JPMorgan's Dimon says bitcoin 'is a fraud'

NEW YORK (Reuters) - Bitcoin “is a fraud” and will blow up, Jamie Dimon, chief executive of JPMorgan Chase & Co, said on Tuesday.

Speaking at a bank investor conference in New York, Dimon said, “The currency isn’t going to work. You can’t have a business where people can invent a currency out of thin air and think that people who are buying it are really smart.”

Dimon said that if any JPMorgan traders were trading the crypto-currency, “I would fire them in a second, for two reasons: It is against our rules and they are stupid, and both are dangerous.”

Dimon’s comments come as the bitcoin, a virtual currency not backed by any government, has more than quadrupled in value since December to more than $4,100.

Bitcoin is a digital currency that enables individuals to transfer value to each other and pay for goods and services bypassing banks and the mainstream financial system.

While banks have largely steered clear of bitcoin since it emerged following the financial crisis, the virtual currency has a range of people who support it, including technololgy enthusiasts, liberterians skeptical of government monetary policy and speculators attracted by its price swings.

“Like it or not, people want exposure to bitcoin,” Edward Tilly, chairman and CEO of exchange group CBOE Holdings Inc., said at the same conference.

CBOE has applied with U.S. regulators to launch a bitcoin futures contract and a bitcoin exchange traded fund on its venues.

Any good trade is started with a difference of opinion, Tilly added. “So Jamie can be on the short side and the issuers and those trading in physical can be on the long side, and it sounds like we have a great trade.”

Dimon may also be on the other side of another bitcoin trade closer to home.

At another conference about two hours later, Dimon said that one of his daughters had bought some bitcoin.

“It went up and she thinks she’s a genius now,” Dimon said at the CNBC Institutional Investor Delivering Alpha Conference.

“WORSE THAN TULIP BULBS”

Banks and other financial institutions have been concerned over bitcoin’s early association with online crime and money laundering.

The supply of bitcoin is meant to be limited to 21 million, but there are clones of the virtual currency in circulation which have made the market for it more volatile.

“It is worse than tulips bulbs,” Dimon said, referring to a famous market bubble from the 1600s.

JPMorgan and many of its competitors, however, have invested millions of dollars in blockchain, the technology that tracks bitcoin transactions. Blockchain is a shared ledger of transactions maintained by a network of computers on the internet.

Dimon said such uses will roll out over coming years as it is adapted to different business lines.

Financial institutions are hoping blockchain can be adapted to simplify and lower the costs of processes such as securities settlement, loan trading and international money transfers.

Dimon predicted big losses for bitcoin buyers. “Don’t ask me to short it. It could be at $20,000 before this happens, but it will eventually blow up.” he said.

“Honestly, I am just shocked that anyone can’t see it for what it is.”

Bitcoin’s price fell as much as 4 percent following Dimon’s comments and was last trading at $4,164. Rumors that the Chinese government is planning to ban trading of virtual currencies on domestic exchanges has weighed on bitcoin recently.

“It feels like we are in the midst of a negative news cycle, but even considering all this, we are still trading above $4,000.” said John Spallanzani, chief macro strategist at GFI Group.

Additional reporting by John McCrank, Angela Moon and Lawrence Delevingne

Big Business Giants From Microsoft to J.P. Morgan Are Getting Behind Ethereum

Thirty big banks, tech giants, and other organizations—including J.P. Morgan Chase, Microsoft, and Intel—are uniting to build business-ready versions of the software behind Ethereum, a decentralized computing network based on digital currency.

The group, called the Enterprise Ethereum Alliance, is set to debut at a summit in Brooklyn, New York on Tuesday, during which members J.P. Morgan Chase (jpm) and Banco Santander (san) are scheduled to demonstrate a pilot of the financial technology as it exists today. The pair plan to show off a “spot trade” on the foreign exchange market for global currencies using an adaptation of Ethereum as the settlement layer.

Ethereum uses a blockchain, often referred to as a distributed ledger, to record and execute transactions without the need of a middleman. Instead of a centrally managed database, copies of the cryptographic balance book are spread across the network and automatically updated as any payment takes place.

Satoshi Nakamoto, the mysterious inventor of Bitcoin, first introduced the concept of a blockchain to the world in a foundational white paper nearly a decade ago. (You can read more about Ethereum, a more flexible and developer-friendly alternative to Bitcoin with its native cryptocurrency, Ether, in this Fortune feature.)

The Ethereum alliance arrives as a challenger to several other extant blockchain ventures. The R3 consortium, for example, counts scores of partnering banks among its members, despite recent high-profile departures by Goldman Sachs, Santander, and Morgan Stanley. It has created “Corda,” its own take on a blockchain.

IBM (ibm), meanwhile, has spearheaded another initiative known as the Hyperledger Project, part of the non-profit Linux Foundation. That group maintains the “fabric” blockchain codebase, which as been used in supply chain trials with Wal-Mart (wmt).

Much of the interest to date from traditional financial firms involves “private” blockchains, meaning permission from an authority is required before a party can join the network. The original versions of Bitcoin and Ethereum have public networks that anyone can join. (At press time, the market caps of their cryptocurrencies were approximately $19 billion and $1.4 billion, respectively.)

Alex Batlin, blockchain lead at Bank of New York Mellon, said that while the Ethereum alliance will focus on the development of private blockchains, the hope is that these will one day link up with the public Ethereum blockchain, which is open to all.

“That interconnection of public and private chains actually creates a very strong network,” Batlin said on a call with Fortune. “Each chain strengthens the other at an exponential level.”

In the view of its proponents, Ethereum’s public and private networks will become analogous to intranets versus internets; they will share standard protocols, but have different configurations for privacy and security, depending on each organization’s needs.

Members of the Ethereum alliance include Accenture, BBVA, BNY Mellon, BNP Paribas, BP, Cisco, Credit Suisse, ING, Thomson Reuters, and UBS. Also joining is IC3, or the Initiative for Cryptocurrencies and Contracts, an academic group consisting of researchers from universities such as Cornell University, UC Berkeley, and Israel’s Technion.

Several representatives from alliance firms cited the energy surrounding Devcon2, Ethereum’s fall developer conference in Shanghai, as the focal point that led to their collaboration on this effort. Despite multiple hacks on Ethereum-based applications and a controversial splitting of the Ethereum network, enthusiasm in the network has apparently not diminished.

J.P. Morgan is responsible for developing the basis of the blockchain tech for the alliance. Called “Quorum,” the bank’s code has been designed to add privacy protections into the mix, among other tweaks.

The partners will help each other develop the foundations for different use cases, such as post-trade settlement, payments between banks, and supply chain tracking, while competing on applications and services built atop the networks. The top priorities for the alliance now include ensuring scalability and security.

The other founding members of the alliance are BlockApps, Nuco, AMIS, Andui, CME Group, ConsenSys, Fubon Financial, brainbot technologies, Chronicled, Cryptape, The Institutes, Monax, String Labs, Telindus, Tendermint, VidRoll, and Wipro.

