Using Bitcoin With Quickbooks- Part 1: Recording Sales and Accepting Payments

This is the first part of a multi-part series that will explain how to integrate Bitcoin as a payment method using your existing small business accounting software package. Why would you need to do this? In short, because accounting principles generally accepted in the United States and state and federal regulatory authorities require reporting in US Dollars. This procedure will allow you to properly account for the full extent of your Bitcoin sales and integrate those sales into your business records as if they had originally been made in your home currency.

Since the vast majority of small business owners use a version of Intuit QuickBooks, this series will refer to that product (specifically the 2014 version). The concepts will be the same regardless of what software or version you use, though the implementation may vary somewhat. I assume as a pre-requisite that you have a basic knowledge of financial accounting, that you are familiar with your accounting software package and that the amounts that you record are determined with reference to US Dollars.

Starting in 2009, most US desktop versions of QuickBooks featured native multi-currency support. This function can be activated from the preferences menu and allows rates to be automatically updated from the internet. The QuickBooks file has a default or “home” currency and then tracks as many other foreign currencies as needed, with the functional currency set by vendor, customer, or account.

Use of the multi-currency feature comes with a few caveats- First, QuickBooks will only update currencies automatically when the home currency is US Dollars so this feature may not work well for users outside the US. Second, add-ins like Statement Writer and Fixed Asset Manager will only work with US Dollars, meaning financial statements cannot be denominated in Bitcoin if you choose to hold them as an asset. Finally, QuickBooks does not integrate with many of the Bitcoin intermediaries in common use at this time. Thus, billing and collection would require an extra step even if you did use multi-currency. For these reasons, this procedure does not make use of multi-currency support.

As of the fall of 2013, Bitpay.com supported ledger downloads in Intuit Interchange File format (.iif). Though this may save some data entry work if your business has considerable Bitcoin transaction activity with Bitpay, you will still need to create the accounts in QuickBooks to classify your transactions. If there is a demand for it, I will address how Bitpay and QuickBooks interact in a later article, though Bitpay’s website already does a good job of this.

To book Bitcoin sales in QuickBooks:

1. First, record sales as normal, using the programmed workflow in QuickBooks (either “create statements” or “create invoices”) in your functional currency (USD, Euro, etc.). If you request funds using Coinbase, Bitpay, BIPS, or another payment service provider, you may want to select the option bill with reference to your functional currency instead of directly in Bitcoin in order to reduce your exchange risk.

2. Before recording payment, you will need to add two new accounts to your company’s chart of accounts (you only need to add these accounts once). From the home screen, select “Chart of Accounts”, then select the “Account” tab and click “New.” The first account will be an “Other Current Asset” account (under “Other Account Types”) called “Bitcoin” (or “Bitcoin Wallet” or whatever works for you). The tax line mapping will be “not tax related.” The second account will be an income account called “Bitcoin Exchange Gains.” The tax line mapping will be “other income.” You may also want to add an expense account called “Bitcoin Exchange Losses”, though gains and losses generally should net out and show up as a single line item on your Profit and Loss statement. Close the chart of accounts.

3. Add Bitcoin as a payment method. From the home screen, select the “Receive Payments” function (also accessible from the Customers menu). On the “Customer Payment” screen, select the “More” button adjacent to the cluster of payment method buttons. Then select “add new payment method.” The new payment method will be called “Bitcoin” of type “Cash.” Select “Ok.”

4. To record a payment on account in Bitcoin, click the “Receive Payments” button and select the customer from the “Received From” menu. Input the amount received in dollars. This should be the same amount that you billed, even if the exchange rate fluctuated between billing and receipt, or else QuickBooks will show an unresolved debit or credit balance on the customer’s account. Click the “More” payment method button (looks like a plus sign), then select “Bitcoin.” In the “Deposit To” box, select the other current asset account you created to track your Bitcoin Wallet. Your customer should now show payment in full for the associated invoice.

This procedure is just one of several possible ways to record Bitcoin sales in QuickBooks and less complicated that some of the others out there. Since you are already using the regular QuickBooks workflow, you should have no problems with your Cost of Goods Sold or Accounts Receivable showing weird balances (they will be denominated in dollars, just as you recorded them). Always remember to record sales and payments in QuickBooks using the “Create Invoices” and “Receive Payments” functions. Not doing so may result in misclassification or underreporting of income, unapplied customer payments and other undesired results.

The next part of the series will be “Revaluing Your Wallet and Converting to Cash.” Feel free to contact me with feedback, questions, or requests.

We’re Now Accepting Bitcoin on Dell.com

[UPDATE 10/19/17] Due to low demand, Bitcoin is no longer available as a form of payment. Our apologies for any inconvenience this may cause. You can still complete your purchase through a number of alternative payment options such as PayPal, all major Credit Cards, and Dell Financial Services.

