Bitcoin Millionaire: Top 5 Bitcoin Millionaires

Last updated on January 2nd, 2018 at 12:00 am

Bitcoin millionaire – bitcoins are truly taking a place among the financial world and everyone wants to know all about the celebrities of the industry. These are the people that have reached the bitcoin millionaire investors club. They did not do it by being a hedge fund manager or by selling the latest greatest product. They became millionaires by purchasing, mining, and trading the cryptocurrency.

The number of actual bitcoin millionaire investors is not known. Bitcoins are contained in virtual wallets and while the number of wallets and the amounts they contain is public knowledge, the people who own these wallets are protected. Considering that people can have as many wallets as they want, it is impossible to say that all the wallets belong to individuals.

Bitcoin Millionaire: List of Individual Bitcoin Millionaires

Bitcoin millionaire Jered Kenna purchased his first batch for $0.20 a piece. He traded them for approximately $258 a piece. This was just the first batch of coins. He lost approximately $200,000 in 2010 when he reformatted his drive. Something that can happen when you are dealing with cryptocurrency he did not worry about the loss, though he would not disclose his actual worth.

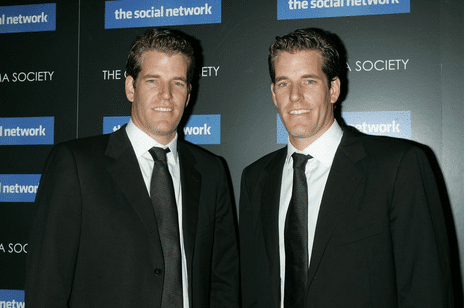

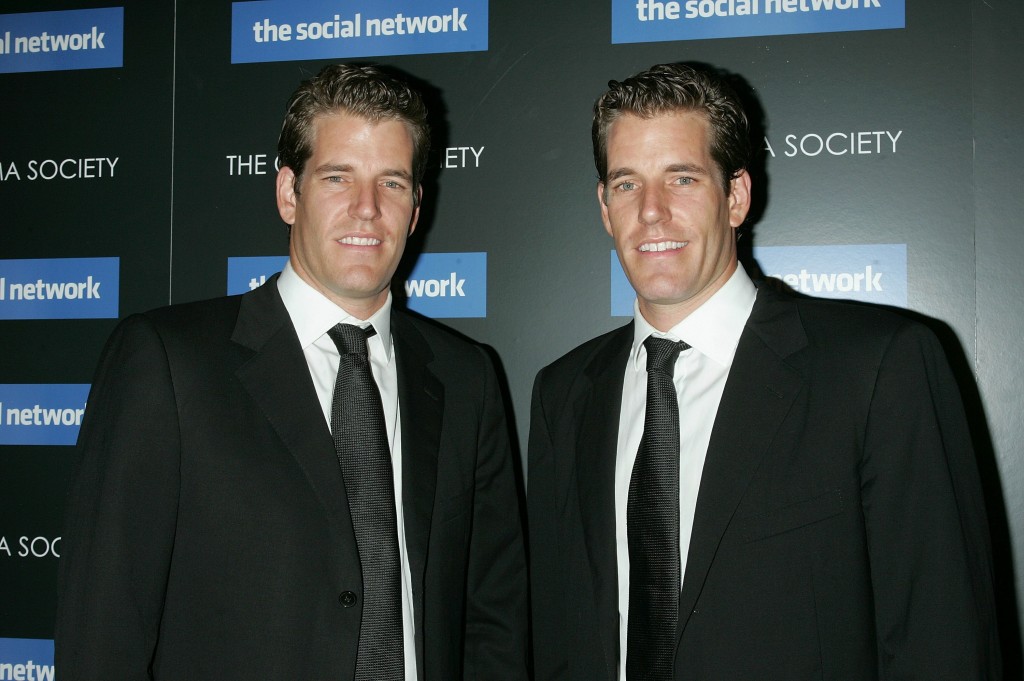

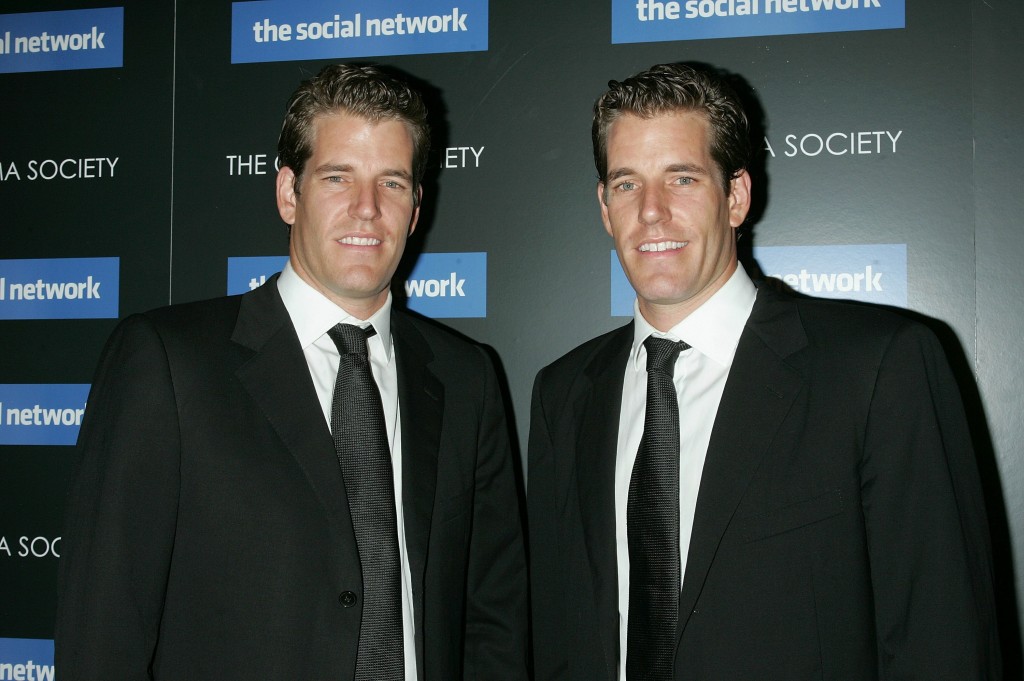

Facebook Litigants the Winklevoss twins became investors in the market, according to the New York Times they have amassed $11 million from their investment. The Winklovess twins joined the Bitcoin millionaire club even before bitcoin was made popular and known to the public.

Charlie Shrem found bitcoins in 2011; he purchased his first batch for between $3-4 a piece. He purchased thousands more when they increased to $20. He then started a company BitInstant that allows people to purchase Bitcoins in physical stores.

Roger Ver, he invested in BitInstant and then started not only purchasing but giving Bitcoins away. He sees it as a reliable store of value. He does everything these days in Bitcoins.

