Bitcoin wert 2009

The Bitcoin.com Composite Price Index

Unlike stocks, bitcoin markets never close. Bitcoin is traded 24 hours a day, 7 days a week, and 365 days a year in dozens of currency pairs at exchanges all over the world. Across the globe, people create buy and sell orders based on their individual valuations of bitcoin, leading to global, real-time price discovery.

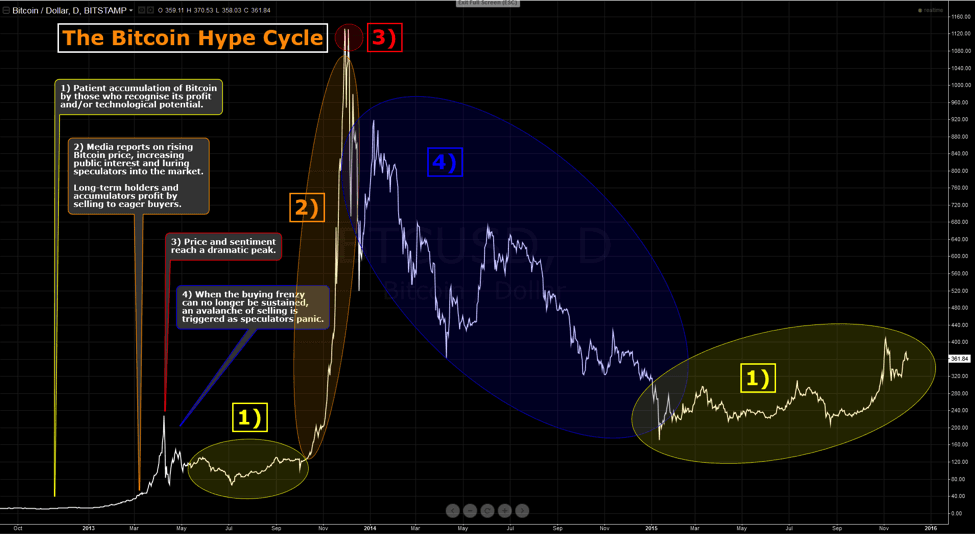

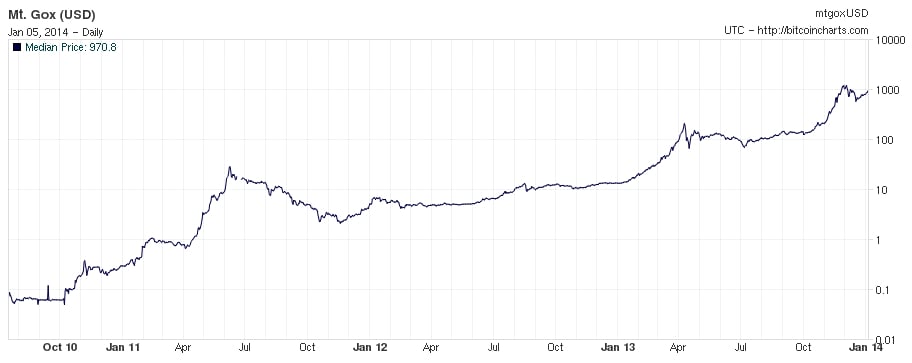

While Bitcoin's price history is not without major bubbles, volatilty overall has been trending downward.

Bitcoin Price History Chart

Loading chart. (uses javascript)

How Much was 1 Bitcoin Worth in 2009?

Bitcoin was not traded on any exchanges in 2009. Its first recorded price was in 2010. Technically, Bitcoin was worth $0 in 2009 during its very first year of existence!

How Much was 1 Bitcoin Worth in 2010?

Bitcoin's price never topped $1 in 2010! Its highest price for the year was just $0.39!

What Determines Bitcoin's Price?

Bitcoin’s price is measured against fiat currency, such as American Dollars (BTCUSD), Chinese Yuan (BTCCNY) or Euro (BTCEUR). Bitcoin therefore appears superficially similar to any symbol traded on foreign exchange markets.

Unlike fiat currencies however, there is no official Bitcoin price; only various averages based on price feeds from global exchanges. Bitcoin Average and CoinDesk are two such indices reporting the average price. It’s normal for Bitcoin to trade on any single exchange at a price slightly different to the average.

But discrepancies aside, what factors determine Bitcoin’s price?

Supply and Demand

The general answer to “why this price?” is “supply and demand.” Price discovery occurs at the meeting point between demand from buyers and supply of sellers. Adapting this model to Bitcoin, it’s clear that the majority of supply is controlled by early adopters and miners.

Inspired by the rarity of gold, Bitcoin was designed to have a fixed supply of 21 million coins, over half of which have already been produced.

Several early adopters were wise or fortunate enough to earn, buy or mine vast quantities of Bitcoin before it held significant value. The most famous of these is Bitcoin’s creator, Satoshi Nakomoto. Satoshi is thought to hold one million bitcoins or roughly 4.75% of the total supply (of 21 million). If Satoshi were to dump these coins on the market, the ensuing supply glut would collapse the price. The same holds true for any major holder. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

Miners currently produce around 3,600 bitcoins per day, some portion of which they sell to cover electricity and other business expenses. The daily power cost of all mining is estimated around $500,000. Dividing that total by the current BTCUSD price provides an approximation of the minimum number of bitcoins which miners supply to markets daily.

With the current mining reward of 12.5 BTC per block solution, Bitcoin supply is inflating at around 4% annually. This rate will drop sharply in 2020, when the next reward halving occurs. That Bitcoin’s price is rising despite such high inflation (and that it rose in the past when the reward was 50 BTC!) indicates extremely strong demand. Every day, buyers absorb the thousands of coins offered by miners and other sellers.

A common way to gauge demand from new entrants to the market is to monitor Google trends data (from 2011 to the present) for the search term “Bitcoin.” Such a reflection of public interest tends to correlate strongly with price. High levels of public interest may exaggerate price action; media reports of rising Bitcoin prices draw in greedy, uninformed speculators, creating a feedback loop. This typically leads to a bubble shortly followed by a crash. Bitcoin has experienced at least two such cycles and will likely experience more in future.

Drivers of Interest

Beyond the specialists initially drawn to Bitcoin as a solution to technical, economic and political problems, interest among the general public has historically been stimulated by banking blockades and fiat currency crises.

Banking Blockades

Probably the first such instance was the late 2010 WikiLeaks banking blockade, whereby VISA, MasterCard, Western Union and PayPal ceased processing donations to WikiLeaks. Following a request from Satoshi, Julian Assange refrained from accepting Bitcoin until mid-way through 2011. Nevertheless, this event shone a light on Bitcoin’s unique value as censorship resistant electronic money.

The most recent such blockade occurred when MasterCard and VISA blacklisted Backpage.com , a Craigslist-style site which lists, inter alia, adult services. Adult service providers whose livelihood depends on such advertising have no way to pay for it besides Bitcoin.

On the subject of business which banks won’t (openly) touch, there’s no avoiding mention of darknet drug markets. While the most (in)famous venue, Silk Road, was taken down, the trade of contraband for bitcoins continues unabated on the darknet. Although only 5% of British users have admitted to purchasing narcotics with Bitcoin, that figure is likely understated for reasons of legal risk. Finally, the media controversy over darknet markets has likely brought Bitcoin to the attention of many who otherwise wouldn’t have encountered it.

