Bitcoin Fees Explained

People often claim that with Bitcoin "you can send money between any two points on earth for free". While that is true in some cases, sometimes a transaction fee is required. The fee, when it is required, is usually worth a few dollars.

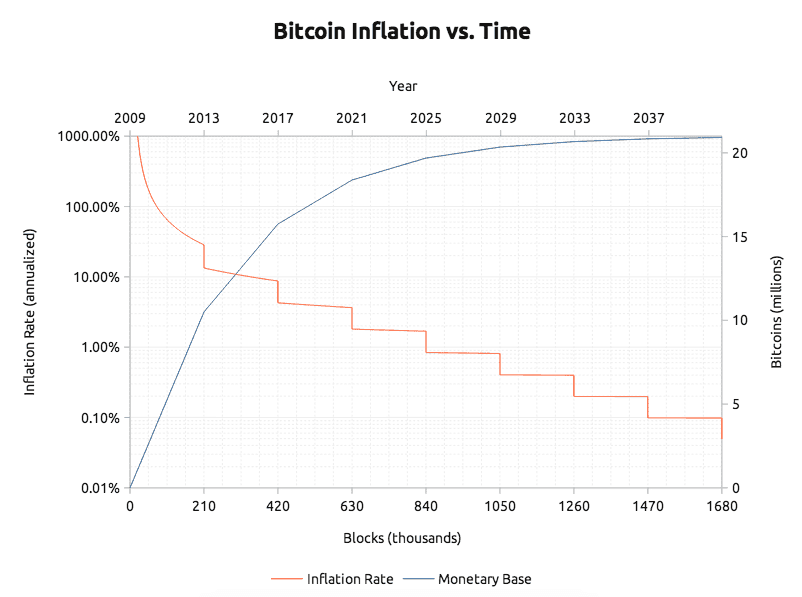

The fees go to the miners to incentivise them to keep mining, which in turn keeps the Bitcoin network secure. They already get a reward of 12.5 XBT for each block they mine, but this reward halves every 4 years. The plan is that as the block reward diminishes over the time, it will be replaced by transaction fees.

So what decides when you have to pay, and how much?

Well, like everything else in Bitcoin, the fee structure is built into the network rules, which are defined as "what the reference client does". When you attempt to send coins using bitcoin core (the current reference client), it goes through the following steps:

1. Pick which coins to spend

The client has to decide which of your coins to use to make up the payment amount. Each time you receive a payment, the payment goes into your wallet and stays there until you spend it.

If you receive a payment of 2 XBT and another of 3 XBT, you'll have 2 new amounts in your wallet, of 2 XBT and 3 XBT. They don't "merge" into a single 5 XBT coin. Over time you'll build up a collection of differently sized amounts in your wallet, and the client needs to decide which ones make the best fit for the amount you're trying to spend.

These amounts are known as the "inputs" of your new transaction, and the amounts you are sending (including any change that gets sent back to your own wallet) are known as the "outputs".

2. Discourage "dust" spam

If any of the outputs (including any change) of your transaction are less than 0.01 XBT, then a fee of 0.0001 XBT is required. The coin selection algorithm is careful to avoid selecting coins that result in a change amount of less than 0.01 XBT if at all possible.

3. Prioritize old and high-value coins

If the coins you're spending are too small or too new then your transaction won't qualify as free. Each transaction is assigned a priority, determined by the age, size, and number of its inputs.

Specifically, for each input, the client calculates the value of the input in XBT multiplied by the age of the input in blocks. It sums these products over all inputs and divides the total by the size of the transaction in bytes. If this gives a number less than 0.576 then the transaction requires a fee. This means that you can include lots of very small, and/or very new inputs in a transaction and have it require no fees at all so long as you include a large old input along with them; it is the average value-times-age that matters.

If step 3 caused a transaction to require a fee when it was originally sent, it's possible that as time passes, and new blocks are found, the transaction's inputs will age, its priority will increase, and as a result step 3 may no longer cause it to require a fee.

4. Charge per kilobyte

Finally, the client checks the size of the transaction in bytes. The size depends on the numbers of inputs and outputs, and is roughly:

148 * number_of_inputs + 34 * number_of_outputs + 10

If this size is less than 10,000 bytes and step 3 found that the transaction's priority was high enough to qualify as free, then the transaction still qualifies as free, otherwise a fee is required. The fee is charged per 1000 bytes or part thereof. The amount charged per 1000 bytes defaults to 0.0001 XBT, but can be increased in the Settings>Options>Main tab of the client. If you set the "fee per kB" to less than 0.0001 XBT in that dialog then a value of 0.0001 XBT will be used. When it applies, this fee per kB replaces any fee from step 2, rather than adding to it.

All these rules are visible in the reference client's source code. See CTransaction::GetMinFee() in src/main.cpp, AllowFree() in src/main.h, and CWallet::CreateTransaction() in src/wallet.cpp.

1. When Too Much is Not Enough.

Suppose you have only two outputs in your wallet, worth 1 XBT and 2 XBT. You want to buy something for 2.999 XBT. The coin selection code has no choice; it has to select both coins to get a big enough total to make the transaction. That means the change will be 0.001 XBT, which triggers the 0.0001 XBT fee for having an output that's less than 0.01 XBT. As a result your transaction will fail, because the amount you're sending plus the fee is more than you have.

What this means is that there's no way of spending 2.999 XBT when you have 3 XBT. You could send the full 3 XBT to the vendor without a fee (assuming the outputs are sufficiently old to satisfy step 3), but some vendors ask you to send the exact amount they specify.

2. The Big Dice Winner

Once, someone got lucky and turned 0.02 XBT into 1280 XBT on a 64000x payout bet on a bitcoin 'dice' game! When the site paid out the winnings they didn't have a single 1280 XBT input lying around in their wallet. Instead what they had was a whole bunch of various sized outputs from other players' losing bets, as well as a lot of change from paying other winners.

The transaction the site created to pay the winner of this jackpot used so many inputs that it ended up being 51,203 bytes long. Being over 10000 bytes, this required a fee of 0.0005 XBT per 1000 bytes or part thereof (prior to being changed to 0.0001, the fee used to be 0.0005), so the required fee was 52 * 0.0005 = 0.026 XBT. That's more than the player bet in the first place. Who says Bitcoin transactions are free!

Of course, this is still less than you would pay in fees if you used PayPal to transfer $40,000.

Note that the dice game actually included a fee of 0.0286 XBT, which is more than is required. That's probably because they don't use the standard satoshi client to create their transactions, and the client they used got it slightly wrong.

3. Pushing the Limit

This transaction just barely qualified as being free. It's 9999 bytes long, which is the biggest a transaction can be without requiring a fee. Notice also that all but one of the inputs are only 10 nXBT (0.00000001 XBT); the single large input that was included with them was big enough to bring its priority up enough to make it free.

Are "required" fees really required?

Incidentally, the concept of "required fee" isn't strictly enforced. Some miners don't follow the rules about what fees are required, and will include a transaction in their blocks even if it doesn't follow the fee rules. Using the "raw transactions" interface of the reference client it's possible to create transactions with less than the required amount of fee. Such transactions may eventually be included in a block by a maverick miner who doesn't enforce the fee rules, although this could take 24 hours or even much longer.

So it's all pretty complex, but hopefully this gives you a better understanding of how and why the client decides when and how much to charge you.

Transaction fees

Transaction fees are a fee that spenders may include in any Bitcoin transaction. The fee may be collected by the miner who includes the transaction in a block.

Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. The difference between the amount being spent and the amount being received is the transaction fee (which must be zero or more).

Bitcoin's design makes it easy and efficient for the spender to specify how much fee to pay, whereas it would be harder and less efficient for the recipient to specify the fee, so by custom the spender is almost always solely responsible for paying all necessary Bitcoin transaction fees.

