Bitcoin Mempool Grows as Miners Switch Over to Bitcoin Cash

The Bitcoin network has dealt with congestion before on multiple occasions. In every single case, the network seems to suffer from major backlogs when it comes to processing transactions. Previous mempool issues have often been the result of spam attacks, but things are very different right now. With over 160,000 unconfirmed transactions at the time of writing, things are not looking all that great for Bitcoin. The network hashrate also continues to drop, which isn’t helping matters much.

Bitcoin Mempool Issues Surface Again

Most people know all too well how the Bitcoin network often gets clogged up. Every time this happens, people try to include higher transaction fees in the hopes of getting their transfers picked up by miners a lot quicker. Right now, that seems to be pretty futile, as there isn’t enough hashpower on the network to make things go quicker. A lot of miners have switched over to Bitcoin Cash in the past few days.

This issue has been brooding for several days, mind you. While the Bitcoin network hashrate was high enough a week ago, things have certainly changed in favor of BCH right now. More specifically, this change has been present for a full day already and will only grow worse over time. Right now, this altcoin’s absolute hashrate is over twice that of Bitcoin itself. Without sufficient miners, the block difficulty will remain extremely high until the next automatic change occurs.

Given that the Bitcoin mining difficulty changes every 2,000+ blocks, this problem may persist for some time to come. It is far too profitable to mine Bitcoin Cash right now, which means there is no reason for people to switch back to Bitcoin right now. In fact, it may provide them with an extra incentive to keep mining BCH, depending on their political orientation. At the time of writing, Bitcoin Cash was 165% more profitable to mine than Bitcoin, and it will continue to be for some time to come.

It is doubtful anything can be done to alleviate these mempool concerns either. There is no point in paying higher fees right now, as it will only make the situation worse. Miners have always been rather selective when it comes to processing transactions, and that situation will only become more prevalent. In fact, diehard Bitcoin Cash supporters will gladly point out that Bitcoin Core developers created this mess in the first place. Sadly, they are not entirely incorrect in that assessment.

Over time, the mempool will continue to grow unless either miners return to Bitcoin or the block difficulty is lowered significantly. Forcing the adjustment is a last-ditch resort, but it may be warranted before things really get out of hand. Some people may argue the 2,000 block retarget mechanism is vastly outdated anyway, as we have seen several altcoins introduce novel approaches in this regard as of late. It will be interesting to see what the Core developers have up their sleeves in this regard.

All of this goes to show there is a need for big changes as far as Bitcoin is concerned. While Bitcoin Cash may not necessarily have all of the answers from a long-term perspective, it is evident that it is doing some things right. It will be very interesting to see how this entire debacle plays out in the long run, as the current situation is not sustainable whatsoever. If both communities came together to create a better Bitcoin, the world would look very different. Unfortunately, that is a highly unlikely outcome.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

This is very old news. Like over 1/2 a day.

The hostile miners have given up losing money for an evil cause and have come back to the real BitCoin.

It’s already down from 160k to 100k and catching up.

Attacking #Bitcoin Playbook:

1. Create altcoin thru hardfork with EDA

2. Pump altcoin price

3. Spam BTC’s mempool

4. Divert hashrate to altcoin

5. Push up BTC fees

6. Have companies delay/refuse to implement SegWit to keep fees high and help narrative

7. Point to BTC high fees constantly

8. Hope users abandon BTC and switch to altcoin because of fees

9. Claim Core is fired

Bitcoin Cash is not Bitcoin. Bitcoin Cash is Bitcoin Cash.

Agreed, bitcoin isn’t here to be paypal.

Unfortunately your whole premise is void because your blind partisanship precludes you from seeing the facts. All you myopic, blind, BTC slaves see every legitimate fundamental challenge to BTC as a conspiracy propagated, by the dark evil forces at BCH. It’s a type of mental illness really. If it spreads sufficiently it will actually kill BTC. The changes he speaks of in is writing are real and they are driven by market forces. Not Darth Vader or whoever else you paranoid idiots attribute it to.

“BTC Slaves” . Dear God, BCH is a hard fork of BTC with a larger block. Cut the hyperbole, the scheme failed. BTC has lots of issues, it needs bigger blocks in the short term, and BCH is ran by a criminal who has more experience selling explosive grade fertilizer than development.

