Top 7 Ways to Short Bitcoin

The vast majority of Bitcoin speculation occurs through long and short positions across trading platforms. Longing and shorting has been a more favorable solution for most national currencies and assets over the past few years. Bitcoin speculators rely on these same tools to guesstimate how the price will evolve in the coming hours, days, and weeks. Given the current BTC price trend, shorting Bitcoin becomes quite appealing. Below is a brief list of ways to short Bitcoin and – hopefully – make a profit while doing so.

#7 Bitcoin Margin Trading

One of the most common ways to short Bitcoin is by using a cryptocurrency margin trading platform. A lot of major Bitcoin exchanges give users this opportunity, albeit some specialized trading platforms are worth checking out. By using margin trading, one essentially “borrows” money from a broker to make a trade. Do keep in mind there is also a leverage factor, which can exponentially increase your profits – and losses.

#6 The Bitcoin Futures Market

Another popular option to short Bitcoin without friction is by venturing into the futures market. A future is a financial contract where a buyer agreed to purchase a security, which is represented by Bitcoin in this case. This security is to be purchased at a future date and a fixed price. In most cases, the person buying a futures contract feels the price per Bitcoin will go up, and they will be able to purchase Bitcoin below the market price when the contract “expires”.

Selling a Bitcoin futures contract indicates a bearish mindset and an expectation of how the Bitcoin price will decline by the predetermined date. Right now, there will be a fair few futures contracts for sale, as the Bitcoin market is in a downward spiral. Selling futures contracts is an excellent way to short Bitcoin.

#5 Lending To Short Bitcoin

Several platforms allow users to receive a loan to short Bitcoin . While this is a rather complicated and lengthy process – including a credit check – it is a great way to short Bitcoin. More importantly, clients using such a service will remain anonymous to the public, yet have their identity verified by the company providing the service. For more privacy-centric users, this may not necessarily be the best solution, even though it is worth checking out.

#4 Binary Options Trading

CALL and PUT Options trading is another opportunity for people looking to short Bitcoin. People looking to short Bitcoin would execute a PUT order, preferably using an Escrow service. Traders who feel the price will go down aim to secure the ability to sell Bitcoin at today’s market price, even if a downward trend would occur. Speculators using a PUT option, provide an incentive to potential buyers in the form of an even lower price per Bitcoin than who the speculator hopes to get. For example, if someone wants to short Bitcoin at the value of US$750, yet wants to secure that price even when the value drops to US$700, they could settle to sell for US$725 as a “premium”.

#3 Bitcoin Options

A Bitcoin option is slightly more advanced than its binary option counterpart. A fall in Bitcoin value will earn a profit, which is exactly what shorting Bitcoin is all about. Options allow speculators to bet the value of Bitcoin will be lower by a specific date or how it won’t reach a particular threshold above its current price within a period. Using Bitcoin options can be done through one of the many platforms or speculators can create their own.

#2 Prediction Markets

Even though prediction markets are a relatively new development in the cryptocurrency world, they can be used to great advantage to short Bitcoin. A prediction market allows anyone to create any event they like, and wage on the outcome. For example, one could create an event, stating how Bitcoin’s price will drop to US$xxx by y date. If anyone takes up the speculator on that bet and loses, the speculator will have effectively shorted Bitcoin and made a profit Keep in mind prediction markets are rarely used to short Bitcoin right now, and this may not be the best solution to make a profit.

#1 Short-selling Bitcoin Assets

The rare breed of cryptocurrency speculators who wants to buy and sell actual Bitcoins can look into short-selling Bitcoin. This works as follows: sell Bitcoin at a price you feel comfortable at, wait until the price drops, and buy Bitcoin again. Although this is how most “traditional” traders make money, it is an efficient way of shorting Bitcoin. The only downside is how getting the price movement wrong will result in a net Bitcoin loss. Buy low and sell high is the most efficient way to publicly short Bitcoin and try to persuade other traders to do so as well.

If you liked this article, follow us on Twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Interesting article, shorting my Bitcoin position for August 2017 when hard or soft fork happens. Options seems good, an insurance premium in case the price falls. I am guessing a lot of Crypto market cap will also go into Ethereum, its probable Ethereum will be the number one market cap coin by then anyway.

