how much was a bitcoin worth in 2008

We are your source for complete information and resources for how much was a bitcoin worth in 2008.

However, the thieves weren’t quite as clever as they thought. Dutch investigators have discovered criminals are shielding activities using “bitcoin mixers.” A bitcoin mixer is a grab bag with bitcoins of several owners. Also bitbuy.in and PayBis, allows you to buy Bitcoins with PayPal. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. If you hand-key a Bitcoin address, and each character is not transcribed exactly - including capitalization - the incorrect address will most likely be rejected by the Bitcoin software.

how can I find out about how much was a bitcoin worth in 2008?

Gox filed for bankruptcy, over 750,000 customer bitcoins had vanished. which at one time reportedly processed 80 per cent of global bitcoin transactions, last week sought bankruptcy protection from the Tokyo District Court and admitted it had lost half a billion US dollars worth of the digital currency. All GDAX customers will be able to trade both Bitcoin (BTC) and Bitcoin2x (B2X) within 4 hours after the fork. Some other solutions involve opening up a laptop and taking out the wi-fi circuit to make sure it cannot ever connect to the Internet or be infiltrated from the outside. Setting the aggressiveness to "dynamic" will try to improve the card's mining performance while still maintaining Windows responsiveness. Laws can be made by governments to either support Bitcoin or to destroy Bitcoin's acceptance.

More information about: bitcoin chart coins.ph

With Bitcoin, there are a few options including market suppliers, network entities that maintain the blockchain, and end users. Let us understand whether money is safe in the Banks or not? 5 BTC Return 45 BTC after 24 hours Pay 1 BTC Return 90 BTC after 24 hours Bliss BTC At Bliss BTC, you can count on us to professionally handle your funds on the stock market and in forex trading in order to make you a REAL 9000% profit, daily. It does this by adjusting a numerical value that is part of the puzzle, called the difficulty.

See also: Address reuse Unlike postal and email addresses, Bitcoin addresses are designed to be used exactly once only, for a single transaction. Also, care should be taken so that panic and ''currency run'' (people running to convert BTCs into something else as soon as they hear of the attack) are triggered just after the attack is completed. More than $1m worth of new coins are generated each day and go to miners. Bitcoin Can Be Easily Lost (and Stolen!) If you have a bank account, you don’t need to memorize your bank account number to access your money. Extreme deflation would render most currencies highly impractical: if a single Canadian dollar could suddenly buy the holder a car, how would one go about buying bread or candy?

Bitcoin wert 2008

The Bitcoin.com Composite Price Index

Unlike stocks, bitcoin markets never close. Bitcoin is traded 24 hours a day, 7 days a week, and 365 days a year in dozens of currency pairs at exchanges all over the world. Across the globe, people create buy and sell orders based on their individual valuations of bitcoin, leading to global, real-time price discovery.

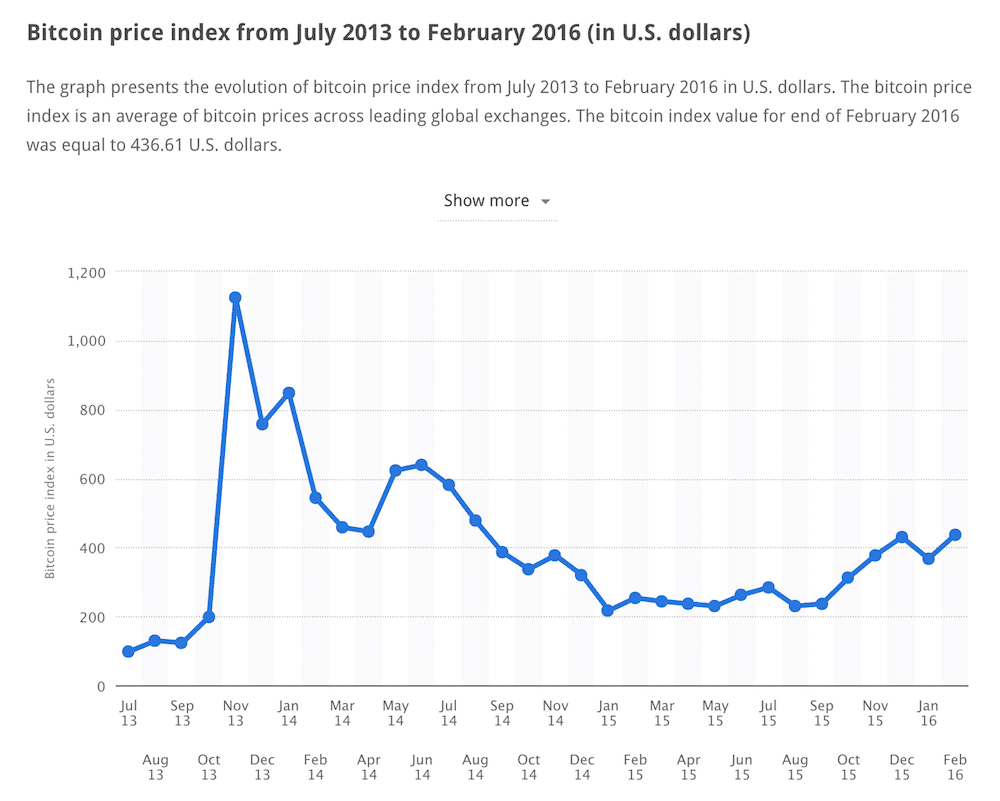

While Bitcoin's price history is not without major bubbles, volatilty overall has been trending downward.

BITCOIN PRICE CHART WITH HISTORIC EVENTS

The chart below display’s Bitcoin’s price throughout any given timeframe. The numbers on the graph represent historical events that seemingly affected Bitcoin’s price at that time. The list of events is detailed below. Click on a number on the chart and you will be transferred to the corresponding event.

Bitcoin Video Crash Course

Join over 94,000 students and know all you need to know about Bitcoin. One email a day for 7 days, short and educational, guaranteed.

We hate spam as much as you do. You can unsubscribe with one click.

Historic Bitcoin Price & Events

South Korea threatens to shut down cryptocurrency exchanges - December 28, 2017

Bitcoin price tumbled after South Korea announced more measures to regulate bitcoin trading, including a potential shutdown of exchanges, amid volatile moves in the world’s third-largest cryptocurrency market. “Cryptocurrency speculation has been irrationally overheated in Korea,” the government said in a statement. “We cannot leave the abnormal situation of speculation any longer.”