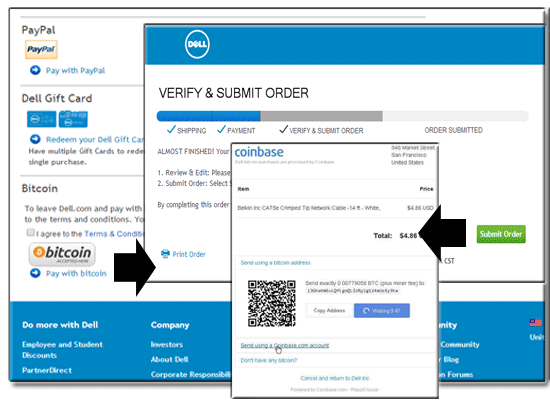

Now you can buy digital with digital – starting today, we’re accepting bitcoin on Dell.com.

We’re piloting bitcoin, the world’s most widely used digital currency, as a purchase option on Dell.com for consumer and small business shoppers in the U.S. We’re excited to bring you the choice and flexibility this payment option offers and have partnered with Coinbase, a trusted and secure third party payment processor, to make this possible.

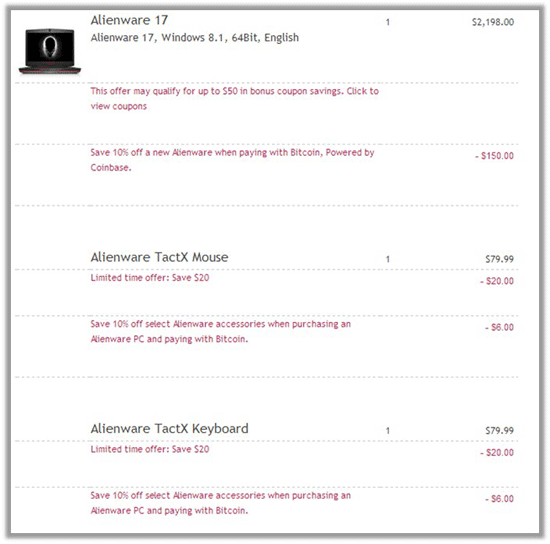

I’m excited to share in the coming days we’ll be offering a special Alienware promotion wherein customers can save 10 percent off a new Alienware system purchase (up to $150 limit) when checking out with bitcoin. Stay tuned to Dell.com/bitcoin for more information on this exciting offer.

When you are ready to make a purchase, simply add the items to your cart and choose Bitcoin as the payment method. Checkout our special video guide on Dell.com/bitcoin to see the bitcoin payment process in action.

We are moving more quickly to meet your needs. In fact, we were able to work with Coinbase to integrate bitcoin payment in just 14 days!

“We’ve fostered a close partnership with the Dell team and that’s been instrumental in getting the Coinbase integration up and running in such a short timeframe. We look forward to continuing to support the team as they explore other ways to offer even more functionality when it comes to bitcoin payments,” said Fred Ehrsam, Co-Founder of Coinbase.

We know you have some questions. We’ve tried our best to answer some of them below, but if you have others, be sure to check out the Terms & Conditions and our FAQ, or feel free to leave them in the comments below.

Bitcoin is a distributed peer-to-peer network offering a payment system based on a completely digital currency. Bitcoin payments can be made easily from anywhere in the world, and offer reduced payment processing costs. Bitcoins can be transferred instantly and securely between any two people in the world.

We have teamed with Coinbase to handle the processing of Dell.com transactions on the bitcoin network. Founded in June of 2012, Coinbase is an international digital wallet that allows you to securely buy, use, and accept bitcoin currency. Many other companies such as Overstock and Expedia are already using Coinbase to accept bitcoin.

How do I get started with bitcoin?

To acquire bitcoin, you’ll need to create a bitcoin wallet on a site such as Coinbase. This is the account from which you can send and receive bitcoin. Once you have a wallet, you can purchase bitcoin from Coinbase directly. Bitcoin can also be mined, though this requires high levels of processing power. This is something Dell Services customer Bitcoin ASIC Hosting found to be true, and is why they partnered with us to provide a large scale and high density crypto-currency hosting facility available to the Bitcoin mining community.

The process of selecting products and services on Dell.com remains the same for bitcoin users as for everyone. Once your selections are made and you are ready to make a purchase, simply add the items to your cart and choose bitcoin as the payment method. You can send payment from your bitcoin wallet by using the generated bitcoin address, by scanning the QR code from your smartphone, or by using a Coinbase account.

You can use bitcoin to purchase any products on Dell’s consumer, EPP or small/medium business sites in the U.S. Bitcoin will only be accepted online at the point of sale, not on existing invoices.

Didn’t Dell already accept Bitcoin?

While it was noted earlier this year that you could purchase Gyft cards with bitcoin and use those to shop on Dell.com, we are now pleased to accept bitcoin as a direct payment option via Coinbase.

