Bitcoin May Fall By a Third in 2018: Study

Bitcoin, the world's largest digital currency by market capitalization, could see that value cut by nearly 40% as the cryptocurrency continues its fall from record highs reached last year, according to two Swiss researchers.

At a price of $7,327.15 as of 15:21 UTC on Tuesday, bitcoin has gained 540% over the last 12 months despite a 63% dip from its mid-December high near $20,000. (See also: NVIDIA Burned on Plummeting Crypto-Prices, Analysts at Odds.)

The highly volatile digital currency is overvalued and should suffer more steep price swings, according to Spencer Wheatley and Didier Sornette, both professors of entrepreneurial risks at ETH Zurich. The two wrote a paper dated March 16 citing Metcalfe's law, which indicates that the value of a network is proportional to the square of its number of users. By a generalization of that principle, the professors expect bitcoin's market value to plummet to $77 billion or lower, compared to its current near $125 billion.

Beware an 'Increasingly Unstable State'

As the growth of of new active bitcoin users slows, Metcalfe's law suggests that the cryptocurrency's market capitalization will also decelerate, wrote the researchers. The paper, which was recently highlighted by the MIT Technology Review, also included "Log-Period Power Law Singularity," a mathematical model for analyzing speculative bubbles. Wheatley and Sornette found four distinct bitcoin bubbles that corresponded to the model and "were followed by crashes or strong corrections," including South Korean regulators' threat to shut down crypto-exchanges and dating back to a 2011 hack at the now-defunct Mt. Gox bitcoin exchange.

While bitcoin bulls see prices recovering as fears ease regarding heightened regulation around the world, championing the idea that blockchain technology will transform the world, the academic researchers contend that a mathematical analysis signals the contrary.

"Looking forward, our analysis identifies a substantial but not unprecedented overvaluation in the price of bitcoin, suggesting many months of volatile sideways bitcoin prices ahead (from the time of writing, March 2018)," read the paper. "We emphasize that one should not focus on the instantaneous and rather unpredictable trigger itself, but monitor the increasingly unstable state of the bubbly market, and prepare for a correction." (See also: Bitcoin Will Become World’s ‘Single Currency’: Dorsey.)

Bitcoin Fall Extends to 25% as Fears of Crypto Crackdown Linger

Bitcoin Loses 50% Since December

January’s cryptocurrency selloff got fresh impetus on Tuesday when Bitcoin slumped as much as 25 percent, as the prospect of regulatory crackdowns appeared to spread.

While the largest digital coin was down 25 percent at $10,338 as of 4:37 p.m. in New York, it was still at the lowest level since early December, according to composite pricing on Bloomberg. As Bitcoin halted its two-day rally, rival cryptocurrencies also tumbled. Ripple sank as much as 40 percent and Ethereum dropped 26 percent.

Speculators across the globe are struggling to determine when or how market watchdogs may rein in an industry that’s decentralized and derives much of its value from anonymous ownership. Many assertions that digital coins represent a bubble have triggered double-digit selloffs over the past year, only to be followed by rebounds.

In South Korea, shutting down cryptocurrency exchanges is still an option, Finance Minister Kim Dong-yeon said in an interview with TBS radio. But measures first need “serious” discussion among ministries, Kim added, holding out hope for traders that a crackdown won’t go that far. Kim said there’s irrational speculation and that rational regulation was

needed.

“The finance minister made it clear they’re definitely considering banning crypto trading -- and it’s probably the third-largest market,” said Neil Wilson, senior market analyst in London for online trading platform ETX Capital. “The news is hitting prices and broader sentiment, and it follows China’s move to shutter mines.”

China, which first began targeting the industry last year, is escalating its clampdown on cryptocurrency trading, particularly online platforms and mobile apps that offer exchange-like services, according to people familiar with the matter.

“We’ve heard reports that South Korea, China and Japan have considered a shared approach, a path, to regulation,” ETX’s Wilson said, also citing a challenge to digital coins from a bill in the U.S Senate. “It looks like the light touch that has allowed the crypto-boom to explode may be coming to an end,” he wrote in a note to investors.

Lower-than-normal trading in Korea and Japan may have exaggerated the moves in Asia hours on Tuesday, said Mati Greenspan, senior market analyst for the eToro currency platform.

Bitcoin trading using the Korean won was about 3.3 percent of the total among major currencies, compared with more than 10 percent reached on several days over the past two weeks, according to cryptocompare.com data.

Steven Maijoor, chairman of the European Securities and Markets Authority, said investors “should be prepared to lose all their money” in Bitcoin, in a Bloomberg TV interview in Hong Kong. “It has an extremely volatile value, which undermines its use as a currency,” he said. “It’s also not broadly accepted.”

For more on cryptocurrencies, check out the Decrypted podcast:

The ESMA warned retail investors against initial coin offerings in November and is monitoring developments in cryptocurrencies, Maijoor said.

Who Is CryptoNick? Bitcoin Price Fall Blamed on Cryptocurrency 'Scammers' Promoting Bitconnect 'Ponzi Scheme'

Bitcoins are seen in this illustration picture taken on September 27, 2017. Some investors in the cryptocurrency are blaming the current cryptocurrency market crash on "scammers." REUTERS/Dado Ruvic/Illustration

As the price of bitcoin continues to tumble, the finger of blame is being pointed everywhere from South Korea, to shills accused of promoting cryptocurrency "Ponzi schemes" for personal gain. One particular scapegoat for investors seeking answers to the market crash is the YouTube personality CryptoNick.

Along with several other popular Youtube accounts, CryptoNick promoted—and was sponsored by—the cryptocurrency lending and exchange platform Bitconnect. The collapse of the platform on Tuesday, January 16, has been seen as a key factor in causing the price of bitcoin and other major cryptocurrencies—including ethereum and litecoin—to crash.

CryptoNick, who describes himself as a 17-year-old crypto millionaire, typically posts videos that include advice and tutorials on which cryptocurrencies and platforms to invest in, as well as how to mine bitcoin and other virtual currencies. Most videos contain a disclaimer in the written description.