Fiat Currency Crises

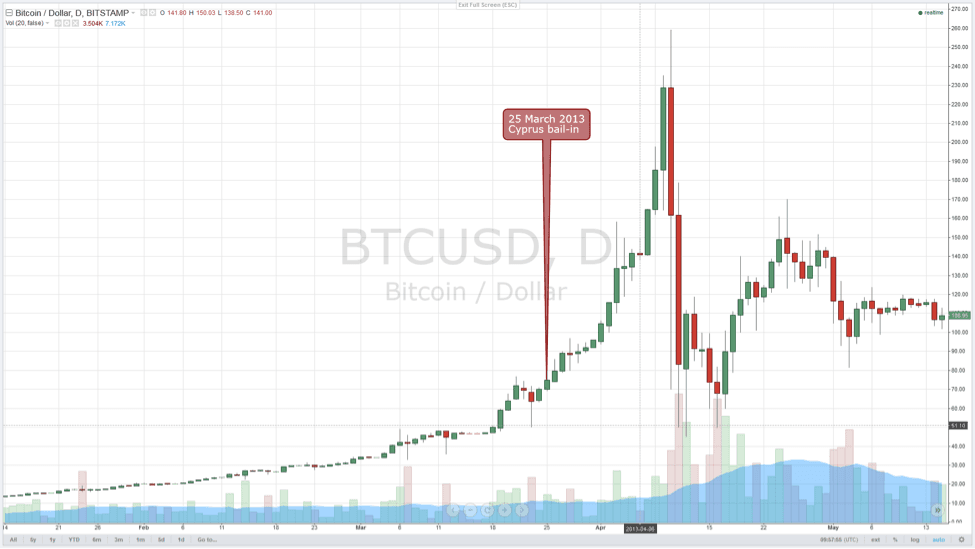

A Bitcoin wallet can be a lot safer than a bank account. Cypriots learnt this the hard way when their savings were confiscated in early 2013. This event was reported as causing a price surge, as savers rethought the relative risks of banks versus Bitcoin.

The next domino to fall was Greece, where strict capital controls were imposed in 2015. Greeks were subjected to a daily withdrawal limit of €60. Bitcoin again demonstrated its value as money without central control.

Soon after the Greek crisis, China began to devalue the Yuan. As reported at the time, Chinese savers turned to Bitcoin to protect their accumulated wealth.

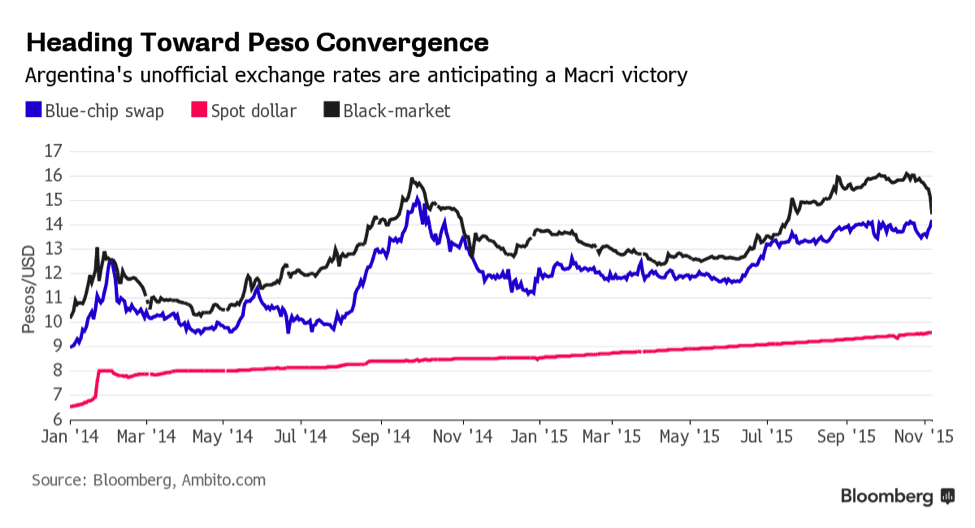

A current positive influencer of Bitcoin price, or at least perception, is the ">Argentinian situation. Argentina’s newly-elected President, Mauricio Macri, has pledged to end capital controls. This would eliminate the wide disparity between the official and black-market peso/USD exchange rates. Argentinians who can purchase bitcoins using black-market dollars will likely avoid considerable financial pain.

Market Manipulation

No discussion of Bitcoin’s price would be complete without a mention of the role market manipulation plays in adding to price volatility. At that time, Bitcoin’s all-time high above $1000 was partly driven by an automated trading algorithms, or “bots,” running on the Mt. Gox exchange. All evidence suggests that these bots were operating fraudulently under the direction of exchange operator, Mark Karpeles, bidding up the price with phantom funds.

Mt. Gox was the major Bitcoin exchange at the time and the undisputed market leader. Nowadays there are many large exchanges, so a single exchange going bad would not have such an outsize effect on price.

Major Downside Risks

It bears repeating that Bitcoin is an experimental project and as such, a highly risky asset. There are many negative influencers of price, chief among them being the legislative risk of a major government banning or strictly regulating Bitcoin businesses. The risk of the Bitcoin network forking along different development paths is also something which could undermine the price. Finally, the emergence of a credible competitor, perhaps with the backing of major (central) banks, could see Bitcoin lose market share in future.

Price Oddities

Sometimes an exchange’s price may be entirely different from the consensus price, as occurred for a sustained period on Mt. Gox prior to its failure and recently on the Winkelvoss’ Gemini exchange.

In mid-Novermber 2015, BTCUSD hit $2200 on Gemini while trading around $330 on other exchanges. The trades were later reversed. Such events occur occasionally across exchanges, either due to human or software error.

Bitcoin is ultimately worth what people will buy and sell it for. This is often as much a matter of human psychology as economic calculation. Don’t allow your emotions to dictate your actions in the market; this is best achieved by determining a strategy and sticking to it.

If your aim is to accumulate Bitcoin, a good method is to set aside a fixed, affordable sum every month to buy bitcoins, no matter the price. Over time, this strategy (known as Dollar-cost averaging), will allow you to accumulate bitcoins at a decent average price without the stress of trying to predict the sometimes wild gyrations of Bitcoin’s price.

Bitcoin (USD) Price

Pricing News

German Authorities Sold $14 Million in Seized Cryptos Over Price Fears

May 29, 2018 at 10:00 | Wolfie Zhao

Prosecutors in Germany have made an emergency sale of cryptocurrencies seized in two investigations due to concerns over price volatility.

Bitcoin Price Faces Last Major Support Level Before $5K

May 29, 2018 at 09:00 | Omkar Godbole

Bitcoin is down again and looks set to test another key support level at $6,900, the technical charts indicate.

Bitcoin Bears In Charge But Indecision Could Spur Rally

May 28, 2018 at 10:25 | Omkar Godbole

While the odds are still stacked in favor of bitcoin's bears, marketplace exhaustion may have provided a chance for a brief rally.

IHS Markit Has A Plan to Tokenize A $1 Trillion Loan Market

May 28, 2018 at 04:00 | Ian Allison

IHS Markit is developing a blockchain-based system to handle cash payments in syndicated loans – and eventually, in a wider range of transactions.

Just One Top Crypto Bucked This Week's Market Downturn

May 25, 2018 at 15:15 | Omkar Godbole

Shadowing the losses in bitcoin, the top-25 cryptocurrencies have all fallen over the last seven days – all bar one, that is.

Bitcoin Faces Close Below Long-Term Support In First Since 2015

May 25, 2018 at 10:00 | Omkar Godbole

If bitcoin closes the week below the 50-week moving average it will increase the likelihood of a sell-off to $6,000

Revolut App Adds XRP, Bitcoin Cash to Crypto Options

May 24, 2018 at 14:35 | Daniel Palmer

Mobile banking app Revolut now lets users buy, sell and hold Ripple's XRP and bitcoin cash, in addition to bitcoin, litecoin and ether.

Bitcoin Faces Drop to $7K as Bull Defense Crumbles

May 24, 2018 at 09:30 | Omkar Godbole

Bitcoin looks set to test $7,000 in the next 24 hours, courtesy of a bear flag breakdown on the technical charts.

Coinbase Is Rebranding Its Crypto Exchange Service

May 23, 2018 at 20:26 | Nikhilesh De

Coinbase announced Wednesday it was rebranding its GDAX platform as Coinbase Pro. Additionally, the company has acquired Paradex, a relay platform.

Bitcoin Price Faces Bear Indicator Not Seen Since 2014

May 23, 2018 at 09:00 | Omkar Godbole

Following bitcoin's recent losses, a key long-term trend indicator is looking increasingly bearish.

