One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422a99e967238f69 • Your IP : 185.87.51.142 • Performance & security by Cloudflare

One more step

Please complete the security check to access bitcoinexchangeguide.com

Why do I have to complete a CAPTCHA?

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

What can I do to prevent this in the future?

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 422a99e9607a8e9d • Your IP : 185.87.51.142 • Performance & security by Cloudflare

The Bitcoin Gold Hard Fork Explained (Coming October 25)

Last updated on January 2nd, 2018 at 12:00 am

Bitcoin Gold (BTG/Bgold) is an upcoming hard fork of the Bitcoin blockchain that’s scheduled to occur on October 25 . Bgold has nothing to do with the yellow metal, so it shouldn’t be confused with BitGold, the gold investment and payments firm. Bgold is equally unrelatedf to both the previous hard fork, Bitcoin Cash (BCH/Bcash), which occurred on August 1 , and the upcoming SegWit2x (S2X/Bizcoin) hard fork, which is scheduled for mid-November.

Why Bitcoin Gold?

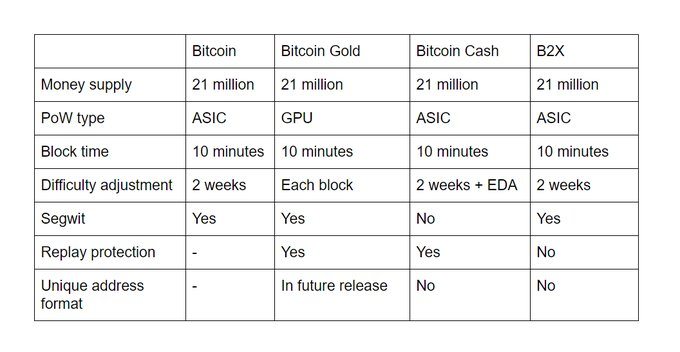

Bitcoin Gold will alter Bitcoin’s proof-of-work algorithm from SHA-256, which is currently dominated mostly by Chinese ASIC miners, to the Equihash algorithm . Equihash is also employed by the zCash (Classic), Zencash, and Hush cryptocurrencies. Equihash is mostly mined by graphics cards (GPUs).

According to the Bgold pitch, returning Bitcoin mining to home users will bring forth greater decentralization. However, massive Russian and Japanese Bitcoin mining operations have been planned for 2018, so it seems that Bitcoin’s mining centralization problem is slowly resolving itself.

The man behind Bgold, Jack Liao, is also the CEO of LightningASIC , a Hong Kong–based company that mines mostly Litecoin and produces cryptocurrency hardware. It’s surely no coincidence that LightningASIC produces a multi-GPU mining unit, of which it currently holds 913 units in stock. Should Bgold succeed in taking market share away from Bitcoin, LightningASIC would benefit greatly from both mining the new altcoin and selling miners for it.

Because the Bcash and Segwit2x forks are just as transparently motivated by financial self-interest, it’s hard to single out LightningASIC for its actions. Were Bitcoiners not compensated with free altcoins by these spin-off forks, the confusion and disruption they caused would be intolerable.

How to Safely Claim Bitcoin Gold

Any bitcoins (BTC) held in your Bitcoin wallet at the time the fork occurs will grant you an equal amount of BTG. This applies only if you have access to the private keys of your wallet, so no exchange wallets apply.

Although the fork will occur on October 25 , exchanges are likely to only open Bgold for trading one week later on November 1. This allows time for technical issues to be resolved by all participants.

Right now, no clear instructions are available for how to split your BTC from your BTG. Exchanges and software/hardware wallets are still deciding on whether they’ll support this fork.

If you participated in the Bitcoin Cash split, the procedure will be similar—though likely smoother, as exchanges and wallets have had practice and more preparation time. As always, the most important thing to do is safeguard your Bitcoin private keys , as BTC’s value is far higher than BTG’s.

Warning: Beware of scammers who promise to give you BTG early if you share your Bitcoin private key with them. At least one such scam site is currently in operation. Sharing the private key of your Bitcoin wallet is sharing full control of any and all bitcoins therein. Beware!

Bitcoin Gold: Hold or Sell?

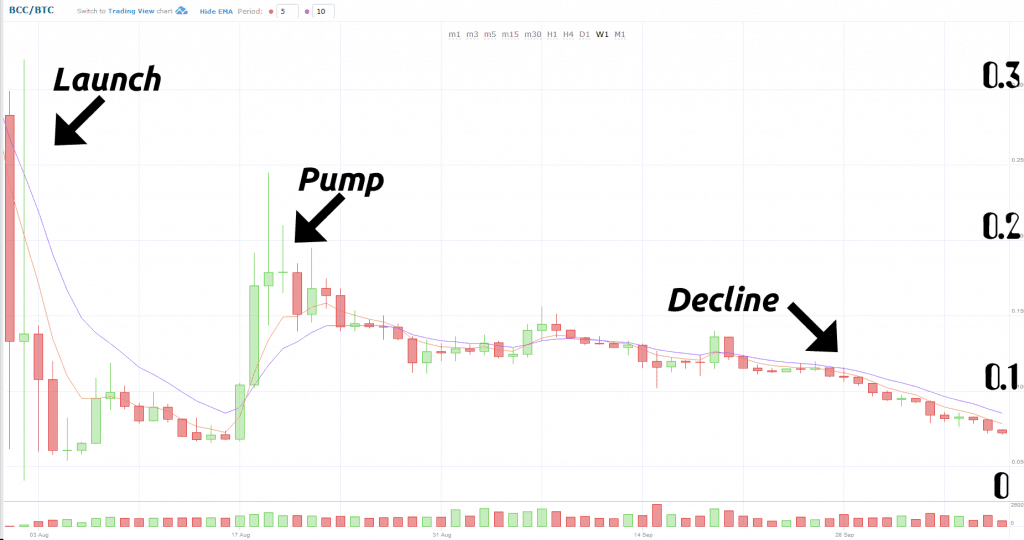

When guessing at the future price of Bgold, the closest example to follow is Bcash. It’s reasonable to expect Bgold to see a far lower launch price than Bcash achieved. Bgold enjoys far less support from miners, companies, and what might be termed the “anti-Core community.”

My personal expectation is that Bgold will initially trade at

10% of Bitcoin’s value at most, probably closer to 5%. I expect high volatility on November 1 when it launches on exchanges, followed by a sharp sell-off, subsequent pumps, and (depending on how Bgold develops) a steady decline. In other words, we’ll see a repeat of the Bcash pattern but at lower price levels.