Wasn’t Dell Security warning about Bitcoin malware earlier this year?

Our SonicWALL researchers did observe an increase in bitcoin mining botnets in our 2013 Threat Report. However, bitcoin adopters can take precautions to ensure security. We’ve enlisted Coinbase, one of the most secure, reputable and widely used bitcoin platforms in North America to help with this. Information on their security protection can be found here.

[UPDATE 7/20/14]

Based on feedback from one of our commenters below, here are some additional precautions bitcoin adopters can take for security:

Dell SecureWorks’ BitCoin security experts Joe Stewart, director of Malware Research for the CTU, and Pat Litke, CTU security researcher, recommend:

- Use a non-web-based wallet, always back up and encrypt your wallet, and ensure that the machine that is used to store the bitcoin wallet is malware free. After all, all other precautions are for naught if the machine is compromised by malware.

- Consider using open-source and trusted wallet software (Electrum, Armory) – Use only in deterministic mode.

- If holding a large sum of currency, consider moving the majority of it over to a cold-storage wallet. When access to those funds is needed, move them back to your “hot” wallet where they can then be spent.

[UPDATE 7/24/14]

Our Alienware promotion mentioned above is now live!

You can now save 10 percent (up to $150 limit) when checking out with bitcoin. The discount will apply to all Alienware computer purchases and select Alienware accessories purchased. The total amount of the discount will be noted during checkout when purchasing with bitcoin. Here’s a sample of what the would look like:

[UPDATE 7/24/14]

Note: This Alienware promotion ends August 14, 2014.

10 210 пользователей находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 3 года назад автор 2weiX

Want to add to the discussion?

[–]surge3d 4 очка 5 очков 6 очков 3 года назад (1 дочерний комментарий)

[–]moleccc 0 очков 1 очко 2 очка 3 года назад (0 дочерних комментарев)

[–]fatoshi 0 очков 1 очко 2 очка 3 года назад (2 дочерних комментария)

[–]surge3d 4 очка 5 очков 6 очков 3 года назад (1 дочерний комментарий)

[–]moleccc 1 очко 2 очка 3 очка 3 года назад (0 дочерних комментарев)

[–]daisycoin 0 очков 1 очко 2 очка 3 года назад (1 дочерний комментарий)

[–]surge3d 0 очков 1 очко 2 очка 3 года назад (0 дочерних комментарев)

[–]nyaaaa 0 очков 1 очко 2 очка 3 года назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 70814 on app-717 at 2018-05-29 17:56:37.884545+00:00 running 578cde9 country code: RU.

Supergeil! Bei Edeka mit Bitcoins Lebensmittel bestellen!

Liebe, Luft und Bitcoin

Nein, das ist kein verspäteter April-Scherz oder so. Man kann bei Edeka-Lebensmittel.de nun mit Bitcoins bestellen. So gut wie alles, was man in den Filialen von “Wir-lieben-Lebensmittel”-Edeka kaufen kann, kann man über das Online-Portal bestellen. Über Shopify und BitPay nimmt Edeka nun dafür auch Bitcoin an. Den Beweis seht ihr in dem Screenshot. Was das für den deutschen Bitcoiner bedeutet, muss ich wohl nicht erklären: Ihr könnt jetzt fast alles, was euer Herz bzw. euer Magen begehrt, mit Bitcoin bestellen. Schokolade, Kaffee, Wurst, Käse, Brot, Ravioli, Schnapps, Dosenfisch …

Die Lieferung kostet bis 30 Kilogramm 3,90 Euro. Ab 100 Euro ist sie kostenlos. Geliefert wird per DHL, so dass man sich noch mindestens einen Tag gedulden muss. Interessant ist auch, dass Edeka auch ins europäische Ausland liefert, was angesichts der mitunter orbitalen Preise für Lebensmittel in unseren Nachbarländern durchaus seinen Reiz haben könnte.

Wer Lust hat, zu unken, der findet natürlich etwas: So liefert Rewe, anders als Edeka, sofort und mit der eigenen Flotte aus, weshalb es besser gewesen wäre, Rewe wäre diesen tollen Schritt gegangen. Außerdem akzeptiert Edeka Bitcoin über BitPay, was vermutlich bedeutet, dass die Bitcoin direkt in Euro gewechselt werden und man genauso oder fast so gut die Bitcoins auch verkaufen könnte. Aber … all das ändert nichts, dass heute, am 2. April, der Tag ist, ab dem man sich in Deutschland von Luft, Liebe und Bitcoin allein ernähren kann.

Bitcoin und Edeka

Bitcoin und Edeka

Hardware Wallet finden

Top 5 Hardware Wallets

Startseite » Bitcoin und Edeka

Bitcoin Empire Card Game – Become a Bitcoin Baron

Bitcoin Beginner Box

An interim change of product specifications, prices, delivery time and costs is possible

You already have experience with the product "Bitcoin und Edeka"? Then I am looking forward to your rating!