BITCOIN PRICE CHART WITH HISTORIC EVENTS

The chart below display’s Bitcoin’s price throughout any given timeframe. The numbers on the graph represent historical events that seemingly affected Bitcoin’s price at that time. The list of events is detailed below. Click on a number on the chart and you will be transferred to the corresponding event.

Bitcoin Video Crash Course

Join over 94,000 students and know all you need to know about Bitcoin. One email a day for 7 days, short and educational, guaranteed.

We hate spam as much as you do. You can unsubscribe with one click.

Historic Bitcoin Price & Events

South Korea threatens to shut down cryptocurrency exchanges - December 28, 2017

Bitcoin price tumbled after South Korea announced more measures to regulate bitcoin trading, including a potential shutdown of exchanges, amid volatile moves in the world’s third-largest cryptocurrency market. “Cryptocurrency speculation has been irrationally overheated in Korea,” the government said in a statement. “We cannot leave the abnormal situation of speculation any longer.”

Bitcoin price hit all time high just below $20,000 - December 18, 2017

Bitcoin hits a new record high, but stops short of $20,000

CBOE Bitcoin Futures are launched - December 11, 2017

Futures on the world’s most popular cryptocurrency surged as much as 26 percent from the opening price in their debut session on Cboe Global Markets Inc.’s exchange, triggering two temporary trading halts designed to calm the market.

Bitcoin price breaks $10,000 for the first time - November 28, 2017

Bitcoin has finally surmounted the greatest psychological barrier of all, passing $10,000.

SegWit2X Cancelled - November 8, 2017

Bitcoin was scheduled to upgrade around Nov. 16 following a proposal called SegWit2x, which would have split the digital currency in two. However, more and more major bitcoin developers dropped their support for the upgrade in the last few months. Developers behind SegWit2x announced they are calling off plans for the upgrade until there is more agreement in the bitcoin community.

CME announces to launch Bitcoin futures - October 31, 2017

CME Group announced that it plans to introduce trading in bitcoin futures by the end of the year, only a month after dismissing such a plan. Chief Executive Officer Terrence Duffy cited increased client demand as a key reason for the change of mind. As a result, the Bitcoin price hit a high of $6,600.84 just hours after breaking through the $6,400 barrier, and a minute after moving past the $6,500 mark, according to data from CoinDesk. Its market capitalization, or the total value of bitcoin in circulation, hit $110 billion.

Bitcoin Hardfork: Bitcoin Gold goes live - October 25, 2017

According to the Bitcoin Gold pitch, returning to home users will bring forth greater decentralization. Since Bitcoin Gold was issued, its price has plunged over 66 percent within the first couple of hours. The sell-off was due to investors dumping the cryptocurrency, perhaps signaling a lack of faith in the newly-created coin.

Bitcoin price breaks $5,000 for the first time - October 13, 2017

The price of bitcoin has smashed through $5,000 to an all-time high. The cryptocurrency rose by more than 8% to $5,243 having started the year at $966.

China Is Shutting Down All Bitcoin and Cryptocurrency Exchanges - September 15, 2017

Chinese authorities have ordered Beijing-based cryptocurrency exchanges to cease trading and immediately notify users of their closure, signaling a widening crackdown by authorities on the industry to contain financial risks. Exchanges were also told to stop allowing new user registrations, according to a government notice signed by the Beijing city group in charge of overseeing internet finance risks that were circulated online and verified by a government source to Reuters.

Jamie Dimon, head of JP Morgan calls Bitcoin as fraud - September 12, 2017

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said he would fire any employee trading bitcoin for being “stupid.” The cryptocurrency “won’t end well,” he told an investor conference in New York, predicting it will eventually blow up. “It’s a fraud” and “worse than tulip bulbs.”

China bans companies from raising money through ICOs - September 3, 2017

Regulators started to scrutinize China's initial coin offerings as announced by a local outlet. Caixin reported that a notice, issued by a working committee that oversees risk in the country's internet finance sector, said new projects raising cash or other virtual currencies through cryptocurrencies are banned. It added that authorities are cracking down on related fraudulent practices. The document defined initial coin offerings (ICOs) as an unauthorized fundraising tool that may involve financial scams, the Caixin report noted. The committee provided a list of 60 major ICO platforms for local financial regulatory bodies to inspect.

Bitcoin "splits" into Bitcoin (BTC) and Bitcoin Cash (BCH) - August 1, 2017

After years of debating about how Bitcoin should scale the controversy turned into action. The Bitcoin code split in two different directions. One direction supporting the optimization of Bitcoin blocks through Segwit, while the other direction supports bigger blocks of up to 8mb.

Japan Declares Bitcoin as Legel Tender - April 1, 2017

Japan recognizes bitcoin as a legal method of payment.

The country's legislature passed a law, following months of debate, that brought bitcoin exchanges under anti-money laundering/know-your-customer rules, while also categorizing bitcoin as a kind of prepaid payment instrument.

SEC denies second Bitcoin ETF application - March 28, 2017

The U.S. Securities and Exchange Commission on Tuesday denied for the second time in a month a request to bring to market a first-of-its-kind product tracking bitcoin, the digital currency.

SEC denies Winkelvos ETF - March 10, 2017

the US government denied the application of Tyler and Cameron Winklevoss — the brothers who once claimed to be co-inventors of Facebook — to operate an exchange-traded fund (ETF) to make it easier for investors to buy Bitcoin.

Bitcoin price breaks $1000 for the first time in 3 years - January 3, 2017

After rallying for most of the second half of 2016 Bitcoin breaches the $1000 mark for the first time in 3 years. Mass media coverage brings in an influx of new users that supposedly will raise the price even higher.

Donald Trump Elected as President, Market Plummet - November 9, 2016

In a shocking turn of events Donald Trump defeats Hillary Clinton and become the 45th president of the United States. The US market drops by over 1% and the Mexican Peso has plumbed record lows, and is now down 10% today at 20.22 peso to the dollar.

Bitfinex Hacked - August 2, 2016

Bitfinex, the largest Bitcoin exchange by volume, announced that 119,756 bitcoins of customer funds had been stolen via a security breach, a value roughly equivalent to $72 million USD. Bitfinex was holding the customer funds in multi-signature addresses in conjunction with its security partner BitGo. It is presumed that the attacker obtained access to the private keys for nearly all Bitfinex customer accounts, as well as access to the BitGo API for the Bitfinex account.

Second Halving Day - July 9, 2016

The block reward was decreased for the second time in Bitcoin's history, resulting in a new reward of 12.5 bitcoins per mined block. The automatic 50% drop continued Bitcoin's original design to gradually decrease the number of newly created bitcoins until the block reward ends completely, which is estimated to occur in the year 2140.

Craig Wright Claims to be Bitcoin's Creator - May 2, 2016

Following a five month absence from the public eye, Craig Wright publicly announced he was Satoshi Nakamoto by means of a blog post. The blog post featured a disjointed demonstration of a private key signing, which seemed to be an attempt to verify Wright was in possession of Nakamoto's private Bitcoin keys. This verification was later debunked by the Bitcoin community.

Steam Accepts Bitcoin - April 27, 2016

The popular gaming platform Steam began accepting Bitcoin as payment for video games and other online media. Valve, the company that owns Steam, enlisted Bitpay as the payment processor to facilitate Bitcoin payments and help target international customers where credit card payments weren't as ubiquitous.

OpenBazaar Launched - April 4, 2016

The initial production version of the first decentralized marketplace software, OpenBazaar, was released to the general public. The goal of the project was to facilitate peer-to-peer trade without a middleman, fees, or restrictions on trade. The software allows users to create virtual stores where buyers can purchase goods using Bitcoin.

Bitcoin Roundtable Consensus - February 21, 2016

Influential members of the Bitcoin community met in Hong Kong to discuss a development plan and timeline for scaling Bitcoin. The closed-door meeting included over 30 miners, service providers, and Bitcoin Core developers and was meant to address solutions to the block size debate.

Mike Hearn Quits Bitcoin (a.k.a The Hearnia) - January 14, 2016

In a public blog post, Mike Hearn declared that Bitcoin had failed and that he will "no longer be taking part in Bitcoin development". Hearn was an ex-Google developer who had been heavily involved in the Bitcoin community and related projects since the early days of the cryptocurrency. His most popular project was bitcoinj, a Java implementation of the Bitcoin protocol.