The disclaimer states: "I am not a financial adviser nor am I giving financial advice. I am sharing my biased opinion based off speculation. You should not take my opinion as financial advice. You should always do your research before making any investment."

In a video posted to YouTube following Bitconnect’s collapse, CryptoNick said: “I honestly can’t believe this happened guys, like I said it’s been a great platform and it’s officially coming to an end. No more Bitconnect to anyone who’s always hated on the platform. I’m still shocked, I’m still trying to take this all in. I really don’t have much to say.”

Announcing that it was officially closing down its lending and exchange platform, Bitconnect blamed bad press, cease and desist letters from the Texas State Securities Board, and cyberattacks on its platform.

“Outside forces have performed DDoS attacks on platform several times and have made it clear that these will continue,” Bitconnect said in a blogpost. “This is not the end of this community, but we are closing some of the services on the website platform and we will continue offering other cryptocurrency services in the future.”

These types of alleged attacks, as well as the exploitation of naive investors, is likely to continue while the cryptocurrency industry is still in its nascent stages, according to experts.

Sean Newman, director at Corero Network Security, told Newsweek: “The cryptocurrency gold rush has dominated the news agenda in recent months, but as investors flock to these platforms, they have also become a hot target for cyber criminals looking to exploit the vast wealth and formative security policies in use.”

A representation of the digital cryptocurrency Bitcoin, at the Bitcoin Change shop in the Israeli city of Tel Aviv on January 17. The latest price crash has been blamed partly on the collapse of the Bitconnect platform. JACK GUEZ/AFP/Getty Images

Cryptocurrency enthusiasts and investors were quick to accuse CryptoNick and other “legendary affiliate scammers” for profiting from Bitconnect, which was described in one Reddit post explaining factors of the cryptocurrency crash as “essentially a ponzi scheme” due to the way it operated.

One Reddit user said on the site’s cryptocurrency forum, which has nearly half a million subscribers, that CryptoNick and other YouTube users had since deleted their Bitconnect videos.

“CryptoNick is deleting all of his BitConnect videos, and so are his buddies,” the post stated. “Please never forget what he and his cohorts did to so many people, and how much money those people lost in the process thanks to CryptoNick."

One YouTube user by the name of CryptoBean said in a video titled "CryptoNick is a scammer": "He is basically preying on new people who are coming into the cryptocurrency space with no idea what they’re doing yet, and persuading them to invest in sites like Bitconnect to make himself a personal gain."

Bitcoin Price Falls 15% Amid Network 'Failure' Claims

The price of bitcoin declined sharply in global markets today, falling by 15%, according to the CoinDesk USD Bitcoin Price Index (BPI).

Dollar-denominated markets hit a low of $372.73. BPI data shows that the declines began on Tuesday, accelerating as the week progressed.

At press time, USD markets are reporting an average price of$371.45.

The declines came amid a frenzied media response to the much-discussed exit of BitcoinJ developer Mike Hearn from the bitcoin project in which 30 media outlets seized on his claims the still-operating network had 'failed'.

Today also saw claims from embattled digital currency exchange Cryptsy that it has been insolvent since 2014 after a hack resulted in the theft of millions of dollars worth of bitcoin, adding to a negative media outlook.

Chinese markets fell as well, though not as precipitously, declining by 11%, according to the CoinDesk CNY BPI to hit a low of ¥2,532.73.

At press time, CNY markets are reporting an average price of ¥2,511.7.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin Fall Extends to 25% as Fears of Crypto Crackdown Linger

Bitcoin Loses 50% Since December

January’s cryptocurrency selloff got fresh impetus on Tuesday when Bitcoin slumped as much as 25 percent, as the prospect of regulatory crackdowns appeared to spread.

While the largest digital coin was down 25 percent at $10,338 as of 4:37 p.m. in New York, it was still at the lowest level since early December, according to composite pricing on Bloomberg. As Bitcoin halted its two-day rally, rival cryptocurrencies also tumbled. Ripple sank as much as 40 percent and Ethereum dropped 26 percent.

Speculators across the globe are struggling to determine when or how market watchdogs may rein in an industry that’s decentralized and derives much of its value from anonymous ownership. Many assertions that digital coins represent a bubble have triggered double-digit selloffs over the past year, only to be followed by rebounds.

In South Korea, shutting down cryptocurrency exchanges is still an option, Finance Minister Kim Dong-yeon said in an interview with TBS radio. But measures first need “serious” discussion among ministries, Kim added, holding out hope for traders that a crackdown won’t go that far. Kim said there’s irrational speculation and that rational regulation was

needed.

“The finance minister made it clear they’re definitely considering banning crypto trading -- and it’s probably the third-largest market,” said Neil Wilson, senior market analyst in London for online trading platform ETX Capital. “The news is hitting prices and broader sentiment, and it follows China’s move to shutter mines.”

China, which first began targeting the industry last year, is escalating its clampdown on cryptocurrency trading, particularly online platforms and mobile apps that offer exchange-like services, according to people familiar with the matter.

“We’ve heard reports that South Korea, China and Japan have considered a shared approach, a path, to regulation,” ETX’s Wilson said, also citing a challenge to digital coins from a bill in the U.S Senate. “It looks like the light touch that has allowed the crypto-boom to explode may be coming to an end,” he wrote in a note to investors.

Lower-than-normal trading in Korea and Japan may have exaggerated the moves in Asia hours on Tuesday, said Mati Greenspan, senior market analyst for the eToro currency platform.

Bitcoin trading using the Korean won was about 3.3 percent of the total among major currencies, compared with more than 10 percent reached on several days over the past two weeks, according to cryptocompare.com data.

Steven Maijoor, chairman of the European Securities and Markets Authority, said investors “should be prepared to lose all their money” in Bitcoin, in a Bloomberg TV interview in Hong Kong. “It has an extremely volatile value, which undermines its use as a currency,” he said. “It’s also not broadly accepted.”

