One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422a8081a6c58f51 • Your IP : 185.87.51.142 • Performance & security by Cloudflare

The Risks of Trading Bitcoin on eToro

If you want to buy or sell Bitcoin, you'll need an exchange/broker. Generally there are two ways of doing this:

- Cryptocurrency exchanges allow you to buy and sell real coins (e.g. if you buy some Bitcoin - you own it). See this guide for some examples.

- Most brokers don't allow you to buy Bitcoin directly. Instead they allow you to invest in it via CFD (Contract for Difference), which means you're not buying the coin itself - the exchange buys it on your behalf, and you have to pay a daily fee to hold it. Some brokers like eToro and IQ Option are starting to take the middle ground, where you can invest in Bitcoin and not pay a daily holding fee.

There are pros and cons to both of these, where pro-exchange arguments will be based around low fees & ownership of the coins, and pro-CFD arguments for reasons such as better user interfaces, better regulation & better risk management (e.g. automated leverage).

eToro is a cross-over between these two. It allows you to buy Bitcoin directly (not via CFD), but it also has a great user interface for things like opening/closing orders and has unique features such as the ability to copy other traders. It does however have many hidden risks which you should be aware of, this guide will explain some of these.

This guide will focus on risks, see this guide for a tutorial on using eToro.

We encourage you to read this entire guide before trying eToro to understand the potential risks; but if after reading this you still want to try it out, here's a link (we'll get some money if you sign up via this).

Is Buying & Selling Too Easy?

When you first use an exchange, you'll find lots of guides and tutorials on how you should be storing your Bitcoin. The general consensus is that once you buy it, you shouldn't keep it on the exchange - it should be moved to a wallet. The most common reason is that the exchange might run away with your money, but there's a second less dramatic one; that by moving your Bitcoin to a wallet, it makes it harder to sell it.

This might seem counter-intuitive, but context is important here. The user interface on eToro is much more user-friendly than most exchanges or CFD brokers, and there are many online reviews stating this causing beginner traders to see eToro as a good platform to try out. When these beginners first trade they're inevitably going to open positions that don't go well and lose them money.

When trading stocks, scenarios where the price will move more than 10% in one day are very rare. In cryptocurrencies they are not. Given the right environment, any cryptocurrency can easily drop 10% or more in a single day (and has done many times). For this to happen to a beginner, the fear of losing more money will often give them a very strong urge to sell. On eToro it's possible to do this in just a few seconds, to close your position and walk away. But a beginner trader would then experience the fear of missing out, and so buy back in again - often at a higher price. This statement is highly speculative, but next time this happens, if you look at the eToro Bitcoin user feed, you'll see many people in this scenario. If you'd stored your Bitcoin on a wallet, the time between moving it back to the exchange would have given you a better time frame to make your decision off.

That said, if you're a more experienced trader you'll likely be aware of this scenario so it won't be an issue for you.

eToro Spreads are Very High

If you were to go on an exchange right now to buy Bitcoin, the price would be determined by the person willing to sell their Bitcoin for the lowest amount. Let's say this amount is $7000. On this exchange you'd normally pay a fee of around 0.2% to buy a coin, and then a second 0.2% fee to sell it, 0.4% total; which would be $28. On eToro you pay a fixed fee of 0.7% to open Bitcoin trades, which is $49. This is only 0.3% higher than exchanges, so not too bad; but on other cryptocurrencies this ranges between 2% and 5%! So if you invested that same amount in Litecoin that would cost you $210, and if you invested that in Bitcoin Cash that would cost you $350 - over 10x more than an exchange.

This problem by itself makes profitable trades harder, but given the extra functionality you get, some justify this as an acceptable cost. Where this isn't ok is how their system for opening orders works. We'll explain a situation we experienced ourselves.

(The rest of this section talks about stop losses, which eToro has since removed)

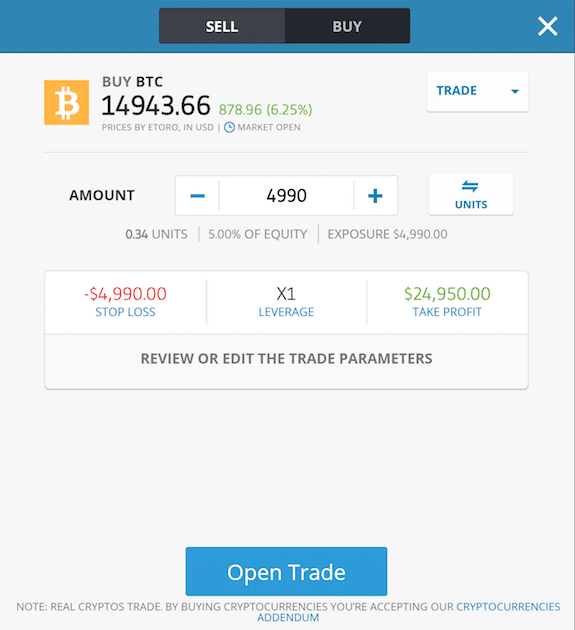

We decided to try and short Bitcoin Cash, to open a sell order for $250 and then buy it back at a lower cost. When we open risky orders like this we normally set a small stop loss, in this case at -$14, which for other coins we'd traded such as Bitcoin and Ethereum allowed a good 1-2% upward movement before the order closed.

