What Is Bitcoin? Is It Legal Money? What Could Happen To Bitcoins In 2017?

A layman's guide to bitcoin!

Short Bytes: Bitcoins, a form of digital currency that operates on the principles of cryptography, has lately come under the scanner of the authorities throughout the world. So, it’s become necessary to know what are Bitcoins, how it works, the legal status of Bitcoins as well as what holds in the future of Bitcoins.

I n the year 1976, F.A Hayek, in his book “The Denationalisation of Money,” propagated the establishment of competitively issued private money. In the mid-70s, what seemed like a farfetched idea was conceived by yet another Economist in the year 1999. Milton Friedman, an American economist who received the 1976 Nobel Memorial Prize in Economic Sciences, predicted of time where internet, (still in a nascent stage then) would help abolish the role of a government and evolve a currency free from the shackles of the government control. Less than ten years later the prophecy came true when Satoshi Nakamoto, a Japanese, invented a form of cryptocurrency called “Bitcoin.” The origin of Bitcoins can be traced to the aftermath of the global recession and money crisis of 2008 that shook the whole world economy.

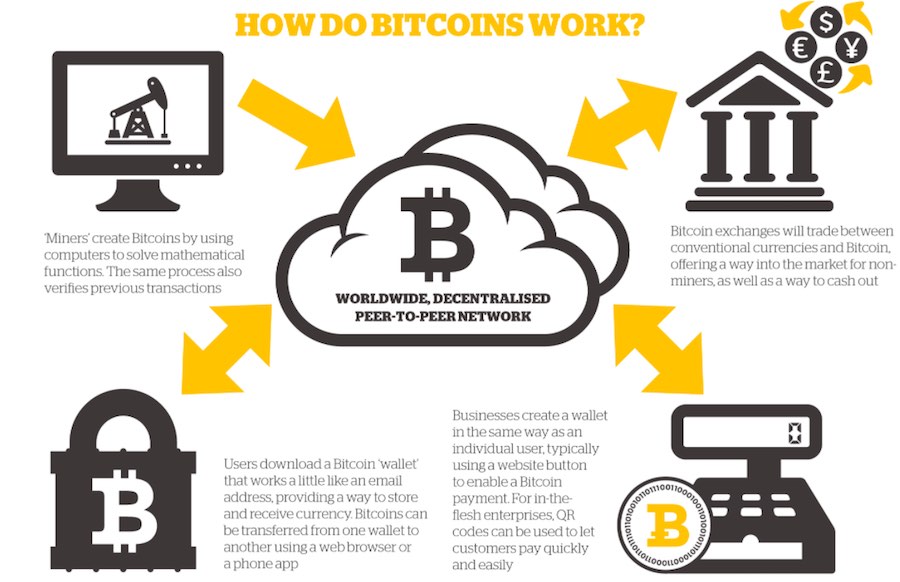

What is bitcoin? How does it work?

In the simplest form, Bitcoins can be described as a “Peer to Peer Electronic cash system.” Bitcoins can be used as a method of payment for numerous goods and services and for simple transactions like purchasing vouchers, paying bills, etc. In different jurisdictions, Bitcoins are treated as a property, currency, virtual asset, good, security or commodity for the purpose of trading on a stock exchange or commodity exchange.

Essentially Bitcoin is a cryptocurrency, i.e., it operates on the principles of cryptography to manage the creation of Bitcoins and securing the transactions. Cryptocurrencies are managed by private parties, without the need for a government authority to monitor the currency system. The currency has been designed in a way that the number of total units of Bitcoins in circulation will always be limited. Going by the pace at which Bitcoins are being minted, the last unit will be mined around the year 2140.

Also Read: What Is The Difference Between Deep Web, Darknet, And Dark Web?

The cryptocurrencies essentially work on the Blockchain system. A Blockchain is a public ledger of Bitcoins that is designed to record all the transactions. The chronological order of Blockchain is enforced with cryptography and each new ledger update creates newly minted Bitcoins. This is designed in a way that Bitcoin wallets can calculate their total balance and new transactions can be verified. The integrity and the chronological order of the block chain are enforced with cryptography.

Image: Pinterest

Image: Pinterest

The buyer and seller can enter into transactions by using their Bitcoin wallets that are secured by a secret piece of data called, a “Private key.” The key is used to authorise the transactions by the owner of the wallet, and cannot be normally tempered by anyone, once it is issued. The transactions are performed by adding the Bitcoin wallets on an exchange, acting as a facilitator for sale and purchase of Bitcoins. All transactions are displayed between the users and usually begin to be confirmed by the network through a process called “Mining.” It is essentially the process of creating new Bitcoins out of the total Bitcoins that are designed to be “Mined” using computers. The transactions transfer the value between the users and get recorded in the Blockchain, ensuring that each transaction is valid.

Is Bitcoin legal money?

The legality of Bitcoins is controversial, while some jurisdictions have express laws and regulations to deal with Bitcoins, others still fall in gray areas. As per a recent bill in Japan, Bitcoins and other virtual currencies have been given legal recognition and are accepted as a mode of payment. While in China, trading in Bitcoins come under the regulatory restrictions imposed by People’s Bank of China.