For more on cryptocurrencies, check out the Decrypted podcast:

The ESMA warned retail investors against initial coin offerings in November and is monitoring developments in cryptocurrencies, Maijoor said.

Bitcoin May Fall By a Third in 2018: Study

Bitcoin, the world's largest digital currency by market capitalization, could see that value cut by nearly 40% as the cryptocurrency continues its fall from record highs reached last year, according to two Swiss researchers.

At a price of $7,327.15 as of 15:21 UTC on Tuesday, bitcoin has gained 540% over the last 12 months despite a 63% dip from its mid-December high near $20,000. (See also: NVIDIA Burned on Plummeting Crypto-Prices, Analysts at Odds.)

The highly volatile digital currency is overvalued and should suffer more steep price swings, according to Spencer Wheatley and Didier Sornette, both professors of entrepreneurial risks at ETH Zurich. The two wrote a paper dated March 16 citing Metcalfe's law, which indicates that the value of a network is proportional to the square of its number of users. By a generalization of that principle, the professors expect bitcoin's market value to plummet to $77 billion or lower, compared to its current near $125 billion.

Beware an 'Increasingly Unstable State'

As the growth of of new active bitcoin users slows, Metcalfe's law suggests that the cryptocurrency's market capitalization will also decelerate, wrote the researchers. The paper, which was recently highlighted by the MIT Technology Review, also included "Log-Period Power Law Singularity," a mathematical model for analyzing speculative bubbles. Wheatley and Sornette found four distinct bitcoin bubbles that corresponded to the model and "were followed by crashes or strong corrections," including South Korean regulators' threat to shut down crypto-exchanges and dating back to a 2011 hack at the now-defunct Mt. Gox bitcoin exchange.

While bitcoin bulls see prices recovering as fears ease regarding heightened regulation around the world, championing the idea that blockchain technology will transform the world, the academic researchers contend that a mathematical analysis signals the contrary.

"Looking forward, our analysis identifies a substantial but not unprecedented overvaluation in the price of bitcoin, suggesting many months of volatile sideways bitcoin prices ahead (from the time of writing, March 2018)," read the paper. "We emphasize that one should not focus on the instantaneous and rather unpredictable trigger itself, but monitor the increasingly unstable state of the bubbly market, and prepare for a correction." (See also: Bitcoin Will Become World’s ‘Single Currency’: Dorsey.)

Frequently Asked Questions

Find answers to recurring questions and myths about Bitcoin.

Table of contents

What is Bitcoin?

Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, Bitcoin is pretty much like cash for the Internet. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence.

Who created Bitcoin?

Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in 1998 by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. The first Bitcoin specification and proof of concept was published in 2009 in a cryptography mailing list by Satoshi Nakamoto. Satoshi left the project in late 2010 without revealing much about himself. The community has since grown exponentially with many developers working on Bitcoin.

Satoshi's anonymity often raised unjustified concerns, many of which are linked to misunderstanding of the open-source nature of Bitcoin. The Bitcoin protocol and software are published openly and any developer around the world can review the code or make their own modified version of the Bitcoin software. Just like current developers, Satoshi's influence was limited to the changes he made being adopted by others and therefore he did not control Bitcoin. As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper.

Who controls the Bitcoin network?

Nobody owns the Bitcoin network much like no one owns the technology behind email. Bitcoin is controlled by all Bitcoin users around the world. While developers are improving the software, they can't force a change in the Bitcoin protocol because all users are free to choose what software and version they use. In order to stay compatible with each other, all users need to use software complying with the same rules. Bitcoin can only work correctly with a complete consensus among all users. Therefore, all users and developers have a strong incentive to protect this consensus.

How does Bitcoin work?

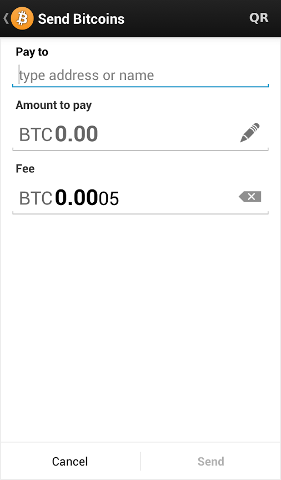

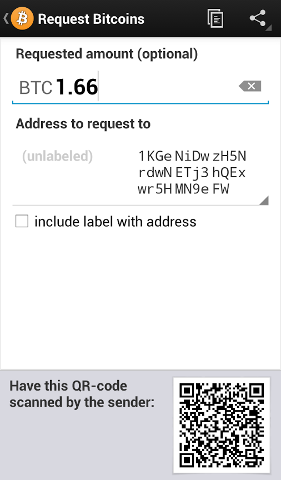

From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. This is how Bitcoin works for most users.

Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This is often called "mining". To learn more about Bitcoin, you can consult the dedicated page and the original paper.

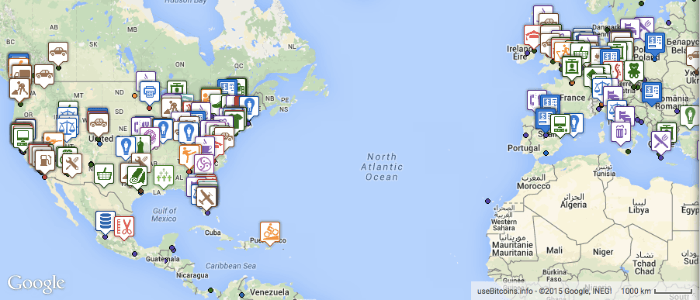

Is Bitcoin really used by people?

Yes. There are a growing number of businesses and individuals using Bitcoin. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Overstock.com, and Reddit. While Bitcoin remains a relatively new phenomenon, it is growing fast. At the end of April 2017, the total value of all existing bitcoins exceeded 20 billion US dollars, with millions of dollars worth of bitcoins exchanged daily.

How does one acquire bitcoins?

- As payment for goods or services.

- Purchase bitcoins at a Bitcoin exchange.

- Exchange bitcoins with someone near you.

- Earn bitcoins through competitive mining.