Bcash priced in Bitcoin on the HitBTC exchange, August 1 to October 9, 2017

Reasons for Optimism

The Bgold team appears to be more technically competent than Bcash’s devs. Bgold’s GitHub repository appears more active than Bcash’s , for example. Unlike Bcash’s website, Bgold’s isn’t running on Wix, the noob-friendly website builder.

Consider the technical differences among Bitcoin and the various pretenders to its crown:

Whereas Bcash has deliberately rejected Bitcoin’s SegWit upgrade, Bgold has embraced it. Thus, Bgold may copy forthcoming Bitcoin improvements, such as Lightning Networks.

It appears that Bgold has plans to change address formatting too—a welcome change made to prevent the accidental sending of BTC to fork-coin addresses.

Further, Bcash’s Emergent Difficulty Algorithm (EDA) has produced erratic block times that are either too slow or too fast. Bgold’s per-block difficulty adjustment will likely encounter difficulties of its own.

These technical considerations lead me to believe that Bgold has a better chance at long-term sustainability than Bcash. Because of the additional attractive prospect of home mining Bitcoin, Bgold may eventually absorb much of Bcash’s value. However, as a mere clone, it seems doubtful that it’ll have much impact on Bitcoin itself.

Reasons for Pessimism

Bgold was initially announced as an ICO, although these early announcements have since been ( unsuccessfully ) scrubbed from the internet. To put it mildly, it seems that the BTG plan has undergone multiple revisions.

Serious questions remain as to whether LightningASIC and its partners will be mining BTG between the fork and exchange listing dates. This kind of midstream pre-mine would send such strong scam signals that LightningASIC would be foolish to attempt it.

Another potential problem is that Bgold and SegWit2x haven’t yet implemented replay protection. Unless this feature is added, in sending BTG, a user might inadvertently send BTC also, which could be a costly mistake.

Update: Bitgold’s site states that Replay protection is added.

Warning : avoid trading BTG (and S2X) until replay protection is in place!

Another compelling reason to be bearish on Bgold is that there’s simply no real need for it. Were BTG to launch as just another Equihash coin without the benefit of Bitcoin’s name and transactional history, it’d go largely unnoticed. The only reason Bgold is interesting is that it’ll be freely distributed to Bitcoin holders. If the majority of Bitcoin holders are hostile to it, it’ll tank.

For further cautions regarding Bitcoin Gold, check out this Reddit thread . While the thread is probably too harsh, I agree that buying Bgold is risky and best avoided.

To my mind, the only question is how much Bgold to dump and when. Holding a small percentage (maybe 5%–25%) long term, as a gamble on future upside, doesn’t seem entirely unreasonable.

Here’s my Bgold trading plan

The following is my own personal take on Bgold and should not be considered as investment advice.

While I dumped all my Bcash as soon as possible, I’ll probably adopt a more patient strategy with Bgold. With Bcash, I had the advantage of being able to sell before most other market participants. This is unlikely to be the case with Bgold. I expect a big rush to sell when it goes live.

Unless Bgold sinks without a trace upon its launch, Bcash history suggests that it’s better to wait for a later pump to sell. If a futures market develops for BTG—similar to Bitfinex’s BT1 and BT2 tokens for Bitcoin and SegWit2x —it will greatly aid the decision on how much Bgold (if any) to sell when it launches. However, it seems like most exchanges are ignoring Bgold at this time, so a futures market probably won’t appear.

In Conclusion, Here Are 3 Things to Do to Survive Any Hard Fork:

- Make sure your Bitcoins are on a wallet that you control the private key to (see a full list of wallets here). Some examples are Electreum, any hardware wallet (Ledger, Trezor, etc.), and Exodus.

- Avoid transactions shortly after the fork.

- After you get the all clear, access your new coins. At this point, you can move them to a designated wallet or sell them.

Follow Bitcoin Gold developments on the official Bitcoin Gold Twitter account.

What are your thoughts about Bitcoin Gold? I would love to hear them in the comment section below.

So what is a Bitcoin Gold Fork?

The cryptoworld will have only just brushed the dust off the last Bitcoin fork, back at the start of August, ahead of which Bitcoin fell to sub-$2,000 levels from a June high of $2,976.41.

We had heard plenty of speculation over possible outcomes, the worst case scenario has been Bitcoin’s collapse, with talk of Bitcoin holders seeing their Bitcoin value fall to zero sending jitters through the cryptoworld.

Things have certainly calmed since the fork, with Bitcoin surging to a September high $4,909.11, before some easing following China’s decision to shut down Bitcoin exchanges and ban initial coin offerings.

So, while many will have been looking ahead to the much talked about November SegWit2x fork, where another split is anticipated, which could result in 3 versions of Bitcoin, few have discussed or focused on this month’s Bitcoin Gold fork, which is scheduled to be implemented on 25 th October.

So why yet another fork? The Bitcoin community is looking to completely decentralize the Bitcoin network that continues to be monopolized by the mining industry and a few miners within the mining community, who have the majority of the hash power at present.

Bitcoin Gold is scheduled for release through this month’s fork in a bid to change Bitcoin’s consensus algorithm, allowing miners to mine Bitcoin with GPUs.

As with Bitcoin Cash this summer, Bitcoin Gold will also be a hard fork, with the new tokens expected to launch on 25 th October before being open to exchanges from 1 st November.

Making it possible to mine with GPUs (Graphic Processing Units) is expected to allow more participants to mine, taking away some of the hash power from the bigger miners who have largely cornered the Bitcoin market.

The new BTG token is planned to be sold at 10BTG to 1 BTC and while there are plans for a Bitcoin Gold initial coin offering, dates have yet to be announced and as with Bitcoin Cash, each Bitcoin user, at the time of the fork, will have an equal amount of Bitcoin Gold associated with their private key.

What is Bitcoin Gold Fork?

On 25 th October, Bitcoin is going to see another hard fork implemented that will result in a new cryptocurrency named Bitcoin Gold (BTG). As we saw with Bitcoin Cash in the summer, existing private keys holding Bitcoin balances will receive the same amount in Bitcoin Gold on 1 st November, though as things stand, it may be a number of weeks before Bitcoin Gold will be tradable.

Developers, miners and a number of key contributors including Jack Liao, the CEO of Hong Kong mining manufacturer LightningAsic, are behind Bitcoin Gold, with other parties involved including Chinese mining tycoon and owner of Bitcoin news portal Jinse.com and the project’s anonymous lead developer H4x3.

For now, Bitcoin Gold has been characterized as a friendly fork by the development team as Bitcoin Gold considered to be complementary to Bitcoin. The key consideration is to block anticipated upgrades of Bitcoin through hard forks.

