A visualisation of live Bitcoin transactions from the Blockchain

Every time a Bitcoin transaction is made it is shown here as coloured ball dropping on the plate, You can click on the transactions to find out exactly how much they are worth in BTC. The the cubes represent the last block from the blockchain which are mined on average every 10 minutes, the size of the block is determined by its size in Kilobytes.

Why do they keep falling off the plate? That is so that your browser doesn't crash but if things are getting too much just press the space bar!

This is made using using the awesome three.js and oimo.js Javascript libraries, and live streaming Bitcoin transaction data from blockchain.info. This demo uses quite experimental browser techniques and works best in the Google Chrome browser

I made this for a bit of fun, If you like it please pass it on. Donations will encourage me to make more fun Bitcoin related stuff!

Why Your Bitcoin Transactions Are Taking So Long to Confirm

If you have sent a bitcoin payment in the last couple of weeks, you may have noticed that your transactions are taking much longer than expected to confirm.

We have received your emails.

Since, like the Bitcoin network, we are currently working through a backlog, we want to thank you for your patience. With the high volume of questions we're getting about delayed payments, we decided it would be best to write a short explanation about what's happening with many bitcoin transactions right now.

How Bitcoin Transactions Get Confirmed (or Delayed)

Transactions on the Bitcoin network itself aren't controlled or confirmed by BitPay, but by the bitcoin miners which group transactions into "blocks" and add those blocks to the Bitcoin "blockchain" – the shared historical record of all transactions. When a transaction has been added to a block six blocks ago, it's considered a done deal.

Currently, bitcoin network traffic is unusually high due to increasing demand for transactions per block. Block sizes are limited, so this means that transactions which exceed the capacity for a block get stuck in a queue for confirmation by bitcoin miners. This queue of unconfirmed transactions is called the bitcoin mempool.

For context on what's happening now, here is a look at the current bitcoin mempool size.

The good news? A lot of people are interested in using bitcoin for transactions. The bad news is that this network traffic may produce delays of a few hours to a few days for some users and a wait time of weeks for a small number of users.

What To Do If You Have an Unconfirmed Transaction

If your bitcoin transaction to a BitPay merchant has not confirmed yet, you will need to wait for it to be confirmed by bitcoin miners. Since BitPay does not control confirmation times, there is unfortunately nothing we can do to speed up the process once your transaction has already been broadcast to the network.

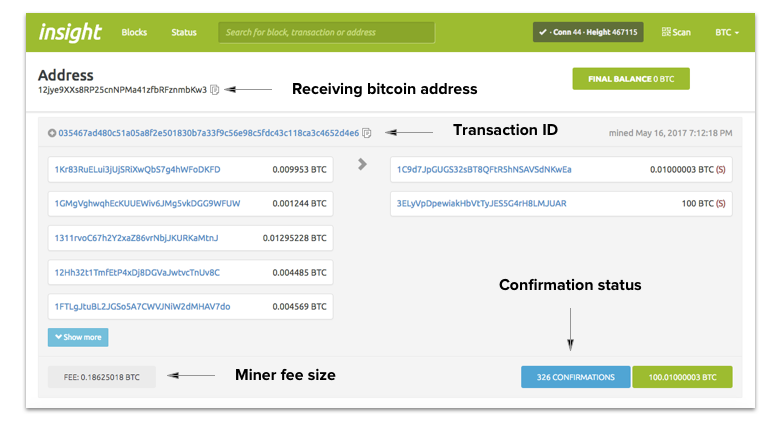

You can check your transaction's confirmation status and other payment details on any blockchain explorer (like BitPay's block explorer Insight). Look up your transaction using your transaction ID or the sending or receiving bitcoin addresses, which can all be found in your bitcoin wallet that sent the payment. For your transaction to be considered fully confirmed by most BitPay merchants, your transaction will need to have six confirmations.

Note that until your payment has six confirmations on the bitcoin blockchain, the recipient will not have access to the funds and will not be able to refund your transaction.

While some BitPay merchants may choose to fulfill orders on payments with fewer block confirmations, you will need at least one block confirmation before your order can be considered complete. If your transaction confirms and the merchant does not fulfill your order, you don't need to reach out to BitPay. Just reach out to the seller and provide your order ID and BitPay invoice URL as proof of payment.

How To Avoid Delayed Transactions

Because block sizes are limited, it's important for bitcoin miners to know which transactions they should include in blocks first. Miners use prices to figure this out. When you broadcast a transaction, your total amount sent usually includes a "miner fee" which goes to pay miners.

If you want your transaction to leave the bitcoin mempool and be added to a block quickly, it's important that you include a sufficient miner fee. This is why we strongly suggest using the BitPay wallet or another true bitcoin wallet that can dynamically calculate the miner fee needed for timely block confirmations. For reference, the website bitcoinfees.21.co gives the minimum miner fee as 360 satoshis/byte, though this amount has been fluctuating throughout this week.

Transactions are being added to the bitcoin mempool's full queue constantly. Some may have been sent with higher miner fees than the one sent with your payment. This means that with current network traffic, miners may deprioritize your unconfirmed transaction even if it was sent with an appropriate fee at the time.

Your transaction will likely confirm, but if the Bitcoin network does not confirm it, it be spendable again in your wallet. Funds are spendable again in the BitPay wallet after transactions fail to confirm for up to 72 hours, but other wallets may behave differently.

If you are not using the BitPay wallet, you should contact your wallet provider for help if your unconfirmed funds do not show up as spendable again after a few days.