The eToro user interface allowed us to do this, but when we opened this order it hit the stop loss immediately at -$14.64. Two things may have happened here, either the price of Bitcoin Cash dropped 1% or 2% within seconds of us opening the trade (which seems very unlikely), or the eToro interface allowed us to set a stop loss that was lower than the spread at the time. Regardless; the trade we just made should not have been possible. On their fees page eToro states that Bitcoin Cash 'typical spread' is 5%, which would be $12.50 for a $250 order, $2 below our stop loss. Allowing a trade to be opened with a difference between the opening value and stop loss of such a low amount is an incredibly dangerous feature.

High Withdrawal Fees

Withdrawal fees on eToro have always been fairly high, but for lower amounts they've had special cases with lower fees; where for a $20-$200 withdrawal the fee was $5, for a $200-$500 withdrawal the fee was $20, and for $500+ withdrawals the fee was $25.

They've since changed this, where now the withdrawal fee is $25 for all withdrawals. If you're depositing/withdrawing large amounts of money this change won't affect you. But if you're dealing with small amounts of a few hundred dollars this will both eat away at your profits and encourage you to deposit and withdraw larger amounts of money to increase profit margins. This is something that we find very concerning as this encourages new traders to invest larger amounts of money than they should given the associated risks of trading cryptocurrencies.

Conclusion

With all the above said, you might think that we don't like eToro, that you should avoid it. But this isn't the case. Being aware of all the above issues, we're able to avoid the issues caused by them; we tend to avoid Bitcoin Cash trades for example! Cryptocurrency trading is still very new to platforms which previously only dealt with CFDs, so quirks like this are expected. Our hope is that over time eToro will decrease their spreads for cryptocurrencies and add functionality to avoid the pitfalls we've described above.

Features such as the ability to trade on a demo account, and the option to follow/copy other popular traders are very useful, and we think balance out some of the more annoying quirks of the platform. eToro is also a regulated broker, which many exchanges are not, another important consideration for people depositing large amounts.

If you want to try out eToro and help us out, here's a link (we'll get some money if you sign up via this).

DISCLAIMER: This site cannot substitute for professional investment or financial advice, or independent factual verification. This guide is provided for general informational purposes only. Anything Crypto is UK-based and not regulated by the FCA (Financial Conduct Authority). The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors. The ideas presented are our analysis, learning & opinions on a range of cryptocurrency topics. Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money.

This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research. As we write new content, we will update this disclaimer to encompass it.

eToro Bitcoin Trading Review

Last updated on January 2nd, 2018 at 12:00 am

eToro’s Review Summary

Pros: Easy to setup, ability to follow and copy experienced traders, Helpful video tutorials

Cons: Only 4 execution times for trades a day, Does not accept US customers

Conclusion: eToro is probably the easiest investment platform to understand from all other alternatives. It’s simple approach and the fact that you can copy trades and diversify your investment in different people is unusual in the Bitcoin trading world and might be worth considering. The trade hours limitation (only 4 times day) do however prevent it from being my all time favorite.

Full review of eToro’s Bitcoin trading platform

One of the most interesting investment platform around for Bitcoin is eToro. Unlike other trading platforms, eToro differentiates itself from competitors by being a social investment network and addresses the facts that:

- Trading platforms are too complex.

- Most people can’t find their way easily when it comes to financial markets.

- There is insufficient access to market information and top traders.

Through the use of eToro’s Openbook the world’s largest social network of investors is built. You can now tap into the wisdom of over 3m investors from 200 different countries and view their portfolios and trades . The basic idea is that you can copy of successful investors, which makes the whole story of knowing when and what to invest in much simpler. So instead of the need to decide in what stock or commodity to invest it, you can decide which person to copy (based on his past failures and success).

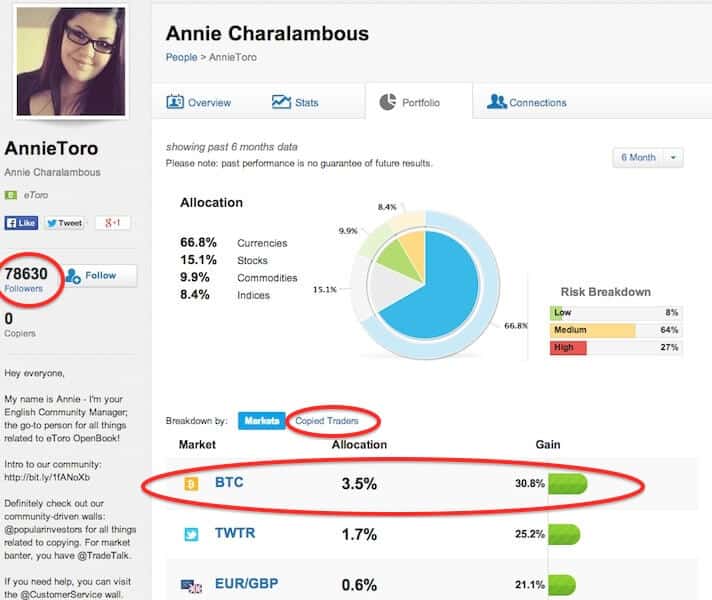

So what you need to do is see, follow and copy the best performing traders in the network. This means that You don’t need to be an expert to invest like a top performer. For example, Annie Charalambous invests 3.5% of her portfolio in Bitcoin and has gained more than 30% on her Bitcoin investments until today. She has almost 80,000 followers and you can also see which traders she copies to get more insights.

I believe that the best thing about eToro is that it’s easy to use for inexperienced traders. It doesn’t involve all sorts of complex trading platform and weird terminology. It only takes 3 clicks and you can start investing.

The downside to eToro as that since it’s made for “simple” traders, it won’t let you short sell and leverage on Bitcoin when that price drop unlike other trading platforms such as AvaTrade or Plus500.