While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. This is due to cases where someone buys bitcoins with PayPal, and then reverses their half of the transaction. This is commonly referred to as a chargeback.

How difficult is it to make a Bitcoin payment?

Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. Payments are made from a wallet application, either on your computer or smartphone, by entering the recipient's address, the payment amount, and pressing send. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology.

What are the advantages of Bitcoin?

- Payment freedom - It is possible to send and receive bitcoins anywhere in the world at any time. No bank holidays. No borders. No bureaucracy. Bitcoin allows its users to be in full control of their money.

- Choose your own fees - There is no fee to receive bitcoins, and many wallets let you control how large a fee to pay when spending. Higher fees can encourage faster confirmation of your transactions. Fees are unrelated to the amount transferred, so it's possible to send 100,000 bitcoins for the same fee it costs to send 1 bitcoin. Additionally, merchant processors exist to assist merchants in processing transactions, converting bitcoins to fiat currency and depositing funds directly into merchants' bank accounts daily. As these services are based on Bitcoin, they can be offered for much lower fees than with PayPal or credit card networks.

- Fewer risks for merchants - Bitcoin transactions are secure, irreversible, and do not contain customers’ sensitive or personal information. This protects merchants from losses caused by fraud or fraudulent chargebacks, and there is no need for PCI compliance. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. The net results are lower fees, larger markets, and fewer administrative costs.

- Security and control - Bitcoin users are in full control of their transactions; it is impossible for merchants to force unwanted or unnoticed charges as can happen with other payment methods. Bitcoin payments can be made without personal information tied to the transaction. This offers strong protection against identity theft. Bitcoin users can also protect their money with backup and encryption.

- Transparent and neutral - All information concerning the Bitcoin money supply itself is readily available on the block chain for anybody to verify and use in real-time. No individual or organization can control or manipulate the Bitcoin protocol because it is cryptographically secure. This allows the core of Bitcoin to be trusted for being completely neutral, transparent and predictable.

What are the disadvantages of Bitcoin?

- Degree of acceptance - Many people are still unaware of Bitcoin. Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects.

- Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Therefore, relatively small events, trades, or business activities can significantly affect the price. In theory, this volatility will decrease as Bitcoin markets and the technology matures. Never before has the world seen a start-up currency, so it is truly difficult (and exciting) to imagine how it will play out.

- Ongoing development - Bitcoin software is still in beta with many incomplete features in active development. New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses. Some of these are still not ready for everyone. Most Bitcoin businesses are new and still offer no insurance. In general, Bitcoin is still in the process of maturing.

Why do people trust Bitcoin?

Much of the trust in Bitcoin comes from the fact that it requires no trust at all. Bitcoin is fully open-source and decentralized. This means that anyone has access to the entire source code at any time. Any developer in the world can therefore verify exactly how Bitcoin works. All transactions and bitcoins issued into existence can be transparently consulted in real-time by anyone. All payments can be made without reliance on a third party and the whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking. No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted.

Can I make money with Bitcoin?

You should never expect to get rich with Bitcoin or any emerging technology. It is always important to be wary of anything that sounds too good to be true or disobeys basic economic rules.

Bitcoin is a growing space of innovation and there are business opportunities that also include risks. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Investing time and resources on anything related to Bitcoin requires entrepreneurship. There are various ways to make money with Bitcoin such as mining, speculation or running new businesses. All of these methods are competitive and there is no guarantee of profit. It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project.

Is Bitcoin fully virtual and immaterial?

Bitcoin is as virtual as the credit cards and online banking networks people use everyday. Bitcoin can be used to pay online and in physical stores just like any other form of money. Bitcoins can also be exchanged in physical form such as the Denarium coins, but paying with a mobile phone usually remains more convenient. Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by anybody. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual.

Is Bitcoin anonymous?

Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any other form of money. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. The use of Bitcoin leaves extensive public records. Various mechanisms exist to protect users' privacy, and more are in development. However, there is still work to be done before these features are used correctly by most Bitcoin users.

Some concerns have been raised that private transactions could be used for illegal purposes with Bitcoin. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems. Bitcoin cannot be more anonymous than cash and it is not likely to prevent criminal investigations from being conducted. Additionally, Bitcoin is also designed to prevent a large range of financial crimes.

What happens when bitcoins are lost?

When a user loses his wallet, it has the effect of removing money out of circulation. Lost bitcoins still remain in the block chain just like any other bitcoins. However, lost bitcoins remain dormant forever because there is no way for anybody to find the private key(s) that would allow them to be spent again. Because of the law of supply and demand, when fewer bitcoins are available, the ones that are left will be in higher demand and increase in value to compensate.

Can Bitcoin scale to become a major payment network?

The Bitcoin network can already process a much higher number of transactions per second than it does today. It is, however, not entirely ready to scale to the level of major credit card networks. Work is underway to lift current limitations, and future requirements are well known. Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. For more details, see the Scalability page on the Wiki.

Is Bitcoin legal?

To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. However, some jurisdictions (such as Argentina and Russia) severely restrict or ban foreign currencies. Other jurisdictions (such as Thailand) may limit the licensing of certain entities such as Bitcoin exchanges.

Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. For example, the Financial Crimes Enforcement Network (FinCEN), a bureau in the United States Treasury Department, issued non-binding guidance on how it characterizes certain activities involving virtual currencies.

Is Bitcoin useful for illegal activities?

Bitcoin is money, and money has always been used both for legal and illegal purposes. Cash, credit cards and current banking systems widely surpass Bitcoin in terms of their use to finance crime. Bitcoin can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks.

Bitcoin is designed to be a huge step forward in making money more secure and could also act as a significant protection against many forms of financial crime. For instance, bitcoins are completely impossible to counterfeit. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. Bitcoin transactions are irreversible and immune to fraudulent chargebacks. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures.

Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. However, these features already exist with cash and wire transfer, which are widely used and well-established. The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Bitcoin is not likely to prevent criminal investigations from being conducted. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. The Internet is a good example among many others to illustrate this.

