How to Invest in Bitcoin

Thinking of investing in Bitcoin?

This post will outline some things you NEED to know before you buy.

We’re going to explain:

- The basics of investing in bitcoin

- Why it needs to be taken seriously

- How to buy bitcoins (with credit card or bank account)

- How to protect and properly secure your bitcoins if you do decide to invest

Note: If you don’t need the details and just want to buy, Coinbase is the easiest way to buy in the USA, Canada, and Europe.

Why Bitcoin is Gaining Traction

The world is becoming ever more reliant on the internet.

It is no surprise that Bitcoin, a secure, global, and digital currency has claimed the interest of investors.

Bitcoin is open to everyone and provides an exciting opportunity to delve into an entirely new asset class.

Investing in bitcoin may seem scary, but know that it takes time and effort to understand how Bitcoin works.

Note: Bitcoin with a capital “B” references Bitcoin the network or Bitcoin the payment system; bitcoin with a lowercase “b” references bitcoin as a currency or bitcoin the currency unit.

Why Invest in Bitcoin?

It seems silly to some people that one bitcoin can be worth hundreds of dollars.

What makes bitcoins valuable?

Bitcoins are scarce and useful.

Let’s look to gold as an example currency. There is a limited amount of gold on earth.

As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

The same is true with Bitcoin.

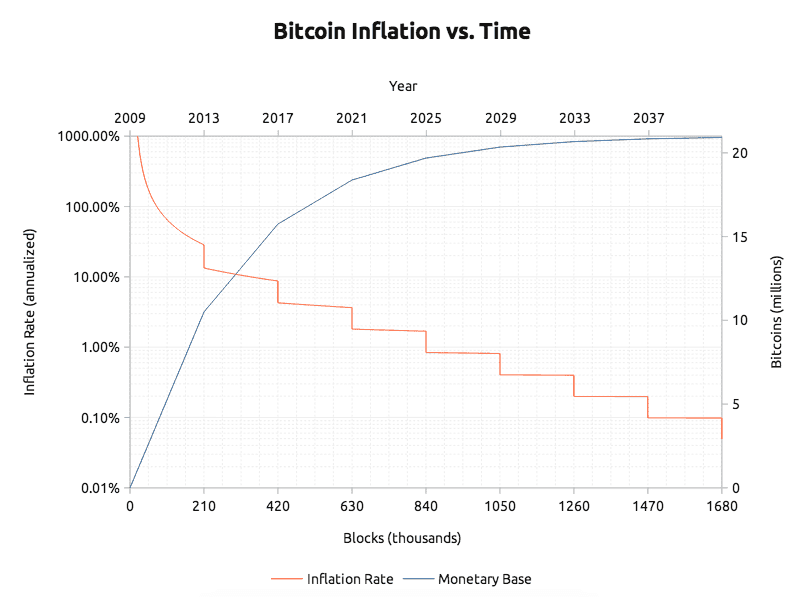

There are only 21 million Bitcoin, and as time goes on, they become harder and harder to mine. Take a look at Bitcoin’s inflation rate and supply rate:

In addition to being scarce, bitcoins are useful.

Bitcoin’s sound monetary policy is one of its most important features. It’s possible to see when new bitcoins are created or how many bitcoins are in circulation.

Bitcoins can be sent from anywhere in the world to anywhere else in the world. No bank can block payments or close your account. Bitcoin is censorship resistant money.

Bitcoin makes cross border payments possible, and also provides an easy way for people to escape failed government monetary policy.

The internet made information global and easy to access. A sound, global currency like Bitcoin will have the same impact on finance and the global economy.

If you understand the potential impact of Bitcoin, it won’t be hard to hard to understand why investing in bitcoin may be a good idea.

Bitcoin’s Price

There is no official Bitcoin price. Bitcoin’s price is set by whatever people are willing to pay. CoinDesk’s price index is a good resource.

Bitcoin’s price is generally shown as the cost of one bitcoin. However, exchanges will let you buy any amount, and you can buy less than one bitcoin. Below is a chart showing Bitcoin’s entire price history:

When is the right time to buy?

As with any market, nothing is for sure.

Throughout its history, Bitcoin has generally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes.

Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts and understand Bitcoin’s price history.

Bitcoin is global and not affected by any single country’s financial situation or stability.

For example, speculation about the Chinese Yuan devaluating has, in the past, caused more demand from China, which also pulled up the exchange rate on U.S. and Europe based exchanges.

Global chaos is generally seen as beneficial to Bitcoin’s price since Bitcoin is apolitical and sits outside the control or influence of any particulate government.

When thinking about how economics and politics will affect Bitcoin’s price, it’s important to think on a global scale and not just about what’s happening in a single country.