Jeeezzz…. remind me to never take advice from you ..

I would be extremely happy with that.

lol how’d that short work out for you buddy?

Good, shorted down to 1900 then went long 😉

Been looking into this, how does one obtain the assets to short in the first place? Referencing the #1 point which you have made.

This article is worthless. Doesn’t say where each of these venues are….

Good thing I got my adblock on, author bishhhhhhhhh

Looks like it topped at 4430. Goldman Sachs (chief technician Sheba Jafari) came out (August 14) and said they have a 4827 price target. When people come out to give higher price targets, they have already marked the top and want people to provide support as they exit the market. At least they tell you when they are about to pick your pocket.

“Buy low and sell high is the most efficient way to publicly short Bitcoin and try to persuade other traders to do so as well.”

I thought in the case of a short the whole point is to buy high and sell low….

“Several platforms allow users to receive a loan to short Bitcoin….” Several like…?

How to short bitcoins (if you really must)

Written by

Written by

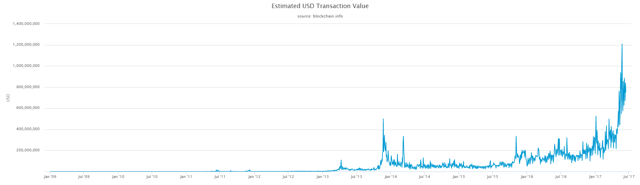

The rise of bitcoin, an electronic currency traded on an online exchange, has generated a media frenzy. Once scoffed at, its value has risen by 631% (denominated in dollars) since the start of 2013.

Lots of people think that means we’re in a bitcoin bubble and it will eventually pop. But if you’re one of these bitcoin bears, it’s not easy for you to “short” it—i.e., bet that its value will go down.

The usual way to short a currency is to use a currency pair—something like EUR/USD, the value of a euro denominated in dollars—which trades as a single unit. For example, if the euro was trading at $1.3000, you would “borrow” a currency pair from your broker, which you have to return within a certain period of time, and sell it on the open market, pocketing $1.30. If after an hour EUR/USD is trading at $1.2950, you can buy the currency pair at that price and return it to your broker, making a profit of $0.0050. (If you’re wrong, you lose out.)

Most of the exchanges which allow you to trade bitcoins, however, don’t currently offer anything like currency pairs, nor any other futures or derivatives. Which means you would have to amass a stock of actual bitcoins to bet on them. That gets expensive.

One day, if bitcoin becomes well established, institutional foreign exchange dealers could make markets in bitcoins. (Among the current obstacles: There are only 11 million bitcoins in existence, and there can never be more than 21 million, so it’s not a very liquid market. If a way ever emerges to break bitcoins up into even smaller fractions, that might solve the problem, according to traders we spoke to.) But for those looking to short bitcoins right now, there are two notable ways to do it:

- Bitfinex: A Hong Kong-based bitcoin exchange based in Hong Kong, Bitfinex allows ordinary bitcoin holders to act like brokers and lend bitcoins to people who want to trade them. The exchange does a lot of this automatically.

- ICBIT: ICBIT allows traders to make bets using futures—financial contracts in which a buyer agrees to buy a security, in this case a bitcoin, at a future date at a predetermined price. Futures contracts can be bought and sold, so you can make money without buying the actual bitcoins themselves. This platform will also let you trade commodities, such as oil, in bitcoins.

Still, do you really want to short bitcoins? The market is still pretty volatile, and because it’s an unfamiliar mix of currency and equity, it’s likely to stay that way for a while. Remarks Cullen Roche, the founder of Orcam Financial Group, “You’d probably be better off just going to Vegas though. You’ll have more fun, about the same odds, and the drinks in the casino will be free.”

If you’d like to make us aware of any other means of shorting bitcoin, please email sf@qz.com.

Update: Article has been amended to reflect that bitcoins can already be traded in small fractions, indeed to 0.00000001 BTC (eight decimal places). Nonetheless, even with the ability to break bitcoins into small pieces, there are too few bitcoins in existence for institutional traders to be willing to trade them.

Our readers also inform us that it’s possible to short bitcoins on MPEx, which allows you to buy and sell BTC/USD currency pairs.