When a miner creates a block proposal, the miner is entitled to specify where all the fees paid by the transactions in that block proposal should be sent. If the proposal results in a valid block that becomes a part of the best block chain, the fee income will be sent to the specified recipient. If a valid block does not collect all available fees, the amount not collected are permanently destroyed; this has happened on more than 1,000 occasions from 2011 to 2017, [1] [2] with decreasing frequency over time.

The market for block space

The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and demand in Bitcoin's free market for block space. [3] On the supply size, Bitcoin has a maximum block size (currently one million vbytes) that limits the maximum amount of transaction data that can be added to a block.

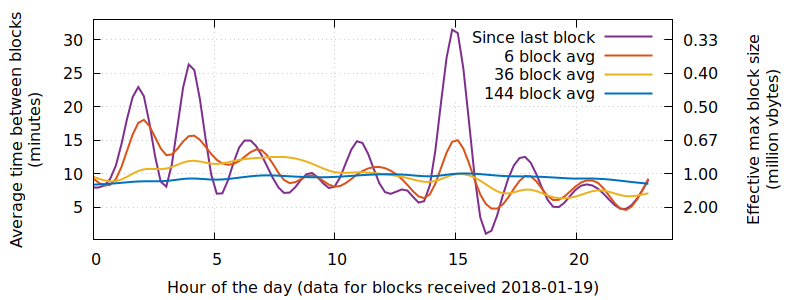

However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. As the number of blocks received in a period of time varies, so does the effective maximum block size. For example, in the illustration below we see the average time between blocks based on the time they were received by a node during a one day period (left axis) and the corresponding effective maximum block size implied by that block production rate (right axis, in million vbytes):

During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed.

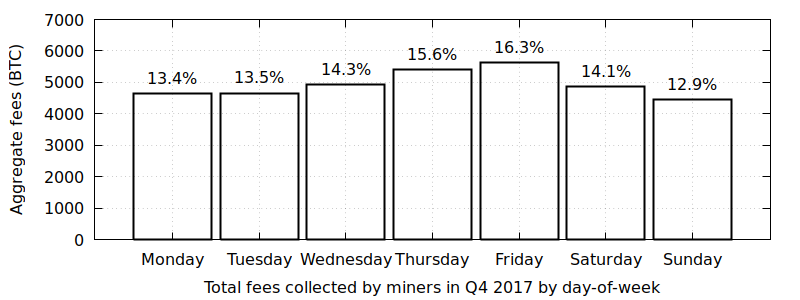

On the demand side of Bitcoin's free market for block space, each spender is under unique constraints when it comes to spending their bitcoins. Some are willing to pay high fees; some are not. Some desire fast confirmation; some are content with waiting a while. Some use wallets with excellent dynamic fee estimation; some do not. In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:

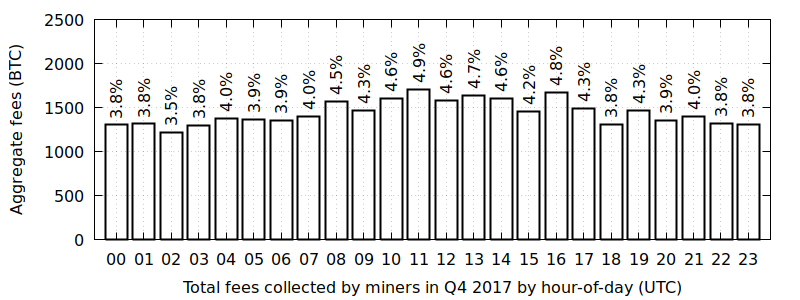

Another less recognizable cycle is the intra-day cycle where fees wax and wane during the day:

These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. Users with high time requirements may pay a higher than average transaction fee to be confirmed quickly, while users under less time pressure can save money by being prepared to wait longer for either a natural (but unpredictable) increase in supply or a (somewhat predictable) decrease in demand.

It is envisioned that over time the cumulative effect of collecting transaction fees will allow those creating new blocks to "earn" more bitcoins than will be mined from new bitcoins created by the new block itself. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. [4]

Perhaps the most important factor affecting how fast a transaction gets confirmed is its fee rate (often spelled feerate). This section describes why feerates are important and how to calculate a transaction's feerate.

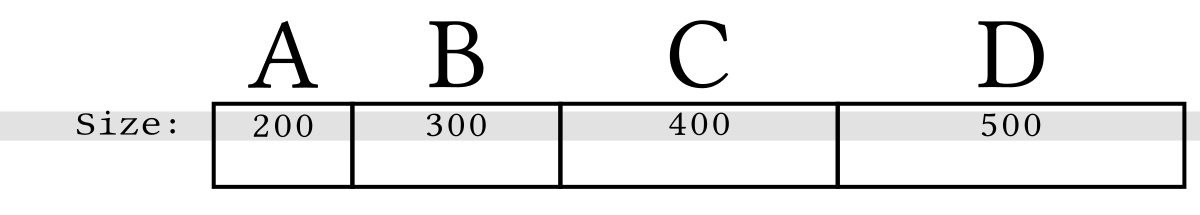

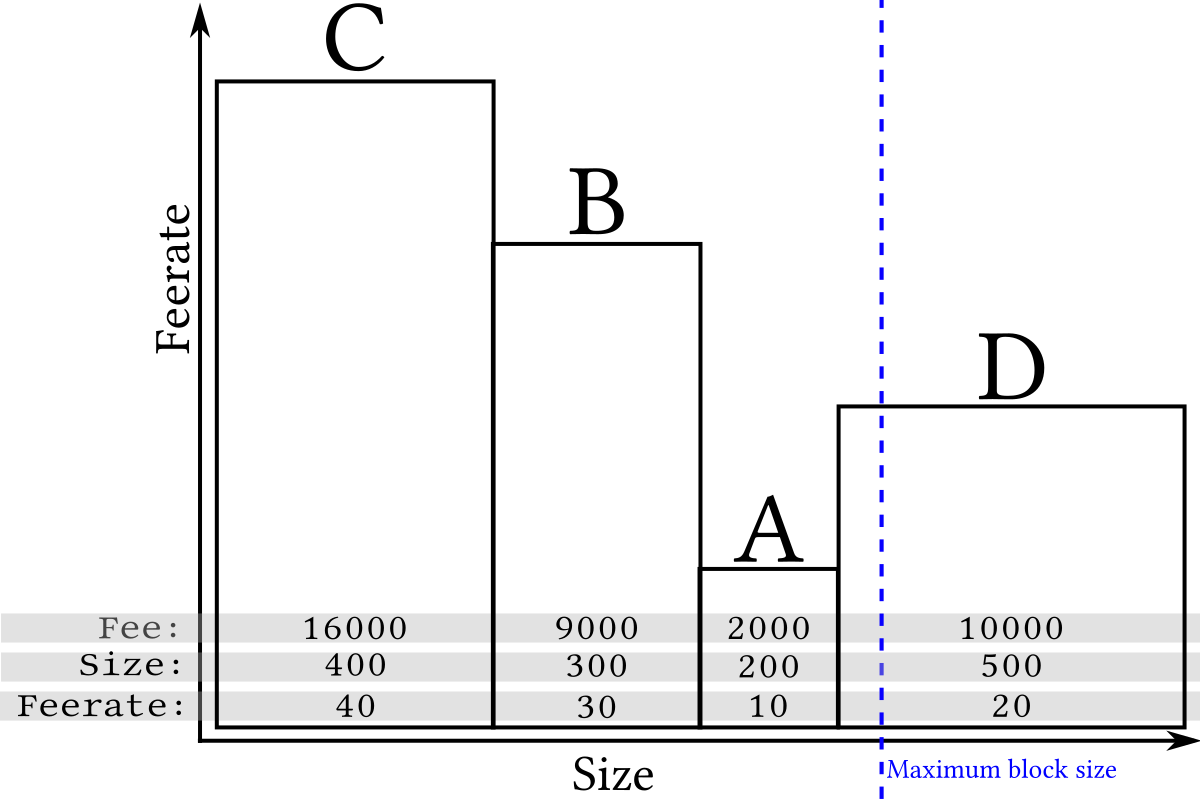

Bitcoin transaction vary in size for a variety of reasons. We can easily visualize that by drawing four transactions side-by-side based on their size (length) with each of our examples larger than the previous one:

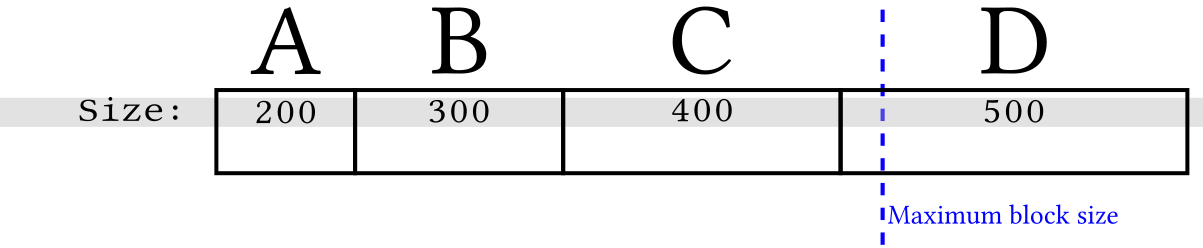

This method of illustrating length maxes it easy to also visualize an example maximum block size limit that constrains how much transaction data a miner can add to an individual block:

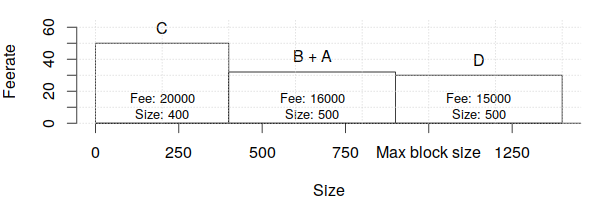

Since Bitcoin only allows whole transactions to be added to a particular block, at least one of the transactions in the example above can't be added to the next block. So how does a miner select which transactions to include? There's no required selection method (called policy) and no known way to make any particular policy required, but one strategy popular among miners is for each individual miner to attempt to maximize the amount of fee income they can collect from the transactions they include in their blocks.

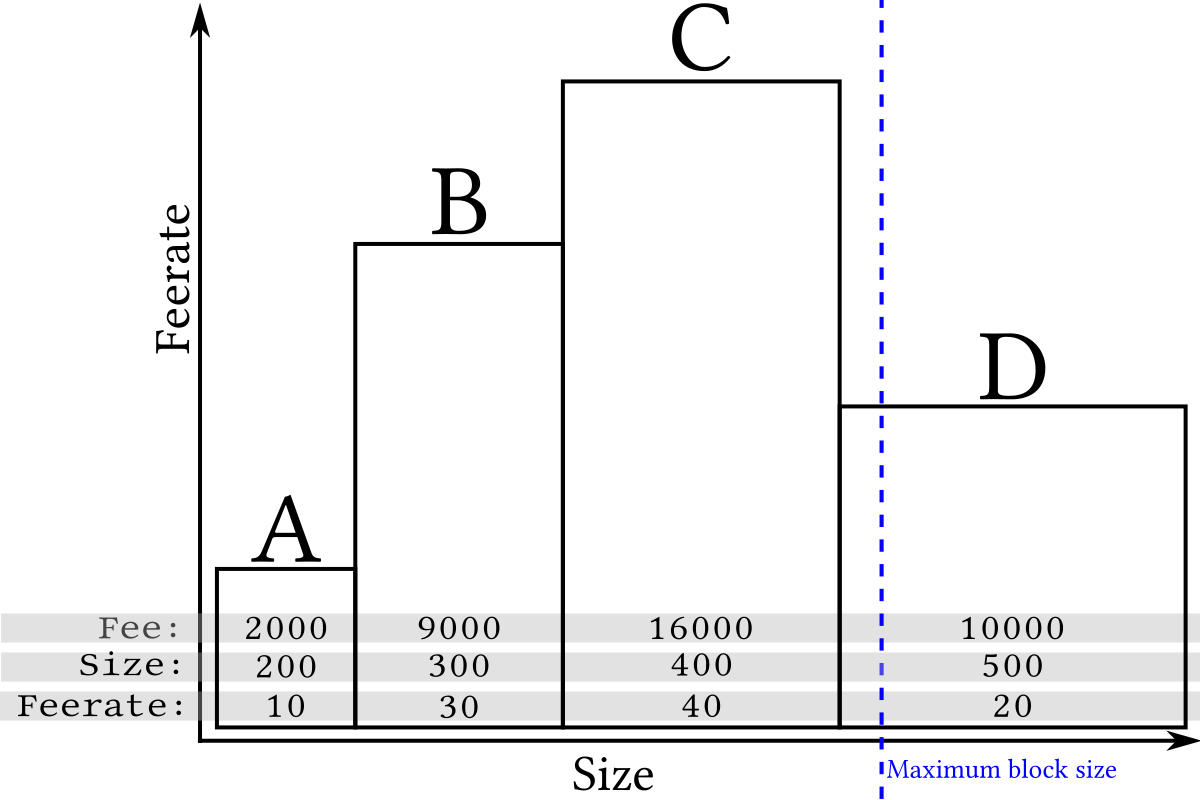

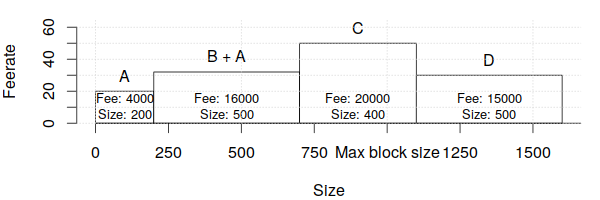

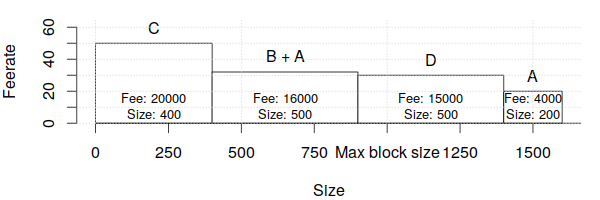

We can add a visualization of available fees to our previous illustration by keeping the length of each transaction the same but making the area of the transaction equal to its fee. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate:

