Bitcoin-friendly Fidor Bank Expands to the United Kingdom

Fidor Bank, the innovative German bank that is bringing Bitcoin and digital fintech to mainstream banking, is now operating in Great Britain.

Fidor Bank, one of the world’s most innovative banks disrupting the traditional banking sector, has been recognized by the World Economic Forum as a “Global Growth Company.”

Founded in Germany in 2009, Fidor Bank offers a new approach to financial services.

“Traditional banks do not reflect their customers’ needs in the digital age,” notes the Fidor Bank UK website. “Customer requirements are not being met by traditional banks because of lack of innovation, increasing the distance between banks and their customers.”

A key feature of Fidor Bank is its community site, where users and representatives of the bank discuss the financial services provided by the bank in an open forum. The Fidor Bank community has become one of the most active financial communities in Germany, where more than 250,000 users, bank employees and board members engage in discussions around the clock. Of course, Fidor Bank UK has also a Facebook page.

The Fidor Bank Community Product Reviews section offers a free overview of the advantages and disadvantages of a wide range of financial products. Product reviews are completely independent and consist solely of the views of community members, with feedback from the bank.

Fidor Bank Community members develop reputation and “karma” points, and can join interest groups. The most popular interest group is dedicated to cryptocurrencies. This is not surprising, because Fidor Bank is popular among Bitcoin users and considered as the most Bitcoin-friendly mainstream bank. In October, Fidor Bank partnered with bitcoin exchange Kraken to create the world’s first cryptocurrency bank.

German-Based Fidor Bank to Offer “Bitcoin Express” Service in UK

German-Based Fidor Bank to Offer “Bitcoin Express” Service in UK

A German-based bank called Fidor Bank recently set up shop in the United Kingdom, prompting speculations that it might start offering its bitcoin services there as well. Fidor Bank is known for being more open to new developments in the digital age and was recognized by the World Economic Forum as a “Global Growth Company” back in 2014, five years after its establishment in 2009.

“Traditional banks do not reflect their customers’ needs in the digital age,” indicated a statement on the Fidor Bank UK website. “Customer requirements are not being met by traditional banks because of lack of innovation, increasing the distance between banks and their customers.”

Fidor Bank’s Bitcoin Express

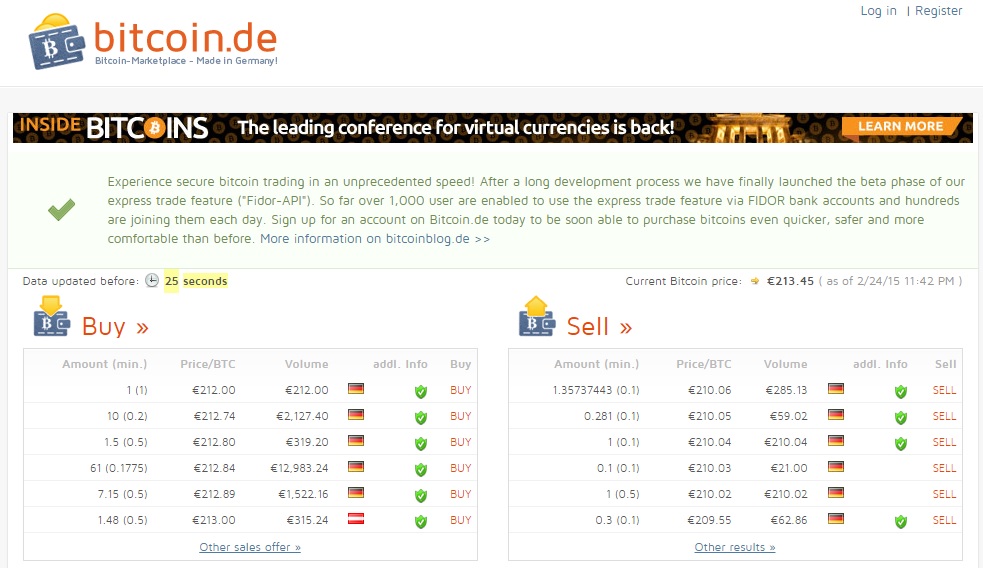

The bank is also known in Germany for welcoming innovations like bitcoin, even launching a service called “Bitcoin Express” for its clients in the country. Through this, customers can be able to buy and sell bitcoin through the bank’s bitcoin exchange partner, bitcoin.de.

In addition, customers with a “Fidor Smart Giro Account”, which is a full bank account with all the standard features such as interest on credit balances and a low-cost credit card that can be recharged with bitcoin, can be able to sell bitcoin from their Smart Giro Account and have the money instantly credited to their accounts.