How to Invest in Bitcoins and Where to Buy

The difficulty of buying bitcoins depends on your country. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker and available in the United States, UK, Canada, Singapore, and most of Europe.

You can use our exchange finder to find a place to buy bitcoins in your country.

How to Secure Bitcoins

As with anything valuable, hackers, thieves, and scammers will all be after your bitcoins, so securing your bitcoins is necessary.

If you’re serious about investing in bitcoin and see yourself buying a significant amount, we recommend using Bitcoin wallets that were built with security in mind.

- Ledger Nano S – Ledger is a Bitcoin security company that offers a wide range of secure Bitcoin storage devices. We currently see the Ledger Nano S as Ledger’s most secure wallet. Read more about the Ledger Nano or buy one.

- TREZOR – TREZOR is a hardware wallet that was built to secure bitcoins. It generates your Bitcoin private keys offline. Read more about TREZOR or buy one.

Bitcoins should only be kept in wallets that you control.

If you leave $5,000 worth of gold coins with a friend, your friend could easily run off with your coins and you might not see them again.

Because Bitcoin is on the internet, they are even easier to steal and much harder to return and trace. Bitcoin itself is secure, but bitcoins are only as secure as the wallet storing them.

Investing in bitcoin is no joke, and securing your investment should be your top priority.

Should you Invest in Bitcoin Mining?

The Bitcoin mining industry has grown at a rapid pace.

Mining, which could once be done on the average home computer is now only done profitably in specialized data centers.

These datacenters are warehouses, filled with computers built for the sole purpose of mining Bitcoin. Today, it costs millions of dollars to even start a profitable mining operation.

Bitcoin miners are no longer a profitable investment for new Bitcoin users.

If you want a small miner to play around with mining, go for it. But don’t treat your home mining operation as an investment or expect to get a return.

Final Thoughts

It’s important to understand how Bitcoin works before investing any money.

Bitcoin is still new and it can take months to understand the true impact Bitcoin can have on the world.

Take some time to understand Bitcoin, how it works, how to secure bitcoins, and about how Bitcoin differs from fiat money.

The above information should not be taken as investment advice. It is for general knowledge purposes only. You should do your own research before buying any bitcoins.

Want to Invest In Bitcoin? Here's What You Need to Know

Bitcoin has captured America’s imagination. Whether or not the cryptocurrency will ultimately turn out to be a good investment or just a passing fad remains to be seen. Indeed, in the past several months Bitcoin prices have enjoyed a run-up that makes the 1999 tech bubble look staid by comparison. That excitement — the promise of sudden riches or sudden ruin — has a lot of people wondering how a bitcoin investment actually works.

If that’s you, here’s a step-by-step guide on how to trade bitcoin. But first…

Should I Invest in Bitcoin?

Like any speculative investment, buying bitcoin at sky-high valuations is risky business. If you’re asking, “Is it smart to invest in bitcoin?” you might do well to heed this advice from billionaire investor Mark Cuban, who told MONEY, “It’s still very much a gamble.” You need to know that your bitcoin investment might lose money. If you’re not prepared to face that prospect, bitcoin investment might not be for you.

You’d be in good company in that case, anyway. Jack Bogle’s bitcoin investment advice is pretty simple, and blunt: You should avoid Bitcoin speculation “like the plague.” And this is coming from the guy who founded Vanguard, so he knows a thing or two about investments. The other risk to keep in mind if you plan to invest in bitcoin, aside from the overall volatility of the cryptocurrency, is of a cyber attack. Hackers descended on digital currency exchange Bitfinex on Tuesday, less than a week after cybercrooks made off with $70 million in a separate heist.

How to Invest in Bitcoin

If you’re aware of the risks and still willing to take the plunge, this is what you need to know about investing in bitcoin: Cryptocurrencies exist in an unregulated, decentralized digital sphere without involvement by (or protection via) a central bank. This is part of bitcoin’s appeal. People or entities can buy and sell cryptocurrency anonymously, and there are fewer middlemen taking a cut of transactions. But it also means you can’t just buy bitcoin via mainstream investing tools like a brokerage account.

First one piece of good news: You can buy fractions up to the eighth decimal place of bitcoin. That means you don’t need to plunk down the nearly $17,000 you often see quoted as the price for a full bitcoin — which is probably for the best, as we noted above. As of Thursday afternoon, that one ten-thousandth — four decimal places or 0.0001 — of a bitcoin is worth about $1.65.

Beyond that, for most people, the best (i.e. simplest) way to invest in bitcoin starts with setting up a cryptocurrency wallet. Some of the better-known sites where you can do this are Coinbase, Bitstamp and Bitfinex, although there are a number of other platforms out there, as well. Once you establish an account, connect it to your payment source — a bank account or a credit or debit card — via two-factor authentication. Of note: It’s important to use a tool like Google Authenticator rather than just relying on text-based authentication, which can be more vulnerable to cybertheft, when investing in bitcoin.

