What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

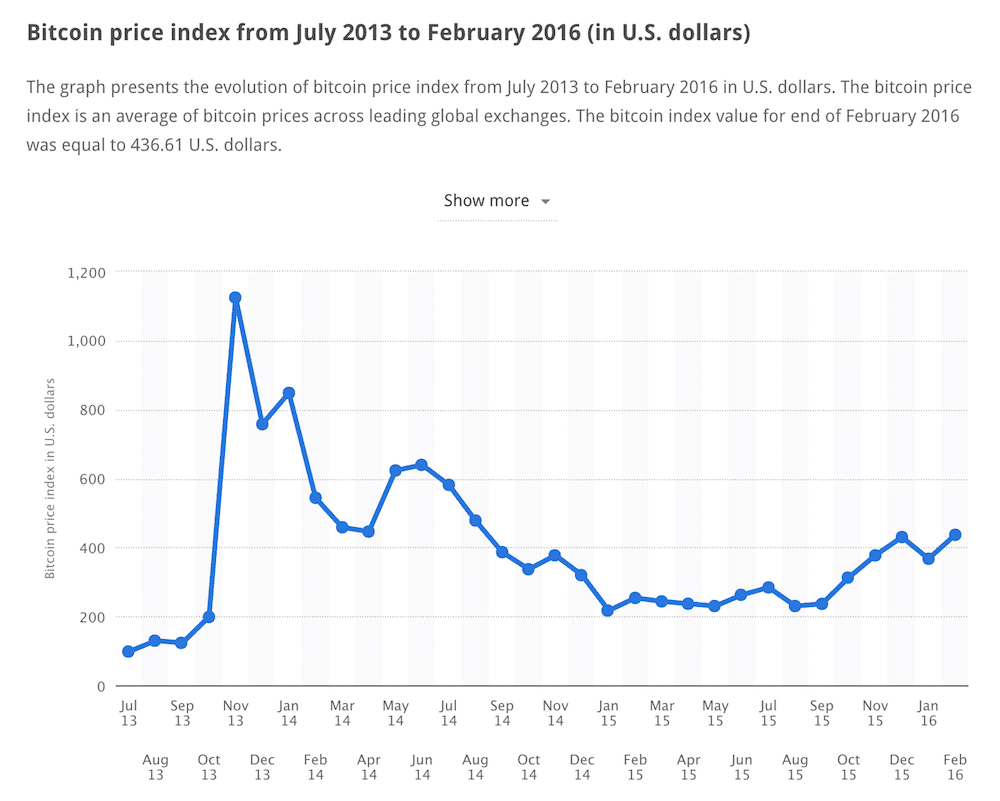

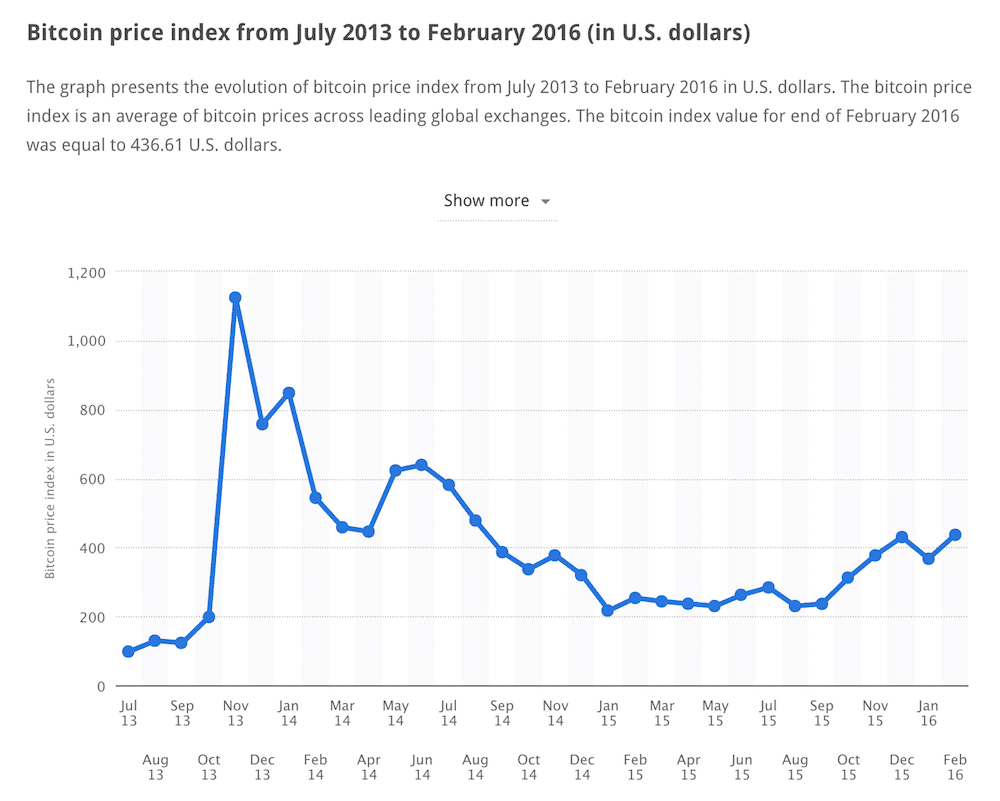

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Bitcoin Futures Quotes Globex

All market data contained within the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds. Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform (MDP). These prices are not based on market activity.

- Legend:

- Options

- Price Chart

- About This Report

Bitcoin Futures

Manage bitcoin market volatility with new Bitcoin futures.

