Bitcoin Explained for Dummies

Bitcoin was invented as a peer-to-peer system for online payments that does not require a trusted central authority. Since its inception in 2008, Bitcoin has grown into a technology, a currency, an investment vehicle, and a community of users. In this guide we hope to explain what Bitcoin is and how it works as well as describe how you can use it to improve your life.

What is Bitcoin?

Since anything digital can be copied over and over again, the hard part about implementing a digital payment system is making sure that nobody spends the same money more than once. Traditionally, this is done by having a trusted central authority (like PayPal) that verifies all of the transactions. The core innovation that makes Bitcoin special is that it uses consensus in a massive peer-to-peer network to verify transactions. This results in a system where payments are non-reversible, accounts cannot be frozen, and transaction fees are much lower.

Where do bitcoins come from?

We go more in-depth about this on the page about mining, but here’s a very simple explanation: Some users put their computers to work verifying transactions in the peer-to-peer network mentioned above. These users are rewarded with new bitcoins proportional to the amount of computing power they donate to the network.

Who controls Bitcoin?

As we mentioned above, there is no central person or central authority in charge of Bitcoin. Various programmers donate their time developing the open source Bitcoin software and can make changes subject to the approval of lead developer Gavin Andresen. The individual miners then choose whether to install the new version of the software or stick to the old one, essentially “voting” with their processing power. It is in the miners’ best interest to only accept changes that are good for the Bitcoin currency in the long run. These checks and balances make it difficult for anyone to manipulate Bitcoin.

How to get started with Bitcoin

The best way to learn about Bitcoin is to get some and experiment. We have written articles about how to set up your own Bitcoin wallet, how to acquire bitcoins, and how to use bitcoins to help you get going.

Also, if you’d like to get a crash course in the basics of Bitcoin… What it is, why it’s so revolutionary, and most importantly, how to safely invest in it without making costly mistakes, we strongly recommend you check out this completely free, 90-Minute Training Seminar with Bitcoin Academy.

How does Bitcoin work?

This is a question that often causes confusion. Here's a quick explanation!

The basics for a new user

As a new user, you can get started with Bitcoin without understanding the technical details. Once you have installed a Bitcoin wallet on your computer or mobile phone, it will generate your first Bitcoin address and you can create more whenever you need one. You can disclose your addresses to your friends so that they can pay you or vice versa. In fact, this is pretty similar to how email works, except that Bitcoin addresses should only be used once.

Balances - block chain

The block chain is a shared public ledger on which the entire Bitcoin network relies. All confirmed transactions are included in the block chain. This way, Bitcoin wallets can calculate their spendable balance and new transactions can be verified to be spending bitcoins that are actually owned by the spender. The integrity and the chronological order of the block chain are enforced with cryptography.

Transactions - private keys

A transaction is a transfer of value between Bitcoin wallets that gets included in the block chain. Bitcoin wallets keep a secret piece of data called a private key or seed, which is used to sign transactions, providing a mathematical proof that they have come from the owner of the wallet. The signature also prevents the transaction from being altered by anybody once it has been issued. All transactions are broadcast between users and usually begin to be confirmed by the network in the following 10 minutes, through a process called mining.

Processing - mining

Mining is a distributed consensus system that is used to confirm waiting transactions by including them in the block chain. It enforces a chronological order in the block chain, protects the neutrality of the network, and allows different computers to agree on the state of the system. To be confirmed, transactions must be packed in a block that fits very strict cryptographic rules that will be verified by the network. These rules prevent previous blocks from being modified because doing so would invalidate all following blocks. Mining also creates the equivalent of a competitive lottery that prevents any individual from easily adding new blocks consecutively in the block chain. This way, no individuals can control what is included in the block chain or replace parts of the block chain to roll back their own spends.

Going down the rabbit hole

This is only a very short and concise summary of the system. If you want to get into the details, you can read the original paper that describes the system's design, read the developer documentation, and explore the Bitcoin wiki.

What is bitcoin? Here's everything you need to know

Blockchains, bubbles and the future of money.

It's been a wild ride.

You heard about this bitcoin thing?

Every bitcoin story must include an image of a physical bitcoin. Note: Physical bitcoin coins do not really exist.

Science Picture Co

We're guessing: yes, you have. The first and most famous digital cryptocurrency has been racking up headlines due to a breathtaking rise in value -- cracking the $1,000 threshold for the first time on Jan. 1, 2017, topping $19,000 in December of that year and then shedding about 50 percent of its value during the first part of 2018.

But the Bitcoin story has so much more to it than just headline-grabbing pricing swings. It incorporates technology, currency, math, economics and social dynamics. It's multifaceted, highly technical and still very much evolving. This explainer is meant to clarify some of the fundamental concepts and provide answers to some basic bitcoin questions.

But first: A quick backstory

Bitcoin was invented in 2009 by a person (or group) who called himself Satoshi Nakamoto. His stated goal was to create "a new electronic cash system" that was "completely decentralized with no server or central authority." After cultivating the concept and technology, in 2011, Nakamoto turned over the source code and domains to others in the bitcoin community, and subsequently vanished. (Check out the New Yorker's great profile of Nakamoto from 2011.)

It's actually a little more complicated than that.

What is bitcoin?

Simply put, bitcoin is a digital currency. No bills to print or coins to mint. It's decentralized -- there's no government, institution (like a bank) or other authority that controls it. Owners are anonymous; instead of using names, tax IDs, or social security numbers, bitcoin connects buyers and sellers through encryption keys. And it isn't issued from the top down like traditional currency; rather, bitcoin is "mined" by powerful computers connected to the internet.

How does one 'mine' bitcoin?

