Bitcoin vs Ethereum – Which one is Better?

With all of the commotion going on in the world of cryptocurrency, some interesting questions arise. A lot of people still feel they need to choose between Bitcoin or Ethereum, because one of them “has” to be better than the other. That is not the case by any means, as both ecosystems are trying to do things entirely. However, there are some aspects of both currencies which can be referred to as “being better than” its counterpart.

3. The Technology Battle

On paper, one could argue Bitcoin is better than any other cryptocurrency, token, or digital asset because those other offerings would not be around, were it not for Bitcoin. In this regard, the popular cryptocurrency has a leg up over any other currency in existence. Bitcoin will always be the first “major” cryptocurrency, and it has been around for 9 years now. Ethereum, on the other hand, only came to market a few years ago.

That being said, Ethereum offers some interesting pieces of technology. Smart contracts have been quite a revolutionary technology, although the same concept will be part of the Bitcoin protocol soon. Bitcoin has a disturbing lack of decentralized application possibilities, which makes Ethereum seem “better” in this regard. Then again, there is no “major” decentralized application in existence to be embraced by mainstream society either. Ethereum has a technological edge over Bitcoin, but until it is used by the masses, it is a matter of semantics.

2. Number of Coins

When we look at the available supply of currency, Bitcoin is clearly more scarce than Ethereum. In fact, Bitcoin has a hard coin supply cap of 21 million BTC. Ethereum has over 92 million coins in circulation, with more being mined every day. Even when Ethereum switches to proof of stake, it will remain an inflationary currency to some degree. A lot of people tend to overlook this fact, although it is certainly worth taking into consideration.

Not knowing how many ETH will be in circulation at its peak is somewhat disconcerting. A lot of Ethereum enthusiasts will shrug this off and claim it doesn’t matter. Rest assured such “details” should matter to everyone who gets involved in any cryptocurrency. Ethereum is not the only currency without a fixed maximum supply cap right now, but given its current market cap, it could become an issue over time. Bitcoin is better in this regard, as there is no confusion regarding the available supply.

1. Speculation

From a speculative point of view, both Bitcoin and Ethereum have seen significant value gains over the past year. In the case of Bitcoin, these gains have been smaller percentage-wise. Then again, Bitcoin was created well before Ethereum and has seen its value increase steadily over the years. Ethereum’s value suddenly picked up over the past year and a half. Whether or not that trend can be sustained over the long term, remains to be seen.

At the same time, the Ethereum price is still linked to the Bitcoin price. When Bitcoin goes up, Ethereum will often go down a bit until it stabilizes. As Bitcoin declines in value, Ethereum either goes down along with it, or sees a small gain. These values often correct themselves within mere hours, though. Right now, Bitcoin is clearly the bullish currency of the two, whereas Ethereum is trying to stabilize. All cryptocurrencies depend on what Bitcoin is doing, and Ethereum is no exception.

If you liked this article, follow us on Twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Nice article, thank you.

This article is not accurate. There is 30% of bitcoin coins that are ‘Lost’, and actually when Bit drops so does Eth, when Bit raises, so does Eth. They are tied very closely to each other. Not in the manner the writer noted. Research before you talk.

You are correct!

Ethereum is garbage.

2008 showed everyone the predatory nature of banks.

The solution Satoshi Nakamoto came up with was to disintermediate the banks entirely. People are corruptible, math is not.

If people want to spurn Nakamoto’s gift and trust bankers with Ripple, Ethereum, etc that’s their business.

I have no doubt that anyone using banker crypto, having forgotten the past, will be doomed to repeat it.

“Ethereum is garbage” – upset that there’s something out there that actually has some utility, that people – and businesses, including banks – are actually using to drive value and efficiency, rather than just hoard like Bitcoin?

Dude is obviously a Bitcoin fanboy. Just look at his comment history. He feels the pressure building because Ethereum is in such high demand. He fears “The Flippening”. In case you haven’t heard, that is when Ethereum will overtake Bitcoin as the new dominant currency. Many Bitcoin fanboys are terrified of what Ethereum is doing right now.

I’ve caught these Ethereum trolls shilling on almost every Bitcoin forum!

Same tactics almost verbatim, no facts and personal attacks, fake names and empty profiles on Facebook.

How much do they pay you to troll Bitcoin forums?

Let’s hope they pay you in something other than Ethereum because in spite of your attacks, Ethereum is a fundamentally bad cryptocurrency.

“Ethereum is garbage” congratulations on being one of the only people on the planet who has this opinion.

No cap on total unit, and a rewritable blockchain…No thanks.

Yeah, because that’s why Bitcoin was originally created. May I remind you that the primary users base of Bitcoin used to be criminals, and to some extent still is. Bitcoin is only the dominant cryptocurrency right now because it is the oldest. The world hasn’t seen anything like Ethereum since Bitcoin, and I think you know it. Ethereum is what Bitcoin should have been all along. If you think Ethereum is garbage, then I’m guessing you have a lot invested in Bitcoin and are scared to death because you know Ethereum is a superior product and will very probably overthrow Bitcoin as the dominant cryptocurrency. If you based your opinion on reality and not just loyalty because of your investment, you would know that Ethereum is a much better solution.

The “primary users base” of Bitcoin has never been criminals. That would be like saying the primary user base of cash was bank robbers, lol.

A few, much publicized cases were used to make headlines and cast aspersions on Bitcoin.

By dollar value the banks themselves were far more guilty of laundering money for drug cartels and financial fraud as in the case of toxic securities. The list goes on, but how about the latest case of fraud by Wells Fargo, does that justify saying “a majority of banks are engaged in criminal fraud”?

As far as Ethereum is concerned there are some very real flaws.

There is no cap on total units and that is ultimately inflationary.

Ethereum is controlled by a small group that can and does edit the Blockchain when it deems necessary, as evidenced by the “DAO Debacle” that led to the Ethereum split. These two factors alone indicate that Ethereum is not a “good store of value”.

If one needs the programmability aspect Of Ethereum I would suggest Ethereum classic, same programmability and much more honest.

As far as cryptocurrencies go there are other altcoin with good fundamentals but as you say Bitcoin is the largest and well established.

If one is interested in altcoins, I would recommend both both Litecoin and Auroracoin for their sound fundamentals.

The majority of the public isn’t ready to give up traditional banking for crypto currencies, and they won’t just jump straight from one to the other. At the same time, the banking industry isn’t going to just fold up shop and go home. They still represent more market share and power than the crypto currency markets. It makes sense that as banks adopt Ethereum, Ripple, and the like, this will be the most likely path for the majority of users to “get on” the blockchain. If you like a return on investment, it makes sense to like all of these coins right now as the public will always prefer the simplest route to adoption.

Exactly. It’s the best way to get rapid development and adoption of crypto of the masses to get a feel of its potential. Any developments and ideas may likely spill over into other crypto markets. And when the mainstream gets comfortable, it may give them the know how to use and trade/invest for better more sound crypto competition in the future as they seek to optimise any flaws out.

It definitely looks like Ethereum supporters are trolls here…. fake names and no Avatars….

Spreading misinformation and FUD.

Good point Russell, I’ve caught these Ethereum trolls shilling on almost every Bitcoin forum!

The writing styles are so similar that I think it’s the same character(s).

Same tactics almost verbatim, no facts and personal attacks, fake names and empty profiles on Facebook.

This author is just trying to down talk Ethereum. What this author is oblivious of or does not want to think of is how POS changes the whole equation.. With POS the power is in the hands of the people who own the Ethers and not just left to the mercy of the miners. So any dilution or inflation just adds to the net worth of those who are the stakeholders only. So contradictory to the propositions made regarding unlimited supply, whoever wants to get a stake or part of the new age economy is well served by taking a stake now itself rather than waiting more time and pay more. POS will actually create more demand with everyone wanting to own a part and especially the enterprises and governments as well. This is something only those in the know now know about. Others creating FUD are those who have a self interest or are paid just to write the article. Worth thinking about.

“any dilution or inflation just adds to the net worth”…Are you crazy?

That goes against any of economic model ever devised by anyone, other than your employer…

Wouldn’t it be wise to have a stake in both BTC and ETH? Would a scenario arise where Bitcoin becomes more of store of value, ‘digital gold’ type hedge against central bank fiat printing where ETH becomes a daily transactional currency with little or no overhead to the buyer and seller with lots of apps for consumers to choose from to load on their smartphones. So the use case is people doing day to day transactions on ETH or Litecoin. Now there are hundreds more with all of them having their own mission statement and purpose.

The diversity you’re talking about is probably Litecoin.

Faster transaction times because of Segwit integration but still good fundamentals of decentralization and an 84 million cap on units.

It’s not that prefer Bitcoin, in fact my all time favorite is Auroracoin.

I just don’t trust a banker crypto especially one with no cap on units and controlled by the same group that brought us the world financial crisis of 2008.

BITCOIN VS ALTCOINS & ETHEREUM

Contrary to the dominant narritive, Bitcoin has no problem…it’s immunities to change is what gives it a credible decentralized quality. It is precisely because Chinese miners, Bitcoin core developers, or these large exchanges cannot make changes or force updates on Bitcoin’s network, that we can see proof that Bitcoin is the most decentralized.

NOTE: Bitcoin already functions perfect as a store of value…It doesn’t need to function as a currency yet.

