Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

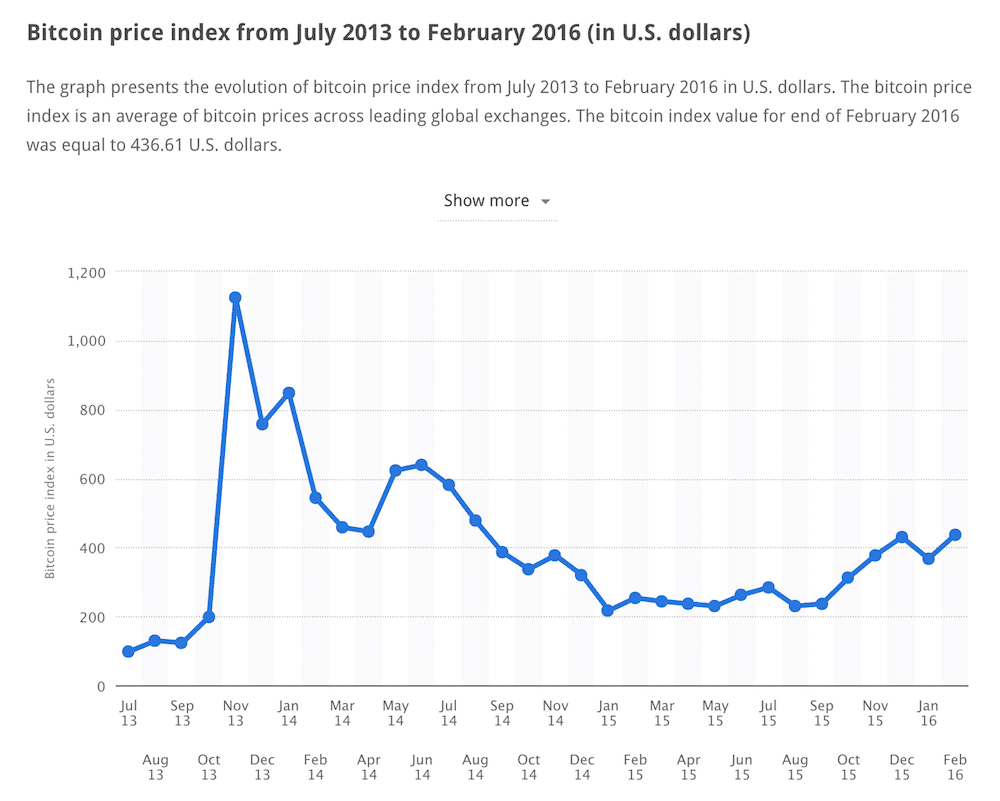

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

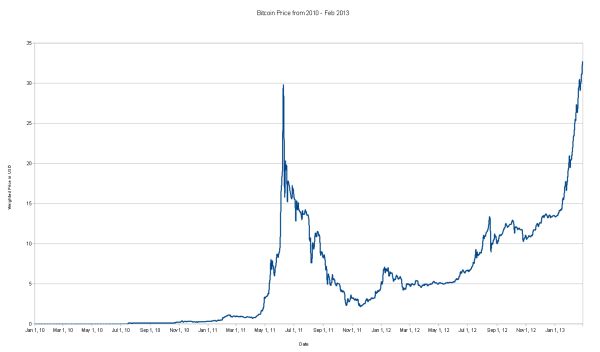

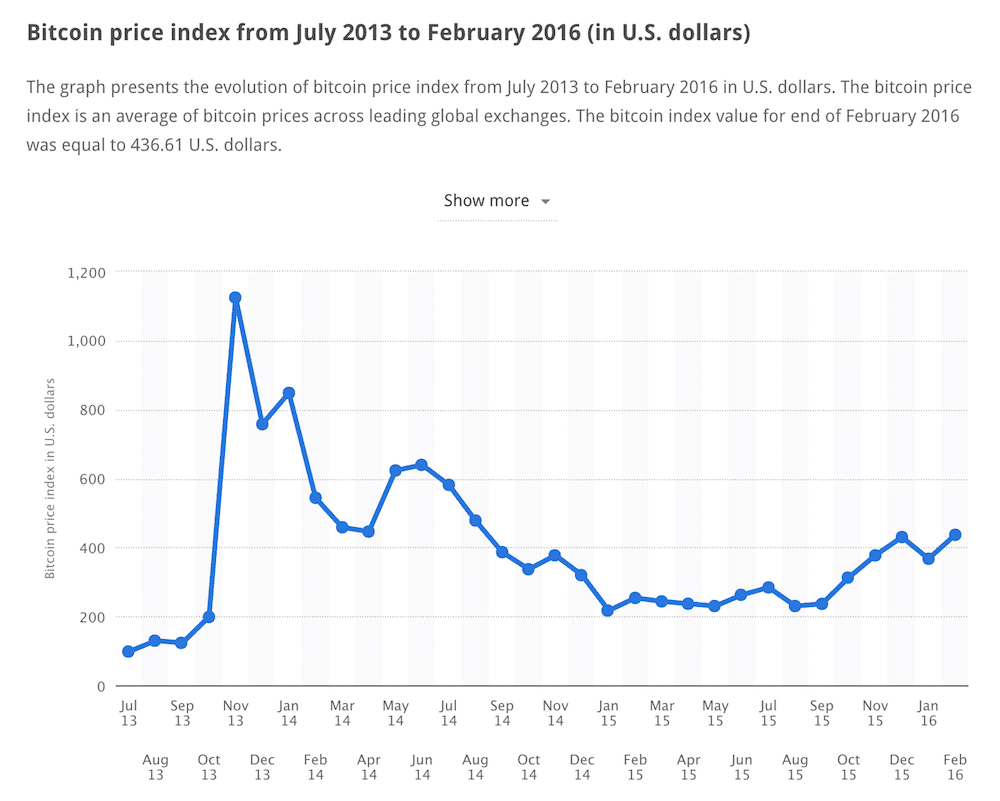

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Simple Bitcoin Converter

Exchange rate calculated using USD Bitcoin price.

