Bitcoin Trading

How to Trade Bitcoin CFDs in 4 Easy Steps

- Open a trading account with AvaTrade

- Fund your account

- Fill in your preferred investment amount

- BUY (go long) or SELL (go short) Bitcoin

Don’t miss your opportunity to trade Bitcoin. Start trading Now!

What is Bitcoin

Bitcoin is the world’s first digital currency and it is expanding in popularity worldwide. Now, traders can trade Bitcoin with AvaTrade as the ideal asset in CFD trades. With our platform – MetaTrader 4 you can trade this rapidly growing currency against the US Dollar 24/7. Bitcoin is highly regarded among currency traders and its volatile nature makes them ideal for CFD trading.

Bitcoin’s Rise to Prominence

Around 2008, Satoshi Nakamoto founded Bitcoin. At the time, a paper was published through the Cryptography Mailing List. The first Bitcoin software client was released in 2009, and he collaborated with many other developers on the open-source team, careful never to reveal his identity. By 2011, the enigmatic Bitcoin founder had disappeared. His peers understood how valuable this cryptocurrency was, and worked feverishly to develop it to its maximum potential.

By October 2009, the world’s first Bitcoin exchange was established. At the time, $1 was the equivalent of 1,309 Bitcoin. Considering how expensive Bitcoin is today, that was a real steal. Bitcoin traded at a fraction of a penny for quite some time. Things started changing in 2010; as the distribution of Bitcoin increased, the digital currency became inherently more valuable.

Demand increased, reversing the exchange rate accordingly. In early 2010, the currency was gaining momentum, and so the distribution of the Bitcoin started to increase along with its demand. By November of that year 4 million Bitcoins had been ‘mined’.

And so, the rise of the Bitcoin began…

Why Trade Bitcoin with AvaTrade

- We offer Bitcoin CFD trades with up to 20:1 leverage

- You can start trading Bitcoin from as little as £100/$100/€100

- This volatile crypto makes for an excellent addition to any financial trading portfolio

- AvaTrade is one of the only brokers that offer Bitcoin trading around the clock, for maximum convenience

- You can sell Bitcoin (go short) and potentially profit even when the market price is downtrend

- Enjoy live language-specific customer support around the clock

- AvaTrade offers zero commissions on Bitcoin trading and no bank fees charged on transactions

- Zero exposure to hacking or theft simply because you don’t actually buy or sell the cryptocurrency

- AvaTrade is regulated on 5 continents

- Execute trades in just 3 clicks, free from the complex crypto purchasing process

How Bitcoin Became So Popular

Bitcoin was the first digital currency to be created. It is also the most respected, capitalised and traded cryptocurrency in the world. Bitcoin trading is booming, and a big reason for this is the volatility of this cryptocurrency.

Currency trading allows for maximum yield when it is volatile – lots of ups and downs. This is precisely the reason global traders enjoy trading Bitcoin. Plenty of profitable opportunities are available when markets are volatile, and Bitcoin ranks highly with currency traders.

The media plays a big part in the volatility of Bitcoin. Whenever a breaking story surfaces, Bitcoin volatility increases, and traders cash in. History has shown that Bitcoin traders and speculators routinely push this digital currency to the forefront of CFD trading.

It is increasingly being used as the preferred payment option for merchants, money transfers and trading purposes. More traders are turning to Bitcoin trading than ever before, and that is why this cryptocurrency is inherently valuable. It is a high demand financial trading instrument, despite no association with governments or central banks.

Bitcoins are mined with powerful computer hardware and software. A maximum of 21 million Bitcoin will be available, after which no further bitcoins will be produced. The algorithm which governs the production of Bitcoin limits the quantity that will be produced, and the rate at which they will be produced. It is a finite commodity – there is a fixed amount, and that ensures that greater demand will always prop up the price. In this way, it is similar to other finite commodities such as crude oil, silver, or gold.

Bitcoin in the News

- August 2017 – Bitcoin reaches a market capital of over $73.4 billion. This is the start of the Bitcoin Boom

- First half of 2017 – Bitcoin hits a high of $2900, and worldwide demand for digital currency soars.

- August 1, 2017 – First fork in Bitcoin was created: Bitcoin Cash

- October 24, 2017 – The second fork in Bitcoin was created: Bitcoin Gold

- October 29, 2017 – Bitcoin hits a new record high of $6,300

- November 28, 2017 – Bitcoin Reaches and unprecedented high of $11,000

- December 10, 2017 – Cboe Futures Exchange (CFE) starts offering Bitcoin futures trading

- December 17, 2017 – Bitcoin keeps climbing, almost hitting the $20,000 mark, setting its new record high

- December 18, 2017 – CME Group’s Bitcoin futures are available for trading

- December 21, 2017 – Bitcoin slumped by almost 21%. At market opening Bitcoin was at $15,561 later reaching a low of $12,504, closing with a slight recovery of $13,942

- December 23, 2017 – The cryptocurrency plummets to $11,000, before seeing its positive recovery to end the year

- December 28, 2017 – Third fork in Bitcoin created: New coin on SegWit2x chain called B2X

We are Here to Help You Trade Bitcoin

AvaTrade offers you the opportunity to Buy (go long) or Sell (go short) on all Bitcoin trades. This service is available to you 24/7. You can use your preferred trading strategies to buy or sell Bitcoin regardless of which way the currency is moving.

We encourage you to learn more about Bitcoin trading by visiting our Trading Conditions & Charges page.

Please note: The cryptocurrencies market’s high volatility offers endless trading opportunities.

- Open a trading account

- Deposit funds to receive a bonus of up to 10.000$

- Choose Bitcoin on the trading platform and open a Long or Short position

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Futures

Get in touch

Call, email 24/7 or visit a branch

- Call us: 800-454-9272

- Email us

Bitcoin futures trading is here

Bitcoin futures trading is available at TD Ameritrade. Quotes and trading capabilities for these futures products are available on our thinkorswim platform and TD Ameritrade Mobile Trader app.

What is bitcoin?

Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. These bitcoins are then stored in a digital wallet that exists on the cloud or the user’s computer. Because bitcoins are not housed in bank accounts, brokerage, or futures accounts, they are not insured by the FDIC or SIPC.

Virtual currencies, including bitcoin, experience significant price volatility. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Investors must be very cautious and monitor any investment that they make.

Get up to $600 when you open and fund an account*

How can I trade bitcoin futures at TD Ameritrade?

To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. There are certain qualifications and permissions required on your account for Cboe Futures Exchange, LLC (CFE) bitcoin futures trading (/XBT) SM , including:

- Margin enabled

- Tier 2 spread option approval

- Advanced features enabled

- Futures trading approval

- Account minimum of $25,000

Once you are approved to trade futures, you still need access to /XBT to add bitcoin trading to your account. To request access, contact the Futures Desk at 866-839-1100.

Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1.5 times higher than the exchange margin requirements, and is subject to change without notice.

Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. ACH and Express Funding methods require up to four business days for deposits to clear. Wire transfers are cleared the same business day.

While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances.

Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Virtual currencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. Profits and losses related to this volatility are amplified in margined futures contracts.

I want to trade bitcoin futures. Can I be enabled right now?

As with any futures product, trading bitcoin futures (/XBT) at TD Ameritrade requires futures approval on your account.

- If you are a client who is already approved to trade futures at TD Ameritrade, please contact our Futures Desk at 866-839-1100 or email us to request access to trade /XBT.

- If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. Please note that the approval process may take 1-2 business days. Once you have been granted futures approval, contact the Futures Desk at 866-839-1100 or email us to request access to /XBT.

- If you don’t have an account at TD Ameritrade, you need to open an account and select that you plan to actively trade during the sign-up process. You will need to request that margin and options trading be added to your account before you can apply for futures. Please keep in mind that the full process may take 5-6 business days. Once you have been granted futures approval, contact the Futures Desk at 866-839-1100 or email us to request access to /XBT.

How can I check my account for qualifications and permissions?

To ensure you meet the requirements to trade futures, you can check by viewing your account settings under Client Services > General > Elections & Routing, or by contacting us at 866-839-1100.

Am I able to trade bitcoin?

At this time, TD Ameritrade does not provide the ability to trade or hold bitcoin or other cryptocurrencies directly in TD Ameritrade accounts, and does not provide access to bitcoin/cryptocurrency exchange networks. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil, etc.

Three reasons to trade futures at TD Ameritrade

Our thinkorswim platform is a premier derivatives trading platform for serious futures traders.

Get live help from traders with hundreds of years of combined experience.

Fair pricing with no hidden fees or complicated pricing structures.

Learn more

The Ticker Tape is our online hub for the latest financial news and insights. Here are a few suggested articles about bitcoin:

For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center.

Let's talk about bitcoin futures

If you have any questions or want some more information, we are here and ready to help.

Get answers on demand through our bot for Facebook Messenger.

Tweet us your questions to get real-time answers.

Prefer one-to-one contact? Send us an email and we'll get in touch.

Check the background of TD Ameritrade on FINRA's BrokerCheck

Trade commission-free for 60 days plus get up to $600* Offer Details

Call Us 800-454-9272

5 Stars Overall

Futures and futures options trading is speculative, and is not suitable for all investors. Please read the Risk Disclosure for Futures and Options prior to trading futures products.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC).

Futures and futures options trading services provided by TD Ameritrade Futures & Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify.

*Offer valid for one new Individual, Joint or IRA TD Ameritrade account opened by 9/30/2018 and funded within 60 calendar days of account opening with $3,000 or more. To receive $100 bonus, account must be funded with $25,000-$99,999. To receive $300 bonus, account must be funded with $100,000-249,999. To receive $600 bonus, account must be funded with $250,000 or more. Offer is not valid on tax-exempt trusts, 401k accounts, Keogh plans, profit sharing plan, or money purchase plan. Offer is not transferable and not valid with internal transfers, TD Ameritrade Institutional accounts, accounts managed by TD Ameritrade Investment Management, LLC, current TD Ameritrade accounts or with other offers. Accounts funded with $3,000 or more are eligible for up to 500 commission-free trade internet equity, ETF, or option trades executed within 60 calendar days of account funding. All other trade types are excluded from this offer. Contract, exercise, and assignment fees still apply. No credit will be given for unexecuted trades. Limit one offer per client. Account value of the qualifying account must remain equal to, or greater than, the value after the net deposit was made (minus any losses due to trading or market volatility or margin debit balances) for 12 months, or TD Ameritrade may charge the account for the cost of the offer at its sole discretion. TD Ameritrade reserves the right to restrict or revoke this offer at any time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business. Please allow 3-5 business days for any cash deposits to post to account. Taxes related to TD Ameritrade offers are your responsibility. All promotional items and cash received during the calendar year will be included 0n your consolidated From 1099. Please consult a legal or tax advisor for the most recent changes to the U.S. tax code and for rollover eligibility rules. (Offer Code: 220)

Futures trades do not qualify for commission-free trade offer.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Brokerage services provided by TD Ameritrade, Inc., member FINRA/ SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2018 TD Ameritrade.

Standard Exchanges

First Select The Country

Buying bitcoin with credit cards is currently unavailable

We have temporarily disabled the page at buy.bitcoin.com, and we will be re-enabling it shortly.

We would like to apologise any inconvenience caused, and look forward to reinstating the service at buy.bitcoin.com in the very near future.

In the meantime please check out the Bitcoin Exchanges listed on this page which you can use to buy and sell bitcoins.

Btc futures with up to 20x leverage

Margin trading, NO USD requirement, high returns, clean management tools and more

trade european style vanilla options

with up to 10x leverage

on the most advanced BTC Options Trading Platform on the Market.

hft high-speed matching engine

with less than 1ms latency

Mobile friendly advanced trading platform or trade via high performance REST, Websocket and FIX API

your bitcoins are safe

90% of bitcoins in cold storage

Buy and sell digital currency

Coinbase is the easiest and most trusted place to buy, sell, and manage your digital currency.