My biggest concern for Ethereum and all other altcoins is their governance models: if Ethereum moves to proof of stake, and the big Banks are the largest stake holders, the promised innovation and decentralization will be captured and put under their control again.

Ethereum seems capable of changes easily, thus it is too centralized to serve as a store of value… it may eventually connect to Bitcoin for value, or it will be replaced by an innovative sidechain or update to Bitcoin soon.

The only thing that matters for a viable blockchain is it’s use as a store of value….all other functionality comes later as the free market demands.

Ethereum is a bad speculative Investment, because it is soo easy to change… Bitcoin is the new standard that has far surpassed Golds’ 5000 year reign…but let’s face it horses have been awround longer, but few people are willing to take a horse, over a car, on a cross country ride. Technology progresses, and when it finally works, it changes even our longest traditions.

The Ethereum shills seem to be repeating the same message in every forum:

“Get on board before you’re left out” and “If you have questions about Ethereum as store of value, you must be a Bitcoin fanboy”.

As I’ve said, I’ve found what appears to be these same people on almost every Bitcoin forum spouting the same nonsense under assumed names and empty profiles.

I’m tempted to start “trolling” the Ethereum forums and injecting common sense but I don’t get paid to do it the way they are.

I think the narrative is starting to break through mainstream conversations…

Bitcoin does not have to be a currency it only has to be a store of value.

But I think once it is a store of value then soon after they will innovate on top of it and develop a currency feature.

In my opinion there’s many reasons why Ethereum is a ridiculous speculative investment… I don’t think it’s going to be much longer before people realize this and start moving coins into Bitcoin.

Bitcoin will fail to be a store of value if it can’t be a currency. The masses wont like 10 minute wait times at best when better real replacement currencies exist. There is simply a larger market to be a currency and a sound currency is always a good store of value.

Bitcoin is only surviving on first mover advantage and will be obsolete if it can’t fix this and service the 99% of the mainstream demand it is leaving on the table.

You people are mental. How in the heck is bitcoin a store of value when it can gain or lose 20% in a week? That is the opposite of a store of value

I don’t know anyone invested in Ethereum who is not either also invested in Bitcoin, or would like to be also invested in Bitcoin. Compare the two communities /r/Bitcoin and /r/Ethereum on reddit. Ethereum’s community is not badmouthing Bitcoin. It exists because of Bitcoin, so that would be a rather ridiculous stance to take. Bitcoin being the first blockchain currency, and now acting as the “gateway” cryptocurrency contains a larger percentage of uneducated (I don’t mean that in a bad way) investors. They want in on the craze but either don’t care to know, or don’t yet know what blockchain is, how it works, and why its existence will impact virtually every existing industry. This is an advantage that the Ethereum community has in that if you’re sold on Ethereum, most likely you understand the benefit and potential of a blockchain that has the capability of attaching contracts to transactions.

No one likes a troll.

You people are mental. How in the heck is bitcoin a store of value when it can gain or lose 20% in a week? That is the opposite of a store of value.

use binary options to increase your bitcoin investments you can start

trading today with only 1.5btc and earn up to 5.5btc in less than a

week,for this reason many bitcoin owners are now opting to use binary

options to improve their bitcoin investments as much as possible,many

people have suffered from the stress involved in investing,many

investments takes long revenue to mature or earn viable revenue,binary

options comes with short term payout unlike the traditional

formats….this is an opportunity for those that have lost too much and

those that are tired of earning less,inbox me via email for more details [email protected]

As I am sure most of you have heard this before I am new to Crypto. Bought into Ethereum a few months back bc I liked what I read about it and where it was heading a few months back and the price predictions for end of year and 2018. I am not invested in Bitcoin and don’t really care to at this point but I do feel more inclined lately to sell off Ethereum and use profits and additional funds to buy into Ripple. I like the idea of being in on something that hasn’t reached over .50 with predictions forecasting a possible of .75-.95 by EOY and 2.00 end of 2018! What do you think of Ripples price predictions for end of year and 2018. Are they too bold like most other Top Ten Cryptos or more legitimate than others.

Bitcoin oder ethereum

What is the main difference?

Well, the fact that Ethereum was created from Bitcoin open-source says a lot about the basic differences between the two of them; the first one is actually the very first cryptocurrency in the world so is the most known, installed and houses any kind of users and investors. On the other side, Ethereum is one of the newest cryptocurrencies but despite that, it quickly positioned right after BTC thanks to its diverse platform that might not be very friendly for the newest users but it is slowly getting more approachable for them as it is quite useful for the most expert traders.

Is in that Ethereum platform where the primordial difference between Ether and Bitcoin is. As BTC is the first cryptoasset, the chainblock was newly developed and though only in relation to the cryptocoin trade, period, that is its final object in order to maintain a relatively stable e-currency. Ethereum, on the contrary, is an integrated platform where users can develop other projects and transactions besides trading cryptocurrencies.

Ether is not only one of the concepts this platform seeks to develop and, as the system grows, it is possible that other cryptocurrencies depend on Ethereum as they do now on Bitcoin. But the smart contracts are what gives Ethereum so much popularity in this short time.

Other differences

In smaller aspects, as Ethereum is newer and therefore has a more modern technology, it surpasses BTC system in some tiny factors:

• Time for transaction confirmation: Bitcoin’s time for confirmation is one of the slowest ones with an average of 10 minutes per transaction while Ethereum works in around 12 seconds thanks to its GHOST protocol.

• Monetary supply: Bitcoin has a quite limited stash that is actually getting to its limits while Ethereum supply is quite greater than BTC’s and is not nearly to its limits, actually it is said that Ether has no total limit and can be created as much of it as necessary, only an annual limit of 18USD million is set.

• The mining reward is quite different too; Bitcoin is quite simpler to mine and has a reward around 12BTC per transaction but it is constantly diminishing with time. On the other hand, Ethereum rewards are lower, only 5ETH per transaction but it seems to be much more stable.

• The cost of transaction: in Bitcoin, every transaction competes equally with each other while in Ethereum, the costing is directly related to the storage needs.

• Turing internal code: unlike Bitcoin, Ethereum counts with its own Turing internal and integral code which gives the possibility to perform any calculation if we have the time and right equipment. Bitcoin is a little bit more uncertain in this aspect.

Bitcoin Vs Ethereum: Driven by Different Purposes

Ethereum has received a lot of attention since its announcement at the North American Bitcoin Conference in early 2014 by Vitalik Buterin. The natural consequence of its rising popularity has been its constant comparison to Bitcoin, the first virtual currency. It is important for investors to understand the similarities and differences between Bitcoin and Ethereum.

Bitcoin, the first virtual currency, was born nine years back in 2008. It introduced a novel idea set out in a white paper by the mysterious Satoshi Nakamoto: Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government issued currencies. There are no physical Bitcoins, only balances associated with public and private keys.

Over these years, the acceptance of the concept of a virtual currency has increased among regulators and government bodies. Although it isn’t a formally recognized medium of payment or store of value, it has managed a niche for itself and continues to coexist in the financial system despite being regularly scrutinized and debated.

Blockchain

The attempts to understand Bitcoin more closely resulted in the discovery of blockchain, the technology that powers it. The blockchain is not just the hottest topic in the FinTech world but also a sought after technology in many industries.

A blockchain is a public ledger of all transactions in a given system that have ever been executed. It is constantly growing as completed blocks are added to it. The blocks are added to the blockchain in linear, chronological order through cryptography, ensuring they remain beyond the power of manipulators. The blockchain thus stands as a tamper-proof record of all transactions on the network, accessible to all participants. The blockchain offers a chance to work at lower costs with greater regulatory compliance, reduced risk, and enhanced efficiency.

Enter Ethereum!

Blockchain technology is being used to create applications which are beyond just supporting a digital currency. Such applications are often referred to as Crypto 2.0, Blockchain 2.0 or even Bitcoin 2.0.

Launched in 2015, Ethereum is the largest and most well-established, open-ended decentralized software platform that enables SmartContracts and Distributed Applications (ĐApps) to be built and run without any downtime, fraud, control or interference from a third party. Ethereum is not just a platform but also a programming language (Turing complete) running on a blockchain, helping developers to build and publish distributed applications. (See also: What is Ethereum?)

The potential applications of Ethereum are wide ranging and run on its platform-specific cryptographic token, Ether. In 2014, Ethereum had launched a pre-sale for ether which received an overwhelming response. Ether is like a vehicle for moving around on the Ethereum platform and is sought by developers looking to develop and run applications inside Ethereum.

Ether is used broadly for two purposes: it is traded as a digital currency exchange like other cryptocurrencies and is used inside Ethereum to run applications and even to monetize work. According to Ethereum, it can be used to “codify, decentralize, secure and trade just about anything.” One of the big projects around Ethereum is Microsoft’s partnership with ConsenSys which offers “Ethereum Blockchain as a Service (EBaaS) on Microsoft Azure so Enterprise clients and developers can have a single click cloud-based blockchain developer environment.”

Bitcoin Vs Ethereum

While both Bitcoin and Ethereum are powered by the principle of distributed ledgers and cryptography, the two differ in many technical ways. For example, the programming language used by Ethereum is Turning complete whereas Bitcoin is in a stack based language. Other differences include block time (Ethereum transaction is confirmed in seconds compared to minutes for Bitcoin) and their basic builds (Ethereum uses ethash while Bitcoin uses secure hash algorithm, SHA-256). (See also: Risks and Rewards of Investing in Bitcoin.)