Yifu Guo began mining coins when he was a student at New York University. He then founded Avalon. Avalon is a company, which is dedicated to building the necessary equipment for data mining required for bitcoins. The goal to further the spread of Bitcoins and help to ensure the network is available over the long term.

Topy Gallippi CEO of BitPay includes Bitcoins in his portfolio right along with his real estate, bonds and stocks. His company is a payment processing company that handles Bitcoin processing.

As previously mentioned, due to the way the bitcoins are stored it is impossible to have a clear understanding of just how many of the wallet owners are actual millionaires. The millionaire status comes from the amount of hard versus cryptocurrency they would hold if they were to cash in their bitcoin holdings.

8 Bitcoin Millionaires: from geeks to rich gurus

Last updated on January 2nd, 2018 at 12:00 am

They are young, they are rich, they are the Bitcoin millionaires! We already talked about some of them in the past at Bitcoin Examiner, but let’s take a closer look into the sweet world of the cryptocurrency millionaires.

1. Charlie Shrem

Charlie Shrem is only 23 years old, but he’s already a millionaire. He’s the co-owner of Evr, one of the most famous gastro pubs in Manhatan and one of the few establishments that accept Bitcoin in the area, and the founder of the exchange platform Bitinstant. Find out more about his story here.

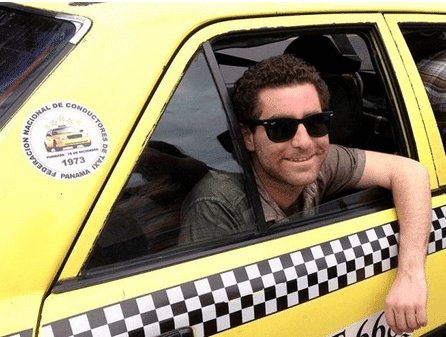

2. Roger Ver

3. Winklevoss twins

The Harvard-educated twins, forever connected to the creation of Facebook, are said to be the owners of 1 percent of all the existing Bitcoins. Besides, the Winklevoss brothers are now launching their new Bitcoin exchange-traded fund. Read more about this here.

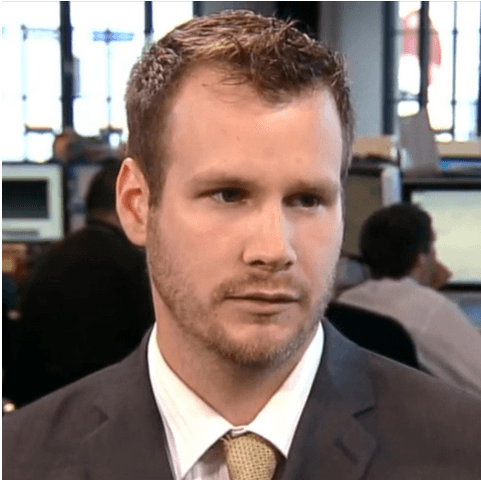

4. Jered Kenna

The founder and Chief Executive Officer of Tradehill got involved in the Bitcoin exchange in 2009. Jered Kenna also owns the 20Mission “hacker hotel” located in the Mission District of San Francisco.