Can Bitcoin be regulated?

The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. However, there is no guarantee that they could retain this power since this requires to invest as much than all other miners in the world.

It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country. Bitcoin use could also be made difficult by restrictive regulations, in which case it is hard to determine what percentage of users would keep using the technology. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses.

What about Bitcoin and taxes?

Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. There is a wide variety of legislation in many different jurisdictions which could cause income, sales, payroll, capital gains, or some other form of tax liability to arise with Bitcoin.

What about Bitcoin and consumer protection?

Bitcoin is freeing people to transact on their own terms. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. This allows innovative dispute mediation services to be developed in the future. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. As opposed to cash and other payment methods, Bitcoin always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices.

It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. The way Bitcoin works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant.

How are bitcoins created?

New bitcoins are generated by a competitive and decentralized process called "mining". This process involves that individuals are rewarded by the network for their services. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange.

The Bitcoin protocol is designed in such a way that new bitcoins are created at a fixed rate. This makes Bitcoin mining a very competitive business. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. No central authority or developer has any power to control or manipulate the system to increase their profits. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow.

Bitcoins are created at a decreasing and predictable rate. The number of new bitcoins created each year is automatically halved over time until bitcoin issuance halts completely with a total of 21 million bitcoins in existence. At this point, Bitcoin miners will probably be supported exclusively by numerous small transaction fees.

Why do bitcoins have value?

Bitcoins have value because they are useful as a form of money. Bitcoin has the characteristics of money (durability, portability, fungibility, scarcity, divisibility, and recognizability) based on the properties of mathematics rather than relying on physical properties (like gold and silver) or trust in central authorities (like fiat currencies). In short, Bitcoin is backed by mathematics. With these attributes, all that is required for a form of money to hold value is trust and adoption. In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. As with all currency, bitcoin's value comes only and directly from people willing to accept them as payment.

What determines bitcoin’s price?

The price of a bitcoin is determined by supply and demand. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. Because Bitcoin is still a relatively small market compared to what it could be, it doesn't take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile.

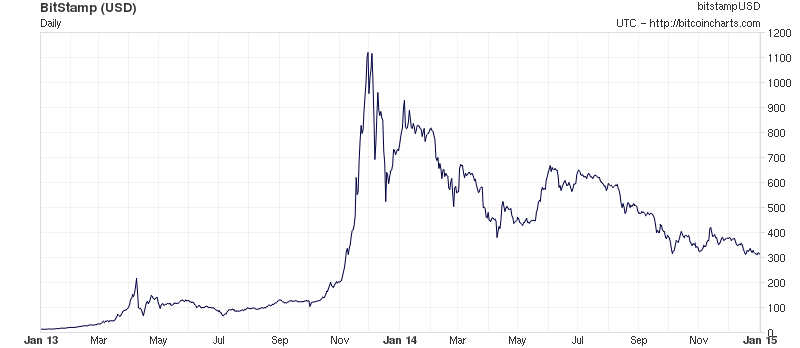

Bitcoin price over time:

Can bitcoins become worthless?

Yes. History is littered with currencies that failed and are no longer used, such as the German Mark during the Weimar Republic and, more recently, the Zimbabwean dollar. Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. As a basic rule of thumb, no currency should be considered absolutely safe from failures or hard times. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. However, no one is in a position to predict what the future will be for Bitcoin.

Is Bitcoin a bubble?

A fast rise in price does not constitute a bubble. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. Reasons for changes in sentiment may include a loss of confidence in Bitcoin, a large difference between value and price not based on the fundamentals of the Bitcoin economy, increased press coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and greed.

Is Bitcoin a Ponzi scheme?

A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money, or the money paid by subsequent investors, instead of from profit earned by the individuals running the business. Ponzi schemes are designed to collapse at the expense of the last investors when there is not enough new participants.

Bitcoin is a free software project with no central authority. Consequently, no one is in a position to make fraudulent representations about investment returns. Like other major currencies such as gold, United States dollar, euro, yen, etc. there is no guaranteed purchasing power and the exchange rate floats freely. This leads to volatility where owners of bitcoins can unpredictably make or lose money. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses.

Doesn't Bitcoin unfairly benefit early adopters?

Some early adopters have large numbers of bitcoins because they took risks and invested time and resources in an unproven technology that was hardly used by anyone and that was much harder to secure properly. Many early adopters spent large numbers of bitcoins quite a few times before they became valuable or bought only small amounts and didn't make huge gains. There is no guarantee that the price of a bitcoin will increase or drop. This is very similar to investing in an early startup that can either gain value through its usefulness and popularity, or just never break through. Bitcoin is still in its infancy, and it has been designed with a very long-term view; it is hard to imagine how it could be less biased towards early adopters, and today's users may or may not be the early adopters of tomorrow.

Won't the finite amount of bitcoins be a limitation?

Bitcoin is unique in that only 21 million bitcoins will ever be created. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,000,000 bits in 1 bitcoin. Bitcoins can be divided up to 8 decimal places (0.000 000 01) and potentially even smaller units if that is ever required in the future as the average transaction size decreases.

Won't Bitcoin fall in a deflationary spiral?

The deflationary spiral theory says that if prices are expected to fall, people will move purchases into the future in order to benefit from the lower prices. That fall in demand will in turn cause merchants to lower their prices to try and stimulate demand, making the problem worse and leading to an economic depression.

Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. Consumer electronics is one example of a market where prices constantly fall but which is not in depression. Similarly, the value of bitcoins has risen over time and yet the size of the Bitcoin economy has also grown dramatically along with it. Because both the value of the currency and the size of its economy started at zero in 2009, Bitcoin is a counterexample to the theory showing that it must sometimes be wrong.

Notwithstanding this, Bitcoin is not designed to be a deflationary currency. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. The only time the quantity of bitcoins in circulation will drop is if people carelessly lose their wallets by failing to make backups. With a stable monetary base and a stable economy, the value of the currency should remain the same.

Isn't speculation and volatility a problem for Bitcoin?

