How to Buy Bitcoins with Cash or Cash Deposit

We can both agree on this:

Buying bitcoins with cash is confusing!

Luckily, today I'll show you how easy and fast it can be.

We've collected the best exchanges and listed them for you below.

Introduction

Why buy bitcoins with cash?

- It's private and usually quick

- One of the easiest ways to get bitcoins

Converting your cash to bitcoin can get you bitcoins within a couple of hours.

Buying bitcoins with cash is also private.

Many of the exchanges below do not require you to verify your identity or provide sensitive personal details.

Make sure you have a Bitcoin wallet before you buy since some of the exchanges below require one.

We suggest using the exchanges listed below or doing research before buying from any exchange.

Many exchanges are simply trying to steal your personal information (like your password).

We do research on every exchange we list and are very careful not to include scam exchanges on our site.

Cash Bitcoin Exchanges

LocalBitcoins

LocalBitcoins

It's possible to buy bitcoins with cash on LocalBitcoins via cash trade in-person or with cash deposit.

A quick step-by-step guide on how to buy bitcoins with cash on LocalBitcoins:

- Find a seller in your area who accepts cash.

- Select amount of coins and place an order.

- Receive account number from the seller.

- Deposit cash into the seller's account.

- Upload your receipt to prove you made the deposit/trade.

- Receive bitcoins! The coins will arrive in your LocalBitcoins wallet.

The above guide was meant to give you an idea on how LocalBitcoins works.

If you want more information, read our full guide on how to use LocalBitcoins.

LocalBitcoins is private and does not require any personal details or verification, although specific sellers may request this info.

Be sure to buy from sellers with previous trade history and positive feedback.

Local Bitcoins charges a flat 1% fee on each purchase.

- Can be private, fast and easy

- In-person trades require no personal information

- Purchases of bitcoin can be made quickly via cash deposit

- Beware of scams; always follow the rules!

- Harder to buy large amounts of bitcoins compared to large exchanges

- Slightly to significantly higher prices than regular exchanges; premium for higher privacy

BitQuick

BitQuick

BitQuick connects you with sellers who want cash for their bitcoins.

BitQuick is only available in the United States and works like this:

- Find a seller. Once you find a seller you agree on a price for the bitcoins.

- Make cash deposit. Go to the seller's bank and make a cash deposit into the seller's account.

- Upload receipt. Upload your receipt to the seller to prove you made the deposit.

- Receive bitcoins! The seller will release bitcoins to you.

This process can be completed at a massive number of banks across the United States.

Bitcoin purchases made with cash deposit are usually delivered within two hours, and in many cases in under an hour!

- One of the fastest ways to buy bitcoins

- More physically secure than other cash payment methods as one pays the money to a bank teller

- 2% fees for buyers are somewhat high for cash trading

- Prices vary and can be much higher (or even lower) than the current Bitcoin price

Wall of Coins

Wall of Coins

Wall of Coins is a peer-to-peer Bitcoin exchange that offers a number of payment methods.

Cash deposit, however, is the exchange's most common payment method.

There are over 100,000 deposit locations available across the United States.

Wall of Coins also supports Canada, the United Kingdom, Germany, Poland, Argentina, Latvia, Poland, and the Philippines.

After a cash deposit is made you'll usually receive your bitcoins within 15 minutes.

- Easy way to purchase bitcoins

- Fairly private way to purchase bitcoins; only your phone number is required

- Currently limited to 22 countries

- Hard to find sellers offering high volume

LibertyX Buy Bitcoin

LibertyX Buy Bitcoin

LibertyX lets you buy bitcoin with cash at a number of retail stores across the United States.

You'll have to verify your identity before buying, making LibertyX less private than some of the other options.

You can buy up to $1000 worth of bitcoin and will be charged a 1% fee on all purchases.

If you sign up with Facebook you can buy your first $1000 fee free.

Your bitcoin should arrive a few minutes after your payment is made.

- Easy and fast way to buy bitcoins with cash

- Low 1.5% (plus store fee) rate for cash purchase method

- Daily $1000 limit is fairly high for a convenience service

- Participating stores add their own variable fee

- Some verification is required which lowers the expected privacy level of cash purchase

- Attaching your Facebook account further degrades privacy

Bitcoin ATMs Buy Bitcoin

Bitcoin ATMs Buy Bitcoin

Our Bitcoin ATM map helps you find a Bitcoin ATM in your local area.

Using Bitcoin ATMs you can buy bitcoins with cash ONLY.

The average ATM charges a fee of 5-10%, but this is what people are willing to pay to buy bitcoins privately and with no verification.

There are many Bitcoin ATM manufacturates, so each ATM is different. Some require verification, although most don't.

- Our map makes it super easy to find a Bitcoin ATM near you

- Bitcoin ATMs often have 5-10% fees per purchase

Bitit Buy Bitcoin Read Review

Bitit Buy Bitcoin Read Review

Bitit is slightly different than the other options on this page. Instead of buying directly with cash, you instead need to use a voucher like Flexepin or Neosurf. The fees are about 8% for buying with Neosurf or Flexepin.

- Unique way of purchasing offers extra privacy over other methods

- 8% Neosurf fee is slightly better than Coinhouse's 10%

- Available in 50 countries

- €10,000 initial weekly Neosurf cash payment limit

- Bitcoin gift cards also available; more expensive than other options

- In-person buying methods offer more privacy but can be confusing

- Identity verification required for buying amounts over €25

- €500 initial weekly credit/debit card limit

Buy Bitcoin with Cash Exchange Comparison

Frequently Asked Questions

If you're still a bit confused, that's okay. Buying bitcoins is hard and that's why I built this site.

The FAQ section below should answer all of your remaining questions.

What are risks are involved buying bitcoins with cash?

Buying bitcoins with cash can be very low risk.

If making a trade in-person, it's best to meet in a public place to reduce the risk of scamming or theft.

If buying bitcoins with cash via cash deposit, use an escrow service (like LocalBitcoins or BitQuick) to ensure the seller must send you the bitcoins after receiving bitcoins.

What are the benefits and advantages?

It's easy to buy small amounts of bitcoin with cash.

It's also private, since no personal information is required in most cases, especially if trading in person or at an ATM with no verification.

Buying bitcoins with cash is also fast, as there is no verification to slow down the process.

What are the disadvantages?

It can be hard to buy large amounts of bitcoins with cash, especially with cash deposit.

Bitcoin ATMs also have limits and some require verification if more than a certain amount is purchased.

Do you want to buy larger amounts of bitcoins? Try buying with a bank account and you'll save on fees, too.

Why do Local Bitcoins and Bitcoin ATMs have a higher price than other exchanges?

The average buy price on Local Bitcoins and Bitcoin ATMs is usually 5-10% higher than the average global rate.

Unlike other exchanges, which require ID verification and personal information, Local Bitcoins and Bitcoin ATMs don't require any information like this.

The 5-10% premium on LocalBitcoins and at ATMs is simply the cost people are willing to pay for privacy when buying bitcoins.

Is it risky giving up my ID in order to buy?

It depends how much you trust the exchanges.

Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to.

One thing that Bitcoin exchanges have going for them is that because they are constantly under attack, they have some of the best security and protections in place to protect against the hacking of your personal info.

There is always risk with anything related to information online.

Even Yahoo was hacked and information on 1 billion accounts was stolen.

Should I leave my bitcoins on the exchange after I buy?

We really recommend storing any bitcoins you want to keep safe in a wallet you own.

Many Bitcoin exchanges have been hacked and lost customer funds. If you don't want to fall victim to these hacks then the easiest way is to store your coins in a wallet you control.

Can you sell bitcoins?

Out of the exchanges we listed, LocalBitcoins, Wall of Coins, and BitQuick all allow you to sell bitcoins for cash.

Tutorials: How You Can Buy Bitcoins with Cash

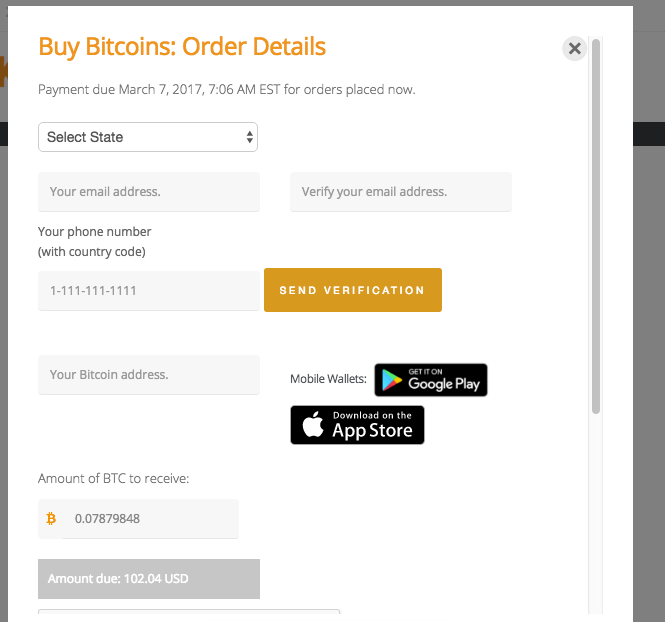

How to Use BitQuick

BitQuick is one of the best ways to buy bitcoins with cash in the United States.

It charges 2% per buy but the exchange rates are generally better than LocalBitcoins.

We will show you how to make your first purchase in the tutorial below.

You will NEED a Bitcoin wallet before you can buy from BitQuick. Don't have one? Read our guide.

Go to BitQuick

You will see the home page. Then, click "Quick Buy"

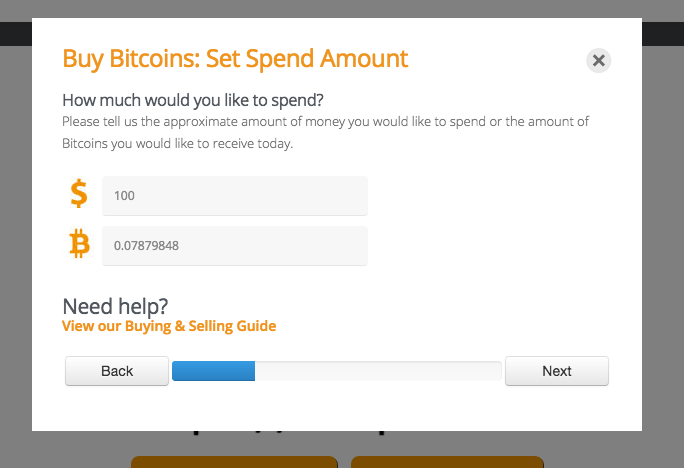

Enter the amount you want to spend. You can enter in dollars or BTC, the fields will update automatically.

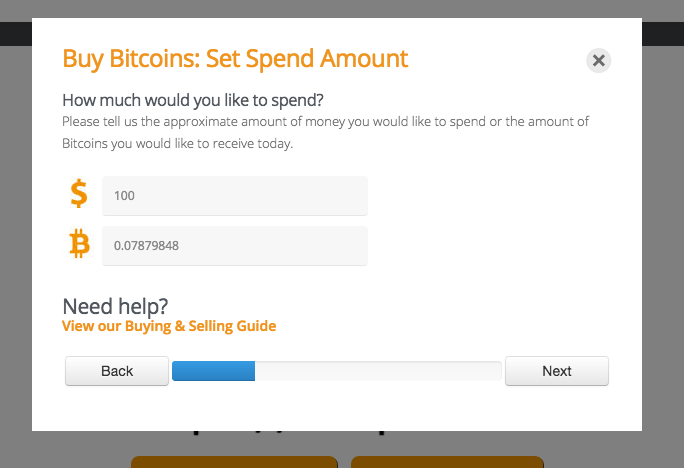

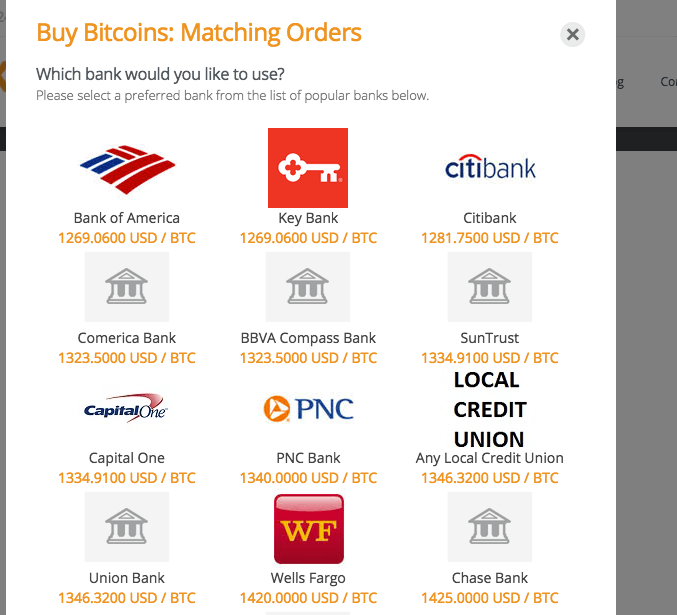

You should now see a list of banks with prices:

You can pick any bank, and banks with the lowest prices will show up first.

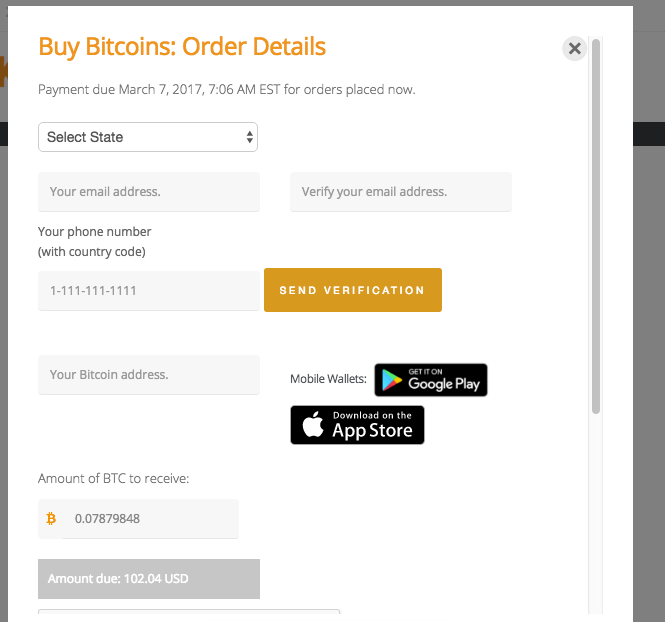

Once you picked a bank you will be required to fill in some details. This includes your email, phone number, and Bitcoin address. You can also change the amount of Bitcoin you want to receive.

Make sure you put in your phone number and press "SEND VERIFICATION". This will send a PIN code to your phone that you need to confirm.

Once you put in your details press "PLACE HOLD". This will lock in your order.

Now you will need to find a bank branch of the bank you chose in your area. Then you go into the bank, make a deposit, and save the receipt.

Go back into BitQuick and upload the receipt to the seller. This proves you made the deposit.

