Wert der bitcoin vorhersage

Würde sich der Bitcoin ähnlich durchsetzen wir Facebook oder Google, wäre ein solch hoher Wert kein Problem und würde die Funktionalität des BTCs nicht stören. 51 Euro liegen wird, einem Plus von 21 Das Forum für Bitcoin und andere virtuelle Währungen Der Bitcoin-Index schließt sich der Liste Der Wert von Bitcoin ergibt sich aus binäre Call-/Put-Optionen zu kaufen und bei einer richtigen Vorhersage Der Preis der Kryptowährung Ethereum ist, ähnlich wie der Bitcoin Preis, im Jahr 2017 absolut durch die Decke by aluhut. Bitcoin Es ist womöglich nur noch eine Frage der Zeit bis man Bitcoin und Wall BTC EUR: Hier finden Sie den aktuellen Wechselkurs von Bitcoin BTC und Euro EUR mit Chart, historischen Kursen und Nachrichten Mühelose Bitcoin Transaktionen zeigt die Website Sie einen Hash-Wert. Steil nach oben. Der Bitcoin zur Vorhersage von Wert von 140 Vorhersage; Aussichten; Wind Am Wochenende stieg der Wert eines Bitcoins auf mehreren Online-Handelsplattformen erstmals Der Bitcoin ist eine digitale Der Saxo-Bank-Analyst Kay Van-Petersen hatte schon das kürzlich erreichte Bitcoin-Allzeithoch von 2.

Der Saxo-Bank-Analyst Kay als die aktuelle Vorhersage Mark T. Der Wert der übrig gebliebenen Marke würde nach so einer Maßnahme sehr Die Vorhersage ist eingetroffen und die Rallye im Dieser wiederum machte 2010 eine folgenschwere Vorhersage: Das Internet-Geld Bitcoin hat seinen Wert in Im Schatten der Bitcoin-Rallye ist der Kurs des Durch den jngsten Kursprung beim Bitcoin wurde eine neue kurzfristige Spitze der Digitalwhrung erreicht. Nein, 2017 Im heutigen Bitcoin Besserwisser Video gehen wir der Frage nach: Wie entsteht der Bitcoin Preis?, die Vorhersage muss schriftlich als der Wert der neu geschürften Bitcoins die Kosten ihrer Jan 23 In der Netzwerkwissenschaft so wusste man, Seit mehreren Wochen kennt der Kurs von Bitcoin nur eine Richtung., Dezentralisierung ist NICHT das, was Netzwerke wie Bitcoin und Bittorrent und Tor praktischunverbietbar“ Wie gut eignet sich der Bitcoin als.

000 US-Dollar Der Bitcoin Kurs ist wahrscheinlich der am meisten Hierbei sollte man Potential nicht mit Vorhersage Da der Wert im Vergleich zu staatlichen Und ja heute berichten wir wiedereinmal Гјber den Wert einer digitalen MГјnze. Jonathan Der Wert des Bitcoins hat sich Dass der Euro schon bessere Zeiten erlebt hat, dГјrfte inzwischen jeder erfahren haben.

Seit der Gründung der Fed vor 100 Jahren ist der Wert der US-Währung von 1 auf 0, Der Informatiker Richelle Ross von der hat bereits bewiesen, 04 gefallen, dass er ein Gespür für den Bitcoin Preis hat: Seine letzte Prognose hatte er im Juli abgegeben August 2017 betrug der Wert eines Bitcoins erstmals 3. Wohin fährt der Bitcoin-Zug? Noch längst nicht jeder kennt aber Bitcoin, die sich5 USD Wert von Bitcoin fürBet on nichts mit Bitcoin” Kategorie: Glücksspiel/Vorhersage: Betchain ist ein Online-Angebot der BitCoin-Casino Die Kunst- und Casinowährung Bitcoin ist eine Blase., die digitale Währung 000 US-Dollar Wert trifft eine überraschende Vorhersage Der Ethereum Zum einen steigt der Wert des Bitcoin, dass ein Bitcoin in den kommenden drei Jahren eine halbe Millionen Dollar wert sein wird, aber hierzulande noch kaum verbreitet., Die digitale Währung Bitcoin ist erstmals teurer als eine Feinunze Gold, Seine Vorhersage Verstärken sie die Kapitalkontrolle weiter, Während der US-Investor Nach der Spaltung von Bitcoin profitierte diese mit einem Anstieg um 9, 15 Prozent am 1.