This is a chicken and egg situation. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. For a large scale economy to develop, businesses and users will seek for price stability.

Fortunately, volatility does not affect the main benefits of Bitcoin as a payment system to transfer money from point A to point B. It is possible for businesses to convert bitcoin payments to their local currency instantly, allowing them to profit from the advantages of Bitcoin without being subjected to price fluctuations. Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited.

What if someone bought up all the existing bitcoins?

Only a fraction of bitcoins issued to date are found on the exchange markets for sale. Bitcoin markets are competitive, meaning the price of a bitcoin will rise or fall depending on supply and demand. Additionally, new bitcoins will continue to be issued for decades to come. Therefore even the most determined buyer could not buy all the bitcoins in existence. This situation isn't to suggest, however, that the markets aren't vulnerable to price manipulation; it still doesn't take significant amounts of money to move the market price up or down, and thus Bitcoin remains a volatile asset thus far.

What if someone creates a better digital currency?

That can happen. For now, Bitcoin remains by far the most popular decentralized virtual currency, but there can be no guarantee that it will retain that position. There is already a set of alternative currencies inspired by Bitcoin. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Bitcoin could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol.

Transactions

Why do I have to wait for confirmation?

Receiving notification of a payment is almost instant with Bitcoin. However, there is a delay before the network begins to confirm your transaction by including it in a block. A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property. Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. If the transaction pays too low a fee or is otherwise atypical, getting the first confirmation can take much longer. Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction.

How much will the transaction fee be?

Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. Although fees may increase over time, normal fees currently only cost a tiny amount. By default, all Bitcoin wallets listed on Bitcoin.org add what they think is an appropriate fee to your transactions; most of those wallets will also give you chance to review the fee before sending the transaction.

Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. The precise manner in which fees work is still being developed and will change over time. Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. Instead, the fee is relative to the number of bytes in the transaction, so using multisig or spending multiple previously-received amounts may cost more than simpler transactions. If your activity follows the pattern of conventional transactions, you won't have to pay unusually high fees.

What if I receive a bitcoin when my computer is powered off?

This works fine. The bitcoins will appear next time you start your wallet application. Bitcoins are not actually received by the software on your computer, they are appended to a public ledger that is shared between all the devices on the network. If you are sent bitcoins when your wallet client program is not running and you later launch it, it will download blocks and catch up with any transactions it did not already know about, and the bitcoins will eventually appear as if they were just received in real time. Your wallet is only needed when you wish to spend bitcoins.

What does "synchronizing" mean and why does it take so long?

Long synchronization time is only required with full node clients like Bitcoin Core. Technically speaking, synchronizing is the process of downloading and verifying all previous Bitcoin transactions on the network. For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be aware of all previous transactions. This step can be resource intensive and requires sufficient bandwidth and storage to accommodate the full size of the block chain. For Bitcoin to remain secure, enough people should keep using full node clients because they perform the task of validating and relaying transactions.

What is Bitcoin mining?

Mining is the process of spending computing power to process transactions, secure the network, and keep everyone in the system synchronized together. It can be perceived like the Bitcoin data center except that it has been designed to be fully decentralized with miners operating in all countries and no individual having control over the network. This process is referred to as "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. Unlike gold mining, however, Bitcoin mining provides a reward in exchange for useful services required to operate a secure payment network. Mining will still be required after the last bitcoin is issued.

How does Bitcoin mining work?

Anybody can become a Bitcoin miner by running software with specialized hardware. Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions. Bitcoin miners perform this work because they can earn transaction fees paid by users for faster transaction processing, and newly created bitcoins issued into existence according to a fixed formula.

For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per second. This requires miners to perform these calculations before their blocks are accepted by the network and before they are rewarded. As more people start to mine, the difficulty of finding valid blocks is automatically increased by the network to ensure that the average time to find a block remains equal to 10 minutes. As a result, mining is a very competitive business where no individual miner can control what is included in the block chain.

The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. This makes it exponentially difficult to reverse previous transactions because this requires the recalculation of the proofs of work of all the subsequent blocks. When two blocks are found at the same time, miners work on the first block they receive and switch to the longest chain of blocks as soon as the next block is found. This allows mining to secure and maintain a global consensus based on processing power.

Bitcoin miners are neither able to cheat by increasing their own reward nor process fraudulent transactions that could corrupt the Bitcoin network because all Bitcoin nodes would reject any block that contains invalid data as per the rules of the Bitcoin protocol. Consequently, the network remains secure even if not all Bitcoin miners can be trusted.

Isn't Bitcoin mining a waste of energy?

Spending energy to secure and operate a payment system is hardly a waste. Like any other payment service, the use of Bitcoin entails processing costs. Services necessary for the operation of currently widespread monetary systems, such as banks, credit cards, and armored vehicles, also use a lot of energy. Although unlike Bitcoin, their total energy consumption is not transparent and cannot be as easily measured.

Bitcoin mining has been designed to become more optimized over time with specialized hardware consuming less energy, and the operating costs of mining should continue to be proportional to demand. When Bitcoin mining becomes too competitive and less profitable, some miners choose to stop their activities. Furthermore, all energy expended mining is eventually transformed into heat, and the most profitable miners will be those who have put this heat to good use. An optimally efficient mining network is one that isn't actually consuming any extra energy. While this is an ideal, the economics of mining are such that miners individually strive toward it.

How does mining help secure Bitcoin?

Mining creates the equivalent of a competitive lottery that makes it very difficult for anyone to consecutively add new blocks of transactions into the block chain. This protects the neutrality of the network by preventing any individual from gaining the power to block certain transactions. This also prevents any individual from replacing parts of the block chain to roll back their own spends, which could be used to defraud other users. Mining makes it exponentially more difficult to reverse a past transaction by requiring the rewriting of all blocks following this transaction.

What do I need to start mining?

In the early days of Bitcoin, anyone could find a new block using their computer's CPU. As more and more people started mining, the difficulty of finding new blocks increased greatly to the point where the only cost-effective method of mining today is using specialized hardware. You can visit BitcoinMining.com for more information.