Subscription Center

Subscription Center

Send Us Feedback

Who We Are

CME Group is the world's leading and most diverse derivatives marketplace. The company is comprised of four Designated Contract Markets (DCMs). Further information on each exchange's rules and product listings can be found by clicking on the links to CME, CBOT, NYMEX and COMEX.

Bitcoin future

Still have a question? Ask your own!

Maybe you should listen to a couple of Billionaires and what they were saying about Bitcoin instead of asking the layman.

In the Lisbon Websummit conference, one of the biggest Silicon Valley icon,

Tim Draper who made over $1 billion by getting early on Twitter, Skype, Tesla had this to say:

"In five years, if you try to use fiat currency, they will laugh at you. Bitcoin and other cryptocurrencies will be so relevant. there will be no reason to have the fiat currencies."

Hedge fund legend Mike Novogratz on the other hand predicted last month that Bitcoin will hit $10,000 in the next few months time.

And he’s not just saying it, he’s putting his money where his mouth is with a $500 million crypto-fund.

Recently, after the short $1000 dip from the Segwit2x cancellation, he was also rumored to have bought $15–20 million worth of Bitcoin. (probably less than 1% of his portfolio)

John McAfee - creator of the antivirus software predicts that Bitcoin will hit $500,000 within three years.

Mark Cuban changed his long term skepticism and invested in a Bitcoin ETN. But he said you got to pretend like you’ve lost your money like collecting art or baseball card.

Bill Gates mentioned in 2014 during an interview that Bitcoin is “Better Than Currency”

Richard Branson Thinks Bitcoin is Working and is an investor in Bitpay a Bitcoin payment processing platform

Of course, there’s no guarantees these guys will be right, but they’re the 1% and we’re the 99%. So who would you listen to?

Warren Buffett is probably one of the famous Billionaires who says Bitcoin is “The Real Bubble”

For me , I haven’t heard of these types of bullish forecasts since the early days of the internet and tech bubble. Or you might have read the famous comparison to the Tulip mania.

But how can you still compare Tulip Bulbs to cryptos? Personally it doesn’t make sense.

To understand why Bitcoin is a revolution and a brand new asset class that is completely different from stocks, bonds and other traditional currencies you’ve got to read this.

In other languages

No one knows for sure (with any degree of certainty). Having said that, most agree the future is bright. That statement does have a few caveats. The following is my prediction:

- Bitcoin itself as a protocol will evolve. Many people forget the simple fact that it is a protocol first and the money part just happens to be the first app written over it. Think of it like the Netscape browser written for (predominantly) HTTP. It was good at its time, but then other browsers took the mantle and Netscape was dethroned. The same analogy could apply to bitcoins (the money). It could be dethroned and for all we know Dogecoin or Litecoin could prevail.

- The Buying process of Bitcoins will have to be made much more simpler than it is at present. All indications point that the process will get more streamlined, so buying bitcoins will be an easy task.

- In most countries (US included), companies that trade Bitcoins onto the local currency would be regulated. More exchange companies will mushroom.

- Acceptance. Until and unless Buyers keep pressing / asking Merchant to accept Bitcoins, merchants will be oblivious to the demand. If you walk into a store and ask if they accept Bitcoins and they answer No, this is the expected answer. Repeat this scenario with 10 other Buyers asking the same and the Merchant will think differently. They just might start looking at Bitcoin acceptance.

- Much of the developed world where payment systems that enable instantaneous person-to-person payment are not available, would love to adopt Bitcoin. The barriers are the regulators and the almost near vacuum of local Bitcoin exchanges. Look at India - no exchange in India. Same can be said of Pakistan, Bangladesh, GCC, Indonesia, Philippines, Thailand (though there are a few players in Thailand who are selling Bitcoins), North Africa, etc. There is a very large population that simply does not have access to buying bitcoins. Since they cannot buy it - they cannot trade with it. This will be changing in the coming months/years.

- Volatility will minimize. I won't say it will disappear, the public at large is too sensitive to everything the media spews out relating to Bitcoins.

- Arbitrage will almost be negligible.

- You will see the movement pickup speed with a few authoritative anchor users accepting Bitcoins. (See this excellent article by our resident Payments Maestro Brian Roemmele - Starbucks To Accept Bitcoin In 2014. by Brian Roemmele on Accepting Payments).

- As more and more larger corporations start offering Bitcoin as a payment alternative, many companies waiting in the shadows will jump onto the bandwagon. This chain-reaction trigger is very important for Bitcoin to survive. Many are waiting for the trigger.

- I don't think the price for the next 2-3 years will break $5,000 (the expectation of it going to $25,000 to $500,00 - will be bad for Bitcoins in my opinion, too many speculative money will enter the ecosystem, which will cause regulators to clamp down hard on Bitcoin). My personal estimation is that it will hover between $1,000 to $2,500 (for the next 24 months at least).

- Acceptance of Bitcoin as an alt. currency in developing countries would be very important (as opposed to outright banning it). I however, have my reservations on this. The regulators in the developing have a very myopic vision when it comes to alternative currencies. Such obtuse undertaking will kill Bitcoin (in a legal manner) in the developing world.

- The market capitalization indicates in some manner that the currency is now too big to collapse (not that it cannot happen), by a measure of its own self, it will most likely survive.

- Bitcoin will be featured regularly in the Remittance World (a sure sign of its success would be the World Bank reporting remittance figures on the Bitcoin platform) - How this will be done, is debatable and questionable, but I'm leaning in as a proponent.