However, from a general point of view, Bitcoin and Ethereum differ in purpose. While Bitcoin is created as an alternative to regular money and is thus a medium of payment transaction and store of value, Ethereum is developed as a platform which facilitates peer-to-peer contracts and applications via its own currency vehicle. While Bitcoin and Ether are both digital currencies, the primary purpose of Ether is not to establish itself as a payment alternative (unlike Bitcoin) but to facilitate and monetize the working of Ethereum to enable developers to build and run distributed applications (ĐApps).

The Bottom Line

In sum, Ethereum is an advancement based on the principle of blockchain that supports bitcoin but with a purpose that does not compete with Bitcoin. However, the popularity and rising market capitalization of Ether brings it in competition with all cryptocurrencies, especially from the trading perspective. Currently, the market cap of Ether (ETH) is more than Ripple and Litecoin, although it’s far behind Bitcoin (BTC). On the whole, Bitcoin and Ethereum are different versions using the blockchain technology, and are set to establish themselves, driven by different intentions.

[ Bitcoin. Ethereum. Ripple. There are new, impactful cryptocurrencies and tokens arriving every day. Learn the basics of cryptocurrency, how we got here, and what the future of crypto holds for us in Investopedia Academy's Cryptocurrency for Beginners course. Taught by fintech Entrepreneur Lex Sokolin, Cryptocurrency for Beginners gives you the foundation you need to successfully enter the world of cryptocurrencies. ]

Ethereum Vs Bitcoin: What's The Main Difference?

While Bitcoin has long been dominant in the cryptocurrency scene, it is certainly not alone. Ethereum is another cryptocurrency related project that has attracted a lot of hype because of its additional features and applications.

Ethereum: More Than Just Money

The first thing about Ethereum is that it is not just a digital currency. It is a blockchain-based platform with many aspects. It features smart contracts, the Ethereum Virtual Machine (EVM) and it uses its currency called ether for peer-to-peer contracts.

Ethereum's smart contracts use blockchain stored applications for contract negotiation and facilitation. The benefit of these contracts is that the blockchain provides a decentralized way to verify and enforce them. The decentralized aspect makes it incredibly difficult for fraud or censorship. Ethereum's smart contracts aim to provide greater security than traditional contracts and bring down the associated costs.

The smart contract applications are powered by ether, Ethereum's blockchain based cryptocurrency. Ether, as well as other crypto-assets, are held in the Ethereum Wallet, which allows you to create and use smart contracts. The system has been described by the New York Times as..

"a single shared computer that is run by the network of users and on which resources are parceled out and paid for by ether."

Implement Smart Contracts With Your Own Cryptocurrency

Ethereum allows you to create digital tokens that can be used to represent virtual shares, assets, proof of membership and more. These smart contracts are compatible with any wallet, as well as exchanges that use a standard coin API. You can copy the code from Ethereum's website and then use your tokens for many purposes, including the representation of shares, forms of voting and also fundraising. You can either have a fixed amount of tokens in circulation or have a fluctuating amount based on predetermined rules.

You Don't Need Kickstarter When You Have Ethereum

One great feature of Ethereum is that it gives developers a means to raise funds for various applications. For your new project, you can set up a contract and seek pledges from the community. The money that is raised will be held until the goal is reached or until an agreed upon date. The funds will be released back to the contributors if the goal is not met, or go on to the project if it is successful. Kicking out Kickstarter means that the third party is taken out, along with their rules, and also the fees they charge (when you include processing fees, Kickstarter can take up to 10% of a project's budget).

Skip the Traditional Management Structure With Democratic Autonomous Organizations

Not only can Ethereum help you source funding, but it can also help to provide the organizational structure to get your idea off the ground. You can collect proposals from the people who backed your project and then hold votes on how you should proceed. This means that you can skip the expense of a traditional structure, such as hiring managers and doing paperwork. Ethereum also protects your project from outside influences, while its decentralized network means that you won't face downtime.

The Finer Details: Differences Between Ethereum and Bitcoin

There are also many smaller aspects that differ between the two blockchain-based projects. Bitcoin's average block time is about 10 minutes, while Ethereum's aims to be 12 seconds. This quick time is enabled by Ethereum's GHOST protocol. A faster block time means that confirmations are quicker. However, there are also more orphaned blocks.

Another key difference between them is their monetary supply. More than two-thirds of all available bitcoin have already been mined, with the majority going to early miners. Ethereum raised its launch capital with a presale and only about half of its coins will have been mined by its fifth year of existence.

The reward for mining Bitcoin halves about every four years and it is currently valued at 12.5 bitcoins. Ethereum rewards miners based on its proof-of-work algorithm called Ethash, with 5 ether given for each block. Ethash is a memory hard hashing algorithm, which encourages decentralized mining by individuals, rather than the use of more centralized ASICs as with Bitcoin.

Bitcoin and Ethereum also cost their transactions in different ways. In Ethereum, it is called Gas, and the costing of transactions depends on their storage needs, complexity and bandwidth usage. In Bitcoin, the transactions are limited by the block size and they compete equally with each other.

Ethereum features its own Turing complete internal code, which means that anything can be calculated with enough computing power and enough time. Bitcoin does not have this capability. While there are certainly advantages to the Turing-complete, its complexity also brings security complications, which contributed to the DAO attack in June.

Ethereum and Bitcoin: Two Very Different Beasts

While many will compare the cryptocurrency aspect of both Ethereum and Bitcoin, the reality is that they are vastly different projects and have different intentions. Bitcoin has emerged as a relatively stable digital currency, while Ethereum aims to encompass more, with ether just a component of its smart contract applications.

Bitcoin VS Ethereum: Cryptocurrency Comparison

Last updated on February 22nd, 2018 at 12:31 pm

Since its release in early 2009, Bitcoin has been the trailblazing leader of the cryptocurrency revolution. Countless imitators have come and gone but Bitcoin remains dominant, despite nearing the current limits of its transactional capacity.

Ethereum, created mid-2015, is Bitcoin’s strongest rival… But can Ethereum deliver on the hype surrounding its complicated technology, as well as recover from the recent spectacular failure of the DAO, to usurp Bitcoin’s primacy?

- Created

- Market cap

- Popular support

- Blockchain

- Scalable

- Mining

- Supply

- Development

- Hash rate

- Initial distribution

Complimentary or Competing Cryptocurrencies?

How valid is the frequent claim that Bitcoin and Ethereum aren’t direct competitors but rather complimentary aspects of the new, blockchain-based economy? The peaceful coexistence theory holds that the web is vast and deep enough for Bitcoin and Ethereum to carve out their respective niches:

Bitcoin specialising in its role as digital gold; offering a dependable monetary system free from unbounded inflation and political intervention.

Bitcoin specialising in its role as digital gold; offering a dependable monetary system free from unbounded inflation and political intervention.

Ethereum evolving into the world computer; a blockchain-based programming language enabling code-based contracts and decentralised applications.

Ethereum evolving into the world computer; a blockchain-based programming language enabling code-based contracts and decentralised applications.

In practice, matters are more complex. Given the extensibility of cryptocurrency, neither coin has a clearly defined sphere of operation. There is considerable overlap between their functions and markets, with nothing to prevent user migration.

For example, additional layers built upon Bitcoin, such as the Rootstock.io smart contact platform, threaten to trespass on Ethereum’s playground. Rootstock promises to do everything Ethereum can, with the added security of a two-way peg to the more secure Bitcoin network.

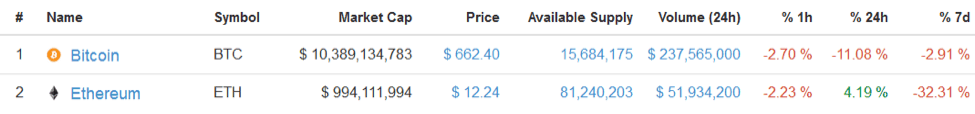

Likewise, Ethereum has become a popular trading and investment instrument, infringing upon Bitcoin’s domain as “magic internet money.” Ethereum’s daily trading volume, insofar as such figures can be trusted for either currency, is currently about 1/5 th that of Bitcoin:

Stats as of the 21 st of June 2016, courtesy of CoinMarketCap

Stats as of the 21 st of June 2016, courtesy of CoinMarketCap

Bitcoin VS Ethereum – Competitive Factors

The following user scenarios serve to illustrate the frequent necessity of choosing between Bitcoin and Ethereum:

- Traders and Investors allocating capital according to expected returns and perceived safety,

- CEOs and Founders must choose the best platform to serve their business,

- Developers have only so much time to contribute to open source projects,

- Miners invest in different types of hardware depending on which coin they mine,

- Media disseminates only the most compelling stories to their audience, etc.

Peaceful coexistence is a myth; Bitcoin and Ethereum clearly compete for users. The good news is that such competition should ultimately produce better cryptocurrencies.

Bitcoin VS Ethereum – Popular Support

Bitcoin users tend to be politically and economically conscious. Many users support certain principles, such as individual sovereignty and free markets. There exists a definite aversion to central planning and control, so Bitcoin is often revered as the counter to central banks and big governments.

