 20 BCH blocks being discovered on the network. That is an absurd amount, to say the very least, as some blocks are literally coming twenty seconds apart. It is evident this situation will continue to spark debate moving forward and also speed up the inflation rate of Bitcoin Cash. As a result, the BCH price is taking a sharp nosedive right now, although there is no real reason to panic just yet.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Bitcoin mining difficulty

Bitcoin Network Faces an 18% Increase in Mining Difficulty

Interesting changes will affect the Bitcoin network in about two days from now. As is the case every 2,160 blocks, the mining difficulty will adjust once again. We have seen some major leaps in this regard throughout the years. It now seems the next adjustment will represent an 18% increase. In most cases, such an adjustment will force more miners to Bitcoin Cash. If that is the case, things can get very interesting for the world’s leading cryptocurrency.

The mining difficulty affects the profitability of Bitcoin. If the difficulty spikes to high, miners often look for alternative mining options. Throughout the past few months, we have seen miners switch over to BCH as a result. Whether or not history will repeat itself in this regard, remains to be determined. A new difficulty adjustment is on the horizon, and it will be a rather juicy one, by the look of things. Fork.lol projects a near 18% increase, which is rather steep.

Upcoming Bitcoin Mining Difficulty is Worrisome

It is true the Bitcoin mining difficulty has seen similar adjustments in the past. Although it isn’t fun, it never caused any major issues either. With Bitcoin Cash now being a thing, that situation is very different. it seems the BCH community anticipates a massive shift in hashpower to their network. Whether or not that will happen, is very difficult to predict. Both currencies are equally profitable to mine right now, give or take. However, the BCH chain runs at 11.57% of Bitcoin’s mining difficulty.

When the Bitcoin network adjusts, things will get very interesting. A major shift in hashpower is not unthinkable. We have seen a lot of miners switch to Bitcoin in the past week or so. As a result, the mining difficulty needs to adjust properly to accommodate this higher amount of power. However, the difficulty will not change back for another 2m160 blocks. If the miners bail on Bitcoin, we may see more delayed transactions and increased fees once again. It is a situation everyone hopes to avoid, for obvious reasons.

For the time being, there is no reason to panic whatsoever. Bitcoin has almost 10 times as much hashpower as Bitcoin Cash. If this remains the same after the difficulty adjustment, everything will be just fine. Some miners will make the switch regardless, though. An interesting few days are ahead for the world’s leading cryptocurrency. In the best case, the BCH users get excited about nothing. In the worst case, Bitcoin will struggle again for a few days or more. It is a situation well worth keeping an eye on, to say the least.

What is Bitcoin Mining?

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntRouter R1

Antminer S9

BPMC Red Fury USB

- Overview - Table of Contents

- What is Bitcoin Mining?

- Technical Background

- Bitcoin Mining Hardware

- Bitcoin Mining Software

- Bitcoin Cloud Mining

- Mining Infographic

- What is Proof of Work?

- What is Bitcoin Mining Difficulty?

- Other Languages

Before we begin.

Before you read further, please understand that most bitcoin users don't mine! But if you do then this Bitcoin miner is probably the best deal. Bitcoin mining for profit is very competitive and volatility in the Bitcoin price makes it difficult to realize monetary gains without also speculating on the price. Mining makes sense if you plan to do it for fun, to learn or to support the security of Bitcoin and do not care if you make a profit. If you have access to large amounts of cheap electricity and the ability to manage a large installation and business, you can mine for a profit.

If you want to get bitcoins based on a fixed amount of mining power, but you don't want to run the actual hardware yourself, you can purchase a mining contract.

Another tool many people like to buy is a Bitcoin debit card which enables people to load a debit card with funds via bitcoins.

What is Bitcoin mining?

Bitcoin mining is a lot like a giant lottery where you compete with your mining hardware with everyone on the network to earn bitcoins. Faster Bitcoin mining hardware is able to attempt more tries per second to win this lottery while the Bitcoin network itself adjusts roughly every two weeks to keep the rate of finding a winning block hash to every ten minutes. In the big picture, Bitcoin mining secures transactions that are recorded in Bitcon's public ledger, the block chain. By conducting a random lottery where electricity and specialized equipment are the price of admission, the cost to disrupt the Bitcoin network scales with the amount of hashing power that is being spent by all mining participants.

Technical Background

During mining, your Bitcoin mining hardware runs a cryptographic hashing function (two rounds of SHA256) on what is called a block header. For each new hash that is tried, the mining software will use a different number as the random element of the block header, this number is called the nonce. Depending on the nonce and what else is in the block the hashing function will yield a hash which looks something like this:

You can look at this hash as a really long number. (It's a hexadecimal number, meaning the letters A-F are the digits 10-15.) To ensure that blocks are found roughly every ten minutes, there is what's called a difficulty target. To create a valid block your miner has to find a hash that is below the difficulty target. So if for example the difficulty target is

any number that starts with a zero would be below the target, e.g.:

If we lower the target to

we now need two zeros in the beginning to be under it:

Because the target is such an unwieldy number with tons of digits, people generally use a simpler number to express the current target. This number is called the mining difficulty. The mining difficulty expresses how much harder the current block is to generate compared to the first block. So a difficulty of 70000 means to generate the current block you have to do 70000 times more work than Satoshi Nakamoto had to do generating the first block. To be fair, back then mining hardware and algorithms were a lot slower and less optimized.

To keep blocks coming roughly every 10 minutes, the difficulty is adjusted using a shared formula every 2016 blocks. The network tries to change it such that 2016 blocks at the current global network processing power take about 14 days. That's why, when the network power rises, the difficulty rises as well.