Bitcoin price hit all time high just below $20,000 - December 18, 2017

Bitcoin hits a new record high, but stops short of $20,000

CBOE Bitcoin Futures are launched - December 11, 2017

Futures on the world’s most popular cryptocurrency surged as much as 26 percent from the opening price in their debut session on Cboe Global Markets Inc.’s exchange, triggering two temporary trading halts designed to calm the market.

Bitcoin price breaks $10,000 for the first time - November 28, 2017

Bitcoin has finally surmounted the greatest psychological barrier of all, passing $10,000.

SegWit2X Cancelled - November 8, 2017

Bitcoin was scheduled to upgrade around Nov. 16 following a proposal called SegWit2x, which would have split the digital currency in two. However, more and more major bitcoin developers dropped their support for the upgrade in the last few months. Developers behind SegWit2x announced they are calling off plans for the upgrade until there is more agreement in the bitcoin community.

CME announces to launch Bitcoin futures - October 31, 2017

CME Group announced that it plans to introduce trading in bitcoin futures by the end of the year, only a month after dismissing such a plan. Chief Executive Officer Terrence Duffy cited increased client demand as a key reason for the change of mind. As a result, the Bitcoin price hit a high of $6,600.84 just hours after breaking through the $6,400 barrier, and a minute after moving past the $6,500 mark, according to data from CoinDesk. Its market capitalization, or the total value of bitcoin in circulation, hit $110 billion.

Bitcoin Hardfork: Bitcoin Gold goes live - October 25, 2017

According to the Bitcoin Gold pitch, returning to home users will bring forth greater decentralization. Since Bitcoin Gold was issued, its price has plunged over 66 percent within the first couple of hours. The sell-off was due to investors dumping the cryptocurrency, perhaps signaling a lack of faith in the newly-created coin.

Bitcoin price breaks $5,000 for the first time - October 13, 2017

The price of bitcoin has smashed through $5,000 to an all-time high. The cryptocurrency rose by more than 8% to $5,243 having started the year at $966.

China Is Shutting Down All Bitcoin and Cryptocurrency Exchanges - September 15, 2017

Chinese authorities have ordered Beijing-based cryptocurrency exchanges to cease trading and immediately notify users of their closure, signaling a widening crackdown by authorities on the industry to contain financial risks. Exchanges were also told to stop allowing new user registrations, according to a government notice signed by the Beijing city group in charge of overseeing internet finance risks that were circulated online and verified by a government source to Reuters.

Jamie Dimon, head of JP Morgan calls Bitcoin as fraud - September 12, 2017

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said he would fire any employee trading bitcoin for being “stupid.” The cryptocurrency “won’t end well,” he told an investor conference in New York, predicting it will eventually blow up. “It’s a fraud” and “worse than tulip bulbs.”

China bans companies from raising money through ICOs - September 3, 2017

Regulators started to scrutinize China's initial coin offerings as announced by a local outlet. Caixin reported that a notice, issued by a working committee that oversees risk in the country's internet finance sector, said new projects raising cash or other virtual currencies through cryptocurrencies are banned. It added that authorities are cracking down on related fraudulent practices. The document defined initial coin offerings (ICOs) as an unauthorized fundraising tool that may involve financial scams, the Caixin report noted. The committee provided a list of 60 major ICO platforms for local financial regulatory bodies to inspect.

Bitcoin "splits" into Bitcoin (BTC) and Bitcoin Cash (BCH) - August 1, 2017

After years of debating about how Bitcoin should scale the controversy turned into action. The Bitcoin code split in two different directions. One direction supporting the optimization of Bitcoin blocks through Segwit, while the other direction supports bigger blocks of up to 8mb.

Japan Declares Bitcoin as Legel Tender - April 1, 2017

Japan recognizes bitcoin as a legal method of payment.

The country's legislature passed a law, following months of debate, that brought bitcoin exchanges under anti-money laundering/know-your-customer rules, while also categorizing bitcoin as a kind of prepaid payment instrument.

SEC denies second Bitcoin ETF application - March 28, 2017

The U.S. Securities and Exchange Commission on Tuesday denied for the second time in a month a request to bring to market a first-of-its-kind product tracking bitcoin, the digital currency.

SEC denies Winkelvos ETF - March 10, 2017

the US government denied the application of Tyler and Cameron Winklevoss — the brothers who once claimed to be co-inventors of Facebook — to operate an exchange-traded fund (ETF) to make it easier for investors to buy Bitcoin.

Bitcoin price breaks $1000 for the first time in 3 years - January 3, 2017

After rallying for most of the second half of 2016 Bitcoin breaches the $1000 mark for the first time in 3 years. Mass media coverage brings in an influx of new users that supposedly will raise the price even higher.

Donald Trump Elected as President, Market Plummet - November 9, 2016

In a shocking turn of events Donald Trump defeats Hillary Clinton and become the 45th president of the United States. The US market drops by over 1% and the Mexican Peso has plumbed record lows, and is now down 10% today at 20.22 peso to the dollar.

Bitfinex Hacked - August 2, 2016

Bitfinex, the largest Bitcoin exchange by volume, announced that 119,756 bitcoins of customer funds had been stolen via a security breach, a value roughly equivalent to $72 million USD. Bitfinex was holding the customer funds in multi-signature addresses in conjunction with its security partner BitGo. It is presumed that the attacker obtained access to the private keys for nearly all Bitfinex customer accounts, as well as access to the BitGo API for the Bitfinex account.

Second Halving Day - July 9, 2016

The block reward was decreased for the second time in Bitcoin's history, resulting in a new reward of 12.5 bitcoins per mined block. The automatic 50% drop continued Bitcoin's original design to gradually decrease the number of newly created bitcoins until the block reward ends completely, which is estimated to occur in the year 2140.

Craig Wright Claims to be Bitcoin's Creator - May 2, 2016

Following a five month absence from the public eye, Craig Wright publicly announced he was Satoshi Nakamoto by means of a blog post. The blog post featured a disjointed demonstration of a private key signing, which seemed to be an attempt to verify Wright was in possession of Nakamoto's private Bitcoin keys. This verification was later debunked by the Bitcoin community.