Create your digital currency portfolio today

Coinbase has a variety of features that make it the best place to start trading

Manage your portfolio

Buy and sell popular digital currencies, keep track of them in the one place.

Recurring buys

Invest in digital currency slowly over time by scheduling buys daily, weekly, or monthly.

Vault protection

For added security, store your funds in a vault with time delayed withdrawals.

Mobile apps

Stay on top of the markets with the Coinbase app for Android or iOS.

The most trusted digital currency platform

Here are a few reasons why you should choose Coinbase

Secure storage

We store the vast majority of the digital assets held on Coinbase in secure offline storage.

Protected by insurance

Digital currency stored on our servers is covered by our insurance policy.

Industry best practices

We take security seriously, and have built a reputation of being the most trusted in the space.

5 Easy Steps For Bitcoin Trading For Profit and Beginners

Bitcoin trading can be extremely profitable for professionals or beginners. The market is new, highly fragmented with huge spreads. Arbitrage and margin trading are widely available. Therefore, many people can make money trading bitcoins.

Bitcoin’s history of bubbles and volatility has perhaps done more to bring in new users and investors than any other aspect of the crpytocurrency.

Each bitcoin bubble creates hype that puts Bitcoin’s name in the news. The media attention causes more to become interested, and the price rises until the hype fades.

Each time Bitcoin’s price rises, new investors and speculators want their share of profits. Because Bitcoin is global and easy to send anywhere, trading bitcoin is simple.

Compared to other financial instruments, Bitcoin trading has very little barrier to entry. If you already own bitcoins, you can start trading almost instantly. In many cases, verification isn’t even required in order to trade.

If you are interested in trading Bitcoin then there are many online trading companies offering this product usually as a contract for difference or CFD.

Avatrade offers 20 to 1 leverage and good trading conditions on its Bitcoin CFD trading program.

Why Trade Bitcoin?

Before we show you how to trade Bitcoin, it’s important to understand why Bitcoin trading is both exciting and unique.

Bitcoin Is Global

Bitcoin isn’t fiat currency, meaning its price isn’t directly related to the economy or policies of any single country. Throughout its history, Bitcoin’s price has reacted to a wide range of events, from China’s devaluation of the Yuan to Greek capital controls.

General economic uncertainty and panic has driven some of Bitcoin’s past price increases. Some claim, for example, that Cyprus’s capital controls brought attention to Bitcoin and caused the price to rise during the 2013 bubble.

Bitcoin Trades 24/7

Unlike stock markets, there are no official Bitcoin exchanges. Instead, there are hundreds of exchanges around the world that operate 24/7. Because there is no official Bitcoin exchange, there is also no official Bitcoin price. This can create arbitrage opportunities, but most of the time exchanges stay within the same general price range.

Bitcoin is Volatile

Bitcoin is known for its rapid and frequent price movements. Looking at this daily chart from the CoinDesk BPI, it’s easy to spot multiple days with swings of 5% or more:

Bitcoin’s volatility creates exciting opportunities for traders who can reap quick benefits at anytime.

Find an Exchange

As mentioned earlier, there is no official Bitcoin exchange. Users have many choices and should consider the following factors when deciding on an exchange:

Regulation & Trust – Is the exchange trustworthy? Could the exchange run away with customer funds?

Location – If you must deposit fiat currency, and exchange that accepts payments from your country is required.

Fees - What percent of each trade is charged?

Liquidity – Large traders will need a Bitcoin exchange with high liquidity and good market depth.

Based on the factors above, the following exchanges dominate the Bitcoin exchange market:

Bitfinex - Bitfinex is the world’s #1 Bitcoin exchange in terms of USD trading volume, with about 25,000 BTC traded per day. Customers can trade with no verification if cryptocurrency is used as the deposit method.

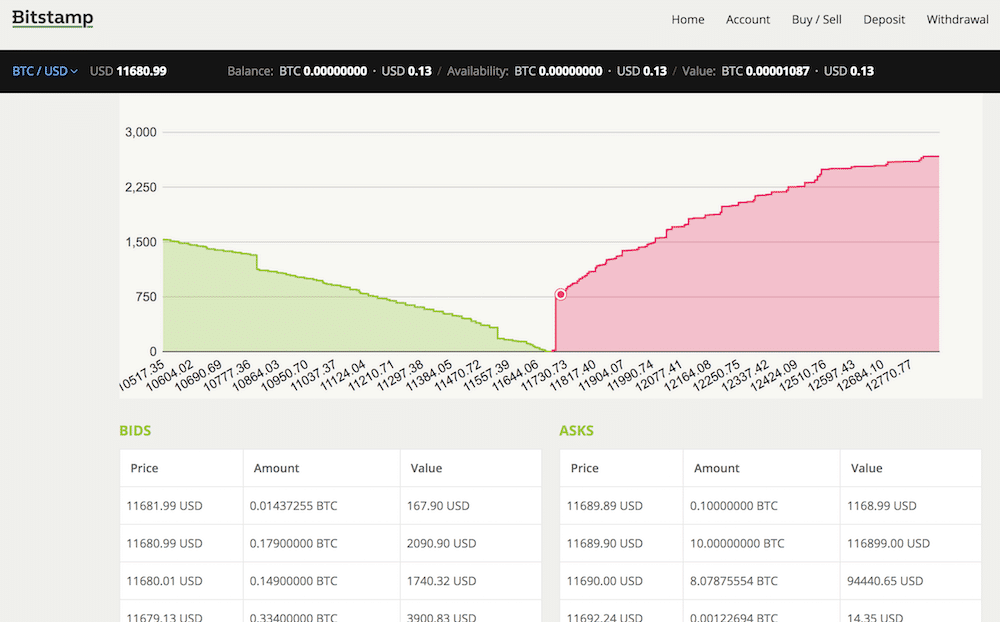

Bitstamp - Bitstamp was founded in 2011 making it one of Bitcoin’s oldest exchanges. It’s currently the world’s second largest exchange based on USD volume, with a little under 10,000 BTC traded per day.