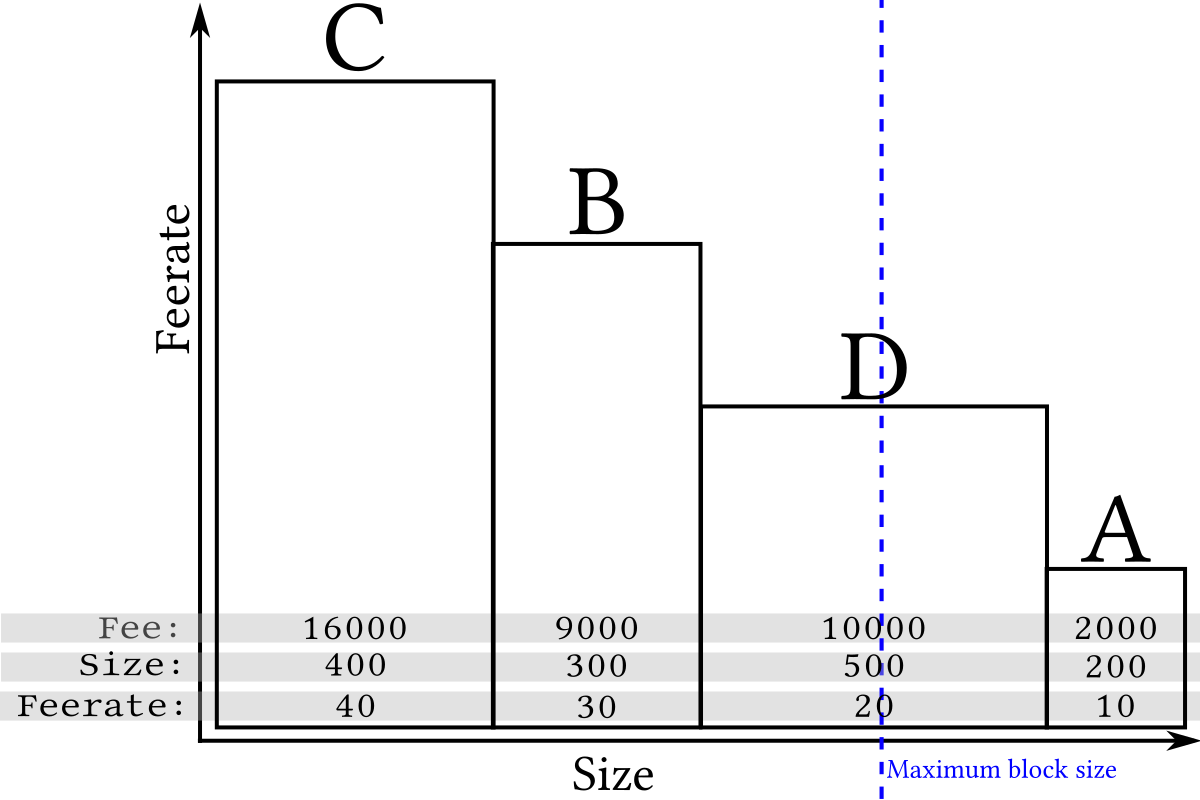

Although long (wide) transactions may contain more total fee, the high-feerate (tall) transactions are the most profitable to mine because their area is greatest compared to the amount of space (length) they take up in a block. For example, compare transaction B to transaction D in the illustration above. This means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:

Because only complete transactions can be added to a block, sometimes (as in the example above) the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit (still in highest-feerate order):

Excluding some rare and rarely-significant edge cases, the feerate sorting described above maximizes miner revenue for any given block size as long as none of the transactions depend on any of the other transactions being included in the same block (see the next section, feerates for dependent transactions, for more information about that).

To calculate the feerate for your transaction, take the fee the transaction pays and divide that by the size of the transaction (currently based on weight units or vbytes but no longer based on bytes). For example, if a transaction pays a fee of 2,250 nanobitcoins and is 225 vbytes in size, its feerate is 2,250 divided by 225, which is 10 nanobitcoins per vbyte (this happens to be the minimum fee Bitcoin Core Wallet will pay by default).

When comparing to the feerate between several transactions, ensure that the units used for all of the measurements are the same. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations.

Feerates for dependent transactions (child-pays-for-parent)

Bitcoin transactions can depend on the inclusion of other transactions in the same block, which complicates the feerate-based transaction selection described above. This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase the feerate of unconfirmed transactions.

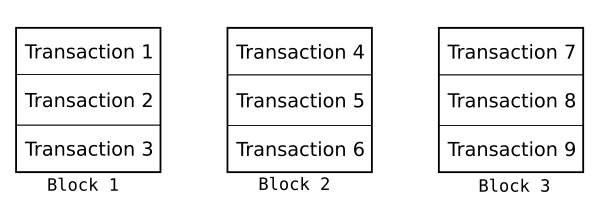

Each transaction in a block has a sequential order, one transaction after another. Each block in the block chain also has a sequential order, one block after another. This means that there's a single sequential order to every transaction in the best block chain.

One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B. Often this is easy to accomplish because transaction A appears in an earlier block than transaction B:

But if transaction A and B both appear in the same block, the rule still applies: transaction A must appear earlier in the block than transaction B.

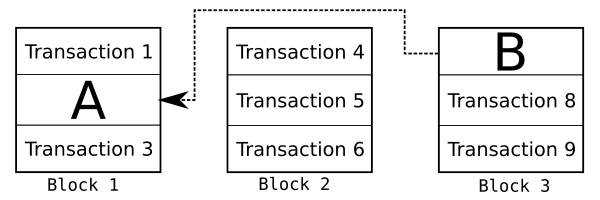

This complicates the task of maximizing fee revenue for miners. Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section above. But if both transaction A and B are unconfirmed, the miner cannot include B earlier in the block than A even if B pays a higher feerate. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Happily, it's only slightly more complex.

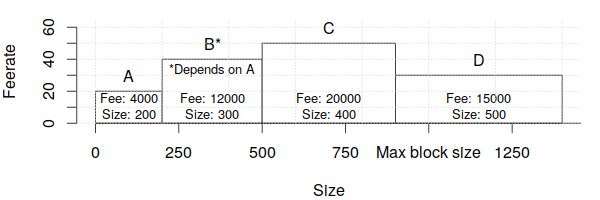

For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:

To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. To do that, every transaction available for inclusion in the next block has its feerate calculated for it and all of its unconfirmed ancestors. In the example, this means that transaction B is now considered as a combination of transaction B plus transaction A:

Note that this means that unconfirmed ancestor transactions will be considered twice or more, as in the case of transaction A in our example which is considered once as part of the transaction B+A group and once on its own. We'll deal with this complication in a moment.

These transaction groups are then sorted in feerate order as described in the previous feerate section:

Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. In the example case, we remove the standalone version of transaction A since it's already part of the transaction B+A group:

Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. In this case, we can't, so no changes are made.

Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies.

Note: to ensure the algorithm runs quickly, implementations such as Bitcoin Core limit the maximum number of related transactions that will be collected together for consideration as one group. As of Bitcoin Core 0.15.0 (released late 2017), this is a maximum of 25 transactions, although there have been proposals to increase this amount somewhat.

For spenders, miner use of transaction grouping means that if you're waiting for an unconfirmed transaction that pays too low a feerate (e.g. transaction A), you can create a child transaction spending an output of that transaction and which pays a much higher feerate (e.g. transaction B) to encourage miners to confirm both transactions in the same block. Wallets that explicitly support this feature often call it child pays for parent (CPFP) because the child transaction B helps pay for the parent transaction A.

To calculate the feerate for a transaction group, sum the fees paid by all the the group's unconfirmed transactions and divide that by the sum of the sizes for all those same transactions (in weight units or vbytes). For example, if transaction A has a fee of 1,000 nanobitcoins and a size of 250 vbytes and transaction B has a fee of 3,000 nanobitcoins and a size of 150 vbytes, the combined feerate is (1,000 + 3,000)/(250 + 150), which is 10 nanobitcoins per vbyte.

The idea behind ancestor feerate grouping goes back to at least 2013 and saw several different proposals to add it to Bitcoin Core, with it finally becoming available for production with the August 2016 release of Bitcoin Core 0.13.0. [5]

Reference Implementation

The following sections describe the behavior of the reference implementation as of version 0.12.0. Earlier versions treated fees differently, as do other popular implementations (including possible later versions).

Users can decide to pay a predefined fee rate by setting `-paytxfee= ` (or `settxfee ` rpc during runtime). A value of `n=0` signals Bitcoin Core to use floating fees. By default, Bitcoin Core will use floating fees.

Based on past transaction data, floating fees approximate the fees required to get into the `m`th block from now. This is configurable with `-txconfirmtarget= ` (default: `2`).