Once you have purchased a bitcoin, it stays in your digital wallet until you trade it — either by using it as currency for a purchase, or by selling it (which is technically “trading” it for American dollars or another currency of your choice).

If you have a brokerage account, you can expect the bitcoin user experience to be similar. And, as with a brokerage account, you’re likely to pay transaction fees whenever you buy or sell. That means day-trading bitcoin probably isn’t a great strategy — since those transaction fees could quickly eat up any profits. If you’re using bitcoin instead of PayPal, Venmo, etc., check first to see if the seller will charge you a fee for paying in bitcoin.

And although bitcoin is technically anonymous, that doesn’t mean you’ll necessarily escape the watchful gaze of the IRS. As MONEY has previously explained, for tax purposes, bitcoin is treated like a stock in that a trade can trigger a capital gains tax bill.

Other Ways to Buy Bitcoin

As of recently, investors can also buy bitcoin futures, which has only added to the hype surrounding it. Bitcoin investment sites are struggling to keep up with the surge in demand.

SPONSORED FINANCIAL CONTENT

Coinbase, for example, has been such a popular bitcoin investment app that its CEO posted to the company’s blog last week a warning that the sudden influx “does create extreme volatility and stress on our systems,” which can create a lag for users. The Chicago Board Options Exchange, on which the first bitcoin futures trading took place this week, warned that a flood of traffic ahead of the launch was slowing its site.

Due to heavy traffic on our website, visitors to https://t.co/jb3O722hoo may find that it is performing slower than usual and may at times be temporarily unavailable. All trading systems are operating normally.

Another exchange, CME Group, is scheduled to begin bitcoin futures trading next week.

There is also the Bitcoin Investment Trust from Grayscale Investments. We’re mentioning it for the sake of comprehensiveness, but it’s a bit of a different animal. The fund is invested in bitcoin, but keep in mind, you’re actually buying the fund, not bitcoin. You’re a step removed from owning actual bitcoin, even though you are still exposed to its volatility. The pluses, Grayscale says on its site, are that you get the structure and tax benefits you wouldn’t get trading bitcoin directly; on the other hand, fees will eat up a chunk of anything you earn, negating the reason many people are drawn to cryptocurrencies in the first place. All of which is to say, you should really, really know what you’re doing as an investor if you’re going to dive into this pool.

5 Ways to Invest in Bitcoins

DoughRoller receives compensation from some companies issuing financial products, like credit cards and bank accounts, that appear on this site. Unless a post is clearly marked "Sponsored", however, products mentioned in editorial articles and reviews are based on the author's subjective assessment of their value to readers, not compensation. Compensation may impact how and where products appear on non-editorial pages (e.g., comparison or "marketplace" pages). That said, our standard is that we will never accept advertising from a product which we wouldn't use ourselves.

Bitcoins are all the rage. If you are looking to get in, here are the 5 most common ways to invest in Bitcoin.

Bitcoins, the most popular in a wave of electronic cryptocurrencies, are taking over the news these days. There’s the Norwegian guy who bought $27 in Bitcoins, only to find four years later, that his investment was worth nearly $1,000,000. Then there’s the first Bitcoin ATM, located inside a Vancouver, British Columbia, coffee shop.

Some investors are all about Bitcoins, while others are wary, to say the least. But investing in Bitcoins can be fun and potentially very profitable.

Just what are Bitcoins, and how do you go about investing in them? Read on to find out.

What are Bitcoins?

As we explained in a past article, “Are Bitcoins a Scam?” Bitcoins are online currency created in 2009. Bitcoin is also the name of the open source software that lets you use this currency.

At its heart, the Bitcoin movement is meant to let people safely send money across a distance without risk of fraud or third-party intervention. While Bitcoin transactions can be relatively anonymous, that’s not the goal. Bitcoins are simply about helping people safely and efficiently complete transactions online and off.

The mathematics behind Bitcoins are quite complex, and the system is set up to limit the number of Bitcoins that can be created. The system will create 21,000,000 Bitcoins before it stops.

This limitation means that as demand grows, Bitcoins are worth more and more – usually. Bitcoins are volatile, to say the least. Their value can change in seconds, and it fluctuates dramatically from day to day.

However, the trend has been upward, which is why you hear astonishing stories like $27 turning into $1,000,000 in just a few years.

How Do You Invest in Bitcoins?

There are several ways to invest in Bitcoins, some of which are more complicated than others. Here are the five most common ways to invest in Bitcoins:

1. Mine Them

OK, so this is a less common option for investing in Bitcoins. Mining Bitcoins involves solving complicated mathematical problems and showing proof of work. When you solve a problem correctly, a new Bitcoin node will appear in the software that runs the currency.

