Welcome to Bitcoin NewYork

Scaling Bitcoin by Decentralization!

Independence Day!

All NYA signers betrayed the b2x investors. No any warning. Lost 90% investment in mins. We must continue B2X.

Decentralize!

Decentralization helps to protect the Bitcoin NewYork Agreement (NYA) 2M+Segwit!

The new Bitcoin NewYork Team is building up with critical focus areas being: 1. Changing mining algo to GPU mining. 2. 2M+SW. 3. Adding a two-way replay attack protection. 4. No premine.

Satoshi Nakamoto

Developer Team

Bitcoin NewYork Team

Former Developer Team

Former Company Advisors

Supported Exchanges

Bitcoin Independence Day

Today November 16, 2017, marks the Bitcoin Independence Day.

Bitcoin was created by the New York Agreement (NYA) in collaboration with community members. The major part of the company was the result of the consensus with the community. The NYA signers’ name falls under

Most exchanges are listed for the future by many companies; therefore, hundreds of thousands of B2X trading occurs daily. An announcement made by signers on November 16, 2017, supported the NYA. The dismissal of the existence of B2X led investors to lose 90 percent of their investment in minutes.

Where are the promises of the company? Where is the credit? Who will pay for the losses incurred by B2X investors?

As the Bitcoin New York team: bitcoinnewyork.org. We aspire to continue with the B2X project to provide financial protection. B2X investors are blameless thus their protection will entail certain conditions. We will allow a B2X user to decide the success or end of Bitcoin 2X by focusing on:

1. Changing mining algo to GPU mining. Dynamic Difficulty Adjusted (DDA) every two blocks.

3. Adding a two-way replay attack protection.

5. Fork height: 494784.

6. Hiring developer volunteers (all to be paid by Bitcoin BTC2 bounty).

The Fork Steps

1. When the 494784 height is achieved, the BitcoinX team will snapshot the blocks. In regards to exchanges, the wallets take internal snapshots.

2. Deploy test networks (which will take 2-3 days).

3. If test networks are stable, we will deploy the main networks (which will take 1-2 weeks). We would like to thank our core team and the Bitcoin Gold team for completing most of the works including replaying the attack protection code. This milestone helped the BitcoinX team to finish Bitcoin Segwit 2M within minimal time.

Thanks a lot to Core team, Bitcoin Gold team. They finished a lot works, and committed mining, replay attack protection code. This helps BitcoinX team to finish Bitcoin Segwit 2M in shortest time.

Here is our contact info: bitcoinnewyork.org

Today being an Independence Day, the journey has started. B2X is back in Bitcoin 2X investors’ hands. Only you have the right to decide the success or end of Bitcoin 2X.

Big news! Bitcoin NewYork team Segwit 2X internal test neworks online.

Big news! Bitcoin NewYork team Segwit 2X internal test neworks online.

Segregated Witness Benefits

The Segregated Witness soft-fork (segwit) includes a wide range of features, many of which are highly technical. This page summarises some of the benefits of those features.

Malleability Fixes

Bitcoin transactions are identified by a 64-digit hexadecimal hash called a transaction identifier (txid) which is based on both the coins being spent and on who will be able to spend the results of the transaction.

Unfortunately, the way the txid is calculated allows anyone to make small modifications to the transaction that will not change its meaning, but will change the txid. This is called third-party malleability. BIP 62 (“dealing with malleability”) attempted to address these issues in a piecemeal manner, but was too complicated to implement as consensus checks and has been withdrawn.

For example, you could submit a transaction with txid ef74…c309 to the network, but instead find that a third-party, such as a node on the network relaying your transaction, or the miner who includes your transaction in a block, modifies the transaction slightly, resulting in your transaction still spending the same coins and paying the same addresses, but being confirmed under the completely different txid 683f…8bfa instead.

More generally, if one or more of the signers of the transaction revise their signatures then the transaction remains valid and pays the same amounts to the same addresses, but the txid changes completely because it incorporates the signatures. The general case of changes to signature data (but not the outputs or choice of inputs) modifying the transaction is called scriptSig malleability.

Segwit prevents third-party and scriptSig malleability by allowing Bitcoin users to move the malleable parts of the transaction into the transaction witness, and segregating that witness so that changes to the witness does not affect calculation of the txid.

Who benefits?

Wallet authors tracking spent bitcoins: it’s easiest to monitor the status of your own outgoing transactions by simply looking them up by txid. But in a system with third-party malleability, wallets must implement extra code to be able to deal with changed txids.

Anyone spending unconfirmed transactions: if Alice pays Bob in transaction 1, Bob uses that payment to pay Charlie in transaction 2, and then Alice’s payment gets malleated and confirmed with a different txid, then transaction 2 is now invalid and Charlie has not been paid. If Bob is trustworthy, he will reissue the payment to Charlie; but if he isn’t, he can simply keep those bitcoins for himself.

The Lightning Network: with third-party and scriptSig malleability fixed, the Lightning Network is less complicated to implement and significantly more efficient in its use of space on the blockchain. With scriptSig malleability removed, it also becomes possible to run lightweight Lightning clients that outsource monitoring the blockchain, instead of each Lightning client needing to also be a full Bitcoin node.

Anyone using the block chain: smart contracts today, such as micropayment channels, and anticipated new smart contracts, become less complicated to design, understand, and monitor.

Note: segwit transactions only avoid malleability if all their inputs are segwit spends (either directly, or via a backwards compatible segwit P2SH address).

Further information

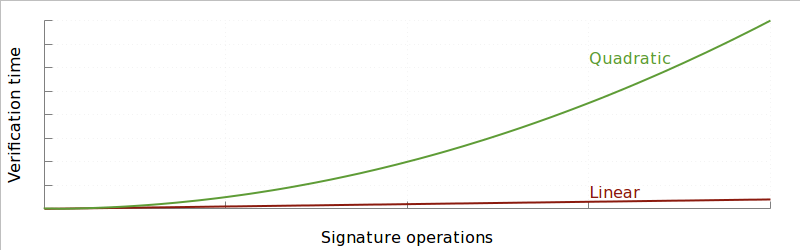

Linear scaling of sighash operations

A major problem with simple approaches to increasing the Bitcoin blocksize is that for certain transactions, signature-hashing scales quadratically rather than linearly.

In essence, doubling the size of a transaction can double both the number of signature operations, and the amount of data that has to be hashed for each of those signatures to be verified. This has been seen in the wild, where an individual block required 25 seconds to validate, and maliciously designed transactions could take over 3 minutes.

