Bitcoin Profitability Calculator – BTC Mining Profit Calculator

Enter your set up information in the form below. Do not enter commas, only dots for decimal separator.

Nothing guaranteed, of course this is only a rough estimate!

Do not enter commas, only dots for decimal separator. You can also calculate rented mining by setting “Power consumption” to 0 and “Cost of mining hardware” to the rent per time frame. Default values are for a system of four 6870s.

Estimate Strategy

Extrapolating bitcoin difficulty or price is pure voodoo. It is much easier to predict the relationship of the two parameters in form of the Mining Factor. The Mining Factor 100 is the value in USD of the bitcoins you can generate if you let a 100MHash/s miner run for 24 hours. If the Mining Factor 100 rises above $2 or so everybody buys mining equipment and thus increases difficulty. If it falls people will stop mining eventually. The estimate starts with the current Mining Factor and decreases it exponentially such that the decrease accounts for the factor decline per year. Please note that a profit/loss by holding the coins is not accounted for in this estimate.

Bitcoin Mining Profitability

Most Bitcoin mining hardware appears profitable at first glance. Bitcoin mining, unfortunately, isn’t simple and there are a number of hidden costs and constantly changing factors. This guide will help you understand Bitcoin mining profitability and give you a good estimate of your expenses and earnings.

Bitcoin Mining Profitability Factors

Hardware Costs

The most obvious expense in Bitcoin mining is mining hardware. Better, newer miners will cost more, so if you’re serious about investing in Bitcoin mining then aim for efficiency (more below). In addition to a Bitcoin miner, you may need extra cables, power supplies, software, and cooling fans.

Efficiency

A bitcoin miner’s job is to convert electricity into hash power. Miners that do this using the least amount of electricity per hash are the most efficient. The Antminer S9, Antminer S7, for example, converts electricity to hash power at 0.25 W/Gh. The SP20 Jackson, a popular miner by Spondoolies Tech, converts at 0.65 w/Gh.

Electricity costs vary by location, but this means that an Antminer S7 run in the same place as an SP20 converts electricity nearly three times more efficiently. It’s important to compare both hardware prices and efficiency when purchasing a miner.

Electricity

Miners with low electricity costs have an advantage, as monthly costs are much lower. Venezuela’s government has implemented price controls, which has created some of the lowest electricity prices in the world. According to an article from Bitcoin Magazine, a 320 kw electric bill cost just 6 cents. About 1,000 people mine Bitcoin full time in Venezuela.

The situation in Venezuela is an extreme example, but shows how cheap electricity effects mining profitability.

Difficulty

Bitcoin mining difficulty measures how difficult it is to find a new block. Assuming a stable Bitcoin price and no change in your hash rate, expect your earnings to decrease as difficulty increases. If difficulty were to decrease with a stable Bitcoin price, your profitability would increase.

When taking difficulty into account, note that:

The network difficulty has been on a steady uptrend since Bitcoin’s creation. Expect mining to become more competitive as time goes on.

Bitcoin price increases can cancel out difficulty increases if you measure your profits in fiat currency. While a rising difficulty with no change in your hash power will always mean you have less BTC earnings, a higher BTC price could mean the BTC you do earn has the same purchasing power.

Bitcoin Price

Early Bitcoin miners were able to gather thousands of Bitcoin. At the time, however, one bitcoin wasn’t worth one penny. Bitcoin’s price, or the purchasing power of one bitcoin, must be considered. A sharp drop in price can turn slightly profitable miners unprofitable very quickly. Price changes are factor, but it often makes more sense to simply purchase bitcoins if your goal is Bitcoin price speculation.

Block Reward

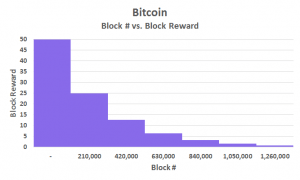

Bitcoin’s block reward halves every 210,000 blocks. Assuming the Bitcoin price remains the same, each block halving cuts miners’ profits in half. Even though block reward halvings are known events with expected dates, it can still have effects on the market and price of Bitcoin.

Location and Weather

Mining farms in hot areas will overheat and require large amounts of cooling fans. There have been fires at mining warehouses created by the excess heat. It is much easier to run a mining farm in cool areas. The heat generated from miners can even be used in place of regular heating to cut costs.

Large mining operations have employees working 24/7 to ensure that all hardware is working properly. A few hours offline could be the difference between thousands of dollars in profits.

Now that you understand the many factors that will affect your mining profitability, plug in some numbers to any Bitcoin mining calculator. Multiple calculators should be used (1, 2 and 3 options) to get the most accurate data.

Will 2017 be Profitable for Bitcoin Mining?

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntMiner S7

AntMiner S9

Bitcoin mining during its early days were generally called as a gold rush. Bitcoin, an invention of Satoshi Nakomoto's, "a peer-to-peer electronic cash system,” opened up an entirely new perimeter, not just of freedom but of profit. People with a strong interest in such things were first to stake their claim, namely cypherpunks, cryptographers, technically-minded libertarians and assorted hackers.

But is there still gold in them thar hills?

From a few of early enthusiasts, it is with certainty that Bitcoin mining has advanced into a cottage industry to a specialized industrial-level venture. The easy money was taken out long ago and the rest are hidden under the cryptographic equivalent of miles of hard rock.

To be able to profitably excavate bitcoins nowadays, you need to have specialized, high-powered machinery. While it is technically possible for anyone to mine, those with underpowered setups will spend more money on electricity than have money generated through mining.

Common Mining Terms

To further understand Bitcoin mining, it helps to know a few basic technical terms:

Block: a group of Bitcoin transactions, as collected from current pending transactions and entered into an ever-growing record of blocks (aka “the blockchain”) by a miner. A new block is created on average every ten minutes.

Proof of Work Hashing: this is the function miners perform in order to define a new block. PoW hashing ensures the proper function of the Bitcoin blockchain. Miners compete to solve a cryptographic “puzzle,” known as a hash. There are no shortcuts in this process, which can only be solved with raw computational power. By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins.

Block Reward: the number of newly-created bitcoins. This number was initially set to 50, halved to 25 in late-2012 and will halve again to 12.5 in mid-2016. This halving process continues, approximately every four years (or every 210,000 blocks), until all 21 million bitcoins are created. This is the only way in which new bitcoins can be created; by miners according to the code’s rate and limit.

Hashrate: a measure of a miner’s computational power. The higher their relative power, the more solutions (and hence, block rewards) they’re likely to find. Initially measured in hash per second (H/s), due to the increasing speed of mining hardware. H/s was soon commonly pre-fixed with SI units as follows:

Kilohash = KH/s (thousands of H/s), then

Megahash = MH/s (millions of H/s), then

Gigahash = GH/s (billions of H/s), then

Terahash = TH/s (trillions of H/s), and even

Petahash = PH/s (quadrillions of H/s).

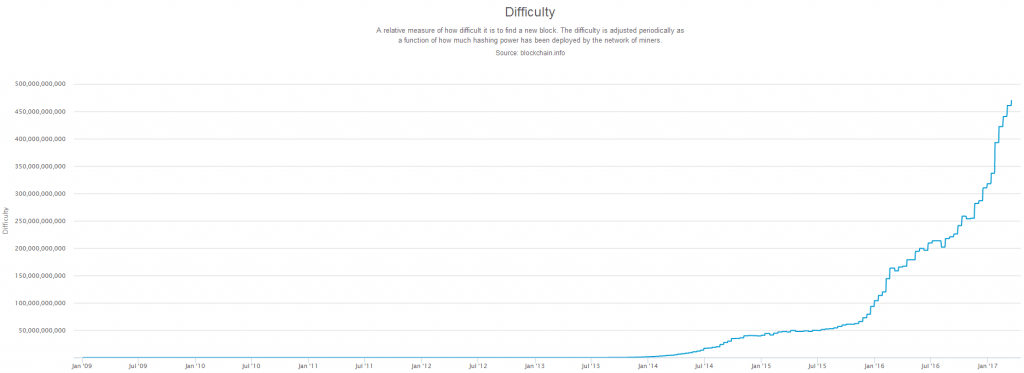

Difficulty: with hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly. Bitcoin’s Difficulty measure is what prevents this from happening, ensuring blocks are found roughly every 10 minutes. When total hashrate rises, the Difficulty of POW hashing adjusts upwards - and the inverse also applies. Difficulty auto-adjusts every two weeks (or 2016 blocks).