Bitcoin users tend to be politically and economically conscious. Many users support certain principles, such as individual sovereignty and free markets. There exists a definite aversion to central planning and control, so Bitcoin is often revered as the counter to central banks and big governments.

Ethereum users tend to be less ideologically-motivated. They are generally content to vest ultimate authority in Vitalik Buterin, inventor of Ethereum. The community’s focus tends to be on the technology’s future business and financial applications.

Ethereum users tend to be less ideologically-motivated. They are generally content to vest ultimate authority in Vitalik Buterin, inventor of Ethereum. The community’s focus tends to be on the technology’s future business and financial applications.

The network effect, expressed mathematically by Metcalfe’s law, states that a network’s value is proportional to its number of users. Whether we’re talking fax machines, social media or cryptocurrency; people are more likely to join popular networks. As the first cryptocurrency, Bitcoin has a clear first-mover advantage here.

Bitcoin VS Ethereum – Scripting Language

Bitcoin transaction data doesn’t just confer ownership of coins; it also conveys certain instructions relating to transaction. For example, a recently-implemented change allows sent coins to be locked for a custom time period. The set of possible instructions is known as Bitcoin’s scripting language and it’s intentionally limited to transactional processing.

Bitcoin transaction data doesn’t just confer ownership of coins; it also conveys certain instructions relating to transaction. For example, a recently-implemented change allows sent coins to be locked for a custom time period. The set of possible instructions is known as Bitcoin’s scripting language and it’s intentionally limited to transactional processing.

Ethereum’s primary innovation was to expand this set of instructions into a fully-featured programming language such as JavaScript, which Ethereum’s language closely resembles. This is what is meant by Ethereum being “Turing-complete.”

Ethereum’s primary innovation was to expand this set of instructions into a fully-featured programming language such as JavaScript, which Ethereum’s language closely resembles. This is what is meant by Ethereum being “Turing-complete.”

Risk vs. Reward: The undeniable fact is that, by adding complexity at the protocol level, Ethereum presents a larger attack surface to adversaries. This heightened risk of attack makes Ethereum an inferior store of value. Further, there is no decisive advantage gained from Ethereum’s scripting language which could not be duplicated via protocol-separate code. Bitcoin may be in trouble if Ethereum ever develops such a killer app but until then…

Bitcoin VS Ethereum – Blockchain

Bitcoin has a Proof of Work blockchain which is currently composed of 1 megabyte blocks. These blocks are mined on average every 10 minutes by SHA-256 hashing. Bitcoin mining is primarily performed by ASIC devices. Bitcoin’s blockchain can process around 3 transactions per second.

Bitcoin has a Proof of Work blockchain which is currently composed of 1 megabyte blocks. These blocks are mined on average every 10 minutes by SHA-256 hashing. Bitcoin mining is primarily performed by ASIC devices. Bitcoin’s blockchain can process around 3 transactions per second.

Ethereum currently has a Proof of Work blockchain, although a proposed fork will switch it to Proof of Stake (PoS). The Ethereum blockchain is composed of blocks of variable size. Blocks are mined on average every 15 seconds by hashing a modified Dagger-Hashimoto algorithm. This algorithm is designed to resist processing by ASIC devices; as a result Ethereum mining is primarily performed by graphics cards. Ethereum’s blockchain can process around 25 transactions per second.

Ethereum currently has a Proof of Work blockchain, although a proposed fork will switch it to Proof of Stake (PoS). The Ethereum blockchain is composed of blocks of variable size. Blocks are mined on average every 15 seconds by hashing a modified Dagger-Hashimoto algorithm. This algorithm is designed to resist processing by ASIC devices; as a result Ethereum mining is primarily performed by graphics cards. Ethereum’s blockchain can process around 25 transactions per second.

Scalability: Ethereum appears to have a clear advantage in terms of blockchain scalability. Bitcoin is in the process of upgrading its transactional capacity.

Security: In terms of blockchain security, massive infrastructure investment by Bitcoin miners has resulted in a peak Bitcoin hashrate of 1,803,059,256 GH/s (1.8 ExaHash). This greatly exceeds Ethereum’s hashrate, which peaked at a comparatively paltry 3,010 GH/s (3 TeraHash). The monetary cost to perform a 51% attack on Bitcoin is proportionately greater.

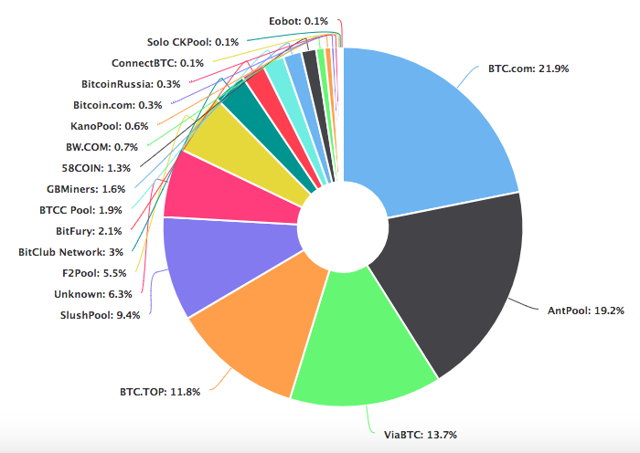

Decentralisation: Hashrate distribution among mining pools is fairly equal between Bitcoin and Ethereum on a percentage basis.

The majority of Bitcoin mining occurs in China due to favourable economic factors. This raises a red flag in terms of the potential pressure the Chinese state could exert on the Bitcoin mining network. While Bitcoin could alter its mining algorithm to thwart any takeover attempt, this “mining hardware reset” would doubtless prove tremendously destructive.

Although Ethereum mining in its current state resembles the glory days of individual-level Bitcoin mining, its planned switch to PoS will likely increase centralisation. Gavin Andresen, former Bitcoin lead developer, succinctly critiqued PoS thus: “I think proof-of-stake is hard coded, ‘the rich get richer’ and is deeply unfair.”

Mining: Ethereum is profitable to mine on high-end GPUs, especially given low power costs. Advanced graphic cards are available for under $200 and can also run games and other apps. However, before investing in a mining rig, aspiring Ethereum miners should consider that the upcoming change to PoS will invalidate their investment.

Bitcoin is only profitable when mined with specialised ASIC hardware running on very low cost electricity. High-end ASIC hardware costs over $2000 per unit and has no purpose besides mining Bitcoin. The pace of ASIC hardware advancement is slowing as it approaches the limits of semiconductor miniaturisation technology; it can be hoped that this process, perhaps in combination with the increasing power generation efficiencies, will eventually lead to a more widely-dispersed Bitcoin mining network.

Bitcoin VS Ethereum – Supply

Bitcoin’s total supply will be strictly limited to 21 million coins. Bitcoin’s issuance is halved roughly every 4 years. As of the next halving in July 2016, Bitcoin’s inflation rate will drop to an annual rate of

Bitcoin’s total supply will be strictly limited to 21 million coins. Bitcoin’s issuance is halved roughly every 4 years. As of the next halving in July 2016, Bitcoin’s inflation rate will drop to an annual rate of

5%. Future halving events, combined with coins lost through user error, will ultimately result in a deflationary currency.

Ethereum’s issuance by miners is capped at an annual rate of 18 million ETH. This represents an inflation rate of

Ethereum’s issuance by miners is capped at an annual rate of 18 million ETH. This represents an inflation rate of

20% at the current supply. As ETH is not consumed by running programs but instead sent to the miner of the associated transaction, Ethereum’s value is likely to decline in the long term.

Implications: All else remaining equal, the purchasing power of a deflationary currency will rise over time whereas the relative value of an inflationary currency will fall. Bitcoin therefore encourages saving and benefits early adopters who bought in cheaply. Ethereum encourages spending and lowers the cost of entry for newcomers.

Bitcoin VS Ethereum – Initial Distribution

Bitcoin is thought to have been mined exclusively by Satoshi Nakomoto in its early phase. At that time, there was no barrier to the entry of other miners, other than Bitcoin’s obscurity. It’s estimated that Satoshi owns roughly 5% of total supply. As Satoshi’s coins have yet to move, some speculate they may be inaccessible.

Bitcoin is thought to have been mined exclusively by Satoshi Nakomoto in its early phase. At that time, there was no barrier to the entry of other miners, other than Bitcoin’s obscurity. It’s estimated that Satoshi owns roughly 5% of total supply. As Satoshi’s coins have yet to move, some speculate they may be inaccessible.

Ethereum’s distribution took the form of an ICO (Initial Coin Offering), whereby 31,529 BTC was traded for 60,102,216 ETH in advance of the Ethereum blockchain’s launch. Approximately $14m USD was raised in this fashion by the Ethereum Foundation, which awarded itself 12m ETH; roughly 14% of the current total supply.

Ethereum’s distribution took the form of an ICO (Initial Coin Offering), whereby 31,529 BTC was traded for 60,102,216 ETH in advance of the Ethereum blockchain’s launch. Approximately $14m USD was raised in this fashion by the Ethereum Foundation, which awarded itself 12m ETH; roughly 14% of the current total supply.

Fairness: Bitcoin had a demonstrably fairer launch. The Ethereum Foundation’s majority stake is somewhat concerning given the intended switch to Proof of Stake mining. Under PoS, the likelihood of minting new tokens is proportional to holdings. This raises the possibility of the further concentration of self-awarded wealth.