How to start investing in Bitcoin with eToro

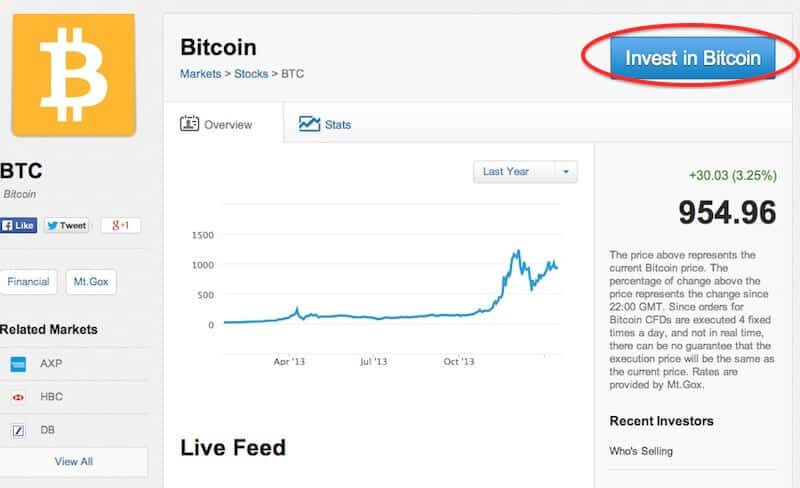

Go to eToro’s Openbook Bitcoin page and click on “Invest in Bitcoin”

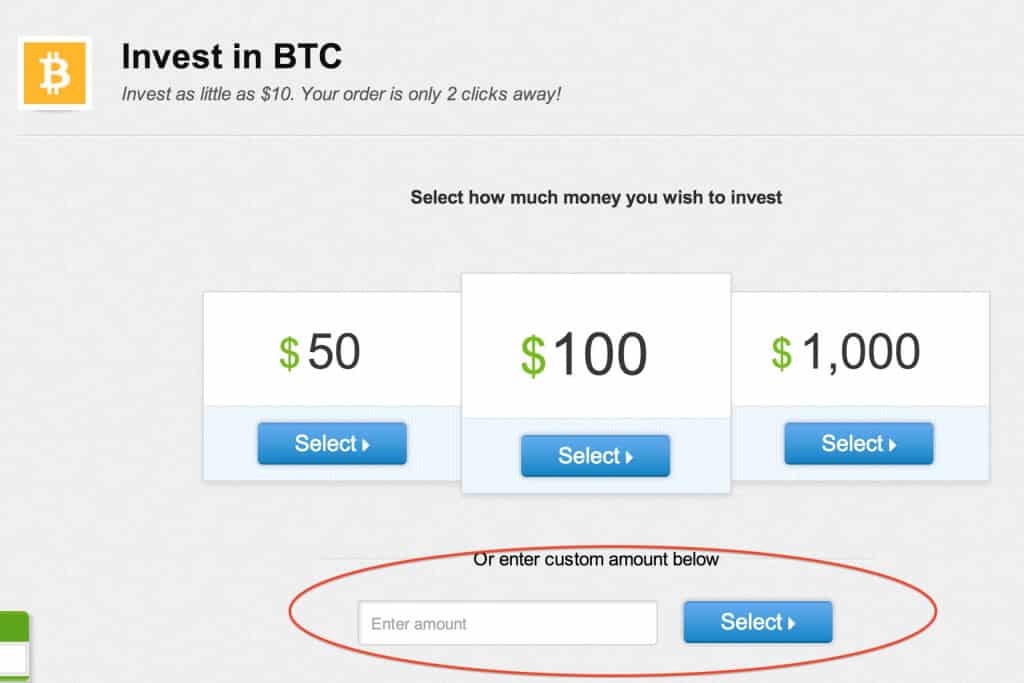

After that you will be able to choose the amount of dollars you wish to invest. You can choose from the defaults of $50, $500 and $1000 or state a custom amount. I suggest starting with the minimum amount of $50 just to get yourself acquainted with the system.

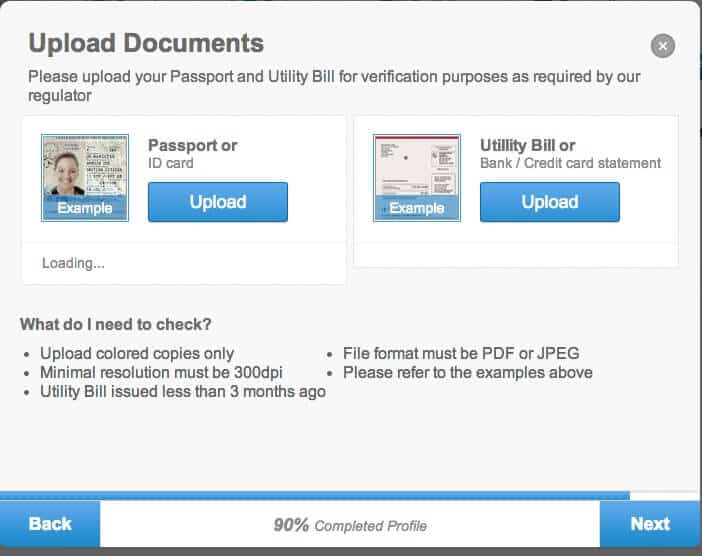

Next you will need to enter your payment method and fill in a short survey which is required by regulations for eToro as it is a trading platform. Once you finish the survey you will be required to upload an identification document for your account to be verified. After you upload this document it can take up to 5 days to get reviewed although from my experience it takes much less.