Bitcoins should arrive to the address you entered earlier within 3 hours!

Buy Bitcoins with Cash from Bitcoin ATMs

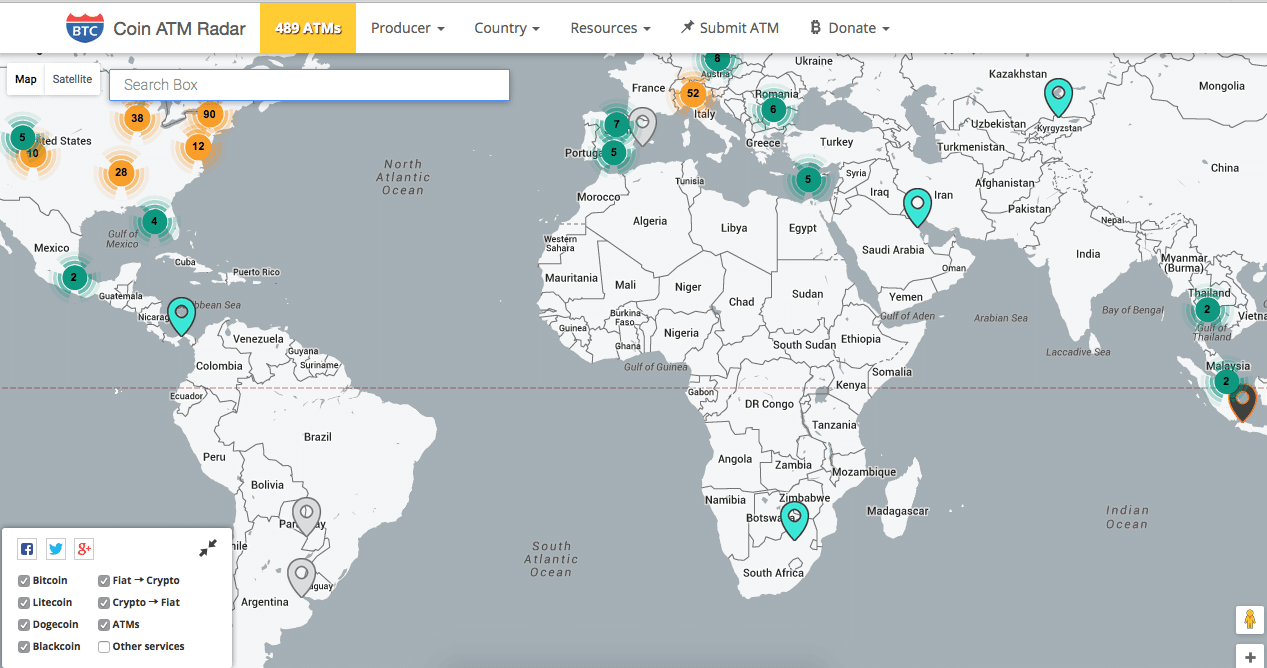

Bitcoin ATMs are another great way to purchase bitcoins with cash!

Think of a Bitcoin ATM as a cash to Bitcoin converter.

While you may have to physically drive or walk to the ATM, once you reach the ATM you can buy bitcoins instantly. You’ll need to be lucky enough to have a Bitcoin ATM in your area.

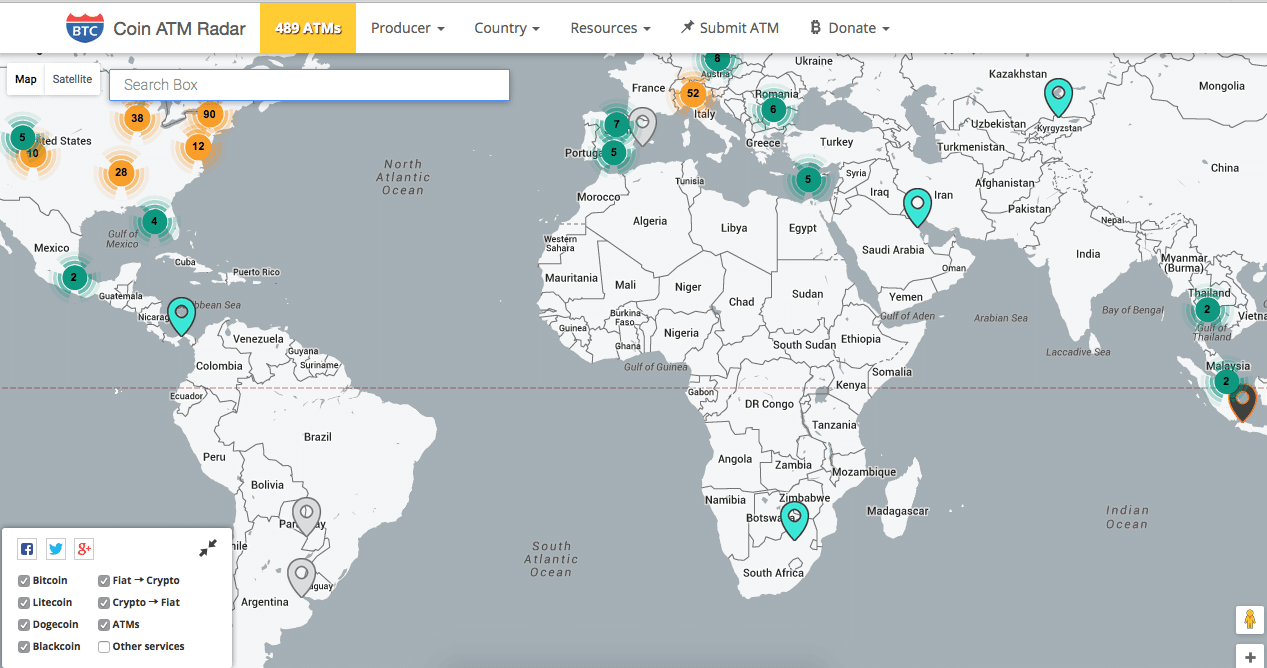

Our Bitcoin ATM map helps you find locations makes it easy to locate a Bitcoin ATM in your area.

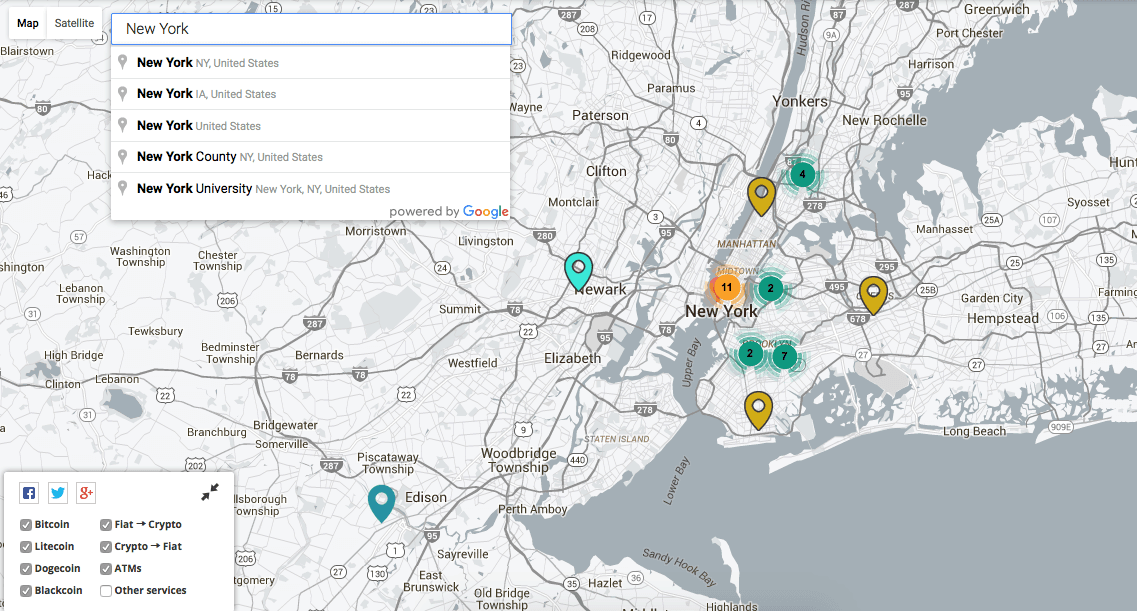

You can do the following to check if there is a Bitcoin ATM near you:

1. Go to the Bitcoin ATM Map

2. Search by Location

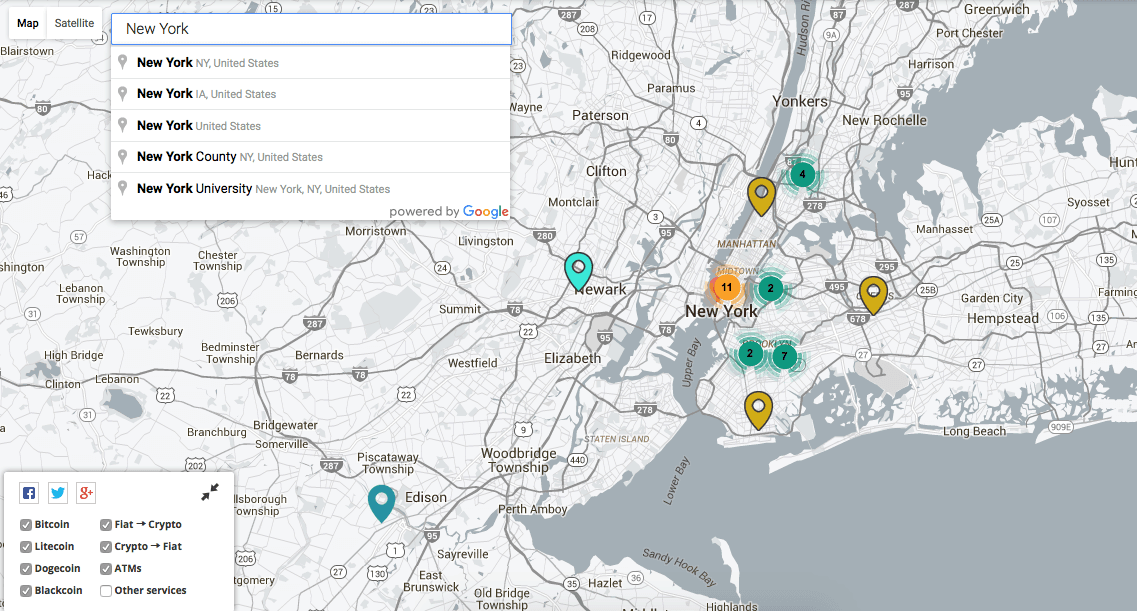

In the search box in the top left, type in the name of your country or city and click enter.

3. Find an ATM

Once you search, you’ll be taken to the location you entered on the map. If you see map pin markers, you’re in luck! That means there are Bitcoin ATMs in your area.

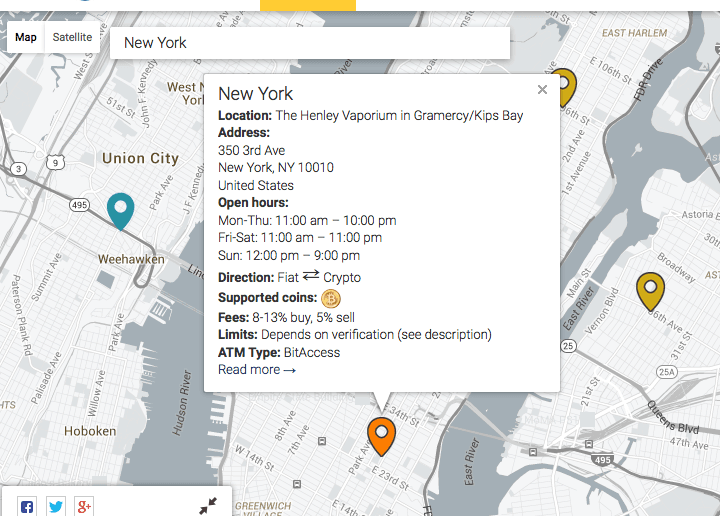

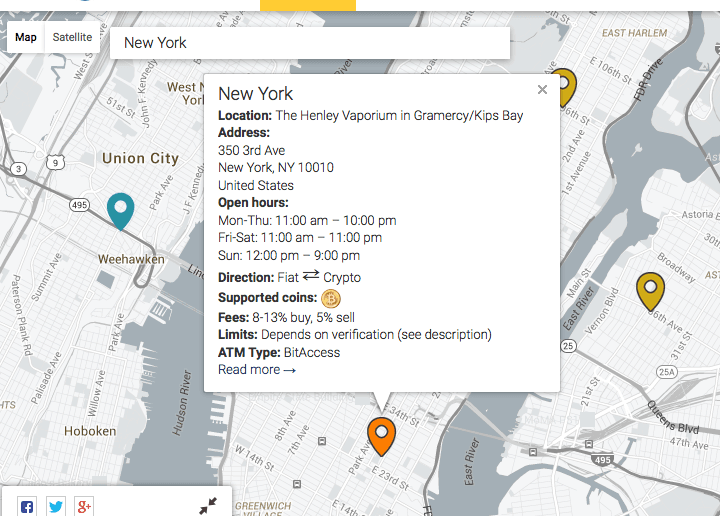

4. Choose an ATM

Click on one of the map markers for more details about a specific ATM. From there, you can also click on “Read More” at the bottom for even more details.

While Bitcoin ATMs make it easy to buy bitcoin with cash, there are some downsides:

Bitcoin ATMs generally sell bitcoins at a mark-up of 5-10%.

Before you buy bitcoin from an ATM, check the ATM’s price against a Bitcoin price index like Bitcoin Average or the CoinDesk BPI.

Some ATMs may require verification, like a picture of an ID or a finger print scan (although most don't).

Buy Bitcoins with Cash at Wall of Coins

Wall of Coins is a peer-to-peer cash exchange, currently available in the United States, Canada, Germany, Argentina, Latvia, Poland, and the Philippines.