Steam Accepts Bitcoin - April 27, 2016

The popular gaming platform Steam began accepting Bitcoin as payment for video games and other online media. Valve, the company that owns Steam, enlisted Bitpay as the payment processor to facilitate Bitcoin payments and help target international customers where credit card payments weren't as ubiquitous.

OpenBazaar Launched - April 4, 2016

The initial production version of the first decentralized marketplace software, OpenBazaar, was released to the general public. The goal of the project was to facilitate peer-to-peer trade without a middleman, fees, or restrictions on trade. The software allows users to create virtual stores where buyers can purchase goods using Bitcoin.

Bitcoin Roundtable Consensus - February 21, 2016

Influential members of the Bitcoin community met in Hong Kong to discuss a development plan and timeline for scaling Bitcoin. The closed-door meeting included over 30 miners, service providers, and Bitcoin Core developers and was meant to address solutions to the block size debate.

Mike Hearn Quits Bitcoin (a.k.a The Hearnia) - January 14, 2016

In a public blog post, Mike Hearn declared that Bitcoin had failed and that he will "no longer be taking part in Bitcoin development". Hearn was an ex-Google developer who had been heavily involved in the Bitcoin community and related projects since the early days of the cryptocurrency. His most popular project was bitcoinj, a Java implementation of the Bitcoin protocol.

Gwern and WIRED Claim Craig Wright is Probably Satoshi Nakamoto - December 8, 2015

Security researcher and writer, Gwern Branwen, published an article in WIRED magazine claiming that an Australian man named Dr. Craig S. Wright was either Satoshi Nakamoto or a "brilliant hoaxer". Gwern cited a number of Wright's deleted blog posts, leaked emails, and transcripts that seemed to suggest Wright is Bitcoin's creator. In one leaked transcript Wright himself claims "I did my best to try and hide the fact that I’ve been running bitcoin since 2009". Another document detailed that Wright had access to a Bitcoin trust worth 1.1 million bitcoins.

Bitcoin Sign Accepted into Unicode - November 3, 2015

The Unicode committee accepted the Bitcoin currency symbol (uppercase B with 2 vertical bars going through it, but only visible at the top and bottom) to be in a future version of the Unicode standard. The glyph will be given the slot "U+20BF BITCOIN SIGN" and eventually will render with standard system fonts.

Bitcoin Featured on Front Page of The Economist - October 31, 2015

The Economist, a globally popular British publication focused on economic liberalism, made it's article "The Trust Machine" the featured cover story of it's weekly print edition. The article focused mainly on the utility of blockchain technology, promoting the idea that banks and government institutions may implement their own blockchains to create "cheap, tamper-proof public databases".

EU Declares No VAT on Bitcoin Trades - October 22, 2015

The European Court of Justice ruled that the exchange of Bitcoin and "virtual currencies" is not subject to value-added-tax (VAT) in the European Union. The ruling acts to classify Bitcoin and related alt-coins as currency, instead of goods or property.

Gemini Exchange Launched - October 8, 2015

Cameron and Tyler Winklevoss released their own US based Bitcoin exchange dubbed "Gemini". Upon launch, the exchange was licensed to operate in 26 states and was able to "service both individual and institutional customers" due to its LLTC corporate structure. Gemini was also able to offer FDIC insurance on customer deposits thanks to a partnership with a New York based bank.

Bitcoin declared as a commodity by the US regulator - September 18, 2015

The Commodity Futures Trading Commission (CFTC), announced it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. They state: "In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,".

Bitcoin XT Fork Released - August 15, 2015

Bitcoin Core developers Mike Hearn and Gavin Andresen released a separate version of the Bitcoin client software, called Bitcoin XT. The release illustrates an ongoing controversy in the Bitcoin development community: what limit should be placed on the size of Bitcoin's blocks? Bitcoin XT implements BIP 101, which proposes "replacing the fixed one megabyte maximum block size with a maximum size that grows over time at a predictable rate".

Mark Karpeles Arrested - August 1, 2015

Mark Karpeles, the CEO of the failed Bitcoin exchange Mt. Gox, was arrested in Japan on charges of fraud and embezzlement in relation to collapse of the exchange. Karpeles faces allegations of illegally manipulating trade volume and the personal use of client deposits, of which may have led to the exchange's insolvency. Mt. Gox is thought to have ultimately lost 744,400 Bitcoins of customer deposits.

2 Federal Agents Plead Guilty to Silk Road Theft - July 1, 2015

Former Federal agents Carl Force IV (DEA) and Shaun Bridges (Secret Service) pleaded guilty to stealing Bitcoins for their personal gain during their active investigation of the Silk Road marketplace.

New York State Releases the BitLicense - June 3, 2015

Superintendent of New York State Department of Financial Services, Benjamin Lawsky, released a set of customized rules meant to regulate Bitcoin and digital currency businesses that serve customers located in New York state. These regulations are the first ever directly targeted at digital currency businesses.

Ross Ulbricht Sentenced to Life in Prison - May 19, 2015

After a month-long jury trial that ended in Ulbricht's conviction, Judge Katherine Forrest sentenced Ulbricht to life in prison without parole. Ulbricht had been found guilty on 7 charges of money laundering, computer hacking, and conspiracy to traffic narcotics in February due to his role as the operator of the Silk Road marketplace (a.k.a "Dread Pirate Roberts"). In a letter to Judge Katherine Forrest prior to his sentencing, Ulbricht admitted to running the Silk Road and made a plea for leniency. The judge's sentencing statement hinted that the harshness of the sentence was to make an example of Ulbricht: members of the public considering following in his footsteps should know "that if you break the law this way, there will be very serious consequences."

Coinbase Launches US Licensed Exchange - January 26, 2015

The VC backed startup Coinbase Inc., a popular Bitcoin outlet and payment processor, announced the release of its own Bitcoin trading platform. The company founders stated they had worked for months to obtain various licenses from state financial regulators, allowing them to legally accept customers from 25 different US states.

Bitstamp Hacked - January 4, 2015

Unknown hackers were able to steal 18,866 bitcoins from Bitstamp's operational hot wallet, worth roughly $5.2 million dollars. The attackers used social engineering against Bitstamp system administrator Luka Kodric to gain access to 2 of Bitstamp's servers and subsequently the hot wallet's private keys. The wallet was completely drained of all bitcoins shortly thereafter.