- Snap Payments with Bitcoins for Websites, Freelancers, etc. would be enabled. This means, very quickly accepting $25 in Bitcoins, which are in turn converted to Euros and available in your pre-paid Debit Card (all by inserting some simple code on your website to accept the payment). Think BitPay or Coinbase on steroids, globally.

- Currency Brokers will be trading and dealing with Bitcoins more regularly.

- Bitcoin exchanges in the West (perhaps US, or UK) will prosper and take over in volume (provided international clients are allowed to hop in and trade).

- Incorporation of Bitcoin payments within Social Media would be the norm. You would definitely see native or plug-in based activity around Bitcoin. Think Twitter, Pinterest, Facebook, LinkedIn, etc.

- Apps not related to money, but related to the open-ledger system of the Bitcoin protocol will start emerging. I'm absolutely lost when it comes to giving such examples, but I am sure, someone out there is thinking of a kick-ass way of using the Bitcoin protocol and building a non-payment app on top of it.

- Currencies based on the Bitcoin protocol or modified protocol, will start seeing a market themselves for specific purposes. It could very well be that Litecoin might dominate the Remittance market, or changing Linden Dollars to Litecoin. Or Mastercoin is used on boards like Warrior Forum or Digital Point (the Affiliate Marketing Ecosystem) or Peercoin is what is most accepted and traded in South Asia or South America. Such patterns and/or segmentation may very well emerge.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Bitcoin future

Discovering Bitcoin's Future

The Future of Bitcoin Conference 2017

Bitcoin’s disruptive technology is decentralised, global, and permissionless.

Today's research and development community reflects these qualities.

Competing and collaborating, Individuals and teams all over the world are working on new and innovative technology.

The Future of Bitcoin is very bright indeed.

*Update*

Watch the video's of the presentations here

What is happening in Arnhem June 29-July 1

Coming together to discuss the Future of Bitcoin

Join us for 2 days of presentations, panels, meeting people from all over the world, enjoying good food, relaxed environment and productive discussions.

This open and inclusive conference offers developers, researchers, industry and enthusiasts an opportunity to meet in person and present and discuss Bitcoin's issues of today and tomorrow.

The Bitcoin friendly city of Arnhem is located on the banks of the river Rhine, a short train ride east of Amsterdam and offers over one hundred Bitcoin accepting merchants, a lively historic center with a number of comfortable hotels. In walking distance next to the train station, the WTC-Arnhem has great food, fantastic view, modern facilities, friendly staff and very fast internet.

The conference starts late afternoon, Thursday with a welcoming social event, where attendees meet each other, register, receive conference packages and directions, while enjoying drinks and snacks.

Friday and Saturday start with breakfast, followed by presentations and discussions. During lunch and breaks there is ample opportunity to speak one-on-one. The location offers many possibilities during the conference. For those that want to use this opportunity to collaborate on projects, there is high quality wifi and many places to work.

Friday ends with a dinner event at the WTC-Arnhem. On Saturday the conference wraps up with a relaxed BBQ party within walking distance.

Tickets are $250 USD

Conference Admission Tickets

Bitcoin Bulls: Four Investors With Bold Predictions About Bitcoin’s Future

These four investors are wildly bullish on bitcoin's future

By Lucas Hahn, InvestorPlace Contributor

Last year, bitcoin exploded in value, going from under $1,000 a coin at the beginning of 2017 to an all-time high of nearly $20,000 on December 17.

Shortly thereafter, bitcoin entered a bear market, and is down nearly 40% since the beginning of the year. According to Google Trends , interest has steadily declined since its peak.

Bear markets, however, usually don’t last forever. Sooner or later, something happens that reignites the public’s interest and causes the bitcoin price to rise. For example, institutional investors such as endowment funds might decide to start dabbling in this new asset class.

Bear markets such as these tend to be good times for long-term investors to start accumulating an asset. Bitcoin currently sits at $8,200 a coin , but some see bitcoin going much higher in the not-too-distant future. Some of these figures have impressive backgrounds in the fields of finance and technology. They have made bold predictions in the past, some of which have come true.

Let’s take a look at four of the biggest bitcoin bulls.

Bitcoin Bull No. 1: Chamath Palihapitiya

Prediction : Bitcoin at $100,000 by 2020/2021, $1 million by 2037.

Chamath Palihapitiya ran AOL Instant Messenger and later served as an executive at Facebook, Inc. (NASDAQ: FB ). He founded the venture capital firm Social Capital in 2011, which has invested in startups such as Box Inc (NYSE: BOX ) and Yammer, which was acquired by Microsoft Corporation (NASDAQ: MSFT ) in 2012.

He also is part-owner of the Golden State Warriors.

Palihapitiya got in early, having bought bitcoin at around $100 a coin . He owned $5 million in bitcoins in October 2013 , when it was trading under $200.

Still, Palihapitiya thinks bitcoin can appreciate further. On December 12, he predicted that bitcoin would reach a price of $100,000 in three or four years, and $1 million within 20 years.

Palihapitiya is known for making bold predictions. As I noted in 2016 , he sees Amazon reaching a market capitalization of $3 trillion. Last year, he predicted that Tesla Inc (NASDAQ: TSLA ) would eventually capture 5% of the global market for cars and a $336 billion valuation.

Bitcoin Bull No. 2: Tim Draper

Prediction : Bitcoin at $250,000 by 2022 (April 2018).

Tim Draper was an early investor in Internet companies. In 1985, he founded the Silicon Valley venture capital firm Draper Fisher Jurvetson, which invested in Skype, Hotmail, Tesla, SpaceX and Baidu Inc (NASDAQ: BIDU ).