How To Short Bitcoin: 5 Ways To Profit From a Falling BTC Price

![]()

![]()

Latest posts by Dean (see all)

- Why We Need Decentralised News Now! - May 28, 2018

- Beyond Blockchain: Safe Network’s PARSEC to power next generation cryptocurrency - May 28, 2018

- 10 of the best ways to earn cryptocurrency - May 16, 2018

The price of any currency or asset goes both up and down over time – and Bitcoin is no different. If you have developed an interest in Bitcoin as an investment, rather than just a way to make payments and avoid feeding the sins of the banking industry, you should therefore consider looking at ways to make a prifit from a falling bitcoin price as well as increases in value. Buy and hold (or hodl as many bitcoiners say) can be good sometimes, but it can’t be the best option 100% of the time – sometimes you will need to ‘go short’ – effectively betting on the price going down.

There are various different ways that you can ‘go short’. Of course if you own a large stash of BTC then you can just sell a few in the hope of buying them back later at a cheaper price. This is the easiest way, but there are other methods that can potentially give you a larger profit – although be warned that this usually means they will also give you a bigger loss if you are wrong and the price goes up.

Here are three of the most popular answers to the question – how to short bitcoin?

1. Margin Trading at Bitfinex

Margin trading means that you borrow money in order to make a trade. For example, if you have 1 bitcoin you would like to use to bet on the price going down, you may be able to use that 1 BTC to borrow 10 btc at 1:10 leverage. This means you will either make 10 times the profit or 10 times the loss.

Check out the video below for a super simply guide to shorting btc using Bitfinex

2. Sell Bitcoin Futures

A futures contract gives its buyer the right to purchase a currency or commodity at a fixed price at some specified date in the future. A person buying this contract is therefore betting that the price will go up, meaning that when their contract expires they can buy at below market price and sell immediately for a profit. The person selling the contract profits if the price goes down, because when the contract expires the other party will have to buy their coins from them at above market price. If you already own Bitcoin this can be a good alternative to ‘hedge your bets’ and profit from a downturn in price, without having to actually sell your coins – because if your coins are bought from you at above market price you can just buy them back on the open market and take the difference as your profit.

You can sell futures contracts at OrderBook.net

3. Bitcoin Options Contracts

Options are another financial derivative which can be used to profit on both rises and falls in price. You can use options to place a bet that the value of Bitcoin will be higher or lower than a particular value at a certain point in the future (say after 1 day, or 1 week), or that the value will or won’t hit a certain level above or below its current price within a particular time period.

You can purchase options contracts or create your own and pay with BTC through services such as BTC Oracle

Another options service with 5 different order types and a kind of practice account set-up for learning how to use them is Gryfx

4. Binary Options

Binary options are a simplified type of options contract, usually aimed at day traders. You simply bet that the price will be higher (in which case you are buying a ‘call’ option) or lower (a ‘put’ option) than its current value at a specified point in the future – usually measured in hours with the end of that day as the limit. This fill give you a fixed profit, usually around 40-80%, if you are correct, but you will lose everything if you are incorrect. This is a ery high risk high return method which often appeals to gamblers.

You can buy Binary options for BTC at Satoshi Options or for USD at AnyOption

5. Electronically Traded Funds (ETFs)

ETFs are funds that track the price of a currency, commodity or asset without actually owning any of it. You can use an ETF to go ‘long’ or ‘short’ – depending on whether you think the price will go up or down. ETFs often come with reliable high level leverage (1:10 or even 1:20).

A popular international ETF fund can be traded through Pluss500

5 Ways to Short Bitcoin

- More on Blockchain and Bitcoin

What's the Vice Industry Token—A Crypto for Porn?

Governance: Why Crypto Investors Should Care

Blockchain-as-a-Service (BaaS)

Blockchain-as-a-Service (BaaS)Which FAANG Will Win the Blockchain Wars?

While bitcoin and other cryptocurrencies have made astronomical gains so far this year, up more than 1,400% in 2017, that hasn't stopped many investors from remaining skeptical about the long-term strength of the industry. In fact, as prices climbed higher and higher, crossing big price milestones very quickly, some analysts predicted that a bubble pop is approaching. For those investors who believe that bitcoin is likely to crash at some point in the future, shorting the currency might be a good option. Here are some ways that you can go about doing that.