What Is BitPay Doing About This?

While BitPay does not control confirmation times on the Bitcoin network, we care about the payment frustrations BitPay merchants and purchasers are experiencing right now.

For purchasers, our BitPay wallet team has been working on updates to the BitPay wallet for our next release which will help to mitigate the effects of these delays on the bitcoin network when they occur.

For bitcoin users and businesses alike, we're also continuing to explore options for faster, simpler, and more affordable bitcoin payments. We'll continue to post here on the BitPay blog as we make progress.

If this article didn't answer your question, check out our payment guide or our new video walkthrough for more info on how to make a successful bitcoin payment.

Bitcoin’s Big Problem: Transaction Delays Renew Blockchain Debate

The continued delay in processing bitcoin transactions coupled with the increased cost has led to record levels of complaints. Photo: Reuters/Benoit Tessier

Bitcoin is facing a major problem as the time it takes transactions to be processed has increased dramatically leading businesses to stop accepting the cryptocurrency and others to issue warnings that the problems could be terminal.

The problem is not something that has come out of the blue with those within the bitcoin community as well as researchers pointing to this looming issue for some time. The problem relates to how transactions are processed on the blockchain, the decentralized, distributed ledger technology that underpins bitcoin.

The average time it takes for a bitcoin transaction to be verified is now 43 minutes, and some transactions remain unverified forever. Some of the problem stems from the fact that anyone can add a fee to every bitcoin transaction, which bumps that transaction up in the queue, meaning that those who didn’t pay such a fee — or didn’t pay a sufficiently big fee — may be waiting hours and sometimes even days for a transaction to complete.

This is how it works. When someone uses bitcoin to pay for an item in a shop, that transaction needs to be verified on the blockchain. This is done by what are known as miners, individuals or groups who use massive computing power to solve increasingly complex mathematical equations to mine new bitcoins, which come in “blocks” and are mined about every 10 minutes. These blocks are used to record all transactions made on the bitcoin network, and have a maximum size of 1 megabyte (MB), meaning they can record just seven transactions per second at most.

To put this in context, Visa says its payment system processes 2,000 transactions per second on average and can handle up to 56,000 transactions per second if needed.

The result of the slowdown in transaction clearance rates has led some businesses to give up on bitcoin completely while others are recommending users to switch from bitcoin to alternative cryptocurrencies like litecoin.

The problem grew so large this week that at one point there were 40,000 bitcoin transactions waiting to be cleared — though at the time of writing, that figure has dropped to under 10,000. This drop has mirrored a drop in bitcoin’s dollar value this week, going from over $440 on Monday to under $420 at the time of writing, according to CoinDesk's tracker.

The bitcoin community has split into two distinct groups over the past one year. The first group is known as Bitcoin Core, the network’s volunteer developers who want to change the way the signatures are stored on the blockchain rather than increase the size of the blocks. The other is known as Bitcoin Classic, a group comprised of developers and enthusiasts who propose the adoption of an alternative blockchain (incompatible with the original) that would increase the block size to 2 MB, a move it believes would increase user adoption.

Some in the Core group have this week suggested the slowdown in transactions observed over the last seven days has been caused by members of the Classic group spamming the network with low-fee transactions that miners simply don’t want to accept, and therefore clogging up the network.

Bitcoin’s architecture worked well when it was not widely used, but with over 200,000 bitcoin transactions processed every day and a market capitalization of over $6.4 billion, the system is beginning to creak.

The problem was flagged up last August by one of the main developers of bitcoin over the last five years, Gavin Andresen, who told MIT Technology Review at the time that the problem with bitcoin’s limited transaction rate "is urgent."

"Looking at the transaction volume on the bitcoin network, we need to address it within the next four or five months,” Andresen said.

Then in January, another core bitcoin developer Mike Hearn penned a widely read missive on Medium, which declared bitcoin a failure. “[Bitcoin] has failed because the community has failed,” Hearn said. “What was meant to be a new, decentralized form of money that lacked ‘systemically important institutions’ and ‘too big to fail’ has become something even worse: a system completely controlled by just a handful of people.”

These concerns were backed up last month with the release of a research paper from a large group of researchers mostly affiliated with Cornell University, titled “On Scaling Decentralized Blockchain.” The research suggests that bitcoin would need a complete redesign if it is to support a much larger network of users and transactions.

In a blog post this week, Andresen said that the block size limits are there to protect the network from attacks — and so far that method has been effective. He added that the current problems could be highlighting an underlying problem. “In my view, people are using the block size limit for something it was never meant to do — to influence how people use the bitcoin blockchain, forcing some users off the blockchain,” he said.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

How Long do Bitcoin Transactions Take?

Bitcoin transaction times vary and can take anywhere from 10 minutes to over 1 day.

The two things that determine Bitcoin transaction times are the amount of network activity and the transaction fees.

The average Bitcoin transaction time is currently around 1 hour.

How Long do Bitcoin Transactions Take?

The short answer : However long it takes to transfer Bitcoin between wallets varies from transaction to transaction.

When you make a Bitcoin transaction, it needs to be approved by the network before it can be completed. The Bitcoin community has set a standard of 6 confirmations that a transfer needs before you can consider it complete.

What determines the Bitcoin transaction times?

The two main factors influencing the transaction time are:

- The amount of network activity

- Transaction fees

The more transactions that the network needs to process, the longer each transaction takes. This is because there are only a finite number of miners to process each block and there are a finite number of transactions that can be included in a block.