Charlie Shrem Sentenced to 2 Years in Prison - December 19, 2014

Labeled Bitcoin's "First Felon", Charlie Shrem, the CEO of bitcoin exchange BitInstant, was sentenced to 2 years in prison for his role in laundering money for users of the Silk Road, an online marketplace that catered to illicit goods and services.

Microsoft Accepts Bitcoin - December 11, 2014

Microsoft revealed it will accept Bitcoin from US customers for "apps, games and other digital content" offered on the Windows and Xbox online stores. The announcement was made via a post on the tech giant's blog and stated that Microsoft had partnered with Bitpay for Bitcoin payment processing.

The Slaying of BearWhale - October 6, 2014

An unknown trader places nearly 30,000 BTC for sale on the Bitstamp exchange at a limit price of $300 per bitcoin, worth roughly $9 million USD. The order was dubbed the "BearWhale" by the Bitcoin community due to its unprecedented size.

Paypal Subsidiary Braintree to Accept Bitcoin - September 8, 2014

Braintree, a subsidiary of Paypal, announces that it is partnering with Coinbase to accept Bitcoin payments on their platform. Over the next three months, the two companies will work on integrating Bitcoin payment processing for Braintree merchants. The Bitcoin payment option will be seamlessly enabled for all merchants on the platform. Braintree merchants need only sign up for a Coinbase account and link it to their Braintree account.

Dell Accepts Bitcoin - July 18, 2014

Founder Michael Dell announces on Twitter that dell.com now accepts Bitcoin. Customers in the United States (only) can purchase any product listed on Dell's online marketplace using Bitcoin. All Bitcoin transactions are to be handled by Coinbase, a Bitcoin payment processor. At a yearly revenue of $56 billion, Dell becomes the largest company to accept Bitcoin.

New York DFS Releases Proposed “BitLicense” - July 17, 2014

Benjamin M. Lawsky, Superintendent of New York's Department of Financial Services, announces a proposed set of regulations for businesses that interact with Bitcoin and cryptocurrencies. The goal of the new regulations, according to Lawsky, are to help "protect consumers and root out illegal activity – without stifling beneficial innovation". The regulations would require entities that deal in Bitcoin to run background checks/fingerprints for all employees, get written approval for new business activities by the state, and to immediately convert any Bitcoin profit to US dollars. Affected entities would be exchanges, mining pools, bulk Bitcoin sellers, and altcoin software creators based in New York state, or that have customers in New York state. News of these regulations are generally rebuked by the cryptocurrency community.

US Marshals Service Auctions 29,656 Seized Bitcoins - June 27, 2014

Nearly 30,000 government seized Bitcoins, obtained by the US Marshals Service during the October 2013 bust of the Silk Road website, are auctioned off in chunks of 3,000 bitcoins. Bidders are required to deposit $200,000 USD via bank wire in order to qualify for the auction. A single bidder (venture capitalist Tim Draper) won every auction, indicating that his winning bid prices were far higher than the current market price.

Mining Pool GHash.io Reaches 51% - June 13, 2014

Due to GHash.io's popularity and partnership with CEX.io to sell mining shares of their own mining hardware, the mining pool giant gains a sole majority of the Bitcoin network hashing power, and the ability to launch a successful 51% attack on the Bitcoin network. With a majority of the Bitcoin network hashing power, GHash.io could temporarily reverse transactions that they send (double spending) and prevent other transactions from being confirmed.

Chinese Exchanges' Bank Accounts Closed - April 10, 2014

The People's Bank of China's frequently updated restrictions against Bitcoin finally pressure some Chinese banks to issue a deadline against several bitcoin exchanges, requiring them to close their accounts by April 15. Although some are spared the warnings, the uncertain regulatory environment holds some prominent loopholes that virtually all Chinese exchanges quickly adopt. Using offshore banks, novel cryptographic voucher systems and other solutions, these trading platforms continue to operate, but at greatly reduced volumes from their hayday in 2013.

IRS Declares Bitcoin To Be Taxed As Property - March 26, 2014

The IRS policy document declares Bitcoin to be property, not currency, subject to capital gains tax – with that tax calculated against every change in buying power for a given amount of bitcoin, from the time it's acquired to the time it's spent. The decision is widely derided as unwieldy and overly complex, requiring users of the currency to record Bitcoin's market price with every transaction, subject to an array of largely unfamiliar calculations. Others, however, remark that the net tax paid may often be less than if Bitcoin were treated as currency proper - but to a market that emerged in tax-free innocence, it is a difficult blow to soften.

Newsweek Claims Dorian Nakamoto is Bitcoin's Creator - March 6, 2014

In an article titled "The Face Behind Bitcoin", journalist Leah McGrath Goodman writes that an unemployed engineer in Temple City, California is in fact Bitcoin's creator. Based on speculations and interviews with Dorian's family, Goodman's article ultimately draws an enourmous amount of worldwide attention to Dorian Nakamoto, who denies any involvement in Bitcoin and asks for privacy from the media.

Mt. Gox Closes - February 24, 2014

After putting an abrupt halt to withdrawals on February 6, claiming that a hacker had exploited their own poorly-implemented software through the use of transaction malleability attacks, disgraced bitcoin exchange Mt. Gox's website and trading engine go blank without official comment. Other exchanges and Bitcoin businesses issue a joint statement condemning the mismanagement, deception, and eventual collapse wrought by the executives of the Japan-based exchange, after an alleged leaked internal document showed that over 744,000 BTC were lost by the company.

Major Exchanges Hit With DDoS Attacks - February 7, 2014

Mt. Gox, Bitstamp, and BTC-e all experienced a stoppage of trading due to massive DDoS attacks that were apparently aimed at exploiting transaction maleability in the exchanges' software. Mt. Gox halted withdrawals first, on February 6, evidently contributing to a sharp drop in BTC price; the DDoS attack was detected on February 11, 2014.

Chinese Government Bans Financial Institutions From Using Bitcoin - December 5, 2013

Putting its first restraints on Bitcoin's surging popularity, the People's Bank of China declares Satoshi Nakamoto's novel invention not to be a currency. The policy change prohibits any financial institution to trade, insure, or otherwise offer services related to Bitcoin. Over the following weeks, further restrictions slowly strangle the Chinese cryptocurrency markets, as exchanges repeatedly try to find innovative, lasting ways to stay in operation, and prices around the globe sink dramatically.