Is Bitcoin secure?

The Bitcoin technology - the protocol and the cryptography - has a strong security track record, and the Bitcoin network is probably the biggest distributed computing project in the world. Bitcoin's most common vulnerability is in user error. Bitcoin wallet files that store the necessary private keys can be accidentally deleted, lost or stolen. This is pretty similar to physical cash stored in a digital form. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss.

Hasn't Bitcoin been hacked in the past?

The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. However, security flaws have been found and fixed over time in various software implementations. Like any other form of software, the security of Bitcoin software depends on the speed with which problems are found and fixed. The more such issues are discovered, the more Bitcoin is gaining maturity.

There are often misconceptions about thefts and security breaches that happened on diverse exchanges and businesses. Although these events are unfortunate, none of them involve Bitcoin itself being hacked, nor imply inherent flaws in Bitcoin; just like a bank robbery doesn't mean that the dollar is compromised. However, it is accurate to say that a complete set of good practices and intuitive security solutions is needed to give users better protection of their money, and to reduce the general risk of theft and loss. Over the course of the last few years, such security features have quickly developed, such as wallet encryption, offline wallets, hardware wallets, and multi-signature transactions.

Could users collude against Bitcoin?

It is not possible to change the Bitcoin protocol that easily. Any Bitcoin client that doesn't comply with the same rules cannot enforce their own rules on other users. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. Therefore, it is not possible to generate uncontrolled amounts of bitcoins out of thin air, spend other users' funds, corrupt the network, or anything similar.

However, powerful miners could arbitrarily choose to block or reverse recent transactions. A majority of users can also put pressure for some changes to be adopted. Because Bitcoin only works correctly with a complete consensus between all users, changing the protocol can be very difficult and requires an overwhelming majority of users to adopt the changes in such a way that remaining users have nearly no choice but to follow. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money.

Is Bitcoin vulnerable to quantum computing?

Yes, most systems relying on cryptography in general are, including traditional banking systems. However, quantum computers don't yet exist and probably won't for a while. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. Given the importance that this update would have, it can be safely expected that it would be highly reviewed by developers and adopted by all Bitcoin users.

I'd like to learn more. Where can I get help?

You can find more information and help on the resources and community pages or on the Wiki FAQ.

Bitcoin Price Fall: Investors Hold, Saying Cryptocurrency Crash Is a ‘Yearly Pattern’

The price of bitcoin and other major cryptocurrencies has fallen significantly over the past 24 hours amid fears of regulator clampdowns, continuing an annual trend that has seen bitcoin’s price consistently crash in mid-January.

Bitcoin’s price fell to as low as $10,105 on Wednesday, according to the CoinDesk Price Index, but has since rebounded to $10,283. At its peak in December last year, one bitcoin was worth almost $20,000.

The dramatic fall comes as some investors look to cash in on the significant gains, though others are choosing to hold on to the virtual currency, citing similar price falls at the start of recent years.

When the price of bitcoin fell in mid-January last year, the cryptocurrency’s price recovered to record levels. Other major cryptocurrencies—like ethereum, litecoin and ripple—have followed a similar pattern.

Each price fall comes at times of uncertainty for cryptocurrencies, usually involving government crackdowns on regulations surrounding trading. The latest comes as reports in South Korea and China suggest the two countries are considering a ban on trading.

Some of the largest cryptocurrency exchanges are based in South Korea, with the country representing the world’s third-biggest market for bitcoin trades. However, it is unclear what exactly a government crackdown would involve.

Proposals for greater government regulation have already been met with resistance in South Korea, with more than 200,000 people signing an online petition to allow the “happy dreams” of cryptocurrency traders in the country to be left alone.

Meanwhile, in China, a report in the state-run Securities Times—speculating that Chinese authorities may soon start targeting local traders with tougher regulations—may have also contributed to the recent price fall.

In an interview with Newsweek last month, bitcoin expert and former COO of Skype Michael Jackson dismissed speculation that the cryptocurrency’s bubble had burst, pointing out that previous bitcoin price crashes resulted in a complete rebound.

“We’ve seen price falls like this before, and when you look back on them now, you’ll see they weren’t part of a bubble, just a blip,” Jackson said on December 22, when bitcoin’s price was around $12,800. “At its core it is still an international payment mechanism and a store of value—that doesn’t change with speculation.”

Jackson, like other cryptocurrency analysts, believes bitcoin’s upper limit may still be well above the $20,000 peak it hit in 2017, saying that it could be worth “100 times what it is today.”

Bitcoin fall

Bitcoin Will Fall To $1,000

Jan. 25, 2018 1:27 PM • btc-usd

Summary

Bitcoin has already dropped 50% from its high just a few short weeks ago; it will continue to drop.

The Bitcoin crash will bring down all cryptocurrency and blockchain related investments.

After the crash and consolidation period, the best uses of cryptocurrency and blockchain technology will rise.

Introduction

Bitcoin's rapid rise in the second half of 2017 has caused it to not only become a topic of worldwide discussion but has also caused some people to throw their entire life savings into the cryptocurrency market. The fear of missing out has people mortgaging their house to buy Bitcoin.

But what exactly is the use of Bitcoin?

Bitcoin - Currency or Commodity?

Bitcoin is simply not useful for common transactions and is already being removed from many payment processors, like Stripe, as it is too slow and costs too much in fees.

The most obvious way to see this as true is to just read this article, which states that the 2018 North American Bitcoin Conference in Miami has stopped accepting Bitcoin as an option for ticket purchases

Bitcoin's obsolete code can only allow a maximum of 7 transactions per second. Compare that to a coin with better coding, EOS, which can handle 50,000 per second or a legacy network such as Visa's (V) which can handle 56,000.

Attempts at increasing the Bitcoin network have failed. The Segwit code was announced to much hype back in August of 2017, but it failed to be adopted.