H4x3 describes Bitcoin gold as a real blockchain to pilot Bitcoin upgrades. Ultimately, the purpose of Bitcoin Gold is to compete with Bitcoin Cash, Ethereum and GPU coins, by bringing down the current Bitcoin mining monopolies and increasing centralization in order to serve and protect the Bitcoin world.

Supporters of Bitcoin Gold hold the view that the best crypto engineers are working on Core and for this reason, Bitcoin Gold will try to follow Core as much as possible.

The biggest change to the code in Bitcoin Gold is that it uses a different mining algorithm, resistant to ASIC chips, called Equihash. Similar to Ethereum, the use of GPUs will be needed to mine Bitcoin Gold in place of Bitcoin’s current Asics mining machines, which have been blamed for the centralization of Bitcoin.

With Ethereum’s planned switch from Proof of Work mining to Proof of Stake next year, Bitcoin Gold developers’ decision to move away from Bitcoin’s SHA-256 algorithm to the Equihash algorithm is a timely one.

Other anticipated changes from Bitcoin include an alteration to the adjustment time. Bitcoin has the level of difficulty to solve a block adjusted every 2-weeks and, with unstable hashpower experienced since the Bitcoin Cash fork, Bitcoin Gold will have the level of difficulty adjusted to every block found.

While miners are yet able to test-mine Bitcoin Gold, plans are in place to enable miners to test on a testnet within the next couple of weeks, though there has yet to be the replay protection coding that will protect Bitcoin Gold users from accidentally spending real Bitcoin or Bitcoin Gold, also referred to as a replay attack.

It all certainly sounds friendly enough, if you’re not one of the mining cartels that control much of the Bitcoin hashpower, though there has been some dissatisfaction over news that developers will be the only miners for a period of time after the hard fork.

The Bitcoin Gold fork is another battle in the war between the mining cartel and Bitcoin’s core developers. The mining cartel in search of even more hashpower and centralization, while Bitcoin’s core developers look to reverse the centralization that has been seen in recent years.

How can Bitcoin Gold Fork Affect Bitcoin Prices?

Despite the talk of hard forks and the possible existence of 4 versions of Bitcoin by the end of the year, Bitcoin’s value has certainly not slumped by any stretch of the imagination, sitting above $4,300 levels with even China’s decision to shut down Bitcoin exchanges and ban ICOs doing little to stall appetite.

The recovery in just a couple of weeks has been a remarkable one and, if there were any suggestions that Bitcoin is a bubble ready to burst, the recovery itself and the market’s ability to shrug off China’s interventions demonstrates quite the opposite, Bitcoin investors in China finding alternative methods to trade.

South Korea’s Financial Supervisory Service decision to ban fundraising through virtual currencies also seemed to do little to Bitcoin’s recovery, which has been fueled by a surge in appetite from Japan, following the Japanese government’s approval of 11 cryptocurrency exchanges, with Japan now touted to become the largest of Bitcoin’s trading hubs.

We would expect this month’s hard fork to have a limited impact on the value of Bitcoin and, while Bitcoin Cash managed to recover from an initial slide following the hard fork in the summer, how Bitcoin Gold fares remains to be seen, but it will boil down to how many different Bitcoin versions the market is likely to accept and whether the intentions of Bitcoin Gold are genuine.

Within the Bitcoin community, there’s been plenty of infighting ahead of November’s planned SegWit2x hard fork, with the battle between the supporters of SegWit2x and core software supporters raging on. A group of core supporters that have created a movement known as NO2x does all it can to repel support for SegWit2x and the NO2x movement has certainly garnered some support from some of Bitcoin’s bigwigs, with one of the leaders of the Bitcoin Gold team, Robert Kuhne, reportedly a member.

Bitcoin Gold could be an attempt by the NO2x movement to merely detract interest from SegWit2 and with that in mind, there are also a number of issues with the Bitcoin Gold project that needs attention, including the fact that the team does not have a testnet of the network created, which prevents miners from testing the system and the project also implements the same per-block difficulty adjustment as Bitcoin in its code, with no signs of an Emergency Difficulty Adjustment (EDA). Also, there is reportedly no replay attack protection through the Bitcoin Gold team which have suggested that the website is under active development at present.

While there are some concerns over the characteristics of Bitcoin Gold, its website lacking in detail, the Fork’s intention of decentralizing a centralized mining industry through the use of GPUs is one that could garner significant support. After all, the ethos of Bitcoin and cryptocurrencies, in general, is decentralization…

H4x3, the anonymous lead developer of Bitcoin Gold, has stated that the purpose of the Bitcoin Gold fork is to encapsulate Satoshi’s one CPU one vote vision, with the current mining domination unacceptable to anyone who understands the importance of decentralization to Bitcoin.

H4x3 added that Bitcoin Gold can be thought of simply as a replication of the Bitcoin protocol and coin distribution that can serve as a backup plan in case the original mining network is destroyed.

Interestingly, H4x3 believes that there has been a significant amount of support for Bitcoin Gold despite a lack of any major marketing. There is an expectation that Ethereum miners may, in fact, switch their GPUs to a Bitcoin Gold pool ahead of Ethereum’s planned shift from proof of work to a new and less popular proof of state system. If it turns out to be true, Bitcoin Gold would likely surpass Bitcoin Cash, though it would be a tall order to rise to the top of the Bitcoin table.

Cash, Gold and What’s Next

With Bitcoin Gold expected to yield yet another version of Bitcoin, the markets will be looking ahead to November and the SegWit2x fork and whether there will be another blockchain split.

There’s plenty hanging on the SegWit2x hard fork and cryptoanalysts have predicted that Bitcoin could hit $6,000 levels by year-end. The forecast dependent upon whether the November hard fork is implemented and how disruptive the fork is to the market.

Bitcoin Gold is expected to be less disruptive than the Bitcoin Cash fork in the summer and the looming SegWit2x fork in November, so while Bitcoin seems to have plenty of support at $4,000, one questions whether Bitcoin has yet to be truly tested as the disagreement between miners and core developers continue to threaten to prize apart Bitcoin.

With SegWit2, the issue of a split comes as there remains disagreement on a proposed increase to the block size. SegWit2 supporters are looking to push through a 2MB increase to the blockchain by way of a user-activated hard fork (UAHF”) that may result in the much talked about the split.

For now, neither the miners nor the core developers have ceded and, until one side decides to compromise, Bitcoin will split, leaving the free market to decide which chain will survive and for now it really is an unknown on what the possible ramifications on Bitcoin will be, over the near-term and longer-term.

