Bitcoin Mining Hardware ASICs

Hobby Bitcoin mining can still be fun and even profitable if you have cheap electricity and get the best and most efficient Bitcoin mining hardware.

It’s important to remember that Bitcoin mining is competitive. It’s not ideal for the average person to mine since China’s cheap electricity has allowed it to dominate the mining market. If you want bitcoins then you are better off buying bitcoins.

Bitcoin Mining Hardware Comparison

What is an ASIC Bitcoin Miner?

Since it’s now impossible to profitably mine Bitcoin with your computer, you’ll need specialized hardware called ASICs.

Here’s what an ASIC miner looks like up close:

The Dragonmint 16T miner.

Originally, Bitcoin’s creator intended for Bitcoin to be mined on CPUs (your laptop or desktop computer). However, Bitcoin miners discovered they could get more hashing power from graphic cards. Graphic cards were then surpassed by ASICs (Application Specific Integrated Circuits).

Think of a Bitcoin ASIC as specialized Bitcoin mining computers, Bitcoin mining machines, or “bitcoin generators”. Nowadays all serious Bitcoin mining is performed on dedicated Bitcoin mining hardware ASICs, usually in thermally-regulated data-centers with access to low-cost electricity.

Don’t Get Confused

There is Bitcoin mining hardware, which mines bitcoins.

There are also Bitcoin hardware wallets like the Ledger Nano S, which secure bitcoins.

Check Profitability

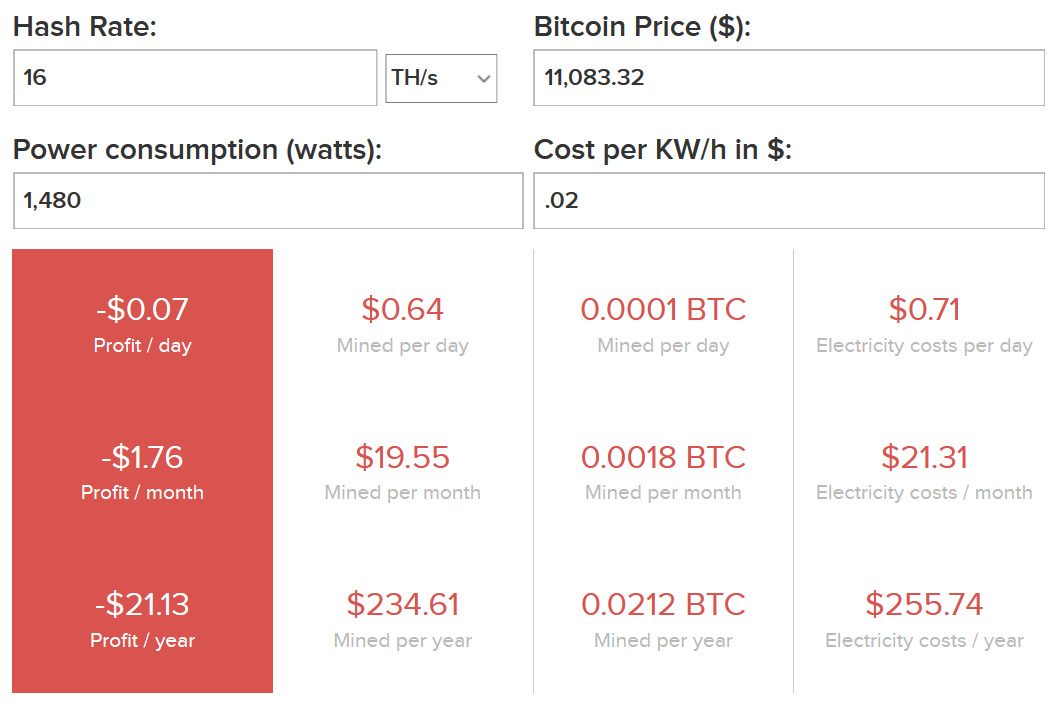

You can use our calculator below to check the mining hardware above. Input your expected electricity price and the hash rate of the miner for an estimate.

Profitability Factors

The Bitcoin price and the total network hash rate are the two main factors that will affect your profitability.

Our calculator is more accurate than most others because ours assumes the 0.4527678% daily increase in network hash rate. This has been the average daily increase over the past 6 months.

Most other calculators do NOT include this metric which makes mining appear way more profitable than it actually is.

The Bitcoin Price

Bitcoin mining is a booming industry, but the Bitcoin price increasing can help make up some of these losses.

The Bitcoin price is increasing at an average of 0.3403% per day over the past year. Try messing with the calculator using different prices.

Know your Competition

It may seem easy to just spin up a miner.

But you NEED to take a look at just how serious mining is.