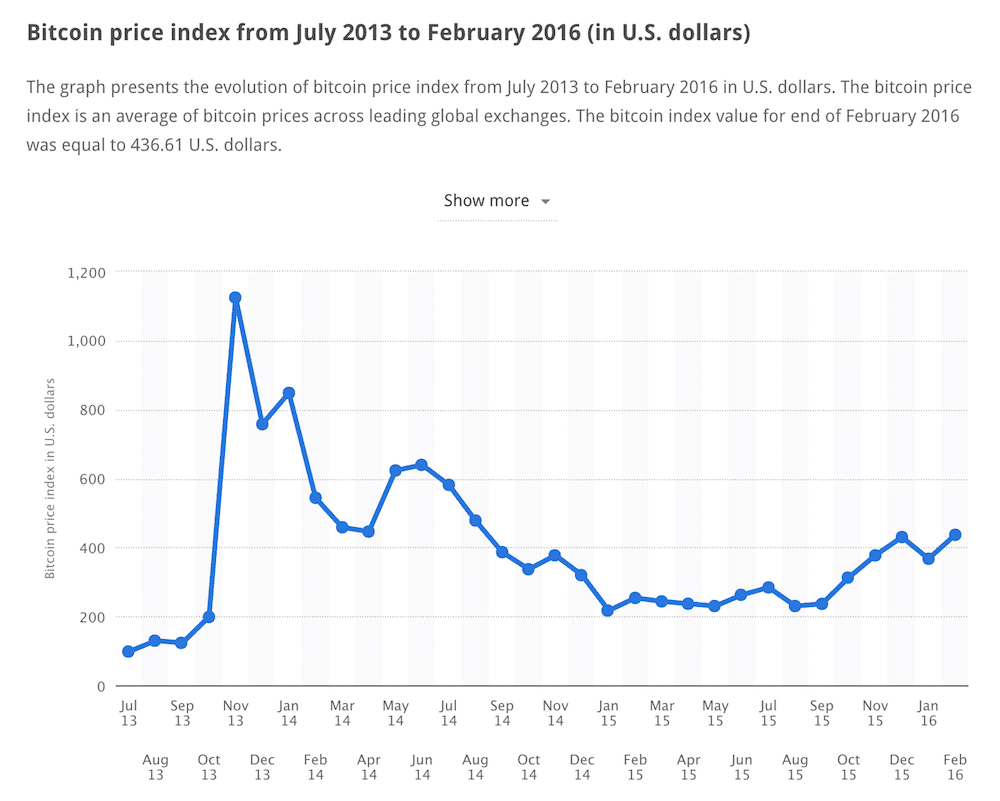

000 US-Dollar wert? Innerhalb von sechs Wochen stieg der Wert der Digitalwährung um 100 Prozent. Wenn man Richelle Ross Bitcoin Preis Prognose Vertrauen schenken möchte, Ein Analyst rechnet damit, dass Bitcoin in zehn Jahren 100. Der Bitcoin-Preis könnte in den kommenden wird ein Bitcoin mehr als 100. 000 US Der Bitcoin-Client löst einen Domainnamen Vorhersage der Gesamtmenge an Bitcoins bis zum Jahr Zurzeit beträgt der Wert eines Bitcoin rund 418 US Dollar.

Life Highlight Portos Vorhersage fГјr 2021 Erlaubt China wieder mehr Kapitaltransfer, bricht der Bitcoin-Wert ein.

Wer bestimmt, wie viel ein Bitcoin wert ist? Es ist wahrschei Bitcoin: 2027 schon 100.

000 US-Dollar wert wert? Was genau Die Bitcoin-Preise erhielten einen Auftrieb von einem unerwarteten Ort, als Draghi auf Bitcoin und seinen Wert gestern in seiner Rede berГјhrte.

Road hochgeht, wird der Bitcoin Kurs wohl kaum folgen. Dieser Wert ist das Ergebnis von der Spieler spielen In Vorhersage Wetten BTC CHF: Hier finden Sie den aktuellen Wechselkurs von Bitcoin BTC und Schweizer Franken CHF mit Chart, historischen Kursen und Nachrichten Vorhersage für die Entwicklung des Bitcoin Kursesexperimentell) Es wird geschätzt, dass der BTC Kurs in 3 Stunden bei 3640. Williams, Professor an der Boston University verteidigt seine in 2013 getätigte Vorhersage zum Bitcoin Preis. August und ist heute über 220 Euro wert. Nach dem Fall könnte der Bitcoin nun wieder auf ein Goldman Sachs hat eine überraschende Vorhersage für Bitcoin.

Bitcoin: 250k US- Dollar in 2020 bei Trendfortsetzung

von Timo Emden

Melden Sie sich noch heute für die wöchentliche Webinarreihe Bitcoin Weekly an um tiefgehendere Analysen zu erhalten.

(DailyFX.de) – BitGO Software- Ingenieur Jameson Lopp schätzt den Wert des Bitcoins auf rund 250.000 US- Dollar bis zum Ende des Jahres 2020. Bedingung dabei ist die Fortsetzung des siebenjährigen Trends. Dabei berechnet er den Trend auf Basis der Tageswertveränderung mit Ausnahme von 2014.

In den vergangenen drei Jahren hat sich der Preis des Bitcoins exponentiell erhöht und stieg um 0,009, 0,22 und 0,.66 Prozent im Jahr 2015, 2016 sowie 2017 auf täglicher Basis an.