Perhaps more interesting is the knock-on effects to other cryptocurrencies. As mentioned earlier in the article, Ethereum miners are looking to move to Bitcoin Gold once the fork has been implemented, which suggests that the value of Ethereum will be under pressure.

Bitcoin could continue to upgrade by way of implementing forks that could see interest in other cryptocurrencies erode.

The Best and Safest Way to Buy and Sell Bitcoins

For those who are looking to take advantage of Bitcoin and other cryptocurrencies price fluctuations, Some brokers provide traders with instant access to trade Bitcoin, Bitcoin Cash, Ethereum and other cryptocurrencies. The process is fast and easy with convenient and advanced trading platform (desktop and mobile), low spreads and instant execution. Click here for more details.

Bitcoin Gold Fork Coming: How To Double Your Bitcoins

It has been only 9 weeks since the Bitcoin Cash hard fork, and we are again discussing another Bitcoin hard fork.

For those of you who don’t know about the previous Bitcoin hard forks and its challenges, read my earlier guides here:

And for those of you who aren’t aware of the upcoming Bitcoin hard fork, pay attention.

In this article, I intend to cover everything you need to know about the upcoming Bitcoin hard fork and how to prepare and benefit from it by doubling you coin holdings.

Wowowow… double!!

Some of you may think this is a good thing as your value will also double!

Note: Doubling of coins does not mean doubling of value, because after a hard fork, the value of both versions of coins are determined based on user sentiments and demand/supply in the market.

So keeping that point in mind, let’s get started…

New Bitcoin Fork – Bitcoin Gold (BTG)

Bitcoin Gold is a new, would be cryptocurrency denoted, as of now, as BTG or “bgold”. It will be a fork of the original Bitcoin that Satoshi Nakamoto invented in 2008.

The Bitcoin Gold community defines BTG in the following fashion:

Bitcoin Gold is a community-activated hard fork of Bitcoin to make mining decentralized again.

At present, there is very little information available about the technical know-how of this fork because their website is under development.

Who Is Doing This Fork And When Is It Happening?

The Bitcoin Gold project is being driven by some developers, miners, and their head Jack Liao, the CEO of the Hong Kong-based mining equipment manufacturing company, LightningAsic.

Bitcoin Gold’s lead developer is someone anonymous by the name of h4x3rotab and he/she claims that:

Bitcoin Gold is also a real blockchain to pilot Bitcoin upgrades.

As per their official website, the exact time is not yet known for this fork.

But the official date for the fork is mentioned as 2017-10-25 (25th October 2017) but better to follow the block height which is block 491407.

Why Is It Happening?

This is a community-driven hard fork without any consensus voting. It is primarily being driven by a few who believe that the original Bitcoin mining system has become centralized and is monopolized by a handful of mining companies.

They believe this because of ASIC miners which provide a very strong entry barrier for an average user or miner like you and me.

And now, these hard fork supporters want to change that and make the process more decentralized.

How Do BTG Supporters Want To Change This Centralization Problem?

BTG (i.e. Bitcoin Gold) advocates have decided to solve this problem by forking Bitcoin on 25th October by changing its original protocol.

Specifically, to combat the mining centralization problem, the BTG developers are implementing a different mining algorithm altogether that will be resistant to ASIC chips called Equihash.

This will make ASIC miners irrelevant for mining Bitcoin Gold because, with the implementation of Equihash, Bitcoin Gold will be mineable simply by using cheap GPUs.

- Note: Currently, Bitcoin uses the SHA-256 mining algorithm (read about SHA-256).

What’s Their Other Agenda?

Their other agenda is to save Bitcoin in case something happens to it in the future, as they claim will.

Also, I think they want to compete with other GPU minable cryptocurrencies like Zcash, Ethereum, and Monero.

And with Ethereum moving to POS consensus, this is a kind of masterstroke for this Bitcoin-branded coin (BTG) because then those Ethereum mining people will have to switch to either BTG or Zcash or another GPU minable currency in the future.

But they know that they are not competing with Bitcoin and Bitcoin Cash as stated by their lead developer in a conversation with Bitcoin.com.

Features of Bitcoin Gold (BTG)

Bitcoin Gold doesn’t bring many features with it, but…

- BTG will be based on Equihash so it will be GPU minable.

- BTG will have inbuilt replay protection because it is a direct fork of BTC.

- BTG will have a variable difficulty that will change per block. (Good thing for GPU miners.)

- And looks like BTG will have a pool of pre-mined coins for 16,000 blocks.

Apart from these, there will be no changes like block size adjustment.

And BTG will be following the suit of the original BTC core developers for the future betterment of their coin because they believe that’s the secure way.

My Opinion

I have mixed feelings toward this because of several reasons…

It’s a good idea to have a GPU-minable algorithm. This will surely prevent centralization and currently, there is no GPU-minable Bitcoin hard fork. So it’s good in that sense.

On the other hand, their development and way forward look depressing. There is literally no information whatsoever on their GitHub or official website. Moreover, on GitHub, none of their developers are publically available.

Also, haywire information sources on the Bitcointalk forum raise massive red flags about their future and their intentions. I was really surprised to learn that they might have an ICO for these pre-mined blocks, but again, there is little clarity about it on their official website.

But… let’s say that around 25th October they have beaten all odds, clarified the much-needed information about their project, and we have a fork… then what to do in that case?

Then the only thing to do is enjoy and claim your free airdropped Bitcoin Gold coins!

Confession: I am going sell some part of BTG immediately (if a fork happens) and will HODL the rest of it.

How To Get Free BTG

One month until #bgold exodus fork.

— Bitcoin Gold [BTG] (@bitcoingold) September 25, 2017

After the BTG fork, you need not do much, but you need to be updated and agile about this subject.

If you want access to your BTG coins, you need to take care of two things:

- You should have your private keys.

- You should avoid being replay attacked.

And here’s the important part: Both of your coins (BTC and BTG) will have the same private keys.

Moreover, due to this fork/split, another problem called Replay Attacks can happen.

Though, they say that they have replay protection in place, but we are not sure how effective it is as it has not been tested live.

So to avoid replay attacks and access your free BTG coins, we suggest you take care of the following things:

- Avoid transactions for some days until the dust settles to avoid replay attacks.

- Keep your Bitcoin private keys with you, not in a third party exchange like Coinbase.

- Use hardware wallets like the Ledger Nano S and Trezor. Last time, during the Bitcoin Cash fork, these two hardware wallets were the first to support the forked coin.

- If you don’t have a hardware wallet, use software wallets like Mycelium, Jaxx, Coinomi, and Exodus to control your private keys.

- You can also use a paper wallet or brain wallet.

- If you hold your keys in a paper wallet or software wallet, wait for instructions on how to access your BTG coins.