The video below offers an inside look at one of China’s largest mines.

How to Find the Best Bitcoin Miner

There are some important factors to look at when determining which Bitcoin mining ASIC to buy:

Hash rate – How many hashes per second can the Bitcoin miner make? More hashes cost more, which is why efficiency is crucial.

Efficiency – You’ll want to buy the most efficient bitcoin mining hardware possible. Right now, this is the Halong Mining Dragonmint T1. Since miners use a large amount of electricity, you want to buy one that converts the most amount of electricity into bitcoins.

Price – How much does the bitcoin miner cost? Cheap mining hardware will mine less bitcoins, which is why efficiency and electricity usage are important. The fastest and more efficient mining hardware is going to cost more.

Don’t try to buy a miner based on only price or only hash rate. The best ASIC miner is the most efficient bitcoin miner. Aim for value.

Bitcoin Miners for Sale on eBay or Amazon

If you’re a hobby miner who wants to buy a couple rigs for your house, eBay and Amazon both have some decent deals on mining hardware.

Used Bitcoin Mining Hardware for Sale

Both new and used bitcoin mining rigs and ASICs are available on eBay. One may want to buy used ASIC mining hardware on eBay because you can get better prices.

eBay’s customer protection ensures you’ll get a working product. Other bundled equipment may be included with your purchase depending on the seller.

We recommend purchasing the Dragonmint or the Antminer S9.

Just Want Bitcoins?

If you just want bitcoins, mining is NOT the best way to obtain coins.

Buying bitcoins is the EASIEST and FASTEST way to purchase bitcoins.

Get $10 worth of free bitcoins when you buy $100 or more at Coinbase.

Hardware Profitability

You can use a bitcoin mining profitability calculator to determine your estimated cost of return on your mining hardware.

Be sure to take electricity costs into account. Most mining hardware appears profitable until electricity costs are accounted for.

Most Efficient Bitcoin Miners

Good Bitcoin mining hardware needs to have a high hash rate. But, efficiency is just as important.

An efficient Bitcoin miner means that you pay less in electricity costs per hash.

To improve your efficiency, there are also companies that will let you order hardware to their warehouse and run the miners for you.

You could also cloud mine bitcoins. But both options are a lot less fun than running your hardware!

Bitcoin Mining Hardware Companies

Halong Mining – Halong Mining is the newest mining hardware company. They have the best miner available. Unfortunately, they already sold out of their first batch but a new batch should be available for sale soon.

Bitmain – Bitmain makes the Antminer line of Bitcoin miners. Bitmain is based in China and also operates a mining pool.

BitFury – BitFury is one of the largest producers of Bitcoin mining hardware and chips. Its hardware is not available for purchase.

Bitcoin Mining Equipment

In addition to a Bitcoin mining ASIC, you’ll need some other Bitcoin mining equipment:

Power Supply – Bitcoin rigs need special power supplies to funnel and use electricity efficiently.

Cooling Fans – Bitcoin hardware can easily overheat and stop working. Buy a sufficient amount of cooling fans to keep your hardware working.

Bitcoin Mining Without Hardware?

It’s still technically possible to mine bitcoins without dedicated mining hardware.

However, you’ll earn less than one penny per month. Mining bitcoins on your computer will do more damage to your computer and won’t earn a profit.

So, it’s not worth it unless you’re just interested to see how the mining process works. You’re best bet is to buy dedicated hardware like the Antminer S7 or Antminer S9.

USB Bitcoin Miners

Using a Bitcoin USB miner with your computer was once a profitable way to mine bitcoins. Today, however, USB miners don’t generate enough hashing power to mine profitably. If you just want to get a Bitcoin miner USB to learn, eBay is a good place to buy a cheap Bitcoin miner.

Halong Mining

The world of crypto was in disbelief when Halong Mining, a new ASIC startup, announced their brand new Dragonmint T16. Halong claimed it to be the most powerful – and efficient – Bitcoin mining ASIC on the market. If they delivered on their promise, Bitmain’s reign as king of ASIC developers would come to an abrupt end.

Unsurprisingly, many prominent members of the Bitcoin community were in disbelief, as cryptocurrency in general has been plagued by fake startups and ICO scams.

In an effort to build trust with their potential buyers, Halong Mining released videos of their ASICs running as advertised. Moreover, they claimed that $30 million dollars was invested in research, development, and prototypes.

Their first batch of Dragonmint T16’s was set for shipment in March of 2018. As the deadline crept up, the world patiently waited for the much anticipated release.

If Halong Mining really did produce the most efficient SHA-256 miner to date, the startup would prove their skeptics wrong and dethrone Bitmain, a company only concerned with their monopoly on the market.