JP Morgan CEO: Bitcoin is Going Nowhere

Noted Bitcoin skeptic Jamie Dimon was asked about Bitcoin during a recent televised interview. He doesn’t see the cryptocurrency going anywhere, although he does state blockchain technology “is real.”

JP Morgan CEO Jamie Dimon appeared in a CNBC interview at the World Economic Forum in Davos, where the interviewer brought up the subject of electronic currencies, specifically Bitcoin.

A previous interview between the two had Dimon remark that bitcoin “was going nowhere fast.” The comment was made during a previous installment of the WEC in Davos, years ago. The question resurfaced, with the interviewer stating, “now, it [bitcoin] seems to be reemerging potentially.”

To this, Dimon responded, “No. I think it’s two things,” he started, separating Bitcoin and blockchain technology.

There’s Bitcoin, the currency, I think is going to go nowhere and that’s not because of anything to do with technology.

The CEO of the largest bank in the United States by assets pointed to governmental controls that will curb virtual currencies.

“Governments, when they form themselves, form their currency. Governments like to control currency [and] know where it goes and who it goes to and control it for monetary purposes,” he added.

There is nothing behind a bitcoin and I think if it was big, the governments would stop it.

The subtle dig at the biggest cryptocurrency there is echoes a previous statement made by Dimon in November 2015 when he claimed Bitcoin “is like 2 billion or 3 billion dollars,” while JP Morgan moves 6 trillion dollars a day. “So, you’ve got to [put it in perspective],” he said at the time.

“That’s my own personal belief,” he added now while including,” I may be dead wrong.”

Having separated the currency from the technology, Dimon then had a different take on the blockchain.

The blockchain is a technology which we have been studying…and yes it’s real.

Dimon quickly explained the blockchain as “keeping a single file as opposed [to multiple files].”

It has certain security measures. If it proves to be cheap and secure, it will be adopted for a whole bunch of stuff.

“Not for everything,” he further opined about the blockchain, “it is not usable for certain types of things.”

JP Morgan is among a group of banks participating in the R3-led blockchain consortium looking into the applications of distributed ledger technology into present-day financial systems. For the first time since putting together a group of 42 global banks, R3 revealed an experiment conducted between 11 partner banks across multiple continents, using a private distributed ledger powered by Ethereum technology.

JP Morgan is also among several banks that form a part of the Open Ledger Project, overseen by the Linux Foundation and headed by IBM as an open-source distributed ledger effort.

Jamie Dimon’s latest comments come after a recent talk at the Fortune Global Forum where he deemed Bitcoin as “a waste of time.”

The full CNBC interview can be found here ($).

JPMorgan patents Bitcoin-like payment system

JPMorgan Chase has patented a digital payment system that could rival Bitcoin.

The system includes digital wallets, the ability to transfer money to anyone and anonymity too, according to a patent application filed to the U.S. Patent and Trade Office on Aug. 5. A blog on Let's Talk Bitcoin first reported the story.

JPMorgan ( JPM ) has also patented payment software that would latch onto your Internet browser and allow you to shop without pausing to fill out forms with personal financial information. And with what the bank calls its Internet Pay Anyone Account, moving funds would be anonymous and as easy as sending an email.

"The credit pushes can be made completely anonymously, with the recipient of the credit having no way to determine from where the credit originated," the bank says in the application.

Another aspect of the digital payment system is a virtual private lockbox. Think of it as a bank account that can only accept funds. That way, users can receive funds from anyone by publishing its digital address publicly without fear that someone can pull money out of it.

The impetus for the project is likely Bitcoin, the independent electronic currency created in 2009 that has gained lots of recent attention. But the patent application shows no mention of Bitcoin.

It does, however, say what led to its development: The modern financial system is outdated.

In the patent application, JPMorgan notes two trends that are making the old banking system obsolete. One is that merchants are establishing direct relationships with customers -- and they don't want middlemen slowing down the transfer of money. The second is that digital products are often sold in small increments for very low prices, and the currently high price of per-transaction fees don't make sense.

"A new marketplace has emerged for low dollar, high volume, real-time payments with payment surety for both consumers and producers," the bank writes in the application.

Social Surge - What's Trending

CNNMoney Sponsors

SmartAsset

NextAdvisor

Most stock quote data provided by BATS. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. All times are ET. Disclaimer. Morningstar: © Morningstar, Inc. All Rights Reserved. Factset: FactSet Research Systems Inc. . All rights reserved. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC and/or its affiliates.

© Cable News Network. A Time Warner Company. All Rights Reserved. Terms under which this service is provided to you.

CryptoCurrency

This Privacy Policy sets out how Finance Magnates LTD uses and protects any information that you give Finance Magnates LTD when you use this website. If you continue to browse or use this website and/or any of its affiliated websites and/or services you are agreeing to comply with and be bound by the following Privacy Policy, which together with our Terms and Conditions (link) govern Finance Magnates LTD’s relationship with you/ This privacy notice applies to any Finance Magnates LTD websites, applications, services, or tools (collectively "Services") where this privacy notice is referenced, regardless of how you access or use them, including through mobile devices. Please review carefully the entire website's Privacy Policy before agreeing to it. By viewing or using this website or any part of it, you agree to the complete Privacy Policy of this website. The term "Finance Magnates LTD", "this website", "the website", "us" or "we" refers to the owner of the website. The term "you" refers to the user or viewer of the website.

Finance Magnates LTD is committed to ensuring that your privacy is protected as provided in this Privacy Policy. Should we ask you to provide certain information by which you can be identified when using this website, you can be assured that it will only be used in accordance with this Privacy Policy.

What is personal information?

Personal Information is information relating to an identified or identifiable natural person. An identifiable natural person is one who can be identified, directly or indirectly, by reference to an identifier such as a name, an identification number, location data, an online identifier, or to one or more factors specific to the physical, physiological, genetic, mental, economic, cultural or social identity of that natural person.

We do not consider personal information to include information that has been anonymized or aggregated so that it can no longer be used to identify a specific natural person, whether in combination with other information or otherwise.

We collect personal information from you when you use our Services.

What we collect

The provision of all personal information is voluntary, but may be necessary in order to use our Services (such as registering an account). We may collect the following personal information:

- Identification details, such as name, age etc:

- When you create an account with us

- When you register to our events

- When you fill in forms on our websites

- Contact information including email address, phone, etc:

- When you create an account with us

- When you register to our events

- When you fill in forms on our websites

- Information we are required or authorized by applicable national laws to collect and process in order to authenticate or identify you or to verify the information we have collected.

- Any information that is provided by you when using our services (community discussions, contact forms, etc).