Miners on the Bitcoin network prioritize transactions by the fee that they receive for confirming them. Therefore, if you pay a higher fee, a miner is more likely to process your transfer which decreases the transaction time.

How long does it take to confirm a Bitcoin transaction?

As mentioned earlier, a Bitcoin transaction generally needs 6 confirmations from miners before it’s processed. The average time it takes to mine a block is 10 minutes, so you would expect a transaction to take around an hour on average.

However, the recent popularity boom of Bitcoin has caused congestion on the network. The average time for one confirmation has recently ranged anywhere from 30 minutes to over 16 hours in extreme cases.

There’s been a divide in the Bitcoin community on how to best address these scaling issues. Some members (specifically those in favor of Bitcoin Cash) believe that the solution is a larger block size that’s capable of holding more transactions per block.

Other community members debate that improvements such as Segregated Witness (SegWit) and the Lightning Network will speed up the network without having to increase the block sizes.

Only time will tell which solution proves to be the best.

What is a bitcoin transaction?

First, let’s remember that bitcoins don’t physically exist. There’s no solid coin to hold in your hand, nor a token or slip of paper to signify the value of your bitcoin. Instead, bitcoins exist in the virtual realm as a series of transactions that have been verified—in essence, legitimized—on the hyper-secure, public ledger known as the “blockchain.” In other words: bitcoins are a history of signatures, secured with cryptography.

So, if you “have” bitcoin, what you really possess is information: the history of your bitcoins, and a pair of “keys” allowing you to use them—the public key and the private key.

Think of your bitcoin as a collection of information tokens stored in a glass box. The public key is the label of your box—everyone knows this is your box and how much bitcoin your box contains. Like a bank account routing number, your public key is shared so that people can send you money.

By contrast, your private key is safely guarded; it is the only way to open your glass box of bitcoin. Having access to the private key is akin to having control of the bank account, which is why people take great pains to prevent private keys from falling into the wrong hands.

In sum, bitcoins are summaries of transaction information. Public keys allow you to possess that information. Private keys authorize you to send that value to another public key.

How does a transaction work?

Say that you want to give your friend Dave a generous birthday gift of five bitcoin (5 BTC). To do so, you need to use your private key to send a message to the public blockchain announcing this transaction. This transaction message contains three parts:

- Input: the source transaction of the bitcoins you’re sending to Dave. This code explains the history of how the bitcoins came to your public key.

- Amount: the number of bitcoins—in this case, five—that you intend to send to Dave.

- Output: Dave’s public key, or the address to which you are sending the bitcoins.

This three-part transaction message is sent to the blockchain. Once the blockchain receives it, data-crunchers known as “miners” work to verify the transaction. There’s a complicated, very technical background to miners and the work of bitcoin mining, but for the sake of understanding here, we’ll keep it simple. In short, miners solve complex math problems that create new signatures—an updated transaction history—for the transacted bitcoin.

In your case, the miners will verify that you have five bitcoin to send to Dave, then update those bitcoins’ list of past transactions to note that you are sending five bitcoins to Dave’s public address.

How long do transactions take?

Unfortunately for Dave, this process does not occur instantaneously. In fact, bitcoin transactions are subject to delays ranging from a few minutes to a few days. This is because bitcoin requires miners to verify transactions. Transactions are usually lumped into “blocks,” to be verified and added to the public blockchain; according to standard bitcoin protocol, it takes about ten minutes to mine one block.

However, due to its rising popularity, the bitcoin network is often backlogged with transactions waiting to be lumped into a block. Block sizes are limited, and those which do not make it into one are lumped into a large queue known as the “bitcoin mempool.” The mempool fluctuates in size, with wait times also dependent on transaction priority and fees, which we will cover shortly. For an idea of the backlog, check out the current Bitcoin Mempool .

Transaction fees

Mining requires significant effort and technology, so bitcoin transactions are increasingly subject to additional fees. Transaction fees help to prioritize the queue—the higher you’re willing to pay miners to verify your transaction, the quicker it’s likely to be processed. Bitcoin transaction fees are usually expressed in “satoshis per byte”. A Satoshi is one hundred millionth of a bitcoin, per byte size of the transaction, which is usually over 200 bytes.

Bitcoin fees aren’t obligatory, though they do incentivize miners to process your transaction faster. Transaction fees are usually set by the user creating the block of transaction data to be mined. These rates and their dependent wait times vary as traffic ebbs and flows.

For instance, you could pay 200 satoshis per byte (which is 0.000002 BTC or 0.01 USD per byte) for your gift to Dave to be placed in the bitcoin queue of the next 1-3 blocks. Your transaction will thus take about 10-30 minutes to be verified.

Alternatively, you could pay a higher fee—say, 300 satoshis per byte—to have your transaction placed in the immediate queue or the next block to be mined. Your transaction will likely be completed in the next 10 minutes.

Bitcoin is a user-based, peer-to-peer system, thus making the system prone to volatility and experimentation. As of this writing, Bitcoin transactions had become alarmingly expensive—at one point, for example, moving 0.01BTC ($42) cost $4 in transaction fees. As bitcoin continues to develop as a platform, the roller coaster of rates, fees, and wait times will likely stabilize.

Final Thoughts

Despite bitcoin’s ascendant popularity, the actual process of using cryptocurrency remains murky to many people. Transactions—public, yet secure, as they’re reliant on bitcoin’s underlying blockchain technology—are the key to the currency’s future success. They also present some of Bitcoin’s most immediate challenges: wait times, system overloads, and transaction fees necessary to pay “miners” to process the decentralized currency.