Edeka bitcoin

Diego Gutiérrez Zaldívar

Co-Founder & CEO RSK Labs

Diego Gutiérrez Zaldívar (Buenos Aires) is the co-founder and CEO of RSK Labs, which builds smart contracts based on the Bitcoin blockchain. He is also the president of the Latin American Bitcoin Association. He will talk about how cryptocurrencies can help the poorest people in developing countries by giving them access to the global financial system.

Erik Voorhees

Co-Founder & CEO ShapeShift

Erik Voorhees (Zug) is a serial entrepreneur and the co-founder and CEO of Shapeshift, an instant exchange for cryptocurrenices. He has been an evangelist for Bitcoin and Blockchain technology since its early days. Coindesk called him the "Most Influential Person in Blockchain" of 2017. Erik will talk about his experiences in the crypto world in a fireside chat with Unchain's head of program Aaron Koenig.

Sterlin Luxan

Communications Ambassador Bitcoin.com

Sterlin Luxan (Austin) is the communication ambassador at Bitcoin.com, a platform that informs and educates about Bitcoin and Blockchain technology. He considers himself a crypto-anarchist who prefers to live in a world without government. In his talk he shows how cryptocurrencies can pave the way to a free society based on voluntary exchange rather than on coercion and force.

Susanne Tarkowski Tempelhof

Co-Founder & CEO Bitnation

Susanne Tarkowski Tempelhof (Amsterdam) is the co-founder and Chief Unicorn of Bitnation, which offers services based on Blockchain technology that were formerly provided by governments. She will talk about how the Blockchain will change the way we live together in the future.

David Schwartz

Chief Cryptographer Ripple

David Schwartz is Chief Cryptographer at Ripple. David is one of the original architects of the Ripple consensus network. Prior to joining Ripple, David Schwartz developed encrypted cloud storage and enterprise messaging systems for organizations like CNN and the National Security Agency (NSA). Known as “JoelKatz”, he is a respected voice in the digital currency community. He will speak on "Enabling the Internet of Value".

Rodolfo Andragnes

Co-Founder Bitcoin Argentina

Rodolfo Andragnes (Buenos Aires) is the executive director of Bitcoin Argentina and the Espacio Bitcoin Buenos Aires. He is also the main organiser of the Latin American Bitcoin Conference. In his talk he will explain why cryptocurrencies are especially strong in Argentina with its history of inflation and frozen bank accounts.

Konstantin Gladych

Co-Founder & CEO Changelly

Konstantin Gladych is the CEO and Co-Founder at Changelly.com, instant cryptocurrency exchange that rapidly gained prominence in the crypto world among 2M users. Being deeply involved into the industry, Konstantin has profound insights of how to make business tools work for the community. He is also acting as an advisor for a range of projects including Cindicator, Genesis Vision, CoinPayments Coin, and MinerGate. Konstantin will give a speech about "Decentralized Exchanges vs. Centralized Services“.

Denitza Tyufekchieva

Co-Founder and VP of Business Development Propy

Denitza Tyufekchieva (Sofia) is the co-founder and VP of Business Development of Propy. She is an expert in token sales, ICO legislation and token economy for physical assets. She will talk about Real Life applications on the Blockchain, one of which is her real estate company Propy.

Rahim Taghizadegan

Economist and Director Scholarium

Rahim Taghizadegan (Vienna) is the last Austrian economist in Austria, an entrepreneur and director of the academic research institute Scholarium (scholarium.at) in Vienna, lecturer at several universities and faculty member at the International Academy of Philosophy in Liechtenstein. He is one of the earliest crypto-adopters among economists and is an expert on monetary theory and history.

Eric Benz

Co-Founder & CEO Cryptopay

Eric Benz (London) ihas over 10 years of experience working in and around Financial Technology. He has delivered innovative SaaS systems for some of today’s biggest institutions around payments, identity, and banking infrastructure. Eric has been in the Blockchain space since 2012 and is involved in a number of blockchain and fintech businesses both as investor and board director.

Maria Jones

Head of Marketing Cointelegraph

Maria Jones (Munich) is the head of marketing of Cointelegraph, one of the most important media outlets of the crypto world. She will speak about the human side of the crypto industry, about crypto meetups, activities and events all around the world.

Ben Stewart

Co-Founder & CTO blackbox.ai

Ben Stewart started at UBS Investment Bank and then transitionend to The Carlyle Group with a host of objectives ranging from quantitative risk assessments to algorithmic trading strategies. After The Carlyle Group, he transitioned to Betterment, the world's largest ”robo” advisor. Currently, Ben is exploring the intersection of AI and Blockchain (Web 3.0) to solve the hardest problems organizations face for the future of work.

Titus Gebel (Monaco) is a serial entrepreneur and the founder and CEO of Free Private Cities, a company that will offer privately managed cities as a business. He will talk about this new form of urban development and about the role that Blockchain technology can play in making it work.