This site allows you to:

- See the Bitcoin exchange rate i.e. the current value of one bitcoin.

- Convert any amount to or from your preferred currency.

Bitcoin is a digital currency. You can use Bitcoin to send money to anyone via the Internet with no middleman. Learn more here.

Keep an eye on the Bitcoin price, even while browsing in other tabs. Simply keep this site open and see the live Bitcoin price in the browser tab. (Note: Some mobile browsers don’t yet support this feature.)

See how many bitcoins you can buy. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left.

See the value of your Bitcoin holdings. Enter the number of bitcoins you have, and watch their value fluctuate over time.

Compare Bitcoin to gold and other precious metals by checking out the converters for Bitcoin to gold, Bitcoin to silver, Bitcoin to platinum, and Bitcoin to palladium.

Try it on your phone or tablet—this site is designed with mobile devices in mind.

Convert in terms of smaller units e.g. microbitcoins (µ), millibitcoins (m). Toggle using keyboard shortcuts: 'u', 'm', and 'k'.

Bookmark your preferred currency e.g. Bitcoin to Euro, or Bitcoin to British Pound. This site currently supports 64 currencies.

Price data is continually gathered from multiple markets. A weighted average price of these markets is shown by default (based on 24-hour trade volume). Alternatively, you can choose a specific source from the settings menu.

Development

- Linkable (i.e. bookmarkable, shareable) amounts.

- A widget to be embedded on other sites.

- Options added for millibitcoins, and 3 new cryptocurrencies. 2014-03-16

- Volume-weighted pricing implemented as the default option. 2013-11-29

- Multiple data source options included. Currency chooser improved. 08-16

- Major Android-related bugs fixed. (Thanks to those who donated!) 07-07

You’re welcome to contact the creator of this site at Reddit or BitcoinTalk. Bug reports are greatly appreciated.

Disclaimer

The exchange rates on this site are for information purposes only. They are not guaranteed to be accurate, and are subject to change without notice.

Bitcoin worth

Still have a question? Ask your own!

Original question: How much will 1 bitcoin be worth in 2026/27?

I don’t really know it, and I’m sure no-one knows it, but chances are that it can be worth $1 trillion. But I’ll explain it at the end of this post.

Now, imagine that you are Nokia in 2000 and produce this:

…also, there is no other competitor that can compare to you in terms of market share, product quality, demand, feedback, etc. In other words, you are the greatest company in the world in your specific niche. Now, you reach this point:

So, considering the fact that your share price costs over $50, how do you think: How much would one Nokia share be worth in 2010? - $100? $200? $500?

None of that - check here:

It was under $13 per share. Today, it is less than $6 I guess.

How comes that? Would people at that time spend $50 for a stock that the very next year would fall under $15? No! So why were they ready to spend $50 per stock anyway?

Because they didn’t know what was coming.

No one knows the future, so making a confident prediction of this kind is not that smart. Well, making a prediction is smart, but a confident one - saying that you know X or Y for sure - doesn’t inspire common sense at all.

However, if you still want a prediction, check this:

In 2026/2027, Bitcoin price can be in these ranges:

- $0–10 - because maybe a completely new and game-changing cryptocurrency takes the leading position. Its blockchain makes the one behind Bitcoin look outdated, while big institutions make the move to the new system. Bitcoin still costs a few dollars because some people are nostalgic and keep it. Maybe a new global currency is officially implemented by the UN or by a new global government.

- $10-$100 - the same reason + a bit inflation in US dollar.

- $100-$1000 - Bitcoin is a cryptocurrency of choice, but loses dominance against Ethereum or some other coin. It’s still in the top 10 or 20.

- $1000 - $10,000 - Bitcoin is doing OK along with other blockchain-based ecosystems.

- $10,000 - $1000,000 - Bitcoin is the leading coin that is regarded as a safe-haven against vulnerable fiat money.

…oh, and it can be this way:

Don’t believe that Bitcoin has this potential to reach $1 trillion? Well, if Bitcoin can’t, then the US dollar can. Hyperinflation is very possible in theory, because the USD is a world reserve currency, and if it loses demand (OPEC selling oil for other currencies - just one example), then people would surely lose confidence and it would devalue.

Hyperinflation already happened in Zimbabwe for example (because of war spending). How about this kind of money?

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Is Bitcoin Mining Worth It?

Last updated on February 26th, 2018 at 03:22 pm

Bitcoin mining has received a lot of attention lately. Since Ghash suspended it’s cloud mining operation, many people have been asking a couple of very simple, but important, questions: Is Bitcoin Mining worth it? Is it possible to profitably mine bitcoins? Well the answer is complicated, and mining bitcoins can be a great financial choice…or lead to financial ruin. Bitcoin mining has a complicated history, but we can learn much from looking at what has happened over the past few years.