A person (or group, or company) mines bitcoin by doing a combination of advanced math and record-keeping. Here's how it works. When someone sends a bitcoin to someone else, the network records that transaction, and all of the others made over a certain period of time, in a "block." Computers running special software -- the "miners" -- inscribe these transactions in a gigantic digital ledger. These blocks are known, collectively, as the "blockchain" -- an eternal, openly accessible record of all the transactions that have ever been made.

Using specialized software and increasingly powerful (and energy-intensive) hardware, miners convert these blocks into sequences of code, known as a "hash." This is somewhat more dramatic than it sounds; producing a hash requires serious computational power, and thousands of miners compete simultaneously to do it. It's like thousands of chefs feverishly racing to prepare a new, extremely complicated dish -- and only the first one to serve up a perfect version of it ends up getting paid.

When a new hash is generated, it's placed at the end of the blockchain, which is then publicly updated and propagated. For his or her trouble, the miner currently gets 12.5 bitcoins -- which, in February 2018, is worth roughly $100,000. Note that the amount of awarded bitcoins decreases over time.

What determines the value of a bitcoin?

Ultimately, the value of a bitcoin is determined by what people will pay for it. In this way, there's a similarity to how stocks are priced.

The protocol established by Satoshi Nakamoto dictates that only 21 million bitcoins can ever be mined -- about 12 million have been mined so far -- so there is a limited supply, like with gold and other precious metals, but no real intrinsic value. (There are numerous mathematical and economic theories about why Nakamoto chose the number 21 million.) This makes bitcoin different from stocks, which usually have some relationship to a company's actual or potential earnings.

No, they're not bitcoins. They're pistachios.

Pistachios/YouTube screenshot by CNET

Without a government or central authority at the helm, controlling supply, "value" is totally open to interpretation. This process of "price discovery," the primary driver of volatility in bitcoin's price, also invites speculation (don't mortgage your house to buy bitcoin) and manipulation (hence the recent talk of tulips and bubbles).

Bitcoin has made Satoshi Nakamoto a billionaire many times over, at least on paper. It's minted plenty of millionaires among the technological pioneers, investors and early bitcoin miners. The Winklevoss twins, who parlayed a $65 million Facebook payout into a venture capital fund that made early investments in bitcoin , are now billionaires according to Fortune.

How do I buy bitcoin?

If you're willing to assume the risk associated with owning bitcoin, there is an increasing number of digital currency exchanges like Coinmama, CEX, Kraken and Coinbase -- the largest and most established of them -- where you can buy, sell and store bitcoins.

Getting started is about as complicated as setting up a Paypal account. With Coinbase, for example, you can use your bank (or Paypal account) to make a deposit into a virtual wallet, of which there are many to choose from. Once your account is funded, which usually takes a few days, you can then exchange traditional currency for bitcoin.

What can I do with bitcoin?

You can use bitcoin to buy things from more than 100,000 merchants, though still few major ones. You can sell it. Or you can just hang on to it. Note that there are no inherent transaction fees with bitcoin, although exchanges like Coinbase typically charge a fee when you buy or sell.

Is all of this legal?

The former Silk Road homepage.

Short, qualified answer: Yes, for now, as long as -- like any currency -- you don't do illegal things with it. For instance, bitcoin was the sole currency accepted on Silk Road, the Dark Web marketplace for drugs and other illicit goods and services that was shuttered by the FBI in 2013 .

Since then, bitcoin has largely evaded regulation and law enforcement in the US, although it's under increased scrutiny as it attracts more mainstream attention. Though it's legal to buy and sell bitcoin, miners and exchanges occupy a gray area that could be vulnerable to future regulation and/or law enforcement action.

What are the risks?

Legal and regulatory hazards aside, as both an investment and currency, bitcoin is very risky. When you wake up in the morning, you know pretty precisely how much a dollar can buy. The financial value of a bitcoin, however, is highly volatile and may swing widely from day to day and even hour to hour. ( Exhibit A: December 2017. )

Bitcoin transactions cannot be traced back individuals -- they are secured but also obscured through the use of public and private encryption keys . This anonymity can be appealing, especially with companies and marketers increasingly tracking our every purchase, but it also comes with drawbacks. You can never be certain who is selling you bitcoin or buying them from you. Opportunities for money laundering abound; in 2016, authorities in the Netherlands arrested 10 men for just this.

Theft is also a risk. The bitcoin subreddit is rife with individuals' stories and even established exchanges are targets. Mt. Gox, based in Japan, "lost" 750,000 of its customers' bitcoins in 2014 and hackers took $60 million from NiceHash in December 2017. There are few avenues for pursuing refunds, challenging a transaction or recovering such losses. Once a transaction hits the blockchain, it's final.

Coinbase has been tested by a massive rise in interest in bitcoin.

OK, so what about --- wait, there are more risks?

Because bitcoin is so new and decentralized, there is plenty of murkiness and many unknowns. Even the technical rules for mining are still evolving and up for debate.

The IRS views bitcoins as property, not currency. There are tax implications and a federal judge recently ruled that Coinbase must surrender records to the IRS on transactions of $20,000 or more.

Then there's the fundamental question of whether you should trust a particular exchange. Even Coinbase, the most established of them all has struggled to keep up with demand, plagued by site outages, scaling issues and customer service complaints. Even if it's venture-backed, every bitcoin player today is by definition a startup and comes with all of the associated risks.

Now I sort of understand bitcoin. WTF is Bitcoin Cash?

In August 2017, different sects within the bitcoin mining community had a disagreement about the rules governing the mining process -- specifically, what constitutes the appropriate size (in megabytes) of a block. Unable to form a consensus, there was a fork in the blockchain , with the bitcoin originalists going one way and the group favoring larger blocks going another to start Bitcoin Cash.

Though they share a common digital ancestry, each now has its own individual blockchain with slightly different protocols. (For what it's worth, bitcoin miners are sticking with 1MB blocks, Bitcoin Cash uses 8MB blocks.) Forking is almost assured to happen again in the future.