Once your account is verified your order will be executed in the next execution time which are at 06:00, 12:00, 18:00 and 00:00 Monday to Friday. So keep in mind that if you want to place a trade at 16:00 you need to place it at least 5 minutes before, meaning 15:55. eToro take a fee of a fixed 1% of the execution price or a minimum of 1 cent per transaction.

The social interaction is a blast!

I must say, that I didn’t sign up for eToro for it’s social platform but I was really amazed by it. After making my initial investment of $50 (which is now a booming $52.23) I started getting people writing on my wall with different suggestions and helping me out to build my portfolio. This is a real big plus for inexperienced traders.

Conclusion – Very attraction investment option for inexperienced traders

eToro is probably the easiest investment platform to understand from all other alternatives. It’s simple approach and the fact that you can copy trades and diversify your investment in different people is unusual in the Bitcoin trading world and might be worth considering. The trade hours limitation (only 4 times day) do however prevent it from being my all time favorite.

PR: eToro Announces Expansion Plans

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

– Launch of a crypto exchange and wallet –

– Bringing crypto offering to the U.S. market –

Global investment platform eToro has today announced plans to expand its cryptocurrency capabilities and subject to regulatory approvals will launch an exchange and a digital wallet. eToro will also bring its cryptocurrency offering to the United States, launching the platform to U.S. customers later this year under the leadership of the newly appointed U.S. Managing Director Guy Hirsch.

Yoni Assia, Co-founder and CEO of eToro, said: “We believe that in the future all assets will become digitised. This will help to open the markets to everyone and enable them to invest in the assets they want in a simple and transparent way. Crypto is the first step on this journey and we are excited to share our plans to launch an exchange and wallet.”

The announcements made today at Consensus 2018 in New York, follow the news in March that eToro had completed its Series E funding round, raising $100m USD to accelerate its global expansion and the development of blockchain technology to support the digitisation of assets. The platform enables people to invest in the assets they want to own from cryptocurrencies though to traditional assets such as commodities.

Yoni Assia, commented: “An exchange and wallet are important additions to our crypto offering and we know that both have been eagerly anticipated by our customers.”

eToro currently offers ten cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, XRP, Litecoin, Ethereum Classic, Dash, Stellar, NEO and EOS) with plans to add more coins over the coming months. eToro’s cryptocurrency to cryptocurrency exchange will launch later this year enabling customers to trade coins.

The wallet will be launched as a phased rollout with select customers participating in beta testing to ensure that eToro provides an app which best meets its customers’ needs. The wallet app will be available to download on the App Store and Play Store and will work across multiple platforms and in multiple languages. It will enable users to hold multiple cryptocurrencies and tokens.

Since launching in 2007, eToro has built a global community of more than ten million investors across 140 countries. Guy Hirsch has been appointed US Managing Director responsible for bringing eToro’s cryptocurrency offering to the United States. Guy previously served as Director of Innovation Strategy at Samsung and has extensive experience across digital transformation and unified commerce.

Guy Hirsch, USA Managing Director, eToro, said: “eToro empowers investors with a platform that gives them access to the assets they want, shared knowledge and ease of transaction. We know that there is a strong demand in the U.S. for crypto and we are excited to be able to offer U.S. investors the opportunity to learn about and invest across multiple cryptocurrencies.”

eToro will offer U.S. investors three ways to access the crypto markets: manually invest in a coin, automatically copy the trades of other traders on the platform to benefit from their knowledge and investment expertise, or invest in a Crypto CopyFund which provides a diversified portfolio of major crypto assets.

From today, U.S. investors can visit eToro.com to join the waiting list ahead of the launch of the U.S. platform later this year.

About eToro

eToro empowers people to invest on their own terms. The platform enables people to invest in the assets they want, from cryptocurrencies to commodities. eToro is a global community of more than ten million people who share their investment strategies; and anyone can follow the approaches of those who have been the most successful. Users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact whenever they want.

Invest in Bitcoin on the World’s Leading Social Trading Network

Join millions who have already discovered smarter strategies for investing in Bitcoin. Learn from experienced eToro traders or copy their positions automatically.

Bitcoin price (PROVIDED BY eToro)

Cryptocurrencies can fluctuate widely in prices and are therefore not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Past performance does not guarantee future results. Trading history presented is less than 5 years and may not suffice as basis for investment decision. Your capital is at risk.

Start Trading the

World’s Most Exciting Cryptocurrency

Use eToro's advanced risk management tools to protect your positions. Enjoy hassle-free deposits and withdrawals, instant execution of trades and a free $100,000 demo account to practice your strategy.

Benefit from falling Bitcoin prices as well as rising Bitcoin prices. Buy or sell instantly

Choose your desired investment amount - from as little as $250 per trade

Volatility means opportunity! Watch price changes reflect directly onto your portfolio

Start trading within minutes – no physical purchase delays

Discuss Bitcoin Trading strategies with eToro’s top traders. Use our patented CopyTrader™ technology to automatically copy investment portfolios of successful traders.

*Past performance is not an indicator of future results.

All trading involves risk. Only risk capital you are prepared to lose.

Bitcoin Market Insights

Receive the latest Bitcoin updates from key financial news sources and trading insight reports from eToro's Bitcoin market analysis team.

On the Go Trading

Trade Bitcoin on your desktop, mobile and tablet using eToro's custom designed trading platform. Follow the markets and manage your portfolio wherever you go.

Learn and Practice Bitcoin Trading For Free

eToro grants each new trader $100,000 in a Demo account. Practice your trading skills for free and start investing in Bitcoin when you're ready!

Bitcoin Trading

Your Questions Answered

Trading in Bitcoin, or any other financial asset like crude oil, offers many opportunities. However, it can be difficult to navigate between brokers, spreads and sky-high management fees. That’s why managing your own investments based on price variances makes sense for many trading beginners.