What Made Bitcoin Mining Worthwhile Before?

Mining bitcoins has been a very profitable venture for a very long time. While many people who tried Bitcoin mining failed to profit, didn’t receive their mining rigs due to fraudulent or inept companies, or barely reached a positive ROI on their Bitcoin mining attempts, that was not true for the more experienced miners. Those who had successfully optimized GPUs, or aquired FPGAs in 2012 and early 2013, as well as those that were able to obtain early ASICs, or were lucky enough to “bet” on the right Bitcoin mining hardware company for the following generations of ASICs have made incredible profit.

However, the business of Bitcoin mining experienced a fundamental shift between when GPUs / FPGAs were the norm, and the rise of ASICs bitcoin mining hardware. These ASICs completely changed the game by increasing the efficiency of mining bitcoins by many orders of magnitude, and completely destroyed the profitability of mining with a traditional computer.

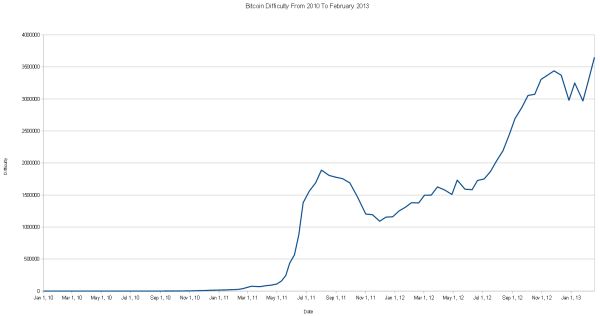

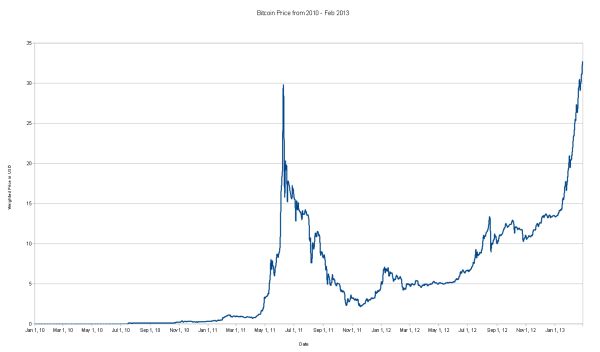

Why Mining Bitcoins With GPUs Was Worth It Until 2013

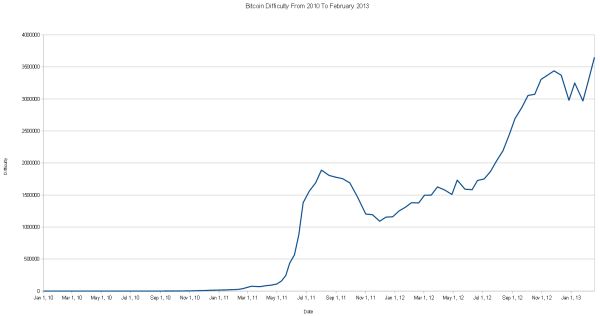

Before the ASICs, Bitcoin mining was worth it simply because the difficulty stayed quite close to Bitcoin’s price. This was true for a few reasons:

- Many Bitcoin miners were only mining part-time, and were simply using GPUs that they already had purchased for gaming to mine when they were not using their computer. This completely removed the equipment cost from the ROI equation, as the ability to effectively mine bitcoins was just a benefit of having a decent gaming computer. Of course, mining at a high intensity had the potential to burn GPUs out, but smart part-time miners would only mine when the difficulty / price really made it worthwhile. Also, these individuals would alter their system settings, as well as the settings for the Bitcoin mining software, to lower the stress placed on their hardware, as well as increase their power efficiency.

- At that time, there were very few huge Bitcoin mining farms. The average miner was not competing with datacenters full of machines…they were competing with one another. This meant that individuals who lived in areas with low kWh (kilowatt-hour) prices could easily mine enough bitcoins to cover any additional power costs, and even those in areas with average – slightly above average electricity costs could profit from mining if they had an efficient setup.

- A large portion of the mining community, at that time, were not mining for profit alone. They were mining to support the Bitcoin network, and/or to obtain BTC that was “clean” and truly anonymous (as long as the were taking certain security measures).

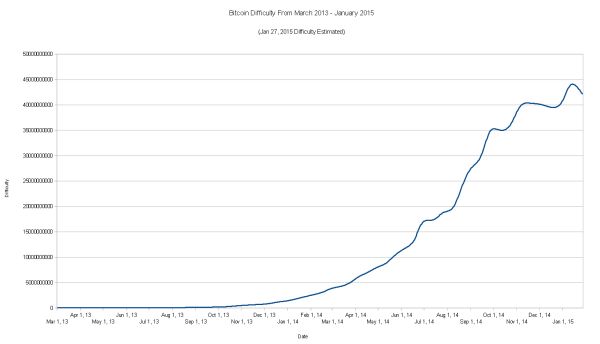

The relationship between difficulty

was not perfect, but mining difficulty generally followed a pattern similar to the Bitcoin to USD exchange rate. FPGAs began to skew this slightly in 2012, then ASICs shattered it completely.