Attacking #Bitcoin Playbook:

1. Create altcoin thru hardfork with EDA

2. Pump altcoin price

3. Spam BTC’s mempool

4. Divert hashrate to altcoin

5. Push up BTC fees

6. Have companies delay/refuse to implement SegWit to keep fees high and help narrative

7. Point to BTC high fees constantly

8. Hope users abandon BTC and switch to altcoin because of fees

9. Claim Core is fired

Bitcoin Cash is not Bitcoin. Bitcoin Cash is Bitcoin Cash.

Credits: Fernando Ulrich

It seems BTC is too fragile, don’t you think

Yes and it is too myopic and set in it’s ways. In this space if you are not versatile and bold you will die. BTC is in the process of committing suicide ala Napster. Having network effect is very important but it does not guarantee a seat at the head of the table.

Bitcoin Cash just broke out of a falling wedge, its heading up, I think its going to pump hard with the EDA today and BTC will start dumping from 7000 down towards 4900. That will skyrocket the BCH/BTC chart price. Lets make some money

They will come back when bitcoin cash falls and until then we wait patiently

Huh? Bitcoin has the majority of the hash power back. Yet another failed attack

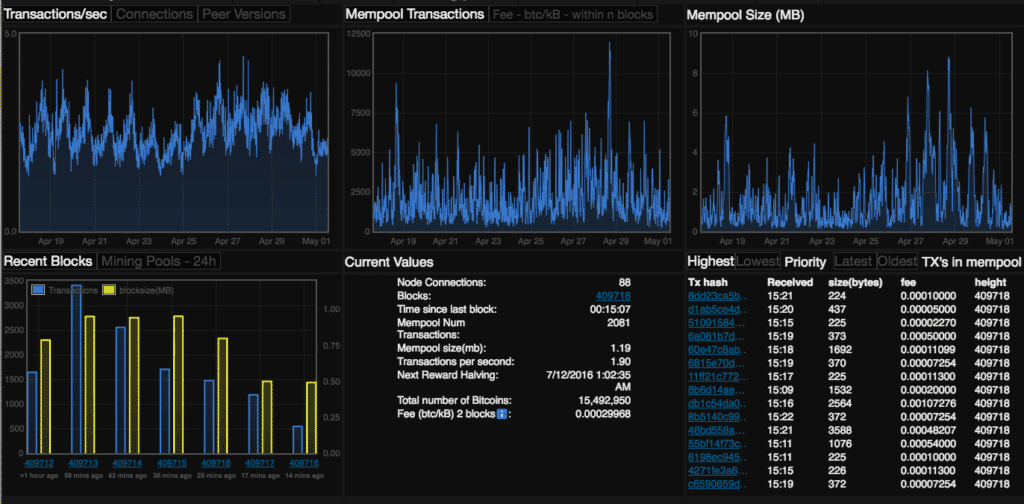

Bitcoin mempool

This page displays the number and size of the unconfirmed bitcoin transactions, also known as the transactions in the mempool. It gives a real-time view and shows how the mempool evolves over the time. The transactions are colored by the amount of fee they pay per byte. The data is generated from my full node and is updated every minute. Note that in bitcoin there is no global mempool; every node keeps its own set of unconfirmed transactions that it has seen. The mempool is also cleared when I reboot my node. The idea is based on the retired service bitcoinqueue.com.

The data is separated into different fee levels given in satoshi per bytes. The lowest colored stripe is for transactions that pay the lowest fee. Higher fee transactions are stacked on top of it. Since miners prefer high fee transactions, a new block usually only removes the top 1 MB from the queue. If a colored stripe persists over several hours without getting smaller, this means that transactions paying this amount of fee are not confirmed during this time, because there are higher paying transactions that take precedence. If a stripe on the bottom chart is much bigger than on the top chart, the transactions are larger than the average.

You can click on some fee level in the legend to hide all fee levels below that level. This way you can better see how many transactions are competing with that fee level.

Note that sizes include the segwit discount. So for the core chain, a block will always take at most 1 MB from the mempool, even if it is bigger than 1 MB, because the lower diagram already shows the size minus three quarter of the witness size. The segwit discount is also included when computing the fee level for a transaction. In case a transaction pays exactly the fee that defines the boundary between stripes, it is included in the higher stripe. Free transactions are not included, even if they make it into the mempool.

What Is The Bitcoin Mempool & Why It Matters??

Every day, I see more and more people joining the realm of Bitcoin.

