Bitcoins for dummies PDF

One thing we have yet to really do on our site, is to promote our bitcoins for dummies pdf (it's really not meant for dummies, but for smart folks who

One thing we have yet to really do on our site, is to promote our bitcoins for dummies pdf (it’s really not meant for dummies, but for smart folks who have yet to study bitcoin as extensively as we have).

Or you can find a free PDF version of the book here

No such thing as a perfect “bitcoins for dummies PDF” book for everyone

You really should head to places like Amazon or Barnes & Noble, and try searching for “bitcoin intro”, or something similar to that. Check through the books, and find one that speaks out to you.

We are obviously biased, but as we are here to help all newbies in the bitcoin space, our encouragement and recommendation stands that you should do your own research and homework (hopefully you still choose our book :).

Most books out there that we have found do not cover the actual investment opportunities there are here in the space.

That’s fine, we do need more and more technical info on bitcoin being made available to everyone, but we wrote our book to fill the niche of people getting into bitcoin to take more control over their own investments. This is one of the most powerful impacts we believe bitcoin can make.

Bitcoin Mining for Dummies: How to Mine Bitcoin

What is Bitcoin Mining?

Bitcoin mining is the validation of transactions that take place on each Bitcoin block. The decentralized nature of Bitcoin means that transactions are broadcasted to the peer-to-peer network and once broadcasted, needs to be verified, confirming that the transaction is valid and then having the transaction recorded on the public transaction database, which is known as the Bitcoin blockchain.

Miners basically are the people involved in the processing and verifying transactions before then recording the transactions on the Bitcoin blockchain.

Miners will then receive transaction fees in the form of newly created Bitcoins.

So, what’s involved in the actual mining process?

Computers are used to include new transactions onto the Bitcoin exchange and while computers will find it relatively easy to complete the verification process, the process becomes more difficult as computer capability becomes more sophisticated with faster processing speeds.

Attempting to get Bitcoin users from around the world to agree on a single version of the transaction is the challenge and it comes down to what is referred to as “proof of work.”

Bitcoin protocol requires those looking to include additional blocks of transactions on the Bitcoin blockchain to provide proof that the user expanded a scarce resource, in the case of mining being the processing power of the computers used for the verification process.

Miners compete with everyone on the peer-to-peer network to earn Bitcoins. The faster the processing power, the more attempts are made by the hardware to attempt to complete the verification, and therefore earning the miner the Bitcoins that are highly sought after along with transaction fees.

The Bitcoin network is self-evolving, to ensure that the time taken for a miner to win a block is steady at approximately 10 minutes.

The speed of processing power in Bitcoin mining is referred to as the hash rate and the processing power is referred to as the hash power of the hardware.

To get slightly more technical and introduce some of the more common terms used in the Cryptoworld, the mining process is where Bitcoin mining hardware runs a cryptographic hashing function on a block header.

For each new hash attempted, the mining software will use different numbers as the random element, the number referred to as the nonce.

Once a proof of work is produced, through the random calculation of nonces until the correct nonce is discovered, a new block is essentially discovered, which is then verified and agreed upon by the peer-to-peer network.

At this stage, the miner is rewarded with a certain number of Bitcoins, currently set at 12.5 coins, though will halve every 210,000 blocks. In addition to the Bitcoins received, the minor will also be awarded the transaction fees paid by users within the successfully mined block, which is of far greater incentive for miners as the number of Bitcoins per block continues to decline.

From Start to Finish: Bundle Transactions, Validation, Proof of Work, Blockchains and the Network

The end to end process can perhaps be best described by the following chart that incorporates the various steps involved from mining to ultimately receiving well-earned Bitcoins and transaction fees:

Bitcoin Mining Step-by-Step

- Verify if transactions are valid.

- Transactions are bundled into a block

- The header of the most recent block is selected and entered into the new block as a hash.

- Proof of work is completed.

- A new block is added to the blockchain and added to the peer-to-peer network.

Proof of Work Step-by-Step

- A new block is proposed.

- A header of the most recent block and nonce are combined and a hash is created.

- A Hash number is generated.

- If the Hash is less than the Target Value the PoW has been solved.

- The miner receives the reward in Bitcoins and transaction fees.

- If the Hash is not less than the Target Value, the calculation is repeated and that takes the process of mining difficulty.

Mining Difficulty Step-by-Step

- More miners join the peer-to-peer network.

- The rate of block creation increases.

- Average mining times reduce.

- Mining difficulty increases.

- The rate of block creation declines.

- Average mining time returns to the ideal average mining time of 10 minutes.

- The cycle continues to repeat at an average 2-week cycle.

What is Bitcoin Cloud Mining?

Bitcoin cloud mining provides a medium to receive newly mined Bitcoins, without the need to own Bitcoin mining hardware or even have any mining ‘knowhow’, allowing the mining world to not only attract the technically minded but a far wider audience, who lack the technical knowledge needed to get into Bitcoin mining.

The Bitcoin novice has certainly embraced the availability of Bitcoin cloud mining, so what’s the difference between Bitcoin mining and cloud mining?

It boils down to the location of the Bitcoin mining hardware. For the Bitcoin miner, the user will buy and set up and maintain the Bitcoin mining rigs, which is not something for the technophobes as sizeable electricity costs also a consideration, mining rigs requiring plenty of ventilation and cooling, not to mention 24-7 processing.

Cloud mining is supported by mining companies setting up the mining rigs at their own facility, with a cloud miner only needing to register and purchase shares or a mining contract. The user doesn’t have to do anything else, with the mining company doing all the work and giving the cloud miner returns on a regular basis. The user essentially buying a proportion of the Bitcoin miners hash power.

One of the major concerns over cloud mining is fraud however, there have been plenty of reports of fraudulent activity, not to mention lower profits and even mining companies having the ability to halt operations if Bitcoin’s price fall below certain levels, so some due diligence on a mining company is recommended, with some basic steps to reduce the risk of being defrauded including:

- No mining address and/or no user selectable pool.

- No ASIC vendor endorsement. If there are no advertisements from the ASIC vendor, the mining company may not even own the hardware.

- No photos of the hardware or data center of the mining company.

- No limit imposed on sales or does not display how much hash rate sold against used in mining.

- Referral programs and social networking. A mining company willing to pay high referral fees should be avoided as these may well be Ponzi schemes.

- Anonymous operators should certainly be avoided…

- No ability to sell your position or get the money out upon sale.