Bitcoin VS Ethereum – Development

Bitcoin’s codebase benefits from over 100 Core contributors and several alternative implementations. With over $10b in assets on the line, they take a conservative approach to development. All proposed improvements must undergo peer review and rigorous testing prior to being merged.

Bitcoin’s codebase benefits from over 100 Core contributors and several alternative implementations. With over $10b in assets on the line, they take a conservative approach to development. All proposed improvements must undergo peer review and rigorous testing prior to being merged.

The perceived slow pace of this process, at least in terms of scaling, led to contention (the so-called Blocksize Debate) and the eventual estrangement of numerous users, several companies and even a few developers. Core developers are now under considerable pressure in terms of delivering scaling solutions without compromising security.

Ethereum is the brainchild of Vitalik Buterin, who handled its initial development along with 3 other skilled developers. They were able to pick and choose ideas from the development of Bitcoin and altcoins and introduce new ideas of their own. However, literally anyone can code a smart contract which runs on top of Ethereum. Herein lays both opportunity and danger.

Ethereum is the brainchild of Vitalik Buterin, who handled its initial development along with 3 other skilled developers. They were able to pick and choose ideas from the development of Bitcoin and altcoins and introduce new ideas of their own. However, literally anyone can code a smart contract which runs on top of Ethereum. Herein lays both opportunity and danger.

Certain estimates put the number of bugs per line of contract code at 1 in 10. As seen with the draining of The DAO and numerous minor incidents, investing in such contracts without proper code review can lead to serious loss. More work is required to secure smart contracts before they can reliably underwrite new ways of doing business.

A Developing Story: both coins face considerable challenges if order to realise their full potential. However, this industry tends to attract some of the world’s best and brightest minds, who invariably relish intellectual challenge.

Final Word

Bitcoin has more lives than a cat, by an order of magnitude. Betting against Bitcoin is just not advisable, as many have learnt to their detriment. If SegWit, the Lightning Network, Rootstock, Elements and other exciting developments play out as expected, Bitcoin will retain its crown with ease.

Bitcoin has more lives than a cat, by an order of magnitude. Betting against Bitcoin is just not advisable, as many have learnt to their detriment. If SegWit, the Lightning Network, Rootstock, Elements and other exciting developments play out as expected, Bitcoin will retain its crown with ease.

Ethereum is no safe bet, which is not to say it couldn’t pay off handsomely. The uncertainty surrounding its prospects increases its volatility, making it a great instrument for traders.

Ethereum is no safe bet, which is not to say it couldn’t pay off handsomely. The uncertainty surrounding its prospects increases its volatility, making it a great instrument for traders.

In the short term, much will depend on how the DAO crisis is resolved. Medium term, there’s considerable uncertainty around the PoS fork and how it’ll impact network security and incentives. Long-term, doubts remain regarding Ethereum’s high rate of inflation and its significant pre-mine. If it’s to survive, it must also evolve past dependence on a single trusted authority, in the person of Vitalik.

Bitcoin Versus Ethereum

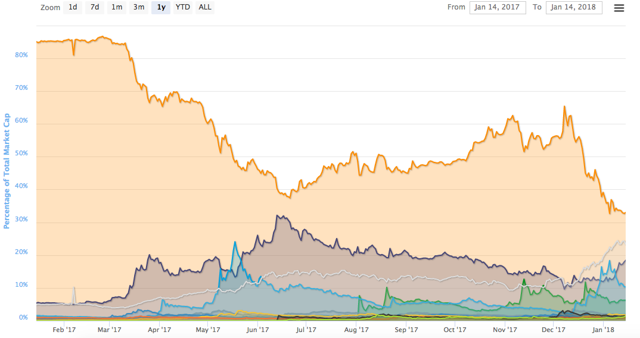

Bitcoin losing dominance amongst cryptocurrencies.

Issues plaguing Bitcoin (Futures markets, China/South Korea).

How Ethereum is a safer bet.

How should investors adjust their portfolio?

Bitcoin is slowly losing its dominance in the cryptocurrency market.

In the chart above (Bitcoin = orange, Ethereum = purple), Bitcoin (BTC) comprised 85% of the cryptocurrency market in January 2017. One year later, Bitcoin only accounts for 33% of the market. Meanwhile, Ethereum (ETH) has risen from just 5% of the market in 2017, to nearly 20% now. At one point, Ethereum peaked at 32% market share during July 2017.

If you look closely at the chart, you can see that whenever Bitcoin trends downwards, Ethereum (along with the others) trends upwards. This is because Bitcoin is the gateway cryptocurrency to other coins. Until now, no other coin was as prevalent in trading pairs as BTC due to its brand name and availability on exchanges that allow users to convert between fiat and BTC. However, Bitcoin is beginning to fall out of favor as exchanges continue to add ETH pairings, which now are almost as common as BTC pairings.

Investors should be mindful of this transition, because as Bitcoin's role as the gateway coin slips away, so does Bitcoin's utility. This mean lower prices for Bitcoin as we move forward into 2018. However, this is the least of BTC's woes; there are a few more issues that threaten the long-term value of Bitcoin, and make its competitor-Ethereum-a better investment.

Issues Plaguing Bitcoin

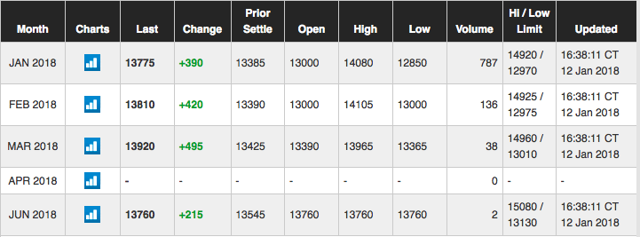

Contrary to my expectations, the futures markets did not help Bitcoin's price after their creation.

The quotes above are from the CME group. Each contract is worth 5 BTC, which essentially prices out most retail investors, leaving institutional investors as the primary participants. If you compare the "JAN 2018" quote to the "JUN 2018" quote, it's clear that institutional investors are not bullish on BTC. They are short Bitcoin. Or if you are optimistic, they could be hedging, but the best way to hedge in the cryptocurrency universe is by not being invested at all.

Whether the large players are short or merely hedging, the futures markets are certainly one reason to be worried about Bitcoin.

Asia Cracking Down on Mining Pools and Exchanges:

Bitcoin is starting to implode in China and South Korea. China already banned ICOs in September, and now the country has outlined plans to decrease energy consumption regarding cryptocurrency mining. Mining has been popular in China due to low energy costs, and the recent popularity of Bitcoin has only added to the surge of virtual mining facilities across the nation.

The four largest mining pools-all Chinese-account for roughly two-thirds of "mining power." From an investor's perspective, this is especially concerning given the Chinese government's intent of clamping down on their miners. Higher energy costs in China will force miners to scale down their networks, or even shut down depending on the circumstances. A smaller network will result in reduced security, which means higher risk of the Bitcoin network being attacked by malicious actors or having slower transaction times.

For me personally, I have liquidated my BTC holdings until I am sure of how Chinese mining pools will be affected. I don't think it makes any sense to expect the Chinese government to allow the proliferation of cryptocurrencies to continue without heavier regulation. And with heavier regulation, means less reason to use BTC yet again. Therefore, I am out.

The other cryptocurrency giant in Asia is South Korea. I talked about the country's actions against exchanges in my previous article. South Korea accounts for 5% of the world's Bitcoin trading, which is roughly $10 billion. The latest data on China shows that they trade approximately $18 billion of the world's Bitcoin. Combined at $28 billion, China and South Korea represent 12% of Bitcoin's market cap. If one country decides to cutoff cryptocurrencies, then the other country will likely feel empowered to follow suit and ban digital currencies in their own market. A cryptocurrency world without China and South Korea would experience a crash in excess of the combined 12% market cap of the two countries, considering investors will be predicting the end of Bitcoin.

Between mining pool energy disputes, and exchange crackdowns, I am more concerned about mining pools. If exchanges are closed, people can still find ways to access other exchanges in order to transact. However, if mining pools are shut down, then there is a sustained loss of hashing power to ensure that coins like Bitcoin are able to maintain secure networks.

This concern has led me to a cryptocurrency that I believe can still thrive despite the potential closure of mining pools: Ethereum.

How Ethereum is Safer than Bitcoin

To start, Ethereum does not have a futures market yet. This means that institutional investors cannot short the coin, and the general market will not be distracted by futures prices that may signal pessimism.

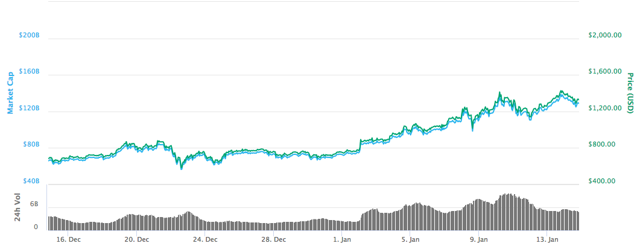

(Ethereum 1 month chart)

(Bitcoin 1 month chart)

The difference between how ETH and BTC have behaved since the introduction of Bitcoin futures is illustrated in the charts above. Ethereum has doubled in one month to $1,300, while Bitcoin has fallen from an all-time-high of $20,000 to $13,000.