Future Of BTG

BTG Blockchain Launch Date: November 12, 2017 – 7:00 PM (19:00 UTC)

The future of BTG isn’t clear yet. But if the fork happens, BTG will likely have some market value and will definitely steal away some hash power from GPU miners.

On the other hand, we really need exchanges and wallets to support this Bitcoin Gold fork; otherwise, it will have a hard time finding any value.

And as the fork time approaches, I will keep updating this article will more information on Bitcoin Gold and which wallets/exchanges are actually supporting it.

Last but not least, don’t fall prey to fake websites/wallets demanding your private keys to let you access your BTG.

So until that time, stay tuned to CoinSutra to keep up with the Bitcoin revolution!

Note: Theoretically Bitcoin Gold Fork is already done around October 24, 6 am UTC at block height 491407. So if you are transferring your BTC now, here and there then you might not get BTG because it’s over now. Regarding claiming your BTG through wallets we will publish further instructions shortly. Happy Forking 🙂

Update 1: Bitcoin Gold’s Website is Live. Read their FAQ section for more details here.

Update 2: Bitcoin Gold’s Roadmap announced here.

Update 3: Read BTG Dev’s Official Statement here.

BTG Dev’s Official statement’s Gist:

The Bitcoin Gold dev team is not holding any information back. We are committed to full transparency.

We do answer all of the questions that are being asked via Twitter, Facebook, Slack, and email, and we

provide all the needed information for the general public.

We don’t hide that we are working hard to provide this solution – to make cryptocurrency that has the

Bitcoin structure and that cannot be mined using ASIC machines. Our project is almost ready, but there

is still a lot of work to be done and we will give all the support if there are people who want to help us.

We don’t make suggestions to buy or not buy any kind of cryptocurrency, especially not Bitcoin Gold

(BTG), as all cryptocurrency markets are still highly volatile and easily manipulated. But the one thing

that you must know is that on October 25, as planned, we will take a snapshot of the Bitcoin blockchain

and everyone will receive 1 BTG free for every 1 BTC in their wallet. So please be sure to keep your

Bitcoin private keys secure in your own possession, as we don’t want any Bitcoin holders to miss out.

For further reading:

Like this post? Don’t forget to share it!

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

First Cash, Now Gold? Another Bitcoin Hard Fork Is on the Way

Bitcoin, bitcoin cash, bitcoin gold?

There could be multiple cryptocurrencies bearing the bitcoin name if a small group of miners and developers carry out a planned fork of the blockchain this month.

Styled as a rebellion of sorts, bitcoin gold aims to follow a similar launch plan as bitcoin cash – the blockchain that split from bitcoin this summer by way of a "hard fork." The idea of the project is to release an improved protocol, one that will challenge bitcoin cash in particular, and details are now starting to come into focus.

Led by Jack Liao, CEO of Hong Kong mining firm LightningASIC, bitcoin gold is slated to launch on October 25, with its cryptocurrency being opened to exchanges on November 1.

Still, while whispers of the event are just beginning to spread, the importance of the project appears up for debate. Given that bitcoin cash produced an ultimately smaller bitcoin network, not to mention a cryptocurrency that's worth about 12 percent as much as bitcoin at press time, most seem to view the plan as another distraction in an already divided community.

For one, bitcoin gold looks like it could be even smaller than bitcoin cash, at least in that not as many miners seem to support it.

In remarks, BTC.Top founder Jiang Zhuoer and ViaBTC CEO Haipo Yang – two early champions of bitcoin cash – went so far as to downplay bitcoin gold as insignificant.

'Decentralized again'

But while those in the know might be skeptical of bitcoin gold, it does have a goal that many in the community may find attractive: creating a truly decentralized bitcoin.

Most notably, the developers behind the network hope to open up mining to more participants by replacing bitcoin's mining algorithm with one that will enable it to be mined with graphics cards. The idea is to make big miners – sometimes controversial figures on the network – less relevant.

"Bitcoin gold will implement a proof-of-work change from bitcoin's SHA256 to Equihash, a memory-hard algorithm that is ASIC-resistant and optimized for GPU mining," explained pseudonymous bitcoin gold developer "The Sorrow."

That the plan is being hatched in China, long the hotbed of bitcoin mining, only adds another layer to the story. Liao, whose mining hardware largely focuses on the litecoin network, is seen as one of the few voices domestically that can challenge the established order.

Yet, Liao was quick to name one mining firm in particular, Bitmain, as the reason that more bitcoin users should support the idea. A mining company that has been at the center of bitcoin drama over the last year, critics have long argued that the firm has too much of an influence over the network.

Still, creating a network that grows so popular as to remove miners is easier said than done, and some are skeptical that this would lead to the end goal that bitcoin gold advocates desire.

"GPU mining can't prevent centralization. GPU [markets] are controlled by Nvidia and AMD," Zhao Dong, a cryptocurrency trader and investor, argued in response to the plan.

Liao, however, argued the accessibility of the companies' products means the distribution of hashing power might evolve differently.

Bitcoin gold's unknowns

Again, though, even project leaders admit many of the details around the hard fork are fuzzy.

Bitcoin gold's pseudonymous lead developer "h4x" said that the project is "still evolving" and details such as exact block height of the hard fork are still up for discussion.

According to the original website text, bitcoin gold was even planning an initial coin offering (ICO) by which 1 percent of the bitcoin gold coins would go to the developer team, but these details have since been removed.

One thing is clear though about the funding: because of the nature of the split, every bitcoin user at the time will have an equal amount of bitcoin gold associated with their private key.

"It is a minimalist fork of the Bitcoin Core codebase in the spirit of litecoin – only a few conservative modifications," said h4x.

H4x went on to describe bitcoin gold in more abstract biological terms, arguing that it tests how well hard forks work and if they benefit the ecosystem.

"Organisms derive benefits from creating offspring. With bitcoin gold we are conducting an experiment to see if that principle holds true in the world of blockchains."

And this sentiment is largely in line with developers who have predicted that more bitcoin forks similar to bitcoin cash will come forth in the future.

After bitcoin cash forked earlier this summer, for example, Lightning Network developer Tadge Dryja argued that more forks would spring up, but for another reason: money.

With bitcoin gold in the works and another hard fork slated for November, it seems that prediction is slowly becoming reality.

Bitcoin image via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

So what is a Bitcoin Gold Fork?

The cryptoworld will have only just brushed the dust off the last Bitcoin fork, back at the start of August, ahead of which Bitcoin fell to sub-$2,000 levels from a June high of $2,976.41.