Gwern and WIRED Claim Craig Wright is Probably Satoshi Nakamoto - December 8, 2015

Security researcher and writer, Gwern Branwen, published an article in WIRED magazine claiming that an Australian man named Dr. Craig S. Wright was either Satoshi Nakamoto or a "brilliant hoaxer". Gwern cited a number of Wright's deleted blog posts, leaked emails, and transcripts that seemed to suggest Wright is Bitcoin's creator. In one leaked transcript Wright himself claims "I did my best to try and hide the fact that I’ve been running bitcoin since 2009". Another document detailed that Wright had access to a Bitcoin trust worth 1.1 million bitcoins.

Bitcoin Sign Accepted into Unicode - November 3, 2015

The Unicode committee accepted the Bitcoin currency symbol (uppercase B with 2 vertical bars going through it, but only visible at the top and bottom) to be in a future version of the Unicode standard. The glyph will be given the slot "U+20BF BITCOIN SIGN" and eventually will render with standard system fonts.

Bitcoin Featured on Front Page of The Economist - October 31, 2015

The Economist, a globally popular British publication focused on economic liberalism, made it's article "The Trust Machine" the featured cover story of it's weekly print edition. The article focused mainly on the utility of blockchain technology, promoting the idea that banks and government institutions may implement their own blockchains to create "cheap, tamper-proof public databases".

EU Declares No VAT on Bitcoin Trades - October 22, 2015

The European Court of Justice ruled that the exchange of Bitcoin and "virtual currencies" is not subject to value-added-tax (VAT) in the European Union. The ruling acts to classify Bitcoin and related alt-coins as currency, instead of goods or property.

Gemini Exchange Launched - October 8, 2015

Cameron and Tyler Winklevoss released their own US based Bitcoin exchange dubbed "Gemini". Upon launch, the exchange was licensed to operate in 26 states and was able to "service both individual and institutional customers" due to its LLTC corporate structure. Gemini was also able to offer FDIC insurance on customer deposits thanks to a partnership with a New York based bank.

Bitcoin declared as a commodity by the US regulator - September 18, 2015

The Commodity Futures Trading Commission (CFTC), announced it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. They state: "In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,".

Bitcoin XT Fork Released - August 15, 2015

Bitcoin Core developers Mike Hearn and Gavin Andresen released a separate version of the Bitcoin client software, called Bitcoin XT. The release illustrates an ongoing controversy in the Bitcoin development community: what limit should be placed on the size of Bitcoin's blocks? Bitcoin XT implements BIP 101, which proposes "replacing the fixed one megabyte maximum block size with a maximum size that grows over time at a predictable rate".

Mark Karpeles Arrested - August 1, 2015

Mark Karpeles, the CEO of the failed Bitcoin exchange Mt. Gox, was arrested in Japan on charges of fraud and embezzlement in relation to collapse of the exchange. Karpeles faces allegations of illegally manipulating trade volume and the personal use of client deposits, of which may have led to the exchange's insolvency. Mt. Gox is thought to have ultimately lost 744,400 Bitcoins of customer deposits.

2 Federal Agents Plead Guilty to Silk Road Theft - July 1, 2015

Former Federal agents Carl Force IV (DEA) and Shaun Bridges (Secret Service) pleaded guilty to stealing Bitcoins for their personal gain during their active investigation of the Silk Road marketplace.

New York State Releases the BitLicense - June 3, 2015

Superintendent of New York State Department of Financial Services, Benjamin Lawsky, released a set of customized rules meant to regulate Bitcoin and digital currency businesses that serve customers located in New York state. These regulations are the first ever directly targeted at digital currency businesses.

Ross Ulbricht Sentenced to Life in Prison - May 19, 2015

After a month-long jury trial that ended in Ulbricht's conviction, Judge Katherine Forrest sentenced Ulbricht to life in prison without parole. Ulbricht had been found guilty on 7 charges of money laundering, computer hacking, and conspiracy to traffic narcotics in February due to his role as the operator of the Silk Road marketplace (a.k.a "Dread Pirate Roberts"). In a letter to Judge Katherine Forrest prior to his sentencing, Ulbricht admitted to running the Silk Road and made a plea for leniency. The judge's sentencing statement hinted that the harshness of the sentence was to make an example of Ulbricht: members of the public considering following in his footsteps should know "that if you break the law this way, there will be very serious consequences."

Coinbase Launches US Licensed Exchange - January 26, 2015

The VC backed startup Coinbase Inc., a popular Bitcoin outlet and payment processor, announced the release of its own Bitcoin trading platform. The company founders stated they had worked for months to obtain various licenses from state financial regulators, allowing them to legally accept customers from 25 different US states.

Bitstamp Hacked - January 4, 2015

Unknown hackers were able to steal 18,866 bitcoins from Bitstamp's operational hot wallet, worth roughly $5.2 million dollars. The attackers used social engineering against Bitstamp system administrator Luka Kodric to gain access to 2 of Bitstamp's servers and subsequently the hot wallet's private keys. The wallet was completely drained of all bitcoins shortly thereafter.

Charlie Shrem Sentenced to 2 Years in Prison - December 19, 2014

Labeled Bitcoin's "First Felon", Charlie Shrem, the CEO of bitcoin exchange BitInstant, was sentenced to 2 years in prison for his role in laundering money for users of the Silk Road, an online marketplace that catered to illicit goods and services.

Microsoft Accepts Bitcoin - December 11, 2014

Microsoft revealed it will accept Bitcoin from US customers for "apps, games and other digital content" offered on the Windows and Xbox online stores. The announcement was made via a post on the tech giant's blog and stated that Microsoft had partnered with Bitpay for Bitcoin payment processing.

The Slaying of BearWhale - October 6, 2014

An unknown trader places nearly 30,000 BTC for sale on the Bitstamp exchange at a limit price of $300 per bitcoin, worth roughly $9 million USD. The order was dubbed the "BearWhale" by the Bitcoin community due to its unprecedented size.

Paypal Subsidiary Braintree to Accept Bitcoin - September 8, 2014

Braintree, a subsidiary of Paypal, announces that it is partnering with Coinbase to accept Bitcoin payments on their platform. Over the next three months, the two companies will work on integrating Bitcoin payment processing for Braintree merchants. The Bitcoin payment option will be seamlessly enabled for all merchants on the platform. Braintree merchants need only sign up for a Coinbase account and link it to their Braintree account.

Dell Accepts Bitcoin - July 18, 2014

Founder Michael Dell announces on Twitter that dell.com now accepts Bitcoin. Customers in the United States (only) can purchase any product listed on Dell's online marketplace using Bitcoin. All Bitcoin transactions are to be handled by Coinbase, a Bitcoin payment processor. At a yearly revenue of $56 billion, Dell becomes the largest company to accept Bitcoin.

New York DFS Releases Proposed “BitLicense” - July 17, 2014

Benjamin M. Lawsky, Superintendent of New York's Department of Financial Services, announces a proposed set of regulations for businesses that interact with Bitcoin and cryptocurrencies. The goal of the new regulations, according to Lawsky, are to help "protect consumers and root out illegal activity – without stifling beneficial innovation". The regulations would require entities that deal in Bitcoin to run background checks/fingerprints for all employees, get written approval for new business activities by the state, and to immediately convert any Bitcoin profit to US dollars. Affected entities would be exchanges, mining pools, bulk Bitcoin sellers, and altcoin software creators based in New York state, or that have customers in New York state. News of these regulations are generally rebuked by the cryptocurrency community.

US Marshals Service Auctions 29,656 Seized Bitcoins - June 27, 2014

Nearly 30,000 government seized Bitcoins, obtained by the US Marshals Service during the October 2013 bust of the Silk Road website, are auctioned off in chunks of 3,000 bitcoins. Bidders are required to deposit $200,000 USD via bank wire in order to qualify for the auction. A single bidder (venture capitalist Tim Draper) won every auction, indicating that his winning bid prices were far higher than the current market price.