Meinhard Benn

Co-Founder & CEO SatoshiPay

Meinhard Benn (Berlin) is a software developer the co-founder and CEO of SatoshiPay, a platform that enables Blockchain based micro- and nanopayments for media companies. He discusses the pros and cons of the models 'Proof of Work' and 'Proof of Stake' which are widely used in cryptocurrencies.

Edan Yago

Co-Founder & CEO Reserve

Edan Yago (London) is a seven-year veteran of the digital currency space and an experienced entrepreneur. As the Founder and CEO of Epiphyte, he helps financial institutions integrate with distributed ledgers to deliver instant settlement. Yago is also the founder and CEO of Reserve, helping banks issue stablecoins through decentralised, transparent and auditable smart contracts on the blockchain.

Mark Smargon

Co-Founder & CEO Colu

Mark Smargon (Tel Aviv) is the co-founder and CEO of Colu, a company that is offering technological solutions for local cryptocurrencies. In his talk we will present his experiences with local cryptocoins in Tel Aviv, Liverpool and London and give an outlook into the future.

Theo Goodman (Frankfurt) is co founder of the Rarepepe Foundation and MEME Consultant at proofofwork.media.

Ira Miller

Co-Founder & CEO Guld

Ira Miller (Panamá) is a software developer and the co-founder and CEO of Guld, a company that offers decentralised encrypted storage space and other features that enhance privacy. Together with Erik Voorhees he co-founded the Bitcoin service provider Coinapult. Ira will talk about his plans to decentralise the Internet.

Michael Merz

Co-Founder & CEO Ponton GmbH

Michael Merz (Hamburg) is a software developer and the co-founder and CEO of Ponton Labs, which has been developing software for the energy industry for many years. Michael has been active in cryptospace since 2012 and will present their project EnerChain, a peer-to-peer energy trading platform based on Blockchain technology.

Jeff Gallas

Consultant, investor and entrepreneur

Jeff Gallas (Berlin) is a Blockchain consultant, investor and entrepreneur. He is the founding director of the German Bitcoin Foundation (Bundesverband Bitcoin) and also a consultant for the award-winning FinTech startup Bitwala. Currently, Jeff is running Fulmo, an enterprise which is dedicated to Research and Development of the Lightning Network. This will be the topic of his talk also.

Stefan Krautwald

Co-Founder Fluz Fluz

Stefan Krautwald (Medellín) is Co-Founder of Fluz Fluz, the global cash back network. He is currently working on Fluzcoin, a next generation virtual retail currency. Among others formerly Stefan was CEO for Latin America at Cdiscount, part of Cnova Group and sixth largest e-commerce company in the world. Stefan will talk about how the use of crypto currencies will affect retail.

Daria Ariefeva

Co-Founder & CEO Cryptofriends

Daria Ariefeva (Moscow) is the co-founder and CEO of cryptofriends, a community platform and series of events for the crypto industry. She will give an overview of the blossoming world of media and events dedicated to all things crypto.

Tim Rehder (Berlin) joined Earlybird in 2018 and is currently a Principal at the Berlin office. Tim is an early Bitcoin adopter and strong Blockchain advocate. He founded Cubits, a European based Bitcoin marketplace, and lead the company (50+ employees) as a CEO for around 3 years. Tim holds an MSc in Finance from the University of St Andrews, where he specialized his studies in Financial Econometrics.

Dominik Weil

Co-Founder & COO BitcoinVN

Born and raised in Europe's Financial Capital Frankfurt/Main, Dominik Weil (Saigon) has been an early adopter and pioneer in the space of digital currencies. He is currently active as the Co-Founder & COO of Vietnam's first & leading Digital Asset Exchange & has been leading the efforts of the organization to implement Blockchain-based Remittance payments with the goal to provide faster processing times and lower transaction fees.

Moritz Schildt

Co-Founder coinIX

Moritz Schildt is co-founder of coinIX, an investment firm focussing on blockchain related projects and crypto assets. Having a background in traditional asset management and serving as managing director of nordIX AG, Moritz will share an institutional investors perspective on crypto assets with us and will talk on valuation of crypto and strategies for composing a crypto portfolio.

Stefan Sohst

Co-Founder and CEO Emotional Leadership

Stefan Sohst (Hamburg) is the founder and CEO of Emotional Leadership, a consulting and coaching company. He is coaching companies and managers about discovering emotions as a business factor. He has been working in the IT and software business for 20 years. Stefan will speak about emotional and also ethical aspects of blockchain technology.

Jed Grant

Co-Founder and CEO KYC3

Jed Grant, MBA, is the founder and CEO of KYC3, one of the original regtech companies in Luxembourg, and the founder of Peer Mountain, a decentralized P2P ecosystem of trust. Prior to these activities Jed held senior positions in technology, finance and security related organizations including Artemis, the International Civil Servants Credit Union (AMFIE), Computacenter, and NATO.