Bitcoin ASICs Killed GPU Mining Profitability

My Batch 2 Avalon ASIC is Literally Collecting Dust at This Point…

In early 2013, Jeff Garzik received the first Bitcoin mining ASIC, produced by Avalon. While one other company may have produced a functional BTC mining ASIC around the same time, Avalon was the first to develop, manufacture, and sell these incredible mining rigs to the public. His review of the Avalon ASIC confirmed that not only was Bitcoin mining worth it, but could be incredibly profitable. His comments on it’s mining power, and how many bitcoins it mined, are eye opening:

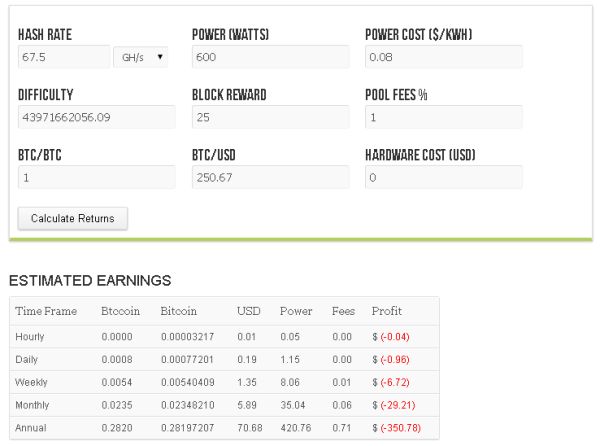

Performance is much higher than announced. 60 Ghps was announced. The unit’s cgminer self-reports 67.5 Ghps.

After 20 hours of mining, the unconfirmed + confirmed rewards equal 14.98832170 BTC.

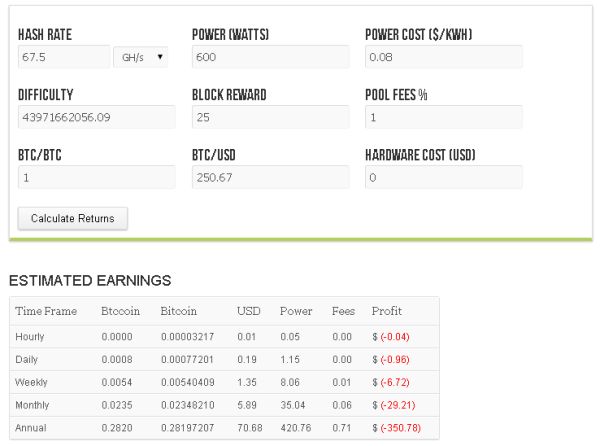

This Bitcoin miner was mining over 15 BTC per day! Of course, for anyone involved with mining today, 67.5 GH/s seems like nothing. Today, one would be lucky to get 0.0007 BTC per day with that hashrate, according to our Bitcoin mining calculator, and the fact that it used over 600 watts of power, makes operating the machine a losing proposition. In fact, by the time most of the pre-orders were shipped, the machines were barely profitable. I did make a small amount of profit with my batch 2 Avalon ASIC, which I had managed to get up to almost 80 GH/s, but not very much.

However, at that time, the top end GPUs were only capable of mining at a rate of 500 MH/s – 1 GH/s (with 1 GH/s requiring perfect conditions and incredible optimization), and often consumed 200-400 watts of power when mining bitcoins.

BFL FPGA miniRig (Courtesy of Tom’s Hardware)

Though, to be fair, Butterfly Labs had successfully produced their first Bitcoin mining “miniRig” in mid 2012, which utilized 18 boards, with 2 45nm FPGAs on each board, and was capable of mining at

25 GH/s while consuming

For those of you that did not know why Butterfly Labs was so trusted by the Bitcoin community, or did not understand why so many people were willing to pre-order their ASICs, this is why. The first miniRig was exceptionally successful, and the powerhouse of the pre-ASIC period.

Still, Avalon’s first ASIC, which was based on ancient 110 nm architecture, managed to mine at over twice the miniRig’s rate, for around half of the power consumption, and was sold at a fraction of the cost of the miniRig. These machines started a revolution in mining that resulted in the Bitcoin network containing a level of processing power that has never been reached before in human history.

Is Bitcoin Mining Worth It In 2018?

Yes and no, depending on your situation. The emergence of ASICs created an arms race that made investing in Bitcoin mining machines more volatile, and risky, than Bitcoin itself. As Bitcoin ASICs began with the 110 nm Avalons, which was architecture available in traditional CPUs in the early 2000s, many companies sprung up to work toward out the next generation, with hopes of eventually reaching “state-of-the-art”, which is

22 nm at the moment.

To date, I do not know of any commercially available ASICs with

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

How to Determine Potential Bitcoin Mining Profitability

So, that brings us back to the central question of this article. Is Bitcoin mining truly worth it? The best way to answer this would be to start out with a Bitcoin mining calculator like this one:

Over the past year and a half, I would have advised against it, and said no. It did have the potential to be profitable, but it was too much of a gamble. However, with the availability of 28 nm ASICs, as well as 45 nm ASICs that can be modified to reach nearly the same efficiency as the 28 nms, and the fact that Bitcoin’s difficulty seems to be stabilizing, then Bitcoin mining may be worth it for you. I say “may” because it truly depends on a few factors:

- As has always been true, your personal cost of electricity is extremely important. However, this is not nearly as important as it was while Bitcoin mining ASICs were experiencing incredibly fast leaps in efficiency. Now, with a bit of work, and a decently priced machine, even people with average electricity costs can mine bitcoins profitably. Of course, those of you that live in areas where electricity is expensive are out of luck, unless you have access to industrial electricity (which is generally cheaper) or a way to access “free” electricity (legally, of course).