LibertyX Review

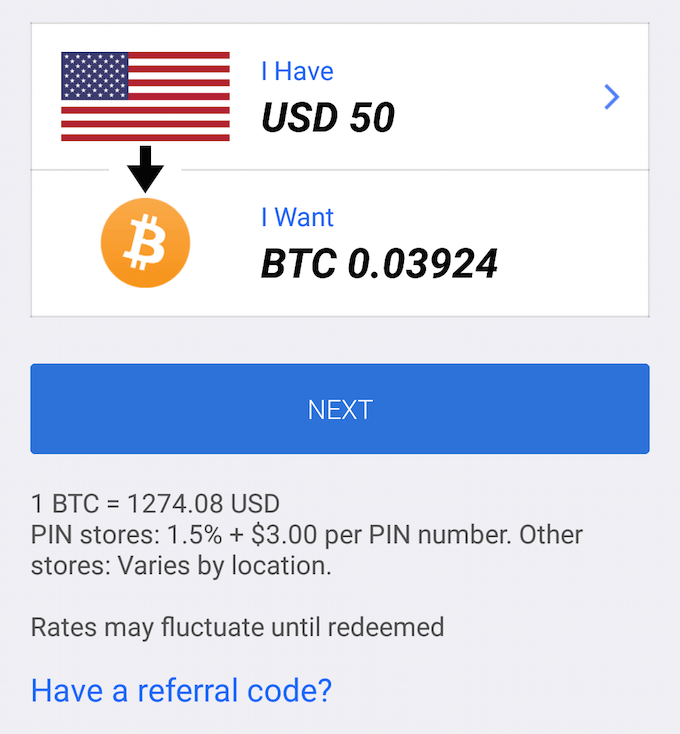

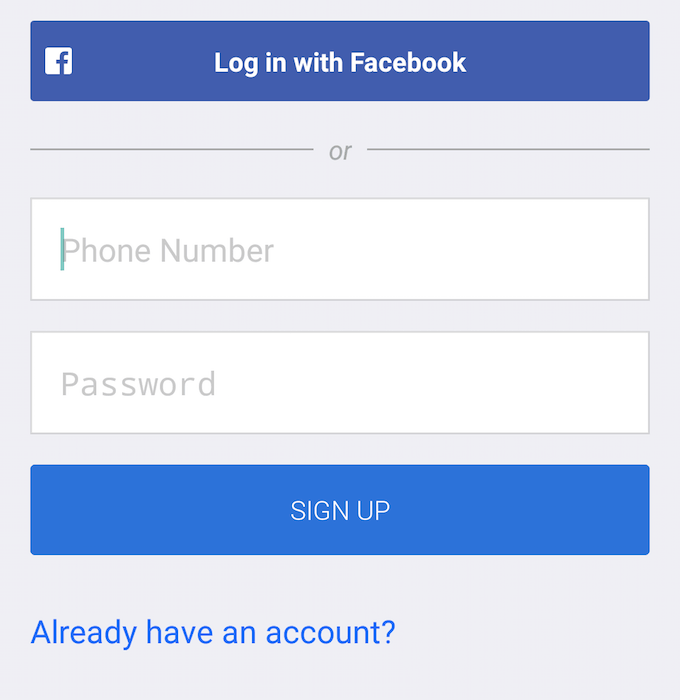

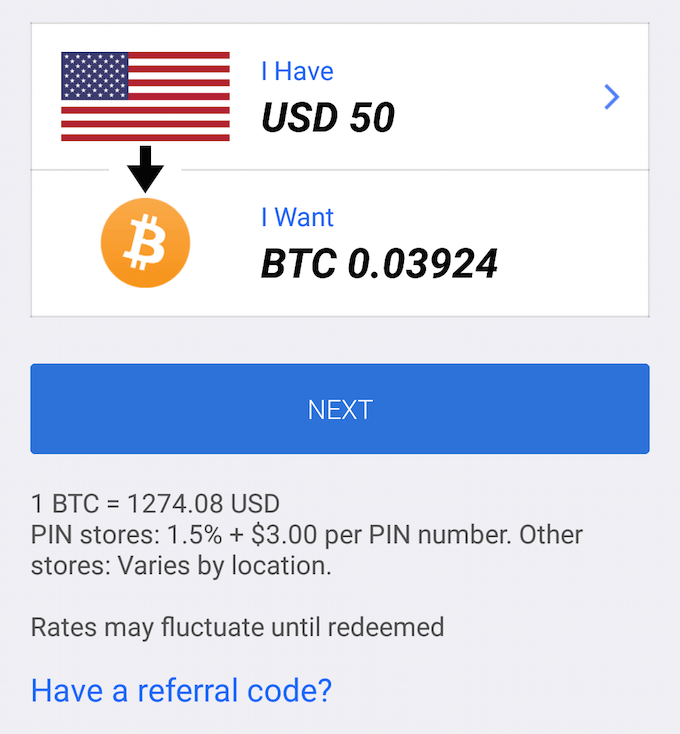

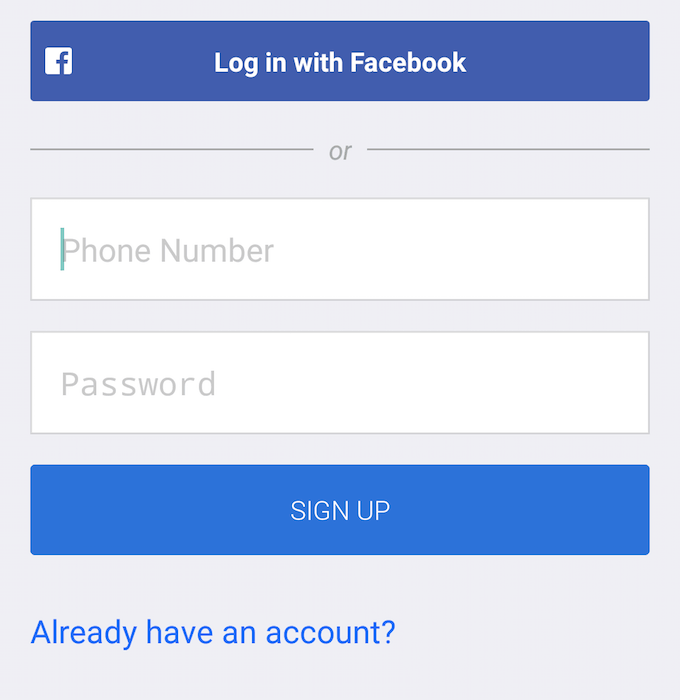

Now that you know a bit about LibertyX we'll show you how to use it. Once you've downloaded the app from the Apple App Store or Google Play Store, open it and you should see a screen like this:

Enter the amount of bitcoins you want to buy and then press "NEXT". You should now see a screen with some options. If you want to find a store near you to buy then click "Find Store". Now you'll see a zoomed out map.

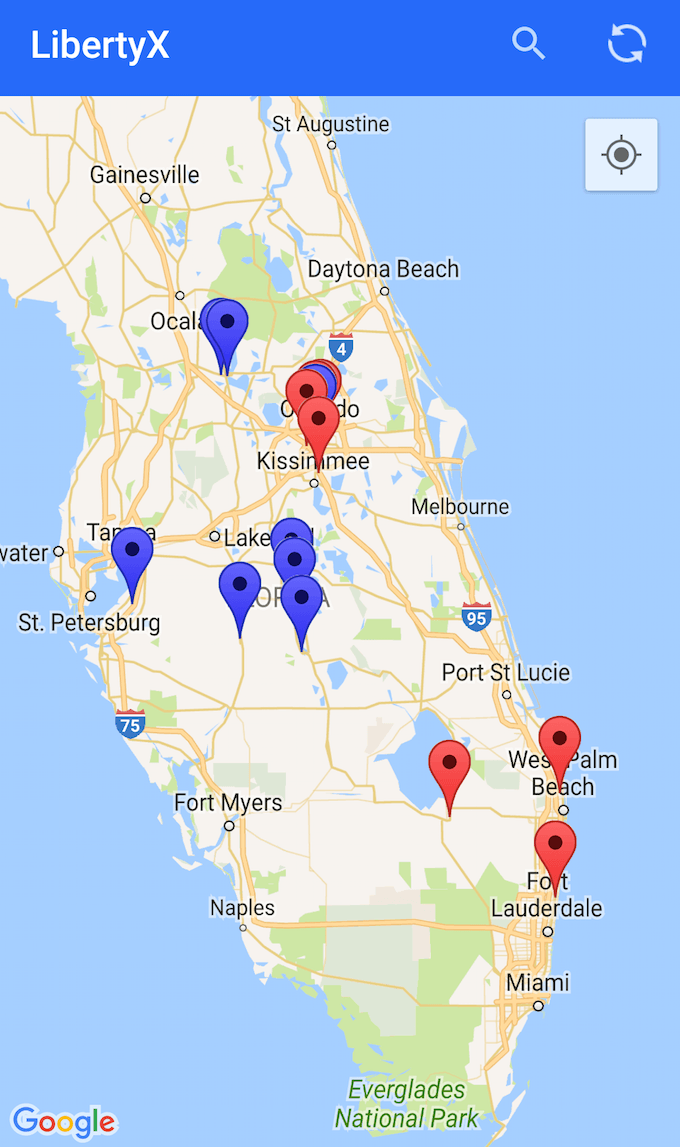

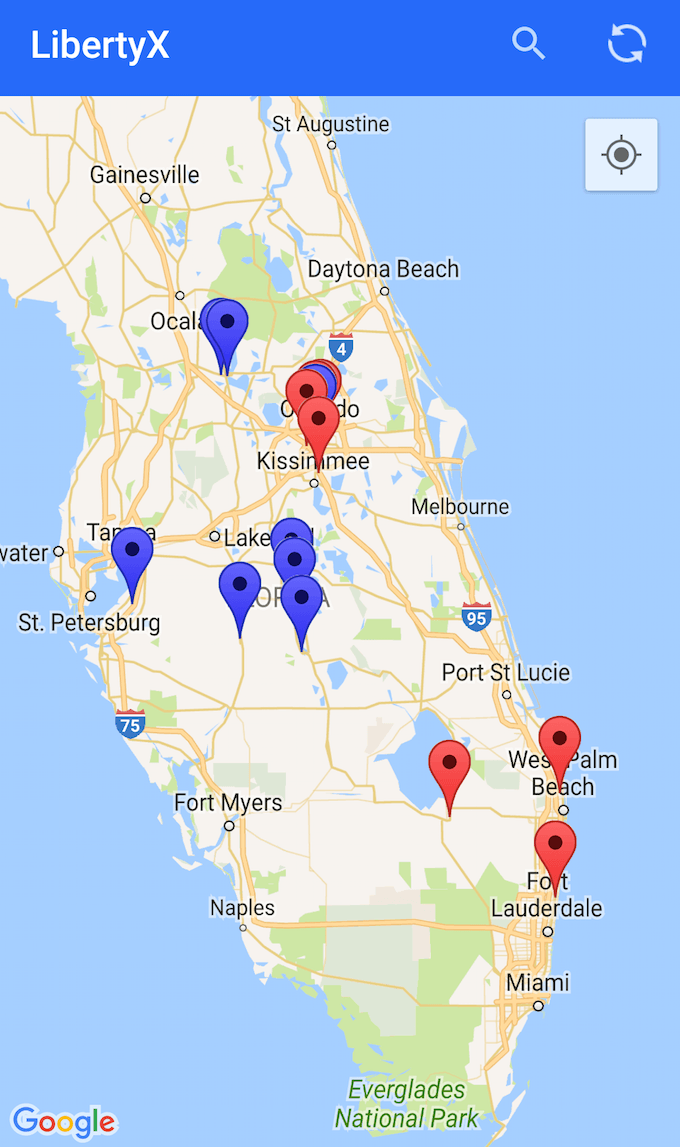

Put in your location or allow the app to see your current location. You should then see a zoomed in map with pins displayed the many locations you can buy from:

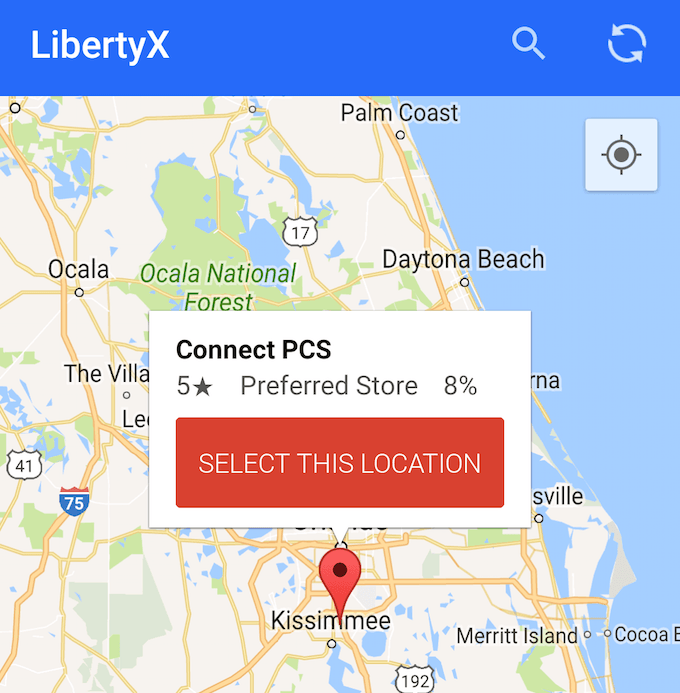

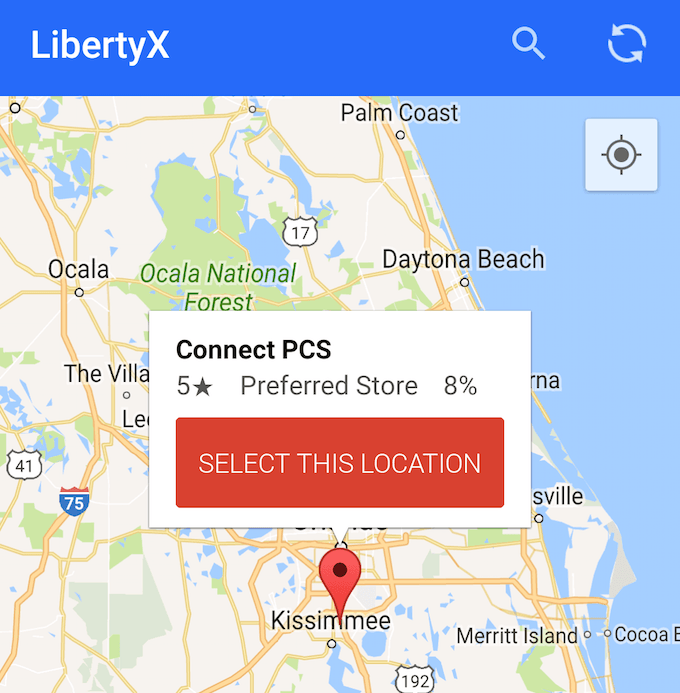

Now tap on a pin and then tap "SELECT THIS LOCATION":