- Information about other services you have bought from us, when you purchase products or services on our sites

- Communication we have with you (emails, letters, messages sent to us through our social media platforms, feedback, contact forms)

- Information about you, your location and how you use our website, information about your interests and preferences:

- When you accept our cookies placed on your device

- When you update your account information

- When you open our marketing emails

- When you click on our banner adverts

- When you fill in forms on our website

- When you get in touch with us

- When you respond to our requests for feedback

- When you opt in to receiving messages from us

We collect information about your interaction with our Services and your communications with us. This is information we receive from devices (including mobile devices) you use when you access our Services. This information could include, but not limited to, Device ID or unique identifier, device type, unique device token.

Location information. Keep in mind that when using a mobile device, you can control or disable the use of location services by any application on your mobile device in the device's settings menu.

Computer and connection information such as statistics on your page views, traffic to and from the sites, referral URL, ad data, your IP address, your browsing history, and your web log information.

Personal information we collect using cookies and similar technologies

We use cookies, web beacons (or pixels), unique identifiers, and similar technologies to collect information about the pages you view, the links you click, and other actions you take when using our Services, within our advertising or email content.

We use Google Analytics which is a web analyzing tool of Google Inc. for the purposes of the adequate design and continuous optimization of our website. Google Analytics works with cookies and creates pseudonymised usage profiles, which enable an analysis of your use of our website. Information stored in such cookies (such as browser type/version, operating system used, referrer URL, Hostname of the accessing computer, time of server request) are usually transmitted to and stored on Google's servers.

How we use cookies

A cookie is a small file which asks permission to be placed on your computer's hard drive. Once you agree, the file is added and the cookie helps analyze web traffic or lets you know when you visit a particular site. Cookies allow web applications to respond to you. As an individual the web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences. We use traffic log cookies to identify which pages are being used. This helps us analyze data about web page traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system. Overall, cookies help us provide you with a better website, by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us. You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

Personal information collected from other sources

We allow you to share information with social media sites, or use social media sites to create your account or to connect your account with the respective social media site. Those social media sites may give us automatic access to certain personal information retained by them about you (e.g., content viewed by you, content liked by you, and information about the advertisements you have been shown or have clicked on, etc.). You control the personal information you allow us to have access to through the privacy settings on the applicable social media site and the permissions you give us when you grant us access to the personal information retained by the respective social media site about you. By associating an account managed by a social media site with your account and authorizing us to have access to this information, you agree that we can collect, use and retain the information provided by these social media sites in accordance with this privacy notice. We may also use plug-ins or other technologies from various social media sites. If you click on a link provided via a social media plug in, you are voluntarily establishing a connection with that respective social media site.

If you give us personal information about someone else, you must do so only with that person's authorization. You should inform them how we collect, use, disclose, and retain their personal information according to our privacy notice.

What we do with the information we gather.

We require this information to understand your needs and provide you with a better service, and in particular for the following reasons:

- Internal record keeping.

- Providing customer service.

- Improvement of our products and services.

- Periodic promotional emails about new products, special offers or other information which we think you may find interesting using the contact details which you have provided. You can opt out of receiving marketing emails by clicking on the unsubscribe link which we include in all our marketing emails.

- Emails/alerts to you based on your account settings.

- Personalized experience (including advertising and marketing) on our sites according to your interests.

- Detect, prevent, mitigate and investigate fraudulent or illegal activities.

We retain your personal information for as long as necessary to provide the Services you have requested, or for other essential purposes such as complying with our legal obligations, resolving disputes, and enforcing our policies.

How we protect your data

We protect your personal data against unauthorised access, unlawful use, accidental loss, corruption or destruction.

We use technical measures such as encryption and password protection to protect your data and the systems they are held in. We also use operational measures to protect the data, for example by limiting the number of people who have access to the databases in which our booking information is held.

We keep these security measures under review and refer to industry security standards to keep up to date with current best practice.

Sharing your data How we might share your personal information

We may disclose your personal information to other separate services within Finance Magnates LTD or to third parties. This disclosure may be required for us to provide you access to our Services, to comply with our legal obligations, to enforce our Terms of Service, to facilitate our marketing and advertising activities, or to prevent, detect, mitigate, and investigate fraudulent or illegal activities related to our Services. We attempt to minimize the amount of personal information we disclose to what is directly relevant and necessary to accomplish the specified purpose.

We do not sell, rent, or otherwise disclose your personal information to third parties for their marketing and advertising purposes without your consent. In the event that Finance Magnates LTD is acquired by or merged with a third party, we reserve the right, in any of these circumstances, to transfer or assign the information we have collected from you as part of such merger, acquisition, sale, or other change of control. In the unlikely event of our bankruptcy, insolvency, reorganization, receivership, or assignment for the benefit of creditors, or the application of laws or equitable principles affecting creditors' rights generally, we may not be able to control how your information is treated, transferred, or used.

How do we protect your personal information

We use secure server software (SSL) and firewalls to protect your information from unauthorized access, disclosure, alteration, or destruction. Furthermore, our employees and third party service providers have access to your non-public personal information only on a "need to know" basis. We follow industry standards to protect the personal information submitted to us, both during transmission and once we receive it. No method of transmission over the Internet, or method of electronic storage, is 100% secure. Therefore, while we use commercially acceptable means to protect your personal information, we cannot guarantee its absolute security.

When your credit or debit card account information is being transmitted to our Sites or through our Sites, it will be protected by cryptographic protocols. To be clear, Finance Magnates LTD does not itself store your credit or debit card account information, and we do not have direct control over or responsibility for your credit or debit card account information. We use third party payment processors that are the controllers of your credit card information. Our contracts with third parties that receive your credit or debit card account information require them to keep it secure and confidential.

You have the following rights concerning our processing of your personal data:

- Right to access

- Right to rectification what is that?

- Right to erasure

- Right to object (on grounds relating your particular situation) in case of processing of your personal data based on our legitimate interest (e.g. direct marketing)

- Right to withdraw your consent at any time in case of any consent-based processing of your personal data without affecting the lawfulness of processing based on consent before your withdrawal;

- Right to lodge a complaint with a supervisory authority.

To raise any objections or to exercise any of your rights, you can send an email to us at privacy@financemagnates.com or you can write to us at 7 Zabotinski Street, Ramat Gan, Israel

To exercise choices regarding cookies, you can modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

To stop receiving marketing emails from us, you can opt out of receiving marketing emails by clicking on the unsubscribe link which we include in all our marketing emails.

If you have created an online Profile with us and would like to update the information you have provided to us, you can access your account to view and make changes or corrections to your information. You may also contact us as detailed in the Contact Us section, below.

When you get in touch, we will come back to you as soon as possible and where possible within one month. If your request is more complicated, it may take a little longer to come back to you but we will come back to you within two months of your request. There is no charge for most requests, but if you ask us to provide a significant about of data for example we may ask you to pay a reasonable admin fee. We may also ask you to verify your identity before we provide any information to you.