Aside from futures, scaling is another issue Bitcoin faces. There has been buzz about the Lightning Network, and how it purports to confirm transactions in seconds, but the reality is that the upgrade is long behind schedule, and has only been tested on extremely small testnets - meaning there is no credibility behind its promise to decrease transaction times.

Without a practical solution to scaling in sight, BTC investors should be cautious of continuing to own a coin with no real utility among its competitors. A brand name alone will not be enough to remain the eminent cryptocurrency.

Ethereum has maintained a decent pace of upgrading their platform to ensure smooth scalability. The founder, Vitalik Buterin, announced a program to fund the development of sharding in the platform. Sharding will essentially break up the system's transactions into digestible chunks, allowing for faster transactions without compromising network security.

You might be wondering how security would be unaffected when Bitcoin's identical solution would result in weaker security on its blockchain. This is the magic of Proof-of-Stake, which eliminates hashing power as the means of confirming transactions, making smaller networks just as secure as larger ones.

The fact that Ethereum's developer team is investing millions into their own platform towards developing a scaling solution that does not compromise security and would barely be affected by mining pool closures is extremely reassuring as an investor. For those reasons, I am long Ethereum.

How Should Investors React?

The days of Bitcoin reigning over the cryptocurrency markets is nearing the end. Bitcoin futures markets, Asia's crackdown on mining pools/exchanges, and Bitcoin's scalability concerns have become too large for me to ignore.

Ethereum is the future star, in my opinion, because of its progress in scalability and its soon-to-be lack of reliance on mining pools once Proof-of-Stake is implemented. A lesser near-term benefit is the absence of a futures market for ETH, which is partially why it has doubled in value in one month.

If you are still invested in Bitcoin, you might want to reconsider allocating a portion of your BTC holdings to ETH, or even divesting out of BTC completely to reinvest into ETH and/or other more utilitarian coins. Finding coins that are essential for operating in a platform, such as using ETH to pay for token transactions, is key to finding a coin with long-term potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long Ethereum.

Bitcoins vs. Ethereum – Vor- und Nachteile der beiden Kryptowährungen

Die Initiatoren von Ethereum haben mit der digitalen Währung ein Produkt entworfen, das mit der bekannteren Währung Bitcoin konkurrieren soll. Für Anleger und Investoren stellt sich nun unweigerlich die Frage: Bitcoins vs. Ethereum – welche der beiden Währungen soll ich kaufen? Eine passende Antwort darauf zu finden, ist nicht so einfach. Um herauszufinden, welche der beiden digitalen Währungen sich eher anbietet, ist es ratsam, beide Produkte miteinander zu vergleichen.

Bitcoin – der Durchstarter am Finanzmarkt

Heute können Interessenten Bitcoins oder Ethereum kaufen. Die Bitcoins tauchten jedoch wesentlich früher, schon im Jahr 2008, als digitale Währung am Finanzmarkt auf. Satoshi Nakamoto entwickelte einst die Idee für Bitcoin. Seit ihrem Markteintritt gilt die Währung deshalb als Favorit unter den Kryptowährungen. Nakamoto verfolgte mit der Entwicklung der Bitcoins von Anfang an die Idee, eine Alternative zu den klassischen Währungen zu schaffen. Letztere spiegeln die Macht der Staaten und Banken wider, was die Bitcoin-Fangemeinschaft nicht gutheißt. In den Anfangszeiten konnten Anleger bereits für wenige Euro in die neuartige Währung investieren.

Heute können Interessenten Bitcoins oder Ethereum kaufen. Die Bitcoins tauchten jedoch wesentlich früher, schon im Jahr 2008, als digitale Währung am Finanzmarkt auf. Satoshi Nakamoto entwickelte einst die Idee für Bitcoin. Seit ihrem Markteintritt gilt die Währung deshalb als Favorit unter den Kryptowährungen. Nakamoto verfolgte mit der Entwicklung der Bitcoins von Anfang an die Idee, eine Alternative zu den klassischen Währungen zu schaffen. Letztere spiegeln die Macht der Staaten und Banken wider, was die Bitcoin-Fangemeinschaft nicht gutheißt. In den Anfangszeiten konnten Anleger bereits für wenige Euro in die neuartige Währung investieren.

Was vielen Anlegern und Investoren zum damaligen Zeitpunkt nicht bewusst war: die Bitcoins sollten sich in den nachfolgenden Jahren enorm entwickeln. Viele Investoren, die schon damals in die Kryptowährung investierten, sind heute unter Umständen sehr reich. Mittlerweile wird viel mehr Kapital benötigt, um bei Bitcoin einzusteigen. Aus diesem Grund suchen Anleger nicht selten nach einer Alternative. Hier kommt wiederum Ethereum ins Spiel.

Das könnte Sie auch interessieren: Bester Bitcoin Broker

So funktionieren Bitcoins

Bitcoin ist vielen Menschen mittlerweile ein Begriff. Die Funktionsweise ist einigen Anlegern hingegen weniger geläufig. Bitcoin besteht aus einem Zahlungssystem und einer Geldeinheit. Letztere nimmt den größeren Stellenwert ein. Denn in Bezug auf Bitcoin ist stets die Rede von einer digitalen Währung beziehungsweise einer Kryptowährung. Aber auch das Zahlungssystem, das hinter Bitcoin steht, ist interessant. Aus diesem Grund ist es lohnenswert, sich auch mit dem System selbst zu befassen.

Bitcoin ist vielen Menschen mittlerweile ein Begriff. Die Funktionsweise ist einigen Anlegern hingegen weniger geläufig. Bitcoin besteht aus einem Zahlungssystem und einer Geldeinheit. Letztere nimmt den größeren Stellenwert ein. Denn in Bezug auf Bitcoin ist stets die Rede von einer digitalen Währung beziehungsweise einer Kryptowährung. Aber auch das Zahlungssystem, das hinter Bitcoin steht, ist interessant. Aus diesem Grund ist es lohnenswert, sich auch mit dem System selbst zu befassen.

Bei eToro können diverse Kryptowährungen gehandelt werden

Die Funktionsweise des Zahlungssystems im Detail

- Das Zahlungssystem basiert auf dem sogenannten Blockchain, einer Datenbank.

- Bei dem Blockchain handelt es sich um eine Art Übersicht über die bei Bitcoin stattfindenden Transaktionen.

- Zu den wichtigsten Grundlagen zählt ein P-to-P-Netzwerk (peer to peer). Alle teilnehmenden Rechner sind hierbei über ein Programm mit dem Netzwerk verbunden.

- Über das Netzwerk können sämtliche Transaktionen eingesehen werden, die über Bitcoin erfolgend.

- Eine stetige System-Aktualisierung macht es möglich, dass die stattfindenden Transaktionen sofort vermerkt werden.

- Zahlungen über das System erfolgen über eine Software, welche mit einem Wallet funktioniert. Hier gibt es bereits praktische und intuitiv bedienbare Anwendungen für den PC.

- Die Weiterleitung der Zahlungen erfolgt an pseudonyme Adressen, die die Software eigens erzeugt. Damit will man verhindern, dass der Handelspartner identifiziert werden kann. Deshalb ist hier auch die Rede von einem weitgehend anonymen Zahlungssystem. Eine hundertprozentige Garantie, dass sich eine Transaktion überhaupt nicht bis zu einer bestimmten Person zurückverfolgen lässt, kann Bitcoin nicht geben.

In Bezug auf das anonyme System hatten diversen Berichten zufolge einige Bitcoin Nutzer bereits Zahlungen auf ihrem Wallet, mit denen sie nicht gerechnet hatten. In solchen Fällen lässt sich der rechtmäßige Inhaber nur schwer finden. Für den Empfänger kann dies ein glücklicher Umstand sein. Denn lässt sich der Absender trotz aller Bemühungen nicht ausfindig machen, so kann der Empfänger die Coins behalten.

Weiter zu eToro: www.etoro.com

Bitcoins als virtuelle Geldeinheit

- Die virtuelle Geldeinheit wird Bitcoins genannt.

- Bei den Bitcoins erfolgt das Mining, um neue Coins zu erzeugen. Dabei handelt es sich um eine Art der Geldschöpfung.

- Um eigene Coins aufzubewahren, wird eine virtuelle Brieftasche benötigt.

- Für die bestmögliche Sicherheit ist diese mittels eines kryptographischen Schlüssels geschützt. Über diesen Schlüssel kann nachgewiesen werden, wer der Besitzer der Bitcoins ist. Zahlungen lassen sich so autorisieren. Die Schlüssel müssen nicht offenbart werden. Sie unterstützen den Nutzer jedoch dabei, die virtuelle Brieftasche zu schützen. Ein Zugriff von außen ist nicht möglich.

- Besonders interessant für den Devisenmarkt: Bitcoins können auch gegen andere Zahlungsmittel getauscht werden.

Teilnehmer, die die erforderliche Rechnerleistung besitzen und diese ebenso zur Verfügung stellen können , sind an der Erschaffung neuer Bitcoins beteiligt. Beim Mining wird alle 10 Minuten eine bestimmte Summe an Bitcoins an die Teilnehmer ausgeschüttet, die den Code lösen konnten. Dadurch entsteht eine Konkurrenz-Situation. Gleichermaßen wird der Markt nicht mit der Währung überschüttet. Es gibt sogar eine Obergrenze, die dies verhindert. Aktuell können über das Netzwerk nicht mehr als 21 Millionen Bitcoins auf den Markt gebracht werden. Dementsprechend ist nicht mit einer Inflation zu rechnen.