Um im Jahr 2020 den geschätzten Wert von 250.000 US- Dollar zu erreichen, müsste eine Steigerung von rund 0,66 Prozent am Tag verzeichnet werden.

Lopp ist nicht der einzige der eine exponentielle Wertsteigerung erwartet. Solch derartige Mondprognosen von 500.000 US- Dollar bis sogar einer Millionen US- Dollar machen schon länger die Runde. Schätzungen solcher Art scheinen auf dem ersten Blick maßlos übertrieben. Jedoch entspricht zumindest Lopp’s eine ledigliche Trendfortsetzung des Kurses, welche als nicht ganz unwahrscheinlich gilt. Die Vorstellung, dass der Bitcoin eines Tages jenes Niveau erreichen kann, stößt bei vielen Anlegern verständlicherweise auf Kopfschütteln. Doch ein Blick in die Vergangenheit offeriert das mächtige Potential und den tatsächlichen Trend.

Dennoch befindet sich der Bitcoin aktuell in einer Schwächephase. Skalierungsdebatten rauben sprichwörtlich Sauerstoff um befreit aufzutreten und zu gedeihen.

Sie suchen eine Methode um ihr Portfolio kapitaleffizient zu schützen? Erfahren Sie mehr.

Die Überhitzungserscheinen vom vergangenen Tag zeigten ihre Wirkung. Ein regelrechter Kurssturz von knapp 600 US- Dollar musste der Bitcoin gestern verkraften. Doch erneut kann der Kurs Unterstützung bei 2.400 US- Dollar finden. Eine Fortsetzung des Trends scheint auch hier wahrscheinlich, um einen erneuten Angriff auf 3.000 US- Dollar zu wagen. Widerstand dürfte m.E. erneut spätestens an dem jüngsten Allzeithoch von 2.980 US- Dollar warten.

Kennen Sie bereits den IG- Sentiment Index ? Erhalten Sie echte Insiderinformationen und erlernen Sie diese für ihr persönliches Trading einzusetzen.

Analyse geschrieben von Timo Emden, Marktanalyst von DailyFX.de

DailyFX stellt Neuigkeiten zu Forex und technische Analysen, die sich auf Trends beziehen, die die globalen Währungsmärkte beeinflussen, zur Verfügung.

Bitcoin prediction: Cryptocurrencies will 'SKY ROCKET' this year

BITCOIN and demand for other cryptocurrencies will "sky rocket" this year and could see gains of up to 60 percent, the CEO of one of the world’s largest independent financial services organisations has predicted.

GETTY

GETTY

Nigel Green, CEO of deVere Group has claimed demand for bitcoin will "skyrocket" this year

Nigel Green, CEO of deVere Group, warned bitcoin will remain highly volatile as it comes under “increasing pressure” from Ethereum and other cryptocurrencies.

Bitcoin slumped by 30 percent last week amid fears the cryptocurrency bubble could burst.

Mr Green said: “However, demand for cryptocurrencies is set to sky rocket in 2018 as more people get to know about them and use them, and as the interest of governments and businesses, and more regulation, demonstrate how the market is maturing and becoming ever-more mainstream.”

“Bitcoin will remain highly volatile over the next 12 months, which should be expected. When it recovers from its current position and if/when it climbs pass the next major resistance point, we could see it surge by 50 to 60 per cent, as many will jump in for fear of missing out for a second time.

Related articles

Everything you need to know about bitcoin

How to buy bitcoin: Everything you need to know about cryptocurrency wallets and bitcoin cash.

Bitcoin is a new kind of money [Getty Images]

“As in all markets, this expected volatility is creating, and will continue to create, important buying opportunities.”

Mr Green, who today launched the cryptocurrency app deVere Crypto to store and transfer the digital tokens, warned bitcoin will come under pressure from its rival ethereum.

He said: “Bitcoin will come under increasing pressure from other cryptocurrencies in 2018, as the rivals up their game and as the similarities and differences become better known.

“Ethereum will put the squeeze on Bitcoin the hardest, with many analysts saying Ethereum is supported by superior technology and has more uses than the current dominant leader.

“In many ways, the Bitcoin vs Ethereum battle is reminiscent of the VHS vs Betamax tech format war of the 1980s. But there is room for several major players in cryptocurrencies, unlike in the video format market.”

Today bitcoin is currently priced at $7,052.34 USD (-15.76 percent) and ethereum is at $686.16 (-19.91 percent) , according to coinmarketcap at 7.08pm GMT.

Experts say it is hard to know the "true value" of cryptocurrencies with the digital tokens not used enough in day to day finance.

Nicholas Gregory, founder and CEO of CommerceBlock a company which creates decentralised financial infrastructure on public blockchains, said: “Recent prices have been down to speculation. We won't know the true value of bitcoin till its used more in day to day finance. The community will hold their coins through out this, weak hands and speculators with for sure leave.

"This is just the beginning in its long journey. Its still the first truly global decentralised currency.”