After prominent members of the Bitcoin community doubted Halong’s legitimacy, including Cøbra, the company proved them wrong. Miners shipped as described, and Halong delivered – quite literally – on their promises.

Slush, the creator of Slush Mining Pool and the TREZOR hardware wallet, claimed on Twitter the miners are legitimate. Halong Mining has earned their keep, finally viewed as a reputable company after months of speculation and debate.

Over 100 individuals took part in the development of the chip, including BtcDrak, one of the leading pseudonymous Bitcoin core developers. According to Bitcoin Magazine, BtcDrak remarked:

The project is motivated by, and driven to help facilitate greater decentralisation in Bitcoin mining at all levels, and make SHA-256 great again.

Dragonmint T16 vs. Antminer S9

The Dragonmint T16 was Halong Mining’s first ASIC to hit the market. Boasting 16 TH/s, it is the most powerful ASIC miner. Additionally, the T16 is remarkably power efficient, consuming a mere 0.075J/GH. Moreover, the Dragonmint T16 utilizes ASICBOOST, an exploit of Bitcoin’s algorithm which improves efficiency by 20%.

Compared to Bitmain’s Antminer S9, which consumes 0.098J/GH, the Dragonmint T16 is not only more powerful, but more efficient as well. The difference in power consumption seems small. However, when mining on a large scale, every bit of saved electricity counts.

What do you get when you combine power and efficiency? An incredibly profitable ASIC! The T16 is 30% more efficient than its competition.