BTC / XBT exchange rate: the current fiat price of Bitcoin; critical for calculating profitability.

W/xHash/s: Watts per hashrate per second. Electricity is the major on-going cost of Bitcoin mining. The price paid per Watt will greatly influence profitability.

Mining Pool: unless you command a tremendous hashrate, your odds of solving a block by yourself (i.e. “solo-mining”) are extremely low. By banding together with other miners in a so-called pool, your combined odds of solving a block rise proportional to the pool’s total hashrate. Whenever they solve blocks, pools reward individual miners according to their contributed hashrate (minus commissions and the like).

Calculating Mining Profitability

Having these terms in mind, it’s viable to calculate the current profitability of Bitcoin mining for your circumstances. Bear in mind that the future profitability of mining cannot be reliably predicted. This is because of the ever-changing nature of the Difficulty modifier and the BTC price, in particular.

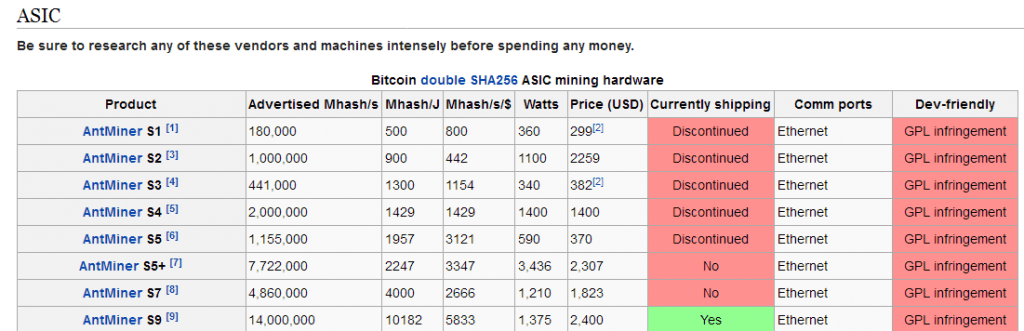

To start, we must select a suitable ASIC mining rig. To help in selection, the Bitcoin Wiki provides a handy mining hardware comparison: We'll select for our example the AntMiner S7 which is pretty much the cutting edge of mining tech and is a modern mining rig that offers a good hashrate for its power consumption. The S7 in Amazon is available for $609 and only $450 from BitMain, exclusive of shipping. $150 or so is added for the power supply units.

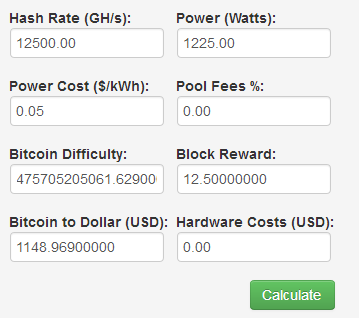

Next, we need to enter the S7’s specs and cost, as well as other info such as power cost and pool fees, into a suitable number-cruncher. CoinWarz.com offers a good mining profitability calculator, which automatically fills in the current BTC price, Difficulty and block reward info.

As a standard in China, the default power cost we will use is 10c (USD), but possibly to be much higher elsewhere. Check worldwide electricity prices or your utility bills for the exact price to know your own power cost. The 2.5% Pool Fee is for AntPool. There is generally lower or no fees for smaller pools but remember that they will seldom find blocks. Various pools’ fees and reward structures are compared in this list.

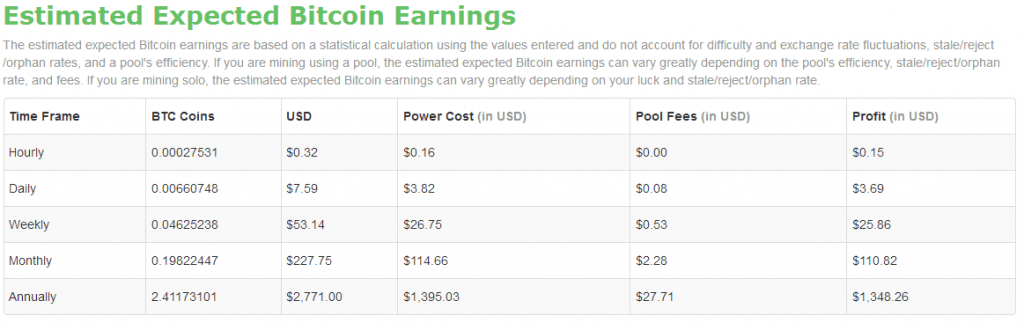

After all the needed info is registered, click Calculate for the profitability result:

Not a bad result! $800 per year and you can use the miner’s excess heat to warm your home.

The American Scenarios

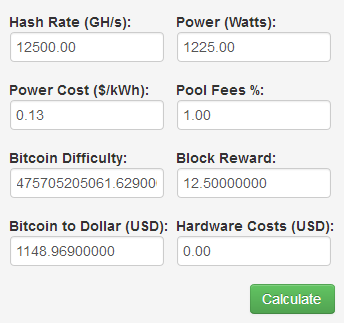

Exciting as it seems, let’s first recompute the average power cost per kWh in the USA (

12.5c) and the 12.5 BTC block reward which becomes the new standard in 45 days or so (see Bitcoin Clock for an up-to-date estimate):

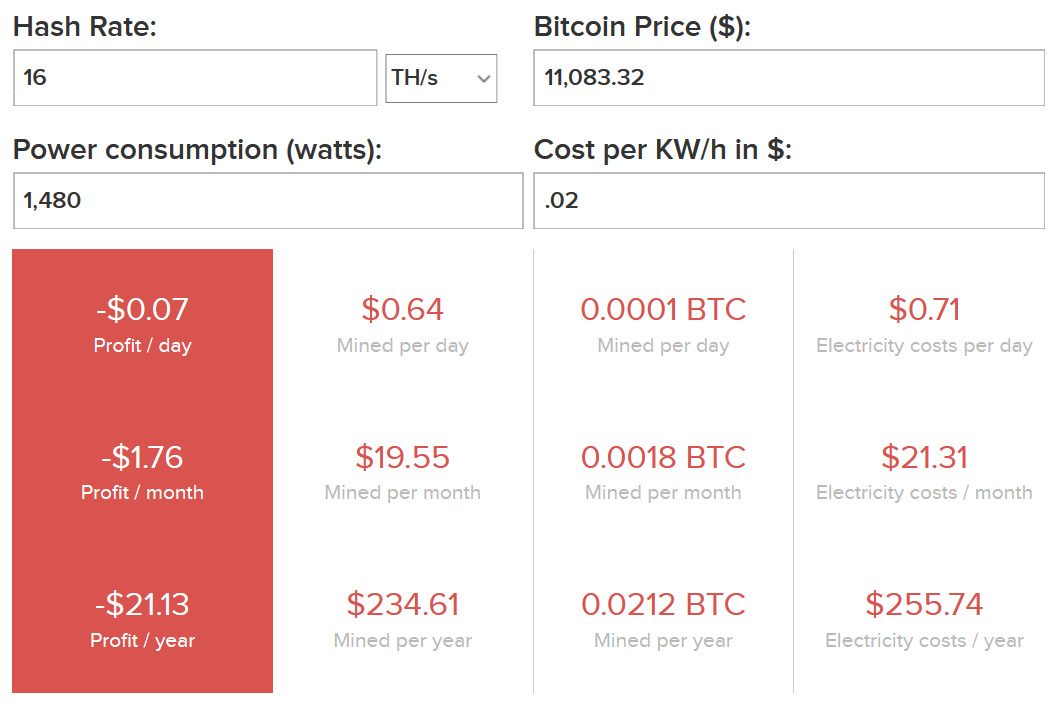

Given the difficulty and price hold steady and by the looks of it, it turns out that in every year, an average American miner can only make $500. But, this could be an unsafe assumption! Bitcoin’s average hashrate surprisingly climbed by a whopping 30 percent by the time this article is being written.