Supergeil! Bei Edeka mit Bitcoins Lebensmittel bestellen!

Liebe, Luft und Bitcoin

Nein, das ist kein verspäteter April-Scherz oder so. Man kann bei Edeka-Lebensmittel.de nun mit Bitcoins bestellen. So gut wie alles, was man in den Filialen von “Wir-lieben-Lebensmittel”-Edeka kaufen kann, kann man über das Online-Portal bestellen. Über Shopify und BitPay nimmt Edeka nun dafür auch Bitcoin an. Den Beweis seht ihr in dem Screenshot. Was das für den deutschen Bitcoiner bedeutet, muss ich wohl nicht erklären: Ihr könnt jetzt fast alles, was euer Herz bzw. euer Magen begehrt, mit Bitcoin bestellen. Schokolade, Kaffee, Wurst, Käse, Brot, Ravioli, Schnapps, Dosenfisch …

Die Lieferung kostet bis 30 Kilogramm 3,90 Euro. Ab 100 Euro ist sie kostenlos. Geliefert wird per DHL, so dass man sich noch mindestens einen Tag gedulden muss. Interessant ist auch, dass Edeka auch ins europäische Ausland liefert, was angesichts der mitunter orbitalen Preise für Lebensmittel in unseren Nachbarländern durchaus seinen Reiz haben könnte.

Wer Lust hat, zu unken, der findet natürlich etwas: So liefert Rewe, anders als Edeka, sofort und mit der eigenen Flotte aus, weshalb es besser gewesen wäre, Rewe wäre diesen tollen Schritt gegangen. Außerdem akzeptiert Edeka Bitcoin über BitPay, was vermutlich bedeutet, dass die Bitcoin direkt in Euro gewechselt werden und man genauso oder fast so gut die Bitcoins auch verkaufen könnte. Aber … all das ändert nichts, dass heute, am 2. April, der Tag ist, ab dem man sich in Deutschland von Luft, Liebe und Bitcoin allein ernähren kann.

Mit Bitcoin bei Edeka einkaufen – ein unterschätzter Meilenstein

Der Markt für Lebensmittel dürfte der älteste Markt der Menschheitsgeschichte sein. So ist es nicht ungewöhnlich, dass er sich ebenfalls weiterentwickelt und das Essen bis nach Hause bringt. Ungewöhnlicher ist es dann, wenn wir einen alten Freund beim Einkaufen treffen: Bitcoin.

Lebensmittel Online

Zahlreiche Nutzer der Internet-Plattform „Reddit“ haben sich in einem Thread/Beitrag zusammengetan, um herauszufinden in welchen Ländern der Welt es möglich ist mit Bitcoin Essen zu bestellen. Zwar ist es mit Sicherheit nicht in allen Ländern die günstigste Methode, aber bestimmt mit Abstand die bequemste.

Ein unerwartetes Bild:

Und mit dabei: Deutschland

Und mit dabei: Deutschland

Edeka & Bitcoin

Auf der Webseite habe ich mir die Situation mal angeschaut. Zahlungsabwickler ist hier das uns bekannte Bitcoin-Unternehmen BitPay, welches die Zahlung für viele Unternehmen einrichtet. Berichtet haben wir bereits darüber im Jahr 2015, was viele für einen verspäteten Aprilscherz hielten.

Verschickt werden die Artikel in einem Paket bis 30 Kg, wobei sich die Versandkosten damit bis jetzt auf 4,99 erhöht haben. Ab 100 Euro Bestellwert ist der Versand frei: Großeinkauf für die nächste Party?

Meilenstein

Für uns ist es ein cooles Gadget, eine nette Spielerei auf dem Weg zur großen Bitcoin-Akzeptanz. Aber an anderen Orten auf der Welt ist diese kleine „Spielerei“ ein Meileinstein – und sogar lebensrettend.

Somit hilft Bitcoin indirekt den Hungernden, und das ist jetzt nicht übertrieben: in Venezuela bricht die Wirtschaft zusammen. Seit Jahren leidet das Land und nicht mal die grundlegenden Dinge für das Leben, Nahrungsmittel und Medizin, können bereitgestellt werden.

Hungernde Familien fliehen aus dem Land, die Militärs versuchen die Nahrungsimporte zu eskortieren. Schwarzmärkte gibt es dort überall, Preise für Mehl und andere simple Dinge liegen bei Preisen, die das 100-fache des normalen Preises ausmachen können.

Und dort greift Bitcoin: Unternehmen und Studenten haben dort das Internet durchforstet und Marktplätze gesucht, die Bitcoin akzeptieren. Für sie ist der Bitcoin allemal stabiler als ihre nationale Währung und Dienstleister wie Purse.io führen dazu, dass man mal eben Nahrungsmittel aus dem Ausland bestellen kann.