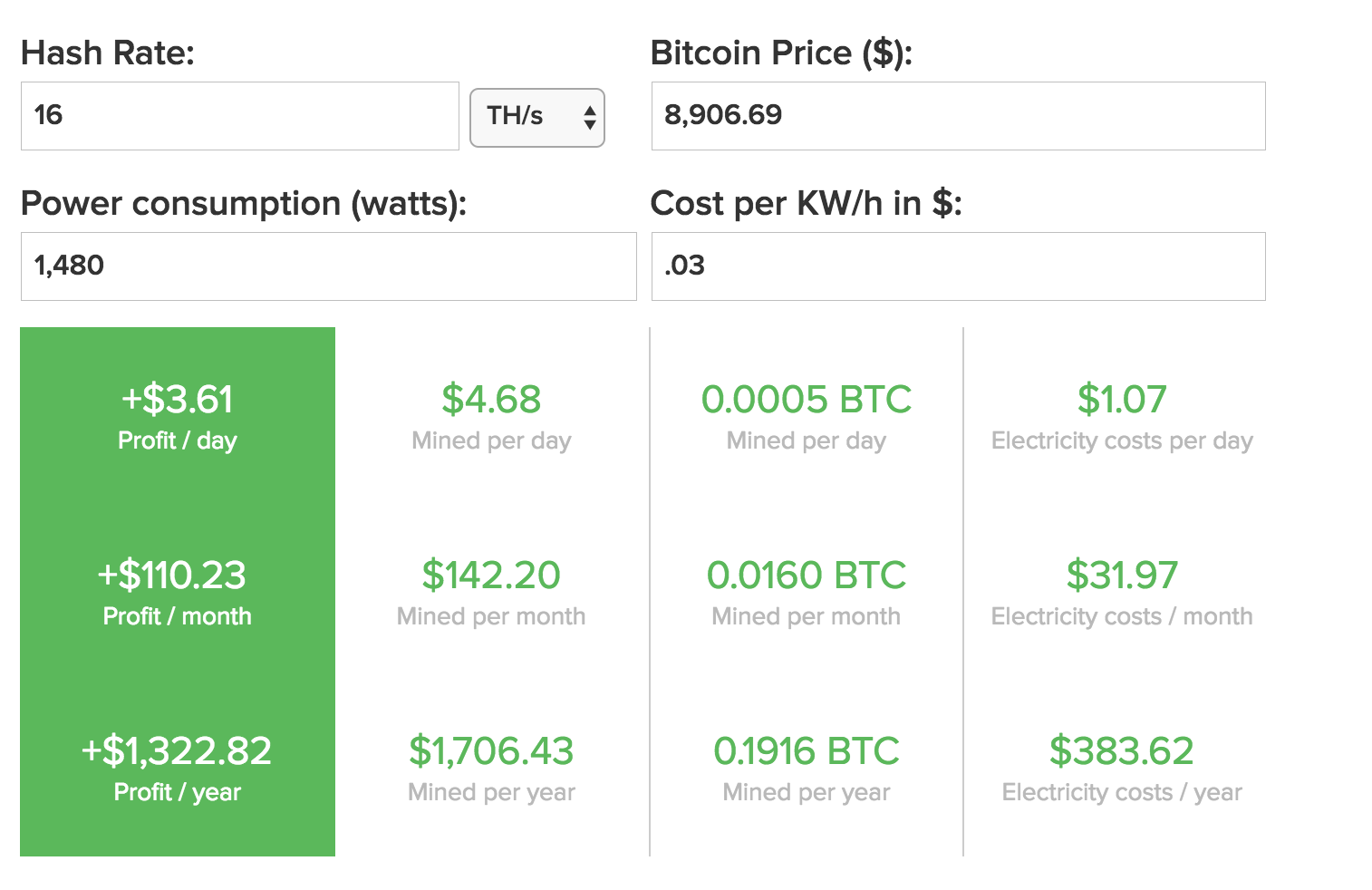

Note that is appears profitable even with high electricity costs ($0.12 per KW/h). With $0.03 / KW/h it’s even more profitable:

The T16’s new DM8575 chip design is largely responsible for the ASIC’s notable improvements over Bitmain’s S9.

Although the Antminer S9 still yields a decent mining profit, it is no match for Halong Mining’s newest chip, the Dragonmint T16. Hashrate and power consumption are the primary factors in mining profitability, next to electricity cost – Halong Mining’s Dragonmint T16 is clearly superior to Bitmain’s best ASIC miner.

ASICs’ Impact on Cryptocurrency

Bitcoin is based on blockchain technology, a decentralized platform which takes power away from a central authority and gives it to the average person. Sensitive information is stored on the blockchain rather than large data centers, and is cryptographically secured. A vast amount of people, known as miners, all work together to validate the network, instead of just one person or government.

In the beginning, CPUs were used to solve cryptographic hash functions, until miners discovered that GPUs were far better equipped for mining. As block difficulty increased, miners turned primarily to GPUs.

Eventually, technology was developed solely for mining, known as ASICs, or Application Specific Integrated Circuits. Their hashrates are significantly higher than anything GPUs are capable of.

With stellar performance comes a high price tag – the best ASIC chips will run you a few thousand dollars each. Upon creation, Bitcoin blocks were confirmed by the average person using their desktop – once ASICs hit the market, things changed.

ASICs rendered GPUs useless. ASIC developers, including Bitmain, granted early access to large mining cartels rather than the average person. Nowadays, a large majority of Bitcoin mining takes place in China where electricity is cheap.

Thousands of ASICs all mine simultaneously in a mining farm (large warehouse). Evidently, most people can’t afford just one or two of ASICs, not to mention thousands of them.

When ASICs hit the market, the blockchain’s validation process became more centralized than decentralized, as the majority of validation is done by a single mining company, rather than being spread out amongst many miners. Unfortunately, Bitcoin is no longer as decentralized as it was once intended to be.

How Does Cloud Mining Bitcoin Work?

If you want to invest in bitcoin mining without the hassle of managing your own hardware, there is an alternative. You can use the cloud to earn your coins.

Put very simply, cloud mining means using (generally) shared processing power run from remote data centres. One only needs a home computer for communications, optional local bitcoin wallets and so on.

However, there are certain risks associated with cloud mining that investors need to understand prior to purchase.

Here's why you might want to consider cloud mining:

- A quiet, cooler home – no constantly humming fans

- No added electricity costs

- No equipment to sell when mining ceases to be profitable

- No ventilation problems with hot equipment

- Reduced chance of being let down by mining equipment suppliers.

Here's why you might not want to consider cloud mining:

- Risk of fraud

- Opaque mining operations

- Less fun (if you're a geek who likes system building!)

- Lower profits – the operators have to cover their costs after all

- Contractual warnings that mining operations may cease depending on the price of bitcoin

- Lack of control and flexibility.

Types of cloud mining

In general, there are three forms of remote mining available at the moment:

- Hosted mining

Lease a mining machine that is hosted by the provider. - Virtual hosted mining

Create a (general purpose) virtual private server and install your own mining software. - Leased hashing power

Lease an amount of hashing power, without having a dedicated physical or virtual computer. (This is, by far, the most popular method of cloud mining.)

How to determine profitability

We have previously covered ways to calculate mining profitability. However, the web services offered are designed to work with your hardware parameters, not cloud-mining parameters.

We have previously covered ways to calculate mining profitability. However, the web services offered are designed to work with your hardware parameters, not cloud-mining parameters.

Even so, you can still use these calculators by thinking clearly about the costs involved. Profitability calculators (for example, The Genesis Block) often ask for your electricity costs, and sometimes the initial investment in hardware. Effectively, you are being asked for your ongoing costs and your one-off investments.