I would even say that 2017 has been the “year of Bitcoin”. Despite several low points (the fork of Bitcoin Cash, China’s ICO ban, bad press, etc.), Bitcoin has shown resilience and an ever-increasing adoption interest throughout the globe.

Take a look at the Google Trends chart for 2017:

This surge makes sense because Bitcoin is a revolutionary and trustless system, and it has proven to be a safe haven for people around the world against their government’s inflationary policies for many years now.

But apart from being trustless, Bitcoin is also quite complex and has a demanding learning curve.

I always tell my friends to make sure that they have a decent grasp of the Bitcoin infrastructure and its workings before they decide to store a significant amount of value in it.

And that’s why I keep sharing Bitcoin-specific things on CoinSutra every now and then. You need to remain aware so that you don’t fall too far out of the loop.

So today, I am going to tell you about a very important part of Bitcoin’s transaction workflow – Mempool.

But before starting, I highly recommend you look through these articles first:

What Is The Bitcoin Mempool?

The Bitcoin mempool is the pool of unconfirmed Bitcoin transactions on the Bitcoin network. Once a Bitcoin transaction happens on Bitcoin’s blockchain, it is not immediately added; instead, it goes into this pool of in-motion transactions.

Each running full node on the Bitcoin network is connected to this mempool, especially the miners. The miners, working at their respective nodes, collate a bunch of transactions from this mempool, and then they try to solve an energy-intensive math problem.

The collection of these transactions is called a “block”, and whichever miner first solves the math problem gets to add this block to Bitcoin’s blockchain. This is the first confirmation of that block.

So that is the mempool, but wait! There’s more to it…

Though the mempool may look like a very simple concept to understand, it has a very complex application.

The question is how do certain transactions get picked out of the mempool before others?

Bitcoin’s block time is 10 minutes, but we all experience extreme delays from time to time in getting our transactions confirmed.

This happens because miners are not picking out our transactions from the mempool.

As I have shared with you in the Bitcoin hash article, miners win a lottery of 12.5 BTC every time they successfully mine a Bitcoin block. But apart from this fixed lottery of 12.5 BTC, miners also get a bonus amount of bitcoins for successfully mining a block. This bonus is called the “Bitcoin mining fee”.

So when a miner successfully mines a block, they get 12.5 BTC plus X amount of transaction fees, which is a cumulative sum of all the transaction fees in that block.

Take a look at this real-time image of blocks being added to the blockchain:

As you can see in the above image, miners or mining pools (Bitcoin.com, BitFury, BitClub, etc.) get an additional reward on top of the standard 12.5 BTC block reward.

And that’s why it stands to reason that a miner will pick to mine the blocks in the mempool with higher transaction fees.

And this is the reason that our Bitcoin transactions sometimes get “stuck” in the mempool and are not picked up until several hours (maybe even days) later.

So how do I get a faster Bitcoin transaction?

There are several things that you can do to avoid transaction confirmation delay from the mempool:

1. The most obvious thing is to send transactions with a high fee attached to it. You can find the latest fee trends by using some of Bitcoin’s block explorers such as BTC.Com or Blockchain.info. For more info on block explorers, check out this post. https://coinsutra.com/wp-admin/post.php?post=3844&action=edit

2. You can find out the number of unconfirmed transactions in the mempool by using this or this to calculate approximately how much time it will take for your transaction to go through.

3. You can hold back and not do any other transaction and check here or here to analyze the current mempool size to decide whether or not making a BTC transaction now is a good idea.

4. If your transaction is “stuck”, you can use a transaction pusher or a transaction accelerator service such as this or this.

***5. Use SegWit-enabled wallets because they help in getting faster confirmations from the mempool.

Understanding The Mempool

One thing that I would like to add here is that the mempool will soon be clogged up pretty badly (despite SegWit) because more and more people are joining the realm of Bitcoin every day.

That’s why you should be prepared to hit this bottleneck again and again until this issue is finally resolved.

Until that time, stay tuned to CoinSutra to learn all the tips and tricks to speed up your Bitcoin life!

If you have any questions about the mempool or speeding up Bitcoin transactions, let me know in the comments below.

And if you like this post, don’t forget to share it!

Coinbase Criticized For Spamming Bitcoin Mempool, CEO Responds

Throughout the past week, Coinbase, the global cryptocurrency market’s largest brokerage and wallet platform valued at $1.6 billion, has been heavily criticized for the absence of Segregated Witness (SegWit) and transaction batching on its platform.