- Because so many people were burned by a combination of price drops, exponential increases in difficulty, the speed at which Bitcoin ASICs evolved, or delayed delivery of machines, there are an abundance of used 45 and 28 nm ASICs available for sale. Amazon and ebay have a large selection of miners.

The people selling these may live in an area where Bitcoin mining isn’t worth it, for whatever reason, or they may just be tired of it after the roller coaster they have been on for so long. Others may be just trying to hedge their bets, and break even on their investment through a combination of the bitcoins they mined and revenue from the sale. Whatever the reasoning, do your homework on the efficiency of the various machines that are available, look into how to lower the voltage for the different machines that are available (especially the 45 nm machines), and do the math on how long you would need to mine to obtain enough bitcoins (at today’s prices) to break even.Your calculations should include potential increases in difficulty, but at this point, increases in difficulty will likely be more closely aligned with the Bitcoin to USD exchange rate, rather than breakthroughs in technology. Is short, use a Bitcoin mining calculator. - Examine any potential ways you could utilize renewable energy. There are many small commercial/residential solar, wind, and hydroelectric energy sources that have become surprisingly affordable. This will not be viable for everyone, but if you live in a generally windy area, a sunnier-than-average area(especially places with intense sunlight), or own/have access to constantly moving water (even if it is quite shallow), you may have the ability to build an off-the-grid Bitcoin mining farm that costs very little to run.

- If you live in a cold region, then you have two amazing options:-Setup miners in a room that is isolated from where you live (either an insulated room with no/closed vents) and pipe the cold air directly into the machines. This will increase the efficiency of the machines, as processors run more efficiently at cooler temperatures. This can either be combined with undervolting (for extreme efficiency), or go the other direction by overclocking your machines, increasing the intensity in the Bitcoin mining software, etc. All of this will allow the machine to mine with a hashrate significantly higher than the advertised rate. If done correctly, this also increases efficiency, as it can run at the increased rate, but the power usage will increase at a proportionally smaller rate. If isolating the machines is not an option, then remember that energy is not lost, nor destroyed.

- If you live in a cold area, and use electric heating, then the question of “Is Bitcoin Mining worth it?” is a resounding YES! 1 kWh = 3412 BTU and it does not matter if that energy is being converted via a central heating unit, a space heater, or a computer…the heating is the same (this was actually tested with a gaming PC vs a space heater). Of course, a Bitcoin miner is not built to evenly distribute that heat, so this may not be extremely noticeable if you have one machine in your entire home, but it will have an effect. Better yet, a few machines, spread throughout a house should, in theory, have the ability to replace a central heating unit…or at least significantly reduce the amount of time it needs to be on.If you use gas heating, or some other form of heating, for your home, then the worth of using Bitcoin miners for heating is not as clear. They certainly will be useful, as they are still putting out heat based on their power consumption, but you will need to do a bit more math. An easy way to do this would be to find out the cost per 3412 BTUs for your primary heating source. As that is equivalent to the heating output of 1 kWh, then you can subtract that cost from your local cost per kWh of electricity. The result will be your true cost per kWh for running your Bitcoin miners.

- In warmer areas, this is reversed:-Your BTC miners may end up requiring more power than just the amount consumed by the mining rigs themselves. If it is warm enough for your air conditioner to be running, then it must counteract the heat put out by your machines. This could be the difference in Bitcoin mining being worth it for you to invest time, and money, into, or not. In fact, this is the reason that I personally stopped running my Avalon ASIC while it was still technically mining enough bitcoins to cover it’s own power costs. When cooling costs were added in, it was no longer profitable. Again, there are solutions to this that could change the worthiness of Bitcoin mining for you. Liquid cooling, along with isolating your machines in a room that removes, or minimizes, the impact on the rest of your home. Also, instead of piping outside air into your machines, it may be worthwhile to flip that around, and pump the exhaust air from your miners out of your home.

Bitcoin’s Price Does Impact Bitcoin Mining’s Worth

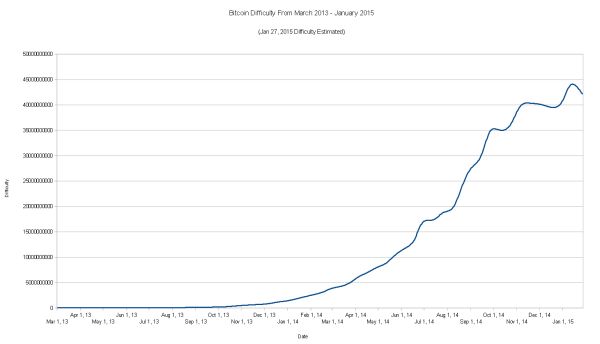

While the Bitcoin mining difficulty is now more likely to fall into a closer relationship with Bitcoin’s price, the link doesn’t guarantee stability. As long as the link between Bitcoin’s price and the total mining power of the network remain close, then changes in the value of Bitcoin would only effect those that are are barely profitable already, and would do little to change the worthiness of mining. This is because miners would be receiving more bitcoins for their hashing power when price and difficulty decline, but less bitcoins as price and difficulty increase. This chart is continuing where the difficulty chart at the start of the article left off, and includes a projected difficulty decrease on January 17. From March 2013 on, the mining difficulty increased exponentially. The last few months seem to have leveled out:

However, it could get out of sync once again.