5. Peter Vessenes

The CEO of CoinLab lives in Seattle (USA) and is one of the greatest personalities in our Bitcoin millionaires list.

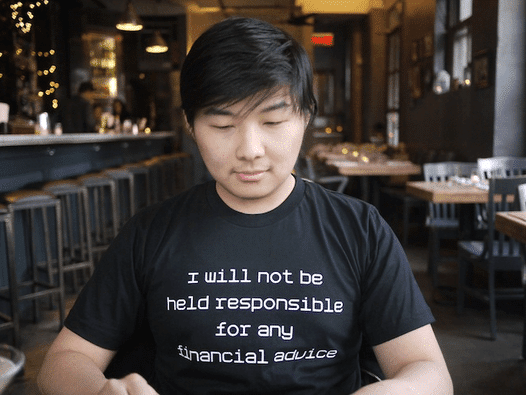

6. Yifu Guo

Yifu Guo is the founder of Avalon, a company that produces ASIC-based Bitcoin miners. The entrepreneur and Bitcoin expert got involved with Bitcoin in 2011.

7. Bruce Wagner

The ex-host of The Bitcoin Show has made a huge amount of money thanks to cryptocurrency. Bruce Wagner was frequently linked to the episode “MyBitcoin scam”, but no one found no evidence of the connection.

8. Mark Karpeles

The well-known founder and CEO of the biggest Bitcoin exchange platform in the world, the Japanese-based Mt. Gox, got very very rich thanks to cryptocurrency. Mark Karpeles was one of the first entrepreneurs to bet on Bitcoin.

If You Bought $5 of Bitcoin 7 Years Ago, You'd Be $4.4 Million Richer

Seven years ago, the value of a single bitcoin was worth a quarter-of-a-cent. Today, that single bitcoin is worth upwards of $2,200.

Monday marked the seventh anniversary of what is said to be the first recorded instance of bitcoin used in a real world transaction. Over the course of seven years, bitcoin’s value has multiplied 879,999 times over since 2010. If an investor had decided to spend five dollars back then on about 2,000 bitcoins, that stake would be worth $4.4 million today. With $1,200 spent on some 480,000 bitcoins, the investor would be worth at least $1.1 billion today.

The early months of 2017 have been particularly heady days for bitcoin. Since the beginning of the year, the value of the cryptocurrency has surged as it gains legitimacy in countries like Japan. Investors have also come to see the currency as something of a safe haven asset amid geopolitical turmoil — and there’s been plenty of that in recent months, in both Europe and the United States.

And that first transaction? A software programmer on “Bitcoin Talk” known as Lazlo Hanyecz offered to 10,000 bitcoins for a couple of pizzas. For a least three days, no one took bite of the offer, with Hanyecz writing: “So nobody wants to buy me pizza? Is the bitcoin amount I’m offering too low?”

A user eventually paid about $25 for two pizzas. In today’s bitcoins, those pizzas cost Hanyecz $22 million.

So You Want To Become A Bitcoin Millionaire?

Last Updated on December 20, 2017 Matthew Vint 1 Comment

This article contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Policy, visit this page.

When you think of trading or investing, you probably think of stocks and bonds. You might also think of commodities, currencies and whatnot. But strolling into a mutual fund manager's office and mentioning Bitcoins would probably get you an odd look, assuming he or she is not an avid reader of TechCrunch.

When you think of trading or investing, you probably think of stocks and bonds. You might also think of commodities, currencies and whatnot. But strolling into a mutual fund manager's office and mentioning Bitcoins would probably get you an odd look, assuming he or she is not an avid reader of TechCrunch.

Introduced in 2009, the electronic currency Bitcoin is exchanged through its own payment network. The Bitcoin can be stored in a virtual wallet and has been described as a cryptocurrency; a decentralized, peer-to-peer currency which relies on cryptography to facilitate currency generation and transactions. To prevent double-spending, computers known as “miners” receive transaction fees and free Bitcoins in exchange for running a proof-of-work system.

If you're just looking on how to invest in Bitcoins, sign up with Coinbase and get started. By using THIS LINK you'll get $10 in bitcoins after you buy $100 in Bitcoins.

If you don't like this idea – check out Stockpile. You can buy fractional shares of Bitcoin using the fund GBTC. You get $5 for free by opening an account at Stockpile here.

Now, if you're looking to become a Bitcoin millionaire, keep reading.

“Do You Take Bitcoins?”

The Bitcoin is essentially a speculative vehicle for geeks. Basically, do not eat out and expect to pay for the meal with Bitcoins. Not long ago you could have bought illicit drugs with the currency, but the FBI closed down “Silk Road” earlier this year, which allowed people to buy illegal substances anonymously.