Segwit resolves this by changing the calculation of the transaction hash for signatures so that each byte of a transaction only needs to be hashed at most twice. This provides the same functionality more efficiently, so that large transactions can still be generated without running into problems due to signature hashing, even if they are generated maliciously or much larger blocks (and therefore larger transactions) are supported.

Who benefits?

Removing the quadratic scaling of hashed data for verifying signatures makes increasing the block size safer. Doing that without also limiting transaction sizes allows Bitcoin to continue to support payments that go to or come from large groups, such as payments of mining rewards or crowdfunding services.

The modified hash only applies to signature operations initiated from witness data, so signature operations from the base block will continue to require lower limits.

Further information

Signing of input values

When a hardware wallet signs a transaction, it can easily verify the total amount being spent, but can only safely determine the fee by having a full copy of all the input transactions being spent, and must hash each of those to ensure it is not being fed false data. Since individual transactions can be up to 1MB in size, this is not necessarily a cheap operation, even if the transaction being signed is itself quite small.

Segwit resolves this by explicitly hashing the input value. This means that a hardware wallet can simply be given the transaction hash, index, and value (and told what public key was used), and can safely sign the spending transaction, no matter how large or complicated the transaction being spent was.

Who benefits?

Manufacturers and users of hardware wallets are the obvious beneficiaries; however this likely also makes it much easier to safely use Bitcoin in small embedded devices for “Internet of things” applications.

This benefit is only available when spending transactions sent to segwit enabled addresses (or segwit-via-P2SH addresses).

Further information

Increased security for multisig via pay-to-script-hash (P2SH)

Multisig payments currently use P2SH which is secured by the 160-bit HASH160 algorithm (RIPEMD of SHA256). However, if one of the signers wishes to steal all the funds, they can find a collision between a valid address as part of a multisig script and a script that simply pays them all the funds with only 80-bits (2 80 ) worth of work, which is already within the realm of possibility for an extremely well-resourced attacker. (For comparison, at a sustained 1 exahash/second, the Bitcoin mining network does 80-bits worth of work every two weeks)

Segwit resolves this by using HASH160 only for payments direct to a single public key (where this sort of attack is useless), while using 256-bit SHA256 hashes for payments to a script hash.

Who benefits?

Everyone paying to multisig or smart contracts via segwit benefits from the extra security provided for scripts.

Further information

Script versioning

Changes to Bitcoin’s script allow for both improved security and improved functionality. However, the design of script only allows backwards-compatible (soft-forking) changes to be implemented by replacing one of the ten extra OP_NOP opcodes with a new opcode that can conditionally fail the script, but which otherwise does nothing. This is sufficient for many changes – such as introducing a new signature method or a feature like OP_CLTV, but it is both slightly hacky (for example, OP_CLTV usually has to be accompanied by an OP_DROP) and cannot be used to enable even features as simple as joining two strings.

Segwit resolves this by including a version number for scripts, so that additional opcodes that would have required a hard-fork to be used in non-segwit transactions can instead be supported by simply increasing the script version.

Who benefits?

Easier changes to script opcodes will make advanced scripting in Bitcoin easier. This includes changes such as introducing Schnorr signatures, using key recovery to shrink signature sizes, supporting sidechains, or creating even smarter contracts by using Merklized Abstract Syntax Trees (MAST) and other research-level ideas.

Reducing UTXO growth

The Unspent Transaction Output (UTXO) database is maintained by each validating Bitcoin node in order to determine whether new transactions are valid or fraudulent. For efficient operation of the network, this database needs to be very quick to query and modify, and should ideally be able to fit in main memory (RAM), so keeping the database’s size in bytes as small as possible is valuable.

This becomes more difficult as Bitcoin grows, as each new user must have at least one UTXO entry of their own and will prefer having multiple entries to help improve their privacy and flexibility, or to provide as backing for payment channels or other smart contracts.

Segwit improves the situation here by making signature data, which does not impact the UTXO set size, cost 75% less than data that does impact the UTXO set size. This is expected to encourage users to favour the use of transactions that minimise impact on the UTXO set in order to minimise fees, and to encourage developers to design smart contracts and new features in a way that will also minimise the impact on the UTXO set.

Because segwit is a soft-forking change and does not increase the base blocksize, the worst case growth rate of the UTXO set stays the same.

Who benefits?

Reduced UTXO growth will benefit miners, businesses, and users who run full nodes, which in turn helps maintain the current security of the Bitcoin network as more users enter the system. Users and developers who help minimise the growth of the UTXO set will benefit from lower fees compared to those who ignore the impact of their transactions on UTXO growth.

Further information

Efficiency gains when not verifying signatures

Signatures for historical transactions may be less interesting than signatures for future transactions – for example, Bitcoin Core does not check signatures for transactions prior to the most recent checkpoint by default, and some SPV clients simply don’t check signatures themselves at all, trusting that has already been done by miners or other nodes. At present, however, signature data is an integral part of the transaction and must be present in order to calculate the transaction hash.

Segregating the signature data allows nodes that aren’t interested in signature data to prune it from the disk, or to avoid downloading it in the first place, saving resources.

Who benefits?

As more transactions use segwit addresses, people running pruned or SPV nodes will be able to operate with less bandwidth and disk space.

Block capacity/size increase

Since old nodes will only download the witness-stripped block, they only enforce the 1 MB block size limit rule on that data. New nodes, which understand the full block with witness data, are therefore free to replace this limit with a new one, allowing for larger block sizes. Segregated witness therefore takes advantage of this opportunity to raise the block size limit to nearly 4 MB, and adds a new cost limit to ensure blocks remain balanced in their resource use (this effectively results in an effective limit closer to 1.6 to 2 MB).

Who benefits?

People who run upgraded wallets will be able to take advantage of the increased block size by moving signatures to the witness section of the transaction.

Moving towards a single combined block limit

Currently there are two consensus-enforced limits on blocksize: the block can be no larger than 1MB and, independently, there can be no more than 20,000 signature checks performed across the transactions in the block.

Finding the most profitable set of transactions to include in a block given a single limit is an instance of the knapsack problem, which can be easily solved almost perfectly with a simple greedy algorithm. However adding the second constraint makes finding a good solution very hard in some cases, and this theoretical problem has been exploited in practice to force blocks to be mined at a size well below capacity.