Bitcoin Mining Hardware

Mining hardware has changed since the early days of Bitcoin when Bitcoin was mined with CPUs. However, as miners have continued to use their technical abilities to develop hardware capable of earning at a much greater number of Bitcoins, leaving CPU and laptop users behind, using a laptop is now unlikely to yield a single Bitcoin even if mining for years.

In place of CPUs came Graphic Processing Units (GPUs), as miners found that using high-end graphics cards were far more effective in mining for Bitcoins. The use of GPUs increased mining power by as much as 100x, with significantly less power usage, saving on sizeable electricity bills.

Next came FPGAs, Field Programmable Gate Aray, the improvement here being in the power usage rather than actual mining speed, with mining speeds slower than GPUs, while power consumption fell by as much as 5x.

Power savings led to the evolution of mining farms and the Bitcoin mining industry as it is known today, where Bitcoin mining power is controlled by a mining few more commonly known as the Bitcoin Cartel.

Since FPGAs, the mining community shifted to Application Specific Integrated Circuits (ASICs), where an ASIC is a chip designed for the sole purpose of mining, with no other functional capabilities.

While an ASIC chip has only a single function, it offers 100x more hashing power, while also using significantly less power than had been the case with CPUs, GPUs, and FPGAs.

Evolution of software has slowed, with nothing in the marketplace at present or in development that is expected to replace ASICs, with ASIC chips likely to see minor tweaks at best to try and squeeze out greater efficiencies, though it will only be a matter of time before the Bitcoin world comes up with something newer and faster as miners catch up on hashing power.

What is Proof-of-Work?

Proof of work is also referred to as PoW. All of the blocks in a Bitcoin blockchain have a series of data referred to as nonces, these are meaningless data strings attached to each block of a Bitcoin blockchain.

Mining rigs/computers need to search for the right nonce and, with no simple way in which to find the correct nonce, random computation is used until the correct data string is calculated by the mining rig.

The proof of work is therefore difficult to produce, while considered simple to verify, the production of a proof of work being a random process, requiring mining rigs to calculate as many computations per second as possible so as to increase the probability of producing the proof of work.

It is for this reason that hash rates/hash power are key considerations in the ability of a mining pool being able to deliver reasonable returns on investment.

What is Bitcoin Mining Difficulty?

Bitcoin mining difficulty is the degree of difficulty in finding a given hash below the target during the proof of work.

Bitcoin’s target value is recalculated every 2,016 blocks, with mining difficulty inversely proportional to a target value. As mining difficulty increases, target value declines and vice-versa.

In basic terms, as more miners join the Bitcoin network, the rate of block creation increases, leading to faster mining times. As mining times speed up, mining difficulty is increased, bringing the block creation rate back down to the desired 10 minutes as mentioned previously.

Once the mining difficulty is increased, the average mining time returns to normal and the cycle repeats itself about every 2-weeks.

How Can You Start Mining Bitcoins?

To begin mining and become a node within the peer-to-peer network, and begin creating Bitcoins, all that’s needed is a computer with internet access.

Wallets can be downloaded for free as can miner programs and once downloaded its ready to go.

The reality is that your desktop computer or laptop will just not cut it in the mining world, so the options are to either make a sizeable investment and create a mining rig, or joining a mining pool or even subscribe to a cloud mining service, the latter requiring some degree of due diligence as is the case with any type of investment.

In mining pools, the company running the mining pool charges a fee, whilst mining pools are capable of solving several blocks each day, giving miners who are part of a mining pool instant earnings.

As a minimum, you’ll need a GPU and somewhere cool for the mining hardware with fans set up to keep the hardware cool, with a stable internet connection also a must.

Two GPU manufacturers are Ati Radeon and Nvidia, whilst Radeon cards are considered much better for mining than Nvidia cards. While you can try to mine with GPUs and gaming machines, income is particularly low and miners may, in fact, lose money rather than make it, which leaves the more expensive alternative of dedicated ASICs hardware.

The best ASICs chips on the market that might be essential for Bitcoin mining in consideration of price per hash and electrical efficiency are Antrouter R1, Antminer S9 and BPMC Red Fury USB, Antminer the most expensive with a price tag of $2,264.51.

How Can You Make Money in Bitcoin Mining?

Miners make Bitcoin by finding proof of work and creating blocks, with the current number of Bitcoins the miner receives per block creation standing at 12.5 coins and then the transaction fees for each block, which is approximately 1.5 Bitcoin equivalent in value for each block.

The ASIC mining hardware is estimated to pay for itself in about 15-days, assuming a retail price of just under $2,500 and after that it ultimately boils down to the rate of increase in miners, which then requires greater computing power to be able to maintain the same level of coin creation and receipt of transaction fees.

In a nutshell, if you’re going to try to use a CPU or laptop, mining pools are going to be a possible option and even then you’re not going to be making much if any, as your contribution to the mining pool’s mining power will be limited at best, which leaves you with cloud mining as the only real option unless you’re willing to invest in the hardware and accept the electricity costs that come from all year round mining and that’s before the necessary upgrades and new equipment that is to be expected with overuse.

Can you get rich off the mining process? More likely from the appreciation in Bitcoin value than the mining itself, with a few mining pools accounting for the lion’s share of Bitcoin’s mining power making it difficult for new miners to enter the fray.

While users have looked at the cloud mining option, the real experience is in owning your own mining rig and learning the technology and processes behind Bitcoin mining, something that you wouldn’t experience through cloud mining.

Bitcoin für dummies

Bitcoin for Dummies

What is Bitcoin?

Bitcoin is a form of currency, known as a cryptocurrency, which is similar to the former US “Gold Standard” currency, but operates like its own internet and is the world’s first free market, decentralized global currency. Bitcoins can be exchanged for other currencies, goods or services.

Bitcoin should be thought of in layers since it offers much more than standard currencies.

Where do Bitcoins come from?

Bitcoins are created out of thin-air through an open-source computer mining system similar to a lottery, yielding a commodity like gold.

I’ll now try to explain the key words here “lottery” and “gold” as they relate to Bitcoin mining.

“Lottery” meaning that your computer is basically trying to decipher a a large number before anyone else on the mining network does. Each time your computer gets the string correct before anyone else, a new block is created and 12.5 BTC (currently) is awarded to the miner or pool (group of miners). But this isn’t a normal lottery. This lottery is millions of times more difficult than a normal lottery, thus why miners spend a lot capital on new hardware for mining. Therefore, the faster your system can mine the higher probability you will be rewarded. Rewards for mining a block decrease in half every 4 years making bitcoin finite in creation.