Therefore, since the provider, not you, is paying the electricity bills, you can enter the monthly mining bill in place of the electricity cost.

The conversion process isn't completely straightforward, though. In the case of hardware miners, you can work out the monthly running cost by multiplying your electricity charge (ie: $ per KWh) by the power consumption of the unit and by a conversion factor of 0.744 (the ratio of seconds per month to joules of energy per KWh).

But, for cloud mining calculations, you need to do the opposite, because the provider gives you an (effective) monthly running cost. Hence, you need to calculate an equivalent cost per kilowatt hour to feed into the mining calculator. This is done by dividing (not multiplying) the monthly running cost by the 0.744 conversion factor mentioned above.

Risk vs reward

When engaging in any type of cryptocurrency mining there are risks, but profitability is possible if you make the right choices. In this article, we've given you some pointers on how to decide which way to go.

When engaging in any type of cryptocurrency mining there are risks, but profitability is possible if you make the right choices. In this article, we've given you some pointers on how to decide which way to go.

In your test calculations, you will likely see that some cloud mining services will be profitable for a few months, but, as the difficulty level of bitcoin increases, you would probably start to make a loss in four to six months and beyond.

A possible remedy to this situation is to reinvest what you have made into maintaining a competitive hashing rate, but this is highly speculative.

As mentioned above, the risk of fraud and mismanagement is all too common in the cloud mining space. Investors should only invest in cloud mining if they are comfortable with these risks – as the saying goes, never invest more than you are willing to lose.

Investigate social media channels, speak with former customers and ask pointed questions of operators prior to investing. Ultimately, you should practice the same kind of due diligence that you would for any investment.

Disclaimer: This article should not be viewed as an endorsement of any of the services mentioned. Please do your own research before considering investing any funds via these services.

USB Bitcoin Miners

USB Bitcoin miners are available to buy, but they don’t really generate any significant profits.

They’re a good choice if you just want to fool around with Bitcoin mining and miners like the Antminer S9, S7, S5, Antminer R4, SP20, and Avalon6 are too expensive for you.

You should buy one to learn how mining works, but other than that don’t expect much! If you are serious about making profit then check out better Bitcoin mining hardware.

You can always check the profitability of a USB miner using our mining calculator.

Don’t Get Confused

There is USB Bitcoin mining hardware, which mines bitcoins.

There are also Bitcoin hardware wallets like the Ledger Nano S, which store bitcoins.

Both are USB type devices that have completely separate functions!

Bitcoin USB Miners Comparison

ASICMiner Block Erupter USB 330MH/s Sapphire Miner

The Sapphire Block Erupters were the first Bitcoin USB miners. They have 330 MH/s of hash power which would net you less than $0.01 per month.

It may be a good choice just to see how mining works, but like with most USB miners: do not expect to turn a profit.

GekkoScience Compac USB Stick Bitcoin Miner

The GekkoScience miners is just slightly better than the original block erupters.

It will net you about $0.15 per month, which is more than a dollar per year! The company claims that the device runs completely silent. It works with just one USB port.

Avalon Nano 3

The Avalon Nano 3 is a 3.6 GH/s miner, which will earn you about $1 per year. No fan is required and it just plugs into your USB port on any computer.

Bitmain Antrouter R1 Wifi Solo Bitcoin Miner

The Bitmain AntRouter isn’t exactly a USB miner, but it is similar. It’s low cost, but with that you get a low GH/s at just 5.5 GH/s which is a little over $1 per year.

The plus side is it works as a wireless router, so you can do some mining while providing internet for all your devices.

21 Bitcoin Computer

The 21 Bitcoin Computer isn’t the typical USB Bitcoin miner. It does, however, plugin to your computer via USB. In terms of $ / hash rate, it’s not a very good choice.

But since it’s still technically a USB miner we have included it in this list.

If you’re not impressed, we don’t blame you! USB Bitcoin mining was only profitable when Bitcoin was in its early years. If you just want bitcoins then invest in serious mining hardware or just buy bitcoins.

Beginner’s Guide to Mining Bitcoins

Last updated on May 18th, 2018 at 03:08 pm

One of the biggest problems I ran into when I was looking to start mining Bitcoin for investment and profit was most of the sites were written for the advanced user. I am not a professional coder, I have no experience with Ubuntu, Linux and minimal experience with Mac. So, this is for the individual or group that wants to get started the easy way.

1. Get a Bitcoin mining rig

Bitcoin mining is a very competitive niche to get into. As more and more miners come on board with the latest mining hardware the difficulty to mine increases each day. Before even starting out with Bitcoin mining you need to do your due diligence. This means you need to find out if Bitcoin mining is even profitable for you.