In the U.S.A, different states have adopted varying approaches to Bitcoins. Recently a U.S Magistrate in the state of New York ruled that Bitcoins are not money, while a contradictory stance was taken by a judge in Manhattan, who ruled that bitcoins are acceptable means of payment. The Internal Revenue Service in the United States, defines bitcoin as property rather than currency for tax purposes. The U.S. Treasury, by contrast, classifies bitcoin as a decentralised virtual currency.

In Russia, reportedly, Bitcoins may soon be regulated in a bid to tackle money laundering, though, in the past, Russia has expressed its displeasure with Bitcoins and other cryptocurrencies. In India, as of now, no regulations have been framed by either Reserve Bank of India or Securities and Exchange Board of India, the two contenders, for the purpose of drafting regulations pertaining to Bitcoins and acting as a watchdog.

In India, who ultimately acts as a regulatory authority can only be decided based on whether the government decides to treat Bitcoins as “Currency” or “Security/Commodity.” As per current Indian laws, “Currency” can only be issued by the government but the residuary powers in this regard lie with the Reserve Bank of India which can notify “Bitcoins” as currency. After the demonetization drive in India, the demand for Bitcoin has more than doubled in less than two months. The Indian government has reportedly set up an inter-disciplinary committee to regulate the Bitcoins amidst the apprehensions that the black money hoarders may have invested into Bitcoins.

Bitcoin trends in 2017

Bitcoins are extremely volatile in nature. While the future trends for Bitcoins can’t be predicted with utmost certainty, as per a report published on Forbes, the market is set to show strong waves in the favor of cryptocurrencies, as predicted by a crypto market intelligence startup. As per the latest position, The 24-hour average rate of exchange across USD Bitcoin markets is US$1184.87, the 7-day average is US$1204.85, and the 30-day average is US$1080.26 confirming only the volatility of Bitcoins.

There are possibilities that some countries may introduce an Exchange Traded Fund (ETF) to make Bitcoin Trading easier and accessible. While a similar application to create an ETF has been rejected by The US Securities and Exchange Commission (SEC), the chances of other countries adopting it are not bleak. Currently, sale and purchase of Bitcoins is a multi-step process. Creating an ETF would make it possible for the investors to buy Bitcoins through the stock market.

Further, In the future Blockchains, the underlying technology to Bitcoins may bring revolution in the music industry. Cryptography could transform the music industry by using Blockchain ledgers. As per reports, an attempt is being made to bring music distribution under the cryptography. This can be done by adding the music to blockchain and letting the users distribute the music by paying a sum. This can also bring down music piracy.

To sum up the discussion, it can be said that while Bitcoins may not replace the “Fiat Currency” anytime soon, but there has been a phenomenal growth in the acceptance of cryptocurrencies around the world. While the investors may still be reluctant to invest in Bitcoins, given the high risks associated with it, the demand for Bitcoins has grown manifold. In the end, it could be argued that a good legal and regulatory framework for Bitcoins would help the investors decide the viability of Bitcoins in the long run.

Did you find this story on Bitcoin and its 2017 trends interesting? Don’t forget to share your views.

Is Bitcoin Legal?

It’s understandable to have questions about the legality of using Bitcoin. The platform introduced a brand new paradigm away from the traditional regulators and regulations that govern fiat currency. Unlike illegal, counterfeit money, which is a blatant example of a “currency” that misrepresents itself as legal tender, Bitcoin is entirely different. Nevertheless, it operates in a seemingly gray area when it comes to regulation. However, many of these concerns boil down to misunderstandings or a lack of concrete rules that govern Bitcoin, rather than overt violations of the law.

The question surrounding the relationship between Bitcoin and the law really depends on how the digital currency is being used.

Ever since the now-defunct Silk Road gained notoriety, regulators have been concerned about Bitcoin’s semi-anonymity and decentralized nature. In the U.S., as well as in other countries, authorities fear that the platform could be used for money laundering and the purchase of illicit goods without being traced.

Not helping Bitcoin’s reputation with authorities was its prevalence as a payment service for the Silk Road, a digital marketplace where users could purchase illegal goods. Whether or not people use Bitcoin as a way to participate in expressly illegal activities doesn’t make the digital currency itself illegal. The illegality of the activity is the issue, whether it’s paid for in bitcoin, cash or gold. However, even when bitcoin is used for legitimate purposes, rules are a little more complex.

According to the U.S. Treasury Department’s Financial Crimes Enforcement Network, as of 2013, using bitcoin to purchase well-natured goods and services is not illegal. However, those who mine bitcoins and trade them for traditional currency or operate exchanges on which bitcoins are bought and sold are labeled “money transmitters” and could be subject to special laws that govern that type of activity. To date, those laws have rarely, if ever, been enforced to crackdown against bitcoin use.

When it comes to taxation, the IRS views bitcoin and other virtual currencies as property for federal tax purposes, similar to stocks and bonds, and federal tax law dictates that purchasers and/or sellers must treat it as such.

In other places around the world, the legality of Bitcoin is viewed differently, but for the most part it remains relatively safe to use as long as it is not tied to illicit purchases or activities. Many countries have issued statements indicating that bitcoin and other digital currencies are not regulated and do not exist as officially sanctioned currencies: a status that could put users at risk but would not have them violating any laws. Bitcoin is outright illegal in some countries, such as Iceland.