He is also bullish on cryptocurrencies. On April 12, Draper predicted that bitcoin would reach a price of $250,000 by 2022. He sees cryptocurrencies like bitcoin eventually replacing fiat currencies such as the U.S. dollar and the Euro.

Why might this be?

Draper says that bitcoin , unlike fiat currency, “is not subject to the whims of some political force or another.”

Central banks such as the Federal Reserve, the European Central Bank and the Bank of Japan can always print more dollars, euros or yen. Indeed, they did this in recent years following the 2008 global financial crisis.

When more dollars are printed, the value of the dollar goes down.

This cannot be done with bitcoin. The total supply of bitcoins is permanently capped at 21 million.

Draper purchased 30,000 bitcoin in 2014 for $19 million. In September 2014, he predicted that the bitcoin price would reach $10,000 within three years.

This prediction came true. Bitcoin hit $10,000 on November 29, 2017 .

Bitcoin Bull No. 3: John McAfee

Prediction : Bitcoin at $500,000 by 2020 (July 2017), $1 million by 2020 (November 2017).

John McAfee founded McAfee Inc., which sells antivirus software, in 1987. McAfee sought the Libertarian Party nomination for president in 2016. He also is an outspoken supporter of cryptocurrencies.

McAfee became chairman and CEO of MGT Capital Investments Inc. (OTCMKTS: MGTI ), a bitcoin mining firm, in May 2016 .

Later that year, the Securities and Exchange Commission (SEC) subpoenaed MGT , causing the stock to fall.

McAfee stepped down as chairman and CEO of MGT in August 2017 and left the company a few months later.

In July 2017, McAfee predicted that bitcoin would reach $5,000 by the end of the year and $500,000 by 2020. In November 2017, he increased this to $1 million .

Despite bitcoin falling in December 2017, he remained bullish, advising investors not to sell .

McAfee is even more bullish on privacy coins such as Monero, Verge and Zcash, which claim to be untraceable and anonymous.

Bitcoin Bull No. 4: James Altucher

Prediction : Bitcoin at $1 million by 2020 (November 2017).

James Altucher is an entrepreneur, angel investor, fund manager, and self-help guru. He founded StockPickr, which was acquired by TheStreet, Inc. (NASDAQ: TST ) in 2007.

Like McAfee, Altucher thinks the price of bitcoin will reach $1 million by 2020 .

In 2013, Altucher released his book Choose Yourself , which for several weeks was available for sale exclusively in bitcoin .

Altucher is bullish on other cryptocurrencies; in December he said he owned Ethereum, Zcash, Litecoin and Filecoin.

Altucher raised eyebrows in 2007 by stating that Facebook could become a $100 billion company , which it did in 2012.

Risks With Bitcoin

Cryptocurrencies are high-risk investments, and investors should understand these risks before they decide to buy bitcoin. Allianz SE (OTCMKTS: AZSEY ) released a report last month calling cryptocurrencies a bubble at risk of bursting.

Richard Turnhill, chief investment strategist at BlackRock, Inc. (NYSE: BLK ), said bitcoin is only for those who can ”stomach complete losses.”

For one thing, if your bank or brokerage fails, the FDIC or SIPC will step in to help you get your money back. This isn’t the case with cryptocurrencies, as Coinbase , a popular cryptocurrency wallet, notes on its site .

Investment risks tend to be even greater with altcoins, cryptocurrencies other than bitcoin.

But if you think bitcoin does have a future, now may be the time to buy.

As of writing, Lucas Hahn was long BTC, BCH and ETH.

What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Bitcoin is skyrocketing because 2 of the biggest exchange groups in the world are launching bitcoin futures — here's what that means

- Nov. 1, 2017, 4:39 PM

- 59,751

A trader signals an offer in the Eurodollar pit at the CME Group prior to the Federal Reserve's announcement that interest rates would remain unchanged November 2, 2011 in Chicago, Illinois. Scott Olson/Getty Images

- CME Group, a leading marketplace for derivatives whichВ handles 3 billion contracts worth about $1 quadrillion annually, is set to roll out bitcoin futures by the fourth quarter.

- A bitcoin future will allow investors to bet on the future price of bitcoin without having to actually hold the coin itself.

- It could bring more Wall Street firms into bitcoin and other cryptocurrencies.В

Just when you thought you finally got your head around bitcoin, along comes aВ new bitcoin-link financial product: bitcoin futures.В

CME, the Chicago-based exchange giant, said on Tuesday that it would launch a bitcoin futures product before the end of the year.В Last year CME launched a bitcoin index CME CF Bitcoin Reference Rate. The bitcoin futures will be based off of this rate.В

Cross-town rival exchange Cboe has long had a plan for bitcoin futures in the works, and is also preparingВ for a possible Q4 launch.

Bitcoin popped after the news and has continued to rise since. It's gained more than $300 since Tuesday and is trading near $6,600 per coin.В

Since the beginning of the year, the price of bitcoin is up over 500%. That epic rise has gripped the attention of Wall Street and Main Street alike. The development of bitcoin futuresВ is the latest chapter in a broader story about cryptocurrencies gaining traction among traditional players in financial services.В

Advertisement

Here's a quick explainer of bitcoin futures and why they could be a big deal for Wall Street and bitcoin.В

What are futures?

Futures, which allow two parties to exchange an assetВ at a specified price at an agreed upon date in the future, have been around since the late 19th century.В TheyВ are traditionally traded by professional investors and firms.В

CME trades futures based on everything fromВ oil to corn. In some cases, when a futures contract settles the buyer of the contract can receive their payment in the product itself (a barrel of oil, say), or in cash.