Wie ein Reddit-Nutzer treffend feststellte, nachdem er die Karte vor sich sah:

„Also mit ein paar Ausnahmen, lässt sich praktisch überall auf der Welt Nahrung für Bitcoin kaufen. Es ist nicht günstig (gerade der internationale Versand), aber möglich.

Warum das wichtig ist?

Je einfacher es ist mit Bitcoin zu leben, desto eher kommt Bitcoin in den Umlauf und desto größer ist die allgemeine Akzeptanz.“

Über Danny de Boer

Als Informatiker schaut Danny de Boer kritisch auf die Blockchain-Entwicklung und Kryptographie. Zwischen Komplexität und Hype erklärt er allgemeinverständlich und anwendungsbezogen. Seit 2014 berichtet er für BTC-ECHO aus der Krypto-Szene.

Als Informatiker schaut Danny de Boer kritisch auf die Blockchain-Entwicklung und Kryptographie. Zwischen Komplexität und Hype erklärt er allgemeinverständlich und anwendungsbezogen. Seit 2014 berichtet er für BTC-ECHO aus der Krypto-Szene.

Mit Bitcoin bei Edeka einkaufen – ein unterschätzter Meilenstein

Der Markt für Lebensmittel dürfte der älteste Markt der Menschheitsgeschichte sein. So ist es nicht ungewöhnlich, dass er sich ebenfalls weiterentwickelt und das Essen bis nach Hause bringt. Ungewöhnlicher ist es dann, wenn wir einen alten Freund beim Einkaufen treffen: Bitcoin.

Lebensmittel Online

Zahlreiche Nutzer der Internet-Plattform „Reddit“ haben sich in einem Thread/Beitrag zusammengetan, um herauszufinden in welchen Ländern der Welt es möglich ist mit Bitcoin Essen zu bestellen. Zwar ist es mit Sicherheit nicht in allen Ländern die günstigste Methode, aber bestimmt mit Abstand die bequemste.

Ein unerwartetes Bild:

Und mit dabei: Deutschland

Und mit dabei: Deutschland

Edeka & Bitcoin

Auf der Webseite habe ich mir die Situation mal angeschaut. Zahlungsabwickler ist hier das uns bekannte Bitcoin-Unternehmen BitPay, welches die Zahlung für viele Unternehmen einrichtet. Berichtet haben wir bereits darüber im Jahr 2015, was viele für einen verspäteten Aprilscherz hielten.

Verschickt werden die Artikel in einem Paket bis 30 Kg, wobei sich die Versandkosten damit bis jetzt auf 4,99 erhöht haben. Ab 100 Euro Bestellwert ist der Versand frei: Großeinkauf für die nächste Party?

Meilenstein

Für uns ist es ein cooles Gadget, eine nette Spielerei auf dem Weg zur großen Bitcoin-Akzeptanz. Aber an anderen Orten auf der Welt ist diese kleine „Spielerei“ ein Meileinstein – und sogar lebensrettend.

Somit hilft Bitcoin indirekt den Hungernden, und das ist jetzt nicht übertrieben: in Venezuela bricht die Wirtschaft zusammen. Seit Jahren leidet das Land und nicht mal die grundlegenden Dinge für das Leben, Nahrungsmittel und Medizin, können bereitgestellt werden.

Hungernde Familien fliehen aus dem Land, die Militärs versuchen die Nahrungsimporte zu eskortieren. Schwarzmärkte gibt es dort überall, Preise für Mehl und andere simple Dinge liegen bei Preisen, die das 100-fache des normalen Preises ausmachen können.

Und dort greift Bitcoin: Unternehmen und Studenten haben dort das Internet durchforstet und Marktplätze gesucht, die Bitcoin akzeptieren. Für sie ist der Bitcoin allemal stabiler als ihre nationale Währung und Dienstleister wie Purse.io führen dazu, dass man mal eben Nahrungsmittel aus dem Ausland bestellen kann.

Wie ein Reddit-Nutzer treffend feststellte, nachdem er die Karte vor sich sah:

„Also mit ein paar Ausnahmen, lässt sich praktisch überall auf der Welt Nahrung für Bitcoin kaufen. Es ist nicht günstig (gerade der internationale Versand), aber möglich.

Warum das wichtig ist?

Je einfacher es ist mit Bitcoin zu leben, desto eher kommt Bitcoin in den Umlauf und desto größer ist die allgemeine Akzeptanz.“

Über Danny de Boer

Als Informatiker schaut Danny de Boer kritisch auf die Blockchain-Entwicklung und Kryptographie. Zwischen Komplexität und Hype erklärt er allgemeinverständlich und anwendungsbezogen. Seit 2014 berichtet er für BTC-ECHO aus der Krypto-Szene.