Typically, your computer can do the mining for you. To mine, you connect your computer to the Bitcoin network and set it to solve a cryptographic puzzle. When the puzzle is solved, the Blockchain – the public record of Bitcoin transactions – gets a new digital block. And in exchange, miners get a set amount of Bitcoins.

Most of the time, these complicated cryptographs are solved by a group of miners who share profits. Thus far, mining has been open, honest and group-oriented.

You can purchase special servers designed specifically to mine digital currencies. Here’s one of the most popular options on Amazon.

2. Trade Online

Online Bitcoin exchanges are one of the more popular ways to invest. Websites like Coinbase allow you to exchange your currency of choice for the virtual currency.

The problem with online transactions is that it can take two weeks for your bank account to be connected and verified. And that’s after you set up your account, which takes photo ID, proof of residency and an even longer wait time.

In that time, the value of Bitcoins can swing dramatically, so you really have no idea at the beginning of the transaction how much you’ll wind up getting in the long run.

Investing in Bitcoins online may not be a bad option, if you’re just looking to make a small investment to play around or get a feel for how Bitcoins work.

3. Buying Face-to-Face

For those who want to purchase Bitcoins more quickly, face-to-face transactions are the best option, though they can be somewhat dangerous.

This article on Read Write notes that some Bitcoin investors have been robbed, primarily because the face-to-face transaction usually involves quite a bit of cash. When one Bitcoin could be worth $100 or more, you can imagine how much money you’d need to bring to a transaction to make a major Bitcoin investment.

There are safe ways to invest in Bitcoins in person. You should take the same precautions you would with a Craigslist transaction – or any transaction where you’re meeting an individual stranger to hand him or her cash in exchange for something else.

Meeting in a public location and taking someone with you are good ways to protect yourself when investing in Bitcoins in person. You can also check out Bitcoin buyers and sellers on sites like LocalBitcoins, which gives each user a reputation score to help you decide whom to buy from.

This type of face-to-face transaction is also interesting in that you give the seller cash, in exchange for virtual Bitcoins. However, unlike buying through the exchanges, the transaction takes seconds. Bitcoin sellers can transfer money directly from their virtual wallets to yours, and you can see it all happen in real time.

4. A Face-to-Face Bitcoin Exchange

Serious Bitcoin investors may look in to this more complicated version of a face-to-face Bitcoin transaction. Bitcoin exchanges, often called Buttonwood meetups, are similar to the oldest version of the New York Stock Exchange: a group of people getting together to exchange goods (silver and gold) and currencies for cryptocurrencies.

As this article from Wired outlines, most Buttonwood transactions aren’t large. Often, the goal is just to get people informed and interested in Bitcoins and other cryptocurrencies. However, these can be a good place to meet with other Bitcoin enthusiasts and to trade coins, currency and other valuables for Bitcoins (and other cryptocurrencies).

5. Go to an ATM

You can invest in Bitcoins through an ATM, but not just any ATM. The world’s first Bitcoin ATM, created by Robocoin, was placed in the Vancouver, British Columbia, coffee shop called Waves Coffee.

The machine in Vancouver charges a transaction fee of 3-5 percent, but even so, it did $100,000 worth of transactions during its first eight days of operation.

Most of the people who use the ATM have been investors who insert cash for a share of Bitcoins. However, some people have used it to sell Bitcoins for cash.

While the Vancouver ATM is the first, Bitcoiniac, who purchased the machine and four others from Robocoin, plans to deploy the others in Toronto, Montreal, London and Berlin soon. Next year, the company hopes to add Boston, Los Angeles, San Francisco and a few other major U.S. cities to the list with Bitcoin ATMs.

Take the 31-Day Money Challenge

Our 31-Day Money Challenge will help you get out of debt, save more, and take back control of your life.

Bonus: You'll also get instant access to my interview of a husband and father who retired at the ripe old age of . . . 30. Seriously!

What others are saying: "Hi Rob. I'm at Day 26 in your 31 day money challenge podcast. Thank you, thank you, thank you! I've been looking for a comprehensive guide to all-things-money and this has been so informative." --Danielle

Start the 31-day money challenge!

5 Responses to “5 Ways to Invest in Bitcoins”

Unless you’re a serious security expert, online exchanges are the way to go. They should be able to verify your bank account instantly and deposit funds right away. ID verification allows for higher buying power.

Should be noted that these fads are dangerous. Coinbase just issued an email this past week addressing system congestion and the fact that there’s clearly a lot of irresponsible trading in these markets.

True… But, consider that it takes time to establish enough trust with an exchange, such as Coinbase, to make a major investment.

so Jason what is the best way in your opinion to start investing in bitcoin?