A breakthrough in ASIC technology is unlikely in the near future, but certainly possible. That would create a new jump in difficulty, and render older ASICs less valuable, as Bitcoin’s price should not be impacted very much. Also, as difficulty is only adjusted every 2016 blocks, sharp declines in Bitcoin’s price can make it so that mining is not very cost effective until the difficulty adjusts.

A sharp enough Bitcoin price drop could, effectively, cause enough miners to be turned off that it takes a very long time to mine enough blocks to reach the difficulty change. Of course, this scenario would also result in a sharp drop in difficulty when the 2016th block is finally mined, instantly increasing the value of mining power…but, until that point is reached, the Bitcoin network could become quite unreliable and chaotic.

Still, outside of these scenarios, difficulty should continue to stabilize, and somewhat follow Bitcoin’s price. This means that yes, Bitcoin mining is worth it in many cases. However, whether it is worth it to you is something that only you can decide. Just remember, if you are considering becoming a Bitcoin miner, work through the math before you invest.

Bitcoin Charts

Bitcoincharts provides financial and technical data related to the Bitcoin network.

Bitcoin News

29 Nov 2017 Bitcoin tops $10,000 milestone

By breaking the $10,000 mark the value of Bitcoin increased tenfold since the beginning of the year.

14 Aug 2017 Bitcoin price climbs over $4,000

Since the beginning of the year the bitcoin price quadrupled. For the first time it reached a value over $4,000.

12 Jun 2017 Bitcoin reaches new all-time high: $3,000

After reaching the all-time high of $ 2,000 at end of May 2017, Bitcoin now passed the next milestone.

11 Apr 2017 Russia’s Finance Ministry: Cryptocurrencies may be recognized in 2018

Russia could accept Bitcoin and other cryptocurrencies as legitimate payment method in the next year. By doing this they hope to advance in the fight against money laundering.

29 Mar 2017 CRYENGINE now accepts Bitcoin

The popular video game engine itself remains free of charge, but CRYENGINE now accepts donations in bitcoins to support ongoing development. They also announced plans to extend the Bitcoin payment to the CRYENGINE Marketplace.

26 Nov 2016 Consulting firm EY Switzerland accepts Bitcoin

EY Switzerland (formerly Ernst & Young) may be the first advisory firm that allows its customers to settle their bills with Bitcoins.

29 Apr 2016 Steam accepts Bitcoin

Valves Steam Platform cooperates with Bitpay to allow its customers to buy games with Bitcoins

18 Dec 2014 Major Magazine Publisher to Accept Bitcoin Payments

Time Inc., publisher of e. g. for People, Sports Illustrated, InStyle and Time, now accepts bitcoin as a payment.

Is Bitcoin Mining Worth It?

Last updated on February 26th, 2018 at 03:22 pm

Bitcoin mining has received a lot of attention lately. Since Ghash suspended it’s cloud mining operation, many people have been asking a couple of very simple, but important, questions: Is Bitcoin Mining worth it? Is it possible to profitably mine bitcoins? Well the answer is complicated, and mining bitcoins can be a great financial choice…or lead to financial ruin. Bitcoin mining has a complicated history, but we can learn much from looking at what has happened over the past few years.

What Made Bitcoin Mining Worthwhile Before?

Mining bitcoins has been a very profitable venture for a very long time. While many people who tried Bitcoin mining failed to profit, didn’t receive their mining rigs due to fraudulent or inept companies, or barely reached a positive ROI on their Bitcoin mining attempts, that was not true for the more experienced miners. Those who had successfully optimized GPUs, or aquired FPGAs in 2012 and early 2013, as well as those that were able to obtain early ASICs, or were lucky enough to “bet” on the right Bitcoin mining hardware company for the following generations of ASICs have made incredible profit.

However, the business of Bitcoin mining experienced a fundamental shift between when GPUs / FPGAs were the norm, and the rise of ASICs bitcoin mining hardware. These ASICs completely changed the game by increasing the efficiency of mining bitcoins by many orders of magnitude, and completely destroyed the profitability of mining with a traditional computer.

Why Mining Bitcoins With GPUs Was Worth It Until 2013

Before the ASICs, Bitcoin mining was worth it simply because the difficulty stayed quite close to Bitcoin’s price. This was true for a few reasons:

- Many Bitcoin miners were only mining part-time, and were simply using GPUs that they already had purchased for gaming to mine when they were not using their computer. This completely removed the equipment cost from the ROI equation, as the ability to effectively mine bitcoins was just a benefit of having a decent gaming computer. Of course, mining at a high intensity had the potential to burn GPUs out, but smart part-time miners would only mine when the difficulty / price really made it worthwhile. Also, these individuals would alter their system settings, as well as the settings for the Bitcoin mining software, to lower the stress placed on their hardware, as well as increase their power efficiency.