Sometimes, it is not possible to give good estimates, or an estimate at all. Therefore, a fallback value can be set with `-fallbackfee= ` (default: `0.0002` BTC/kB).

At all times, Bitcoin Core will cap fees at `-maxtxfee= ` (default: 0.10) BTC. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. Finally, a user can set the minimum fee rate for all transactions with `-mintxfee=`, which defaults to 1000 satoshis per kB.

Note that a typical transaction is 500 bytes.

Including in Blocks

This section describes how the reference implementation selects which transactions to put into new blocks, with default settings. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more or fewer free transactions.

Then transactions that pay a fee of at least 0.00001 BTC/kb are added to the block, highest-fee-per-kilobyte transactions first, until the block is not more than 750,000 bytes big.

The remaining transactions remain in the miner's "memory pool", and may be included in later blocks if their priority or fee is large enough.

For Bitcoin Core 0.12.0 zero bytes [6] in the block are set aside for the highest-priority transactions. Transactions are added highest-priority-first to this section of the block.

The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0.00001 BTC is used to determine whether or not a transaction is considered "Free". However, the rule that all outputs must be 0.01 BTC or larger does not apply. To prevent "penny-flooding" denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to (by default) 15 thousand bytes per minute.

View Full Site

Policy / Civilization & Discontents

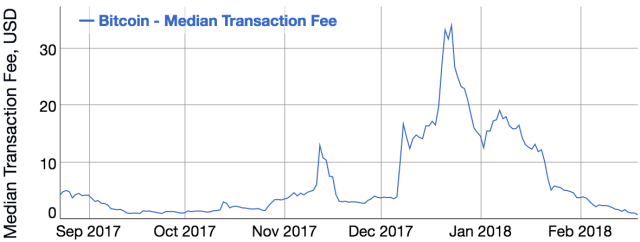

Bitcoin’s transaction fee crisis is over—for now

The median fee peaked at $34 in mid-December—now it's less than $1.

by Timothy B. Lee - Feb 20, 2018 12:15 pm UTC

The median daily transaction fee on the bitcoin network fell to $0.79 on Sunday, a six-month low. That represents a dramatic 97-percent decline from the peak of $34 reached on December 23. The median daily bitcoin transaction fee was more than $10 from mid-December until mid-January but has been declining steadily since then.

The high fees of the last few months have been a crisis for the bitcoin network. Bitcoin fans once touted the network's near-zero fees as a selling point. But as fees soared in late 2017, businesses started backing away from the network.

Video game maker Valve stopped accepting bitcoin payments for its Steam platform in December, writing that "it has become untenable to support Bitcoin as a payment option." That same month Bitpay, a company that accepts bitcoin payments on behalf of merchants, announced that it was setting a minimum transaction size of $100—though the company quickly cut the minimum to $5 in response to customer outrage. Stripe, a major credit card processor, stopped accepting bitcoin payments for customers in January, arguing that thanks to high fees, there were "fewer and fewer use cases" for the payment network.

But fees have fallen in recent weeks. Yesterday, the median bitcoin fee fell below $1 for the first time since September. The question is whether these fees will stay low—or if it's a temporary reprieve. The bitcoin community is racing to implement new technologies that could allow bitcoin payment volumes to continue expanding without a return of crippling fees.

Why bitcoin fees have fallen

To a large extent, high fees became a problem that solved itself. As fees soared, some users looked for ways to use the network more efficiently, while others stopped using the network altogether.

For example, it's technically possible for a single bitcoin transaction to include payments to many different recipients simultaneously. This effectively packs more payments into less space on the blockchain. When fees were low, companies didn't bother with these kinds of optimizations. As fees rose, companies made them a priority. As a result, the number of outputs per transaction has been rising in recent weeks, helping to relieve congestion.

At the same time, as we've seen, high fees have also encouraged some companies to simply stop using bitcoin. Some companies, like Valve, have gotten out of the cryptocurrency game altogether. Others have shifted to other blockchain networks—like litecoin, Ethereum, or Bitcoin Cash—where transaction fees are much lower. When companies leave the bitcoin ecosystem, it helps to push fees downward. But that's obviously not a positive sign for bitcoin's long-term future.

At the same time, bitcoin's speculative bubble has been cooling in recent weeks, and that has likely pushed fees down as well. In December, money was pouring into the bitcoin market, and people were willing to pay top dollar to get their bitcoins into exchanges to sell them at high prices. But bitcoin's price has fallen dramatically since the December peak of $19,500. It reached a low of $6,000 earlier this month, and by Monday afternoon one bitcoin was worth around $11,000. A cooling market naturally means less demand to move bitcoins around for speculative purposes.

Segregated Witness could provide some breathing room

The big question is what will happen if usage of the bitcoin network continues to grow. A hard-coded limit on the size of blocks limits how many transactions the bitcoin network can process per second. Some in the bitcoin community wanted to simply raise the block size. But they didn't get their way and became so frustrated that they launched a rival network called Bitcoin Cash last August.

Since their departure, the mainstream bitcoin network has been controlled by bitcoin's "small block" faction. Instead of simply increasing the maximum block size, they've focused on a technological upgrade called Segregated Witness that separates cryptographic signatures from the rest of the blockchain data. These signatures aren't counted against that one-megabyte block-size limit, so this is a de facto block-size increase. It went into effect in August, which should have helped with the capacity problems the network experienced last fall.

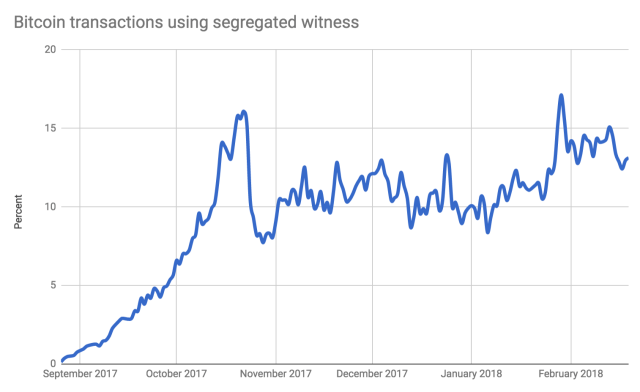

The problem is that users had to modify their bitcoin software to use a new, more efficient transaction format. But it takes time for software providers to roll out the necessary changes, and the process has been slower than proponents had hoped. Six months after the upgrade went into effect, only about 14 percent of bitcoin transactions use the new format—a figure that has barely changed since initial excitement about the upgrade wore off around October.

The slow rollout by some bitcoin companies has enraged some bitcoin partisans. Coinbase—one of the most popular services for buying, selling, and storing bitcoin—has been a popular target of criticism.

Coinbase has insisted that updating software for a company of its scale simply takes time. The company says it plans to begin supporting Segregated Witness by the end of February.

Other companies are hard at work on the upgrade as well, which means we should see a steady increase in Segregated Witness adoption in the coming months. That should give the bitcoin world a bit of breathing room.

But Segregated Witness is not a panacea. If 100 percent of transactions use the new format, it will roughly double the network's capacity—but that's it. Further increases will require more radical changes.

The bitcoin community is pinning its hopes on Lightning

The bitcoin community's longer-term vision is a new payment network called Lightning that operates as a second layer on top of the existing bitcoin network. It could dramatically expand the bitcoin network's capacity by shifting most routine transactions outside the blockchain. You can check out our recent Lightning explainer for a full explanation of how this will work.

In theory, Lightning should allow a significant expansion in the practical capacity of the bitcoin network. But there are a lot of practical challenges ahead. Lightning will be a good fit for some bitcoin applications and a poor fit for others—it remains to be seen how much of the bitcoin community will ultimately switch from old-fashioned bitcoin transactions to new-fangled Lightning ones.