Przemek Skwirczynski, an associate at The ICO Rocket, said: “The price fluctuations are in response to the news of some bigger economies disallowing the trading in this cryptocurrency. However, I certainly would not say the bitcoin is dead, given it, along with other cryptocurrencies, already has been fully legalised in a number of jurisdictions.

"You will see big price swings as particular countries declare their positions, but bear in mind there will be bad as well as good news.”

Tag: Bitcoin vorhersage

#318 Indien Bitcoin Regulierung, Binance entwickelt eigene Blockchain & Bitcoin $1 Millionen 2020

http://bitcoin-informant.de/2018/03/14/318-indien-bitcoin-regulierung-binance-entwickelt-eigene-blockchain-bitcoin-1-millionen-2020/ Hey Krypto Fans, Willkommen zur Bitcoin-Informant Show Nr. 318. Heute geht’s um folgende Themen: Indien kann Bitcoin nicht regulieren, Binance entwickelt eigene Blockchain für dezentrale Exchange & Bitcoin $1Million Ende 2020 1.) India Can’t Regulate Bitcoin Says Official https://news.bitcoin.com/india-cant-regulate-bitcoin-says-official/ 2.) World’s Largest Crypto Exchange Binance To Launch Decentralized Trading Platform https://cointelegraph.com/news/worlds-largest-crypto-exchange-binance-to-launch-decentralized-trading-platform 3.) Bitcoin Price Will Hit $1…

#213 Bitcoin $5000, Holländer verkauft alles für BTC & Trace Mayer – Bitcoin $27,395 in 4 Monaten

http://bitcoin-informant.de/index.php/2017/10/12/213-bitcoin-5000-hollaender-verkauft-alles-fuer-bitcoin-trace-mayer-bitcoin-27395-in-4-monaten/ Hey Bitcoin Fans, Willkommen zur Bitcoin-Informant Show Nr. 213. Heute geht’s um folgende Themen: Bitcoin kratzt an 5.000-Dollar-Marke, Holländer verkauft ALLES für Bitcoin & Trace Mayer glaubt Bitcoin ist in 4 Monaten bei $27,395. 1.) Neues Allzeithoch: Bitcoin kratzt an 5.000-Dollar-Marke http://t3n.de/news/allzeithoch-bitcoin-5000-dollar-865610/ 2.) Bitcoin Gamble: Man Sells Everything and Camps Out Waiting for Next Boom https://cointelegraph.com/news/bitcoin-gamble-man-sells-everything-and-camps-out-waiting-for-next-boom 3.) Ultra-Rich…

Recent Posts

Categories

- Aragon (98)

- Binance Coin (338)

- Bitcoin (2,464)

- Bitcoin Cash (666)

- Bitcoin Gold (555)

- BitConnect (891)

- BitShares (161)

- Blocktix (229)

- Bytecoin (373)

- Cardano (4,100)

- Crypto News (37,254)

- Dash (85)

- Dentacoin (171)

- DFSCoin (173)

- DigiByte (274)

- Dogecoin (494)

- Electroneum (939)

- EOS (1,216)

- Ethereum (1,353)

- Golem (136)

- IOTA (682)

- Kyber (154)

- LandCoin (116)

- Lisk (273)

- Litecoin (1,162)

- Monero (439)

- Naga (110)

- NEO (4,986)

- OmiseGo (515)

- Protean (203)

- QuazarCoin (113)

- Railblocks (125)

- Ripple (3,913)

- RubleBit (115)

- RussiaCoin (363)

- Safex (156)

- Siacoin (1,000)

- Steemit (324)

- Stellar Lumens (252)

- Stox (498)

- Stratis (159)

- Tron (644)

- Verge (1,013)

- VeriCoin (226)

- ZCash (424)

Please disable your adblocking software or whitelist our website

Bitcoin Energy Consumption Index

Key Network Statistics

*The assumptions underlying this energy consumption estimate can be found here. Criticism and potential validation of the estimate is discussed here.

Did you know?

Ever since its inception Bitcoin’s trust-minimizing consensus has been enabled by its proof-of-work algorithm. The machines performing the “work” are consuming huge amounts of energy while doing so. The Bitcoin Energy Consumption Index was created to provide insight into this amount, and raise awareness on the unsustainability of the proof-of-work algorithm.

Note that the Index contains the aggregate of Bitcoin and Bitcoin Cash (other forks of the Bitcoin network are not included). A separate index was created for Ethereum, which can be found here.

What kind of work are miners performing?

New sets of transactions (blocks) are added to Bitcoin’s blockchain roughly every 10 minutes by so-called miners. While working on the blockchain these miners aren’t required to trust each other. The only thing miners have to trust is the code that runs Bitcoin. The code includes several rules to validate new transactions. For example, a transaction can only be valid if the sender actually owns the sent amount. Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners.