- At that time, there were very few huge Bitcoin mining farms. The average miner was not competing with datacenters full of machines…they were competing with one another. This meant that individuals who lived in areas with low kWh (kilowatt-hour) prices could easily mine enough bitcoins to cover any additional power costs, and even those in areas with average – slightly above average electricity costs could profit from mining if they had an efficient setup.

- A large portion of the mining community, at that time, were not mining for profit alone. They were mining to support the Bitcoin network, and/or to obtain BTC that was “clean” and truly anonymous (as long as the were taking certain security measures).

The relationship between difficulty

was not perfect, but mining difficulty generally followed a pattern similar to the Bitcoin to USD exchange rate. FPGAs began to skew this slightly in 2012, then ASICs shattered it completely.

Bitcoin ASICs Killed GPU Mining Profitability

My Batch 2 Avalon ASIC is Literally Collecting Dust at This Point…

In early 2013, Jeff Garzik received the first Bitcoin mining ASIC, produced by Avalon. While one other company may have produced a functional BTC mining ASIC around the same time, Avalon was the first to develop, manufacture, and sell these incredible mining rigs to the public. His review of the Avalon ASIC confirmed that not only was Bitcoin mining worth it, but could be incredibly profitable. His comments on it’s mining power, and how many bitcoins it mined, are eye opening:

Performance is much higher than announced. 60 Ghps was announced. The unit’s cgminer self-reports 67.5 Ghps.

After 20 hours of mining, the unconfirmed + confirmed rewards equal 14.98832170 BTC.

This Bitcoin miner was mining over 15 BTC per day! Of course, for anyone involved with mining today, 67.5 GH/s seems like nothing. Today, one would be lucky to get 0.0007 BTC per day with that hashrate, according to our Bitcoin mining calculator, and the fact that it used over 600 watts of power, makes operating the machine a losing proposition. In fact, by the time most of the pre-orders were shipped, the machines were barely profitable. I did make a small amount of profit with my batch 2 Avalon ASIC, which I had managed to get up to almost 80 GH/s, but not very much.

However, at that time, the top end GPUs were only capable of mining at a rate of 500 MH/s – 1 GH/s (with 1 GH/s requiring perfect conditions and incredible optimization), and often consumed 200-400 watts of power when mining bitcoins.

BFL FPGA miniRig (Courtesy of Tom’s Hardware)

Though, to be fair, Butterfly Labs had successfully produced their first Bitcoin mining “miniRig” in mid 2012, which utilized 18 boards, with 2 45nm FPGAs on each board, and was capable of mining at

25 GH/s while consuming

For those of you that did not know why Butterfly Labs was so trusted by the Bitcoin community, or did not understand why so many people were willing to pre-order their ASICs, this is why. The first miniRig was exceptionally successful, and the powerhouse of the pre-ASIC period.

Still, Avalon’s first ASIC, which was based on ancient 110 nm architecture, managed to mine at over twice the miniRig’s rate, for around half of the power consumption, and was sold at a fraction of the cost of the miniRig. These machines started a revolution in mining that resulted in the Bitcoin network containing a level of processing power that has never been reached before in human history.

Is Bitcoin Mining Worth It In 2018?

Yes and no, depending on your situation. The emergence of ASICs created an arms race that made investing in Bitcoin mining machines more volatile, and risky, than Bitcoin itself. As Bitcoin ASICs began with the 110 nm Avalons, which was architecture available in traditional CPUs in the early 2000s, many companies sprung up to work toward out the next generation, with hopes of eventually reaching “state-of-the-art”, which is

22 nm at the moment.

To date, I do not know of any commercially available ASICs with

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

How to Determine Potential Bitcoin Mining Profitability

So, that brings us back to the central question of this article. Is Bitcoin mining truly worth it? The best way to answer this would be to start out with a Bitcoin mining calculator like this one:

Over the past year and a half, I would have advised against it, and said no. It did have the potential to be profitable, but it was too much of a gamble. However, with the availability of 28 nm ASICs, as well as 45 nm ASICs that can be modified to reach nearly the same efficiency as the 28 nms, and the fact that Bitcoin’s difficulty seems to be stabilizing, then Bitcoin mining may be worth it for you. I say “may” because it truly depends on a few factors:

- As has always been true, your personal cost of electricity is extremely important. However, this is not nearly as important as it was while Bitcoin mining ASICs were experiencing incredibly fast leaps in efficiency. Now, with a bit of work, and a decently priced machine, even people with average electricity costs can mine bitcoins profitably. Of course, those of you that live in areas where electricity is expensive are out of luck, unless you have access to industrial electricity (which is generally cheaper) or a way to access “free” electricity (legally, of course).

- Because so many people were burned by a combination of price drops, exponential increases in difficulty, the speed at which Bitcoin ASICs evolved, or delayed delivery of machines, there are an abundance of used 45 and 28 nm ASICs available for sale. Amazon and ebay have a large selection of miners.