Depending on where and how you utilize bitcoin, it is important to remain up-to-date on the latest regulations concerning the digital currency. As laws change across borders, governing bodies and, increasingly, as the platform gains popularity, questions about bitcoin’s legality will continue to be raised.

Is bitcoin legal

Enter up to 25 symbols separated by commas or spaces in the text box below. These symbols will be available during your session for use on applicable pages.

Customize your NASDAQ.com experience

Please confirm your selection:

You have selected to change your default setting for the Quote Search. This will now be your default target page; unless you change your configuration again, or you delete your cookies. Are you sure you want to change your settings?

Please disable your ad blocker (or update your settings to ensure that javascript and cookies are enabled), so that we can continue to provide you with the first-rate market news and data you've come to expect from us.

Is Bitcoin legal in the US?

The digital currency known as bitcoin was created in 2009 by a person called Satoshi Nakamoto, but whose true identity has never been established. It is legal to use bitcoin in the United States, and payments are subject to the same taxes and reporting requirements as any other currency.

There is no physical bitcoin currency the way there is a dollar, euro or pound. It exists only on the Internet, usually in a digital wallet, which is software that stores relevant information such as the private security key that enables transactions. Ledgers known as blockchains are used to keep track of the existence of bitcoin. It can be given directly to or received from anyone who has a bitcoin address via so-called peer-to-peer transactions. It is also traded on various exchanges around the world, which is how its value is established.

Legal and Regulatory Issues

Bitcoin exists in a deregulated marketplace; there is no centralized issuing authority and no way to track back to the company or individual who created the bitcoin. There is no personal information required to open a bitcoin account or to make a payment from an account as there is with a bank account. There is no oversight designed to ensure the information on the ledger is true and correct.

The Mt. Gox bankruptcy in July 2014 brought to the forefront the risk inherent in the system. Roughly $500 million worth of bitcoin listed on the company's ledgers did not exist. In addition to the money that account holders lost, the blow to confidence in the currency drove its global valuation down by $3 billion in a matter of weeks. The system had been established to eliminate the risk of involving third parties in transactions, but the bankruptcy highlighted the risks that exist in peer-to-peer transactions.

Bitcoin payments in the U.S. are subject to the same anti-money laundering regulations that apply to transactions in traditional currencies, and to payments by banks and other financial institutions. However, the anonymity of these transactions makes it far easier to flout the rules. There are concerns, voiced by former Federal Reserve Chairman Ben Bernanke, that terrorists may use bitcoin because of its anonymity. Drug traffickers are known to use it, with the best-known example being the Silk Road market. This was a section of the so-called dark Web where users could buy illicit drugs; all transactions on the Silk Road were done via bitcoin. It was eventually shut down by the FBI in October 2013, and its founder, Ross William Ulbricht, is serving multiple life sentences. However, numerous other dark Web bitcoin-based markets have reportedly taken its place.

International Acceptance

Bitcoin can be transferred from one country to another without limitation. However, the exchange rate against other currencies can be very volatile. This is partly because the price is often driven by speculation, but also because it is a fairly small market compared with other currencies.

Some countries explicitly permit the use of bitcoin, including Canada and Australia. It is prohibited in Iceland, which has had strict capital controls since the collapse of its banks during the 2008 financial crisis. China allows private individuals to hold and trade bitcoin, but participation by banks and other financial institutions is prohibited. The European Union does not have an overall position but may become restrictive in the wake of the November 2015 terror attacks in Paris.

Is Bitcoin Legal?

As the market capitalization of the cryptocurrency market shoots up, through price movements and a surge in new tokens, regulators around the world are stepping up the debate on oversight into the use and trading of digital assets.

This affects all cryptocurrencies, but especially bitcoin, given its market leadership and integration into the global startup ecosystem.

Very few countries have gone as far as to declare bitcoin illegal. That does not, however, mean that bitcoin is "legal tender" – so far, only Japan has gone as far as to give bitcoin that designation. However, just because something isn't legal tender, does not mean that it cannot be used for payment – it just means that there are no protections for either the consumer or the merchant, and that its use as payment is completely discretionary.

Other jurisdictions are still mulling what steps to take. The approaches vary: some smaller nations such as Zimbabwe have few qualms about making brash pronouncements casting doubts on bitcoin's legality. Larger institutions, such as the European Commission, recognize the need for dialogue and deliberation, while the European Central Bank (ECB) believes that cryptocurrencies are not yet mature enough for regulation (although with bitcoin almost 10 years old, one is left wondering when we will know it has reached sufficient maturity). In the United States, the issue is complicated further by the fractured regulatory map – who would do the legislating, the federal government or individual states?

A related question in other countries, to which there is not yet a clear answer, is: should central banks keep an eye cryptocurrencies, or financial regulators? In some countries they are one and the same thing, but in most developed nations, they are separate institutions with distinct remits.

Another divisive issue is: should bitcoin be regulated on a national or international basis? France is pushing for the G20 (an international forum for governments and central banks) to discuss establishing parameters at the upcoming summit in April 2018.

A further distinction needs to be made between regulation of the cryptocurrency itself (is it a commodity or a currency, is it legal tender?) and cryptocurrency businesses (are they money transmitters, do they need licenses?). In a few countries the considerations are tied together – in most others, they have been dealt with separately.

Below is a brief summary of pronouncements made by certain countries. This list is updated monthly.