[ Bitcoin futures take cryptocurrency trading to a new level, but before diving in, it's important to know how we got to this point. The world of cryptocurrency is complex which is why Investopedia Academy created Cryptocurrency for Beginners. With extensive explanations of blockchain, Bitcoin and how to operate in the cryptocurrency sphere, it is the ideal way to build the knowledge you need to begin intelligently trading cryptocurrencies. Check it out today! ]

Margin Trading

One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. Many exchanges allow this type of trading, with margin trades allowing for investors to "borrow" money from a broker in order to make a trade. It's important to remember that there may be a leverage factor, which could either increase your profits or your losses. Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AVAtrade, and Plus500 as some popular options.

Futures Market

Bitcoin, like other assets, has a futures market. In a futures trade, a buyer agrees to purchase a security with a contract which specifies when and at what price the security will be sold. If you buy a futures contract, you're likely to feel that the price of the security will rise; this ensures that you can get a good deal on the security later on. However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. According to the Merkle, "selling futures contracts is an excellent way to short bitcoin." Futures markets are somewhat more difficult to find, but OrderBook.net has been known as a place to buy and sell bitcoin futures.

Binary Options Trading

Call and put options also allow people to short bitcoin. If you wish to short the currency, you'd execute a put order, probably with an escrow service. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. Binary options are available through a number of offshore exchanges, but the costs (and risks) are high.

Prediction Markets

Prediction markets are another way to consider shorting bitcoin. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin. These markets allow for investors to create an event make a wager based on the outcome. You could, therefore, predict that bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you'd stand to profit if it comes to pass. Predictious is one example of a prediction market for bitcoin.

Short-Selling Bitcoin Assets

While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process.

Short sell Bitcoin Guide for Beginners – Profit when Bitcoin prices drops

Last updated on January 2nd, 2018 at 12:00 am

Short-selling is an investment method that allows investors to benefit from drops in prices and value of a particular asset, in this case, Bitcoins.

What is Short Selling Bitcoin All About?

Short selling allows you to basically borrow an asset, such as Bitcoins, and sell it at current prices. Later on, you can purchase the Bitcoins to pay back the person or organization you borrowed them from when selling the first time around. Hopefully, when you go to repurchase the Bitcoins, prices will have dropped, so it will be cheaper to purchase the assets that need to be paid back.

Let’s illustrate this with a short example:

- You short sale (borrow and sell) 10 Bitcoins when the price is $4,000

- This means you get $40,000

- Price of Bitcoin drops to $3,500

- You repurchase 10 Bitcoins to give back to the agency you borrowed from at 10*$3,500 = $35,000

- Your total profit is $40,000-$35,000 = $5,000

How to Short Sell Bitcoin?

If you want to short sell Bitcoins, you will contact a trading agency or platform and place a short sell order. The agency will then sell the Bitcoins from their own supply, based on the assumption that in the future you will repay them with an equal number of Bitcoins. If you sell 10 Bitcoins, for example, you will eventually have to “cover” those 10 Bitcoins, whether prices rise or drop. If prices drop, it will be cheaper to rebuy these 10 Bitcoins. If prices rise, it will be more expensive.

When short-selling, the firm or individual who loaned Bitcoins to you can generally recall the assets at any given time and are required to give you only a short notice. So make sure you read any rules, regulations, or guidelines for “covering” any assets you short sell. With markets fluctuating at such a rapid rate, costs can swing wildly, putting you at risk. Short selling can be especially risky if the lender calls in the assets before prices have a chance to drop.

There are a variety of ways to short Bitcoin:

Short Sell CFDs

Short selling is actually very common with stocks and most major trading platforms allow you to short stocks. Some Bitcoin CFD trading platforms now allow you to short-sell Bitcoins (e.g. AvaTrade or Plus500), when trading CFDs your capital is at risk. Also, Keep in mind that these platforms don’t actually hold Bitcoins and are using a method called Contract for Difference.

Shorting via a Bitcoin Exchange

Exchanges geared towards crypto traders offer short support as a matter of course, and some allow for leveraged shorting too. These exchanges include:

… and many more. Ensure that the exchange you pick is reputable and remember; any bitcoins kept on an exchange are only yours in theory.