Mining Pool GHash.io Reaches 51% - June 13, 2014

Due to GHash.io's popularity and partnership with CEX.io to sell mining shares of their own mining hardware, the mining pool giant gains a sole majority of the Bitcoin network hashing power, and the ability to launch a successful 51% attack on the Bitcoin network. With a majority of the Bitcoin network hashing power, GHash.io could temporarily reverse transactions that they send (double spending) and prevent other transactions from being confirmed.

Chinese Exchanges' Bank Accounts Closed - April 10, 2014

The People's Bank of China's frequently updated restrictions against Bitcoin finally pressure some Chinese banks to issue a deadline against several bitcoin exchanges, requiring them to close their accounts by April 15. Although some are spared the warnings, the uncertain regulatory environment holds some prominent loopholes that virtually all Chinese exchanges quickly adopt. Using offshore banks, novel cryptographic voucher systems and other solutions, these trading platforms continue to operate, but at greatly reduced volumes from their hayday in 2013.

IRS Declares Bitcoin To Be Taxed As Property - March 26, 2014

The IRS policy document declares Bitcoin to be property, not currency, subject to capital gains tax – with that tax calculated against every change in buying power for a given amount of bitcoin, from the time it's acquired to the time it's spent. The decision is widely derided as unwieldy and overly complex, requiring users of the currency to record Bitcoin's market price with every transaction, subject to an array of largely unfamiliar calculations. Others, however, remark that the net tax paid may often be less than if Bitcoin were treated as currency proper - but to a market that emerged in tax-free innocence, it is a difficult blow to soften.

Newsweek Claims Dorian Nakamoto is Bitcoin's Creator - March 6, 2014

In an article titled "The Face Behind Bitcoin", journalist Leah McGrath Goodman writes that an unemployed engineer in Temple City, California is in fact Bitcoin's creator. Based on speculations and interviews with Dorian's family, Goodman's article ultimately draws an enourmous amount of worldwide attention to Dorian Nakamoto, who denies any involvement in Bitcoin and asks for privacy from the media.

Mt. Gox Closes - February 24, 2014

After putting an abrupt halt to withdrawals on February 6, claiming that a hacker had exploited their own poorly-implemented software through the use of transaction malleability attacks, disgraced bitcoin exchange Mt. Gox's website and trading engine go blank without official comment. Other exchanges and Bitcoin businesses issue a joint statement condemning the mismanagement, deception, and eventual collapse wrought by the executives of the Japan-based exchange, after an alleged leaked internal document showed that over 744,000 BTC were lost by the company.

Major Exchanges Hit With DDoS Attacks - February 7, 2014

Mt. Gox, Bitstamp, and BTC-e all experienced a stoppage of trading due to massive DDoS attacks that were apparently aimed at exploiting transaction maleability in the exchanges' software. Mt. Gox halted withdrawals first, on February 6, evidently contributing to a sharp drop in BTC price; the DDoS attack was detected on February 11, 2014.

Chinese Government Bans Financial Institutions From Using Bitcoin - December 5, 2013

Putting its first restraints on Bitcoin's surging popularity, the People's Bank of China declares Satoshi Nakamoto's novel invention not to be a currency. The policy change prohibits any financial institution to trade, insure, or otherwise offer services related to Bitcoin. Over the following weeks, further restrictions slowly strangle the Chinese cryptocurrency markets, as exchanges repeatedly try to find innovative, lasting ways to stay in operation, and prices around the globe sink dramatically.

Exchange Rate Peaks at $1,242 on Mt. Gox - November 29, 2013

Rapidly growing Bitcoin investment from China steadily drives prices higher and higher, reaching a peak on November 29th. Subject to strict controls concerning the movement of money across the country's borders, Chinese citizens embrace the freedom provided by Bitcoin with open arms, seeking an alternative to the state's inflating official currency, the Renminbi. The origin of mainstream Chinese interest in Bitcoin is largely credited to Jet Li's One Foundation, which publicized a Bitcoin address for donations in the wake of the April 20th, 2013 Lushan earthquake and received over 230 BTC in just two days, covered widely in the national media.

People’s Bank of China OK's Bitcoin - November 20, 2013

Speaking in Chinese at an economic forum, Mr. Yi says that “people are free to participate in the Bitcoin market,” and that he would “personally adopt a long-term perspective on the currency.” News of his statements energize the already active Chinese bitcoin markets, with the largest, BTC China, seeing trade volumes more than twice those of the world's second-largest exchange, Mt. Gox.

US Senate Holds Hearing On Bitcoin - November 18, 2013

Announced under the title "Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies," hope for the U.S. Government panel's discussion is dim among the Bitcoin community leading up to the hearing. As the proceedings commence, however, many of the panelists and Senators agree that Bitcoin holds great promise. The general consensus is summed up by Jennifer Shasky Calvery, Director of the U.S. Government's Financial Crimes Enforcement Network (FinCEN), who testified, “We want to operate in a way that does not hinder innovation.”

Dread Pirate Roberts Arrested - October 1, 2013

Following a trail of clues left carelessly across the internet, the U.S. Federal Bureau of Investigation (in conjunction with other agencies) manages to identify the alleged operator of the dark web marketplace, which saw most of its sales in illicit drugs. Ross Ulbricht, claimed by the FBI to be the site's founder, Dread Pirate Roberts, is arrested in a San Francisco Public Library and charged with narcotics trafficking, computer hacking, money laundering and engaging in a “continuing criminal enterprise.” About 30,000 BTC of the Silk Road's alleged bitcoin holdings are seized at the time, and an additional 144,000 BTC from DPR's private holdings are swept up three weeks later.

Tradehill Shuts Down (Again) - August 30, 2013

The business-to-business bitcoin exchange had been reliant on the relatively new Internet Archive Federal Credit Union to hold its clients' deposits in regulation-compliant, insured accounts. When the IAFCU determines that it can not reasonably handle the myriad regulatory issues surrounding Bitcoin, Tradehill is forced to halt operations and return customers' funds.

DHS Seizure Warrant Against Mt. Gox - May 14, 2013

When Mt. Gox opened an American bank account with Wells Fargo, President and CEO Mark Karpelès answered “no” to the questions, “Do you deal in or exchange currency for your customer?” and “Does your business accept funds from customers and send the funds based on customers’ instructions (Money Transmitter)?” The U.S. Government thinks otherwise. With the warrant signed, Homeland Security Investigations seizes $2,915,507.40 from an account owned by a Mt. Gox subsidiary that was used to process payments to and from U.S. customers, and the future of Bitcoin's legal status becomes ever more uncertain.

Increased Trading Volume Breaks Mt. Gox - April 10, 2013

Originally thought to be a Distributed Denial-of-Service (DDoS) attack on the largest bitcoin exchange, the great influx of traders on the heels of Cyprus's bailout announcement overwhelms Mt. Gox's servers, causing trades to stutter and fail. Speculative concerns about the exchange's hiccups feed a powerful panic-sell that saturates the market and drives prices down to pre-rally levels, before rising again a few days later.

Cyprus Bail-In - March 25, 2013

Orchestrated by Cyprus President Nicos Anastasiades, the Eurogroup, the European Commission, the European Central Bank and the International Monetary Fund, the €10 billion bailout is hoped to fortify the flagging Cypriot economy. Among its conditions, however, is a sizable levy collected from most bank accounts with holdings over the €100,000 cutoff - a serious concern not just for wealthy Cypriots but many internationals, as the nation's favorable policies had made it a popular global tax haven, particularly in Russia. Seeking solutions to preserve their holdings before the bailout's conditions take effect, many of these account holders begin buying bitcoin en masse, driving a price rally through early April that brought the value of one bitcoin from about $80 to over $260.

Bitcoin 0.8 Causes Brief Hard Fork - March 11, 2013

Shaking confidence in Bitcoin and the validity of some transactions, the price briefly plummets and the Mt. Gox exchange temporarily suspends bitcoin deposits. Thanks to a swift and coordinated response by Bitcoin developers, miners, and community members, the fork is resolved within hours after the operators of two large mining pools, Michael Marsee (of BTC Guild) and Marek Palatinus (of slush's pool), honorably forgo some of their accumulated mining rewards in order to downgrade to the previous, compatible version. An updated version, 0.8.1, is released shortly after, containing safeguards to prevent the original problem.