The latter are referred to as cash settled futures.

For instance,В an investorВ can buy a future forВ a commodity like oil betting that its price goes up at a certain point inВ time. Let's say oil is trading at $50 right now, and the investor thinks the price is going to go higher. They might buy a future to buy oil at $55 a month later. If the price of oil is $60 when the contract expires, they get the $5 difference.В

What would a bitcoinВ future look like?

Both Cboe and CME have said that their bitcoin futures products would settle in cash. And that's exactly what makes the possible marketВ so appealing to Wall Street. Firms who buy or sell bitcoin futures don't have to worry about actually holding the cryptocurrencyВ itself.В

In a way, bitcoin futures would be similar to other futures traded on Wall Street, according to Bank of America Merril Lynch.В

"The reason this may be relatively straightforward is that there is no conceptualВ difference between running a futures market on bitcoin (or technically some cross rateВ involving bitcoin) and oil," the bank said in a wide-ranging note about cryptocurrencies.В

John Deters, chief strategy officer of Cboe, highlighted this feature of the product in a recent interview with Business Insider.

"People will be able to settle in cash," Deters said. "So you can take a speculative position without touching bitcoin itself, which helps make it more attractive to all sorts of folks."

You can take a speculative position without touching bitcoin itself, which helps make it more attractive to all sorts of folks.

WhyВ do people care?

There are a number of reasons why bitcoin futures products would be a big deal for Wall Street and the world of crypto. First, the launch of bitcoin futures by establishment firms is likely to to open the door to wider participation in bitcoin trading by other Wall Street firms.

" The CME announcement provides the first step in legitimizing the ever-growing crypto space as a true financial asset," Dave Johnson, the CEO of Latium, a cryptocurrency technology company, told Business Insider. "For market makers this presents access from a known and trusted party into a $94 billion marketplace."

Business Insider previously reported two high-frequency traders, Virtu Financial and DRW, are looking to provide liquidity in bitcoin futures markets. And otherВ firms are likely to jump on the bandwagon as well. Goldman Sachs, for instance, is thinking about setting up a bitcoin trading operation.В

Futures could also help dampen volatility in the underlying bitcoin market, which is known for its wild price swings. Here's Bank of America:

We would not overstate this, as a material reduction in volatility would require there to be a large community of speculators prepared to provide liquidity to the natural owners of the various coins, but given the volatility of the coin markets, maybe there already exists a cadre of participants who would look to short coins on strong days and vice versa, which could overall reduce volatility.

Bitcoin Price Predictions

Sign up to receive bitcoin daily – We find the top 3 crypto stories and deliver them to your inbox each morning.

Bitcoin was created in early 2009. Since then, we’ve seen its price increase from Bitcoins to the cent (circa March 2010), all the way up to $8,700+. One of the stories that illustrate this growth best is that of two pizzas, which were bought for 10,000 Bitcoins, on May 22, 2010, by a Florida developer by the name of Laszlo Hanyecz. Those 10,000 Bitcoins (at $8,700 per bitcoin) would be worth over 87 million US dollars today, pitted against the $40 or so they were worth then.

Is there any limit to this growth, and if so, where? While nobody knows for sure, there are plenty of anti-Bitcoiners who see the market as a bubble, ready to pop and have Bitcoin’s price fizzle back to mere cents, and plenty of pro-Bitcoiners, or Bitcoin evangelists, who see little hinderance in Bitcoin growing up to 200 times its current price. Here are seven of those Bitcoin evangelists, and what they think Bitcoin will go on to be worth.

Wences Casares – $1,000,000 (by 2027)

Wences Casares is an Argentinian technology entrepreneur living in the US. He is the founder and CEO of Xapo, a Bitcoin wallet startup, and a board member at PayPal, among various other roles. Casares says he first found interest in Bitcoin because of high financial volatility in Argentina’s native currency, the Peso. The tech giant bought his first Bitcoins in 2011.

Casares believes that Bitcoin will hit $1 million sometime before 2027, speaking at the Consensus 2017 conference in New York. Even better, he believes that Bitcoin could hit one million dollars in as few as 5 years, saying on May 23, 2017, that the milestone will be reached “in 5-10 years”.

Chamath Palihapitiya – $1,000,000 (by 2037)

Chamath Palihapitiya, the founder of Social Capital and co-owner of the Golden State Warriors, started investing in Bitcoin in 2012. In 2013, he mentioned that he owns Bitcoin in his hedge fund, general fund, private account, and at one point he owned 5% of all Bitcoin in circulation.

Palihapitiya has predicted Bitcoin price will reach $100,000 in the next 3-4 years and in the next 20 years, it will be worth $1 million. He explained his prediction as based on the evaluation of Bitcoin as a store of value just like gold.

He said, “This thing has the potential to be comparable to the value of gold…This is a fantastic hedge and store of value against autocratic regimes and banking infrastructure that we know is corrosive to how the world needs to work properly”

John Pfeffer – $700,000 (no date)

John Pfeffer, a partner at his London-based family office Pfeffer Capital, is not only betting on Bitcoin, but giving it a bold price target of $700,000—about 75 times the current Bitcoin price of nearly $9,500. Pfeffer said that Bitcoin is the first viable candidate to replace gold the world has ever seen.