The compensatory Difficulty spike, expected on the day following reports of this spike, completely alters the previous equation:

If we bump up the Difficulty in the mining calculator by the corresponding 30%, all profit evaporates! $500 is lost over one year’s worth of mining.

Unexpected Profit Loss: Difficulty Spikes, Price Crashes, Equipment Failures, Power Cuts, Shipping Delays & More

The aforementioned scene works as a perfect picture of the risks present in the Bitcoin mining. There is a possibility that even some big, corporate miners will be injured from such a steep Difficulty spike. Unless home miner has access to free or very low-cost electricity, it really has zero chance to compete in such challenging environment.

Remember also that the rate of degeneration in Bitcoin hardware is tremendously fast! One should be knowledgeable that during (pre-) ordering equipment, potential manufacturing, shipping, customs or other delays could be very costly in the end as difficulty rises or price falls during the interim.

There are many of other inaccurate things, and such downside risks must always be considered into any concept business plan.

The Chinese Scenarios

For interest’s sake, let’s check the scenario of Chinese miners, who represent the majority of Bitcoin mining power for good reason. The results may help us better predict the post-halving Bitcoin environment, as this article attempts to do.

Hobby Miners

Some Chinese regions are over-supplied with electricity, which are subsidized in many instances. Because of this, low power cost is made and we’ll assume to be 7c for a miner in the right province. To add, a number of mining hardware is invented in China resulting to likely be bought cheaper (and received sooner) by locals of the Middle Kingdom. We’ll assume a ¾ hardware price.

Before the Difficulty spike, a small-time Chinese miner with a single S7 connected to AntPool could have made over $1000 annually. That’s twice the profit of their American counterpart!

After the halving and Difficulty spike, the same miner would lose about $40 per year. For a Bitcoin lover, this is an easily-acceptable loss.

Industrial Miners

Cheap power sources are present in remote provinces so large-scale mining operations will situate closely there. One popular option is hydroelectric power from dams. From such enterprises we can assume a very low power cost, let’s say 5c. These operations also buy hardware in volumes so assuming they get S7s at $325, which is only half the price. One thousand S7 units seems a reasonable number, which permits us to simply add three zeros to hash rate, hardware and power costs. Lastly, these setups often run their own pools and so we’ll suppose zero pool fees.

The operation would net $1.4m annually, before the halving and Difficulty spike.

The operation would profit by about $200k annually, after the halving and Difficulty spike.

Given the initial hardware investment of $325k, a profit of $200k doesn’t look great. It can be seen that marginal mining operations will be forced out of business post-halving given the other costs involved in mining, such as property, salaries, maintenance, etc. Only those with the latest and greatest hardware and the cheapest electricity are likely to pull through. Bitcoin price is the only wild card. It’ll allow less efficient miners to keep the lights on for longer, if it rises sufficiently.

Conclusion

For an average home miner it will be a struggle to regain the cost of mining hardware and electricity. In this current given circumstance, profitability is highly unlikely. Once ASIC mining hardware innovation reaches the point of diminishing returns, the situation may improve in future. That, together with cheap, hopefully sustainable power solutions may once again make Bitcoin mining profitable to small individual miners around the world. The decentralization of the Bitcoin network, will also greatly improve hardening it against legislative risk.

Is Bitcoin Mining Profitable or Worth it in 2017 & 2018?

The early days of Bitcoin mining are often described as a gold rush.

The early days of Bitcoin mining are often described as a gold rush.

Satoshi Nakomoto’s invention of Bitcoin, “a peer-to-peer electronic cash system,” opened up an entirely new frontier, not just of freedom but of occasionally outrageous profits.

Those with a strong interest in such things, namely cypherpunks, cryptographers, technically-minded libertarians and assorted hackers, were first to stake their claim.

But is there still gold in them thar hills?

Bitcoin mining has grown from a handful of early enthusiasts into a cottage industry, into a specialized industrial-level venture. The easy money was scooped out a long time ago and what remains is buried under the cryptographic equivalent of tons of hard rock.

The sad truth is:

Only those with specialised, high-powered machinery are able to profitably extract bitcoins nowadays. While mining is still technically possible for anyone, those with underpowered setups will find more money is spent on electricity than is generated through mining.

In other words, mining won’t be profitable at a small scale unless you have access to free or really cheap electriciy.

We’ll explain this situation in depth but first, you need to know a few basic technical terms from the world of Bitcoin mining:

A group of Bitcoin transactions, chosen from the mempool (the list of all currently pending transactions) and recorded by a miner into the ever-growing record of blocks known as “the blockchain.”

A new block is created on average every ten minutes.

Proof of Work Hashing:

This is the cryptographic work which miners perform in order to find the solution which allows them to define a new block.

PoW hashing ensures the proper function of the Bitcoin blockchain. Miners compete to solve a cryptographic “puzzle,” known as a hash.

There are no shortcuts in this process, which can only be solved with raw computational power.

By correctly hashing the current block, miners prove their investment of work and are rewarded with a certain number of newly-created bitcoins.

Block Reward:

The number of newly-created bitcoins, awarded to whichever miner creates a block.

This number was initially set to 50, halved to 25 in late-2012, and halved again to 12.5 in mid-2016. The next halving event expected is around mid-2020.

This halving process will continue in this fashion, halving the block reward approximately every four years / 210,000 blocks, until all 21 million bitcoins are created.

Achieving the block reward is the only valid way in which new bitcoins can be created; by miners according to the code’s rate and limit.

Hashrate is the measure of a miner’s computational power.

The higher their relative power, the more solutions (and hence, block rewards) a miner is likely to find.

Initially measured in hash per second (H/s), due to the increasing speed of mining hardware. H/s was soon commonly pre-fixed with SI units as follows:

- Kilohash = KH/s(thousands of H/s), then

- Megahash =MH/s(millions of H/s), then

- Gigahash = GH/s(billions of H/s), then

- Terahash =TH/s(trillions of H/s), and even

- Petahash =PH/s(quadrillions of H/s).

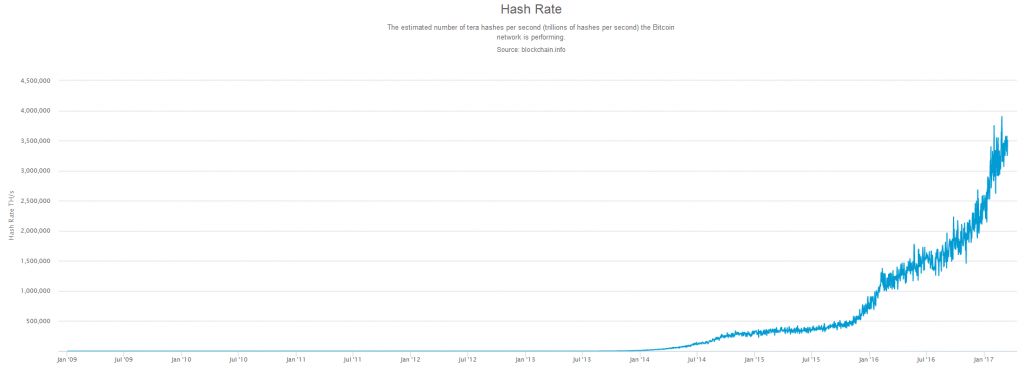

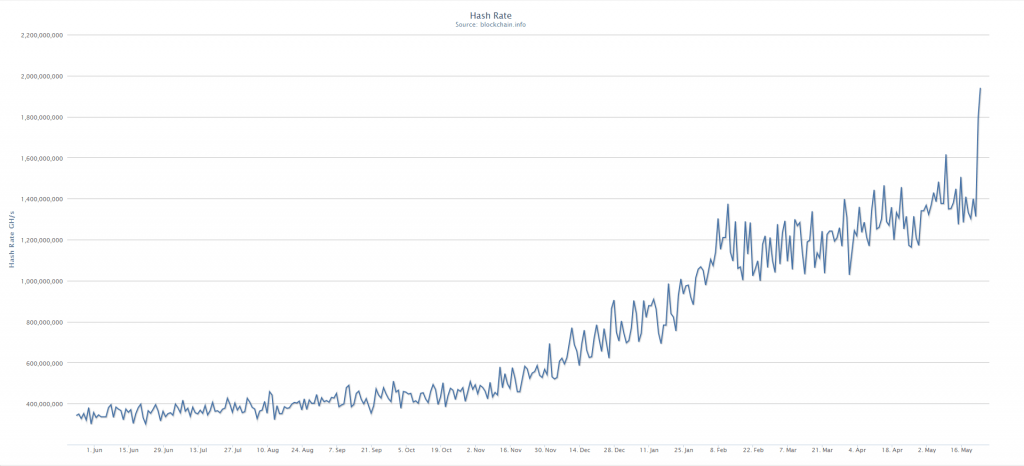

In early 2017, Bitcoin’s collective hashrate reached nearly 4 Exahash. This represents a tremendous investment into mining hardware, the R&D of such hardware, and electrical expenditure.