Last updated: 29 April 2018

Australia

In October 2017, the Australian Senate began debating a bill that would apply anti-money laundering statutes to the country's cryptocurrency exchanges, as well as mandate criminal charges for exchanges that operate without a license.

That same month, the tax authorities removed the "double taxation" of bitcoin, which was a result of a decision in 2014 to treat the cryptocurrency as a "bartered good" rather than a currency or asset.

As of the end of 2017, cryptocurrency exchanges have to register with the country's financial intelligence agency Austrac, and comply with customer verification and record preservation requirements.

Further moves are unlikely for now, however, as officials from the central bank recently said that regulation is not needed for the use of cryptocurrencies as payment.

Argentina

In spite of a strong bitcoin ecosystem, Argentina has not yet drawn up regulations for the cryptocurrency, although the central bank has issued official warnings of the risks involved.

Bangladesh

In 2015, Bangladesh expressly declared that using cryptocurrencies was a "punishable offence."

Bolivia

In 2014, the central bank of Bolivia officially banned the use of any currency or tokens not issued by the government.

Canada

Canada was one of the first countries to draw up what could be considered "bitcoin legislation," with the passage of Bill C-31 in 2014, which designated "virtual currency businesses" as "money service businesses," compelling them to comply with anti-money laundering and know-your-client requirements.

The government has specified that bitcoin is not legal tender, and the country's tax authority has deemed bitcoin transactions taxable, depending on the type of activity.

China

While China has not banned bitcoin (and insists it has no plans to do so), it has cracked down on bitcoin exchanges - all major bitcoin exchanges in the country, including OKCoin, Huobi, BTC China, and ViaBTC, suspended order book trading of digital assets against the yuan in 2017.

It also appears to be withdrawing preferential treatment (tax deductions and cheap electricity) for bitcoin miners.

Ecuador

In 2014, the National Assembly of Ecuador banned bitcoin and decentralized digital currencies while establishing guidelines for the creation of a new, state-run currency.

Egypt

In January 2018, the Grand Mufti of Egypt declared that cryptocurrency trading was forbidden under Islamic religious law due to the risk associated with the activity. While this is not legally binding, it does count as a high-level legal opinion.

Europe

The European Union is taking a cautious approach to cryptocurrency regulation, with several initiatives underway to involve sector participants in the drafting of supportive rules. The focus appears to be on learning before regulating, while boosting innovation and taking into account the needs of the ecosystem.

The European Central Bank (ECB), however, is pushing for tighter control over movements of digital currencies as part of a broader crackdown on money laundering, while recognizing the jurisdictional complexities in regulating an asset with no boundaries. In late in 2017, an ECB official stated that the institution did not see bitcoin as a threat, and president Mario Draghi recently confirmed that, in the eyes of the ECB, bitcoin was not "mature enough" for regulation.

In April 2018, the parliament's members voted by a large majority to support a December 2017 agreement with the European Council for measures aimed, in part, to prevent the use of cryptocurrencies in money laundering and terrorism financing.

G20

The G20 - comprised of the world's 20 largest economies - recently turned its attention to cryptocurrencies in general, and committed to drafting recommendations on the first steps towards regulation by July 2018.

India

The Indian central bank has issued a couple of official warnings on bitcoin, and at the end of 2017 the country's finance minister clarified in an interview that bitcoin is not legal tender. The government does not yet have any regulations that cover cryptocurrencies, although it is looking at recommendations.

The central bank, however, has barred Indian financial institutions from working with cryptocurrency exchanges and other related services (although this is being contested in the judicial system).

Iran

In April 2018, Iran's central bank and one of its principal market regulators said that financial businesses should not deal in bitcoin or other cryptocurrencies.

Japan

Japan was the first country to expressly declare bitcoin "legal tender," passing a law in early 2017 that also brought bitcoin exchanges under anti-money laundering and know-your-customer rules (although license applications have temporarily been suspended as the regulators deal with a hack on the Coincheck exchange in early 2018).

Recently the Financial Servivces Agency has been cracking down on exchanges, suspending two and mandating improved security measures in five others. It has also established a cryptocurrency exchange industry study group which aims to examine institutional issues regarding bitcoin and other assets.

Kazakhstan

According to reports, the National Bank of Kazakhstan recently hinted at plans to ban cryptocurrency trading and mining, although as yet no strict regulations have been passed.

Kyrgyzstan

The central bank of Kyrgyzstan declared in 2014 that using cyrptocurrencies for transactions was against the law.

Malaysia

Malaysia's Securities Commission is working together with the country's central bank on a cryptocurrency regulation framework.

Mexico

In 2014, Mexico's central bank issued a statement blocking banks from dealing in virtual currencies. The following year, the finance ministry clarified that, although bitcoin was not "legal tender," it could be used as payment and therefore was subject to the same anti-money laundering restrictions as cash and precious metals.

At the end of 2017, Mexico's national legislature approved a bill that would bring local bitcoin exchanges under the oversight of the central bank.

Morocco

Towards the end of 2017, Morocco's foreign exchange authority declared that the use of cryptocurrencies within the country violated foreign exchange regulations and would be met with penalties.

Namibia

Namibia is one of the few countries to have expressly declared that purchases with bitcoin are "illegal."

Nigeria

While Nigerian banks are prohibited from handling virtual currencies, the central bank is working on a white paper which will draft its official stance on use of cryptocurrencies as a payment method.