“Gold” meaning only 21,000,000 Bitcoins will ever be created just as only X amount of gold will ever be discovered on Earth. Thus, this form of payment tends to see an opposite affect of that which you are used to. Bitcoins become worth more as time goes on (finite supply) vs. traditional currencies today which lose more value as time goes on (infinite supply; central banks can print money at their discretion, and they do).

How do Bitcoins work?

Bitcoins are bit more different than a standard currency since it has it's own built in transaction system through its mining process. If the dollar, gold and visa had a baby we'd call it Bitcoin.

Bitcoins operates on a open transaction ledger called the 'Blockchain'. All transaction data on the network is recorded on the blockchain. Each time a new block is mined the transaction data held inside that block is added to the blockchain and confirmed. The blockchain is then downloaded by every wallet making it irreversible. All information on the network is encrypted to create anonymity, but this still needs more improvement.

How are Bitcoins stored?

Bitcoins are stored on wallet which essentially serving as their own bank for the user. A wallet program is provided by the Bitcoin network which allows users to transfer bitcoin between one another. Wallets can be stored in a variety of ways:

- online wallet provider

- CPU wallet

- Paper wallet

- Mobile wallet device

- Smartphone apps

- In your brain

Bitcoins are stored on the blockchain so they're essentially like cloud money. Your accessing the rights to them when you exchange them through a wallet or service provider.

How do Bitcoins have a real world value?

As Bitcoins continue to be mined they begin to create more value since more and more people begin to own them. You can kind of think of them as trading cards or beanie babies. The longer you hold onto these things the more value they tend to take on as more and more people begin collecting them. The biggest difference is you can’t take your Babe Ruth rookie card to the car dealership and trade it for a car because it’s not a universal means of exchange like Bitcoins or a credit card. You have to go through the painstaking process of finding a buyer and turning that card into money. Bitcoin itself has consolidated that process.

People worked hard for months or years to mine these things, investing time, hardware, and energy in the process. This is where the initial value of the currency is born, since time and money was used to create them.

Put yourself in the shoes of a miner: you invest time, money and brainpower into mining these coins against thousands of other people around the planet. You’re not just going to give them all away for free. Everyone wants to get their money back from an investment, so people started exchanging Bitcoin for different things including currencies like the US dollar and the Euro. In return this allowed new people outside of the mining ring to collect and exchange Bitcoin, thus the currency began to grow which started to create a networking effect.

Now normal everyday people are exchanging cash for Bitcoins, wondering what the hell can I do with these things?

Why are people investing so much money into Bitcoin?

Because it’s like gold, or more accurately, the gold of the Internet. As long as people trust that this currency has value, people will continue to invest in Bitcoin. Bitcoin is open-source software, so it has no central control with corrupt bankers and politicians, just really smart people working for free to keeping it running.

Given all the problems we see in world economies, people are rapidly beginning to lose faith in conventional legal tender like the EUR and USD. Governments have demonstrated that they can seize your bank-accessible assets if necessary. With Bitcoin, this is not possible as they have no access to your funds. Your Bitcoin wallet is essentially your own bank. It’s similar to the idea of people stuffing cash into their mattresses, except this is a lot more profitable and accessible. People will perhaps one day refer to this era as the gold rush of the 21st century.

Bitcoin or cryptocurrencies are not an easy thing to wrap your head around. Imagine trying to explain the internet to someone who lived in the 70′s, they might think they get it, but without actually experiencing it, they’d never truly understand. So dive in because this idea is spreading and I don’t believe cryptocurrencies like Bitcoin are going anywhere. I’m having a hard time wrapping my head around what the world may be like 5-10 years from now if cryptocurrencies really do take off, but I’m excited for the possibilities.

Whomever Satoshi Nakamoto is, they’re a freaking genius and a humanitarian in my opinion.

For a more technical explanation, see the official PDF on the original whitepaper on Bitcoin here at http://bitcoin.org/bitcoin.pdf . I hope you enjoyed my beginner’s guide to Bitcoin, “Bitcoin for Dummies”. If you liked the tutorial, please upvote!

Where can I buy Bitcoins?

For novice users in the US I'd highly recommend using Coinbase, it offers ACH bank transactions and friendly user interface, its also the most heavily funded Bitcoin company at this point in time. It doesn't work like a typical exchange, but offers a secure method of attaining bitcoin easily and securely online. Use this referral link and we both get free Bitcoin:

Bitcoin For Dummies Cheat Sheet

Bitcoin has gotten a lot of press, and not all of it good. So is it Internet money, an alternative currency, a parallel financial system, a new way of life? The answer is yes, it’s all of those things and more. Start by finding out the basics of what it is, where it came from, what it does. You can buy bitcoins just like you can buy ice cream and concert tickets. But you can’t really keep them under your mattress or in your piggy bank — or your regular bank account, for that matter. In fact, you had better pay some extra attention to securing your bitcoins once you get some. Bitcoins don’t come from any gothic-columned mint, but from a complicated digital calculating process known colorfully as mining.

Bitcoin Basics

Bitcoin is an alternative type of payment system that is sometimes mentioned in the media. Is it “Internet” or “digital” money? Is it a way to conduct business outside the mainstream financial infrastructure? Is it a new way of life that could transform multiple aspects of society in the future? The answer is yes.

Origins: Bitcoin was created by developer Satoshi Nakamoto in 2008.

Purpose: Bitcoin provides a viable decentralized alternative to the current mainstream financial infrastructure.

Method: Bitcoin enables spending with full transparency through a publicly available ledger known as the blockchain.

Security: A bitcoin transaction involves both a public key, which is generally known to everyone, and a private key known only to the bitcoin user. No coins can be spent without knowing the private key.

Buying Bitcoins

To use bitcoins, at some point you actually have to acquire some bitcoins. Unfortunately, doing so is not quite as easy as sticking a card into an ATM. The following are a few of the ways you can get your hands on some bitcoins.

Establish that the platform you are using or the person you are buying from is legitimate, as you would with any other online transaction.

Use an exchange such as Gemini to purchase. You register your details through this trusted exchange, deposit your local currency such as USD or GBP, and then purchase the bitcoin at the current rate of exchange.

Buy in person by purchasing directly in the same way.

Remember that once you have purchased your bitcoin, move them to a location that is in within your control. Don’t store them long-term on an exchange.