You can write to us at 7 Zabotinski Street, Ramat Gan, Israel

or you can send an email to us at privacy@financemagnates.com.

Finance Magnates LTD may change this policy from time to time by updating this page, and by providing any information to Finance Magnates LTD you're accepting such changes. You should check this page from time to time for any changes. This policy is effective from 25/05/ 2018.

Cookies Policy : What Are Cookies

As is common practice with almost all professional websites this site uses cookies, which are tiny files that are downloaded to your computer, to improve your experience. This page describes what information they gather, how we use it and why we sometimes need to store these cookies. We will also share how you can prevent these cookies from being stored however this may downgrade or ‘break’ certain elements of the sites functionality.

For more general information on cookies see the Wikipedia article on HTTP Cookies

How We Use Cookies

We use cookies for a variety of reasons detailed below. Unfortunately is most cases there are no industry standard options for disabling cookies without completely disabling the functionality and features they add to this site. It is recommended that you leave on all cookies if you are not sure whether you need them or not in case they are used to provide a service that you use.

You can prevent the setting of cookies by adjusting the settings on your browser (see your browser Help for how to do this). Be aware that disabling cookies will affect the functionality of this and many other websites that you visit. Disabling cookies will usually result in also disabling certain functionality and features of the this site. Therefore it is recommended that you do not disable cookies.

The Cookies We Set

If you create an account with us then we will use cookies for the management of the signup process and general administration. These cookies will usually be deleted when you log out however in some cases they may remain afterwards to remember your site preferences when logged out.

We use cookies when you are logged in so that we can remember this fact. This prevents you from having to log in every single time you visit a new page. These cookies are typically removed or cleared when you log out to ensure that you can only access restricted features and areas when logged in.

This site offers newsletter or email subscription services and cookies may be used to remember if you are already registered and whether to show certain notifications which might only be valid to subscribed/unsubscribed users.

This site offers e-commerce or payment facilities and some cookies are essential to ensure that your order is remembered between pages so that we can process it properly.

From time to time we offer user surveys and questionnaires to provide you with interesting insights, helpful tools, or to understand our user base more accurately. These surveys may use cookies to remember who has already taken part in a survey or to provide you with accurate results after you change pages.

When you submit data to through a form such as those found on contact pages or comment forms cookies may be set to remember your user details for future correspondence.

In order to provide you with a great experience on this site we provide the functionality to set your preferences for how this site runs when you use it. In order to remember your preferences we need to set cookies so that this information can be called whenever you interact with a page is affected by your preferences.

Third Party Cookies

In some special cases we also use cookies provided by trusted third parties. The following section details which third party cookies you might encounter through this site.

Third party analytics are used to track and measure usage of this site so that we can continue to produce engaging content. These cookies may track things such as how long you spend on the site or pages you visit which helps us to understand how we can improve the site for you.

From time to time we test new features and make subtle changes to the way that the site is delivered. When we are still testing new features these cookies may be used to ensure that you receive a consistent experience whilst on the site whilst ensuring we understand which optimisations our users appreciate the most.

As we sell products it’s important for us to understand statistics about how many of the visitors to our site actually make a purchase and as such this is the kind of data that these cookies will track. This is important to you as it means that we can accurately make business predictions that allow us to monitor our advertising and product costs to ensure the best possible price.

The Google AdSense service we use to serve advertising uses a DoubleClick cookie to serve more relevant ads across the web and limit the number of times that a given ad is shown to you.

For more information on Google AdSense see the official Google AdSense privacy FAQ.

We use adverts to offset the costs of running this site and provide funding for further development. The behavioural advertising cookies used by this site are designed to ensure that we provide you with the most relevant adverts where possible by anonymously tracking your interests and presenting similar things that may be of interest.

In some cases we may provide you with custom content based on what you tell us about yourself either directly or indirectly by linking a social media account. These types of cookies simply allow us to provide you with content that we feel may be of interest to you.

We also use social media buttons and/or plugins on this site that allow you to connect with your social network in various ways. For these to work the following social media sites including; Facebook, Twitter, Instagram, YouTube, LinkedIn, Google+, will set cookies through our site which may be used to enhance your profile on their site or contribute to the data they hold for various purposes outlined in their respective privacy policies.

Agreement or the failure of either Party to exercise any right or remedy to which it, he or they are entitled hereunder shall not constitute a waiver thereof and shall not cause a diminution of the obligations under this or any Agreement. No waiver of any of the provisions of this or any Agreement shall be effective unless it is expressly stated to be such and signed by both Parties.

Notification of Changes

Hopefully that has clarified things for you and as was previously mentioned if there is something that you aren’t sure whether you need or not it’s usually safer to leave cookies enabled in case it does interact with one of the features you use on our site. However if you are still looking for more information then you can contact us through one of our preferred contact methods.

Terms Of Use: In using this website you are deemed to have read and agreed to the following terms and conditions:

The following terminology applies to these Terms and Conditions, Privacy Statement and Disclaimer Notice and any or all Agreements: “Client”, “You” and “Your” refers to you, the person accessing this website and accepting the Finance Magnates LTD’s terms and conditions. “The Finance Magnates LTD”, “Ourselves”, “We” and “Us”, refers to our Finance Magnates LTD. “Party”, “Parties”, or “Us”, refers to both the Client and ourselves, or either the Client or ourselves. All terms refer to the offer, acceptance and consideration of payment necessary to undertake the process of our assistance to the Client in the most appropriate manner, whether by formal meetings of a fixed duration, or any other means, for the express purpose of meeting the Client’s needs in respect of provision of the Finance Magnates LTD’s stated services/products, in accordance with and subject to, prevailing English Law. Any use of the above terminology or other words in the singular, plural, capitalisation and/or he/she or they, are taken as interchangeable and therefore as referring to same.

We are committed to protecting your privacy. Authorized employees within the Finance Magnates LTD on a need to know basis only use any information collected from individual customers. We constantly review our systems and data to ensure the best possible service to our customers. Parliament has created specific offences for unauthorised actions against computer systems and data. We will investigate any such actions with a view to prosecuting and/or taking civil proceedings to recover damages against those responsible.

Client records are regarded as confidential and therefore will not be divulged to any third party, other than Finance Magnates LTD, if legally required to do so to the appropriate authorities.

We will not sell, share, or rent your personal information to any third party or use your e-mail address for unsolicited mail. Any emails sent by this Finance Magnates LTD will only be in connection with the provision of agreed services and products.

Exclusions and Limitations The information on this web site is provided on an “as is” basis. To the fullest extent permitted by law, this Finance Magnates LTD:excludes all representations and warranties relating to this website and its contents or which is or may be provided by any affiliates or any other third party, including in relation to any inaccuracies or omissions in this website and/or the Finance Magnates LTD’s literature; and excludes all liability for damages arising out of or in connection with your use of this website. This includes, without limitation, direct loss, loss of business or profits (whether or not the loss of such profits was foreseeable, arose in the normal course of things or you have advised this Finance Magnates LTD of the possibility of such potential loss), damage caused to your computer, computer software, systems and programs and the data thereon or any other direct or indirect, consequential and incidental damages.Finance Magnates LTD does not however exclude liability for death or personal injury caused by its negligence. The above exclusions and limitations apply only to the extent permitted by law. None of your statutory rights as a consumer are affected.