The best way to do this is through the use of a Bitcoin mining calculator. Just enter the data of the Bitcoin miner you are planning on buying and see how long it will take you to break even or make a profit. However, I can tell you from the get go that if you don’t have a few hundred dollars to spare you probably won’t be able to mine any Bitcoins.

Once you’ve finished with your calculations it’s time to get your miner. Make sure to go over our different Bitcoin mining hardware reviews to understand which miner is best for you. Today, the Antminer S9 is the newest and most powerful miner.

Select miner

AntMiner S9

Antminer R4

Antminer T9

AntMiner S7

AntMiner S5

Antrouter R1

As a side note it’s important to state that in the past it was possible to mine Bitcoins with your computer or with a graphics card (also known as GPU mining). Today however, the mining niche has become so competitive that you’ll need to use ASIC miners – special computers built strictly for mining Bitcoins.

2. Get a Bitcoin wallet

First thing you need to do is get a “Bitcoin Wallet“. Because Bitcoin is an internet based currency, you need a place to keep your Bitcoins. Once you have a wallet make sure to get your wallet address. It will be a long sequence of letters and numbers. Each wallet has a different way to get the public Bitcoin address but most wallets are pretty straight forward about it. Notice that you’ll need your PUBLIC bitcoin address and not your PRIVATE KEY (which is like a password for your wallet).

If you’re using a self hosted wallet (i.e. you downloaded a program to your computer and are not using an internet based service) there’s one additional very important step. Make sure you have a copy of the wallet.dat file on a thumb drive and print a copy out and keep it in a safe location. You can view a tutorial on how to create a secure wallet here. The reason is that if you computer crashes and you do not have a copy of your wallet.dat file, you will lose all of your Bitcoins. They won’t go to someone else, they will disappear forever. It is like burning cash.

3. Find a mining pool

Now that you have a wallet you are probably roaring to go, but if you actually want to make Bitcoin (money), you probably need to join a mining pool. A mining pool is a group of Bitcoin miners that combines their computing power to make more Bitcoins. The reason you shouldn’t go it alone is that Bitcoins are awarded in blocks, usually 12.5 at a time, and unless you get extremely lucky, you will not be getting any of those coins.

In a pool, you are given smaller and easier algorithms to solve and all of your combined work will make you more likely to solve the bigger algorithm and earn Bitcoins that are spread out throughout the pool based on your contribution. Basically, you will make a more consistent amount of Bitcoins and will be more likely to receive a good return on your investment.

When choosing which mining pool to join you will need to ask several questions:

- What is the reward method? – Proportional/Pay Per Share/Score Based/PPLNS

- What fee they charge for mining and withdrawal of funds?

- How frequently they find a block (means how frequently I get rewarded)?

- How easy it is to withdraw funds?

- What kind of stats they provide?

- How stable is the pool?

To answer most of these questions you can use our best Bitcoin mining pools review or this excellent post from BitcoinTalk. You can also find a complete comparison of mining pools inside the Bitcoin wiki. For the purpose of demonstration I will use Slush’s Pool when mining for Bitcoins. Once you are signed up with a pool you will get a username and password for that specific pool which we will use later on.

Follow the link to go to their site and click the “Sign up here” link at the top of their site and follow their step by step instructions. After you have your account set up, you will need to add a “Worker”. Basically, for every miner that you have running, you will need to have a worker ID so the pool can keep track of your contributions.

4. Get a mining program for your computer

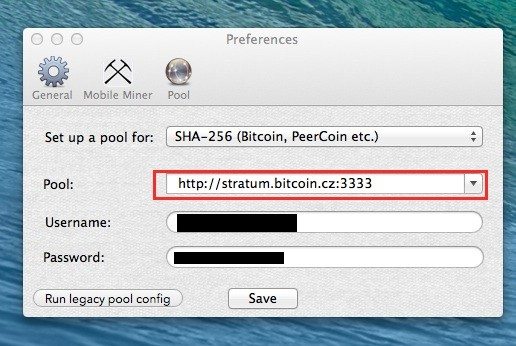

Now that you’ve got the basics covered we’re almost ready to mine. You will need a mining client to run on your computer to that you will be able to control and monitor your mining rig. Depending on what mining rig you got you will need to find the right software. Many mining pools have their own software but some don’t. You can find a list of Bitcoin mining software here.

I’m using a mac so I will use a program called MacMiner. The most popular program I’ve found for a PC are BFGMiner and 50Miner . If you want to compare different mining software you can do this here.

5. Start mining

OK, so hopefully now everything is ready to go. Connect you miner to a power outlet and fire it up. Make sure to connect it also to your computer (usually via USB) and open up your mining software. The first thing you’ll need to do is to enter your mining pool, username and password.