We had heard plenty of speculation over possible outcomes, the worst case scenario has been Bitcoin’s collapse, with talk of Bitcoin holders seeing their Bitcoin value fall to zero sending jitters through the cryptoworld.

Things have certainly calmed since the fork, with Bitcoin surging to a September high $4,909.11, before some easing following China’s decision to shut down Bitcoin exchanges and ban initial coin offerings.

So, while many will have been looking ahead to the much talked about November SegWit2x fork, where another split is anticipated, which could result in 3 versions of Bitcoin, few have discussed or focused on this month’s Bitcoin Gold fork, which is scheduled to be implemented on 25 th October.

So why yet another fork? The Bitcoin community is looking to completely decentralize the Bitcoin network that continues to be monopolized by the mining industry and a few miners within the mining community, who have the majority of the hash power at present.

Bitcoin Gold is scheduled for release through this month’s fork in a bid to change Bitcoin’s consensus algorithm, allowing miners to mine Bitcoin with GPUs.

As with Bitcoin Cash this summer, Bitcoin Gold will also be a hard fork, with the new tokens expected to launch on 25 th October before being open to exchanges from 1 st November.

Making it possible to mine with GPUs (Graphic Processing Units) is expected to allow more participants to mine, taking away some of the hash power from the bigger miners who have largely cornered the Bitcoin market.

The new BTG token is planned to be sold at 10BTG to 1 BTC and while there are plans for a Bitcoin Gold initial coin offering, dates have yet to be announced and as with Bitcoin Cash, each Bitcoin user, at the time of the fork, will have an equal amount of Bitcoin Gold associated with their private key.

What is Bitcoin Gold Fork?

On 25 th October, Bitcoin is going to see another hard fork implemented that will result in a new cryptocurrency named Bitcoin Gold (BTG). As we saw with Bitcoin Cash in the summer, existing private keys holding Bitcoin balances will receive the same amount in Bitcoin Gold on 1 st November, though as things stand, it may be a number of weeks before Bitcoin Gold will be tradable.

Developers, miners and a number of key contributors including Jack Liao, the CEO of Hong Kong mining manufacturer LightningAsic, are behind Bitcoin Gold, with other parties involved including Chinese mining tycoon and owner of Bitcoin news portal Jinse.com and the project’s anonymous lead developer H4x3.

For now, Bitcoin Gold has been characterized as a friendly fork by the development team as Bitcoin Gold considered to be complementary to Bitcoin. The key consideration is to block anticipated upgrades of Bitcoin through hard forks.

H4x3 describes Bitcoin gold as a real blockchain to pilot Bitcoin upgrades. Ultimately, the purpose of Bitcoin Gold is to compete with Bitcoin Cash, Ethereum and GPU coins, by bringing down the current Bitcoin mining monopolies and increasing centralization in order to serve and protect the Bitcoin world.

Supporters of Bitcoin Gold hold the view that the best crypto engineers are working on Core and for this reason, Bitcoin Gold will try to follow Core as much as possible.

The biggest change to the code in Bitcoin Gold is that it uses a different mining algorithm, resistant to ASIC chips, called Equihash. Similar to Ethereum, the use of GPUs will be needed to mine Bitcoin Gold in place of Bitcoin’s current Asics mining machines, which have been blamed for the centralization of Bitcoin.

With Ethereum’s planned switch from Proof of Work mining to Proof of Stake next year, Bitcoin Gold developers’ decision to move away from Bitcoin’s SHA-256 algorithm to the Equihash algorithm is a timely one.

Other anticipated changes from Bitcoin include an alteration to the adjustment time. Bitcoin has the level of difficulty to solve a block adjusted every 2-weeks and, with unstable hashpower experienced since the Bitcoin Cash fork, Bitcoin Gold will have the level of difficulty adjusted to every block found.

While miners are yet able to test-mine Bitcoin Gold, plans are in place to enable miners to test on a testnet within the next couple of weeks, though there has yet to be the replay protection coding that will protect Bitcoin Gold users from accidentally spending real Bitcoin or Bitcoin Gold, also referred to as a replay attack.

It all certainly sounds friendly enough, if you’re not one of the mining cartels that control much of the Bitcoin hashpower, though there has been some dissatisfaction over news that developers will be the only miners for a period of time after the hard fork.

The Bitcoin Gold fork is another battle in the war between the mining cartel and Bitcoin’s core developers. The mining cartel in search of even more hashpower and centralization, while Bitcoin’s core developers look to reverse the centralization that has been seen in recent years.

How can Bitcoin Gold Fork Affect Bitcoin Prices?

Despite the talk of hard forks and the possible existence of 4 versions of Bitcoin by the end of the year, Bitcoin’s value has certainly not slumped by any stretch of the imagination, sitting above $4,300 levels with even China’s decision to shut down Bitcoin exchanges and ban ICOs doing little to stall appetite.

The recovery in just a couple of weeks has been a remarkable one and, if there were any suggestions that Bitcoin is a bubble ready to burst, the recovery itself and the market’s ability to shrug off China’s interventions demonstrates quite the opposite, Bitcoin investors in China finding alternative methods to trade.

South Korea’s Financial Supervisory Service decision to ban fundraising through virtual currencies also seemed to do little to Bitcoin’s recovery, which has been fueled by a surge in appetite from Japan, following the Japanese government’s approval of 11 cryptocurrency exchanges, with Japan now touted to become the largest of Bitcoin’s trading hubs.

We would expect this month’s hard fork to have a limited impact on the value of Bitcoin and, while Bitcoin Cash managed to recover from an initial slide following the hard fork in the summer, how Bitcoin Gold fares remains to be seen, but it will boil down to how many different Bitcoin versions the market is likely to accept and whether the intentions of Bitcoin Gold are genuine.

Within the Bitcoin community, there’s been plenty of infighting ahead of November’s planned SegWit2x hard fork, with the battle between the supporters of SegWit2x and core software supporters raging on. A group of core supporters that have created a movement known as NO2x does all it can to repel support for SegWit2x and the NO2x movement has certainly garnered some support from some of Bitcoin’s bigwigs, with one of the leaders of the Bitcoin Gold team, Robert Kuhne, reportedly a member.

Bitcoin Gold could be an attempt by the NO2x movement to merely detract interest from SegWit2 and with that in mind, there are also a number of issues with the Bitcoin Gold project that needs attention, including the fact that the team does not have a testnet of the network created, which prevents miners from testing the system and the project also implements the same per-block difficulty adjustment as Bitcoin in its code, with no signs of an Emergency Difficulty Adjustment (EDA). Also, there is reportedly no replay attack protection through the Bitcoin Gold team which have suggested that the website is under active development at present.