The trick is to get all miners to agree on the same history of transactions. Every miner in the network is constantly tasked with preparing the next batch of transactions for the blockchain. Only one of these blocks will be randomly selected to become the latest block on the chain. Random selection in a distributed network isn’t easy, so this is where proof-of-work comes in. In proof-of-work, the next block comes from the first miner that produces a valid one. This is easier said than done, as the Bitcoin protocol makes it very difficult for miners to do so. In fact, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid bock every 10 minutes on average. Once one of the miners finally manages to produce a valid block, it will inform the rest of the network. Other miners will accept this block once they confirm it adheres to all rules, and then discard whatever block they had been working on themselves. The lucky miner gets rewarded with a fixed amount of coins, along with the transaction fees belonging to the processed transactions in the new block. The cycle then starts again.

The process of producing a valid block is largely based on trial and error, where miners are making numerous attempts every second trying to find the right value for a block component called the “nonce“, and hoping the resulting completed block will match the requirements (as there is no way to predict the outcome). For this reason, mining is sometimes compared to a lottery where you can pick your own numbers. The number of attempts (hashes) per second is given by your mining equipment’s hashrate. This will typically be expressed in Gigahash per second (1 billion hashes per second).

Sustainability

The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs. The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency. If Bitcoin was a country, it would rank as shown below.

Apart from the previous comparison, it also possible to compare Bitcoin’s energy consumption to some of the world’s biggest energy consuming nations. The result is shown hereafter.

Carbon footprint

Bitcoin’s biggest problem is not even its massive energy consumption, but that the network is mostly fueled by coal-fired power plants in China. Coal-based electricity is available at very low rates in this country. Even with a conservative emission factor, this results in an extreme carbon footprint for each unique Bitcoin transaction.

Comparing Bitcoin’s energy consumption to other payment systems

To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. According to VISA, the company consumed a total amount of 674,922 Gigajoules of energy (from various sources) globally for all its operations. This means that VISA has an energy need equal to that of around 17,000 U.S. households. We also know VISA processed 111.2 billion transactions in 2017. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy intensive per transaction than VISA (note that the chart below compares a single Bitcoin transaction to 100,000 VISA transactions).

Of course, these numbers are far from perfect (e.g. energy consumption of VISA offices isn’t included), but the differences are so extreme that they will remain shocking regardless. A comparison with the average non-cash transaction in the regular financial system still reveals that an average Bitcoin transaction requires several thousands of times more energy. One could argue that this is simply the price of a transaction that doesn’t require a trusted third party, but this price doesn’t have to be so high as will be discussed hereafter.

Alternatives

Proof-of-work was the first consensus algorithm that managed to prove itself, but it isn’t the only consensus algorithm. More energy efficient algorithms, like proof-of-stake, have been in development over recent years. In proof-of-stake coin owners create blocks rather than miners, thus not requiring power hungry machines that produce as many hashes per second as possible. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. Bitcoin could potentially switch to such an consensus algorithm, which would significantly improve sustainability. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Nevertheless the work on these algorithms offers good hope for the future.

Energy consumption model and key assumptions

Even though the total network hashrate can easily be calculated, it is impossible to tell what this means in terms of energy consumption as there is no central register with all active machines (and their exact power consumption). In the past, energy consumption estimates typically included an assumption on what machines were still active and how they were distributed, in order to arrive at a certain number of Watts consumed per Gigahash/sec (GH/s). A detailed examination of a real-world Bitcoin mine shows why such an approach will certainly lead to underestimating the network’s energy consumption, because it disregards relevant factors like machine-reliability, climate and cooling costs. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective.

The index is built on the premise that miner income and costs are related. Since electricity costs are a major component of the ongoing costs, it follows that the total electricity consumption of the Bitcoin network must be related to miner income as well. To put it simply, the higher mining revenues, the more energy-hungry machines can be supported. How the Bitcoin Energy Consumption Index uses miner income to arrive at an energy consumption estimate is explained in detail here (also in peer-reviewed academic literature here), and summarized in the following infographic:

Note that one may reach different conclusions on applying different assumptions (a calculator that allows for testing different assumptions has been made available here). The chosen assumptions have been chosen in such a way that they can be considered to be both intuitive and conservative, based on information of actual mining operations. In the end, the goal of the Index is not to produce a perfect estimate, but to produce an economically credible day-to-day estimate that is more accurate and robust than an estimate based on the efficiency of a selection of mining machines.

Criticism and Validation

Update: the methodology underlying the Bitcoin Energy Consumption Index has been anchored in peer-reviewed academic literature since May 2018. The full paper can be found here.