How can I make millions off bitcoins

I am a 67 yo female wanting/needing to retire. I have heard of bit coin for several years now. I only have a small (100.00) amt to begin with. Where should I begin?

Leave a Reply

Take Control of Your Money

Join over 23,000 who get our free weekly newsletter.

Basics For Buying And Investing In Bitcoin

Bitcoin (BTC) is a decentralized cryptocurrency payment system designed by Satoshi Nakamoto. The software-based currency was released to the public in 2009. Since then, updates and improvements have been made by a network of developers, partially funded by the Bitcoin Foundation.

So how can you be part of the action?

Investing in Bitcoin for the Average Joe

The simplest way the Average Joe can invest in Bitcoin is to outright buy some. Buying BTC today is simpler than ever, with many established firms in the US and abroad involved in the business of buying and selling bitcoins. For investors in the USA, the simplest solution is Coinbase. The company sells BTC to customers at a mark-up that is usually around 1% over the current market price.

For Americans, Coinbase has an option to link your bank account to your Coinbase wallet. This makes future payment transfers easier. The company also offers automatic bitcoin buying at regular intervals. For example, say you want to buy $50 in bitcoins every 1 st or 2 nd of the month, right after you get your paycheck. You can setup an auto-buy for that amount on Coinbase. Take into account a few caveats before you start using this service. If you issue an automatic buy order, you will not have control over the price at which the BTC is bought. Next thing to note is that Coinbase is not a bitcoin exchange, you are buying/selling your coins directly from the firm, which in turn has to source them from other buyers. This creates issues or delays when executing orders during fast market moves.

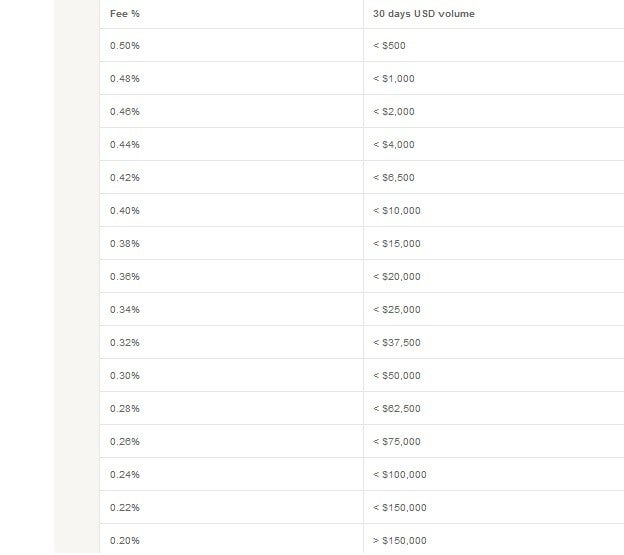

For traders that want a traditional bitcoin exchange, BitStamp may be a better option. With BitStamp, you are trading with other users and not the company, which only acts as a middleman. Liquidity is higher and you can almost always find another person to take the other side of your trade. The fees start at 0.5% and go all the way down to 0.2% if you have traded over $150,000 in the past 30 days.

Other Ways to Buy Bitcoins

Exchanges are not the only way you can acquire bitcoins. A popular route for buying BTC offline is with Local Bitcoins. The website pairs up potential buyers and sellers. When buying BTC, the bitcoins are locked from the seller in the escrow. The seller can only release them to buyers (in case of a problem, file a dispute after 24 hours). When buying bitcoins offline, you should take the usual precautions as you would when meeting a stranger. Meet during the daytime at a public place and if possible, bring a friend.

[ Now you know how to buy Bitcoins, but do you know what you're actually buying? Investopedia Academy's course Cryptocurrency for Beginners provides a thorough explanation of the world of crypto, from blockchain basics to demystifying altcoins. And for only $99, it's a great way to get your foot in the door with cryptocurrency. Check it out today! ]

The Bottom Line

Bitcoin is hot right now and investors and venture capital firms are betting that it is here to stay. For the average person, numerous ways exist to get into investing and buying Bitcoin. In the U.S., the most popular avenues are CoinBase, Bitstamp and Local Bitcoins. Each have their advantages and disadvantages, so do your research to find the best fit for you.

Are you a business thinking about adding bitcoin as a payment option?

Disclaimer: This information is intended for informational purposes only. Investing in crypto-currencies is highly speculative. The value of Bitcoin and other virtual currencies can go up or down substantially. Always consult with a qualified professional before making any investment decisions.

About the Author -Petar Koteveski is a forex trader and writer with 9 years of experience in financial markets. He has been following bitcoin since 2010. Last year, Petar started getting more involved by writing articles for Forex News, on bitcoin and other alternative currencies. New to bitcoin? Check out his Bitcoin Trading Guide.