It is not possible to solve this problem without either a hardfork, or substantially decreasing the block size. Since segwit can’t fix the problem, it settles on not making it worse: in particular, rather than introducing an independent limit for the segregated witness data, instead a single limit is applied to the weighted sum of the UTXO data and the witness data, allowing both to be limited simultaneously as a combined entity.

Who benefits?

Ultimately miners will benefit if a future hardfork that changes the block capacity limit to be a single weighted sum of parameters. For example:

This lets miners easily and accurately fill blocks while maximising fee income, and that will benefit users by allowing them to more reliably calculate the appropriate fee needed for their transaction to be mined.

Further information

Update 2016-10-19

Earlier versions of this page listed “Compact fraud proofs” as a benefit of segwit. However, as implemented, segwit does not make this any easier: with or without segwit, a future soft-fork enabling compact fraud proofs and the benefits they bring, will need to include its own commitment (eg, in the coinbase transaction), rather than being able to extend the commitment data used by segwit.

The previous text was:

Compact fraud proofs

As the Bitcoin userbase expands, validating the entire blockchain naturally becomes more expensive. To maintain the decentralised, trustless nature of Bitcoin, it is important to allow those who cannot afford to validate the entire blockchain to at least be able to cheaply validate as much of it as they can afford.

Segwit improves the situation here by allowing a future soft-fork to extend the witness structure to include commitment data, which will allow lightweight (SPV) clients to enforce consensus rules such such as the number of bitcoins introduced in a block, the size of a block, and the number of sigops used in a block.

Who benefits?

Fraud proofs allow SPV users to help enforce Bitcoin’s consensus rules, which will potentially greatly increase the security of the Bitcoin network as a whole, as well as reduce the ways in which individual users can be attacked.

These fraud proofs can be added to the witness data structure as part of a future soft-fork, and they’ll help SPV clients enforce the rules even on transactions that don’t make use of the segwit features.

Segregated Witness Benefits was published on January 26, 2016 .

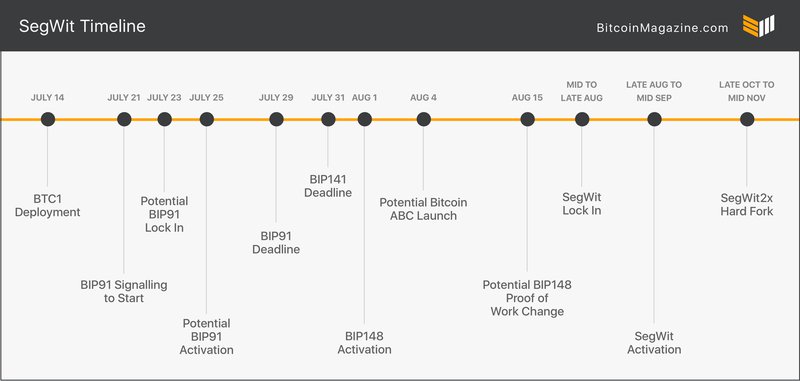

Countdown to SegWit: These Are the Dates to (Still) Keep an Eye On

Aaron van Wirdum

Bitcoin’s very public scaling debate is entering a crucial phase. Two of the most popular scaling proposals available today — BIP148 and SegWit2x — both intend to trigger Segregated Witness (“SegWit”) activation within a month, which means that the protocol upgrade could be live within two.

At the same time, there is a very real risk that Bitcoin “splits.” Both BIP148 and SegWit2x could diverge from the current Bitcoin protocol, which could in turn lead to even more splits.

Here is a list of dates for July, August and beyond to keep an eye on.

This article was last updated on August 8th.

Recap: Segregated Witness Activation

August 2nd update: Most of the information in this section is still accurate, but some of it is a bit outdated now. Keep in mind it was written about a month ago, before many of the recent developments occurred.

First, a brief recap on Segregated Witness and its potential activation methods.

SegWit is a backwards compatible protocol upgrade originally proposed by the Bitcoin Core development team. It has been a centrepiece of the scaling roadmap supported by Bitcoin Core since the protocol upgrade was first proposed in December 2015, and it is implemented on many active Bitcoin nodes on the network today. SegWit is now also part of the “New York Agreement”: an alternative scaling roadmap forged between a significant number of Bitcoin companies, including many miners. And Bitcoin Improvement Proposal 148, or BIP148, is a user activated soft fork (UASF) scheduled for August 1st that also intends to activate SegWit.

The difference lies in how the activation should happen.

The first and original option was proposed by the Bitcoin Core development team. Their SegWit code, defined by BIP141, activates if 95 percent of hash power within a single difficulty period of about two weeks signals readiness before November 15th. Assuming that the miners who signal readiness are actually ready to support the upgrade, risks of a split in Bitcoin’s blockchain and currency are minimal.

However, currently only some 40 to 45 percent of hash power is signaling readiness for BIP141. This is why a segment of Bitcoin users plans to activate SegWit with the BIP148 UASF. Starting on August 1st, their nodes will reject all blocks that do not signal readiness for BIP141. If this proposal is supported by any majority of miners (by hash power), these miners should always claim the longest valid chain, which should activate SegWit on all SegWit-ready Bitcoin clients and avoid a split. But if this proposal is supported by a minority of miners, a “BIP148 chain” would split off from the current protocol.

The New York Agreement, also referred to as the “Silbert Accord” or “SegWit2x,” plans to activate SegWit through BIP91. Like BIP148, all BIP91 nodes would reject any blocks that do not signal readiness for BIP141. But unlike BIP148, BIP91 nodes would only do this once 80 percent of hash power signals that they support BIP91, within a period about two days. This should also minimize the chance of a split.

However, the second step of the New York Agreement is a hard fork to double Bitcoin’s “base block size.” This change, as opposed to Segregated Witness itself, is not backwards compatible, and could therefore lead to a “split” as well.

There is also such a thing as miners signaling intent to support the New York Agreement, but this is effectively meaningless and will be ignored for the purpose of this article.

Now for the dates…

July 14: BTC1 Deployment

The software client that resulted from the New York Agreement is a fork of the Bitcoin Core codebase, called “BTC1.” BTC1’s beta software was released on June 30th. But according to the SegWit2x roadmap, July 14th is the day that signatories to the New York Agreement should actually install the BTC1 beta software and test it for themselves.

This shouldn’t affect regular users or miners much, however.

July 17th update: Deployment of BTC1 is delayed by a couple of days, but not in such a way as to distort the remainder of the timeline.

July 21: BIP91 Signaling to Start

The SegWit2x development team aims for July 21st to be the day that BTC1 nodes are actually up and running, and, importantly, the day that miner signaling should commence.