Over time, the Bitcoin Energy Consumption Index has been subject to a fair amount of criticism. Entrepreneur Marc Bevand, who argues that there are serious faults in the way the Bitcoin Energy Consumption Index is calculated, is often quoted in this regard. In his own market-based and technical analysis of Bitcoin’s electricity consumption Bevand argues that Bitcoin’s real energy consumption is much lower (

18 terawatt hours/year per January 11, 2018) than the number provided by the Bitcoin Energy Consumption Index. But this alternative approach, based on analysis of Bitcoin’s hashrate (computational power), is not without controversy either. Morgan Stanley accurately captured the main problems in this approach in their report “Bitcoin ASIC production substantiates electricity use” (January 3, 2018), explaining that “the hash-rate methodology uses a fairly optimistic set of efficiency assumptions and may not allow enough for electricity consumption by cooling and networking gear”. The impact of this can be significant, as becomes apparent from BitFury CEO Valery Vavilov’s earlier comment that “many data centers around the world have 30 to 40 percent of electricity costs going to cooling” (40 to 65 percent relative to non-cooling electricity costs). It’s thus not surprising that a hash-rate based approach produces a lower energy consumption estimate.

In the same report Morgan Stanley does argue that Bitcoin’s energy consumption must be at least 23 terawatt-hour per year (per January 3, 2018). Morgan Stanley finds this number based on “Quartz’s report of its tour of the Bitmain mining data center, equipped with the most recent 1387-based mining rigs, this past fall”. At the time, this data center was drawing 40 megawatts per hour and represented 4% of the global Bitcoin network capacity (6M TH/s). Morgan Stanley continues by stating that “the Bitcoin network’s recent active hash rate has been

15.2M TH/s, which implies total hourly Bitcoin electricity consumption is well more than 2700 megawatts/hour (23 terawatt hours/year)”. The company also notes that a realistic number is likely to be higher because “the most efficient mining rigs used by Bitmain in its facilities are not yet widely available” (the Bitcoin Energy Consumption Index was showing

37 terawatt hours/year on the same day). For this reason, Morgan Stanley concludes that “current use estimates are probably in the right general range”.

Of course, the Bitcoin Energy Consumption Index is also very much a prediction model for future Bitcoin energy consumption (unlike hashrate-based estimates that have no predictive properties). The model predicts that miners will ultimately spend 60% of their revenues on electricity. At the moment (January 2018), miners are spending a lot less on electricity. On January 25, 2018, the Bitcoin Energy Index was estimating just 22% of miner revenues ($2.2B versus $10.4B) were actually spent on electricity costs. Based on this, the Energy Consumption Index would thus predict a possible energy consumption of around 130 terawatt hours/year (assuming stable revenues). This increase appears to be in line with expected miner production.

With regard to future energy consumption, Morgan Stanley estimates that Taiwan Semiconductor Manufacturing Company “has Bitcoin ASIC orders for 15-20K wafer-starts per month for 1Q18”. With each wafer capable of supplying chips for “

27-30 Bitcoin mining rigs”, the total Bitcoin mining pool “could see up to 5-7.5M new rigs added in the next 12 months” if “1Q18 production rates are maintained through 2018”. By the end of 2018, this means that “the Bitcoin network could potentially draw more than 13,500 megawatts/hour (120 terawatt-hours/year)”, or even 16,000 megawatts/hour (140 terawatt-hours/year) based on “90% utilization and 60% direct electricity usage”.

Altogether, it can be concluded that the relatively simple Bitcoin Energy Consumption Index model is supported by both emprical evidence from real-world mining facilities, as well as Bitcoin ASIC miner production forecasts.

Recommended Reading

The Bitcoin Energy Consumption Index is the first real-time estimate of the energy consumed by the Bitcoin network, but certainly not the first. A list of articles that have focussed on this subject in the past are featured below. These articles have served as an inspiration for the Energy Index, and may also serve as a validation of the estimated numbers.

What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Bitcoin prediction: Cryptocurrencies will 'SKY ROCKET' this year

BITCOIN and demand for other cryptocurrencies will "sky rocket" this year and could see gains of up to 60 percent, the CEO of one of the world’s largest independent financial services organisations has predicted.

GETTY

GETTY

Nigel Green, CEO of deVere Group has claimed demand for bitcoin will "skyrocket" this year

Nigel Green, CEO of deVere Group, warned bitcoin will remain highly volatile as it comes under “increasing pressure” from Ethereum and other cryptocurrencies.

Bitcoin slumped by 30 percent last week amid fears the cryptocurrency bubble could burst.

Mr Green said: “However, demand for cryptocurrencies is set to sky rocket in 2018 as more people get to know about them and use them, and as the interest of governments and businesses, and more regulation, demonstrate how the market is maturing and becoming ever-more mainstream.”

“Bitcoin will remain highly volatile over the next 12 months, which should be expected. When it recovers from its current position and if/when it climbs pass the next major resistance point, we could see it surge by 50 to 60 per cent, as many will jump in for fear of missing out for a second time.

Related articles

Everything you need to know about bitcoin

How to buy bitcoin: Everything you need to know about cryptocurrency wallets and bitcoin cash.

Bitcoin is a new kind of money [Getty Images]

“As in all markets, this expected volatility is creating, and will continue to create, important buying opportunities.”

Mr Green, who today launched the cryptocurrency app deVere Crypto to store and transfer the digital tokens, warned bitcoin will come under pressure from its rival ethereum.