How to Invest in Bitcoin

There has been a massive wave of conversation surrounding cryptocurrency but, some people are still a bit confused by the whole phenomenon. Here are the major keys that you need to know if you are interested in investing in bitcoin.

Bitcoin

The mother coin is bitcoin, the first decentralized digital currency created by, “Satoshi Nakamoto” which is actually an alias. To this day, no one really knows who that is. Think of bitcoin as the gold standard, because it came to market first so it is seen as the most valuable. All other coins are considered altcoins or alternative coins to bitcoin.

Coinbase

Coinbase is the largest secure online platform for buying, selling, transferring, and storing digital currency. Here, you can purchase bitcoin, and other coins such as Ethereum, Litecoin, and most recently added Bitcoin Cash. Do your research before purchasing. Each coin supports different technologies in the market and was created for very different reasons. Example, bitcoin was created as a response to the centralized banking system, giving the power of currency back to the people. The other coins were created with other purposes in mind. Find their whitepapers and read them.

Setting up an account on Coinbase is a fairly straightforward process but it can take anywhere from several days to a couple of weeks to get approval because the systems are so backed up with new registrants. Additionally, when you make your first investment, it will take several weeks to post for the same reason so the name of the game is patience.

Coinmarketcap

If you are interested in following the market and seeing the fluctuation of this very volatile coin and other coins on the market, you can visit Coinmarketcap.

Cryptocurrency gets much deeper than this, but this is some surface-level information to get you started. Remember to only invest what you can afford to lose. Ready to take the dive? Head on over to Coinbase and get started.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

How to Invest in Bitcoin

There has been a massive wave of conversation surrounding cryptocurrency but, some people are still a bit confused by the whole phenomenon. Here are the major keys that you need to know if you are interested in investing in bitcoin.

Bitcoin

The mother coin is bitcoin, the first decentralized digital currency created by, “Satoshi Nakamoto” which is actually an alias. To this day, no one really knows who that is. Think of bitcoin as the gold standard, because it came to market first so it is seen as the most valuable. All other coins are considered altcoins or alternative coins to bitcoin.

Coinbase

Coinbase is the largest secure online platform for buying, selling, transferring, and storing digital currency. Here, you can purchase bitcoin, and other coins such as Ethereum, Litecoin, and most recently added Bitcoin Cash. Do your research before purchasing. Each coin supports different technologies in the market and was created for very different reasons. Example, bitcoin was created as a response to the centralized banking system, giving the power of currency back to the people. The other coins were created with other purposes in mind. Find their whitepapers and read them.

Setting up an account on Coinbase is a fairly straightforward process but it can take anywhere from several days to a couple of weeks to get approval because the systems are so backed up with new registrants. Additionally, when you make your first investment, it will take several weeks to post for the same reason so the name of the game is patience.

Coinmarketcap

If you are interested in following the market and seeing the fluctuation of this very volatile coin and other coins on the market, you can visit Coinmarketcap.

Cryptocurrency gets much deeper than this, but this is some surface-level information to get you started. Remember to only invest what you can afford to lose. Ready to take the dive? Head on over to Coinbase and get started.

Why You Shouldn’t Invest in Bitcoin

As bitcoin prices dominate headlines, you might be wondering whether you should invest in the popular cryptocurrency.

Probably not: It’s just too volatile. The virtual currency is known for wild fluctuations in price. The value of one bitcoin—which was created in 2008 by an anonymous programmer or group of programmers—reached its all-time high of $1,165.89 in November 2013 before taking a major dive, according to CoinDesk data.

Since then, prices have more or less inched up, and at the turn of the year, they started to approach record highs. On Thursday, the value of a bitcoin reached $1,153.02. However, later Thursday morning, prices suddenly fell by about $200.

“Liquidity dried up—no shorts, no sellers, which means a volatile little bubble formed quickly,” Peter Smith, chief executive of bitcoin wallet Blockchain, told CNBC.

Those sudden ups and downs would be bad news for your portfolio. Although bitcoin had a more than 100% return on investment in 2016, it’s also five times more volatile than the S&P 500, said Campbell Harvey, a professor of finance at Duke University, who described bitcoin as “an extremely risky investment.”

Even if you were to buy bitcoin low and sell high, you still might not see the big payday you’re hoping for. “You try to sell it, and by the time the order goes through, the price may have dropped,” said Matthew Elbeck, a professor of marketing at Troy University. “It’s really, really not worth it for the ordinary consumer.”

If you do choose to take the plunge and buy a bitcoin, make sure it’s a very small part of your diversified portfolio—and that you can afford to lose your investment. “I would never recommend this on a stand-alone basis,” Harvey said.

SPONSORED FINANCIAL CONTENT

Still, for some people living internationally—like Venezuelans plagued with a shortage of cash and those in China, where the government has restricted movement of capital outside of the country—bitcoin presents an attractive option to get ahold of cash, Harvey said. Its rising popularity in these countries are part of the reason behind bitcoin’s recent surge.