Put Options

Certain specialized exchanges, such as BitMEX, offer Bitcoin options trading. Purchase of an option grant the ability, but not the obligation, to trade at a specific price by a certain expiry date. If you have experience with options trading this method might suit you, otherwise it’s not recommended for beginners. Options are complex but do allow for greater flexibility and higher leverage.

Timing a Bitcoin Short Sell

IF you time it right… Shorting Bitcoin is trading against the long-term uptrend; the longer you hold your trade the riskier this becomes. Of course, this is only true provided Bitcoin markets remain bullish (i.e. price go up) – but in July 2017 this appears to be the expectation of amateur and professional traders alike.

Another thing to remember – the maximum profit potential of a short is limited to a Bitcoin price of 0, whereas buyers have an unlimited upside of [infinity].

If you examine Bitcoin price charts, you’ll soon realize the truth of the old trading aphorism, “price takes the stairs up but the elevator down.” Whereas bullish moves take time to build and develop, bearish moves tend to be relatively short and sharp.

Trying to short the top of a big bull run is tough; you’re likely to stop out multiple times as Bitcoin keeps rising like a stubborn zombie. The smarter play is to short when price reaches resistance; such as the top of an established downtrend line, channel, or previous major high. If price persistently pushes through any of these structures, you’ll soon know that your short was wrong and can exit (“close”) it at only a minor loss.

Keep in mind that if many traders are positioned similarly, a price surge may result as fearful traders compete to close their shorts. This is known as a short squeeze. A perfect example may be seen at the right edge of the above chart.

Analyzing the market for Short Sell Opportunities

Beyond technical analysis, it helps to know the Bitcoin space well. Certain past events have triggered major sell-offs:

- Failure of major exchanges, eg. Gox collapse.

- Hostile regulatory action in major countries, eg. “China bans Bitcoin” fake news.

- Well-known developers throwing a quit fit, eg. Mike Hearn.

- Heightened hard fork risks, eg. the recent anxieties over UASF before BIP 91 locked in (review the last couple of weeks on the above chart).

- Delays or setbacks in widely-desired upgrades, eg. SegWit.

Events expected to have a very negative impact on price, should they ever occur, include:

- Any contentious hard fork.

- Breach of the cryptographic primitives used in Bitcoin (SHA256, secp256k1).

- Discovery of Bitcoin code exploits which threaten wallet security or network operation.

- Hostile actions against Bitcoin mining companies by the Chinese government.

- Movement in the first million or so bitcoins mined by Satoshi Nakomoto.

Events which, thus far, have had surprisingly little negative impact on price include:

- The failure (through fraud or seizure) of darknet markets, eg. Silk Road or Alpha Bay.

- Full blocks and correspondingly high transaction fees.

- Claims of having unmasked the identity of Satoshi Nakomoto, eg. Dorian Nakomoto fake news or Craig Wright hoax.

- Hostile pronouncements from journalists, economists, politicians, bankers, etc.

None of the above lists should be considered exhaustive. Remember that bullish markets tend to shrug off bad news and that markets may ignore, misinterpret or overreact to negative events.

The risks of Bitcoin Short Trading

We should warn you, however, that short-selling any asset is a high-risk venture. Normally, when you invest in an asset your losses are limited to the amount of money you have invested in that asset. For example, if you invest $10,000 dollars in a stock, and that stock suddenly collapses and become worthless, your losses will be limited to the $10,000 dollars you invested.

When short selling, however, your losses could extend far beyond your initial investment, something that is very important to consider, especially with Bitcoin. The easiest way to explain this is to use an example:

Let’s say you short-sold $100 dollars worth of Bitcoin back when prices were only $10 dollars per coin. That means you short-sold 10 coins. Let’s assume that you have yet to repurchase the coins, meaning that you still have to pay the owner back with 10 Bitcoins. At current prices that would cost more than $40,000 dollars!

As you can see, short-selling any asset can be very risky. If you want to short sell Bitcoins or anything else, you need to be very careful. Only invest if you are very confident that prices will drop, and if you have money to cover your losses if investments rise. Make sure you watch prices closely and cut your losses if prices start to rise too quickly. That being said, if your intuition turns out to be correct and prices do drop, you could make a lot of money. If you short-sold a single Bitcoin that’s currently selling for $1,200 dollars, for example, and prices collapsed back to $100 dollars, you’d make approximately $1,100 bucks, and that’s not a bad pay day at all!