Storing Bitcoins

Don’t use exchanges to store your bitcoins for any length of time. Exchange storage is only as secure as the exchange’s security infrastructure, so although many people do use this option, the coins are still not within your control. Storing on an exchange should not be considered as anything other than a temporary option.

Instead, use a software wallet (such as the Bitcoin QT client) to store your bitcoins. A software wallet allows you to secure your bitcoins on your own computer. Encrypt the wallet and make backups to ensure your bitcoins are safe. This option requires you to carry out virus checks and have a good understanding of Internet security. Alternatively, you can try a popular online wallet such as the one offered at Blockchain.info while you become familiar with the workings of a wallet. This can simplify the process for you.

Another option is to use a paper wallet to send your coins to a bitcoin address that is not connected to any online exchange nor to software that is on your computer. This bitcoin can only be spent when you decide to manually redeem it through using your private key.

Securing Bitcoins

Security is as paramount with bitcoin as it is with your personal bank account. The more secure you make access to your bitcoins, the less likely somebody will succeed in nabbing them. When asked to provide a password, for example, make sure it is unique. Don’t use any password that you use on any other website, in case that website is compromised.

When using any online service, look out for additional security such as 2FA, which stands for two-factor authentication. With 2FA, even if somebody else discovers your password, they would also need to gain access to the second-level password which normally is reset every 20–30 seconds using a device such as a smartphone. Always immediately enable this additional security feature if offered.

Mining Bitcoins

Bitcoin mining is accomplished with very fast computers solving complex equations, not with picks and shovels. It’s how bitcoins are created. Without bitcoin miners, no transactions could be processed, and no confirmations could be given to validate your bitcoins were genuine. And of course no new coins could be brought into circulation, because no rewards would be given.

The bitcoin network is only as strong and secure as the people and companies who are supporting it, either by running a bitcoin node or by dedicating computational power to the mining process, which is what miners do.

You have the option of setting up your own “rig” by buying your own hardware (very expensive) or alternatively using a third-party cloud-mining service such as Genesis Mining, which allows you to mine bitcoin without the hassles of maintaining your own hardware.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin for Dummies

Bitcoin for Dummies

Explaining Bitcoin So You Can Actually Understand It

To start, do not let the title of this piece make you feel any less of a human being or think that you are in fact a bitcoin dummy. That is not the case! Bitcoin is complex. There have been several very intelligent computer programmers and system developers (We are talking people who have invented the very technology that allows us to even get online!) who are on record as saying that they even have trouble understanding Bitcoin fully.

Introduction to Bitcoin

Bitcoin is the first ever invented digital currency. It works the basis of the blockchain technology. It is continuously being created through a process called mining that involves computers solving cryptographic puzzles. Each block has its own cryptographic puzzle, and the unique solution represents 1 Bitcoin and the current state of all pending transactions.

- Bitcoin is a digital currency.

- Using encryption techniques is how it is created and how transactions are verified as legitimate and recorded to the ledger.

- Operating independently of a central bank means that there is no person, company, government agency or any other single entity that controls bitcoin, it is governed by the very people who use it.

But before we can delve into the peculiarities of Bitcoin we need to lay some foundations.

What is Cryptography?

Imagine you have a letter, cut it to little pieces and scramble them. By doing so you are encrypting the information that is contained in the letter. Meaning that when someone stumbles upon the scattered pieces, they would not be able to understand anything. That is until they decipher, decrypt the message by placing the pieces in the right order. This visualization of sorting algorithms explains the process best.

What is Blockchain?

Blockchain quite resembles a database. However, while traditional databases have a couple of locations where the information is hosted, blockchain hosts the information on each computer on the network. Hence the term decentralized.

Traditional banking works like Microsoft Office Documents and blockchain is like Google Docs. For the sake of simplicity let us assume that there is one spreadsheet that contains the state of all accounts balances and transactions.

If Sally sends John 10$ via a bank wire.

To reflect this transaction Sally’s bank credits her account in the spreadsheet, then the file would be sent to John’s bank to make their changes and then sent back to Sally’s bank so that they both have the updated version of the spreadsheet. Although there is no such spreadsheet, bank settlements operate in relatively the same manner – a lot of files being exchanged to reflect every transaction.

With blockchain when Sally tells her bank to send 10 BTC to John, the two banks simply both edit the Google spreadsheet and without any time wasted on exchanging files, the transaction is recorded.

If you have ever edited a Google spreadsheet simultaneously with many people, you would know that it will start bugging, the new information is just too much to be reflected at once. Therefore, the network separates the whole spreadsheet (there is no actual spreadsheet we are continuing the example) into smaller blocks of information that can be more easily processed.

Want a quick and condensed guide about the Blockchain Technology? Read our Blockchain Guide

What is Bitcoin?

The Oxford English Dictionary defines Bitcoin as “a type of digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank”

However, this definition is for the whole system of Bitcoin. Each Bitcoin is nothing more than a 12-digit code that is encrypted.

Bitcoin is a Digital Currency! What is a Digital Currency?

A digital currency is money that has no physical form. Reach into your pocket, wallet or wherever it is you keep your dollars, Euros, Yen, Rupies, etc.. and pull out the equivalent of 1 US Dollar, or even a quarter, dime, nickel or penny. Hold it. Look at it. Feel it. That is called fiat, which is the currency of your nation (or some nation depending on what you may have.)

With digital currency, you cannot hold it. You cannot feel it. You cannot look at it. It only exists as a number entry in a transaction ledger on a network somewhere. Now, while this may make some people shun digital currencies, they are simply being childish and sort of ignorant. Think about it. Most people simply swipe a card and their money is magically moved from there account into the account of the store that they are paying, right? So technically, we all use digital currency already, we just have the ability to actually get some of the money to put in our pockets or respective money holding places.

A Really Deep Understanding of Money in General

Then to get even more technical about it, the money you may have in your pocket is nothing more than cheap paper and ink or cheap metals that have been stamped by a machine. It technically is not worth anything. It is nothing more than a marker that says you have the rights to spend the amount indicated on the bill or coin and the bill or coin simply is a guarantee from the national bank who issues it that they will cover the debt.

If you owed someone five dollars and wrote them an IOU on a piece of paper, it is no different than a 5-dollar bill in the sense that the money you have is nothing more than an IOU from the national bank who issued your particular currency. I can go to the store right now and buy a ream of copy paper, the 500-sheet pack for about $7 USD. You can fit 4 US Dollar bills of any denomination on each sheet, so if I used 100-dollar bills, that would be $200,000.00 USD. Does that make the paper worth $200,000.00 USD? I think not. So why would the paper that the national bank prints currency on be worth anything more? Well, it isn’t.