We use IP addresses to analyse trends, administer the site, track user’s movement, and gather broad demographic information for aggregate use. IP addresses are not linked to personally identifiable information. Additionally, for systems administration, detecting usage patterns and troubleshooting purposes, our web servers automatically log standard access information including browser type, access times/open mail, URL requested, and referral URL. This information is not shared with third parties and is used only within this Finance Magnates LTD on a need-to-know basis. Any individually identifiable information related to this data will never be used in any way different to that stated above without your explicit permission.

Like most interactive web sites this Finance Magnates LTD’s website [or ISP] uses cookies to enable us to retrieve user details for each visit. Cookies are used in some areas of our site to enable the functionality of this area and ease of use for those people visiting.

Links to this website

You may not create a link to any page of this website without our prior written consent. If you do create a link to a page of this website you do so at your own risk and the exclusions and limitations set out above will apply to your use of this website by linking to it.

Links from this website

We do not monitor or review the content of other party’s websites which are linked to from this website. Opinions expressed or material appearing on such websites are not necessarily shared or endorsed by us and should not be regarded as the publisher of such opinions or material. Please be aware that we are not responsible for the privacy practices, or content, of these sites. We encourage our users to be aware when they leave our site & to read the privacy statements of these sites. You should evaluate the security and trustworthiness of any other site connected to this site or accessed through this site yourself, before disclosing any personal information to them. This Finance Magnates LTD will not accept any responsibility for any loss or damage in whatever manner, howsoever caused, resulting from your disclosure to third parties of personal information.

Copyright and other relevant intellectual property rights exists on all text relating to the Finance Magnates LTD’s services and the full content of this website.

All rights reserved. All materials contained on this site are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of Finance Magnates LTD. You may not alter or remove any trademark, copyright or other notice from copies of the content. All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you.Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Opinions expressed at Finance Magnates LTD are those of the individual authors and do not necessarily represent the opinion of Fthe Finance Magnates LTD or its management. Finance Magnates LTD has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions might occur. Any opinions, news, research, analyses, prices or other information contained on this website, by Finance Magnates LTD, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. Finance Magnates LTD will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Neither party shall be liable to the other for any failure to perform any obligation under any Agreement which is due to an event beyond the control of such party including but not limited to any Act of God, terrorism, war, Political insurgence, insurrection, riot, civil unrest, act of civil or military authority, uprising, earthquake, flood or any other natural or man made eventuality outside of our control, which causes the termination of an agreement or contract entered into, nor which could have been reasonably foreseen. Any Party affected by such event shall forthwith inform the other Party of the same and shall use all reasonable endeavours to comply with the terms and conditions of any Agreement contained herein.

Failure of either Party to insist upon strict performance of any provision of this or any Agreement or the failure of either Party to exercise any right or remedy to which it, he or they are entitled hereunder shall not constitute a waiver thereof and shall not cause a diminution of the obligations under this or any Agreement. No waiver of any of the provisions of this or any Agreement shall be effective unless it is expressly stated to be such and signed by both Parties.

Notification of Changes

The Finance Magnates LTD reserves the right to change these conditions from time to time as it sees fit and your continued use of the site will signify your acceptance of any adjustment to these terms. If there are any changes to our privacy policy, we will announce that these changes have been made on our home page and on other key pages on our site. If there are any changes in how we use our site customers’ Personally Identifiable Information, notification by e-mail or postal mail will be made to those affected by this change. Any changes to our privacy policy will be posted on our web site 30 days prior to these changes taking place. You are therefore advised to re-read this statement on a regular basis.

These terms and conditions form part of the Agreement between the Client and ourselves. Your accessing of this website and/or undertaking of a booking or Agreement indicates your understanding, agreement to and acceptance, of the Disclaimer Notice and the full Terms and Conditions contained herein. Your statutory Consumer Rights are unaffected.

© Finance Magnates 2015 All Rights Reserved

US Search Mobile Web

Welcome to the Yahoo Search forum! We’d love to hear your ideas on how to improve Yahoo Search.

The Yahoo product feedback forum now requires a valid Yahoo ID and password to participate.

You are now required to sign-in using your Yahoo email account in order to provide us with feedback and to submit votes and comments to existing ideas. If you do not have a Yahoo ID or the password to your Yahoo ID, please sign-up for a new account.

If you have a valid Yahoo ID and password, follow these steps if you would like to remove your posts, comments, votes, and/or profile from the Yahoo product feedback forum.

- Vote for an existing idea ( )

- or

- Post a new idea…

- Hot ideas

- Top ideas

- New ideas

- Category

- Status

- My feedback

Improve your services

Your search engine does not find any satisfactory results for searches. It is too weak. Also, the server of bing is often off

I created a yahoo/email account long ago but I lost access to it; can y'all delete all my yahoo/yahoo account except for my newest YaAccount

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be 'secure' then it'll be 'unfair' gaming and I'll lose because of the insecurity can be a 'Excuse'. Hope y'all understand my explanation!

I want all my lost access yahoo account 'delete'; Requesting supporter for these old account deletion; 'except' my Newest yahoo account this Account don't delete! Because I don't want it interfering my online 'gamble' /games/business/data/ Activity , because the computer/security program might 'scure' my Information and detect theres other account; then secure online activities/ business securing from my suspicion because of my other account existing will make the security program be 'Suspicious' until I'm 'secure'; and if I'm gambling online 'Depositing' then I need those account 'delete' because the insecurity 'Suspicioun' will program the casino game 'Programs' securities' to be… more

chithidio@Yahoo.com

i dont know what happened but i can not search anything.

Golf handicap tracker, why can't I get to it?

Why do I get redirected on pc and mobile device?

Rahyaftco@yahoo.com

RYAN RAHSAD BELL literally means

Question on a link

In the search for Anaïs Nin, one of the first few links shows a picture of a man. Why? Since Nin is a woman, I can’t figure out why. Can you show some reason for this? Who is he? If you click on the picture a group of pictures of Nin and no mention of that man. Is it an error?

Repair the Yahoo Search App.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and I signed in so he could try to fix the Yahoo Search App not working. He also used another phone, installed the app from the Google Play Store to see if the app would do any kind of search thru the app. The Yahoo Search App just wasn't working.

I also had At&t try to help me because I have UVERSE for my internet service. My internet was working perfectly. Their Technical Support team member checked the Yahoo Search App and it wouldn't work for him either.

We can go to www.yahoo.com and search for any topic or website. It's just the Yahoo Search App that won't allow anyone to do web searches at all.