Pakistan

In April 2018, Pakistan's central bank issued a statement barring financial companies in the country from working with cryptocurrency firms.

Russia

Draft cryptocurrency legislation from the State Duma's financial regulator is expected in mid-2018. The focus appears to be on protecting citizens from scams, while allowing individuals and businesses to work legally with cryptocurrencies.

The efforts of the State Duma have been bolstered by a mandate from Putin himself, issued in October 2017, urging development of a "single payment space" within the Eurasian Economic Union (an alliance of countries including Armenia, Belarus and others), increased scrutiny of token sales, as well as licensing of bitcoin mining operations.

Singapore

The Monetary Authority of Singapore is reportedly examining at whether new rules are needed to protect cryptocurrency investors, and while it is not likely to ban cryptocurrency trading, it is looking at imposing anti-money laundering and terrorism financing rules on exchanges.

The central bank is also working on a regulatory framework for bitcoin payments, and has issued warnings on bitcoin investments.

South Africa

In 2017, the South Africa Reserve Bank implemented a "sandbox approach," testing draft bitcoin and cryptocurrency regulation with a selected handful of startups.

South Korea

In early 2018, South Korea banned anonymous virtual currency accounts. And in an effort to curb cryptocurrency speculation, the authorities are working on increased oversight of exchanges (which could include a licensing scheme), although the governor of the Financial Supervisory Service has said the government will support "normal" cryptocurrency trading.

In an interesting shift in strategy, a recent report in the South Korean press indicated that the country's financial authorities are in talks with similar agencies in Japan and China over joint oversight of cryptocurrency investment.

In April 2018, the Fair Trade Commission ordered 12 of the country's cryptocurrency exchanges to revise their user agreements.

Thailand

After allegedly declaring bitcoin illegal, the Bank of Thailand issued a backtracking statement in 2014, clarifying that it is not legal tender (but not technically illegal), and warning of the risks.

In March 2018, the government's executive branch provisionally passed two royal decree drafts, establishing formal rules to protect cryptocurrency investors (as well as setting KYC requirements), and setting a tax on their capital gains. The drafts have yet to receive final cabinet approval.

United States of America

The U.S. is plagued by a fragmented regulatory system, with legislators at both the state and the federal level responsible for layered jurisdictions and a complex separation of powers.

Some states are more advanced than others in cryptocurrency oversight. New York, for instance, unveiled the controversial BitLicense in 2015, granting bitcoin businesses the official go-ahead to operate in the state (many startups pulled out of the state altogether rather than comply with the expensive requirements). In mid-2017, Washington passed a bill that applied money transmitter laws to bitcoin exchanges.

New Hampshire requires bitcoin sellers to get a money transmitter license and post a $100,000 bond. In Texas, the state securities commission is monitoring (and, on occasion, shutting down) bitcoin-related investment opportunities. And California is in bitcoin regulation limbo after freezing progress on Bill 1326 which – while criticized for issues such as overly broad definitions – was seen as less oppressive than New York's BitLicense.

At the federal level, the Securities and Exchange Commission's focus has been on the use of blockchain assets as securities, such as whether or not certain bitcoin investment funds should be sold to the public, and whether or not a certain offering is fraud.

The Commodities Futures Trading Commission (CFTC) has a bigger potential footprint in bitcoin regulation, given its designation of the cryptocurrency as a "commodity." While it has yet to draw up comprehensive bitcoin regulations, its recent efforts have focused on monitoring the nascent futures market. It has also filed charges in several bitcoin-related schemes, which underlines its intent to exercise jurisdiction over cryptocurrencies whenever it suspects there may be fraud.

The Uniform Law Commission, a non-profit association that aims to bring clarity and cohesion to state legislation, has drafted the Uniform Regulation of Virtual Currency Business Act, which several states are contemplating introducing in upcoming legislative sessions. The Act aims to spell out which virtual currency activities are money transmission businesses, and what type of license they would require. Critics fear it too closely resembles the New York BitLicense.

United Kingdom

Britain's Financial Conduct Authority (FCA) sees bitcoin as a "commodity," and therefore does plan to regulate it. It has hinted, however, that it will step in to oversee bitcoin-related derivatives. This lack of consumer protection has been behind recent FCA warnings on the risks inherent in cryptocurrencies.

Ukraine

The government of Ukraine has created a working group composed of regulators from various branches to draft cryptocurrency regulation proposals, including the determination of which agencies will have oversight and access. Also, a bill already before the legislature would bring cryptocurrency exchanges under the jurisdiction of the central bank.

Zimbabwe

Late in 2017, a senior official from Zimbabwe's central bank stated that bitcoin was not "actually legal." While the extent to which it can and cannot be used is not yet clear, the central bank is apparently undertaking research to determine the risks.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Countries Where Bitcoin Is Legal & Illegal (DISH, OTSK)

The peer-to-peer digital currency Bitcoin made its debut in 2009 and with it ushered in a new era of cryptocurrency. Today, there are more than 500 different cryptocurrencies to choose from, but Bitcoin still enjoys the first mover advantage. While tax authorities, enforcement agencies, and regulators are still exploring the phenomenon, one pertinent question is—is bitcoin legal or illegal? The answer is, it depends on the location and activity of the user.