Are there other cryptocurrencies?

Yes. More than a thousand, with more sprouting up every day. Aside from bitcoin, which is the real progenitor of them all, other well-known alternative currencies include Ethereum, Ripple and Litecoin. We take a look at the pros and cons of each, and how they stack up, in this explainer .

Buying and selling bitcoin : A quick and dirty introduction to trading cryptocurrency.

Still Don't Get Bitcoin? Here's an Explanation Even a Five-Year-Old Will Understand

If you still can't figure out what the heck a bitcoin is, this simple explanation for a five-year-old may help you .

We're sitting on a park bench. It's a great day. I have one apple with me, I give it to you.

You now have one apple and I have zero. That was simple, right?

Let's look closely at what happened:

My apple was physically put into your hand. You know it happened. I was there, you were there – you touched it.

We didn't need a third person there to help us make the transfer. We didn't need to pull in Uncle Tommy (who's a famous judge) to sit with us on the bench and confirm that the apple went from me to you.

The apple's yours! I can't give you another apple because I don't have any left. I can't control it anymore. The apple left my possession completely. You have full control over that apple now. You can give it to your friend if you want, and then that friend can give it to his friend, and so on.

So that's what an in-person exchange looks like. I guess it's really the same, whether I'm giving you a banana, a book, a quarter, or a dollar bill …

But I'm getting ahead of myself.

Back to apples!

![]()

Now, let's say I have one digital apple. Here, I'll give you my digital apple. Ah! Now it gets interesting.

How do you know that digital apple which used to be mine, is now yours, and only yours? Think about it for a second. It's more complicated, right? How do you know that I didn't send that apple to Uncle Tommy as an email attachment first? Or your friend Joe? Or my friend Lisa too?

Maybe I made a couple of copies of that digital apple on my computer. Maybe I put it up on the internet and one million people downloaded it.

As you see, this digital exchange is a bit of a problem. Sending digital apples doesn't look like sending physical apples.

Some brainy computer scientists actually have a name for this problem: it's called the double-spending problem. But don't worry about it. All you need to know is that it's confused them for quite some time and they've never solved it. Until now.

But let's try to think of a solution on our own.

Maybe these digital apples need to be tracked in a ledger. It's basically a book where you track all transactions – an accounting book.

This ledger, since it's digital, needs to live in its own world and have someone in charge of it.

Just like World of Warcraft, say. Blizzard, the guys who created the online game, have a "digital ledger" of all the rare flaming fire swords that exist in their system. So, cool, someone like them could keep track of our digital apples. Awesome – we solved it!

There's a bit of a problem though:

1) What if some guy over at Blizzard created more? He could just add a couple of digital apples to his balance whenever he wants!

2) It's not the same as when we were on the bench that day. It was just you and me then. Going through Blizzard is like pulling in Uncle Tommy (a third-party) out of court (did I mention he's a famous judge?) for all our park bench transactions. How can I just hand over my digital apple to you in the usual way?

Is there any way to closely replicate our park bench transaction digitally? Seems kinda tough …

The Solution

What if we gave this ledger to everybody? Instead of the ledger living on a Blizzard computer, it'll live in everybody's computers. All the transactions that have ever happened, from all time, in digital apples, will be recorded in it.

You can't cheat it. I can't send you digital apples I don't have, because then it wouldn't sync up with everybody else in the system. It'd be a tough system to beat. Especially if it got really big.

Plus, it's not controlled by one person, so I know there's no one that can just decide to give himself more digital apples. The rules of the system were already defined at the beginning.

And the code and rules are open source – kinda like the software used in your mom's Android phone. Or kinda like Wikipedia. It's there for smart people to maintain, secure, improve, and check.

You could participate in this network too – updating the ledger and making sure it all checks out. For the trouble, you could get like 25 digital apples as a reward. In fact, that's the only way to create more digital apples in the system.

I simplified quite a bit … But that system I explained exists. It's called the Bitcoin protocol. And those digital apples are the bitcoins within the system. Fancy! So, did you see what happened?

What does the public ledger enable?

1) It's open source, remember? The total number of apples was defined in the public ledger at the beginning. I know the exact amount that exists. Within the system, I know they are limited (scarce).

2) When I make an exchange I now know that digital apple certifiably left my possession and is now completely yours. I used to not be able to say that about digital things. It will be updated and verified by the public ledger.

3) Because it's a public ledger, I didn't need Uncle Tommy (third-party) to make sure I didn't cheat, or make extra copies for myself, or send apples twice, or thrice…

Within the system, the exchange of a digital apple is now just like the exchange of a physical one. It's now as good as seeing a physical apple leave my hand and drop into your pocket. Just like on the park bench, the exchange involved two people only. You and me , we didn't need Uncle Tommy there to make it valid.

In other words, it behaves like a physical object.

But you know what's cool? It's still digital.

We can now deal with 1,000 apples, or 1 million apples, or even .0000001 apples. I can send it with a click of a button, and I can still drop it in your digital pocket if I was in Nicaragua and you were all the way in New York.

I can even make other digital things ride on top of these digital apples! It's digital after all. Maybe I can attach some text on it – a digital note. Or maybe I can attach more important things; like say a contract, or a stock certificate, or an ID card …

So this is great! How should we treat or value these "digital apples"? They're quite useful aren't they?

Well, a lot of people are arguing over it now. There's debate between this and that economic school, between politicians, between programmers. Don't listen to all of them though. Some people are smart; some are misinformed. Some say the system is worth a lot; some say it's actually worth zero. Some guy actually put a hard number on it: $1,300 per apple. Some say it's digital gold; some say it's a currency. Others say they're just like tulips. Some people say it'll change the world; some say it's just a fad.

I have my own opinion about it, but that's a story for another time.

Hey kid, you now know more about Bitcoin than most.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Yahoo!-ABC News Network | © 2018 ABC News Internet Ventures. All rights reserved.