Once this is configured you’ll basically start mining for Bitcoins. You will actually start collections shares which represent your part of the work in finding the next block. According to the pool you’ve chosen you will be paid for your share of coins – just make sure that you enter your address in the required fields when signing up to the pool. Here’s a full video of me mining in action:

Conclusion – perhaps it’s better just to buy the coins?

To conclude this article here’s something to consider. Perhaps it would be more profitable for you to just buy Bitcoins with the money you plan to spend on Bitcoin mining. Many times just buying the coins will yield a higher ROI (return on investment) than mining. If you want to dig into this a bit deeper here’s a post about exactly that.

Bitcoin selber minen

How Bitcoin Mining Works

Where do bitcoins come from? With paper money, a government decides when to print and distribute money. Bitcoin doesn't have a central government.

With Bitcoin, miners use special software to solve math problems and are issued a certain number of bitcoins in exchange. This provides a smart way to issue the currency and also creates an incentive for more people to mine.

Bitcoin is Secure

Bitcoin miners help keep the Bitcoin network secure by approving transactions. Mining is an important and integral part of Bitcoin that ensures fairness while keeping the Bitcoin network stable, safe and secure.

- We Use Coins - Learn all about crypto-currency.

- Bitcoin News - Where the Bitcoin community gets news.

- Bitcoin Knowledge Podcast - Interviews with top people in Bitcoin

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

AntMiner S7

AntMiner S9

- Overview - Table of Contents

- Mining Hardware Comparison

- What is Bitcoin Mining?

- What is the Blockchain?

- What is Proof of Work?

- What is Bitcoin Mining Difficulty?

- The Computationally-Difficult Problem

- The Bitcoin Network Difficulty Metric

- The Block Reward

Bitcoin mining is the process of adding transaction records to Bitcoin's public ledger of past transactions or blockchain. This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place.

Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

What is Bitcoin Mining?

What is the Blockchain?

Bitcoin mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a "subsidy" of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

What is Proof of Work?

A proof of work is a piece of data which was difficult (costly, time-consuming) to produce so as to satisfy certain requirements. It must be trivial to check whether data satisfies said requirements.

Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated. Bitcoin uses the Hashcash proof of work.

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block's header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Bitcoin Network Difficulty Metric

The Bitcoin mining network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

Contribute and translate!

We want to spread knowledge about Bitcoin everywhere, do you think you can help us increase our content or translate for those who don't speak English?

Visit us on GitHub and learn how to contribute.

We tried mining bitcoins… Here’s what happened…

Ever considered mining bitcoins? Well, as a business with 3,000 servers, IDrive decided to look into the idea to see if bitcoin mining was an option during non-peak times, a possible untapped revenue stream. We learned some valuable bit(coin)s of information; here’s what happened…

Most of our users backup their files at night, so our non-peak times are during the day (between 3am and 4pm). During this time, there is unused server capacity that can be used for other operations. Utilizing independent resources (since bitcoining is decentralized) such as the source code on Github, forums on Bitcoin Wiki, bitcoin.org, and the bitcoin simulator on coinplorer.com, a dedicated team of our best engineers spent a week testing the possibility and found that using our servers to mine bitcoins would affect our business model in four main areas:

1) Cost

Although IDrive owns 3,000 servers, we used 600 (each with a quad core processor operating at 2.8 GHz) for our simulated tests. Our study projected a year of mining at 100% processing power 24/7 and the assumption that the difficulty of mining (the calculating of hashes) would increase linearly. (We also assumed that there would be no additional charge for operating our servers consistently at full power for an entire year.*) Since mining bitcoins is designed to take a certain amount of time to ensure legitimacy, as more people get involved and more power is added, the cryptography is made more complex to slow down the process. Therefore, as time progresses, more power will be needed to mine (and, thus, more airflow for cooling is also necessary). As a result, it will take more energy to mine fewer bitcoins, with the energy needed consistently increasing.

*IDrive pays a set rate for a certain amount of electricity which we use to power servers. Mining bitcoins uses energy which increases our power expenditure. In our research, the amount of energy used for mining (during non-peak times) never exceeded our set amount, so this particular factor did not cost more. However, there are two other factors to consider. First, the servers usually operate at about 5% of their capacity during non-peak times; while mining bitcoins, the servers would operate at 100% the entire time. If you pay for the amount of electricity used, this increase in energy would cost more. Second, the increase in server usage could potentially wear out the servers faster, as they are operating at a higher capacity for longer amounts of time. This could shorten their lifespan and require replacing servers more frequently, which is another added cost. Lastly, it is possible that we could eventually exceed our electricity usage limit, which would result in our servers being shut down.