However, Fidor Bank isn’t set to offer these types of services to its UK customers just yet, as it might have to look into the regulatory requirements in the region. Even so, bitcoin enthusiasts in London are showing increased interest in the German bank, urging for similar bitcoin-friendly services to be offered there as well.

London is known for being one of the cities that are most open-minded about cryptocurrency developments and initiatives, with the UK government and central bank also taking the necessary steps to learn more about the industry and support innovation.

German Fidor Bank teams up with Bitcoin.de to offer instant Bitcoin transactions

Last updated on January 2nd, 2018 at 12:00 am

Some banks fear Bitcoin, some even try to prevent its clients from dealing with cryptocurrency, but not Fidor Bank. The Munich-based bank has partnered with the German Bitcoin exchange Bitcoin.de to offer a new “Express Trade” option to its customers.

This feature will allow the bank’s customers to buy and sell BTC instantly on the exchange. Fidor customers with a ‘Smart Giro Account’ can now “conduct a Bitcoin trade on Bitcoin.de within a matter of seconds. Via their ‘Express Trade’ system, Fidor and Bitcoin.de offer the fastest option in Europe of buying and selling Bitcoins,” the companies announced in a press release.

The bank’s ‘Smart Giro Account’ is a complete bank account that includes all the standard features offered by the bank such as a low-cost credit card, which works can be recharged with BTC.

The bank’s ‘Smart Giro Account’ is a complete bank account that includes all the standard features offered by the bank such as a low-cost credit card, which works can be recharged with BTC.

Clients with a ‘Smart Giro Account’ are now able to purchase Bitcoin directly from a bank account and receive the digital coins immediately after the operation, as well as sell Bitcoin to another ‘Smart Giro Account’ holder and receive the money instantly.

The benefits of this partnership are pretty amazing. Most Bitcoin exchanges usually take several hours or even days to complete a transaction. Also, safety is not always a total guarantee.

At Bitcoin exchanges, which are often unregulated and operate from abroad, the customers’ money generally lies unsecured on the company bank account of the operator of the trading platform and is as such exposed to the risk of total loss in the case of insolvency, for example.

This risk also exists in the case of fraud. The numerous examples of the bankruptcy of foreign Bitcoin exchanges show that this is not merely a theoretical risk. At Bitcoin.de, by contrast, the customers’ money is always on their own bank accounts – in the case of Fidor Bank with statutory deposit security of 100,000.- euro per private customer.

“We are proud that we at Bitcoin.de have been able to develop further together with our bold partners from Fidor Bank towards an exchange,” Oliver Flaskämper, board member of Bitcoin Deutschland AG, said.

“We are proud that we at Bitcoin.de have been able to develop further together with our bold partners from Fidor Bank towards an exchange,” Oliver Flaskämper, board member of Bitcoin Deutschland AG, said.

“That is not only good news for all Bitcoin fans, but also good news for fin-tech companies based in Germany. Together with the right partners more is possible in Germany than one might think,” he added.

The CEO of Fidor Bank agrees. “Above all in an innovative environment such as that in which Bitcoin operates, the top priority must be to provide the users this offer of security and sustainability,” Matthias Kroner said.

According to the banking expert, “the prompt conducting of money transactions in the environment of Bitcoin transactions from one bank customer to another bank customer enhances security massively. As such Fidor Bank is setting a further milestone in digital banking.”

The German bank is no stranger to Bitcoin-related innovation. Back in October 2014, Fidor announced it wanted to team up with the digital currency exchange Kraken to create the world’s first cryptocurrency bank.

Fidor Bank also disclosed recently its plans to expand its services to the United States market. Bitcoin Magazine reports that Kroener praised the American authorities’ open and pragmatic middle-of-the-road approach to Bitcoin regulation.

Fidor Bank – Bitcoin, Ripple, What's Next?

Fidor Bank – Bitcoin, Ripple, What's Next?

A bank in Germany that goes by the name of Fidor Bank AG is truly differentiating itself even further from your grandparents’ bank. You may have read that Fidor became the first bank to utilize Ripple’s payment protocol, so why is this bank so different?

Fidor is not your traditional bank. Just take a second to digest all the features Fidor’s smart checking account offers besides the trite bank/bank card “perks” that every bank offers.

Fidor’s smart checking account enables users to:

- Have no account fees

- Borrow money from friends

- Buy precious metals

- Buy foreign currencies

- Buy alternative currencies (BTC and some AltCoins)

- Send payments to e-mail addresses, twitter handles or phone numbers

- And much more.