If you have never stopped to really think about it, do so now. That money in your piggy bank is nothing more than a guarantee from the Federal Reserve (if you are in the U.S.), or national bank of some nation that you are entitled to that much of the gold* that they own, and that you have the rights to trade that guarantee for goods and service and upon doing so, the receiver of the money will then inherit the same guarantee for the same value that is shown on the piece of paper or metal coin.

You Are the bank… Sort of

So, in all reality, the only real difference that Bitcoin offers is that it does not have a physical marker, or guarantee in the form of a mass printed, regulated piece of paper guaranteeing the holder to the value of the Bitcoin.

That actually sounds horrible. No guarantee that you have a right to the Bitcoin in the national bank? Well, you don’t need it. Nope. Not at all. Why, you may ask? Why would you risk not having that guarantee? Well, because you have the actual Bitcoin. Th national bank doesn’t have it, in fact, no bank or any other person or business has it. You have it. You hold it and when you send it to someone, it goes directly from you to them. When you receive it from someone, you get it directly from them. So, there is no guarantee needed. You have the actual bitcoin in your hands, err, well, figuratively speaking of course.

The balance of your bitcoin wallet is public record. The encryption methods used, which will be explained in later chapters, ensures that any and all transactions are legitimate and that the balance are absolutely correct. Don’t worry though, while the ledger of balances is public record, your identity is not. More on that later. While an explanation of how it all works is the focus of this entire piece, I will try and put it into perspective for you:

The technology that ensures that all balances and transactions are valid and legitimate is so ingenious, so technologically advanced that every single one of the 50 United States, as well as the Federal Government of the United States, Governments of the entire European Union, China, Japan, South Africa, The United Arab Emirates and many more nations have legislation either already voted into law or are in the process of putting into law, statutes that integrate the technology with the government and how it does day to day business.

That Wraps Up Digital Currency

So, hopefully you have an idea of what bitcoin is by now, but i will spell it out for you anyways; Bitcoin is money. It isn’t money you can touch with your hands and it isn’t money that a bank or government holds or controls, but it is money. It can be used to buy things online from Microsoft, Dell, Walmart, Overstock and thousands of other retailers. You can use it in the United States to pay the IRS and other government entities and you can send it to anyone who accepts it personally. The difference between bitcoin and the money in your pocket is that bitcoin is the same value in North America, as it is in all of Europe, Asia, Africa, South America, Australia and even Antarctica. That includes every single Island, Atoll or other landmass and hell, even all of the pacific, Atlantic, Indian, Arctic and Antarctic Oceans as well. Basically, everywhere on the planet earth that you can go, Bitcoin will be worth the same exact amount.

*The gold reference is being used as a generalization. The national banks of the world hold more than just gold to determine their total wealth. It should be understood that other commodities, such as a nation’s chief exports, silver and other valuables are also used to back currency.

Who invented Bitcoin?

The simple answer? No one knows for sure. Someone, who was using the name of Satoshi Nakamoto is the creator of bitcoin. Whether that is a single person, a group of people, a man, a woman or someone who is gender neutral is simply not known. However, since the name that was used is a Japanese male’s name, Satoshi Nakamoto will be referred to as “he” or “him”, since typing Satoshi Nakamoto at every reference is simply horrible grammar.

There lies a shroud of mystery behind Satoshi Nakamoto. It is a great mystery that has the entire community enthralled. There have been a few educated guesses as to his actual identity and even one man from Australia who has claimed that he is the creator of Bitcoin, but there is no definitive proof. All that is known for sure is that he is a genius who had an ingenious idea and he implemented it in such a technologically advanced way, that there is nothing to even compare it to that has ever been done.

Science Fiction from the Future

To try and put this in perspective for you, imagine when you were a child and watched Star Trek. Those hand-held communicators were science fiction for us at the time. 25-30 years later, we carry around mobile phones that not only communicate, but play videos, music, talk to us, provide virtual reality, etc.… Science fiction turned into reality.

Well, Bitcoin, in comparison is like The Guardians of the Galaxy movies. Yeah, they just came out recently, no, we cannot even fathom being able to travel through space with a fox, intelligent plant or any of the other stuff in the movies. Depending on where you get your scientific information from, we are somewhere between 100 years and never being able to accomplish that stuff, so Bitcoin is like 100 years away, at least, from reality.

Except that it’s not, it’s here already and was actually here before The Guardians of the Galaxy movie was. That is how technologically advanced and ingenious Satoshi Nakamoto is; was; might be again.

How it All Went Down

In October of 2008, Satoshi Nakamoto published the first bitcoin paper via a cryptology mailing list. This paper described Bitcoin in detail. The title of the paper was, Bitcoin: A Peer-to-Peer Electronic Cash System. On January 9, 2009, The Bitcoin software version 0.1 was released publicly on SourceForge.net.

Satoshi claimed that he was a male, living in japan and his profiles on the various forums and boards listed his birthdate as April 5, 1975. The first block (transaction verification) was mined by him on January the 3rd of 2009 and he left a text message within it that reads: ‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks‘ referring to an article in the New York Times that day. This has been dubbed, the Genesis Block and is timestamped at 18:15:05 GMT on January 3, 2009.

Satoshi Nakamoto or Houdini?

He handled all of the coding himself until mid-2010, when he handed over the project to the current lead developer, Gavin Andresen, distributed all of his digital assets, including domain names to other prominent members of the Newly Formed Bitcoin community and then simply vanished. His bitcoin Wallets have not had a single transaction since mid-2009 and currently contain approximately 1 million Bitcoins, valued at roughly 4.053 Billion US Dollars.

While you can search and find compelling stories that would prove to have discovered the true identity of Satoshi Nakamoto, in Newsweek, the New York Times, Investopedia and about a hundred other reliable Bitcoin news sources, the answer is still unknown. Whoever he or she is or they may be, bitcoin is a work of true and pure genius. There is no argument there.

How is digital currency created?

Each digit is unveiled by solving a cryptographic algorithm, or in simpler terms a something like a mathematical equation. The process of this calculation is called mining and is done by either processor-based operations or graphic-card based operations, performed by a large number of computers in complex installations. All of the transactions on the network are encrypted with a cryptographic puzzle that all participants race to solve. The solution of this puzzle creates and sets* the state of the network – all pending transactions and account balances. Once a computer on the network finds a solution it records the solution* on the blockchain; then all network participants update their ledgers. In the instant that this happens the information is set and sealed. No one can edit information on the blockchain unless their computational power is at least 51% of the whole network’s power, which almost impossible.