Bitcoins are not issued, endorsed, or regulated by any central bank. Instead, they are created through a computer-generated process known as mining. In addition to being a cryptocurrency unrelated to any government, Bitcoin is also necessarily a peer-to-peer payment system since it does not exist in any physical form and must be exchanged online. As such, it offers a convenient way to conduct cross-border transactions with no exchange rate fees. It also allows users to remain anonymous. (Related reading The Risks Of Buying Bitcoin)

Consumers have greater ability now to purchase goods and services with bitcoins directly at online retailers and and using bitcoin-purchased gift cards at bricks and mortar stores. The currency is being traded on exchanges, and companies have even made investments in virtual currency-related ventures. These activities portray a technically well-established virtual currency system, but there is still no uniform international legal law covering the use of bitcoin. (For more see Stores Where You Can Buy Things With Bitcoins)

Countries that Say Yes to Bitcoin

The fact that bitcoin can be anonymously used to conduct transactions between any account holders, anywhere and anytime across the globe, makes it attractive to criminal elements. They may use bitcoins to buy or sell illegal goods like drugs or weapons. Most countries have not clearly made determinations on the legality of bitcoin, preferring instead to take a wait-and-see approach. Some countries have indirectly assented to the legal usage of bitcoins by enacting some regulatory oversight. However, bitcoin is never legally acceptable as a substitute for a country’s legal tender.

The United States

The United States has taken a generally positive approach towards bitcoin. At the same time, it has several government agencies working on preventing or reducing the use of bitcoin for illegal transactions. Prominent businesses like Dish Network (DISH), Dell, and Overstock.com (OSTK) welcome payment in bitcoin. The digital currency has also made its way to the U.S. derivatives markets, which speaks about its increasingly legitimate presence.

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) has been issuing guidance on bitcoin since the beginning of 2013. The Treasury has defined bitcoin not as currency, but as a money services business (MSB). This places it under the Bank Secrecy Act which requires exchanges and payment processors to adhere to certain responsibilities like reporting, registration, and record keeping. In addition, bitcoin is categorized as property for taxation purposes by the Internal Revenue Service (IRS). (Related Bitcoin: Current And Future Legal Framework)

Canada

Like its southern neighbor the United States, Canada maintains a generally bitcoin-friendly stance while also ensuring the cryptocurrency is not used for money laundering. Bitcoin is viewed as a commodity by the Canada Revenue Agency (CRA). This means that bitcoin transactions are viewed as barter transactions, and the income generated is considered as business income. The taxation also depends whether the individual has a buying-selling business or is only concerned with investing.

Canada considers bitcoin exchanges to be money service businesses. This brings them under the purview of the anti-money laundering (AML) laws. Bitcoin exchanges need to register with Financial Transactions and Reports Analysis Centre (FINTRAC), report any suspicious transactions, abide by the compliance plans, and even keep certain records. In addition, the Canadian government has tasked the Senate Banking Committee with drafting guidelines for the legislature of virtual currencies by July of 2015.

Australia

Australia allows entities to trade, mine, or buy bitcoin. The Australian Taxation Office (ATO) considers bitcoin transactions barter arrangement subject to appropriate taxes depending upon the use and user (full document).

The European Union

Though the European Union (EU) has followed developments in cryptocurrency, it has not issued any official decision on legality, acceptance, or regulation. In the absence of central guidance, individual EU countries have developed their own bitcoin stances. A few nations are allowing bitcoin while others are either undecided or issuing warnings.

In Finland, the Central Board of Taxes (CBT) has given bitcoin a value-added tax exempt status by classifying it as a financial service. Bitcoin is treated as a commodity in Finland and not as a currency. The Federal Public Service Finance of Belgium has also made bitcoin exempt from value added tax (VAT). In Cyprus, bitcoins are not controlled or regulated but are not illegal either. The Financial Conduct Authority (FCA) in the United Kingdom (UK) has a pro-bitcoin stance and wants the regulatory environment to be supportive of the digital currency. Bitcoin is under certain tax regulations in UK. The National Revenue Agency (NRA) of Bulgaria has also brought bitcoin under its existing taw laws. Germany is open to bitcoin; it is considered legal but taxed differently depending upon whether the authorities are dealing with exchanges, miners, enterprises, or users.

Countries That Say No to Bitcoin

While bitcoin is fairly welcomed in many parts of the world, there are few countries which are wary of bitcoin because of its volatility, decentralized nature, perceived threat to the current monetary system, and link to illicit activities like drug dealing and money laundering. Some of these nations have outright banned the digital currency while others have tried to cut off any support from the banking and financial system essential for its trading and usage.

Iceland

The island nation has been exercising stringent capital controls as a part of its monetary policies adopted after the global economic crisis of 2008. It seeks to protect the outflow of Icelandic currency from the country. Under the same pretext, foreign exchange trading with bitcoin is banned in Iceland as the cryptocurrency is not compatible with the country’s Foreign Exchange Act. Interestingly, a new cryptocurrency called Auroracoin has lauched out of Iceland. Its founders wished to create a viable alternative to the present Icelandic banking system.

Vietnam

From the beginning, Vietnam’s government and its state bank have maintained that bitcoin is a not a legitimate payment method. After a few initial rounds of public rejoinders against the use of bitcoin, Vietnam made it illegal for both financial institutions and citizens to deal in bitcoin. It links the cryptocurrency to criminal activities such as money laundering.