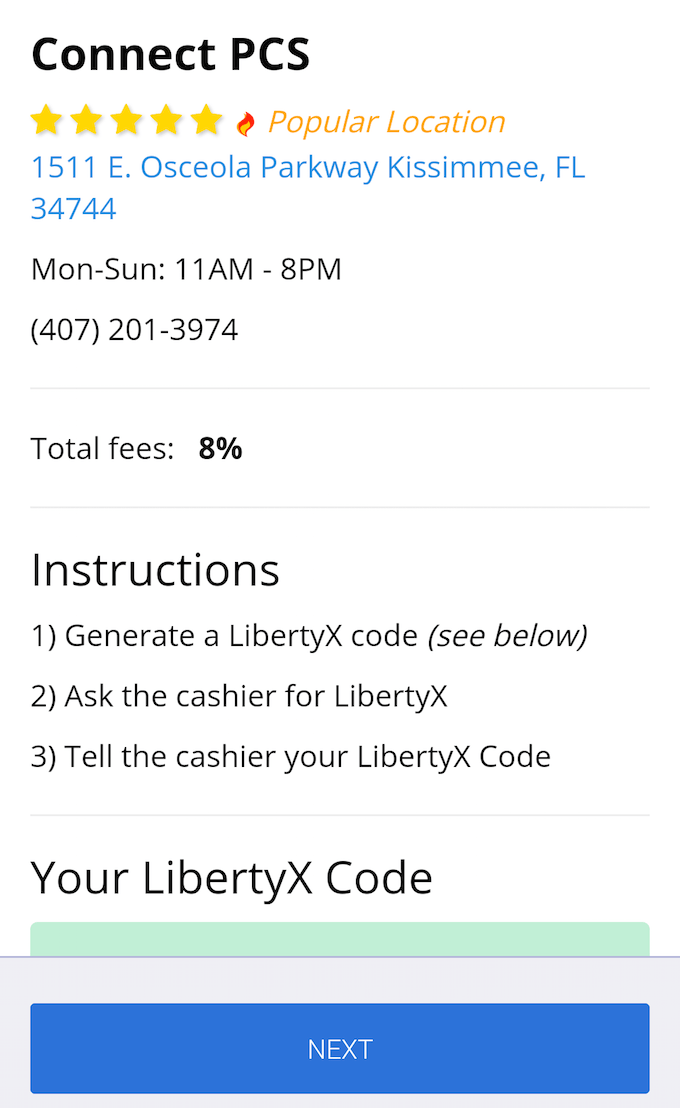

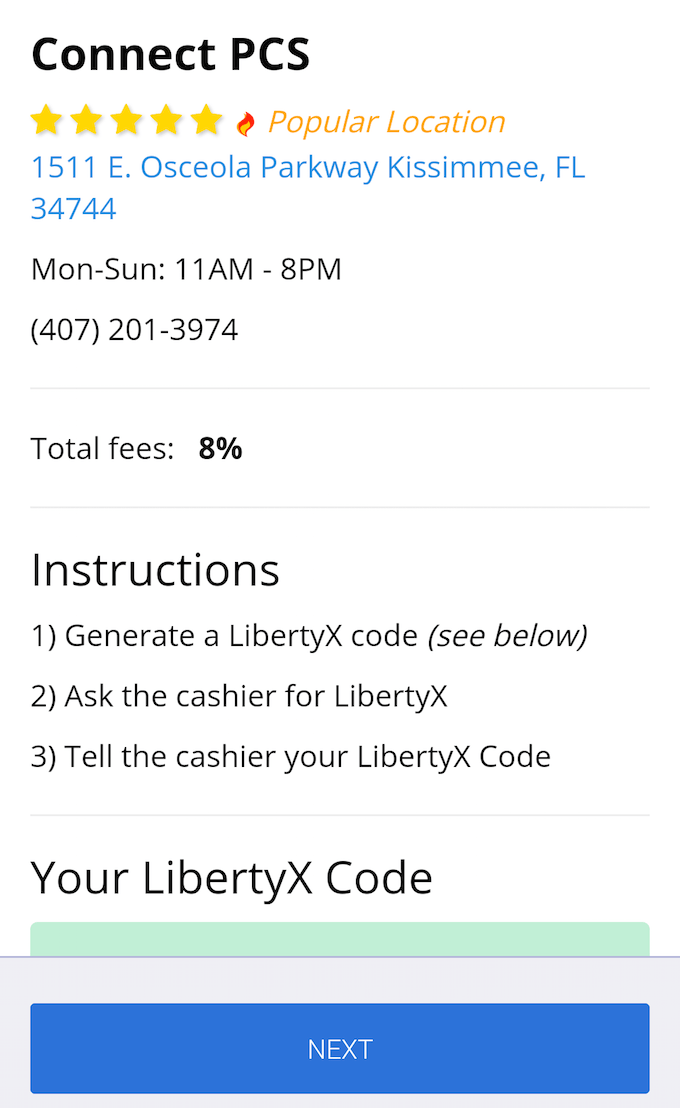

You will get more information on the location, like the store's hours, fees, phone number, and instructions for buying the coins:

In the next step you will need to login with Facebook or make an account:

Once you login you will also need to link your phone number.

Once you confirm your phone number you can get your LibertyX code that you show the store!

At the store you present the code to the cashier and pay for the amount of coins you want. The cashier will then print out another code that you enter into the LibertyX app. Once you enter the code from the cashier you receive bitcoins!

Trades Near You: Mycelium Local Trader

Mycelium Local Trader is part of the Mycelium Bitcoin Wallet for Android.

If you live in a city, you're in luck:

There may be a number of sellers in your area.

Make sure you meet in a public space. Going with a friend is best, too. There have been reports of scams and robberies, so just make sure you take precautions when buying.

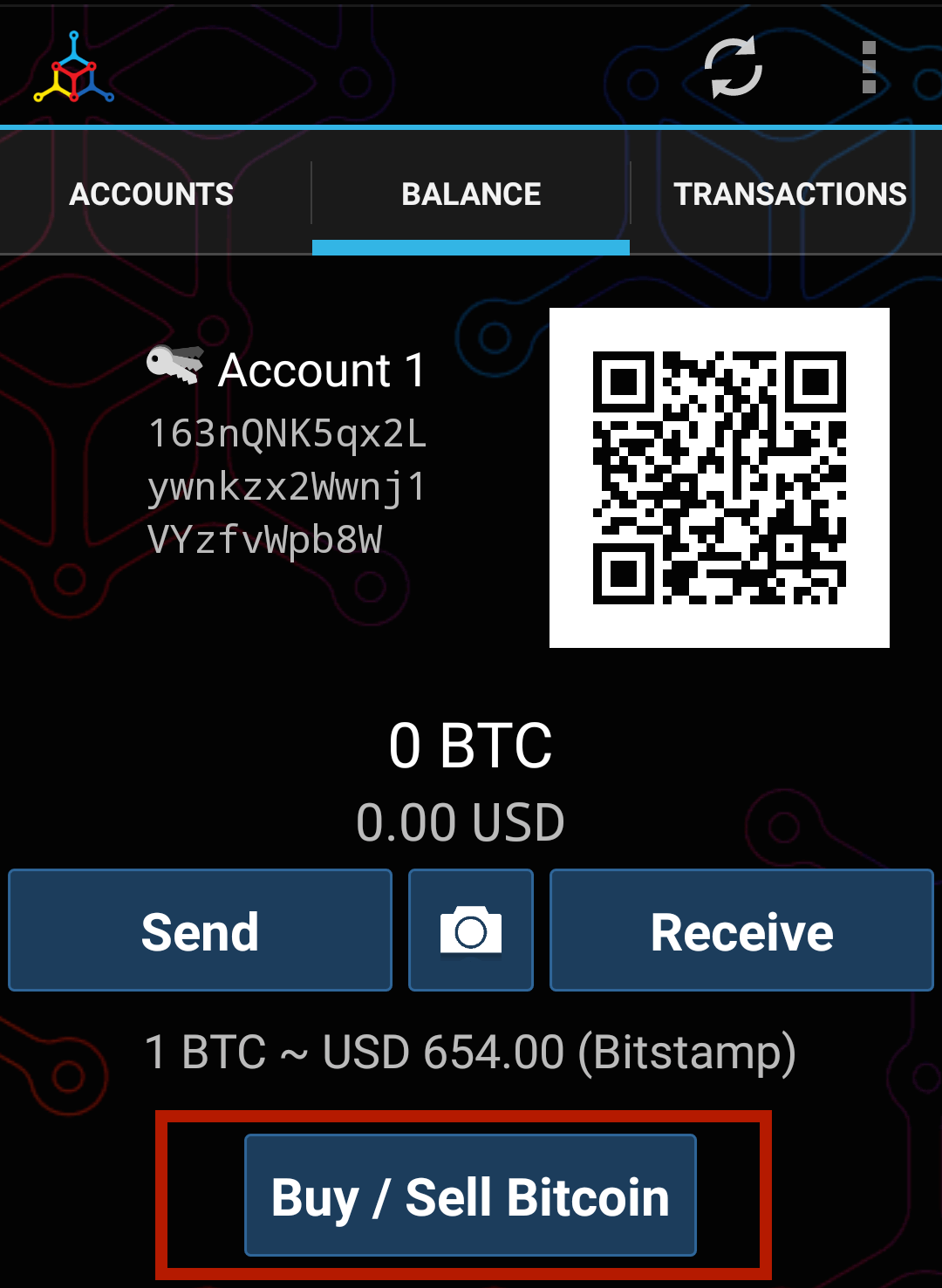

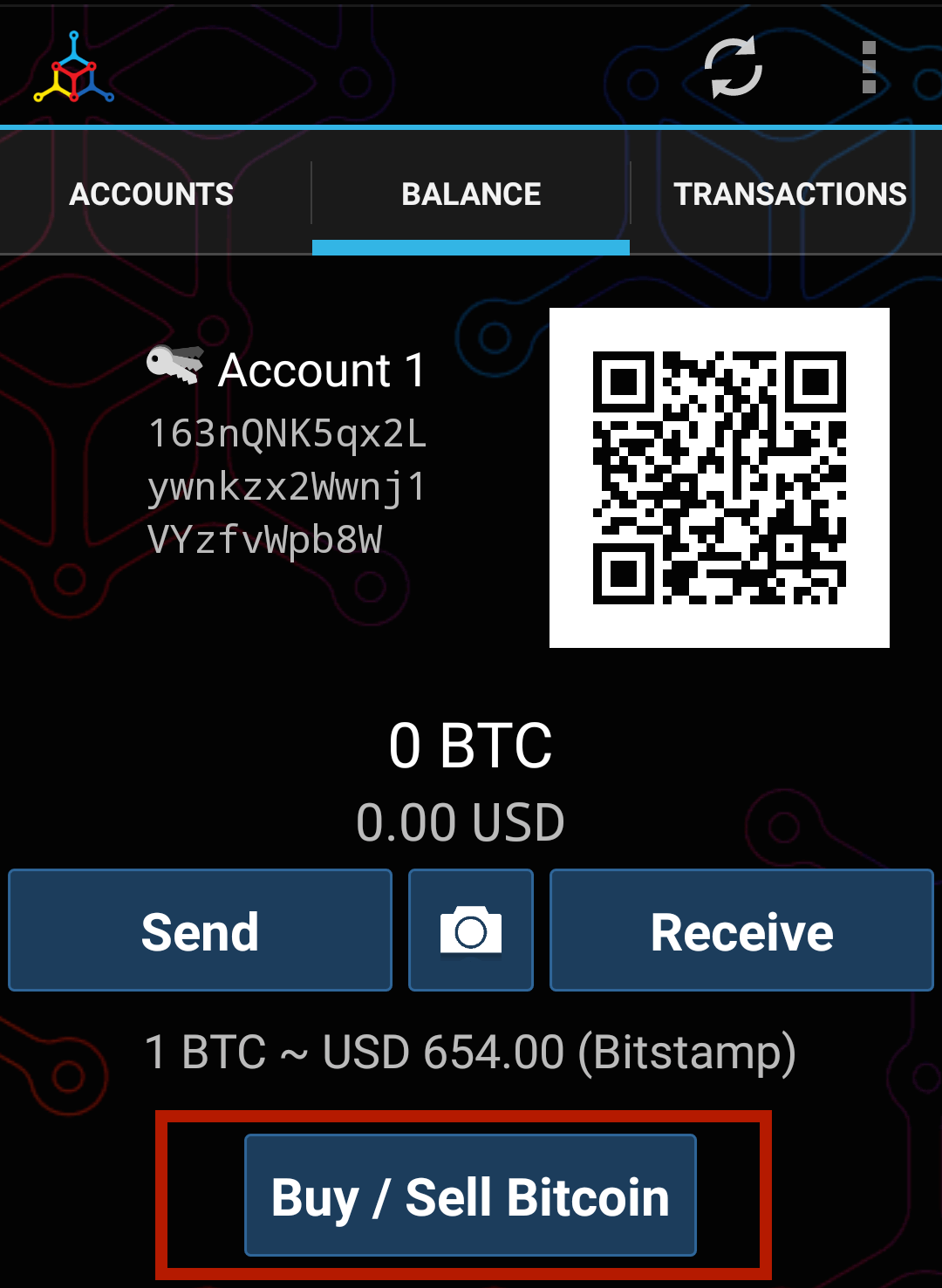

Once you download the app, click Buy/Sell:

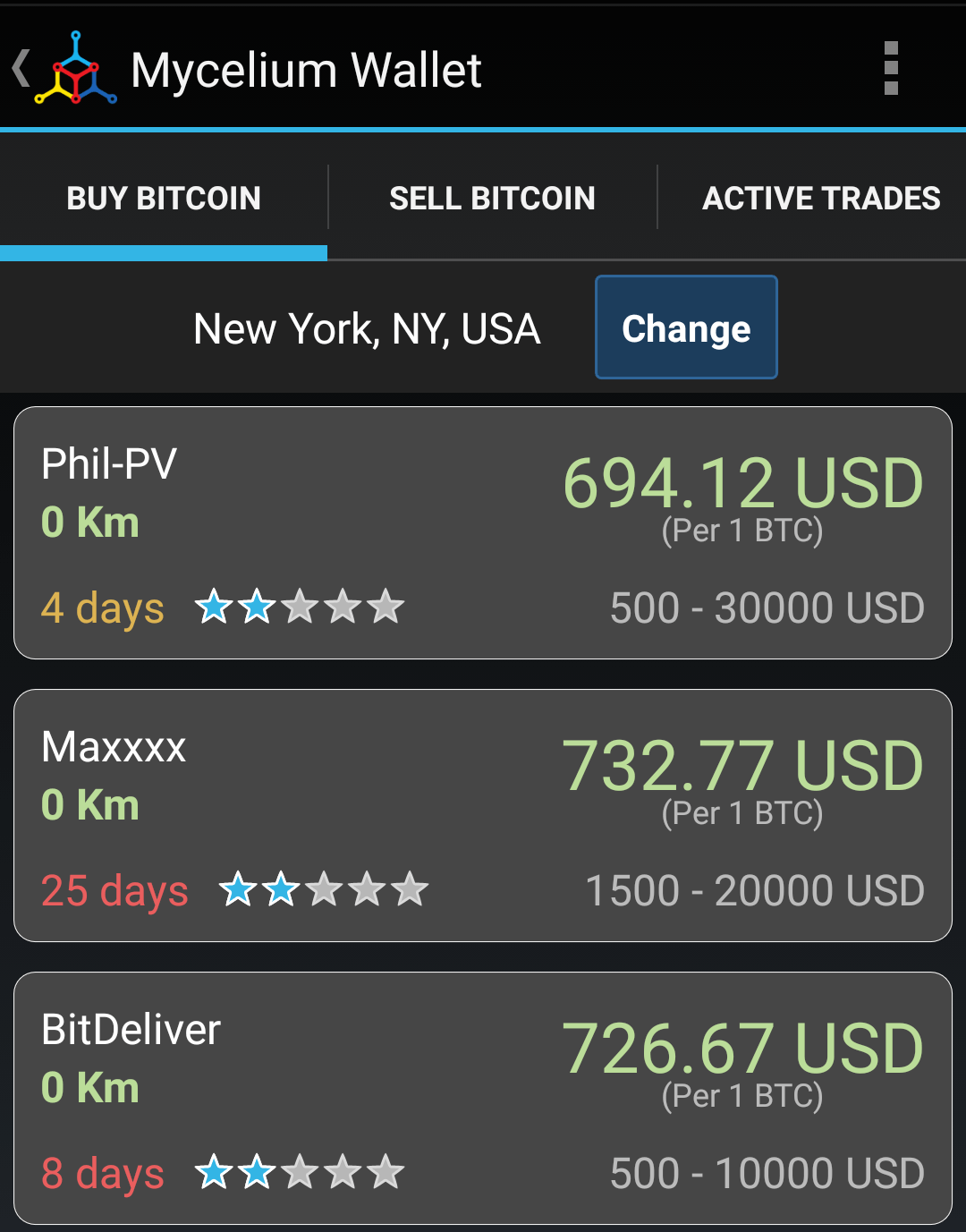

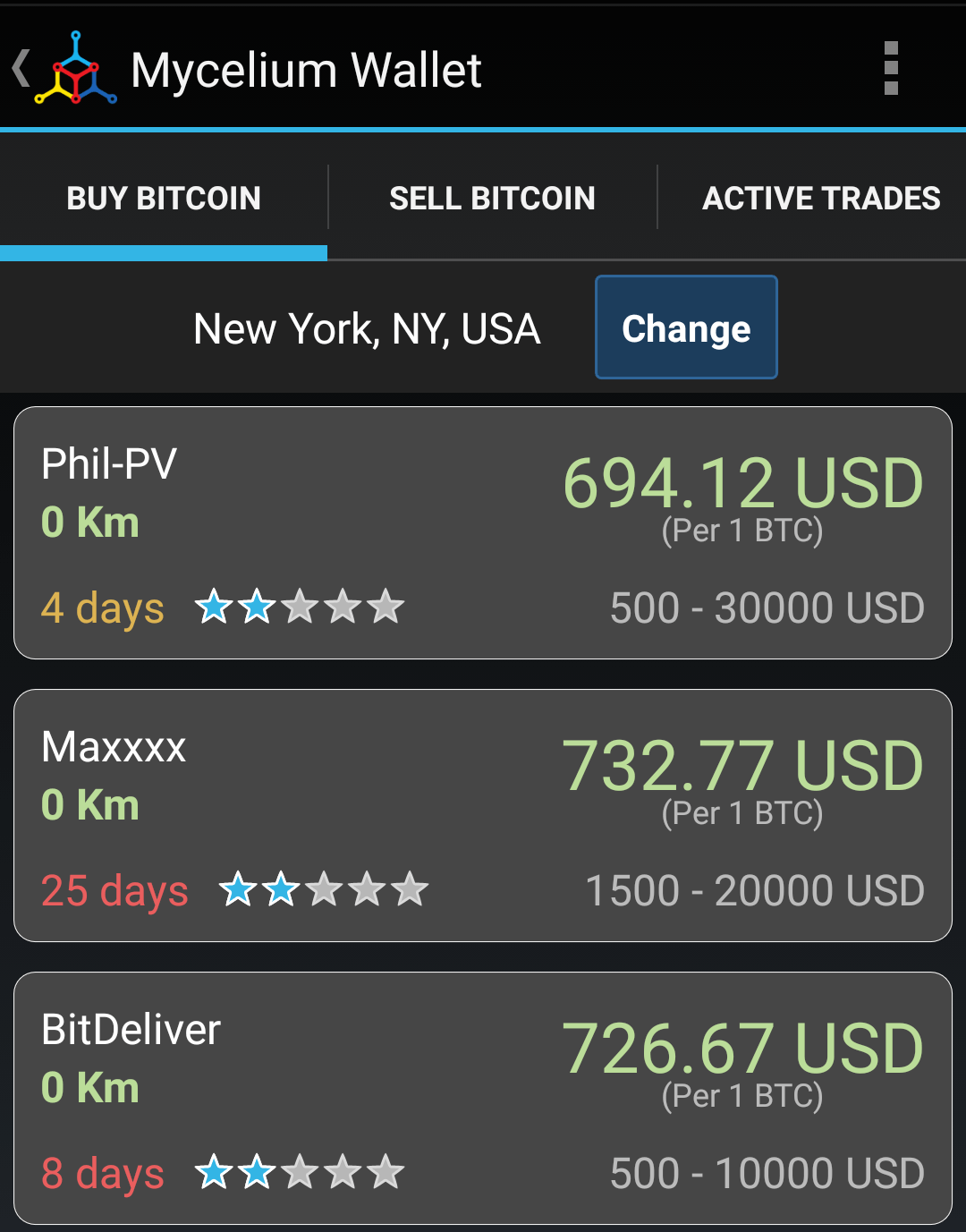

Once you enter your location you should see a list of local sellers:

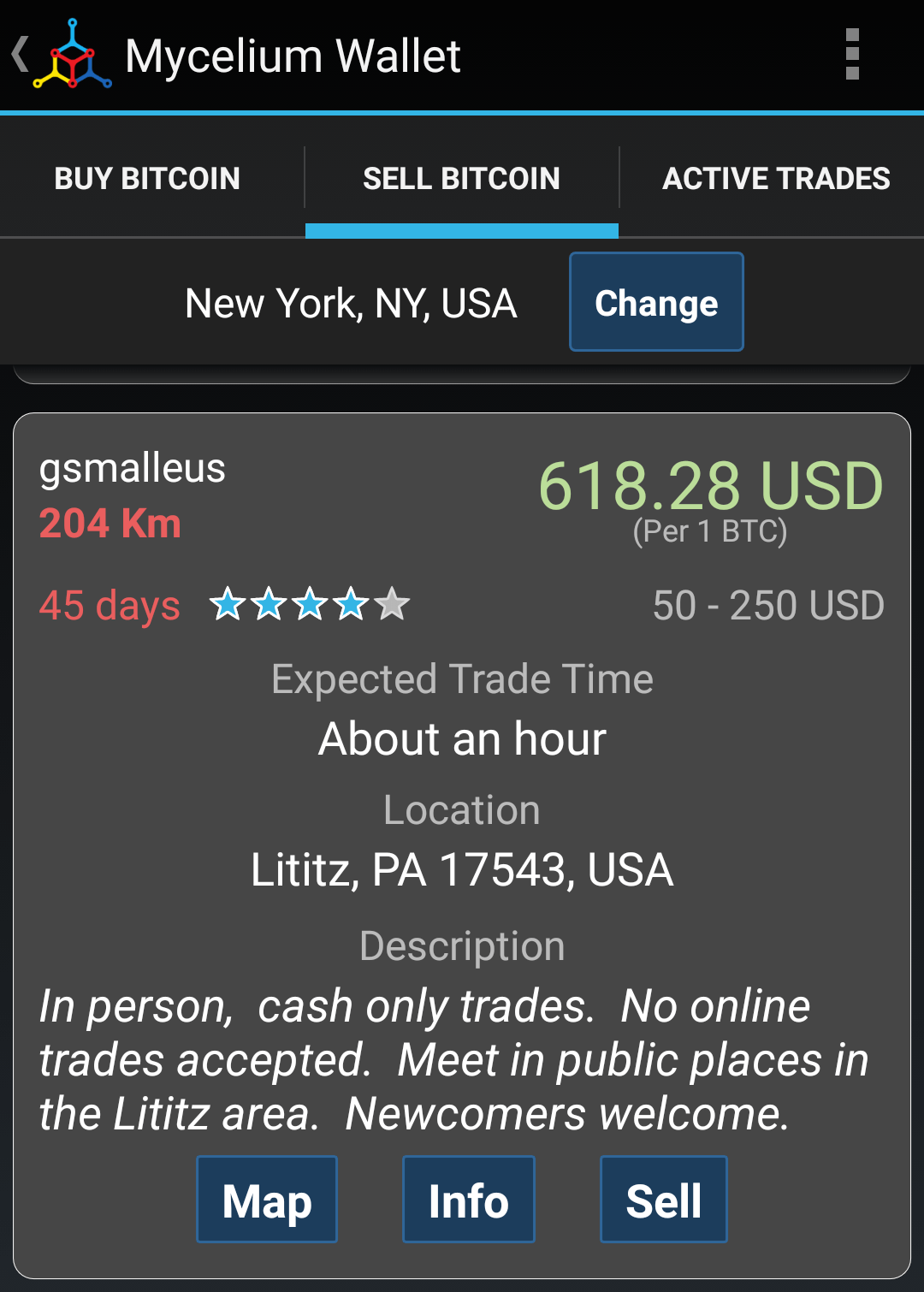

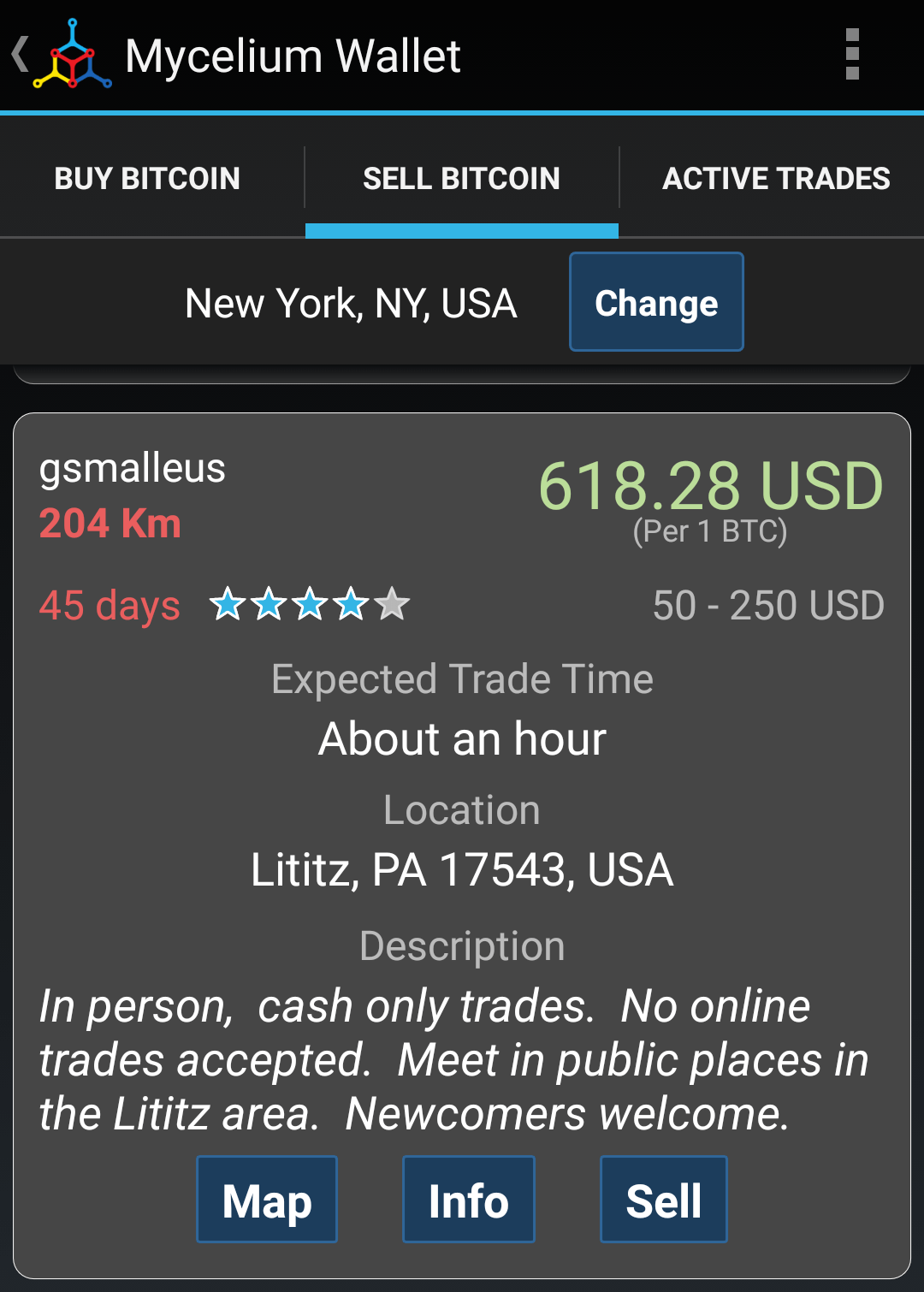

Click on a seller for more info:

Again, make sure you buy from sellers with good feedback! If you meet, meet in a public space and go with another person.

Peer-to-Peer Exchange Explanation

The exchanges mentioned above (LocalBitcoins, Wall of Coins, and Bitquick) all work in almost the same way.

This section aims to provide more clarity on how a trade might work using one of these exchanges.

Buying Bitcoins at Peer-to-Peer Exchanges

Peer-to-peer (P2P) Bitcoin exchanges are a great way to get bitcoins with cash. A P2P trade usually works something like this:

- A buyer and seller use a site like LocalBitcoins or Wall of Coins and agree on a price.

- The seller’s bitcoins are held by the site and only released to the buyer upon confirmation of payment.

- The buyer deposits cash into the seller’s bank account.

- The seller confirms payment. Usually, the buyer sends the seller a receipt to prove that cash was deposited into the seller's account.

- The site (LocalBitcoins or Wall of Coins) releases the bitcoins to the buyer.

- The seller got cash, and the buyer got bitcoins. The trade is complete!

The above was just an example!

Through sites like LocalBitcoins you are free to agree on other payment methods besides cash deposit.

You could arrange to meet in person and exchange cash for Bitcoin.

Yes, using LocalBitcoins you can even exchange that Starbucks gift card from Christmas a few years ago for bitcoins ;)

Why Are Peer-to-Peer Exchanges Good?

- No verification is required. You don’t need to submit any personal details and there is no verification process that takes up time.

- Cash payments are irreversible. Once cash is in someone’s bank account, the buyer of bitcoin has no way to reverse the transaction. So the seller can feel confident that he received payment for bitcoins, and release the bitcoins to the buyer.

A Note on Exchange Rates

Peer-to-peer Bitcoin exchanges offer a fast way to buy bitcoins.

Peer-to-peer exchange rates may be a bit higher than the global average Bitcoin exchange rate.

People are willing to pay more to buy bitcoins both more privately and faster. The markup is usually somewhere around 5-10% on LocalBitcoins. Wall of Coins generally has rates close to market.

Check the against a Bitcoin price index like Bitcoin Average or the CoinDesk BPI.

Best Practices for In-Person Cash Trading

If you decide to meet up with another person then make sure to take some precautions.

Meet in a public area. Most trades will go through fine but a search on Google shows people getting robbed or scammed at in-person trades.