His math works like this: First, he assumes that Bitcoin can logically replace all of the gold bullion currently held by private investors—in other words, the gold bars that people keep in a safe-deposit box or bury in their backyard, simply as a way to park their money in something more dependable than paper. “Bitcoin is vastly easier to store and secure,” Pfeffer said.

As per Pfeffer, the current value of all privately held gold bullion is about $1.6 trillion. Assuming there will be 18 million Bitcoins in circulation by the time the cryptocurrency fully replaces gold bullion, the implied value of a Bitcoin would then be $90,000. This is Pfeffer’s most conservative scenario, which he gives 8% odds of coming to fruition. Pfeffer has even higher hopes for Bitcoin — that it could eventually be to central banks what traditional foreign reserve currencies are today.

John McAfee – $500,000 (by 2020)

John McAfee is the founder of McAfee Associates which launched first commercial antivirus software in the late 1980s. He recently founded MGT Capital, a company that mines various cryptocurrencies in and outside the United States. John got involved with Bitcoin because according to him it will eventually become ‘the standard for the world.’

McAfee recently made waves in the cryptocurrency world after claiming that each unit of Bitcoin would be worth half a million dollars by 2020. He did not stop there. He went on to predict that Bitcoin could even reach as much as $2.6 million in the same time frame. There is no way of knowing whether McAfee did this to get attention or if he actually means it. Only time will tell.

Jeremy Liew – $500,000 (by 2030)

Jeremy Liew is a partner at Lightspeed Venture Partners, famed as the first investor in the social media app Snapchat. Liew’s other investments include the multimedia company Beme, the listing service VarageSale, and the hardware wallet LedgerX. His net worth is estimated at north of $2 billion.

In an exchange with Business Insider, Liew said that the Bitcoin price can “realistically” reach $500,000 by 2030. Liew’s prediction was backed by Peter Smith, the CEO, and co-founder of Blockchain — the world’s most popular Bitcoin wallet. The estimate was made on May 4, 2017.

Mark Yusko – $400,000 (no date)

Mark Yusko, the billionaire investor and founder of Morgan Creek Capital defended his prediction that Bitcoin will be worth $400,000 in the long term. Yusko’s now-famous prediction made headlines because of its grandiose scale.

“It’s just math. It is gold equivalent…there are about 20 mln Bitcoin available today. Gold today is about $8 tln. That gives you $400,000. And that doesn’t include use cases that relate to currency.” Yusko said.

He also pointed out that the asset is striking fear into the hearts of bankers precisely because Bitcoin eliminates the need for banks. When transactions are verified on a Blockchain, banks become obsolete.

Roger Ver – $250,000 (no date)

Roger Ver is an early investor in Bitcoin and its related startups. Born in the US and now with citizenship in Saint Kitts and Nevis, Ver started his business career with a computer parts business, MemoryDealers.com. By early 2011, Ver had begun investing in Bitcoin, now with a portfolio including startups like Bitinstant, Ripple, Blockchain, Bitpay, and Kraken. He is sometimes nicknamed the “Bitcoin Jesus”.

In an interview Jeff Berwick, for The Dollar Vigilante blog, Roger Ver said in October 2015 that Bitcoin “could very easily be worth $2,500, or $25,000 per Bitcoin, or even $250,000 per Bitcoin”. Ver’s estimate is based on the principles of supply and demand, which he believes creates great potential for Bitcoin as a store of value.

Kay Van-Petersen – $100,000 (by 2027)

Kay Van-Petersen is an analyst at Saxo Bank, a Danish investment bank which specializes in online trading and investment. Based out of Singapore and with an MSc in Applied Economics & Finance from Copenhagen Business School, Van-Petersen is an active Twitter user with no fear of speculating on tough topics like the prices of cryptocurrencies.

Van-Petersen believes that Bitcoin will rise to $100,000 per unit by 2027, according to a feature by CNBC news published on May 31, 2017. As the man who successfully predicted Bitcoin’s flow up to $2,000 by 2017, Kay Van-Petersen’s most recent estimate, perhaps a little optimistic, suggests that Bitcoin would then account for 10% of the volume in the foreign exchange market.

Tom Lee – $91,000 (by 2020)

Tom Lee, co-founder of the market strategy firm Fundstrat Global Advisors and a well-known bitcoin bull, sees bitcoin’s price “easily double” in 2018. Lee initially set his bitcoin price target for $11,500 for mid-2018, and then increased it to $20,000 as the cryptocurrency’s intrinsic value had increased over the last few months due to the growth of new bitcoin wallets, according to him.

Tom Lee recently went a bit further stating that Bitcoin’s price will reach $91,000 by March 2020, basing his prediction on a chart that shows Bitcoin’s (BTC) performances after past market dips. Lee and Fundstrat used an average of the percentage gained in price after each dip to arrive at the 2020 figure.

Tai Lopez – $60,000 (mid-term)

Tai Lopez – $60,000 (mid-term)

Tai Lopez, a renowned investor and analyst, believes that if a small portion (1%) of the assets of millionaires globally is invested into Bitcoin in the upcoming months, the price of Bitcoin would justifiably be around $60,000.

Given that the adoption of Bitcoin as a store of value and a medium of exchange within the global finance market is increasing exponentially, $60,000 remains as a viable mid-term price target.

Ronnie Moas – $50,000 (2020)

Ronnie Moas is the founder and director of research at Standpoint Research, an equity research firm accounting for both traditional investments and new-time ones. Moas is an avid Twitter user and Wall Street analyst who has been featured on dozens of TV and radio interviews and holds an MBA in finance.