That being said, if your intuition turns out to be correct and prices do drop, you could make a lot of money. If you short-sold a single Bitcoin that’s currently selling for $4,000 dollars, for example, and prices collapsed back to $2,500 dollars, you’d make approximately $1,500 bucks, and that’s not a bad pay day at all!

If you have any experiece with short selling Bitcoin I’d love to hear about it in the comment section below.

This Is How You Can Short Bitcoin

Bitcoin’s assault on $10,000 has stirred bears who see fresh evidence of a bubble. There are ways to bet on a crash, but they’re even riskier than trading the cryptocurrency on the way up.

The options to short bitcoin are mostly through unregulated exchanges, and very risky given bitcoin’s volatility. Not to mention it hasn’t exactly been a good year for bitcoin bears given the 10-fold surge in price. But for those daring enough to try, there are ways to bet against bitcoin’s rise.

“All the options to short in common markets are becoming available in the bitcoin market,” said Charles Hayter, co-founder of market tracker CryptoCompare. “There’s pretty good liquidity for shorting bitcoin. The main difference with shorting the Nasdaq for example, is it will be a lot more volatile, so there’s a lot more risk. The rate to borrow will also be a bit higher.”

Contracts for Difference

One of the most popular ways to short bitcoin is through CFDs, a derivative that mirrors the movements of the asset. It’s a contract between the client and the broker, where the buyer and seller of the CFD agree to settle any rise or drop in prices in cash on the contract date.

“CFD is currently a great market if you want to short bitcoin, especially ahead of that milestone 10K mark, which we think will bring some retracement,” said Naeem Aslam, a chief market analyst at TF Global Markets in London, which offers the contracts. “The break could push the price well above $10,100 and it would be in that area when we could see some retracement.”

Margin Trading

Another common way to short bitcoin is through margin trading, which allows investors to borrow the cryptocurrency from a broker to make the trade. The trade goes both ways; a trader can also increase their long or short position through leverage. Depending on the funds kept as collateral to pay back the debt, this option increases the already risky bitcoin trade. Bitfinex, one of the biggest cryptocurrency exchanges, requires initial equity of 30 percent of the position.

Short-margin trading positions on Bitfinex were at around 19,188 bitcoins on Monday, versus 23,931 long positions, according to bfxdata.com, which tracks data on the bourse.

Borrow to Short Bitcoin

Most of the brokerages that allow margin trading will also let clients borrow bitcoin to short with no leverage. This will be a less risky way to bet bitcoin prices will fall.

Futures Contracts

The futures market isn’t as widely developed as CFDs and margin trading, but it’s still possible to make bearish bets on bitcoin with options. For now, LedgerX is the only regulated exchange and clearing agent for cryptocurrency options in the U.S. The CME Group Inc. and the Chicago Board Options Exchange have both asked for approval to list bitcoin futures, so that may open up the market to more investors.

Shorting Bitcoin ETNs

Investors can also indirectly bet against bitcoin by shorting exchange traded notes with exposure to the cryptocurrency, like Stockholm-based Bitcoin Tracker One, and Grayscale Investments LLC’s Bitcoin Investment Trust. The risk is that these notes don’t always trade in line with bitcoin, so the exposure won’t be perfect.

Aslam at TF Global Markets said he’s not seeing an increase in demand to short bitcoin.

“Right now as of this minute, the race is still to the upside,” he said.

How to Short Bitcoin

Shorting assets is risky, and you can lose more than your original investment if the asset continues to rise. That being said, there’s plenty of people who’ve made a significant amount of money through short selling and making investments that seem to go against the grain.

To manage risks when shorting Bitcoin, make sure you work with funds that you can afford to lose. Bitcoin is extremely volatile and shorting it has the potential to lose a great amount of money.

Shorting Bitcoin is not advisable for beginners. Only experienced traders with a high-risk tolerance should even think about shorting Bitcoin.

How to Short Bitcoin

Bitcoin has recently risen to historic levels at an unprecedented rate leaving many people worried about how long this growth can last. Whether you’re a Bitcoin skeptic or want to take advantage of the seemingly imminent correction, you’re probably wondering, “Can I short Bitcoin?”

Can you short Bitcoin?