Fidor has partnered with the German bitcoin exchange bitcoin.de all the way back in July and more recently announced it’s Bitcoin derivatives market back in January.

Fidor will begin using Ripple for intra-bank payments in its’ German branches and with their international partners. If this does bring down the cost of doing business, as planned, more banks may soon follow.

Fidor is bucking the trend for what a modern bank could become, using technology to bring down the costs of banking and giving customers more freedom over their money.

Kraken partners with Fidor Bank to offer bitcoin trading services in the EU

Digital currency exchange Kraken has forged a partnership with Munich-based Fidor Bank to offer its European customers regulated bitcoin trading services.

Jesse Powell, CEO of Payward Ltd, which is the developer of Kraken, said the exchange has found its "ideal partner" in Fidor Bank.

He described the bank as a "responsible, forward-thinking financial institution" and praised its desire to combine the "predictability and stability of traditional banking relationships with the social and economic benefits of new digital currencies". Powell added:

"From the beginning, our goal has been to establish bitcoin and other digital currencies as legitimate complements to the euro, the pound and other traditional, government-issued currencies."

Kraken is now looking to offer its services outside the EU by cooperating with financial industry partners and regulatory authorities across the world.

This isn't the first bitcoin company Fidor has partnered with – back in July the bank teamed up with German bitcoin marketplace bitcoin.de, which is operated by Bitcoin Deutschland GmbH.

Upon the announcement of this partnership, Oliver Flaskämper, managing director of Bitcoin Deutchland GmbH, said: "With Fidor Bank AG as our partner, the digital bitcoin currency, which was initially smiled at as internet play money, is increasingly turning into a serious alternative currency after only four years."

Fidor Bank says its long-term goal is to bring important market innovations to its customers. Matthias Kröner, CEO of Fidor, said the bank has noticed digital currencies start to emerge as "serious and useful alternatives to government-issued currencies".

"With Kraken, we can enable our customers to trade bitcoin and other digital currencies just as securely, easily and flexibly as they trade other foreign currencies today," he added.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin.de Launches Integration With Fidor Bank Accounts

Bitcoin.de's long-standing partnership with Fidor Bank has finally borne fruit, with the company claiming it is the world's first bitcoin trading platform with a "direct connection to the classic banking system".

Bitcoin.de says the arrangement brings a far faster service, allowing EUR/BTC trades to be completed within "seconds" when both customers have a free 'FIDOR Smart Giro Account'.

Extra security is also promised, with customers' funds staying within their Fidor Bank accounts, rather than being held by a centralised body, such as an exchange.

In the case of insolvency or security breach, Bitcoin.de points out, those funds are all too easily lost, with no guarantee of return. The same applies should a bitcoin exchange prove fraudulent, as was alleged recently in Hong Kong.

Accounts held at Fidor Bank – which, as a licensed German bank, is highly regulated – are covered by a "standard deposit security of €100,000".

To put this arrangement in place, took over one and a half years of development work, with regulatory requirements being taken into account and a new set of Terms and Conditions being created for the business, according to Bitcoin.de.

'Massively enhanced security'

Oliver Flaskämper, board member of Bitcoin Deutschland AG, said.

"That is not only good news for all bitcoin fans, but also good news for FinTech companies based in Germany. Together with the right partners more is possible in Germany than one might think."

Fidor Bank CEO Matthias Kröner explained that, in the bitcoin environment, conducting money transactions promptly from one bank customer to another enhances security "massively".

"As such," he said, "Fidor Bank is setting a further milestone in digital banking".

Bitcoin.de is a peer-to-peer bitcoin trading platform that allows bitcoin buyers and sellers to deal directly with one another, rather than dealing with the company, as is the case with bitcoin exchanges.

Crypto-friendly bank

In October 2013, digital currency exchange Kraken also forged a partnership with Fidor to offer its European customers regulated bitcoin trading services.

Unlike most other banks globally, Fidor seems very open to cryptocurrency business, as well as the technology itself. In May of last year, it became the first bank to integrate Ripple's payment protocol, allowing its customers to instantly send any currency in any amount through the bank's money transfer system.

Kröner said at the time:

"Ripple enables us to securely and instantly send money anywhere in the world at no additional cost and through the same customer facing products and relationships we offer today."

Finding solutions to risks of centralising customers' funds in a single company's bank account seems to be a growing trend. In Hong Kong, bitcoin exchange Gatecoin recently launched, promising segregated bank accounts for customers, and notably covering 40 countries across the globe.