Ethereum – ein starker Konkurrent für Bitcoin?

Ethereum ist ebenfalls eine sogenannt Kryptowährung. Die Währung wird hierbei als Ether bezeichnet. Sie kam erst viel später auf den Markt als Bitcoin, konnte jedoch ebenfalls in den ersten beiden Jahren nach der Einführung große Erfolge erzielen. Nicht zuletzt ist dieser Erfolg auch auf Bitcoin zurückzuführen. Denn mehr denn je wächst das Interesse an digitalen Währungen.

Ethereum ist ebenfalls eine sogenannt Kryptowährung. Die Währung wird hierbei als Ether bezeichnet. Sie kam erst viel später auf den Markt als Bitcoin, konnte jedoch ebenfalls in den ersten beiden Jahren nach der Einführung große Erfolge erzielen. Nicht zuletzt ist dieser Erfolg auch auf Bitcoin zurückzuführen. Denn mehr denn je wächst das Interesse an digitalen Währungen.

Von Beginn an war Bitcoin vs. Ethereum ein Thema. Häufig wurden die beiden Kryptowährungen miteinander verglichen. Ethereum konnte im direkten Vergleich durch eine sehr gut funktionierende dezentrale Plattform punkten, über die ein sicherer Geldtransfer möglich ist. Allerdings hängt dies auch mit dem Umstand zusammen, dass Ethereum zunächst gar nicht als Kryptowährung angedacht war, sondern in erster Linie als Plattform für Smart Contracts dienen sollte. Heute ist eine Zahlung mit Ethereum möglich. Ferner besteht die Möglichkeit, Smart Contracts über die Plattform zu fördern. Mit Hilfe sogenannter Dapps – Distributed Apps – lassen sich Vertragsverhandlungen noch einfacher machen. Auch die Verwaltung ist über die Dapps möglich.

So präsentiert sich der Social Trading Broker eToro auf seiner Homepage

Die Idee hinter Ethereum

Vitalik Buterin, der sich zuvor in der Bitcoin Community bereits einen Namen gemacht hatte, entwickelte Ethereum. Die Idee basierte auf der eigenen Faszination für das System der Bitcoins. Er stellte dabei fest, dass die Kryptowährung in Bezug auf technische Highlights durchaus noch mehr Potenzial hatte. Allerdings brachten ihm die Bitcoin-Entwicklung wenig Interesse entgegen, was seine innovativen Ideen anbelangte. Und so entschied sich Buterin, die Entwicklung der neuen digitalen Währung selbst zu übernehmen. Er setzte seine Idee für Ethereum in die Tat um. Die Umsetzung seiner Idee sollte schon bald erste Erfolge erzielen. Ethereum wird ähnlich wie Bitcoin immer beliebter. Dies hängt zum einen mit den günstigeren Preisen für Ether zusammen, weshalb sie auch für Einsteiger leichter zu bekommen sind. Zum anderen spielen natürlich auch die zu erzielenden Renditen eine Rolle. In 2017 erwartet man bei Ethereum ein neues Rekordhoch, das den Anlegern gute Gewinne einbringen soll. Der Analyst Brunner sieht dabei eine gute Chance, dass die Währung Ether die Marke von 1.000 Dollar erzielen kann.

Vitalik Buterin, der sich zuvor in der Bitcoin Community bereits einen Namen gemacht hatte, entwickelte Ethereum. Die Idee basierte auf der eigenen Faszination für das System der Bitcoins. Er stellte dabei fest, dass die Kryptowährung in Bezug auf technische Highlights durchaus noch mehr Potenzial hatte. Allerdings brachten ihm die Bitcoin-Entwicklung wenig Interesse entgegen, was seine innovativen Ideen anbelangte. Und so entschied sich Buterin, die Entwicklung der neuen digitalen Währung selbst zu übernehmen. Er setzte seine Idee für Ethereum in die Tat um. Die Umsetzung seiner Idee sollte schon bald erste Erfolge erzielen. Ethereum wird ähnlich wie Bitcoin immer beliebter. Dies hängt zum einen mit den günstigeren Preisen für Ether zusammen, weshalb sie auch für Einsteiger leichter zu bekommen sind. Zum anderen spielen natürlich auch die zu erzielenden Renditen eine Rolle. In 2017 erwartet man bei Ethereum ein neues Rekordhoch, das den Anlegern gute Gewinne einbringen soll. Der Analyst Brunner sieht dabei eine gute Chance, dass die Währung Ether die Marke von 1.000 Dollar erzielen kann.

Weiter zu eToro: www.etoro.com

Bitcoin vs. Ethereum – die Unterschiede im Blick

Aufgrund der zuvor genannten Punkte sind also bereits deutliche Unterschiede zwischen Ethereum und Bitcoin zu erkennen. Dies macht einen direkten Vergleich nicht unbedingt leichter. Vielmehr sollten die Unterschiede im Detail betrachtet werden.

Aufgrund der zuvor genannten Punkte sind also bereits deutliche Unterschiede zwischen Ethereum und Bitcoin zu erkennen. Dies macht einen direkten Vergleich nicht unbedingt leichter. Vielmehr sollten die Unterschiede im Detail betrachtet werden.

Nachfolgend ein Überblick – Bitcoin vs. Ethereum:

- Einsatzzweck: Die digitale Währung Bitcoins wurde entwickelt, um eine Alternative zu klassischen Währungen zu bieten. Ethereum sollte zu Beginn nur als Plattform mit Smart Contracts arbeiten. Obgleich sich die Währung (Ether) ähnlich wie Bitcoins sehr gut entwickelt hat, stellt diese lediglich einen weiteren Faktor dar.

- Transaktionen: Bei digitalen Währungen werden sämtliche Transaktionen über das Internet durchgeführt. Kunden sollen hiermit eine bestmögliche Schnelligkeit sowie eine hohe Sicherheit garantiert werden. Innerhalb weniger Minuten werden die Transaktionen bei Bitcoin verarbeitet. Bei Ethereum vollzieht sich die Verarbeitung sogar in wenigen Sekunden. Bei Letzterem liegt die Schnelligkeit also deutlich vorn.

- Blockchain: Auch die Schnelligkeit im Blockchain nimmt einen hohen Stellenwert ein. Hierüber erfolgt die Erstellung neuer Währungsblöcke. Bitcoin benötigt für diesen Prozess eine Zeit von 10 Minuten. Bei Ethereum sind es wiederum nur 10 Sekunden.

Hinweis zu Smart Contracts: Sogenannte Smart Contracts kommen für diverse Anwendungen zum Einsatz. Sie werden zum Beispiel für E-Voting-Systeme genutzt oder kommen dann zum Zuge, wenn Crowdfunding betrieben werden soll. Allerdings bewegt sich die Verwendung der Smart Contracts bislang in einem überschaubaren Rahmen. Vor allem private Anleger haben diese noch nicht für sich entdeckt. Oberstes Ziel der Smart Contracts ist es, Zeit und Gebühren zu sparen. Als Beispiel kann etwa der Verweis auf eine Rechnung genannt werden, die bezahlt werden soll, aber eigentlich über eine Lastschrift eingezogen wird. Dieser Einzug soll über Ether-Token erfolgen, nachdem die Dienstleistung geliefert wurde. Diese Abwicklung ist gänzlich ohne Bank durchführbar.

Bei eToro können Trader in den CryptoFund investieren

Vergleich der Wertentwicklung von Bitcoin und Ethereum

Vor der Entscheidung, ob man Bitcoins oder Ethereum kaufen möchte, sollte der Blick zunächst auf die Wertentwicklung führen. Dass dies durchaus Sinn macht, zeigt sich insbesondere beim jeweiligen Börsenwert. Zwar ist immer wieder die Rede davon, dass Bitcoins vor allem im Jahr 2017 eine enorme Steigerung verzeichnen konnten. Aber wie steht es im Vergleich dazu eigentlich mit Ethereum? Ein guter Anhaltspunkt stellt in dem Zusammenhang der Börsenwert in Millionen Dollar dar. Dieser lag bei Bitcoin im Januar 2017 bei einer Summe von 15.491 Millionen Dollar. Ethereum verzeichnete zur selben Zeit einen Wert in Höhe von 698 Millionen Dollar. Interessant ist die weitere Entwicklung in den darauffolgenden Monaten. In einem Zeitraum zwischen Januar und August 2017 stieg Bitcoin auf eine Summe von 71.084 Millionen Dollar. Ethereum stieg innerhalb dieser acht Monate auf 32.192 Millionen Dollar. Auch wenn der Wert geringer ist, so zeigt sich im direkten Vergleich, dass Bitcoin um rund 359 Prozent gestiegen ist. Ethereum konnte sogar eine Steigerung von 4.512 Prozent erzielen.