What Are Bitcoins? Virtual Currency Explained (Like You're an Idiot)

Tomohiro Ohsumi/Bloomberg via Getty Images

Members of Congress today will get a crash course on bitcoin, the digital "currency" that allows users to conduct transactions online. In just five years the virtual currency has gone from being worth pennies to nearly $600 apiece. It has funded nascent democracy movements as well as a huge underground marketplace for illegal drugs and weapons.

We set out to answer the question: What Are Bitcoins?

Below is an attempt to answer that and many other questions surrounding the virtual currency. And we promise to speak really, really slowly.

When I was 4, I bit a coin, swallowed it, and had to go to the emergency room. I've had a fear of payphones and gumball machines ever since. Thank goodness Congress has finally gotten around to fixing the scourge of people biting coins. Wait. is this the same thing?

You never have to worry about choking on a bitcoin. Unlike U.S. quarters, Canadian loonies, or, for that matter, the currencies of every country in the world, bitcoins are completely virtual. They exist only online and are not controlled by a central authority like the Federal Reserve.

If hard currency is like a record, then a bitcoin is like an MP3.

Interested in ?

That means you can't get them from a bank, or drop them in a wishing well. All transactions take place in an online marketplace, where users are untraceable.

If I can't hide it under my mattress, how can I know my stash is safe?

You hold bitcoins in an online "wallet." This is an account set up on a secure third-party website.

Unlike banks, wallet firms won't invest your money. Nor do they guarantee the same protections afforded banks by institutions like the FDIC.

If your wallet is hacked and your bitcoins are stolen, there is not much you can do about it.

This sounds a lot like the coins from Super Mario Brothers. Do I have to bang my head against a brick wall to get the money?

New bitcoins enter the market by a process called "mining." Available bitcoins are hidden amid a complex encrypted computer program. Users' computers are working round the clock to solve a complicated mathematical problem in order to release new coins.

The easiest-mined bitcoins have already been discovered. Finding new coins requires huge amounts of computing power. That has led some hackers to take over unsuspecting users' computers to harness their power to mine for more bitcoins.

The system is designed to require more work to get coins as time goes by, that makes the currency's growth rate, also known as inflation, steady and predictable.

About 11 million bitcoins have already been found. But only 21 million exist in total.

How do I use bitcoins? I have a feeling my kids won't be happy when I tell them they're getting virtual currency for Christmas.

You can use bitcoins to buy anything with which you would use any other kind of currency. There's just one huge hitch: the business has to accept bitcoins, and most don't.

When you want to buy something, you find out the anonymous identification number attached to the seller's wallet, and transfer coins from your wallet to his.

It's this anonymity that has made the currency popular with drug dealers.

Drug dealers? I knew this sounded sketchy. Are these things even legal?

Recently, Silk Road, an online marketplace for illicit drugs, which used bitcoins to facilitate transactions was shut down by the FBI.

Like cash, bitcoins are untraceable, which makes drug dealers like them. Unlike cash, however, bitcoins can easily be transferred anywhere in the world.

For now bitcoins are legal, so long as they're being used for legal purchases.

At today's Senate Homeland Security Committee hearing, a lawyer for bitcoin is expected to ask Congress to "chart a safe and sane regulatory course" without limiting its economic potential.

Patrick Murck, general counsel for the Bitcoin Foundation, is expected to tell the committee that bitcoins are vital for developing economies and developing democracies. They allow users to spend money on political acts that some governments might find threatening and they let users sidestep corrupt practices and punitive taxes.

"Bitcoin can facilitate private and anonymous transactions, which are resistant to oversight and control," Murck will testify, according to released copies of his remarks. "This by no means implies that using Bitcoin can or should provide anyone immunity from the law."

Who came up with this whole idea in the first place?

It's a bit weird. Officially, bitcoins were invented by a Japanese programmer named Satoshi Nakamot, who outlined the process in an academic paper before disappearing in 2009, shortly after the first bitcoins were released.

Satoshi is widely believed to be a pseudonym and given his use of English in some of those papers, many believe he is an American.

What are bitcoins actually worth?

As of today, one bitcoin is worth $568, leading many to believe they are overvalued and the bubble is likely to burst.

The currency is extremely volatile. There's no control over how bitcoins are valued against other currencies and there are no large exchanges that can prevent manipulation and speculation.

Every time bitcoins make the news – like when Silk Road was shuttered, or when the tech investor Winklevoss twins – revealed they owned million of dollars in bitcoins, the value has wildly fluctuated.

So, if they're this invisible, virtual currency, how is it that people keep biting them?

Bitcoin is going wild — here's what the cryptocurrency is all about

Andrew Burton/Getty Images

Andrew Burton/Getty Images

Bitcoin is back in the headlines after soaring in value. One bitcoin was worth $2,800 on May 25, up from $1,200 at the end of April.

In countries that accept it, you can buy groceries and clothes just as you would with the local currency. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket.

Bitcoin is divorced from governments and central banks. It's organized through a network known as a blockchain, which is basically an online ledger that keeps a secure record of each transaction all in one place. Every time anyone buys or sells bitcoin, the swap gets logged. Several hundred of these back-and-forths make up a block.

No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins.

Why bother using it?

True to its origins as an open, decentralized currency, bitcoin is meant to be a quicker, cheaper, and more reliable form of payment than money tied to individual countries. In addition, it's the only form of money users can theoretically "mine" themselves, if they (and their computers) have the ability.

But even for those who don't discover using their own high-powered computers, anyone can buy and sell bitcoins, typically through online exchanges like Coinbase or LocalBitcoins.

A 2015 survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested.

Each bitcoin has a complicated ID, known as a hexadecimal code, that is many times more difficult to steal than someone's credit-card information. And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing.