And Lightning will also face the same challenge as Segregated Witness: even after the network is officially launched, it will take months, if not years, for it to be widely adopted. Indeed, Lightning is a bigger change than Segregated Witness, so we can expect the shift to take longer. This means that even if Lightning fulfills all of its supporters' hopes, years might go by before it can make a serious dent in demand for the underlying bitcoin network.

All of which means that a resurgence of bitcoin fees is a real possibility. A lot depends on what happens to bitcoin's price in the coming months. If bitcoin's price reaches new highs, we're likely to see bitcoin fees hit new highs as well. On the other hand, if the bitcoin bubble continues to deflate, fees are likely to remain reasonable. In that sense, a falling bitcoin price could be a blessing in disguise.

New Service Finds Optimum Bitcoin Transaction Fee

A new service is offering bitcoin users an answer to the common question: what is the optimum transaction fee?

Using network data from the past three hours, CoinTape lets users compare the current waiting times associated with various fee tiers, calculated in satoshis per byte.

It claims to predict delays with 90% confidence.

The default fee used by many bitcoin wallets is 10 satoshis (0.0000001) per byte. However, according to CoinTape, paying 20 satoshis (0.0000002 BTC) per byte will get you the fastest and cheapest transaction on the network.

For the average-sized bitcoin transaction, 645 bytes, this equates to a fee of 129 bits (0.000129 BTC ) (note that this is calculated on a transaction's size, not its dollar value).

The most popular fee ratio CoinTape lists, 41–50 satoshis per byte, used in more than 30,000 transactions today alone, is double this.

Network competition

As the number of bitcoin transactions rise, competition for space in each block is heating up. Miners prioritise transactions with the highest fees, working down the list until the block reaches its limit, commonly 750,000 bytes.

Transactions that don't make the cut remain in the miner's 'memory pool', a kind of bitcoin limbo. They may be included in future blocks depending on their priority or fee.

Currently, you can opt out of the fee altogether. However, there has been debate as to whether this should be raised, with a recent pull request to make a 10,000 satoshi minimum to reduce spam on the network.

CoinTape indicates that avoiding a fee is more likely to result in delays to your payment. It could take up to six blocks, or around one hour (blocks are created roughly every 10 minutes).

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

How do Bitcoin Mining Fees Work?

Miners provide an important service: network security. A large network hash rate keeps Bitcoin safe from attacks by bad actors.

Miners need an incentive to pay for electricity and hardware costs. ASIC mining hardware keeps Bitcoin secure through proof of work. Right now, miners are paid through a combination of Bitcoin’s block reward and transaction fees.

Bitcoin’s block reward is still large and provides the majority of miners’ earnings. The block reward started at 50 bitcoins per block. Currently, it is 25 bitcoins per block. In July 2016 it will drop to 12.5 bitcoins per block.

Transaction Fees

Once the majority of bitcoins have been mined, the block reward will become an insignificant percentage of miners’ overall earnings. Instead, mining fees–paid by users who transact on the network–will make up the majority of miners’ earnings.

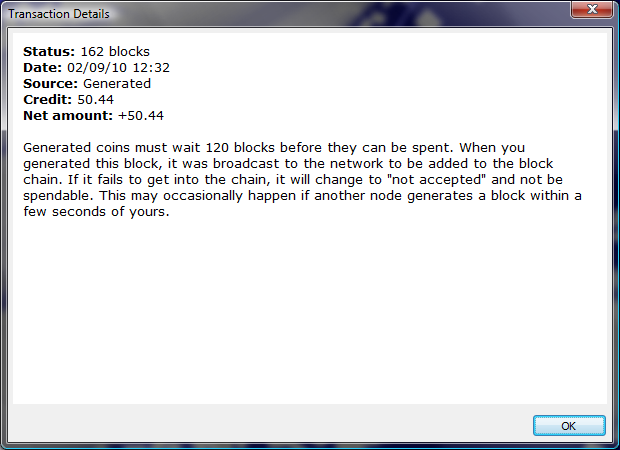

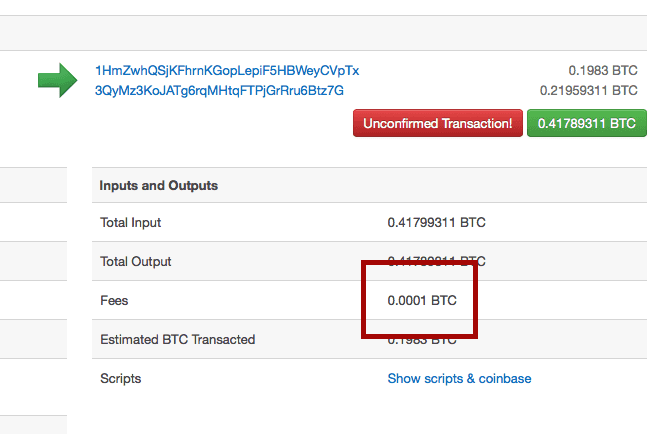

Mining fees are paid each time a user sends a transaction on the network. In the example below, a user sent 0.21959311 BTC and included a 0.0001 BTC fee.

Fees incentivize miners to include transactions in a block. Once a transaction has been included in a block it is confirmed. Unconfirmed transactions sit in something called the mempool until they are confirmed.

Since miners want to maximize income, they will include transactions that include higher fees.

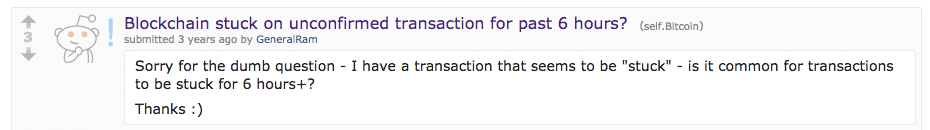

Stuck Transaction?

Transactions sent with low fees may get stuck in the mempool. Posts about stuck transactions like the one below are published many times per day on Bitcoin message boards.

New users often don’t know to include a sufficient fee in order to ensure quick confirmation. Transactions sent with proper fee amounts are confirmed in about 10 minutes.

21’s fee tool will help you include the right fee amount when sending your transaction.

Fee Collection by Miners

The miner or mining pool that includes a transaction in a block collects the transaction fee.

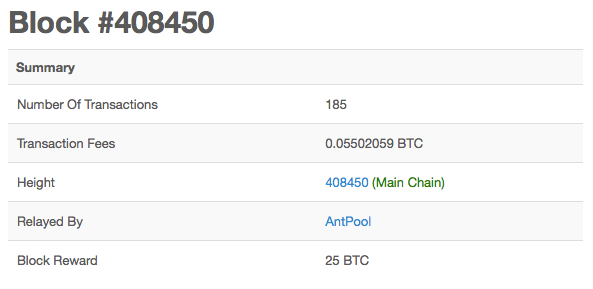

In the example above, Antpool mined block #408450. This block included 185 transactions with a total of 0.05502059 BTC in transaction fees.

The total reward for this block is the block reward plus the total amount of transaction fees: 0.05502059 BTC + 25 BTC = 25.05502059 BTC. The transaction fees for this block were just 0.2% of the total reward.

The example block above is just one of many. It’s clear, however, that in the future transaction fees must rise in order to compensate for the decreasing block reward.

Bitcoin is sometimes advertised as a way to make cheap payments, which makes mining fees confusing at first.

In reality, mining fees are needed and incentivize miners to secure the network. Without miners, the network could be attacked and would be vulnerable to 51% attacks.

Mining fees also represent users’ willingness to pay to use Bitcoin. If someone is willing to pay $5 to send one Bitcoin transaction, it is clear that Bitcoin is providing a valuable service.