Bolivia

El Banco Central de Bolivia has banned the use of bitcoin and other cryptocurrencies.

Kyrgyzstan

Using bitcoin and altcoin as a payment form is illegal in Kyrgyzstan.

Ecuador

Bitcoin and other cryptocurrencies were banned in Ecuador by a majority vote in the national assembly. However, the nation has plans to create its own cryptocurrency in the future.

Russia

The legality of bitcoin in Russia is disputed. Russia’s Ministry of Finance is hoping to pass a law to ban bitcoin sometime this year.

China

All banks and other financial institutions like payment processors are prohibited from transacting or dealing in bitcoin. Individuals, however, are free to deal in bitcoin between themselves. Bitcoin culture is thriving in China. It continues to be one of the worlds larges bitcoin markets. (Related reading How Bitcoin Can Change The World)

The Bottom Line

Although Bitcoin is now five years into existence, countries still do not have explicit systems that restrict, regulate, or ban the cryptocurrency. The decentralized and anonymous nature of bitcoin has challenged many governments on how to allow legal use while preventing criminal transactions. Most countries are still analyzing ways to properly regulate the the cryptocurrency. Overall, bitcoin remains in a grey area as the technological leap has left lawmakers far behind.

One more step

Please complete the security check to access www.zebpay.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422b378e771b8d53 • Your IP : 185.87.51.142 • Performance & security by Cloudflare

Legal disclaimer

1. Information published on bitcoin.org

The website https://bitcoin.org/ (hereinafter, referred to as the "Website") provides information and material of a general nature. You are not authorized and nor should you rely on the Website for legal advice, business advice, or advice of any kind. You act at your own risk in reliance on the contents of the Website. Should you make a decision to act or not act you should contact a licensed attorney in the relevant jurisdiction in which you want or need help. In no way are the owners of, or contributors to, the Website responsible for the actions, decisions, or other behavior taken or not taken by you in reliance upon the Website.

2. Translations

The Website may contain translations of the English version of the content available on the Website. These translations are provided only as a convenience. In the event of any conflict between the English language version and the translated version, the English language version shall take precedence. If you notice any inconsistency, please report them on GitHub.

3. Risks related to the use of Bitcoin

The Website will not be responsible for any losses, damages or claims arising from events falling within the scope of the following five categories:

(1) Mistakes made by the user of any Bitcoin-related software or service, e.g., forgotten passwords, payments sent to wrong Bitcoin addresses, and accidental deletion of wallets.

(2) Software problems of the Website and/or any Bitcoin-related software or service, e.g., corrupted wallet file, incorrectly constructed transactions, unsafe cryptographic libraries, malware affecting the Website and/or any Bitcoin-related software or service.

(3) Technical failures in the hardware of the user of any Bitcoin-related software or service, e.g., data loss due to a faulty or damaged storage device.

(4) Security problems experienced by the user of any Bitcoin-related software or service, e.g., unauthorized access to users' wallets and/or accounts.

(5) Actions or inactions of third parties and/or events experienced by third parties, e.g., bankruptcy of service providers, information security attacks on service providers, and fraud conducted by third parties.

4. Investment risks

The investment in Bitcoin can lead to loss of money over short or even long periods. The investors in Bitcoin should expect prices to have large range fluctuations. The information published on the Website cannot guarantee that the investors in Bitcoin would not lose money.

5. Compliance with tax obligations

The users of the Website are solely responsible to determinate what, if any, taxes apply to their Bitcoin transactions. The owners of, or contributors to, the Website are NOT responsible for determining the taxes that apply to Bitcoin transactions.

6. The Website does not store, send, or receive bitcoins

The Website does not store, send or receive bitcoins. This is because bitcoins exist only by virtue of the ownership record maintained in the Bitcoin network. Any transfer of title in bitcoins occurs within a decentralized Bitcoin network, and not on the Website.

7. No warranties

The Website is provided on an "as is" basis without any warranties of any kind regarding the Website and/or any content, data, materials and/or services provided on the Website.

8. Limitation of liability

Unless otherwise required by law, in no event shall the owners of, or contributors to, the Website be liable for any damages of any kind, including, but not limited to, loss of use, loss of profits, or loss of data arising out of or in any way connected with the use of the Website.

9. Arbitration

The user of the Website agrees to arbitrate any dispute arising from or in connection with the Website or this disclaimer, except for disputes related to copyrights, logos, trademarks, trade names, trade secrets or patents.

10. Last amendment

This disclaimer was amended for the last time on July 5th, 2016.

Is Bitcoin mining illegal?

Last updated on January 2nd, 2018 at 12:00 am

The short answer: In most cases, bitcoin mining is perfectly legal. In a few countries, however, bitcoin mining, as well as the possession and use of bitcoin is illegal. If you live in North America and most of Western Europe, bitcoin mining, as well as possession, is not only legal, but local regulatory frameworks actually provide certain protections and basic oversight.

In many cases, bitcoin is not treated as a currency by governments, but instead as an asset or property. As such, bitcoin is afforded some legal protection, just like any other type of property. In most cases, national governments that have not outlawed bitcoin, have not passed laws regarding bitcoin mining. Globally, with only a few exceptions, bitcoin mining is generally considered to be legal.