This shouldn’t really affect regular users either.

But if you are a miner, you may want to help activate SegWit by signaling readiness for BIP91. (This is done by mining “bit 4” blocks; for example, by mining with BTC1 or with Bitcoin software that includes a BIP91 patch.)

July 17th update: Several mining pools have already started signaling support for BIP91, even before the announced signaling date. At the time of publication of this update, the hash power threshold has not yet been met, however.

July 21st update: BIP91 is now locked in. See below.

July 23 (at the earliest): BIP91 Lock In

The precise threshold for BIP91 activation requires that within a pre-defined series of 336 blocks, 269 blocks must signal readiness. That’s some 80 percent of hash power, over about 2 1/3 days. So assuming the SegWit2x roadmap is followed, BIP91 could, at the very soonest, lock in on July 23rd.

Again, this shouldn’t really affect regular users.

But if you are a miner and BIP91 does activate, you now have another day or two to comply with the BIP91 soft fork. If you don’t, you risk mining invalid blocks.

July 17th update: Since a number of mining pools have started to signal support for BIP91 early, the earliest BIP91 lock-in date has moved forward, too.

July 21st update: BIP91 is now locked in. See below.

July 25 (at the earliest): BIP91 Activation

On July 25th, another 336 blocks after BIP91 “lock in”, BIP91 could actually go into effect, at the soonest. Any blocks that do not signal readiness for Segregated Witness (per BIP141) should now be rejected by a majority of miners (by hash power).

This still shouldn’t really affect regular users.

But if you are miner, you should now only mine blocks, and only mine on top of blocks, that signal readiness for SegWit (BIP141). Else you risk having your blocks rejected by a hash power majority.

July 17th update: Since several mining pools have started to signal support for BIP91 early, the earliest BIP91 activation date has moved forward too.

July 21st update: The 80 percent hash power lock-in threshold for BIP91 was reached today (UTC). This means that BIP91 should activate on July 23rd. If at least a majority of miners (by hash power) actually does enforce BIP91 for the next couple of weeks, this should make BIP148 obsolete. For more information, see this article.

August 8th update: BIP91 and/or BIP148 have done its job: Segregated Witness (BIP141) is no past the point of return for lock-in. See below.

July 29: BIP91 "Deadline"

If Bitcoin miners want to be sure to avoid a “split” in Bitcoin’s blockchain and currency as a result of BIP148 activation, July 29th is a first deadline day for them.

July 17th update: Since the next deadline is already missed (see below), July 29th is now the second deadline day for miners, not the first.

To ensure that BTC1’s BIP91 is activated in time to be compatible with BIP148, it should be locked in on this day at the very latest, say, before 08:00 UTC. (That’s 4 am on the U.S. east coast.) But sooner is better: The closer to the deadline BIP91 locks in, the bigger the risk it doesn’t activate in time.

If BIP91 has not activated by this deadline, Bitcoin may well be heading for a chain-split.

If this happens, and if you are a regular user, and you haven’t prepared for a potential BIP148 UASF chain-split yet, you now have two days left to do so. And you really should. This article explains how.

If BIP91 has not activated by July 29th and you are a miner, you now have two days to decide on which chain you will mine on August 1st: on the BIP148 chain, or on the original (“Legacy”) chain. July 17th update: Or perhaps on the Bitcoin ABC chain; see below.

July 21st update: BIP91 is now locked in. See above.

July 31: BIP141 "Deadline"

If Bitcoin miners want to be sure to avoid a “split” in Bitcoin’s blockchain and currency as a result of BIP148 activation, July 31st is technically the miners’ second deadline day to avoid a split.

On this day (UTC), at the very latest, either BIP91 must activate, or BIP141 must lock in. In other words, if BIP91 did not lock in in time, there must now have been a two-week difficulty period in which 95 percent of hash power signals support for SegWit.

In reality, the chance is small that July 31st actually coincides with the closing day for a difficulty period. And even if it does, it’s unlikely that it will take until this day before it’s clear whether the 95 percent threshold will be met.

As such, both users and miners should have probably already prepared for a potential split, as explained for July 29th. But July 31st really is your last chance to get ready.

July 17th update: As of July 15th, this deadline can no longer be met.

August 1: BIP148 Activation

This is the day BIP148 activates, which makes it the third and final deadline day for miners to avoid a split.

On August 1st, at 00:00 UTC (note that this is still July 31st in the U.S.), all BIP148 nodes will start rejecting any blocks that do not signal readiness for Segregated Witness (per BIP141). If Bitcoin Core’s BIP141 or BTC1’s BIP91 have locked in and/or activated in time, there should be no chain-split.

If neither has happened, a majority of miners (by hash power) now have one last chance to avoid a chain-split: by supporting BIP148 themselves. This would ensure they always (re-)claim the longest valid chain according to all current Bitcoin nodes, and will activate SegWit through BIP141.

If BIP141, BIP91 nor BIP148 have attracted sufficient hash power by August 1st, but BIP148 does gain some traction, the chain could split on this day. If that happens, there will be two types of “Bitcoin,” which we’ll refer to as “148 Bitcoin” or “148BTC” for the BIP148 side of the split, and “Legacy Bitcoin” or “LegacyBTC” for the other side. (This split could resolve over time if 148 Bitcoin ever reclaims the longest chain, or if 148 Bitcoin is abandoned by all miners and users for good, but this is not the focus of this article.)

If you own bitcoin (that is: private keys) at the time of split you should automatically own both 148BTC and LegacyBTC. Though, to access both types, you probably need to download new software. That said, if you are a regular user, it is probably best to initially halt any and all transactions, at least until the situation is more clear. Failing to do so may cost you money! For more information, see this article.

If a split happens and you are a miner, you should have by now decided on which chain you’ll mine, and mine on that chain. (Of course, you can still switch at any time. You may simply want to mine the most profitable chain, for example.)

July 21st update: The 80 percent hash power activation threshold for BIP91 was reached today (UTC). This should make BIP148 obsolete. However, if a majority of hash power does not actually enforce BIP91 by August 1st, the scenario described here does still hold up. For more information, see this article.

August 2nd update: BIP148 has now activated, and so far all is going well. Miners are mining SegWit-signaling blocks-only, which is compatible with both BIP91 and BIP148, which means that all Bitcoin nodes are united on one chain. Segregated Witness (BIP141) is currently scheduled to lock-in on August 8th.