Bitcoin Mining Hardware

In the beginning, mining with a CPU was the only way to mine bitcoins and was done using the original Satoshi client. In the quest to further secure the network and earn more bitcoins, miners innovated on many fronts and for years now, CPU mining has been relatively futile. You might mine for decades using your laptop without earning a single coin.

About a year and a half after the network started, it was discovered that high end graphics cards were much more efficient at bitcoin mining and the landscape changed. CPU bitcoin mining gave way to the GPU (Graphical Processing Unit). The massively parallel nature of some GPUs allowed for a 50x to 100x increase in bitcoin mining power while using far less power per unit of work.

While any modern GPU can be used to mine, the AMD line of GPU architecture turned out to be far superior to the nVidia architecture for mining bitcoins and the ATI Radeon HD 5870 turned out to be the most cost effective choice at the time.

As with the CPU to GPU transition, the bitcoin mining world progressed up the technology food chain to the Field Programmable Gate Array. With the successful launch of the Butterfly Labs FPGA 'Single', the bitcoin mining hardware landscape gave way to specially manufactured hardware dedicated to mining bitcoins.

While the FPGAs didn't enjoy a 50x - 100x increase in mining speed as was seen with the transition from CPUs to GPUs, they provided a benefit through power efficiency and ease of use. A typical 600 MH/s graphics card consumed upwards of 400w of power, whereas a typical FPGA mining device would provide a hashrate of 826 MH/s at 80w of power.

That 5x improvement allowed the first large bitcoin mining farms to be constructed at an operational profit. The bitcoin mining industry was born.

The bitcoin mining world is now solidly in the Application Specific Integrated Circuit (ASIC) era. An ASIC is a chip designed specifically to do one thing and one thing only. Unlike FPGAs, an ASIC cannot be repurposed to perform other tasks.

An ASIC designed to mine bitcoins can only mine bitcoins and will only ever mine bitcoins. The inflexibility of an ASIC is offset by the fact that it offers a 100x increase in hashing power while reducing power consumption compared to all the previous technologies.

Unlike all the previous generations of hardware preceding ASIC, ASIC may be the "end of the line" when it comes to disruptive mining technology. CPUs were replaced by GPUs which were in turn replaced by FPGAs which were replaced by ASICs. There is nothing to replace ASICs now or even in the immediate future.

There will be stepwise refinement of the ASIC products and increases in efficiency, but nothing will offer the 50x to 100x increase in hashing power or 7x reduction in power usage that moves from previous technologies offered. This makes power consumption on an ASIC device the single most important factor of any ASIC product, as the expected useful lifetime of an ASIC mining device is longer than the entire history of bitcoin mining.

It is conceivable that an ASIC device purchased today would still be mining in two years if the device is power efficient enough and the cost of electricity does not exceed it's output. Mining profitability is also dictated by the exchange rate, but under all circumstances the more power efficient the mining device, the more profitable it is. If you want to try your luck at bitcoin mining then this Bitcoin miner is probably the best deal.

Bitcoin Mining Software

There are two basic ways to mine: On your own or as part of a Bitcoin mining pool or with Bitcoin cloud mining contracts and be sure to avoid Bitcoin cloud mining scams. Almost all miners choose to mine in a pool because it smooths out the luck inherent in the Bitcoin mining process. Before you join a pool, make sure you have a bitcoin wallet so you have a place to store your bitcoins. Next you will need to join a mining pool and set your miner(s) to connect to that pool. With pool mining, the profit from each block any pool member generates is divided up among the members of the pool according to the amount of hashes they contributed.

How much bandwidth does Bitcoin mining take? If you are using a bitcoin miner for mining with a pool then the amount should be negligible with about 10MB/day. However, what you do need is exceptional connectivity so that you get any updates on the work as fast as possible.

This gives the pool members a more frequent, steady payout (this is called reducing your variance), but your payout(s) can be decreased by whatever fee the pool might charge. Solo mining will give you large, infrequent payouts and pooled mining will give you small, frequent payouts, but both add up to the same amount if you're using a zero fee pool in the long-term.

Bitcoin Cloud Mining

By purchasing Bitcoin cloud mining contracts, investors can earn Bitcoins without dealing with the hassles of mining hardware, software, electricity, bandwidth or other offline issues.

Being listed in this section is NOT an endorsement of these services and is to serve merely as a Bitcoin cloud mining comparison. There have been a tremendous amount of Bitcoin cloud mining scams.

Hashflare Review: Hashflare offers SHA-256 mining contracts and more profitable SHA-256 coins can be mined while automatic payouts are still in BTC. Customers must purchase at least 10 GH/s.

Genesis Mining Review: Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Genesis Mining offers three Bitcoin cloud mining plans that are reasonably priced. Zcash mining contracts are also available.

Hashing 24 Review: Hashing24 has been involved with Bitcoin mining since 2012. They have facilities in Iceland and Georgia. They use modern ASIC chips from BitFury deliver the maximum performance and efficiency possible.

What is Bitcoin Mining?

Bitcoin mining is the process of adding transaction records to Bitcoin's public ledger of past transactions. This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place.

Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Bitcoin mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a "subsidy" of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

What is Proof of Work?

A proof of work is a piece of data which was difficult (costly, time-consuming) to produce so as to satisfy certain requirements. It must be trivial to check whether data satisfies said requirements.

Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated. Bitcoin uses the Hashcash proof of work.

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Bitcoin Network Difficulty Metric

The Bitcoin mining network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply or use a bitcoin mining calculator.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

Blitzboom and the guys from #bitcoin-dev for their help with writing the guide!

Комментариев нет:

Отправить комментарий