Regardless of bitcoin’s ups and downs, the technology behind it—particularly the blockchain, the common ledger that the virtual currency uses—could have a long-lasting impact as a medium of exchange. As Harvey told MONEY’s Taylor Tepper in 2015:

For me, though, I look at Bitcoin not just as a currency, but what it could do in the future in other applications. Think of the Bitcoin technology as a way to exchange and verify ownership. It’s like getting into your car with your smartphone. You present cryptographic proof of ownership. You’re the owner, and it’s verified through this common ledger. The car is able to identify that it is your car, and so the car starts. You’re done.

How to Invest in Bitcoin in 2018

The value of bitcoin has risen about 1800 percent since January 2017. That makes bitcoin an attractive investment for 2018.

Before investing in bitcoin, however, you should understand the different ways of making such investment — such as the different exchanges available, and different bitcoin investment options — as well as newer types of bitcoin investment opportunities, such as bitcoin ETFs.

What Is Bitcoin?

Released in 2009, bitcoin is the oldest and best known digital currency built using blockchain technology.

Bitcoin is a way to make payments securely and anonymously (although there are limitations: bitcoin transactions can sometimes be traced, and investing in bitcoin sometimes requires proving your real-world identity).

Dozens of other blockchain-based digital currencies exist alongside bitcoin, but bitcoin remains the original and most highly valued digital currency.

Why Invest in Bitcoin?

The most obvious reason to invest in bitcoin is that the value of bitcoin versus traditional currencies, such as the U.S. dollar, has climbed very steadily over the past several years.

Other reasons to invest in bitcoin include:

- Its value is virtually unaffected by fluctuations in the stock market. This makes bitcoin a good asset for diversifying portfolios beyond stocks.

- No single authority controls bitcoin or guarantees its value. As a result, a government shutdown would not cause uncertainty for the value of bitcoin in the same way that it would for currencies such as the U.S. dollar.

- Bitcoin can be bought and sold very easily by individual investors, for minimal exchange fees. This makes bitcoin more attractive than investing in the stock market, which can require more skill on the part of the investor and sometimes involves paying large commissions to middlemen.

Of course, bitcoin investment is not without risks and drawbacks, which include:

- Bitcoin is highly volatile. Although bitcoin’s value climbed relatively steadily overall in 2017, price drops of 20 percent or more in a single day are not uncommon. In the less recent past, price drops of more than 90 percent occurred.

- The use of bitcoin for real-world transactions today remains limited. Bitcoin’s value is therefore driven largely by speculation. People want it because its supply is limited and they believe it will become widely used in the future. In this respect, bitcoin is a riskier investment than other investment instruments that are linked to present-day value.

How Can You Invest in Bitcoin?

There are several ways to invest in bitcoin:

- Using a bitcoin exchange. (For a ranking of bitcoin exchanges, click here.) Using an exchange, you can buy bitcoin in U.S. dollars. Most exchanges charge a small commission, which varies depending on the volume of the exchange and your method of payment.

- Buying in cash. Matchmaking sites like LocalBitcoins pair people who want to sell bitcoin to people who want to pay for them in cash. To use this option, you have to deposit cash in a physical location; however, this approach can be more private because it does not require registration with an exchange.

- Mining. Rather than purchasing bitcoins, you can “mine” them by performing the computations required to add new bitcoin to the blockchain. Mining requires specialized hardware and consumes a lot of electricity, which means it is not always cost-efficient and is difficult to set up — although cloud-based bitcoin mining platforms are available in which you essentially pay someone else to mine bitcoin for you on their servers.

- Investing in bitcoin ETFs (keep reading for more on these).

Can You Invest in Bitcoin ETFs?

Bitcoin ETFs, which track bitcoin futures, have been rising in popularity, and are set to become available soon on major stock exchanges.

Bitcoin ETFs are an attractive investment option for people who want to add bitcoin to their portfolios while working within their traditional investment frameworks. Bitcoin ETFs may also be more cost-effective for some investors since they can be purchased directly.

Want to learn more about ways to make advancing technologies like the bitcoin blockchain work for you? Learn how at our Cryptocurrency Millionaire Summit.

4 Ways To Invest In Digital Currency Bitcoin

Bitcoin continues to gain currency, and here's how you can get in

By Traders Reserve

Bitcoin is not a stock, a bond or even a legal entity. Created and held exclusively in cyberspace, the currency isn’t tied to, managed or regulated by any bank or government agency.

The digital currency may wind up as brilliant an innovation as the personal computer and Internet. But Bitcoin’s role as an investment has yet to be defined, leaving many investors intrigued – but wondering whether it has a place in their portfolio.