Vor der Entscheidung, ob man Bitcoins oder Ethereum kaufen möchte, sollte der Blick zunächst auf die Wertentwicklung führen. Dass dies durchaus Sinn macht, zeigt sich insbesondere beim jeweiligen Börsenwert. Zwar ist immer wieder die Rede davon, dass Bitcoins vor allem im Jahr 2017 eine enorme Steigerung verzeichnen konnten. Aber wie steht es im Vergleich dazu eigentlich mit Ethereum? Ein guter Anhaltspunkt stellt in dem Zusammenhang der Börsenwert in Millionen Dollar dar. Dieser lag bei Bitcoin im Januar 2017 bei einer Summe von 15.491 Millionen Dollar. Ethereum verzeichnete zur selben Zeit einen Wert in Höhe von 698 Millionen Dollar. Interessant ist die weitere Entwicklung in den darauffolgenden Monaten. In einem Zeitraum zwischen Januar und August 2017 stieg Bitcoin auf eine Summe von 71.084 Millionen Dollar. Ethereum stieg innerhalb dieser acht Monate auf 32.192 Millionen Dollar. Auch wenn der Wert geringer ist, so zeigt sich im direkten Vergleich, dass Bitcoin um rund 359 Prozent gestiegen ist. Ethereum konnte sogar eine Steigerung von 4.512 Prozent erzielen.

Nicht grundlos also wecken die Ether zunehmen das Interesse der Anleger, auch wenn die Nachfolger-Währung noch immer im Schatten der Bitcoins steht. Es wird davon ausgegangen, dass es auch nach 2017 zu einer starken Wertsteigerung kommen wird. Aufgrund ihrer rasanten Entwicklung haben die Ether auf der Rangliste der wertvollen Kryptowährungen bereits den 2. Platz eingenommen.

Weiter zu eToro: www.etoro.com

Trotz rasanter Entwicklung – der Aufstieg von Ethereum steht nicht im Mittelpunkt

Viele News beschreiben noch immer mit Erstaunen die beeindruckende Entwicklung der Bitcoins. In den Schlagzeilen bezieht sich der Trend 2017 vorrangig auf den Marktführer der digitalen Währungen. Die ebenfalls erfolgreiche Kryptowährung Ethereum gerät dabei etwas in den Hintergrund. Auch Ethereum konnte schon im Mai eine hohe Steigerung des Wertes vorweisen. Diese war im Vergleich zum Jahresanfang sogar rund 24 Mal höher. Dennoch profitiert Ethereum nicht wie Bitcoin von einer guten Presse. Dies ist vor allem deshalb schade, weil möglicherweise interessierte Anleger so die Chance versäumen, in die Währung zu investieren. Ein genauer Blick lohnt sich hier also in jedem Fall.

Viele News beschreiben noch immer mit Erstaunen die beeindruckende Entwicklung der Bitcoins. In den Schlagzeilen bezieht sich der Trend 2017 vorrangig auf den Marktführer der digitalen Währungen. Die ebenfalls erfolgreiche Kryptowährung Ethereum gerät dabei etwas in den Hintergrund. Auch Ethereum konnte schon im Mai eine hohe Steigerung des Wertes vorweisen. Diese war im Vergleich zum Jahresanfang sogar rund 24 Mal höher. Dennoch profitiert Ethereum nicht wie Bitcoin von einer guten Presse. Dies ist vor allem deshalb schade, weil möglicherweise interessierte Anleger so die Chance versäumen, in die Währung zu investieren. Ein genauer Blick lohnt sich hier also in jedem Fall.

Bitcoins haben einen deutlichen Vorsprung, auch in der Presse

Bitcoins sind seit ungefähr 10 Jahren am Markt. Ethereum existiert seit mehr als zwei Jahren. Die bekanntere der beiden Währungen, Bitcoin, hatte also viel mehr Zeit, das Interesse potenzieller Anleger zu wecken. Der Aufstieg erfolgte zunächst konkurrenzlos und hatte das Hauptziel, Banken davon zu überzeugen, dass digitale Währungen ernstzunehmen seien. Ob es Ethereum ohne die Bitcoins geben würde, ist eine interessante Frage. Denn immerhin gilt Bitcoin als Vorreiter für alle Kryptowährungen. Trotzdem ist es schade, dass sich die heutige Berichterstattung nach wie vor eher auf die Bitcoins fokussiert.

Bitcoins sind seit ungefähr 10 Jahren am Markt. Ethereum existiert seit mehr als zwei Jahren. Die bekanntere der beiden Währungen, Bitcoin, hatte also viel mehr Zeit, das Interesse potenzieller Anleger zu wecken. Der Aufstieg erfolgte zunächst konkurrenzlos und hatte das Hauptziel, Banken davon zu überzeugen, dass digitale Währungen ernstzunehmen seien. Ob es Ethereum ohne die Bitcoins geben würde, ist eine interessante Frage. Denn immerhin gilt Bitcoin als Vorreiter für alle Kryptowährungen. Trotzdem ist es schade, dass sich die heutige Berichterstattung nach wie vor eher auf die Bitcoins fokussiert.

Hinweis: Interessenten, die nicht abschätzen können, ob sie Bitcoins oder Ethereum kaufen sollen, haben die Möglichkeit, einen Chart-Vergleich durchzuführen. Bei einem direkten Vergleich der Wertentwicklung ist es auch ratsam, den Zeitraum in Relation zu stellen, in welchem die Kryptowährungen bereits am Markt sind. Auf diese Weise lässt sich ein guter Überblick ermitteln, der zu einer Entscheidung beitragen kann. Ein wichtiger Punkt ist etwa das steigende Interesse großer Unternehmen an der Währung Ethereum. Dies könnte ein deutliches Zeichen sein, dass sich die digitale Währung weiter stabilisieren kann. Generell ist eine rückwirkende und aktuelle Beobachtung des Finanzmarktes empfehlenswert und eine gute Basis, um eigene Entscheidungen zu treffen.

SimpleFX bietet alle wichtigen Informationen zum Thema Kryptowährungen, darunter auch Bitcoins

Bitcoin oder Ethereum kaufen: Ist ein Vergleich wirklich sinnvoll?

Die Unterschiede zwischen den Kryptowährungen Ethereum und Bitcoin sind deutlich. Die Frage, welche der beiden Währungen zu den eigenen Interessen passt, ist deshalb nicht einfach zu beantworten. Grundsätzlich handelt es sich bei beiden Varianten um digitale Währungen. Dennoch werden werden, je nach Währung, verschiedene Zielgruppen angesprochen. Bitcoin konnte vor allem im Jahr 2017 einen enormen Anstieg verzeichnen und ist mittlerweile eine recht stabile Währung. Auch die Währung Ethereum, die wesentlich jünger ist, stabilisiert sich zunehmend am Markt. Beide Plattformen und Investitionen sind also durchaus für Investoren interessant.

Die Unterschiede zwischen den Kryptowährungen Ethereum und Bitcoin sind deutlich. Die Frage, welche der beiden Währungen zu den eigenen Interessen passt, ist deshalb nicht einfach zu beantworten. Grundsätzlich handelt es sich bei beiden Varianten um digitale Währungen. Dennoch werden werden, je nach Währung, verschiedene Zielgruppen angesprochen. Bitcoin konnte vor allem im Jahr 2017 einen enormen Anstieg verzeichnen und ist mittlerweile eine recht stabile Währung. Auch die Währung Ethereum, die wesentlich jünger ist, stabilisiert sich zunehmend am Markt. Beide Plattformen und Investitionen sind also durchaus für Investoren interessant.

Allerdings stellen sich Anleger zu Recht die Frage, welche Investition lohnenswerter ist. Aber spiegelt ein geradliniger Vergleich tatsächlich auch die persönlichen Interessen wider? Wer in Bitcoin investiert, findet in dieser Währung eine gute Geldanlage mit hohen Rendite-Chancen. Wer sich darüber hinaus für die Fortentwicklung der FinTech-Branche interessiert und welche Zahlungsalternativen es zu den klassischen Varianten gibt, der liegt vermutlich mit Ethereum richtig. Als weiterer Aspekt für eine Investition in die neuere Kryptowährung Ethereum sei genannt, dass durchaus große Unternehmen bereits einen Blick auf das Zahlungssystem geworfen haben.

Bitcoin vs. Ethereum

What’s the difference between Bitcoin and Ethereum?

First, it’s important to understand that there are two categories of digital coins: Cryptocurrencies (e.g. Bitcoin, Litecoin, ZCash, Monero, etc) and Tokens (e.g. Ethereum, Filecoin, Storj, Blockstack, etc.)

Bitcoin is a “cryptocurrency.” Bitcoin and other cryptocurrencies are competing against existing money (and gold) to replace them with a truly global currency.

The promise of Bitcoin is that it is:

- A global currency which allows individuals to own their own money (without having to rely on national banks).

- Lower fees for transferring money across geographic borders.

- Financial stability for people who live in countries with unstable currencies. (e.g. In 2016, the Venezuela’s currency hit an inflation rate of 800%). In addition, two-thirds of the current global population has no access to banking, or limited access — Bitcoin is changing that.

Ethereum is a “token.” What Bitcoin does for money, Ethereum does for contracts. Ethereum’s innovation is that is allows you to write Smart Contracts: basically any digital agreement where you can say “if this” happens, “then something else happens.” For example:

- If I vote for the President, then my vote is official and no one else can vote as me.

- If I sign my name on this document, then I own the car, and you no longer own the car.

- Up until now we’ve carried out these agreements with a signature at the bottom of a paper document. Ethereum dramatically improves this model because it is digital, and proof of the transaction can never be deleted.

A crypto expert explains the difference between the two largest cryptocurrencies in the world: bitcoin and Ethereum