The money creation process of Bitcoin again involves solving cryptographic puzzles. We explained that the solution to the puzzle contains all transactional information; however, it also contains information about the digits of each Bitcoin. By helping people settle transactions, miners are also slowly uncovering the digits of new Bitcoins that would enter the system. There are only 21,000,000 Bitcoins. Once the last one has been mined there can be no further money creation.

How is its value determined?

When money was first created to determine its value, we used the gold standard. Each dollar or pound in circulation in the economy had a gold equivalent in the vault of the central bank. In other words, if someone went to the bank they could for their money get a certain amount of gold.

The value of bitcoin and other digital currency is backed by proof of work or computational power. The calculation of each BTC requires a certain amount of effort, think electricity, computers, software and rent. The network knows how much computational power is needed to uncover a Bitcoin, so once a computer calculates the 12-digit code, the network rewards miners for doing the needed amount of work.

Here comes the tricky part. Each next Bitcoin always requires a bit more computing power to be mined than the previous. As we said, each BTC can be mined only once. The first BTC mined requires only the solution to the algorithm, and that it is. However, for every next BTC to be mined, after calculating the code the computer has to go through all the previously mined BTCs and it has to check whether this one is a new BTC or not. The more BTC are mined, the more newly generated Bitcoin requires.

Currently, the value of BTC is determined by two factors. The first one is how hard is mining, i.e. how much computational power is required for the calculation and check with the database of existing BTCs. If before it took a couple of graphics cards to mine one BTC for a predefined period “x”, now it takes much more computing power to mine a BTC for the same “x” period. The other factor is Bitcoin’s attractiveness as an investment. Currently, most people do not use Bitcoin so much as a medium of exchange, than they use and perceive as an investment.

What happens when the last BTC is mined?

Then free markets take over. The value of Bitcoin would then be determined only by the amount people that will be willing to pay for it.

Bitcoin For Dummies

Book Description

Learn the ins and outs of Bitcoin so you can get started today

Bitcoin For Dummies is the fast, easy way to start trading crypto currency, with clear explanations and expert advice for breaking into this exciting new market. Understanding the mechanisms and risk behind Bitcoin can be a challenge, but this book breaks it down into easy-to-understand language to give you a solid grasp of just where your money is going. You'll learn the details of Bitcoin trading, how to set up your Bitcoin wallet, and everything you need to get started right away. An in-depth discussion on security shows you how to protect yourself against some of the riskier aspects of this open-source platform, helping you reduce your risks in the market and use Bitcoin safely and effectively.

Bitcoin uses peer-to-peer technology to operate with no central authority or banks, with transaction management and issuing of Bitcoins carried out collectively by the network. Bitcoin allows easy mobile payments, fast international payments, low- or no-fee transactions, multi-signature capabilities, and more, but the nuances of the market can be difficult to grasp. This informative guide lays it all out in plain English, so you can strengthen your understanding and get started now.

- Understand the ins and outs of the Bitcoin market

- Learn how to set up your Bitcoin wallet

- Protect yourself against fraud and theft

- Get started trading this exciting new currency

The Bitcoin market is huge, growing quickly, and packed with potential. There's also some risk, so you need to go in fully informed and take steps to manage your risk wisely. Bitcoin For Dummies is the clear, quick, easy-to-follow guide to getting started with Bitcoin.

Table of Contents

Part I Bitcoin Basics

Chapter 1 Introducing Bitcoin

Chapter 2 Buying and Storing Bitcoins

Chapter 3 Bitcoin Pros and Cons

Chapter 4 Making Money with Bitcoin

Part II Banking with Bitcoin

Chapter 5 Your Bitcoin Wallet

Chapter 6 Bitcoin Transactions

Chapter 7 The Blockchain

Part III Using Bitcoin in Business

Chapter 8 Using Bitcoin in Commerce

Chapter 9 Staying on the Right Side of Legal

Chapter 10 Bitcoin Security

Chapter 11 Mining for Bitcoins

Part IV The Part of Tens

Chapter 12 Ten Great Ways to Use Bitcoin

Chapter 13 Ten (or So) Other Crypto-Currencies

Chapter 14 Ten Online Bitcoin Resources

Bitcoin For Dummies

Book Description:

Learn the ins and outs of Bitcoin so you can get started today

Bitcoin For Dummies is the fast, easy way to start trading crypto currency, with clear explanations and expert advice for breaking into this exciting new market. Understanding the mechanisms and risk behind Bitcoin can be a challenge, but this book breaks it down into easy-to-understand language to give you a solid grasp of just where your money is going. You’ll learn the details of Bitcoin trading, how to set up your Bitcoin wallet, and everything you need to get started right away. An in-depth discussion on security shows you how to protect yourself against some of the riskier aspects of this open-source platform, helping you reduce your risks in the market and use Bitcoin safely and effectively.

Bitcoin uses peer-to-peer technology to operate with no central authority or banks, with transaction management and issuing of Bitcoins carried out collectively by the network. Bitcoin allows easy mobile payments, fast international payments, low- or no-fee transactions, multi-signature capabilities, and more, but the nuances of the market can be difficult to grasp. This informative guide lays it all out in plain English, so you can strengthen your understanding and get started now.

- Understand the ins and outs of the Bitcoin market

- Learn how to set up your Bitcoin wallet

- Protect yourself against fraud and theft

- Get started trading this exciting new currency

The Bitcoin market is huge, growing quickly, and packed with potential. There’s also some risk, so you need to go in fully informed and take steps to manage your risk wisely. Bitcoin For Dummies is the clear, quick, easy-to-follow guide to getting started with Bitcoin.

bitcoin erklrung fr dummies

Table of contents

bitcoin erklrung fr dummies - Cryptocurrency News

Bitcoin ist eine vollkommen dezentral organisierte Whrung, die mit keinem der bisher realisierten Geldsysteme auch nur annhernd zu vergleichen ist Entsprechend schwer tun sich die Medien, das System zu erklren Hier wird Bitcoin fr Laien und Einsteiger ohne ITKenntnisse erklrt, ganz einfach und mit bildhaftennbspWie funktioniert Bitcoin Es gibt .

bitcoinsnews.org

Bitcoin For Dummies Cheat Sheet - dummies

Bitcoin has gotten a lot of press, . Bitcoin For Dummies Cheat Sheet. From Bitcoin For Dummies. Bitcoin has gotten a lot of press, and not all of it good.

www.dummies.com

What is a good 'Bitcoin for dummies' summary? Can bitcoins .