With eToro, you have access to:

- Multiple successful Bitcoin traders you can learn from

- Live discussions on our Bitcoin trading page regarding market trends

- A $100K practice trading account called the virtual portfolio

- Email updates on the markets

- Blog posts, live hangouts and video tutorials on how to trade

The eToro platform has millions of users, with varying levels of experience in the market. Investment discussions and portfolio allocations are open to other users, as is the ability to automatically copy successful traders. Because many first-time investors are not yet familiar with the markets, eToro also provides new users with $100K of virtual funds to practice with until they are ready to start investing.

Forex investments are particularly volatile, making this type of trading very popular for investors looking for quick results. However, most professional investors recommend diversifying between several types of instruments, in order to properly manage risk levels.

At eToro, you can invest in currency, commodity, index, stock and ETF CFDs on our easy-to-use platform. If you aren’t sure of the best way to invest in a specific type of instrument, you can use our People Discovery tool to find traders who specialize in that instrument and learn from them or copy them directly.

The global leader of social trading

Join millions of users from over 140 countries

Trusted Company

A global Fintech leader since 2007

We will never share your private data without your permission

Your funds are kept in a segregated account

eToro (Europe) Ltd., a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under the license # 109/10. eToro (UK) Ltd, a Financial Services Company authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263

Past performance is not an indication of future results

General Risk Disclosure | Terms & Conditions

CFDs are leveraged products. Trading in CFDs related to foreign exchange, commodities,indices and other underlying variables, carries a high level of risk and can result in the loss of all of your investment. As such, CFDs may not be suitable for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever. Trading with eToro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders and the overall risk associated in CFD trading or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro - Your Social Investment Network.

Copyright © 2006-2017 eToro - Your Social Investment Network, All rights reserved.

Investment Platform Etoro Launches in the US with 10 Cryptocurrencies

Social trading platform Etoro is expanding into the US. Pre-registration has already begun. Initially, 10 cryptocurrencies will be offered, but the company plans to add more throughout the year. The company’s crypto business has boomed in recent years, with 70% of its users reportedly trading cryptocurrencies.

Etoro Launching in the US

Social investment platform Etoro has announced that it is expanding into the US market. CEO Yoni Assia unveiled the company’s plans at the Consensus conference on Tuesday. According to the announcement:

The launch will initially enable U.S.-based users to invest in 10 cryptocurrencies, with more to be added throughout 2018. Users will have access to a community feed and tools, letting them engage in conversations about cryptocurrencies and follow the investment strategies of other U.S. users.

Launched in 2007, Etoro is regulated in Europe by Cyprus Securities and Exchange Commission and in the UK by the Financial Conduct Authority. The company says it has more than 10 million registered users across 140 countries in Europe, Asia, and Australia, with an accumulated capital funding of more than $162 million. Currently, its website shows 247,387,974 open trades on the platform.

Assia commented, “Etoro will continue to focus on simplicity and user-friendliness so that more diverse groups will feel welcomed into the global crypto community.”

Pre-Registration Begins for US Users

The company explained that US users can join the waiting list for the platform starting on May 15. “Users will be able to experience the interface and perform mock cryptocurrency investments via a virtual portfolio,” its announcement details, adding:

The 10 cryptocurrencies that will be initially available are: bitcoin, ethereum, litecoin, XRP, dash, bitcoin cash, stellar, ethereum classic, NEO, and EOS. Etoro intends to integrate several more cryptocurrencies throughout 2018.

“The platform will offer U.S. investors three ways to access the crypto markets,” Etoro described. The first way is “by manually investing in a coin.” The second is “by automatically copying the trades of other traders on the platform to benefit from their knowledge and investment expertise.” The third is “by investing in a Crypto Copyfund which provides a diversified portfolio of major crypto assets.”

“The platform will offer U.S. investors three ways to access the crypto markets,” Etoro described. The first way is “by manually investing in a coin.” The second is “by automatically copying the trades of other traders on the platform to benefit from their knowledge and investment expertise.” The third is “by investing in a Crypto Copyfund which provides a diversified portfolio of major crypto assets.”

A Copyfund is Etoro’s investment product aimed at helping investors minimize long-term risk, its website states. “Once you invest in a Copyfund, your capital is professionally managed by Etoro’s investment committee. Each Copyfund’s performance is analysed in depth and rebalanced automatically to maximise its gain potential.”

Etoro’s Booming Crypto Business

In January last year, the platform added cryptocurrencies. According to Fortune, “In recent years, the company’s crypto business has boomed with 70% of its users trading digital currency.”

Yoni Assia.

Yoni Assia.

In an interview with the news outlet, Assia predicted that Etoro’s “unusual social media features would help it gain a foothold” in the US. “Those features let users create a public profile of their investments, which in turn allows others on Etoro to track and copy their trading decisions.”

Commenting on the crackdown by the US Securities and Exchange Commission (SEC) targeting tokens that resemble securities, Assia told the publication that he is confident “the digital assets Etoro plans to list are currencies not securities.” He expects Etoro will list as many as 15 tokens by the end of the year, the news outlet conveyed, adding that the company also “plans to open a global wallet and exchange service later this year that is aimed at institutional traders.”

Currently, the aforementioned ten cryptocurrencies are already being offered on the platform for non-US users.

What do you think of Etoro launching in the US? Let us know in the comments section below.

Images courtesy of Shutterstock, Medium, and Etoro.