August 8th update: Segregated Witness (BIP141) is now past the point of no return for lock-in. All Bitcoin nodes are still united on one chain.

August 4: Potential Bitcoin ABC Launch

Although the exact date is not set in stone, August 4th may see the introduction of a new type of “Bitcoin”: Bitcoin ABC.

Major Bitcoin mining hardware producer Bitmain recently announced that if BIP91 does not activate before August 1st and BIP148 is showing signs of life after August 1st, it will launch a “contingency plan.” More recently, the implementation to embody this contingency plan — named “Bitcoin ABC” — was announced at the Future of Bitcoin conference.

Bitcoin ABC will share a common history with Bitcoin up until August 1st, but will, for the first couple of days after that, probably be privately mined by Bitmain. It will also include several new and incompatible protocol rules, perhaps most importantly an increased block size limit.

If you owned bitcoin at the time of split — August 1st, 00:00 UTC — you should automatically own “Bitcoin ABC” as well. But you may, in that case, need to download software to be able to send (and receive) the coins. More information will likely become available if this event occurs.

If you are a miner you should be able to mine Bitcoin ABC on August 4th. (And perhaps sooner.)

July 17th update: It now seems a bit more likely that Bitcoin ABC will launch, regardless of BIP148. This launch is scheduled for August 1st, 12:20 (PM). It may still take a couple of days before Bitcoin ABC becomes widely accessible for miners and users. At least one mining pool and exchange, China-based ViaBTC, has announced support for the coin, which it will list as "Bitcoin Cash", with the ticker "BCC".

July 21st update: Contraryto earlier reports, it appears that Bitcoin ABC will not include two-way replay protection. If you want to make sure you don't lose access to your Bitcoin ABC coins, you should not send any bitcoins (whether 148BTC or LegacyBTC) until you have "separated" your Bitcoin ABC coins. For more information, see this article. (Also note that Coinbase has explicitly stated that users will not have access to their Bitcoin ABC coins.)

August 2nd update: Bitcoin Cash (BCH), as the new cryptocurrency is now called, launched yesterday. While the project is off to a slow start when it comes to hash power and blocks, trading has opened, and it seems as if the coin could make it.

August 8th update: Bitcoin Cash (Bcash; BCH) is alive and well as an alternative cryptocurrency.

August 15: Potential BIP148 Proof-of-Work Change

While this date is not set in stone either, August 15th could see the introduction of yet another type of “Bitcoin,” which we’ll refer to as “NewPoW Bitcoin” or “NewPoWBTC.”

As a UASF, August 1st’s BIP148 fork should initially be effectuated by users — not miners. Users would start to reject any blocks that do not signal readiness for Segregated Witness (per BIP141). This should incentivize miners to follow the BIP148 chain (ideally, at least for BIP148 users, to the point where it’s the only chain left). But whether this will actually happen remains to be seen. So far, few miners have publicly indicated they will support the UASF.

If miner support on 148 Bitcoin remains low, (some of) its users may opt to implement a hard fork to change the proof-of-work algorithm. This would “fire” the existing group of miners by making their specialized ASIC mining hardware obsolete on the BIP148 chain, and could open the door for new miners — possibly re-decentralising the mining ecosystem back to home users with CPUs or GPUs. (At least temporarily.)

An open BIP148 “working group” on a channel of the "Bitcoin Core Community" Slack is currently working out the details to be proposed. But it seems that if by August 15th less than 15 percent of total hash power mines on 148 Bitcoin, this hard fork will be deployed. This would make the split with “Legacy Bitcoin” definite. It could technically also lead to another split on the 148 Bitcoin side, if some of its users decline to join the hard fork that changes the proof-of-work algorithm.

If you are a regular user and owned bitcoin at the time of the August 1st split, and you didn’t spend any until August 15th, you should now also own NewPoWBTC. If you bought or earned 148BTC between August 1st and August 15th, you should now (also) own NewPoWBTC.

But if you did spend bitcoins on any side of the split, that’s not as certain. Again, if you want to be on the safe side, don’t transact at all until the situation becomes more clear. (For more information, see this article.)

If you are one of the few miners that was mining on 148 Bitcoin with ASIC hardware, you may now want to point your hardware elsewhere — or shut it down completely. (This depends, of course, on whether or not it’s still profitable to mine 148BTC or anything else.)

And of course, anyone should by now be able to mine on NewPoWBTC without specialized ASIC hardware.

August 2nd update: As BIP148 has locked in and Segregated Witness seems increasingly likely to activate smoothly, there will almost certainly not be any proof-of-work change any time soon.

August 8th update: Segregated Witness (BIP141) is now past the point of return. BIP148 is virtually made obsolete, and a proof-of-work change will (almost certainly) not be needed.

Mid- to late- August: SegWit Lock In

If miners avoided a chain-split through BIP141, BIP91 or BIP148, Segregated Witness should at the latest lock in between mid-August or late August. This should be a bit a non-event if it happens through BIP91 or BIP148, as it would at this point be expected, and wouldn’t change much for anyone.

But what the lock-in means is that all SegWit-ready clients will start enforcing the new rules in the next difficulty period: after another two weeks. So if you are a regular user and would like to use the new features or want to maintain top-notch security, you now have two weeks to upgrade to software that enforces SegWit.

If a chain-split is not avoided, the situation could become far more complex. By mid-August, there could potentially be one, two, three or maybe even four “Bitcoins”: “148 Bitcoin”, “NewPoW Bitcoin”, “Bitcoin ABC,” as well as “Legacy Bitcoin”.

At the time of writing this article, it’s hard to say how best to deal with this situation. For a regular user, it’s always best to hold onto your private keys, and it’s probably best not to transact at all until the situation resolves in some way or another. (For more information, see this article.)

For a miner, it’s probably best to just mine the most profitable chain.

August 2nd update: Segregated Witness lock-in is currently scheduled for August 8th. (The exact time and date depends on how fast new Bitcoin blocks are found.)

August 8th update: Segregated Witness (BIP148) is now past the point of no return for lock-in. (Technically, it will lock-in tomorrow; this is now virtually guaranteed.)

Late August to Mid-September: SegWit Activation

If a chain-split is avoided by miners, SegWit should activate around this time. If you’re running a compatible client by now, you can begin to enjoy the new features while maintaining top-notch security.

If a chain-split is not avoided, the situation is (still) too complex to predict.

August 2nd update: Segregated Witness activation is currently scheduled for around August 23th. (The exact time and date depends on how fast new Bitcoin blocks are found.)