I let Google know that the Yahoo Search App installed from their Google Play Store had completely stopped working on May 18, 2018.

I told them that Yahoo has made sure that their Yahoo members can't contact them about anything.

I noticed that right after I accepted the agreement that said Oath had joined with Verizon I started having the problem with the Yahoo Search App.

No matter what I search for or website thru the Yahoo Search App it says the following after I searched for

www.att.com.

WEBPAGE NOT AVAILABLE

This webpage at gttp://r.search.yahoo.com/_ylt=A0geJGq8BbkrgALEMMITE5jylu=X3oDMTEzcTjdWsyBGNvbG8DYmyxBHBvcwMxBHZ0aWQDTkFQUEMwxzEEc2VjA3NylRo=10/Ru=https%3a%2f%2fwww.att.att.com%2f/Rk=2/Es=plkGNRAB61_XKqFjTEN7J8cXA-

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

I tried to search for things like www.homedepot.com. The same thing happened. It would say WEBPAGE NOT AVAILABLE. The only thing that changed were all the upper and lower case letters, numbers and symbols.

Then it would again say

could not be loaded because:

net::ERR_CLEARTEXT_NOT_PERMITTED

This is the same thing that happened when Samsung and At&t tried to do any kind of searches thru the Yahoo Search App.

Yahoo needs to fix the problem with their app.

Yahoo Search App from the Google Play Store on my Samsung Galaxy S8+ phone stopped working on May 18, 2018.

I went to the Yahoo Troubleshooting page but the article that said to do a certain 8 steps to fix the problem with Yahoo Services not working and how to fix the problem. Of course they didn't work.

I contacted Samsung thru their Samsung Tutor app on my phone. I gave their Technican access to my phone to see if there was a problem with my phone that stopped the Yahoo Search App from working. He went to Yahoo and… more

JPMorgan Publishes The "Bitcoin Bible"

Five months after Jamie Dimon's infamous outburst, in which the JPM CEO called Bitcoin a fraud, and threatened any JPMorgan trader caught trading cryptocurrencies with immediate termination "for being stupid", which was followed by JPM's head quant alleging bitcoin was a pyramid scheme, the largest US bank has released what can only be called the "Bitcoin Bible": 71 pages of excruciating detail on everything from the technology of cryptocurrencies, to their applications and challenges.

While there is too much in the report - which was published on the same day that the NY Fed admitted that in "A Dystopian World, Bitcoin Would Dominate Payment Methods" which of course is the whole point behind cryptos which as a contingency plan to the collapse of fiat currencies - to be summarized in one post, and instead we will focus on the key points over the next few days, below we republish the Executive Summary from the report, highlighting the key sections.

Executive Summary

Introduction

- J.P. Morgan researchers from across a wide range of expertise analyze various aspects of Cryptocurrency (CC) to gain insight on this market and its potential evolution in this report. CCs’ extremely rapid growth, and then fall, both in terms of number of CCs and prices and their challenge to the current financial infrastructure, are forcing all market participants to closely monitor and understand this new market.

- Cryptocurrencies are virtual currencies that are created, stored and governed electronically by an open, decentralized, cryptography system. CCs can be used to exchange money, to buy certain goods/services or as an investment. There are over 1,500 cryptocurrencies with a market cap of some $400bn as of February 8, 2018, with Bitcoin being the largest representing a third of the market according to CoinMarketCap.

- Launched in early 2009, Bitcoin (BTC) is the dominant cryptocurrency with a market cap of $140 billion (representing one-third of the CC market) and nearly 17 million BTC units in circulation (capped at 21 million). Bitcoin was the first major cryptocurrency and has spawned many competing CCs and technologies, many of which still fall back to Bitcoin as a support currency. Bitcoin itself has split into two cryptocurrencies, Bitcoin and Bitcoin Cash, to improve liquidity.

Technology

- Cryptocurrencies are the face of the innovative maelstrom around the Blockchain technology that is bringing both massive price volatility and a constant trial-and-error of new product try-outs and failures.

- CCs are unlikely to disappear completely and could easily survive in varying forms and shapes among players who desire greater decentralization, peer-to-peer networks and anonymity, even as the latter is under threat. The underlying technology for CCs could have the greatest application in areas where current payments systems are slow, such as across borders, as payment, reward tokens or funding systems for other Blockchain innovations and the Internet of Things, as well as parts of the underground economy.

Applications

- There are over 1,500 CCs with a market cap of $400bn. Transactions in the three largest CCs average $550bn per month and come mostly from individuals. Ownership is highly concentrated. The opportunity set around direct CC trading appears relatively limited for banks, while the two Bitcoin futures recently launched are seeing only $140mn in daily trading.

- Blockchain saw its first expression through Bitcoin – the first CC – but is more likely to ultimately see its greatest application outside of CCs across other financial and non-financial transactions, even as Blockchain itself looks set to evolve fast as the market learns about what works best.

- There is the potential for increased usage of Blockchain in cross-border payments, settlement/clearing/collateral management as well as the broader world of TMT, Transportation and Healthcare but only where any cost efficiencies offset regulatory, technical and security hurdles.

- Hedge funds have been moving into this market making up most of the 175 CC funds but AUM remains only a few billion dollars. Asset managers are experiencing limited success in bringing products to market and have not been able to launch CC funds or ETFs without support from the SEC or major distributors.

- While about half of the early CC transactions happened in the underground economy, the share of this is declining, with investing and speculation now taking a much larger share.

Challenges

- It will be extremely hard for CCs to displace and compete with government-issued currencies, as dollars to euros and yuan are virtual natural monopolies in their regions and will not easily give up their seigniorage profits.

- CCs are experiencing heightened volatility and will face challenges from both technology (such as rising mining costs and hacking) and regulators who are concerned about anti-money laundering and investor protection, as CC payments are irreversible and there is no recourse.

- Security concerns have mounted in Bitcoin exchanges as hackers have infiltrated a number of CC exchanges generating large losses, while regulators are challenging anonymity.

Below are some of the JPM team's observations on what the future could bring for cryptos, with highlights, however the most notable admission is JPM stating that cryptocurrencies "could potentially have a role in diversifying one’s global bond and equity portfolio", a far cry from Jamie Dimon's emotional appeal that all cryptos are a giant fraud.

In the early stages of innovation, usually set off by new technology — in this case Blockchain — the market experiments with many different approaches to see what shape and form will stick and end up offering the most economic value-added. We would note that it is not pre-ordained that cryptocurrencies will succeed as there are valid concerns about what economic value they really contribute. But in a time of rapid innovation, many new products will are often-and-errored. We believe the potential disruption from Blockchain cannot be ignored.

The excitement of innovation typically also leads to price booms and then crashes among the early movers, before more realistic prices emerge among the eventual survivors. Much of this is what we see today with exponential price gains and losses, growth and diversity among cryptocurrencies. Given the amount of speculation in these markets, technical signals can be very useful in gauging market direction and they have been sending the right signals in recent months. Fundamentals are a lot less informative here, although it can be useful to look at the cost of mining CCs, even as one must also account for the elasticity of supply.