Exchange Rate Peaks at $1,242 on Mt. Gox - November 29, 2013

Rapidly growing Bitcoin investment from China steadily drives prices higher and higher, reaching a peak on November 29th. Subject to strict controls concerning the movement of money across the country's borders, Chinese citizens embrace the freedom provided by Bitcoin with open arms, seeking an alternative to the state's inflating official currency, the Renminbi. The origin of mainstream Chinese interest in Bitcoin is largely credited to Jet Li's One Foundation, which publicized a Bitcoin address for donations in the wake of the April 20th, 2013 Lushan earthquake and received over 230 BTC in just two days, covered widely in the national media.

People’s Bank of China OK's Bitcoin - November 20, 2013

Speaking in Chinese at an economic forum, Mr. Yi says that “people are free to participate in the Bitcoin market,” and that he would “personally adopt a long-term perspective on the currency.” News of his statements energize the already active Chinese bitcoin markets, with the largest, BTC China, seeing trade volumes more than twice those of the world's second-largest exchange, Mt. Gox.

US Senate Holds Hearing On Bitcoin - November 18, 2013

Announced under the title "Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies," hope for the U.S. Government panel's discussion is dim among the Bitcoin community leading up to the hearing. As the proceedings commence, however, many of the panelists and Senators agree that Bitcoin holds great promise. The general consensus is summed up by Jennifer Shasky Calvery, Director of the U.S. Government's Financial Crimes Enforcement Network (FinCEN), who testified, “We want to operate in a way that does not hinder innovation.”

Dread Pirate Roberts Arrested - October 1, 2013

Following a trail of clues left carelessly across the internet, the U.S. Federal Bureau of Investigation (in conjunction with other agencies) manages to identify the alleged operator of the dark web marketplace, which saw most of its sales in illicit drugs. Ross Ulbricht, claimed by the FBI to be the site's founder, Dread Pirate Roberts, is arrested in a San Francisco Public Library and charged with narcotics trafficking, computer hacking, money laundering and engaging in a “continuing criminal enterprise.” About 30,000 BTC of the Silk Road's alleged bitcoin holdings are seized at the time, and an additional 144,000 BTC from DPR's private holdings are swept up three weeks later.

Tradehill Shuts Down (Again) - August 30, 2013

The business-to-business bitcoin exchange had been reliant on the relatively new Internet Archive Federal Credit Union to hold its clients' deposits in regulation-compliant, insured accounts. When the IAFCU determines that it can not reasonably handle the myriad regulatory issues surrounding Bitcoin, Tradehill is forced to halt operations and return customers' funds.

DHS Seizure Warrant Against Mt. Gox - May 14, 2013

When Mt. Gox opened an American bank account with Wells Fargo, President and CEO Mark Karpelès answered “no” to the questions, “Do you deal in or exchange currency for your customer?” and “Does your business accept funds from customers and send the funds based on customers’ instructions (Money Transmitter)?” The U.S. Government thinks otherwise. With the warrant signed, Homeland Security Investigations seizes $2,915,507.40 from an account owned by a Mt. Gox subsidiary that was used to process payments to and from U.S. customers, and the future of Bitcoin's legal status becomes ever more uncertain.

Increased Trading Volume Breaks Mt. Gox - April 10, 2013

Originally thought to be a Distributed Denial-of-Service (DDoS) attack on the largest bitcoin exchange, the great influx of traders on the heels of Cyprus's bailout announcement overwhelms Mt. Gox's servers, causing trades to stutter and fail. Speculative concerns about the exchange's hiccups feed a powerful panic-sell that saturates the market and drives prices down to pre-rally levels, before rising again a few days later.

Cyprus Bail-In - March 25, 2013

Orchestrated by Cyprus President Nicos Anastasiades, the Eurogroup, the European Commission, the European Central Bank and the International Monetary Fund, the €10 billion bailout is hoped to fortify the flagging Cypriot economy. Among its conditions, however, is a sizable levy collected from most bank accounts with holdings over the €100,000 cutoff - a serious concern not just for wealthy Cypriots but many internationals, as the nation's favorable policies had made it a popular global tax haven, particularly in Russia. Seeking solutions to preserve their holdings before the bailout's conditions take effect, many of these account holders begin buying bitcoin en masse, driving a price rally through early April that brought the value of one bitcoin from about $80 to over $260.

Bitcoin 0.8 Causes Brief Hard Fork - March 11, 2013

Shaking confidence in Bitcoin and the validity of some transactions, the price briefly plummets and the Mt. Gox exchange temporarily suspends bitcoin deposits. Thanks to a swift and coordinated response by Bitcoin developers, miners, and community members, the fork is resolved within hours after the operators of two large mining pools, Michael Marsee (of BTC Guild) and Marek Palatinus (of slush's pool), honorably forgo some of their accumulated mining rewards in order to downgrade to the previous, compatible version. An updated version, 0.8.1, is released shortly after, containing safeguards to prevent the original problem.

Halving Day - November 28, 2012

In line with the original design for Bitcoin's maturation, the number of coins created to reward miners undergoes its first reduction, beginning the long and gradual process of tapering the amount of new currency entering the economy. These “Halving Days” are scheduled to occur every four years, stepping down the number of new bitcoins generated until the reward reaches 0 in the year 2140, to yield a fixed money supply of 20,999,999.9769 BTC. This pre-programmed limit to inflation is a major driver of the currency's economic controversy, value appreciation and speculation.

Wordpress Accepts Bitcoin - November 15, 2012

In a smart and savvy release, Wordpress explains the decision: “PayPal alone blocks access from over 60 countries, and many credit card companies have similar restrictions. we don’t think an individual blogger from Haiti, Ethiopia, or Kenya should have diminished access to the blogosphere because of payment issues they can’t control. Our goal is to enable people, not block them.” As one of the 25 most popular domains on the web, Wordpress's move paves the way for later retail ventures in Bitcoin.