Difficulty:

With hashrate shooting up over the years, it would seem blocks would be found by miners ever more rapidly.

Bitcoin’s Difficulty measure is what prevents this from happening. It adjusts to hashrate to ensure that blocks are found roughly every 10 minutes.

Note how closely Difficulty matches Hashrate in the 2 charts above.

When total hashrate rises, the Difficulty of POW hashing adjusts upwards – and the inverse also applies.

Difficulty auto-adjusts every two weeks (or 2016 blocks).

BTC / XBT exchange rate:

Watts per hashrate per second. Electricity is the major on-going cost of Bitcoin mining. The price paid per Watt will greatly influence profitability.

Mining Pool:

Unless you command a tremendous hashrate, your odds of solving a block by yourself (i.e. “solo-mining”) are extremely low.

By banding together with other miners in a so-called pool, your combined odds of solving a block rise proportional to the pool’s total hashrate.

Whenever they solve blocks, pools reward individual miners according to their contributed hashrate (minus commissions and the like).

Calculating Mining Profitability

With these terms in mind, it’s possible to calculate the current profitability (circa March 2017) of Bitcoin mining for your circumstances.

The future profitability of mining cannot be reliably predicted.

This is due to the ever-changing nature of the Difficulty modifier and the BTC price, in particular.

To begin, we must select a suitable ASIC mining rig. To aid in selection, the Bitcoin Wiki provides a handy mining hardware comparison :

Although Bitcoin Wiki doesn’t list many models as currently shipping on from their manufacturers, all these mining rigs (and more) are available for resale as new or used.

The AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption.

It’s pretty much the cutting edge of mining tech so we’ll select it for our example.

The S9 is available for roughly $1800 up to $2400 from Amazon, or about $1365 from BitMain, shipping excluded. Power supply units will add another $120 or so to the price.

Next, we need to enter the S9’s specs and cost, as well as other info such as power cost and pool fees, into a suitable number-cruncher.

CoinWarz.com offers a good mining profitability calculator, which automatically fills in the current BTC price, Difficulty and block reward info. Note that the Hardware Costs field does not seem to influence the final calculation.

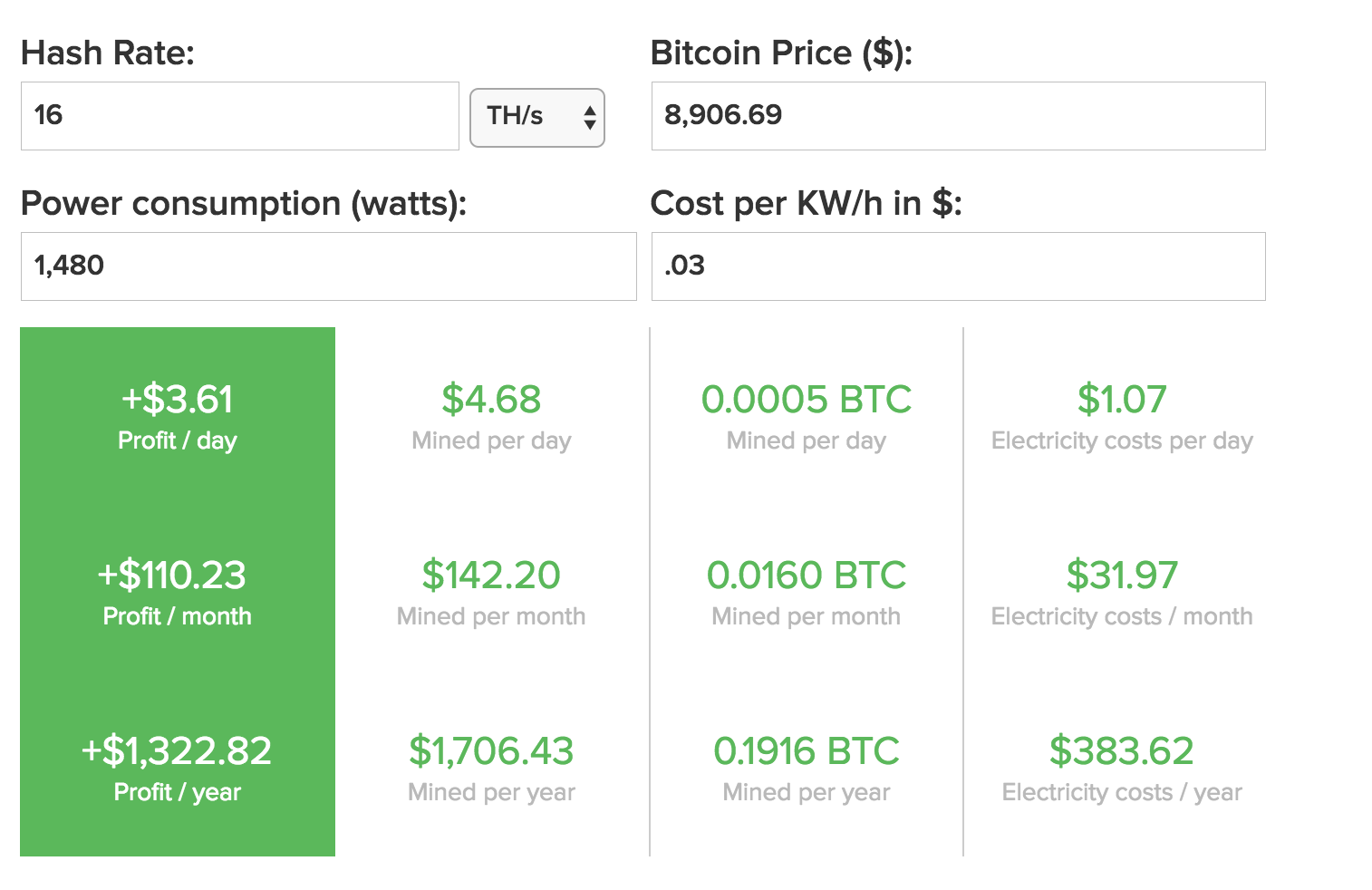

Scenario 1: Big Chinese Miners

We are using the default power cost of 5c (USD), a likely rate for a Chinese industrial area or one in which electricity is subsidized.

To determine your own power cost, check worldwide electricity prices or your utility bill for the exact price.

The 0% Pool Fee assumes a mining farm large enough to run its own pool. Smaller pools will generally offer lower or even no fees, but keep in mind they will seldom find blocks.

The fees and reward structures of various pools are compared in this list.

Once all the necessary info is entered, hit Calculate for the profitability result:

An excellent result! At this rate, the S9 unit would pay for itself within a year as well as make about $600 in profit! As a large miner would be able to negotiate a lower unit price on each S9, we can assume they’ll research profit even sooner.

Scenario 2: An American Hobby Miner

Before getting too excited about your potential mining profits, let’s recalculate them using the average residential Power cost per kWh in the USA (

12.5c) and a typical pool fee of 1%.

It’s not looking so great now.