Gatecoin is a licensed Money Services Operator in Hong Kong, meaning it is monitored by the country's Customs and Excise Department.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Fidor bank bitcoin

Fidor, a German bank known for its embrace of bitcoin, has announced it is expanding operations to Great Britain. UK users can now open their online Fidor UK accounts via the bank’s newly launched website, fidorbank.uk.

Fidor Bank is a digital bank that is regulated in Germany. Now, it will also trade in the UK under EU law. The innovative bank opts for transparency of services and a customer-focused approach to banking.

In February, Fidor teamed up with the bitcoin marketplace Bitcoin.de to make it possible for users to trade in bitcoins and euros. At the same time, Fidor introduced a new “express trade” feature, Fidor-API, to their website, which allows customers to trade using their Fidor bank accounts. The transactions between Fidor and Bitcoin.de are processed thourhg the FIDOR Smart Giro, a digital finance management platform that includes online and mobile, peer-to-peer transactions, Twitter transfers, as well as integrations with social trading and crowdfunding systems.

Fidor announced its UK launch very soon after Coinbase expanded their wallet services to the country, adding GBP to their exchange options. Coinbase’s official bank partner in Europe is the Estonian bank LHV.

UK banks are notoriously unfriendly to bitcoin businesses and tend to close down accounts that are involved in operations with bitcoin. In February, the Safello bitcoin exchange had to withdraw its services from the UK market after their account was apparently closed simply for dealing with bitcoin. CoinFox earlier wrote about the joint report on digital disruption by the British Bankers’ Association (BBA) that saw bitcoin and other cryptocurrencies as one of the most important threats to banking. However, there is hope that after the UK Treasury’s statement that it intends to regulate digital currency firms in the UK the situation is going to improve.

Fidor Bank – Bitcoin, Ripple, What's Next?

Fidor Bank – Bitcoin, Ripple, What's Next?

A bank in Germany that goes by the name of Fidor Bank AG is truly differentiating itself even further from your grandparents’ bank. You may have read that Fidor became the first bank to utilize Ripple’s payment protocol, so why is this bank so different?

Fidor is not your traditional bank. Just take a second to digest all the features Fidor’s smart checking account offers besides the trite bank/bank card “perks” that every bank offers.

Fidor’s smart checking account enables users to:

- Have no account fees

- Borrow money from friends

- Buy precious metals

- Buy foreign currencies

- Buy alternative currencies (BTC and some AltCoins)

- Send payments to e-mail addresses, twitter handles or phone numbers

- And much more.

Fidor has partnered with the German bitcoin exchange bitcoin.de all the way back in July and more recently announced it’s Bitcoin derivatives market back in January.

Fidor will begin using Ripple for intra-bank payments in its’ German branches and with their international partners. If this does bring down the cost of doing business, as planned, more banks may soon follow.

Fidor is bucking the trend for what a modern bank could become, using technology to bring down the costs of banking and giving customers more freedom over their money.

German-Based Fidor Bank to Offer “Bitcoin Express” Service in UK

German-Based Fidor Bank to Offer “Bitcoin Express” Service in UK

A German-based bank called Fidor Bank recently set up shop in the United Kingdom, prompting speculations that it might start offering its bitcoin services there as well. Fidor Bank is known for being more open to new developments in the digital age and was recognized by the World Economic Forum as a “Global Growth Company” back in 2014, five years after its establishment in 2009.

“Traditional banks do not reflect their customers’ needs in the digital age,” indicated a statement on the Fidor Bank UK website. “Customer requirements are not being met by traditional banks because of lack of innovation, increasing the distance between banks and their customers.”

Fidor Bank’s Bitcoin Express

The bank is also known in Germany for welcoming innovations like bitcoin, even launching a service called “Bitcoin Express” for its clients in the country. Through this, customers can be able to buy and sell bitcoin through the bank’s bitcoin exchange partner, bitcoin.de.

In addition, customers with a “Fidor Smart Giro Account”, which is a full bank account with all the standard features such as interest on credit balances and a low-cost credit card that can be recharged with bitcoin, can be able to sell bitcoin from their Smart Giro Account and have the money instantly credited to their accounts.

However, Fidor Bank isn’t set to offer these types of services to its UK customers just yet, as it might have to look into the regulatory requirements in the region. Even so, bitcoin enthusiasts in London are showing increased interest in the German bank, urging for similar bitcoin-friendly services to be offered there as well.

London is known for being one of the cities that are most open-minded about cryptocurrency developments and initiatives, with the UK government and central bank also taking the necessary steps to learn more about the industry and support innovation.

Комментариев нет:

Отправить комментарий