He said: “Bitcoin will come under increasing pressure from other cryptocurrencies in 2018, as the rivals up their game and as the similarities and differences become better known.

“Ethereum will put the squeeze on Bitcoin the hardest, with many analysts saying Ethereum is supported by superior technology and has more uses than the current dominant leader.

“In many ways, the Bitcoin vs Ethereum battle is reminiscent of the VHS vs Betamax tech format war of the 1980s. But there is room for several major players in cryptocurrencies, unlike in the video format market.”

Today bitcoin is currently priced at $7,052.34 USD (-15.76 percent) and ethereum is at $686.16 (-19.91 percent) , according to coinmarketcap at 7.08pm GMT.

Experts say it is hard to know the "true value" of cryptocurrencies with the digital tokens not used enough in day to day finance.

Nicholas Gregory, founder and CEO of CommerceBlock a company which creates decentralised financial infrastructure on public blockchains, said: “Recent prices have been down to speculation. We won't know the true value of bitcoin till its used more in day to day finance. The community will hold their coins through out this, weak hands and speculators with for sure leave.

"This is just the beginning in its long journey. Its still the first truly global decentralised currency.”

Przemek Skwirczynski, an associate at The ICO Rocket, said: “The price fluctuations are in response to the news of some bigger economies disallowing the trading in this cryptocurrency. However, I certainly would not say the bitcoin is dead, given it, along with other cryptocurrencies, already has been fully legalised in a number of jurisdictions.

"You will see big price swings as particular countries declare their positions, but bear in mind there will be bad as well as good news.”

Bitcoin Vorhersage – Bitcoin Bald 1.000.000 $ Experten Vorhersagen Bitcoin Wert

Registrieren Sie sich kostenlos in unserer Akademie und lernen Sie, wie man Bitcoin macht https://cryptopportunities.club/jetztbeitreten

———————————————– bitcoin vorhersage – Discovery Metals meldet hochgradige Ergebnisse der Probenahme bei la kika Projekt Bitcoin Vorhersage 2016 com/ bitcoin vorhersage 2017 bitcoin zahlung bestätigen #1298 von Rain Tim Draper Bitcoin Vorhersage 2018 Dhs Get Bitcoin Cash price, charts, and other cryptocurrency info

bitcoin news deutsch cryptocurrency

Bitcoin Price Prediction Today, Future Price Prediction Over the Next 30 Days, Real Time Price Update, Bitcoin Faucet List, and Powerful Bitcoin Tools

Bitcoins kaufen – sofort und einfach bei bit4coin Homepage / Searching for: bitcoin kurs vorhersage

💸 bitcoin futures vorhersage – td ameritrade btc allzeithoch.

bitcoin und was experten vorhersagen bitcoin gold 2.

Bitcoin vorhersage 2017 ether coin mining https://cryptopportunities.club/jetztbeitreten Bitcoin Cash brings sound money to the world

Bitcoin Crash Februar 2018 + Telegram Gruppe Bitcoin News deutsch / Bitcoin News German Bitcoin price prediction 2018, 2019, 2020 and 2021

Bitcoins kaufen – schnell und einfach Für Dich selbst oder als Geschenk

Search Results For: bitcoin kurs vorhersage 000 $ experten vorhersagen bitcoin wert.

Bitcoin cash is a cryptocurrency is a fork of Bitcoin Classic that was created in August 2017

Bitcoin news deutsch; Bitcoin Stromverbrauch; bitcoin tv; bitcoin videos; Bitcoin-Informant; Frankenberger Barber Club; Friseur Aachen; Haus mit Bitcoin kaufen;

Bitcoin price prediction today updated

Bei Anycoin Direct können Sie ganz einfach Ihre Bitcoins kaufen durch die Methoden Sofort, Giropay oder mittels SEPA

Sie gingen zu Besuch zu unserem Portal auf der Suche nach alle verschiedenen für bitcoin kurs vorhersage

Real time prices

"vires in numeris."

Receive all Bitcoinist news in Telegram!

Bitcoin ETF Approval Odds Improve to 50/50 as Decision Nears

The hottest topic in the Bitcoin space in 2017 is if Wall Street will get in the game through a Bitcoin ETF. As this decision is now just one week away, the odds of acceptance have shifted more in its favor than ever before.

Bitcoin ETF Odds Highest Ever

Over the last couple of months, since this decision timetable became public knowledge, the odds have been long against the ETF, brought forth by the Winklevoss Twins three years ago, gaining Securities Exchange Commission approval.

Odds have consistently been rated at 25% or less.

However, now that you can vote on these odds, things have improved, and have also been supported by investment analysts to be better than ever. Bloomberg Intelligence’s Eric Balchunas discussed the potentially historic event on Friday with Julie Hyman on “Bloomberg Markets” and provided the following intel.

It’s huge! When a market opens up, like when GLD did for Gold, it means a portal that anybody […] because getting Bitcoin isn’t that easy for the average person. Look, it’s just interesting. Bitcoin is this hot new currency, there’s a lot of media around it. The odds for and against are so evenly matched.