Cryptocurrencies are both a new technology — Blockchain — and a new currency (many new ones). The new shape and form of the CC market in the future will likely ultimately depend on what economic value they are perceived to add. We would expect the marketplace and regulators to ultimately weed out what are perceived the negative, less useful characteristics of CCs and retain the positive elements that add economic value.

As discussed more in detail below, the Blockchain technology driving CCs offers transparency to transactions and allows them to be virtual and peer-to-peer. Distributed ledger technology has the potential to offer regulators greater degrees of transparency, higher levels of resiliency and shorter settlement times, reducing counterparty and market risk.

Allen similarly discusses various efforts under way with, for example, a number of payment processing firms increasingly partnering with technology firms/Blockchain providers to offer an alternative settlement engine to various payment participants. We expect various Blockchain-based ecosystems to coexist and compete with each other (similar to Payments networks in the current environment), with success predicating on technology capabilities (such as API features), number of participants on the network and ease of adoption. Given the hurdles, CCs are more likely to be used as ancillary payment methods rather than gaining traction as a primary source of exchange.

While seeing a potential for the deployment of the underlying Blockchain technology in payments, we do not see cryptocurrencies competing with central bank-issued money for lawful transactions. We note that CCs have not attained the relative stability of value to make them useful as money for everyday transactions. The current set of government-issued fiat currencies — such as the dollar and the euro — provide efficient media of exchange, stores of value and units of account. Some of the early buyers of CC were clearly dismayed by ballooning balance sheets of the major central banks in the aftermath of the global financial crisis (GFC), but the lack of any meaningful inflation since, in both developed markets (DM) and emerging markets (EM), has surely reduced concerns about fiat (legal tender issued by a central bank) money.

In addition, we find that local legal tender money tends to be a natural monopoly with only extreme hyperinflation leading people to seek out a monetary alternative. To add, we do not find that CCs are currently meeting the standards of what constitutes money as the huge volatility of CC has made use of it as a unit of account impractical. Finally, given the huge returns from running a central bank (seigniorage), governments will be quite possessive of their legal tender role and will likely put up a fight if CCs were to gain broader traction domestically.

Some EMs, such as Venezuela and Russia, appear to be considering issuing CCs as a way to improve international funding and evade US sanctions. Aziz is quite dubious about whether any of this will work as CCs face regulatory headwinds and are neither better than fiat money in establishing policy credibility nor in providing liquidity during crises.

Several central banks, as discussed in Feroli, are investigating whether they should issue CCs in their own currency, but are very far from actually doing so, as any increased efficiency in payments technology does not appear to be that obvious. In addition, the issuance of crypto dollars, for example, would give non-banks access to the Fed balance sheet, and thus could endanger the economically and socially important financial intermediation function of commercial banks.

In market economies, commercial banks manage the largest part of what we call money through their deposit

base that they in turn lend out to the economy, after holding back a fraction as reserves at the central bank. If cryptocurrencies were seen as superior to bank deposits, prompting a wholesale shift into cryptocurrencies, then a much larger share of savings would go to the central bank's assets (government debt) and less to commercial banks loans, thus potentially dramatically increasing private credit risk premia and reducing the flow of credit to the private sector. Fractional reserve banking was a tremendous innovation that surely contributed greatly to global growth over the last two centuries, and we would expect that central banks would think twice before disturbing this source of capital to the private sector.

We examine the potential role of CCs in terms of offering diversification in a global portfolio, given both their high returns over the past several years and their low correlation with the major asset classes, offsetting some of the cost of high volatility. If past returns, volatilities and correlations persist, CCs could potentially have a role in diversifying one’s global bond and equity portfolio. But in our view, that is a big if given the astronomic returns and volatilities of the past few years. If CCs survive the next few years and remain part of the global market, then they will likely have exited their current speculative phase and would then have more normal returns, volatilities (both much lower) and correlations (more like that of other zero-return assets such as gold and JPY). Based on its historical performance, CCs can be 10 times more volatile than core assets like stocks, or than portfolio hedges, like commodities. Liquidity is also well below most other potential hedges. Extraordinary returns can be generated in the price discovery phase, only to be followed by several years of mean-reversion toward the eventual, long-term average level. In the current market conditions, we do not believe that an allocation to Cryptocurrencies as insurance should be a portfolio’s main or only hedge. Note that even though CCs have improved risk-adjusted returns over the past several years, they have not prevented portfolio drawdown during periods of acute market stress, like the equity flash crashes of August 2015 and February 2018.

Below we highlight some of the key charts from the JPM "cryptobible":

What a typical bitcoin transaction flow looks like:

Cryptocorrelation with other asset classes: virtually nil, i.e., a perfect diversifier.

Cryptocurrency liquidity in the context of all other major asset classes.

Current state of cryptocurrency regulation around the globe.

Market liquidity: average bid/ask spread to buy 10 BTC:

Cryptocurrency concentration of hodlers:

JP Morgan, Bank of America and Citigroup are banning customers from buying bitcoin on their credit cards

- Jasper Jolly, City AM

- Feb. 3, 2018, 11:52 AM

- 6,397

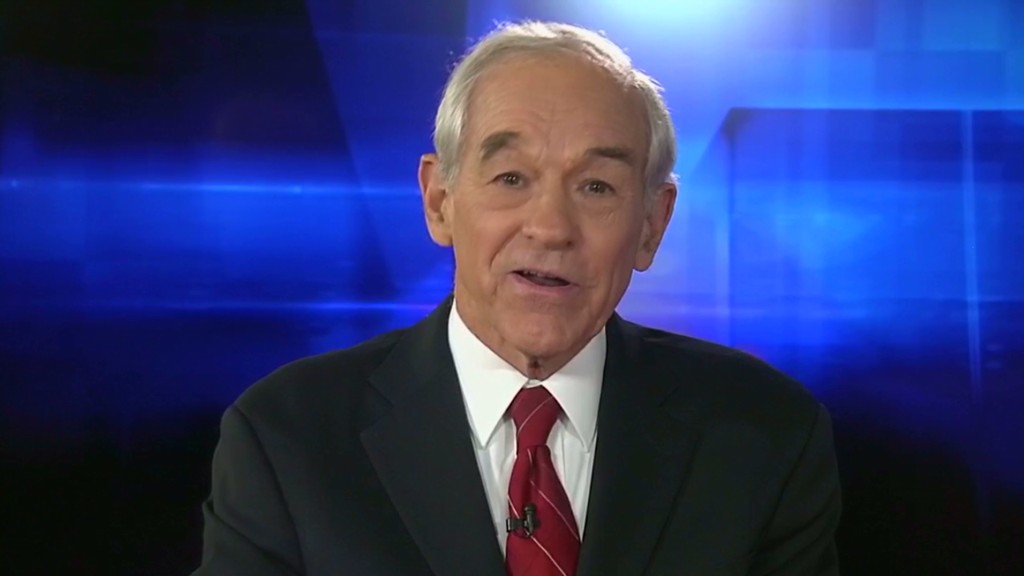

Jamie Dimon, Chairman and CEO of JPMorgan Chase. Thomson Reuters

- JPMorgan, Bank of America, and Citi are banning bitcoin purchases using their cards.