OKCoin - Bitcoin exchange based in China but trades in USD.

Coinbase -

Coinbase - Coinbase Exchange was the first regulated Bitcoin exchange in the United States. With about 8,000 BTC traded daily, it’s the world’s 4 th largest exchange based on USD volume.

Kraken - Kraken is the #1 exchange in terms of EUR trading volume at

6,000 BTC per day. It’s currently a top-15 exchange in terms of USD volume.

Bitcoin Trading in China

Global Bitcoin trading data shows that a very large percent of the global price trading volume comes from China. It’s important to understand that the Chinese exchanges lead the market, while the exchanges above simply follow China’s lead.

The main reason China dominates Bitcoin trading is because financial regulations in China are less strict than in other countries. Therefor, Chinese exchanges can offer leverage, lending, and futures options that exchanges in other countries can’t. Additionally, Chinese exchanges charge no fees so bots are free to trade back and forth to create volume.

If you’d like to learn more about Bitcoin trading in China, this video from Bitmain’s Jihan Wu provides additional insight.

How to Trade Bitcoin

Kraken will be used as an example for this guide. The process and basic principles remain the same across all exchanges.

First, create an account on Kraken by clicking the black sign up box in the right corner:

You’ll have to confirm your account via email. Once your account is confirmed and you’ve logged in, you must verify your personal information. All Bitcoin exchanges require varying levels of verification as required by AML and KYC laws. Below you can find the first three verification levels:

Once your account is verified, head over to the “funding” tab. You should see something similar to the screenshot below. Select your funding method from the left side:

Kraken offers many deposit methods, which are listed here:

EUR SEPA Deposit (Free) - EEA countries only

EUR Bank Wire Deposit (€5) - EEA countries only

USD Bank Wire Deposit (Free until 3/1/2016, then $5 USD) - US only

USD SEPA and SWIFT Deposit (0.19%, $20 minimum)

GBP SEPA and SWIFT Deposit (0.19%, £10 minimum)

JPY Bank deposit (Free, ¥5,000 deposit minimum) - Japan only

CAD Interac Deposit (Free until 3/1/2016, then 1%, $10 CAD fee minimum, $5,000 CAD deposit maximum)

CAD EFT Deposit (Free until 3/1/2016, then 1%, $10 CAD fee minimum, $50 CAD fee maximum, $10,000 CAD deposit maximum)

Deposits made using the traditional banking system will take anywhere from one to three days. Bitcoin deposits require six confirmations, which is about one hour.

Now, navigate to the “Trade” tab. Using the black bar at the top of the page, you can switch trading pairs. In this example we’ll use XBT/USD. We want to buy bitcoins, so let’s put in an order. Navigate to the “New Order” tab.

Let’s say I’ve deposited $300 into my account with a USD bank wire. In the example below, I’ve submitted an order to buy 0.5 bitcoins (XBT) at a price of $370 per bitcoin.

Check the black bar at the top, and you’ll notice that the last trade price was $383.17.

Why submit an order to buy at $370 per bitcoin (XBT) and not $383.17? One may submit an order lower than the current price if one expects the price of Bitcoin to fall. In this case, since my order is lower than other offers in the orderbook, I won’t receive my order for 0.5 bitcoin immediately. Placing an order at a specified price is called a _limit order._ Before placing an order, be sure to check the orderbook for your trading pair.

In the example orderbook below, you can see that the highest buy offer is for $382.5 per bitcoin, while the lowest sell order is at $384.07 per bitcoin.

Using the order form there’s also an option for “Market”.

A market order in this case would submit a buy order for XBT at the price of the lowest available sell order. Using the orderbook above, a market order for 0.5 XBT would purchase 0.5 XBT at $384.07 per XBT. If selling bitcoins, a market order would sell bitcoins for the highest available price based on the current buy orderbook—in this case $382.5.

Trading Risks

Bitcoin trading is exciting because of Bitcoin’s price movements, global nature, and 24/7 trading. It’s important, however, to understand the many risks that come with trading Bitcoin.

Leaving Money on an Exchange

Perhaps one of the most famous events in Bitcoin’s history is the collapse of Mt. Gox. In Bitcoin’s early days, Gox was the largest Bitcoin exchange and the easiest way to buy bitcoins. Customers from all over the world were happy to wire money to Mt. Gox’s Japanese bank account just to get their hands on some bitcoins.

Many users forgot one of the most important features of Bitcoin—controlling your own money—and left more than 800,000 bitcoins in Gox accounts. In February 2014, Gox halted withdrawals and customers were unable to withdrawal their funds. The company’s CEO claimed that the majority of bitcoins were lost due to a bug in the Bitcoin software. Customers still have not received any of their funds from Gox accounts.

Gox’s catastrophic collapse highlights the risk that any trader takes by leaving money on an exchange. Using a regulated Bitcoin exchange like Kraken can decrease your risk.

Your Capital is at Risk

Remember that as with any type of trading, your capital is at risk. New traders should start trading with small amounts or trade on paper to practice. Beginners should also learn Bitcoin trading strategies and understand market signals.

Bitcoin Trading Tools & Resources

Cryptowatch & Bitcoin Wisdom – Live price charts of all major Bitcoin exchanges.

Bitcoin Charts – More price charts to help you understand Bitcoin’s price history.

bitcoinmarkets – A Bitcoin trading sub-reddit. New users can ask questions and receive guidance on trading techniques and strategy.

TradingView – Trading community and a great resource for trading charts and ideas.

Bitcoin Trading Guide for Beginners + Examples and Common Mistakes

Last updated on May 8th, 2018 at 04:06 pm

What are the five common mistakes of 90% of Bitcoin traders?

How do I even start trading?

How do I read all of these confusing price charts that I see online?

Well, stick around… Here on Bitcoin Whiteboard Tuesday, we’ll answer these questions and more.

What you will learn in this video

- What are the differences between trading & investing?

- What are the different types of trading?

- How does Fundamental Analysis differ from Technical Analysis?

- Understanding Bitcoin trading terms

- How to read price charts?