Some legitimate vendors have taken to Bitcoin, allowing customers to purchase real products and services with the digital currency. Richard Branson of the Virgin Group has even decided to accept Bitcoins through his Virgin Galactic. Reddit allows you to use Bitcoin to buy Reddit Gold. Yes, you can't buy your everyday groceries with Bitcoins, but you can buy a trip to space. While some everyday vendors have looked into accepting Bitcoins too, most of the demand for the currency has been fueled by speculators, rather than early adopters.

If you're looking to use Bitcoin to pay for stuff, you need a Bitcoin wallet like Coinbase. It's a simple website/app that allows you to securely store your Bitcoins and sell them.

With so much volatility, using Bitcoins in everyday life would be extremely risky anyway. Buying a TV for $1,000 might have cost up to 10 Bitcoins last month and just one Bitcoin now. With such volatility, any serious commerce conducted with Bitcoins is likely to result in one party losing out on a lot of value. So right now, the cryptocurrency is realistically just a tool for speculation. Coinbase is one of the major Bitcoin exchanges, which allows you to buy and sell Bitcoins as you please. You sign up, deposit real-world money and exchange the currency with relatively low fees.

Bitcoin's Bullish History

First, let's take a look at the price history. According to Bitstamp, as of today the market capitalization is over $12B with over 12 million Bitcoins in the system. Until 2013, Bitcoins were trading for either less than $10 each or not much over. As soon as 2013 started, Bitcoins seemed to ever-increase in value until April 9 where they peaked at well over $200. By April 16, Bitcoins had lost almost half their value.

Since April, Bitcoins have made a ridiculous comeback. Bitstamp shows that the price of a Bitcoin didn't reach its previous peak until November this year. However, in this same month, Bitcoins surged up to well over $1,000 a piece.

Right now, they seem to be fluctuating. Of course this is all speculative. You can make all the predictions you want, but no one knows what the future holds for Bitcoin. Is it just a fad or could Bitcoin genuinely develop into an everyday currency? If it really took off, would the government not just ban it completely? Only time will tell, but for now let's speculate.

As of December 2017, the price of Bitcoin is past $18,000 – some people have made millions and billions investing in Bitcoin. Furthermore, there have been hard forks (i.e. splits) into things like Bitcoin Cash, which also have boosted people's profits.

How To Make A Million With Bitcoins

You have two options: mine or trade. By mining for Bitcoins, as long as the markets remain active you can basically make money for nothing. But the problem is, mining is such a tough gig now that it is hardly worth it. Turning your computer into a miner will likely make it noisy and heat up. It would likely take you a long time to even mine a single Bitcoin, by which time you probably would have spent more on electricity. However, if you have access to some serious computing power and you don't have to pay the bills, you could make some easy money here.

The more realistic way of making a million with Bitcoins is going to be trading them through the most prominent exchanges, such as Coinbase. Back in 2011, you could have bought Bitcoins for $10. Selling them at $1,000 today would have delivered a profit of $990 per Bitcoin. Basically you should have bought about 1,000 Bitcoins back when they were cheap. This would have cost you around $10,000 in 2011, making you a millionaire today.

Making a million with Bitcoins today is probably still possible, but you will need some capital. Bitcoins can fluctuate many percentage points every day (on May 22, 2017 the price jumped up 10%). Day trading Bitcoins is going to be risky, but where is there is volatility there is opportunity. Otherwise, you need to take a longer-term approach and conclude whether or not you think Bitcoin will be successful. If you think Bitcoin is going to be traded by foreign exchange dealers, market makers and institutions one day, you might want to go long. Buying right now would be incredibly risky; the price chart is screaming “bubble”, but your point of entry is up to you. Don't expect to see more of the same fast growth now though.

On the other hand, if you have a strong conviction in the downfall of the Bitcoin, you need to short the cryptocurrency in any way you can. This would be an extremely risky endeavor still, but if the Bitcoin market is truly destined for failure, why not get rich when the bubble pops? To short Bitcoin, you will either need to get creative or join an exchange which allows you to do so.

Other Ways To Invest In Bitcoin

It's important to remember that Bitcoin is a currency – not a stock or bond. This means that “investing” in it is like investing in a currency. You're essentially hoping the value of Bitcoin relative to your native currency goes up.

The easiest way to invest in Bitcoin is to simply get a Bitcoin wallet and buy Bitcoins. We recommend Coinbase for U.S. investors – it's the easiest, links to your bank account, and allows you to buy and sell Bitcoins. Plus, if you buy $100 USD in Bitcoins, Coinbase will give you a $10 bonus! That's awesome.

If you want to invest in an ETF through your broker, check out the GBTC at Stockpile. This ETF tracks Bitcoin, and you can invest in fractional shares. Get started at Stockpile and get $5 for free. Start here.