August 8th update: Segregated Witness activation is still scheduled for around August 23th. (The exact time and date depends on how fast new Bitcoin blocks are found.)

Late October to Mid-November: SegWit2x Hard Fork (see update)

Toward the end of this year (though potentially even up to early 2018), the hard fork part of SegWit2x should take place. To be exact, this hard fork activates on BTC1 clients three months after SegWit locks in. This activation means that a “base block” bigger than 1 megabyte should be mined, which makes BTC1 clients incompatible with all Bitcoin clients that do not have the hard fork code implemented.

At this point in time, it seems almost certain that not everyone will change their software to support this hard fork. Bitcoin’s development community in particular has almost unanumously rejected the proposal, while several companies have indicated their intentions not to support the change, and not all users seem on board either. As such, this could lead to another chain-split. (Theoretically, this could lead to the fifth “Bitcoin,” though it seems very unlikely there would still be four "Bitcoins" by then in the first place.)

How to deal with this situation as a regular users will be announced on Bitcoin Magazine closer to the actual date.

If you are a miner and you were only running the BTC1 client to help activate SegWit with no intention to support the hard fork, you should make sure to switch back to a non-BTC1 client before this hard fork takes place.

July 17th update: As per the implementation of BTC1, this "2x hard fork" should actually activate three months after SegWit activation — not three months after (BIP91) lock in. This moves the hard fork date back by about a month, closer to late November or mid-December.

August 2nd update: With Segregated Witness activation currently scheduled around August 23th, the "2x hard fork" should happen around November 23th. (The exact time and date depends on how fast new Bitcoin blocks are found. Over a timespan of several months, this could possibly deviate by more than a week from November 22nd.)

August 8th update: With Segregated Witness past the point of no return for lock-in, the "2x hard fork" should happen around November 23th. (The exact time and date depends on how fast new Bitcoin blocks are found. Over a timespan of several months, this could possibly deviate by more than a week from November 22nd.) Apart from Bitcoin and Bitcoin Cash (Bcash) the "2x hard fork" could lead to a third type of "Bitcoin." How likely this is to actually happen remains to be seen.

Barring unexpected and unlikely events, this article will no longer be updated.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

SegWit Goes Live: Why Bitcoin's Big Upgrade Is a Blockchain Game-Changer

That's when Segregated Witness (SegWit) will activate on bitcoin late today or tomorrow morning, bringing the years-long debate over the contentious code upgrade to an official close. At that time, users will finally be able to take advantage of the long-promised technology.

Looking back, it's important to note how long the change – perhaps the biggest ever made to the bitcoin software – has taken. To start, the community has been embroiled in politics since SegWit was first proposed in 2015 by Bitcoin Core contributor Pieter Wuille as a possible "compromise" to the scaling debate.

Since then, there's been no shortage of drama – mining firm Bitmain was accused of blocking SegWit in order to boost its revenue; major bitcoin companies and mining pools united behind their own scaling plan; and finally, unhappy with the plan, users equipped with GIFs and branded hats responded with a kind of revolt.

And that's not even the half of it.

But with SegWit soon to be guaranteed, today marks the first day it will be usable on bitcoin. Here are the key things that SegWit enables:

- It rearranges how data is stored in bitcoin blocks.

- It boosts capacity while remaining compatible with past versions of the software.

- It removes transaction malleability, a bug that's been the primary roadblock for many bitcoin projects.

Eliminating the roadblock

The final point is what might have the most lasting impact.

Indeed, many developers believe SegWit will boost the development of more forward-looking technologies necessary for bitcoin's mainstream use.

The best known is the Lightning Network, first proposed in a 2015 white paper by Joseph Poon and Tadge Dryja. The idea is payment channels that move transactions off the blockchain could boost bitcoin's capacity to millions of transactions per second.

But the project has grown in scope considerably since its 2015 ideation.

Working under the assumption that SegWit would eventually activate on bitcoin, a handful of developers have built active Lightning Network implementations, and they're now working to ensure that all of them work with one another.

And, since the Lightning Network is now possible on two major cryptocurrencies – bitcoin and litecoin – developers are also planning on using the network to create a new type of trustless trading between the two. It's also possible that these tools could potentially eradicate the need for cryptocurrency exchanges, which have been under scrutiny recently for messing up at the expense of cryptocurrency users.

And other projects that need, or at the least, work better with SegWit capability are well underway, too.

Developers preparing for SegWit activation have been working on MAST (which enables more complex bitcoin smart contracts), schnorr signatures (which would enable another transaction capacity boost) and TumbleBit (an anonymous top-layer network).

Continuing politics

And while SegWit looks to enable a bright future for bitcoin, it doesn't exactly bring an end to the debate and politics that have mired the community for years.

Some bitcoin users still believe SegWit is the wrong choice, and they're so adamant about this that they forked the bitcoin blockchain (creating a new version entirely). Called bitcoin cash, the blockchain eliminates SegWit in favor of other scaling tech.

Now, bitcoin and bitcoin cash are competing, putting two ideologies to the test – with real money on the line.

The questions being asked now are: Which cryptocurrency has the best technical roadmap? Which will attract the most users and attention? And which will remain the most decentralized? Or, do both of them have merit?

While answers to those questions are uncertain, one thing is for sure. With SegWit activating today, the community is one step closer to determining whether it's scaling capabilities are all they were touted as.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

What is SegWit?

Last updated: 22 February, 2018

SegWit (short for Segregated Witness) is a protocol upgrade that changes the way data is stored. It was activated on litecoin on May 10, 2017, and on bitcoin on 23 August, 2017.

Developer Pieter Wiulle first presented the idea at the Scaling Bitcoin conference in December 2015.

Many hailed it as a long-awaited solution to bitcoin's scaling problem. The maximum block size in the main protocol is 1MB, which restricts the number of transactions bitcoin can process to approximately 7 per second. This was going to limit bitcoin's potential growth, and prevent it from becoming a usable high-volume payment system.

While the upgrade does enable a greater number of transactions in bitcoin's blocks, SegWit's initial intention was to fix a bug in the bitcoin code called transaction malleability. This flaw allowed anyone to change small details that modified the transaction id (and the subsequent hash) but not the content. While not a critical problem for bitcoin, it prevented the development of more complex features such as second-layer protocols and smart contracts.

SegWit fixed transaction malleability by removing the signature information (otherwise known as the "witness" information) and storing it outside the base transaction block. With that, signatures and scripts can be changed without affecting the transaction id.