Coinbase Lacking SegWit and Batching Transactions

Jameson Lopp, the lead engineer and architect at multi-signature blockchain security service provider BitGo, stated:

“Low hanging fruit for Coinbase: offers users high, medium, and low priority fee choice when sending. Batch transactions together every X minutes.

It’s not a new revelation that a significant cause of bitcoin network congestion is from popular services such as Blockchain, Coinbase, and Gemini who are using block space inefficiently. If you don’t want to contribute to the problem, don’t use them.”

Lopp added that several major cryptocurrency exchanges are currently using batching IIRC and SegWit to reduce transaction fees and relieve the Bitcoin blockchain network from congestion. “Bitstamp, HitBTC, Kraken, LocalBitcoins, and QuadrigaCX all use both SegWit and batching IIRC,” Lopp noted.

According to the bitcoin and market data provided by Blockchain, the second most popular wallet platform in the cryptocurrency market, the size of the bitcoin mempool remains above 121 million bytes, with blocks averaging at 1.05MB. But, the daily transaction volume of bitcoin is actually down from over 450,000 transactions to 225,800 transactions.

The Bitcoin blockchain network is demonstrating a similar level of congestion as a few weeks ago, when the network processed nearly twice as much as the current daily transaction volume.

On the Bitcoin network, the mempool operates as the holding area for unconfirmed transactions. Miners have to pick up transactions from the mempool to verify and confirm payments, and send the transactions to the main Bitcoin blockchain.

If the Bitcoin blockchain network’s mempool is congested, it is difficult for the miners to process transactions in a speedy manner, decreasing the usability, efficiency, and accessibility of bitcoin as a digital currency and a medium of exchange.

Lopp and other renowned experts in the cryptocurrency sector have criticized major businesses like Coinbase and Blockchain for not implementing dynamic fee systems, SegWit, and batching to reduce fees for their customers and for the entire Bitcoin network. Large-scale platforms like Coinbase process more transactions than 70 percent of the businesses in the industry combined. As such, the impact Coinbase has on the ecosystem of bitcoin is truly immense.

Coinbase CEO Responds

In response to the criticism, Brian Armstrong, the CEO at Coinbase, announced that the company will add SegWit, batching transactions, and other innovative solutions to improve the backlog of transactions on the Bitcoin network. He stated:

“Coinbase is working on batching transactions, SegWit, and a number of other strategies to improve transaction backlog. Thanks for bearing with us.”

Whether the integration of SegWit and batching transactions can drastically improve the scalability of bitcoin and reduce congestion on the Bitcoin network by large margins remain unclear. But, the overall stance of the bitcoin community as of now is to have SegWit and batching completed first, and discuss on-chain scaling and block size increase after, if SegWit and batching are not sufficient.

What is the Bitcoin Mempool?

Last updated on January 2nd, 2018 at 12:00 am

When a Bitcoin transaction is transmitted to the network it first gets verified by all of the Bitcoin nodes available. After it successfully passes verification it goes and sits inside the “Mempool” (short for Memory Pool) and patiently awaits until a miner picks it up to include it in the next block. So the Mempool is basically the node’s holding area for all the pending transactions.

Here’s a short video about this (the mempool is the unconfirmed transactions pool basically):

All nodes have a different RAM capacity to store unconfirmed transactions. As a result, each node has its own rendition of the pending transactions, this explains the variety of Mempool sizes & transactions counts found on different sources.

But how do the nodes avoid from crashing due to overload by the Mempool size? If the Mempool size gets too close to the RAM capacity, the node sets up a minimal fee threshold. Transactions with fees per kB lower than this threshold are immediately removed from the Mempool and only new transactions with a fee per kB large enough are allowed access to the Mempool.

The Mempool is part of BIP 35 (Bitcoin Improvement Proposal), and it helps SPV wallets (lightweight wallets) record transactions, Bitcoin miners that wish to catch up with transactions after the previous block was mined and more.

So basically the Mempool is the bottleneck of the Bitcoin network. The faster transactions are cleared from it into the Blockchain, the better experience the users get. If the rate of mining new blocks of transaction is lower than the rate of new transactions arriving into the Mempool a “traffic jam” will occur and transactions can take a long time to get approved (depending on their size and attached fee).

When a node receives a new valid block, it removes all the transactions contained in this block from its mempool. This results in a sharp drop in the Mempool size.