But What If I'm Sane?

If you are a sane individual, Bitcoins probably don't excite you too much. The risk/reward profile of the Bitcoin market is not going to be very appealing to the savvy investor. This is just a chance to either make a quick buck, or lose everything. Bitcoins may well take off in the real-world in the future, but then again what would stop another cryptocurrency from emerging and defeating the Bitcoin, especially if it was indeed better?

So in conclusion, if you want to be a Bitcoin millionaire, you need to hijack someone else's hardware and get mining for an extended period of time (and cash out before you get penalized or arrested). Failing that, you need to either day trade Bitcoins and take advantage of the short-term price volatility, or make an extremely risky long or short bet on the long-term success or demise of the Bitcoin.

By shorting, you might be able to make money on the downside in the short-term too if the so-called Bitcoin bubble is about to burst. On the other hand if you are sane, it's probably wise to just sit back and watch the chaos unfold.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

8 Bitcoin Millionaires: from geeks to rich gurus

Last updated on January 2nd, 2018 at 12:00 am

They are young, they are rich, they are the Bitcoin millionaires! We already talked about some of them in the past at Bitcoin Examiner, but let’s take a closer look into the sweet world of the cryptocurrency millionaires.

1. Charlie Shrem

Charlie Shrem is only 23 years old, but he’s already a millionaire. He’s the co-owner of Evr, one of the most famous gastro pubs in Manhatan and one of the few establishments that accept Bitcoin in the area, and the founder of the exchange platform Bitinstant. Find out more about his story here.

2. Roger Ver

3. Winklevoss twins

The Harvard-educated twins, forever connected to the creation of Facebook, are said to be the owners of 1 percent of all the existing Bitcoins. Besides, the Winklevoss brothers are now launching their new Bitcoin exchange-traded fund. Read more about this here.

4. Jered Kenna

The founder and Chief Executive Officer of Tradehill got involved in the Bitcoin exchange in 2009. Jered Kenna also owns the 20Mission “hacker hotel” located in the Mission District of San Francisco.

5. Peter Vessenes

The CEO of CoinLab lives in Seattle (USA) and is one of the greatest personalities in our Bitcoin millionaires list.

6. Yifu Guo

Yifu Guo is the founder of Avalon, a company that produces ASIC-based Bitcoin miners. The entrepreneur and Bitcoin expert got involved with Bitcoin in 2011.

7. Bruce Wagner

The ex-host of The Bitcoin Show has made a huge amount of money thanks to cryptocurrency. Bruce Wagner was frequently linked to the episode “MyBitcoin scam”, but no one found no evidence of the connection.

8. Mark Karpeles

The well-known founder and CEO of the biggest Bitcoin exchange platform in the world, the Japanese-based Mt. Gox, got very very rich thanks to cryptocurrency. Mark Karpeles was one of the first entrepreneurs to bet on Bitcoin.

'If you don't get rich, it's all your fault': Teenager who bought Bitcoin when he was 12 and is now worth $6million claims anyone can become a 'crypto' millionaire - but you must buy NOW

By Josh Hanrahan For Daily Mail Australia 05:19 BST 02 Feb 2018, updated 10:21 BST 02 Feb 2018

Latest From MailOnline

- Erik Finman, 19, has made close to USD$6million since first investing in Bitcoin

- The teenage rich kid bought his first cryptocurrency with $1000 when he was 12

- Finman claims that if you're not a millionaire in the next decade: 'It's your fault'

- Bitcoin dropped to a low of USD$8,568 overnight, half the price from December

Erik Finman was only a child when he invested the $1,000 he got from his grandma in Bitcoin.

He came from a rich and well-educated family in Idaho, in the north-west US, but just a few years into high school realised that college wasn't for him.

With his parents desperate for him to follow in their footsteps he made them a bet: If he could become a millionaire before his 18th birthday he could skip college.

Now, having watched the price of the Bitcoin skyrocket well beyond the $12 when he began, the 19-year-old has amassed a cryptocurrency wealth of more than $6million.

Despite the price of the 'crypto' plummeting across the board over recent weeks, Mr Finman has made a bold claim to the doubters: 'If you're not a millionaire in the next decade, it's your fault'.

After hitting a high of USD$19,343 (AUD$24,161) in mid-December 2017, the price of one Bitcoin dropped to as low as USD$8,568 (AUD$10,702) overnight.

The volatility of cryptocurrency, combined with a widespread lack of understanding of the market, has led many financial experts to warn people to steer clear.

But Mr Finman, the budding tech and cryptocurrency expert, told Business Insider he found it so easy to get rich, there's no excuses for anyone not to do the same.

Related Articles

'I say if you do not become a millionaire in the next 10 years, then it’s your own fault,' the teenage millionaire said.

But while many of his peers aren't confident in the strength of cryptocurrencies like Bitcoin and Ethereum, the rich kid is telling anyone and everyone to invest.