Need to calculate your bitcoin holdings? Check our tools section.

eToro Cryptofund Review: Investing in Bitcoin, Ethereum, and More

Last updated on May 13th, 2018 at 04:53 pm

Important: At the time of writing, eToro services aren’t available to US customers. CryptoFund is a highly volatile investment product – Your capital is at risk. Past performance is not an indication of future results. The content is intended for educational purposes only and should not be considered as an investment advice

eToro is a digital global trading market for currencies, cryptocurrencies, commodities, indexes, and stocks. Like most cryptocurrency trading platforms, it’s experiencing rapid growth and now boasts over 7 million users worldwide.

In operation since 2008, eToro aims to offer fluid web-based and mobile platforms, enabling users to trade almost anything in one portfolio. Branded as a social investment network, it combines a lag-free modern trading system with the ability to interact with other users.

Young CEO Yoni Assia wants the platform to disrupt the outdated banking system and help usher in a new digital financial age. If you’re investing in cryptocurrencies, then there are probably some ideals to be matched in this respect. eToro provides trading for a select number of cryptocurrencies.

With an angle on cryptocurrencies in this review, we’ll take a hands-on look at the eToro platform, its pros and cons, and whether it’s right for your trading goals.

Using eToro

The usability of eToro is astonishingly fluid. It’s painless and straightforward to get started. Signing up takes less than five minutes, and there’s no need for slow verification methods or confirmations. Simply hit the Sign Up button and add your personal details.

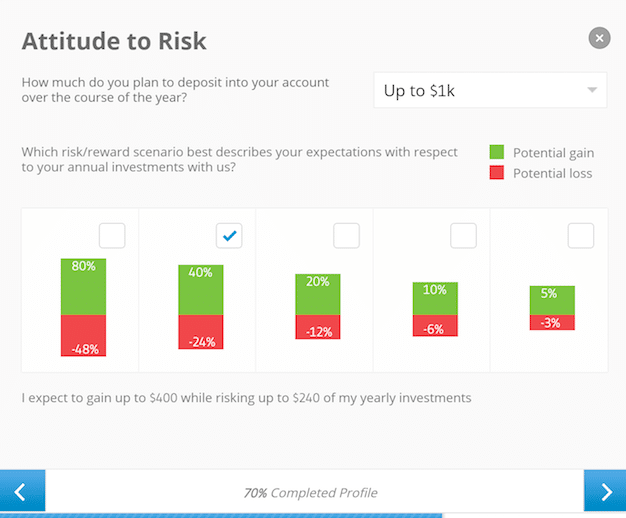

Next, you’ll be greeted with a questionnaire to assess your trading personality—quite a nifty feature on the face of it, but it rang more alarm bells than I would have liked. Revealing my income levels, my employer, and my other investment levels felt like a bit much. More importantly, all users are left trusting eToro with sensitive personal data.

After some more digging, I found that this is part of a standard KYC (Know Your Customer) process eToro is compelled to perform as part of its being a regulated company.

The system as a whole is smooth, with no lag or connection problems. After you sign up, deposits are made swiftly via credit, debit, or PayPal at no fee. You can start trading to a limit of $2,000 immediately without verification, which should be enough for most to do a little test of the service.

Portfolio trackers, watch lists, featured markets, and the ability to follow successful traders are all sitting in this slick, modern trading client. In under ten minutes, you can be ready to go and opening positions on Bitcoin and Facebook simultaneously.

eToro’s Crypto Copyfund

eToro also has a very special product called a Crypto Copyfund. It basically allows you to invest in the most popular cryptocurrencies like Bitcoin, Ethereum, Dash, Litcoin, Ripple and Ethereum Classic. The minimum investment for the crpyto fund is $5,000.

Investing in the fund will basically expose you to more currencies simultainiously and diversify some of the risk involved with investing in only a single cryptocurrency. There are several requirements that a cryptocurrency has to meet in order to be included in the fund:

- Minimum market cap of $1 billion

- Minimum average monthly trading volume of $20 million.

Each currency will have a weight in the fund that is equal to the size of its market cap (the minimum is 5%). Of course if for some reason a currency drops below the minimum requirements it’s removed from the fund automatically.

The Crypto CopyFund is analyzed and rebalanced on the first trading day of each month.

Currency Support

As eToro is not a cryptocurrency-dedicated exchange, there are currently only a select few cryptocurrencies available. That being said, what they do offer is a pretty decent collection—more than some other notable names in the industry.

- Bitcoin

- Bitcoin Cash

- Ether

- Ethereum Classic

- Ripple

- Litecoin

- Dash

There are some real powerhouse cryptocurrencies listed there, and while Bitcoin is still king, it’s exciting to see Ripple, Litecoin, and Dash open for business on the exchange. Keep in mind that when trading on eToro, you don’t have actual access to your coins; you’re only speculating on the USD value of those coins.

Due to the complex amount of trading options on eToro, the fee structure varies from asset to asset. Looking directly at the cryptocurrency trade fees will be quite a shock for serious investors. Bitcoin costs a hefty 0.70% fee when exiting a position, higher than most other exchanges.

The other altcoins trade at a 2%–5% fee which is extortionate. For example, you’ll be paying 5% on Bitcoin Cash. Check out the full list of fees here.

Keep in mind that there’s also a withdrawal fee applicable when you decide it’s time to cash out. You can only cash fiat money out of eToro, and you’ll be charged $25 for each withdrawal.

Another sting in the tail exists for some unfortunate users. eToro charges an inactivity fee to users who have not logged in for 12 months. If you’re a long-term holder, don’t get caught out by this; your account balance will be debited $5 per month once it’s deemed inactive. Remember to log in and check up on your investments every quarter.