If you want to see the current status on the Mempool you can take a look at the graph below (source):

Mempool size is shown on the right. If, for example, the Mempool size is around 3MB then a transaction will take 3 blocks on average in order to get confirmed. Keep in mind that some of the Mempool transactions are low priority transactions that their sender knows they will take a long time to be confirmed – for example “dust transactions” (sending really small amounts of Bitcoin).

Got more questions about the Mempool? Leave the in the comment section below!

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

What is the Bitcoin Mempool?

The bitcoin mempool is a collection of all transactions waiting to receive a network confirmation. Every time a bitcoin transaction is broadcasted to the network, it takes an average of 10 minutes before it receives the first confirmation. However, depending on how many pending transactions there are in the mempool at any given time, that 10-minute windows can be larger. Over the past few months, there have been multiple mempool incidents causing significant transaction confirmation delays.

A Closer Look At The Bitcoin Mempool

The concept of the bitcoin mempool is not all that difficult to grasp. Every new bitcoin transaction that is validated by the network will automatically be added to the mempool, where it awaits confirmations from miners. Once a miner picks up the transaction in question for inclusion in the next block, it will automatically receive its first confirmation.

Each node has it’s own mempool and can set the preferred size. When a new block is broadcasted to the network, each node removes the transactions that are in the mempool that have been confirmed. Getting that transaction picked up by bitcoin miners can be quite challenging, though. Miners prioritize validated unconfirmed mempool transactions based on their individual mining fees. These mining fees are distributed to the miners as a “bonus” for their efforts in solving the next block on the bitcoin network. Users who include a higher transaction fee will have their bitcoin transfers picked up quicker compared to the ones who have a low transaction fee.

The bitcoin mempool is a large collection of network transactions waiting to be confirmed. However, similar to any “pool” containing a lot of data, there are only so many transactions that can be kept in pending until a backlog is created. In most cases, the bitcoin mempool contains a relatively small number of unconfirmed transactions, which is not an issue. Unfortunately, a backlog can occur out of nowhere.

This makes the mempool the effective bottleneck of the bitcoin ecosystem as a whole. Faster transactions are prioritized, yet a lot of people prefer to pay very small fees. Should the rate of mining new bitcoin blocks decrease for some reason, those lower-fee transactions will face even larger delays. It is not uncommon to experience a mempool backlog when there are more incoming transactions compared to transfers picked up by miners.

It is not difficult to determine when and if the mempool could cause a transaction confirmation delay. As long as the mempool size remains well below the 1MB mark, there is no delay whatsoever. Any increase in size will indicate the average transaction confirmation time will take x amount of blocks mined on the network. For example, a 20MB mempool size would mean low-fee transactions will take an average of 20 mined blocks to receive their first network confirmation.

For the time being, there is only one viable way bitcoin users can bypass any mempool issues. Including a higher transaction fee is not a popular choice, yet it is the “best” way to circumvent any mempool backlog. Until blocks can contain more transactions than right now, mempool issues will continue to occur over time. Moreover, people flooding the bitcoin network with zero-fee or small fee transactions can cause quite the mempool backlog as well. Higher transaction fees will always be prioritized, that much is certain.

If you liked this article, follow us on Twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news.

About The Author

JP Buntinx is a FinTech and Bitcoin enthusiast living in Belgium. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Bitcoin mempool

This server has a mempool limit of 300 MB (this is the default limit). When the mempool is full, low fee transactions are removed until the mempool clears again. The other BTC servers have a higher mempool limit.

This page displays the number and size of the unconfirmed bitcoin transactions, also known as the transactions in the mempool. It gives a real-time view and shows how the mempool evolves over the time. The transactions are colored by the amount of fee they pay per byte. The data is generated from my full node and is updated every minute. Note that in bitcoin there is no global mempool; every node keeps its own set of unconfirmed transactions that it has seen. The mempool is also cleared when I reboot my node. The idea is based on the retired service bitcoinqueue.com.

The data is separated into different fee levels given in satoshi per bytes. The lowest colored stripe is for transactions that pay the lowest fee. Higher fee transactions are stacked on top of it. Since miners prefer high fee transactions, a new block usually only removes the top 1000 kB from the queue. If a colored stripe persists over several hours without getting smaller, this means that transactions paying this amount of fee are not confirmed during this time, because there are higher paying transactions that take precedence. If a stripe on the bottom chart is much bigger than on the top chart, the transactions are larger than the average.