But while fraudulent credit-card purchases are reversible, bitcoin transactions are not.

21 million

Bitcoin is unique in that there are a finite number of them: 21 million. Satoshi Nakamoto, bitcoin's enigmatic founder, arrived at that number by assuming people would discover, or "mine," a set number of blocks of transactions daily.

Every four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. (The reward right now is 12.5 bitcoins.) As a result, the number of bitcoins in circulation will approach 21 million, but never hit it.

This means bitcoin never experiences inflation. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won't be more bitcoin available in the future. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement.

The future of bitcoin

Historically, the currency has been extremely volatile. But go by its recent boom — and a forecast by Snapchat's first investor, Jeremy Liew, that it will hit $500,000 by 2030 — and nabbing even a fraction of a bitcoin starts to look a lot more enticing.

Bitcoin users predict 94% of all bitcoins will have been released by 2024. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference.

Bitcoin explained: Its history, why is it so valuable, and will the bubble burst?

With one bitcoin worth $10,000, 2017 has seen this cryptocurrency go stratospheric. But what exactly is it?

Bitcoin has been around since 2009, but cryptocurrencies – as in, a digital currency that operates outside of a central bank – have suddenly shot up in value, leaving many wondering if a solid investment could reap thousands. Recently, Bjork encouraged fans to buy her ‘Utopia’ album with Bitcoin, Litecoin, Dashcoin or AudioCoin . This looks far from being a digital fad, and many who invested several years ago are on the brink of being millionaires. So here’s a quick guide to the currency, why it’s all the rage, and whether the bitcoin bubble will burst.

What is Bitcoin?

Bitcoin first went online in 2009 as open-source technology, invented by a mysterious, anonymous individual going by the pseudonym Satoshi Nakamoto.

It’s a digital currency, used to pay for items online without any additional bank charges, or government control. Companies and people can buy or sell items using bitcoin as payment. In 2017, these companies include Microsoft, Virgin Airlines, WordPress and Subway.

Hard, real-life currencies such as the Pound sterling or US dollar are managed by a central bank (in this case the Bank of England and US Federal Reserve), which steadies rates and manages supply and demand. Bitcoin has no overall regulation, but it relies on the activity of “miners”. This is the complicated part. The currency’s quantity can only be increased if it is “mined” – a process which involves computers collecting pending bitcoin transactions and turning them into a complex mathematical equation. The first miner to solve this puzzle then chains together a “block” of transactions (called a “blockchain”), and they are then rewarded with newly-created bitcoin.

A maximum 21 million bitcoins can be created. As of June 1 2017, there were 16,366,275 in circulation. It is expected to hit 21 million by 2140.

How much is Bitcoin worth?

At the time of writing, 1 bitcoin is currently the equivalent of £7418.32, or $9,858.69. Its price can be followed here.

It first entered mainstream circulation in 2009, and its price only began to rise significantly in April 2013 ($153). It rose to just under $1000 in late 2013, before experiencing a dip and a steady up-down pattern, hovering between the $500-1000 mark for the next four years.

In 2017, Bitcoin’s situation changed significantly. On January 3, its price rose above $1000 for the first time. Its price had doubled by May, and again by August. By November, it was worth close to ten times its value in January 2017. It surpassed $11,000 for the first time on November 29 2017.

What explains bitcoin’s meteoric rise? Regulators are imposing fewer restrictions on the cryptocurrency. NASDAQ, the world’s second largest stock exchange, has outlined plans to enable bitcoin futures – which would allow market traders to bet on the rise and fall of its price. Major financial institutions are beginning to view bitcoin as a legitimate currency, and not as some Ponzi scheme, and this is contributing to the spike in price.

NME Newsletter

Sign up for the newsletter

A quick history of its peak price in the last six years:

Dec 2011 – $2.00

Dec 2012 – $3.00

Dec 2013 – $800

Dec 2014 – $300

Nov 2015 – $500

Nov 2016 – $700

Nov 2017 – $11,000

2017 is the year bitcoin went stratospheric.

Why is Bitcoin controversial?

Many are comparing bitcoin’s rise to the transition from gold to paper money. Banks and institutions simply aren’t used to it, which is why they remain so suspicious. Remember, it was also invented by an unknown who goes under an alias, and the cryptocurrency is hard to trace.

Plus, bitcoin has been subject to high-profile hacks, putting its credibility – and the security of its owners – under threat. On November 21, cryptocurrency Tether reported a $31m theft, which led to bitcoin’s prices temporarily plummeting. It remains a risky investment.

Bitcoin also has an association with the black market and the dark web. In the past, it could be used to buy illegal drugs on Silk Road, a service that could be used anonymously on the private Tor browser. It’s also been used for everything from fake IDs to sex workers, and has links to money laundering.

Popular Topics

5 StumbleUpon Alternatives That Still Work to Pass Time

Bitcoin Explained: Why Is It Worth So Much Money?

Do you follow Bitcoin? At the start of December, the price of the cryptocurrency rocketed up to over $19,000 per coin. Early investors with nerves of steel now have portfolios worth thousands, if not millions of dollars.

But the question on everyone’s lips is this: is it too late for me to invest in Bitcoin?

The price of an individual Bitcoin plowed through previous records, almost hitting the magical $20,000 level for the first time. At this point, buying a whole Bitcoin is simply beyond the means of most people. But that doesn’t mean you shouldn’t bother at all Is There Ever a Safe Time to Invest in Bitcoin or Ethereum? Is There Ever a Safe Time to Invest in Bitcoin or Ethereum? There will always be a measure of risk when "investing" in Bitcoin, Ethereum, or any other form of cryptocurrency. However, that risk can be managed. Here's how to do it. Read More . Consider the following.