Halving Day - November 28, 2012

In line with the original design for Bitcoin's maturation, the number of coins created to reward miners undergoes its first reduction, beginning the long and gradual process of tapering the amount of new currency entering the economy. These “Halving Days” are scheduled to occur every four years, stepping down the number of new bitcoins generated until the reward reaches 0 in the year 2140, to yield a fixed money supply of 20,999,999.9769 BTC. This pre-programmed limit to inflation is a major driver of the currency's economic controversy, value appreciation and speculation.

Wordpress Accepts Bitcoin - November 15, 2012

In a smart and savvy release, Wordpress explains the decision: “PayPal alone blocks access from over 60 countries, and many credit card companies have similar restrictions. we don’t think an individual blogger from Haiti, Ethiopia, or Kenya should have diminished access to the blogosphere because of payment issues they can’t control. Our goal is to enable people, not block them.” As one of the 25 most popular domains on the web, Wordpress's move paves the way for later retail ventures in Bitcoin.

Bitcoins Savings & Trust Halts Payments - August 17, 2012

Promising consistent weekly “interest” returns of 7% to its creditors, Trendon T. Shavers (known on BitcoinTalk as Pirateat40) manages the secretive operation for about eight months, accepting only large deposits of bitcoin (50+ BTC) and paying out “interest” weekly. On August 17, 2012, Pirateat40 announces a halt to the operation, and absconds with deposits estimated between 86,202 and 500,000 BTC. On July 23, 2013, the U.S. Securities and Exchange Commission files charges against Shavers for defrauding investors in a Ponzi scheme.

Linode Hacked, Over 46,000 BTC Stolen - March 1, 2012

An unknown hacker breaches Linode's server network and immediately seeks out accounts related to bitcoin, quickly compromising the wallets of eight customers. Bitcoinica, a large online bitcoin exchange, is hardest hit, losing more than 43,000 BTC, while other prominent victims include Bitcoin's lead developer Gavin Andresen as well as Marek Palatinus (also known as slush), the operator of a large mining pool. Both Bitcoinica and slush's pool bear the theft's losses on behalf of their customers.

Paxum and Tradehill Drop Bitcoin - February 11, 2012

On February 11, 2012, Paxum, an online payment service and popular means for exchanging bitcoin announces it will cease all dealings related to the currency due to concerns of its legality. Two days later, regulatory issues surrounding money transmission compel the popular bitcoin exchange and services firm TradeHill to terminate its business and immediately begin selling its bitcoin assets to refund its customers and creditors. The following day, Patrick Strateman, known on BitcoinTalk as phantomcircuit, benevolently discloses a devastating bug in how BTC-E, another online exchange, secures its clients' accounts and funds.

"The Good Wife" Airs "Bitcoin for Dummies" TV Episode - December 19, 2011

After the initial announcement of this upcoming, Bitcoin-themed episode, investors bet big on the show to catapult prices to new highs. About 9.45 million viewers tune in to watch "Bitcoin for Dummies" on January 15, 2012; the story involves a government manhunt for the creator of Bitcoin, who is charged with creating a currency in competition with the U.S. Dollar. Despite the massive exposure, prices remain stagnant following the show's airing.

Mt. Gox Hacked - June 19, 2011

By gaining access to the credentials of an official auditor working for the Mt. Gox bitcoin exchange, a hacker downloads a slightly out-of-date copy of the website's user database, including email addresses and insecurely hashed passwords. Using their newfound administrator-level access to the site, they place countless offers to sell bitcoins that don't exist, falsely deflating prices until the going rate reaches just $0.01 per coin. Mt. Gox reverses the fraudulent transactions and halts trading for seven days to re-secure their systems, and two other large exchanges issue temporary halts while their own security is reviewed. Soon after, a copy of the database is leaked and is used to launch attacks against accounts held by users of the MyBitcoin online wallet service who share the same password on both sites, resulting in thefts of over 4,019 BTC from roughly 600 wallets.

Gawker Publishes Article About The Silk Road - June 1, 2011

Titled “The Underground Website Where You Can Buy Any Drug Imaginable,” Adrian Chen's piece on Gawker is as provocative as it is popular. To many people reading it, the sudden realization that Bitcoin has a useful value – one that's entirely unique - hits home. With a link to Mt. Gox in the text, the article starts an enormous upswing in price that beats all previous records, reaching over $31 per bitcoin just one week after publication.

Three New Exchanges Open Supporting More Fiat Currencies - March 27, 2011

On March 27, 2011, Britcoin launches the first exchange to trade bitcoin and British Pound Sterling (GBP). Just days later, on March 31, Bitcoin Brazil opens a service for face-to-face exchange in Brazilian Reals (BRL) and U.S. Dollars. On April 5, BitMarket.eu begins facilitating trades in Euros (EUR) and other currencies. Together, they simplify bitcoin ownership and trading for hundreds of millions of new users and the market is expanded enormously.

Bitcoin Price Hits $1.00 USD - February 9, 2011

Just two years old, Bitcoin achieves parity with the U.S. Dollar on the Mt. Gox exchange. The following day, some popular news outlets feature stories on the symbolic milestone, causing such a surge of interest in the growing currency that the official Bitcoin website is temporarily hobbled.

Bitcoin Protocol Bug Causes Hard Fork - August 15, 2010

Using a peculiar quirk of the way computers process numbers, an unknown person creates a fraudulent transaction that generates 184,467,440,737.08554078 bitcoins – nearly nine-thousand times as many as can legitimately exist in the entire system. The oddity is quickly spotted by Bitcoin developers and community members, and a fixed version of the Bitcoin software is released within hours. By the next day, the corrected blockchain overtakes the exploited one, and Bitcoin is back in normal operation – but not before the market is badly shaken.

Mt. Gox Opens For Business - July 18, 2010

Jed McCaleb, a programmer best known for creating the successful eDonkey peer-to-peer network in 2000, announces the launch of Mt. Gox, a new full-time bitcoin exchange. Based on a prior, abandoned project of McCaleb's to create an online exchange for Magic: The Gathering cards, he soon struggles to keep up with the demands of the business and sells mtgox.com to Mark Karpelès on March 6, 2011. Mt. Gox would slowly grow to dominate the world of bitcoin trading over the next three years.

Bitcoin Posted on Slashdot - July 11, 2010

The release of Bitcoin version 0.3 is featured on slashdot.org, a popular news and technology website. Reaching a large audience of technophiles, the article brings many newly-interested people on board, driving the exchange value of a single bitcoin up nearly tenfold, from approximately $0.008 to $0.08 in just five days.

Two Pizzas Are First Material Item Purchased Using Bitcoin - May 22, 2010

BitcoinTalk user laszlo (Laszlo Hanyecz) pays 10,000 BTC for two pizzas delivered to their house (valued at about $25), ordered and paid for by another user, jercos. This assigns the first concrete valuation to bitcoin - about $0.0025 per coin.

The First Bitcoin-to-Fiat Exchange Occurs - October 12, 2009

Using PayPal, NewLibertyStandard buys 5,050 BTC from Sirius for $5.02, equating to roughly one tenth of a cent per bitcoin.

New Liberty Standard Publishes First Exchange Rate - October 5, 2009

New Liberty Standard opens a service to buy and sell bitcoin, with an initial exchange rate of 1,309.03 BTC to one U.S. Dollar, or about eight hundredths of a cent per bitcoin. The rate is derived from the cost of electricity used by a computer to generate, or “mine” the currency.

Genesis Block Established - January 3, 2009

The first Bitcoin transaction record, or genesis block, kicks off the Bitcoin blockchain and includes a reference to a pertinent newspaper headline of that day:

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

12 484 пользователя находятся здесь

МОДЕРАТОРЫ

Welcome to Reddit,

the front page of the internet.

and subscribe to one of thousands of communities.

отправлено 2 года назад автор BitcoinCollege

Want to add to the discussion?