Als Informatiker schaut Danny de Boer kritisch auf die Blockchain-Entwicklung und Kryptographie. Zwischen Komplexität und Hype erklärt er allgemeinverständlich und anwendungsbezogen. Seit 2014 berichtet er für BTC-ECHO aus der Krypto-Szene.

Värdex Suisse AG

Blockchain technologies are rapidly changing the way we think about our digital identities and the way we interact with the world around us. Inherently decentralised, common cryptocurrencies like Bitcoin, and Ethereum, as well as, other Altcoins, are pioneering new innovations in a number of global industries.

Since 2008, Blockchain applications have increased dramatically, proving effective as technologies to reduce transaction costs, eliminate inefficient intermediaries and shift our reliance from subjective to objective decision making. For example, international remittances utilising Bitcoin will cost less and will settle faster, than utilising the service of a conventional global payment providers such as Western Union or XE. Despite the many benefits associated with cryptocurrencies, their integration into mainstream business and consumer industries has been latent.

The greatest impediment for mass market adoption, can often be explained by the complex nature of Blockchain technologies. Businesses are often required to make an upfront investment in new technical capabilities, or purchase additional hardware, before they add value onto existing products and services. Subsequently, the locations where consumers can currently use Bitcoin and other cryptocurrencies, for transactional purposes, are limited.

Additionally, consumers often face liquidity constraints when storing cryptocurrencies both on and offline . Exchanging Ethereum and Bitcoin for cash, despite the benefits of such cryptocurrencies, is complex and time consuming- transfers from exchanges to a nominated bank account can take several days- precluding these digital assets from being used practically.

Enter Bitcoin ATMs

Bitcoin ATMS, make buying and selling cryptocurrencies accessible for everyday customers, by instantly exchanging cryptocurrency for cash. The team at Värdex Suisse AG, has recognised the need and demand for a Swiss Bitcoin ATM network, to provide greater access and flexibility to the growing world of Blockchain. Founded in late 2017, our mission has been to make buying and selling Bitcoins as simple as using a normal ATM. Since the start of the year, our Bitcoin network has

facilitated more than 3 million CHF of buy and sell orders, and this number continues to grow rapidly. Thanks to the ongoing support of our customers, the Värdex Bitcoin ATM network is now the largest in Switzerland. And, we’re just getting started.

In collaboration with Bitcoin Suisse AG, the team has focused intensively on expanding the number of terminals offered throughout the country and you can currently find Värdex ATMs in 10 unique and convenient Swiss locations. This number will increase and we’re working hard to ensure that all 4 corners of the country are fully serviced to meet the demands of our Blockchain enthusiasts, investors and newcomers.

So what are the benefits of a Bitcoin ATM and why is it better than purchasing cryptocurrency on an exchange?

Our team has decided that there are at least 6 benefits consumers can take advantage of, when purchasing Bitcoins from our Värdex network. These benefits, include

ATMs execute buy and sell requests almost instantaneously. As soon as money has been inserted into the terminal, a purchase or sale is executed for a sum equivalent to the payment amount. If you’re looking to convert your cryptocurrency into cash, this means no longer needing to wait several days to transfer cash from exchanges to your bank account- get your cash quickly and as you need it!

#2 Accessibility

A simple three-step process is all you need to know when using our terminals. You don’t need to setup an online wallet, nor deal with lengthy public keys, Your receipt contains a QR code, public and private key, which can be scanned and is immediately recognised by our terminals.

#3 Security

Whenever a new purchase request is accepted, our terminals generate a new private key and QR code, which will be printed on a paper receipt. This receipt is also known as a paper wallet- similar to a hard wallet which is tangible and an offline method of storing Bitcoin(s). So long as the receipt is stored in a secure location, your tokens will always be safe from online attacks by malicious agents.

#4 Flexibility – You Decide!

Choose between keeping your Bitcoins offline, or transfer them Online; onto an exchange to buy and sell for a number of other cryptocurrencies, or keep them in an online wallet. Whether you’ve purchased Bitcoins as a long term investment, to capitalise on a trend, or to use for payment, our ATMs offer superior liquidity and flexibility.

5. Anonymity: Despite global discrepancies of Anti Money Laundering (AML) and Know Your Customer (KYC) legislation, Värdex does not require customers to complete identity verification checks. We set a maximum sell and buy value, equivalent to 2,000 CHF, per day, to enable customers to use our machines hassle-free. Feel comforted knowing that you can execute your purchase and sale requests directly on the terminal and never require human intervention.

#6 Superior Customer Support

Unlike relying on the customer support offered by online exchanges, which usually only offer an email address for enquiries, the team at Värdex is here for you every step of the way with speedy response times. More than 90% of all tickets are actioned within 24 hours. If you have a question, a problem arises, or if you just want to get in touch to learn more about our terminals, our team is available 9am to 6pm,Monday to Friday and 9am to 3pm on Saturday.

Комментариев нет:

Отправить комментарий