Limited Supply

The Bitcoin total supply limit is 21 million coins. Of those 21 million coins, some four million are already considered irretrievably lost Why Your Crypto Coin Is Not as Secure as You Think Why Your Crypto Coin Is Not as Secure as You Think Bitcoin continues to hit new highs. Cryptocurrency newcomer Ethereum threatens to explode into its own bubble. Interest in blockchain, mining, and cryptocurrency is at an all-time high. So why are cryptocurrency enthusiasts under threat? Read More (thrown away, willfully destroyed, held on encrypted drives with lost passwords, and so on).

Bitcoin creator Satoshi Nakamoto is mooted to have mined 1 million Bitcoin (a cool $19 billion at the recent $19,000 high) before publicizing the blockchain. There are also several people known to hold huge amounts of Bitcoin, and I’m sure more than a few governments have substantial holdings too.

According to career investor Ronnie Moas, there are probably “between 3-5 million Bitcoin” in actual circulation. That number does increase incrementally as miners “release” more Bitcoin. But that is still only 12.5 coins per block, and the vast majority now go to mining pools.

Bitcoin is a scarce resource, then. Another factor of consideration is the sheer number of users. Between Q3 2014 and Q3 2017, the number of Blockchain wallet users rose from 1.9 million to 14.7 million. And given the enormous leaps observed in December, it is fair to say that the overall number of Bitcoin users will have risen further.

All in all, it means more users competing for less Bitcoin — and we all know what that means for prices.

More Investors Incoming

The number of people investing Bitcoin is rising too.

Exact numbers are extremely difficult to arrive at, though. Some estimates peg the number of users to the number of wallets. Using the bitinfocharts website, we can break down Bitcoin distribution by wallet address.

Check out the table below. We can see that there are around 13.7 million wallets holding less than 0.001 BTC, and two holding between 100,000 to 1,000,000 (they actually hold 127k and 119k, and are the wallets for two crypto-exchanges). That aside, this table tells us that there are nearly 25 million active wallets.

A more recent University of Cambridge study [PDF] estimates that there are between 2.9 to 5.8 million active cryptocurrency users, with the vast majority using Bitcoin. The study also estimates there to be between 5.8 million and 11.5 million “active” wallets.

The biggest change, however, is the recent introduction of Wall Street to the Bitcoin trading environment. The Chicago Board Options Exchange (CBOE) added Bitcoin futures to their trading options on Sunday, December 10. The price immediately soared by over 25 percent, causing a temporary trading halt, as well as crashing the CBOE website due to demand (a mini-DDoS of sorts).

The combination of Bitcoin and Wall Street trading will introduce a significant number of individuals to cryptocurrencies.

SMS Bitcoin

But it isn’t just Wall Street that has climbed aboard the Bitcoin hype-train. There are a number of blockchain startups How Bitcoin's Blockchain Is Making the World More Secure How Bitcoin's Blockchain Is Making the World More Secure Bitcoin's greatest legacy will always be its blockchain, and this magnificent piece of technology is set to revolutionize the world in ways we always thought improbable. until now. Read More that will bring banking facilities to the previously unbanked 3 Blockchain Credit Agencies Changing Our Relationship With Money 3 Blockchain Credit Agencies Changing Our Relationship With Money Credit agencies are relics of the past, dinosaurs prone to abuse, fraud, and identity theft. It's time to talk about the technology that will stop another Equifax-style loss of data taking place: blockchain. Read More . These services will bring credit opportunities to those otherwise unable to obtain financing solutions. Furthermore, several startups are attempting to sell and trade Bitcoin via SMS. While only 30 percent of the world have consistent access to the internet, SMS is ubiquitous Say Goodbye to SMS: The Best Google Hangouts Alternatives Say Goodbye to SMS: The Best Google Hangouts Alternatives On May 22, 2017, Google Hangouts will lose SMS integration. Here's how to prepare for that day. Read More in almost every country.

The SMS Bitcoin services are targeting the African continent as a major untapped Bitcoin marketplace. Residents of countries with repressive governments or societal unrest also present opportunities for Bitcoin (and other cryptocurrencies) to protect wealth.

Bitcoin is infamously volatile. The price volatility is a major contributor to Bitcoin and other cryptos’ derision as a serious investment. While the introduction of Bitcoin futures to the CBOE caused an immediate 25 percent price spike, there is hope that the influence of Wall Street trading will have a calming effect on the overall price volatility of Bitcoin. In turn, this will allow other cryptocurrencies (commonly referred to as altcoins) to gain traction.

Financial Predictions

What will the Bitcoin price be in one year? $20K? $50K? Even more than that? It all depends on what you read. Here are five Bitcoin price predictions from a range of individuals.

- Saxo Bank: $60,000 in 2018, before crashing back to $1,000 before 2019

- John McAfee: $1,000,000 by 2020

- James Altucher: $1,000,000 by 2020

- Winklevoss twins: $152,000, unspecified date

- Masterluc: (legendary crypto-trader) $40,000-$110,000 by 2019

Quite the range of predictions, but one thing is sure: Bitcoin will continue to rise for at least another year, if not two. As with all investments, knowing when to bow out is part of the problem. And the whales (those holding a significant amount of Bitcoin) always have the drop on the rest of populace.

As it stands, Bitcoin is already a top-30 world currency, with a current market capitalization of over $250 billion. It is widely expected to surpass the $1 trillion mark before 2020. A vast increase, but this would move the Bitcoin price toward the Winklevoss twins’ per-coin estimate.

Overall Awareness

Overall Awareness ties into the “more investors incoming” section but needs a few words of its own. The hype surrounding Bitcoin makes it feel like everyone is at it. Your grandma, the postman, your dentist — everyone. In fact, nothing could be further from the truth. Check out this absolutely non-scientific graph.

Bitcoin is generating an enormous amount of interest and has a huge market capitalization, but global adoption rates are still below 1 percent of the population. That’s right. And even 1 percent estimates are shaky. Consider the University of Cambridge study we looked at earlier. Even at the maximum estimate of 11 million active wallets, that’s only roughly 0.14 percent of the global population.