2) Time

As mentioned before, it takes a longer time to mine a single bitcoin as more people get involved and the complexity of the cryptography becomes more difficult. Another point we found valuable is the fact that the time spent figuring out the details of the mining process detracted from time that could be spent focusing on our core services.

3) Revenue

The value of bitcoins is continually fluctuating based on the market. The ROI would be unpredictable, not to mention the price paid to bitcoin miners will decrease as time goes on since there is a cap on the amount of bitcoins that can be created. Process, energy, complexity, and time will continue to rise as the ROI drops. In our simulated study, it would take a year to mine a total of 0.863 bitcoins. Using the current exchange rate, that would equal around $550.15 USD. As time went on, mining one bitcoin would continue to take longer and longer (while also using more energy). Further, considering we wouldn’t be mining during peak hours, that would cut our processing time in half, doubling the time to make a single bitcoin. So, actually, one year would result in .4315 bitcoins and $275.08 USD.

4) Security

Our servers are not currently optimized or configured to mine bitcoins. Running bitcoin software on our servers would require installing the bitcoin daemon on each of them as well as re-opening parts of our network infrastructure (that we’d previously locked down) to enable the bitcoin network to periodically access and talk with our servers. We do continuous network security audits to ensure that we don’t have any areas of our network open that do not need to be. Opening up our network for something non-essential, like bitcoin, seemed like an unnecessary security risk.

In the end, we learned a lot about the interesting process of bitcoin mining, however, for us, the pros did not outweigh the cons. So, IDrive decided to stick with that we do best.

Bitcoincash

3 134 пользователя находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 4 месяца назад автор Bitclub-Network

Want to add to the discussion?

[–]fulltrottel 1 очко 2 очка 3 очка 4 месяца назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 105334 on app-207 at 2018-05-29 19:34:59.478890+00:00 running 7e980a7 country code: RU.

You want known more about bitcoin and bitcoin mining? We give you all information about crypto-currency world!

What is Bitcoin?

Bitcoin is an modern crypto-currency network and a new type of electronic money. Some people believe that bitcoin is the new gold standard. Bitcoin based on peer-to-peer technology and works without any central authority for processing transactions. Bitcoin platform is fully open source, so nobody owns or controls Bitcoin.

What is bitcoin mining?

Bitcoin mining allows many miners to work together and therefore reduce variance in their Bitcoin reward over time. This is achieved by fairly distributing the reward from any blocks found by the server according to how much work you as an individual miner have contributed.

Bitcoin for newbies

If you still know less than nothing about Bitcoin, then watch this great bitcoin learning video.

Want get some free bitcoins?

Just visit bitcoin websites were you can get free bitcoins and play free bitcoin games or you can read our articles:

Bitcoin ASIC Hosting

Co-location Hosting for Bitcoin Mining Hardware Equipment

- 1

- 2

Bitcoin ASIC Hosting Winter Fire Sale

Check out Cryptocoinnews for our Partnership with Dell

Objective:

Provide the most efficient and optimal co-located hosting opportunity for Bitcoin miner’s hardware.

Bitcoin ASIC miners are extremely valuable units of hardware, as they continuously generate Bitcoins 24 hours a day.

Colocation:

The profitability of these miners is dependent on how efficiently they can be run. We offer the most competitive kWh rates in the nation, as well as provide adequate power and cooling. ASIC units produce large amounts of heat and require significant electricity. We will also keep your units up to date with the latest firmware and hardware upgrades.

Security:

Our hosting facility is an interior unit located on secure commercial property. We also have independent security on site. Only staff will have access to the location of the units. Our servers for e-mail and websites are not hosted at the same location.

Insurance:

Our hosting facility is fully insured with liability coverage and extended coverage to cover client’s equipment hosted with us for the duration of the service.

Ist es lohnend selbst zu minen?

Empfohlene Beiträge

Erstelle ein Benutzerkonto oder melde dich an, um zu kommentieren

Du musst ein Benutzerkonto haben, um einen Kommentar verfassen zu können

Benutzerkonto erstellen

Neues Benutzerkonto für unsere Community erstellen. Es ist einfach!

Du hast bereits ein Benutzerkonto? Melde dich hier an.

- Alle Aktivitäten

- Startseite

- Bitcoins

- Mining

- Ist es lohnend selbst zu minen?

Aktivitäten

Wichtige Information

Wir speichern Cookies auf Ihrem Gerät, um diese Seite besser zu machen. Sie können Ihre Cookie-Einstellungen anpassen, ansonsten gehen wir davon aus, dass Sie damit einverstanden sind. In unseren Datenschutzerklärungen finden sie weitere Informationen.

Комментариев нет:

Отправить комментарий