Customer Support

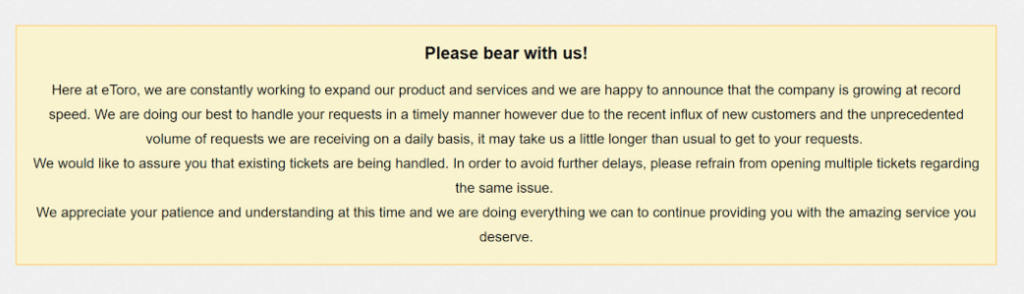

eToro has experienced rapid growth over the past year. One imagines this is down to its push on cryptocurrency trading. Unfortunately, this means it hasn’t escaped the issue dogging the whole blockchain industry: customer support is always an unhappy feature in reviews. Companies can’t seem to cope with their own success, and this includes eToro.

Quite inspiringly, the eToro team isn’t trying to hide its shortcomings. The contact area of the website carries an apology message to help users understand that they aren’t being ignored. Of course, complaints and bad reviews still exist, but it’s nice to stay informed.

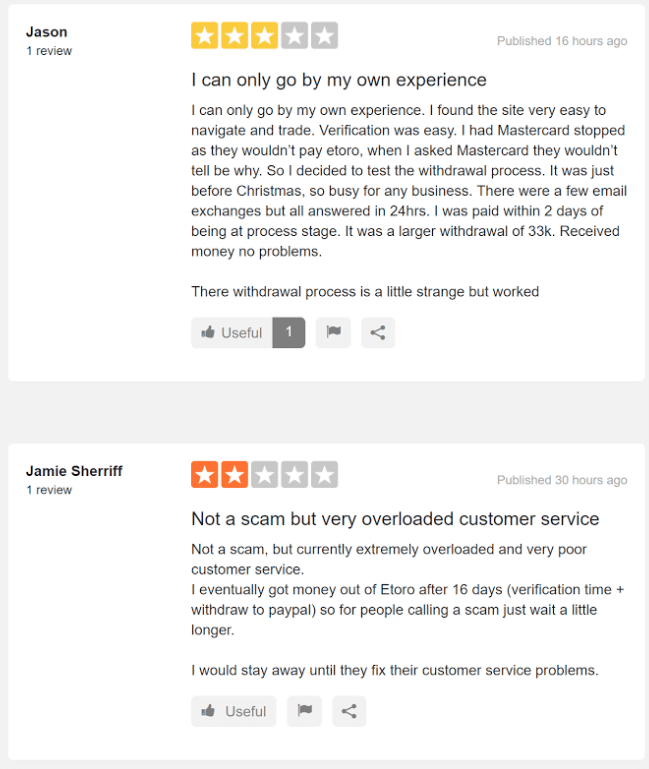

Public Opinion/Online Reviews

Bad news travels like wildfire, and people are always more likely to write bad reviews than good ones. That being said, there seems to be one particular worrying point investors bring up upon using the service: the platform seems to get a little temperamental with withdrawals. Many reports of extended waiting times for withdrawing funds to bank accounts and PayPal litter online forums.

A few comments have popped up saying the experience was smooth with no problems. Seven million users can’t all be struggling to liquidate their assets, or the company wouldn’t be where it is today.

Conclusion: Is eToro a good place to trade cryptocurrencies?

The eToro platform as a whole is a joy to use. Its browser is responsive, intuitive, and packed with handy features. Add a decent selection of cryptocurrencies to this, and you can really get a lot out of the exchange. Within ten minutes you can be trading and opening positions in Bitcoin, Ethereum, Ripple, Litecoin, and more.

That being said, there are clearly issues for users when liquidating assets and withdrawing funds. Perhaps this is down to the overloaded customer service, where sometimes you’ll have to be patient. The fees for cryptocurrencies are also overpriced, and for me, that’s a big turnoff.

If you’re looking to trade and leverage currency, then other services such as Bitmex might be better suited for you. If you’re looking to create an all-around investment portfolio that includes some cryptocurrencies for long-term holds, then you might just do alright with eToro.

Have you tried eToro yourself? We’d love to hear what you think about it in the comment section below.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422a80aad5488f45 • Your IP : 185.87.51.142 • Performance & security by Cloudflare

The Risks of Trading Bitcoin on eToro

If you want to buy or sell Bitcoin, you'll need an exchange/broker. Generally there are two ways of doing this:

- Cryptocurrency exchanges allow you to buy and sell real coins (e.g. if you buy some Bitcoin - you own it). See this guide for some examples.

- Most brokers don't allow you to buy Bitcoin directly. Instead they allow you to invest in it via CFD (Contract for Difference), which means you're not buying the coin itself - the exchange buys it on your behalf, and you have to pay a daily fee to hold it. Some brokers like eToro and IQ Option are starting to take the middle ground, where you can invest in Bitcoin and not pay a daily holding fee.