We are still at the tip of the global awareness and uptake iceberg. At most, we are just entering the “public awareness” phase. Public awareness increases, mania and FUD skyrocket, and greed and delusion set in. The Bitcoin price will continue to rise dramatically throughout this time until something spooks the market — and the capitulation begins.

So, Should I Invest?

I’m not a financial organization. Nor am I in any way qualified to give investment advice The Best Reddit Personal Finance Tips You Should Use The Best Reddit Personal Finance Tips You Should Use We've gone through the personal finance sub-reddits to find the best pieces of financial wisdom out there and help you learn from others' experience. Read More . I invest in and trade small amounts of Bitcoin and other altcoins.

My advice is simple: do your research, do not believe everything you read, and do not invest money you cannot afford to lose.

What do you think about the future of Bitcoin after reading this? Will you invest in Bitcoin? Share your thoughts in the comments.

What is Bitcoin? Bitcoin Explained Simply for Dummies

Last updated on May 8th, 2018 at 02:35 pm

Today we’re going to start from scratch and answer the third most searched term on Google today – What is Bitcoin?

What you will learn in this video

- What is money?

- What is the Double Spend Problem?

- What are the problems with Centralization?

- What is Bitcoin?

- How does Bitcoin compare with banks?

- Who accepts Bitcoin?

If you’re worried that we’re going to get too technical and use a lot of complicated words – don’t. Here at 99Bitcoins we translate Bitcoin into plain English so even if you have no technical background you’ll be able to understand everything. By the end of this course you’ll know more about Bitcoin and how it works than 99% of the population. Let’s get started…

What is Money?

Before we talk about Bitcoin I want to take a moment and talk about money. What is money exactly?

At its core, money represents value. If I do some work for you, you give me money in exchange for the value I gave you. I can then use that money to get something of value from someone else in the future.

Throughout history, value has taken many forms and people used a lot of different materials to represent money. Salt, wheat, shells and of course gold have all been used as a medium of exchange.

However, in order for something to represent value people have to trust that it is indeed valuable and will stay valuable long enough for them to redeem that value in the future.

Changing the Trust Model of Money

Up until a hundred years ago or so we always trusted in someTHING to represent money. However something happened along the way and we’ve changed our trust model from trusting someTHING to trusting in someONE.

Over time, people found it too cumbersome to walk around the world carrying bars of gold or other forms of money, so paper money was invented. Here’s how it worked: a bank or government would offer to take possession of your bar of gold; let’s say worth $1000, and in return, that bank would give you receipt certificates, which we call bills, amounting to $1000.

Not only were these pieces of paper much easier to carry, but you could spend a dollar on a cup of coffee and not have to cut your gold bar into a thousand pieces. And if you wanted your gold back, you simply took $1000 in bills back to the bank to redeem them for the actual form of money, in this case that gold bar, whenever you needed…And so, paper began its use as money as an instrument of practicality and convenience.

However as time progressed, and due to macroeconomic changes, this bond between the paper receipt and the gold it stands for was broken. Now, to explain the path that led us away from the gold standard is extremely complex, but suffice to say that governments told their people that the government itself would be liable for the value of that paper money. Basically we all said “let’s just forget about gold and trade paper instead”.

So people continued to trade with receipts that are backed by nothing but the government’s promise.

And why did it continue to work? Well, because of trust. Even though there is no actual commodity backing paper money, people trusted the government and that’s how fiat money was created.

Fiat Money and its drawbacks

Fiat is a Latin word that means “by decree”. Meaning the dollars, or euros or any other currency for that matter have value because the government orders it to. It’s what is known as “legal tender” – coins or banknotes that must be accepted if offered as payment.

So the value of today’s money actually comes from a legal status given to it by a central authority, in this case, the government. And so the trust model has changed, from trusting someTHING to trusting someONE (in this case, the government).

Fiat money has two main drawbacks:

- It is centralized – You have a central authority that controls and issues it. In this case the government or central bank.

- It is not limited by quantity – The government or central bank can print as much as they want whenever needed and inflate the money supply on the market. The problem with printing money is that because you’re flooding the market with more money the value of each dollar drops, so your own money is worth less. When you see prices rising throughout the years it’s not necessarily that prices are rising as much as that the purchasing power of your money is dropping. You need more dollars to buy something that used to “cost less”.

The move to digital money

Once fiat money was in place, the move to digital money was pretty simple. We already have a central authority that issues money, so why not make money mostly digital and let that authority keep track of who owns what.

Today we mainly use credit cards, wire transfers, Paypal and others forms of digital money. The amount of physical money in the world is almost negligible and is getting smaller with each year that passes.

So if money today is digital, how does that even work? I mean, if I have a file that represents a dollar, what’s to stop me from copying it a million times and having a million dollars? This is called the “double spend problem”.

The solution that banks use today is a “centralized” solution – they keep a ledger on their computer which keeps track of who owns what. Everyone has an account and this ledger keeps a tally for each account. We all trust the bank and the bank trusts their computer, and so the solution is centralized on this ledger in this computer.

You may not know this, but there were many attempts to create alternative forms of digital currencies, however none were successful in solving the double spend problem without a central authority.

The problems of a centralized money system

Whenever you give a anyone control over the money supply you’re giving them enormous power and this creates three major issues:

- Corruption – power corrupts, and absolute power corrupts absolutely. When banks have a mandate to create money, or value, they basically control the flow of value in the world, which gives them almost unlimited power. A small example of how power corrupts can be seen in Wells Fargo’s scandal where employees secretly created millions of unauthorized bank and credit card accounts in order to inflate the bank’s revenue stream, without their customers knowing about it for years.