'I still believe in cryptocurrencies, there are always ups and downs on the way up,' Mr Finman said.

IS IT TOO LATE TO MAKE A BITCOIN FORTUNE?

Bitcoin is a digital currency, known as cryptocurrency, which began in 2009 and were initially worth just a few cents.

In 2013 it hit the USD$100 mark for the first time, before rising to USD$900 at the start of 2017. Today it is worth USD$8,600 (AUD$10,700).

Thousands of amateur traders are now betting huge amounts, while start-up companies use bitcoin to raise money and avoid the transparency needed in a stock market float.

But experts fear the currency has become a vast speculative bubble detached from reality.

Watchdogs across the world have warned there could be a sudden massive crash if the market turns, losing investors billions of dollars.

Economist Nouriel Roubini, who predicted the global financial crisis (GFC), is one who has called cryptocurrency a 'giant speculative bubble' bound to end in disaster.

Cryptocurrency investors claim the price will continue to boom, potentially as high as USD$80,000 or AUD$100,000.

Bitcoins are generated by using an open-source computer program to solve complex math problems. This process is known as 'mining'.

Each Bitcoin has a unique fingerprint and is defined by a public address and a private key. Owners of bitcoin do not own a physical coin, but instead a string of numbers and letters that give a specific identity.

Other types of coins are available online including Ethereum, LiteCoin, Neo and Monero — these non-bitcoin cryptocurrencies are often called altcoins.

'I have many friends and fans who almost begged for a crash. because they wanted to buy but thought the price was too high.

'The biggest mistake (you) can make is to get out of the market now and sell (your) bitcoins just because of a setback.'

Happy to brag about his success Mr Finman has some 8,700 followers on Instagram where he's shared pictures of himself in luxury cars and playing with wads of cash.

His bold story of success has seen him featured on stage at Tedx and regularly talk at business forums.

The 19-year-old who made his fortune in bitcoin says if you don't become a millionaire in the next 10 years, it's your own fault

Erik Finman dropped out of school at 15 to pursue a career as an entrepreneur. Now, he's worth over $1.5 million in bitcoin holdings. Finman

Erik Finman dropped out of school at 15 to pursue a career as an entrepreneur. Now, he's worth over $1.5 million in bitcoin holdings. Finman

- Erik Finman, 19, bet his parents that he wouldn't have to go to college if he was a millionaire before age 18 — and he won by investing in bitcoin.

- He told Business Insider Germany there was still a lot of opportunity in cryptocurrencies.

- He says he's found there's no need to panic over lows or bubbles.

German teenager Erik Finman has an unusual success story.

When was 12 years old, he realized school wasn't his future. Most of his classmates felt the same, of course, but Finman took action: He made a bet with his parents.

His parents promised that if he became a millionaire before his 18th birthday, he wouldn't have to go to college.

So Finman took the 1,000 euros from his grandmother meant for his studies and bought bitcoins at a rate of about 10 euros each. He won that bet with his parents by becoming a bitcoin millionaire before he turned 18.

Finman, now 19, has been trading in bitcoin and other cryptocurrencies for seven years.

Our colleagues from Business Insider Germany spoke exclusively with Finman, who explained why you can still become a millionaire with cryptocurrencies over the next 10 years and discussed the crash earlier this month.

Business Insider: Erik, we speak to each other at a time when the prices of cryptocurrencies have plummeted across the board. Was this the start of a crash and perhaps the bursting of a bubble, or just a late correction after the quick gain of recent months?

Erik Finman: I still believe in cryptocurrencies. There are always ups and downs on the way up. Many people have anticipated this decline. It was almost a self-fulfilling prophecy after many experts spoke of a bubble.

For me, the decline is due to a decrease in momentum — after the development of the last few months, it had to happen at some point. It was foreseeable because value continued to rise steadily while many people were not convinced of the rise in prices.

Of course, I didn't know exactly on which day that setback would come. However, the advance of cryptocurrencies is unstoppable. A single crash does not change that. People will continue to invest in it and become increasingly emotionally connected with digital currencies.

Business Insider: That means that you keep your bitcoins?

Finman: That is true. I remain stuck with my bitcoins — and there are a lot of them.

Business Insider: These are the words of someone who has been investing in cryptocurrencies for seven years and has a lot of relevant experience. But somebody who has only recently entered the currency is likely to become nervous after the recent losses .

Finman: I have met many such people. As interest increased and the price rose, they were attracted and invested their money in it. But the biggest mistake they can make is to get out of the market now and sell their bitcoins just because of a setback.

It is important to know — and especially when you invest a lot of money — that the prices fluctuate greatly. In the past, bitcoin has had these setbacks time and time again, and this is unlikely to change in the future. But bitcoin will probably continue to rise. Maybe it only takes a few weeks; maybe years. Of course, no one knows.