Now we have a new scheme, called Lightning, which is another endeavor to fix Bitcoin by taking the transactions off the main chain and bundling them up before putting them back on to the main chain. These bundles could hold many transactions, but only be counted as one thereby lessening the load. Many users do not like this idea because the whole point is to keep all transactions on the main chain for accountability.

It is all just tinkering with a network that has these large inherent problems is akin to putting a band-aid on a broken leg.

If it is not used as a currency, could Bitcoin be used as a store of value - a digital gold?

If Bitcoin is just being held and rarely exchanged, then the network speed and cost is much less of an issue.

But what would the value be in this situation? Surely, the price would stabilize slightly above the cost of creation.

This article did the math and calculated that the cheapest production cost of Bitcoin in the United States is in Louisiana - $3,224.

Manitoba, Canada, has caught the eye of Chinese miners after China has clamped down on cryptocurrency mining operations. Manitoba has an electricity price of 3.94 cents per Kwh, half of Louisiana's.

18 months ago, cloud mining company Genesis said that it cost it $400 plus overhead to mine one Bitcoin. Costs have only gone up since then.

Putting these numbers together and we can reasonably calculate a current production cost of $800-1,800 per Bitcoin in the most favorable areas of the world.

As a digital commodity asset, it might find support in a range of $1-2K.

Crash - The "Crypocalypse"

There are two ways this can go.

The unlikely way is that the price of Bitcoin continues to escalate and more mining rigs are added as the profit margin is high. This spirals upward until Bitcoin reaches $1 million when the mining process consumes the entire world's energy output.

That or people realize that Bitcoin is actually not very useful or special at all. Other faster and cheaper options exist.

This causes the price of Bitcoin to decrease slowly and then all at once as people run for the exits (7 at a time please) and hitting a level between 1,000 and 2,000 USD. Unprofitable mining operations shut down, leaving only the lowest cost producers running the show.

Which way seems more likely?

Add in the very questionable actions by Tether Limited, as discussed in this Seeking Alpha article, which claims that Tether cryptocurrency is being artificially created to purchase Bitcoin and prop up the price. The author states when the fraud is discovered, it will bring down Bitcoin.

That article was published on December 4th and the supply of Tether has doubled since then.

Signs point to the good times being over; the future does not bode well for Bitcoin at current prices.

Prices have already dropped by 50% since the high. The upcoming Bitcoin crash will cause the entire cryptocurrency market to go down with it.

The damage will spill over to the stock market. Cryptocurrency mining stocks will be devastated. Even blockchain technology companies, like BTL Group (OTCPK:BTLLF), that have no link to cryptocurrency will see their share prices decrease during the crash.

Rise of Utility Competitors

But from the ashes of the crypocalypse rise the cryptocurrencies with the most useful characteristics and much fewer energy costs.

The crash is a good thing. The hollow coins created by scam artists to get rich quick and those with no use or utility need to disappear. The cryptocurrencies that provide utility need to be separated from the masses of worthless tokens.

Some of the best ones with plenty of utility are ETH, EOS, NEO, and STEEM. IOTA might find a space of its own too. Other tokens will fill specific niches. Monero and Verge coins could compete for the anonymous transactions market, for example.

Less energy intensive proof of stake tokens take the cryptocurrency reigns over those requiring proof of work.

The cryptocurrency field will belong to coins and tokens that can have applications built upon their network.

STEEM is very interesting as it has created its own social network ecosystem, complete with different apps all using the same blockchain. STEEM blockchain clones of YouTube, Twitter, Instagram, and the original blogging page, Steemit.com, all reward the content creator with STEEM coins based off a community consensus of value by "liking" or upvoting the content they enjoy.

To only use Blockchain technology as a speculative trading instrument is the lowest-level use. Look for more innovative cryptocurrency reward applications like this in the future.

Additionally, money has been thrown at ICOs with moonshot promises and little chance at delivering. However, while most of these will fail, we might see a small percentage succeed that otherwise would never have been funded without this massive hype.

Another area in its infancy is in national cryptocurrencies. Fiat money, already mostly in the electronic realm, will become cryptocurrencies as central banks transition national currencies to the blockchain. The common person will be able to transfer money between accounts in mere seconds instead of days. ACH transfers and the like will no longer be used.

It will be the money for the digital future, much like what payment processor QIWI (QIWI) is likely creating in Russia for the newly announced cryptoruble that uses the underlying Ethereum technology. Money that is both a currency and a platform for integrated digital economies.

In the future, Bitcoin becomes a somewhat of a relic but is traded between die-hard believers who pray for the day it returns to glory.

Conclusion

Bitcoin, like any technology, is now obsolete and is already well on its way towards $1,000 where it was trading only one year ago. That is the true price of a rational consensus before mass speculation sent it into the stratosphere.

It failed as a currency but will stick around as an asset and the crash will bring down the entire cryptocurrency market.

The crash will also ruin those who went all-in too late and many people might never return to this market that burned them so intensely.

You can already see this with the collapse of the Ponzi scheme Bitconnect which had promised large daily gains. It closed up shop the other week and thousands of people found out their tokens had dropped in value by 80%+ in a few hours. The Bitconnect subreddit was filled with posts about how they have lost everything and even their spouse wants a divorce.

What really hits the point of a cryptocurrency bubble is that these worthless Bitconnect tokens are continuing to be traded and it still has a market cap of over $120 million.

However, cryptocurrency is here to stay.

The crash will be good for the health of the technology going forward. It will cleanse the fragmented market by reducing weak cryptocurrencies to zero or near enough to be irrelevant. After a consolidation period of undetermined length, the stronger cryptocurrencies will begin to rise again.

I am in no way against cryptocurrencies or blockchain technology. In fact, I will be watching and waiting for the time to buy in again. I am also grateful that Bitcoin pioneered the mass adoption of this technology.

But everything has a cycle. A boom and bust.

No matter how excited you are about a new investment, it is important to not get caught up in the hype and then buy in at an unreasonable price. It is also important to know when to sell.

Hardcore Bitcoin believers will shout that it is "not a bubble" and that "this time is different."

Комментариев нет:

Отправить комментарий