- What are the most common trading mistakes?

Bitcoin Trading Resource Section

Chris Dunn – Free Bitcoin trading webinar (great for additional trading education)

Coinigy – Bitcoin trading software

The following sites are suited for Bitcoin trading:

AvaTrade – Bitcoin CFD trading (keep in mind that when trading CFDs your capital is at risk).

For additional exchanges visit our Bitcoin exchange page.

If there’s one thing we get asked A LOT here on 99Bitcoins, it’s how to trade Bitcoins. So we decided to dedicate this episode of Bitcoin Whiteboard Tuesday to teaching you what Bitcoin trading is all about.

This lesson will be longer than usual, but I assure you, it will be worth your time. We’re going to cover four major topics:

- The definition of Bitcoin trading

- The main terms you’ll encounter when trading on exchanges

- A very short intro into reading price graphs

- And finally, we’ll go over some common trading mistakes

Let’s get started….

Bitcoin Trading vs. Investing

So what is Bitcoin trading, and how is it different from investing in Bitcoin?

Well, when people invest in Bitcoin, it usually means that they are buying Bitcoin for the long term. In other words, they believe that the price will ultimately rise, regardless of the ups and down that occur along the way.

Usually, people invest in Bitcoin because they believe in the technology, ideology, or team behind the currency.

Bitcoin investors tend to HODL the currency long-term. HODL is a popular term in the Bitcoin community that was actually born out of a typo of the word “hold”—in an old 2013 post in the BitcoinTalk forum.

So while Bitcoin investors buy and HODL for the long term, Bitcoin traders buy and sell Bitcoin in the short term, whenever they think a profit can be made.

Traders view Bitcoin as an instrument for making profits. Sometimes, they don’t really care about the technology or the ideology behind the product they’re trading. Of course, people can still trade Bitcoin if they do care about it. And many people out there invest and trade at the same time.

But why are so many people looking to trade cryptocurrencies (especially Bitcoin) all of a sudden?

Here are a few of the reasons:

First, bitcoin is very volatile. In other words, you can make a nice amount of profit if you manage to correctly anticipate the market.

Second, Unlike traditional markets, Bitcoin trading is open 24/7. Most traditional markets, such as stocks and commodities, have an opening and closing time. With Bitcoin, you can buy and sell whenever you please.

Finally, Bitcoin’s unregulated landscape makes it relatively easy to start trading—without the need for long identity-verification processes.

Trading method types

For example, day trading involves conducting multiple trades throughout the day, and trying to profit from short-term price movements. Day traders spend a lot of time staring at computer screens, and at the end of the day, they usually just close all of their trades.

Scalping is a day-trading strategy that a lot of people are talking about. Scalping attempts to make substantial profits on small price changes, and it’s often referred to as “picking up pennies in front of a steamroller.”

Scalping focuses on extremely short-term trading, and it’s based on the idea that making small profits repeatedly limits risks and creates advantages for traders. Scalpers can make dozens—or even hundreds—of trades in one day.

Meanwhile, swing trading tries to take advantage of the natural “swing” of the price cycles. Swing traders try to spot the beginning of a specific price movement, and enter the trade. Then they hold on until the movement dies out, and take the profit. They try to see the big picture without constantly monitoring their computer screen. Swing traders can open a trading position, and hold it open for weeks (or months), until they reach the desired result.

So now that you know what trading is, how is it actually accomplished? How can someone predict what Bitcoin will do?

The short answer is that no one can really predict what will happen to the price of Bitcoin. However, some traders have identified certain patterns, methods, and rules that allow them to make a profit in the long run. No one exclusively makes profitable trades, but here’s the idea: At the end of the day, you should still see a positive balance, even though you suffered some losses along the way.

Fundamental vs. Technical analysis

People follow two main methodologies when they trade Bitcoins (or anything else, for that matter): fundamental analysis and technical analysis.

Fundamental analysis looks at the big picture. In Bitcoin’s case, fundamental analysis evaluates Bitcoin’s industry, news about the currency, technical developments of Bitcoin (such as the lightning network), regulations around the world, and any other news or issues that can affect the success of Bitcoin.

This methodology looks at Bitcoin’s value as a technology (regardless of the current price) and at outside forces (in order to determine what will happen to the price). For example, if China suddenly decides to ban Bitcoin, this analysis will predict when the price will probably drop.

Technical analysis tries to predict the price by studying market statistics, such as past prices movement and trading volumes. It tries to identify patterns and trends in the price, which may suggest what will happen to the price in the future.

Technical analysis assumes the following: Regardless of what’s currently happening in the world, price movements speak for themselves, and tell some sort of a story that helps you predict what will happen next.

So which methodology is better?

Well, like I said in the beginning, no one can accurately predict the future. However, a healthy mix of both methodologies will probably yield the best results.

Understanding Bitcoin Trading Terms

Now let’s continue to break down some of the confusing terms and statistics you’ll encounter on most of exchanges.

Bitcoin exchanges are online sites where buyers and sellers are automatically matched. An exchange is different than a Bitcoin company that sells you Bitcoin directly, such as Coinmama. This type of company will usually charge a higher fee. An exchange is also different from a marketplace such as Local Bitcoins, where buyers and sellers directly communicate with each other, in order to complete a trade.

The order book

The complete list of buy orders and sell orders are listed in the market’s order book, which can be viewed on the exchange. The buy orders are called bids, since people are bidding on the prices to buy Bitcoin. However, the sell orders are called asks, since they show the asking price that the sellers request.

Whenever people refer to Bitcoin’s “price,” they are actually referring to the price of the last trade conducted on a specific exchange. This important distinction occurs because there is no single, global Bitcoin price that everyone follows. And sometimes, Bitcoin’s price in other countries can be different from Bitcoin’s price in the US, since the major exchange in these countries include different trades.

Aside from the price, you will also sometimes see the terms high and low. These terms refer to the highest and lowest prices in the last 24 hours.

Another important term is volume. It stands for the number of overall Bitcoins that have been traded in the given timeframe. Significant trends are usually accompanied by large trading volumes, while weak trends are accompanied by low volumes.