At a Bitcoin price around $1150, it appears that the average American home miner makes only $1348 a year, assuming difficulty and price hold steady. In other words, the unit will pay for itself within a year.

This is a dangerous assumption! Bitcoin’s total hashrate – and thus its difficulty, has been consistently rising since the early years, sometimes jumping by double digit percentages within a month!

Therefore, any calculations should be regarded skeptically, as likely best-case scenarios.

Sources of Unexpected Profit Loss:

Difficulty Spikes, Price Crashes, Equipment Failures, Power Cuts, Shipping Delays & More!

Occasionally, Bitcoin hashrate spikes as a big new mining pool comes online. This happened in early 2016:

It’s quite possible that even some big, corporate miners found their profit margins under threat from the resulting steep spike in competition. Indeed, in mid-2016, Swedish Bitcoin mining firm KnCMiner declared bankruptcy.

The home miner really has no chance to compete in such a challenging environment, unless they have access to free or extremely low-cost electricity…

Also bear in mind that the rate of obsolescence in Bitcoin mining hardware is quite fast! New, more efficient mining hardware may be released at any time, although we are reaching the technological limits of improved efficiencies.

If (pre-)ordering any such equipment, be aware that potential manufacturing, shipping, customs or other delays could end up being very costly as difficulty rises or price falls during the interim.

There are plenty of other things which can wrong, for example:

- hardware failures,

- power outages,

- network disconnections &

- price crashes.

Such downside risks must always be factored into any sound business plan.

Conclusion

The average home miner will struggle to be profitable or recoup the cost of mining hardware and electricity.

Profitability is highly unlikely given the current circumstances.

The situation may improve in future once ASIC mining hardware innovation reaches the point of diminishing returns.

That, coupled with cheap, hopefully sustainable power solutions may once again make Bitcoin mining profitable to small individual miners around the world.

This would also greatly improve the decentralization of the Bitcoin network, hardening it against legislative risk.

How to Run a Profitable Bitcoin Mining Farm

Last updated on January 2nd, 2018 at 12:00 am

One of the most unique aspects of Bitcoin is that you can generate it through the process of mining, which is something anyone with a computer can do. This is unlike fiat currency which can only be printed by the government. This makes Bitcoin somewhat similar to gold and other precious metals, since they can only be mined, not printed on demand. Bitcoin mining is far different than extracting resources out of the Earth however. Instead it involves your computer solving complex equations. The equations solved during Bitcoin mining are cryptographic hashing functions, which are usually referred to as hashes.

Why is Bitcoin Mining Important?

Mining is important because it confirms transactions and secures the blockchain. Without mining Bitcoin transactions would never be confirmed and Bitcoin would become unusable. The blockchain is a list of all the transactions in Bitcoin’s history, and it is composed of blocks which are groups of transactions from around the same time. There is on average a new Bitcoin block every 10 minutes, but this can vary wildly from a few seconds between blocks to several hours.

When mining your computer turns all of the data from the most recent block of transactions into a hash, which is far shorter than the original transaction data and is comprised of a complex series of letters and numbers.

It would be relatively easy to solve Bitcoin hashes if turning a list of transactions into a hash was the only requirement, but Bitcoin protocol makes this more difficult through requiring a string of zeroes in the hash. The ‘nonce’ variable is used to get the required string of zeroes, and it takes many iterations to get the correct hash format.

Everytime the computer gets a wrongly formatted hash the nonce variable is changed and the computer tries again. In general it takes billions of iterations in order to find the correct Bitcoin block hash. Changing even 1 letter in the transaction data leads to a completely different hash, so as more transactions are added to a block the correct hash is constantly changing.

How Can I Start Mining Bitcoins?

There are many types of Bitcoin mining hardware. It is possible to mine Bitcoin on any computer using the central processing unit (CPU). However your hash rate will be on the order of MH/s (millions of hashes per second), which is an infinitesimally small hash rate in the Bitcoin world. It would take millions of years to find a block with a hashrate in the MH/s range.

The next step up from using a CPU is using your computer’s graphics processing unit (GPU). The fastest GPUs in existence can mine Bitcoin around 1 GH/s (billions of hashes per second). It would take thousands of years to find a Bitcoin block however when mining at 1 GH/s. Even if you have a powerful 1 TH/s (trillions of hashes per second) mining rig, which costs at least $1000, it would take several years to find a block.

The solution to this is joining a mining pool, which is a network of miners that combine their mining power in order to find blocks. The biggest Bitcoin mining pools are Ghash.io and Slush’s pool. When you mine on a pool you earn a share of the block reward proportional to the amount of hashes you solved, and on big pools like ghash.io you can earn a piece of a block every hour or less. Mining Bitcoin by yourself only becomes feasible when you have 1 PH/s (1 quadrillion hashes per second) or more, at 1 PH/s it takes on average 20 hours to find a block and currently there are no miners with such a hash rate.

So it’s simply not worthwhile to mine Bitcoin with a CPU or GPU. Currently the only way to profitably mine Bitcoin is to use an application-specific integrated circuit (ASIC), which is a machine built specifically for mining Bitcoin. The weakest ASICs have hashrates from 1-3 GH/s, they are the size of your thumb and can be plugged into a USB port. Generally these cost around $20, making it affordable for anyone who wants to get into Bitcoin mining. These small ASICS are unprofitable however, it would take well over a year to earn the $20 you initially spent on the ASIC, and this estimate doesn’t even account for electricity costs.

In order to make real profits when mining Bitcoin you need to buy a much larger rig, since the price per hashrate drops the larger the rig is. A 1 TH/s Bitcoin mining rig costs between $200 and $500, and will generate 0.05 Bitcoin ($30) per month. This means a 1 TH/s mining rig will break even in 7-15 months, but this does not take into account the hefty electricity costs. After the break even point you would make several hundred dollars a year of profit with a 1 TH/s mining rig.

Thus, in order to run a profitable Bitcoin mining operation you need to continuously buy new and more advanced mining rigs with your profits. Many serious Bitcoin miners buy new mining rigs each month. Theoretically you can turn a 1 rig mining operation into a full-fledged Bitcoin mining farm within a few years if you start with a powerful rig and re-invest profits into new machinery.

Is There A Simpler Way to Start Mining Bitcoins?

Another way to mine Bitcoin is through buying mining contracts on a cloud mining website. The most popular Bitcoin cloud mining site is Genesis Mining. When you buy mining contracts on you start receiving Bitcoin payouts immediately, and the mining contract lasts forever. One of the caveats of cloud mining operations is they charge you electricity and hardware maintenance fees, and these fees absorb about 30% of your mining profits initially.

Personally I think most if not all cloud mining sites should be avoided. The reason being is that 99% of them are just ponzi schemes and the rest just won’t be profitable enough.

What is the Most Profitable Way to Mine Bitcoins?

In order to profitably mine Bitcoin you need to buy your own ASIC mining rig. Here’s a list of the most successful rigs today:

Select miner

AntMiner S9

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

Mining Bitcoin with your GPU/CPU will cost more in electricity than it will generate in Bitcoin. Also, buying mining contracts on a cloud mining site is guaranteed to lose money in the long term. In order to make significant profits you need to use a Bitcoin mining calculator and figure out your required hash rate. Smaller mining rigs will eventually make profit, but it might take a year to break even and the profits wouldn’t be worthwhile.

Is Bitcoin Mining Profitable in 2018?

Last updated on February 26th, 2018 at 03:20 pm

Before we start, if you’re new to Bitcoin mining and don’t know what it is watch this short and simple explanation:

“Is Bitcoin Mining Profitable in 2018?“

The short answer would be “It depends on how much you’re willing to spend”. Each person asking himself this will get a slightly different answer since Bitcoin Mining profitability depends on many different factors. In order to find out Bitcoin mining profitability for different factors “mining profitability calculators” were invented.

These calculators take into account the different parameters such as electricity cost, the cost of your hardware and other variables and give you an estimate of your projected profit. Before I give you a short example of how this is calculated let’s make sure you are familiar with the different variables:

Bitcoin Mining terms you should get to know

Hash Rate – A Hash is the mathematical problem the miner’s computer needs to solve. The Hash Rate is the rate at which these problems are being solved. The more miners that join the Bitcoin network, the higher the network Hash Rate is.