- Mismanagement – If the central authority’s interest isn’t aligned with the people it controls there may be a case of mismanagement of the money. For example, printing a lot of money in order to save a certain bank or institution from collapsing, as what happened in 2008. The problem with printing too much money is that it causes inflation and basically erodes the value of the citizen’s money. One extreme example for this is Venezuela, where the government has printed so much money, and the value of it has dropped so much, that people are no longer counting money but are weighing it instead.

- Control – You are basically giving away all control of your money to the government or bank. At any point in time the government can decide to freeze your account and deny you access to your funds. Even if you use only cold hard cash the government can cancel the legal status of your currency as was done in India a few years back.

This was the state of things until 2009. Creating an alternative to the current monetary system seemed like a lost cause. But then everything changed….

Hello Bitcoin!

In October 2008 a document was published online by a guy calling himself Satoshi Nakamoto. The document, also called a whitepaper, suggested a way of creating a system for a decentralised currency called Bitcoin. This system claimed to create digital money that solves the double spend problem without the need for a central authority.

At its core Bitcoin is a transparent ledger without a central authority, but what does this confusing phrase even mean?

Well, let’s compare Bitcoin to the bank. Since most money today is already digital, the bank basically manages its own ledger of balances and transactions. However the bank’s ledger is not transparent and it is stored on the bank’s main computer. You can’t sneak a peek into the bank’s ledger, and only the bank has complete control over it.

Bitcoin on the other hand is a transparent ledger. At any point in time I can sneak a peek into the ledger and see all of the transactions and balances that are taking place. The only thing you can’t figure out is who owns these balances and who is behind each transaction. This means Bitcoin is pseudo-anonymous – everything is open, transparent and trackable but you still can’t tell who is sending what to whom.

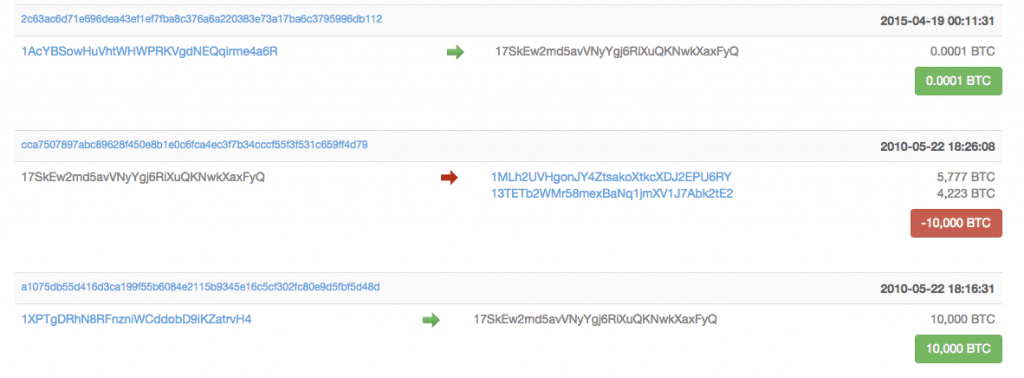

Let’s explain this with an example. Before you can see certain rows from Bitcoin’s ledger. We can see that a certain Bitcoin address sent 10,000 Bitcoins to another Bitcoin address on May of 2010.

This specific transaction is the first purchase that was ever made with Bitcoin and it was used to buy 2 pizzas by a guy named Laszlo. Laszlo published a post back in 2010 asking for someone to sell him 2 pizzas in exchange for 10,000 Bitcoins. Well, someone did, and now the price of these two Pizzas is worth well over 100 million dollars today.

Bitcoin is decentralized

there’s no one computer that holds the ledger. With Bitcoin, every computer that participates in the system is also keeping a copy of the ledger, also known as the Blockchain. So if you want to take down the system or hack the ledger you’ll have to take down thousands of computers which are keeping a copy of it and constantly updating it.

Bitcoin is digital

This means there’s nothing physical that you can touch in Bitcoin. There are no actual coins, there are only rows of transactions and balances. When you “own” Bitcoin it means you own the right to access a specific Bitcoin address record in the ledger and send funds from it to a different address.

Why is Bitcoin such big news?

Well for the first time since digital money came into existence we now have an alternative to the current system. Bitcoin is a form of money that no government or bank can control. Think about the time before the Internet, how centralized the flow of information was. Basically if you wanted information you could get it from a few major players like the New York Times, The Washington Post and others like them.

Today, thanks to the Internet, information is decentralized and you can communicate and consume knowledge from around the world with the click of a button. Bitcoin is the Internet of money – it’s offering a decentralized solution to money.

Bitcoin advantages over the current system

Complete control over your money

With Bitcoin, you and you alone can access your funds (how you actually do this will be explained in a later video). No government or bank can decide to freeze your account or confiscate your holdings.

Cuts the middlemen

This means that in many cases Bitcoin is cheaper to use than traditional wire transfers or money orders. Also, unlike fiat currencies Bitcoin was designed to be digital by nature, this means you can add additional layers of programming on top of it and turn it into “smart money”, but more on that on later videos.

Free for all

Bitcoin opens up digital commerce to 2.5 billion people around the world who don’t have access to the current banking system. These people are unbanked or underbanked because of where they leave and the reality they have been born into. However today, with a mobile phone and a click of a button they can start trading using Bitcoin, no permission needed.

Who accepts Bitcoin?

Today there are several merchants online and offline that accept Bitcoin. You can order a flight or book a hotel with Bitcoin if you like. There are even Bitcoin debit cards that allow you to pay at almost any store with your Bitcoin balance. However the road toward acceptance by the majority of the public is still a long one.

As we continue in this video series, we will break down exactly how Bitcoin works and how to use it. We will learn about Bitcoin mining, Bitcoin wallets, how to buy Bitcoins and much more. The revolution of money began in 2009 and these days we are seeing it change money as we know it.

Комментариев нет:

Отправить комментарий