Moas projects that Bitcoin will reach a price of $50,000 by late 2020. He also believes that the market cap of all cryptocurrencies will burst up to a whopping $2 trillion (from the current $150 billion) within the next 10 years. Moas has also compared the wealth proposition of cryptocurrencies to that of the dot-com boom.

Thomas Glucksmann – $50,000 (2018)

Thomas Glucksmann, head of APAC business at Gatecoin, sees regulation, the introduction of institutional capital, and technological advances like the Lightning Network as the main factors in rising cryptocurrency prices.

“There is no reason why we couldn’t see bitcoin pushing $50,000 by December.” he said. Glucksmann also wrote that a possible element in market growth going forward could be the release of a cryptocurrency-based ETF, similar to when BTC’s price shot up to $16,800 in Dec. 2017 after the CBOE’s futures launch.

Ran Neuner – $50,000 (end of 2018)

Ran Neuner, the host of CNBC’s show Cryptotrader and the 28th most influential Blockchain insider according to Richtopia, calims that Bitcoin will end 2018 at the price point of $50,000. Interestingly, The CNBC channel has been increasingly involved in cryptocurrency reporting over the past few months. On Jan. 8, the cable network aired a step-by-step tutorial on how to buy Ripple using the Poloniex exchange as a platform for the purchase.

Masterluc – $40,000 to $110,000 (by 2019)

Masterluc is an anonymous Bitcoin trader, known for his impressive predictions in the price of Bitcoin. Most notable was his prediction of the end of the 2013 Bitcoin bubble, which was then followed by a bearish market for multiple years.

Masterluc sees Bitcoin reaching a price of between 40,000 and 110,000 US dollars by the end of this bull run, sharing his thoughts publicly on the TradingView platform. In his May 26th, 2017 post, the legendary trader said he expects the price to be reached sometime before 2019.

Mike Novogratz – $40,000 (by end of 2018)

After correctly predicting the $10,000 milestone, hedge fund manager Michael Novogratz thinks that Bitcoin price can go four times by the end of 2018 and cross $40,000. According to him, high demand from Asia and a limited supply of the cryptocurrency has lead to cryptocurrency’s exuberant growth.

Novogratz is starting a $500 million cryptocurrency hedge fund to invest in cryptocurrencies, initial coin offerings, and related companies.

Trace Mayer – $27,395 (by Feb 2018)

Trace Mayer, who according to his website, is an entrepreneur, investor, journalist, monetary scientist and ardent defender, has predicted Bitcoin price to hit $27,000 by February 2018. Mayer has been involved with Bitcoin since its early days, initially investing in the cryptocurrency when it was worth $0.25.The host of The Bitcoin Knowledge Podcast is basing his prediction on a 200-day moving average. He’s assuming that by taking the 200-day moving average, in four months it will reach $5,767. At which point, he believes that each bitcoin will be worth over $27,000, increasing its relative price by 4.75 times.

Winklevoss Twins – $5 trillion market cap (by 2028 – 2038)

Winklevoss twins – the famous Bitcoin billionaires has said Bitcoin has the potential to of thirty to forty times its current value. That would put the Winklevoss’ estimation of Bitcoin’s future market cap at over $5 trillion. This number comes from a comparison to the $7 trillion global gold market, which the brothers claim Bitcoin will disrupt.

Cameron Winklevoss said, “We’ve always felt that Bitcoin, given its properties, is gold 2.0 — it disrupts gold. Gold is scarce, Bitcoin is actually fixed. Bitcoin is way more portable and way more divisible. At a $300 bln market cap, it’s certainly seen a lot of price appreciation, but gold is at $6 tln and if Bitcoin disrupting gold is true and it plays out … then you can see 10 to 20 times appreciation because there is a significant delta still.”

Bitcoin Predictions that have proven correct

As of November 28, 2017, bitcoin has crossed the $10,000 dollars per bitcoin making Tim Draper and Mike Novogratz predictions correct.

Tim Draper – $10,000 (by 2018)

Tim Draper, a billionaire venture capitalist, envisions Bitcoin to hit a $10,000 USD per bitcoin by 2018. Draper scored big as an early backer of Skype and Baidu. He is also an early supporter of Bitcoin and its underlying technology blockchain.

In July 2014, Draper purchased nearly 30,000 bitcoins (worth around $19 million at the time) which had been seized by the US Marshals service from the Silk Road (a marketplace website).

Mike Novogratz – $10,000 (by April 2018)

Mike Novogratz is a former hedge fund manager who has been investing in Bitcoin and Blockchain technology for a long time. Due to heavy investor interest in the cryptocurrency, Mike believes Bitcoin price could rise up to $10,000 by April 2018.

Novogratz is supposedly going all in by starting a $500 million fund to invest in cryptocurrencies, initial coin offerings, and related companies. He has already put his own $150 million and plans to raise the rest from outside sources, mainly from wealthy individuals and families and fellow hedge fund managers.

Are we missing any important bitcoin predictions? Let us know and we will add them to the page.

Bitcoin Bulls: Four Investors With Bold Predictions About Bitcoin’s Future

These four investors are wildly bullish on bitcoin's future

By Lucas Hahn, InvestorPlace Contributor

Last year, bitcoin exploded in value, going from under $1,000 a coin at the beginning of 2017 to an all-time high of nearly $20,000 on December 17.

Shortly thereafter, bitcoin entered a bear market, and is down nearly 40% since the beginning of the year. According to Google Trends , interest has steadily declined since its peak.

Bear markets, however, usually don’t last forever. Sooner or later, something happens that reignites the public’s interest and causes the bitcoin price to rise. For example, institutional investors such as endowment funds might decide to start dabbling in this new asset class.