Bring a friend. If possible, try to bring along a friend or family member just so you're not alone.

These tips are not meant to scare you and there is nothing wrong with trading bitcoins. But when dealing with any amount of money or trade it's best to be safe.

Theft, Scams, and Storage

If you get one thing from this article let it be this:

Don't store your bitcoins on exchanges.

I've been buying bitcoins for more than three years. I've never lost any money to scams or thefts. Follow the guidelines in this article and you'll be able to do the same.

Here are two examples where users got screwed by leaving bitcoins on exchanges:

And there are many more I could list.

If you're buying with cash from an ATM you won't have to worry about this, since ATMs always send bitcoins directly to a wallet or Bitcoin address.

If you're buying from BitQuick or LocalBitcoins:

Make sure to move the coins you bought to your own wallet right after you buy!

Secure Your Coins: Get a Good Bitcoin Wallet

Make sure you get yourself a Bitcoin wallet that will securely store your bitcoins.

Besides storage, there are many scam exchanges out to steal your personal information and/or bitcoins.

Following these two basic principles should help you avoid theft, scams, and any other loss of funds:

- Do research before buying on any exchange. Check reviews, ratings, and regulation information.

- Don't store coins on the exchange. Already mentioned above but worth repeating.

Bitcoin Cash

DEFINITION of 'Bitcoin Cash'

Bitcoin cash is a cryptocurrency created in August 2017, arising from a fork of Bitcoin Classic. Bitcoin Cash increases the size of blocks, allowing more transactions to be processed.

Bitcoin Unlimited

Bitcoin XT

Block Reward

BREAKING DOWN 'Bitcoin Cash'

Since its launch, Bitcoin faced pressure from community members on the topic of scalability. Specifically, that the size of blocks – set at 1 megabyte (MB), or a million bytes, in 2010 – would slow down transaction processing times, thus limiting the currency’s potential, just as it was gaining in popularity. The block size limit was added to the Bitcoin code in order to prevent spam attacks on the network at a time when the value of a Bitcoins was low. By 2015, the value of Bitcoins had increased substantially and average block size had reached 600 bytes, creating a scenario in which transaction times could run into delays as more blocks reached maximum capacity.

[ Bitcoin prices depend on a wide range of dynamics, including scalability and security issues, as well as simple supply and demand dynamics. If you're interested in trading cryptocurrencies, Investopedia's Crypto Trading Course provides a comprehensive overview of the topic, covering subjects like crypto basics, researching coins, technical analysis techniques, various exchanges, and other need-to-know topics to be a successful trader. ]

A number of proposals have been made to deal with transaction processing over the years, often focusing on increasing block size. Because the Bitcoin code is not managed by a central authority, changes to the code require buy-in from developers and miners. This consensus-driven approach can lead to proposals taking a long time to finalize. This has resulted in groups creating separate blockchain ledgers using new standards, called a fork. Several forks, such as Bitcoin XT and Bitcoin Unlimited, failed to be adopted by a wide audience. Bitcoin Cash, launched in August 2017, is another fork from Bitcoin Classic.

Bitcoin Cash differs from Bitcoin Classic in that it increases the block size from 1 MB to 8 MB. It also removes Segregated Witness (SegWit), a proposed code adjustment designed to free up block space by removing certain parts of the transaction. The goal of Bitcoin Cash is to increase the number of transactions that can be processed, and supporters hope that this change will allow Bitcoin Cash to compete with the volume of transactions that PayPal and Visa can handle by increasing the size of blocks.

Because the computer power required to process larger blocks could price out some smaller miners, critics worry that adopting Bitcoin Cash’s approach will lead to power being concentrated in the hands of companies that can afford more and better equipment. Opponents to the fork worry that this will threaten the consensus-driven approach to Bitcoin, as a small number of companies could control Bitcoin and more readily force changes on the community in the future.

A successful hard fork for Bitcoin Cash entails surviving long enough to entice individuals and companies to use and mine the new digital currency if it is able to build substantial interest and reach critical mass. Once this point is reached, however, Bitcoin Cash may find that its success has prompted others to develop their own alternative coins, which would put the same pressure on Bitcoin Cash that it had placed on Bitcoin Classic. Since the issue of scalability tends to be at the forefront of cryptocurrency debates, developers have made increasing block size and improving transaction processing speeds their top focus areas.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Cash: Why It's Forking the Blockchain And What That Means

Bitcoin's scaling debate finally seems to be shaking out, but some users aren't happy with the results.

After a few years of debate, it was perhaps to be expected that at least some were going to come away empty-handed. Controversial scaling proposal Segwit2x tried to remedy this by joining two code change ideas – the code optimization Segregated Witness (SegWit) and a block size increase.

Today, SegWit is just a couple of steps away from activating on bitcoin, but some bitcoin users are unhappy about the outcome.

Others who originally backed the Segwit2x proposal appear to be losing confidence in an eventual block size increase and are now taking matters into their own hands by making their own version of bitcoin – and they're doing so on a short timeline.

On August 1, at precisely 12:20 UTC, the group claims that they will split off from bitcoin, creating a new cryptocurrency called Bitcoin Cash.

Developer Calin Culianu, who's contributing code to an implementation of Bitcoin Cash, is one user who doesn't like SegWit, suspecting that others feel the same way.

Culianu told CoinDesk:

"If the Segwit2x agreement fails to implement the 2x part, which is not entirely unreasonable, and only ends up being being basically SegWit without the 2x, many miners will likely defect to Bitcoin Cash."

What is Bitcoin Cash?

So, what is it? And how does it differ from bitcoin?

There are two main changes of note:

- It increases the block size to 8 MB.

- It removes SegWit, a code change that might activate on the bitcoin blockchain by the end of August.

Some, including a few of the project's supporters, call Bitcoin Cash an "altcoin," a term that usually denotes a fork of the software that creates a new cryptocurrency, with its own market.

Indeed, the cryptocurrency is currently trading at $461, meaning it's worth about 18% of bitcoin's current price of $2,568, in an already-open futures market.

Unlike other altcoins, though, Bitcoin Cash's transaction history would be the same as bitcoin's – at least up until the point of the split. So, if and when Bitcoin Cash splits off, users would have bitcoin on both blockchains.

Another difference is the project says it will support multiple implementations of its software, a move that's not surprising given the criticism that Bitcoin Core's software is too dominant on the bitcoin network.

BitcoinABC is the first software to implement the Bitcoin Cash protocol, but the goal is for there to be many implementations.

Culianu said that both Bitcoin Unlimited and Bitcoin Classic, other implementations that aim to increase bitcoin's block size, are working on a version compatible with Bitcoin Cash.

These might or might not be ready for August 1.

Who's involved?

So far, most bitcoin companies, mining pools, users and bitcoin developers seem uninterested in the effort. Yet, there are some eager supporters.

Beijing-based mining firm ViaBTC, which boasts roughly 4% of bitcoin's computing power, is the clear ringleader.

The firm, which also operates an exchange, has become the first to list the cryptocurrency and also has plans to launch a new mining pool dedicated solely to Bitcoin Cash. (Though, so far, it's not clear how much of its 4% mining hashrate it will commit to the effort.)

Asked if he believed Segwit2x would fulfill its roadmap, CEO Haipo Yang responded: "I doubt it."

Further, Bitcoin Cash has attracted support from some users who want a block size increase, as well as developers of other proposals such as Bitcoin Classic and Bitcoin Unlimited.

What might be more surprising, though, is who's not involved.

Even former supporters, including mining firms Bitcoin.com and Bitmain, seem hesitant to back the effort. For now, they remain committed to controversial scaling proposal Segwit2x.

Mining company Bitmain even inspired Bitcoin Cash. Yet, the firm said that they only planned on going through with making the switch under certain conditions. Still, the firm might support both Segwit2x and Bitcoin Cash in the future.

In a PSA statement, Bitcoin.com said that it will allow miners in its pool to choose if they want to mine the Bitcoin Cash token BCC.

For now, though, it will mine on Segwit2x chain, though it said it "will immediately shift all company resources to supporting Bitcoin Cash exclusively" if the block size increase part of SegWit, scheduled for roughly three months from now, falls through.

Wait, but why?

There are a few reasons users and mining pools might like to break off from bitcoin:

- These users want an increase in bitcoin's block size parameter, and believe that the cryptocurrency's future depends on it.

- SegWit is likely going to activate soon and some users want to avoid the feature.

- There's a possibility that Segwit2x's block size parameter increase will ultimately fall through.

This mix of ideological and technical reasons was also on display in conversations with users.

When asked by CoinDesk what BitcoinABC's goal is, Culianu responded:

"To save bitcoin. We want to scale bitcoin up so that it won't die. It's already a bit sick and dying."

What's different here?

Many other efforts over the last couple of years have said they would split off from bitcoin, if they gained enough support from those operating the computers that secure the network. But, to date, no group has actually carried through with this plan so far.

Bitcoin Cash might be unique in that it's actually committing to a deadline to split bitcoin into two, and that deadline is less than a week away.

If miners and users indeed go ahead with the split, it would mark the first time a cryptocurrency split off from bitcoin, carrying with it bitcoin's transaction history.

Like past efforts intended to replace the bitcoin used today with a new bitcoin, however, Bitcoin Cash has the same goal, but it seems willing to wait and see if users join the effort.

Rather than call it bitcoin, ViaBTC, as well as a group of bitcoin companies in China, signed an agreement to label it a "competitive currency," not the "real" bitcoin.

The move could set up the split to happen more quickly, as in the past exchanges have expressed confusion over how to handle a fork.

What's next?

If a new cryptocurrency splits off from the main bitcoin network, it will mark a first. So, some users are curious to see what happens.

Still, without much support from miners and users, it might not end up having that much of an impact on the course of the main network.

Nonetheless, it might if be worth watching if the second half of Segwit2x falls through. That's when it might see some more supporters.

Culianu, for example, concluded on an optimistic note:

"My secret gut feeling is Bitcoin Cash may surprise all of us. It is not entirely impossible that it will be the de-facto bitcoin after a few months. The much roomier 8 MB block space is attractive."

Bitcoin voucher image via CoinDesk archives

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422bf810a0ee8fcf • Your IP : 185.87.51.142 • Performance & security by Cloudflare

How to Buy Bitcoins with Cash or Cash Deposit

We can both agree on this:

Buying bitcoins with cash is confusing!

Luckily, today I'll show you how easy and fast it can be.

We've collected the best exchanges and listed them for you below.

Introduction

Why buy bitcoins with cash?

- It's private and usually quick

- One of the easiest ways to get bitcoins

Converting your cash to bitcoin can get you bitcoins within a couple of hours.

Buying bitcoins with cash is also private.

Many of the exchanges below do not require you to verify your identity or provide sensitive personal details.

Make sure you have a Bitcoin wallet before you buy since some of the exchanges below require one.

We suggest using the exchanges listed below or doing research before buying from any exchange.

Many exchanges are simply trying to steal your personal information (like your password).

We do research on every exchange we list and are very careful not to include scam exchanges on our site.

Cash Bitcoin Exchanges

LocalBitcoins

LocalBitcoins

It's possible to buy bitcoins with cash on LocalBitcoins via cash trade in-person or with cash deposit.

A quick step-by-step guide on how to buy bitcoins with cash on LocalBitcoins:

- Find a seller in your area who accepts cash.

- Select amount of coins and place an order.

- Receive account number from the seller.

- Deposit cash into the seller's account.

- Upload your receipt to prove you made the deposit/trade.

- Receive bitcoins! The coins will arrive in your LocalBitcoins wallet.

The above guide was meant to give you an idea on how LocalBitcoins works.

If you want more information, read our full guide on how to use LocalBitcoins.

LocalBitcoins is private and does not require any personal details or verification, although specific sellers may request this info.

Be sure to buy from sellers with previous trade history and positive feedback.

Local Bitcoins charges a flat 1% fee on each purchase.

- Can be private, fast and easy

- In-person trades require no personal information

- Purchases of bitcoin can be made quickly via cash deposit

- Beware of scams; always follow the rules!

- Harder to buy large amounts of bitcoins compared to large exchanges

- Slightly to significantly higher prices than regular exchanges; premium for higher privacy

BitQuick

BitQuick

BitQuick connects you with sellers who want cash for their bitcoins.

BitQuick is only available in the United States and works like this:

- Find a seller. Once you find a seller you agree on a price for the bitcoins.

- Make cash deposit. Go to the seller's bank and make a cash deposit into the seller's account.

- Upload receipt. Upload your receipt to the seller to prove you made the deposit.

- Receive bitcoins! The seller will release bitcoins to you.

This process can be completed at a massive number of banks across the United States.

Bitcoin purchases made with cash deposit are usually delivered within two hours, and in many cases in under an hour!

- One of the fastest ways to buy bitcoins

- More physically secure than other cash payment methods as one pays the money to a bank teller

- 2% fees for buyers are somewhat high for cash trading

- Prices vary and can be much higher (or even lower) than the current Bitcoin price

Wall of Coins

Wall of Coins

Wall of Coins is a peer-to-peer Bitcoin exchange that offers a number of payment methods.

Cash deposit, however, is the exchange's most common payment method.

There are over 100,000 deposit locations available across the United States.

Wall of Coins also supports Canada, the United Kingdom, Germany, Poland, Argentina, Latvia, Poland, and the Philippines.

After a cash deposit is made you'll usually receive your bitcoins within 15 minutes.

- Easy way to purchase bitcoins

- Fairly private way to purchase bitcoins; only your phone number is required

- Currently limited to 22 countries

- Hard to find sellers offering high volume

LibertyX Buy Bitcoin

LibertyX Buy Bitcoin

LibertyX lets you buy bitcoin with cash at a number of retail stores across the United States.

You'll have to verify your identity before buying, making LibertyX less private than some of the other options.

You can buy up to $1000 worth of bitcoin and will be charged a 1% fee on all purchases.

If you sign up with Facebook you can buy your first $1000 fee free.

Your bitcoin should arrive a few minutes after your payment is made.

- Easy and fast way to buy bitcoins with cash

- Low 1.5% (plus store fee) rate for cash purchase method

- Daily $1000 limit is fairly high for a convenience service

- Participating stores add their own variable fee

- Some verification is required which lowers the expected privacy level of cash purchase

- Attaching your Facebook account further degrades privacy

Bitcoin ATMs Buy Bitcoin

Bitcoin ATMs Buy Bitcoin

Our Bitcoin ATM map helps you find a Bitcoin ATM in your local area.

Using Bitcoin ATMs you can buy bitcoins with cash ONLY.

The average ATM charges a fee of 5-10%, but this is what people are willing to pay to buy bitcoins privately and with no verification.

There are many Bitcoin ATM manufacturates, so each ATM is different. Some require verification, although most don't.

- Our map makes it super easy to find a Bitcoin ATM near you

- Bitcoin ATMs often have 5-10% fees per purchase

Bitit Buy Bitcoin Read Review

Bitit Buy Bitcoin Read Review

Bitit is slightly different than the other options on this page. Instead of buying directly with cash, you instead need to use a voucher like Flexepin or Neosurf. The fees are about 8% for buying with Neosurf or Flexepin.