What is a good "Bitcoin for dummies" summary? Can bitcoins be used like actual currency, and what does mining for bitcoins mean?

www.quora.com

2018 Guide: Bitcoin Explained Simply for Dummies & Beginners

Bitcoin Explained for Dummies. Bitcoin was invented as a peer-to-peer system for online payments that does not require a trusted central authority.

www.buybitcoinworldwide.com

Bitcoin For Dummies: Prypto: 9781119076131: Amazon.com: Books

Bitcoin For Dummies [Prypto] on Amazon.com. *FREE* shipping on qualifying offers. Learn the ins and outs of Bitcoin so you can get started today Bitcoin For Dummies is the fast

www.amazon.com

Bitcoin for Beginners and Dummies! Easily understand all .

Bitcoin for Dummies Explaining Bitcoin So You Can Actually Understand It. To start, do not let the title of this piece make you feel any less of a human being or .

www.coinstaker.com

Bitcoin For Dummies - PDF Free Download - Fox eBook

Bitcoin For Dummies PDF Free Download, Reviews, Read Online, ISBN: 1119076137, By Prypto

www.foxebook.net

What is Bitcoin? Bitcoin Explained Simply for Dummies

At its core Bitcoin is a transparent ledger without a central authority. . What is Bitcoin? Bitcoin Explained Simply for Dummies By Ofir Beigel 20 Comments.

99bitcoins.com

Bitcoin Mining for Dummies - Step-by-step guide to mine .

A step-by-step guide for bitcoin mining, Learn how to mine bitcoins. FXEMPIRE. English. English; . bitcoin mining for dummies; Bitcoin Mining for Dummies: How to .

www.fxempire.com

What is Bitcoin? Bitcoin Explained Simply for Dummies

Today we're going to start from scratch and answer the third most searched term on Google today - What is Bitcoin? If you're worried that we're going to get too technical and use a lot of complicated words - don't. Here at 99Bitcoins we translate Bitcoin into plain English so even if you have no technical background you'll be able to understand everything. By the end of this course you'll know more about Bitcoin

Wed, 4 Apr 2018 21:10:24

What is Bitcoin? Bitcoin Explained Simply for Dummies

Last updated on May 8th, 2018 at 02:35 pm

Today we’re going to start from scratch and answer the third most searched term on Google today – What is Bitcoin?

What you will learn in this video

- What is money?

- What is the Double Spend Problem?

- What are the problems with Centralization?

- What is Bitcoin?

- How does Bitcoin compare with banks?

- Who accepts Bitcoin?

If you’re worried that we’re going to get too technical and use a lot of complicated words – don’t. Here at 99Bitcoins we translate Bitcoin into plain English so even if you have no technical background you’ll be able to understand everything. By the end of this course you’ll know more about Bitcoin and how it works than 99% of the population. Let’s get started…

What is Money?

Before we talk about Bitcoin I want to take a moment and talk about money. What is money exactly?

At its core, money represents value. If I do some work for you, you give me money in exchange for the value I gave you. I can then use that money to get something of value from someone else in the future.

Throughout history, value has taken many forms and people used a lot of different materials to represent money. Salt, wheat, shells and of course gold have all been used as a medium of exchange.

However, in order for something to represent value people have to trust that it is indeed valuable and will stay valuable long enough for them to redeem that value in the future.

Changing the Trust Model of Money

Up until a hundred years ago or so we always trusted in someTHING to represent money. However something happened along the way and we’ve changed our trust model from trusting someTHING to trusting in someONE.

Over time, people found it too cumbersome to walk around the world carrying bars of gold or other forms of money, so paper money was invented. Here’s how it worked: a bank or government would offer to take possession of your bar of gold; let’s say worth $1000, and in return, that bank would give you receipt certificates, which we call bills, amounting to $1000.

Not only were these pieces of paper much easier to carry, but you could spend a dollar on a cup of coffee and not have to cut your gold bar into a thousand pieces. And if you wanted your gold back, you simply took $1000 in bills back to the bank to redeem them for the actual form of money, in this case that gold bar, whenever you needed…And so, paper began its use as money as an instrument of practicality and convenience.

However as time progressed, and due to macroeconomic changes, this bond between the paper receipt and the gold it stands for was broken. Now, to explain the path that led us away from the gold standard is extremely complex, but suffice to say that governments told their people that the government itself would be liable for the value of that paper money. Basically we all said “let’s just forget about gold and trade paper instead”.

So people continued to trade with receipts that are backed by nothing but the government’s promise.

And why did it continue to work? Well, because of trust. Even though there is no actual commodity backing paper money, people trusted the government and that’s how fiat money was created.

Fiat Money and its drawbacks

Fiat is a Latin word that means “by decree”. Meaning the dollars, or euros or any other currency for that matter have value because the government orders it to. It’s what is known as “legal tender” – coins or banknotes that must be accepted if offered as payment.

So the value of today’s money actually comes from a legal status given to it by a central authority, in this case, the government. And so the trust model has changed, from trusting someTHING to trusting someONE (in this case, the government).

Fiat money has two main drawbacks:

- It is centralized – You have a central authority that controls and issues it. In this case the government or central bank.

- It is not limited by quantity – The government or central bank can print as much as they want whenever needed and inflate the money supply on the market. The problem with printing money is that because you’re flooding the market with more money the value of each dollar drops, so your own money is worth less. When you see prices rising throughout the years it’s not necessarily that prices are rising as much as that the purchasing power of your money is dropping. You need more dollars to buy something that used to “cost less”.

The move to digital money

Once fiat money was in place, the move to digital money was pretty simple. We already have a central authority that issues money, so why not make money mostly digital and let that authority keep track of who owns what.

Today we mainly use credit cards, wire transfers, Paypal and others forms of digital money. The amount of physical money in the world is almost negligible and is getting smaller with each year that passes.

So if money today is digital, how does that even work? I mean, if I have a file that represents a dollar, what’s to stop me from copying it a million times and having a million dollars? This is called the “double spend problem”.

The solution that banks use today is a “centralized” solution – they keep a ledger on their computer which keeps track of who owns what. Everyone has an account and this ledger keeps a tally for each account. We all trust the bank and the bank trusts their computer, and so the solution is centralized on this ledger in this computer.