A side benefit that is taking on a much greater importance is that, without the signature information, the transactions weigh much less. This means that more can fit in a block, and bitcoin can process a greater throughput without changing the block size.

SegWit introduced a new concept called "block weight." This is a mashup of the block size with and without the signature data, and is capped at 4MB, while the block size limit for the base transactions remains at 1MB. This means that the SegWit upgrade is compatible with the previous protocol, and avoids the need for a hard fork.

So, SegWit does not increase the block size limit, but it does enable a greater number of transactions within the 1MB blocks. The 4MB cap includes the segregated witness data, which technically does not form part of the 1MB base transaction block.

Building on top

Another big step forward made possible by SegWit is that it supports the development of second layer protocols, such as the lightning network. The malleability fix made any feature that relied on unconfirmed transactions less risky and easier to design.

The lightning network will further boost bitcoin's transaction capacity by taking frequent, small transactions off-chain, only settling on the bitcoin blockchain when the users are ready.

SegWit activation also boosted development work on other features such as MAST (which enables more complex bitcoin smart contracts), Schnorr signatures (which would enable another transaction capacity boost) and TumbleBit (an anonymous top-layer network).

Not everyone's happy

Not everyone in the bitcoin community agrees that SegWit is the solution bitcoin has been waiting for. Some believe that it is a case of "kicking the can down the road," and at best a temporary fix.

Resistance to SegWit was one of the factors behind the development of bitcoin cash, a fork of the bitcoin network which chose to implement a larger block size limit rather than rely on a new transaction structure.

In spite of the obvious advantages, the rollout of the upgrade is moving slowly. At pixel time, 14% of transactions were using the new format (you can follow the progress here).

The main reason is that many wallets have yet to add SegWit support. Some big names such as Trezor, Ledger, Electrum and Kraken have already done so. Coinbase – the largest wallet provider in terms of number of transactions – is working on it, and expects to implement the upgrade in early 2018. And the wallet attached to bitcoin's most popular full node implementation, Bitcoin Core, is expected to roll out SegWit in the first quarter of 2018.

With the main bitcoin code also making SegWit-friendly adjustments, this could lead to an uptick in both usage and additional functionality experimentation. Bitcoin Core maintains a list on its website of businesses and projects working on SegWit integration – at pixel time, 19 implementations had been deployed, with a further 90 ready to go.

As more wallets embrace the upgrade, the percentage of transactions that use the SegWit structure will increase, and bitcoin fees should drop as blocks contain a greater number of transactions. Furthermore, the development of lightning and similar second layer protocols should get more of a boost, enhancing bitcoin's scope and potential. This is unlikely to happen overnight – but the change is an important one, and represents a big step forward.

Authored by: Noelle Acheson; Image of door opening via Shutterstock

My Vision For SegWit And Lightning Networks On Litecoin And Bitcoin

You’ve probably seen that I recently started advocating for SegWit to activate on Litecoin and Bitcoin. I wasn’t doing any of this before because it would be wasted energy when the code was not finished. But now that the release candidate code is tagged and binaries close to release, I figure it’s time for me to start making some noise.

So you may wonder why I’m pushing for SegWit. Litecoin does not have a block size problem. That’s right, and SegWit is not just a block scaling solution. I would even say block scaling is just a side benefit of SegWit. The main fix is transaction malleability, which would allow Lightning Networks (LN) to be built on top of Litecoin. And there are a bunch more nice features of SegWit.

But some people say LN on Bitcoin will kill any reason to use Litecoin. If people can do instantaneous transactions on Bitcoin, why would they use Litecoin? My gut feel is that this is not the case. Even with LN, Bitcoin still cannot service every person in the world. I think the calculation was that at 1MB blocks, LN and SegWit on Bitcoin can service 500M users. LN nodes will charge a fee for LN txns going through them and that fee will be relative to the Bitcoin network fee. So Bitcoin LN txns will be more expensive than Litecoin LN txns. It may make economic sense for a LN txn to go via Litecoin and back to Bitcoin to get the cheapest rate. Lightning makes this possible because it allows the two LN to be interoperable. I don’t know that this use case will be economical or not, but we won’t know until both LNs are built and running.

Think of it being two highways: Today, Bitcoin is packed full of cars and Litecoin is empty. Even with Bitcoin packed, the cars are not coming to use the Litecoin highway today because it’s not connected and it’s inconvenient (centralized exchanges and slow on-chain transfers) to go across. LN will build bridges over the highways. But a side benefit is that these bridges will connect both highways together. Maybe the bridges on Bitcoin are enough such that cars will still stay on the Bitcoin highway. My bet is that the convenience and the cheaper tolls on Litecoin highway will convince cars to cross over and use Litecoin. But we won’t know until both are built.

Another benefit is atomic cross-chain transactions via LN. Two users can trade BTC and LTC instantaneous and without risk. Efficient decentralized exchanges are now possible. Or what if a merchant accepts only BTC but you only have LTC. You can now pay LTC and exchange them instantly through a LN exchange node and send BTC to the merchant. That’s basically decentralized ShapeShift. One last thing I thought of recently is the ability to balance lopsided payment channels on both lightning networks. There are probably millions of other cool things that SegWit and LN open up that we have yet scratched the surface of.

Until SegWit, LN, and Confidential Transactions, I didn’t see a need for Litecoin to come out to help test features before they are on Bitcoin. So I was happy to let Litecoin go on without a lot of development. Hence my tweet about Litecoin not needing development. But with SegWit and Bitcoin’s current block scaling deadlock, I see a potential for Litecoin to help Bitcoin break through this deadlock. Litecoin can take a lead and be a positive force in the cryptocurrency space. We have been drafting behind the Bitcoin race car for many years. It’s about time to take a turn out front.

This is my vision for how Litecoin and Bitcoin will work together to solve the world’s transaction needs in the future. And it is why the Silver to Bitcoin’s Gold analogy always resonated with me. Do you want to come along for the ride?

Welcome to Bitcoin NewYork

Scaling Bitcoin by Decentralization!

Independence Day!

All NYA signers betrayed the b2x investors. No any warning. Lost 90% investment in mins. We must continue B2X.

Decentralize!

Decentralization helps to protect the Bitcoin NewYork Agreement (NYA) 2M+Segwit!

The new Bitcoin NewYork Team is building up with critical focus areas being: 1. Changing mining algo to GPU mining. 2. 2M+SW. 3. Adding a two-way replay attack protection. 4. No premine.