- Buying bitcoin on credit is higher risk than other transactions due to the high price volatility of cryptocurrencies.

US banks are queueing up to stop customers from buying bitcoin using credit cards, as wild price swings continue on the biggest cryptocurrency.

JP Morgan Chase and Bank of America both said last night they will ban the practice, according toВ CNBC, which could leave customers chasing the big price rises which bitcoin has seen over the past year with big losses. Citigroup also joined in the ban, according toВ Bloomberg.

Credit card providers which allow transactions with cryptocurrency exchanges could be left exposed to higher risk than usual because of the massive volatility of the assets.

Bitcoin has seen its price surge by more than 700%В over the past year, according to the OnchainFX website, but the last month has seen its dollar price fall by more than 40% as fears of what many economists have called a bubble spread.

Yesterday the price of bitcoin fell below the $8,000 mark for the first time since November, after rising almost as far as $20,000 in December, amid a broad fall in dollar values across the major cryptocurrencies.

Advertisement

Jamie Dimon, the chief executive of JP Morgan, has been among the most prominent sceptics of digital currencies, infamously describing bitcoin as a "fraud."

Yesterday Nouriel Roubini, a New York University economist who is credited with having predicted the financial crisis, said bitcoin is the "mother of all bubbles", and added that he expects regulators around the world to crack down on the lightly regulated space in an interview with Bloomberg television.

Get the latest Bank of America stock price here.

Read the original article on City AM. Copyright 2018.

JP Morgan Chase: Cryptocurrency a Threat to its Own Services

JP Morgan Chase: Cryptocurrency a Threat to its Own Services

JP Morgan’s CEO has been backpedaling on calling Bitcoin a fraud for months now but he has stuck to the line that no government (especially the US) will allow cryptocurrency to exist on a large scale. A new report shows though that JP Morgan is very aware of the ‘risk’ cryptocurrency puts on its own services and how they are dealing with it.

A Risky Future

In its annual report released on Tuesday, JP Morgan recognized that cryptocurrencies such as Bitcoin and Ethereum are potential competition to the bank’s own services that could potentially take money from their very deep pockets.

CEO Jamie Dimon has been on record deriding the risk of cryptocurrency to fiat institutions for a long time. He has also publicly recognized that the underlying blockchain technology will most likely be implemented to move currency but has added, that the currency would be dollars, not Bitcoin.

The report released on Tuesday details ways in which the bank has had to change its practices in order to compete with the new technologies in order to retain customers. Payment processing and other currency transfer services were highlighted by the report as being especially susceptible to technologies like cryptocurrency that require no inter-mediation.

“Ongoing or increased competition may put downward pressure on prices and fees for JPMorgan Chase’s products and services or may cause JPMorgan Chase to lose market share,”

JP Morgan’s annual report.

JP Morgan isn’t the only major financial institution in the US to come around to the ‘threat of cryptocurrency’. In their own report, last week Bank of America recognized the risk of losing their own customers to competitors offering products “in areas we deem speculative or risky, such as cryptocurrencies.”

The Bitcoin Bible

This reported recognition by JP Morgan doesn’t come as much of a surprise to those who have read the 71-page research report released more than a week and a half ago that some have dubbed the ‘Bitcoin Bible’. The report gives a thorough analysis of multiple cryptocurrency issues the banking industry faces. This includes assessing the banks own crypto and blockchain based ventures.

That report concluded that “Opportunities for banks to utilize blockchain technologies for conducting business could have far-reaching implications for the sector.”

In actuality, JP Morgan has been one of the first major financial institutions to recognize and adapt to the reality of cryptocurrency. As well as one of the first to implement its own Ethereum based blockchain.

Earlier this month Umar Farook, JP Morgan Chase’s head of blockchain initiatives, gave a glimpse into how serious the bank was taking new technology speaking at Yahoo Finance All Markets Summit in New York. “It’s more than thriving. People have been surprised how quickly it basically spread as a way to address and think about customers differently. It’s quite insane.” He said.

JP Morgan Trades Bitcoin ETN for Clients After CEO Calls It a 'Fraud'

JP Morgan CEO Jamie Dimon made headlines last week for his harsh words on cryptocurrencies, and he saved special vitriol for bitcoin in particular. Of the largest digital currency in the world, the banking boss said the entire enterprise was a "fraud" and suggested he would fire any employee who was caught trading a digital currency because that employee would be "stupid" for doing so. (See more: Jamie Dimon Calls Bitcoin a 'Fraud.')

Now, Bitcoin.com reveals that JP Morgan has been routing customer orders for XBT shares, exchange-traded notes that track the price of bitcoin. In an interview with Reuters, JP Morgan spokesman Brian Marchiony said, “They are not JPMorgan orders. These are clients purchasing third-party products directly.”

JP Morgan and Morgan Stanley Buy Bitcoin ETNs

Reports suggest that both JP Morgan and Morgan Stanley have recently routed client orders for XBT note shares. The information comes via public records of Nordnet trading logs.

According to Bitcoin.com, JP Morgan routed the most XBT shares of all of the big banks included in the list of purchasers.

Bitcoin ETNs have become a popular means of investing in the cryptocurrency among mainstream investors and large-scale financial firms looking to add exposure in the area. Bitcoin-tracking ETNs follow bitcoin price movements as compared with major currencies like the euro and the U.S. dollar. Generally, bitcoin ETNs have provided exceptionally strong results so far in 2017, which isn't surprising, considering the rapid growth of the currency itself over the course of the year.

JP Morgan Also Involved in Blockchain

Dimon's firm is also involved in the recent uptick in blockchain interest increasingly common amongst big banks. (See more: How Blockchain Technology is Changing Real Estate.)

JP Morgan has applied for a "bitcoin alternative" patent in the United States more than 175 times since 2013. The company is also reportedly developing a blockchain based on the ethereum system.

All of these developments suggest that there may be more overlap between the world of traditional Wall Street finance and cryptocurrencies than some investors are willing to let on. Investors have generally been divided over their approach to currencies like bitcoin, with some quickly rallying behind the new investment area and others, like Dimon, speaking out against it.

Concerns about a bitcoin and cryptocurrency bubble are commonly heard, and extreme volatility in the cryptocurrency space suggests that the proposition of investing is risky. But there also have been many opportunities for investors of all types to make a substantial amount of money through digital currency investments.

Комментариев нет:

Отправить комментарий