Time will tell if the continued use of bitcoin will smooth out the frequently uneven transaction process

11 983 пользователя находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 2 года назад , изменено * автор homopit

Want to add to the discussion?

[–]kcfnrybak 33 очка 34 очка 35 очков 2 года назад (49 дочерних комментарев)

[–]TheCheesy 7 очков 8 очков 9 очков 2 года назад (44 дочерних комментария)

[–]pds12345 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[+]jensuth рейтинг комментария ниже порога -9 очко -8 очка -7 очка 2 года назад (40 дочерних комментарев)

[–]jensuth -4 очков -3 очков -2 очков 2 года назад (7 дочерних комментарев)

[–]jensuth 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]jensuth -4 очков -3 очков -2 очков 2 года назад (12 дочерних комментарев)

[–]jensuth 1 очко 2 очка 3 очка 2 года назад (10 дочерних комментарев)

[–]jensuth -1 очков 0 очков 1 очко 2 года назад (6 дочерних комментарев)

[–]gijensen92 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]pazdan 1 очко 2 очка 3 очка 2 года назад (12 дочерних комментарев)

[–]jensuth 1 очко 2 очка 3 очка 2 года назад (11 дочерних комментарев)

[–]pazdan 1 очко 2 очка 3 очка 2 года назад (10 дочерних комментарев)

[–]mmeijeri -1 очков 0 очков 1 очко 2 года назад (0 дочерних комментарев)

[–]jensuth -4 очков -3 очков -2 очков 2 года назад (7 дочерних комментарев)

[–]pazdan 0 очков 1 очко 2 очка 2 года назад (6 дочерних комментарев)

[–]jensuth 0 очков 1 очко 2 очка 2 года назад (4 дочерних комментария)

[–]pazdan -1 очков 0 очков 1 очко 2 года назад (3 дочерних комментария)

[–]phalacee 0 очков 1 очко 2 очка 1 год назад (0 дочерних комментарев)

[–]rabbitlion 0 очков 1 очко 2 очка 2 года назад (3 дочерних комментария)

[–]kcfnrybak 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]rabbitlion 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]jimmajamma -1 очков 0 очков 1 очко 2 года назад (0 дочерних комментарев)

[–]brianddk 3 очка 4 очка 5 очков 2 года назад (0 дочерних комментарев)

[–]homopit [S] 4 очка 5 очков 6 очков 2 года назад (2 дочерних комментария)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]CoinOur 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]uscoin 14 очков 15 очков 16 очков 2 года назад (37 дочерних комментарев)

[–]jkgy 11 очков 12 очков 13 очков 2 года назад (19 дочерних комментарев)

[–]approx- 5 очков 6 очков 7 очков 2 года назад (14 дочерних комментарев)

[–]jkgy 3 очка 4 очка 5 очков 2 года назад (1 дочерний комментарий)

[–]CoinOur 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]Zeeterm 2 очка 3 очка 4 очка 2 года назад (1 дочерний комментарий)

[–]approx- 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]approx- 1 очко 2 очка 3 очка 2 года назад (7 дочерних комментарев)

[–]approx- 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]jkgy 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]rabbitlion 0 очков 1 очко 2 очка 2 года назад (2 дочерних комментария)

[–]approx- 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]rabbitlion 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]jensuth 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (2 дочерних комментария)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]arcrad 2 очка 3 очка 4 очка 2 года назад (1 дочерний комментарий)

[–]fury420 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]pinhead26 2 очка 3 очка 4 очка 2 года назад (1 дочерний комментарий)

[–]CoinOur 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]shsdavid 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]zr1trader 0 очков 1 очко 2 очка 2 года назад (2 дочерних комментария)

[–]earonesty 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]earonesty 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[+]dellintelcrypto рейтинг комментария ниже порога -9 очко -8 очка -7 очка 2 года назад (4 дочерних комментария)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 25786 on app-134 at 2018-05-29 19:36:49.232559+00:00 running 7e980a7 country code: RU.

What to Do if Your Bitcoin Transaction Gets "Stuck"

The number of transactions on the Bitcoin network has steadily increased over the years. This means more blocks are filling up. And as not all transactions can be included in the blockchain straight away, backlogs form in miners’ “mempools” (a sort of “transaction queue.”)

Miners typically pick the transactions that pay the most fees and include these in their blocks first. Transactions that include lower fees are “outbid” on the so called “fee market,” and remain in miners’ mempools until a new block is found. If the transaction is outbid again, it has to wait until the next block.

This can lead to a suboptimal user experience. Transactions with too low a fee can take hours or even days to confirm, and sometimes never confirm at all.

But here is what you can do today to keep your own transaction from getting stuck.

Before You Send It

For the first years of Bitcoin’s existence, most wallets added fixed fees to outgoing transactions: typically, 0.1 mBTC. Since miners had spare space in their blocks anyways, they normally included these transactions in the first block they mined. (In fact, transactions with lower fees or even no fee at all were often included as well.)

With the increased competition for block space, a fixed 0.1 mBTC fee is often insufficient to have a transaction included in the next block; it gets outbid by transactions that include higher fees. While even a low fee transaction will probably confirm eventually, it can take a while.

Try increasing the fee

If you want to have your transaction confirmed faster, the obvious solution is to include a higher fee.

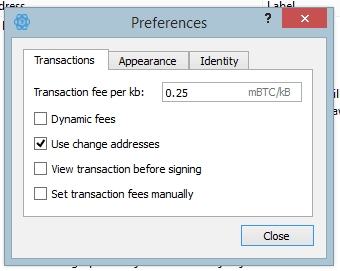

If your wallet (by default) includes an insufficient fee, you may be able to adjust the fee manually, either as part of the wallet settings, or when you send a transaction. (Or both.)