Bitcoins Savings & Trust Halts Payments - August 17, 2012

Promising consistent weekly “interest” returns of 7% to its creditors, Trendon T. Shavers (known on BitcoinTalk as Pirateat40) manages the secretive operation for about eight months, accepting only large deposits of bitcoin (50+ BTC) and paying out “interest” weekly. On August 17, 2012, Pirateat40 announces a halt to the operation, and absconds with deposits estimated between 86,202 and 500,000 BTC. On July 23, 2013, the U.S. Securities and Exchange Commission files charges against Shavers for defrauding investors in a Ponzi scheme.

Linode Hacked, Over 46,000 BTC Stolen - March 1, 2012

An unknown hacker breaches Linode's server network and immediately seeks out accounts related to bitcoin, quickly compromising the wallets of eight customers. Bitcoinica, a large online bitcoin exchange, is hardest hit, losing more than 43,000 BTC, while other prominent victims include Bitcoin's lead developer Gavin Andresen as well as Marek Palatinus (also known as slush), the operator of a large mining pool. Both Bitcoinica and slush's pool bear the theft's losses on behalf of their customers.

Paxum and Tradehill Drop Bitcoin - February 11, 2012

On February 11, 2012, Paxum, an online payment service and popular means for exchanging bitcoin announces it will cease all dealings related to the currency due to concerns of its legality. Two days later, regulatory issues surrounding money transmission compel the popular bitcoin exchange and services firm TradeHill to terminate its business and immediately begin selling its bitcoin assets to refund its customers and creditors. The following day, Patrick Strateman, known on BitcoinTalk as phantomcircuit, benevolently discloses a devastating bug in how BTC-E, another online exchange, secures its clients' accounts and funds.

"The Good Wife" Airs "Bitcoin for Dummies" TV Episode - December 19, 2011

After the initial announcement of this upcoming, Bitcoin-themed episode, investors bet big on the show to catapult prices to new highs. About 9.45 million viewers tune in to watch "Bitcoin for Dummies" on January 15, 2012; the story involves a government manhunt for the creator of Bitcoin, who is charged with creating a currency in competition with the U.S. Dollar. Despite the massive exposure, prices remain stagnant following the show's airing.

Mt. Gox Hacked - June 19, 2011

By gaining access to the credentials of an official auditor working for the Mt. Gox bitcoin exchange, a hacker downloads a slightly out-of-date copy of the website's user database, including email addresses and insecurely hashed passwords. Using their newfound administrator-level access to the site, they place countless offers to sell bitcoins that don't exist, falsely deflating prices until the going rate reaches just $0.01 per coin. Mt. Gox reverses the fraudulent transactions and halts trading for seven days to re-secure their systems, and two other large exchanges issue temporary halts while their own security is reviewed. Soon after, a copy of the database is leaked and is used to launch attacks against accounts held by users of the MyBitcoin online wallet service who share the same password on both sites, resulting in thefts of over 4,019 BTC from roughly 600 wallets.

Gawker Publishes Article About The Silk Road - June 1, 2011

Titled “The Underground Website Where You Can Buy Any Drug Imaginable,” Adrian Chen's piece on Gawker is as provocative as it is popular. To many people reading it, the sudden realization that Bitcoin has a useful value – one that's entirely unique - hits home. With a link to Mt. Gox in the text, the article starts an enormous upswing in price that beats all previous records, reaching over $31 per bitcoin just one week after publication.

Three New Exchanges Open Supporting More Fiat Currencies - March 27, 2011

On March 27, 2011, Britcoin launches the first exchange to trade bitcoin and British Pound Sterling (GBP). Just days later, on March 31, Bitcoin Brazil opens a service for face-to-face exchange in Brazilian Reals (BRL) and U.S. Dollars. On April 5, BitMarket.eu begins facilitating trades in Euros (EUR) and other currencies. Together, they simplify bitcoin ownership and trading for hundreds of millions of new users and the market is expanded enormously.

Bitcoin Price Hits $1.00 USD - February 9, 2011

Just two years old, Bitcoin achieves parity with the U.S. Dollar on the Mt. Gox exchange. The following day, some popular news outlets feature stories on the symbolic milestone, causing such a surge of interest in the growing currency that the official Bitcoin website is temporarily hobbled.

Bitcoin Protocol Bug Causes Hard Fork - August 15, 2010

Using a peculiar quirk of the way computers process numbers, an unknown person creates a fraudulent transaction that generates 184,467,440,737.08554078 bitcoins – nearly nine-thousand times as many as can legitimately exist in the entire system. The oddity is quickly spotted by Bitcoin developers and community members, and a fixed version of the Bitcoin software is released within hours. By the next day, the corrected blockchain overtakes the exploited one, and Bitcoin is back in normal operation – but not before the market is badly shaken.

Mt. Gox Opens For Business - July 18, 2010

Jed McCaleb, a programmer best known for creating the successful eDonkey peer-to-peer network in 2000, announces the launch of Mt. Gox, a new full-time bitcoin exchange. Based on a prior, abandoned project of McCaleb's to create an online exchange for Magic: The Gathering cards, he soon struggles to keep up with the demands of the business and sells mtgox.com to Mark Karpelès on March 6, 2011. Mt. Gox would slowly grow to dominate the world of bitcoin trading over the next three years.

Bitcoin Posted on Slashdot - July 11, 2010

The release of Bitcoin version 0.3 is featured on slashdot.org, a popular news and technology website. Reaching a large audience of technophiles, the article brings many newly-interested people on board, driving the exchange value of a single bitcoin up nearly tenfold, from approximately $0.008 to $0.08 in just five days.

Two Pizzas Are First Material Item Purchased Using Bitcoin - May 22, 2010

BitcoinTalk user laszlo (Laszlo Hanyecz) pays 10,000 BTC for two pizzas delivered to their house (valued at about $25), ordered and paid for by another user, jercos. This assigns the first concrete valuation to bitcoin - about $0.0025 per coin.

The First Bitcoin-to-Fiat Exchange Occurs - October 12, 2009

Using PayPal, NewLibertyStandard buys 5,050 BTC from Sirius for $5.02, equating to roughly one tenth of a cent per bitcoin.

New Liberty Standard Publishes First Exchange Rate - October 5, 2009

New Liberty Standard opens a service to buy and sell bitcoin, with an initial exchange rate of 1,309.03 BTC to one U.S. Dollar, or about eight hundredths of a cent per bitcoin. The rate is derived from the cost of electricity used by a computer to generate, or “mine” the currency.