While there are some concerns over the characteristics of Bitcoin Gold, its website lacking in detail, the Fork’s intention of decentralizing a centralized mining industry through the use of GPUs is one that could garner significant support. After all, the ethos of Bitcoin and cryptocurrencies, in general, is decentralization…

H4x3, the anonymous lead developer of Bitcoin Gold, has stated that the purpose of the Bitcoin Gold fork is to encapsulate Satoshi’s one CPU one vote vision, with the current mining domination unacceptable to anyone who understands the importance of decentralization to Bitcoin.

H4x3 added that Bitcoin Gold can be thought of simply as a replication of the Bitcoin protocol and coin distribution that can serve as a backup plan in case the original mining network is destroyed.

Interestingly, H4x3 believes that there has been a significant amount of support for Bitcoin Gold despite a lack of any major marketing. There is an expectation that Ethereum miners may, in fact, switch their GPUs to a Bitcoin Gold pool ahead of Ethereum’s planned shift from proof of work to a new and less popular proof of state system. If it turns out to be true, Bitcoin Gold would likely surpass Bitcoin Cash, though it would be a tall order to rise to the top of the Bitcoin table.

Cash, Gold and What’s Next

With Bitcoin Gold expected to yield yet another version of Bitcoin, the markets will be looking ahead to November and the SegWit2x fork and whether there will be another blockchain split.

There’s plenty hanging on the SegWit2x hard fork and cryptoanalysts have predicted that Bitcoin could hit $6,000 levels by year-end. The forecast dependent upon whether the November hard fork is implemented and how disruptive the fork is to the market.

Bitcoin Gold is expected to be less disruptive than the Bitcoin Cash fork in the summer and the looming SegWit2x fork in November, so while Bitcoin seems to have plenty of support at $4,000, one questions whether Bitcoin has yet to be truly tested as the disagreement between miners and core developers continue to threaten to prize apart Bitcoin.

With SegWit2, the issue of a split comes as there remains disagreement on a proposed increase to the block size. SegWit2 supporters are looking to push through a 2MB increase to the blockchain by way of a user-activated hard fork (UAHF”) that may result in the much talked about the split.

For now, neither the miners nor the core developers have ceded and, until one side decides to compromise, Bitcoin will split, leaving the free market to decide which chain will survive and for now it really is an unknown on what the possible ramifications on Bitcoin will be, over the near-term and longer-term.

Perhaps more interesting is the knock-on effects to other cryptocurrencies. As mentioned earlier in the article, Ethereum miners are looking to move to Bitcoin Gold once the fork has been implemented, which suggests that the value of Ethereum will be under pressure.

Bitcoin could continue to upgrade by way of implementing forks that could see interest in other cryptocurrencies erode.

The Best and Safest Way to Buy and Sell Bitcoins

For those who are looking to take advantage of Bitcoin and other cryptocurrencies price fluctuations, Some brokers provide traders with instant access to trade Bitcoin, Bitcoin Cash, Ethereum and other cryptocurrencies. The process is fast and easy with convenient and advanced trading platform (desktop and mobile), low spreads and instant execution. Click here for more details.

Meet Bitcoin Gold, Yet Another New Kind of Bitcoin

After bitcoin endured a split back in August, creating the new Bitcoin Cash cryptocurrency, it happened again on Tuesday. This time, the aim was to create a new coin called Bitcoin Gold.

As before, the split—known as a “fork” in the industry—has led to two currencies (the other being the classic bitcoin, or BTC), each having the same transaction history up until the point of separation, where they went their own ways. And as before, anyone holding bitcoin at the time of the split should get the equivalent in Bitcoin Gold, for free.

As usual, the split comes with a degree of rancor. Soon after the Bitcoin Gold fork occurred, its website came under a distributed denial-of-service attack

The creation of Bitcoin Cash was intended as a solution to bitcoin’s scaling problems, so what’s the deal with Bitcoin Gold? The new version has a different goal: to re-decentralize the mining of bitcoin.

While bitcoin started out as something that many people could “mine”—with their computers racing against others to be the first to verify blocks of transactions—it can these days only be mined by someone with warehouses full of specialist equipment. This leaves the profitable activity in the hands of a relatively small group of players, and the people behind Bitcoin Gold (BTG) want regular people to be able to play again.

The forked Bitcoin Gold system will therefore use a different “proof-of-work” block-verification algorithm that’s friendlier to the kinds of graphics processing units (GPUs) that regular people can buy. The code for mining Bitcoin Gold will come out in November, at which point people can start mining the new coin, and those who had regular bitcoins on Tuesday will get the equivalent in Bitcoin Gold.

That is, if their exchanges and wallet services support the new cryptocurrency. Late last week, Coinbase said it won’t support Bitcoin Gold for now “because its developers have not made the code available to the public for review.”

Some, such as BitBay and Coinomi, have said they’re on board with Bitcoin Gold. Others are keeping a cautious eye on developments. One wallet service, Uphold, said it will “conduct an operational and security review of the new coin” once the code is out. “Once exchanges open to supporting BTG and the liquidity of BTG stabilizes, we will then provide updates when it will be offered for use on our platform and allocation of Bitcoin Gold to eligible members,” it said.

Time will tell as to whether Bitcoin Gold ends up being a significant player. In August, Bitcoin Cash started trading not much above $200 per coin, and at the time of writing it’s worth $327. Bitcoin itself has almost doubled in value over the same period.

That said, bitcoin took a bit of a dip following the Bitcoin Gold split, falling as low as $5,374 before recovering to $5,580 (at the time of writing). Some analysts have suggested this was because certain investors bought into the system just before the fork, in order to get as many BTG coins as they could when the fork occurred, then sold their bitcoins afterwards.

View Full Site

Policy / Civilization & Discontents

Bitcoin Gold, the latest Bitcoin fork, explained

Bitcoin is dominated by big mining companies. Bitcoin Gold wants to change that.

by Timothy B. Lee - Nov 13, 2017 9:45 pm UTC

A new cryptocurrency called Bitcoin Gold is now live on the Internet. It aims to correct what its backers see as a serious flaw in the design of the original Bitcoin.

There are hundreds of cryptocurrencies on the Internet, and many of them are derived from Bitcoin in one way or another. But Bitcoin Gold—like Bitcoin Cash, another Bitcoin spinoff that was created in August—is different in two important ways.

Bitcoin Gold is branding itself as a version of Bitcoin rather than merely new platforms derived from Bitcoin's source code. It has also chosen to retain Bitcoin's transaction history, which means that, if you owned bitcoins before the fork, you now own an equal amount of "gold" bitcoins.