The Hash Rate can also refer to your miner’s performance. Today Bitcoin miners (those super powerful computers talked about in the video) come with different Hash Rates. Miners’ performance is measured in MH/s (Mega hash per second), GH/s (Giga hash per second), TH/s (Terra hash per second) and even PH/s (Peta hash per second).

Bitcoins per Block – Each time a mathematical problem is solved, a constant amount of Bitcoins are created. The number of Bitcoins generated per block starts at 50 and is halved every 210,000 blocks (about four years). The current number of Bitcoins awarded per block is 12.5. The last block halving occurred on July 2016 and the next one will be in 2020.

Bitcoin Difficulty – Since the Bitcoin network is designed to produce a constant amount of Bitcoins every 10 minutes, the difficulty of solving the mathematical problems has to increase in order to adjust to the network’s Hash Rate increase. Basically this means that the more miners that join, the harder it gets to actually mine Bitcoins.

Electricity Rate – Operating a Bitcoin miner consumes a lot of electricity. You’ll need to find out your electricity rate in order to calculate profitability. This can usually be found on your monthly electricity bill.

Power consumption – Each miner consumes a different amount of energy. Make sure to find out the exact power consumption of your miner before calculating profitability. This can be found easily with a quick search on the Internet or through this list. Power consumption is measured in Watts.

Pool fees – In order to mine you’ll need to join a mining pool. A mining pool is a group of miners that join together in order to mine more effectively. The platform that brings them together is called a mining pool and it deducts some sort of a fee in order to maintain its operations. Once the pool manages to mine Bitcoins the profits are divided between the pool members depending on how much work each miner has done (i.e. their miner’s hash rate).

Time Frame – When calculating if Bitcoin mining is profitable you’ll have to define a time frame to relate to. Since the more time you mine, the more Bitcoins you’ll earn.

Profitability decline per year – This is probably the most important and elusive variable of them all. The idea is that since no one can actually predict the rate of miners joining the network no one can also predict how difficult it will be to mine in 6 weeks, 6 months or 6 years from now. This is one of the two reasons no one will ever be able to answer you once and for all “is Bitcoin mining profitable ?”. The second reason is the conversion rate. In the case below, you can insert an annual profitability decline factor that will help you estimate the growing difficulty.

Conversion rate – Since no one knows what the BTC/USD exchange rate will be in the future it’s hard to predict if Bitcoin mining will be profitable. If you’re into mining in order to accumulate Bitcoins only then this doesn’t need to bother you. But if you are planning to convert these Bitcoins in the future to any other currency this factor will have a major impact of course.

Get a mining calculator

In order to calculate all of these parameters and get an answer to our question we will use a mining profitability calculator. here’s a simple mining calculator from 99Bitcoins:

Is bitcoin mining profitable

You don’t have to mine yourself anymore !

Genesis mining is awesome.

It’s super simple - Your mining rigs are already set up and running.

As soon as you’ve set-up your account you can start to earn your first coins from our bitcoin cloud mining service!

(1) to be honest, your best bet with Genesis, at the moment, is either the Lifetime SHA-256 (slow but steady) mining or the 2-year X11 contracts. Some have complained that Genesis is slow, but that’s because they’re legit. The legit operations (Genesis, Eobot, etc.) have slower payouts because they’re actually paying out at sustainable levels instead of promising you the moon and shutting down in a few months like HashOcean, BitMinister, and now Coince (site still up but no longer allowing withdrawals) all have.

(2) Any time you purchase hashpower on Genesis Mining, whether you are new to Genesis Mining or have purchased hashpower from them before, you can enter a code at time of purchase and get 3% off with a code AFTER their first purchase (beware, if you try to use a code generated from your own account it will not work!). If you need a 3% OFF code you can use 45LxMS and get 3% off whenever you join or upgrade your hashpower.

Yes, mining is was very profitable in 2016 and still is in 2017. Bitcoin has yet to hit its S curve and gain tremendous value via the momentum caused by a high volume of users. Therefore, cloud mining is always a smart option for gaining bitcoin steadily over time.

Genesis Mining was founded in 2013. It currently owns mining farms located in Europe, America and Asia but exact locations are not known to the general public due to security reasons.

Genesis Mining is the most transparent cloud mining company and not a scam.

Hashing24 and GM are the only two cloud mining companies we are even willing to write about. Get bitcoin wallet here .

It is arguably the largest and most popular cloud mining provider for Bitcoin, Ethereum, and other coins.

It has even registered with the SEC for a Bitcoin mining fund. Free bitcoins you can get here.

Some algorithms can still be run more or less 'effectively' on CPUs (eg, Cryptonight), others work best on GPUs (Ethereum, Zcash, Vertcoin), and still others are the domain of custom ASICs (Bitcoin, Litecoin). But besides having the hardware, there are other steps to take to get started with Mining.

- In the early days of Bitcoin and some other cryptocurrencies, you could effectively solo-mine the algorithms. That meant downloading (or even compiling) the wallet for a particular coin and the correct mining software. Then configure the mining software to join the cryptocurrency network of your choosing, and dedicate your CPU/GPU/ASIC to the task of running calculations. The hope was to find a valid block solution before anyone else. Each time a block is found, the calculations restart, so having hardware that can search potential solutions more quickly is beneficial.

- These days, a lot of people forego running the wallet software. It takes up disk space, network bandwidth, and isn't even required for mining. Just downloading the full Bitcoin blockchain currently requires over 45GB of disk space, and it can take a while to get synced up. There are websites that take care of that part of things, assuming you trust the host.

The short answer to if it is profitable or not would be “It depends on how much you’re willing to spend”. Each person asking himself this will get a slightly different answer since Bitcoin Mining profitability depends on many different factors. In order to find out Bitcoin mining profitability for different factors “mining profitability calculators” were invented.

These calculators take into account the different parameters such as electricity cost, the cost of your hardware and other variables and give you an estimate of your projected profit.

So now I think you might have got what you looking for, if not feel free to ask me.

Note that this does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers.

It is important to note that these mining contracts are life time contracts, meaning they do not have a maturity date and as long as the contract is profitable you will continue to mine and receive payouts.

How Does Genesis Mining Work?

Genesis Mining, according to their website, is an easy and safe way to purchase hash power without having to deal with the complex hardware and software set up.

Genesis Mining specializes in building the most efficient and reliable mining rigs that they offer to their clients for rent. I've used their services and they could provide you a decent amount of bitcoins BUT it is entirely dependent on the amount of hashpower you invest in to. As of this day, I could say that you can break-even in a year's time and profit from their onwards. They are offering a lifetime bitcoin mining contract with your one-time spend. As long as their venture remains profitable, then they're good. This may change in the future.

All you need to do is set up an account with them to start mining.

After signing up, fund your account via Bitcoin, PayPal, credit card, or wire transfer, and then choose the mining plan that’s best for you.

For newbies you can start with a 100 GH/s (Gold) lifetime Bitcoin mining contract which will cost you $19. It will help you in understanding how cloud mining works and what the profitability might be.

If that proves to be small you can try the 2,000 GH/s (Platinum) lifetime Bitcoin mining contract and this will cost you $340.

The third and the largest is the 10,000 GH/s (Diamond) lifetime Bitcoin mining contract which will cost you $1,600.

What Coins Can You Mine?

Genesis mining makes it possible for you to earn different coins but it is dependent on which contract you buy.

Let us now look at different contracts and the different coins you can mine as of June 2016.

For X11 contracts you can mine the following coins: Bitcoin, Litecoin, Dogecoin, Dash, Peercoin, Startcoin and Namecoin.

For SHA-256 contracts you can mine the following coins: Bitcoin, Litecoin, Dash, Zetacoin and Darkcoin.

Of course it makes no sense buying contracts from Genesis Mining if it’s not profitable.

With that in mind let us analyze the profitability of the different contracts I mentioned under the previous section i.e. SHA-256 and X11.