There are pros and cons to both of these, where pro-exchange arguments will be based around low fees & ownership of the coins, and pro-CFD arguments for reasons such as better user interfaces, better regulation & better risk management (e.g. automated leverage).

eToro is a cross-over between these two. It allows you to buy Bitcoin directly (not via CFD), but it also has a great user interface for things like opening/closing orders and has unique features such as the ability to copy other traders. It does however have many hidden risks which you should be aware of, this guide will explain some of these.

This guide will focus on risks, see this guide for a tutorial on using eToro.

We encourage you to read this entire guide before trying eToro to understand the potential risks; but if after reading this you still want to try it out, here's a link (we'll get some money if you sign up via this).

Is Buying & Selling Too Easy?

When you first use an exchange, you'll find lots of guides and tutorials on how you should be storing your Bitcoin. The general consensus is that once you buy it, you shouldn't keep it on the exchange - it should be moved to a wallet. The most common reason is that the exchange might run away with your money, but there's a second less dramatic one; that by moving your Bitcoin to a wallet, it makes it harder to sell it.

This might seem counter-intuitive, but context is important here. The user interface on eToro is much more user-friendly than most exchanges or CFD brokers, and there are many online reviews stating this causing beginner traders to see eToro as a good platform to try out. When these beginners first trade they're inevitably going to open positions that don't go well and lose them money.

When trading stocks, scenarios where the price will move more than 10% in one day are very rare. In cryptocurrencies they are not. Given the right environment, any cryptocurrency can easily drop 10% or more in a single day (and has done many times). For this to happen to a beginner, the fear of losing more money will often give them a very strong urge to sell. On eToro it's possible to do this in just a few seconds, to close your position and walk away. But a beginner trader would then experience the fear of missing out, and so buy back in again - often at a higher price. This statement is highly speculative, but next time this happens, if you look at the eToro Bitcoin user feed, you'll see many people in this scenario. If you'd stored your Bitcoin on a wallet, the time between moving it back to the exchange would have given you a better time frame to make your decision off.

That said, if you're a more experienced trader you'll likely be aware of this scenario so it won't be an issue for you.

eToro Spreads are Very High

If you were to go on an exchange right now to buy Bitcoin, the price would be determined by the person willing to sell their Bitcoin for the lowest amount. Let's say this amount is $7000. On this exchange you'd normally pay a fee of around 0.2% to buy a coin, and then a second 0.2% fee to sell it, 0.4% total; which would be $28. On eToro you pay a fixed fee of 0.7% to open Bitcoin trades, which is $49. This is only 0.3% higher than exchanges, so not too bad; but on other cryptocurrencies this ranges between 2% and 5%! So if you invested that same amount in Litecoin that would cost you $210, and if you invested that in Bitcoin Cash that would cost you $350 - over 10x more than an exchange.

This problem by itself makes profitable trades harder, but given the extra functionality you get, some justify this as an acceptable cost. Where this isn't ok is how their system for opening orders works. We'll explain a situation we experienced ourselves.

(The rest of this section talks about stop losses, which eToro has since removed)

We decided to try and short Bitcoin Cash, to open a sell order for $250 and then buy it back at a lower cost. When we open risky orders like this we normally set a small stop loss, in this case at -$14, which for other coins we'd traded such as Bitcoin and Ethereum allowed a good 1-2% upward movement before the order closed.

The eToro user interface allowed us to do this, but when we opened this order it hit the stop loss immediately at -$14.64. Two things may have happened here, either the price of Bitcoin Cash dropped 1% or 2% within seconds of us opening the trade (which seems very unlikely), or the eToro interface allowed us to set a stop loss that was lower than the spread at the time. Regardless; the trade we just made should not have been possible. On their fees page eToro states that Bitcoin Cash 'typical spread' is 5%, which would be $12.50 for a $250 order, $2 below our stop loss. Allowing a trade to be opened with a difference between the opening value and stop loss of such a low amount is an incredibly dangerous feature.

High Withdrawal Fees

Withdrawal fees on eToro have always been fairly high, but for lower amounts they've had special cases with lower fees; where for a $20-$200 withdrawal the fee was $5, for a $200-$500 withdrawal the fee was $20, and for $500+ withdrawals the fee was $25.

They've since changed this, where now the withdrawal fee is $25 for all withdrawals. If you're depositing/withdrawing large amounts of money this change won't affect you. But if you're dealing with small amounts of a few hundred dollars this will both eat away at your profits and encourage you to deposit and withdraw larger amounts of money to increase profit margins. This is something that we find very concerning as this encourages new traders to invest larger amounts of money than they should given the associated risks of trading cryptocurrencies.

Conclusion

With all the above said, you might think that we don't like eToro, that you should avoid it. But this isn't the case. Being aware of all the above issues, we're able to avoid the issues caused by them; we tend to avoid Bitcoin Cash trades for example! Cryptocurrency trading is still very new to platforms which previously only dealt with CFDs, so quirks like this are expected. Our hope is that over time eToro will decrease their spreads for cryptocurrencies and add functionality to avoid the pitfalls we've described above.

Features such as the ability to trade on a demo account, and the option to follow/copy other popular traders are very useful, and we think balance out some of the more annoying quirks of the platform. eToro is also a regulated broker, which many exchanges are not, another important consideration for people depositing large amounts.

If you want to try out eToro and help us out, here's a link (we'll get some money if you sign up via this).

DISCLAIMER: This site cannot substitute for professional investment or financial advice, or independent factual verification. This guide is provided for general informational purposes only. Anything Crypto is UK-based and not regulated by the FCA (Financial Conduct Authority). The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors. The ideas presented are our analysis, learning & opinions on a range of cryptocurrency topics. Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money.

This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research. As we write new content, we will update this disclaimer to encompass it.

Комментариев нет:

Отправить комментарий