[–]btcsa 47 очков 48 очков 49 очков 2 года назад (5 дочерних комментарев)

[–]_niko 7 очков 8 очков 9 очков 2 года назад (0 дочерних комментарев)

[–]gubatron 4 очка 5 очков 6 очков 2 года назад (1 дочерний комментарий)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]calaber24p 17 очков 18 очков 19 очков 2 года назад (7 дочерних комментарев)

[–]HitMePat 11 очков 12 очков 13 очков 2 года назад (1 дочерний комментарий)

[–]RemindMeBot 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]RulerOf 3 очка 4 очка 5 очков 2 года назад (0 дочерних комментарев)

[–]zapdrive 5 очков 6 очков 7 очков 2 года назад (0 дочерних комментарев)

[–] [deleted] 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]veritasBS 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]tequila13 6 очков 7 очков 8 очков 2 года назад (3 дочерних комментария)

[–]b_coin -2 очков -1 очков 0 очков 2 года назад (0 дочерних комментарев)

[–]Essexal 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]Floooge 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]zapdrive 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]puck2 3 очка 4 очка 5 очков 2 года назад (4 дочерних комментария)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (3 дочерних комментария)

[–]tehchives 0 очков 1 очко 2 очка 2 года назад (2 дочерних комментария)

[–]puck2 2 очка 3 очка 4 очка 2 года назад (1 дочерний комментарий)

[–]nitiger 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]conv3rsion 12 очков 13 очков 14 очков 2 года назад (8 дочерних комментарев)

[–]circuitloss 10 очков 11 очков 12 очков 2 года назад (6 дочерних комментарев)

[+]rydan рейтинг комментария ниже порога -9 очко -8 очка -7 очка 2 года назад (5 дочерних комментарев)

[–]Sigg3net 1 очко 2 очка 3 очка 2 года назад (4 дочерних комментария)

[–]Shibinator 10 очков 11 очков 12 очков 2 года назад * (3 дочерних комментария)

[–]BeardMilk 1 очко 2 очка 3 очка 2 года назад (1 дочерний комментарий)

[–]Sigg3net 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]ddepra 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]col381 4 очка 5 очков 6 очков 2 года назад (25 дочерних комментарев)

[–] [deleted] 24 очка 25 очков 26 очков 2 года назад (15 дочерних комментарев)

[–]Sigg3net 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]Elanthius 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]rydan -1 очков 0 очков 1 очко 2 года назад (1 дочерний комментарий)

[–] [deleted] 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]utuxia 0 очков 1 очко 2 очка 2 года назад (10 дочерних комментарев)

[–] [deleted] 3 очка 4 очка 5 очков 2 года назад (9 дочерних комментарев)

[–]utuxia 0 очков 1 очко 2 очка 2 года назад (8 дочерних комментарев)

[–]p-o-t-a-t-o 4 очка 5 очков 6 очков 2 года назад (0 дочерних комментарев)

[–]tequila13 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]miles37 -5 очков -4 очков -3 очков 2 года назад (4 дочерних комментария)

[–]Jamiebtc 3 очка 4 очка 5 очков 2 года назад (2 дочерних комментария)

[–]miles37 1 очко 2 очка 3 очка 2 года назад * (1 дочерний комментарий)

[–]Jamiebtc 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[+]rydan рейтинг комментария ниже порога -8 очка -7 очка -6 очка 2 года назад (0 дочерних комментарев)

[–]whoisjordi 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]way2know 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]RulerOf 1 очко 2 очка 3 очка 2 года назад (0 дочерних комментарев)

[–]gonzobon 2 очка 3 очка 4 очка 2 года назад (0 дочерних комментарев)

[–]utuxia -2 очков -1 очков 0 очков 2 года назад (0 дочерних комментарев)

[–]_niko 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]jasonmoola 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]ToroArrr 0 очков 1 очко 2 очка 2 года назад (1 дочерний комментарий)

[–]puck2 0 очков 1 очко 2 очка 2 года назад (0 дочерних комментарев)

[–]Borax -4 очков -3 очков -2 очков 2 года назад (0 дочерних комментарев)

- приложенияи инструменты

- Reddit for iPhone

- Reddit for Android

- mobile website

- кнопки

Использование данного сайта означает, что вы принимаете пользовательского соглашения и Политика конфиденциальности. © 2018 reddit инкорпорейтед. Все права защищены.

REDDIT and the ALIEN Logo are registered trademarks of reddit inc.

![]()

π Rendered by PID 104100 on app-482 at 2018-05-29 20:08:59.049361+00:00 running 7e980a7 country code: RU.

This man bought $27 of bitcoins in 2009 and they're now worth $980k

A Norwegian man who bought $27 worth of bitcoins in 2009 and forgot about them discovered their value had since shot up - to $980,000 at today's price.

Kristoffer Koch decided to buy 5,000 bitcoins for only 150 Norwegian kroner ($26.60) in 2009, after discovering bitcoin as part of an encryption thesis he was working on.

Koch probably didn't think he would become wealthy as a result, but his 5,000 BTC has turned into a goldmine. It was a wise investment by someone who stumbled across bitcoin before many others did.

Koch found that his bitcoins were worth 5 million Norwegian kroner ($886,000) when he checked back in on them. At the current Bitcoin Price Index of $196, those coins are now worth about $980,000.

After purchasing the 5,000 bitcoins, Koch pretty much forgot about them altogether. That is, until the price shot up to over $200 back in April and he started seeing press coverage about bitcoin's rise.

"I thought to myself, didn't I have something like that?" Koch told NRK, a Norwegian news outlet.

He did, and after figuring out the password to his wallet and seeing how valuable those bitcoins had become, he sold off a portion of them. Now he has an apartment that he purchased in an expensive part of Oslo, Norway. All thanks to the huge price gain that bitcoin has experienced, mostly in the past year.

The one-year rise of bitcoin's price. Source: CoinDesk Bitcoin Price Index

The one-year rise of bitcoin's price. Source: CoinDesk Bitcoin Price Index

It turns out that Koch's frivolous technology spending, against his girlfriend's wishes, actually turned out to be a great investment.

"I buy a lot of technical little things that I never have time to use, and this was the worst of all, the fact that I was buying fake money," Koch told NRK.

It's not fake anymore, at least not to Kristoffer Koch.

Many people have become wealthy as a result of bitcoin's rise, although stories like this are rarely in the public eye. There's the story on the Bitcointalk forums about Kevin, who purchased 259,684 BTC for under $3,000 in 2011.

Then there is Erik Voorhees, who founded the bitcoin gambling site Satoshi Dice and sold it for 126,315 BTC, worth about $24.7 million at the current bitcoin price.

And The Verge reported earlier this year that Satoshi Nakamoto, the Bitcoin network's mysterious founder, has an address with over one million bitcoins.

Of course, we shouldn't forget about the person who bought two pizzas for 10,000 bitcoins back in 2009. Now, if only that person had kept them, or perhaps forgot about them and rediscovered them years later like Kristoffer Koch did.

Featured image: antanacoins / Flickr

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Bitcoin price from 2009

IT pro says he threw out 7,500 bitcoins, now worth $7.5 million

Launched in 2009, bitcoin price was tremendously changing: from zero to 1300 USD in 2015, and 300 USD at the moment of this article btc e usd charts.

What is Bitcoin Index?

For starters let’s define bitcoin price index (or bitcoin index as further). Bitcoin index is based on a weighted average of prices from exchanges all over the world. Due to high volatility bitcoin index is changing dramatically and when the bitcoin market valuation approached US$1 billion and few price index ups and downs, some people called bitcoin index a bubble.

How Bitcoin Price History Started?

The fact that the bitcoin was able to gain any value (and thus, the bitcoin price) in a free market proves that it does has some kind of underlying value as a commodity. While the early days of the currency were really just a few computer geeks sending meaningless payments back and forth between each other for fun, the bitcoin was eventually traded for real dollars when someone decided to take a gamble on the future value of the currency. Many of these early transactions, including the purchase of roughly $25 worth of pizza for 10, 000 bitcoins, showed that the right to use the Bitcoin payment network was reason enough for bitcoins to have value and the bitcoin price started to increase.