You may not know this, but there were many attempts to create alternative forms of digital currencies, however none were successful in solving the double spend problem without a central authority.

The problems of a centralized money system

Whenever you give a anyone control over the money supply you’re giving them enormous power and this creates three major issues:

- Corruption – power corrupts, and absolute power corrupts absolutely. When banks have a mandate to create money, or value, they basically control the flow of value in the world, which gives them almost unlimited power. A small example of how power corrupts can be seen in Wells Fargo’s scandal where employees secretly created millions of unauthorized bank and credit card accounts in order to inflate the bank’s revenue stream, without their customers knowing about it for years.

- Mismanagement – If the central authority’s interest isn’t aligned with the people it controls there may be a case of mismanagement of the money. For example, printing a lot of money in order to save a certain bank or institution from collapsing, as what happened in 2008. The problem with printing too much money is that it causes inflation and basically erodes the value of the citizen’s money. One extreme example for this is Venezuela, where the government has printed so much money, and the value of it has dropped so much, that people are no longer counting money but are weighing it instead.

- Control – You are basically giving away all control of your money to the government or bank. At any point in time the government can decide to freeze your account and deny you access to your funds. Even if you use only cold hard cash the government can cancel the legal status of your currency as was done in India a few years back.

This was the state of things until 2009. Creating an alternative to the current monetary system seemed like a lost cause. But then everything changed….

Hello Bitcoin!

In October 2008 a document was published online by a guy calling himself Satoshi Nakamoto. The document, also called a whitepaper, suggested a way of creating a system for a decentralised currency called Bitcoin. This system claimed to create digital money that solves the double spend problem without the need for a central authority.

At its core Bitcoin is a transparent ledger without a central authority, but what does this confusing phrase even mean?

Well, let’s compare Bitcoin to the bank. Since most money today is already digital, the bank basically manages its own ledger of balances and transactions. However the bank’s ledger is not transparent and it is stored on the bank’s main computer. You can’t sneak a peek into the bank’s ledger, and only the bank has complete control over it.

Bitcoin on the other hand is a transparent ledger. At any point in time I can sneak a peek into the ledger and see all of the transactions and balances that are taking place. The only thing you can’t figure out is who owns these balances and who is behind each transaction. This means Bitcoin is pseudo-anonymous – everything is open, transparent and trackable but you still can’t tell who is sending what to whom.

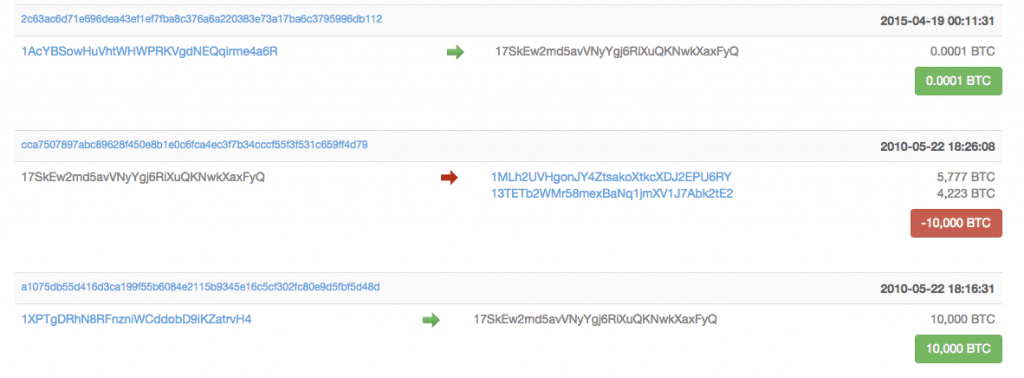

Let’s explain this with an example. Before you can see certain rows from Bitcoin’s ledger. We can see that a certain Bitcoin address sent 10,000 Bitcoins to another Bitcoin address on May of 2010.

This specific transaction is the first purchase that was ever made with Bitcoin and it was used to buy 2 pizzas by a guy named Laszlo. Laszlo published a post back in 2010 asking for someone to sell him 2 pizzas in exchange for 10,000 Bitcoins. Well, someone did, and now the price of these two Pizzas is worth well over 100 million dollars today.

Bitcoin is decentralized

there’s no one computer that holds the ledger. With Bitcoin, every computer that participates in the system is also keeping a copy of the ledger, also known as the Blockchain. So if you want to take down the system or hack the ledger you’ll have to take down thousands of computers which are keeping a copy of it and constantly updating it.

Bitcoin is digital

This means there’s nothing physical that you can touch in Bitcoin. There are no actual coins, there are only rows of transactions and balances. When you “own” Bitcoin it means you own the right to access a specific Bitcoin address record in the ledger and send funds from it to a different address.

Why is Bitcoin such big news?

Well for the first time since digital money came into existence we now have an alternative to the current system. Bitcoin is a form of money that no government or bank can control. Think about the time before the Internet, how centralized the flow of information was. Basically if you wanted information you could get it from a few major players like the New York Times, The Washington Post and others like them.

Today, thanks to the Internet, information is decentralized and you can communicate and consume knowledge from around the world with the click of a button. Bitcoin is the Internet of money – it’s offering a decentralized solution to money.

Bitcoin advantages over the current system

Complete control over your money

With Bitcoin, you and you alone can access your funds (how you actually do this will be explained in a later video). No government or bank can decide to freeze your account or confiscate your holdings.

Cuts the middlemen

This means that in many cases Bitcoin is cheaper to use than traditional wire transfers or money orders. Also, unlike fiat currencies Bitcoin was designed to be digital by nature, this means you can add additional layers of programming on top of it and turn it into “smart money”, but more on that on later videos.

Free for all

Bitcoin opens up digital commerce to 2.5 billion people around the world who don’t have access to the current banking system. These people are unbanked or underbanked because of where they leave and the reality they have been born into. However today, with a mobile phone and a click of a button they can start trading using Bitcoin, no permission needed.

Who accepts Bitcoin?

Today there are several merchants online and offline that accept Bitcoin. You can order a flight or book a hotel with Bitcoin if you like. There are even Bitcoin debit cards that allow you to pay at almost any store with your Bitcoin balance. However the road toward acceptance by the majority of the public is still a long one.

As we continue in this video series, we will break down exactly how Bitcoin works and how to use it. We will learn about Bitcoin mining, Bitcoin wallets, how to buy Bitcoins and much more. The revolution of money began in 2009 and these days we are seeing it change money as we know it.

Комментариев нет:

Отправить комментарий