Satoshi Nakamoto

Developer Team

Bitcoin NewYork Team

Former Developer Team

Former Company Advisors

Supported Exchanges

Bitcoin Independence Day

Today November 16, 2017, marks the Bitcoin Independence Day.

Bitcoin was created by the New York Agreement (NYA) in collaboration with community members. The major part of the company was the result of the consensus with the community. The NYA signers’ name falls under

Most exchanges are listed for the future by many companies; therefore, hundreds of thousands of B2X trading occurs daily. An announcement made by signers on November 16, 2017, supported the NYA. The dismissal of the existence of B2X led investors to lose 90 percent of their investment in minutes.

Where are the promises of the company? Where is the credit? Who will pay for the losses incurred by B2X investors?

As the Bitcoin New York team: bitcoinnewyork.org. We aspire to continue with the B2X project to provide financial protection. B2X investors are blameless thus their protection will entail certain conditions. We will allow a B2X user to decide the success or end of Bitcoin 2X by focusing on:

1. Changing mining algo to GPU mining. Dynamic Difficulty Adjusted (DDA) every two blocks.

3. Adding a two-way replay attack protection.

5. Fork height: 494784.

6. Hiring developer volunteers (all to be paid by Bitcoin BTC2 bounty).

The Fork Steps

1. When the 494784 height is achieved, the BitcoinX team will snapshot the blocks. In regards to exchanges, the wallets take internal snapshots.

2. Deploy test networks (which will take 2-3 days).

3. If test networks are stable, we will deploy the main networks (which will take 1-2 weeks). We would like to thank our core team and the Bitcoin Gold team for completing most of the works including replaying the attack protection code. This milestone helped the BitcoinX team to finish Bitcoin Segwit 2M within minimal time.

Thanks a lot to Core team, Bitcoin Gold team. They finished a lot works, and committed mining, replay attack protection code. This helps BitcoinX team to finish Bitcoin Segwit 2M in shortest time.

Here is our contact info: bitcoinnewyork.org

Today being an Independence Day, the journey has started. B2X is back in Bitcoin 2X investors’ hands. Only you have the right to decide the success or end of Bitcoin 2X.

Big news! Bitcoin NewYork team Segwit 2X internal test neworks online.

Big news! Bitcoin NewYork team Segwit 2X internal test neworks online.

[Video] What is Segwit? (Segregated Witness)

Last updated on January 2nd, 2018 at 12:00 am

In today’s video we’re going to talk about a term you may have heard bouncing around lately. I’m talking about “Segregated Witness” or Segwit in short.

IMPORTANT: Segwit includes a wide range of features, many of which are highly technical. In this video we focus on one main feature that is easier to explain.

Segwit was invented in order to help shrink the file size of a Bitcoin transaction. This allows more transactions to be approved each time a block of transactions is confirmed. Basically, its purpose is to make the Bitcoin network approve more transactions with each block.

Every Bitcoin transaction has 3 parts – who sent it, who receives it, and a digital signature that verifies the sender has the right to send the coins. The signature is considered to be “the witness” for the transaction.

Segregated Witness means that we are separating the witness from the transaction in order to make it smaller in size. The signature data, or witness, will still be transmitted, however it won’t be included inside of the transaction.

What’s special about Segwit is that a consensus of the entire Bitcoin network isn’t required in order to make it work. This is known as a “soft fork” – meaning Segwit will work even if some users don’t update their software to the new version, making it much easier to implement.

To conclude Segwit is a method of scaling the Bitcoin network to confirm more transaction on each block without increasing the block size itself. I hope you enjoyed this video, and I’ll see you in the next one. Bye for now!

For more information about Segwit’s benefits here’s a complete resource.

Coinbase Is Adding Segwit Support

After months of prevarication, Coinbase has announced that it will add Segwit support to its bitcoin wallets. The much anticipated and long overdue move will go some way towards reducing transaction fees for users of Coinbase and GDAX, assuming it follows suit. Coinbase has come in for repeated criticism over the inefficient way it handles bitcoin transactions, costing itself, and ultimately its users, unnecessary fees. Due to the dominance of Coinbase, it is hoped that Segwit activation will help achieve the tipping point required for the technology become the default setting throughout the industry.

Coinbase Gets Its Act Together

In a tweet on Monday, Coinbase issued the news their customers have been waiting months to hear: “Our engineering team has begun the final testing phase of SegWit for Bitcoin on Coinbase. SegWit compatible Bitcoin sends/receives will be available for customers in the next few weeks.”

In a tweet on Monday, Coinbase issued the news their customers have been waiting months to hear: “Our engineering team has begun the final testing phase of SegWit for Bitcoin on Coinbase. SegWit compatible Bitcoin sends/receives will be available for customers in the next few weeks.”

By any reckoning, Coinbase has taken its sweet time over introducing Segwit compatibility to its bitcoin wallets. The scaling technology helps to reduce the median size of each bitcoin transaction, thereby enabling more data to be squeezed into each block. With bitcoin transactions priced per byte, smaller transactions means lower fees. Despite Segwit being backwards compatible, and thus not the riskiest of code changes to implement, Coinbase has been dragging its heels for months.

In fairness to the exchange, which has custody over billions of dollars of institutional assets, it has a duty of care to its customers not to screw things up. But as Coinbase dragged its heels over Segwit while CEO Brian Armstrong waxed lyrical over pet ethereum projects, the bitcoin community accused the company of having its priorities all wrong. High fees have been a bugbear of bitcoiners in general, and have been of particular concern to users of r/Bitcoin. Stung by reminders of bitcoin’s formerly low fees, a luxury still enjoyed by bitcoin cash, they’ve been desperate for good news on the fee front.

Segwit Adoption Is Still Low

Segwit isn’t a magic bullet that does away with high bitcoin fees, but it automatically shaves at least a third off the median fee, which is a start. Fees have been dropping in general lately, as bitcoin has been dropping, and today stand at around 130 satoshis per byte ($6) on average. Segwit adoption, meanwhile, while on the up, still stands at a pitiful 16%, despite the scaling technology having been available for six months.

When Coinbase finally adds Segwit in the coming weeks it will be interesting to see what effect this has on the overall figure. Once that’s done, all Coinbase needs to do is start batching its bitcoin transactions and then the community might finally cut it some slack.

Do you think Coinbase adoption of Segwit will spur other platforms into following suit? Let us know in the comments section below.

Images courtesy of Shutterstock, and Segwit.party.

Want to create your own secure cold storage paper wallet? Check our tools section.

Комментариев нет:

Отправить комментарий