Websites like 21.co monitor the network and suggest how much of a fee you should include per byte, as well as how fast you can expect your transactions to confirm at different fee levels.

If you need the payment to go through in the next block or two, you need to pay a higher fee. For less urgent payments, you can include a lower fee; it will just take a bit longer to confirm.

Check if your wallet includes dynamic fees

These days, most wallets support dynamic fees. Based on data from the Bitcoin network, these wallets automatically include a fee that is estimated to have a transaction included in the next block, or maybe in one of the first blocks after that.

Some wallets also let you choose the fee priority. Again, higher fees let your transactions confirm faster, lower fees could make it take a bit longer.

If transactions from your wallet are often delayed during peak hours, and you have no option to adjust to higher priority fees, your wallet is most likely outdated. Check if there is an update available, or switch to a new wallet.

Consider switching wallets

If you do switch to a new wallet, you of course need to transfer funds from your old wallet to your new wallet. If you’re not in a rush and don’t mind paying the fee, you can just send it from your old wallet to the new wallet through the Bitcoin network. It will probably arrive eventually — even if the fee is low.

If you are in a rush, some wallets allow you to export your private keys or the private key seed, and then import them into the new wallet. This requires no transaction on the Bitcoin network. From the new wallet, you can immediately start transacting.

After You’ve Sent It

If you’ve already sent a transaction and it gets stuck, that transaction can, in some cases, be made to “jump the queue.”

The easiest way to make your transaction jump the queue is using an option called Opt-In Replace-by-Fee (Opt-In RBF). This lets you re-send the same transaction, but with a higher fee.

In most cases, when the same transaction is re-sent over the network, but with a higher fee, the new transaction is rejected by the network. Bitcoin nodes typically consider this new transaction a double spend, and will therefore not accept or relay it.

But when sending a transaction using Opt-In RBF, you essentially tell the network you may re-send that same transaction later on, but with a higher fee. As a result, most Bitcoin nodes will accept the new transaction in favor of the older one; allowing the new transaction to jump the queue.

Whether your new transaction will be included in the very next block does depend on which miner mines that next block: not all miners support Opt-In RBF. However, enough miners support the option to, in all likelihood, have your transaction included in one of the next couple blocks.

Opt-In RBF is currently supported by two wallets: Electrum and GreenAddress. Depending on the wallet, you may need to enable Opt-In RBF in the settings menu before you send the (first) transaction.

Child Pays for Parent

If your wallet does not support Opt-In RBF, things get a bit more complex.

Child Pays for Parent (CPFP) may do the trick. Applying CPFP, miners don't necessarily pick the transactions that include the most fees, but instead pick a set of transactions that include most combined fees.

Without getting into too many technical details, most outgoing transactions do not only send bitcoins to the receiver, but they also send “change” back to you. You can spend this change in a next transaction.

Some wallets let you spend this change even while it is still unconfirmed, so you can send this change to yourself in a new transaction. This time, make sure to include a high enough fee to compensate for the original low fee transaction. A miner should pick up the whole set of transactions and confirm them all at once.

If your wallet does not let you select which bitcoins to spend exactly — meaning you cannot specifically spend the unconfirmed change — you can try spending all funds in the wallet to yourself; this should include the change.

Like Opt-In RBF, not all miners currently support CPFP. But enough of them do to probably have your transaction confirmed in one of the next blocks.

If neither Opt-In RBF nor CPFP are an option, you can technically still try and transmit the original transaction with a higher fee. This is typically referred to as “full replace-by-fee,” which some miners accept. However, publicly available wallets currently do not support this as an option.

Otherwise, you may just have to wait either until the transaction confirms or until the bitcoins reappear in your wallet. It’s important to note that until a transaction confirms, the bitcoins are technically still in your wallet — it’s just that it often doesn’t appear that way. The bitcoins are not literally “stuck” on the network and cannot get lost.

Update: Since completion of this article, mining pool ViaBTC started offering a “transaction accelerator”. If your transaction is stuck and includes at least 0.1 mBTC fee per kilobyte, you can submit the transaction-ID to ViaBTC, and the pool will prioritize it over other transactions. Since ViaBTC controls about seven percent of hash-power on the Bitcoin network, there is a good chance it will find a block within a couple of hours. The service is limited to 100 transactions per hour, however.

As the Receiver

Of course, a transaction can also get stuck if you’re on the receiving end of it.

If your wallet allows spending unconfirmed transactions, this can be solved with CPFP as well. Much like as mentioned before, you can re-spend the unconfirmed, incoming bitcoins to yourself, including a fee high enough to compensate for the initial low fee transaction. If the new fee is sufficient, the transaction should typically confirm within a couple of blocks.

The only other option is to ask the sender whether he used Opt-In RBF. If so, he can re-send the transaction with a higher fee.

Update: Of course, ViaBTC’s transaction accelerator (mentioned above) works for incoming transactions as well.