Here's how to deal with those ridiculously high Bitcoin transaction fees

Four dollars. That's how much it'd cost me to send 0.01 bitcoins, or about $42, from one Bitcoin address to another right now.

And this is actually quite cheap compared to a few days ago, when transaction fees were even higher, making Bitcoin barely usable for microtransactions. And cheap transactions, especially for small amounts of BTC, are supposedly one of Bitcoin's biggest advantages.

The transaction fees are raging due to several factors. One is the size of the block in Bitcoin's blockchain, which is limiting the number of transactions that can go through at any given time. Bitcoin's network is powered by miners, people and companies who use a tremendous amount of computing power to create new bitcoins. And when there's too many transactions to process—which currently happens very often—miners will prioritize transactions that pay a higher fee.

The situation improved with the recent SegWit upgrade of the Bitcoin software, but it will take a while—weeks or months—before users start seeing benefits of SegWit.

Another reason is Bitcoin Cash, a competing cryptocurrency that split off from Bitcoin on August 1. Since the two cryptocurrencies are similar, it's simple for miners to switch from mining Bitcoin to Bitcoin Cash. And for reasons explained here, sometimes it's more profitable to mine Bitcoin Cash than Bitcoin. Whenever miners start switching to Bitcoin Cash, Bitcoin's network becomes slower, and transaction fees rise; we've seen this swing happen a couple of times before and it's likely to keep happening for a while.

This is not good for Bitcoin. A few bucks (or even a few dozen bucks) per transaction isn't a deal breaker for investors, but for someone who wants to use Bitcoin as payment—which is kind of the point of Bitcoin in the first place—that's far too expensive.

The good news is that the fees are likely to get better. The bad news is that it won't happen very soon. SegWit has paved the way for a further upgrade called the Lightning Network, which should vastly reduce fees, but the software, or even its specifications, aren't ready yet. And in November, Bitcoin is expected to be upgraded again with the SegWit2x proposal, which should increase the block size in Bitcoin's blockchain from 1MB to 2MB. This will reduce strain on the network and make transaction fees lower, but switching to SegWit2x requires a so-called hard fork, meaning that Bitcoin is once again splitting into two, which could bring new trouble.

Yes, you can pay smaller fees and get away with it

Luckily, Bitcoin users aren't completely without options right now. One thing you can do is wait until the network is less strained (at night, during the weekend), which is when transaction fees will go down.

You can also check this service to see which transaction fees are currently the most economic for you. At the time of this writing, a Bitcoin fee of 200 satoshis per byte will be enough for your transaction to go through in about 30 minutes (Bitcoin transaction fees are expressed in satoshis , which is one hundred millionth of a Bitcoin, per byte size of the transaction, which is typically a little over 200 bytes). Have in mind that fee estimators aren't perfect; an alternative service that shows you the currently optimal fee is this one.

' data-credit-provider="custom type" data-caption="Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all." title="Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all." src="https://i.amz.mshcdn.com/ZCSdh4Bvm3T-is4ox-5tSCu4NwM=/fit-in/1200x9600/https%3A//blueprint-api-production.s3.amazonaws.com/uploads/card/image/575211/e6c84e4c-5983-4516-a84f-bae3e3ba47da.png" alt="Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all." data-fragment="m!a52e" data-image="https://i.amz.mshcdn.com/--AZsvEV9kGL9OrSCq_5BRpKGWM=/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F575211%2Fe6c84e4c-5983-4516-a84f-bae3e3ba47da.png" data-micro="1">

Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all.

This information won't help you much if you use a wallet that doesn't let you change transaction fees, so maybe it's time to switch to a different wallet. For example, a mobile Bitcoin wallet called Mycelium offers several possibilities for Bitcoin transaction fees: low-priority, economic, normal priority and high priority. If you choose the low-priority fee, your transaction might take longer to go through but it will be cheaper. Conversely, a high priority transaction will almost surely go through quickly but it will be expensive. Right now, Mycelium is offering me 339 satoshi/byte as an economic transaction fee price, which is still a little expensive, but better than the "normal" price of 419 satoshi/byte.

This is too expensive.

Image: Stan Schroeder/Mashable

For even more control, you could try out the Electrum wallet, which lets you set any fee for your transactions, though you need to enable the option manually in the settings. Be careful, though: If you choose too small a fee, your transaction might forever stay in Bitcoin's backlog. Coinomi is another (mobile-only) wallet which lets you customize your transaction fees.

There are other things you could do to make transaction fees lower, though it requires a slightly higher level of knowledge. If you've received a lot of small transactions to a Bitcoin address, and then send bitcoins from that address, the transaction will be larger (in bytes) and thus more expensive. If you enable the "Coins" tab in the desktop version of Electrum you can minimize the number of inputs for your transaction, which will make it cheaper.

If you're moving bitcoins from an exchange and not a wallet, you likely won't be able to set a fee, and many exchanges have very high fees set up. Exchanges mostly don't do that because they're evil; they do it because they want to make sure the transaction went through, or else they'll need to deal with support tickets. Unfortunately, at this point there's little you can do about this besides find an exchange that is a bit more reasonable with this regard than others. Have in mind that, on top of transaction fees, exchanges will likely charge their own additional fees, so you should focus on the total costs.

To sum up: Bitcoin fees are currently very expensive, but this will likely get better in a few months. But even right now, by choosing the right wallet and making sure you use the optimal fee, you'll do a lot better than just paying whichever fee you're offered.

The author of this text would like to thank Luka Zubović for his suggestions and corrections.

Disclosure: The author of this text owns, or has recently owned, a number of cryptocurrencies, including BTC and ETH.

Bitcoin miners are making a killing in transaction fees

FILE PHOTO - A Bitcoin sign is seen in a window in Toronto Thomson Reuters Bitcoin miners are making money hand-over-fist.

According to data from blockchain.info.com, the value of transaction fees paid to miners has reached an all-time high of $2.3 million.

Miners are basically the hamsters in the wheel that keep bitcoin's network going. They use rigs of computers to unlock the blocks (underpinning bitcoin's network) on which transactions are made. Every time a miner unlocks a bitcoin block, vis-a-vis mining, all the transactions on that block are processed. The miner, in return for his hard work, is rewarded with 12.5 bitcoins for unlocking the block. They also get to keep the transaction fees bitcoin holders pay when they transact with the cryptocurrency.

In the early days, miners would only get a couple bucks in transaction fees. On Wednesday, however, miners received a whopping $2.3 million.

"That's on top of the millions of dollars they received in their bitcoin rewards," according to Aaron Lasher, the chief marketing officer at Breadwallet. He estimates miners, in total, were rewarded with 1,800 bitcoins, or $7 million.

"That's going to about five to 10 companies," Lasher said. But he says the exact number is hard to pinpoint.

Since more people are using bitcoin, the demand to make a transaction has gone up. As such, the price to get to the front of the line has gone up.

"I just made a transaction this morning," Lasher said."It cost me $25."

That's on par with the average wire transfer fee. Still, it's a far cry from the pennies it cost to send bitcoin back in its earliest days.

Transaction fees have been on a tear since August 5, a few days after Bitcoin split in two. Blockchaininfo.com

Transaction fees have whipped around, in line with the uncertainty underpinning the cryptocurrency space. Transaction fees slid from late May to early August from about $1.7 million on June 6 to a bottom of $205,000 on July 31.

Aaron says this dip was likely the result of a decline in bitcoin transactions leading up to the fork, which split bitcoin into two different digital currencies: bitcoin and bitcoin cash.

"Once the fork completed on August 1, people began using bitcoin again," Lasher said. "But now that Segwit has activated, we should see some easing over the coming weeks and months."