- Unique way of purchasing offers extra privacy over other methods

- 8% Neosurf fee is slightly better than Coinhouse's 10%

- Available in 50 countries

- €10,000 initial weekly Neosurf cash payment limit

- Bitcoin gift cards also available; more expensive than other options

- In-person buying methods offer more privacy but can be confusing

- Identity verification required for buying amounts over €25

- €500 initial weekly credit/debit card limit

Buy Bitcoin with Cash Exchange Comparison

Frequently Asked Questions

If you're still a bit confused, that's okay. Buying bitcoins is hard and that's why I built this site.

The FAQ section below should answer all of your remaining questions.

What are risks are involved buying bitcoins with cash?

Buying bitcoins with cash can be very low risk.

If making a trade in-person, it's best to meet in a public place to reduce the risk of scamming or theft.

If buying bitcoins with cash via cash deposit, use an escrow service (like LocalBitcoins or BitQuick) to ensure the seller must send you the bitcoins after receiving bitcoins.

What are the benefits and advantages?

It's easy to buy small amounts of bitcoin with cash.

It's also private, since no personal information is required in most cases, especially if trading in person or at an ATM with no verification.

Buying bitcoins with cash is also fast, as there is no verification to slow down the process.

What are the disadvantages?

It can be hard to buy large amounts of bitcoins with cash, especially with cash deposit.

Bitcoin ATMs also have limits and some require verification if more than a certain amount is purchased.

Do you want to buy larger amounts of bitcoins? Try buying with a bank account and you'll save on fees, too.

Why do Local Bitcoins and Bitcoin ATMs have a higher price than other exchanges?

The average buy price on Local Bitcoins and Bitcoin ATMs is usually 5-10% higher than the average global rate.

Unlike other exchanges, which require ID verification and personal information, Local Bitcoins and Bitcoin ATMs don't require any information like this.

The 5-10% premium on LocalBitcoins and at ATMs is simply the cost people are willing to pay for privacy when buying bitcoins.

Is it risky giving up my ID in order to buy?

It depends how much you trust the exchanges.

Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to.

One thing that Bitcoin exchanges have going for them is that because they are constantly under attack, they have some of the best security and protections in place to protect against the hacking of your personal info.

There is always risk with anything related to information online.

Even Yahoo was hacked and information on 1 billion accounts was stolen.

Should I leave my bitcoins on the exchange after I buy?

We really recommend storing any bitcoins you want to keep safe in a wallet you own.

Many Bitcoin exchanges have been hacked and lost customer funds. If you don't want to fall victim to these hacks then the easiest way is to store your coins in a wallet you control.

Can you sell bitcoins?

Out of the exchanges we listed, LocalBitcoins, Wall of Coins, and BitQuick all allow you to sell bitcoins for cash.

Tutorials: How You Can Buy Bitcoins with Cash

How to Use BitQuick

BitQuick is one of the best ways to buy bitcoins with cash in the United States.

It charges 2% per buy but the exchange rates are generally better than LocalBitcoins.

We will show you how to make your first purchase in the tutorial below.

You will NEED a Bitcoin wallet before you can buy from BitQuick. Don't have one? Read our guide.

Go to BitQuick

You will see the home page. Then, click "Quick Buy"

Enter the amount you want to spend. You can enter in dollars or BTC, the fields will update automatically.

You should now see a list of banks with prices:

You can pick any bank, and banks with the lowest prices will show up first.

Once you picked a bank you will be required to fill in some details. This includes your email, phone number, and Bitcoin address. You can also change the amount of Bitcoin you want to receive.

Make sure you put in your phone number and press "SEND VERIFICATION". This will send a PIN code to your phone that you need to confirm.

Once you put in your details press "PLACE HOLD". This will lock in your order.

Now you will need to find a bank branch of the bank you chose in your area. Then you go into the bank, make a deposit, and save the receipt.

Go back into BitQuick and upload the receipt to the seller. This proves you made the deposit.

Bitcoins should arrive to the address you entered earlier within 3 hours!

Buy Bitcoins with Cash from Bitcoin ATMs

Bitcoin ATMs are another great way to purchase bitcoins with cash!

Think of a Bitcoin ATM as a cash to Bitcoin converter.

While you may have to physically drive or walk to the ATM, once you reach the ATM you can buy bitcoins instantly. You’ll need to be lucky enough to have a Bitcoin ATM in your area.

Our Bitcoin ATM map helps you find locations makes it easy to locate a Bitcoin ATM in your area.

You can do the following to check if there is a Bitcoin ATM near you:

1. Go to the Bitcoin ATM Map

2. Search by Location

In the search box in the top left, type in the name of your country or city and click enter.

3. Find an ATM

Once you search, you’ll be taken to the location you entered on the map. If you see map pin markers, you’re in luck! That means there are Bitcoin ATMs in your area.

4. Choose an ATM

Click on one of the map markers for more details about a specific ATM. From there, you can also click on “Read More” at the bottom for even more details.

While Bitcoin ATMs make it easy to buy bitcoin with cash, there are some downsides:

Bitcoin ATMs generally sell bitcoins at a mark-up of 5-10%.

Before you buy bitcoin from an ATM, check the ATM’s price against a Bitcoin price index like Bitcoin Average or the CoinDesk BPI.

Some ATMs may require verification, like a picture of an ID or a finger print scan (although most don't).

Buy Bitcoins with Cash at Wall of Coins

Wall of Coins is a peer-to-peer cash exchange, currently available in the United States, Canada, Germany, Argentina, Latvia, Poland, and the Philippines.

LibertyX Review

Now that you know a bit about LibertyX we'll show you how to use it. Once you've downloaded the app from the Apple App Store or Google Play Store, open it and you should see a screen like this:

Enter the amount of bitcoins you want to buy and then press "NEXT". You should now see a screen with some options. If you want to find a store near you to buy then click "Find Store". Now you'll see a zoomed out map.

Put in your location or allow the app to see your current location. You should then see a zoomed in map with pins displayed the many locations you can buy from:

Now tap on a pin and then tap "SELECT THIS LOCATION":

You will get more information on the location, like the store's hours, fees, phone number, and instructions for buying the coins:

In the next step you will need to login with Facebook or make an account:

Once you login you will also need to link your phone number.

Once you confirm your phone number you can get your LibertyX code that you show the store!

At the store you present the code to the cashier and pay for the amount of coins you want. The cashier will then print out another code that you enter into the LibertyX app. Once you enter the code from the cashier you receive bitcoins!

Trades Near You: Mycelium Local Trader

Mycelium Local Trader is part of the Mycelium Bitcoin Wallet for Android.

If you live in a city, you're in luck:

There may be a number of sellers in your area.

Make sure you meet in a public space. Going with a friend is best, too. There have been reports of scams and robberies, so just make sure you take precautions when buying.

Once you download the app, click Buy/Sell:

Once you enter your location you should see a list of local sellers:

Click on a seller for more info:

Again, make sure you buy from sellers with good feedback! If you meet, meet in a public space and go with another person.

Peer-to-Peer Exchange Explanation

The exchanges mentioned above (LocalBitcoins, Wall of Coins, and Bitquick) all work in almost the same way.

This section aims to provide more clarity on how a trade might work using one of these exchanges.

Buying Bitcoins at Peer-to-Peer Exchanges

Peer-to-peer (P2P) Bitcoin exchanges are a great way to get bitcoins with cash. A P2P trade usually works something like this:

- A buyer and seller use a site like LocalBitcoins or Wall of Coins and agree on a price.

- The seller’s bitcoins are held by the site and only released to the buyer upon confirmation of payment.

- The buyer deposits cash into the seller’s bank account.

- The seller confirms payment. Usually, the buyer sends the seller a receipt to prove that cash was deposited into the seller's account.

- The site (LocalBitcoins or Wall of Coins) releases the bitcoins to the buyer.

- The seller got cash, and the buyer got bitcoins. The trade is complete!

The above was just an example!

Through sites like LocalBitcoins you are free to agree on other payment methods besides cash deposit.

You could arrange to meet in person and exchange cash for Bitcoin.

Yes, using LocalBitcoins you can even exchange that Starbucks gift card from Christmas a few years ago for bitcoins ;)

Why Are Peer-to-Peer Exchanges Good?

- No verification is required. You don’t need to submit any personal details and there is no verification process that takes up time.

- Cash payments are irreversible. Once cash is in someone’s bank account, the buyer of bitcoin has no way to reverse the transaction. So the seller can feel confident that he received payment for bitcoins, and release the bitcoins to the buyer.

A Note on Exchange Rates

Peer-to-peer Bitcoin exchanges offer a fast way to buy bitcoins.

Peer-to-peer exchange rates may be a bit higher than the global average Bitcoin exchange rate.

People are willing to pay more to buy bitcoins both more privately and faster. The markup is usually somewhere around 5-10% on LocalBitcoins. Wall of Coins generally has rates close to market.

Check the against a Bitcoin price index like Bitcoin Average or the CoinDesk BPI.

Best Practices for In-Person Cash Trading

If you decide to meet up with another person then make sure to take some precautions.

Meet in a public area. Most trades will go through fine but a search on Google shows people getting robbed or scammed at in-person trades.

Bring a friend. If possible, try to bring along a friend or family member just so you're not alone.

These tips are not meant to scare you and there is nothing wrong with trading bitcoins. But when dealing with any amount of money or trade it's best to be safe.

Theft, Scams, and Storage

If you get one thing from this article let it be this:

Don't store your bitcoins on exchanges.

I've been buying bitcoins for more than three years. I've never lost any money to scams or thefts. Follow the guidelines in this article and you'll be able to do the same.

Here are two examples where users got screwed by leaving bitcoins on exchanges:

And there are many more I could list.

If you're buying with cash from an ATM you won't have to worry about this, since ATMs always send bitcoins directly to a wallet or Bitcoin address.

If you're buying from BitQuick or LocalBitcoins:

Make sure to move the coins you bought to your own wallet right after you buy!

Secure Your Coins: Get a Good Bitcoin Wallet

Make sure you get yourself a Bitcoin wallet that will securely store your bitcoins.

Besides storage, there are many scam exchanges out to steal your personal information and/or bitcoins.

Following these two basic principles should help you avoid theft, scams, and any other loss of funds:

- Do research before buying on any exchange. Check reviews, ratings, and regulation information.

- Don't store coins on the exchange. Already mentioned above but worth repeating.

The bitcoin cash faucet where YOU decide when to claim!

Facebook and Twitter

Join us on Facebook or Twitter so that you are the first to know of any special offers, promotions and changes to Moon Cash!

Facebook and Twitter

Join us on Facebook or Twitter so that you are the first to know of any special offers, promotions and changes to Moon Cash!

What is Moon Cash?

Moon Cash is a bitcoin cash faucet with a difference. YOU decide how often to claim!

Whereas most faucets only allow you to claim once per hour or once per day, we allow you to claim as often or as little as you like*

The faucet will gradually fill up - quite quickly initially but it will slow down over time - until you make a claim. So the longer you leave it the more you will be able to claim.

You may prefer to claim a smaller amount every 5 minutes, or visit once per day and claim the large amount that has built up while you were away!

(* minimum 5 minutes between claims per account/IP address)

How much can I claim?

Click here to view the current claim rates.

You can increase your claim amounts by up to 300% by taking advantage of the Daily Loyalty Bonus,

Referral Bonus and

Mystery Bonus schemes!

How are my earnings paid?

Moon Cash uses CoinPot for instant payment of your earnings.

If you do not already have a CoinPot account then you must register first

Why can't I make a faucet claim?

You might be having problems making a faucet claim for one of the following reasons.

Advert Blocking

If we detect that you have blocked adverts or they aren't showing up in your web browser then we will prevent you from making a faucet claim. If any of our adverts are not showing then there must be something blocking them on your browser/device. This may be an ad-blocking browser plug-in or extension - if so, please disable your ad-blocking browser plugin/software or add this page to the exception list.

Browser/Device incompatability

This faucet web site is designed to work on the broadest range of web browsers and devices possible. However it may be that your browser/device is not supported and you receive an error message when you try to claim. If so, please try a different browser or device to check that this is the problem before contacting us about it.

Do you have an affiliate/referral program?

Yes we do - click here for full details

Can I advertise on Moon Cash?

Yes you can! We have several advertising spaces that are available directly - CPM/CPC at Mellow Ads

Sign in to moon cash

Moon Cash uses CoinPot for instant payment of your earnings - so please enter your CoinPot email address below.

If you do not already have a CoinPot account then you must register first

Contact us

Before you contact us please be aware that we have limited resources for email support therefore.

- Please read through our terms of service before sending us an email. We will not reply to emails asking questions that have already been answered there.

- We can only reply to emails written clearly in English

- We will NOT reply to emails that are abusive or threatening

- We will endeavour to reply to emails within 48 hours

If your enquiry meets the conditions above then please email us at enquiries@moonbitcoin.cash

Terms of service

By registering and signing in to Moon Cash you agree to accept and comply with the following terms.

- Only 1 account is allowed per person

- Do not attempt to claim more frequently than the allowed time, using proxies or IP address changing services

- Do not use bots or any other kind of automation

- Do not abuse the referral system by attempting to refer yourself

- In any correspondence with us please be civil and refrain from any strong or abusive language

Privacy policy

We take your privacy seriously. This policy describes what personal information we collect and how we use it.

(This privacy policy is applicable to the Moon Cash web site)

Routine Information Collection

All web servers track basic information about their visitors. This information includes, but is not limited to, IP addresses, browser details, timestamps and referring pages. None of this information can personally identify specific visitors to this site. The information is tracked for routine administration and maintenance purposes, and lets me know what pages and information are useful and helpful to visitors.

Cookies and Web Beacons

Where necessary, this site uses cookies to store information about a visitor's preferences and history in order to better serve the visitor and/or present the visitor with customized content.

Advertising partners and other third parties may also use cookies, scripts and/or web beacons to track visitors to our site in order to display advertisements and other useful information. Such tracking is done directly by the third parties through their own servers and is subject to their own privacy policies.

Controlling Your Privacy

Note that you can change your browser settings to disable cookies if you have privacy concerns. Disabling cookies for all sites is not recommended as it may interfere with your use of some sites. The best option is to disable or enable cookies on a per-site basis. Consult your browser documentation for instructions on how to block cookies and other tracking mechanisms.

Bitcoincash

3 244 пользователя находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 9 месяцев назад автор BitcoinXio - announcement

отправлено 2 ч назад автор haumeris28

отправлено 3 ч назад автор haumeris28

отправлено 20 ч назад автор BitcoinIsTehFuture

отправлено 13 ч назад автор haumeris28

отправлено 5 ч назад автор tordirescu

отправлено 8 ч назад автор cryptoplatforms

отправлено 12 ч назад автор freebitcoinloans

отправлено 1 ч назад автор drkid111

отправлено 1 ч назад автор deezydmv

отправлено 7 ч назад автор MBMwarhammer270

отправлено 5 ч назад автор Azedd1

Bitcoin expectations: deal wit it!