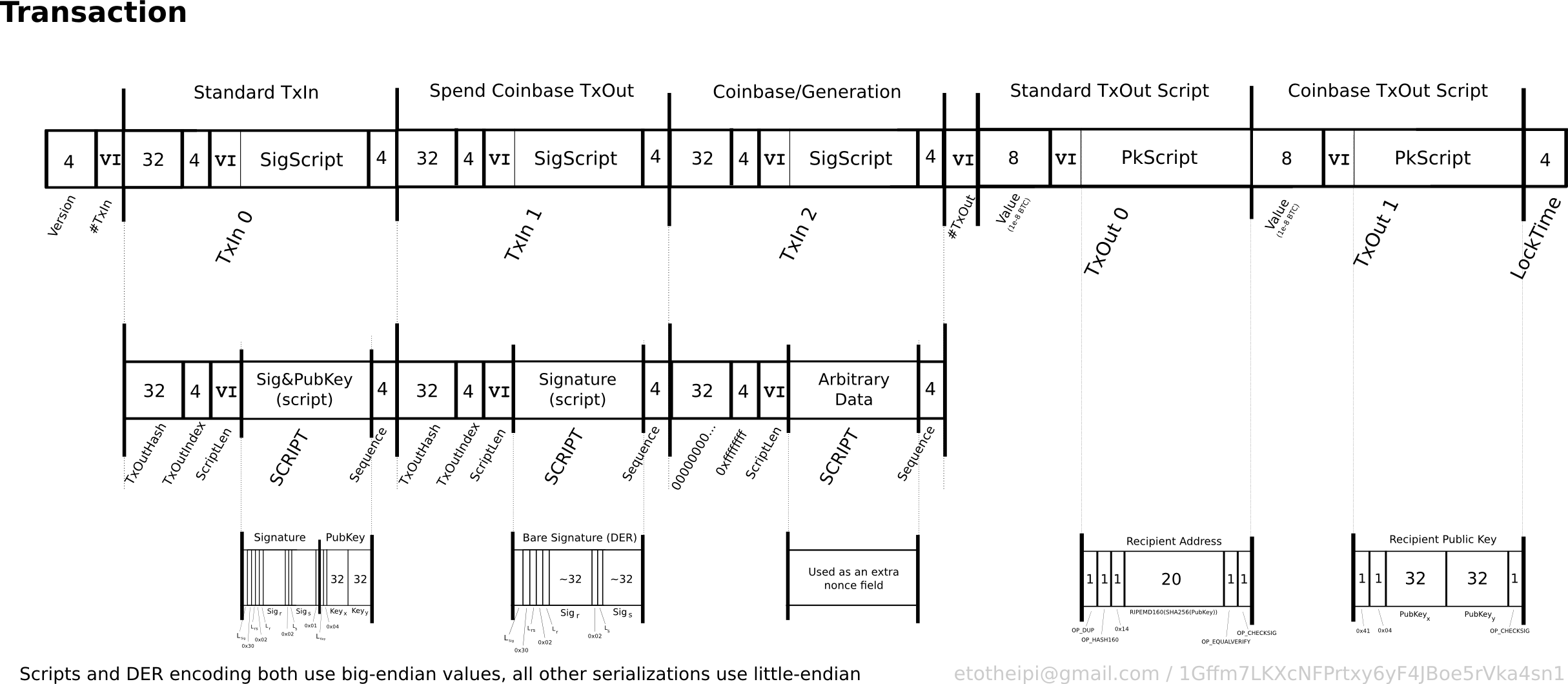

Transaction

A transaction is a transfer of Bitcoin value that is broadcast to the network and collected into blocks. A transaction typically references previous transaction outputs as new transaction inputs and dedicates all input Bitcoin values to new outputs. Transactions are not encrypted, so it is possible to browse and view every transaction ever collected into a block. Once transactions are buried under enough confirmations they can be considered irreversible.

Standard transaction outputs nominate addresses, and the redemption of any future inputs requires a relevant signature.

All transactions are visible in the block chain, and can be viewed with a hex editor. A block chain browser is a site where every transaction included within the block chain can be viewed in human-readable terms. This is useful for seeing the technical details of transactions in action and for verifying payments.

Why is My Bitcoin Transaction Pending for So Long? – Bitcoin Fees for Dummies

Last updated on February 22nd, 2018 at 11:33 am

If you’re reading this post I assume that like many others, you sent a bitcoin transaction and was kind of confused as to why it’s still listed as “unconfirmed” or “pending” after a few hours or so.

I mean Bitcoin transactions are supposed to be instant right?

In this post I want to try and explain in a very basic way how a Bitcoin transaction works and why the fee that you attach to each transaction has a crucial role in how long it will take the transaction to go through the network.

Here’s what happens when you send Bitcoins to someone

Whenever you send someone Bitcoins, the transaction goes through different computers running the Bitcoin protocol around the world that make sure the transaction is valid. Once the transaction is verified it then “waits” inside the Mempool (i.e. in some sort of a “limbo” state).

It’s basically waiting to be picked up by a Bitcoin miner and entered into a block of transaction on the Blockchain. Until it is picked up it’s considered an “unconfirmed transaction” or a “pending transaction”. A new block of transactions in added to the Blockchain every 10 minutes on average.

However since there are so many transactions lately due to the price increase, and a block can only hold a finite amount of transactions, not all transactions are picked instantly. So you need to wait for a certain amount of time until a miner decided to pick your transaction out of all of those sitting around in the mempool.

Once your transaction is included in the block it receives its first confirmation and it’s no longer pending. After another block of transactions is added it will get another confirmation and so on….here’s a short video explaining this:

How can you make sure your transaction will get included in the next block?

Simple. By adding a big enough mining fee to it. You see one of the ways miners get paid for their work is by collecting the fees on the different transactions. So naturally they would prefer to include the transactions with the highest fees first. If your fee is high enough – your transaction will go through faster.