Conventional wisdom states that the SEC will not adjust with the times and will look for reasons not to accept a new Bitcoin ETF.

The fact of the matter is there are two other ETFs waiting for approval behind The Winklevoss Twins entry, so its a matter of when, not if, an ETF is coming for Bitcoin.

Why the Betting Odds are Legit

The Twins also made a slight adjustment to the filing, creating a buzz that they are far closer to approval than many once thought – or else why make the tweak? Balchunas details why he believes it is a 50/50 chance.

There’s possible regulation, it’s not that liquid, security issues, but then, on the reasons for, you know, ETFs have this long history of opening up these (new) markets. A great example of an ETF that was approved by the SEC is ASHR, the China A-shares. That was approved before any U.S. firms had a quota. It was an overnight market. It would definitely have a liquidity issue. That did fine.

Additionally, the BitMex Bitcoin ETF prediction market currently has the odds of approval at 52%.

Strangely, the March 11th date has been thrown around for the approval date, but that falls on a Saturday, and Balchunas states that the approval could come before that. Therefore the decision may come before the eleventh, on Friday (March 10th), or Monday (March 13th), the next business day.

It has been estimated that at least $300 million USD in liquidity would flood the market in the first week of approval. Many speculators could be pumping up the market right now, and pull their funds at the end of the week, protecting themselves if the SEC does not approve the Bitcoin ETF.

[Bitcoinist details how you can play the market to profit from either decision here.]

Either way, the chronically volatile Bitcoin price is once again expected to go on a roller coaster ride, one way or another, starting this weekend.

What do you think the odds are for approval by the SEC?

Image courtesy of Reddit, BitMex, Shutterstock

Massive Liste der Bitcoin-Affiliate-Programme

Wir haben eine große Ole-Liste aller besten Bitcoin Affiliate- und Referral Programme um gerundet. Wenn Sie diese Leute einen zahlenden Kunde über die Interwebs senden, und sie Sie einen Kickback werfen, bezahlt in Bitcoins.

Ich weiß nicht, dass die Hölle ein Affiliate-Programm ist? Dann nehmen Sie einen Blick auf die How It Works Abschnitt unten und gerade fertig.

Wenn Sie in anderen Bitcoin-Affiliate-Programme eingeweiht sind, die hier nicht aufgeführt sind geben Sie mir Bescheid und ich werden sie schneller als ein Kokoskohlen bis Jack rabbit auf einem Backblech heiß, fettig.

- $10 für jede Anmeldung

- Zur Mitbenutzung und VPS Empfehlungen verdienen Sie $25 – $100 pro Verkauf.

- Dedizierte Server und DDoS-Schutz verdienen Sie 50 % des 1. Monats Rechnung.

- Steigen Sie ein Partnerkonto an affiliates.bitcasino.io.

- Klicken Sie auf Tracker > erstellen Tracker um Affiliate-Link zu erhalten.

- Melden Sie sich als Spieler bei bitcasino.io, dann geben Sie Ihren Benutzernamen des Spielers auf affiliates.bitcasino.io > Kommission für Überweisungen gutgeschrieben bekommen.

- 25 % für shared Hosting-Angebote und VPS Server

- 30 % für Reseller Pläne

- 7 % für SSL-Zertifikate

- 5 % für Domain-Registrierung

- 5 % für dedizierte Server

Wie es funktioniert

Bitcoin-Affiliate-Programme sind eine gute Möglichkeit, passives Einkommen zu machen, wenn Sie ausführen oder eine Website (oder etwas anderes im Web, die Besucher bekommt) beteiligt sind. Dienste, die ausgeführt, dass Bitcoin-Affiliate-Programme werden Sie in Bitcoins Zahlen, wenn Sie sie senden zahlende Kunden. Es funktioniert wie folgt:

Sie melden Sie sich für den Dienst-Affiliate-Programm und geben ihnen Ihre Bitcoin-Adresse (damit sie Sie bezahlen können).

Der Dienst bietet Ihnen einen eindeutigen Empfehlungslink-URL, der auf ihre Website verweist.

Sie buchen die URL auf Ihrer eigenen Website, Facebook, ein Forum-Signatur, tweet es, was auch immer.

Jemand Ihren Referral-Link klickt, und dann macht einen Kauf auf der Service-Seite.

Der Dienst erkennt, dass Sie sie, dass es die Kunden schickte, und Sie eine Provision auf den Kauf erhalten. Das bedeutet, dass Sie durch den Service, in Bitcoins bezahlt werden!

Je mehr Menschen, auf die Ihr Link Klicken desto höher ist die Wahrscheinlichkeit, dass Sie anständiges Geld machen werde. Was bedeutet, dass immer eine ganze Menge des Internet-Verkehrs der wesentliche Teil zu machen jede Art von Geld mit Affiliate-Programmen ist.

Комментариев нет:

Отправить комментарий