Why is the Price Volatile?

When people complain about the volatility associated with Bitcoins, it’s important to keep the discussion in the context of what’s really going on with the world’s first widely used cryptocurrency. First of all, this is an experiment. The price of a single Bitcoin reached over $1, 000 before the software even reached version 1.0, so it’s safe to say that we still have a ways to go when it comes to the maturation of the protocol. Sometimes it helps to take a step back and realize that this is a new invention that was only released in 2009. The fact that the Bitcoins price is already where it is today is rather incredible, and the volatility is to be expect at this young age.

Is Bitcoin Price a Bubble?

One of the main criticisms that people make when talking about a possible bubble in the bitcoin market is that there is nothing to prevent bitcoin price from crashing to zero. People will point to the fact that you need dollars to pay for taxes in the United States or natural resources on the world stage, and they’ll also mention that gold also cannot drop to zero due to the fact that it’s used for jewelry and the production of various electronic devices. The people making these claims have not done their research because the fact of the matter is the Bitcoin payment system is what prevents bitcoins and the bitcoin index from dropping to zero. The protocol and the currency are linked together, and you cannot have one without the other.

Warum hat Bitcoin Wert

In den letzten 3 Jahren ist der Wechselkurs Bitcoin sprunghaft angestiegen. Anfang Januar 2011, würde 1 Bitcoin für ca. 0,31 Dollar eintauschen. Derzeit holt 1 Bitcoin Anfang April 2014, 445 US-Dollar. Das ist ein Anstieg von etwa 143.548 % im Laufe von 3 Jahren.

Warum sollte jemand bezahlen, dass viel “echtes Geld” für einige digitale Hoosie-Whats-its erfunden, dass Sie sogar in Ihren Händen halten können?

Die Antwort kommt von Verständnis, dass jede Form von Geld, von Dollar auf Gold zu Bitcoins, nur nützlich sein ist, wenn Menschen ihn wertvoll halten. Eine geldwerte basiert vollständig auf unsere eigene individuellen Wahrnehmungen. Wenn wir Vertrauen und eine Form von Geld schätzen, werden wir es als Gegenleistung für unsere eigenen waren und die Arbeit übernehmen. Aber unser Vertrauen vor allem Formen des Geldes ist nicht willkürlich oder ohne Grund. Fast jede Form von beliebten Geld in der Geschichte hat besondere Eigenschaften besaß, die Menschen wollen es nutzen verursacht haben.

Bitcoin hat fast alle Eigenschaften der sichere, solide und nützliche Geld. Und wenn eine neue Form von Geld genug, diese Qualitäten, vor allem auf den Punkt besitzt, es vorteilhaft ist, über andere vorhandenen Formen des Geldes, verwenden, Menschen freiwillig entscheiden sich als Zahlungsmittel zu akzeptieren, und halten Sie ihn Wert zu speichern. Als die Nachfrage steigt, steigt der Wert, und der Wechselkurs steigt.

Die Einführung des Bitcoin als Zahlungsmittel war während den letzten Nachrichten. Bitpay jetzt verarbeitet Bitcoin Zahlungen für mehr als 10.000 Händler, Virgin Atlantic wird fliegen Sie in den Weltraum für Bitcoins, und Overstock.com startet akzeptieren Bitcoins im Jahr 2014. Vielleicht die aussagekräftigste aller ist, dass ein Escort-Agentur in Großbritannien jetzt akzeptiert Bitcoins als Bezahlung für ihre Dienste “Begleitung”. Man könnte das sagen, wenn Leute Sex, für Bitcoin haben, dann das Geld ist.

Dies wird kein Skonto, dass einige der kurzfristige Gewinne und Verluste, die Bitcoin erlebt hat können durch Spekulation. Investoren suchen, um schnelle Gewinne zu machen sind Bargeld in Bitcoin Gießen; nicht, um es als Tauschmittel verwenden, sondern später für eine einfache Gewinn zu verkaufen. Preis Blasen aufgeblasen und platzen in dramatische Abstürze wie panische Spekulanten ihre Bestände nach Anhörung Wort des negativen Bitcoin verkaufen haben ähnliche News und Events.

Bitcoin ist doch noch ein neues Konzept noch in den Kinderschuhen. Der Markt wird versucht herauszufinden, wie viel es Wert ist, verursacht den kurzfristigen Preis sehr volatil sein. Zeit bewegt sich auf und Bitcoin wird mehr entdeckt und gleichmäßig verteilte, werden den Marktwert weniger volatil. Zum Beispiel, wenn die 4-Jahres-Preis des Bitcoin wird auf einer logarithmischen Skala betrachtet, wird deutlich, dass jede nachfolgende Blase weniger dramatisch (in Bezug auf Zehnerpotenzen), und der langfristige Preis wurde kontinuierlich nach oben verschoben.

Die Qualitäten des Geldes

Hier ist eine Liste von einigen der wichtigsten Eigenschaften der Garant, gefolgt von einer einfachen Tabelle, die verschiedene Formen von Geld und welche Eigenschaften anwenden.

Begrenzte Versorgung/Rare: eine Form von Geld, um erfolgreich zu sein, muss es in begrenzten Mengen verfügbar sein. Dies ist grundlegende Angebot und Nachfrage: eine kleine, feste Versorgung entspricht in der Regel eine gewisse Menge an Wert. Je seltener ein Stoff ist, desto mehr wird es in der Regel geschätzt.

Dienstprogramm: das Dienstprogramm eines Objekts spielt eine große Rolle in der Bestimmung seines Wertes. Weitere nützliche Elemente ergeben eine höhere Nachfrage und daher Befehl einen höheren Preis.

Fungible: einzelne Einheiten des Geldes müssen identisch und untereinander austauschbar sein. Andernfalls entstehen Konflikte: bestimmte Einheiten im Endeffekt mehr Wert als andere, Handel weiter erschwert.

Teilbar: die Fähigkeit, eine Einheit in kleinere Stücke teilen ist notwendig, bestimmte Preise, wie kleinere Zahlungen für preiswerte waren und Dienstleistungen entsprechen. Geld, der nicht ausreichend kleine Einheiten oder durch Teilung in kleinere Teile, zerstört wird, ist weniger als ideal.

Gefälschte Beweise: Wenn Geld gefälscht sein kann, kann es nicht Wert halten. Fälschungen erstellt eine falsche Wahrnehmung des Wertes von Wertlosigkeit und künstlich vergrößert die Geldmenge, die Fahrt über den Wert der anderen Einheiten.

Zerfallen Nachweis: ist eines der Ziele des Geldes als Wertaufbewahrungsmittel. Wenn die Währungseinheiten tendenziell verrotten oder im Laufe der Zeit verschwinden, gibt es wenig Anreiz zu halten oder das Geld als Zahlungsmittel akzeptieren.

Leicht übertragbare: Geld existiert auch als Methode von Exchange verwendet werden. Wenn Geld kann nicht bequem für Güter und Dienstleistungen austauschen, wird es nicht verwendet werden.

Freiwillige/ungesteuert Behörde: Diese Eigenschaft bedeutet, dass die Verwendung des Geldes nicht von einer Behörde vorgeschrieben ist. Menschen sollten frei sein, das Geld zu verwenden, nur, wenn sie beschließen, so zu tun. Andernfalls werden sie eine andere Form von Geld oder Revolte gegen die Behörde schließlich wählen. Darüber hinaus ist eine Autorität in der Steuerung der Geldmenge, die Behörde muss vertrauenswürdig sein, nicht die Macht, Geld zu schaffen und nicht begrenzen zu missbrauchen wie und wann das Geld ausgegeben werden kann. Geld zu Unrecht von einer Behörde kontrolliert wird von einer freien, allgemeine Öffentlichkeit aufgegeben werden.

Anonyme: alle Menschen haben ein Recht auf Privatsphäre, mit halten das wissen wie, wann und wo ihr Geld ausgegeben und begrenzt empfangen wird.

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

Комментариев нет:

Отправить комментарий