A healthy upward trend is accompanied by high volumes (when the price rises) and low volumes (when the price declines). If you are witnessing a sudden change of direction in the price, experts recommend checking how significant the trading volume is, in order to determine if it’s just a minor correction or the beginning of an opposite trend.

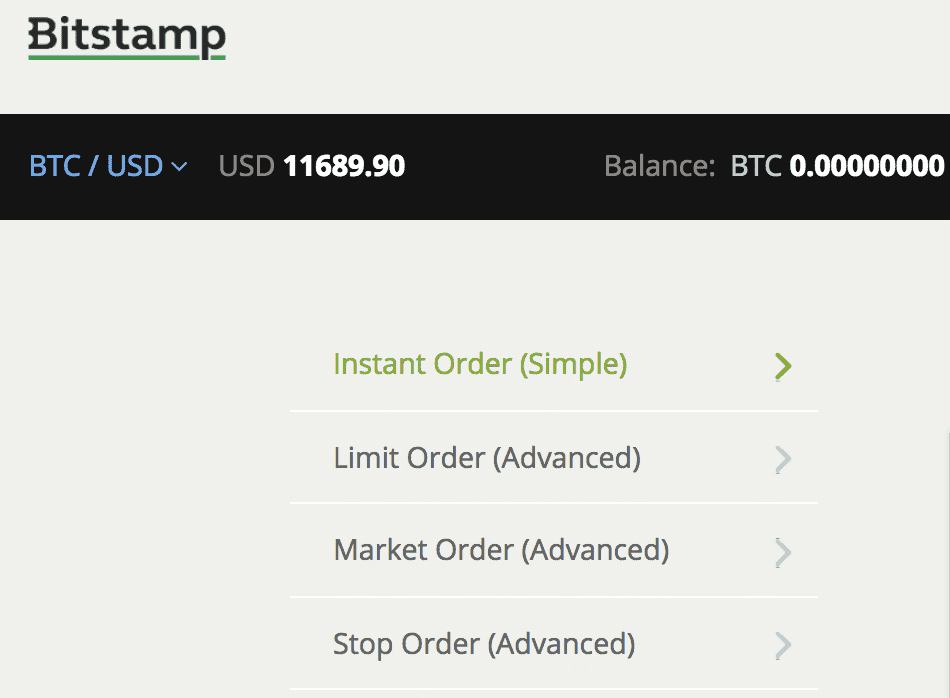

So now, you know most of the terms you’ll encounter on the average exchange. It’s time for us to move on, and go over the types of orders that you can place on an exchange.

Three Types of Orders

A market (or instant) order refers to an order that will be instantly fulfilled at any possible price So if you put a market order in to buy five Bitcoins, you will find the cheapest sellers possible, until it accumulates enough sellers to hand over five Bitcoins.

In other words, you might end up buying three Bitcoins at one price, and the other two at a higher price. In a market order, you don’t stop buying Bitcoin until the amount requested is reached. With market orders, you may end up paying more than you intended, so be careful.

Meanwhile, with a limit order, you will only buy or sell Bitcoin at a specific price that you decide on. In other words, the order may not be entirely fulfilled, since there won’t be enough buyers or sellers to meet your requirements.

Let’s say that you place a limit order to buy five Bitcoins at $10,000 per coin. Then you could end up only owning 4 Bitcoins, because there were no other sellers willing to sell you the final Bitcoin at $10,000. The remaining order for 1 Bitcoin will stay there, until the price hits $10,000 again, and the order will then be fulfilled.

A stop-loss order lets you set a specific price that you want to sell at in the future, in case the price dramatically drops. This type of order is useful for minimizing losses. It’s basically an order that tells the exchange the following: If the price drops by a certain percentage or to a certain level, I will sell my Bitcoins at the preset price, so I will lose as little money as possible.

A stop-loss order acts like a market order. In other words, once the stop price is reached, the market will start selling your coins at any price until the order is fulfilled.

Maker and Taker fees

Other terms that you may encounter when trading on exchanges are maker fees and taker fees. Personally, I still find this model to be one of the more confusing ones, but let’s try to break it down.

Exchanges want to encourage people to trade. In other words, they want to “make a market.” Therefore, whenever you create a new order that can’t be matched by any existing buyer or seller, you’re basically a market maker, and you will usually have lower fees.

Meanwhile, a market taker place orders that are instantly fulfilled, since there was already a market maker in place to match their requests.

Takers remove business from the exchange, so they usually have higher fees than makers, who add orders to the exchange’s order book.

For example, perhaps you put a limit order in to buy one Bitcoin at $10,000 (at most), but the lowest seller is only willing to sell at $11,000. Then you’ve just created a new market for sellers who want to sell at $10,000. So whenever you place a buy order below the market price or a sell order above the market price, you become a market maker.

Using that same example, perhaps you place a limit order to buy one Bitcoin at $12,000 (at most), and the lowest seller is selling one Bitcoin at $11,000. Then your order will be instantly fulfilled. You will be removing orders from the exchange’s order book, so you’re considered a market taker.

Reading Price Graphs

Now that you’re familiar with the main Bitcoin exchange terms let me give you a short intro into reading price graphs.

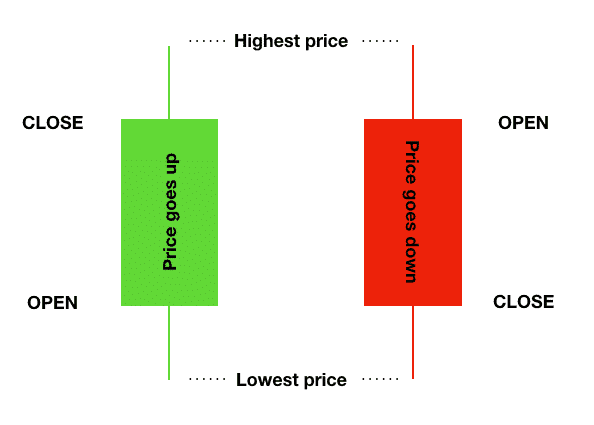

Japanese candlesticks

They are based on an ancient Japanese method of technical analysis, used in trading rice in 1600’s. Each candle shows the opening, lowest, highest, and closing prices of the given time period. That’s why you’ll sometimes see people refer to candles as OHLC (Open, High, Low, Close).