Yes. Although not as prevalent as buying, there are a few different ways you can short Bitcoin:

- Shorting Bitcoin on an exchange

- Shorting Bitcoin CFDs

- Bitcoin futures market

Shorting Bitcoin on an exchange

If you already have experience trading cryptocurrency, the most natural way for you to short Bitcoin is on a cryptocurrency exchange. Many of the major exchange such as GDAX and Kraken give you the option to short the coins on their platform.

Bitfinex and some other exchanges also have leverage trading. You can leverage your Bitcoin short (up to 5x on some exchanges) if you’re feeling particularly confident or risky.

Shorting Bitcoin CFDs

A CFD (Contract for Difference) is a contract between two parties that speculates on the price of an underlying asset – in this case, Bitcoin. These investment derivatives allow you to “bet” on the price of Bitcoin without having to actually purchase it.

Not all CFD platforms have Bitcoin shorting options. If this method seems well suited for you, you may want to check out AvaTrade, one of the most popular Bitcoin CFD websites.

Bitcoin futures market

Similar to a Bitcoin CFD, you can also short Bitcoin through a futures trade. To short Bitcoin with this method you need to sell a future contract for Bitcoin at a price that’s lower than it is currently.

Until recently, there weren’t many reputable trading platforms you could do this through. However, the Chicago Mercantile Exchange (CME), Nasdaq, and most recently CBOE all announced that they’re opening up Bitcoin futures trading early this December.

Is shorting Bitcoin risky?

Yes. When you buy “long” on an asset, the maximum amount that you can lose is what you’ve invested because an asset can’t be worth less than $0.

When you short an asset, you can lose all your money if the asset continues to rise.

With Bitcoin sometimes doubling in price before any significant pullback, shorting it could be a risky endeavor. That being said, there’s plenty of people who’ve made a significant amount of money through short selling and making investments that seem to go against the grain.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Price Prediction, BTC Forecast - Is Bitcoin a Good Investment?

Bitcoin Forecast, Short-Term BTC/USD Price Prediction for Next Days and Weeks

Bitcoin Forecast, Long-Term Price Predictions for Next Months and Year: 2018, 2019

Detailed Trend Components of the Bitcoin Forecast & Prognosis

Currency Converter / Calculator

Questions & Answers about Bitcoin Projection

What is the Bitcoin price today?

The current price of Bitcoin is 7419.990 USD today.

Will Bitcoin price grow / rise / go up?

Yes. The Bitcoin price can go up from 7419.990 USD to 15957.70 USD in one year.

Is it profitable to invest in Bitcoin?

Yes. The long-term earning potential is +115.06% in one year.

Will Bitcoin price fall / drop?

What will Bitcoin be worth in five years (2023)?

The Bitcoin (BTC ) future price will be 52467.80 USD.

Will Bitcoin crash?

According to our analysis, this will not happen.

Will Bitcoin hit 10 000 USD in a year?

Yes, within a year ( see above).

Will Bitcoin hit 20 000 USD in a year?

Not within a year ( see above).

Will Bitcoin hit 50 000 USD in a year?

Not within a year ( see above).

See Our Other Forecasts

Bitcoin (BTC) Forecast Earnings Grow

Bitcoin (BTC) Cryptocurrency Market info

Bitcoin (BTC) Price Prediction, Forecast for next months and years

Bitcoin price predictions by tech sector

gregsavchuk

That said, sorry, but it's about time that the Rothchild's & any other hyper rich bankers have any control of currency, it belongs to us, the workers, creators, artists & poor.

Cryptos take monetary control away from the debt system they created & love & rely on.

I don't need them or their loaner $$$ with a %, I have my own.

Have a great day!

Rothschild Will Destroy Bitcoin, Warns Top Investor

chris-claim

buy or sell bitcoins at furcoins, they are better with less rates on any transaction with them.

If you can't buy a lot of BITCOINS then generate and increase them with easy, simple, legit and safe method.

Complete step by step guide to become wealthy.