To invest or not to invest? It’s a billion-dollar debate. Advocates think the digital currency—unhinged to the dollar—can act as a hedge against economic collapse and provide growth, much like gold. Skeptics sees it as a volatile, speculative, tulip-like bubble waiting to burst.

Is Bitcoin right for your portfolio?

Bitcoin, only four years old, has crowned a new class of millionaires who bought the digital coins for pennies early on, then watched their value rise 9,000% in 2013.

So far in 2014, Bitcoin has suffered a steady stream of negative headlines and a 50% selloff.

- Cyberattacks Force Bitcoin Exchanges to Halt Withdrawals

- Bitcoin Millionaire Arrested for Alleged Money Laundering

- China Forbids Companies from Accepting Bitcoin

As some bitcoin holders cash in, others wonder whether the dramatic drop creates stellar buying opportunity.

If you’re wondering the same thing, take to heart this advice from Gary Gordon, president of Pacific Park Financial and CFP, with $120 million under management:

“At the present, it is more appropriate for active traders than it is for mom-and-pop investors. If mom-and-pop feel the need to participate, they should probably keep it to 1% or 2% of a total portfolio, whereby ‘virtually’ nothing that happens to bitcoin could permanently harm their portfolio,” suggests the financial advisor and avid proponent of ETFs.

Your mantra, should you choose to invest, is this: If you can’t afford to lose it, don’t bet it.

Proceed with caution. Here are four ways to gain a stake, both for those thinking about getting in, and for those of us who are just curious about how it works:

Purchase Coins Directly From an Exchange

This is easiest, most direct way to invest in bitcoin. Choose Coinbase as your exchange. Backed by Silicon Valley royalty, Coinbase combines the two things you need to start collecting bitcoin: a wallet (a digital place to receive, send, and/or store your bitcoin), and an exchange (to buy the bitcoin with U.S. dollars).

At the time of this writing (February 17), one whole bitcoin will cost you about $660. But there’s no need to buy a whole one because the currency can be divided into tiny fractions, up to eight decimal places.

Once you create a Coinbase account, you’ll need to link a bank account and verify your phone number. At this point, you can buy bitcoin, but you will have to wait a few days for the transaction to go through while Coinbase verifies all your details. The price will be locked in when you make your purchase, so if the exchange rate jumps or dives, your cost remains the same.

Since the object of your purchase is not to spend but to save bitcoin, just leave them in your wallet, or transfer them onto a USB drive, as one investor suggests.

Bitcoin-Related Stocks

While a new penny stock out to cash in on the bitcoin craze doesn’t give you direct exposure to the currency’s price, it does allow you to reap the rewards of growing popularity.

But buyer beware: Bitcoin Shop (TUCND) went public on Feb. 6 and shot from $0 to $4.57 per share the next day then promptly declined 53% over the past five.

As the first company with “bitcoin” in its name to be publicly traded, Bitcoin Shop is an online retailer that sells everything from appliances to gourmet goods and accepts the digital currency as payment.

While volume averaged 1.2 million since going public, the frenzy has slowed to just over 111,000. If you choose to invest in TUCND, buy very small increments and use disposable money.

Bitcoin Investment Trust: Non-Wealthy Need Not Apply

SecondMarket, a platform for investing in private assets, launched a fund called the Bitcoin Investment Trust (BIT) on Sept. 25. You can make bitcoin part of your retirement account by investing in it, but there’s a $25,000 minimum, lots of fees, and you need to be an accredited investor. This means you must earn more than $200,000 a year and own at least $1 million in assets, excluding your primary home.

BIT has actually amassed $51.1 million in assets and performed quite favorably since its inception, up $386%. Like all bitcoin- related investments lately, it has fallen 25% in the last month.

If you can swing this type of investment, advisors say stick to the minimum and make sure it doesn’t account for more than 2% of your total portfolio.

A Bitcoin ETF on the Horizon

The Winklevoss Bitcoin ETF, named after brothers Cameron and Tyler who are known for filing a lawsuit against Facebook founder Mark Zuckerberg, is currently under review by the SEC and may be available by the end of 2014.

It would basically legitimize bitcoin investing and make it as simple and straightforward as commodity-based ETFs are for gold and silver. The Trust buys the bitcoins to back the ETF shares, and daily transactions would go through a regulated trading desk.

Is it worth monitoring the Bitcoin ETF’s potential approval?

Yes, says Gordon of Pacific Park Financial. “In the same way that a wildly popular IPO comes to market, the ability for everyday Joes and Joans to invest in the virtual currency may send prices soaring. By the same token, it may give hedge funds — “the big money” — an opportunity to short the heck out of it, sending the price plummeting.”

Whatever you choose to do, be safe out there.

Комментариев нет:

Отправить комментарий