отправлено 10 ч назад автор h214289

отправлено 11 ч назад автор BigBlockIfTrue

отправлено 12 ч назад автор didang

отправлено 5 ч назад автор Azedd1

Gotta keep the faith

отправлено 1 день назад автор cryptoplatforms

отправлено 1 день назад автор haumeris28

отправлено 1 день назад , изменено * автор mr9714

отправлено 1 день назад автор BitMarKas

отправлено 1 день назад автор jonald_fyookball

отправлено 1 день назад автор Rroadhog

отправлено 16 ч назад автор DeplorableProTrump

отправлено 1 день назад автор Msbend

отправлено 1 день назад автор haumeris28

отправлено 19 ч назад автор ballgames001

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 6633 on app-447 at 2018-05-29 21:14:09.624220+00:00 running 06400a4 country code: RU.

Why Bitcoin Cash Is Not Bitcoin [BTC vs. BCH – Differences That You Should Know]

The crypto-sphere is heating up and simultaneously becoming more confusing as it evolves.

I am sad to see how the viruses of confusion and myth are purposely injected into the ecosystem and how the whole system is manipulated as well as hijacked on a regular basis.

Specifically, I am talking about the recent insane price spike of Bitcoin Cash and the doomed price fall of Bitcoin in just a matter of hours.

Some of you who are old players of the crypto-sphere must have benefitted from this sudden rise and fall, but I think it’s not good for newcomers, and it’s not healthy for Bitcoin in the long term.

That’s why in this write-up I wish to convey some of my thoughts on how Bitcoin Cash is not Bitcoin. And I also want to clarify why the newcomers should not fall prey to the Bitcoin Cash PR campaign.

For the latecomers, I want to first explain what Bitcoin Cash is and show you some facts. Then, I’ll explain Bitcoin and leave it to you to decide for yourself.

Who/What is Bitcoin Cash?

Bitcoin Cash is a Bitcoin fork which was created this year on the 1st of August by a minority group of influential miners, developers, investors, and users who were against the agreed consensus of SegWit implementation to scale Bitcoin.

Namely, there are three main players in the Bitcoin Cash community – Roger Ver, Jihan Wu, and Deadal Nix.

They decided to fork the original Bitcoin blockchain and create a new version called “Bitcoin Cash” (aka BCH) with an adjustable block size up to 8 MB blocks.

Some of the benefits & features of Bitcoin Cash…

This on-chain increase in the ability of Bitcoin Cash provides several benefits to its users against ‘Bitcoin’, but these benefits come at a huge price that its users have to pay. (I will explain this ‘huge price’ further in the article.)

- On-chain scalability

- New transaction signatures

- Emergency Difficulty Adjustment (EDA)

- Decentralized development

For more details, read our extensive guide on Bitcoin Cash:

Price One Needs To Pay To Enjoy BCH Benefits

Ignoring the fact that many of you would have made a good amount of money in the recent Bitcoin Cash rally, one needs to pay a huge cost for using Bitcoin Cash.

This cost cannot be measured in dollars, euros, or yens, but instead, it is a cost that you pay by compromising the original dream of Satoshi Nakamoto – to make an uncensorable alternative monetary system which isn’t controlled by an individual or a group of people.

Some of you might say that I am incorrect because Bitcoin Cash’s official site claims that they are carrying forward Satoshi’s Vision by stating:

Some of the developers

Bitcoin Cash is the continuation of the Bitcoin project as peer-to-peer digital cash.

But actually speaking, they are not even close to Satoshi’s original vision of decentralized and uncensored money.

Bitcoin Cash is extremely censored.

Wait! Some of you might say that I am biased and I am just a Bitcoin fan, but I have facts!

Want To Know The Facts?

1. A decentralized cryptocurrency having a CEO? Really.

Do you really need a CEO for a currency? If you do, then what’s the difference between a business and a crypto?

An official statement from the CEO of #Bitcoin Cash: how we resolve conflicts in our community, our values, and our development of leaders and people https://t.co/BaNupOmh2m

— Rick Falkvinge (@Falkvinge) November 12, 2017

Archive of @Falkvinge "Official Statement" procaliming himself CEO of $BCH in incoherent/confusing post (now taken down https://t.co/IzBiFYCXZI) available here: https://t.co/PefMk1JsH6. Very creepy and immature rambling, hallmark of $BCH poor leadership 🤡$BCH BUYERS MUST READ pic.twitter.com/HIDdbaoaxU

— Francis Pouliot (@francispouliot_) November 12, 2017

2. Centralized mining

Bitcoin Cash mining is highly centralized. If you look at the above image, you will certainly be able to put in perspective what I am talking about.

This is the hash power distribution for Bitcoin Cash mining for the last 144 blocks mined.

If we combine the hash power of Antpool, ViaBTC, and BTC.com, which makes more than 50% hash power, this is detrimental for any coin. To make a 51% attack on Bitcoin Cash would be a decision of three mining parties coming together.

Forgot to mention. BCH is a lot more miner centralized. Because its network hashrate is a lot less than BTC, a small BTC pool can 51% attack it. So it's security is weak because of that. Litecoin doesn't have this problem because Litecoin dominates Scrypt hashing.

— Charlie Lee [LTC] (@SatoshiLite) November 12, 2017

The argument is that Bitcoin also had such hashrate distribution in its early days; but don’t forget that Bitcoin was trading in pennies at that time. Anyone attacking BTC at that time had no incentive in doing so because it was almost worthless.

But now that Bitcoin Cash is trading well above $1000, it’s very susceptible to 51% attacks, which is not good. Read more about 51% attacks here.

3. Total full nodes are fewer than Bitcoin

Bitcoin has more than 10,000 active full nodes running, which is one of the most important factors of a truly decentralized currency. This means that anyone attacking Bitcoin would need to have the ability to hijack more than 50% of the 10,000 nodes that are running across the globe.

On the other hand, Bitcoin Cash only has around 1200 nodes as per Coin.Dance’s node summary.

4. Hard forks without polls

Who does hard forks or upgrades in the currency protocols without polls?

Well, Bitcoin Cash does.

Bitcoin Cash had their hard fork (or protocol upgrade) on 13th November 2017.

The upgrade/fork was done to change the underlying mining algorithm to make it more competitive against Bitcoin and to prevent it from miners’ abuse in the event of reduced or increased difficulty. Read more about the Bitcoin Cash fork here.

Well, I am not against Bitcoin Cash changing something and trying to be competitive, but they should not try being competitive in this way – by doing things without polling the community.

If something is getting upgraded in the protocol, then it has to happen with proper polling and agreements. But this official write-up shows that they didn’t have any such polls.

Also, this write-up gives a hint that there is actually no need for polling because their community is so small and censored. In reality, there are only three individuals who made the decision. (Their names aren’t there but everyone knows who these three were – Roger Ver, Jihan Wu, and Deadal Nix.)

You can see how easy it is to upgrade Bitcoin Cash. Their community is comprised of 3 people. They are the miners, the developers, and the users. Funny!!

Now Let’s See… Who/What is Bitcoin?

Bitcoin is the DADDY of cryptocurrencies. Some of the facts that make Bitcoin truly decentralized and much better than Bitcoin Cash are:

- It is truly decentralized with its hash power widely distributed when compared to Bitcoin Cash. See here for the hash power distribution of Bitcoin which makes it quite difficult for a single mining rig to overpower others with a 51% rate.

- It has (by far) the most number of full nodes in this crypto-sphere which makes it difficult to be attacked by governments or centralized organizations.

- Bitcoin continues to live on Satoshi’s original code of 1 MB blocks and simultaneously keeps exploring new avenues for off-chain scalability solutions.

- Bitcoin is not a company, and hence, no CEO or certain group of people control it.

- Bitcoin upgrades or forks happen due to pollings and BIP proposals which are transparent for all to see. Track the polls here.

- Additionally, Bitcoin has no direct ties to Roger Ver or some other human, unlike Bitcoin Cash. Of course, Satoshi Nakamoto was there in the beginning, but he/she did the smart thing by not revealing his/her identity because he/she well understood how important it is for a nationless currency to not to have any strings attached to any single entity.

I know that some of you might be thinking that I am a huge Bitcoin fan and that’s why I am biased towards Bitcoin Cash, but I want you to make one thing clear: I am not really that biased.

I certainly think that Bitcoin Cash has a future, but if it is trying to be ‘Bitcoin’ and continue down this same path that it’s on now, it’s not going to end well.

If you are a Bitcoin Cash fan, then you should try to convince the community that BCH is BCH… it can’t be Bitcoin. And if Bitcoin Cash continues to be an altcoin and not attack Bitcoin, then I don’t think there are any problems.

Even Andreas suggested this to both communities.

Bitcoin and Bitcoin Cash will coexist and serve different use cases, just like Bitcoin and Ethereum. Its not a zero sum game. Work on building your project, not on destroying the other

On the other hand, I am not naive or ignorant about current challenges that Bitcoin is facing in terms of scalability (despite SegWit implementation).

But let’s remember that it wasn’t always so easy to send emails in the early days of the internet. Similarly, Bitcoin will scale with the much-anticipated Lightning networks or sidechains in the future. And yes, those scaling solutions need to happen soon, otherwise, there will be more drama like this for ages to come.

Also for the newcomers: Stay away from Roger Ver’s owned domain Bitcoin.com that is trying spread this FUD and exclaiming that ‘Bitcoin Cash is Bitcoin‘.

So that’s all from my side in this article.

If you are with me and understand Bitcoin’s true nature, then do retweet/share this write-up with the Bitcoin community, and join hands in finding permanent solutions to Bitcoin’s scalability.

Become a Part of CoinSutra Bitcoin community

Deals & Discounts

CoinSutra Users, Rejoice! Exclusive 10% off On Gate.io Trading Fees Just For You

BitMEX Deal: 10% Fee Discount For 6 months

Wirex Deal: Free Bitcoin Debit Card & Claim 0.5% Cash Back On Purchases

COMMENTs ( 44 )

Very nice article. Totally agree .

Bch is just manipulation and fud

Glad, When I saw firstly Bitcoin cash option in my ZebPay account I thought of its something new to look for and leave it then just like that. Today I found this article very helpful to know more about BCH.

Please i am having difficulty sending bitcion on blockchain ,the last time i use my blokchain was march

Sudhir Khatwani says

Hi Sudhir, how can i connect with you? have invested money in Gainbitcoin which is stuck.

Sudhir Khatwani says

I cannot help in that regard.

Very relevant article. This debate is long not over yet. It is difficult to find an objective perspective on this debate. This is more than just a debate; it is an active and potentially destructive tug-of-war. The sad thing is that as long as Bitcoin core struggles with slow confirmations (Scalability) and inflated transaction fees, and in so doing compromise its original core principals, then BCH as well as future potential Hard Fork derivatives might find sympathetic support in the crypto community. The sooner these issues can be addressed effectively, the sooner the public can rally behind the core movement and consolidate support and resources behind BTC.

Very good article

Simona Smith says

This is one of the best articles about Bitcoin Cash that I have read. Really thanks for sharing this valuable info. I consider myself an expert with Bitcoin Cash now. Cheers!

Damian Williamson says

I cannot say this strongly enough: Since BCH is a separate currency, it should not be allowed to use the name Bitcoin at all. Just adding the word Cash after something existing is a deliberate ploy to confuse and trap those in the market who do not know better.

IMO there should be a number of civil suits taken out against BCH for their deceptive naming and marketing. People have suffered losses.

Sudhir Khatwani says

Agree and Cheers but Cannot make a suit.

Also, do you bit by telling others about it and keep it simple. Just consider BCH as an altcoin that’s it.

Damian Williamson says

Also, IMO BCH is quite short-sighted. If BCH doesn’t have people paying fees (or just has lower fees) for transactions then after blockchain rewards are eventually dropped, who will mine it?

RE: Transactions stuck in the pool, there has always been the possibility that transactions made with a low fee may take a long time to confirm. Bitcoin Core wallet even has a written warning regarding never confirming transactions. Just pay the fee, it pays the miners.

Lighting network has a CEO ? Are you not aware or you skipped it intentionally ?

Sudhir Khatwani says

Yeah, I know.

But the implementation will be decentralized. Read more about how Lightning network payment channel works.

Just a confused guy says

Read about who is being the lightning framework and see which company has the most no of developers in bitcoin core.

Satoshi nakamoto himself wanted to get rid of the blocksize in (his) future – since the number of trxs back then were not too high.

A simple google search might help u.

The hash power distribution of Bitcoin looks similar to BCH — get AntPool, BTC.com, ViaBTC and BTC.TOP and you have majority.

I’ve been involved with Bitcoin (lurking) since prior to the coin was mined. I strongly disagree with this article. Bitcoin cash is Bitcoin. Segwit by default makes what is calling itself “bitcoin” not bitcoin.

hmm.. so, since segwit solves malleability thus allowing secure sidechains and since on-chain scaling to millions tx/sec is not possible, how do you figure that bitcoin cash will scale to that usage?

Sudhir Khatwani says

Couldn’t quite understand your question.

And what about Bitcore (BTX)? The best tech out of BTC,BTG,BCH. BTX appears to have an intentionally suppressed value. For months there has been an incorrect circulating supply/market cap on coinmarketcap (BTX should be in top 50 coins for months now). It is a more advanced coin with compounding Airdrops every Monday and yet you have never heard of it. Obviously, whales with lined pockets influence the monetary value of a coin.

Sudhir Khatwani says

I know about it but not very confident about what they are doing.

will bitcoin cash price also be high as bitcoin in the future

Sudhir Khatwani says

But doesn’t looks like…

will bitcoin cash price also be high as bitcoin in the future?

i meAN LIKE RISING TO $10,000

Sudhir Khatwani says

Free market economy…cannot predict…like that..

Chris Bell says

Incredibly helpful. My friend tried to tell me that BTC would go to zero and BCH was going to take over. That’s why I searched and found this article. You explain the difference perfectly and I like how you tried to stay unbiased.

Sudhir Khatwani says

I am sorry, but this article has a lot of hear say and I think beats around the bush too much.

When a thing gets too complex look for the bottom line, here it is:

BTC legacy has slow (sometimes days) transactions and expensive fees. It has been hijacked by a team of developers with ulterior motives (Blockstream).

BCH is fast cheap and reliable.

If BTC legacy was truly about Satoshi’s vision then they would have increased the proverbial block size, instead they created a very complicated “solution” ( segwit) for a simple problem.

Stay sharp kids!

EXCELLENT ARTICLE! EVERYTHING YOU SAID IS 100% TRUE 👏

Nice post. BCH is not decentralized and thus a violation of the philosophy of crypto currencies in general… people trying to take advantage of others is always a thing. I’d love to see BTC go get more popular.

Sudhir Khatwani says

Wait and Let the market forces come into the play.