Depending on whether the candle is green or red, you can tell if the closing price of the timeframe was higher or lower than the opening price. If a candle is green, it means that the opening price was lower than the closing price, so the price went up overall during this timeframe. On the other hand, if the candle is red, it means that the opening price was higher than the closing price, so the price went down.

In the image, you can see the opening price in the wide-bottom part of the candle, the closing price in the wide-top part on the candle, and the highest and lowest trades within this timeframe on both ends of the candle.

When we’re in a bull market, most of the candlesticks will usually be green. And if it’s a bear market, most of the candlesticks will be red.

bull or bear markets

These markets are named after these animals because of the ways they attack their opponents. A bull thrusts its horns up into the air, while a bear swipes its paws downward. So these animals are metaphors for the movement of a market. If the trend is up, it’s a bull market. But if the trend is down, it’s a bear market.

resistance and support levels

Occasionally, Bitcoin’s price seems to hit a virtual ceiling, and you can’t break through it for a long time. That’s a resistance level. So if Bitcoin fails to break $10,000, the resistance level is $10,000. Usually, at a resistance level, you will see a lot of sell orders, and that’s why the price fails to break through that specific point.

Meanwhile, there’s also a support level. In other words, there’s a price that Bitcoin might not go below. Support levels act as floors by preventing the price of an asset from being pushed downward. A support level will be accompanied by a lot of buy orders set at the level’s price. The high demand of a buyer at the support level cushions the downtrend.

Historically, the more frequently the price has been unable to move beyond the

support or resistance levels, the stronger these levels are considered.

Here’s a common characteristic of both support and resistance levels: They are usually set at a round number, since most inexperienced traders tend to buy or sell when the price is at a whole number.

So usually, you’ll see a lot of buy or sell orders around prices like $10,000, rather than a price like $10,034. Because so many orders are placed at the same level, these round numbers tend to act as strong price barriers.

Psychology also creates support and resistance levels. For example, until 2017, it seemed expensive to pay $1,000 per Bitcoin. So there was a strong resistance level at $1,000. But once that level was breached, a new psychological resistance level was created: $10,000.

Common trading mistakes

You now know the basics of Bitcoin trading. However, there’s still a lot more to it. Since we can’t possibly go over everything in one lesson, I want to direct you to additional resources that will take you to the next level of trading.

Take a look at the resource section at the end of this video. Then you can find out about advanced Bitcoin trading lessons, the top Bitcoin trading tools, and the best Bitcoin exchanges for starting your trade.

But before we end this video, let’s go over the most common mistakes that people make when they start trading—in the hopes that you’ll be able to avoid them.

Mistake #1 – Risking more than you can afford to lose

The biggest mistake you can make is to risk more money than you can afford to lose. Take a look at the amount you feel comfortable with. Here’s the worst-case scenario: You’ll end up losing it all. If you find yourself trading above that amount, stop. You’re doing it wrong.

Trading is a very risky business, and if you invest more money than you’re comfortable with, it will affect how you trade, and it may cause you to make bad decisions. Mostly, you may end up losing a portion of your money that you can’t do without.

Mistake #2 – Not having a plan

Another mistake that people make when starting out with trading is not having an action plan that’s clear enough. In other words, they don’t know why they’re entering a specific trade, and more importantly, when they should exit that trade. So clear profit goals and stop-losses should be decided before starting the trade.

Mistake #3- Leaving money on an exchange

Moving on, NEVER leave money on an exchange that you’re not currently trading with. If your money is sitting on the exchange, it means that you don’t have any control over it. If the exchange gets hacked, goes offline, or goes out of business, you may end up losing that money. Whenever you have money that isn’t needed in the short term for trading on an exchange, make sure to move it into your own Bitcoin wallet or bank account for safekeeping.

Mistake #4 – Giving into fear or greed

Two basic emotions tend to control the actions of many traders: fear and greed. Fear can appear in the form of prematurely closing your trade, because you read a disturbing news article, heard a rumor from a friend, or got scared by a sudden dip in the price (that will soon be corrected).

The other major emotion, greed, is actually also based on fear: the fear of missing out. When you hear people telling you about the next big thing, or when market prices rise sharply, you don’t want to miss out on all the action. So you may get into a trade too soon, or even delay closing an open trade.

Remember that in most cases, our emotions rule us. So never say, “This won’t happen to me.” Be aware of your natural tendency towards fear and greed, and make sure to stick to the plan that was laid before you started the trade.

Mistake #5 – Not learning the lesson

Regardless of whether or not you made a successful trade, there’s always a lesson to be learned. No one manages to only make profitable trades, and no one gets to the point of making money without losing some money on the way.

The important thing isn’t necessarily whether or not you made money. Rather, it’s whether or not you managed to gain some new insight into how to trade better next time.

Let’s wrap it up…

We’ve spent a great deal of time today talking about Bitcoin trading, but I have to warn you: The majority of people who start trading Bitcoin stop after a short while, because they don’t successfully make any money.

Here’s my opinion: If you want to be successful at trading, you’ll have to put in a significant amount of time and money to acquire the relevant skills, just like any other venture. If you want to get into trading just to make a quick buck, then perhaps it’s better to just avoid trading altogether. There’s no such thing as quick, easy money—without a risk or downside at the other end.

However, if you’re committed to learning how to become a professional Bitcoin trader, take a look at our resource section below. Then you can get the best possible tools, and continue your education.

You may still have some questions. If so, just leave them in the comment section below.

Sail the high seas of success.

Buy, Sell, & Trade Bitcoin

Create an account

The Best Bitcoin Exchange

The best bitcoin exchange is needed for serious and professional bitcoin traders. Bitcoin security must be impeccable. Banking relationships must be sound and reliable. The trading engine must be fast. Order types must be advanced. And profits must be able to be multiplied with Bitcoin margin trading so you can leverage long bitcoin positions or short bitcoin positions.