The factors that make a contract profitable or not are constantly changing. Each coin’s price, network difficulty, and hash rate change every day. Read our article on mining profitability to learn more.

SHA-256: You can expect payouts of 0.37mBTC per 1TH/s per day and a cost of 0.25 BTC per 1TH/s so expect to break-even after approximately 670 days.

X11: You can expect payouts of 0.027mBTC per 1MH/s per day and a cost of 13.6mBTC per 1MH/s therefore expect to break-even after approximately 500 days.

It is also important to keep in mind that for lifetime contracts as long as they are profitable, a small maintenance fee is deducted.

How is Genesis Mining Different from Other Cloud Mining Providers?

As mentioned earlier, Genesis Mining is the largest and most popular cloud mining provider.

Genesis Mining has made mining an easy and pleasant experience.

For any miner, a significant investment in mining hardware is required. If you cloud mine with Genesis Mining you will not have to go through the hassles of setting up hardware or maintenance of mining rigs.

With Genesis Mining remember you are mining online therefore you will not have to deal with loud rigs which produce a lot of heat. There are also no mining pool fees.

One factor that really stands out is the fact that you can decide which coins you want to mine with the purchased hashpower.

This makes it possible for you to split up your total hashpower to different coins.

It is clear that GM aims to provide both the average miner and the big investor. Genesis Mining currently has more than 300,000 members.

There have been serious concerns of whether Genesis Mining is legit or a scam but after doing research it is quite clear that it is not a scam; that does not mean Genesis Mining is profitable, but means that Genesis Mining honestly provides the services it offers.

Genesis Mining is great for cloud miners who want to mine without having to go through the stress of choosing a bitcoin mining pool, hardware, software or setting up a rig at home.

Bitcoin mining depends on the computing capacity. There are many online sites that let you buy computing capacities for a one time fee (+daily maintenance fee). I use Minergate to mine and i’m doing it from 3+ years.

I Sometimes use my CPU/GPU to mine overnight.

Is Bitcoin Mining Still Profitable?

Bitcoin mining is the process of earning bitcoin in exchange for running the verification to validate bitcoin transactions. These transactions provide security for the Bitcoin network which in turn compensates miners by giving them bitcoins. Miners can profit if the price of bitcoins exceeds the cost to mine. With recent changes in technology and the creation of professional mining centers with enormous computing power, many individual miners are asking themselves, is bitcoin mining still profitable?

There are several factors that determine whether bitcoin mining is still a profitable venture. These include the cost of the electricity to power the computer system (cost of electricity), the availability and price of the computer system, and the difficulty in providing the services. Difficulty is measured in the hashes per second of the Bitcoin validation transaction. The hash rate measures the rate of solving the problem—the difficulty changes as more miners enter because the network is designed to produce a certain level of bitcoins every ten minutes. When more miners enter the market, the difficulty increases to ensure that the level is static. The last factor for determining profitability is the price of bitcoins against standard, hard currency.

The Components of Bitcoin Mining

Prior to the advent of new bitcoin mining software in 2013, mining was generally done on personal computers. But the introduction of application specific integrated circuit chips (ASIC) offered up to 100x the capability of older personal machines, rendering the use of personal computing to mine bitcoins inefficient and obsolete. When miners used the old machines, the difficulty in mining bitcoins were in line with the price of bitcoins. But with these new machines came issues related to both the high cost to obtain and run the new equipment and the lack of availability.

Profitability Before and After ASIC

Old timers (say, way back in 2010) mining bitcoins using just their personal computers were able to make a profit for several reasons. First, these miners already owned their systems, so equipment costs were nil. They could change the settings on their computers to run more efficiently with less stress. Second, these were the days before professional bitcoin mining centers with massive computing power entered the game. Early miners only had to compete with other individual miners on home computer systems. The competition was on even footing. Even when electricity costs varied based on geographic region, the difference was not enough to deter individuals from mining.

After ASICs came into play, the game changed. Individuals were now competing against large bitcoin mining centers who had more computing power. Mining profits were getting chipped away by expenses like purchasing new computing equipment, paying higher energy costs for running the new equipment, and the continued difficulty in mining.

Profitability in Today’s Environment

Bitcoin mining can still make sense and be profitable for some individuals. Equipment is more easily obtained and various efficiency machines are available. For example, some machines allow users to alter settings to lower energy requirements, thus lowering overall costs. Prospective miners should perform a cost/benefit analysis to understand their breakeven price before making the fixed-cost purchases of the equipment. The variables needed to make this calculation are:

- Cost of power: what is your electricity rate? Keep in mind that rates change depending on the season, the time of day, and other factors. You can find this information on your electric bill measured in kWh.

- Efficiency: how much power does your system consume, measured in watts?

- Time: what is the anticipated length of time you will spend mining?

- Bitcoin value: what is the value of a bitcoin in U.S. dollars or other official currency?

There are several web-based profitability calculators, such as ones provided by vnbitcoin.org or mining-profit.org, that would-be miners can use to analyze the cost benefit equation of bitcoin mining. Profitability calculators differ slightly and some are more complex than others.

Run your analysis several times using different price levels for both the cost of power and value of bitcoins. Also, change the level of difficulty to see how that impacts the analysis. Determine at what price level bitcoin mining becomes profitable for you—that is your breakeven price.

To compete against the mining mega centers, individuals can join a mining pool, which is a group of miners who work together and share the rewards. This can increase the speed and reduce the difficulty in mining, putting profitability in reach.

The Bottom Line

To answer the question of whether bitcoin mining is still profitable, use a web-based profitability calculator to run a cost-benefit analysis. You can plug in different numbers and find your breakeven point (after which mining is profitable). Determine if you are willing to lay out the necessary initial capital for the hardware, and estimate the future value of bitcoins as well as the level of difficulty. When both bitcoin prices and mining difficulty decline, it usually indicates fewer miners and more ease in receiving bitcoins. When bitcoin prices and mining difficulty rise, expect the opposite—more miners competing for fewer bitcoins.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Mining Hardware ASICs

Hobby Bitcoin mining can still be fun and even profitable if you have cheap electricity and get the best and most efficient Bitcoin mining hardware.

It’s important to remember that Bitcoin mining is competitive. It’s not ideal for the average person to mine since China’s cheap electricity has allowed it to dominate the mining market. If you want bitcoins then you are better off buying bitcoins.

Bitcoin Mining Hardware Comparison

What is an ASIC Bitcoin Miner?

Since it’s now impossible to profitably mine Bitcoin with your computer, you’ll need specialized hardware called ASICs.

Here’s what an ASIC miner looks like up close:

The Dragonmint 16T miner.

Originally, Bitcoin’s creator intended for Bitcoin to be mined on CPUs (your laptop or desktop computer). However, Bitcoin miners discovered they could get more hashing power from graphic cards. Graphic cards were then surpassed by ASICs (Application Specific Integrated Circuits).

Think of a Bitcoin ASIC as specialized Bitcoin mining computers, Bitcoin mining machines, or “bitcoin generators”. Nowadays all serious Bitcoin mining is performed on dedicated Bitcoin mining hardware ASICs, usually in thermally-regulated data-centers with access to low-cost electricity.

Don’t Get Confused

There is Bitcoin mining hardware, which mines bitcoins.

There are also Bitcoin hardware wallets like the Ledger Nano S, which secure bitcoins.

Check Profitability

You can use our calculator below to check the mining hardware above. Input your expected electricity price and the hash rate of the miner for an estimate.

Profitability Factors

The Bitcoin price and the total network hash rate are the two main factors that will affect your profitability.

Our calculator is more accurate than most others because ours assumes the 0.4527678% daily increase in network hash rate. This has been the average daily increase over the past 6 months.

Most other calculators do NOT include this metric which makes mining appear way more profitable than it actually is.

The Bitcoin Price

Bitcoin mining is a booming industry, but the Bitcoin price increasing can help make up some of these losses.

The Bitcoin price is increasing at an average of 0.3403% per day over the past year. Try messing with the calculator using different prices.

Know your Competition

It may seem easy to just spin up a miner.

But you NEED to take a look at just how serious mining is.