For me, however, it would be the wrong strategy to sell after such a fall in prices, because I believe that there is a real chance that value will rise again to the levels we last saw.

Business Insider: If you are so convinced, does this mean that you see a good chance to buy bitcoins when the price is so low?

Finman: Yes, exactly. But not only me. I have many friends and fans who almost begged for a crash. They asked for a correction and a crash because they wanted to buy but thought the price was too high.

This drop in the price of bitcoin gives them a chance. And now you must have the courage to really get involved. Otherwise, at some point, you look back and think, "If only I had bought after the reset." So I really guess people are now using the reset to buy.

Business Insider: Not only has bitcoin collapsed, but most other cryptocurrencies have also fallen. Are you still convinced that bitcoin is the best digital currency, or do you also have other favorites?

Finman: Today, bitcoin is the best cryptocurrency for me.

But bitcoin is like Netscape or Myspace. Bitcoin is sort of a pioneer of a new technology, so it's important that it continues to exist. But the technology is already beginning to be obsolete — to buy a coffee for $2, you have to pay a transaction fee of $30.

These issues need to be addressed at the technology level, by giving a new coin or updating a coin. Add to that the electricity costs for the mining — to mine a bitcoin, you need so much energy, with which you could cover the needs of a house over a whole year.

In addition, most of the miners are located in China, and thus the energy comes from Chinese coal-fired power plants, so bitcoin, meanwhile, contributes to massive environmental pollution. Also this problem can be solved by a new technology or an update of an existing technology.

Bitcoin has been around for a long time, and Myspace or Netscape have been successful for a while. But at some point, better products came on the market — Facebook or Google Chrome, as an example.

Fact is, bitcoin as we know it today will not last forever. The only question is what comes next — either an update that solves the problem, or another coin will prevail.

Finman speaks at a TEDx Teen conference in 2014. Erik Finman

Business Insider: Technology also has its limits, and cryptocurrency today has a completely different status than a few years ago. Do you think you would be just as easy to win that bet today with your parents?

Finman: If you are smart about cryptocurrency over the next 10 years, many people can build their fortunes even better than before.

The area is still relatively small; the market capitalization is just over half a trillion dollars. I do not want to be misunderstood: This is, of course, a very high amount, but in comparison to other asset classes, it's small. Therefore, I say if you do not become a millionaire in the next 10 years, then it's your own fault.

New business models and innovations are still emerging in this area, and therefore, there are many investment opportunities. It's a new kind of gold fever, or a new kind of Silicon Valley — there are really plenty of opportunities.

Business Insider: That sounds very easy. After all, more and more initial coin offerings are springing up — and there is always the risk of a total loss.

Finman: That is true, and it takes a certain amount of effort to analyze. But this situation will also improve with time — there will be better and more credible ICOs.

But it's not just about investing in existing things. Everyone is free to start their own business in the field with an idea and earn a lot of money. That's risky, too, but a bit less risky for me than the pure investment.

But there are already two different ways to get rich in this area: You can start a new business, or invest in existing coins or ideas. You can also count on those who have proven for a while that they can be successful, like Monero. I like this cryptocurrency because it also has a good field of application.

The bottom line is that you should be careful and deal well with the currencies you want to invest in.

Get the latest Bitcoin price here.>>

This post originally appeared on Business Insider Deutschland and has been translated from German.

A Secret Bitcoin Millionaire Is Giving Away $86m To Charity Through New 'Pineapple Fund'

An anonymous crypto-philanthropist is giving away $86 million in bitcoin after holding onto the lucrative digital currency as its price reached meteoric levels at the end of 2017.

The bitcoiner, who has chosen to remain unknown, has already handed out $7.5 million in bitcoin to charities and charitable causes across the world, and wants to give away the remaining amount away.

The creator of the charitable group known as The Pineapple Fund said that "once you have enough money, money doesn't matter," in an interview with The Guardian.

The user, named only as Pine, is giving away more than 5,000 bitcoins, each of which was prized at around $13,500 at the time of writing. Earlier this month, the bitcoin scaled record highs of $20,000. Some experts have cautioned that it could be a bubble ready to burst, or a blip that will see the digital currency steadily climb again.

In any case, Pine is getting rid of the majority of the bitcoins he or she owns, they say.

“I’m happy that I can help change the world for the better,” Pine told The Guardian in a phone conversation, on condition of anonymity. “I have a great deal of faith in humanity, but I wish more people could live with love and respect for each other.”

A visual representation of the digital Cryptocurrency, Bitcoin on December 07, 2017 in London, England. Cryptocurrencies including Bitcoin, Ethereum, and Lightcoin have seen unprecedented growth in 2017, despite remaining extremely volatile. Dan Kitwood/Getty

Pine is using three factors to decide on who should receive his or her digital coins.

“How impactful their work is (especially on an international scale), what new innovative skills they are bringing to the table, and how efficient and sustainable they are.”