While Bitcoin Cash was designed to resolve Bitcoin's capacity crunch with larger blocks, Bitcoin Gold aims to tackle another of Bitcoin's perceived flaws: the increasing centralization of the mining industry that verifies and secures Bitcoin transactions.

The original vision for Bitcoin was that anyone would be able to participate in Bitcoin mining with their personal PCs, earning a bit of extra cash as they helped to support the network. But as Bitcoin became more valuable, people discovered that Bitcoin mining could be done much more efficiently with custom-built application-specific integrated circuits (ASICs).

As a result, Bitcoin mining became a specialized and highly concentrated industry. The leading companies in this new industry wield a disproportionate amount of power over the Bitcoin network.

Bitcoin Gold aims to dethrone these mining companies by introducing an alternative mining algorithm that's much less susceptible to ASIC-based optimization. In theory, that will allow ordinary Bitcoin Gold users to earn extra cash with their spare computing cycles, just as people could do in the early days of Bitcoin.

How Bitcoin mining became centralized

At the core of the Bitcoin network is the blockchain, a distributed ledger that records every transaction that has ever occurred. Every 10 minutes, on average, one computer in Bitcoin's peer-to-peer network adds a block to the end of the blockchain and collects a reward of 12.5 bitcoins—currently worth around $75,000.

Miners compete for the privilege of adding a block to the blockchain by racing to solve a difficult mathematical problem. Here's how it works: the miner takes a list of transactions and adds a random string called a nonce to the end. Then it computes a SHA-256 hash function of this entire block.

A hash function is designed to produce an essentially random string of bits that uniquely represents the data that was hashed. The miner "wins" if these random bits begin with a certain number of zeros. Most of the time, this doesn't happen, so the miner chooses another nonce and repeats the calculation until a winning block comes up.

A miner who discovers a winning block announces it to the rest of the network; everyone else on the network verifies that it meets all the requirements of the Bitcoin rules and then adds the block to their copies of the blockchain. Then the race begins again.

The point of this rather elaborate process is to give the network a way to reach a consensus without a central authority to count votes. If two blocks are announced around the same time, producing a disagreement about which one is the "official" block, the dispute is settled by running another round of the race. Whoever wins the next round gets to choose which block in the preceding round becomes official.

In practice, this means that a node's influence over the network is proportional to the amount of computing power it has. In Bitcoin's early years, this gave Bitcoin mining a democratic character. Almost everyone in the community had spare computing power sitting on their desks that they could devote to Bitcoin mining, earning virtual currency in the process. There were few professional bitcoin miners with dedicated hardware because somebody buying special hardware couldn't compete with a bunch of guys using spare computing cycles they already had.

But that changed when people began building custom Bitcoin-mining ASICs. These chips could compute SHA-256 hashes so much more efficiently than a PC that PC miners soon couldn't even produce enough bitcoins to cover their electricity bills. Mining became an ASIC-only operation heavily concentrated in places with low electricity costs.

Bitcoin Gold hopes to make mining democratic again

This strategy of making influence over a network proportional to computing power is known as proof-of-work. The more work you do—in this case, computing SHA-256 hashes billions of times—the more likely you are to win a chance to add a block to the blockchain.

Bitcoin Gold is identical to vanilla Bitcoin in most respects, but it uses an alternative proof-of-work algorithm called Equihash that supporters believe is impervious to being sped up with custom hardware. Equihash has also been adopted by a Bitcoin rival called Zcash for the same reason.

The key idea behind Equihash is that the algorithm is constrained more by memory than by computing power. Here's a simplified summary of how Equihash works (you can get all the gory details in the Equihash white paper):

- Equihash starts with a list of pseudorandom bit strings derived from the block the miner wants to add to the blockchain.

- The miner tries to find a subset of n strings (out of the ones generated in step 1) that XOR to zero.

- The bit strings chosen in step 2 are concatenated together and hashed with the goal (as in the original Bitcoin) of finding a value below some pre-defined value.

Step 2 is the hard part of this process—the first and third steps are relatively trivial. And the most efficient algorithm for completing step 2 requires a lot of memory. Trying to solve the problem with less than the optimal amount of memory imposes drastic computational penalties. In one example presented in the Equihash paper, solving a version of the problem with 700 megabytes took about 15 seconds, while solving the same problem with 250 megabytes took 1,000 times as long.

The reason this matters, the creators of Equihash say, is that it's not really feasible to optimize memory-intensive algorithms with custom silicon the way you can optimize compute-intensive algorithms. Bitcoin mining hardware is blazingly fast because a chip custom-designed for computing SHA-256 hashes can compute vastly more hashes per second than a conventional CPU with the same number of transistors. But 1GB of memory takes up as much space on a chip whether it's being used for custom mining hardware or a general purpose PC.

The result, supporters hope, is that Bitcoin Gold will always be accessible to ordinary users who want to mine cryptocurrency with their PCs. That could give Bitcoin a more democratic character and reduce the influence of the big mining pools that are so powerful within the mainstream Bitcoin network.

Bitcoin Gold is still a fringe cryptocurrency

Bitcoin Gold's vision of democratizing Bitcoin mining appeals to a lot of people in the mainstream Bitcoin world. But the currency still faces a ton of skepticism in the broader Bitcoin community.

Critics have objected to the unusual way that Bitcoin Gold launched the currency. After forking the main Bitcoin blockchain a few weeks ago, the Bitcoin Gold team operated the new network privately, allowing them to mine a bunch of "gold" bitcoins without competition from the rest of the Bitcoin world. Critics say this leaves fewer bitcoins available for anyone else to mine.

The broader objection, though, is that many bitcoiners look with suspicion on any effort to split the Bitcoin community. They worry that having multiple, competing versions of Bitcoin will confuse the public. Opponents argue that Bitcoin Gold is unfairly capitalizing on the Bitcoin name.

But the Bitcoin Gold team insists that their project will be good for Bitcoin in the long run. They say their ultimate goal is to prove the viability of Equihash as an alternative proof-of-work algorithm and eventually convince the mainstream Bitcoin network to make a similar move. That seems like an uphill battle, however, given the millions of dollars Bitcoin miners have invested in their existing hashing hardware.

The market values Bitcoin Gold much less than vanilla bitcoin or even Bitcoin Cash. On Monday afternoon, one unit of Bitcoin Gold was worth around $250, compared to $1,400 for Bitcoin Cash and $6,300 for normal Bitcoin. Still, with more than 16 million bitcoins in circulation, the creation of Bitcoin Gold created $4 billion in new cryptocurrency value—at least on paper.

Комментариев нет:

Отправить комментарий