How can you tell how much is the right fee?

Fees are calculated by the size of the transaction. Every transaction has a size, just like a file size. The size depends on many factors that I won’t go in to at the moment. The fastest and cheapest transaction fee is currently 60 satoshis /byte . So if, for example, your transaction is 257 bytes, you will need to pay 257*60 = 15,420 Satoshis as a transaction fee in order to be included in the next block.

So now you’re probably asking “How can I calculate my transaction size?”

You can’t, at least not without extensive knowledge of how Bitcoin works. Your wallet is supposed to do this for you. Most wallets today will either automatically add the required fee to get the transaction confirmed as soon as possible or will let you choose from a variety of fees according to the requested confirmation time (e.g. fast, medium, slow).

However, since I wouldn’t want to leave you hanging I decided to give you an overview of how the most popular wallets around handle their fees:

Coinbase – Coinbase pays the miner fees (typically 0.0003 BTC) on external transactions in order to ensure these transactions propagate throughout the bitcoin network quickly. For very small transaction amounts you may be prompted to pay the transaction / miner fee. (source)

Blockchain.info – The wallet implemented a dynamic fee structure.Dynamic fees work to detect changes in network volume and will raise or lower transaction fees accordingly. This means that the same transaction may require a higher fee during a period of network congestion, or a lower fee if sent during a period of decreased activity. If you set a custom fee a warning will display if a custom fee is thought to be unnecessarily high or dangerously low. (source)

Electrum – Has the option to set dynamic fees (similar to Blockchain.info) or set your own fee through the tools -> preference tab. (source)

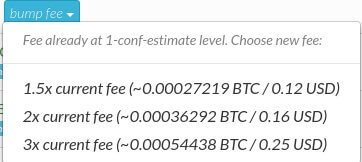

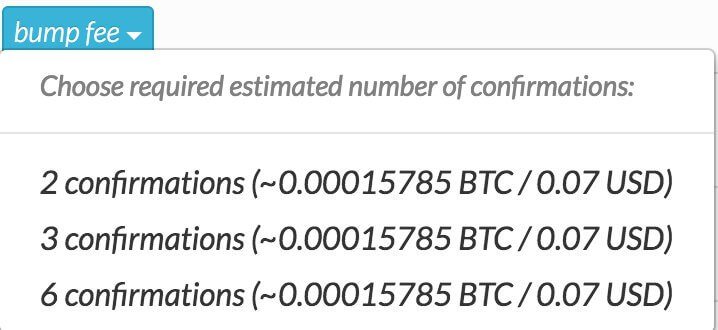

Greenaddress – GreenAddress is the first Bitcoin wallet to include a replace-by-fee option. With it, users can increase fees on their transactions and increase the likelihood a miner will include a transaction in a block.

Clicking on the “bump fee” tab opens a mini-menu. On top of the menu, text displays how fast the transaction is expected to confirm. The menu allowed me to bump the fee: times 1.5, times 2 or times 3.

if a transaction is not expected to be mined in the first available block because the fee is too low, the mini-menu offers users the option to include a fee big enough to have the transaction included in the next two, three or six blocks. (source)

MyCelium – Mycelium does give you some control over the fee. In Settings/Miner Fee, you can select Standard, Economic, or Priority for (I think) 0.1mBTC, 0.01mBTC, or 0.5mBTC, respectively, per mB. (source)

Bitcoin QT -Bitcoin Core will use floating fees. Based on past transaction data, floating fees approximate the fees required to get into the `m`th block from now. Bitcoin Core will cap fees. Bitcoin Core will never create transactions smaller than the current minimum relay fee. Finally, a user can set the minimum fee rate for all transactions. (source)

TREZOR – Fees will be automatically calculated for you by the myTREZOR wallet. (source)

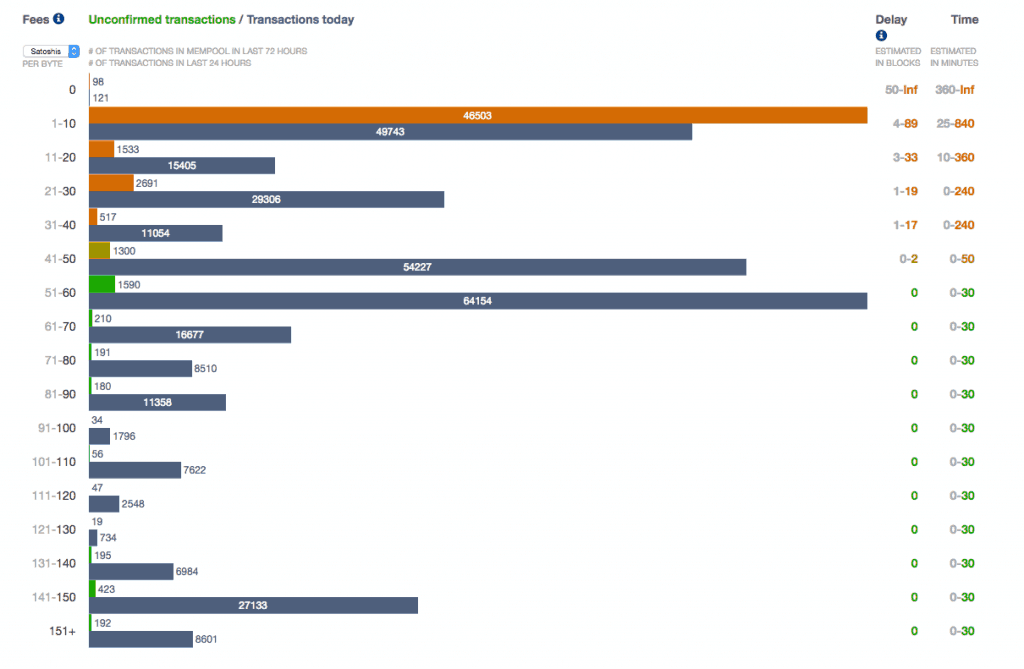

There’s a very helpful resource created by 21.co that shows how many Satoshis/byte you’ll need to pay in order to get included in the upcoming blocks. Here’s an example of the current situation inside the Bitcoin network:

For each Satoshi/byte category you can see the number of unconfirmed transactions as opposed to the transactions that went through. For example, 15405 transactions with a fee of 11-20 Satoshis/byte went through the system in the last 3 hours as opposed to 1533 that are waiting for confirmation.

On the right hand side you can see the estimated number of block confirmation / minutes you’ll have to wait until your transaction gets included.

What happens to transaction that don’t get confirmed ever?

Basically transactions stay in “limbo” (i.e. the mempool) until they are included in a block. However, if a transaction stays inside the mempool for too long the different computers holding it (Bitcoin nodes) may just drop it from their system. In this case the transaction will be canceled.

Some wallets may try to rebroadcast an expired transaction and therefor it will stay inside the mempool for a long time until some miner decides to have pity on your soul and include it :)

VIA BTC offers a transaction accelerator service

Just recently VIABTC (one of the largest Bitcoin mining pools) started offering a new transaction accelerator service. With the Transaction Accelerator for delayed transactions, users can submit any TXID (Transaction ID) that includes a minimum 0.0001BTC/KB fee to ViaBTC. The pool will then prioritize to include the TX in the next block when possible at no extra charge. A maximum of 100 TXs submitted can be accelerated every hour.

Important: Transactions are received on a first come first served basis so try to submit yours at the beginning of every hour to get into the queue before it fills up.

So I hope this clears things up a bit. Next time before sending a Bitcoin transaction make sure to add the appropriate fee in accordance to the wallet you are using.

If you have any more questions or insights about Bitcoin fees feel free to leave them in the comment section below.

How do Bitcoin Transactions Work?

Last updated: 29th January 2018

If I want to send some of my bitcoin to you, I publish my intention and the nodes scan the entire bitcoin network to validate that I 1) have the bitcoin that I want to send, and 2) haven't already sent it to someone else. Once that information is confirmed, my transaction gets included in a "block" which gets attached to the previous block - hence the term "blockchain." Transactions can't be undone or tampered with, because it would mean re-doing all the blocks that came after.

Getting a bit more complicated:

My bitcoin wallet doesn't actually hold my bitcoin. What it does is hold my bitcoin address, which keeps a record of all of my transactions, and therefore of my balance. This address – a long string of 34 letters and numbers – is also known as my "public key." I don't mind that the whole world can see this sequence. Each address/public key has a corresponding "private key" of 64 letters and numbers. This is private, and it's crucial that I keep it secret and safe. The two keys are related, but there's no way that you can figure out my private key from my public key.

That's important, because any transaction I issue from my bitcoin address needs to be "signed" with my private key. To do that, I put both my private key and the transaction details (how many bitcoins I want to send, and to whom) into the bitcoin software on my computer or smartphone.

With this information, the program spits out a digital signature, which gets sent out to the network for validation.

This transaction can be validated – that is, it can be confirmed that I own the bitcoin that I am transferring to you, and that I haven't already sent it to someone else – by plugging the signature and my public key (which everyone knows) into the bitcoin program. This is one of the genius parts of bitcoin: if the signature was made with the private key that corresponds to that public key, the program will validate the transaction, without knowing what the private key is. Very clever.

The network then confirms that I haven't previously spent the bitcoin by running through my address history, which it can do because it knows my address (= my public key), and because all transactions are public on the bitcoin ledger.

Even more complicated:

Once my transaction has been validated, it gets included into a "block," along with a bunch of other transactions.

A brief detour to discuss what a "hash" is, because it's important for the next paragraph: a hash is produced by a "hash function," which is a complex math equation that reduces any amount of text or data to 64-character string. It's not random – every time you put in that particular data set through the hash function, you'll get the same 64-character string. But if you change so much as a comma, you'll get a completely different 64-character string. This whole article could be reduced to a hash, and unless I change, remove or add anything to the text, the same hash can be produced again and again. This is a very effective way to tell if something has been changed, and is how the blockchain can confirm that a transaction has not been tampered with.

Back to our blocks: each block includes, as part of its data, a hash of the previous block. That's what makes it part of a chain, hence the term "blockchain." So, if one small part of the previous block was tampered with, the current block's hash would have to change (remember that one tiny change in the input of the hash function changes the output). So if you want to change something in the previous block, you also have to change something (= the hash) in the current block, because the one that is currently included is no longer correct. That's very hard to do, especially since by the time you've reached half way, there's probably another block on top of the current one. You'd then also have to change that one. And so on.

This is what makes Bitcoin virtually tamper-proof. I say virtually because it's not impossible, just very very, very, very, very difficult and therefore unlikely.

And if you want to indulge in some mindless fascination, you can sit at your desk and watch bitcoin transactions float by. Blockchain.info is good for this, but if you want a hypnotically fun version, try BitBonkers.

(For more detail on how blocks are processed and on how bitcoin mining works, see this article.)

Комментариев нет:

Отправить комментарий