The video below offers an inside look at one of China’s largest mines.

How to Find the Best Bitcoin Miner

There are some important factors to look at when determining which Bitcoin mining ASIC to buy:

Hash rate – How many hashes per second can the Bitcoin miner make? More hashes cost more, which is why efficiency is crucial.

Efficiency – You’ll want to buy the most efficient bitcoin mining hardware possible. Right now, this is the Halong Mining Dragonmint T1. Since miners use a large amount of electricity, you want to buy one that converts the most amount of electricity into bitcoins.

Price – How much does the bitcoin miner cost? Cheap mining hardware will mine less bitcoins, which is why efficiency and electricity usage are important. The fastest and more efficient mining hardware is going to cost more.

Don’t try to buy a miner based on only price or only hash rate. The best ASIC miner is the most efficient bitcoin miner. Aim for value.

Bitcoin Miners for Sale on eBay or Amazon

If you’re a hobby miner who wants to buy a couple rigs for your house, eBay and Amazon both have some decent deals on mining hardware.

Used Bitcoin Mining Hardware for Sale

Both new and used bitcoin mining rigs and ASICs are available on eBay. One may want to buy used ASIC mining hardware on eBay because you can get better prices.

eBay’s customer protection ensures you’ll get a working product. Other bundled equipment may be included with your purchase depending on the seller.

We recommend purchasing the Dragonmint or the Antminer S9.

Just Want Bitcoins?

If you just want bitcoins, mining is NOT the best way to obtain coins.

Buying bitcoins is the EASIEST and FASTEST way to purchase bitcoins.

Get $10 worth of free bitcoins when you buy $100 or more at Coinbase.

Hardware Profitability

You can use a bitcoin mining profitability calculator to determine your estimated cost of return on your mining hardware.

Be sure to take electricity costs into account. Most mining hardware appears profitable until electricity costs are accounted for.

Most Efficient Bitcoin Miners

Good Bitcoin mining hardware needs to have a high hash rate. But, efficiency is just as important.

An efficient Bitcoin miner means that you pay less in electricity costs per hash.

To improve your efficiency, there are also companies that will let you order hardware to their warehouse and run the miners for you.

You could also cloud mine bitcoins. But both options are a lot less fun than running your hardware!

Bitcoin Mining Hardware Companies

Halong Mining – Halong Mining is the newest mining hardware company. They have the best miner available. Unfortunately, they already sold out of their first batch but a new batch should be available for sale soon.

Bitmain – Bitmain makes the Antminer line of Bitcoin miners. Bitmain is based in China and also operates a mining pool.

BitFury – BitFury is one of the largest producers of Bitcoin mining hardware and chips. Its hardware is not available for purchase.

Bitcoin Mining Equipment

In addition to a Bitcoin mining ASIC, you’ll need some other Bitcoin mining equipment:

Power Supply – Bitcoin rigs need special power supplies to funnel and use electricity efficiently.

Cooling Fans – Bitcoin hardware can easily overheat and stop working. Buy a sufficient amount of cooling fans to keep your hardware working.

Bitcoin Mining Without Hardware?

It’s still technically possible to mine bitcoins without dedicated mining hardware.

However, you’ll earn less than one penny per month. Mining bitcoins on your computer will do more damage to your computer and won’t earn a profit.

So, it’s not worth it unless you’re just interested to see how the mining process works. You’re best bet is to buy dedicated hardware like the Antminer S7 or Antminer S9.

USB Bitcoin Miners

Using a Bitcoin USB miner with your computer was once a profitable way to mine bitcoins. Today, however, USB miners don’t generate enough hashing power to mine profitably. If you just want to get a Bitcoin miner USB to learn, eBay is a good place to buy a cheap Bitcoin miner.

Halong Mining

The world of crypto was in disbelief when Halong Mining, a new ASIC startup, announced their brand new Dragonmint T16. Halong claimed it to be the most powerful – and efficient – Bitcoin mining ASIC on the market. If they delivered on their promise, Bitmain’s reign as king of ASIC developers would come to an abrupt end.

Unsurprisingly, many prominent members of the Bitcoin community were in disbelief, as cryptocurrency in general has been plagued by fake startups and ICO scams.

In an effort to build trust with their potential buyers, Halong Mining released videos of their ASICs running as advertised. Moreover, they claimed that $30 million dollars was invested in research, development, and prototypes.

Their first batch of Dragonmint T16’s was set for shipment in March of 2018. As the deadline crept up, the world patiently waited for the much anticipated release.

If Halong Mining really did produce the most efficient SHA-256 miner to date, the startup would prove their skeptics wrong and dethrone Bitmain, a company only concerned with their monopoly on the market.

After prominent members of the Bitcoin community doubted Halong’s legitimacy, including Cøbra, the company proved them wrong. Miners shipped as described, and Halong delivered – quite literally – on their promises.

Slush, the creator of Slush Mining Pool and the TREZOR hardware wallet, claimed on Twitter the miners are legitimate. Halong Mining has earned their keep, finally viewed as a reputable company after months of speculation and debate.

Over 100 individuals took part in the development of the chip, including BtcDrak, one of the leading pseudonymous Bitcoin core developers. According to Bitcoin Magazine, BtcDrak remarked:

The project is motivated by, and driven to help facilitate greater decentralisation in Bitcoin mining at all levels, and make SHA-256 great again.

Dragonmint T16 vs. Antminer S9

The Dragonmint T16 was Halong Mining’s first ASIC to hit the market. Boasting 16 TH/s, it is the most powerful ASIC miner. Additionally, the T16 is remarkably power efficient, consuming a mere 0.075J/GH. Moreover, the Dragonmint T16 utilizes ASICBOOST, an exploit of Bitcoin’s algorithm which improves efficiency by 20%.

Compared to Bitmain’s Antminer S9, which consumes 0.098J/GH, the Dragonmint T16 is not only more powerful, but more efficient as well. The difference in power consumption seems small. However, when mining on a large scale, every bit of saved electricity counts.

What do you get when you combine power and efficiency? An incredibly profitable ASIC! The T16 is 30% more efficient than its competition.

Note that is appears profitable even with high electricity costs ($0.12 per KW/h). With $0.03 / KW/h it’s even more profitable:

The T16’s new DM8575 chip design is largely responsible for the ASIC’s notable improvements over Bitmain’s S9.

Although the Antminer S9 still yields a decent mining profit, it is no match for Halong Mining’s newest chip, the Dragonmint T16. Hashrate and power consumption are the primary factors in mining profitability, next to electricity cost – Halong Mining’s Dragonmint T16 is clearly superior to Bitmain’s best ASIC miner.

ASICs’ Impact on Cryptocurrency

Bitcoin is based on blockchain technology, a decentralized platform which takes power away from a central authority and gives it to the average person. Sensitive information is stored on the blockchain rather than large data centers, and is cryptographically secured. A vast amount of people, known as miners, all work together to validate the network, instead of just one person or government.

In the beginning, CPUs were used to solve cryptographic hash functions, until miners discovered that GPUs were far better equipped for mining. As block difficulty increased, miners turned primarily to GPUs.

Eventually, technology was developed solely for mining, known as ASICs, or Application Specific Integrated Circuits. Their hashrates are significantly higher than anything GPUs are capable of.

With stellar performance comes a high price tag – the best ASIC chips will run you a few thousand dollars each. Upon creation, Bitcoin blocks were confirmed by the average person using their desktop – once ASICs hit the market, things changed.

ASICs rendered GPUs useless. ASIC developers, including Bitmain, granted early access to large mining cartels rather than the average person. Nowadays, a large majority of Bitcoin mining takes place in China where electricity is cheap.

Thousands of ASICs all mine simultaneously in a mining farm (large warehouse). Evidently, most people can’t afford just one or two of ASICs, not to mention thousands of them.

When ASICs hit the market, the blockchain’s validation process became more centralized than decentralized, as the majority of validation is done by a single mining company, rather than being spread out amongst many miners. Unfortunately, Bitcoin is no longer as decentralized as it was once intended to be.

Комментариев нет:

Отправить комментарий