Download Free EBOOK: http://bit.do/EBOOK-DOWNLOAD

kundan-vyas

2 and 1/2 years before i checking currency convertor and found btc(bitcoin) then i don't know about that what is it

but 7 months ago i'm started trading in btc it gives me huge opportunities and i'm happy with it

last 2 months bitcoin falling so much as we know it is like bubble so not trusted but no one

predict this falling and now days again all over the internetpredictions go higher and higher so Q. is it is trust worthy.

bhupen-b-tumbapo

adjusting forecast according to price movement is ridiculous

Bitcoin advancing to $100,000 in 2018, claims expert who predicted last year's price increase.

Bitcoin could reach $100,000 until the end of 2018, an expert who accurately estimated the cryptocurrency's move in the beginning of the last year informed CNBC

vlad-direscu

Bad News From India Makes Bitcoin Price Fall

Bitcoin exchanges in India suffer bad times as the biggest national Banks of the country have frozen their accounts. The news led to turmoil in the domestic market as well as bringing the price of bitcoin down.

Read the details in the article of Coinidol dot com, the world blockchain news outlet: https://coinidol.com/bad-news-from-india-makes-bitcoin-price-fall/

i want to puchase bitcoin but how to start ?

Bitcoin short

Should I Short Bitcoin?

Jun. 16, 2017 12:19 AM

Summary

Bitcoin is hard to short, but shorting the asset is possible - it is increasingly looking like a good idea.

Bitcoin has fundamental catalysts for downside.

The currency suffers from scaling problems and competition from faster alternatives like Ethereum.

First off, shorting Bitcoin (COIN) isn't the easiest thing to do. There are several exchange-traded products that loosely track its value: BTCS Inc. (OTCQB:BTCS), The Bitcoin Investment Trust (OTCQX:GBTC), and others. But most of these are over the counter, thinly-traded or both. There are several crypto exchanges that offer the ability to short the asset through crowed-sourced leverage, but this option is restricted in some geographies.

Regardless of the difficulties involved in shorting Bitcoin, it can be done. The only question left is whether or not it should be done. In my opinion, the answer to this question is a cautious yes. Bitcoin has scaling issues and conflicting interests may hinder the resolution of this problem. Bitcoin's fundamental value as a medium of exchange is under threat, and alternatives like Ethereum may take its market share.

Technical and Speculative Factors

The nature of cryptocurrency investment necessitates some attention be given to speculative factors like technical analysis and chart reading. Despite the subjective nature of such analysis, it shouldn't be controversial to assert that Bitcoin faces strong resistance at the price of $3,000. Bitcoin's price has fallen sharply on several occasions after approaching this benchmark.

The problem is that Bitcoin's commercial use is growing along with its price. Many investors see crypto as a speculative asset class with little fundamental support, but this isn't necessarily the case. Bitcoin's transaction volume (fundamental demand) is linked to its price because when the value of Bitcoin goes up, its purchasing power follows. And holders of the asset often use it to purchase less volatile assets like gold, gift cards, and even cash - done through "cash out" services on the dark web.

Bitcoin's continual failure to break past $3,000 may not be due to speculative failures alone. It may actually be a sign of limits on scalability. As the asset's transaction volume increases, so do fees. And the speed of the network reduces because of its large backlog.

According to Coindesk, there are conflicting interests seeking to "steer discourse and development" in a situation the writer called a "digital Cuban Missile Crisis." - Possible exaggeration aside, this is a serious problem because there is disagreement about how best to resolve Bitcoin's scalability issues with users divided between something called Segregated Witness "SEGWIT" and a User-Activated Soft Fork "UASF".

Getting into the specifics of these two options would distract from the investment thesis of this article, but the key point is that Bitcoin is losing its status as a fluid, non-political, decentralized means of conducting business online. And Ethereum, its biggest competitor does not have the same issues with scaling and transaction speed. Ethereum has also gained some mainstream adoption via the Ethereum Alliance which includes many Fortune 500 members like JPMorgan Chase (NYSE:JPM), and Microsoft (NASDAQ:MSFT).

Conclusion

There is no such thing as a perfect investment thesis, and this thesis has risks. Bitcoin is an extremely volatile asset, and because shorting involves borrowing, theoretical losses are infinite. Even though Bitcoin has issues in scalability, shorting the asset may end up being riskier than buying it. Investing in Ethereum may prove to be a better alternative than shorting Bitcoin as the smaller cryptocurrency looks likely to continue taking Bitcoin's market share.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Комментариев нет:

Отправить комментарий