The people selling these may live in an area where Bitcoin mining isn’t worth it, for whatever reason, or they may just be tired of it after the roller coaster they have been on for so long. Others may be just trying to hedge their bets, and break even on their investment through a combination of the bitcoins they mined and revenue from the sale. Whatever the reasoning, do your homework on the efficiency of the various machines that are available, look into how to lower the voltage for the different machines that are available (especially the 45 nm machines), and do the math on how long you would need to mine to obtain enough bitcoins (at today’s prices) to break even.Your calculations should include potential increases in difficulty, but at this point, increases in difficulty will likely be more closely aligned with the Bitcoin to USD exchange rate, rather than breakthroughs in technology. Is short, use a Bitcoin mining calculator. - Examine any potential ways you could utilize renewable energy. There are many small commercial/residential solar, wind, and hydroelectric energy sources that have become surprisingly affordable. This will not be viable for everyone, but if you live in a generally windy area, a sunnier-than-average area(especially places with intense sunlight), or own/have access to constantly moving water (even if it is quite shallow), you may have the ability to build an off-the-grid Bitcoin mining farm that costs very little to run.

- If you live in a cold region, then you have two amazing options:-Setup miners in a room that is isolated from where you live (either an insulated room with no/closed vents) and pipe the cold air directly into the machines. This will increase the efficiency of the machines, as processors run more efficiently at cooler temperatures. This can either be combined with undervolting (for extreme efficiency), or go the other direction by overclocking your machines, increasing the intensity in the Bitcoin mining software, etc. All of this will allow the machine to mine with a hashrate significantly higher than the advertised rate. If done correctly, this also increases efficiency, as it can run at the increased rate, but the power usage will increase at a proportionally smaller rate. If isolating the machines is not an option, then remember that energy is not lost, nor destroyed.

- If you live in a cold area, and use electric heating, then the question of “Is Bitcoin Mining worth it?” is a resounding YES! 1 kWh = 3412 BTU and it does not matter if that energy is being converted via a central heating unit, a space heater, or a computer…the heating is the same (this was actually tested with a gaming PC vs a space heater). Of course, a Bitcoin miner is not built to evenly distribute that heat, so this may not be extremely noticeable if you have one machine in your entire home, but it will have an effect. Better yet, a few machines, spread throughout a house should, in theory, have the ability to replace a central heating unit…or at least significantly reduce the amount of time it needs to be on.If you use gas heating, or some other form of heating, for your home, then the worth of using Bitcoin miners for heating is not as clear. They certainly will be useful, as they are still putting out heat based on their power consumption, but you will need to do a bit more math. An easy way to do this would be to find out the cost per 3412 BTUs for your primary heating source. As that is equivalent to the heating output of 1 kWh, then you can subtract that cost from your local cost per kWh of electricity. The result will be your true cost per kWh for running your Bitcoin miners.

- In warmer areas, this is reversed:-Your BTC miners may end up requiring more power than just the amount consumed by the mining rigs themselves. If it is warm enough for your air conditioner to be running, then it must counteract the heat put out by your machines. This could be the difference in Bitcoin mining being worth it for you to invest time, and money, into, or not. In fact, this is the reason that I personally stopped running my Avalon ASIC while it was still technically mining enough bitcoins to cover it’s own power costs. When cooling costs were added in, it was no longer profitable. Again, there are solutions to this that could change the worthiness of Bitcoin mining for you. Liquid cooling, along with isolating your machines in a room that removes, or minimizes, the impact on the rest of your home. Also, instead of piping outside air into your machines, it may be worthwhile to flip that around, and pump the exhaust air from your miners out of your home.

Bitcoin’s Price Does Impact Bitcoin Mining’s Worth

While the Bitcoin mining difficulty is now more likely to fall into a closer relationship with Bitcoin’s price, the link doesn’t guarantee stability. As long as the link between Bitcoin’s price and the total mining power of the network remain close, then changes in the value of Bitcoin would only effect those that are are barely profitable already, and would do little to change the worthiness of mining. This is because miners would be receiving more bitcoins for their hashing power when price and difficulty decline, but less bitcoins as price and difficulty increase. This chart is continuing where the difficulty chart at the start of the article left off, and includes a projected difficulty decrease on January 17. From March 2013 on, the mining difficulty increased exponentially. The last few months seem to have leveled out:

However, it could get out of sync once again.

A breakthrough in ASIC technology is unlikely in the near future, but certainly possible. That would create a new jump in difficulty, and render older ASICs less valuable, as Bitcoin’s price should not be impacted very much. Also, as difficulty is only adjusted every 2016 blocks, sharp declines in Bitcoin’s price can make it so that mining is not very cost effective until the difficulty adjusts.

A sharp enough Bitcoin price drop could, effectively, cause enough miners to be turned off that it takes a very long time to mine enough blocks to reach the difficulty change. Of course, this scenario would also result in a sharp drop in difficulty when the 2016th block is finally mined, instantly increasing the value of mining power…but, until that point is reached, the Bitcoin network could become quite unreliable and chaotic.

Still, outside of these scenarios, difficulty should continue to stabilize, and somewhat follow Bitcoin’s price. This means that yes, Bitcoin mining is worth it in many cases. However, whether it is worth it to you is something that only you can decide. Just remember, if you are considering becoming a Bitcoin miner, work through the math before you invest.

Bitcoin worth

The Bitcoin.com Composite Price Index

Unlike stocks, bitcoin markets never close. Bitcoin is traded 24 hours a day, 7 days a week, and 365 days a year in dozens of currency pairs at exchanges all over the world. Across the globe, people create buy and sell orders based on their individual valuations of bitcoin, leading to global, real-time price discovery.

While Bitcoin's price history is not without major bubbles, volatilty overall has been trending downward.

What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Комментариев нет:

Отправить комментарий