Bear markets such as these tend to be good times for long-term investors to start accumulating an asset. Bitcoin currently sits at $8,200 a coin , but some see bitcoin going much higher in the not-too-distant future. Some of these figures have impressive backgrounds in the fields of finance and technology. They have made bold predictions in the past, some of which have come true.

Let’s take a look at four of the biggest bitcoin bulls.

Bitcoin Bull No. 1: Chamath Palihapitiya

Prediction : Bitcoin at $100,000 by 2020/2021, $1 million by 2037.

Chamath Palihapitiya ran AOL Instant Messenger and later served as an executive at Facebook, Inc. (NASDAQ: FB ). He founded the venture capital firm Social Capital in 2011, which has invested in startups such as Box Inc (NYSE: BOX ) and Yammer, which was acquired by Microsoft Corporation (NASDAQ: MSFT ) in 2012.

He also is part-owner of the Golden State Warriors.

Palihapitiya got in early, having bought bitcoin at around $100 a coin . He owned $5 million in bitcoins in October 2013 , when it was trading under $200.

Still, Palihapitiya thinks bitcoin can appreciate further. On December 12, he predicted that bitcoin would reach a price of $100,000 in three or four years, and $1 million within 20 years.

Palihapitiya is known for making bold predictions. As I noted in 2016 , he sees Amazon reaching a market capitalization of $3 trillion. Last year, he predicted that Tesla Inc (NASDAQ: TSLA ) would eventually capture 5% of the global market for cars and a $336 billion valuation.

Bitcoin Bull No. 2: Tim Draper

Prediction : Bitcoin at $250,000 by 2022 (April 2018).

Tim Draper was an early investor in Internet companies. In 1985, he founded the Silicon Valley venture capital firm Draper Fisher Jurvetson, which invested in Skype, Hotmail, Tesla, SpaceX and Baidu Inc (NASDAQ: BIDU ).

He is also bullish on cryptocurrencies. On April 12, Draper predicted that bitcoin would reach a price of $250,000 by 2022. He sees cryptocurrencies like bitcoin eventually replacing fiat currencies such as the U.S. dollar and the Euro.

Why might this be?

Draper says that bitcoin , unlike fiat currency, “is not subject to the whims of some political force or another.”

Central banks such as the Federal Reserve, the European Central Bank and the Bank of Japan can always print more dollars, euros or yen. Indeed, they did this in recent years following the 2008 global financial crisis.

When more dollars are printed, the value of the dollar goes down.

This cannot be done with bitcoin. The total supply of bitcoins is permanently capped at 21 million.

Draper purchased 30,000 bitcoin in 2014 for $19 million. In September 2014, he predicted that the bitcoin price would reach $10,000 within three years.

This prediction came true. Bitcoin hit $10,000 on November 29, 2017 .

Bitcoin Bull No. 3: John McAfee

Prediction : Bitcoin at $500,000 by 2020 (July 2017), $1 million by 2020 (November 2017).

John McAfee founded McAfee Inc., which sells antivirus software, in 1987. McAfee sought the Libertarian Party nomination for president in 2016. He also is an outspoken supporter of cryptocurrencies.

McAfee became chairman and CEO of MGT Capital Investments Inc. (OTCMKTS: MGTI ), a bitcoin mining firm, in May 2016 .

Later that year, the Securities and Exchange Commission (SEC) subpoenaed MGT , causing the stock to fall.

McAfee stepped down as chairman and CEO of MGT in August 2017 and left the company a few months later.

In July 2017, McAfee predicted that bitcoin would reach $5,000 by the end of the year and $500,000 by 2020. In November 2017, he increased this to $1 million .

Despite bitcoin falling in December 2017, he remained bullish, advising investors not to sell .

McAfee is even more bullish on privacy coins such as Monero, Verge and Zcash, which claim to be untraceable and anonymous.

Bitcoin Bull No. 4: James Altucher

Prediction : Bitcoin at $1 million by 2020 (November 2017).

James Altucher is an entrepreneur, angel investor, fund manager, and self-help guru. He founded StockPickr, which was acquired by TheStreet, Inc. (NASDAQ: TST ) in 2007.

Like McAfee, Altucher thinks the price of bitcoin will reach $1 million by 2020 .

In 2013, Altucher released his book Choose Yourself , which for several weeks was available for sale exclusively in bitcoin .

Altucher is bullish on other cryptocurrencies; in December he said he owned Ethereum, Zcash, Litecoin and Filecoin.

Altucher raised eyebrows in 2007 by stating that Facebook could become a $100 billion company , which it did in 2012.

Risks With Bitcoin

Cryptocurrencies are high-risk investments, and investors should understand these risks before they decide to buy bitcoin. Allianz SE (OTCMKTS: AZSEY ) released a report last month calling cryptocurrencies a bubble at risk of bursting.

Richard Turnhill, chief investment strategist at BlackRock, Inc. (NYSE: BLK ), said bitcoin is only for those who can ”stomach complete losses.”

For one thing, if your bank or brokerage fails, the FDIC or SIPC will step in to help you get your money back. This isn’t the case with cryptocurrencies, as Coinbase , a popular cryptocurrency wallet, notes on its site .

Investment risks tend to be even greater with altcoins, cryptocurrencies other than bitcoin.

But if you think bitcoin does have a future, now may be the time to buy.

As of writing, Lucas Hahn was long BTC, BCH and ETH.

Комментариев нет:

Отправить комментарий