Genesis Block Established - January 3, 2009

The first Bitcoin transaction record, or genesis block, kicks off the Bitcoin blockchain and includes a reference to a pertinent newspaper headline of that day:

Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

This man bought $27 of bitcoins in 2009 and they're now worth $980k

A Norwegian man who bought $27 worth of bitcoins in 2009 and forgot about them discovered their value had since shot up - to $980,000 at today's price.

Kristoffer Koch decided to buy 5,000 bitcoins for only 150 Norwegian kroner ($26.60) in 2009, after discovering bitcoin as part of an encryption thesis he was working on.

Koch probably didn't think he would become wealthy as a result, but his 5,000 BTC has turned into a goldmine. It was a wise investment by someone who stumbled across bitcoin before many others did.

Koch found that his bitcoins were worth 5 million Norwegian kroner ($886,000) when he checked back in on them. At the current Bitcoin Price Index of $196, those coins are now worth about $980,000.

After purchasing the 5,000 bitcoins, Koch pretty much forgot about them altogether. That is, until the price shot up to over $200 back in April and he started seeing press coverage about bitcoin's rise.

"I thought to myself, didn't I have something like that?" Koch told NRK, a Norwegian news outlet.

He did, and after figuring out the password to his wallet and seeing how valuable those bitcoins had become, he sold off a portion of them. Now he has an apartment that he purchased in an expensive part of Oslo, Norway. All thanks to the huge price gain that bitcoin has experienced, mostly in the past year.

The one-year rise of bitcoin's price. Source: CoinDesk Bitcoin Price Index

The one-year rise of bitcoin's price. Source: CoinDesk Bitcoin Price Index

It turns out that Koch's frivolous technology spending, against his girlfriend's wishes, actually turned out to be a great investment.

"I buy a lot of technical little things that I never have time to use, and this was the worst of all, the fact that I was buying fake money," Koch told NRK.

It's not fake anymore, at least not to Kristoffer Koch.

Many people have become wealthy as a result of bitcoin's rise, although stories like this are rarely in the public eye. There's the story on the Bitcointalk forums about Kevin, who purchased 259,684 BTC for under $3,000 in 2011.

Then there is Erik Voorhees, who founded the bitcoin gambling site Satoshi Dice and sold it for 126,315 BTC, worth about $24.7 million at the current bitcoin price.

And The Verge reported earlier this year that Satoshi Nakamoto, the Bitcoin network's mysterious founder, has an address with over one million bitcoins.

Of course, we shouldn't forget about the person who bought two pizzas for 10,000 bitcoins back in 2009. Now, if only that person had kept them, or perhaps forgot about them and rediscovered them years later like Kristoffer Koch did.

Featured image: antanacoins / Flickr

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

13 310 пользователей находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 2 года назад автор BitcoinCollege

Want to add to the discussion?

[–]btcsa 44 очка 45 очков 46 очков 2 года назад (5 дочерних комментарев)

[–]_niko 5 очков 6 очков 7 очков 2 года назад (0 дочерних комментарев)

[–]gubatron 3 очка 4 очка 5 очков 2 года назад (1 дочерний комментарий)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]calaber24p 15 очков 16 очков 17 очков 2 года назад (7 дочерних комментарев)

[–]HitMePat 10 очков 11 очков 12 очков 2 года назад (1 дочерний комментарий)

[–]RemindMeBot 5 очков 6 очков 7 очков 2 года назад (0 дочерних комментарев)

[–]RulerOf 5 очков 6 очков 7 очков 2 года назад (0 дочерних комментарев)

[–]zapdrive 5 очков 6 очков 7 очков 2 года назад (0 дочерних комментарев)

[–] [deleted] 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]veritasBS 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]tequila13 7 очков 8 очков 9 очков 2 года назад (3 дочерних комментария)

[–]b_coin -2 очков -1 очков 0 очков 2 года назад (0 дочерних комментарев)

[–]Essexal 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]Floooge 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]zapdrive 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]puck2 5 очков 6 очков 7 очков 2 года назад (4 дочерних комментария)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (3 дочерних комментария)

[–]tehchives 0 очков 1 очко 2 очка 2 года назад (2 дочерних комментария)

[–]puck2 2 очка 3 очка 4 очка 2 года назад (1 дочерний комментарий)

[–]nitiger 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]conv3rsion 13 очков 14 очков 15 очков 2 года назад (8 дочерних комментарев)

[–]circuitloss 11 очков 12 очков 13 очков 2 года назад (6 дочерних комментарев)

[+]rydan рейтинг комментария ниже порога -8 очка -7 очка -6 очка 2 года назад (5 дочерних комментарев)

[–]Sigg3net 1 очко 2 очка 3 очка 2 года назад (4 дочерних комментария)

[–]Shibinator 10 очков 11 очков 12 очков 2 года назад * (3 дочерних комментария)

[–]BeardMilk 1 очко 2 очка 3 очка 2 года назад (1 дочерний комментарий)

[–]Sigg3net 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]ddepra 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]col381 4 очка 5 очков 6 очков 2 года назад (25 дочерних комментарев)

[–] [deleted] 26 очков 27 очков 28 очков 2 года назад (15 дочерних комментарев)

[–]Sigg3net 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]Elanthius 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]rydan -2 очков -1 очков 0 очков 2 года назад (1 дочерний комментарий)

[–] [deleted] 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]utuxia 0 очков 1 очко 2 очка 2 года назад (10 дочерних комментарев)

[–] [deleted] 6 очков 7 очков 8 очков 2 года назад (9 дочерних комментарев)

[–]utuxia 0 очков 1 очко 2 очка 2 года назад (8 дочерних комментарев)

[–]p-o-t-a-t-o 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]tequila13 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[+]miles37 рейтинг комментария ниже порога -6 очка -5 очков -4 очков 2 года назад (4 дочерних комментария)

[–]Jamiebtc 3 очка 4 очка 5 очков 2 года назад (2 дочерних комментария)

[–]miles37 1 очко 2 очка 3 очка 2 года назад * (1 дочерний комментарий)

[–]Jamiebtc 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[+]rydan рейтинг комментария ниже порога -8 очка -7 очка -6 очка 2 года назад (0 дочерних комментарев)

[–]whoisjordi 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]way2know 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]RulerOf 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]gonzobon 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]utuxia -2 очков -1 очков 0 очков 2 года назад (0 дочерних комментарев)

[–]_niko 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]jasonmoola 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]ToroArrr 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]Borax -2 очков -1 очков 0 очков 2 года назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 125764 on app-212 at 2018-05-29 20:16:17.926812+00:00 running 7e980a7 country code: RU.