On December 14, the anonymous bitcoiner posted a message on Reddit to tell the world about his or her philanthropic effort.

"I remember starting at bitcoin a few years ago. When bitcoin broke single digits for the first time, I thought that was a triumphant moment for bitcoin. I watched and admired the price jump to $15.. $20.. $30.. wow! Today, I see $17,539 per BTC (bitcoin)," they wrote.

"I still don't believe reality sometimes. Bitcoin has changed my life, and I have far more money than I can ever spend," they continued.

"My aims, goals, and motivations in life have nothing to do with having XX million or being the mega rich. So I'm doing something else: donating the majority of my bitcoins to charitable causes. I'm calling it The Pineapple Fund."

The bitcoiner said they chose to call the fund after a pineapple because if you eat too much of the fruit your mouth "becomes tender," so while then would be a good time to share pineapple, now is a good time to share bitcoin, and the wealth accumulated from it, with the world.

"I have too many bitcoins for the life I would like to live, so I am sharing them,” they concluded.

YahooFinance

Starbucks dips, Hormel up slightly, Apple sinks

Bitcoin millionaire: Don't buy bitcoin

I first invested $5,000 in bitcoin back in 2013 at $72 per coin and now own approximately 69.2 bitcoins. While I had first heard about bitcoin in 2011, it wasn't until I watched a documentary and started reading forums about the cryptocurrency that I decided to buy it . It was easy to see how bitcoin could disrupt the entire financial system. I decided to buy as a long-term experiment and used less than 1 percent of my net worth at the time to buy into bitcoin. Sure, I wanted to make money on it, but if I lost everything, it wasn't going to change the course of my life. As of this writing, bitcoin is trading at $16,600, which makes my bitcoins now worth $1,148,720. It took me five years working 80-hour weeks to make over $1 million saving and investing in the stock market, but with bitcoin, my coins have increased to over $1 million in 2017 alone. It's by far, without a doubt, the easiest money I have ever made. But I don't recommend you invest in Bitcoin today. On my blog Millennial Money, I've received over 100 emails from readers asking about investing in bitcoin and other cryptocurrencies. I was even talking to a reader last week who told me he put his entire life savings into bitcoin, buying in at around $11,000. That's a terrible idea. I got another email from a 22-year-old who is looking to invest his first $5,000 and wanted to know if bitcoin should be his first investment. That's also a terrible idea. Here's why, even though I'm a bitcoin millionaire, I don't recommend that you invest in it today.

1. It's impossible to actually value bitcoin Bitcoin is a global craze. Even my barber, who has no idea what a blockchain is, is buying it. Because so many new people are buying it (and so quickly!), it's impossible to accurately value . When the price of anything fluctuates 20-30 percent in one day, it's obviously unstable, so you could lose all of your money very quickly. Especially if you need your money in the next year, don't buy bitcoin. With the insane short-term fluctuations, bitcoin is short-term gambling , not investing.

2. There may not be any value in bitcoin at all The value behind bitcoin is the blockchain technology, which has been easily replicated by other digital currencies. Many of those have actually built better and easier-to-use versions. Litecoin is a good example. Sure, bitcoin has an early mover advantage, but it was created to buy and sell things online securely, which no one is doing right now because the price is so insane and transaction costs are skyrocketing. All of the trading volume is also causing significant delays, with some exchanges reporting up to 10 days to get your money in or out and more than a week for your bitcoin to be sent. The cost of sending bitcoin is also skyrocketing since the price is fluctuating so wildly, the value of it could be significantly higher or lower than when you sent the money. Most people aren't buying into the value of the technology, they're buying into the hype. This is gambling, not investing.

3. Bitcoin still isn't that secure You might think that digital wallets are secure, but cryptocurrency exchanges and wallets continue to get hacked regularly. More than $70 million in bitcoin was hacked from NiceHash, a bitcoin mining marketplace, last week. Just because exchanges like Coinbase have $200 million in venture funding and a nice shiny marketplace doesn't mean that they can't get hacked either. Because there is no central governing body guaranteeing your bitcoin, if you lose it, it can be difficult to get back. If it gets stolen, then you are out of luck. Hacks will continue to happen. If you do decide to buy bitcoin, I encourage you to buy responsibly. Don't buy using more than 1 percent of your net-worth, and be honest with yourself: Bitcoin is a gamble, not an investment. It's super risky and there are far better places to invest your money securely for both the long- and short-term. Grant Sabatier is the founder of Millennial Money, where he writes about personal finance, side hustling and investing. He reached financial independence at the age of 30 and is currently working on his first book for Penguin/Random House, set to be released in 2018. Like this story? Like CNBC Make It on Facebook! Don't miss: Here's how you can—and can't—spend bitcoin Should you buy into bitcoin? Here's what top investors say What a 20-something bitcoin millionaire learned from going to prison and starting over

Комментариев нет:

Отправить комментарий