You can click on some fee level in the legend to hide all fee levels below that level. This way you can better see how many transactions are competing with that fee level. You can also click in the legend to toggle the visibility of the total fee statistics.

Note that sizes include the segwit discount. So for the core chain, a block will always take at most 1 MB from the mempool, even if it is bigger than 1 MB, because the lower diagram already shows the size minus three quarter of the witness size. The segwit discount is also included when computing the fee level for a transaction. In case a transaction pays exactly the fee that defines the boundary between stripes, it is included in the higher stripe.

Bitcoin mempool

- Blockchains

- Bitcoin

- Bitcoin Cash

- Ethereum β

- Bitcoin Cash Blockchain

- Blocks

- Transactions

- Outputs

- Bitcoin Cash Mempool and Latest Block

- Transactions

- Outputs

- Misc

- Network nodes

- Whitepaper

- Show new results without expanding the table

- Condense the table

You can export the entire result set * in one of the supported formats (CSV or TSV) to process and analyse the data using various tools like R or Statistica.

If the resulting number of cells is less than 1 million, you'll get the data automatically and for free.

You are requesting to export more than 1 million cells. As of now, we process such requests manually and on a paid basis (unless you're conducting an academic research — in that case it's possible to get the data for free). If you have any questions, please, contact us at .

Real time prices

"vires in numeris."

Receive all Bitcoinist news in Telegram!

Bitcoin Fees Fall 34% As Bloated Mempool Deflates

Amid anger and even despair over Bitcoin’s fees, the recommended rate per transaction has quietly dipped by 34% amid a drop in mempool size.

Bitcoin Fees Fall But Delays Stretch On

From a recommended 450 satoshis per byte, figures this week have fallen to just 300 according to unnamed sources quoted by crypto angel investor Alistair Milne.

Headlines you don't see: "Recommended Bitcoin transaction fees crash 33% in 24hrs" … down from 450sats/byte to 300 and falling

— Alistair Milne (@alistairmilne) May 19, 2017

Data from 21.co meanwhile also confirms a fall in the “fastest and cheapest” transaction fee, albeit not as drastic, current figures quoting 390 satoshis per byte versus a previous 450.

Milne added the proviso that the discount was in fact volatility, a characteristic detrimental to the Bitcoin network which would be solved by Layer 2 tech, specifically the Lightning Network.

“We need Lightning ASAP,” he said in a discussion of the fee findings.

Moon Fever Versus Daily Grind

Despite fees rising at a considerable rate for the past two months, transaction delays and even failures are becoming a common narrative in Bitcoin.

An influx of new users lacking knowledge about fees has likely compounded the problem, Bitcoin’s simultaneous price increases leading to a 600% surge in exchange use, Poloniex said this week.

Meanwhile, other commentators remain critical of the economic state of the network. Entrepreneur Vinny Lingham asserted Friday that Bitcoin “ doesn’t make economic sense for any transaction less than $100” compared to “credit cards and PayPal.”

Bitcoin now doesn't make economic sense for any transaction less than $100… #justsaying – can't wait until we hit $5,000! ;)

— Vinny Lingham (@VinnyLingham) May 19, 2017

At the same time, however, his apparent excitement for prices continuing past $2000 per coin to hit $5000 suggests a U-turn.

In a succession of blog posts throughout the first quarter of 2017, Lingham explicitly warned against Bitcoin becoming too valuable too quickly, the effect of a bubble having an adverse effect on its economy.

Bitpay To Users: We Hear You

As Bitcoinist reported earlier this week, rising fees no longer guarantee even comparable transaction processing times to previous months. Bitcoin’s mempool was laden with hundreds of thousands of dollars’ worth of unconfirmed payments, this number, however, falling sharply Friday.

In a blog post about the mempool and transactions issue, Bitpay wrote:

The bad news is that this network traffic may produce delays of a few hours to a few days for some users and a wait time of weeks for a small number of users.

“…We care about the payment frustrations BitPay merchants and purchasers are experiencing right now,” it continued, adding that it was “continuing to explore options for faster, simpler, and more affordable bitcoin payments.”

Bitpay had responded to the fee increases early, raising its minimum invoice amount from 4 cents to $1.

What do you think about Bitcoin’s drop in fees and mempool size? Let us know in the comments below!

Images courtesy of Wikimedia, QuickMeme, Pixabay

Комментариев нет:

Отправить комментарий