What Will Bitcoin Be Worth In 5 year / 2020?

Last updated on January 2nd, 2018 at 12:00 am

The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pickup bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

Bitcoin Price (BTC - USD)

GO IN-DEPTH ON BITCOIN PRICE

Crypto is making a comeback as Italy's political crisis mounts

Crypto markets are making a big comeback as political uncertainty grips Italy and Europe. .

NEWS FOR BITCOIN PRICEMore

INFO ON Bitcoin

BITCOIN HISTORICAL PRICES

BITCOIN CURRENCY CONVERTER More

About Bitcoin Price

What is Bitcoin? By Markets Insider

Bitcoin keeps coming back in the headlines. With any Bitcoin price change making news and keeping investors guessing.

In countries that accept it, you can buy groceries and clothes just as you would with the local currency. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket.

Bitcoin is divorced from governments and central banks. It's organized through a network known as a blockchain, which is basically an online ledger that keeps a secure record of each transaction and bitcoin price all in one place. Every time anyone buys or sells bitcoin, the swap gets logged. Several hundred of these back-and-forths make up a block.

No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins.

Why bother using it?

True to its origins as an open, decentralized currency, bitcoin is meant to be a quicker, cheaper, and more reliable form of payment than money tied to individual countries. In addition, it's the only form of money users can theoretically "mine" themselves, if they (and their computers) have the ability.

But even for those who don't discover using their own high-powered computers, anyone can buy and sell bitcoins at the bitcoin price they want, typically through online exchanges like Coinbase or LocalBitcoins.

A 2015 survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. The people with the most bitcoins are more likely to be using it for illegal purposes, the survey suggested.

Each bitcoin has a complicated ID, known as a hexadecimal code, that is many times more difficult to steal than someone's credit-card information. And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing.

But while fraudulent credit-card purchases are reversible, bitcoin transactions are not.

Bitcoin is unique in that there are a finite number of them: 21 million. Satoshi Nakamoto, bitcoin's enigmatic founder, arrived at that number by assuming people would discover, or "mine," a set number of blocks of transactions daily.

Every four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. (The reward right now is 12.5 bitcoins.) As a result, the number of bitcoins in circulation will approach 21 million, but never hit it.

This means bitcoin never experiences inflation. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won't be more bitcoin available in the future. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement. Which could render bitcoin price irrelevant.

The future of bitcoin

Historically, the currency has been extremely volatile. But go by its recent boom — and a forecast by Snapchat's first investor, Jeremy Liew, that it will hit a bitcoin price of $500,000 by 2030 — and nabbing even a fraction of a bitcoin starts to look a lot more enticing.

Bitcoin users predict 94% of all bitcoins will have been released by 2024. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. With bitcoin’s price dropping significantly. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference.

One of the biggest moments for Bitcoin came in August 2017. When the digital currency officially forked and split in two: bitcoin cash and bitcoin.

Miners were able to seek out bitcoin cash beginning Tuesday August 1st 2017, and the cryptocurrency-focused news website CoinDesk said the first bitcoin cash was mined at about 2:20 p.m. ET.

Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly 10-year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds.

Bitcoin power brokers have been squabbling over the rules that should guide the cryptocurrency's blockchain network.

On one side are the so-called core developers. They are in favor of smaller bitcoin blocks, which they say are less vulnerable to hacking. On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable.

Until just before the decision, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support.

Then bitcoin cash came along. The solution is a fork of the bitcoin system. The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes.

Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets.

"A group of miners who didn't like SegWit2x are opting for this new software that will increase the size of blocks from the current 1 megabyte to 8," Morris told Business Insider.

To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency.

Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. But that doesn't mean the value of investors' holdings will double.

Because bitcoin cash initially drew its value from bitcoin's market cap, it caused bitcoin's value to drop by an amount proportional to its adoption on launch.

The future of bitcoin and bitcoin’s price remains uncertain. It could go to a $1,000,000 or it could go to $0. No one truly knows.

Simple Bitcoin Converter

Exchange rate calculated using USD Bitcoin price.

This site allows you to:

- See the Bitcoin exchange rate i.e. the current value of one bitcoin.

- Convert any amount to or from your preferred currency.

Bitcoin is a digital currency. You can use Bitcoin to send money to anyone via the Internet with no middleman. Learn more here.

Keep an eye on the Bitcoin price, even while browsing in other tabs. Simply keep this site open and see the live Bitcoin price in the browser tab. (Note: Some mobile browsers don’t yet support this feature.)

See how many bitcoins you can buy. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left.

See the value of your Bitcoin holdings. Enter the number of bitcoins you have, and watch their value fluctuate over time.

Compare Bitcoin to gold and other precious metals by checking out the converters for Bitcoin to gold, Bitcoin to silver, Bitcoin to platinum, and Bitcoin to palladium.

Try it on your phone or tablet—this site is designed with mobile devices in mind.

Convert in terms of smaller units e.g. microbitcoins (µ), millibitcoins (m). Toggle using keyboard shortcuts: 'u', 'm', and 'k'.

Bookmark your preferred currency e.g. Bitcoin to Euro, or Bitcoin to British Pound. This site currently supports 64 currencies.

Price data is continually gathered from multiple markets. A weighted average price of these markets is shown by default (based on 24-hour trade volume). Alternatively, you can choose a specific source from the settings menu.

Development

- Linkable (i.e. bookmarkable, shareable) amounts.

- A widget to be embedded on other sites.

- Options added for millibitcoins, and 3 new cryptocurrencies. 2014-03-16

- Volume-weighted pricing implemented as the default option. 2013-11-29

- Multiple data source options included. Currency chooser improved. 08-16

- Major Android-related bugs fixed. (Thanks to those who donated!) 07-07

You’re welcome to contact the creator of this site at Reddit or BitcoinTalk. Bug reports are greatly appreciated.

Disclaimer

The exchange rates on this site are for information purposes only. They are not guaranteed to be accurate, and are subject to change without notice.

Комментариев нет:

Отправить комментарий