Fast funding and low fees

Bitcoin dark pool

Reliability

24/7/365 support

Legally compliant

Ranked #1 security

Encrypted cold storage

Bitcoin Margin Trading

Leveraged trading up to 5x

Shorting allowed

Advanced Order Types

Stop-loss orders

Automate your strategy

Proof of Reserves Audits

Cryptographically verified

Pioneered the industry standard

[The MtGox trustee picked them] because of Kraken's proven operating history, and because its system has never been breached by hackers.

Kraken is an exemplary institution that the rest of the Bitcoin world should look up to. One of the first exchanges to pass an independent audit.

Integration with Kraken was a seamless process. It's clear their team is comprised of experienced traders and technologists.

Bitcoin / U.S. Dollar BTCUSD

BTCUSD Crypto Chart

Technical Analysis Summary

Related Symbols

First off let me say I am not a fan of Elliott Waves, now I know some traders rely solely on E.W. but as time goes on and they gain more experience those analysts will eventually come to the same conclusion as I have. Elliott Waves are subjective, I rely on very little wave analysis, I do take it into account, but I never base a trade solely on them. That being .

The target of 6900/7000 did not get reached, because it was getting bought at the lows yesterday. In my last update i posted i said that it was clear that bearish momentum was dropping. A few hours before that i showed a bullish wedge that could possibly show a reversal as well, but the price dropped below it, which happens very often but than it should go up .

Nothing has changed since my previous update, price is still moving sideways. Yesterday it looked like Bitcoin was slipping and would make another drop but there were some buyers who pushed the price back into the triangle again. In one of my previous updates, i mentioned that i was thinking about 2 options. A bear flag, which would mean the price has to go .

Hi Everyone, for today's Intraday trade we'll be shorting BITCOIN at $7450 please wait for the price of render at INTRA R1 in order to validate this pattern for more updates gives this analysis a Thumbs up!

What's up traders, I hope you're all having a good trading week. Let's analyse BTC/USD on the 4H chart. This analysis is a follow up of my previous analysis (See related ideas for information on this analysis) and I recommend viewing the previous analysis to better understand this new follow up analysis. Bitcoin is currently trading below a side-wards support .

BTCUSD , 240, Education

Hello! "When you go fishin' in a lake, you don't just row out to the middle and throw a line in the water. You go where the fish live - around the edge and near the sunken trees. Same way, you enter trades near the edges of congestion zones, where bulls or bears are so exhausted that a small amount of pressure can reverse a trend." Trading Ranges is where the .

In the previous idea we defined the current reversal zone as 6950-7100. Overnight the price dropped to 7040, triggering some limit orders: https://www.tradingview.com/chart/BTCUSD/emLvDuqG-Bitcoin-BTC-Buy-Levels/ I still expect the bottom to be formed in the next couple of days. There a couple of technical readings to consider: Key Support Area Bullish .

Hey Guys & Girls, SONG OF THE DAY. I'll never miss a beat, I'm lightning on my feet And that's what they don't see mmm mmm, that's what they don't see mmm mmm I'm dancing on my own (dancing on my own), I'll make the moves up as I go (moves up as I go) And that's what they don't know mmm mmm, that's what they don't know mmm mmm But I keep cruising, can't stop, .

At the beginning I would like to say that I am still bearish, even if this scenario occurs. That would only mean that we would probably make a longer correction by 3-4 months before the final crash comes. So that some are not surprised: The final crash does not mean for me that Bitcoin will drop to zero. It just means that we will see one last impulse down before .

Hello traders and fellow gamblers! So this is the promised compiled chart that has the magical Gann Square, Fib circles (I added one more) and updated Fib fan, as well as Fib retracements and extensions. Bearish scenario: Sooner or later we are going to bounce. If we bounce without breaking the giant triangle with thick orange line at its base, bulls have a .

BTCUSD , 1D, Short ,

The bottom I talked about in my last update (link below) is actually only A wave. The whole thing is A wave; The projected B and C waves are plotted in this chart and things dont look good for bitcoin I feel sorry for all bitcoin holders including myself for squandering my money in it. I hope everyone recovers their investments. If you want me to continue .

Hope this idea will inspire some of you ! Don't forget to hit the like/follow button if you feel like this post deserves it ;) That's the best way to support me and help pushing this content to other users. If you want to see my chart more closely, click the share button below that video.. You will be able to have access to the chart used in that .

11:34 Gmt 06:34 Est Bitcoin Coinbase Update OK. So a little a break higher to bust out bear stops around 7166 - stop hunters and bots! But at least a little continuation pattern looks to be forming now giving us break points either side of the smallest parallels . Only gets interesting again once we see a break either up or down - which we can follow with .

BTCUSD , 1M, Long ,

Bitcoin has produced a bull pennant on the monthly time frame and higher highs and lowers lows on the monthly candle. Looks good on this time frame.

An in depth analysis of Bitcoin shows that not only has its price increased with time, but its rate of increase has increased as well. The above chart demonstrates this analysis and comprises of two types of Bitcoin (BTC) rallies: Rally X and Rally Y. The former comprises of a period of 12 months and is an extended rally whereas the latter comprises of 6.5 months .

a potential bear cypher advanced formation is setting up.

BTCUSD , 60, Long ,

Since yesterday, little has changed. The price slowly decreases in the local wave (B)-blue, in which the triple with the finale diagonal triangle in the wave (c)-red. As well as yesterday I expect a pitch in the wave (C)-blue, and following decline in the wave C-red may continue.

BTCUSD , 1W, Short ,

This is a update to my idea "Bull trap? Return to normal OR Return to mean", linked at the bottom. I have been watching the Weekly of Bitcoin. I am following up on a previous idea, where I was looking out for bitcoin to fall below the 50 week MA, which happened last week. Assuming bitcoin is continuing a downtrend to 4900 these are some potential bounce points .

Комментариев нет:

Отправить комментарий