Segwit is an update to bitcoin's software that was agreed to by the cryptocurrency's powerbrokers in order to address the scaling problem that it faces. Segwit proponents hope the update will make the network faster and in turn bring down those pesky fees.

Josh Olszewicz, a bitcoin trader, told Business Insider that bitcoin cash may be the culprit.

According to Olszewicz, some bitcoin miners moved over to bitcoin cash, thus lowering the network's hash rate (HR). In other words, there were fewer hamsters in the wheel.

"HR moved to bitcoin cash temporarily," Olszewicz said."As a result, confirm times spiked to over 15 minutes."

Bitcoin transaction fees: what are they & why should you care?

This week, we’ve invited Ofir Beigel to guest blog for us. We’ll let him take it from here.

Recently, scaling bitcoin has been a hot topic for the bitcoin community. Why is this? Well, as bitcoin grows and more users hop onboard, a big priority is to ensure the network can efficiently handle the increasing transaction volume. And lately, many users have been expressing their worries over transaction delays caused by network congestion. In this post I’m going to talk a bit about how transaction confirmations work, and the role that fees play in the process.

Miners, bounties, and newly-generated bitcoins

In order to understand transaction confirmations, we’ll need to cover some key concepts of bitcoin mining. I won’t attempt to explain the whole process of bitcoin mining in this post, but I’ll try to simplify the process with this short explanation. Every day hundreds of thousands of transactions are sent and received on the bitcoin network. These transactions need to be ordered and documented on what is called the blockchain, or the global ledger that references every bitcoin transaction ever made.

Bitcoin miners are powerful computers that connect to and make up the network. They decide which transactions to include, and in what order. And how is that? Well, it’s based on several factors, but one of the most important (and the one we’ll dive into here) is how big of a mining fee was included with a transaction.

You see, miners don’t spend all of this electricity and computing power for free; they get paid. Each time a new block of transactions is added to the blockchain, the miner(s) responsible receive a bounty in the form of new bitcoins ; that’s how bitcoins are “born”. They also get to keep all the fees attached to the transactions they included in the block, so miners have an incentive to include transactions with higher fees into their blocks.

Today, the lion’s share of the payment is based on the new coins generated with each block, but since the coin reward halves approximately every four years, transaction fees will become more and more prominent in the decision of prioritizing transactions.

Transactions fees and transaction size

In order to further understand fees, it will help to know how to spot the fees for transactions in the first place. Using a block explorer, you can identify the fee paid for a transaction by viewing transaction details. You can also identify it by calculating the difference between the inputs (sending funds) and the outputs (receiving funds). In the example below you can see that the input equals 0.12605724 and the output equals 0.12583356. The fee, 0.00022368, is actually the difference between these two numbers.

So the question remains – how do I know how much of a fee to pay in order for my transaction to confirm as quickly as possible? Well, it depends mainly on the size of your transaction.

Each bitcoin transaction is just a piece of code that has a certain size , just like a file on your computer. The size of the transaction isn’t related to how much money you’re sending but to other factors we won’t get into in this post. And the larger the size of the transaction, the more space it takes up inside each block of transactions. If it takes up more space, it means other transactions will be left out as the block size is limited. Hence, the bigger the transaction, the bigger the fee you’ll need to pay in order to compensate for taking up space inside the block.

Once you know your transaction size you can decide how many satoshis (0.00000001 bitcoins) you want to pay per byte of your transaction. This chart shows the probability of your transaction being included and in which block depending on your fee per byte ratio.

For example, if your transaction is 600 bytes and you pay a fee of 10,000 Satoshis you will be in the 16.66 Satoshi per byte section (10,000/600=16.66). At the time of writing this post, this will probably get your transaction included somewhere within the next 15 blocks of transactions (or roughly 150 minutes, since a new block is found every 10 minutes on average).

So, now you know about the important role transaction fees play on the bitcoin network. But you don’t have to give another thought if you’re using a Blockchain Wallet , which uses dynamic fees to calculate an appropriate fee based on the transaction size, and the degree of traffic on the network.

To wrap things up, you’ve learned:

- Mining is how bitcoin transactions are confirmed, and also how new bitcoins are generated.

- Fees are collected by the miners, who also receive the block reward of new coins.

- Transaction priority is based on a few factors, including the fee amount and transaction size (in bytes).

- The Blockchain Wallet (and other bitcoin wallets) uses a dynamic fee structure, so you don’t need to worry about calculating your own fees

Still curious? Keep an eye out for my next guest post (or scroll down to subscribe and get it delivered directly to your inbox) where I’m going to answer some of the most common questions bitcoin users tend to ask about fees.

A bitcoin blogger since 2013, Ofir owns 99Bitcoins and the popular Bitcoin Obituaries section. He is an Internet marketer and public speaker focused on getting as many people as possible to know what Bitcoin is and why it is so important.

Bitcoin’s median transaction fee lowest since 2011 — nearing BCH

The gap between the transaction fees for BTC and BCH is closing in significantly

Neer Varshney

The transaction fees and time involved with Bitcoin have been some of the biggest hurdles in the adoption of the cryptocurrency as a medium of exchange. While multiple cryptocurrencies have emerged touting themselves as the solution — without actually providing any — things seem to be getting better for Bitcoin meanwhile.

The median transaction fee rate for Bitcoin has been some of the lowest since 2011 in the last three months.

Median transaction fee rate for Bitcoin since early 2010. Image Credits: transactionfee.info/charts

Median transaction fee rate for Bitcoin since early 2010. Image Credits: transactionfee.info/charts

As per transactionfee.info statistics, the median fee rate for Bitcoin hit the lowest on April 4 and 5 at 6.86 satoshi/bytes (sat/B). The fee rate increased to 39.29 on April 30, but has since come down again.

The transaction fee rate came under 10 again on Saturday (9.43), and closed on 8.86 on Sunday.

This is a quite a decline from the beginning of this year. The transaction fee rate was 453.57 sat/B on the new year’s eve — a graph that has sloped significantly downward since then.

Median transaction fee rate for Bitcoin since January this year. Image Credits: transactionfee.info/charts

Median transaction fee rate for Bitcoin since January this year. Image Credits: transactionfee.info/charts

The low fee rate indicates that it is getting cheaper to transfer Bitcoin among different wallets. The high costs and time involved with Bitcoin transactions led to a controversial split of Bitcoin’s blockchain — creating Bitcoin Cash (BCH).

Bitcoin Cash promised faster and cheaper transactions as compared to Bitcoin. While the gap between the median transaction fee rate was overbearing initially, it seems that this gap has closed to negligible in these last three months as well. The median transaction fee rate was $34.095 for Bitcoin in comparison to the $0.0333 USD for Bitcoin Cash, but on Sunday it was a meagre $0.113 compared to the $0.0038 for Bitcoin Cash.

Image Credits: https://bitinfocharts.com/

Image Credits: https://bitinfocharts.com/

Bitcoin’s soft fork Segregated Witness (SegWit) has been seeing exponential adoption — a fact that could explain the reduced transaction fee-rate. While only 28.34 percent of all transactions were utilizing SegWit, the number is close to 38 percent on Sunday. The transaction fees involved in the SegWit transactions are fairly lower — at the moment, they amount to only 18 percent of the total transaction costs in spite of contributing 38 percent of the total transaction volume.

With further adoption of SegWit and Lightening Network (LN), Bitcoin’s scalability problems are expected to resolve. While Lightening Network, which promises to make Bitcoin transactions faster and cheaper— is still in a nascent stage, the development has been impressive so far. The LN network capacity crossed $150,000 last month, and near-instant successful transactions have already been made through the network.

With reduced costs and time incurred with Bitcoin transactions, it may finally become viable to buy coffee and doughnuts with it.

Комментариев нет:

Отправить комментарий