Before digging into the legal issues, I’m going to offer a brief overview of bitcoin mining. If you’re already familiar with the mining process, feel free to skip ahead.

The Short Story: What is bitcoin mining

Bitcoin mining refers to the process of adding transaction records to the public ledger. Basically, every bitcoin transaction ever conducted is recorded in the public ledger, although actual users can remain hidden behind anonymous names. This ledger is called the blockchain, and transactions are organized into blocks.

The mining process refers to the creation of new blocks of transactions. Once a new block is created, it is added to the blockchain, AKA public ledger. This block is created through solving algorithms with computer processors.

Over time, the algorithms have grown progressively more difficult, meaning more computing power and time is now needed to create a block. Further, approximately every four years, the number of bitcoins rewarded for creating a new block is cut in half. Originally 50 bitcoins were rewarded for mining a block, then 25, and now 12.5. This makes mining more difficult and restricts the bitcoin money supply, and over time should lead to bitcoin gradually gaining value.

Essentially, any processor can be used to mine bitcoins, but without a powerful processor, you won’t have much success. Now-a-days, there are bitcoin-specific machines called bitcoin “mining rigs.” Bitcoin mining rigs are machines that are designed specifically to mine new bitcoins, or in other words, solve the algorithms needed to create a new block. In order for mining to be economically feasible, it’s important for the rigs to run on as little energy as possible, and to solve the algorithms as quickly as possible.

So Why Would Bitcoin Mining Ever Be Considered Illegal?

This is a complex subject, and the reasoning can vary from jurisdiction to jurisdiction. Sometimes, people falsely believe that bitcoin mining is like counterfeiting money, but this simply isn’t true. You’re not creating fake duplicates of a national currency, but instead creating an entirely new currency.

This last bit is also why some governments oppose bitcoin, and thus bitcoin mining. Some governments view bitcoin as a threat because it competes with national currencies. Some governments believe that bitcoin actually undermines the government itself by offering a non-state currency.

Bitcoin can also be mined illegally. Perhaps the most common example has been the use of malicious viruses to hijack people’s computers and to then use their processors to mine bitcoins. This can slow down computers, and also run up energy bills. This is illegal in essentially every jurisdiction.

Where is Bitcoin Mining Illegal?

Bitcoin mining, as well as the possession and use of bitcoin, is illegal in a few countries. In other countries, bitcoin use and mining is more ambiguous with the government sending mixed messages.

Bitcoin is currently banned in Russia, although the most recent legislation to ban bitcoin use and mining was actually withdrawn. The reason for the withdrawal seems less about outlawing bitcoin, and more over the extent of punishment. Some Russian authorities want people who use bitcoin to face multi-year sentences in jail. Others are advocating for a softer touch. The legal status around bitcoin mining is a bit ambiguous since no formal laws have been passed, but for now mining in Russia is a high risk proposition, at the very least.

No other country is as anti-bitcoin as Russia. Of course, Russia is known for being a relatively authoritarian country. On top of that, Russia has been struggling through an economic crisis caused by low oil prices, and sanctions instituted because of Russian activities in Ukraine. Part of the strong anti-bitcoin sentiments in the country may be due to efforts to protect the ruble, which has suffered massive inflation over the past few years.

In South America, Ecuador explicitly outlaws the production of digital currencies, but interestingly enough, has launched its own digital currency. The electronic currency is linked to the U.S. dollar (which is Ecuador’s official currency), and has been designed to decrease dependence on physical money, and the associated costs, such as wear and tear of the bills themselves. Ecuador apparently doesn’t want other digital currencies, such as bitcoin, competing with their own.

The reasons for outlawing bitcoin aren’t always authoritarian in nature. For example, Iceland currently prohibits trading the local kroner for bitcoins. This is because the Icelandic economy struggled in the years following the Great Recession, and authorities instituted capital controls in order to protect the kroner. Authorities were worried that people would essentially flee the kroner, and that the currency would be adversely affected. Iceland does not, however, prohibit the mining of bitcoin.

Other governments, like the Indian government, have made negative remarks against bitcoin but have not launched any official bans on ownership or mining. For now, mining bitcoin in said countries is generally legal and safe, but the regulatory environment could change quickly.

Legal bitcoin mining

In most countries, bitcoin mining is legal. Of course, there are legal ways to mine bitcoin, which generally means using your own resources, such as electricity and processing power. On the other hand, there are illegal ways to mine bitcoin, such as stealing said resources. In this case, mining bitcoins is legal, but you’re stealing the resources needed to mine them, which is illegal.

Also, prosecutors in various countries, such as the United States and South Korea, have made it clear that they will prosecute people who use bitcoin for illicit purposes. This should come as no surprise, and anyone who mines bitcoin or uses it should know not to conduct illegal activities.

Conclusion

By and large bitcoin mining is a perfectly legal activity. Even in a few countries that do regulate the use of bitcoin, such as Iceland, mining bitcoin is still legal. Many countries, including most African countries, have not passed any legislation for or against bitcoin, and have generally remained silent on the issue. It’s important to keep a close eye on these countries, because the regulatory environment could change at the drop of a hat.

Please keep in mind that this post does not substitute legal advise and you should consult a lawyer for your specific case and jurisdiction.

Комментариев нет:

Отправить комментарий